21bd3bf248ab3595bbdfed17533429e0.ppt

- Количество слайдов: 47

National Treasury Presentation to Portfolio Committee on Finance - 8 May 2001

National Treasury Presentation to Portfolio Committee on Finance - 8 May 2001

Aim The National Treasury aims to promote economic development, good governance, social progress and rising living standards through accountability, economy, efficiency, equity and sustainability in the public finances

Aim The National Treasury aims to promote economic development, good governance, social progress and rising living standards through accountability, economy, efficiency, equity and sustainability in the public finances

Key objectives • Advance economic growth, employment and income redistribution • Sound and sustainable national budget and equitable division of resources • Raise revenue required equitably and efficiently • Sound management of State’s financial assets and liabilities • Promote accountability through financial reporting, systems and controls

Key objectives • Advance economic growth, employment and income redistribution • Sound and sustainable national budget and equitable division of resources • Raise revenue required equitably and efficiently • Sound management of State’s financial assets and liabilities • Promote accountability through financial reporting, systems and controls

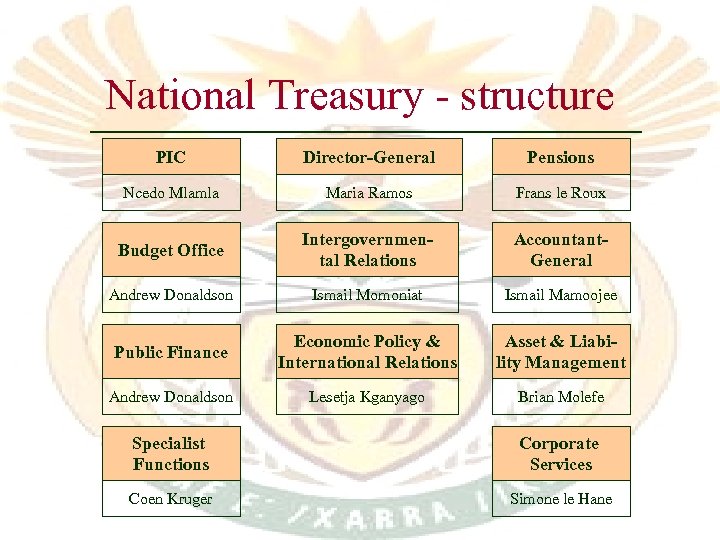

National Treasury - structure PIC Director-General Pensions Ncedo Mlamla Maria Ramos Frans le Roux Budget Office Intergovernmental Relations Accountant. General Andrew Donaldson Ismail Momoniat Ismail Mamoojee Public Finance Economic Policy & International Relations Asset & Liability Management Andrew Donaldson Lesetja Kganyago Brian Molefe Specialist Functions Corporate Services Coen Kruger Simone le Hane

National Treasury - structure PIC Director-General Pensions Ncedo Mlamla Maria Ramos Frans le Roux Budget Office Intergovernmental Relations Accountant. General Andrew Donaldson Ismail Momoniat Ismail Mamoojee Public Finance Economic Policy & International Relations Asset & Liability Management Andrew Donaldson Lesetja Kganyago Brian Molefe Specialist Functions Corporate Services Coen Kruger Simone le Hane

International and domestic relations SA Reserve Bank Budget Council SA Revenue Service Development Bank of SA National Treasury Provincial Treasuries International Monetary Fund Financial Services Board FOSAD clusters National Departments World Bank African Development Bank G 20 forum

International and domestic relations SA Reserve Bank Budget Council SA Revenue Service Development Bank of SA National Treasury Provincial Treasuries International Monetary Fund Financial Services Board FOSAD clusters National Departments World Bank African Development Bank G 20 forum

Strategic overview: policy objectives • Economic policy and financial oversight – Growth-oriented fiscal stance – Sound financial regulation & consumer protection • Budget reform – Strengthened MTEF process – Improved intergovernmental cooperation – Establishment of PPP Unit • Tax policy and revenue management – Broadening of tax base – Tax system modernisation and law reform

