9-10. NPV, AAR, IRR, payback.ppt

- Количество слайдов: 62

Net Present Value and Capital Investment Decisions FIN- 311 Corporate Finance

Net Present Value and Capital Investment Decisions FIN- 311 Corporate Finance

Net Present Value (NPV). Net Present Value is found by subtracting the present value of the after -tax outflows from the present value of the aftertax inflows.

Net Present Value (NPV). Net Present Value is found by subtracting the present value of the after -tax outflows from the present value of the aftertax inflows.

Net Present Value (NPV). Net Present Value is found by subtracting the present value of the after-tax outflows from the present value of the after-tax inflows. Decision Criteria If NPV > 0, accept the project If NPV < 0, reject the project If NPV = 0, indifferent

Net Present Value (NPV). Net Present Value is found by subtracting the present value of the after-tax outflows from the present value of the after-tax inflows. Decision Criteria If NPV > 0, accept the project If NPV < 0, reject the project If NPV = 0, indifferent

Net Present Value

Net Present Value

Net present value You are considering a project which requires an initial investment of $24, 000. The project will produce cash inflows of $8, 000, $9, 800, $7, 600 and $6, 900 over the next four years, respectively. What is the net present value of this project if the required rate of return is 12%? Should this project be accepted? CF 0 = -$24, 000 CO 1 = $ 8, 000 FO 1 CO 2 = $ 9, 800 FO 2 CO 3 = $ 7, 600 FO 3 CO 4 = $ 6, 900 FO 4 i = 12% NPV CPT $749. 96 =1 =1

Net present value You are considering a project which requires an initial investment of $24, 000. The project will produce cash inflows of $8, 000, $9, 800, $7, 600 and $6, 900 over the next four years, respectively. What is the net present value of this project if the required rate of return is 12%? Should this project be accepted? CF 0 = -$24, 000 CO 1 = $ 8, 000 FO 1 CO 2 = $ 9, 800 FO 2 CO 3 = $ 7, 600 FO 3 CO 4 = $ 6, 900 FO 4 i = 12% NPV CPT $749. 96 =1 =1

Payback A project has an initial cost of $199, 000. The project produces cash inflows of $46, 000, $54, 000, $57, 500, $38, 900 and $46, 500 over the next five years, respectively. What is the payback period for this project? Should the project be accepted if the required payback period is 3 years? Year 1 2 3 4 5 Cash flow $46, 000 $54, 000 $57, 500 $38, 900 $46, 500 Cumulative cash flow $ 46, 000 $100, 000 $157, 500 $196, 400 $242, 900

Payback A project has an initial cost of $199, 000. The project produces cash inflows of $46, 000, $54, 000, $57, 500, $38, 900 and $46, 500 over the next five years, respectively. What is the payback period for this project? Should the project be accepted if the required payback period is 3 years? Year 1 2 3 4 5 Cash flow $46, 000 $54, 000 $57, 500 $38, 900 $46, 500 Cumulative cash flow $ 46, 000 $100, 000 $157, 500 $196, 400 $242, 900

Discounted payback A project has an initial cost of $200, 000 and produces cash inflows of $86, 000, $93, 600, $42, 000 and $38, 000 over the next four years, respectively. What is the discounted payback period if the discount rate is 10%? Should this project be accepted if the required discounted payback period is 3 years? Year 1 2 3 4 Discounted cash flow $86, 000/(1+. 10)1 = $78, 181. 82 $93, 600/(1+. 10)2 = $77, 355. 37 $42, 000/(1+. 10)3 = $31, 555. 22 $38, 000/(1+. 10)4 = $25, 954. 51 Cumulative discounted cash flow $ 78, 181. 82 $155, 537. 19 $187, 092. 41 $213, 046. 92

Discounted payback A project has an initial cost of $200, 000 and produces cash inflows of $86, 000, $93, 600, $42, 000 and $38, 000 over the next four years, respectively. What is the discounted payback period if the discount rate is 10%? Should this project be accepted if the required discounted payback period is 3 years? Year 1 2 3 4 Discounted cash flow $86, 000/(1+. 10)1 = $78, 181. 82 $93, 600/(1+. 10)2 = $77, 355. 37 $42, 000/(1+. 10)3 = $31, 555. 22 $38, 000/(1+. 10)4 = $25, 954. 51 Cumulative discounted cash flow $ 78, 181. 82 $155, 537. 19 $187, 092. 41 $213, 046. 92

Average accounting return A project has an initial cost of $134, 000 for equipment. This equipment will be depreciated using straight line depreciation to a zero book value over the four year life of the project. The project is expected to produce annual net income of $4, 700, $5, 100, $5, 800 and $6, 500 over the four years, respectively. What is the average accounting return (AAR)? Should this project be accepted if the required AAR is 8%?

Average accounting return A project has an initial cost of $134, 000 for equipment. This equipment will be depreciated using straight line depreciation to a zero book value over the four year life of the project. The project is expected to produce annual net income of $4, 700, $5, 100, $5, 800 and $6, 500 over the four years, respectively. What is the average accounting return (AAR)? Should this project be accepted if the required AAR is 8%?

