b07674befe849f608fb9cde2d643915b.ppt

- Количество слайдов: 35

Negotiations 101 (or what they do teach you at Harvard Business School) Guhan Subramanian Joseph Flom Professor of Law & Business, Harvard Law School H. Douglas Weaver Professor of Business Law, Harvard Business School June 2010 1 Copyright © President & Fellows of Harvard College.

Negotiations 101 (or what they do teach you at Harvard Business School) Guhan Subramanian Joseph Flom Professor of Law & Business, Harvard Law School H. Douglas Weaver Professor of Business Law, Harvard Business School June 2010 1 Copyright © President & Fellows of Harvard College.

Three Core Concepts in Negotiations BATNA: Best Alternative to a Negotiated Agreement Reservation Value: The value at which you would be indifferent between entering into or not entering into an agreement ZOPA: Zone of Possible Agreement 2

Three Core Concepts in Negotiations BATNA: Best Alternative to a Negotiated Agreement Reservation Value: The value at which you would be indifferent between entering into or not entering into an agreement ZOPA: Zone of Possible Agreement 2

Example: The Frasier Negotiation (2001) NBC Executive: “We knew that ABC wasn’t a player at the prices that we were already talking about. . . though Paramount kept promising us that ABC was very interested in it. . . I estimated that CBS’s break-even license fee would be about $3 million. . Without Frasier, our Tuesday night was kind of a wasteland. That year we already had a wasteland on Monday night, on Sunday night, and on Saturday night. There are only so many nights you can be out of business. . So we figured out that we could pay up to about $6. 0 million for the show. ” From: Subramanian, Frasier (A) (Harvard Business School Case 9 -801 -447) 3

Example: The Frasier Negotiation (2001) NBC Executive: “We knew that ABC wasn’t a player at the prices that we were already talking about. . . though Paramount kept promising us that ABC was very interested in it. . . I estimated that CBS’s break-even license fee would be about $3 million. . Without Frasier, our Tuesday night was kind of a wasteland. That year we already had a wasteland on Monday night, on Sunday night, and on Saturday night. There are only so many nights you can be out of business. . So we figured out that we could pay up to about $6. 0 million for the show. ” From: Subramanian, Frasier (A) (Harvard Business School Case 9 -801 -447) 3

A BATNA Checklist 1. Identify all the plausible things you might do without the other party, if you are unable to reach an agreement. 2. Calculate the value associated with each alternative. 3. Select which of these alternatives is best…this is your BATNA. 4. Important: always analyze the other parties’ BATNAs with equal care and objectivity. 4

A BATNA Checklist 1. Identify all the plausible things you might do without the other party, if you are unable to reach an agreement. 2. Calculate the value associated with each alternative. 3. Select which of these alternatives is best…this is your BATNA. 4. Important: always analyze the other parties’ BATNAs with equal care and objectivity. 4

A BATNA Illustration After Mississippi legalizes riverboat gambling in the late 1980 s/early 1990 s, entrepreneur approaches farmer to buy land for casino development. Before meeting, farmer hires an agriculture professor to estimate the value of the land. Agriculture professor conducts soil tests and estimates cash flows to conclude that the land is worth ~ $3. 0 million. In the negotiation, farmer (luckily) keeps quiet – first offer from entrepreneur is $7. 0 million. Farmer negotiates further and eventually reaches a deal at $8. 5 million. From: Subramanian, Taking BATNA to the Next Level, Negotiation (Nov. 2006) 5

A BATNA Illustration After Mississippi legalizes riverboat gambling in the late 1980 s/early 1990 s, entrepreneur approaches farmer to buy land for casino development. Before meeting, farmer hires an agriculture professor to estimate the value of the land. Agriculture professor conducts soil tests and estimates cash flows to conclude that the land is worth ~ $3. 0 million. In the negotiation, farmer (luckily) keeps quiet – first offer from entrepreneur is $7. 0 million. Farmer negotiates further and eventually reaches a deal at $8. 5 million. From: Subramanian, Taking BATNA to the Next Level, Negotiation (Nov. 2006) 5

Best Practices on Playing The Traditional Game Well 1. Set an effective anchor. 2. Make sure the process is perceived to be fair. 3. Manage your patterns of concession. 4. If a gap still exists, seek agreement on process to close the deal. 6

Best Practices on Playing The Traditional Game Well 1. Set an effective anchor. 2. Make sure the process is perceived to be fair. 3. Manage your patterns of concession. 4. If a gap still exists, seek agreement on process to close the deal. 6

Anchoring Effectively Anchoring: a potent cognitive bias in dealing with uncertainty in negotiations, in which people give too much weight to the first tangible number or “evidence, ” and adjust too little from that starting point. Implications for first offers in negotiations: (1) Anchor the negotiation by making a first offer, but only if you have a good sense for where the ZOPA is. (2) If you don’t know where the ZOPA is, or even whether it exists, hang back and let the other side make a first offer, or consider setting a “soft” anchor. (3) Avoid being anchored – defuse the anchor clearly and forcefully if your counterparty sets one against you. 7

Anchoring Effectively Anchoring: a potent cognitive bias in dealing with uncertainty in negotiations, in which people give too much weight to the first tangible number or “evidence, ” and adjust too little from that starting point. Implications for first offers in negotiations: (1) Anchor the negotiation by making a first offer, but only if you have a good sense for where the ZOPA is. (2) If you don’t know where the ZOPA is, or even whether it exists, hang back and let the other side make a first offer, or consider setting a “soft” anchor. (3) Avoid being anchored – defuse the anchor clearly and forcefully if your counterparty sets one against you. 7

