7b1cb57ea4ae905e5d0bb09ff7fe2483.ppt

- Количество слайдов: 19

Need for Standardization and Interoperability in the Transformation of Capital markets R Vivekanand Head, e. Clear. Settle Tata Consultancy Services © Tata Consultancy Services Ltd. 1

Our Lineage : TATA Group § India’s Largest Conglomerate - 91 operating companies across 7 industry sectors § Represents Excellence & Integrity § Trusteeship Concept § Pioneering Spirit § Leaders in multiple businesses § Total Market Cap - Rs. 196, 422 Crs. ($ 42. 8 bn. ) as of 30 th June 2006 2

About TCS Ø FY 2006 revenue of USD 2. 97 Billion Ø Over 71, 000 employees Ø Global presence - Operations in 47 countries, 169 offices Ø 1 st Company in the world to be assessed at Level 5 for integrated enterprise-wide CMMI and PCMM Ø First and Largest Ø Software R&D Centre in India Ø Software Exporter in India Ø Awarded triple certification for Ø Quality (ISO 9001: 2000) Ø Security (BS 7799 -2: 2002) Ø Services (BS 15000 -1: 2002) 3

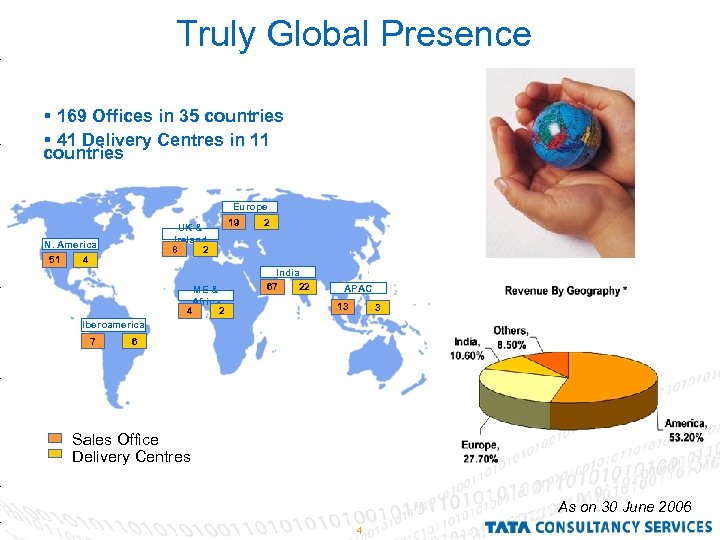

Truly Global Presence § 169 Offices in 35 countries § 41 Delivery Centres in 11 countries Europe UK & Ireland 8 2 N. America 51 4 ME & Africa 4 2 19 2 India 67 22 APAC 13 3 Iberoamerica 7 6 Sales Office Delivery Centres As on 30 June 2006 4

