0b6458e8cbab79b736a333adae21d15f.ppt

- Количество слайдов: 22

NESTOR Osteuropa Fonds Access to the Eastern European Opportunities (as of 31 Jan, 2006)

NESTOR Osteuropa Fonds Access to the Eastern European Opportunities (as of 31 Jan, 2006)

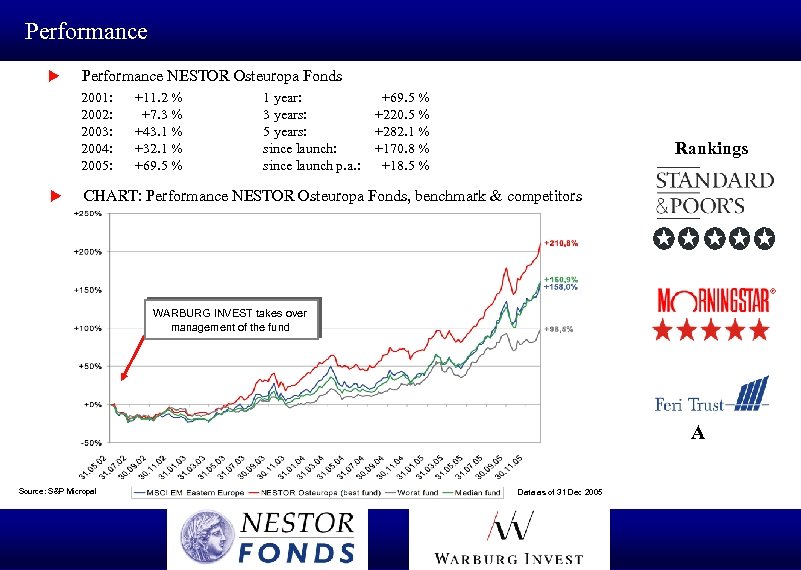

Performance u Performance NESTOR Osteuropa Fonds 2001: 2002: 2003: 2004: 2005: u +11. 2 % +7. 3 % +43. 1 % +32. 1 % +69. 5 % 1 year: 3 years: 5 years: since launch p. a. : +69. 5 % +220. 5 % +282. 1 % +170. 8 % +18. 5 % Rankings CHART: Performance NESTOR Osteuropa Fonds, benchmark & competitors WARBURG INVEST takes over management of the fund A Source: S&P Micropal Data as of 31 Dec 2005

Performance u Performance NESTOR Osteuropa Fonds 2001: 2002: 2003: 2004: 2005: u +11. 2 % +7. 3 % +43. 1 % +32. 1 % +69. 5 % 1 year: 3 years: 5 years: since launch p. a. : +69. 5 % +220. 5 % +282. 1 % +170. 8 % +18. 5 % Rankings CHART: Performance NESTOR Osteuropa Fonds, benchmark & competitors WARBURG INVEST takes over management of the fund A Source: S&P Micropal Data as of 31 Dec 2005

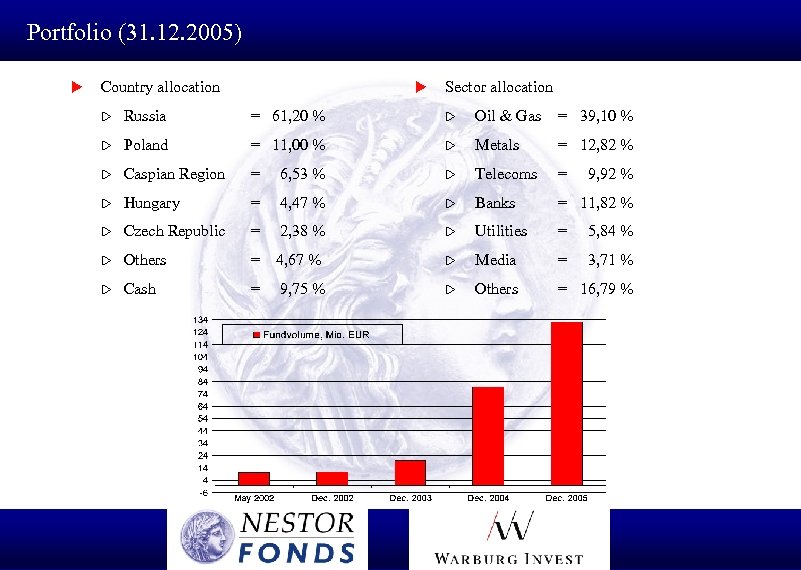

Portfolio (31. 12. 2005) u Country allocation u Sector allocation w Russia = 61, 20 % w Oil & Gas = 39, 10 % w Poland = 11, 00 % w Metals = 12, 82 % w Caspian Region = 6, 53 % w Telecoms = w Hungary = 4, 47 % w Banks = 11, 82 % w Czech Republic = 2, 38 % w Utilities = 5, 84 % w Others = 4, 67 % w Media = 3, 71 % w Cash = 9, 75 % w Others = 16, 79 % 9, 92 %

