cb8272ec3487755d25934291e588fbfd.ppt

- Количество слайдов: 21

Natural Gas Business Overview ° ° Antonio Castro Executive Manager Gas & Energy

AGENDA Ø The Brazilian Natural Gas Market Ø Investments in Natural Gas Infrastructure Ø The Role of LNG Ø New Policy for Gas Contracts Ø Natural Gas Integration with Electric System

Brazilian Natural Gas Market – 2012 Supply and Demand 160 Million m 3/d @ 9. 400 kcal/m 3 134, 0 140 120 134, 0 31, 1 Bolívia 72, 9 (1) LNG 30, 0 43, 9 E&P 100 80 60 48, 3 40 17, 5 20 25, 3 0 42, 1 y. % , 7 10 p. 48, 0 (2) 5, 5 2007 Thermoeletric 2012 Industry Supply 2012 Others (1) Others: vehicular, residencial, commercial, refinaries e fertilizer plants. (2) Considering Maximum Dispatch of every thermoeletric power plant

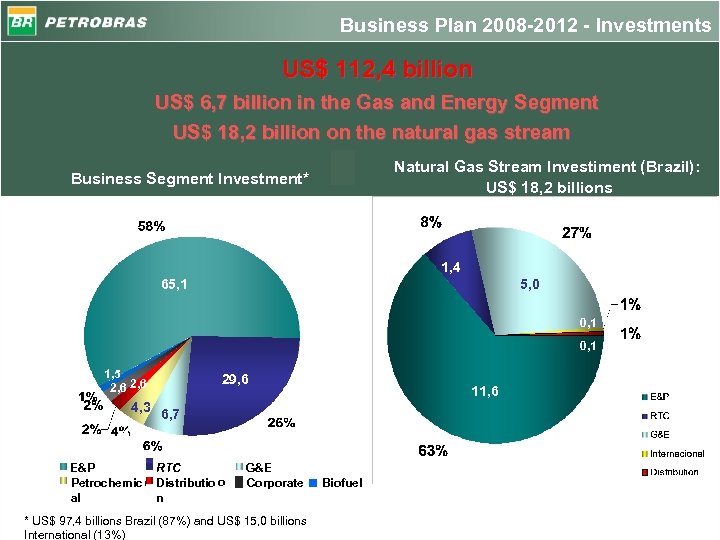

Business Plan 2008 -2012 - Investments US$ 112, 4 billion US$ 6, 7 billion in the Gas and Energy Segment US$ 18, 2 billion on the natural gas stream Natural Gas Stream Investiment (Brazil): US$ 18, 2 billions Business Segment Investment* 1, 4 5, 0 65, 1 0, 1 1, 5 2, 6 4, 3 29, 6 11, 6 6, 7 4, 3 E&P RTC G&E Petroquímica Distributio Petrochemic Distribuição Corporate al n Nota: Inclui Internacional * US$ 97, 4 billions Brazil (87%) and US$ 15, 0 billions International (13%) Biofuel

