afd5ceaddecb8ba1118a45e4c66ddf08.ppt

- Количество слайдов: 100

Networks Economics Presentation for MBA Course Prof. Nicholas Economides Stern School of Business, New York University http: //www. stern. nyu. edu/networks/ and NET Institute http: //www. NETinst. org/ mailto: economides@stern. nyu. edu Copyright 2009

Network industries are a large part of the world economy and some are growing very fast n n n n n Telecommunications (data, voice) n Internet / world wide web Broadcasting (TV, radio) Cable television Financial networks n Credit and debit card networks n ATMs, bank networks; payment systems; check clearing houses n Financial exchanges (equities, bonds, derivatives) B 2 B, B 2 C exchanges Electricity Railroads Airlines Roads Virtual networks n Computer software and hardware n Information servers (yellow pages, Yahoo, Google, MSN) 2

A virtual network n is a collection of compatible goods/components that share a common technical platform. n n For example, all VHS video players make up a virtual network. Similarly, all computers running Windows can be thought of as a virtual network. Compatible computer software and hardware make up a “network, ” and so do computer operating systems and compatible applications. More generally, virtual networks are composed of complementary components, so they also encompass wholesale and retail networks, as well as information networks and servers such as telephone yellow pages, Yahoo, Google, etc.

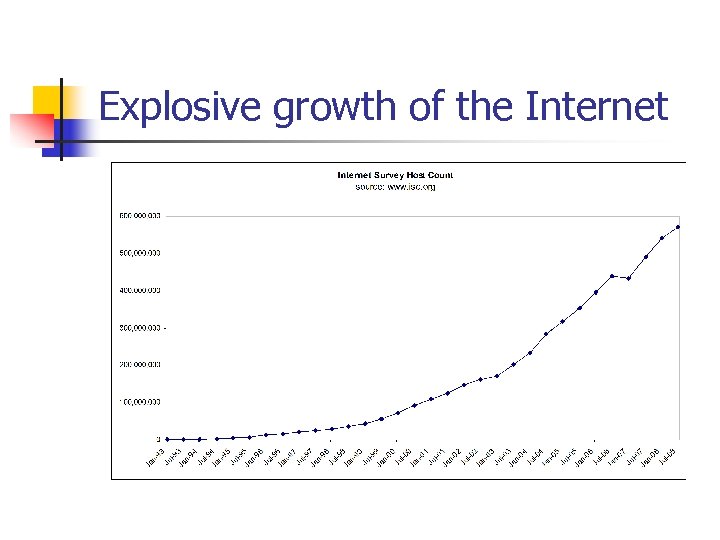

Explosive growth of the Internet

US lagging in Broadband

US has higher per capita income than 11 OECD countries with higher broadband penetration

n Network industries often provide necessities n provide infrastructure n are key to economic growth Network industries have special features n n 7

Is competition different in these industries? What are successful strategies for companies in markets and industries with network effects? Is there a special case for or against antitrust or competition policy scrutiny for network industries? What form should intervention take (if any)? n n n n Price controls Structural changes (breakups, divestitures, etc. ) Imposition of technical compatibility Regulation 8

Networks are composed of complementary nodes and links n n n The crucial defining feature of networks is the complementarity between the various nodes and links A service delivered over a network requires the use of two or more network components Thus, network components are complementary to each other

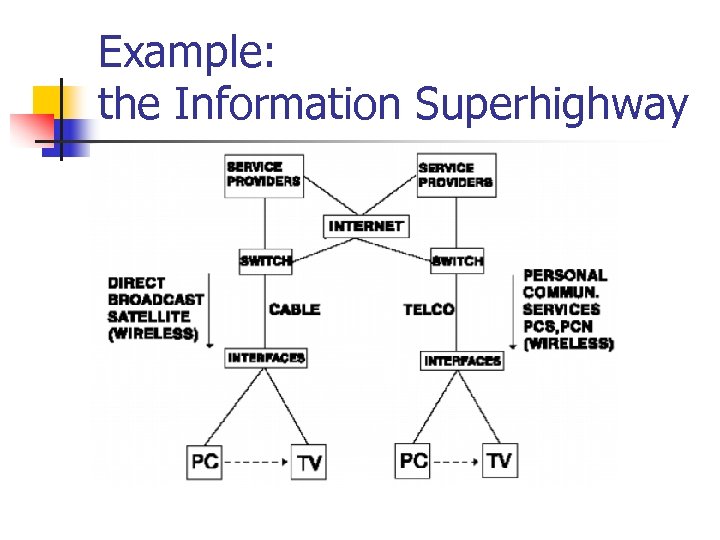

Example: the Information Superhighway

Special features of markets with network effects n n Increasing returns to scale in consumption (network effects) A market exhibits network effects when the value of an additional transaction is higher when more units change hands, everything else being equal 11

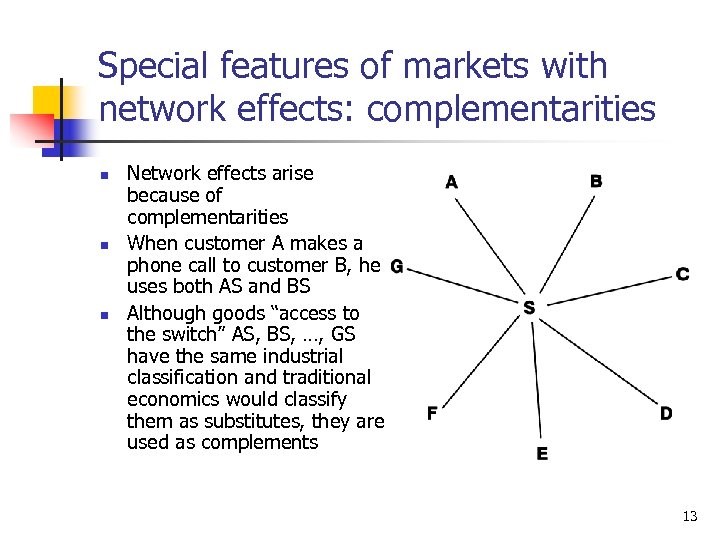

Special features of markets with network effects: complementarities n In a traditional network, network externalities arise because a typical subscriber can reach more subscribers in a larger network 12

Special features of markets with network effects: complementarities n n n Network effects arise because of complementarities When customer A makes a phone call to customer B, he uses both AS and BS Although goods “access to the switch” AS, BS, …, GS have the same industrial classification and traditional economics would classify them as substitutes, they are used as complements 13

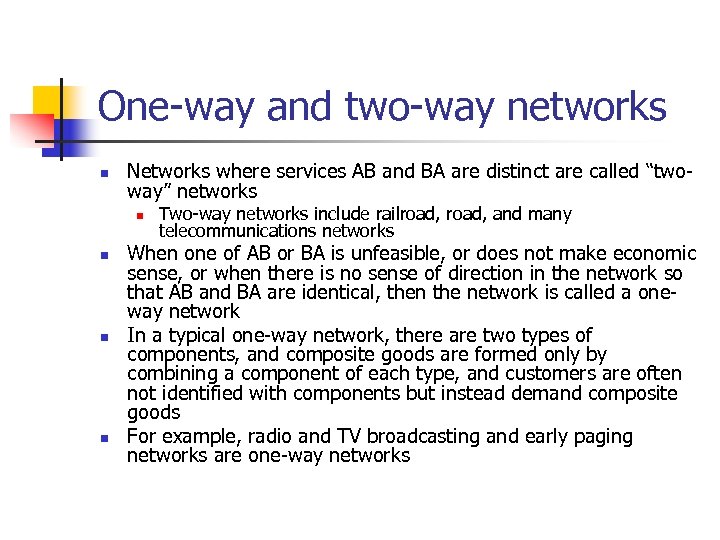

One-way and two-way networks n Networks where services AB and BA are distinct are called “twoway” networks n n Two-way networks include railroad, and many telecommunications networks When one of AB or BA is unfeasible, or does not make economic sense, or when there is no sense of direction in the network so that AB and BA are identical, then the network is called a oneway network In a typical one-way network, there are two types of components, and composite goods are formed only by combining a component of each type, and customers are often not identified with components but instead demand composite goods For example, radio and TV broadcasting and early paging networks are one-way networks