Portfolio (31. 12. 2005) u Country allocation u Sector allocation w Russia = 61, 20 % w Oil & Gas = 39, 10 % w Poland = 11, 00 % w Metals = 12, 82 % w Caspian Region = 6, 53 % w Telecoms = w Hungary = 4, 47 % w Banks = 11, 82 % w Czech Republic = 2, 38 % w Utilities = 5, 84 % w Others = 4, 67 % w Media = 3, 71 % w Cash = 9, 75 % w Others = 16, 79 % 9, 92 %

Why Eastern Europe? – Ideas u „New“ Russia w w Development process and momentum of change is being underestimated by the west w u The value system of people is changing There a lot undiscovered opportunities Europe is going East w Growth potential is higher than in Western Europe w Process is well known and understood

Why Eastern Europe? – Ideas u „New“ Russia w w Development process and momentum of change is being underestimated by the west w u The value system of people is changing There a lot undiscovered opportunities Europe is going East w Growth potential is higher than in Western Europe w Process is well known and understood

Fund Outlook Priorities u Russia w Commodities w Local Gazprom Shares via a special vehicle w Utilities w Mobile telephone companies u Poland u Western Companies with main businesses in Eastern Europe u Oil companies in Caspian region u New potential EU Members: Turkey, Bulgaria, Romania, Ukraine

Fund Outlook Priorities u Russia w Commodities w Local Gazprom Shares via a special vehicle w Utilities w Mobile telephone companies u Poland u Western Companies with main businesses in Eastern Europe u Oil companies in Caspian region u New potential EU Members: Turkey, Bulgaria, Romania, Ukraine

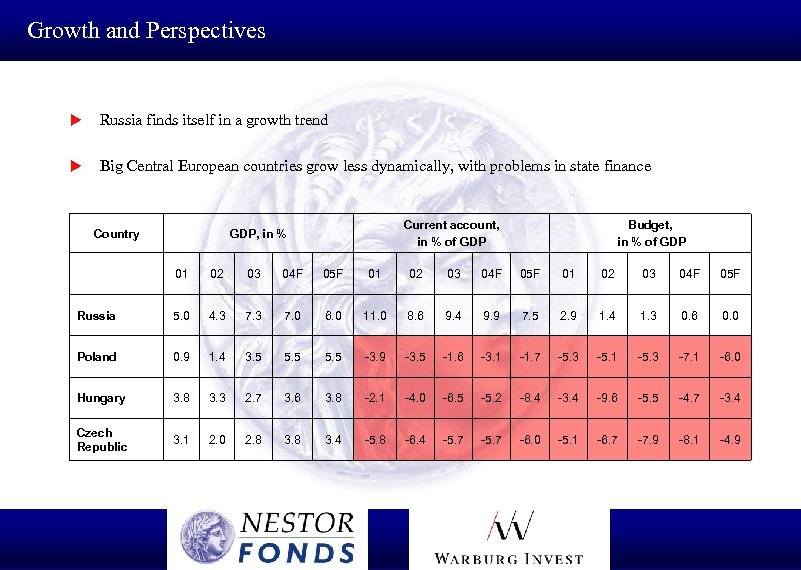

Growth and Perspectives u Russia finds itself in a growth trend u Big Central European countries grow less dynamically, with problems in state finance Country Current account, in % of GDP, in % Budget, in % of GDP 01 02 03 04 F 05 F Russia 5. 0 4. 3 7. 0 6. 0 11. 0 8. 6 9. 4 9. 9 7. 5 2. 9 1. 4 1. 3 0. 6 0. 0 Poland 0. 9 1. 4 3. 5 5. 5 -3. 9 -3. 5 -1. 6 -3. 1 -1. 7 -5. 3 -5. 1 -5. 3 -7. 1 -6. 0 Hungary 3. 8 3. 3 2. 7 3. 6 3. 8 -2. 1 -4. 0 -6. 5 -5. 2 -8. 4 -3. 4 -9. 6 -5. 5 -4. 7 -3. 4 Czech Republic 3. 1 2. 0 2. 8 3. 4 -5. 8 -6. 4 -5. 7 -6. 0 -5. 1 -6. 7 -7. 9 -8. 1 -4. 9