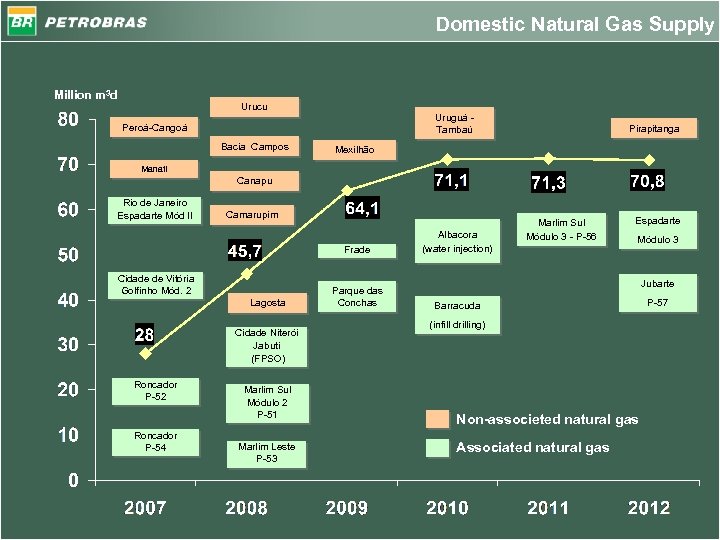

Domestic Natural Gas Supply Million m 3 d Urucu Uruguá Tambaú Peroá-Cangoá Bacia Campos Pirapitanga Mexilhão Manati Canapu Rio de Janeiro Espadarte Mód II Camarupim Frade Cidade de Vitória Golfinho Mód. 2 Lagosta Cidade Niterói Jabuti (FPSO) Roncador P-52 Roncador P-54 Marlim Sul Módulo 2 P-51 Marlim Leste P-53 Parque das Conchas Albacora (water injection) Marlim Sul Módulo 3 - P-56 Espadarte Módulo 3 Jubarte Barracuda (infill drilling) Non-associeted natural gas Associated natural gas P-57

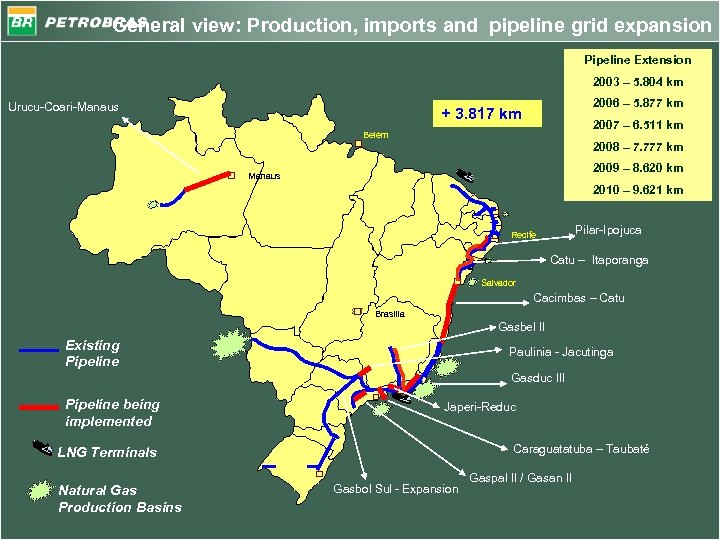

General view: Production, imports and pipeline grid expansion Pipeline Extension 2003 – 5. 804 km Urucu-Coari-Manaus 2006 – 5. 877 km + 3. 817 km 2007 – 6. 511 km Belém 2008 – 7. 777 km 2009 – 8. 620 km Manaus 2010 – 9. 621 km Pilar-Ipojuca Recife Catu – Itaporanga Salvador Cacimbas – Catu Brasília Gasbel II Existing Pipeline Paulinia - Jacutinga Gasduc III Pipeline being implemented Japeri-Reduc Caraguatatuba – Taubaté LNG Terminals Natural Gas Production Basins Gasbol Sul - Expansion Gaspal II / Gasan II

Pipeline construction COARI – MANAUS Pipeline CATU – ITAPORANGA Pipeline Tubes for CACIMBAS-CATU Pipeline