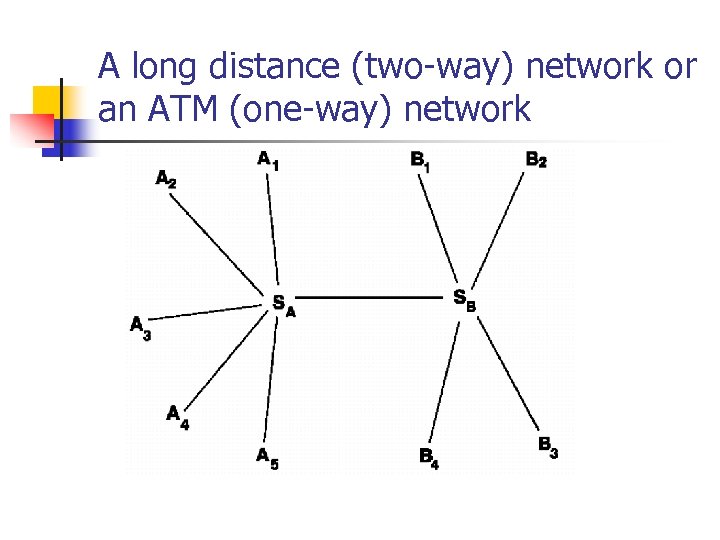

A long distance (two-way) network or an ATM (one-way) network

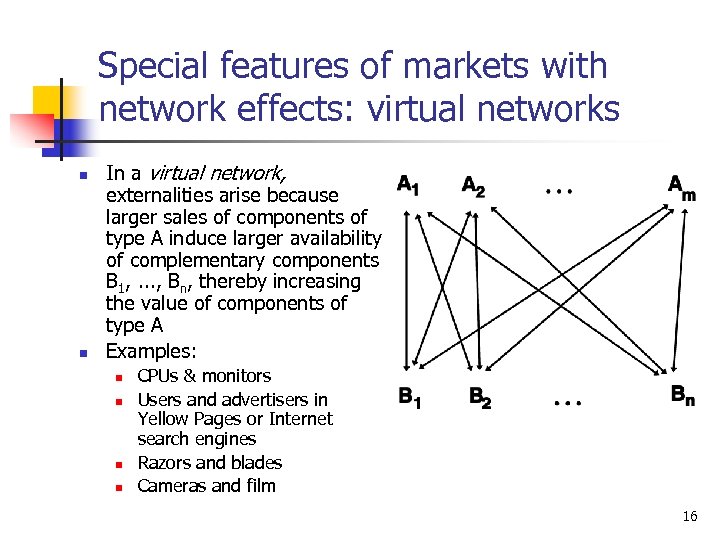

Special features of markets with network effects: virtual networks n n In a virtual network, externalities arise because larger sales of components of type A induce larger availability of complementary components B 1, . . . , Bn, thereby increasing the value of components of type A Examples: n n CPUs & monitors Users and advertisers in Yellow Pages or Internet search engines Razors and blades Cameras and film 16

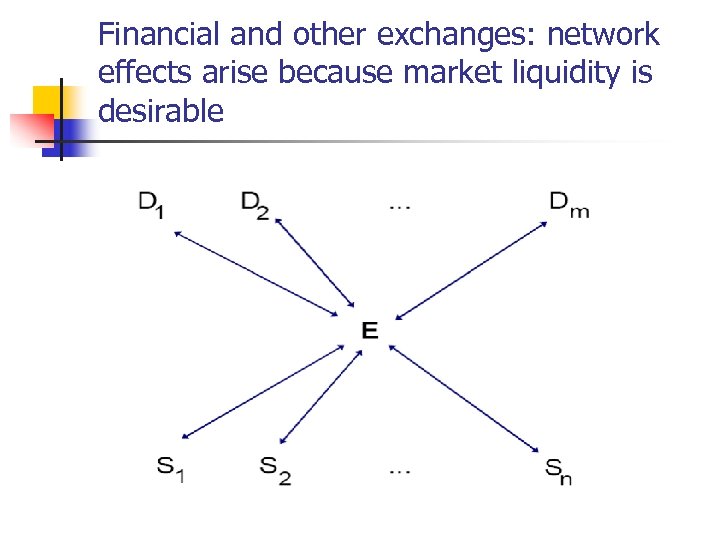

Financial and other exchanges: network effects arise because market liquidity is desirable

Technology platforms are the hubs of the value chains in technology industries n Examples of technology platforms: n n Microsoft Windows (PC operating systems) Intel processors (PC hardware) Sony Play. Station (game consoles) A platforms the framework on which complementary goods (applications) attach (run) 18

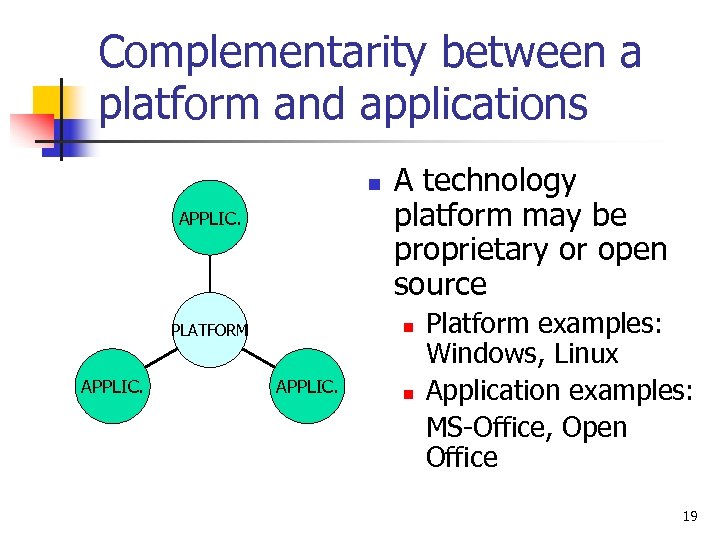

Complementarity between a platform and applications n APPLIC. n PLATFORM APPLIC. A technology platform may be proprietary or open source APPLIC. n Platform examples: Windows, Linux Application examples: MS-Office, Open Office 19