Growth and Perspectives u Russia finds itself in a growth trend u Big Central European countries grow less dynamically, with problems in state finance Country Current account, in % of GDP, in % Budget, in % of GDP 01 02 03 04 F 05 F Russia 5. 0 4. 3 7. 0 6. 0 11. 0 8. 6 9. 4 9. 9 7. 5 2. 9 1. 4 1. 3 0. 6 0. 0 Poland 0. 9 1. 4 3. 5 5. 5 -3. 9 -3. 5 -1. 6 -3. 1 -1. 7 -5. 3 -5. 1 -5. 3 -7. 1 -6. 0 Hungary 3. 8 3. 3 2. 7 3. 6 3. 8 -2. 1 -4. 0 -6. 5 -5. 2 -8. 4 -3. 4 -9. 6 -5. 5 -4. 7 -3. 4 Czech Republic 3. 1 2. 0 2. 8 3. 4 -5. 8 -6. 4 -5. 7 -6. 0 -5. 1 -6. 7 -7. 9 -8. 1 -4. 9

Russia: More promising than ever u Basic background information: w w Democratisation process should sustain, even though the way is not easy w u Improving political stability Structural reforms (not dependent on Yukos affair) Basic economic information: w Russia has investment grade from all three major agencies w Positive trend in capital flows after all w Corporate governance is improving w „Yukos“ failure is the „one-off“

Russia: More promising than ever u Basic background information: w w Democratisation process should sustain, even though the way is not easy w u Improving political stability Structural reforms (not dependent on Yukos affair) Basic economic information: w Russia has investment grade from all three major agencies w Positive trend in capital flows after all w Corporate governance is improving w „Yukos“ failure is the „one-off“

Poland: Taking off u Basic background information: w w Political changes are not harming economic situation w u EU membership is a stabilising factor Structural reforms are being continued Basic economic information: w Polish companies have been restructured during the economic slowdown w Monetary policy is not an obstacle anymore for economic development w Competitive advantage through cheaper but nevertheless well educates labour force

Poland: Taking off u Basic background information: w w Political changes are not harming economic situation w u EU membership is a stabilising factor Structural reforms are being continued Basic economic information: w Polish companies have been restructured during the economic slowdown w Monetary policy is not an obstacle anymore for economic development w Competitive advantage through cheaper but nevertheless well educates labour force

Caspian Region: Oil „Bonanza“ u Basic background information: w No „Yukos-like“ oligarchy w Stable and investor friendly legislation in Kazakhstan w The political system is authoritarian and might stay so w Western Countries and especially USA have big political and economic interests in the region u Basic economic information: w Region holds 5 % of world oil and gas reserves w Low costs and high profit margins w Transportation problems will be solved in the near future w The majority of western fund managers are not familiar with the region

Caspian Region: Oil „Bonanza“ u Basic background information: w No „Yukos-like“ oligarchy w Stable and investor friendly legislation in Kazakhstan w The political system is authoritarian and might stay so w Western Countries and especially USA have big political and economic interests in the region u Basic economic information: w Region holds 5 % of world oil and gas reserves w Low costs and high profit margins w Transportation problems will be solved in the near future w The majority of western fund managers are not familiar with the region

Approach u Portfolio Approach w Benchmark: MSCI EM Eastern Europe (EUR) w Combination of «Top Down» and «Bottom Up» approachies w No hesitation to go into cash in case of negative market development

Approach u Portfolio Approach w Benchmark: MSCI EM Eastern Europe (EUR) w Combination of «Top Down» and «Bottom Up» approachies w No hesitation to go into cash in case of negative market development

Approach u Top Down Approach: countries w Political situation: sources of disturbance / social peace / ethnic peace w Economic development, business climate w GDP Growth and industrial production w Current account w Fiscal discipline w Indebtedness w Interest rates w Inflation / money supply / currency reserves / capital flows w Development of real income / trends of labor market

