Session 1_MSF16.pptx

- Количество слайдов: 52

NES MSF 2016 FINANCIAL ACCOUNTING SESSION 1 Introduction to Accounting Model Maria Simatova

NES MSF 2016 FINANCIAL ACCOUNTING SESSION 1 Introduction to Accounting Model Maria Simatova

Objectives n Present the main components of the financial statements n Present the fundamental accounting equation n Learn how to use the transactions worksheet n Analyse the effects of basic transactions on the financial statements n Prepare basic financial statements 2

Objectives n Present the main components of the financial statements n Present the fundamental accounting equation n Learn how to use the transactions worksheet n Analyse the effects of basic transactions on the financial statements n Prepare basic financial statements 2

Components of Financial Reports Accounting Information n Balance Sheet n Profit and Loss Account/Income Statement n Cash Flow Statement n Notes 3

Components of Financial Reports Accounting Information n Balance Sheet n Profit and Loss Account/Income Statement n Cash Flow Statement n Notes 3

Balance Sheet A balance sheet is a summary of the financial position of the business at a particular point in time Essentially, it is a list of the business’ investments (assets) and the financing of those investments (liabilities and equity) 4

Balance Sheet A balance sheet is a summary of the financial position of the business at a particular point in time Essentially, it is a list of the business’ investments (assets) and the financing of those investments (liabilities and equity) 4

The Fundamental Accounting Equation It is always the case that INVESTMENTS = FINANCING or ASSETS = LIABILITIES + EQUITY - this is the Fundamental Accounting Equation 5

The Fundamental Accounting Equation It is always the case that INVESTMENTS = FINANCING or ASSETS = LIABILITIES + EQUITY - this is the Fundamental Accounting Equation 5

Balance Sheet Definitions: Assets Asset – a resource controlled by an entity as a result of past events and from which future economic benefits are expected to flow to the entity Note: control does not necessarily equate to ownership e. g. leased equipment 6

Balance Sheet Definitions: Assets Asset – a resource controlled by an entity as a result of past events and from which future economic benefits are expected to flow to the entity Note: control does not necessarily equate to ownership e. g. leased equipment 6

Balance Sheet: Categories of Assets n Fixed Assets § assets with a relatively long life and which are intended for use on a continuing basis in the company’s activities § Intangible assets, Tangible assets and Long term investments 7

Balance Sheet: Categories of Assets n Fixed Assets § assets with a relatively long life and which are intended for use on a continuing basis in the company’s activities § Intangible assets, Tangible assets and Long term investments 7

Balance Sheet: Categories of Assets n Current Assets § all assets which are not fixed assets! § essentially cash and assets which are likely to be converted into cash in the near future e. g. stocks, debtors, short term investments 8

Balance Sheet: Categories of Assets n Current Assets § all assets which are not fixed assets! § essentially cash and assets which are likely to be converted into cash in the near future e. g. stocks, debtors, short term investments 8

Balance Sheet: Asset Recognition Asset recognition criteria: Two conditions for an asset to be recognised (as opposed to disclosure) i. e. recorded on balance sheet (IASB Conceptual Framework): 1. Probable economic benefits: sufficient evidence that future benefits will flow to the entity 2. Measurement reliability: the cost or value can be measured reliably (i. e. , free of material error or bias). 9

Balance Sheet: Asset Recognition Asset recognition criteria: Two conditions for an asset to be recognised (as opposed to disclosure) i. e. recorded on balance sheet (IASB Conceptual Framework): 1. Probable economic benefits: sufficient evidence that future benefits will flow to the entity 2. Measurement reliability: the cost or value can be measured reliably (i. e. , free of material error or bias). 9

Balance Sheet: Asset Recognition Asset recognition examples: n Purchase of equipment with five years useful life? n Placing the order for the above equipment – can the equipment be recognised as an asset? n Selling merchandise on account? n Research and development? 10

Balance Sheet: Asset Recognition Asset recognition examples: n Purchase of equipment with five years useful life? n Placing the order for the above equipment – can the equipment be recognised as an asset? n Selling merchandise on account? n Research and development? 10

Balance Sheet Definitions: Liabilities Liability – a present obligation of the entity arising from past events, the settlement of which is expected to result in an outflow of resources embodying economic benefits 11

Balance Sheet Definitions: Liabilities Liability – a present obligation of the entity arising from past events, the settlement of which is expected to result in an outflow of resources embodying economic benefits 11

Balance Sheet: Categories of Liabilities Current liabilities - amount due within one year e. g. , § trade creditors § bank overdrafts § corporation tax payable. 12

Balance Sheet: Categories of Liabilities Current liabilities - amount due within one year e. g. , § trade creditors § bank overdrafts § corporation tax payable. 12

Balance Sheet: Categories of Liabilities n Long term liabilities - amounts due after more than one year e. g. § a 5 year bank loan n Provisions – liabilities for which the timing and the amount of the obligation are uncertain e. g. § settlement of legal dispute 13

Balance Sheet: Categories of Liabilities n Long term liabilities - amounts due after more than one year e. g. § a 5 year bank loan n Provisions – liabilities for which the timing and the amount of the obligation are uncertain e. g. § settlement of legal dispute 13

Balance Sheet: Liability Recognition Two conditions for a liability to be recognised (similar to the conditions set out for assets): 1. sufficient evidence of transfer of benefits 2. reliable measurement of cost or value 14

Balance Sheet: Liability Recognition Two conditions for a liability to be recognised (similar to the conditions set out for assets): 1. sufficient evidence of transfer of benefits 2. reliable measurement of cost or value 14

Balance Sheet: Liability Recognition Liability recognition examples: n Unpaid salaries? n Placing an order for equipment costing $1, 000 – should a trade creditor (account payable) be recognised? 15

Balance Sheet: Liability Recognition Liability recognition examples: n Unpaid salaries? n Placing an order for equipment costing $1, 000 – should a trade creditor (account payable) be recognised? 15

Balance Sheet Definitions: Equity is a residual interest which is a claim on all assets not required to meet the business’ liabilities 16

Balance Sheet Definitions: Equity is a residual interest which is a claim on all assets not required to meet the business’ liabilities 16

Balance Sheet: Components of Equity § Share capital § Share premium account § Retained profits (profits which the company has made but has not yet paid out as a dividend to shareholders) 17

Balance Sheet: Components of Equity § Share capital § Share premium account § Retained profits (profits which the company has made but has not yet paid out as a dividend to shareholders) 17

Income Statement The Income Statement is a summary of the financial performance of the business over a particular period in time It reports: • Sales or turnover • Operating expenses 18

Income Statement The Income Statement is a summary of the financial performance of the business over a particular period in time It reports: • Sales or turnover • Operating expenses 18

Income Statement • Almost all companies use vertical format, most classify by function • Classification by function: § Cost of sales § General and administrative expenses § Finance costs § Taxation 19

Income Statement • Almost all companies use vertical format, most classify by function • Classification by function: § Cost of sales § General and administrative expenses § Finance costs § Taxation 19