Internal Rate of Return (IRR) • The Internal Rate of Return (IRR) is the discount rate that will equate the present value of the outflows with the present value of the inflows • The IRR is the project’s intrinsic rate of return

Internal Rate of Return (IRR) • The Internal Rate of Return (IRR) is the discount rate that will equate the present value of the outflows with the present value of the inflows • The IRR is the project’s intrinsic rate of return

Internal Rate of Return Decision Criteria If IRR > k, accept the project If IRR < k, reject the project If IRR = k, indifferent

Internal Rate of Return Decision Criteria If IRR > k, accept the project If IRR < k, reject the project If IRR = k, indifferent

The Internal Rate of Return

The Internal Rate of Return

Internal rate of return (IRR) You are considering a project with an initial cost of $48, 500. The project has a five year life and produces cash inflows of $9, 800, $12, 200, $12, 850, $13, 200 and $13, 600 over the five years, respectively. What is the internal rate of return on this project? Should this project be accepted if the required rate of return is 8%? CF 0 = -$48, 500 CO 1 = $ 9, 800 FO 1 CO 2 = $12, 200 FO 2 CO 3 = $12, 850 FO 3 CO 4 = $13, 200 FO 4 CO 5 = $13, 600 FO 5 IRR CPT=> 8. 14% =1 =1 =1

Internal rate of return (IRR) You are considering a project with an initial cost of $48, 500. The project has a five year life and produces cash inflows of $9, 800, $12, 200, $12, 850, $13, 200 and $13, 600 over the five years, respectively. What is the internal rate of return on this project? Should this project be accepted if the required rate of return is 8%? CF 0 = -$48, 500 CO 1 = $ 9, 800 FO 1 CO 2 = $12, 200 FO 2 CO 3 = $12, 850 FO 3 CO 4 = $13, 200 FO 4 CO 5 = $13, 600 FO 5 IRR CPT=> 8. 14% =1 =1 =1

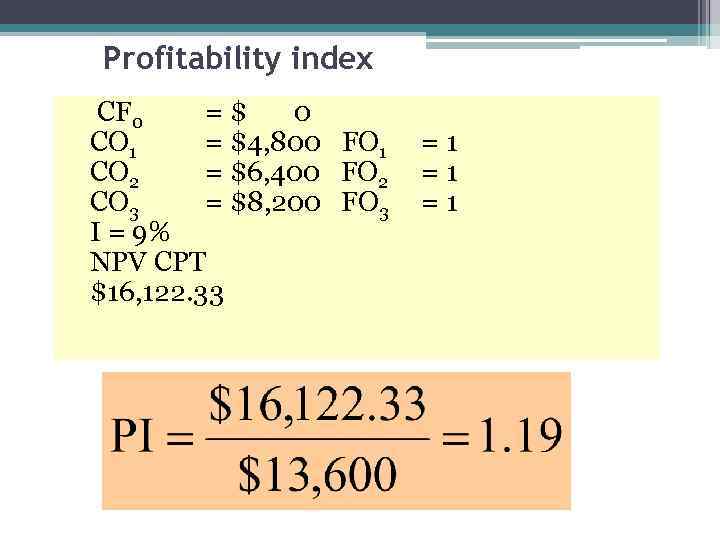

Profitability index The project you are considering has cash inflows of $4, 800, $6, 400 and $8, 200 over the three year life of the project. The initial cash requirement is $13, 600. What is the profitability index if the discount rate is 9%? Should this project be accepted if the discount rate is 9%?

Profitability index The project you are considering has cash inflows of $4, 800, $6, 400 and $8, 200 over the three year life of the project. The initial cash requirement is $13, 600. What is the profitability index if the discount rate is 9%? Should this project be accepted if the discount rate is 9%?

Profitability index CF 0 =$ 0 CO 1 = $4, 800 FO 1 CO 2 = $6, 400 FO 2 CO 3 = $8, 200 FO 3 I = 9% NPV CPT $16, 122. 33 =1 =1 =1

Profitability index CF 0 =$ 0 CO 1 = $4, 800 FO 1 CO 2 = $6, 400 FO 2 CO 3 = $8, 200 FO 3 I = 9% NPV CPT $16, 122. 33 =1 =1 =1

Definitions §Capital Budgeting is the process of identifying, evaluating, and implementing a firm’s investment opportunities §Mutually Exclusive Projects are investments that compete in some way for a company’s resources – a firm can select one or another but not both §Independent Projects, on the other hand, do not compete with the firm’s resources. A company can select one, or the other, or both – so long as they meet minimum profitability thresholds.

Definitions §Capital Budgeting is the process of identifying, evaluating, and implementing a firm’s investment opportunities §Mutually Exclusive Projects are investments that compete in some way for a company’s resources – a firm can select one or another but not both §Independent Projects, on the other hand, do not compete with the firm’s resources. A company can select one, or the other, or both – so long as they meet minimum profitability thresholds.