Approach u Top Down Approach: countries w Political situation: sources of disturbance / social peace / ethnic peace w Economic development, business climate w GDP Growth and industrial production w Current account w Fiscal discipline w Indebtedness w Interest rates w Inflation / money supply / currency reserves / capital flows w Development of real income / trends of labor market

Approach u Bottom up: Stock Selection w Market capitalization 200 Mio. EUR w Shareholder-Value-Orientation w Leading position in it‘s sector w Financials better than in average in the sector w „Western-minded“ and well trained management w Strategical use of information technology w Accounting under western standards w Audited by well known western companies

Approach u Bottom up: Stock Selection w Market capitalization 200 Mio. EUR w Shareholder-Value-Orientation w Leading position in it‘s sector w Financials better than in average in the sector w „Western-minded“ and well trained management w Strategical use of information technology w Accounting under western standards w Audited by well known western companies

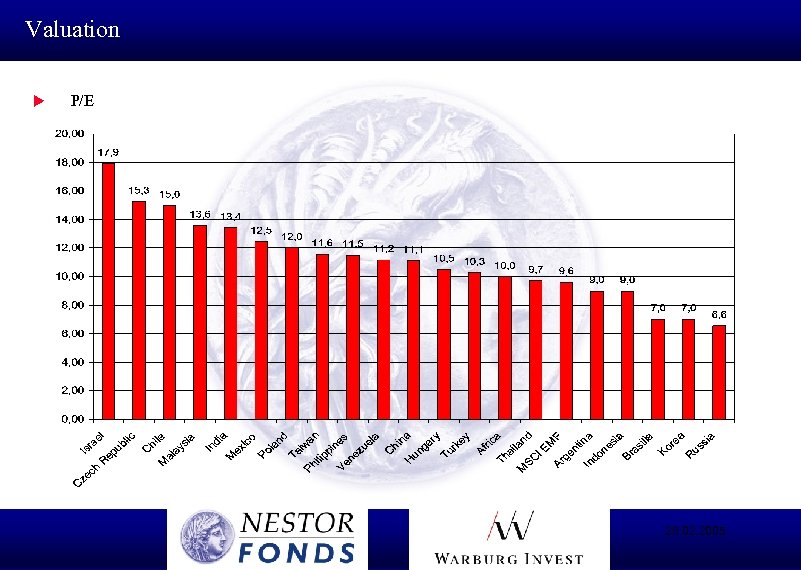

Valuation u P/E 28. 02. 2005

Valuation u P/E 28. 02. 2005

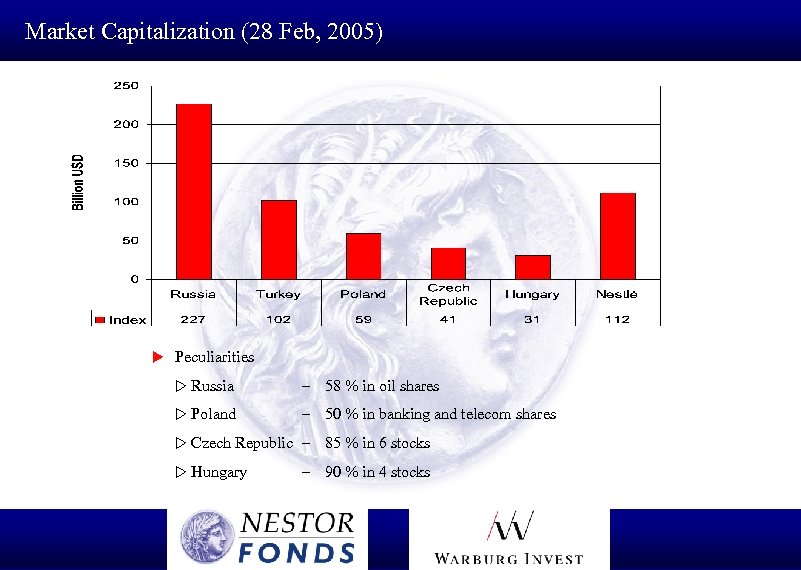

Market Capitalization (28 Feb, 2005) u Peculiarities w Russia – 58 % in oil shares w Poland – 50 % in banking and telecom shares w Czech Republic – w Hungary 85 % in 6 stocks – 90 % in 4 stocks

Market Capitalization (28 Feb, 2005) u Peculiarities w Russia – 58 % in oil shares w Poland – 50 % in banking and telecom shares w Czech Republic – w Hungary 85 % in 6 stocks – 90 % in 4 stocks

