eee2dc33a52ed05e95e355549456400f.ppt

- Количество слайдов: 40

NEOTEC RAZILIAN MMDS OPERATORS ASSOCIATIO José Luiz N. Frauendorf June, 2001

NEOTEC RAZILIAN MMDS OPERATORS ASSOCIATIO José Luiz N. Frauendorf June, 2001

WHAT IS MMDS ? NEOTEC

WHAT IS MMDS ? NEOTEC

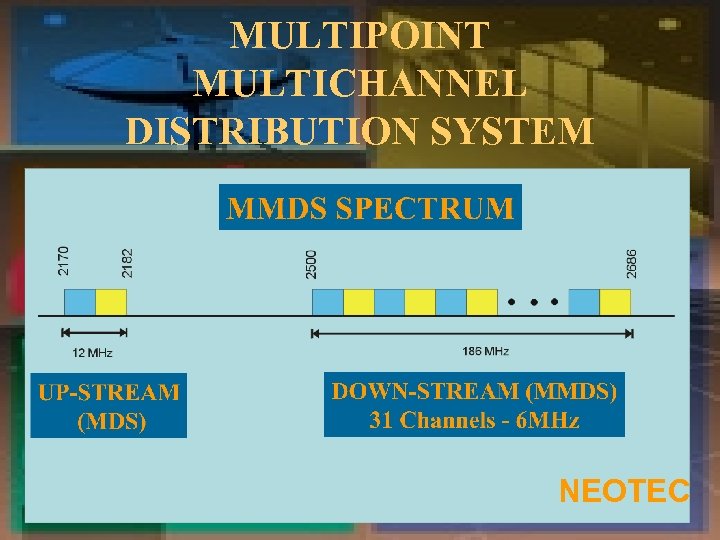

MULTIPOINT MULTICHANNEL DISTRIBUTION SYSTEM NEOTEC

MULTIPOINT MULTICHANNEL DISTRIBUTION SYSTEM NEOTEC

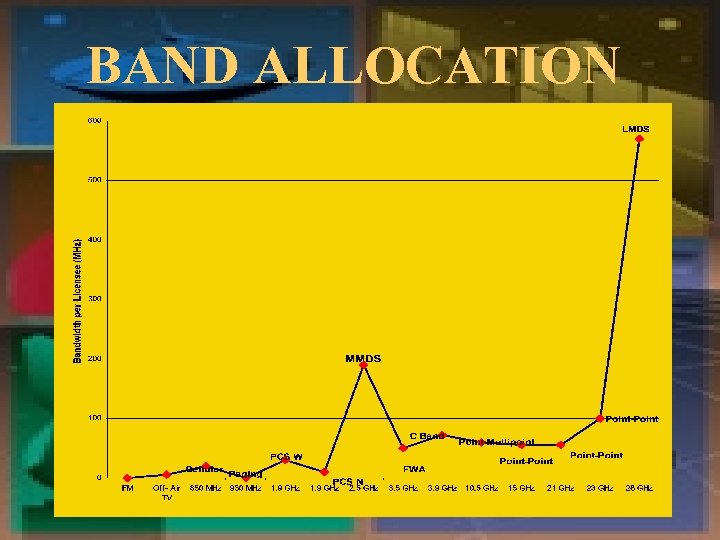

BAND ALLOCATION

BAND ALLOCATION

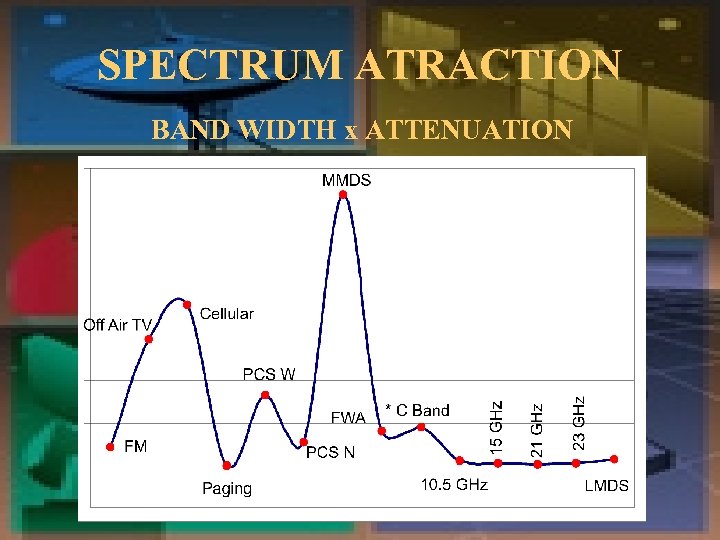

SPECTRUM ATRACTION BAND WIDTH x ATTENUATION

SPECTRUM ATRACTION BAND WIDTH x ATTENUATION

MMDS STRENGTH • Lower cost than cable • Investment only at customer’s premise • Fast to implement • Reliable - protected spectrum • Ideal for small and medium markets • Convergent Technology (video, voice and data) • Benefits from cellular technology NEOTEC

MMDS STRENGTH • Lower cost than cable • Investment only at customer’s premise • Fast to implement • Reliable - protected spectrum • Ideal for small and medium markets • Convergent Technology (video, voice and data) • Benefits from cellular technology NEOTEC