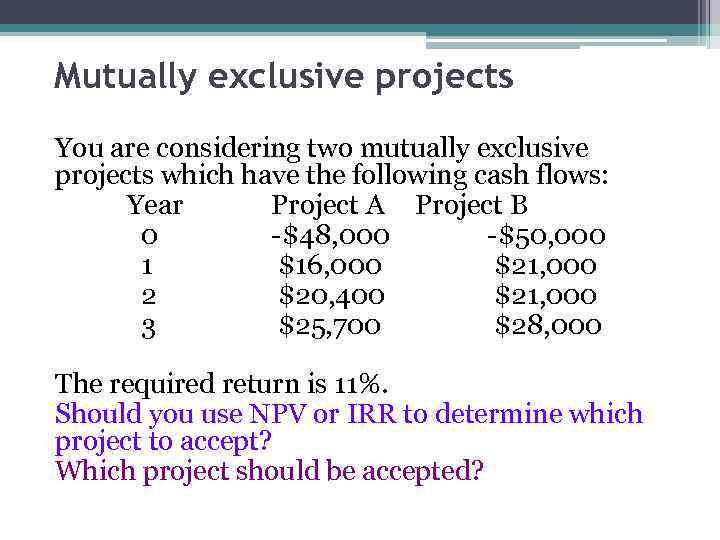

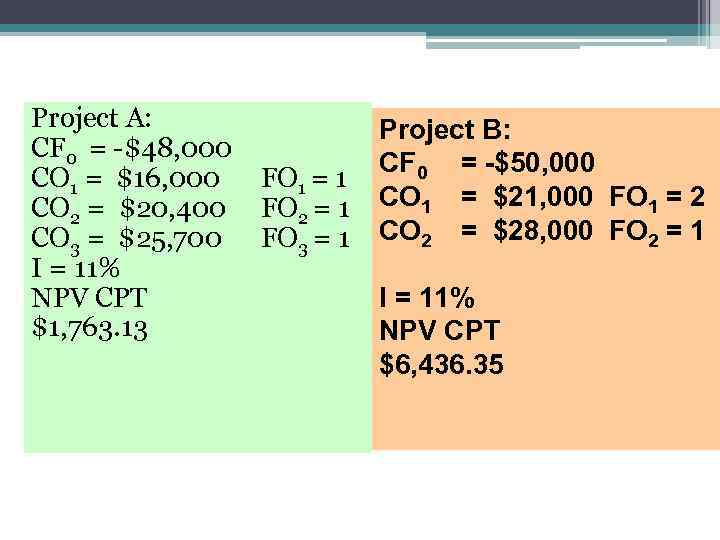

Mutually exclusive projects You are considering two mutually exclusive projects which have the following cash flows: Year Project A Project B 0 -$48, 000 -$50, 000 1 $16, 000 $21, 000 2 $20, 400 $21, 000 3 $25, 700 $28, 000 The required return is 11%. Should you use NPV or IRR to determine which project to accept? Which project should be accepted?

Mutually exclusive projects You are considering two mutually exclusive projects which have the following cash flows: Year Project A Project B 0 -$48, 000 -$50, 000 1 $16, 000 $21, 000 2 $20, 400 $21, 000 3 $25, 700 $28, 000 The required return is 11%. Should you use NPV or IRR to determine which project to accept? Which project should be accepted?

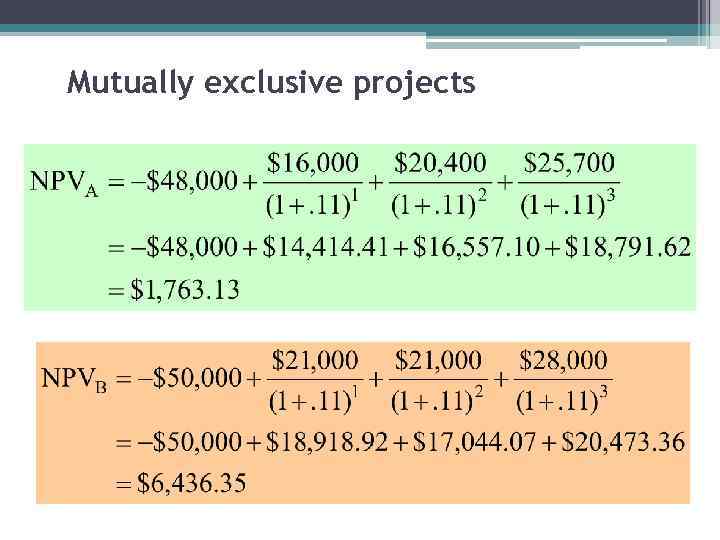

Mutually exclusive projects

Mutually exclusive projects

Project A: Mutually exclusive CF 0 = -$48, 000 CO 1 = $16, 000 FO 1 = 1 CO 2 = $20, 400 FO 2 = 1 CO 3 = $25, 700 FO 3 = 1 I = 11% NPV CPT $1, 763. 13 Project B: projects CF 0 CO 1 CO 2 = -$50, 000 = $21, 000 FO 1 = 2 = $28, 000 FO 2 = 1 I = 11% NPV CPT $6, 436. 35

Project A: Mutually exclusive CF 0 = -$48, 000 CO 1 = $16, 000 FO 1 = 1 CO 2 = $20, 400 FO 2 = 1 CO 3 = $25, 700 FO 3 = 1 I = 11% NPV CPT $1, 763. 13 Project B: projects CF 0 CO 1 CO 2 = -$50, 000 = $21, 000 FO 1 = 2 = $28, 000 FO 2 = 1 I = 11% NPV CPT $6, 436. 35

Net Present Value Profiles

Net Present Value Profiles

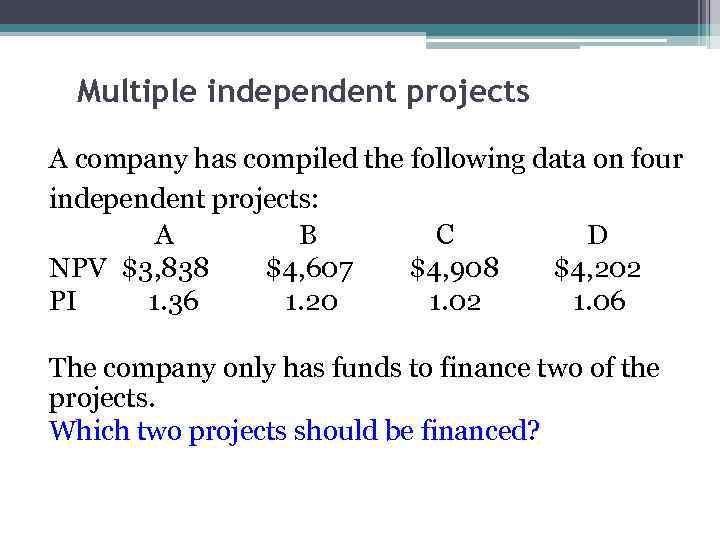

Multiple independent projects A company has compiled the following data on four independent projects: A B C D NPV $3, 838 $4, 607 $4, 908 $4, 202 PI 1. 36 1. 20 1. 02 1. 06 The company only has funds to finance two of the projects. Which two projects should be financed?