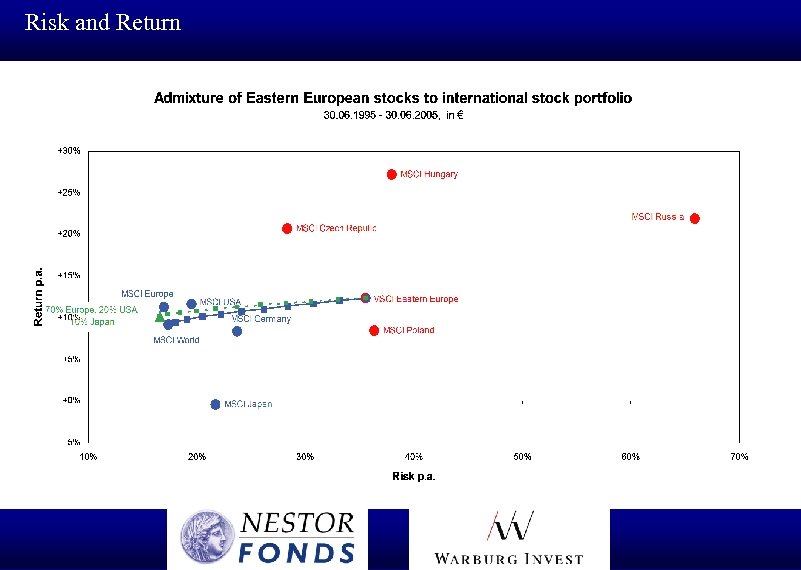

Risk and Return

Risk and Return

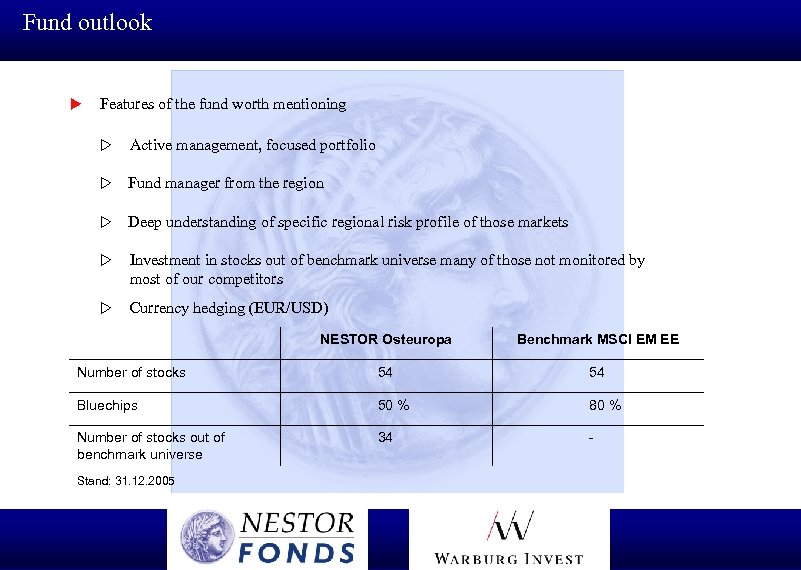

Fund outlook u Features of the fund worth mentioning w Active management, focused portfolio w Fund manager from the region w Deep understanding of specific regional risk profile of those markets w Investment in stocks out of benchmark universe many of those not monitored by most of our competitors w Currency hedging (EUR/USD) NESTOR Osteuropa Benchmark MSCI EM EE Number of stocks 54 54 Bluechips 50 % 80 % Number of stocks out of benchmark universe 34 - Stand: 31. 12. 2005

Fund outlook u Features of the fund worth mentioning w Active management, focused portfolio w Fund manager from the region w Deep understanding of specific regional risk profile of those markets w Investment in stocks out of benchmark universe many of those not monitored by most of our competitors w Currency hedging (EUR/USD) NESTOR Osteuropa Benchmark MSCI EM EE Number of stocks 54 54 Bluechips 50 % 80 % Number of stocks out of benchmark universe 34 - Stand: 31. 12. 2005