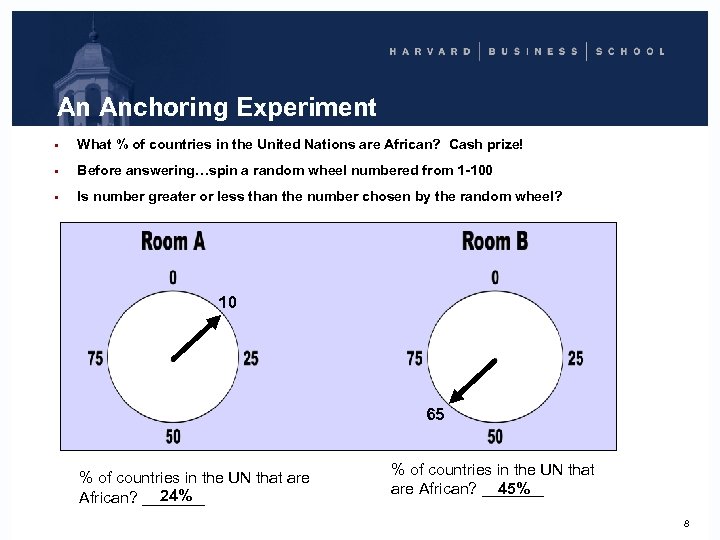

An Anchoring Experiment • What % of countries in the United Nations are African? Cash prize! • Before answering…spin a random wheel numbered from 1 -100 • Is number greater or less than the number chosen by the random wheel? 10 65 % of countries in the UN that are 24% African? _______ % of countries in the UN that 45% are African? _______ 8

An Anchoring Experiment • What % of countries in the United Nations are African? Cash prize! • Before answering…spin a random wheel numbered from 1 -100 • Is number greater or less than the number chosen by the random wheel? 10 65 % of countries in the UN that are 24% African? _______ % of countries in the UN that 45% are African? _______ 8

How High Should I Aim? In general: People estimate that the pie is about 1/3 smaller than it actually is, which results in first offers that are too conservative. Ask yourself: “What is the most aggressive offer I can justify? ” But always make sure to explain your proposal: Don’t just throw a number over the fence. 9

How High Should I Aim? In general: People estimate that the pie is about 1/3 smaller than it actually is, which results in first offers that are too conservative. Ask yourself: “What is the most aggressive offer I can justify? ” But always make sure to explain your proposal: Don’t just throw a number over the fence. 9

Managing Your Patterns of Concession 1. Know the midpoint rule: The best predictor of the final outcome is the midpoint of the first semireasonable offer and counter-offer. Plan in advance to converge your concessions to a desirable outcome. 2. Beware large concessions! Medium concessions trigger reciprocity, but large concessions indicate that there is more to come. 3. Signal the end of the road: Make smaller and smaller concessions to indicate that you are reaching your limit before having to walk away. 10

Managing Your Patterns of Concession 1. Know the midpoint rule: The best predictor of the final outcome is the midpoint of the first semireasonable offer and counter-offer. Plan in advance to converge your concessions to a desirable outcome. 2. Beware large concessions! Medium concessions trigger reciprocity, but large concessions indicate that there is more to come. 3. Signal the end of the road: Make smaller and smaller concessions to indicate that you are reaching your limit before having to walk away. 10

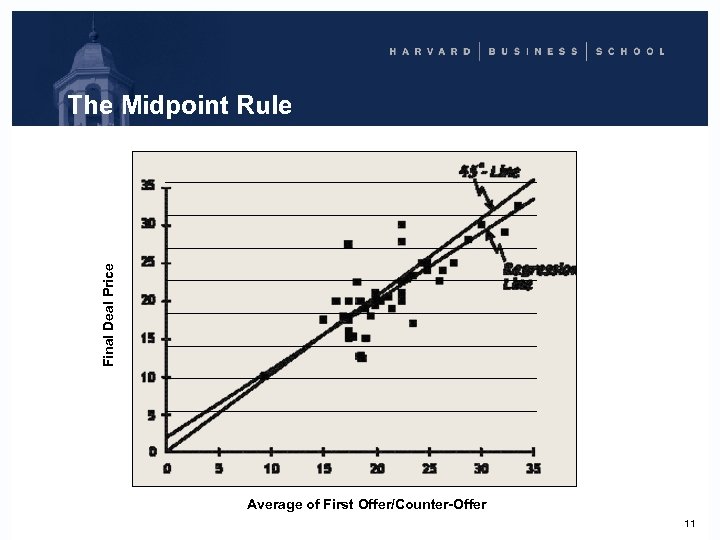

Final Deal Price The Midpoint Rule Average of First Offer/Counter-Offer 11

Final Deal Price The Midpoint Rule Average of First Offer/Counter-Offer 11

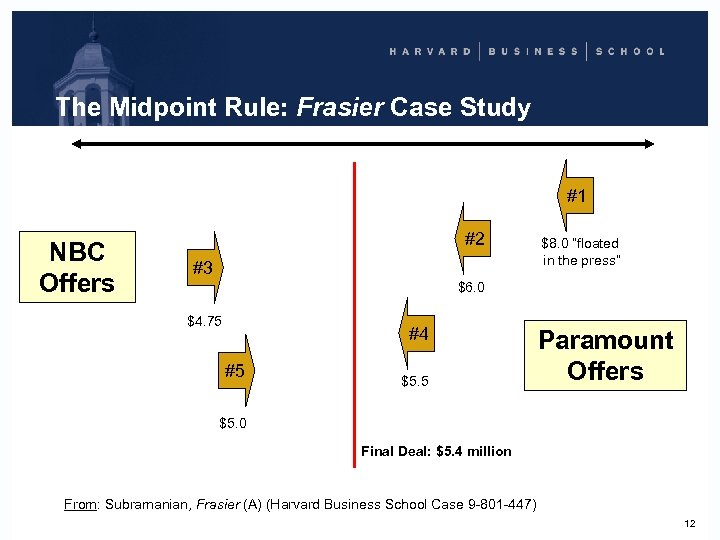

The Midpoint Rule: Frasier Case Study #1 NBC Offers #2 #3 $8. 0 “floated in the press” $6. 0 $4. 75 #4 #5 $5. 5 Paramount Offers $5. 0 Final Deal: $5. 4 million From: Subramanian, Frasier (A) (Harvard Business School Case 9 -801 -447) 12