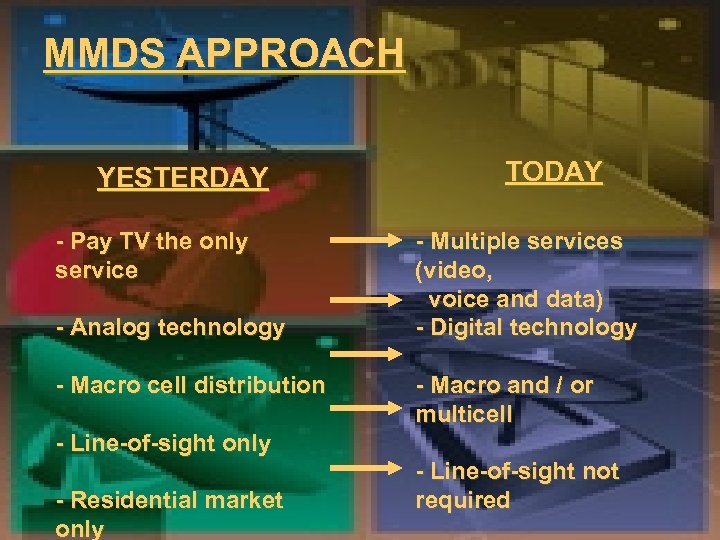

MMDS APPROACH YESTERDAY - Pay TV the only service - Analog technology - Macro cell distribution TODAY - Multiple services (video, voice and data) - Digital technology - Macro and / or multicell - Line-of-sight only - Residential market only - Line-of-sight not required

MMDS APPROACH YESTERDAY - Pay TV the only service - Analog technology - Macro cell distribution TODAY - Multiple services (video, voice and data) - Digital technology - Macro and / or multicell - Line-of-sight only - Residential market only - Line-of-sight not required

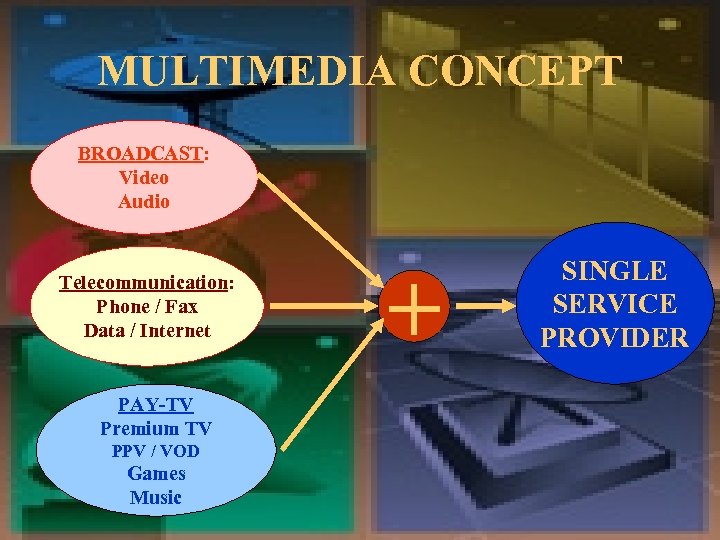

MULTIMEDIA CONCEPT BROADCAST: Video Audio Telecommunication: Phone / Fax Data / Internet PAY-TV Premium TV PPV / VOD Games Music + SINGLE SERVICE PROVIDER

MULTIMEDIA CONCEPT BROADCAST: Video Audio Telecommunication: Phone / Fax Data / Internet PAY-TV Premium TV PPV / VOD Games Music + SINGLE SERVICE PROVIDER

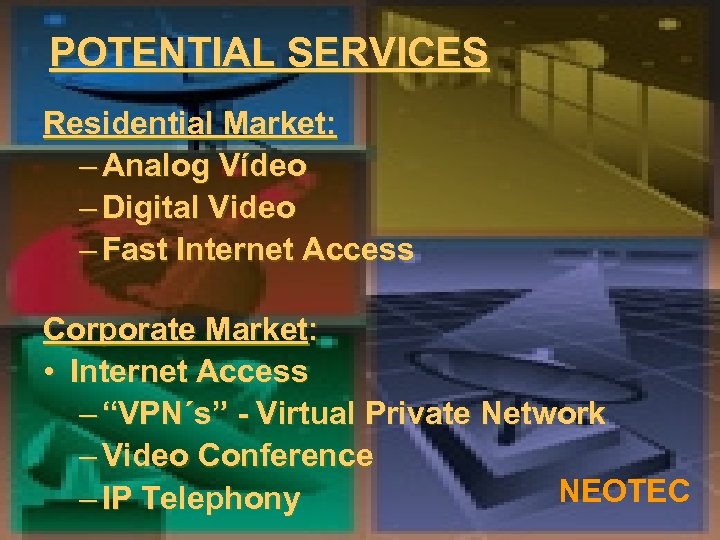

POTENTIAL SERVICES Residential Market: – Analog Vídeo – Digital Video – Fast Internet Access Corporate Market: • Internet Access – “VPN´s” - Virtual Private Network – Video Conference NEOTEC – IP Telephony

