lecture 3.ppt.pptx

- Количество слайдов: 64

Net Present Value and Other Investment Criteria Lecture 3

Net Present Value and Other Investment Criteria Lecture 3

AGENDA 1. 2. 3. 4. 5. 6. An Overview of Capital Budgeting Net Present Value Payback period Internal Rate of Return Average Accounting Return Profitability Index

AGENDA 1. 2. 3. 4. 5. 6. An Overview of Capital Budgeting Net Present Value Payback period Internal Rate of Return Average Accounting Return Profitability Index

Key Concepts and Skills Be able to compute payback and discounted payback and understand their shortcomings Understand accounting rates of return and their shortcomings Be able to compute internal rates of return (standard and modified) and understand their strengths and weaknesses Be able to compute the net present value and understand why it is the best decision criterion Be able to compute the profitability index and understand its relation to net present value

Key Concepts and Skills Be able to compute payback and discounted payback and understand their shortcomings Understand accounting rates of return and their shortcomings Be able to compute internal rates of return (standard and modified) and understand their strengths and weaknesses Be able to compute the net present value and understand why it is the best decision criterion Be able to compute the profitability index and understand its relation to net present value

1. An Overview of Capital Budgeting

1. An Overview of Capital Budgeting

Three Lessons from Disney’s decision to invest $17. 5 million to build Disneyland park in California is an example of capital budgeting decision. Subsequently, Disney opened theme parks in Orlando, Tokyo, Paris and most recently invested $3. 5 billion to build a theme park in Hong Kong. Today parks and resorts account for over 30% of Disney’s Revenue.

Three Lessons from Disney’s decision to invest $17. 5 million to build Disneyland park in California is an example of capital budgeting decision. Subsequently, Disney opened theme parks in Orlando, Tokyo, Paris and most recently invested $3. 5 billion to build a theme park in Hong Kong. Today parks and resorts account for over 30% of Disney’s Revenue.

Three Lessons from Disney 1. Capital budgeting decisions are critical in defining a company’s success. 2. Very large investments are frequently the result of many smaller investment decisions that define a business strategy. 3. Successful investment choices lead to the development of managerial expertise and capabilities that influence the firm’s choice of future investments.

Three Lessons from Disney 1. Capital budgeting decisions are critical in defining a company’s success. 2. Very large investments are frequently the result of many smaller investment decisions that define a business strategy. 3. Successful investment choices lead to the development of managerial expertise and capabilities that influence the firm’s choice of future investments.

The Typical Capital Budgeting Process Phase I: The firm’s management identifies promising investment opportunities. Phase II: The value creating potential of various opportunities are thoroughly evaluated. So the goal is to identify promising opportunities and select those that will create the most value for the firm’s common stockholders.

The Typical Capital Budgeting Process Phase I: The firm’s management identifies promising investment opportunities. Phase II: The value creating potential of various opportunities are thoroughly evaluated. So the goal is to identify promising opportunities and select those that will create the most value for the firm’s common stockholders.

What Are the Sources of Good Investment Projects? It is not easy to find profitable investment opportunities in competitive markets. Good investments are most likely to be found in markets that are less competitive where barriers to new entrants are sufficiently high to keep out wouldbe competitors.

What Are the Sources of Good Investment Projects? It is not easy to find profitable investment opportunities in competitive markets. Good investments are most likely to be found in markets that are less competitive where barriers to new entrants are sufficiently high to keep out wouldbe competitors.

Types of Capital Investment Projects Revenue enhancing Investments (for example, entering a new market) 2) Cost-reduction investments (for example, installing a more efficient equipment) 3) Mandatory investments that are a result of government mandate (for example, installing mandatory safety features in a car) 1)

Types of Capital Investment Projects Revenue enhancing Investments (for example, entering a new market) 2) Cost-reduction investments (for example, installing a more efficient equipment) 3) Mandatory investments that are a result of government mandate (for example, installing mandatory safety features in a car) 1)

Investment criteria How should a firm make an investment decision n What assets do we buy? n What is the underlying goal? n What is the right decision criterion?

Investment criteria How should a firm make an investment decision n What assets do we buy? n What is the underlying goal? n What is the right decision criterion?

The Six Criteria There are six criteria that we will use: Net present value (NPV) The payback period The discounted payback period Internal rate of return (IRR) Modified internal rate of return (MIRR) Profitability index (PI)

The Six Criteria There are six criteria that we will use: Net present value (NPV) The payback period The discounted payback period Internal rate of return (IRR) Modified internal rate of return (MIRR) Profitability index (PI)

2. Net Present Value

2. Net Present Value

Net Present Value The net present value (NPV) is the difference between the present value of cash inflows and the cash outflows. NPV estimates the amount of wealth that the project creates.

Net Present Value The net present value (NPV) is the difference between the present value of cash inflows and the cash outflows. NPV estimates the amount of wealth that the project creates.

Net Present Value The difference between the market value of a project and its cost NPV = –Initial Cost + Market Value NPV = – Initial Cost + PV(Expected Future CF’s)

Net Present Value The difference between the market value of a project and its cost NPV = –Initial Cost + Market Value NPV = – Initial Cost + PV(Expected Future CF’s)

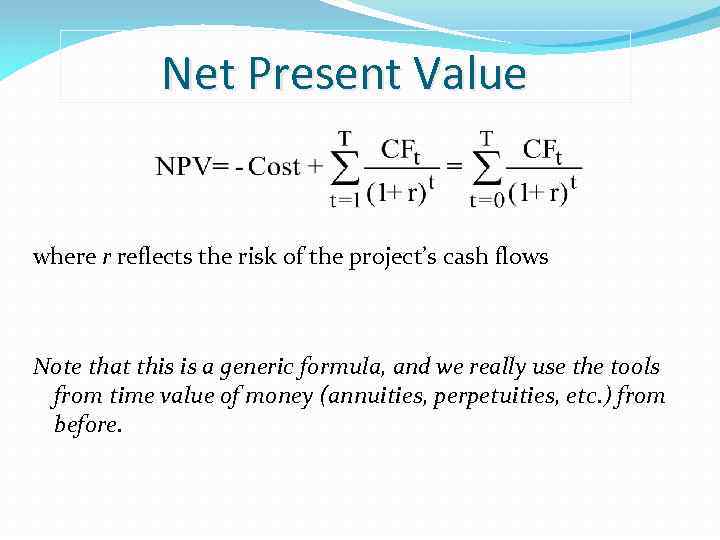

Net Present Value where r reflects the risk of the project’s cash flows Note that this is a generic formula, and we really use the tools from time value of money (annuities, perpetuities, etc. ) from before.

Net Present Value where r reflects the risk of the project’s cash flows Note that this is a generic formula, and we really use the tools from time value of money (annuities, perpetuities, etc. ) from before.

NPV – Decision Rule Net Present Value (NPV) Rule: NPV > 0 Accept the project. NPV < 0 Reject the project. A positive NPV means that the project is expected to add value to the firm and will therefore increase the wealth of the owners. Since our goal is to increase owner wealth, NPV is a direct measure of how well this project will meet our goal.

NPV – Decision Rule Net Present Value (NPV) Rule: NPV > 0 Accept the project. NPV < 0 Reject the project. A positive NPV means that the project is expected to add value to the firm and will therefore increase the wealth of the owners. Since our goal is to increase owner wealth, NPV is a direct measure of how well this project will meet our goal.