Multiple independent projects A company has compiled the following data on four independent projects: A B C D NPV $3, 838 $4, 607 $4, 908 $4, 202 PI 1. 36 1. 20 1. 02 1. 06 The company only has funds to finance two of the projects. Which two projects should be financed?

Multiple independent projects A NPV $3, 838 PI 1. 36 B $4, 607 1. 20 C $4, 908 1. 02 D $4, 202 1. 06 Given that the projects are independent, your best choice, given the information provided, is to select the projects with the highest profitability index (PI) values. Thus, you should select projects A and B as they return more per dollar spent.

Multiple independent projects A NPV $3, 838 PI 1. 36 B $4, 607 1. 20 C $4, 908 1. 02 D $4, 202 1. 06 Given that the projects are independent, your best choice, given the information provided, is to select the projects with the highest profitability index (PI) values. Thus, you should select projects A and B as they return more per dollar spent.

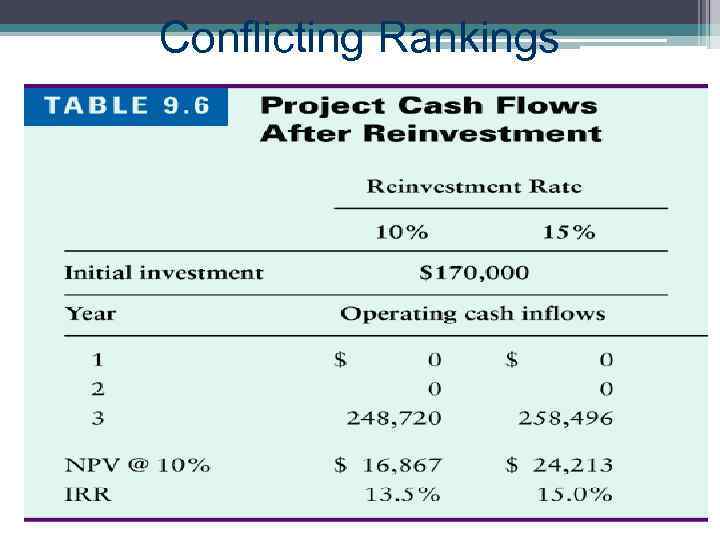

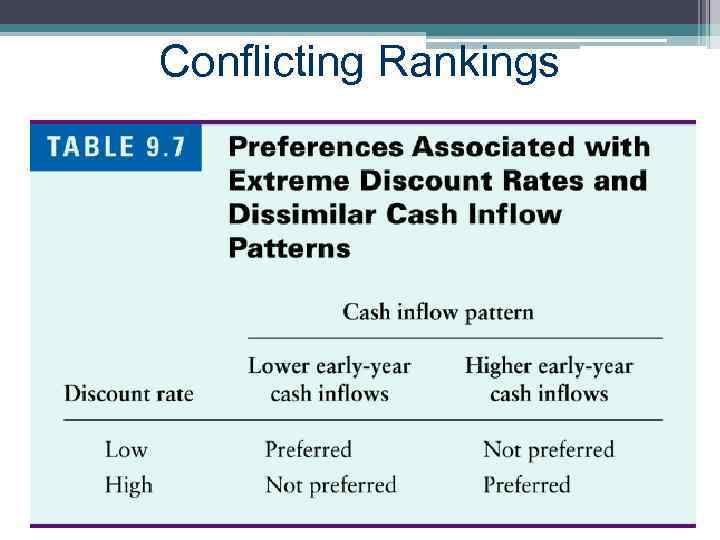

Conflicting Rankings • Conflicting rankings between two or more projects using NPV and IRR sometimes occurs because of differences in the timing and magnitude of cash flows • This underlying cause of conflicting rankings is the implicit assumption concerning the reinvestment of intermediate cash inflows – cash inflows received prior to the termination of the project • NPV assumes intermediate cash flows are reinvested at the cost of capital, while IRR assumes that they are reinvested at the IRR

Conflicting Rankings • Conflicting rankings between two or more projects using NPV and IRR sometimes occurs because of differences in the timing and magnitude of cash flows • This underlying cause of conflicting rankings is the implicit assumption concerning the reinvestment of intermediate cash inflows – cash inflows received prior to the termination of the project • NPV assumes intermediate cash flows are reinvested at the cost of capital, while IRR assumes that they are reinvested at the IRR

Conflicting Rankings

Conflicting Rankings

Conflicting Rankings

Conflicting Rankings

Conflicting Rankings

Conflicting Rankings

Which Approach is Better? • On a purely theoretical basis, NPV is the better approach because: • NPV assumes that intermediate cash flows are reinvested at the cost of capital whereas IRR assumes they are reinvested at the IRR, • Certain mathematical properties may cause a project with non-conventional cash flows to have zero or more than one real IRR • Despite its theoretical superiority, however, financial managers prefer to use the IRR because of the preference for rates of return

Which Approach is Better? • On a purely theoretical basis, NPV is the better approach because: • NPV assumes that intermediate cash flows are reinvested at the cost of capital whereas IRR assumes they are reinvested at the IRR, • Certain mathematical properties may cause a project with non-conventional cash flows to have zero or more than one real IRR • Despite its theoretical superiority, however, financial managers prefer to use the IRR because of the preference for rates of return

Relevant Cash Flow • Categories of Cash Flows: ▫ Initial Cash Flows are cash flows resulting initially from the project. These are typically net negative outflows ▫ Operating Cash Flows are the cash flows generated by the project during its operation. These cash flows typically net positive cash flows ▫ Terminal Cash Flows result from the disposition of the project. These are typically positive net cash flows