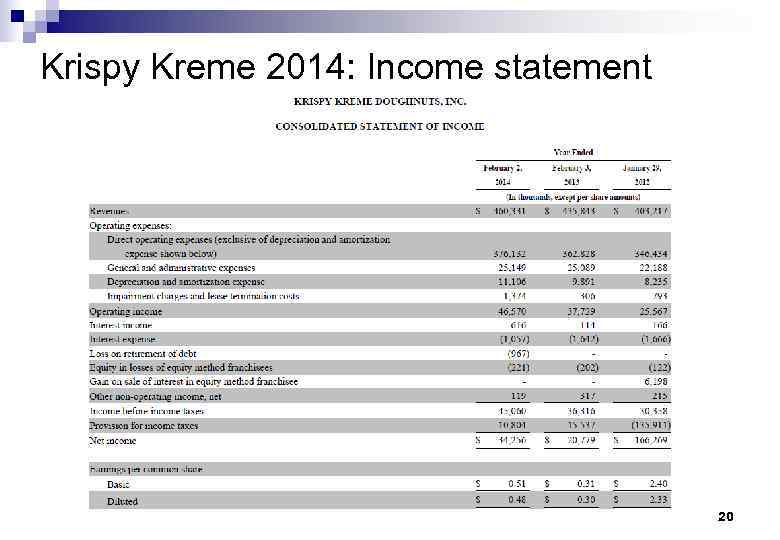

Krispy Kreme 2014: Income statement 20

Krispy Kreme 2014: Income statement 20

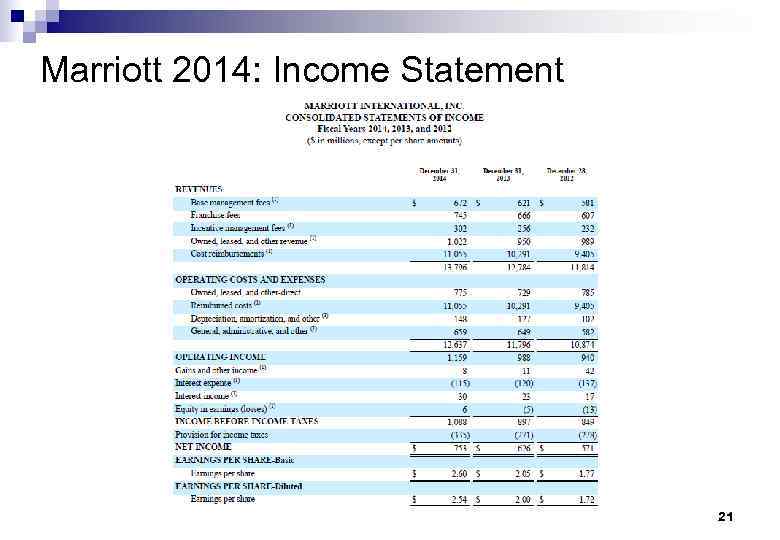

Marriott 2014: Income Statement 21

Marriott 2014: Income Statement 21

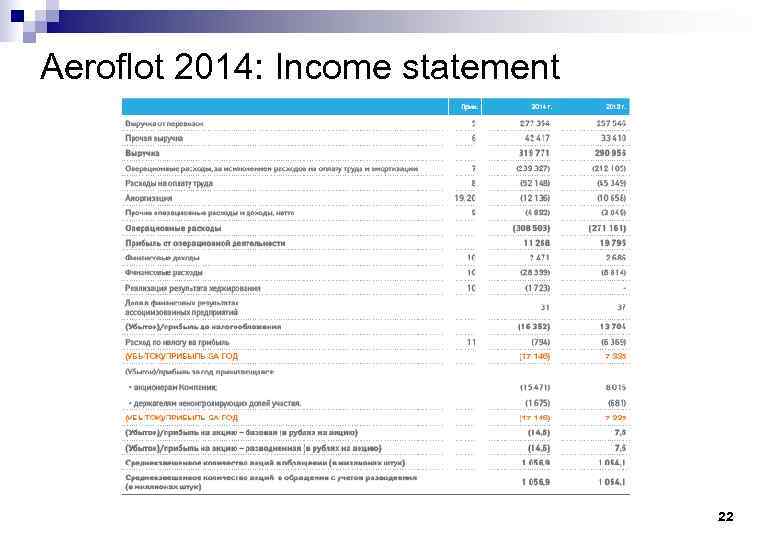

Aeroflot 2014: Income statement 22

Aeroflot 2014: Income statement 22

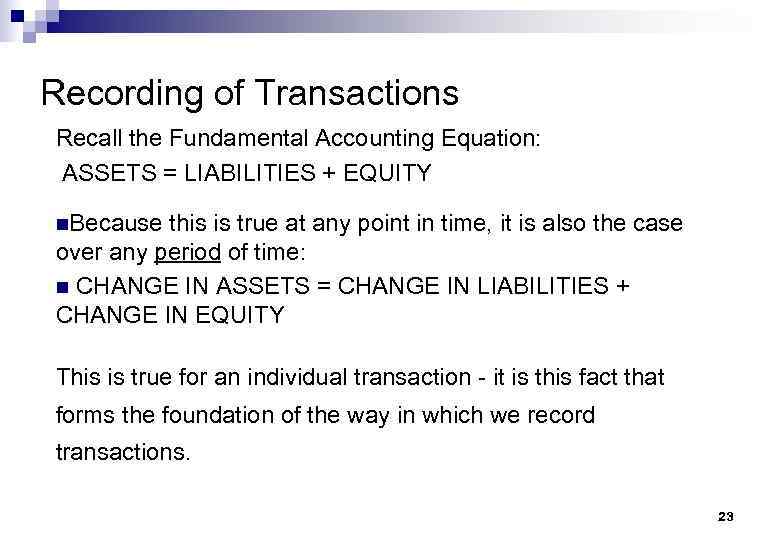

Recording of Transactions Recall the Fundamental Accounting Equation: ASSETS = LIABILITIES + EQUITY n. Because this is true at any point in time, it is also the case over any period of time: n CHANGE IN ASSETS = CHANGE IN LIABILITIES + CHANGE IN EQUITY This is true for an individual transaction - it is this fact that forms the foundation of the way in which we record transactions. 23

Recording of Transactions Recall the Fundamental Accounting Equation: ASSETS = LIABILITIES + EQUITY n. Because this is true at any point in time, it is also the case over any period of time: n CHANGE IN ASSETS = CHANGE IN LIABILITIES + CHANGE IN EQUITY This is true for an individual transaction - it is this fact that forms the foundation of the way in which we record transactions. 23