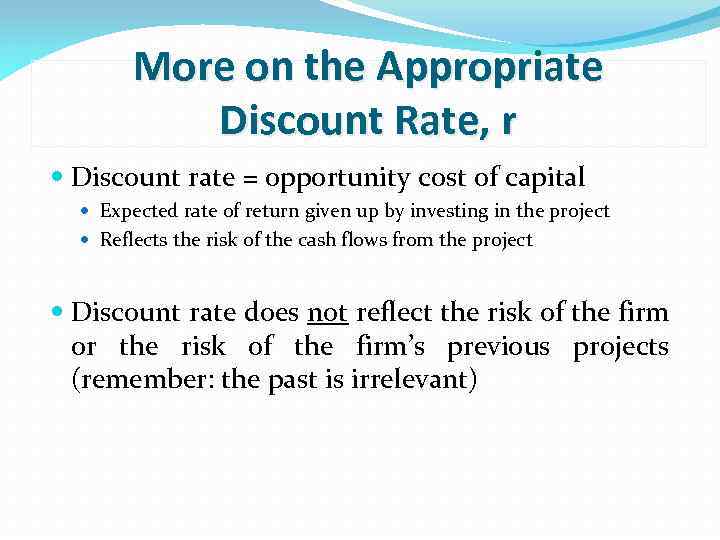

More on the Appropriate Discount Rate, r Discount rate = opportunity cost of capital Expected rate of return given up by investing in the project Reflects the risk of the cash flows from the project Discount rate does not reflect the risk of the firm or the risk of the firm’s previous projects (remember: the past is irrelevant)

More on the Appropriate Discount Rate, r Discount rate = opportunity cost of capital Expected rate of return given up by investing in the project Reflects the risk of the cash flows from the project Discount rate does not reflect the risk of the firm or the risk of the firm’s previous projects (remember: the past is irrelevant)

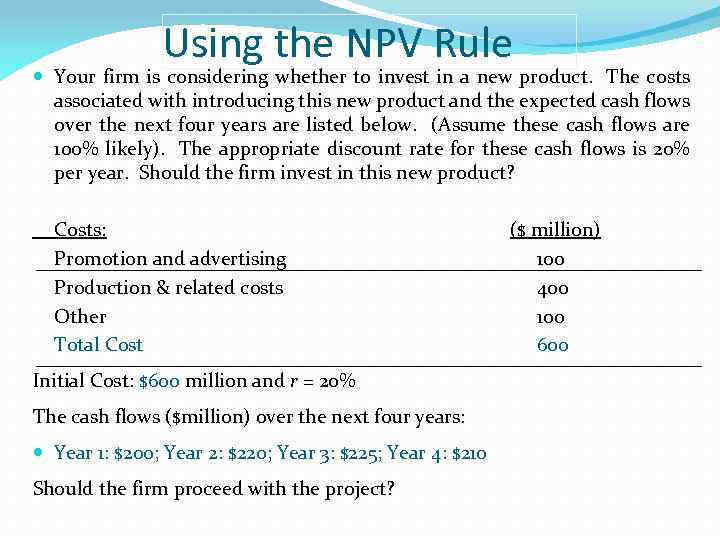

Using the NPV Rule Your firm is considering whether to invest in a new product. The costs associated with introducing this new product and the expected cash flows over the next four years are listed below. (Assume these cash flows are 100% likely). The appropriate discount rate for these cash flows is 20% per year. Should the firm invest in this new product? Costs: Promotion and advertising Production & related costs Other Total Cost Initial Cost: $600 million and r = 20% The cash flows ($million) over the next four years: Year 1: $200; Year 2: $220; Year 3: $225; Year 4: $210 Should the firm proceed with the project? ($ million) 100 400 100 600

Using the NPV Rule Your firm is considering whether to invest in a new product. The costs associated with introducing this new product and the expected cash flows over the next four years are listed below. (Assume these cash flows are 100% likely). The appropriate discount rate for these cash flows is 20% per year. Should the firm invest in this new product? Costs: Promotion and advertising Production & related costs Other Total Cost Initial Cost: $600 million and r = 20% The cash flows ($million) over the next four years: Year 1: $200; Year 2: $220; Year 3: $225; Year 4: $210 Should the firm proceed with the project? ($ million) 100 400 100 600

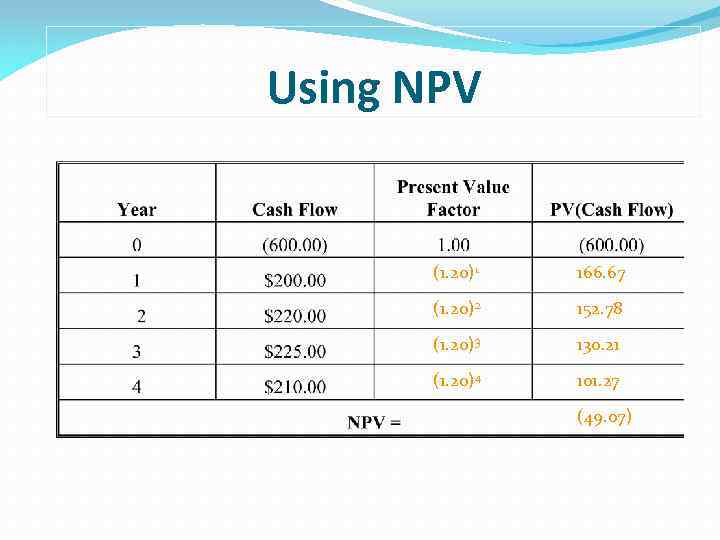

Using NPV (1. 20)1 166. 67 (1. 20)2 152. 78 (1. 20)3 130. 21 (1. 20)4 101. 27 (49. 07)

Using NPV (1. 20)1 166. 67 (1. 20)2 152. 78 (1. 20)3 130. 21 (1. 20)4 101. 27 (49. 07)

Decision Criteria Test - NPV Does the NPV rule account for the time value of money? Does the NPV rule account for the risk of the cash flows? Does the NPV rule provide an indication about the increase in value? Should we consider the NPV rule for our primary decision rule?

Decision Criteria Test - NPV Does the NPV rule account for the time value of money? Does the NPV rule account for the risk of the cash flows? Does the NPV rule provide an indication about the increase in value? Should we consider the NPV rule for our primary decision rule?

3. Payback period

3. Payback period

Payback Period The Payback period for an investment opportunity is the number of years needed to recover the initial cash outlay required to make the investment. Decision Criteria: Accept the project if the payback period is less than a pre-specified number of years.

Payback Period The Payback period for an investment opportunity is the number of years needed to recover the initial cash outlay required to make the investment. Decision Criteria: Accept the project if the payback period is less than a pre-specified number of years.