POTENTIAL SERVICES Residential Market: – Analog Vídeo – Digital Video – Fast Internet Access Corporate Market: • Internet Access – “VPN´s” - Virtual Private Network – Video Conference NEOTEC – IP Telephony

WHY IS MMDS SO IMPORTANT TO BRAZIL? NEOTEC

WHY IS MMDS SO IMPORTANT TO BRAZIL? NEOTEC

BRAZIL RESIDENTIAL MULTIMEDIA MARKET • • Total Population = 160. 000 Inhabitants Total Homes = 40. 000 HH Total “A”, “B” and “C” classes = 30% Total Market = 12. 000 HH Total Subscribers = 3. 500. 000 (Today) Penetration in 2, 005 = 60% Total Subscribers in 2, 005 = 7. 200. 000 HH

BRAZIL RESIDENTIAL MULTIMEDIA MARKET • • Total Population = 160. 000 Inhabitants Total Homes = 40. 000 HH Total “A”, “B” and “C” classes = 30% Total Market = 12. 000 HH Total Subscribers = 3. 500. 000 (Today) Penetration in 2, 005 = 60% Total Subscribers in 2, 005 = 7. 200. 000 HH

BRAZIL CORPORATE MARKET LARGE COMPANIES: SMALL + MEDIUM CO. • Quantity= 5. 000 • Quantity = 3. 5 mi. • Top size = 350 • PIB - 52% total • Revenue = US$ 200 mi. • Revenue = US$ 50, 000 to to US$ 4. 7 bi. (top 350) • Data service = R$ 5. 9 bi. US$ 200 mi. • Data service = R$ 12 bi. Source TELETIME March 2, 001

BRAZIL CORPORATE MARKET LARGE COMPANIES: SMALL + MEDIUM CO. • Quantity= 5. 000 • Quantity = 3. 5 mi. • Top size = 350 • PIB - 52% total • Revenue = US$ 200 mi. • Revenue = US$ 50, 000 to to US$ 4. 7 bi. (top 350) • Data service = R$ 5. 9 bi. US$ 200 mi. • Data service = R$ 12 bi. Source TELETIME March 2, 001

MMDS MARKET POSITIONING Rural Region (< 50 HP/Km) • MMDS • Satellite Periferic Region ( < 200 HP / Km) • MMDS • DSL modems • Cable modems Urban Region ( > 200 HP/Km) • Fiber • LMDS • MMDS • DSL modems • Cable modems NEOTEC

MMDS MARKET POSITIONING Rural Region (< 50 HP/Km) • MMDS • Satellite Periferic Region ( < 200 HP / Km) • MMDS • DSL modems • Cable modems Urban Region ( > 200 HP/Km) • Fiber • LMDS • MMDS • DSL modems • Cable modems NEOTEC