Relevant Cash Flow • Categories of Cash Flows: ▫ Initial Cash Flows are cash flows resulting initially from the project. These are typically net negative outflows ▫ Operating Cash Flows are the cash flows generated by the project during its operation. These cash flows typically net positive cash flows ▫ Terminal Cash Flows result from the disposition of the project. These are typically positive net cash flows

Incremental cash flows: ▫ are cash flows specifically associated with the investment, and ▫ their effect on the firms other investments (both positive and negative) must also be considered • Estimating incremental cash flows is relatively straightforward in the case of expansion projects, but not so in the case of replacement projects. • With replacement projects, incremental cash flows must be computed by subtracting existing project cash flows from those expected from the new project • Note that cash outlays already made (sunk costs) are irrelevant to the decision process • However, opportunity costs, which are cash flows that could be realized from the best alternative use of the asset, are relevant.

Incremental cash flows: ▫ are cash flows specifically associated with the investment, and ▫ their effect on the firms other investments (both positive and negative) must also be considered • Estimating incremental cash flows is relatively straightforward in the case of expansion projects, but not so in the case of replacement projects. • With replacement projects, incremental cash flows must be computed by subtracting existing project cash flows from those expected from the new project • Note that cash outlays already made (sunk costs) are irrelevant to the decision process • However, opportunity costs, which are cash flows that could be realized from the best alternative use of the asset, are relevant.

Relevant costs Three years ago, the Jamestown Co. purchased some land for $1. 24 million. Today, the land is valued at $1. 32 million. Six years ago, the company purchased some equipment for $189, 000. This equipment has a current book value of zero and a current market value of $39, 900. What value should be assigned to the land the equipment if the Jamestown Co. opts to use both for a new project? Relevant cost = $1, 320, 000 + $39, 900 = $1, 359, 900

Relevant costs Three years ago, the Jamestown Co. purchased some land for $1. 24 million. Today, the land is valued at $1. 32 million. Six years ago, the company purchased some equipment for $189, 000. This equipment has a current book value of zero and a current market value of $39, 900. What value should be assigned to the land the equipment if the Jamestown Co. opts to use both for a new project? Relevant cost = $1, 320, 000 + $39, 900 = $1, 359, 900

Relevant cash flows The Blue Shoe currently sells 13, 000 pairs of athletic shoes and 4, 500 pairs of dress shoes every year. The athletic shoes sell for an average price of $79 a pair while the average price for the dress shoes is $49. The company is considering expanding their offerings to include sandals at an average price of $29 a pair. The Blue Shoe estimates that the addition of sandals to their lineup will reduce their dress shoe sales by 1, 000 pairs and increase their athletic shoes sales by 800 pairs. The Blue Shoe expects to sell 4, 500 pairs of sandals if they decide to carry them. What amount should the Blue Shoe use as the annual estimated sales revenue when they analyze the addition of sandals to their lineup?

Relevant cash flows The Blue Shoe currently sells 13, 000 pairs of athletic shoes and 4, 500 pairs of dress shoes every year. The athletic shoes sell for an average price of $79 a pair while the average price for the dress shoes is $49. The company is considering expanding their offerings to include sandals at an average price of $29 a pair. The Blue Shoe estimates that the addition of sandals to their lineup will reduce their dress shoe sales by 1, 000 pairs and increase their athletic shoes sales by 800 pairs. The Blue Shoe expects to sell 4, 500 pairs of sandals if they decide to carry them. What amount should the Blue Shoe use as the annual estimated sales revenue when they analyze the addition of sandals to their lineup?

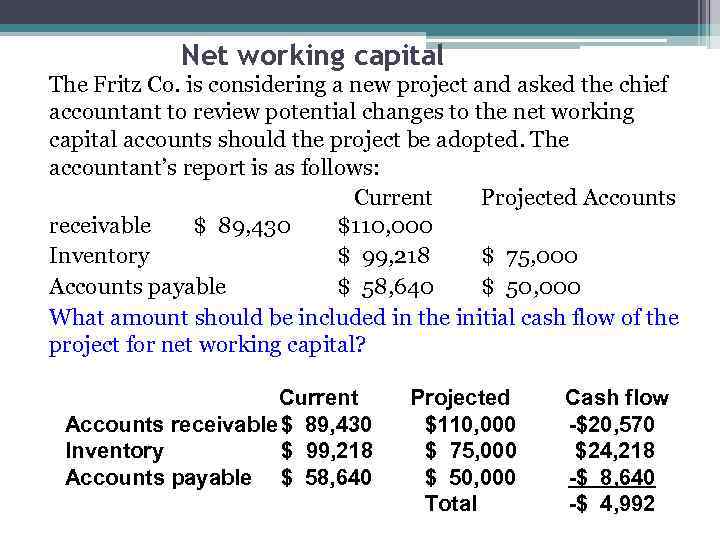

Net working capital The Fritz Co. is considering a new project and asked the chief accountant to review potential changes to the net working capital accounts should the project be adopted. The accountant’s report is as follows: Current Projected Accounts receivable $ 89, 430 $110, 000 Inventory $ 99, 218 $ 75, 000 Accounts payable $ 58, 640 $ 50, 000 What amount should be included in the initial cash flow of the project for net working capital? Current Accounts receivable$ 89, 430 Inventory $ 99, 218 Accounts payable $ 58, 640 Projected $110, 000 $ 75, 000 $ 50, 000 Total Cash flow -$20, 570 $24, 218 -$ 8, 640 -$ 4, 992

Net working capital The Fritz Co. is considering a new project and asked the chief accountant to review potential changes to the net working capital accounts should the project be adopted. The accountant’s report is as follows: Current Projected Accounts receivable $ 89, 430 $110, 000 Inventory $ 99, 218 $ 75, 000 Accounts payable $ 58, 640 $ 50, 000 What amount should be included in the initial cash flow of the project for net working capital? Current Accounts receivable$ 89, 430 Inventory $ 99, 218 Accounts payable $ 58, 640 Projected $110, 000 $ 75, 000 $ 50, 000 Total Cash flow -$20, 570 $24, 218 -$ 8, 640 -$ 4, 992

MACRS depreciation Year 5 -year 1 20. 00% 2 32. 00% 3 19. 20% 4 11. 52% 5 11. 52% 6 5. 76% Williamson Industries purchased some 5 -year property at a cost of $264, 900. What is the depreciation expense for year 2? What is the depreciation expense for year 4?