Strategic overview: policy objectives • Economic policy and financial oversight – Growth-oriented fiscal stance – Sound financial regulation & consumer protection • Budget reform – Strengthened MTEF process – Improved intergovernmental cooperation – Establishment of PPP Unit • Tax policy and revenue management – Broadening of tax base – Tax system modernisation and law reform

Strategic overview (cont. ) • Debt management aimed at reducing debt service costs in long-term • Asset management – coordination of public enterprise borrowing – contribution to state asset restructuring process – broader oversight of cash management • Strengthened international relations – participation in financial reform initiatives – international debt reduction – African and regional economic development

Strategic overview (cont. ) • Debt management aimed at reducing debt service costs in long-term • Asset management – coordination of public enterprise borrowing – contribution to state asset restructuring process – broader oversight of cash management • Strengthened international relations – participation in financial reform initiatives – international debt reduction – African and regional economic development

Strategic overview (cont. ) • PFMA implementation – legislative amendments & revision of regulations – modernisation of reporting, accountability & controls • Financial management reforms – – – Overhaul of government procurement processes Acquisition of new financial systems Establishment of Accounting Standards Board Support & monitoring of internal audit Development of accounting policies Consolidation of financial statements

Strategic overview (cont. ) • PFMA implementation – legislative amendments & revision of regulations – modernisation of reporting, accountability & controls • Financial management reforms – – – Overhaul of government procurement processes Acquisition of new financial systems Establishment of Accounting Standards Board Support & monitoring of internal audit Development of accounting policies Consolidation of financial statements

Key publications • • • Budget Review Estimates of National Expenditure Intergovernmental Fiscal Review Medium Term Budget Policy Statement Guidelines: – Guide for Accounting Officers – Treasury Guidelines for budget submissions – Public-Private Partnership Guidelines

Key publications • • • Budget Review Estimates of National Expenditure Intergovernmental Fiscal Review Medium Term Budget Policy Statement Guidelines: – Guide for Accounting Officers – Treasury Guidelines for budget submissions – Public-Private Partnership Guidelines