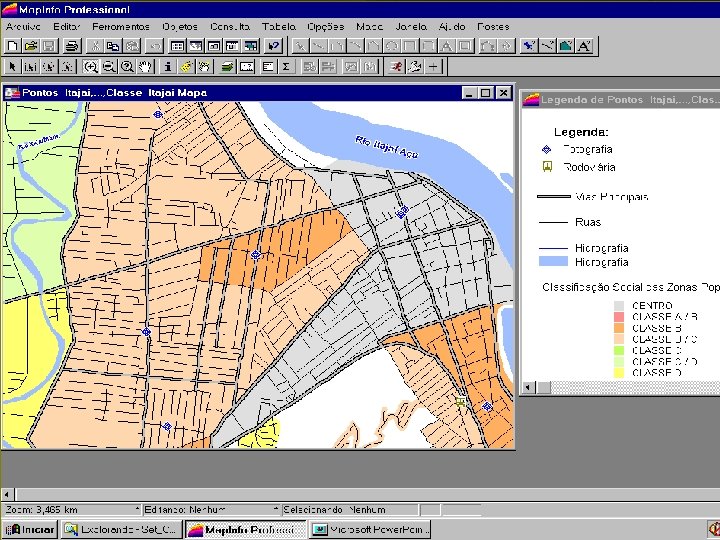

MMDS - PLANNING NEOTEC

MMDS - PLANNING NEOTEC

MMDS - PLANNING KEY POINTS PCAPACITY PCOVERAGE PINTERFERENCE NEOTEC

MMDS - PLANNING KEY POINTS PCAPACITY PCOVERAGE PINTERFERENCE NEOTEC

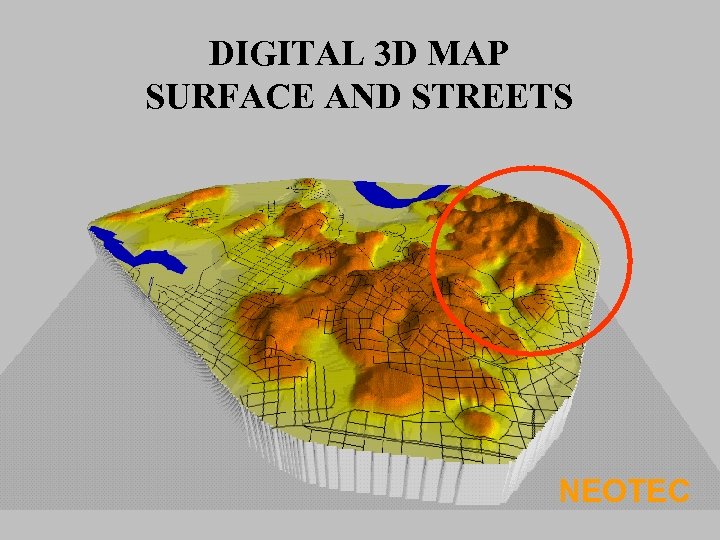

DIGITAL 3 D MAP SURFACE AND STREETS NEOTEC

DIGITAL 3 D MAP SURFACE AND STREETS NEOTEC

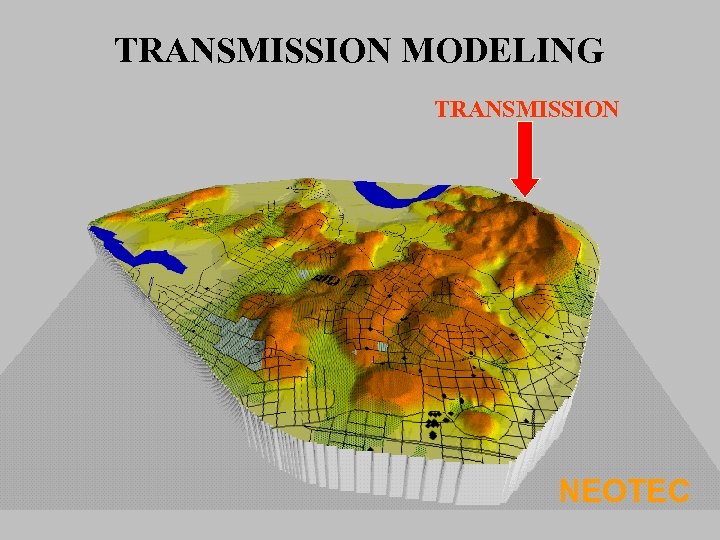

TRANSMISSION MODELING TRANSMISSION NEOTEC

TRANSMISSION MODELING TRANSMISSION NEOTEC

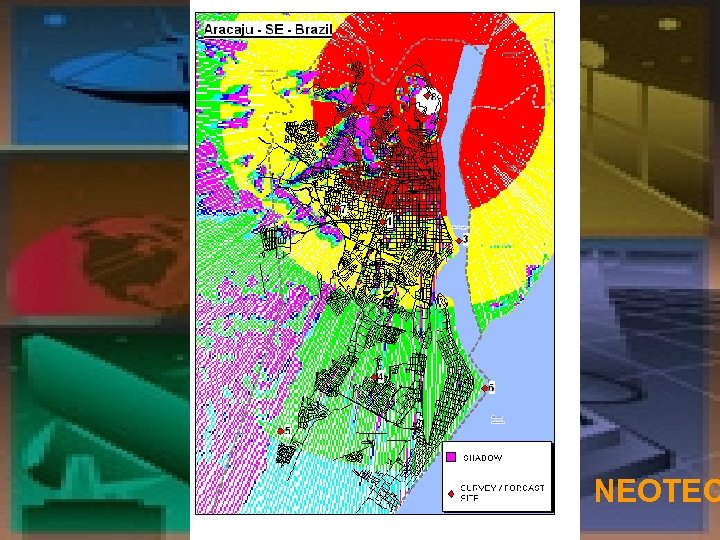

NEOTEC

NEOTEC

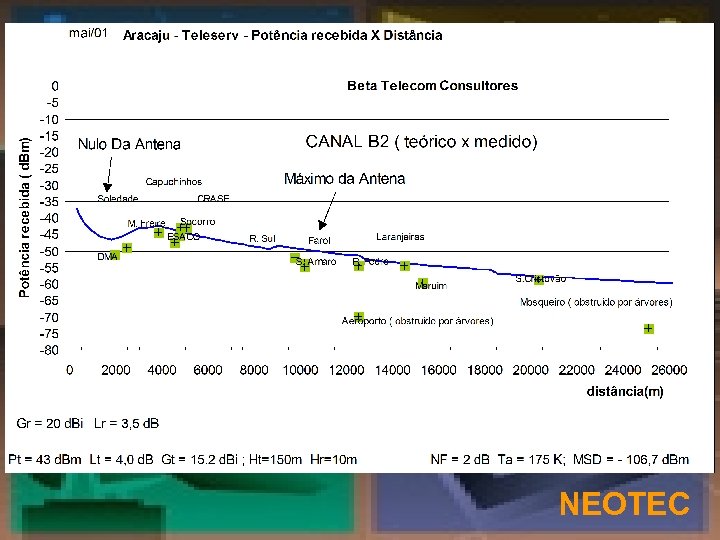

NEOTEC

NEOTEC

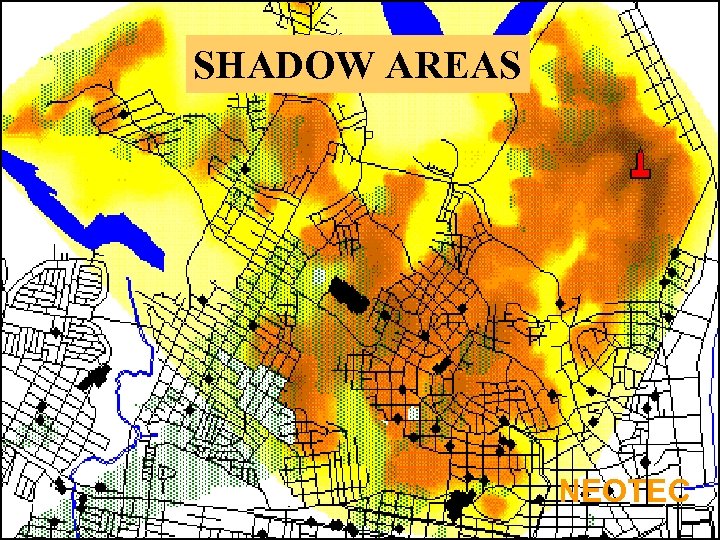