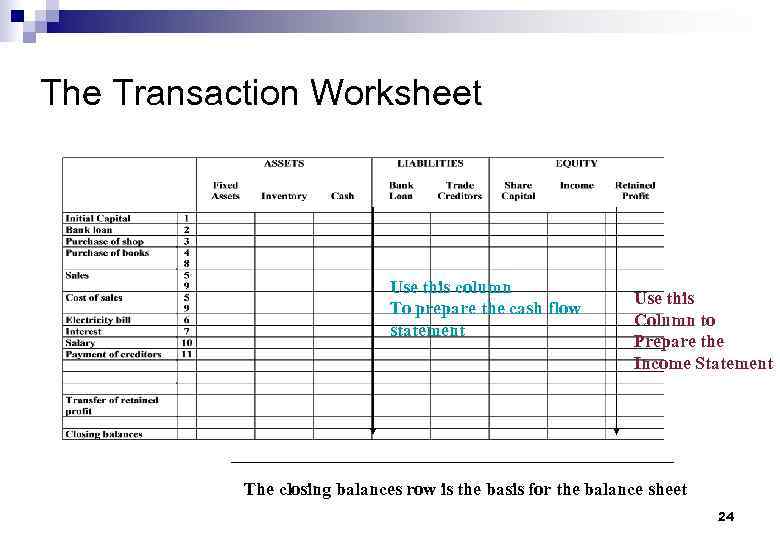

The Transaction Worksheet Use this column To prepare the cash flow statement Use this Column to Prepare the Income Statement The closing balances row is the basis for the balance sheet 24

The Transaction Worksheet Use this column To prepare the cash flow statement Use this Column to Prepare the Income Statement The closing balances row is the basis for the balance sheet 24

Recording of Transactions Example 1 Suppose that a company buys a machine costing £ 100, 000 on credit. This transaction has two effects: n assets increase by £ 100, 000 (the cost of the machine) n liabilities increase by £ 100, 000 (the amount owed to the supplier of the machine) 25

Recording of Transactions Example 1 Suppose that a company buys a machine costing £ 100, 000 on credit. This transaction has two effects: n assets increase by £ 100, 000 (the cost of the machine) n liabilities increase by £ 100, 000 (the amount owed to the supplier of the machine) 25

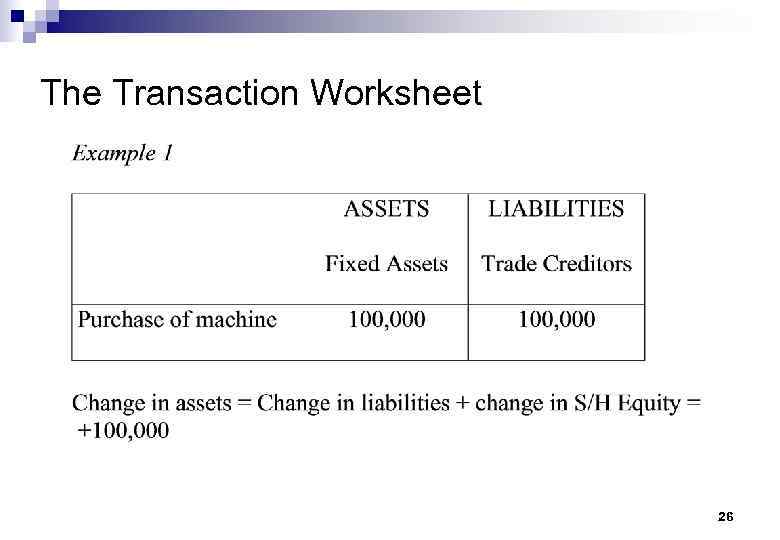

The Transaction Worksheet 26

The Transaction Worksheet 26

Recording of Transactions Example 2 Suppose that a company has previously sold goods worth £ 50, 000 to a customer who has yet to pay - the amount owed by the customer is therefore included on the balance sheet as an asset (a trade debtor) n assets fall by £ 50, 000 (the inventory is no longer on the balance sheet) n assets increase by £ 50, 000 (the amount owed by a customer) 27

Recording of Transactions Example 2 Suppose that a company has previously sold goods worth £ 50, 000 to a customer who has yet to pay - the amount owed by the customer is therefore included on the balance sheet as an asset (a trade debtor) n assets fall by £ 50, 000 (the inventory is no longer on the balance sheet) n assets increase by £ 50, 000 (the amount owed by a customer) 27

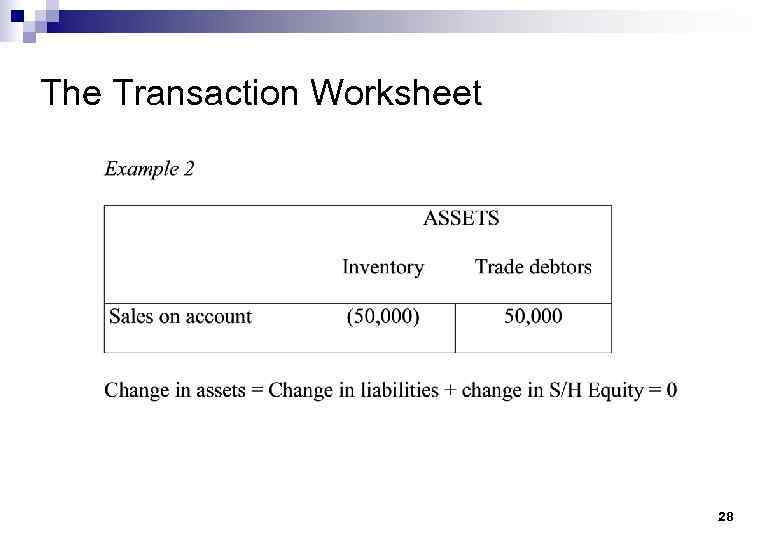

The Transaction Worksheet 28

The Transaction Worksheet 28

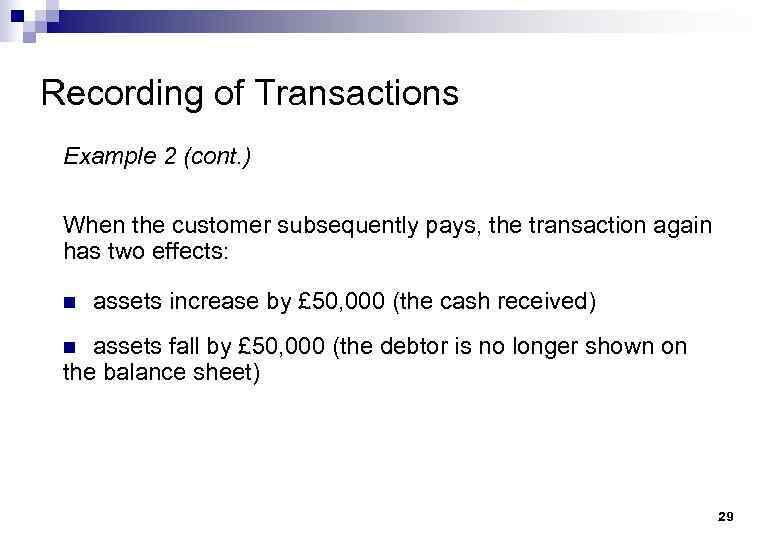

Recording of Transactions Example 2 (cont. ) When the customer subsequently pays, the transaction again has two effects: n assets increase by £ 50, 000 (the cash received) n assets fall by £ 50, 000 (the debtor is no longer shown on the balance sheet) 29

Recording of Transactions Example 2 (cont. ) When the customer subsequently pays, the transaction again has two effects: n assets increase by £ 50, 000 (the cash received) n assets fall by £ 50, 000 (the debtor is no longer shown on the balance sheet) 29

