2a3f23dbeef91c1226b76cb1fe5f7419.ppt

- Количество слайдов: 17

• New Clicks Australia • Jeff Sher

• New Clicks Australia • Jeff Sher

New Clicks Australia – Review • Shared service capability now in place • Franchise skills developing • Successful integration of Price Attack • Formulated & started to roll out pharmacy model • New management structure – ASF/OMF • Restructured to meet future growth • Leading the way in haircare, homeware & healthcare

New Clicks Australia – Review • Shared service capability now in place • Franchise skills developing • Successful integration of Price Attack • Formulated & started to roll out pharmacy model • New management structure – ASF/OMF • Restructured to meet future growth • Leading the way in haircare, homeware & healthcare

New Clicks Australia – The new way 1. Selling of stores: – Non-performers converted to Pharmacy – Franchisees who do not meet compliance standards - managed – Buying & selling now part of the business – Not limited to Priceline 2. Profit centres: – Marketing services – Store development

New Clicks Australia – The new way 1. Selling of stores: – Non-performers converted to Pharmacy – Franchisees who do not meet compliance standards - managed – Buying & selling now part of the business – Not limited to Priceline 2. Profit centres: – Marketing services – Store development

New Clicks Australia – Behind the numbers • One-off costs quite significant for pharmacy & completion of Price Attack acquisition • Anomalies in the House performance • Pharmacy development • Reallocation of costs to meet demands of franchise business

New Clicks Australia – Behind the numbers • One-off costs quite significant for pharmacy & completion of Price Attack acquisition • Anomalies in the House performance • Pharmacy development • Reallocation of costs to meet demands of franchise business

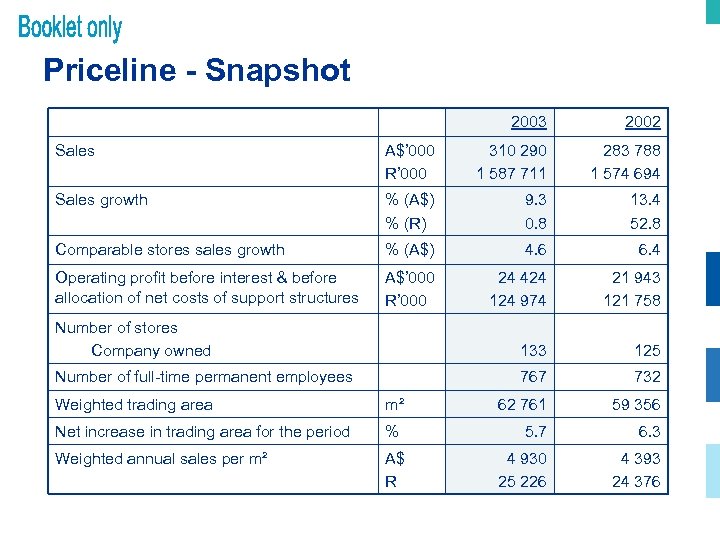

Priceline - Snapshot 2003 2002 Sales A$’ 000 R’ 000 310 290 1 587 711 283 788 1 574 694 Sales growth % (A$) % (R) 9. 3 0. 8 13. 4 52. 8 Comparable stores sales growth % (A$) 4. 6 6. 4 Operating profit before interest & before allocation of net costs of support structures A$’ 000 R’ 000 24 424 124 974 21 943 121 758 Number of stores Company owned 133 125 Number of full-time permanent employees 767 732 Weighted trading area m² 62 761 59 356 Net increase in trading area for the period % 5. 7 6. 3 Weighted annual sales per m² A$ R 4 930 25 226 4 393 24 376

Priceline - Snapshot 2003 2002 Sales A$’ 000 R’ 000 310 290 1 587 711 283 788 1 574 694 Sales growth % (A$) % (R) 9. 3 0. 8 13. 4 52. 8 Comparable stores sales growth % (A$) 4. 6 6. 4 Operating profit before interest & before allocation of net costs of support structures A$’ 000 R’ 000 24 424 124 974 21 943 121 758 Number of stores Company owned 133 125 Number of full-time permanent employees 767 732 Weighted trading area m² 62 761 59 356 Net increase in trading area for the period % 5. 7 6. 3 Weighted annual sales per m² A$ R 4 930 25 226 4 393 24 376