SHADOW AREAS NEOTEC

SHADOW AREAS NEOTEC

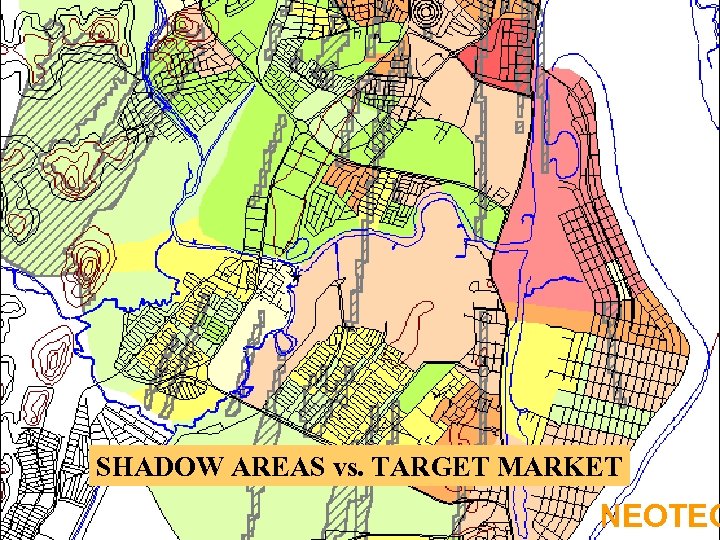

SHADOW AREAS vs. TARGET MARKET NEOTEC

SHADOW AREAS vs. TARGET MARKET NEOTEC

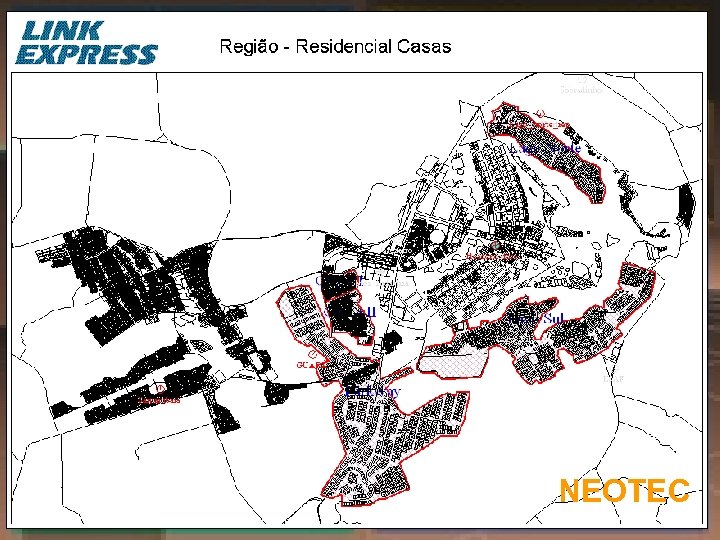

NEOTEC

NEOTEC

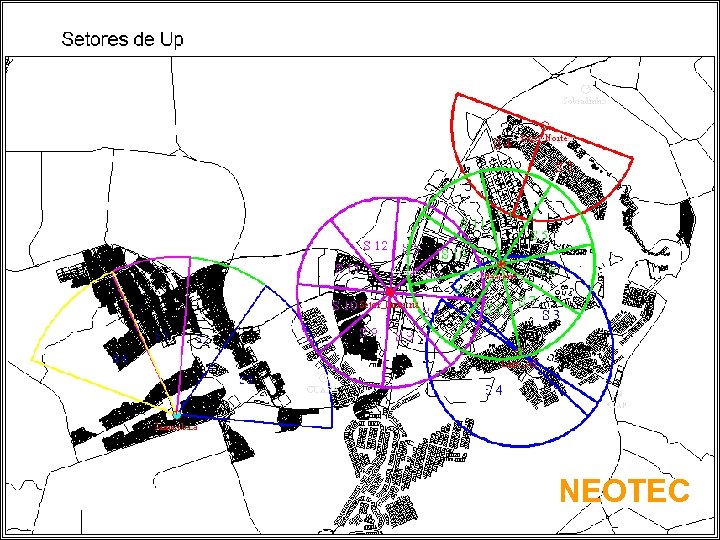

NEOTEC

NEOTEC

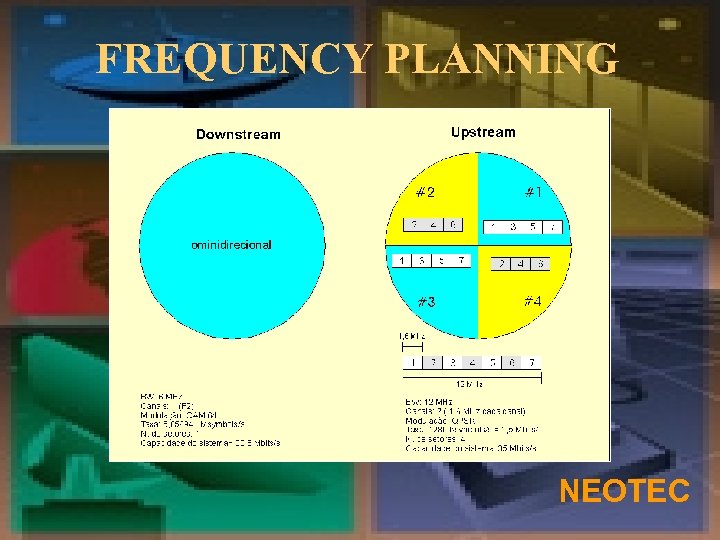

FREQUENCY PLANNING NEOTEC

FREQUENCY PLANNING NEOTEC

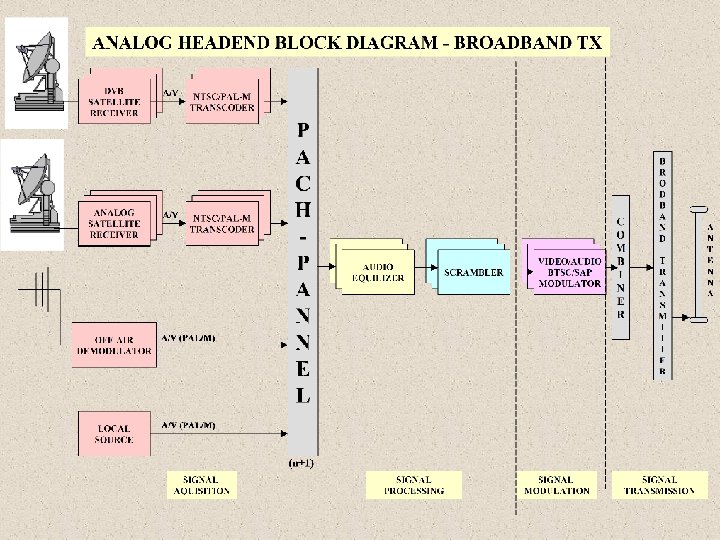

ANALOG / DIGITAL VIDEO HEADEND BLOCK DIAGRAM NEOTEC

ANALOG / DIGITAL VIDEO HEADEND BLOCK DIAGRAM NEOTEC

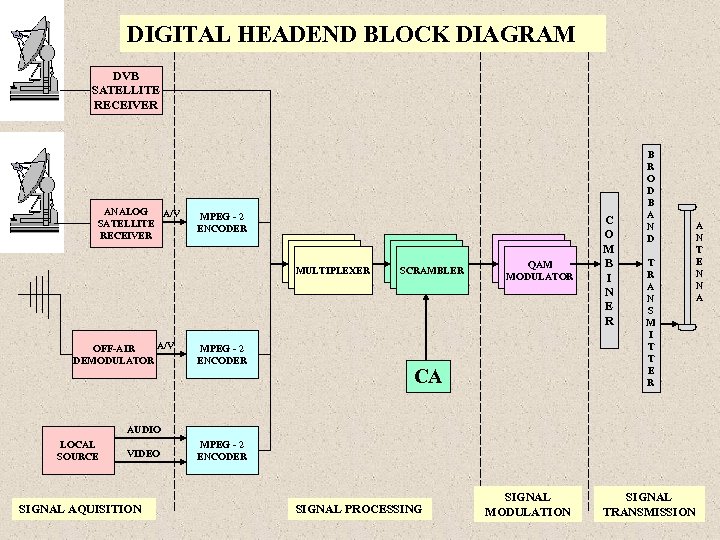

DIGITAL HEADEND BLOCK DIAGRAM DVB SATELLITE RECEIVER ANALOG A/V SATELLITE RECEIVER MPEG - 2 ENCODER MULTIPLEXER A/V OFF-AIR DEMODULATOR MPEG - 2 ENCODER SCRAMBLER QAM MODULATOR CA C O M B I N E R B R O D B A N D T R A N S M I T T E R AUDIO LOCAL SOURCE VIDEO SIGNAL AQUISITION MPEG - 2 ENCODER SIGNAL PROCESSING SIGNAL MODULATION SIGNAL TRANSMISSION A N T E N N A

DIGITAL HEADEND BLOCK DIAGRAM DVB SATELLITE RECEIVER ANALOG A/V SATELLITE RECEIVER MPEG - 2 ENCODER MULTIPLEXER A/V OFF-AIR DEMODULATOR MPEG - 2 ENCODER SCRAMBLER QAM MODULATOR CA C O M B I N E R B R O D B A N D T R A N S M I T T E R AUDIO LOCAL SOURCE VIDEO SIGNAL AQUISITION MPEG - 2 ENCODER SIGNAL PROCESSING SIGNAL MODULATION SIGNAL TRANSMISSION A N T E N N A