The Transaction Worksheet 30

The Transaction Worksheet 30

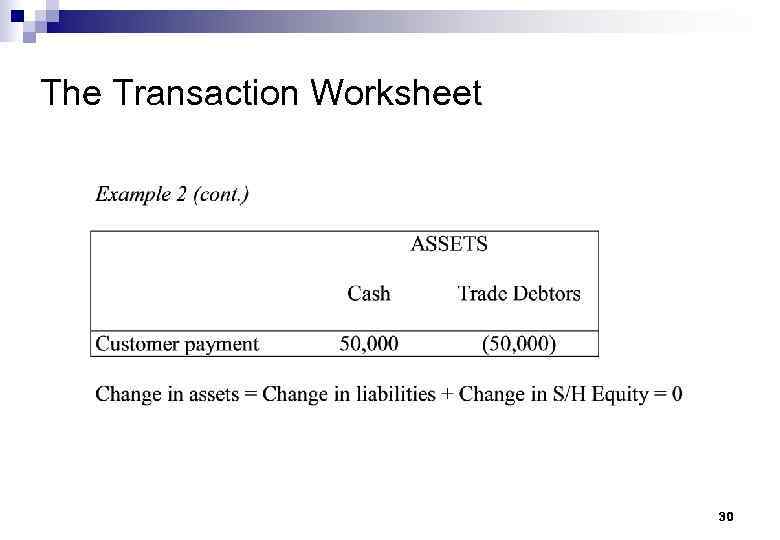

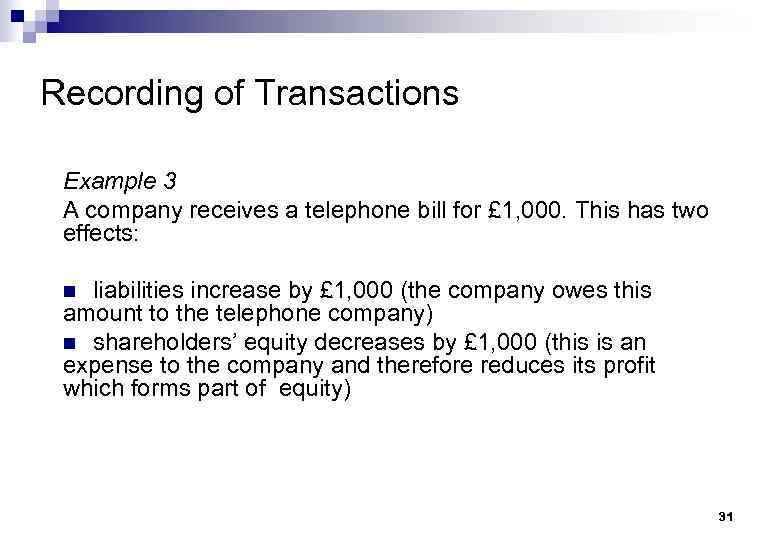

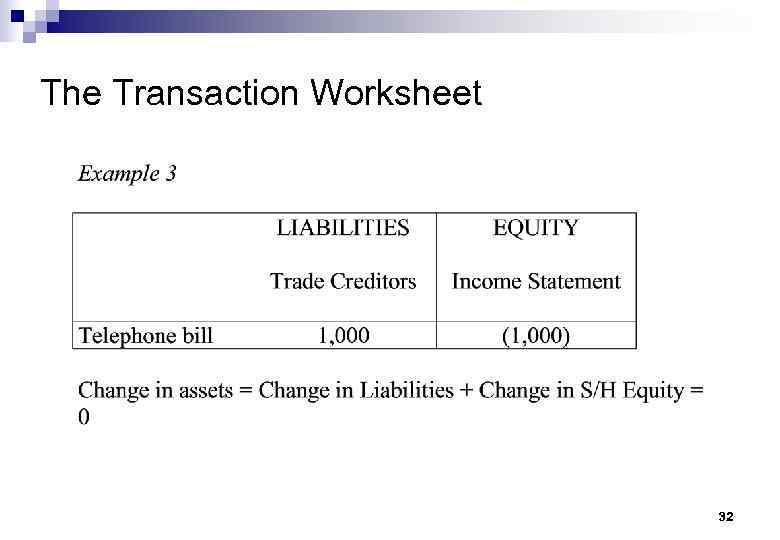

Recording of Transactions Example 3 A company receives a telephone bill for £ 1, 000. This has two effects: n liabilities increase by £ 1, 000 (the company owes this amount to the telephone company) n shareholders’ equity decreases by £ 1, 000 (this is an expense to the company and therefore reduces its profit which forms part of equity) 31

Recording of Transactions Example 3 A company receives a telephone bill for £ 1, 000. This has two effects: n liabilities increase by £ 1, 000 (the company owes this amount to the telephone company) n shareholders’ equity decreases by £ 1, 000 (this is an expense to the company and therefore reduces its profit which forms part of equity) 31