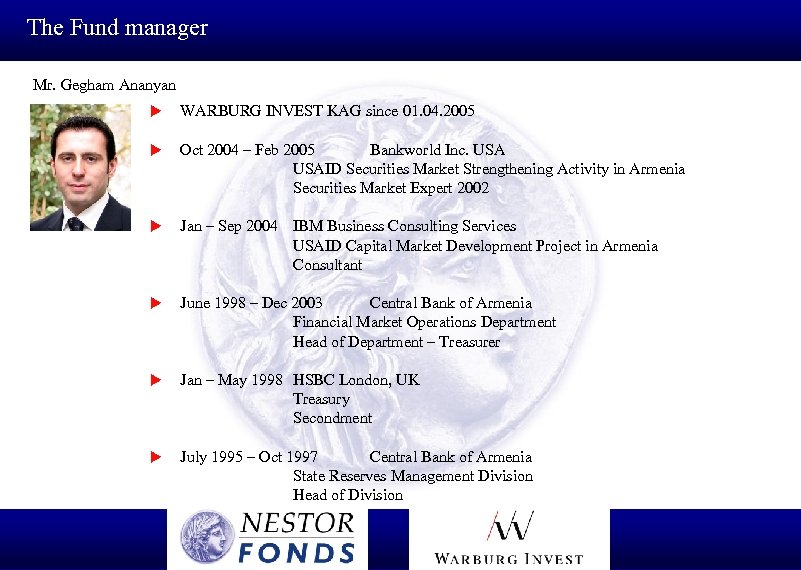

The Fund manager Mr. Gegham Ananyan u WARBURG INVEST KAG since 01. 04. 2005 u Oct 2004 – Feb 2005 Bankworld Inc. USAID Securities Market Strengthening Activity in Armenia Securities Market Expert 2002 u Jan – Sep 2004 IBM Business Consulting Services USAID Capital Market Development Project in Armenia Consultant u June 1998 – Dec 2003 Central Bank of Armenia Financial Market Operations Department Head of Department – Treasurer u Jan – May 1998 HSBC London, UK Treasury Secondment u July 1995 – Oct 1997 Central Bank of Armenia State Reserves Management Division Head of Division

The Fund manager Mr. Gegham Ananyan u WARBURG INVEST KAG since 01. 04. 2005 u Oct 2004 – Feb 2005 Bankworld Inc. USAID Securities Market Strengthening Activity in Armenia Securities Market Expert 2002 u Jan – Sep 2004 IBM Business Consulting Services USAID Capital Market Development Project in Armenia Consultant u June 1998 – Dec 2003 Central Bank of Armenia Financial Market Operations Department Head of Department – Treasurer u Jan – May 1998 HSBC London, UK Treasury Secondment u July 1995 – Oct 1997 Central Bank of Armenia State Reserves Management Division Head of Division

The Fundmanager u Key skills and achievements w Key fields: reserves managements, capital markets, macroeconomics w Analytical, languages, managerial, teamwork, communication skills and contacts w Became Head of State Reserves Management Division of the Central Bank of Armenia in 1 year after graduation w A pioneer of state foreign exchange reserves management in Armenia (Author of the number of articles on reserve management) w Became Head of Financial Market Operations Department-Treasurer of the Central Bank in 4 years after graduation w Member of the Committee for Developing of Armenian Precious Metals Industry and Gold Market under the Prime Minister of Armenia w Made headed Committee for conducting primary auctions of Government Securities w As a key negotiator of the Central Bank and the Government of Armenia, was responsible for the relations with the international private financial institutions w Seconded for work in the Capital and Emerging Markets desks of the global international bank in London w Trainings, including „on-the-job“ in the leading world financial institutions: Deutsche Bank, UBS, Citibank, HSBC, Commerzbank, Credit Suisse First Boston, Chase Manhattan, Bundesbank, Bank England, De Nederlandsche Bank, World Bank, IMF

The Fundmanager u Key skills and achievements w Key fields: reserves managements, capital markets, macroeconomics w Analytical, languages, managerial, teamwork, communication skills and contacts w Became Head of State Reserves Management Division of the Central Bank of Armenia in 1 year after graduation w A pioneer of state foreign exchange reserves management in Armenia (Author of the number of articles on reserve management) w Became Head of Financial Market Operations Department-Treasurer of the Central Bank in 4 years after graduation w Member of the Committee for Developing of Armenian Precious Metals Industry and Gold Market under the Prime Minister of Armenia w Made headed Committee for conducting primary auctions of Government Securities w As a key negotiator of the Central Bank and the Government of Armenia, was responsible for the relations with the international private financial institutions w Seconded for work in the Capital and Emerging Markets desks of the global international bank in London w Trainings, including „on-the-job“ in the leading world financial institutions: Deutsche Bank, UBS, Citibank, HSBC, Commerzbank, Credit Suisse First Boston, Chase Manhattan, Bundesbank, Bank England, De Nederlandsche Bank, World Bank, IMF