Problems with the Payback Period The payback period suffers from two primary problems that limit its usefulness in evaluating investments: It ignores the time value of money It ignores all cash flows beyond the payback period Still, it has a couple of redeeming qualities It is quick and easy to calculate It gives a measure of the liquidity of the project

Problems with the Payback Period The payback period suffers from two primary problems that limit its usefulness in evaluating investments: It ignores the time value of money It ignores all cash flows beyond the payback period Still, it has a couple of redeeming qualities It is quick and easy to calculate It gives a measure of the liquidity of the project

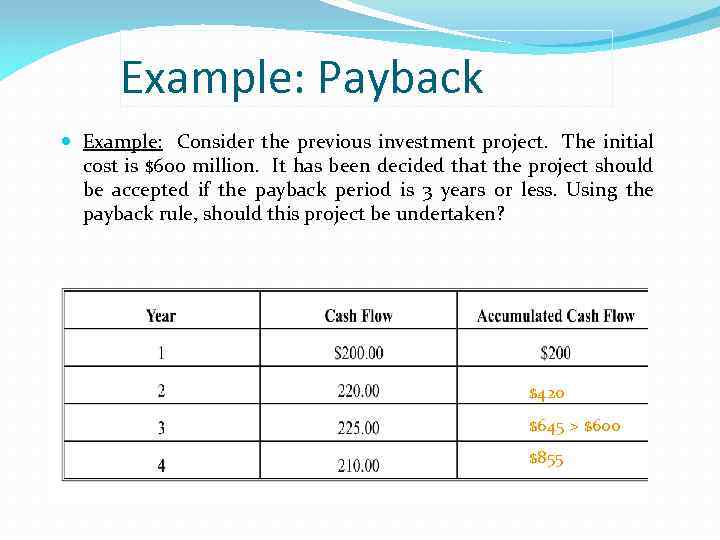

Example: Payback Example: Consider the previous investment project. The initial cost is $600 million. It has been decided that the project should be accepted if the payback period is 3 years or less. Using the payback rule, should this project be undertaken? $420 $645 > $600 $855

Example: Payback Example: Consider the previous investment project. The initial cost is $600 million. It has been decided that the project should be accepted if the payback period is 3 years or less. Using the payback rule, should this project be undertaken? $420 $645 > $600 $855

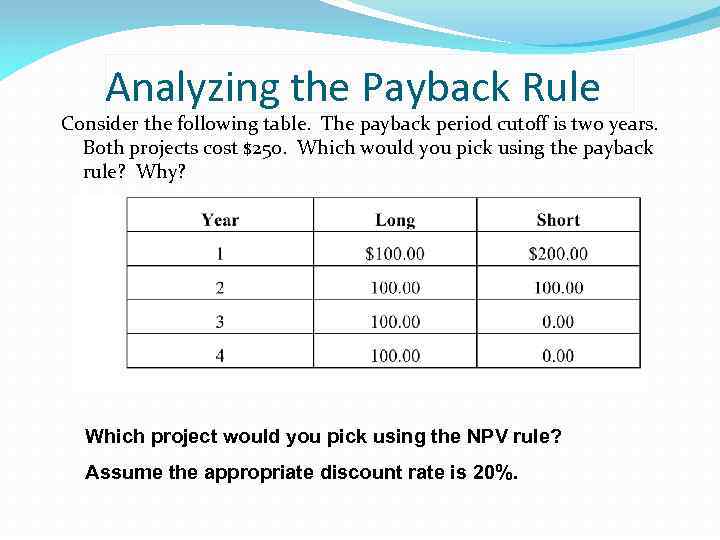

Analyzing the Payback Rule Consider the following table. The payback period cutoff is two years. Both projects cost $250. Which would you pick using the payback rule? Why? Which project would you pick using the NPV rule? Assume the appropriate discount rate is 20%.

Analyzing the Payback Rule Consider the following table. The payback period cutoff is two years. Both projects cost $250. Which would you pick using the payback rule? Why? Which project would you pick using the NPV rule? Assume the appropriate discount rate is 20%.

Discounted Payback period: The length of time until the accumulated discounted cash flows from the investment equal or exceed the original cost. (We will assume that cash flows are generated continuously during a period)

Discounted Payback period: The length of time until the accumulated discounted cash flows from the investment equal or exceed the original cost. (We will assume that cash flows are generated continuously during a period)

The Discounted Payback Rule: An investment is accepted if its calculated discounted payback period is less than or equal to some pre-specified number of years.

The Discounted Payback Rule: An investment is accepted if its calculated discounted payback period is less than or equal to some pre-specified number of years.

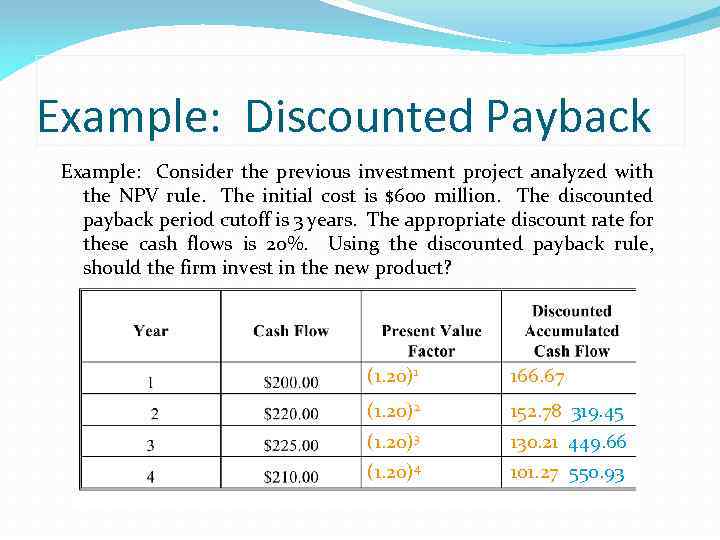

Example: Discounted Payback Example: Consider the previous investment project analyzed with the NPV rule. The initial cost is $600 million. The discounted payback period cutoff is 3 years. The appropriate discount rate for these cash flows is 20%. Using the discounted payback rule, should the firm invest in the new product? (1. 20)1 166. 67 (1. 20)2 152. 78 319. 45 (1. 20)3 (1. 20)4 130. 21 449. 66 101. 27 550. 93

Example: Discounted Payback Example: Consider the previous investment project analyzed with the NPV rule. The initial cost is $600 million. The discounted payback period cutoff is 3 years. The appropriate discount rate for these cash flows is 20%. Using the discounted payback rule, should the firm invest in the new product? (1. 20)1 166. 67 (1. 20)2 152. 78 319. 45 (1. 20)3 (1. 20)4 130. 21 449. 66 101. 27 550. 93

Problems with Discounted Payback The discounted payback period solves the time value problem, but it still ignores the cash flows beyond the payback period Therefore, you may reject projects that have large cash flows in the outlying years that make it very profitable In other words, any measure of payback can lead to a focus on short-run profits at the expense of larger long-term profits

Problems with Discounted Payback The discounted payback period solves the time value problem, but it still ignores the cash flows beyond the payback period Therefore, you may reject projects that have large cash flows in the outlying years that make it very profitable In other words, any measure of payback can lead to a focus on short-run profits at the expense of larger long-term profits

4. Internal Rate of Return

4. Internal Rate of Return

Internal Rate of Return This is the most important alternative to NPV It is often used in practice and is intuitively appealing It is based entirely on the estimated cash flows and is independent of interest rates found elsewhere 9 -31

Internal Rate of Return This is the most important alternative to NPV It is often used in practice and is intuitively appealing It is based entirely on the estimated cash flows and is independent of interest rates found elsewhere 9 -31