The Transaction Worksheet 32

The Transaction Worksheet 32

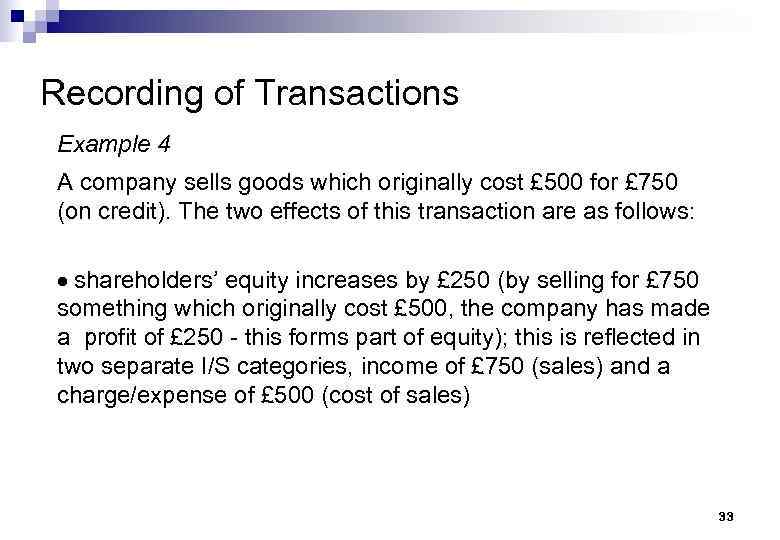

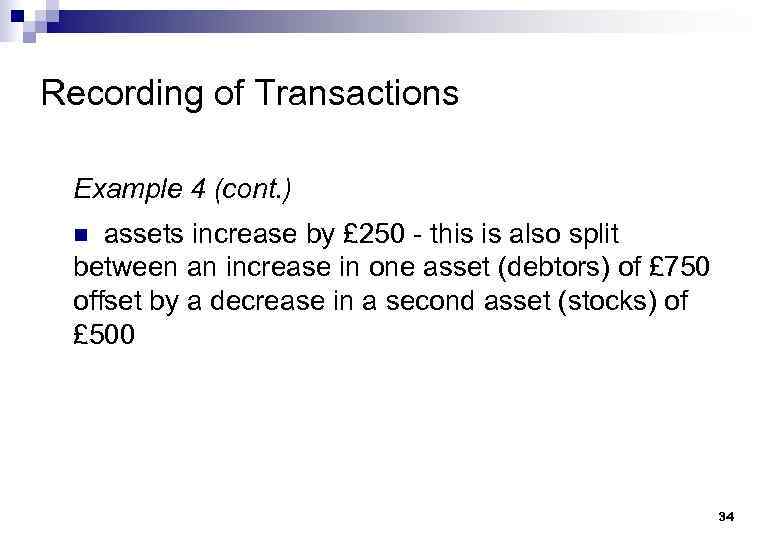

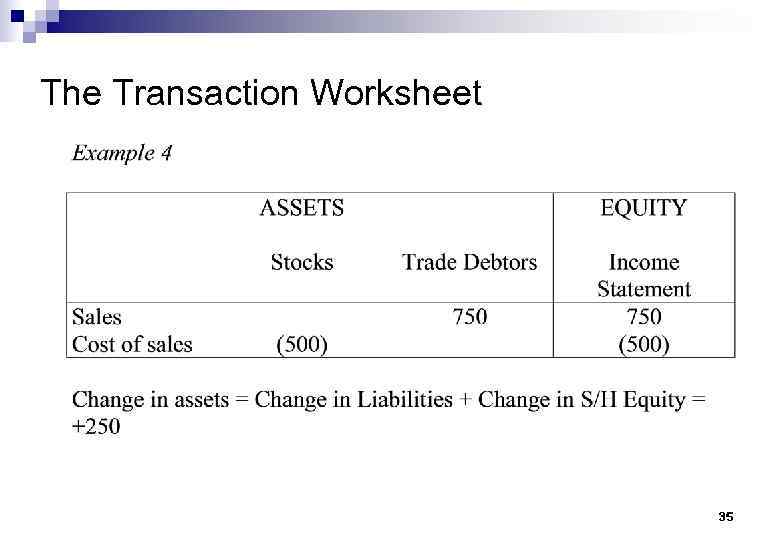

Recording of Transactions Example 4 A company sells goods which originally cost £ 500 for £ 750 (on credit). The two effects of this transaction are as follows: · shareholders’ equity increases by £ 250 (by selling for £ 750 something which originally cost £ 500, the company has made a profit of £ 250 - this forms part of equity); this is reflected in two separate I/S categories, income of £ 750 (sales) and a charge/expense of £ 500 (cost of sales) 33

Recording of Transactions Example 4 A company sells goods which originally cost £ 500 for £ 750 (on credit). The two effects of this transaction are as follows: · shareholders’ equity increases by £ 250 (by selling for £ 750 something which originally cost £ 500, the company has made a profit of £ 250 - this forms part of equity); this is reflected in two separate I/S categories, income of £ 750 (sales) and a charge/expense of £ 500 (cost of sales) 33

Recording of Transactions Example 4 (cont. ) n assets increase by £ 250 - this is also split between an increase in one asset (debtors) of £ 750 offset by a decrease in a second asset (stocks) of £ 500 34

Recording of Transactions Example 4 (cont. ) n assets increase by £ 250 - this is also split between an increase in one asset (debtors) of £ 750 offset by a decrease in a second asset (stocks) of £ 500 34

The Transaction Worksheet 35

The Transaction Worksheet 35

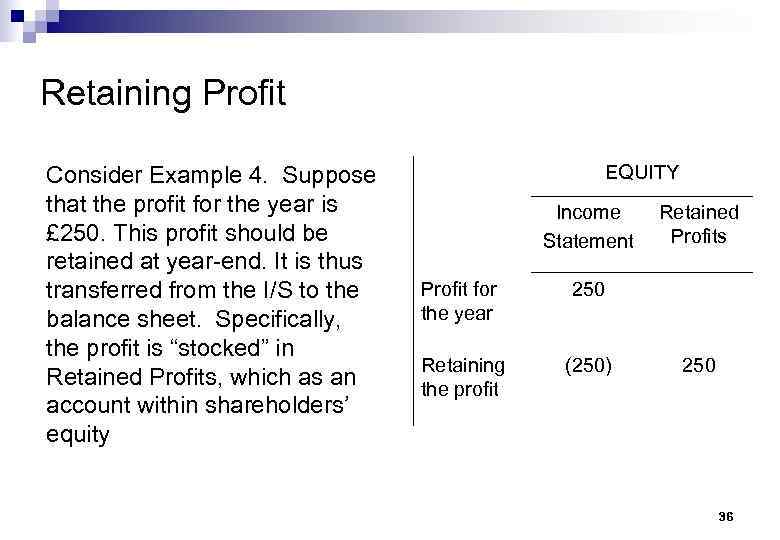

Retaining Profit Consider Example 4. Suppose that the profit for the year is £ 250. This profit should be retained at year-end. It is thus transferred from the I/S to the balance sheet. Specifically, the profit is “stocked” in Retained Profits, which as an account within shareholders’ equity EQUITY Income Statement Profit for the year 250 Retaining the profit (250) Retained Profits 250 36

Retaining Profit Consider Example 4. Suppose that the profit for the year is £ 250. This profit should be retained at year-end. It is thus transferred from the I/S to the balance sheet. Specifically, the profit is “stocked” in Retained Profits, which as an account within shareholders’ equity EQUITY Income Statement Profit for the year 250 Retaining the profit (250) Retained Profits 250 36

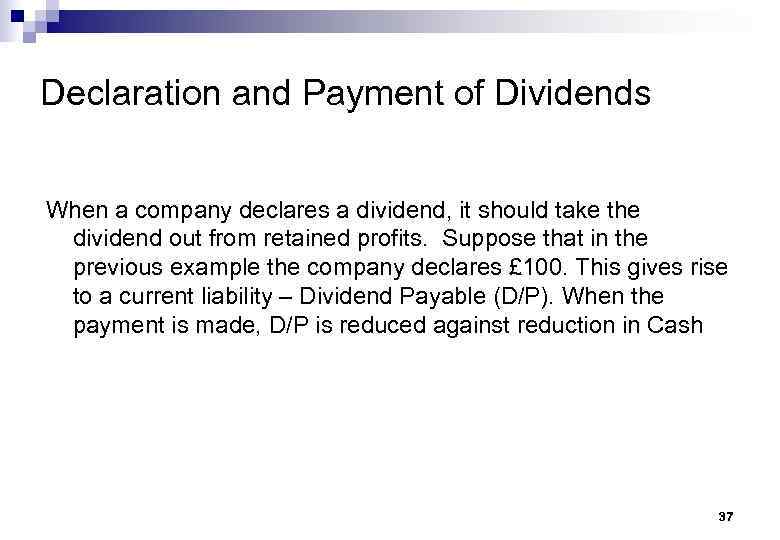

Declaration and Payment of Dividends When a company declares a dividend, it should take the dividend out from retained profits. Suppose that in the previous example the company declares £ 100. This gives rise to a current liability – Dividend Payable (D/P). When the payment is made, D/P is reduced against reduction in Cash 37