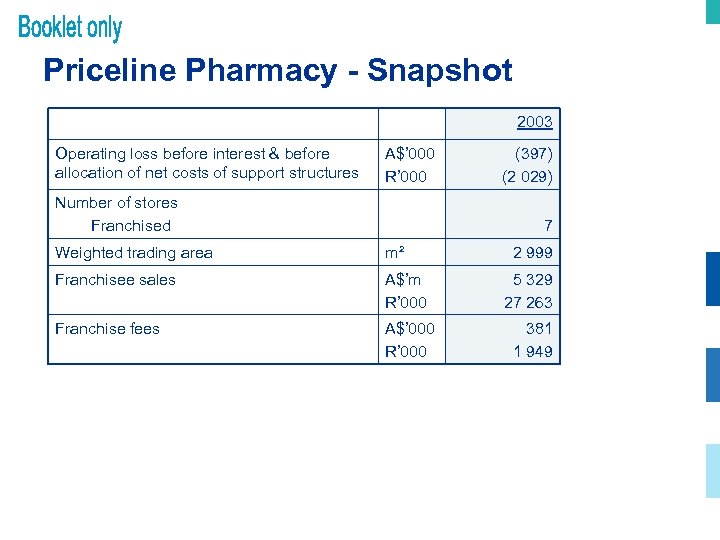

Priceline Pharmacy - Snapshot 2003 Operating loss before interest & before allocation of net costs of support structures A$’ 000 R’ 000 Number of stores Franchised (397) (2 029) 7 Weighted trading area m² 2 999 Franchisee sales A$’m R’ 000 5 329 27 263 Franchise fees A$’ 000 R’ 000 381 1 949

Priceline Pharmacy - Snapshot 2003 Operating loss before interest & before allocation of net costs of support structures A$’ 000 R’ 000 Number of stores Franchised (397) (2 029) 7 Weighted trading area m² 2 999 Franchisee sales A$’m R’ 000 5 329 27 263 Franchise fees A$’ 000 R’ 000 381 1 949

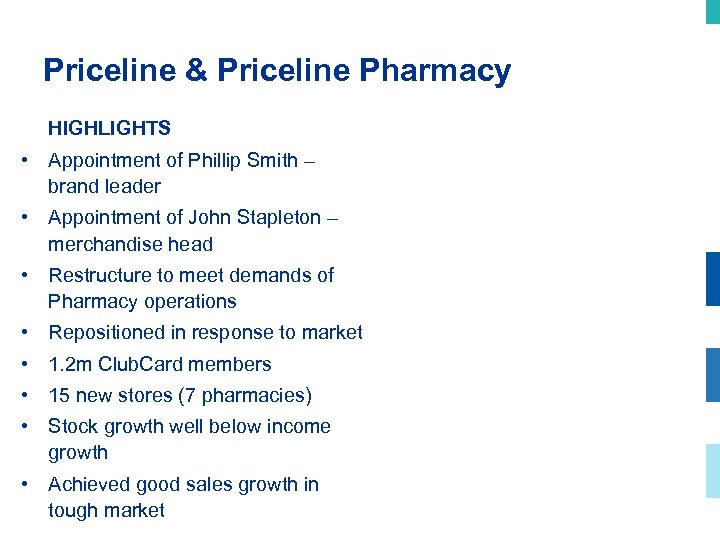

Priceline & Priceline Pharmacy HIGHLIGHTS • Appointment of Phillip Smith – brand leader • Appointment of John Stapleton – merchandise head • Restructure to meet demands of Pharmacy operations • Repositioned in response to market • 1. 2 m Club. Card members • 15 new stores (7 pharmacies) • Stock growth well below income growth • Achieved good sales growth in tough market

Priceline & Priceline Pharmacy HIGHLIGHTS • Appointment of Phillip Smith – brand leader • Appointment of John Stapleton – merchandise head • Restructure to meet demands of Pharmacy operations • Repositioned in response to market • 1. 2 m Club. Card members • 15 new stores (7 pharmacies) • Stock growth well below income growth • Achieved good sales growth in tough market