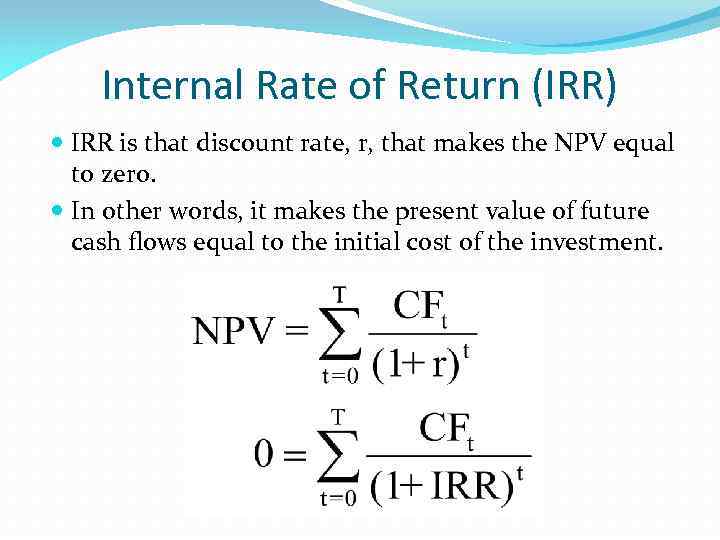

Internal Rate of Return (IRR) IRR is that discount rate, r, that makes the NPV equal to zero. In other words, it makes the present value of future cash flows equal to the initial cost of the investment.

Internal Rate of Return (IRR) IRR is that discount rate, r, that makes the NPV equal to zero. In other words, it makes the present value of future cash flows equal to the initial cost of the investment.

IRR – Definition and Decision Rule Definition: IRR is the return that makes the NPV = 0 Decision Rule: Accept the project if the IRR is greater than the required rate of return (discount rate). Otherwise, reject the project. 9 -33

IRR – Definition and Decision Rule Definition: IRR is the return that makes the NPV = 0 Decision Rule: Accept the project if the IRR is greater than the required rate of return (discount rate). Otherwise, reject the project. 9 -33

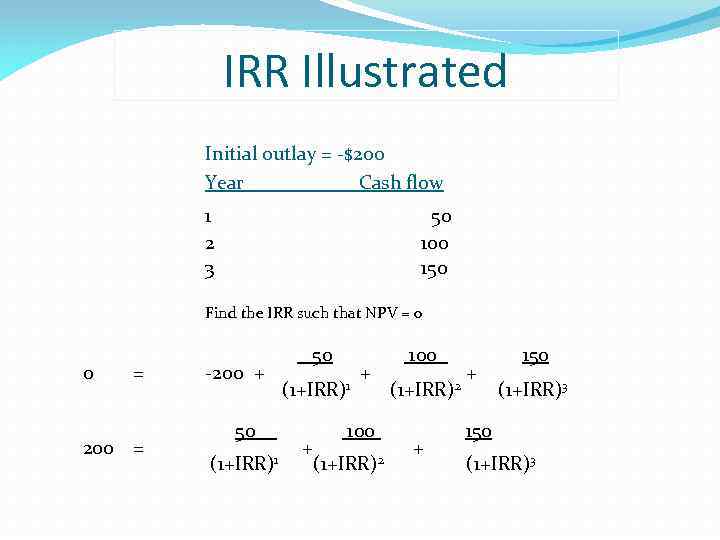

IRR Illustrated Initial outlay = -$200 Year Cash flow 1 2 3 50 100 150 Find the IRR such that NPV = 0 0 = 200 = -200 + 50 (1+IRR)1 + + 100 (1+IRR)2 + + 150 (1+IRR)3

IRR Illustrated Initial outlay = -$200 Year Cash flow 1 2 3 50 100 150 Find the IRR such that NPV = 0 0 = 200 = -200 + 50 (1+IRR)1 + + 100 (1+IRR)2 + + 150 (1+IRR)3

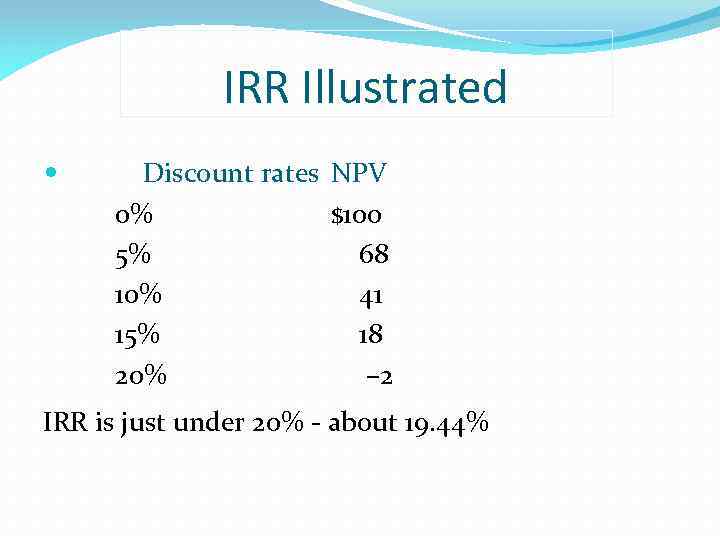

IRR Illustrated Discount rates NPV 0% $100 5% 68 10% 41 15% 18 20% – 2 IRR is just under 20% - about 19. 44%

IRR Illustrated Discount rates NPV 0% $100 5% 68 10% 41 15% 18 20% – 2 IRR is just under 20% - about 19. 44%

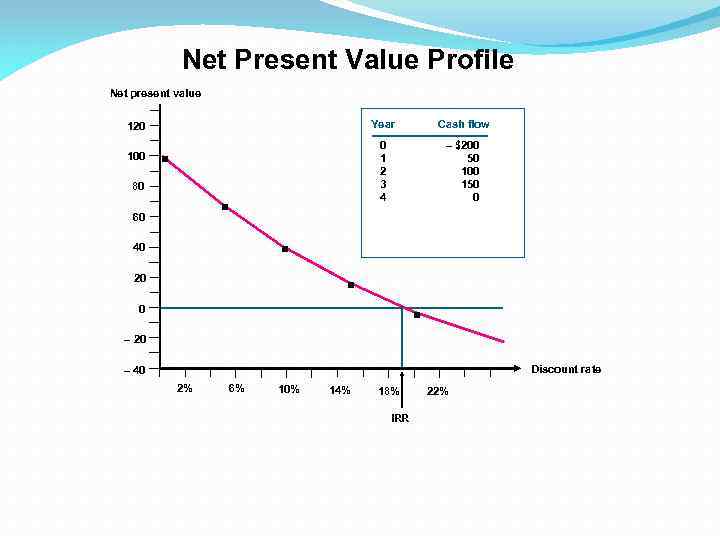

Net Present Value Profile Net present value Year 100 80 Cash flow 0 1 2 3 4 120 – $200 50 100 150 0 60 40 20 0 – 20 Discount rate – 40 2% 6% 10% 14% 18% IRR 22%

Net Present Value Profile Net present value Year 100 80 Cash flow 0 1 2 3 4 120 – $200 50 100 150 0 60 40 20 0 – 20 Discount rate – 40 2% 6% 10% 14% 18% IRR 22%