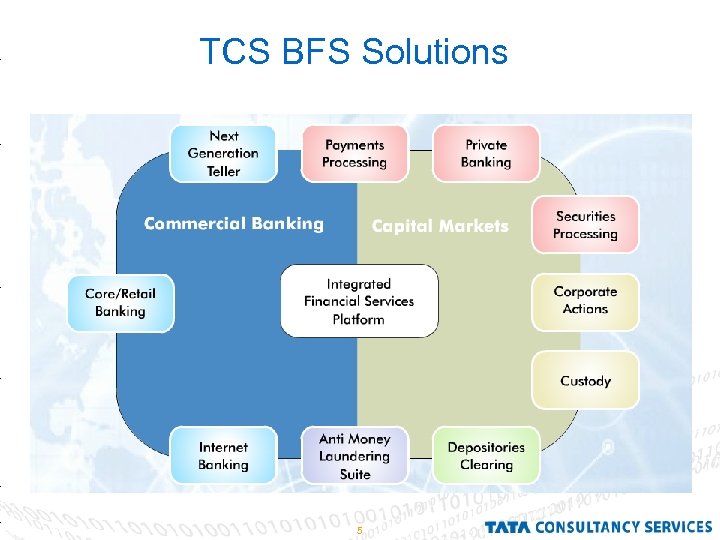

TCS BFS Solutions 5

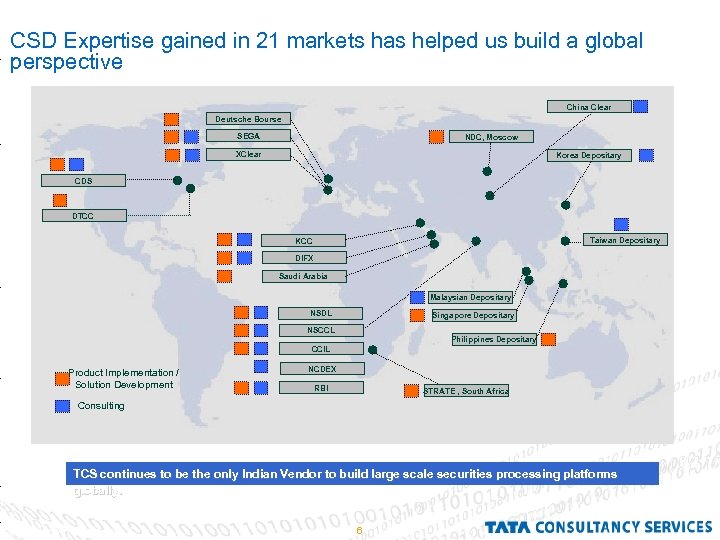

CSD Expertise gained in 21 markets has helped us build a global perspective China Clear Deutsche Bourse SEGA NDC, Moscow XClear Korea Depositary CDS DTCC Taiwan Depositary KCC DIFX Saudi Arabia Malaysian Depositary NSDL Singapore Depositary NSCCL Philippines Depositary CCIL Product Implementation / Solution Development NCDEX RBI STRATE , South Africa Consulting TCS continues to be the only Indian Vendor to build large scale securities processing platforms globally. 6

Agenda § Business Drivers, Trends in the CSD space § Path to Transformation § Benefits of Global Standards § Need for interoperability § Local Practices § Technology § Market Transformation Model § STRATE – A case study 7

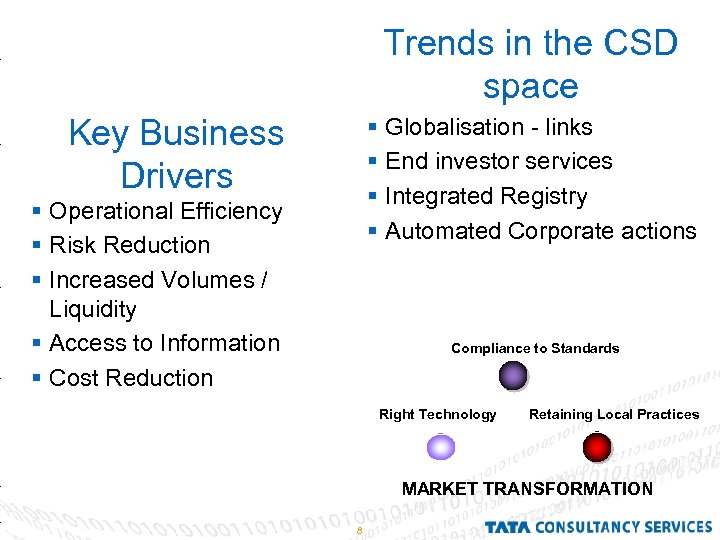

Trends in the CSD space Key Business Drivers § Globalisation - links § End investor services § Integrated Registry § Automated Corporate actions § Operational Efficiency § Risk Reduction § Increased Volumes / Liquidity § Access to Information § Cost Reduction Compliance to Standards Right Technology Retaining Local Practices MARKET TRANSFORMATION 8