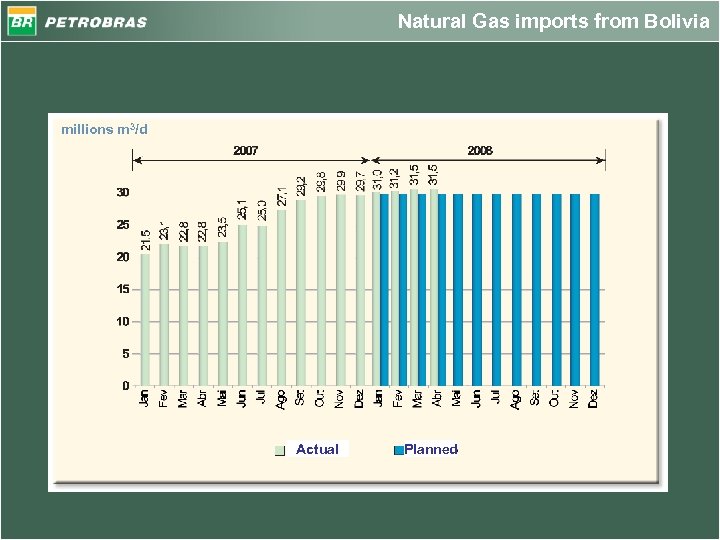

Natural Gas imports from Bolivia millions m 3/d Actual Planned

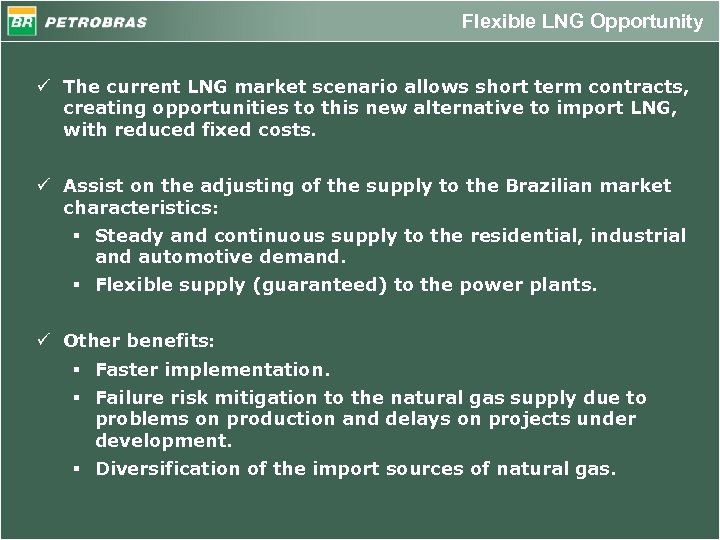

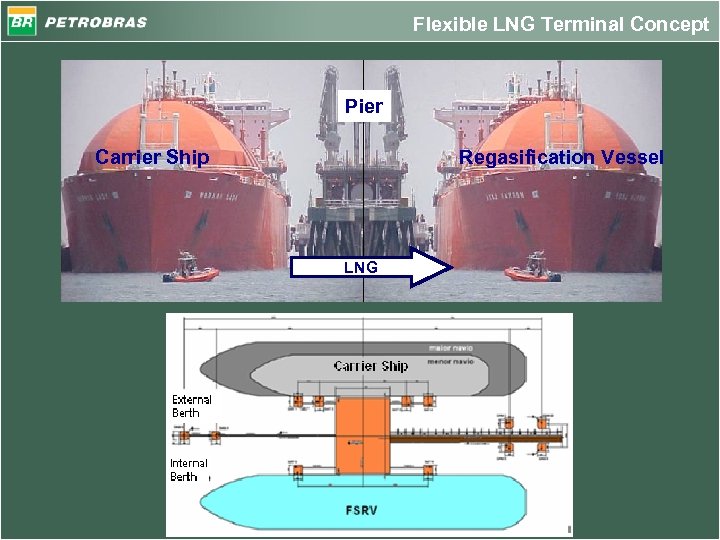

Flexible LNG Opportunity ü The current LNG market scenario allows short term contracts, creating opportunities to this new alternative to import LNG, with reduced fixed costs. ü Assist on the adjusting of the supply to the Brazilian market characteristics: § Steady and continuous supply to the residential, industrial and automotive demand. § Flexible supply (guaranteed) to the power plants. ü Other benefits: § Faster implementation. § Failure risk mitigation to the natural gas supply due to problems on production and delays on projects under development. § Diversification of the import sources of natural gas.