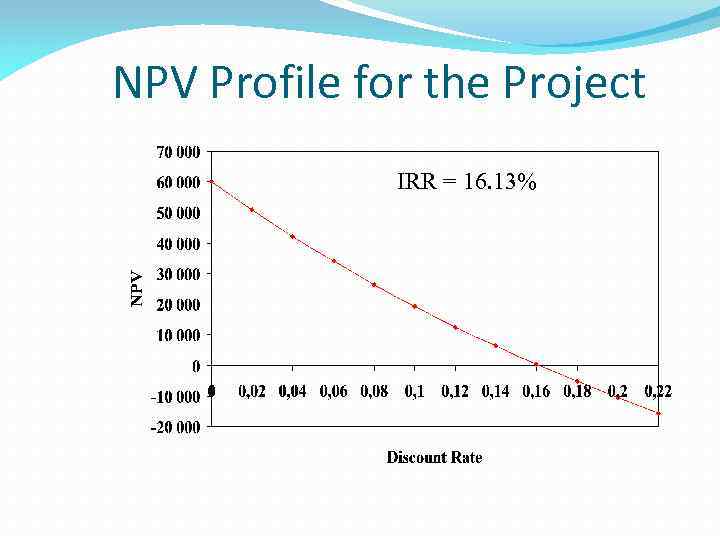

NPV Profile for the Project IRR = 16. 13%

NPV Profile for the Project IRR = 16. 13%

Decision Criteria Test - IRR Does the IRR rule account for the time value of money? Does the IRR rule account for the risk of the cash flows? Does the IRR rule provide an indication about the increase in value? Should we consider the IRR rule for our primary decision criteria? 9 -38

Decision Criteria Test - IRR Does the IRR rule account for the time value of money? Does the IRR rule account for the risk of the cash flows? Does the IRR rule provide an indication about the increase in value? Should we consider the IRR rule for our primary decision criteria? 9 -38

Comparison of IRR and NPV rules lead to identical decisions following conditions are satisfied: IF the Conventional Cash Flows: The first cash flow (the initial investment) is negative and all the remaining cash flows are positive Project is independent: A project is independent if the decision to accept or reject the project does not affect the decision to accept or reject any other project. When one or both of these conditions are not met, problems with using the IRR rule can result!

Comparison of IRR and NPV rules lead to identical decisions following conditions are satisfied: IF the Conventional Cash Flows: The first cash flow (the initial investment) is negative and all the remaining cash flows are positive Project is independent: A project is independent if the decision to accept or reject the project does not affect the decision to accept or reject any other project. When one or both of these conditions are not met, problems with using the IRR rule can result!

Unconventional Cash Flows l Unconventional Cash Flows: Cash flows come first and investment cost is paid later. In this case, the cash flows are like those of a loan and the IRR is like a borrowing rate. Thus, in this case a lower IRR is better than a higher IRR. Multiple rates of return problem: Multiple sign changes in the cash flows introduce the possibility that more than one discount rate makes the NPV of an investment project zero.

Unconventional Cash Flows l Unconventional Cash Flows: Cash flows come first and investment cost is paid later. In this case, the cash flows are like those of a loan and the IRR is like a borrowing rate. Thus, in this case a lower IRR is better than a higher IRR. Multiple rates of return problem: Multiple sign changes in the cash flows introduce the possibility that more than one discount rate makes the NPV of an investment project zero.

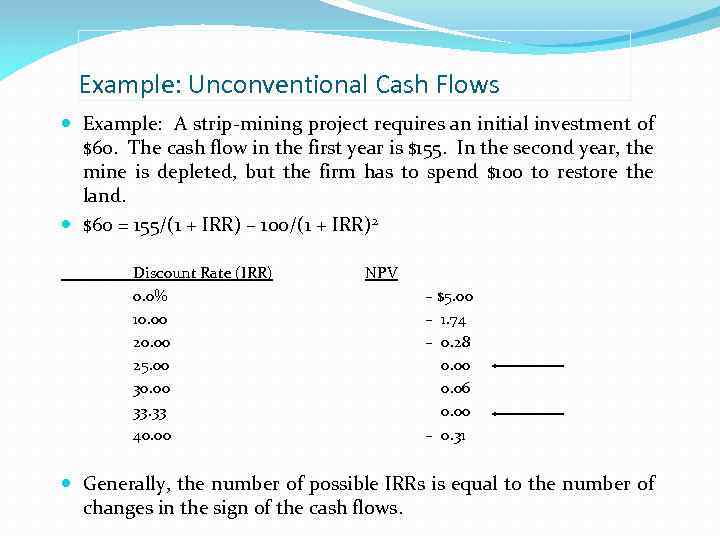

Example: Unconventional Cash Flows Example: A strip-mining project requires an initial investment of $60. The cash flow in the first year is $155. In the second year, the mine is depleted, but the firm has to spend $100 to restore the land. $60 = 155/(1 + IRR) – 100/(1 + IRR)2 Discount Rate (IRR) 0. 0% 10. 00 25. 00 30. 00 33. 33 40. 00 NPV – $5. 00 – 1. 74 – 0. 28 0. 00 0. 06 0. 00 – 0. 31 Generally, the number of possible IRRs is equal to the number of changes in the sign of the cash flows.

Example: Unconventional Cash Flows Example: A strip-mining project requires an initial investment of $60. The cash flow in the first year is $155. In the second year, the mine is depleted, but the firm has to spend $100 to restore the land. $60 = 155/(1 + IRR) – 100/(1 + IRR)2 Discount Rate (IRR) 0. 0% 10. 00 25. 00 30. 00 33. 33 40. 00 NPV – $5. 00 – 1. 74 – 0. 28 0. 00 0. 06 0. 00 – 0. 31 Generally, the number of possible IRRs is equal to the number of changes in the sign of the cash flows.

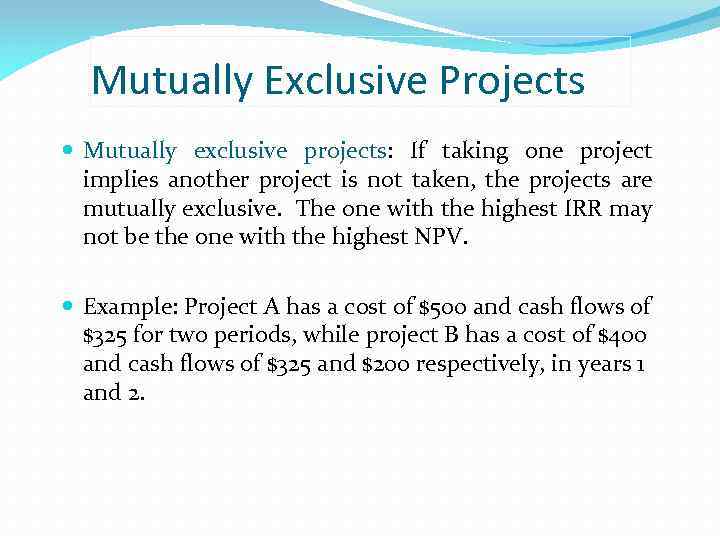

Mutually Exclusive Projects Mutually exclusive projects: If taking one project implies another project is not taken, the projects are mutually exclusive. The one with the highest IRR may not be the one with the highest NPV. Example: Project A has a cost of $500 and cash flows of $325 for two periods, while project B has a cost of $400 and cash flows of $325 and $200 respectively, in years 1 and 2.