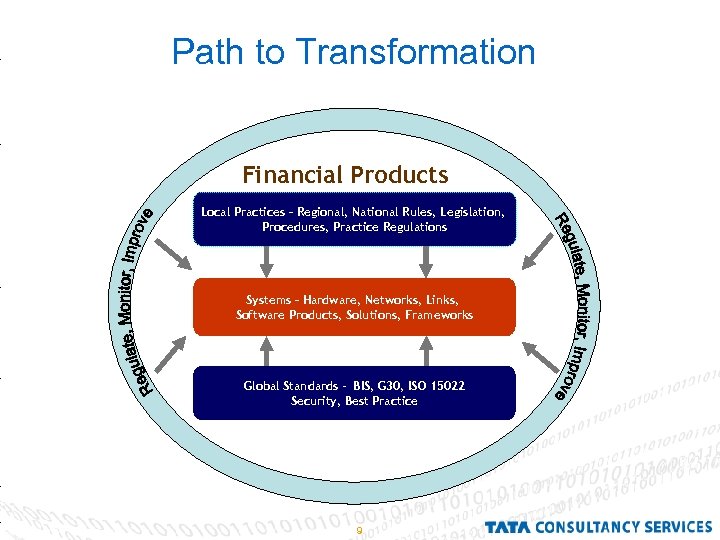

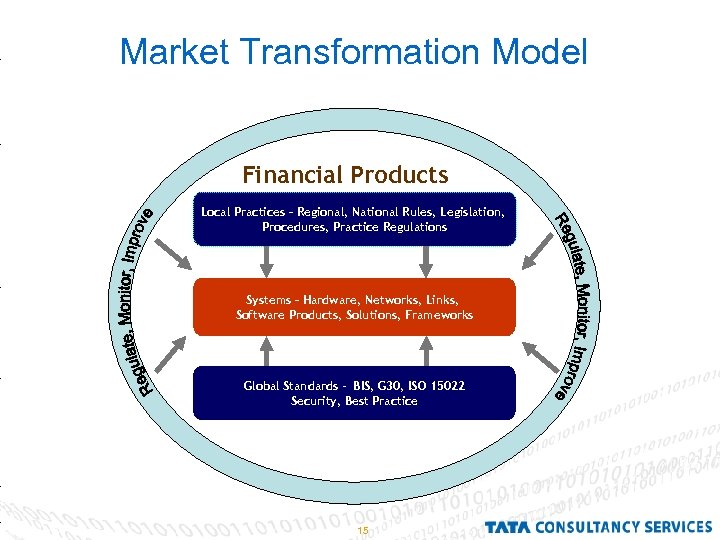

Path to Transformation Financial Products Local Practices – Regional, National Rules, Legislation, Procedures, Practice Regulations Systems – Hardware, Networks, Links, Software Products, Solutions, Frameworks Global Standards - BIS, G 30, ISO 15022 Security, Best Practice 9

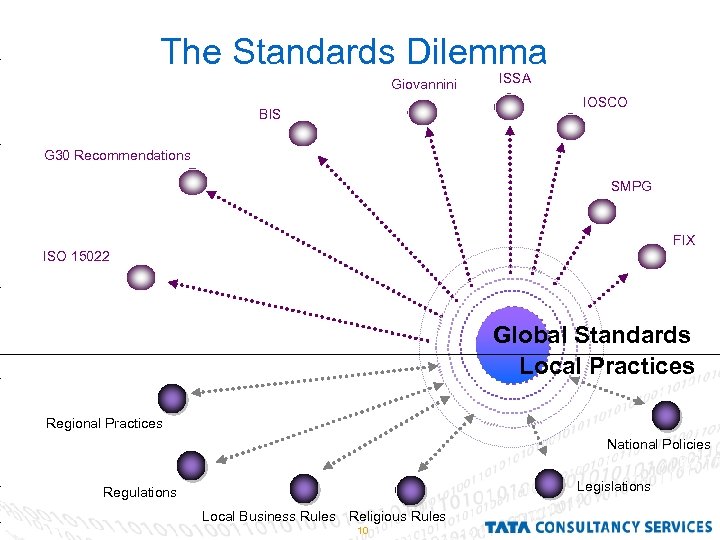

The Standards Dilemma Giovannini ISSA IOSCO BIS G 30 Recommendations SMPG FIX ISO 15022 Global Standards Local Practices Regional Practices National Policies Legislations Regulations Local Business Rules Religious Rules 10

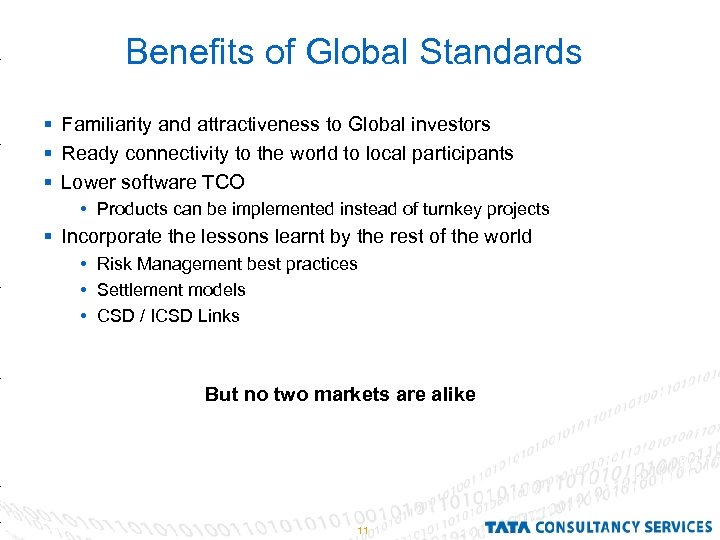

Benefits of Global Standards § Familiarity and attractiveness to Global investors § Ready connectivity to the world to local participants § Lower software TCO Products can be implemented instead of turnkey projects § Incorporate the lessons learnt by the rest of the world Risk Management best practices Settlement models CSD / ICSD Links But no two markets are alike 11