MACRS depreciation Year 5 -year 1 20. 00% 2 32. 00% 3 19. 20% 4 11. 52% 5 11. 52% 6 5. 76% Williamson Industries purchased some 5 -year property at a cost of $264, 900. What is the depreciation expense for year 2? What is the depreciation expense for year 4?

The Modified Accelerated Cost Recovery System (MACRS) is the current tax depreciation system in the United States. Under this system, the capitalized cost (basis) of tangible property is recovered over a specified life by annual deductions for depreciation.

The Modified Accelerated Cost Recovery System (MACRS) is the current tax depreciation system in the United States. Under this system, the capitalized cost (basis) of tangible property is recovered over a specified life by annual deductions for depreciation.

MACRS depreciation Appleton’s, Inc. purchased equipment which is classified as 5 -year property for MACRS. The equipment cost $178, 400. What is the book value of the equipment at the end of the first year? What is the book value of the equipment at the end of year four? 5 -year 1 20. 00% 2 32. 00% 3 Book value at end of year one $178, 400 (1 -. 20) = $142, 720. 00 Book value at end of year four $178, 400 (1 -. 20 -. 32 -. 192 -. 1152) = $30, 827. 52 Yea r 19. 20% 4 11. 52% 5 11. 52% 6 5. 76%

MACRS depreciation Appleton’s, Inc. purchased equipment which is classified as 5 -year property for MACRS. The equipment cost $178, 400. What is the book value of the equipment at the end of the first year? What is the book value of the equipment at the end of year four? 5 -year 1 20. 00% 2 32. 00% 3 Book value at end of year one $178, 400 (1 -. 20) = $142, 720. 00 Book value at end of year four $178, 400 (1 -. 20 -. 32 -. 192 -. 1152) = $30, 827. 52 Yea r 19. 20% 4 11. 52% 5 11. 52% 6 5. 76%

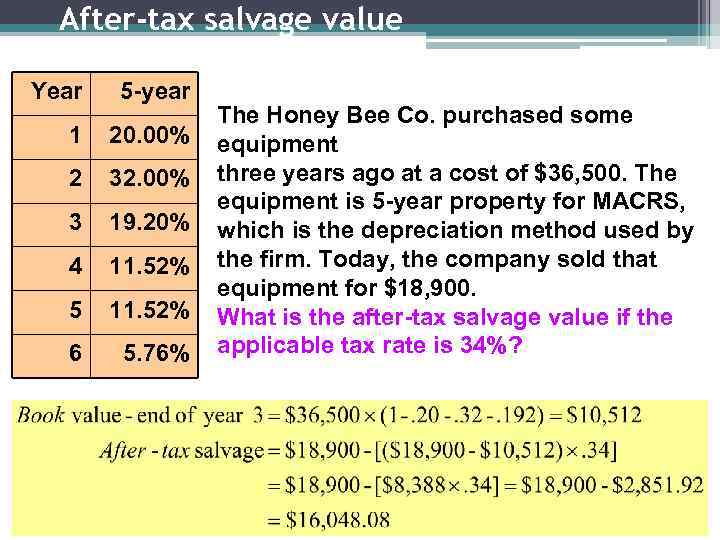

After-tax salvage value Year 5 -year 1 20. 00% 2 32. 00% 3 19. 20% 4 11. 52% 5 11. 52% 6 5. 76% The Honey Bee Co. purchased some equipment three years ago at a cost of $36, 500. The equipment is 5 -year property for MACRS, which is the depreciation method used by the firm. Today, the company sold that equipment for $18, 900. What is the after-tax salvage value if the applicable tax rate is 34%?

After-tax salvage value Year 5 -year 1 20. 00% 2 32. 00% 3 19. 20% 4 11. 52% 5 11. 52% 6 5. 76% The Honey Bee Co. purchased some equipment three years ago at a cost of $36, 500. The equipment is 5 -year property for MACRS, which is the depreciation method used by the firm. Today, the company sold that equipment for $18, 900. What is the after-tax salvage value if the applicable tax rate is 34%?