Mutually Exclusive Projects Mutually exclusive projects: If taking one project implies another project is not taken, the projects are mutually exclusive. The one with the highest IRR may not be the one with the highest NPV. Example: Project A has a cost of $500 and cash flows of $325 for two periods, while project B has a cost of $400 and cash flows of $325 and $200 respectively, in years 1 and 2.

Mutually Exclusive Projects 19. 43% 22. 17% Project B appears better because of the higher return. However. . .

Mutually Exclusive Projects 19. 43% 22. 17% Project B appears better because of the higher return. However. . .

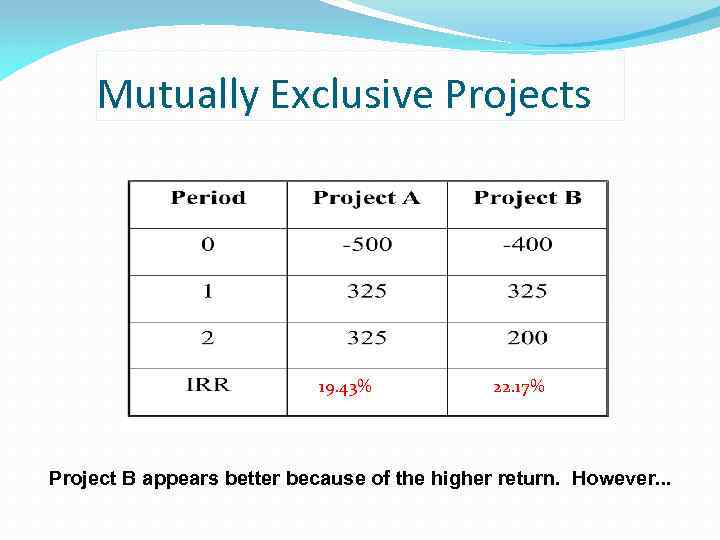

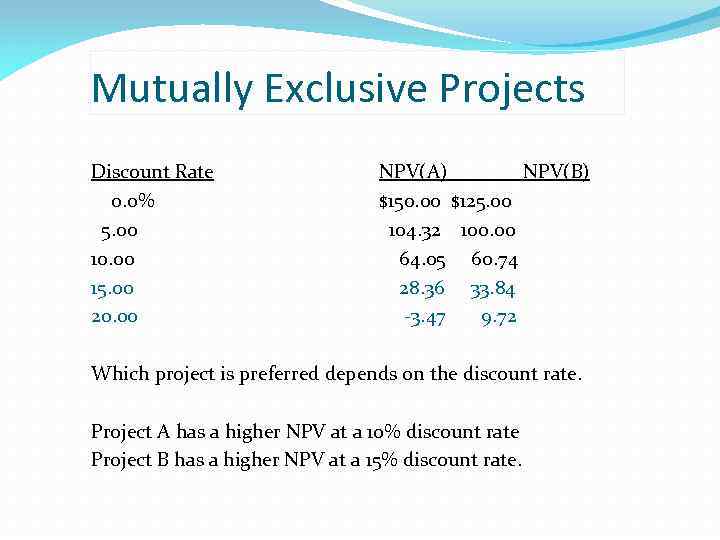

Mutually Exclusive Projects Discount Rate 0. 0% 5. 00 10. 00 15. 00 20. 00 NPV(A) NPV(B) $150. 00 $125. 00 104. 32 100. 00 64. 05 60. 74 28. 36 33. 84 -3. 47 9. 72 Which project is preferred depends on the discount rate. Project A has a higher NPV at a 10% discount rate Project B has a higher NPV at a 15% discount rate.

Mutually Exclusive Projects Discount Rate 0. 0% 5. 00 10. 00 15. 00 20. 00 NPV(A) NPV(B) $150. 00 $125. 00 104. 32 100. 00 64. 05 60. 74 28. 36 33. 84 -3. 47 9. 72 Which project is preferred depends on the discount rate. Project A has a higher NPV at a 10% discount rate Project B has a higher NPV at a 15% discount rate.

Crossover Rate Crossover Rate: The discount rate that makes the NPV of the two projects the same. Finding the Crossover Rate Use the NPV profiles Calculate the IRR based on the incremental cash flows. If the incremental IRR is greater than the required rate of return, take the larger project.

Crossover Rate Crossover Rate: The discount rate that makes the NPV of the two projects the same. Finding the Crossover Rate Use the NPV profiles Calculate the IRR based on the incremental cash flows. If the incremental IRR is greater than the required rate of return, take the larger project.

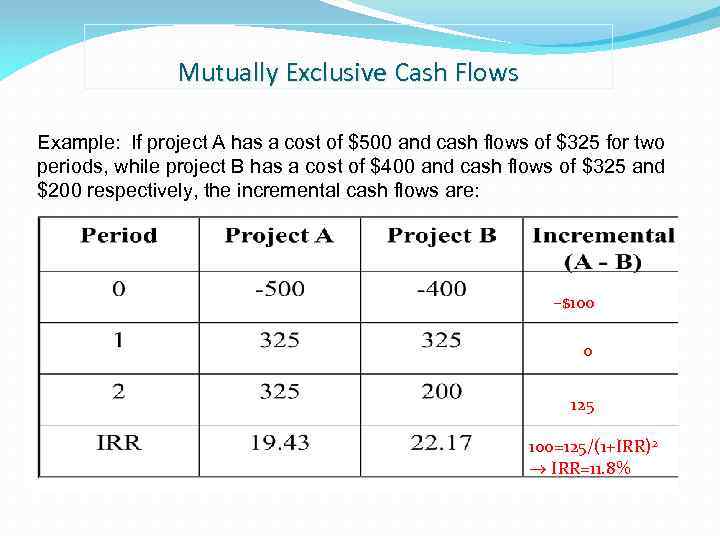

Mutually Exclusive Cash Flows Example: If project A has a cost of $500 and cash flows of $325 for two periods, while project B has a cost of $400 and cash flows of $325 and $200 respectively, the incremental cash flows are: –$100 0 125 100=125/(1+IRR)2 IRR=11. 8%

Mutually Exclusive Cash Flows Example: If project A has a cost of $500 and cash flows of $325 for two periods, while project B has a cost of $400 and cash flows of $325 and $200 respectively, the incremental cash flows are: –$100 0 125 100=125/(1+IRR)2 IRR=11. 8%

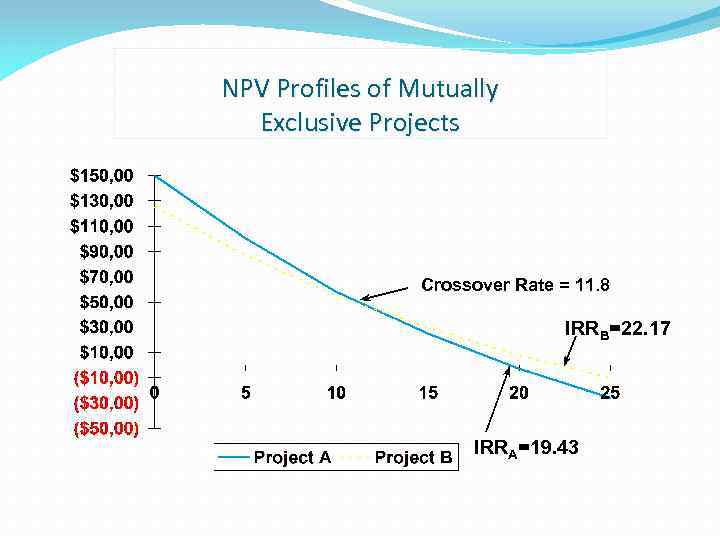

NPV Profiles of Mutually Exclusive Projects Crossover Rate = 11. 8 IRRB=22. 17 IRRA=19. 43