Declaration and Payment of Dividends When a company declares a dividend, it should take the dividend out from retained profits. Suppose that in the previous example the company declares £ 100. This gives rise to a current liability – Dividend Payable (D/P). When the payment is made, D/P is reduced against reduction in Cash 37

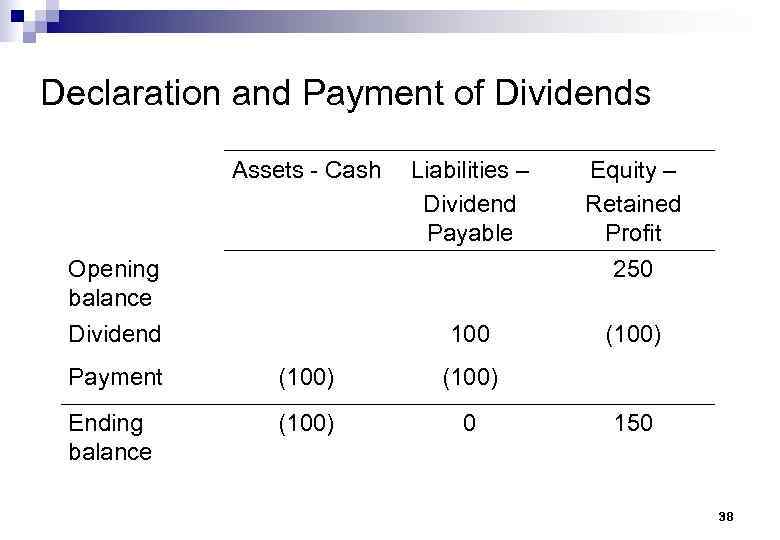

Declaration and Payment of Dividends Assets - Cash Liabilities – Dividend Payable Equity – Retained Profit 250 100 (100) Opening balance Dividend Payment (100) Ending balance (100) 0 150 38

Declaration and Payment of Dividends Assets - Cash Liabilities – Dividend Payable Equity – Retained Profit 250 100 (100) Opening balance Dividend Payment (100) Ending balance (100) 0 150 38

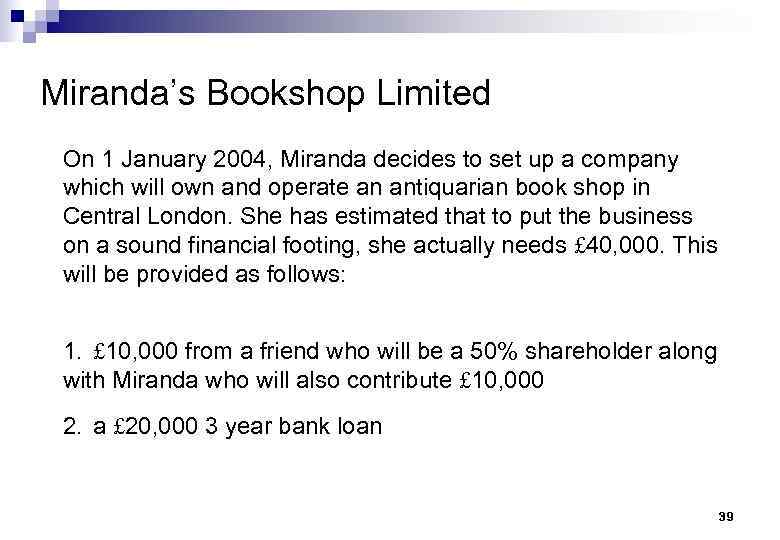

Miranda’s Bookshop Limited On 1 January 2004, Miranda decides to set up a company which will own and operate an antiquarian book shop in Central London. She has estimated that to put the business on a sound financial footing, she actually needs £ 40, 000. This will be provided as follows: 1. £ 10, 000 from a friend who will be a 50% shareholder along with Miranda who will also contribute £ 10, 000 2. a £ 20, 000 3 year bank loan 39

Miranda’s Bookshop Limited On 1 January 2004, Miranda decides to set up a company which will own and operate an antiquarian book shop in Central London. She has estimated that to put the business on a sound financial footing, she actually needs £ 40, 000. This will be provided as follows: 1. £ 10, 000 from a friend who will be a 50% shareholder along with Miranda who will also contribute £ 10, 000 2. a £ 20, 000 3 year bank loan 39

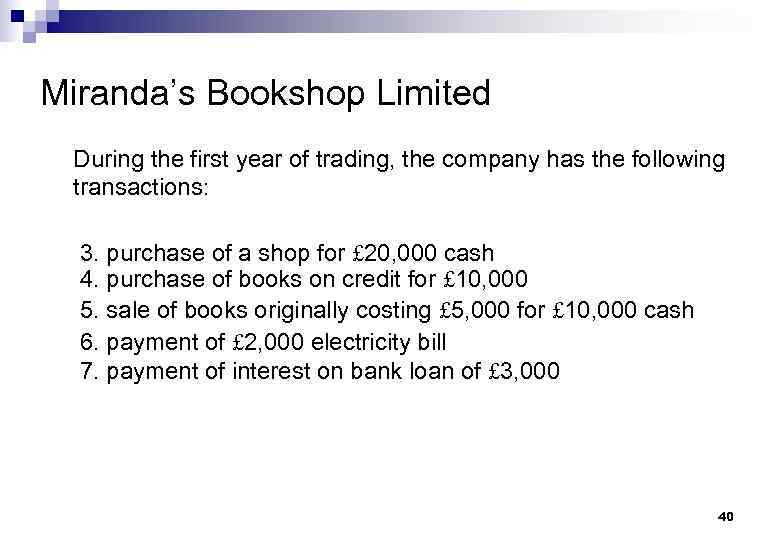

Miranda’s Bookshop Limited During the first year of trading, the company has the following transactions: 3. purchase of a shop for £ 20, 000 cash 4. purchase of books on credit for £ 10, 000 5. sale of books originally costing £ 5, 000 for £ 10, 000 cash 6. payment of £ 2, 000 electricity bill 7. payment of interest on bank loan of £ 3, 000 40

Miranda’s Bookshop Limited During the first year of trading, the company has the following transactions: 3. purchase of a shop for £ 20, 000 cash 4. purchase of books on credit for £ 10, 000 5. sale of books originally costing £ 5, 000 for £ 10, 000 cash 6. payment of £ 2, 000 electricity bill 7. payment of interest on bank loan of £ 3, 000 40