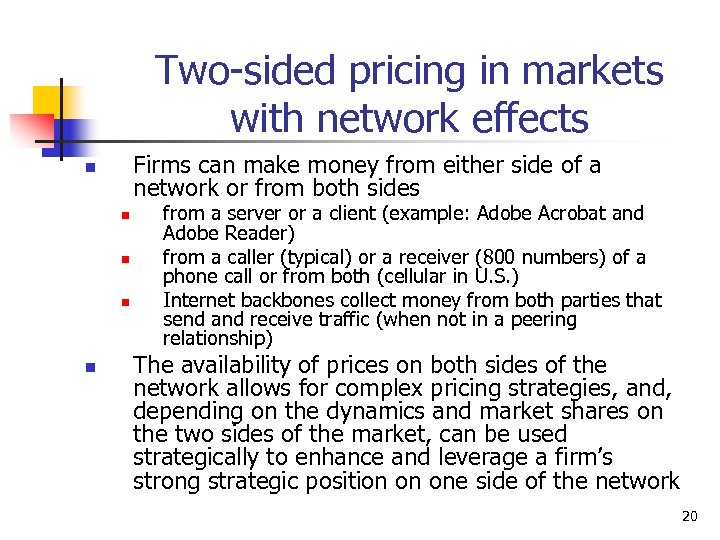

Two-sided pricing in markets with network effects Firms can make money from either side of a network or from both sides n n n from a server or a client (example: Adobe Acrobat and Adobe Reader) from a caller (typical) or a receiver (800 numbers) of a phone call or from both (cellular in U. S. ) Internet backbones collect money from both parties that send and receive traffic (when not in a peering relationship) The availability of prices on both sides of the network allows for complex pricing strategies, and, depending on the dynamics and market shares on the two sides of the market, can be used strategically to enhance and leverage a firm’s strong strategic position on one side of the network 20

In networks, price discrimination schemes can be complex (1) n n Because a network may have different degrees of market power on different sides of the market A firm that controls a proprietary platform n n sets a price strategically for its end-user products and collects a fee for complementary products to its platform sold by other firms Sony controlling its game console sets a price for the game console and charges royalties to developers of games Microsoft n n n sells Windows to end-users provides application developers with information and resources; embeds subroutines in Windows useful to application developers makes money from licensing application development tools and support 21

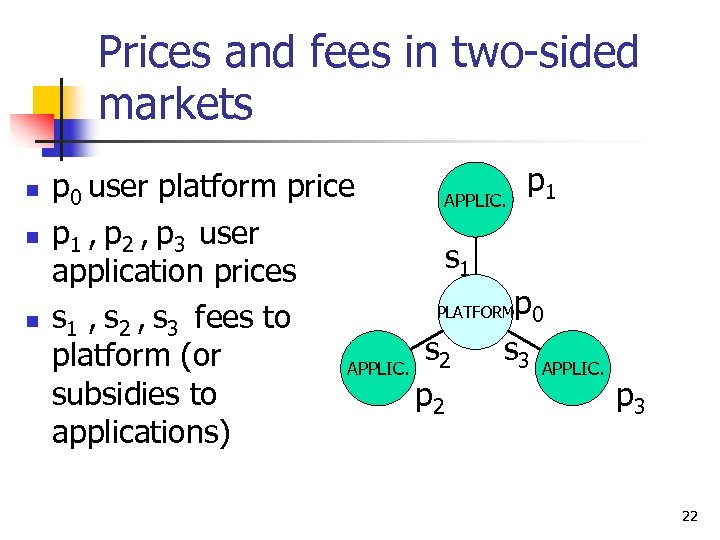

Prices and fees in two-sided markets n n n p 1 p 0 user platform price APPLIC. p 1 , p 2 , p 3 user s 1 application prices PLATFORMp 0 s 1 , s 2 , s 3 fees to s 2 s 3 APPLIC. platform (or APPLIC. subsidies to p 2 p 3 applications) 22

In networks, price discrimination schemes can be complex (2) n n Since the creation of the Internet, there was no price (or other) discrimination based on what service or what application the bits came from (so called “net neutrality”) Now AT&T, Verizon and cable TV networks advocate price discrimination based on which application and on which provider the bits come from AT&T, Verizon and cable TV networks propose to kill net neutrality by charging both the DSL subscriber and the application provider (such as Google) where the bits originate, even when the application provider is not directly connected to AT&T or Verizon (i. e. , Google’s ISP is not AT&T or Verizon) Note that the proposal is to impose price discrimination on the provider side of the market and not on the subscriber (i. e. , it is a version of two-sided pricing) 23

Why is technical standards competition important? n n n Because of network effects Network effects create inequality Competing standards can be marginalized

Technical standards competition n n VHS vs. Beta Windows vs. Mac vs. Linux MP 3 vs. WMA vs. Real. Audio HD DVD vs. Blu-Ray

Technical Compatibility n n when various links and nodes on the network can be costlessly combined to produce demanded goods Two complementary components A and B are compatible when they can be combined to produce a composite good or service n n Two substitute components A 1 and A 2 are compatible when each of them can be combined with a complementary good B to produce a composite good or service n n Example: we say that a VHS-format video player is compatible with a VHSformat tape Example: two VHS tapes are compatible; two VHS video players are compatible Similarly we say that two software products are compatible (more precisely two-way compatible) when they each can read and write files in a common format n n Compatibility may be one-way when the files of format B 1 of software A 1 can be read by software A 2 , but the files format B 2 of software A 2 cannot be read by software A 1 Moreover, compatibility may be only partial in the sense that software A 1 is able to read files of format B 2 but unable to write files in that format.

Complementarity and compatibility n n n Links on a network are potentially complementary, but it is compatibility that makes complementarity actual Some network goods and some vertically related goods are immediately combinable because of their inherent properties However, for many complex products, actual complementarity can be achieved only through the adherence to specific technical compatibility standards Thus, many providers of network or vertically-related goods have the option of making their products partially or fully incompatible with components produced by other firms This can be done through the creation of proprietary designs or the outright exclusion or refusal to interconnect with some firms As we will see, it is not always in the best interests of a firm to allow full compatibility of its products with those of its competitors

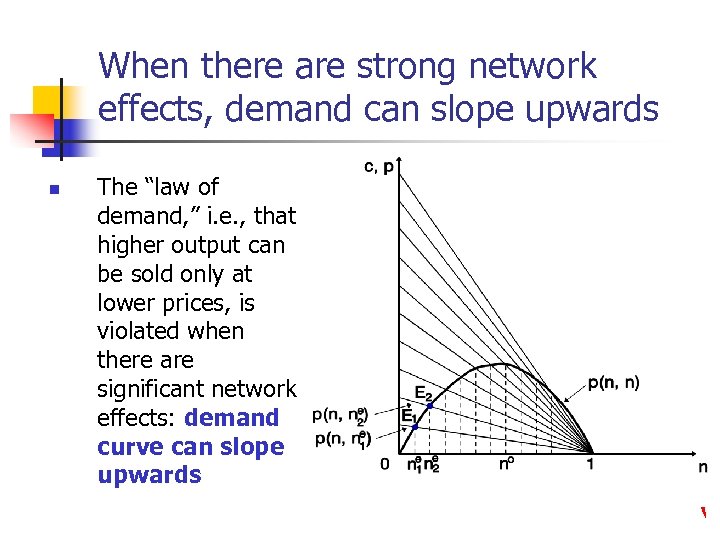

Sources of Network Effects (1) n In traditional non-network industries, the willingness to pay for the last unit of a good decreases with the number of units sold. n n This is called the law of demand, and is traditionally considered to hold for almost all goods However, the existence of network effects implies that, as more units are sold, the willingness to pay for the last unit may be higher This means that for network goods, the fundamental law of demand is violated: for network goods, some portions of the curve demand can slope upwards For some portions of the demand curve, as sales expand, people are willing to pay more for the last unit

Sources of Network Effects (2) n n The law of demand is still correct if one disregards the effects of the expansion of sales on complementary goods But, as increased sales of a network good imply an expansion in the sales of complementary goods, the value of the last unit increases Combining the traditional downward slopping effect with the positive effect due to network expansion can result in a demand curve that has an upwardslopping part The key reason for the appearance of network externalities is the complementarity between network components

