ca25e9eecec8b9af0caad1e9b3876549.ppt

- Количество слайдов: 25

NBBL • The Norwegian Federation of Co-operative Housing Associations (NBBL) • 92 co-operative housing associations • 4600 housing co-operatives affiliated • 250 000 housing units • 20 000 working as volunteers • In Oslo 40% of households live in co-operative owned dwellings

DUGNAD –”sweat equity” NBBL: 60 years anniversary 10 years in development coopration • South Africa • Zambia • Tanzania • Kenya • Latin America • Bosnia • North-Vest Russia

NBBL’s mission in development co-operation • Contribute towards poverty reduction through improvement of housing and settlements • Utilizing experiences of the Norwegian co-op housing movement • Working in partnership with organisations in the South Eventuell kommentar

Housing micro finance • A tool for housing development? • A tool for sustainable urban development? • WAT Tanzania: core house, self built, micro finance • NACHU Kenya: walk-up flats, self built, incremental development, micro finance

WAT’s experiences • Dream house: people have big families, need a big house, the swahili house, several bedrooms, ”min” 75 sqm • IDLE: houses incomplete for many years/capital invested non productive • Affordability: the relationship between people’s abilities of monthly repayment, size of house/time it takes to complete

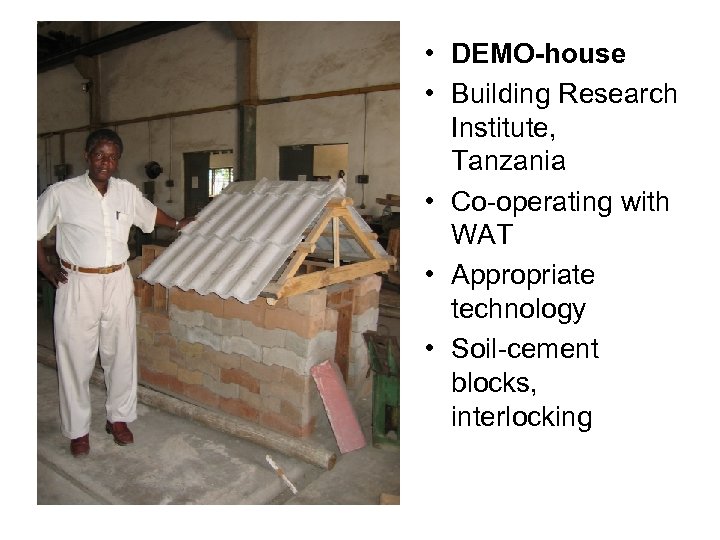

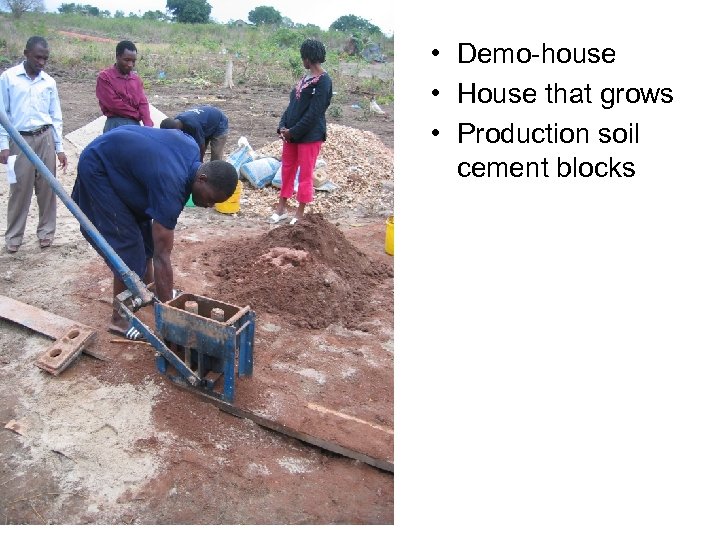

• DEMO-house • Building Research Institute, Tanzania • Co-operating with WAT • Appropriate technology • Soil-cement blocks, interlocking