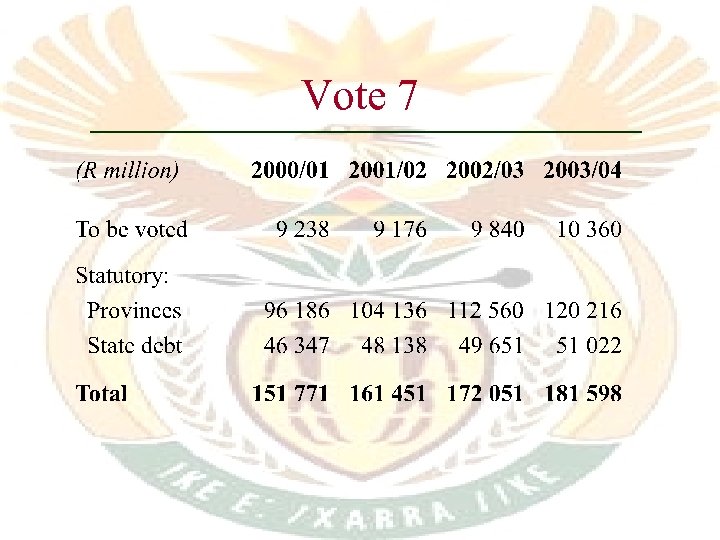

Vote 7

Vote 7

Amounts to be voted: operational budget & transfers

Amounts to be voted: operational budget & transfers

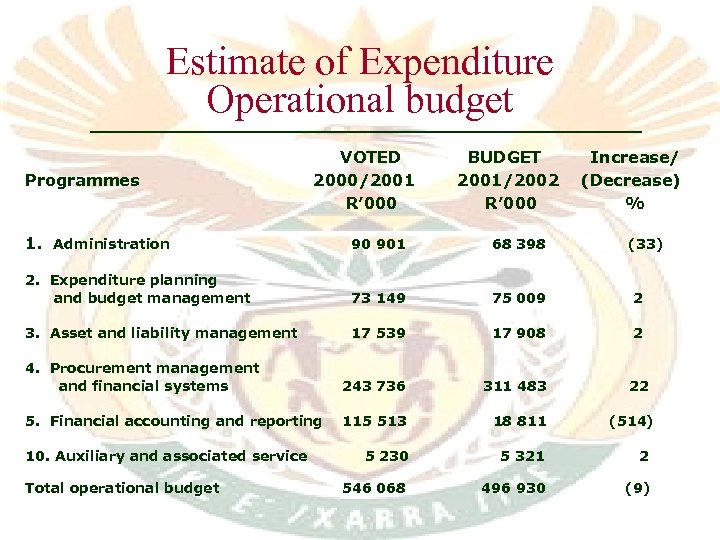

Estimate of Expenditure Operational budget Programmes VOTED 2000/2001 R’ 000 BUDGET 2001/2002 R’ 000 Increase/ (Decrease) % 1. Administration 90 901 68 398 2. Expenditure planning and budget management 73 149 75 009 2 3. Asset and liability management 17 539 17 908 2 4. Procurement management and financial systems 243 736 311 483 22 5. Financial accounting and reporting 115 513 18 811 5 230 5 321 2 546 068 496 930 (9) 10. Auxiliary and associated service Total operational budget (33) (514)

Estimate of Expenditure Operational budget Programmes VOTED 2000/2001 R’ 000 BUDGET 2001/2002 R’ 000 Increase/ (Decrease) % 1. Administration 90 901 68 398 2. Expenditure planning and budget management 73 149 75 009 2 3. Asset and liability management 17 539 17 908 2 4. Procurement management and financial systems 243 736 311 483 22 5. Financial accounting and reporting 115 513 18 811 5 230 5 321 2 546 068 496 930 (9) 10. Auxiliary and associated service Total operational budget (33) (514)

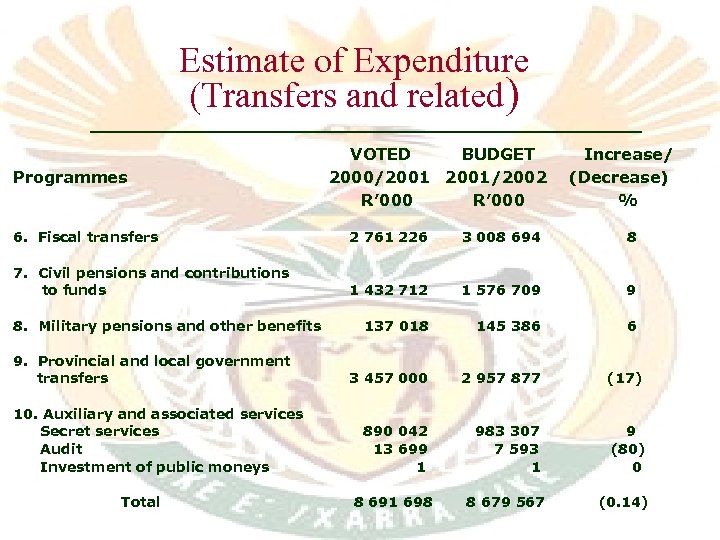

Estimate of Expenditure (Transfers and related) Programmes VOTED BUDGET 2000/2001/2002 R’ 000 Increase/ (Decrease) % 6. Fiscal transfers 2 761 226 3 008 694 8 7. Civil pensions and contributions to funds 1 432 712 1 576 709 9 137 018 145 386 6 3 457 000 2 957 877 (17) 890 042 13 699 1 983 307 7 593 1 9 (80) 0 8 691 698 8 679 567 (0. 14) 8. Military pensions and other benefits 9. Provincial and local government transfers 10. Auxiliary and associated services Secret services Audit Investment of public moneys Total