Sources of Network Effects (3) n n n n Depending on the network, the network effect may be direct or indirect When customers are identified with components, the network effect is direct Consider for example a typical two-way network, such as the local telephone network In this n-nodes 2 -way network, there are n(n - 1) potential goods. An additional (n + 1 th) customer provides direct network effects to all other customers in the network by adding 2 n potential new goods through the provision of a complementary link to the existing links In typical one-way networks, the network effect is only indirect When there are m varieties of component A and n varieties of component B (and all A-type goods are compatible with all of Btype), there are mn potential composite goods An extra customer yields indirect network effects to other customers, by increasing the demand for components of types A and B

Sources of Network Effects (4) n n Exchange networks (financial networks such as the NYSE and NASDAQ, commodities, futures, and options exchanges as well as business to business “B 2 B” exchanges) also exhibit indirect network effects There are two ways in which these network effects arise: n n Network effects arise in the act of exchanging assets or goods Network effects may arise in the array of vertically related services that compose a financial transaction. n n n These include the services of a broker, bringing the offer to the floor, matching the offer, etc. The second type of network effects are similar to other vertically-related markets The first way in which network effects arise in financial markets is more important The act of exchanging goods or assets brings together a trader who is willing to sell with a trader who is willing to buy The exchange brings together the two complementary goods, “willingness to sell at price p” (the “offer”) and “willingness to buy at price p” (the “counteroffer”) and creates a composite good, the “exchange transaction”

Sources of Network Effects (5) n n n The two original goods were complementary and each had no value without the other one Clearly, the availability of the counteroffer is critical for the exchange to occur Put in terms commonly used in Finance, minimal liquidity is necessary for the transaction to occur Financial and business-to-business exchanges also exhibit positive size externalities in the sense that the increasing size (or thickness) of an exchange market increases the expected utility of all participants Higher participation of traders on both sides of the market (drawn from the same distribution) decreases the variance of the expected market price and increases the expected utility of risk-averse traders Higher liquidity increases traders’ utility

Network Effects Under Compatibility and Perfect Competition (1) n n Let the willingness to pay for the nth unit of the good when ne units are expected to be sold be p(n; n) n and ne are normalized so that they represent market coverage, ranging from 0 to 1, rather than absolute quantities Willingness to pay p(n; ne) is a decreasing function of n because the demand slopes downward p(n; ne) increases in ne; this captures the network externalities effect, i. e. , that the good is more valuable when the expected sales ne are higher

Network Effects Under Compatibility and Perfect Competition (2) n n n At a market equilibrium of the simple single-period world, expectations are fulfilled, n = ne, thus defining the fulfilled expectations demand p(n, n) Each willingness-to-pay curve p(n, nie), i = 1, 2, . . . , shows the willingness to pay for a varying quantity n, given an expectation of sales ne = nie. At n = nie, expectations are fulfilled and the point belongs to p(n, n) as p(nie, nie) Thus p(n, n) is constructed as a collection of points p(nie, nie)

When there are strong network effects, demand can slope upwards n The “law of demand, ” i. e. , that higher output can be sold only at lower prices, is violated when there are significant network effects: demand curve can slope upwards

Economides and Himmelberg (1995) show that n the fulfilled expectations demand is increasing for small n if either one of three conditions hold: n n n (i) the utility of every consumer in a network of zero size is zero; or (ii) there are immediate and large external benefits to network expansion for very small networks; or (iii) there is a significant number of high-willingness-to-pay consumers who are just indifferent on joining a network of approximately zero size The first condition is straightforward and applies directly to all two-way networks, such as the telecommunications and fax networks where the good has no value unless there is another user to connect to The other two conditions are a bit more subtle, but commonly observed in networks and vertically-related industries

n The secondition holds for networks where the addition of even few users increases significantly the value of the network n n A good example of this is a newsgroup on an obscure subject, where the addition of very few users starts a discussion and increases significantly its value The third condition is most common in software markets n n n A software application has value to a user even if no one else uses it The addition of an extra user has a network benefit to other users (because they can share files or find trained workers in the specifics of the application), but this benefit is small However, when large numbers of users are added, the network benefit can be very significant

Critical Mass n n n When the fulfilled expectations demand increases for small n, we say that the network exhibits a positive critical mass under perfect competition. If we imagine a constant marginal cost c decreasing as technology improves, the network will start at a positive and significant size no (corresponding to marginal cost co) For each smaller marginal cost, c < co, there are three network sizes consistent with marginal cost pricing: n n n a zero size network; an unstable network size at the first intersection of the horizontal through c with p(n, n); and the Pareto optimal stable network size at the largest intersection of the horizontal with p(n, n)

Multiplicity of Equilibria n n n The multiplicity of equilibria is a direct result of the coordination problem that arises naturally in the typical network externalities model The existence of an upward slopping part of the demand curve and the multiplicity of equilibria even under perfect competition also allows for a network to start with a small size and then expand significantly Suppose, for example, that marginal cost is at c < co and a new invention creates a new product with significant network effects Then, it is possible that the industry starts at the left intersection of the horizontal at c with p(n, n) as expectations are originally low, and later on advances suddenly and quickly to the right intersection of the horizontal at c with p(n, n) Thus, the multiplicity of equilibria in network industries can lead to sudden significant expansions of network size

Efficiency (1) n n n In the presence of network externalities, it is evident that perfect competition is inefficient The marginal social benefit of network expansion is larger than the benefit that accrues to a particular firm under perfect competition Perfect competition will provide a smaller network than is socially optimal, and, for some relatively high marginal costs, perfect competition will not provide the good while it is socially optimal to provide it

Efficiency (2) n Since perfect competition is inefficient, state subsidization of network industries is beneficial to society n n The Internet is a very successful network that was subsidized by the US government for many years The subsidized Internet was aimed at promoting interaction among military research projects During the period of its subsidization, almost no one imagined that the Internet would become a ubiquitous commercial network The foundation of the Internet on publicly and freely available standards has facilitated its expansion and provided a guarantee that no firm can dominate it

Complex pricing: externalities internalized or not? n Often the additional subscriber/user is not rewarded for the benefit that he/she brings to others by subscribing n n Hence there may be “externalities, ” i. e. , benefits not fully intermediated by the market In some cases, externalities are fully intermediated through non-linear pricing n n Example: Cantor Fitzgerald pricing towards Salomon Brothers in secondary U. S. bonds market (before 2001) Typical trader paid $20 per $1 million face value Salomon paid $1 per $1 million face value plus a fixed fee Why? Salomon brought immense liquidity to the secondary market because it controlled 40% of the primary market 42

Market penetration of innovations is much faster in network industries than in non-network industries Penetration time Diffusion of an innovation with and without network effects 43

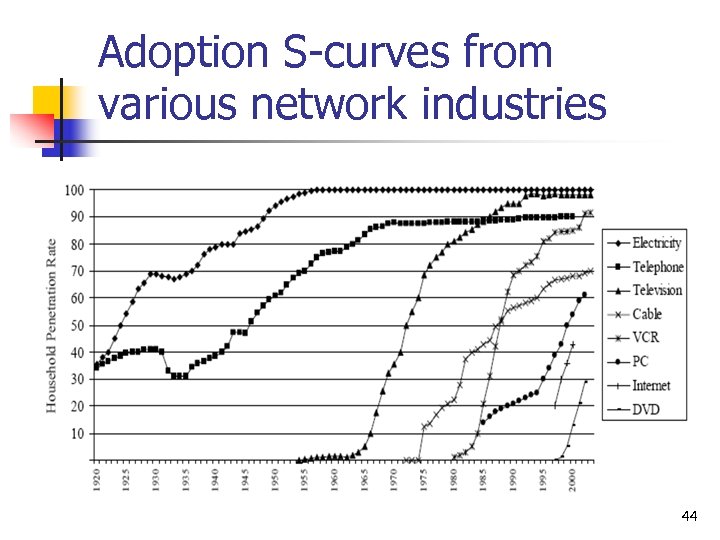

Adoption S-curves from various network industries 44

Dichotomy in markets with network effects (1) n Full compatibility networks n n n Voice telecommunications (by regulation) Internet data communications (by design) Fax (by design) Cars and gasoline (by market evolution) Tables and chairs (by market evolution) 45