Flexible LNG Terminal Concept Pier Carrier Ship Regasification Vessel LNG

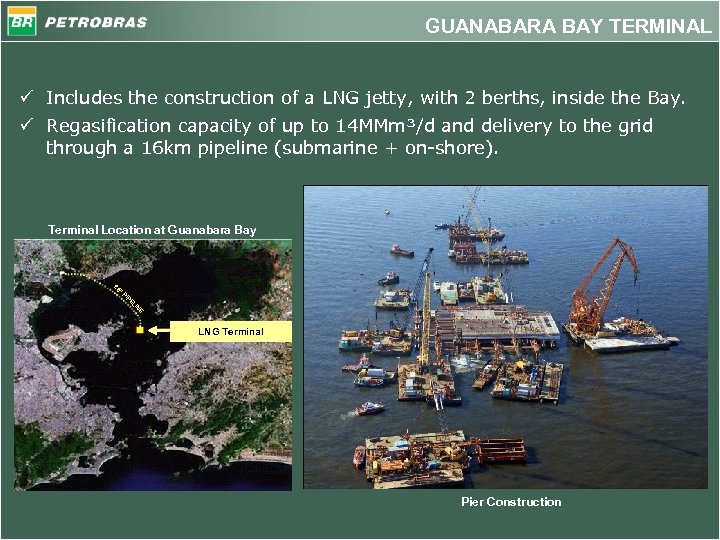

GUANABARA BAY TERMINAL ü Includes the construction of a LNG jetty, with 2 berths, inside the Bay. ü Regasification capacity of up to 14 MMm³/d and delivery to the grid through a 16 km pipeline (submarine + on-shore). Terminal Location at Guanabara Bay 28 ” PI PE LI N E LNG Terminal Pier Construction

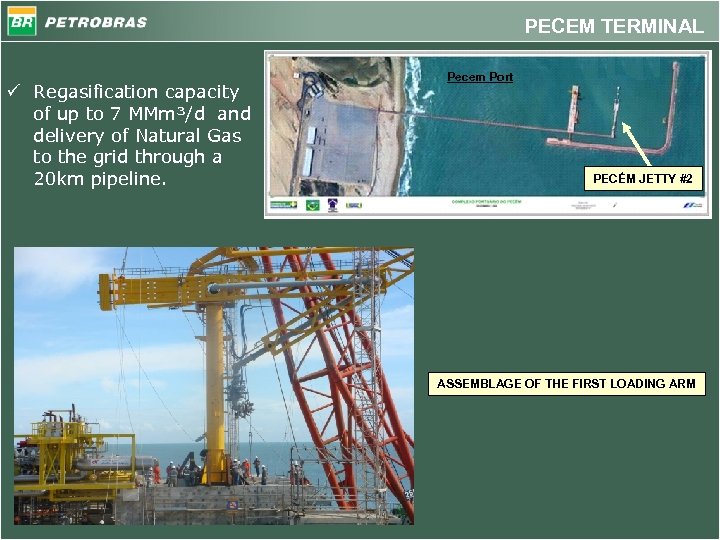

PECEM TERMINAL ü Regasification capacity of up to 7 MMm³/d and delivery of Natural Gas to the grid through a 20 km pipeline. Pecem Port PECÉM JETTY #2 ASSEMBLAGE OF THE FIRST LOADING ARM

REGAS Vessels ü Golar Winter ü Golar Spirit ü Delivery: May, 2009 ü Delivered on: June 11 th, 2008 ü Max. Send-out: 14 MMm³/d ü Storage Capacity: 138, 000 m³ ü Max. Send-out : 7 MMm³/d ü Storage Capacity: 129, 000 m³