Die Fondsdaten Investment focus: Investment company: Fund manager: x ISIN Code: Fund currency: Initial issue: End of commercial year: Dividend policy: Calculation of the Net Asset Value: Registered for sale in: Eastern- and South Eastern European equities NESTOR Investment Management S. A. , Luxembourg Gegham ANANYAN, Warburg Invest KAG mb. H, Frankfurt/Main LU 0108457267 Euro 21 February, 2000 June, 30 thesaurierend täglich Germany, Luxembourg, Austria

Die Fondsdaten Investment focus: Investment company: Fund manager: x ISIN Code: Fund currency: Initial issue: End of commercial year: Dividend policy: Calculation of the Net Asset Value: Registered for sale in: Eastern- and South Eastern European equities NESTOR Investment Management S. A. , Luxembourg Gegham ANANYAN, Warburg Invest KAG mb. H, Frankfurt/Main LU 0108457267 Euro 21 February, 2000 June, 30 thesaurierend täglich Germany, Luxembourg, Austria

Die Fondsdaten Depository bank: Partner for institutional investors: Settlement: Kassenverein Clearstream Fundsettle Cut-off time: Partner for any sales matters: M. M. Warburg & CO Luxembourg S. A. Daniela Schiffels, Sylvia Bono Tel: +352 45 45 -279 Fax: +352 42 45 45 -405 E-Mail: depotbankstelle@mmwarburg. lu Delivery against payment M. M. Warburg & CO Luxembourg S. A. 3049 30864 14878 on every valuation day in Luxembourg at the latest by 16 p. m. ; application shall be dealt with at the following valuation day NESTOR-Fonds-Vertriebs-Gmb. H Tel: 0800/063 78 67 E-Mail: info@nestor-fonds. de

Die Fondsdaten Depository bank: Partner for institutional investors: Settlement: Kassenverein Clearstream Fundsettle Cut-off time: Partner for any sales matters: M. M. Warburg & CO Luxembourg S. A. Daniela Schiffels, Sylvia Bono Tel: +352 45 45 -279 Fax: +352 42 45 45 -405 E-Mail: depotbankstelle@mmwarburg. lu Delivery against payment M. M. Warburg & CO Luxembourg S. A. 3049 30864 14878 on every valuation day in Luxembourg at the latest by 16 p. m. ; application shall be dealt with at the following valuation day NESTOR-Fonds-Vertriebs-Gmb. H Tel: 0800/063 78 67 E-Mail: info@nestor-fonds. de

NESTOR Investment Management S. A. NESTOR-Fonds-Vertriebs-Gmb. H 2, Place Dargent, L-1413 Luxembourg Ottostraße 5, D-80333 München Tel. + 352/42 70 42 Fax: +352/42 74 Tel. 089/54 59 03 -80 54 E-Mail: luxinvest@mmwarburg. lu Fax: 089/54 59 03 -85 E-Mail: info@nestor-fonds. de www. nestor-fonds. de

NESTOR Investment Management S. A. NESTOR-Fonds-Vertriebs-Gmb. H 2, Place Dargent, L-1413 Luxembourg Ottostraße 5, D-80333 München Tel. + 352/42 70 42 Fax: +352/42 74 Tel. 089/54 59 03 -80 54 E-Mail: luxinvest@mmwarburg. lu Fax: 089/54 59 03 -85 E-Mail: info@nestor-fonds. de www. nestor-fonds. de