Dichotomy in markets with network effects (2) n Incompatible networks n n n n Operating Systems for PCs (Windows, Mac OS X, Linux) Game platforms (Xbox, Sony, Nintendo) Digital audio formats (i. Pod, Windows Media Player “WMA, ” MP 3, Real. Audio) High definition DVDs (HD-DVD, Blu-ray) Video players (Betamax, VHS) Information servers (Google, MSN, Yahoo, yellow pages) Exchanges 46

Path-dependence is the dependence of a system or network on past decisions of producers and consumers Today’s sales of Windows are path-dependent because they depend on the number of Windows sold earlier (the installed base Windows). The existence of an installed base of consumers favors an incumbent However, competitors with significant product advantages or a better pricing strategy can overcome the advantage of an installed base Example: VHS overcame Beta after six years of higher installed base by Beta n n n n Sony’s mistakes in disregarding network externalities and not licensing the Beta format JVC’s widespread cheap licensing of VHS A low-end, low-price VHS player can contribute as much to the network effect as a high-end high-price Beta player 47

Strategic Choices of Technical Standards and Compatibility In Network Industries n n n Standards Wars (1) A key strategic decision for a firm is the extent to which it will be compatible with other firms A network good has higher value because of the existence of network effects n n Different firms conforming to the same technical standard can create a larger network effect while still competing with each other in other dimensions (such as quality and price) The decision to conform to the same technical standard is a strategic one n n A firm can choose to be compatible with a rival and thereby create a larger network effect and share it with the rival. A firm could alternatively choose to be incompatible with the rival, but keep all the network effects it creates to itself

Standards Wars (2) n 1. 2. 3. 4. 5. Which way the decision will go depends on a number of factors: In some network industries, such as telecommunications, interconnection and compatibility at the level of voice and low capacity data transmission is mandated by law The decision will depend on the expertise that a firm has on a particular standard (and therefore on the costs that it would incur to conform to it) The choice on compatibility will depend on the relative benefit of keeping all the network effects to itself by choosing incompatibility versus receiving half of the larger network benefits by choosing compatibility. The choice on compatibility depends on the ability of a firm to sustain a dominant position in an ensuing standards war if incompatibility is chosen The compatibility choice depends on the ability of firms to leverage any monopoly power that they manage to attain in a regime of incompatibility to new markets.

Standards Wars (3) n n n Standards may be defined by the government (as in the case of the beginning of the Internet), a world engineering body (as in the case of the FAX), an industry-wide committee, or just sponsored by one or more firms Even when industry-wide committees are available, firms have been known to introduce and sponsor their own standards Incentives of firms to choose to be compatible with others; coordination game

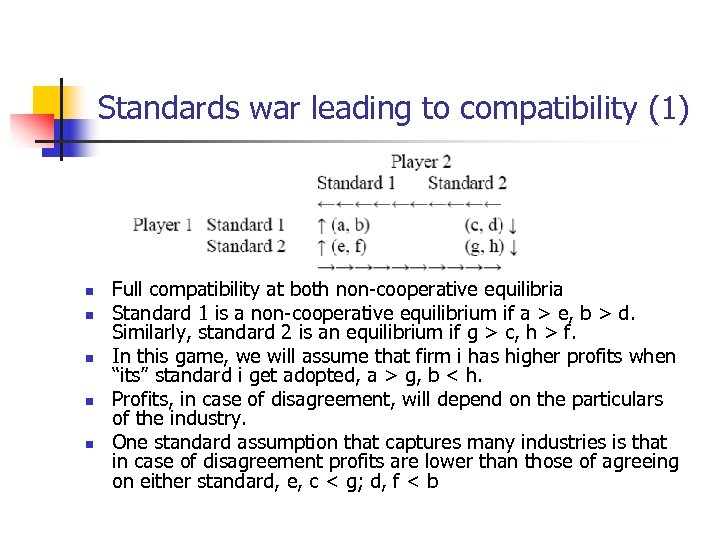

Standards war leading to compatibility (1) n n n Full compatibility at both non-cooperative equilibria Standard 1 is a non-cooperative equilibrium if a > e, b > d. Similarly, standard 2 is an equilibrium if g > c, h > f. In this game, we will assume that firm i has higher profits when “its” standard i get adopted, a > g, b < h. Profits, in case of disagreement, will depend on the particulars of the industry. One standard assumption that captures many industries is that in case of disagreement profits are lower than those of agreeing on either standard, e, c < g; d, f < b

Standards war leading to compatibility (2) n n There is no guarantee that the highest joint profit standard will be adopted Since consumers surplus does not appear in the matrix, there is no guarantee of profit maximization at equilibrium

Standards war leading to incompatibility n n n n Compatibility with competitors brings higher network externality benefits (“network effect”) and therefore is desirable. At the same time, compatibility makes product X a closer substitute to competing products (“competition effect”), and it is therefore undesirable. In making a choice on compatibility, a firm has to balance these opposing incentives. Firms want to differentiate their products because they want to avoid intense competition. In a network industry, the traditional decisions of output and price take special importance since higher output Inequality in market shares and profitability is a natural consequence of incompatibility Under incompatibility, network externalities act as a quality feature that differentiates the products

Markets with strong network effects where firms can choose to be incompatible are “winner-takes-most” markets In these markets, there is extreme market shares and profits inequality The market share of the largest firm can be a multiple of the market share of the second largest, the second largest firm’s market share can be a multiple of the market share of the third, and so on n Example: 66%, 22%, 7%, 2. 5%, 1%, … Geometric sequence of market shares implies that, even for small n, the nth firm’s market share is tiny n n Examples: PC operating systems market; software applications markets Why? A firm with a large market share has more complementary goods and therefore its good is more valuable to consumers Why “winner-takes-most” and not “winner-takes-all”? n n n Because to “take all” requires an undesirable cut in price 54

“Winner-takes-most” markets n n n n When fixed costs are small, a very large number of firms can survive, but there is tremendous inequality in market shares, prices, and profits among them Examples of this market structure are the PC operating systems market and many software applications markets Setup of Economides and Flyer (1998) All firms produce identical products, except for what quality is added to them by network externalities No firm has any technical advantage in production over any other with respect to any particular platform and no production costs “Pure network goods” where there is no value to the good in the absence of network externalities Consumers are differentiated in their willingness to pay for the network good

With network effects, natural inequality: “winner-takes-most” Markets for incompatible products have inequality n n n n Hits in blogs Hits in Internet engines Market share of firms in traditional Yellow pages Size distribution of connections of Internet hosts Because of natural inequality in the market structure of network industries, there should be no presumption that anti-competitive actions are responsible for the creation of market share inequality or very high profitability of a top firm No anti-competitive acts are necessary to create this inequality 56

Profits inequality and network effects k = value of the good with no network effects