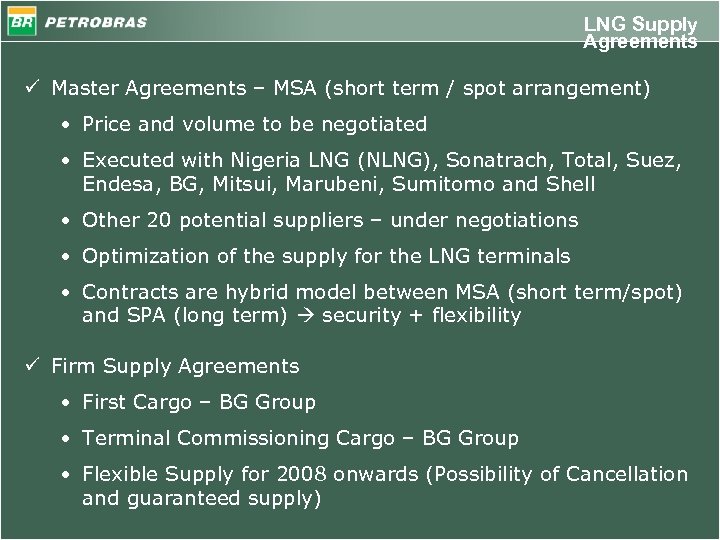

LNG Supply Agreements ü Master Agreements – MSA (short term / spot arrangement) • Price and volume to be negotiated • Executed with Nigeria LNG (NLNG), Sonatrach, Total, Suez, Endesa, BG, Mitsui, Marubeni, Sumitomo and Shell • Other 20 potential suppliers – under negotiations • Optimization of the supply for the LNG terminals • Contracts are hybrid model between MSA (short term/spot) and SPA (long term) security + flexibility ü Firm Supply Agreements • First Cargo – BG Group • Terminal Commissioning Cargo – BG Group • Flexible Supply for 2008 onwards (Possibility of Cancellation and guaranteed supply)

New Natural Gas Contract Modalities Firm Inflexible: This cathegory bears a firm supply, with a delivery warranty from the supplier. Firm Flexible: Natural gas delivery can be suspended for a while (*), during which it will be replaced with another fuel, mostly commonly fuel oil. Interruptible: If necessary, delivery can be suspended for a while (*). There will be no fuel replacement in this case, but prices in this cathegory reflect that. Preferential (Thermal Power Plants) In this cathegory, consumers (thermal power plants only) have the option to buy the natural gas when they will be consuming, subject to a previous notice. (*) natural gas is alocated to thermoeletric dispatch

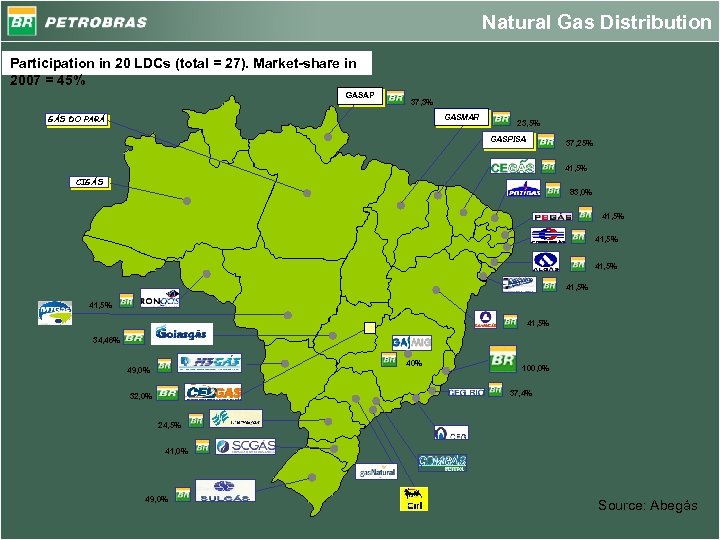

Natural Gas Distribution Participation in 20 LDCs (total = 27). Market-share in 2007 = 45% GASAP 37, 3% GASMAR GÁS DO PARÁ 23, 5% GASPISA 37, 25% 41, 5% CIGÁS 83, 0% 41, 5% 41, 5% 34, 46% 40% 49, 0% 100, 0% 37, 4% 32, 0% 24, 5% 41, 0% 49, 0% Source: Abegás