The Midpoint Rule: Frasier Case Study #1 NBC Offers #2 #3 $8. 0 “floated in the press” $6. 0 $4. 75 #4 #5 $5. 5 Paramount Offers $5. 0 Final Deal: $5. 4 million From: Subramanian, Frasier (A) (Harvard Business School Case 9 -801 -447) 12

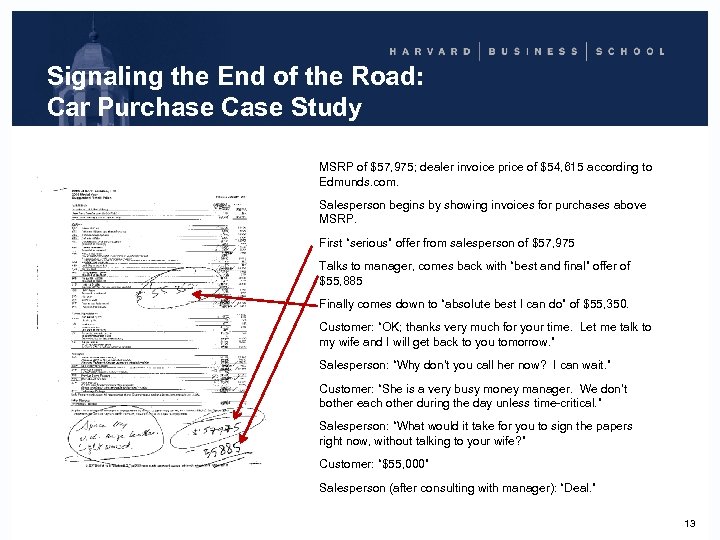

Signaling the End of the Road: Car Purchase Case Study MSRP of $57, 975; dealer invoice price of $54, 615 according to Edmunds. com. Salesperson begins by showing invoices for purchases above MSRP. First “serious” offer from salesperson of $57, 975 Talks to manager, comes back with “best and final” offer of $55, 885 Finally comes down to “absolute best I can do” of $55, 350. Customer: “OK; thanks very much for your time. Let me talk to my wife and I will get back to you tomorrow. ” Salesperson: “Why don’t you call her now? I can wait. ” Customer: “She is a very busy money manager. We don’t bother each other during the day unless time-critical. ” Salesperson: “What would it take for you to sign the papers right now, without talking to your wife? ” Customer: “$55, 000” Salesperson (after consulting with manager): “Deal. ” 13

Signaling the End of the Road: Car Purchase Case Study MSRP of $57, 975; dealer invoice price of $54, 615 according to Edmunds. com. Salesperson begins by showing invoices for purchases above MSRP. First “serious” offer from salesperson of $57, 975 Talks to manager, comes back with “best and final” offer of $55, 885 Finally comes down to “absolute best I can do” of $55, 350. Customer: “OK; thanks very much for your time. Let me talk to my wife and I will get back to you tomorrow. ” Salesperson: “Why don’t you call her now? I can wait. ” Customer: “She is a very busy money manager. We don’t bother each other during the day unless time-critical. ” Salesperson: “What would it take for you to sign the papers right now, without talking to your wife? ” Customer: “$55, 000” Salesperson (after consulting with manager): “Deal. ” 13

If All Else Fails, Try Agreement on Process Example: Hollywood unknowns Ben Affleck and Matt Damon write script for “Good Will Hunting, ” starring themselves. Close to selling the script to Miramax, but negotiations break down when they demand “final cut rights” for director Gus Van Sant (Drugstore Cowboy, Even Cowgirls Get the Blues). Solution: Van Sant retains final cut rights, but movie will be shown to a test audience selected according to predetermined criteria; if audience reaction is not sufficiently positive, Miramax gets to re-cut the movie for final release. 14

If All Else Fails, Try Agreement on Process Example: Hollywood unknowns Ben Affleck and Matt Damon write script for “Good Will Hunting, ” starring themselves. Close to selling the script to Miramax, but negotiations break down when they demand “final cut rights” for director Gus Van Sant (Drugstore Cowboy, Even Cowgirls Get the Blues). Solution: Van Sant retains final cut rights, but movie will be shown to a test audience selected according to predetermined criteria; if audience reaction is not sufficiently positive, Miramax gets to re-cut the movie for final release. 14

Tactics for Playing the Traditional Game Well: Synthesis 1. Anchor appropriately: Choose the right kind of anchor based on how much you know about the ZOPA. 2. Make sure that the process is perceived to be fair: Explain your proposals (don’t just throw offers over the fence); remember that people want to feel good about the process (“transactional utility”). 3. Manage your patterns of concession: Work backwards from the midpoint rule to determine your counter-offer. 4. If negotiations break down: Try reaching agreement on process instead. 15