• Demo-house • House that grows • Production soil cement blocks

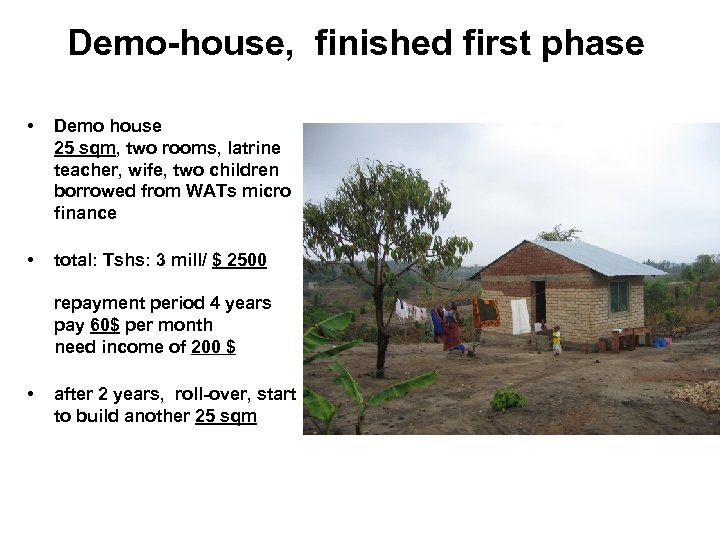

Demo-house, finished first phase • Demo house 25 sqm, two rooms, latrine teacher, wife, two children borrowed from WATs micro finance • total: Tshs: 3 mill/ $ 2500 repayment period 4 years pay 60$ per month need income of 200 $ • after 2 years, roll-over, start to build another 25 sqm

Core house - big investment • Core House with latrine: $2 500 • Even core house – big investment for low income people • Need to pay 60 $ per month to repay in 4 years • People that can only pay 20 $ per month need 10 -12 years to pay for 25 sqm

Lessons learned • New housing construction using micro-finance works with lower – to medium income people • Appripriate technology/local building materials a pre-conditon to bring down cost • House a product • Very low income people- micro finance for: – Housing upgrading – Income generating activities

continuing urbanisationnew challenges • Cities transform into higher densities /multi storey structures. • Offers new challenges! • The self-help and squatter upgrading approach from the seventies not sufficient

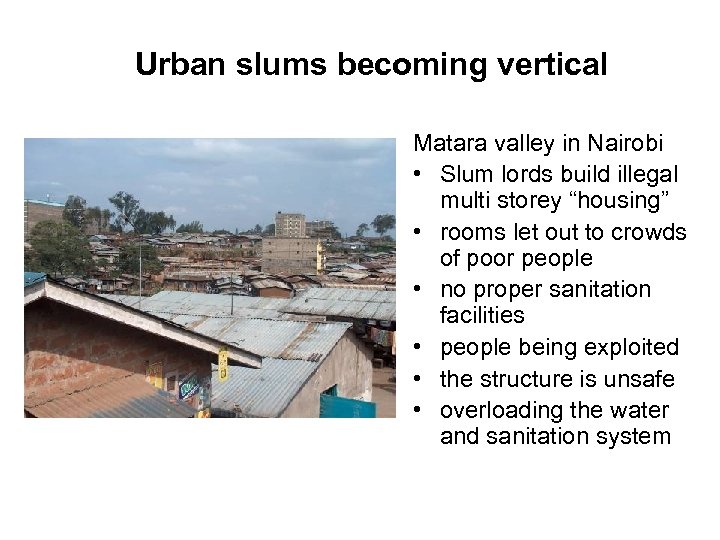

Urban slums becoming vertical Matara valley in Nairobi • Slum lords build illegal multi storey “housing” • rooms let out to crowds of poor people • no proper sanitation facilities • people being exploited • the structure is unsafe • overloading the water and sanitation system

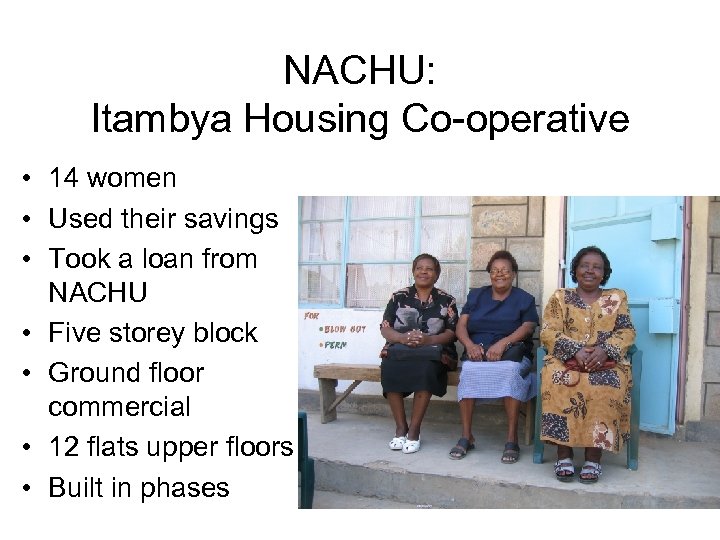

NACHU: Itambya Housing Co-operative • 14 women • Used their savings • Took a loan from NACHU • Five storey block • Ground floor commercial • 12 flats upper floors • Built in phases