INTERNET HEADEND BLOCK DIAGRAM NEOTEC

INTERNET HEADEND BLOCK DIAGRAM NEOTEC

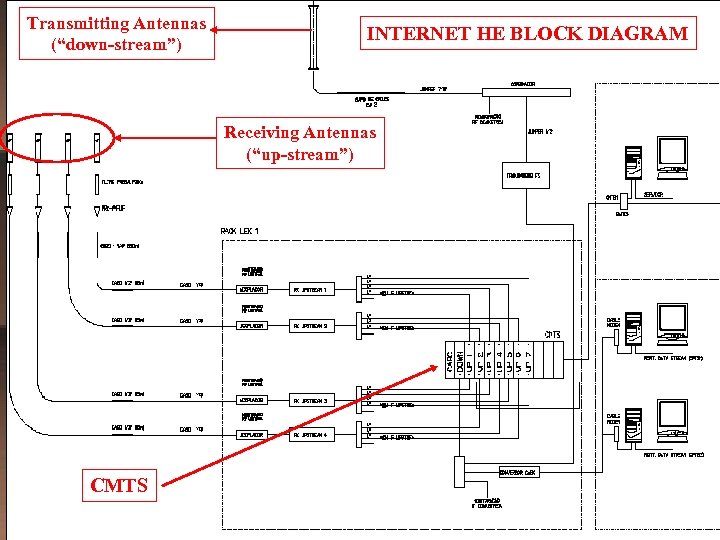

Transmitting Antennas (“down-stream”) INTERNET HE BLOCK DIAGRAM Receiving Antennas (“up-stream”) CMTS

Transmitting Antennas (“down-stream”) INTERNET HE BLOCK DIAGRAM Receiving Antennas (“up-stream”) CMTS