Estimate of Expenditure (Transfers and related) Programmes VOTED BUDGET 2000/2001/2002 R’ 000 Increase/ (Decrease) % 6. Fiscal transfers 2 761 226 3 008 694 8 7. Civil pensions and contributions to funds 1 432 712 1 576 709 9 137 018 145 386 6 3 457 000 2 957 877 (17) 890 042 13 699 1 983 307 7 593 1 9 (80) 0 8 691 698 8 679 567 (0. 14) 8. Military pensions and other benefits 9. Provincial and local government transfers 10. Auxiliary and associated services Secret services Audit Investment of public moneys Total

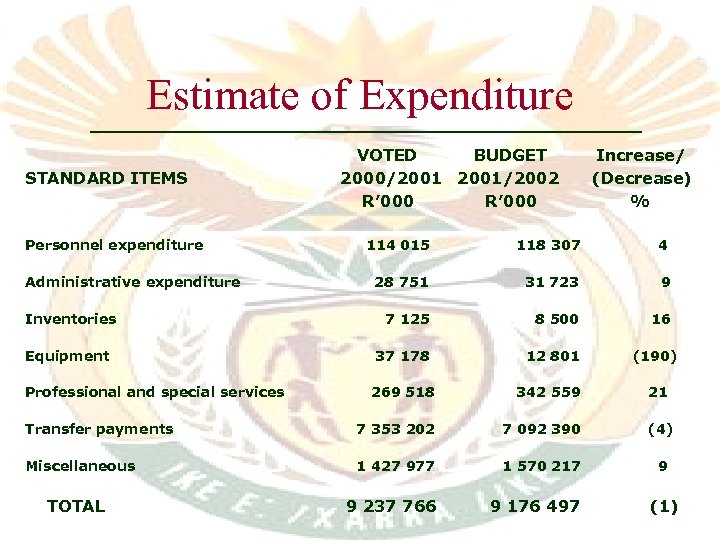

Estimate of Expenditure STANDARD ITEMS Personnel expenditure Administrative expenditure Inventories Equipment Professional and special services VOTED BUDGET 2000/2001/2002 R’ 000 Increase/ (Decrease) % 114 015 118 307 4 28 751 31 723 9 7 125 8 500 16 37 178 12 801 (190) 269 518 342 559 Transfer payments 7 353 202 7 092 390 (4) Miscellaneous 1 427 977 1 570 217 9 9 237 766 9 176 497 TOTAL 21 (1)

Estimate of Expenditure STANDARD ITEMS Personnel expenditure Administrative expenditure Inventories Equipment Professional and special services VOTED BUDGET 2000/2001/2002 R’ 000 Increase/ (Decrease) % 114 015 118 307 4 28 751 31 723 9 7 125 8 500 16 37 178 12 801 (190) 269 518 342 559 Transfer payments 7 353 202 7 092 390 (4) Miscellaneous 1 427 977 1 570 217 9 9 237 766 9 176 497 TOTAL 21 (1)

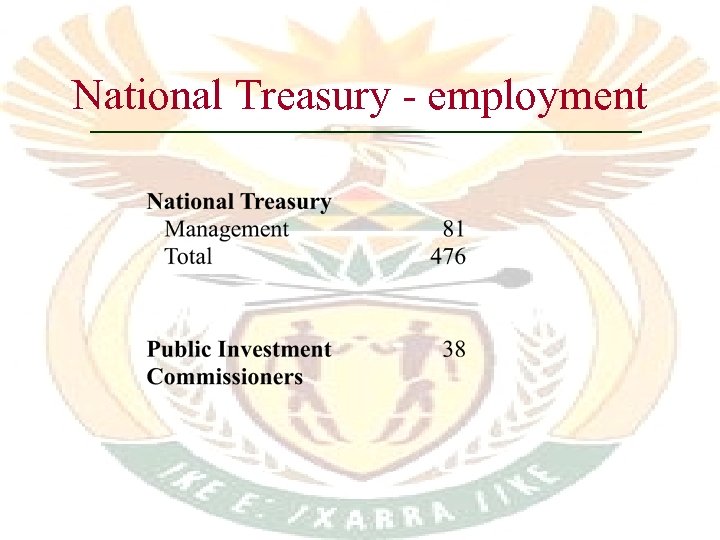

National Treasury - employment

National Treasury - employment

Restructuring of National Treasury • • Strategic plan Structure to be finalised Staff consultation Absorption framework Employment Equity Employee Assistance Programme Education Training & Development