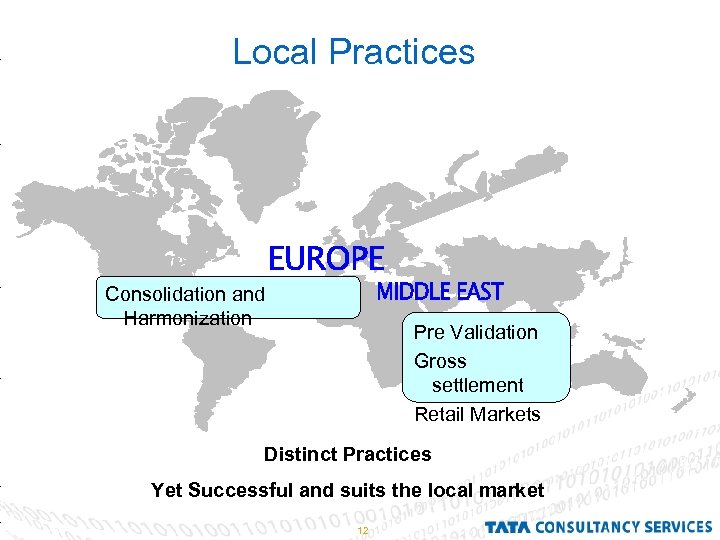

Local Practices Consolidation and Harmonization Pre Validation Gross settlement Retail Markets Distinct Practices Yet Successful and suits the local market 12

Need for Interoperability § Expand reach to Global markets § Easy connectivity, Improve STP § Leverage investments made using technology Service oriented architecture – Software as a service § Eliminate duplication of networks, infrastructure, software § Reduce operation costs 13

Technology § Multi Tier technology – Move away from monolithic tightly coupled systems § Interoperability, Service Oriented Architecture § Multiple Access Channels – Web, Phone, Mobile, Email § High availability and redundancy without high cost § Seamless Integration to external systems – to achieve STP 14

Market Transformation Model Financial Products Local Practices – Regional, National Rules, Legislation, Procedures, Practice Regulations Systems – Hardware, Networks, Links, Software Products, Solutions, Frameworks Global Standards - BIS, G 30, ISO 15022 Security, Best Practice 15

CASE STUDY A market revolution - STRATE, South Africa © Tata Consultancy Services Ltd. 16

South African Market - 1998 • Regarded as a market with high Settlement Risk by GSCS Benchmarks (Minus 1. 28 rating) • Low Foreign Investments, Flight of capital • May 1998 contract for system implementation signed with TCS • Transactions could take weeks to settle or would fail • Dematerialization and Electronic settlement revolutionized the market • Major companies were moving their primary listing to London • The new SAFIRES application was one of the first in the world to be ISO 15022 compliant - 1998 • Early adopter of SWIFTNet - 2002 17

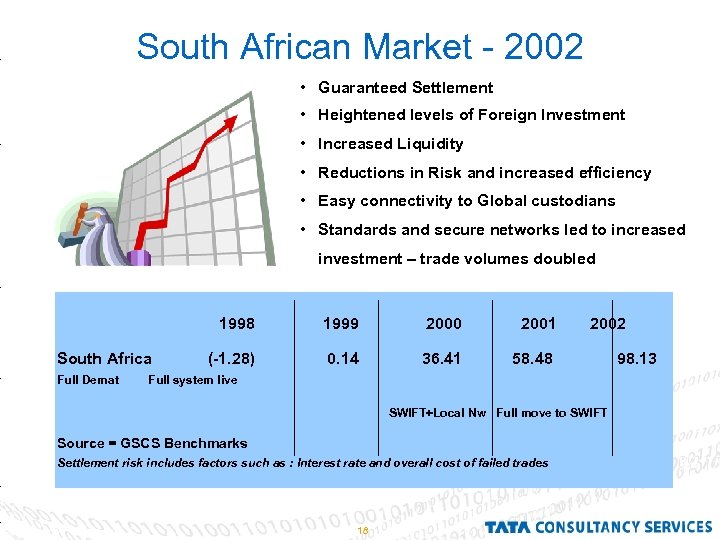

South African Market - 2002 • Guaranteed Settlement • Heightened levels of Foreign Investment • Increased Liquidity • Reductions in Risk and increased efficiency • Easy connectivity to Global custodians • Standards and secure networks led to increased investment – trade volumes doubled 1998 South Africa Full Demat 1999 2000 2001 (-1. 28) 0. 14 36. 41 2002 58. 48 Full system live SWIFT+Local Nw Full move to SWIFT Source = GSCS Benchmarks Settlement risk includes factors such as : Interest rate and overall cost of failed trades 18 98. 13

THANK YOU 19

7b1cb57ea4ae905e5d0bb09ff7fe2483.ppt