Tactics for Playing the Traditional Game Well: Synthesis 1. Anchor appropriately: Choose the right kind of anchor based on how much you know about the ZOPA. 2. Make sure that the process is perceived to be fair: Explain your proposals (don’t just throw offers over the fence); remember that people want to feel good about the process (“transactional utility”). 3. Manage your patterns of concession: Work backwards from the midpoint rule to determine your counter-offer. 4. If negotiations break down: Try reaching agreement on process instead. 15

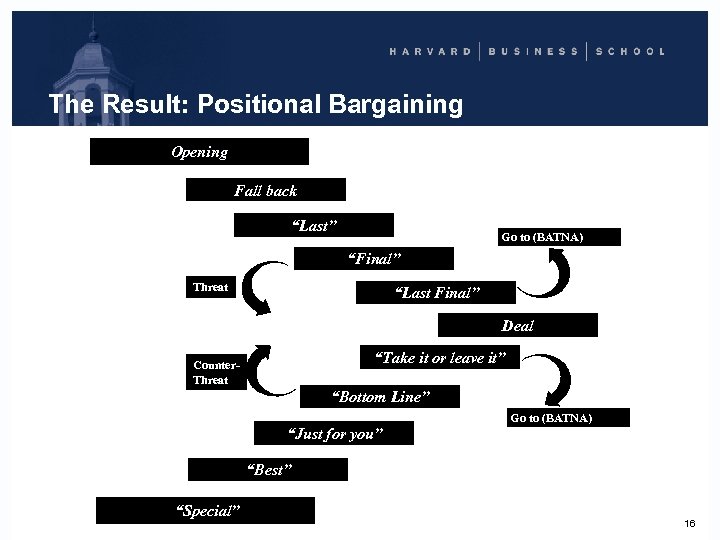

The Result: Positional Bargaining Opening Fall back “Last” Go to (BATNA) “Final” Threat “Last Final” Deal “Take it or leave it” Counter. Threat “Bottom Line” Go to (BATNA) “Just for you” “Best” “Special” 16

The Result: Positional Bargaining Opening Fall back “Last” Go to (BATNA) “Final” Threat “Last Final” Deal “Take it or leave it” Counter. Threat “Bottom Line” Go to (BATNA) “Just for you” “Best” “Special” 16

The Benefits of Interest-Based Negotiation Makes it far more likely that “win-win” opportunities will be identified and captured: Issues that are cheap for you and valuable for me (and vice versa) permit joint gains rather than compromise. Preserves the relationship between the parties: Important in virtually every negotiation, even perceived “one -shot” or “end-game” situations. Compare: “At the end of the day they weren’t very happy and we weren’t very happy, which are the hallmarks of a good deal. ” (lead NBC negotiator for Frasier) 17

The Benefits of Interest-Based Negotiation Makes it far more likely that “win-win” opportunities will be identified and captured: Issues that are cheap for you and valuable for me (and vice versa) permit joint gains rather than compromise. Preserves the relationship between the parties: Important in virtually every negotiation, even perceived “one -shot” or “end-game” situations. Compare: “At the end of the day they weren’t very happy and we weren’t very happy, which are the hallmarks of a good deal. ” (lead NBC negotiator for Frasier) 17

Some Specific Tactics 1. Before you begin: Manage the physical space, e. g. , sit on the same side of the table. 2. Get off to a good start: Build trust by framing the negotiation as a joint problem to solve. 3. Identify the ZOPA: Share information reciprocally, ask questions, and practice “active listening. ” 4. Propose packages: Negotiate multiple issues simultaneously rather than negotiating issue-byissue. 18

Some Specific Tactics 1. Before you begin: Manage the physical space, e. g. , sit on the same side of the table. 2. Get off to a good start: Build trust by framing the negotiation as a joint problem to solve. 3. Identify the ZOPA: Share information reciprocally, ask questions, and practice “active listening. ” 4. Propose packages: Negotiate multiple issues simultaneously rather than negotiating issue-byissue. 18

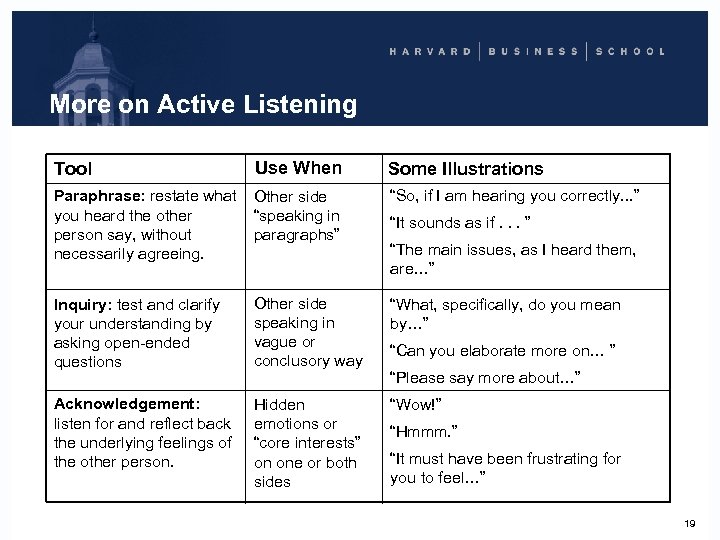

More on Active Listening Tool Use When Some Illustrations Paraphrase: restate what you heard the other person say, without necessarily agreeing. Other side “speaking in paragraphs” “So, if I am hearing you correctly. . . ” Inquiry: test and clarify your understanding by asking open-ended questions Other side speaking in vague or conclusory way “What, specifically, do you mean by…” Acknowledgement: listen for and reflect back the underlying feelings of the other person. Hidden emotions or “core interests” on one or both sides “Wow!” “It sounds as if. . . ” “The main issues, as I heard them, are…” “Can you elaborate more on… ” “Please say more about…” “Hmmm. ” “It must have been frustrating for you to feel…” 19