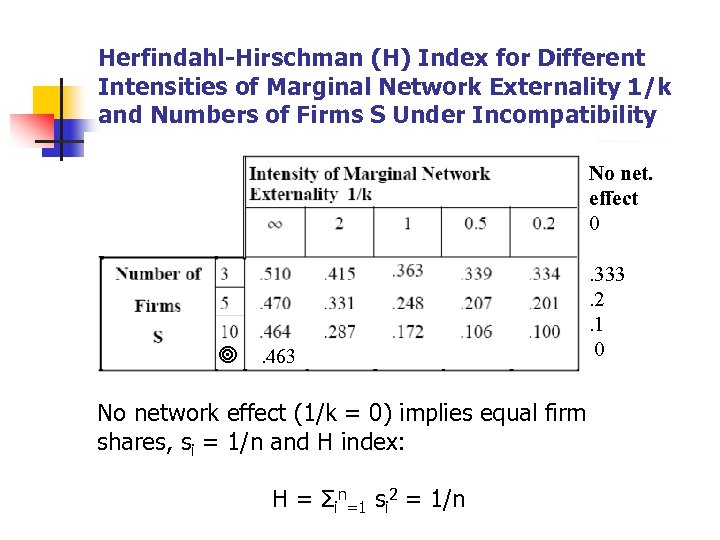

Herfindahl-Hirschman (H) Index for Different Intensities of Marginal Network Externality 1/k and Numbers of Firms S Under Incompatibility No net. effect 0 . 463 No network effect (1/k = 0) implies equal firm shares, si = 1/n and H index: H = Σin=1 si 2 = 1/n . 333. 2. 1 0

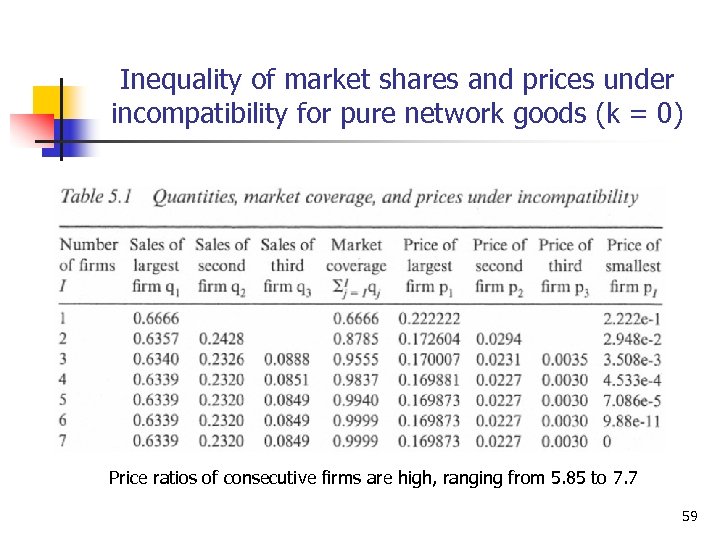

Inequality of market shares and prices under incompatibility for pure network goods (k = 0) Price ratios of consecutive firms are high, ranging from 5. 85 to 7. 7 59

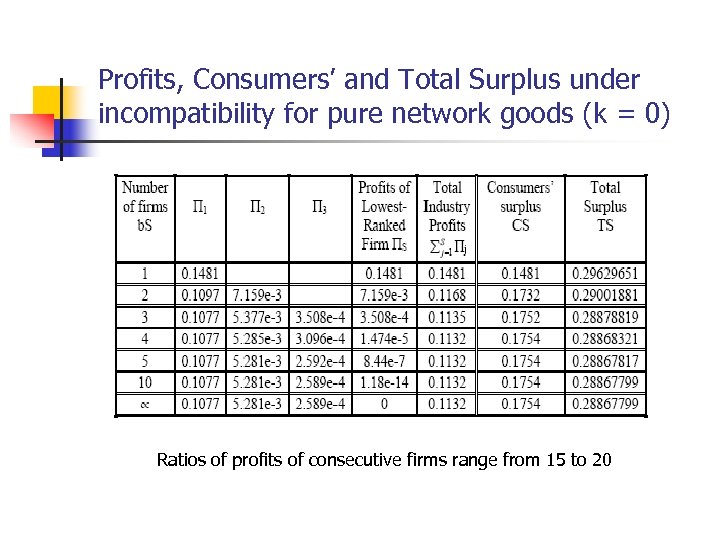

Profits, Consumers’ and Total Surplus under incompatibility for pure network goods (k = 0) Ratios of profits of consecutive firms range from 15 to 20

Monopoly Maximize Total Surplus (1) n n When here are fewer firms in the market there is more coordination and the network effects are larger As the number of firms decreases, the positive network effects increase more than the dead weight loss, so that total surplus is maximized in a monopoly! Total surplus is highest while consumers’ surplus is lowest in a monopoly This poses an interesting dilemma for antitrust authorities n n n Should they intervene or not? In non-network industries, typically both consumers’ and total surplus are lowest in a monopoly In this network model, total maximizing consumer’s surplus would imply minimizing total surplus

No Anti-Competitive Acts are Necessary to Create Market Inequality n n n In network industries, free entry does not lead to perfect competition Antitrust and competition law have placed a tremendous amount of hope on the ability of free entry to spur competition, reduce prices, and ultimately eliminate profits In network industries, free entry brings into the industry an infinity of firms but it fails miserably to reduce inequality in market shares, prices and profits Entry does not eliminate the profits of the high production firms Imposing a “competitive” market structure is likely to be counterproductive

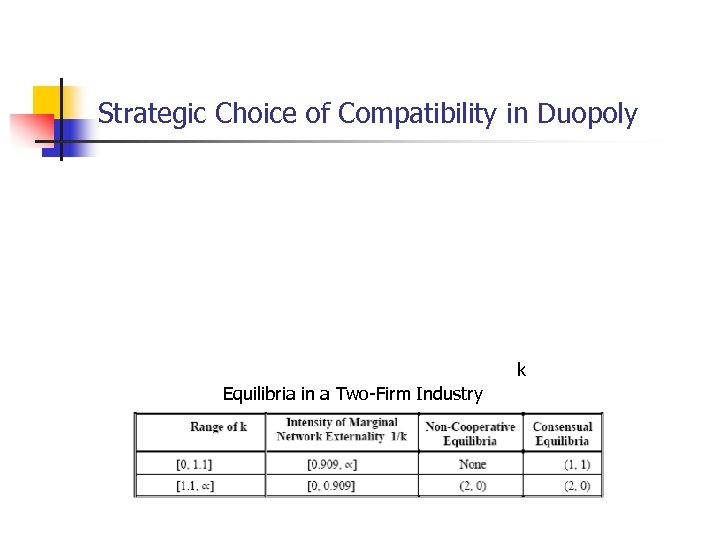

Strategic Choice of Compatibility in Duopoly k Equilibria in a Two-Firm Industry

Competition for the market takes precedence over competition in the market Intense competition on which firm will create the top platform and reap most of the benefits Example: Schumpeterian races for market dominance among dot-coms in 1999 -2000 n n Very high valuation of dominant vs. other dotcom firms in that period; Wall Street perception Strategic effect: firms advertised very intensely and subsidized consumers to achieve a dominant position 64