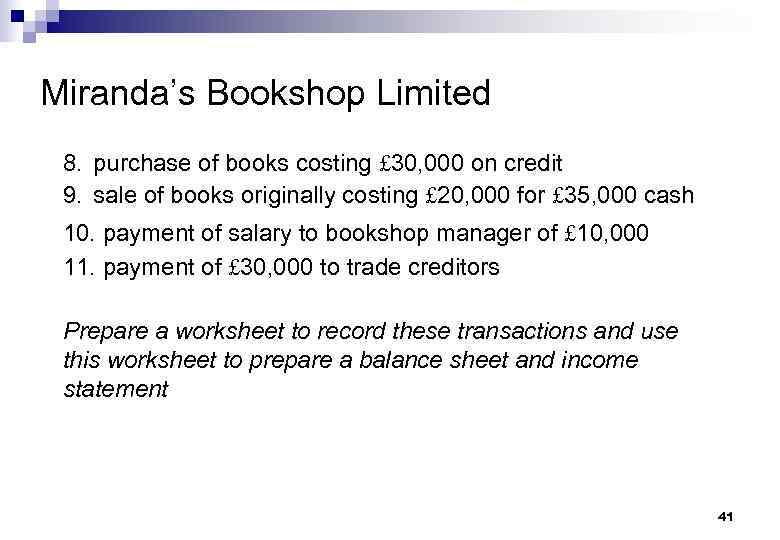

Miranda’s Bookshop Limited 8. purchase of books costing £ 30, 000 on credit 9. sale of books originally costing £ 20, 000 for £ 35, 000 cash 10. payment of salary to bookshop manager of £ 10, 000 11. payment of £ 30, 000 to trade creditors Prepare a worksheet to record these transactions and use this worksheet to prepare a balance sheet and income statement 41

Miranda’s Bookshop Limited 8. purchase of books costing £ 30, 000 on credit 9. sale of books originally costing £ 20, 000 for £ 35, 000 cash 10. payment of salary to bookshop manager of £ 10, 000 11. payment of £ 30, 000 to trade creditors Prepare a worksheet to record these transactions and use this worksheet to prepare a balance sheet and income statement 41

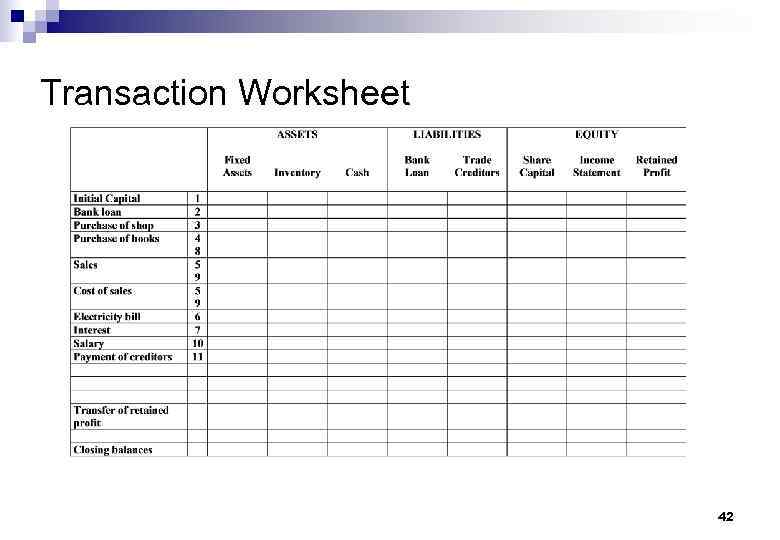

Transaction Worksheet 42

Transaction Worksheet 42

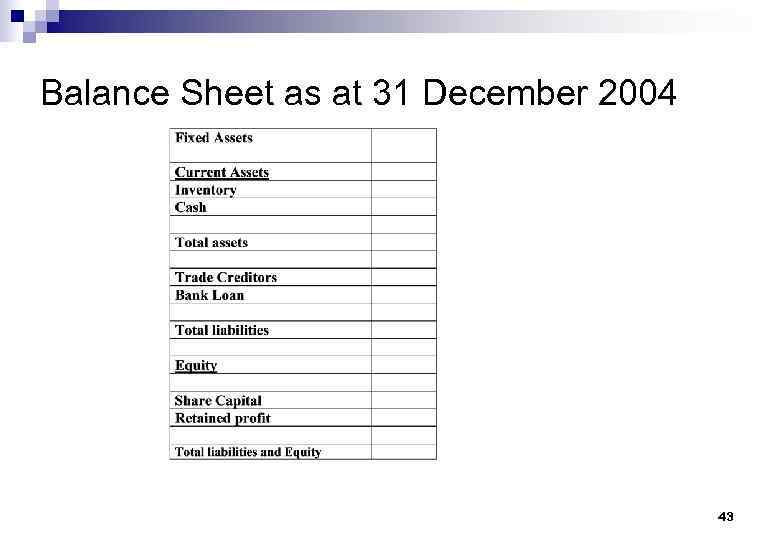

Balance Sheet as at 31 December 2004 43

Balance Sheet as at 31 December 2004 43

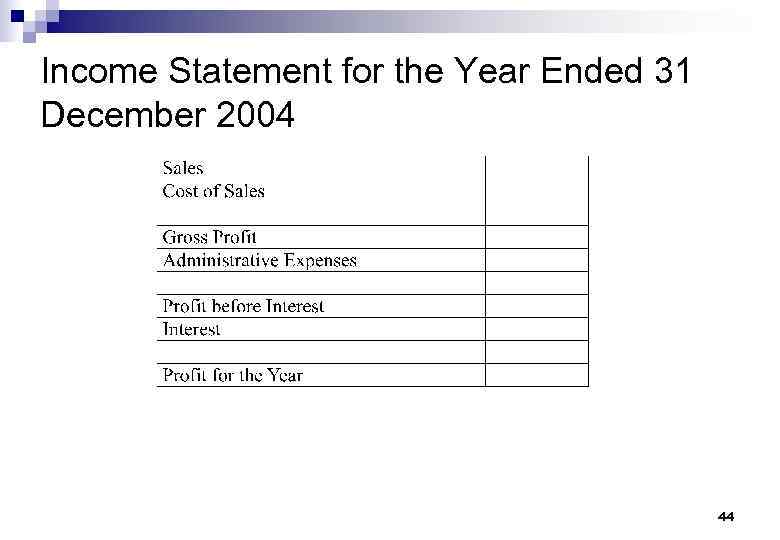

Income Statement for the Year Ended 31 December 2004 44

Income Statement for the Year Ended 31 December 2004 44

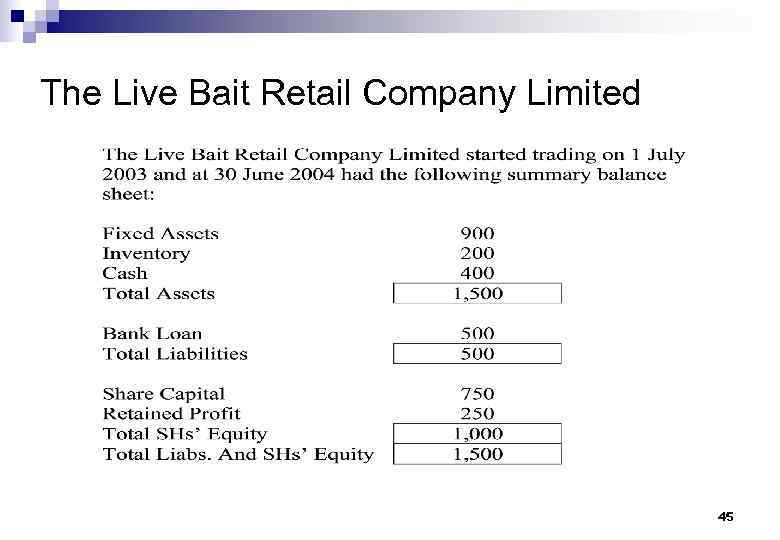

The Live Bait Retail Company Limited 45

The Live Bait Retail Company Limited 45

The Live Bait Retail Company Limited During the year ended 30 June 2005, the company engages in the following transactions: 1. purchase of bait on credit for £ 700 2. sale of bait originally costing £ 600 for £ 1, 200 of which £ 800 on credit, the remainder in cash 3. payment of salaries to office staff (£ 85) and van driver (£ 75), both in cash 4. payment of interest on bank loan of £ 100 5. increase bank loan by £ 500 46