More on Active Listening Tool Use When Some Illustrations Paraphrase: restate what you heard the other person say, without necessarily agreeing. Other side “speaking in paragraphs” “So, if I am hearing you correctly. . . ” Inquiry: test and clarify your understanding by asking open-ended questions Other side speaking in vague or conclusory way “What, specifically, do you mean by…” Acknowledgement: listen for and reflect back the underlying feelings of the other person. Hidden emotions or “core interests” on one or both sides “Wow!” “It sounds as if. . . ” “The main issues, as I heard them, are…” “Can you elaborate more on… ” “Please say more about…” “Hmmm. ” “It must have been frustrating for you to feel…” 19

The Most Famous Active Listener The New York Times, April 20, 2009: “Look, in Canada, we’re used to the American president being the celebrity, ” [Canadian Prime Minister Stephen] Harper said, professing not to mind being in Mr. Obama’s shadow. He went on, “What’s interesting is that his desire, his clear desire to listen — not necessarily to agree but to listen — has won him a lot of friends. ” 20

The Most Famous Active Listener The New York Times, April 20, 2009: “Look, in Canada, we’re used to the American president being the celebrity, ” [Canadian Prime Minister Stephen] Harper said, professing not to mind being in Mr. Obama’s shadow. He went on, “What’s interesting is that his desire, his clear desire to listen — not necessarily to agree but to listen — has won him a lot of friends. ” 20

The Most Famous Active Listener (cont) “The way I think about interacting with people generally is to find out what it is that they’re thinking, to give them a sense for what I’m thinking, and then to try to synthesize and try to find the truth that lies between people. . My natural instinct is not to try to beat the other person down, but rather to understand their point of view and make sure they understand my point of view, and then see if we can find common ground. ” Source: Richard Wolfe, Renegade p. 190 (interview with Barack Obama) 21

The Most Famous Active Listener (cont) “The way I think about interacting with people generally is to find out what it is that they’re thinking, to give them a sense for what I’m thinking, and then to try to synthesize and try to find the truth that lies between people. . My natural instinct is not to try to beat the other person down, but rather to understand their point of view and make sure they understand my point of view, and then see if we can find common ground. ” Source: Richard Wolfe, Renegade p. 190 (interview with Barack Obama) 21

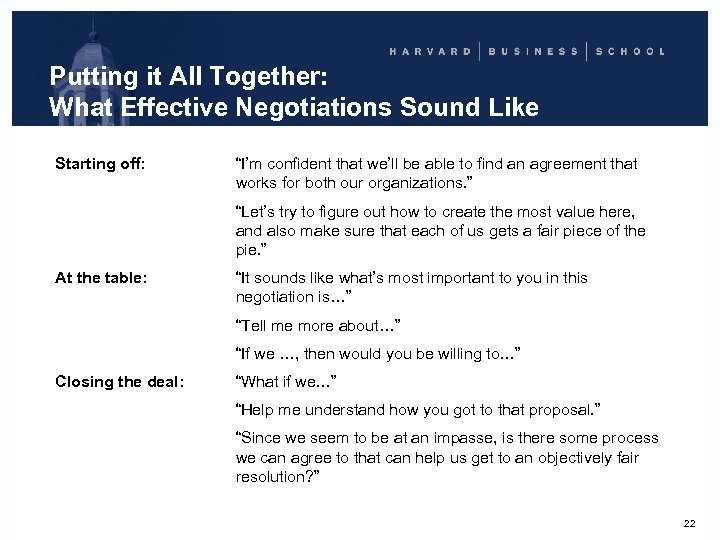

Putting it All Together: What Effective Negotiations Sound Like Starting off: “I’m confident that we’ll be able to find an agreement that works for both our organizations. ” “Let’s try to figure out how to create the most value here, and also make sure that each of us gets a fair piece of the pie. ” At the table: “It sounds like what’s most important to you in this negotiation is…” “Tell me more about…” “If we …, then would you be willing to…” Closing the deal: “What if we…” “Help me understand how you got to that proposal. ” “Since we seem to be at an impasse, is there some process we can agree to that can help us get to an objectively fair resolution? ” 22

Putting it All Together: What Effective Negotiations Sound Like Starting off: “I’m confident that we’ll be able to find an agreement that works for both our organizations. ” “Let’s try to figure out how to create the most value here, and also make sure that each of us gets a fair piece of the pie. ” At the table: “It sounds like what’s most important to you in this negotiation is…” “Tell me more about…” “If we …, then would you be willing to…” Closing the deal: “What if we…” “Help me understand how you got to that proposal. ” “Since we seem to be at an impasse, is there some process we can agree to that can help us get to an objectively fair resolution? ” 22