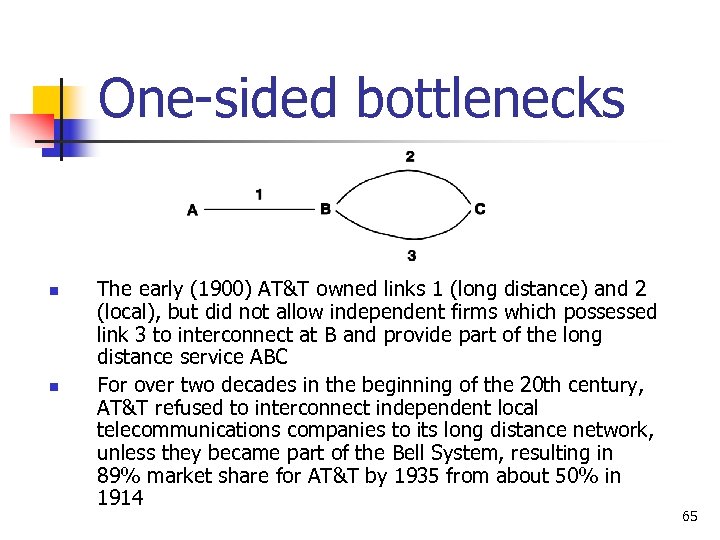

One-sided bottlenecks n n The early (1900) AT&T owned links 1 (long distance) and 2 (local), but did not allow independent firms which possessed link 3 to interconnect at B and provide part of the long distance service ABC For over two decades in the beginning of the 20 th century, AT&T refused to interconnect independent local telecommunications companies to its long distance network, unless they became part of the Bell System, resulting in 89% market share for AT&T by 1935 from about 50% in 1914 65

Leveraging of market power across markets n n Various types of exclusionary arrangements Instruments: n n n Technical standards Bundling and other pricing strategies Non-price discrimination strategies (raising rivals’ costs) 66

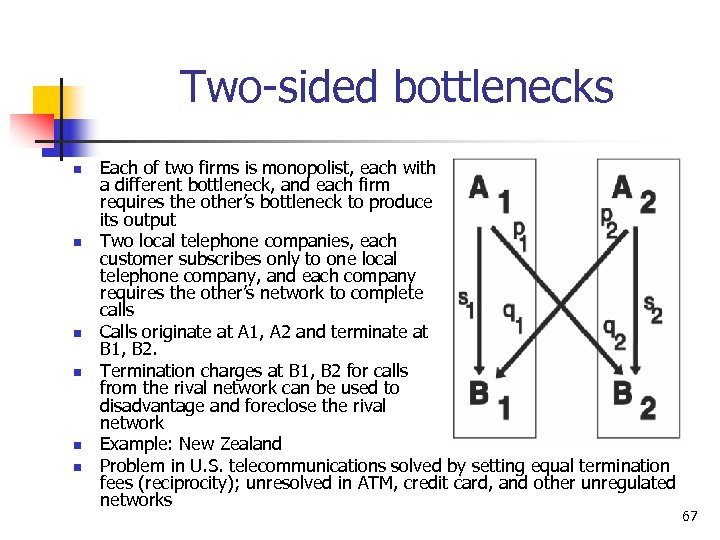

Two-sided bottlenecks n n n Each of two firms is monopolist, each with a different bottleneck, and each firm requires the other’s bottleneck to produce its output Two local telephone companies, each customer subscribes only to one local telephone company, and each company requires the other’s network to complete calls Calls originate at A 1, A 2 and terminate at B 1, B 2. Termination charges at B 1, B 2 for calls from the rival network can be used to disadvantage and foreclose the rival network Example: New Zealand Problem in U. S. telecommunications solved by setting equal termination fees (reciprocity); unresolved in ATM, credit card, and other unregulated networks 67

Limited effects of antitrust policy n n n In markets with strong network effects, once few firms are in operation, the addition of new competitors, even under free entry, does not change the market structure in any significant way Although eliminating barriers to entry can encourage competition, the resulting competition may not significantly affect market structure In markets with strong network effects, antitrust authorities may not be able to significantly affect market structure by eliminating barriers to entry 68

Leveraging Example n n n In the middle 1980 s Nintendo refused to allow third party games (software) to play on its game console (hardware) unless the software manufacturers agreed not to write a similar game for two years for competing game systems Nintendo used the dominance of the game market at the time to coerce developers to write software just for its platform, and thereby to increase the value of the Nintendo virtual network (of hardware and software) Practice stopped under threat from DOJ 69

n n Issues in “after-markets” where consumers are “locked-in” in a durable good or service arises out of commitments of durable nature Examples n n n refusal of Kodak to supply to repair companies replacement parts for Kodak photocopiers lack of email address portability for ISPs lack of number portability for wireless phones long after it was feasible 70

Example from computing industry: subsidizing complementary goods n n Firm A chooses to make its product incompatible with others Firm A subsidizes firms that produce complementary goods Alternatively, firm A subsidizes its division that sells complementary goods As a result n n n The value of firm A’s product increase The entry hurdle of firm A’s rivals increases Possible creation of market power, but action also has procompetitive justification 71

Impose compatibility? n n n Incompatibility is a necessary condition for possible creation of market power Key to increasing social welfare: public standards, compatibility But, it is very difficult for US antitrust authorities to intervene and/or define standards Different in the EU which is trying to impose compatibility between Microsoft and Sun servers (MS and Linux servers are compatible) Imposing compatibility may reduce incentives to innovate The “dynamically incorrect” standard may be chosen n n If forced to choose a single standard, the FCC would have chosen TDMA or GSM at the first PCS auctions CDMA proved more efficient later on 72

Dynamic efficiency issues n n n Static efficiency may lack in dynamic efficiency Possibility of a lock-in to a technology which, when decisions taken in every period, looks optimal given past decisions, but is sub-optimal if decisions are delayed and all the decisions are taken at once Lock-in may occur as a consequence of the race to be a dominant firm in a network industry 73

Innovation issues n Efficiency and intensity of innovation in monopoly compared to competition and oligopoly is an open question in economics 74

When should regulation be used? n n n Regulation it is best suited for industries with well defined and not changing products and services Regulation is not well suited in industries with rapid technological change and frequently changing product definitions Regulation can be used by the regulated companies to keep prices relatively high, as exemplified by telecommunications regulation Often regulators are very close to the interests of the regulated parties rather than to the interests of the public Often regulators are not well informed about key variables as well as changes in the industry 75

When should regulation be used? n n Regulators at both the state and federal levels are under pressure and influence by both the executive and the legislative part of government, and cannot be as impartial as a court There is a tendency for regulators to expand their reach into related and new markets These drawbacks can create significant surplus loss due to regulation However, regulatory rules can and should be used effectively and appropriately in cases of dominance or monopolization of essential network bottlenecks to assure n n that firms do not leverage their monopoly to adjacent markets that prices are not too high 76

Companies’ strategies that were successful in network industries 1. Vertical extension of the company 2. Discount pricing based on volume to take advantage of network effects 3. Discount pricing based on volume to take advantage of dominant position and disadvantage competitors 4. Subsidizing complementary goods 5. Control of bottlenecks 6. Exclusive contracts 77

1. Vertical extension of the company n n n Example: Microsoft 92% market share in operating systems for PCs Over time, it added functions to the OS that used to be independent applications or middleware: n n n Browser Windows Media Player Hard disk defragmenter Anti-spyware Anti-virus But MS does not go in hardware in PCs; is aware of its core competency 78

Advantages of extending the firm vertically n Offensive advantage n n Takes away value from complementary goods and adds value to own product Defensive advantage n Avoids complementary goods firms creating a challenge to own product n Netscape browser + Java might challenge Windows 79

Disadvantages of extending the firm vertically n Strategy may be illegal as in the Microsoft cases in the US and EU n n But strategy very likely legal if market share is below 50% Vertical extension could distract from the core competency of the firm 80

Success? Very successful against Netscape n But, so-and-so in audio players 81

2. Discount pricing based on volume to take advantage of network effects n n Example: Cantor Fitzgerald in the secondary market for US government bonds; had 70+% share Offered per unit pricing very significantly above marginal cost to all traders except Salomon Brothers Salomon was offered marginal cost pricing plus a fixed fee Why? To get the very high liquidity of Salomon that had 40+% in primary market 82