NPV Profiles of Mutually Exclusive Projects Crossover Rate = 11. 8 IRRB=22. 17 IRRA=19. 43

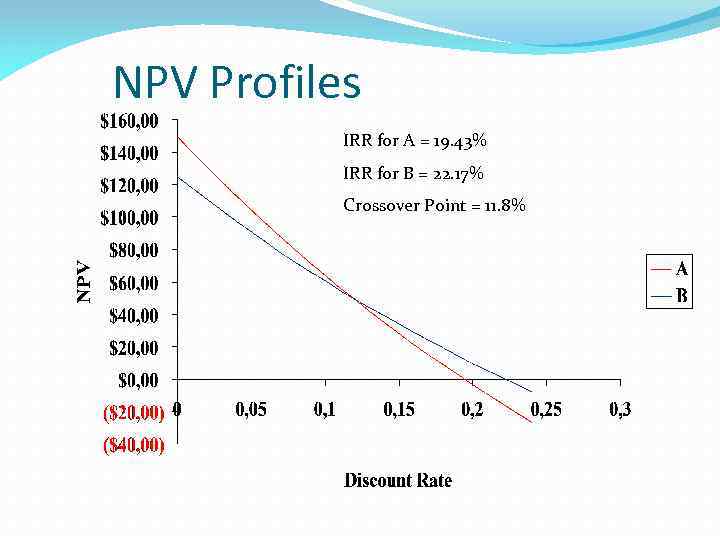

NPV Profiles IRR for A = 19. 43% IRR for B = 22. 17% Crossover Point = 11. 8%

NPV Profiles IRR for A = 19. 43% IRR for B = 22. 17% Crossover Point = 11. 8%

Conflicts Between NPV and IRR NPV directly measures the increase in value to the firm Whenever there is a conflict between NPV and another decision rule, you should always use NPV IRR is unreliable in the following situations Nonconventional cash flows Mutually exclusive projects 9 -49

Conflicts Between NPV and IRR NPV directly measures the increase in value to the firm Whenever there is a conflict between NPV and another decision rule, you should always use NPV IRR is unreliable in the following situations Nonconventional cash flows Mutually exclusive projects 9 -49

5. Average Accounting Return

5. Average Accounting Return

Average Accounting Return There are many different definitions for average accounting return The one used in the book is: Average net income / average book value Note that the average book value depends on how the asset is depreciated. Need to have a target cutoff rate Decision Rule: Accept the project if the AAR is greater than a preset rate 9 -51

Average Accounting Return There are many different definitions for average accounting return The one used in the book is: Average net income / average book value Note that the average book value depends on how the asset is depreciated. Need to have a target cutoff rate Decision Rule: Accept the project if the AAR is greater than a preset rate 9 -51

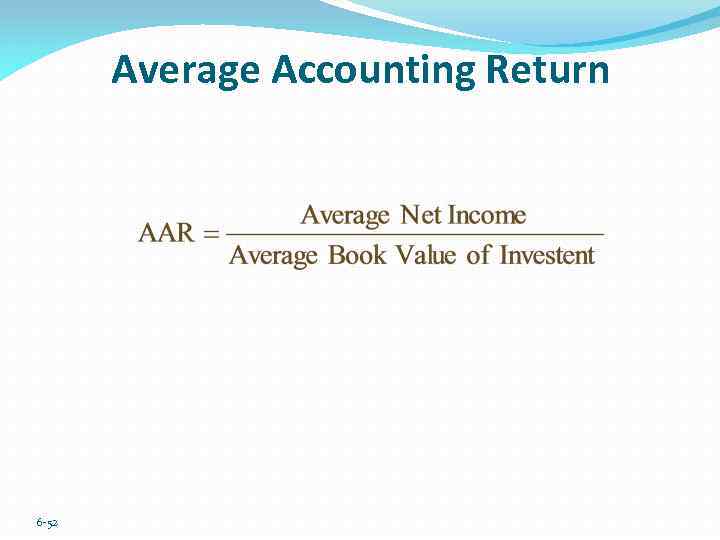

Average Accounting Return 6 -52

Average Accounting Return 6 -52

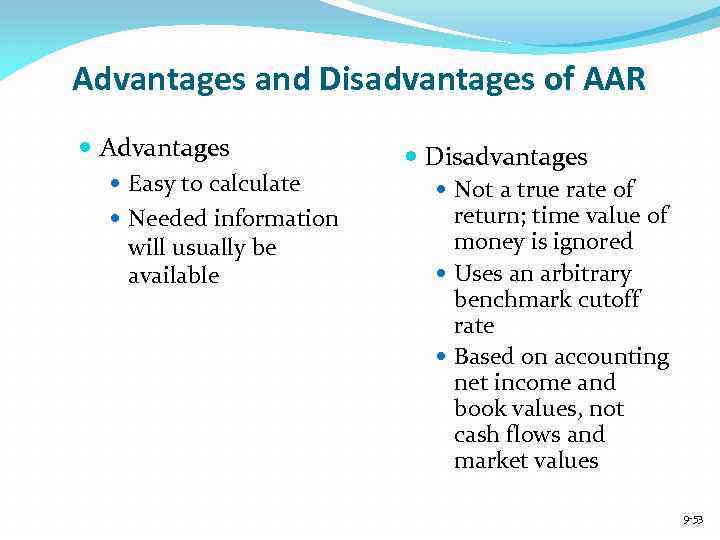

Advantages and Disadvantages of AAR Advantages Easy to calculate Needed information will usually be available Disadvantages Not a true rate of return; time value of money is ignored Uses an arbitrary benchmark cutoff rate Based on accounting net income and book values, not cash flows and market values 9 -53

Advantages and Disadvantages of AAR Advantages Easy to calculate Needed information will usually be available Disadvantages Not a true rate of return; time value of money is ignored Uses an arbitrary benchmark cutoff rate Based on accounting net income and book values, not cash flows and market values 9 -53

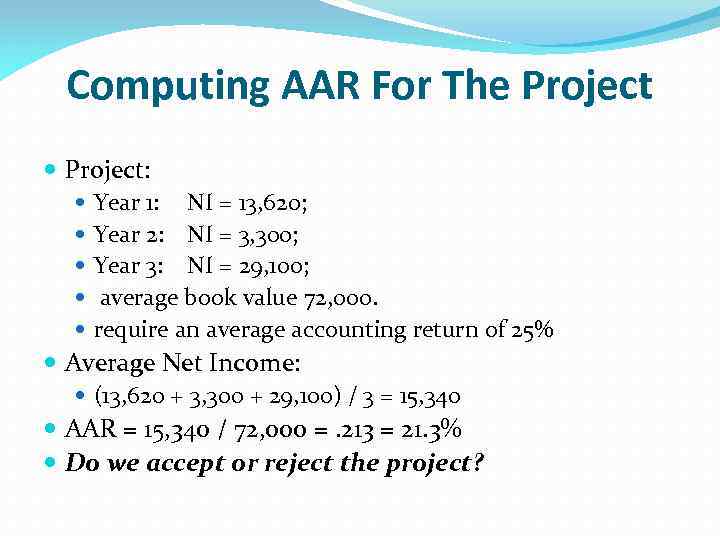

Computing AAR For The Project: Year 1: NI = 13, 620; Year 2: NI = 3, 300; Year 3: NI = 29, 100; average book value 72, 000. require an average accounting return of 25% Average Net Income: (13, 620 + 3, 300 + 29, 100) / 3 = 15, 340 AAR = 15, 340 / 72, 000 =. 213 = 21. 3% Do we accept or reject the project?

