Navigating the Process of Outsourcing your Investment Proposition Geoff Balzano CEO, Morningstar/OBSR

Navigating the Process of Outsourcing your Investment Proposition Geoff Balzano CEO, Morningstar/OBSR

Brief for today’s workshop Financial planners who do not want to outsource the investment management function are using model portfolio solutions to provide suitable investment advice to a range of client profiles. The session will discuss how well this works in practice and identify the main advantages and drawbacks for both clients and advisers • • The range of services available DIFs - distributor influenced funds In-house or out of house portfolio design The due diligence process - assessing performance and service quality Allocating clients to the appropriate portfolios Fund selection strategies - active, passive or both Model portfolios vs. discretionary fund managers and other solutions

Brief for today’s workshop Financial planners who do not want to outsource the investment management function are using model portfolio solutions to provide suitable investment advice to a range of client profiles. The session will discuss how well this works in practice and identify the main advantages and drawbacks for both clients and advisers • • The range of services available DIFs - distributor influenced funds In-house or out of house portfolio design The due diligence process - assessing performance and service quality Allocating clients to the appropriate portfolios Fund selection strategies - active, passive or both Model portfolios vs. discretionary fund managers and other solutions

Agenda • • • The Outsourcing Decision Outsourcing Options Discussion: How to make the best decision

Agenda • • • The Outsourcing Decision Outsourcing Options Discussion: How to make the best decision

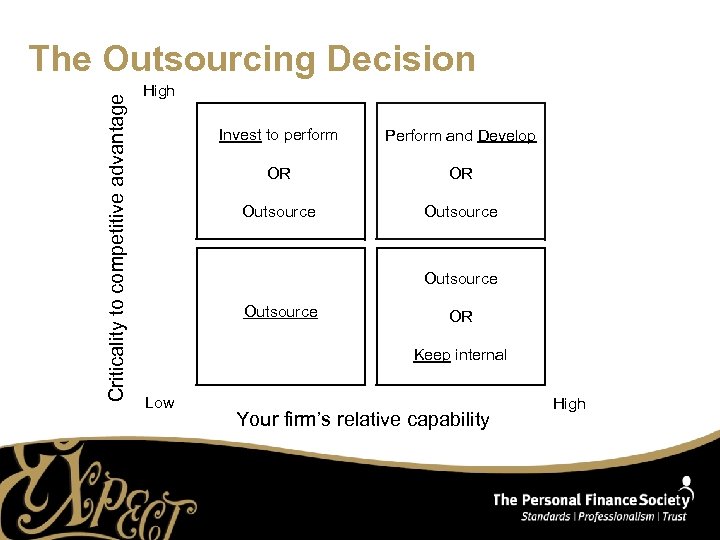

Criticality to competitive advantage The Outsourcing Decision High Invest to perform Perform and Develop OR OR Outsource OR Keep internal Low Your firm’s relative capability High

Criticality to competitive advantage The Outsourcing Decision High Invest to perform Perform and Develop OR OR Outsource OR Keep internal Low Your firm’s relative capability High

A Case Study

A Case Study

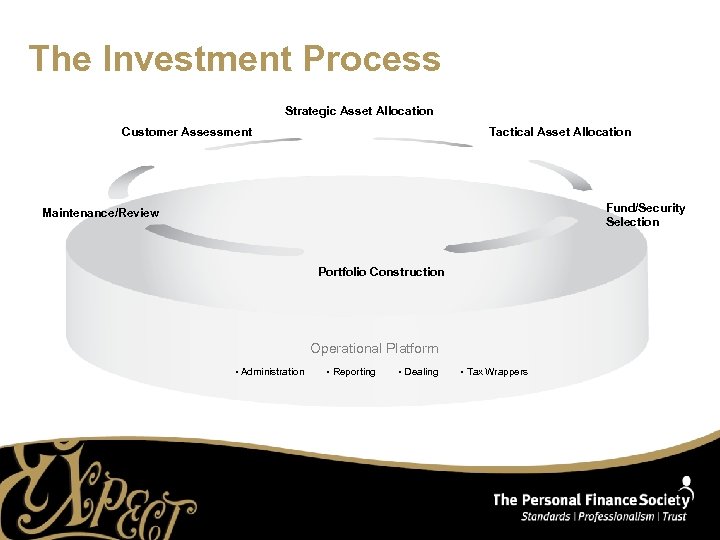

The Investment Process Strategic Asset Allocation Customer Assessment Tactical Asset Allocation Fund/Security Selection Maintenance/Review Portfolio Construction Operational Platform • Administration • Reporting • Dealing • Tax Wrappers

The Investment Process Strategic Asset Allocation Customer Assessment Tactical Asset Allocation Fund/Security Selection Maintenance/Review Portfolio Construction Operational Platform • Administration • Reporting • Dealing • Tax Wrappers

Outsourcing Options • Multi-Manager Funds • Return-based • Risk-based • • • Model Portfolios Asset Class Models + Fund Panel/Select List DFMs

Outsourcing Options • Multi-Manager Funds • Return-based • Risk-based • • • Model Portfolios Asset Class Models + Fund Panel/Select List DFMs

Evaluating your options • Break into 4 groups – Multi-Manager, Model Portfolios, A/A + Panels, DFM • Answer 5 questions: • • What are the pros and cons of outsourcing using your approach? • What skills/responsibilities need to exist within the firm to support this outsourcing option? What type of adviser firms are ideally suited for your approach? What type of consumers are ideally suited for your approach? If you could ask an outsourced partner of your type just five due diligence questions, what would they be?

Evaluating your options • Break into 4 groups – Multi-Manager, Model Portfolios, A/A + Panels, DFM • Answer 5 questions: • • What are the pros and cons of outsourcing using your approach? • What skills/responsibilities need to exist within the firm to support this outsourcing option? What type of adviser firms are ideally suited for your approach? What type of consumers are ideally suited for your approach? If you could ask an outsourced partner of your type just five due diligence questions, what would they be?