Success? n n n Very successful for Cantor Kept dominant position despite an inefficient trading platform Primary dealers had to set up their own exchanges as a threat to constrain the per-unit pricing of Cantor 83

3. Discount pricing based on volume to take advantage of dominant position and disadvantage competitors n n n Example: Microsoft’s “per processor” pricing before 1995 Offered Windows at a per unit price, say $30 Also offered Windows to a PC manufacturer, say Compaq, that produced say 1 mil. units, at a flat price of $24 mil. with the right to install in all units For Compaq, the last 200, 000 units effectively had zero price Compaq had a strong incentive not to buy from competitors 84

Advantages n n When marginal cost is very low, this strategy can rapidly increase market share (as it did for Microsoft) Great success for Microsoft that marginalized DOS competitor DR-DOS and increased the market share of Windows computers to 90+% 85

Disadvantages n n n The strategy is likely illegal for a dominant firm in the US and EU In 1995 (before the big antitrust suit) Microsoft agreed with USDOJ to stop using this strategy But, it is probably a legal strategy for non-dominant firms 86

4. Subsidizing complementary goods n n n Example: Microsoft It chooses to make its product (OS) incompatible with others It subsidizes firms that produce complementary goods (by including in Windows features that are useful to application developers but not to users) Alternatively, MS subsidizes its division that sells complementary goods (Office) As a result n n The value of MS’s product increases The entry hurdle of MS’s rivals increases 87

Advantages of subsidizing complementary goods n Offensive advantage n n Defensive advantage n n The value of own product increases The entry hurdle of rivals increases It can make a platform dominant Huge mistake of Apple not to adopt this strategy when Bill Gates pushed Apple to adopt it (before the creation of Windows) Refusal by Apple prompted MS to create Windows and made MS the key player in PCs 88

Disadvantages of subsidizing complementary goods n n It costs money that may not be recoverable for some time However, as Microsoft showed, subsidizing complementary goods can create dominance in the long run with very large benefits 89

5. Control of bottlenecks n n n Is crucial for creation and maintenance of dominant market position Sometimes innovation can eliminate the bottleneck Example: software services can eliminate the bottleneck of OSs 90

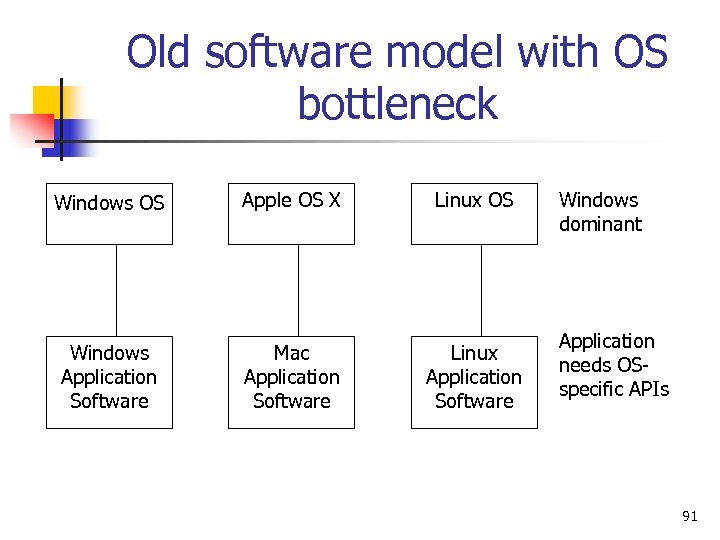

Old software model with OS bottleneck Windows OS Apple OS X Linux OS Windows Application Software Mac Application Software Linux Application Software Windows dominant Application needs OSspecific APIs 91

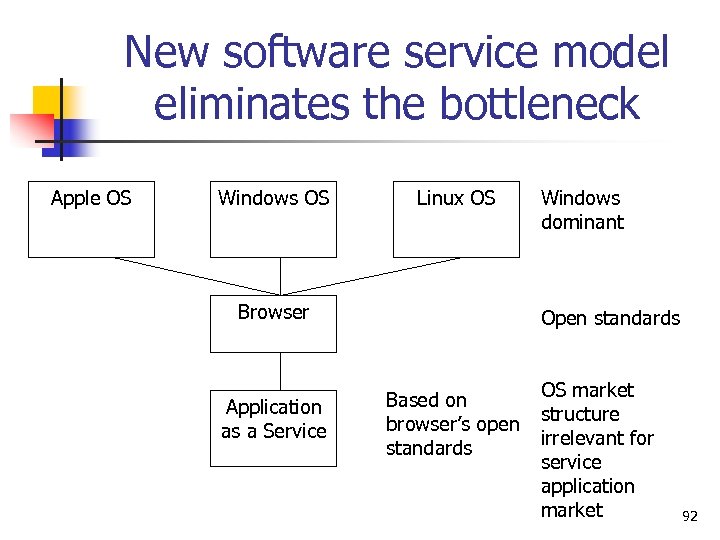

New software service model eliminates the bottleneck Apple OS Windows OS Linux OS Browser Application as a Service Windows dominant Open standards Based on browser’s open standards OS market structure irrelevant for service application market 92

6. Exclusive contracts n n n Example: Microsoft Exclusive contracts with AOL and other ISPs on adoption of Internet Explorer Successful but illegal for a dominant firm 93

Some Big Upheavals in Network Industries 1. 2. 3. 4. 5. Google in Internet search/advertising i. Pod big success in digital audio VHS killing Betamax Internet Explorer displacing Netscape Alternating current displacing direct current in electricity 94

Being first is no guarantee of long run success n Examples n Google in Internet search n n Arrived very late Used a different algorithm for search Based its revenue on advertising Apple’s i. Pod n n n Also arrived very late Hardware-software combination More liberal contract on legal copies (at the time) 95

Betamax/VHS: Sony’s strategic error n VHS video recorder (JVC/Matsushita) n n n Came later than Betamax (Sony) Was widely licensed; low price Betamax was not widely licensed; high price Much bigger network effects of VHS After 5 years, Betamax withdraws from the USA Strategic error of Sony n n n Originally video recorders were used for timeshifting (like Tivo) – there were no network effects Only later movies for rental appeared -- crucial complementary good creating network effects Sony’s managers missed the transition … 96

Internet Explorer displaces Netscape n n Originally Netscape (based on Mosaic of the Univ. of Illinois) was dominant with 90+% market share Microsoft makes a huge effort to write browser from scratch IE 3 is significantly better than Netscape Microsoft uses exclusive contracts and bundling in Windows to boost IE’s market share 97

Alternating current displacing direct current in electricity n n n Originally electricity generation and distribution was developed as direct current (DC) by Edison Significant municipal networks (New York City, Philadelphia) were created based on DC Light bulbs last much longer on DC Westinghouse pushed AC because its motors run much better on AC AC won because of the efficiency of its long distance transportation (Niagara Falls to NYC) 98

Bottom line (1) 1. 2. 3. 4. Incompatibility is key Under incompatibility, “winner-takes-most” Crucial to have the top market share Competition for the market more important than competition in the market; make early sacrifices 5. Extend the firm vertically without going outside core competences 99

Bottom line (2) 6. Use price discrimination to a. take advantage of network effects b. take advantage of or create dominant position c. disadvantage competitors 7. Subsidize complementary goods to create a dominant platform 8. Try to keep control of bottlenecks 9. May use exclusive contracts if legal 100

afd5ceaddecb8ba1118a45e4c66ddf08.ppt