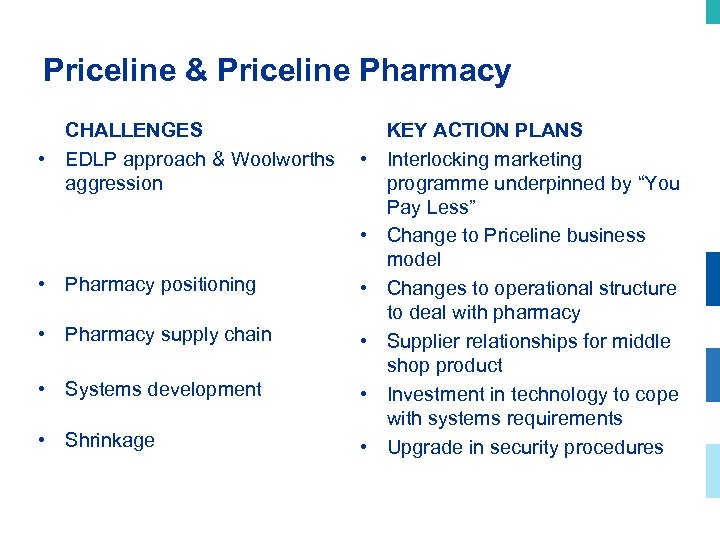

Priceline & Priceline Pharmacy CHALLENGES • EDLP approach & Woolworths aggression • • • Pharmacy positioning • • Pharmacy supply chain • • Systems development • • Shrinkage • KEY ACTION PLANS Interlocking marketing programme underpinned by “You Pay Less” Change to Priceline business model Changes to operational structure to deal with pharmacy Supplier relationships for middle shop product Investment in technology to cope with systems requirements Upgrade in security procedures

Priceline & Priceline Pharmacy CHALLENGES • EDLP approach & Woolworths aggression • • • Pharmacy positioning • • Pharmacy supply chain • • Systems development • • Shrinkage • KEY ACTION PLANS Interlocking marketing programme underpinned by “You Pay Less” Change to Priceline business model Changes to operational structure to deal with pharmacy Supplier relationships for middle shop product Investment in technology to cope with systems requirements Upgrade in security procedures

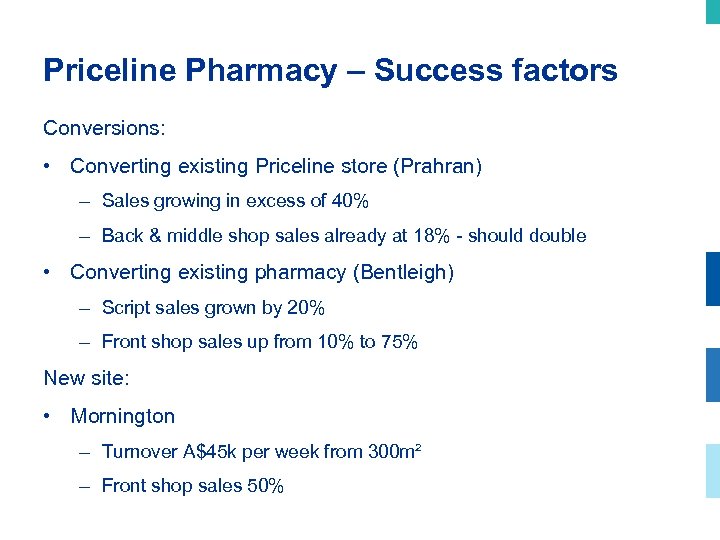

Priceline Pharmacy – Success factors Conversions: • Converting existing Priceline store (Prahran) – Sales growing in excess of 40% – Back & middle shop sales already at 18% - should double • Converting existing pharmacy (Bentleigh) – Script sales grown by 20% – Front shop sales up from 10% to 75% New site: • Mornington – Turnover A$45 k per week from 300 m² – Front shop sales 50%

Priceline Pharmacy – Success factors Conversions: • Converting existing Priceline store (Prahran) – Sales growing in excess of 40% – Back & middle shop sales already at 18% - should double • Converting existing pharmacy (Bentleigh) – Script sales grown by 20% – Front shop sales up from 10% to 75% New site: • Mornington – Turnover A$45 k per week from 300 m² – Front shop sales 50%