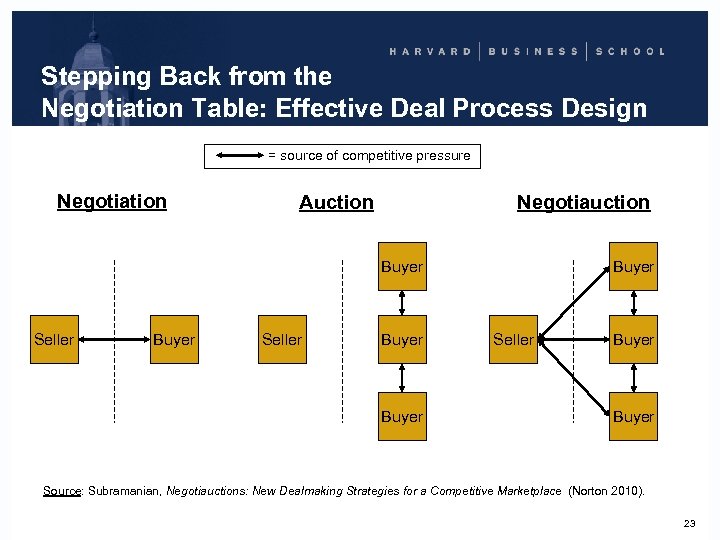

Stepping Back from the Negotiation Table: Effective Deal Process Design = source of competitive pressure Negotiation Auction Negotiauction Buyer Seller Buyer Source: Subramanian, Negotiauctions: New Dealmaking Strategies for a Competitive Marketplace (Norton 2010). 23

Stepping Back from the Negotiation Table: Effective Deal Process Design = source of competitive pressure Negotiation Auction Negotiauction Buyer Seller Buyer Source: Subramanian, Negotiauctions: New Dealmaking Strategies for a Competitive Marketplace (Norton 2010). 23

How Not to Play in Negotiauctions: RJR Nabisco Case Study “We’re not done!”, Goldstone insisted. “Peter, we’re willing to bid more. We’ll bid more! What is this nonsense about starting an auction and shutting it down an hour later? There are no rules governing these procedures. We put in a bid saying we’ll bid more, and we will. How can you do this? It’s not fair!” Atkins tried to calm the feverish lawyer but got nowhere. “Peter you’ve got to keep the bidding open. You’ve got to keep the bidding open as long as people are willing to bid. ” Source: Burrough & Helyar, Barbarians at the Gate, p. 462. 24

How Not to Play in Negotiauctions: RJR Nabisco Case Study “We’re not done!”, Goldstone insisted. “Peter, we’re willing to bid more. We’ll bid more! What is this nonsense about starting an auction and shutting it down an hour later? There are no rules governing these procedures. We put in a bid saying we’ll bid more, and we will. How can you do this? It’s not fair!” Atkins tried to calm the feverish lawyer but got nowhere. “Peter you’ve got to keep the bidding open. You’ve got to keep the bidding open as long as people are willing to bid. ” Source: Burrough & Helyar, Barbarians at the Gate, p. 462. 24

Playing Effectively in Negotiauctions: A Taxonomy of Moves Setup Moves: establishes the terms of entry into a negotiation or auction situation Rearranging Moves: reconfigures the assets or the parties, or both, in ways that create and claim value Shut-Down Moves: short-circuits a negotiation or auction situation that is underway Source: Subramanian, Negotiauctions: New Dealmaking Strategies for a Competitive Marketplace (Norton 2010). 25

Playing Effectively in Negotiauctions: A Taxonomy of Moves Setup Moves: establishes the terms of entry into a negotiation or auction situation Rearranging Moves: reconfigures the assets or the parties, or both, in ways that create and claim value Shut-Down Moves: short-circuits a negotiation or auction situation that is underway Source: Subramanian, Negotiauctions: New Dealmaking Strategies for a Competitive Marketplace (Norton 2010). 25

Setup Moves: Kerzner International Case Study February 3 rd, 2006: Sol Kerzner, billionaire founder of Kernzer International, proposes an MBO to his board. March 20 th: Independent committee reaches a deal to sell the company to Kerzner for $76 per share, with 45 -day “go shop” clause. April 11 th: “Party A” expresses interest in making an offer but requires significant “pay to play” incentives: (1) reimbursement of expenses in the event that Party A made a firm offer at $78 per share or better; (2) $100 million more in the event that Party A’s bid was the highest outside bid and the board nevertheless did not sign a deal with Party A within 10 days of the bid being made. From Kernzer’s 13 E-3 filing: “[D]ue to its concerns that the investor group [led by Mr. Kerzner] had a natural advantage over other bidders from its pre-existing knowledge of the company and established relationships with governmental authorities and joint venture partners, it would require an inducement to complete. . . due diligence and to submit a proposal to acquire the company. ” 26

Setup Moves: Kerzner International Case Study February 3 rd, 2006: Sol Kerzner, billionaire founder of Kernzer International, proposes an MBO to his board. March 20 th: Independent committee reaches a deal to sell the company to Kerzner for $76 per share, with 45 -day “go shop” clause. April 11 th: “Party A” expresses interest in making an offer but requires significant “pay to play” incentives: (1) reimbursement of expenses in the event that Party A made a firm offer at $78 per share or better; (2) $100 million more in the event that Party A’s bid was the highest outside bid and the board nevertheless did not sign a deal with Party A within 10 days of the bid being made. From Kernzer’s 13 E-3 filing: “[D]ue to its concerns that the investor group [led by Mr. Kerzner] had a natural advantage over other bidders from its pre-existing knowledge of the company and established relationships with governmental authorities and joint venture partners, it would require an inducement to complete. . . due diligence and to submit a proposal to acquire the company. ” 26

Rearranging Moves: Toys “R” Us Case Study In March 2005, the Toys “R” Us board decides to sell the company. CSFB contacts 29 financial buyers. Nine make preliminary bids, and eventually the field is narrowed to four: Cerberus club (joined by six others); Apollo club (joined by one other); KKR; and Bain/Vornado club. In “best and final” round, KKR agrees to bid only if it can club with Bain/Vornado. Q: What do you do as the Toys “R” Us board? Toys board agrees to let KKR team with Bain/Vornado. Final bids come in: Apollo club bids $24 -26 per share conditional on further due diligence; Cerberus bids $25. 25; KKR club bid $26. 75. 27