Pro-forma income statement A project is expected to generate $48, 400 in sales, $31, 500 in costs and $7, 500 in depreciation expense. What is the projected net income for this project if the applicable tax rate is 34%? Sales Costs Depreciation EBIT Tax (34%) Net income $48, 400 31, 500 7, 500 $ 9, 400 3, 196 $ 6, 204

Pro-forma income statement A project is expected to generate $48, 400 in sales, $31, 500 in costs and $7, 500 in depreciation expense. What is the projected net income for this project if the applicable tax rate is 34%? Sales Costs Depreciation EBIT Tax (34%) Net income $48, 400 31, 500 7, 500 $ 9, 400 3, 196 $ 6, 204

Project operating cash flow Betty’s Boutique is considering a project with projected sales of $46, 000. Costs are estimated at $29, 500. The project will require $20, 000 initially for the purchase of new equipment. This equipment will be depreciated using straight line depreciation to a zero book value over the four year life of the project. The equipment will be worthless at the end of the four years. The tax rate is 35%. What is the amount of the projected annual operating cash flow for this project? Sales $46, 000 Costs 29, 500 Depreciation 5, 000 ($20, 000 4) EBIT $11, 500 Tax (35%) 4, 025 Net income $ 7, 475 OCF = EBIT + Depreciation - Taxes OCF = $11, 500 + $5, 000 - $4, 025 = $12, 475

Project operating cash flow Betty’s Boutique is considering a project with projected sales of $46, 000. Costs are estimated at $29, 500. The project will require $20, 000 initially for the purchase of new equipment. This equipment will be depreciated using straight line depreciation to a zero book value over the four year life of the project. The equipment will be worthless at the end of the four years. The tax rate is 35%. What is the amount of the projected annual operating cash flow for this project? Sales $46, 000 Costs 29, 500 Depreciation 5, 000 ($20, 000 4) EBIT $11, 500 Tax (35%) 4, 025 Net income $ 7, 475 OCF = EBIT + Depreciation - Taxes OCF = $11, 500 + $5, 000 - $4, 025 = $12, 475

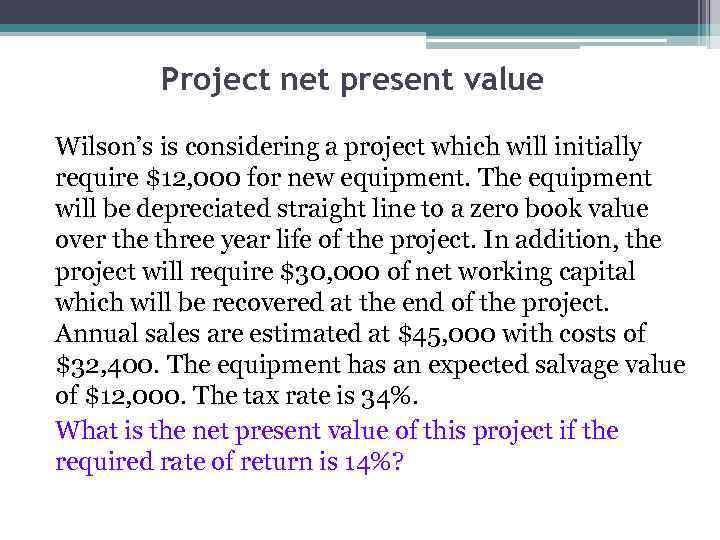

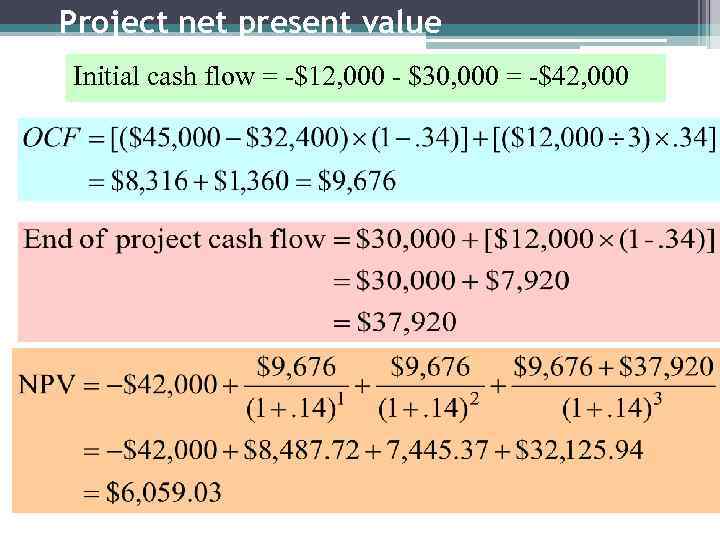

Project net present value Wilson’s is considering a project which will initially require $12, 000 for new equipment. The equipment will be depreciated straight line to a zero book value over the three year life of the project. In addition, the project will require $30, 000 of net working capital which will be recovered at the end of the project. Annual sales are estimated at $45, 000 with costs of $32, 400. The equipment has an expected salvage value of $12, 000. The tax rate is 34%. What is the net present value of this project if the required rate of return is 14%?

Project net present value Wilson’s is considering a project which will initially require $12, 000 for new equipment. The equipment will be depreciated straight line to a zero book value over the three year life of the project. In addition, the project will require $30, 000 of net working capital which will be recovered at the end of the project. Annual sales are estimated at $45, 000 with costs of $32, 400. The equipment has an expected salvage value of $12, 000. The tax rate is 34%. What is the net present value of this project if the required rate of return is 14%?

Project net present value Initial cash flow = -$12, 000 - $30, 000 = -$42, 000

Project net present value Initial cash flow = -$12, 000 - $30, 000 = -$42, 000

Tax-shield OCF La. Mont, Inc. is analyzing a project that has projected sales of $56, 800, costs of $46, 700 and annual depreciation of $4, 500. The tax rate is 35%. Use the tax-shield approach to compute the annual operating cash flow for this project.

Tax-shield OCF La. Mont, Inc. is analyzing a project that has projected sales of $56, 800, costs of $46, 700 and annual depreciation of $4, 500. The tax rate is 35%. Use the tax-shield approach to compute the annual operating cash flow for this project.