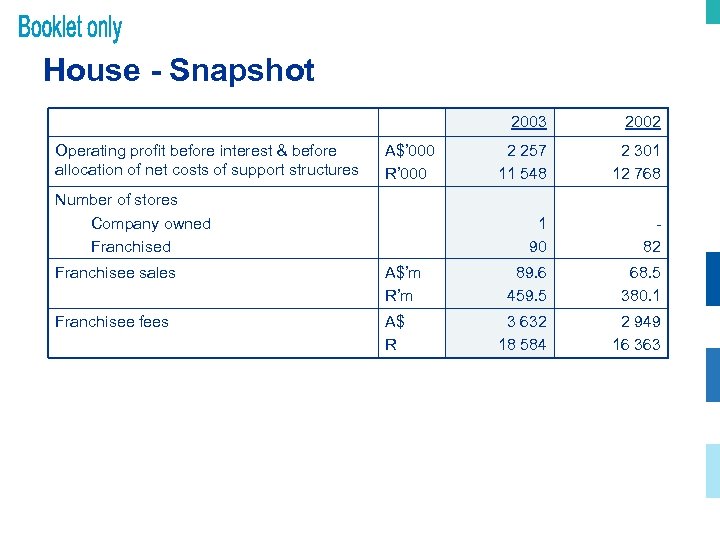

House - Snapshot 2003 Operating profit before interest & before allocation of net costs of support structures Number of stores Company owned Franchisee sales A$’m R’m Franchisee fees A$ R 2 257 11 548 2 301 12 768 1 90 A$’ 000 R’ 000 2002 82 89. 6 459. 5 68. 5 380. 1 3 632 18 584 2 949 16 363

House - Snapshot 2003 Operating profit before interest & before allocation of net costs of support structures Number of stores Company owned Franchisee sales A$’m R’m Franchisee fees A$ R 2 257 11 548 2 301 12 768 1 90 A$’ 000 R’ 000 2002 82 89. 6 459. 5 68. 5 380. 1 3 632 18 584 2 949 16 363

House • • • HIGHLIGHTS Brand Repositioning – Inspirational Homewares Appointment of Simon Dryden & a restructured brand team Developed a Local area marketing approach Developed strategic Supplier relationships enhancements to other income to follow Achieved 23% growth in Franchise fees Won National Award for Retail Excellence

House • • • HIGHLIGHTS Brand Repositioning – Inspirational Homewares Appointment of Simon Dryden & a restructured brand team Developed a Local area marketing approach Developed strategic Supplier relationships enhancements to other income to follow Achieved 23% growth in Franchise fees Won National Award for Retail Excellence

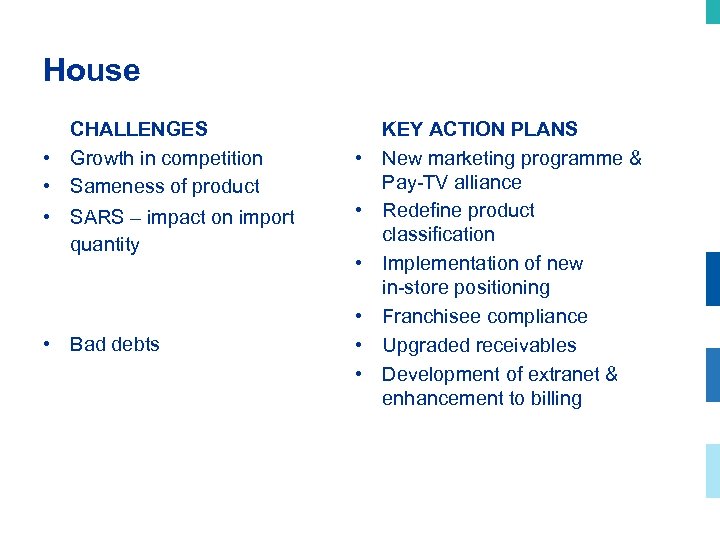

House CHALLENGES • Growth in competition • Sameness of product • SARS – impact on import quantity • Bad debts • • • KEY ACTION PLANS New marketing programme & Pay-TV alliance Redefine product classification Implementation of new in-store positioning Franchisee compliance Upgraded receivables Development of extranet & enhancement to billing

House CHALLENGES • Growth in competition • Sameness of product • SARS – impact on import quantity • Bad debts • • • KEY ACTION PLANS New marketing programme & Pay-TV alliance Redefine product classification Implementation of new in-store positioning Franchisee compliance Upgraded receivables Development of extranet & enhancement to billing