Computing AAR For The Project: Year 1: NI = 13, 620; Year 2: NI = 3, 300; Year 3: NI = 29, 100; average book value 72, 000. require an average accounting return of 25% Average Net Income: (13, 620 + 3, 300 + 29, 100) / 3 = 15, 340 AAR = 15, 340 / 72, 000 =. 213 = 21. 3% Do we accept or reject the project?

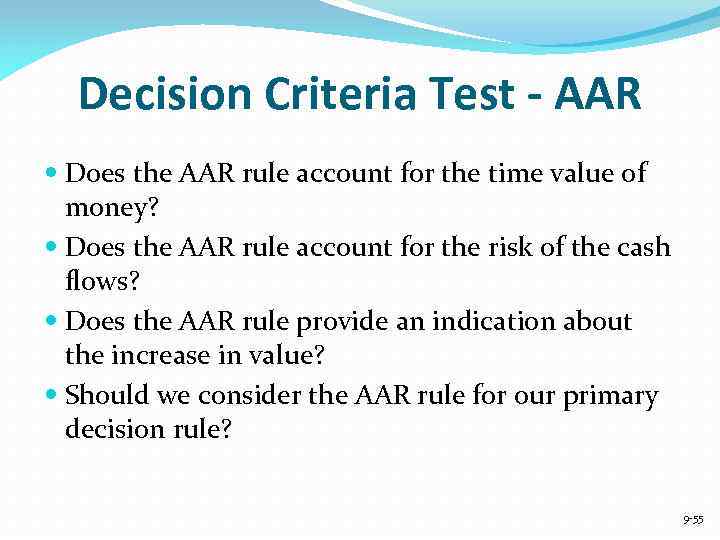

Decision Criteria Test - AAR Does the AAR rule account for the time value of money? Does the AAR rule account for the risk of the cash flows? Does the AAR rule provide an indication about the increase in value? Should we consider the AAR rule for our primary decision rule? 9 -55

Decision Criteria Test - AAR Does the AAR rule account for the time value of money? Does the AAR rule account for the risk of the cash flows? Does the AAR rule provide an indication about the increase in value? Should we consider the AAR rule for our primary decision rule? 9 -55

6. Profitability Index

6. Profitability Index

Profitability Index Measures the benefit per unit cost, based on the time value of money A profitability index of 1. 1 implies that for every $1 of investment, we create an additional $0. 10 in value This measure can be very useful in situations in which we have limited capital 9 -57

Profitability Index Measures the benefit per unit cost, based on the time value of money A profitability index of 1. 1 implies that for every $1 of investment, we create an additional $0. 10 in value This measure can be very useful in situations in which we have limited capital 9 -57

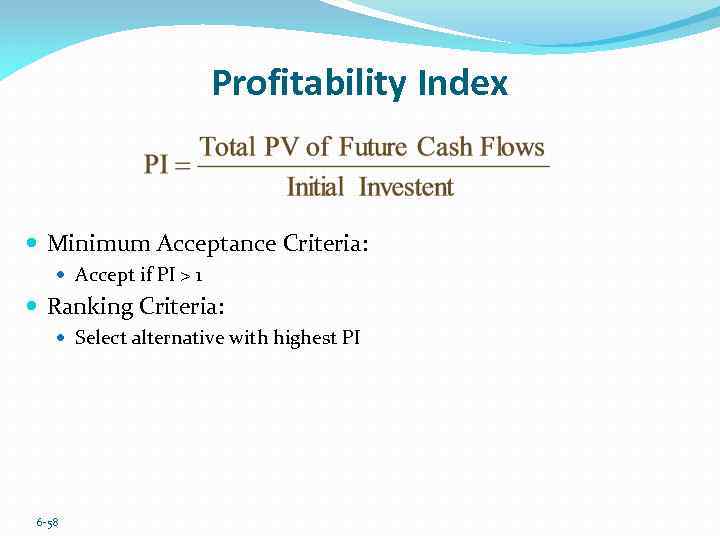

Profitability Index Minimum Acceptance Criteria: Accept if PI > 1 Ranking Criteria: Select alternative with highest PI 6 -58

Profitability Index Minimum Acceptance Criteria: Accept if PI > 1 Ranking Criteria: Select alternative with highest PI 6 -58

Profitability Index Disadvantages: Problems with mutually exclusive investments Advantages: May be useful when available investment funds are limited Easy to understand communicate Correct decision when evaluating independent projects 6 -59

Profitability Index Disadvantages: Problems with mutually exclusive investments Advantages: May be useful when available investment funds are limited Easy to understand communicate Correct decision when evaluating independent projects 6 -59

Advantages and Disadvantages of Profitability Index Advantages Closely related to NPV, generally leading to identical decisions Easy to understand communicate May be useful when available investment funds are limited 9 -60

Advantages and Disadvantages of Profitability Index Advantages Closely related to NPV, generally leading to identical decisions Easy to understand communicate May be useful when available investment funds are limited 9 -60

CONCLUSION

CONCLUSION

Capital Budgeting In Practice We should consider several investment criteria when making decisions NPV and IRR are the most commonly used primary investment criteria Payback is a commonly used secondary investment criteria

Capital Budgeting In Practice We should consider several investment criteria when making decisions NPV and IRR are the most commonly used primary investment criteria Payback is a commonly used secondary investment criteria

Quick Quiz Consider an investment that costs $100, 000 and has a cash inflow of $25, 000 every year for 5 years. The required return is 9%, and required payback is 4 years. What is the discounted payback period? What is the NPV? What is the IRR? Should we accept the project? What decision rule should be the primary decision method? When is the IRR rule unreliable?

Quick Quiz Consider an investment that costs $100, 000 and has a cash inflow of $25, 000 every year for 5 years. The required return is 9%, and required payback is 4 years. What is the discounted payback period? What is the NPV? What is the IRR? Should we accept the project? What decision rule should be the primary decision method? When is the IRR rule unreliable?

Comprehensive Problem An investment project has the following cash flows: CF 0 = -1, 000; C 01 – C 08 = 200, 000 each If the required rate of return is 12%, what decision should be made using NPV? How would the IRR decision rule be used for this project, and what decision would be reached? How are the above two decisions related?

Comprehensive Problem An investment project has the following cash flows: CF 0 = -1, 000; C 01 – C 08 = 200, 000 each If the required rate of return is 12%, what decision should be made using NPV? How would the IRR decision rule be used for this project, and what decision would be reached? How are the above two decisions related?