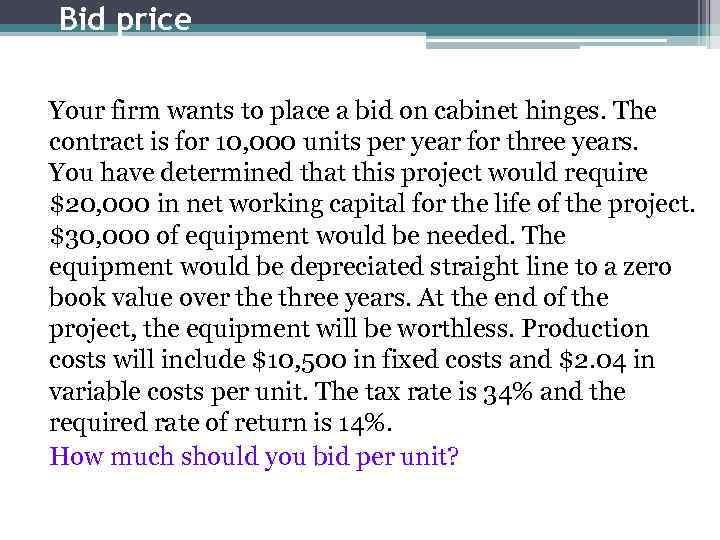

Bid price Your firm wants to place a bid on cabinet hinges. The contract is for 10, 000 units per year for three years. You have determined that this project would require $20, 000 in net working capital for the life of the project. $30, 000 of equipment would be needed. The equipment would be depreciated straight line to a zero book value over the three years. At the end of the project, the equipment will be worthless. Production costs will include $10, 500 in fixed costs and $2. 04 in variable costs per unit. The tax rate is 34% and the required rate of return is 14%. How much should you bid per unit?

Bid price Your firm wants to place a bid on cabinet hinges. The contract is for 10, 000 units per year for three years. You have determined that this project would require $20, 000 in net working capital for the life of the project. $30, 000 of equipment would be needed. The equipment would be depreciated straight line to a zero book value over the three years. At the end of the project, the equipment will be worthless. Production costs will include $10, 500 in fixed costs and $2. 04 in variable costs per unit. The tax rate is 34% and the required rate of return is 14%. How much should you bid per unit?

Bid price

Bid price

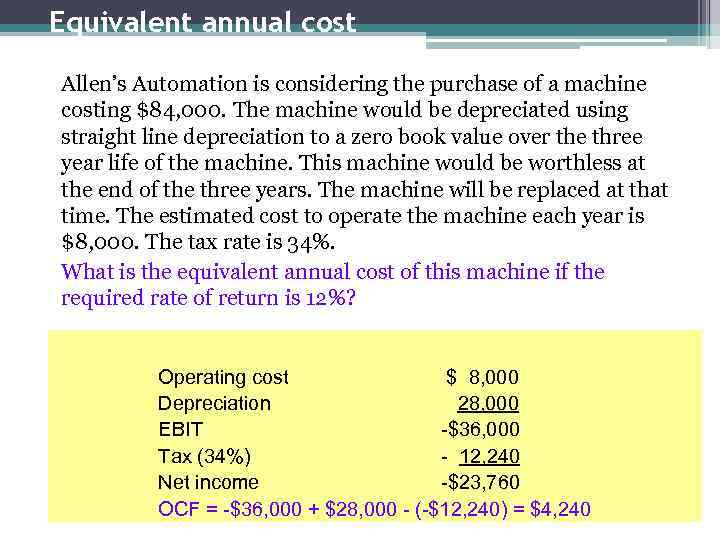

Equivalent annual cost Allen’s Automation is considering the purchase of a machine costing $84, 000. The machine would be depreciated using straight line depreciation to a zero book value over the three year life of the machine. This machine would be worthless at the end of the three years. The machine will be replaced at that time. The estimated cost to operate the machine each year is $8, 000. The tax rate is 34%. What is the equivalent annual cost of this machine if the required rate of return is 12%? Operating cost $ 8, 000 Depreciation 28, 000 EBIT -$36, 000 Tax (34%) - 12, 240 Net income -$23, 760 OCF = -$36, 000 + $28, 000 - (-$12, 240) = $4, 240

Equivalent annual cost Allen’s Automation is considering the purchase of a machine costing $84, 000. The machine would be depreciated using straight line depreciation to a zero book value over the three year life of the machine. This machine would be worthless at the end of the three years. The machine will be replaced at that time. The estimated cost to operate the machine each year is $8, 000. The tax rate is 34%. What is the equivalent annual cost of this machine if the required rate of return is 12%? Operating cost $ 8, 000 Depreciation 28, 000 EBIT -$36, 000 Tax (34%) - 12, 240 Net income -$23, 760 OCF = -$36, 000 + $28, 000 - (-$12, 240) = $4, 240

Equivalent annual cost

Equivalent annual cost

NPV -IRR

NPV -IRR

• Firstly, IRR assumes that interim Problems with IRR positive cash flows are reinvested at the same rate of return as that of the project that generated them. • This is usually an unrealistic scenario and a more likely situation is that the funds will be reinvested at a rate closer to the firm's cost of capital. • The IRR therefore often gives an unduly optimistic picture of the projects under study. Generally for comparing projects more fairly, the weighted average cost of capital should be used for reinvesting the interim cash flows. • Secondly, more than one IRR can be found for projects with alternating positive and negative cash flows, which leads to confusion and ambiguity.

• Firstly, IRR assumes that interim Problems with IRR positive cash flows are reinvested at the same rate of return as that of the project that generated them. • This is usually an unrealistic scenario and a more likely situation is that the funds will be reinvested at a rate closer to the firm's cost of capital. • The IRR therefore often gives an unduly optimistic picture of the projects under study. Generally for comparing projects more fairly, the weighted average cost of capital should be used for reinvesting the interim cash flows. • Secondly, more than one IRR can be found for projects with alternating positive and negative cash flows, which leads to confusion and ambiguity.

MIRR

MIRR