Rearranging Moves: Toys “R” Us Case Study In March 2005, the Toys “R” Us board decides to sell the company. CSFB contacts 29 financial buyers. Nine make preliminary bids, and eventually the field is narrowed to four: Cerberus club (joined by six others); Apollo club (joined by one other); KKR; and Bain/Vornado club. In “best and final” round, KKR agrees to bid only if it can club with Bain/Vornado. Q: What do you do as the Toys “R” Us board? Toys board agrees to let KKR team with Bain/Vornado. Final bids come in: Apollo club bids $24 -26 per share conditional on further due diligence; Cerberus bids $25. 25; KKR club bid $26. 75. 27

Shut-Down Moves: New York Magazine Case Study After faltering performance and an overall decline in the magazine industry, Primedia (owned by KKR) puts New York magazine up for sale in September 2003. Several interested parties emerge: American Media, Curtco Robb Media, a consortium led by Mort Zuckerman, and Bruce Wasserstein. Preliminary bids range from $30 -$80 million. Binding bids come in on Thursday, December 11, 2003: American Media ($40 million); Zuckerman consortium ($44 million); Curt. Co Robb Media ($52. 5 million); and a last-minute stealth bid from Wasserstein ($55 million). Wasserstein conducts due diligence over the weekend and negotiates personally with Henry Kravis to reach a “deal in principle” by Tuesday, December 16 th. Other bidders offer more but Kravis refuses to extend the bidding further. Source: David Chen & Guhan Subramanian, New York Magazine (HBS Case N 9 -908 -012) 28

Shut-Down Moves: New York Magazine Case Study After faltering performance and an overall decline in the magazine industry, Primedia (owned by KKR) puts New York magazine up for sale in September 2003. Several interested parties emerge: American Media, Curtco Robb Media, a consortium led by Mort Zuckerman, and Bruce Wasserstein. Preliminary bids range from $30 -$80 million. Binding bids come in on Thursday, December 11, 2003: American Media ($40 million); Zuckerman consortium ($44 million); Curt. Co Robb Media ($52. 5 million); and a last-minute stealth bid from Wasserstein ($55 million). Wasserstein conducts due diligence over the weekend and negotiates personally with Henry Kravis to reach a “deal in principle” by Tuesday, December 16 th. Other bidders offer more but Kravis refuses to extend the bidding further. Source: David Chen & Guhan Subramanian, New York Magazine (HBS Case N 9 -908 -012) 28

New York Magazine: Commentary on the Deal Zuckerman insider: “By 11 a. m. Tuesday, we heard that Wasserstein was [negotiating] and we thought, ‘Uh oh, there’s a wrinkle—we’re going to have to pay more. ’ By 2 p. m. it started looking bleak. By 2: 30 it was over. We were screwed. ” Mort Zuckerman: “We made it clear that we were willing to put more money on the table, but after they had a handshake, they were not willing to entertain other offers. It was inconsistent with the normal bidding process. ” David Pecker (American Media): “We had more money on the table, but never had the opportunity to put in the second bid. ” Wasserstein (HBS Class visit 4/07): “It is very rare for the rules of an auction to actually be the rules. . . When there are rules, you always have to think of the way you want to play it and what degree of hand you want to show. So I really don’t care what rules people purport to have. You have to think about what works for you, and the power of the situation. ” Source: Subramanian, Negotiauctions (2010) 29

New York Magazine: Commentary on the Deal Zuckerman insider: “By 11 a. m. Tuesday, we heard that Wasserstein was [negotiating] and we thought, ‘Uh oh, there’s a wrinkle—we’re going to have to pay more. ’ By 2 p. m. it started looking bleak. By 2: 30 it was over. We were screwed. ” Mort Zuckerman: “We made it clear that we were willing to put more money on the table, but after they had a handshake, they were not willing to entertain other offers. It was inconsistent with the normal bidding process. ” David Pecker (American Media): “We had more money on the table, but never had the opportunity to put in the second bid. ” Wasserstein (HBS Class visit 4/07): “It is very rare for the rules of an auction to actually be the rules. . . When there are rules, you always have to think of the way you want to play it and what degree of hand you want to show. So I really don’t care what rules people purport to have. You have to think about what works for you, and the power of the situation. ” Source: Subramanian, Negotiauctions (2010) 29

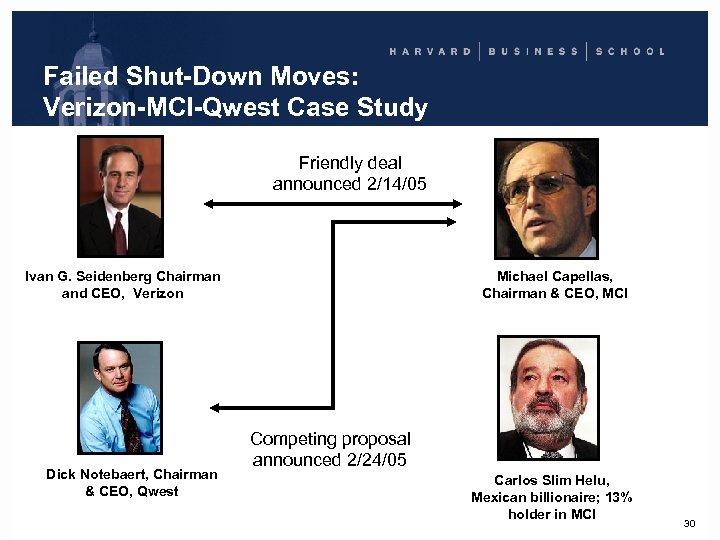

Failed Shut-Down Moves: Verizon-MCI-Qwest Case Study Friendly deal announced 2/14/05 Ivan G. Seidenberg Chairman and CEO, Verizon Dick Notebaert, Chairman & CEO, Qwest Michael Capellas, Chairman & CEO, MCI Competing proposal announced 2/24/05 Carlos Slim Helu, Mexican billionaire; 13% holder in MCI 30