CUSTOMER’S PREMISE EQUIPMENT (CPE) BLOCK DIAGRAM NEOTEC

CUSTOMER’S PREMISE EQUIPMENT (CPE) BLOCK DIAGRAM NEOTEC

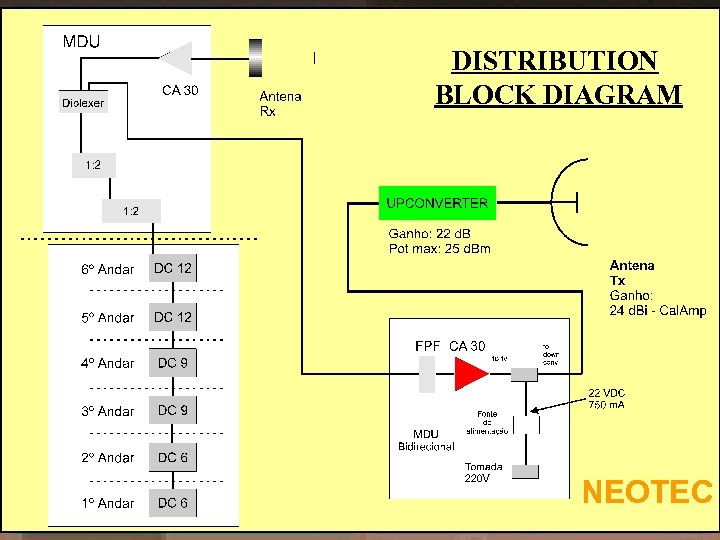

DISTRIBUTION BLOCK DIAGRAM NEOTEC

DISTRIBUTION BLOCK DIAGRAM NEOTEC

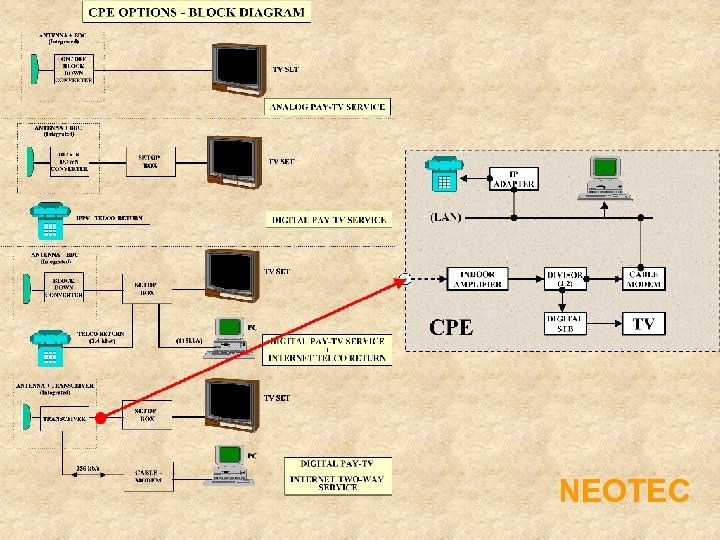

NEOTEC

NEOTEC

SYSTEM ARCHITECTURE NEOTEC

SYSTEM ARCHITECTURE NEOTEC

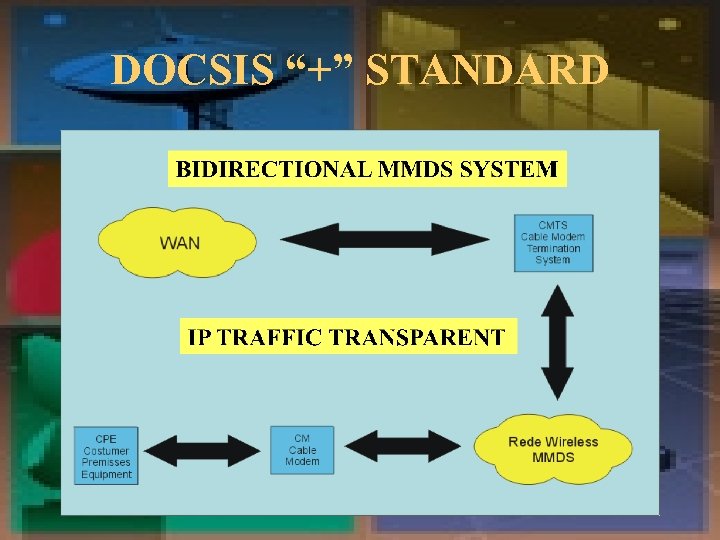

DOCSIS “+” STANDARD

DOCSIS “+” STANDARD

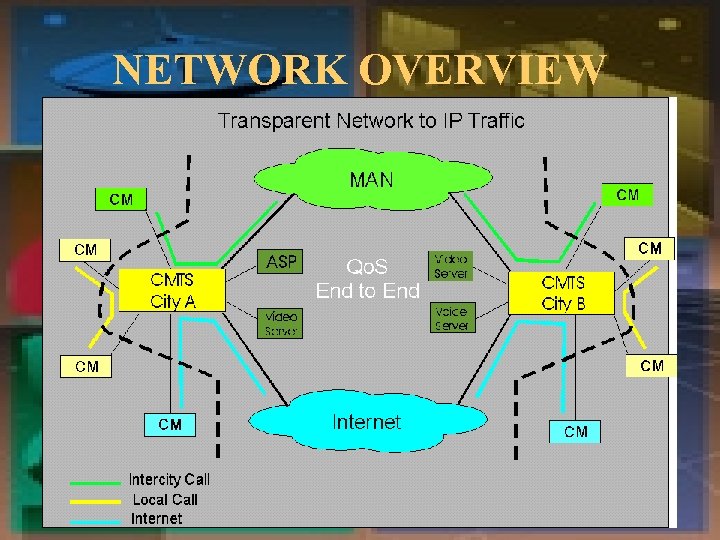

NETWORK OVERVIEW

NETWORK OVERVIEW

WHAT IS “NEOTEC”? NEOTEC

WHAT IS “NEOTEC”? NEOTEC

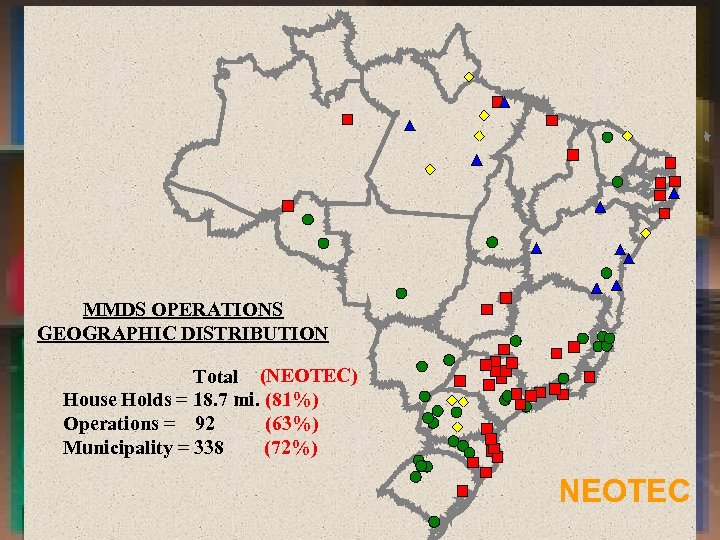

MMDS OPERATIONS GEOGRAPHIC DISTRIBUTION Total (NEOTEC) House Holds = 18. 7 mi. (81%) Operations = 92 (63%) Municipality = 338 (72%) NEOTEC

MMDS OPERATIONS GEOGRAPHIC DISTRIBUTION Total (NEOTEC) House Holds = 18. 7 mi. (81%) Operations = 92 (63%) Municipality = 338 (72%) NEOTEC

CHALLENGES • • Internacional Market Demand Industry Standard Open System Near “line-of-site” Installation Suppliers Diversity Equipment Cost Market / Investor’s perception Latin America and specially Brazil are the largest markets

CHALLENGES • • Internacional Market Demand Industry Standard Open System Near “line-of-site” Installation Suppliers Diversity Equipment Cost Market / Investor’s perception Latin America and specially Brazil are the largest markets

THANK YOU NEOTEC R. Pedroso Alvarenga, 505 /132 04531 -011 São Paulo S. P. Brazil c/o: José Luiz N. Frauendorf e. mail: jlfrau@uol. com. br Phone: (55 -11) 3167 -6252

THANK YOU NEOTEC R. Pedroso Alvarenga, 505 /132 04531 -011 São Paulo S. P. Brazil c/o: José Luiz N. Frauendorf e. mail: jlfrau@uol. com. br Phone: (55 -11) 3167 -6252