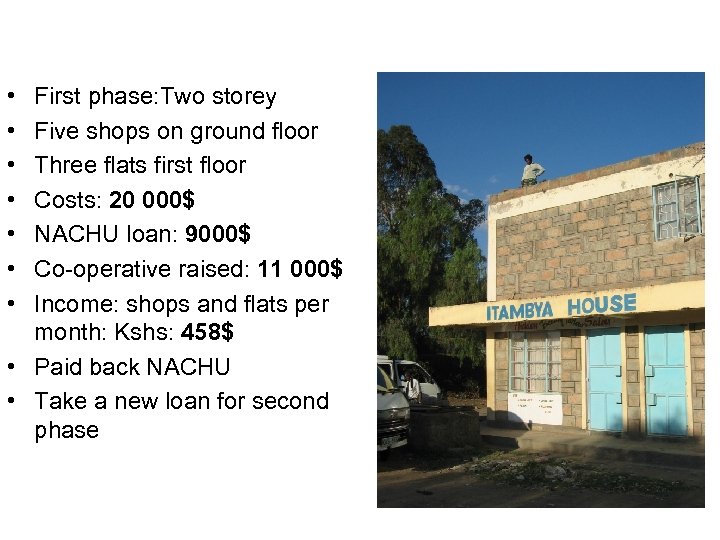

• • First phase: Two storey Five shops on ground floor Three flats first floor Costs: 20 000$ NACHU loan: 9000$ Co-operative raised: 11 000$ Income: shops and flats per month: Kshs: 458$ • Paid back NACHU • Take a new loan for second phase

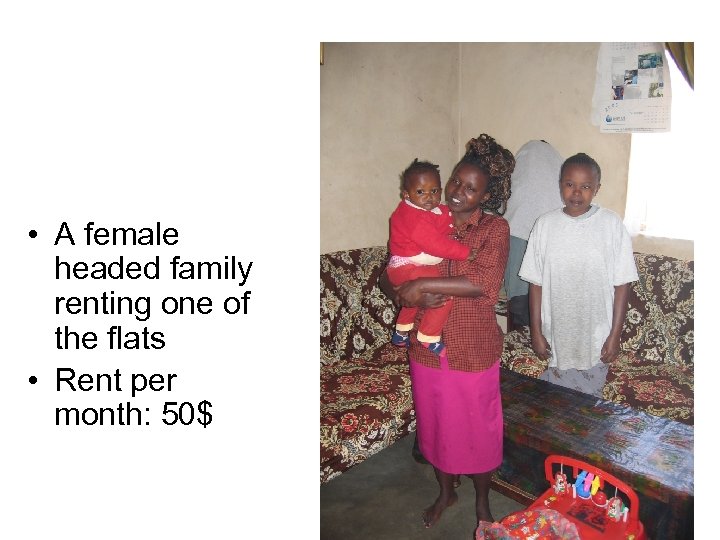

• A female headed family renting one of the flats • Rent per month: 50$

Second phase: Three new storeys with flats

Lessons learned Development of walk-up flats • Self built – properly organised through co-oprative, number of members small • Supervised by NACHU • Built in stages, using micro finance • Income from commercial on ground floor helps the affordability • Can work! • Scaling up?

(Only) South Africa has answers • By providing an enabling environment • comprehensive policy/ multiple approaches • Subsidies/housing bank • supporting Peoples Housing Process/self-help housing – squatter upgrading As well as • developing Social Housing (non profit )rental and co-operatives • apartment blocks/walk-ups in inner city areas • for low income people • where they have their jobs • LOCOMOTIVE for rest of Africa?

DIFID’s evaluation of Cope’s co-ops • A study (DFID/Payne, 2001) gives a very positive description of co-operative housing developed by Cope : • “The co-operative model delivers secure tenure rights over good quality housing stock in areas that are well located, which beneficiaries are proud to call town-houses, a term normally used for middle-income housing stock – a viable alternative to the individually owned one-houseper-plot model that dominates the South African landscape. ”

Housing Micro-Finance: Lessons and Future Directions from Eastern & Southern Africa Tabitha Siwale Executive Director, WAT Human Settlements, Tanzania

Housing Micro-Finance: Lessons and Future Directions from Eastern & Southern Africa Barry Pinsky Executive Director Rooftops Canada - Abri International,

Housing Micro-Finance: Lessons and Future Directions from Eastern & Southern Africa Mary Mathenge General Manager, National Cooperative Housing Union, Kenya

ca25e9eecec8b9af0caad1e9b3876549.ppt