Failed Shut-Down Moves: Verizon-MCI-Qwest Case Study Friendly deal announced 2/14/05 Ivan G. Seidenberg Chairman and CEO, Verizon Dick Notebaert, Chairman & CEO, Qwest Michael Capellas, Chairman & CEO, MCI Competing proposal announced 2/24/05 Carlos Slim Helu, Mexican billionaire; 13% holder in MCI 30

Representative Analyst Commentary “Attractive acquisition for Verizon – a MUST HAVE for Qwest – Investors should not be surprised to see Qwest’s premium bid for MCI, as such a deal is in our opinion absolutely necessary for the company if it ever expects to begin paying down its onerous $17 billion debt load, which it likely could not do on its own. ” 31

Representative Analyst Commentary “Attractive acquisition for Verizon – a MUST HAVE for Qwest – Investors should not be surprised to see Qwest’s premium bid for MCI, as such a deal is in our opinion absolutely necessary for the company if it ever expects to begin paying down its onerous $17 billion debt load, which it likely could not do on its own. ” 31

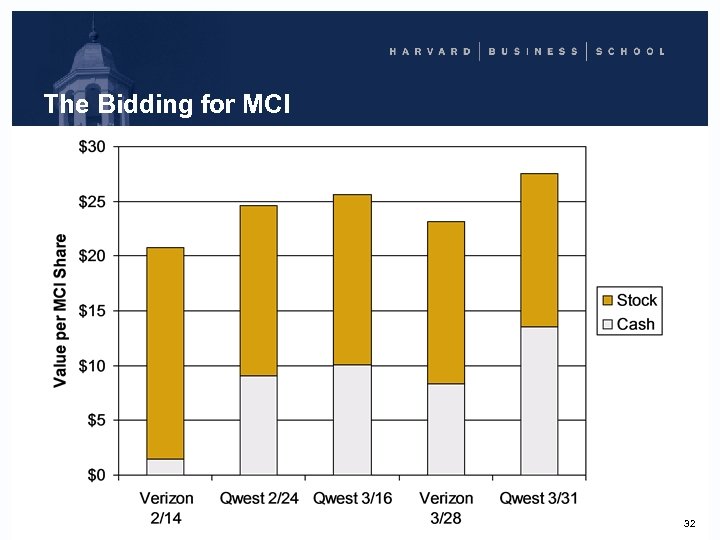

The Bidding for MCI 32

The Bidding for MCI 32

Verizon Press Release (April 4, 2005) “Qwest has submitted what we believe to be an inferior offer. If the MCI board, capitulating to Qwest’s artificial deadline, declares this bid to be ‘superior, ’ it would seem to us that the decision-making process is being driven by the interests of short-term investors rather than the company’s long-term strength and viability. Should this occur, we would no longer be interested in participating in such a process. ” 33

Verizon Press Release (April 4, 2005) “Qwest has submitted what we believe to be an inferior offer. If the MCI board, capitulating to Qwest’s artificial deadline, declares this bid to be ‘superior, ’ it would seem to us that the decision-making process is being driven by the interests of short-term investors rather than the company’s long-term strength and viability. Should this occur, we would no longer be interested in participating in such a process. ” 33

Phillip Mills, Davis Polk & Wardwell “When I saw Verizon’s April 4 th press release, I laughed. . It told me that Verizon was in for the long haul. Verizon knew how to say ‘We’re out of here, ’ but they didn’t. Instead they said ‘We would no longer be interested in participating in your process. ’ What does that mean? The ambiguity told me that we could continue to use Qwest as a stalking horse to extract more from Verizon, without risking that Verizon was going to walk away. Instead of telling me that we were about to lose Verizon, it told me just the opposite. ” Source: Subramanian, Negotiauctions (2010) 34

Phillip Mills, Davis Polk & Wardwell “When I saw Verizon’s April 4 th press release, I laughed. . It told me that Verizon was in for the long haul. Verizon knew how to say ‘We’re out of here, ’ but they didn’t. Instead they said ‘We would no longer be interested in participating in your process. ’ What does that mean? The ambiguity told me that we could continue to use Qwest as a stalking horse to extract more from Verizon, without risking that Verizon was going to walk away. Instead of telling me that we were about to lose Verizon, it told me just the opposite. ” Source: Subramanian, Negotiauctions (2010) 34

Negotiations 101: A Summary Good negotiators are effective at playing the traditional game of carving up a fixed pie. Prepare for your important negotiations by thinking through BATNA’s, reservation prices, and whether a ZOPA exists. Very good negotiators are able to transform a potentially adversarial negotiation into a joint problem-solving process. Communicate the mutual benefits of collaboration in order to craft sustainable, long-term agreements. Exceptional negotiators are able to change the game. Use setup, rearranging, and shut-down moves to shape the deal process to your advantage. 35

Negotiations 101: A Summary Good negotiators are effective at playing the traditional game of carving up a fixed pie. Prepare for your important negotiations by thinking through BATNA’s, reservation prices, and whether a ZOPA exists. Very good negotiators are able to transform a potentially adversarial negotiation into a joint problem-solving process. Communicate the mutual benefits of collaboration in order to craft sustainable, long-term agreements. Exceptional negotiators are able to change the game. Use setup, rearranging, and shut-down moves to shape the deal process to your advantage. 35