Rechtlicher Hinweis Diese Präsentation wurde von der NESTOR Investment Management S. A. , Luxemburg publiziert und stellt kein Angebot zum Kauf von Anteilen und keine Aufforderung zur Abgabe eines Angebotes zum Kauf von Anteilen der NESTOR Osteuropa Fonds dar. Die bisherige Wertentwicklung ist keine Garantie für zukünftige Ergebnisse. Der Anteilerwerb erfolgt ausschließlich auf der Grundlage des gültigen Verkaufsprospektes in Verbindung mit dem letzten Jahresbericht des Fonds und, wenn dessen Stichtag länger als 8 Monate zurückliegt, zusätzlich mit dem letzten Halbjahresbericht. Alle Verkaufsunterlagen sind kostenlos am Sitz der Verwaltungsgesellschaft sowie bei allen Zahlund Informationsstellen erhältlich (NESTOR Investment Management S. A. oder M. M. Warburg Bank Luxembourg S. A. , beide 2, Place Dargent, L-1413 Luxembourg oder NESTOR-Fonds-Vertriebs-Gmb. H, Ottostraße 5, D-80333 München). Wertpapieranlagen besitzen nicht nur die Möglichkeit zur Wertsteigerung des eingesetzten Kapitals, sondern sind auch mit erheblichen Verlustrisiken behaftet. Dies trifft insbesondere auf Anlagen in Aktien und in davon abgeleitete Wertpapiere wie Optionsscheine zu, die Eigenkapital von Aktiengesellschaften und damit Risikokapital im ureigensten Sinne darstellen. Die in dieser Ausarbeitung enthaltenen Informationen beruhen auf Aussagen des Investmentmanagers Warburg Invest KAG mb. H, Frankfurt, die aus verlässlichen Quellen stammen und ggf. die persönliche Meinung des Managers wiedergeben. Sie erheben nicht den Anspruch auf Vollständigkeit und sind daher unverbindlich. Soweit in dieser Ausarbeitung Aussagen über Preise, Zinssätze oder sonstige Indikationen getroffen werden, beziehen sich diese ausschließlich auf den Zeitpunkt der Erstellung der Ausarbeitung und enthalten keine Aussage über die zukünftige Entwicklung, insbesondere nicht hinsichtlich zukünftiger Gewinne oder Verluste. Diese Ausarbeitung stellt ferner keinen Rat oder Empfehlung dar. Vor Abschluß eines in dieser Ausarbeitung dargestellten Geschäfts ist auf jeden Fall eine kunden- und produktgerechte Beratung durch Ihren Berater erforderlich.

Rechtlicher Hinweis Diese Präsentation wurde von der NESTOR Investment Management S. A. , Luxemburg publiziert und stellt kein Angebot zum Kauf von Anteilen und keine Aufforderung zur Abgabe eines Angebotes zum Kauf von Anteilen der NESTOR Osteuropa Fonds dar. Die bisherige Wertentwicklung ist keine Garantie für zukünftige Ergebnisse. Der Anteilerwerb erfolgt ausschließlich auf der Grundlage des gültigen Verkaufsprospektes in Verbindung mit dem letzten Jahresbericht des Fonds und, wenn dessen Stichtag länger als 8 Monate zurückliegt, zusätzlich mit dem letzten Halbjahresbericht. Alle Verkaufsunterlagen sind kostenlos am Sitz der Verwaltungsgesellschaft sowie bei allen Zahlund Informationsstellen erhältlich (NESTOR Investment Management S. A. oder M. M. Warburg Bank Luxembourg S. A. , beide 2, Place Dargent, L-1413 Luxembourg oder NESTOR-Fonds-Vertriebs-Gmb. H, Ottostraße 5, D-80333 München). Wertpapieranlagen besitzen nicht nur die Möglichkeit zur Wertsteigerung des eingesetzten Kapitals, sondern sind auch mit erheblichen Verlustrisiken behaftet. Dies trifft insbesondere auf Anlagen in Aktien und in davon abgeleitete Wertpapiere wie Optionsscheine zu, die Eigenkapital von Aktiengesellschaften und damit Risikokapital im ureigensten Sinne darstellen. Die in dieser Ausarbeitung enthaltenen Informationen beruhen auf Aussagen des Investmentmanagers Warburg Invest KAG mb. H, Frankfurt, die aus verlässlichen Quellen stammen und ggf. die persönliche Meinung des Managers wiedergeben. Sie erheben nicht den Anspruch auf Vollständigkeit und sind daher unverbindlich. Soweit in dieser Ausarbeitung Aussagen über Preise, Zinssätze oder sonstige Indikationen getroffen werden, beziehen sich diese ausschließlich auf den Zeitpunkt der Erstellung der Ausarbeitung und enthalten keine Aussage über die zukünftige Entwicklung, insbesondere nicht hinsichtlich zukünftiger Gewinne oder Verluste. Diese Ausarbeitung stellt ferner keinen Rat oder Empfehlung dar. Vor Abschluß eines in dieser Ausarbeitung dargestellten Geschäfts ist auf jeden Fall eine kunden- und produktgerechte Beratung durch Ihren Berater erforderlich.