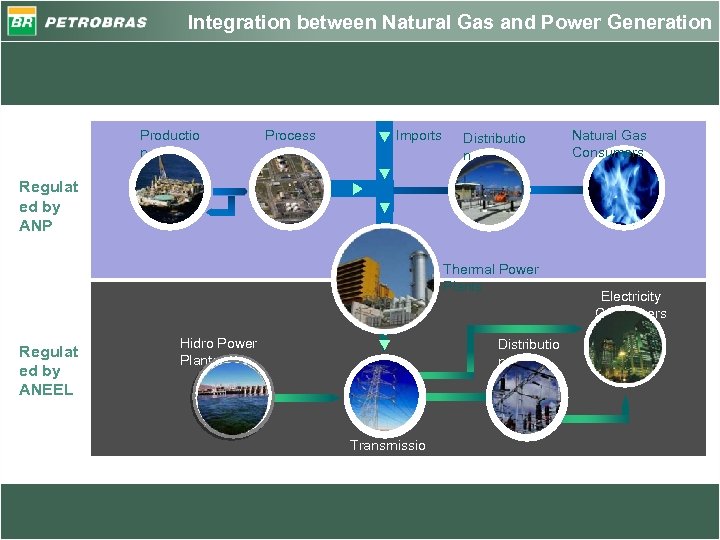

Integration between Natural Gas and Power Generation Productio n Process Imports Distributio n Natural Gas Consumers Regulat ed by ANP Thermal Power Plants Regulat ed by ANEEL Hidro Power Plants Distributio n Transmissio n Electricity Consumers

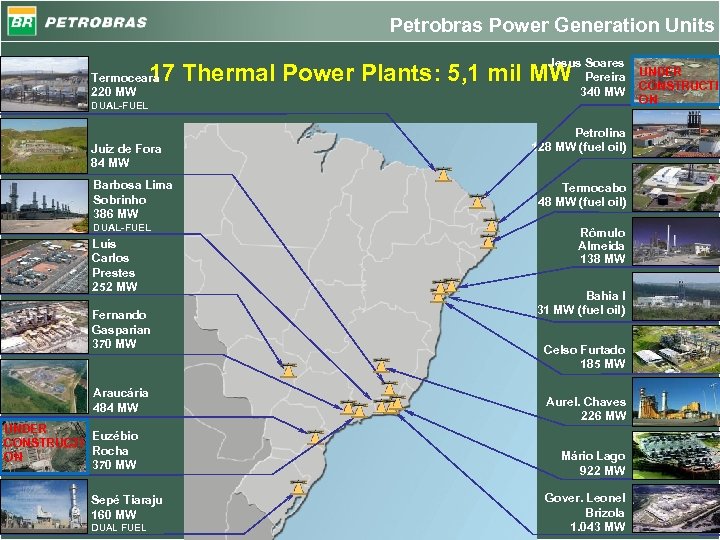

Petrobras Power Generation Units Jesus Soares Pereira 340 MW 17 Thermal Power Plants: 5, 1 mil MW Termoceará 220 MW DUAL-FUEL Juiz de Fora 84 MW Barbosa Lima Sobrinho 386 MW DUAL-FUEL Luís Carlos Prestes 252 MW Fernando Gasparian 370 MW Araucária 484 MW UNDER Euzébio CONSTRUCTI Rocha ON 370 MW Sepé Tiaraju 160 MW DUAL FUEL Petrolina 128 MW (fuel oil) Termocabo 48 MW (fuel oil) Rômulo Almeida 138 MW Bahia I 31 MW (fuel oil) Celso Furtado 185 MW Aurel. Chaves 226 MW Mário Lago 922 MW Gover. Leonel Brizola 1. 043 MW UNDER CONSTRUCTI ON

Final Comments Huge investments throughout the Natural Gas chain Need for supply and demand adequacy (strong influence from thermal power plants dispatching) LNG and new Natural Gas Contracts aiming at flexibility

Thank you very much for your Attention CHALLENGE IS OUR ENERGY

cb8272ec3487755d25934291e588fbfd.ppt