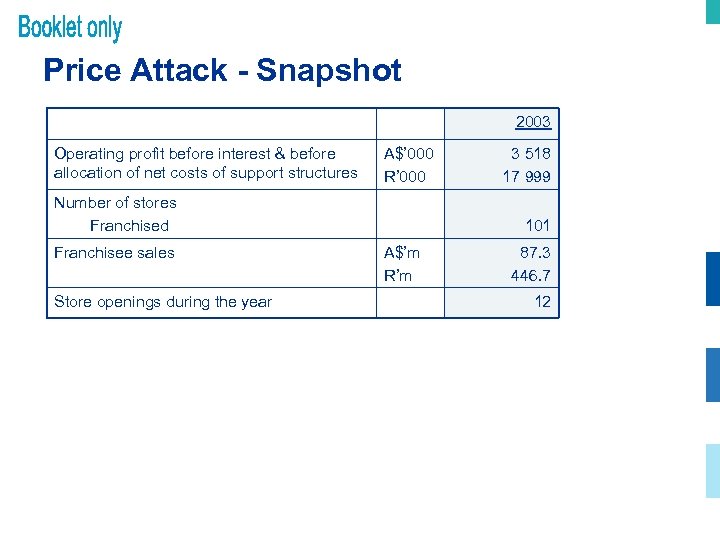

Price Attack - Snapshot 2003 Operating profit before interest & before allocation of net costs of support structures A$’ 000 R’ 000 Number of stores Franchised Franchisee sales Store openings during the year 3 518 17 999 101 A$’m R’m 87. 3 446. 7 12

Price Attack - Snapshot 2003 Operating profit before interest & before allocation of net costs of support structures A$’ 000 R’ 000 Number of stores Franchised Franchisee sales Store openings during the year 3 518 17 999 101 A$’m R’m 87. 3 446. 7 12

Price Attack • • • HIGHLIGHTS Successful integration into business Resolved all franchise agreements Appointed Carmelo Francese as the new brand leader Resolved Master Franchisee in Western Australia Adopted a Marketing focus Overcome supplier & franchisee scepticism

Price Attack • • • HIGHLIGHTS Successful integration into business Resolved all franchise agreements Appointed Carmelo Francese as the new brand leader Resolved Master Franchisee in Western Australia Adopted a Marketing focus Overcome supplier & franchisee scepticism

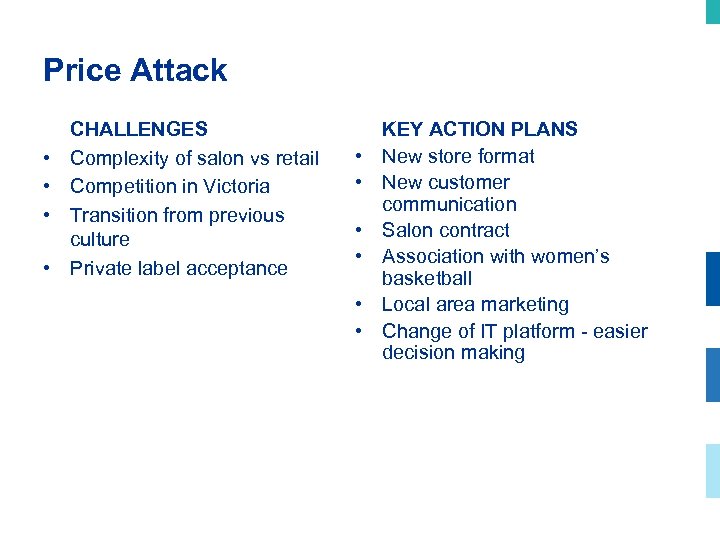

Price Attack • • CHALLENGES Complexity of salon vs retail Competition in Victoria Transition from previous culture Private label acceptance • • • KEY ACTION PLANS New store format New customer communication Salon contract Association with women’s basketball Local area marketing Change of IT platform - easier decision making

Price Attack • • CHALLENGES Complexity of salon vs retail Competition in Victoria Transition from previous culture Private label acceptance • • • KEY ACTION PLANS New store format New customer communication Salon contract Association with women’s basketball Local area marketing Change of IT platform - easier decision making

Shared Services • • • HIGHLIGHTS Store development & marketing services shift to nil cost Development of franchise skills JDA first phase completed Developed an Integrated IT pharmacy solution Realigned costs from the centre to brands • • CHALLENGES Moving from cost centre to profit generation Growth in staff numbers to deal with franchise capability Getting expense allocations right with diversity of business models Office accommodation

Shared Services • • • HIGHLIGHTS Store development & marketing services shift to nil cost Development of franchise skills JDA first phase completed Developed an Integrated IT pharmacy solution Realigned costs from the centre to brands • • CHALLENGES Moving from cost centre to profit generation Growth in staff numbers to deal with franchise capability Getting expense allocations right with diversity of business models Office accommodation

New Clicks Australia – The year ahead • Restructured – governance in place • No additional funding required – store sale methodology • Priceline positioning • Store growth in pharmacy • House marketing • Price Attack – Victoria solution • Systems development – Franchise • Enhance capability – reduce costs

New Clicks Australia – The year ahead • Restructured – governance in place • No additional funding required – store sale methodology • Priceline positioning • Store growth in pharmacy • House marketing • Price Attack – Victoria solution • Systems development – Franchise • Enhance capability – reduce costs