The Live Bait Retail Company Limited During the year ended 30 June 2005, the company engages in the following transactions: 1. purchase of bait on credit for £ 700 2. sale of bait originally costing £ 600 for £ 1, 200 of which £ 800 on credit, the remainder in cash 3. payment of salaries to office staff (£ 85) and van driver (£ 75), both in cash 4. payment of interest on bank loan of £ 100 5. increase bank loan by £ 500 46

The Live Bait Retail Company Limited 6. payment of 80% of trade creditors, collection of 80% of trade debtors In addition, as a result of these transactions, the company will engage in the following two transactions which need to be recorded in the 2004/05 accounts: 7. Tax (at a rate of 33%) is payable on the company’s profit before tax and is due on 31 March 2006 47

The Live Bait Retail Company Limited 6. payment of 80% of trade creditors, collection of 80% of trade debtors In addition, as a result of these transactions, the company will engage in the following two transactions which need to be recorded in the 2004/05 accounts: 7. Tax (at a rate of 33%) is payable on the company’s profit before tax and is due on 31 March 2006 47

The Live Bait Retail Company Limited 8. On 30 September 2005, the company will pay a dividend of £ 100 Prepare a worksheet to record these transactions and use this worksheet to prepare a balance sheet and income statement 48

The Live Bait Retail Company Limited 8. On 30 September 2005, the company will pay a dividend of £ 100 Prepare a worksheet to record these transactions and use this worksheet to prepare a balance sheet and income statement 48

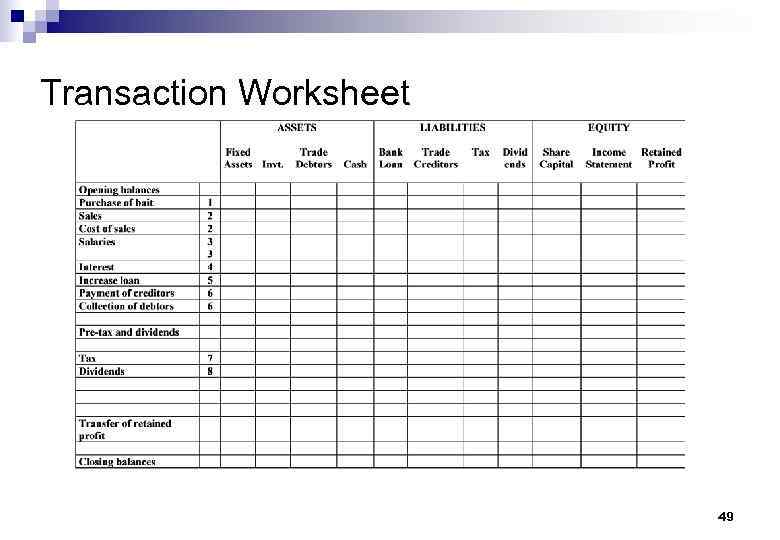

Transaction Worksheet 49

Transaction Worksheet 49

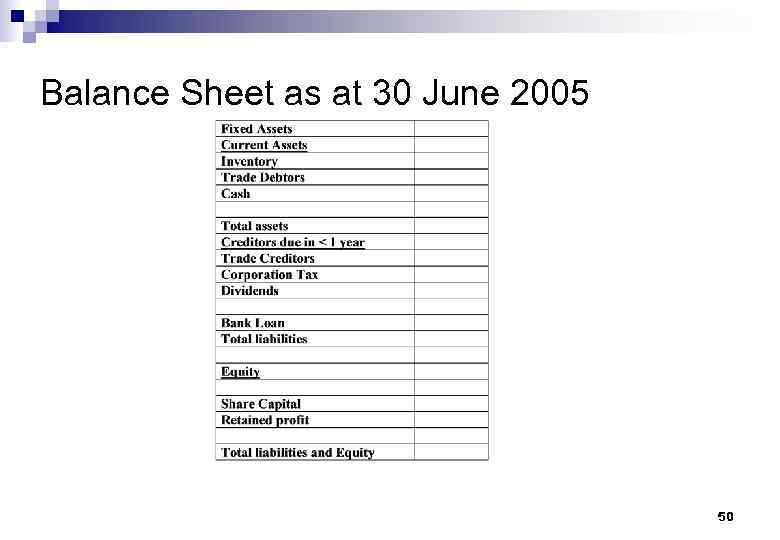

Balance Sheet as at 30 June 2005 50

Balance Sheet as at 30 June 2005 50

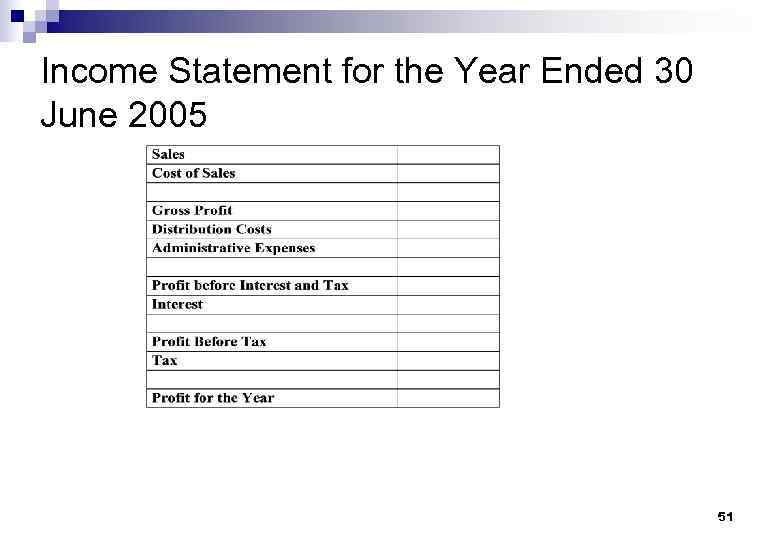

Income Statement for the Year Ended 30 June 2005 51

Income Statement for the Year Ended 30 June 2005 51

Summary The objectives of this session were to n Present the main components of the financial statements n Present the fundamental accounting equation n Learn how to use the transactions worksheet n Analyse the effects on the financial statements of basic transactions n Prepare basic financial statements 52

Summary The objectives of this session were to n Present the main components of the financial statements n Present the fundamental accounting equation n Learn how to use the transactions worksheet n Analyse the effects on the financial statements of basic transactions n Prepare basic financial statements 52