Restructuring of National Treasury • • Strategic plan Structure to be finalised Staff consultation Absorption framework Employment Equity Employee Assistance Programme Education Training & Development

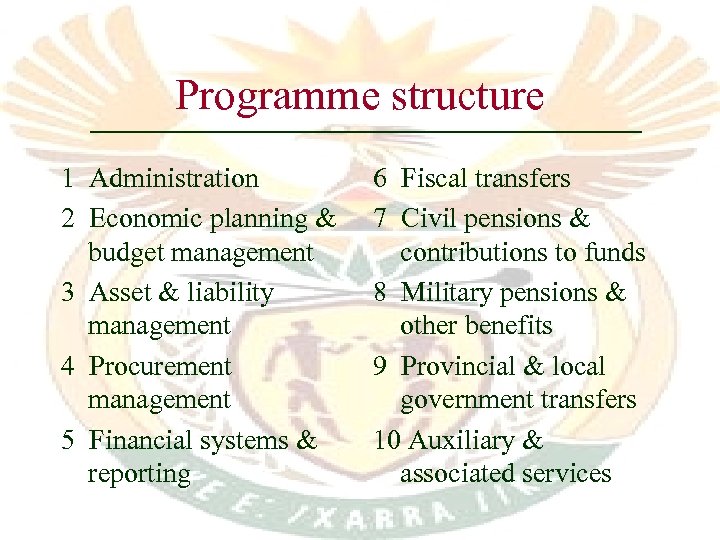

Programme structure 1 Administration 2 Economic planning & budget management 3 Asset & liability management 4 Procurement management 5 Financial systems & reporting 6 Fiscal transfers 7 Civil pensions & contributions to funds 8 Military pensions & other benefits 9 Provincial & local government transfers 10 Auxiliary & associated services

Programme structure 1 Administration 2 Economic planning & budget management 3 Asset & liability management 4 Procurement management 5 Financial systems & reporting 6 Fiscal transfers 7 Civil pensions & contributions to funds 8 Military pensions & other benefits 9 Provincial & local government transfers 10 Auxiliary & associated services

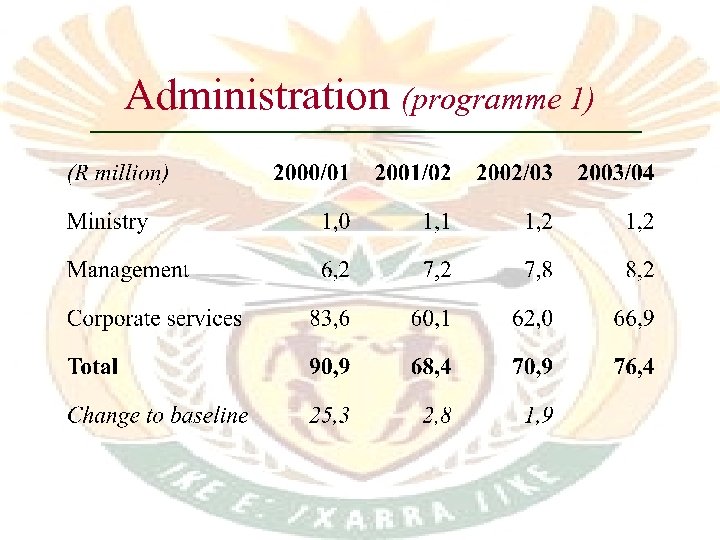

Administration (programme 1)

Administration (programme 1)

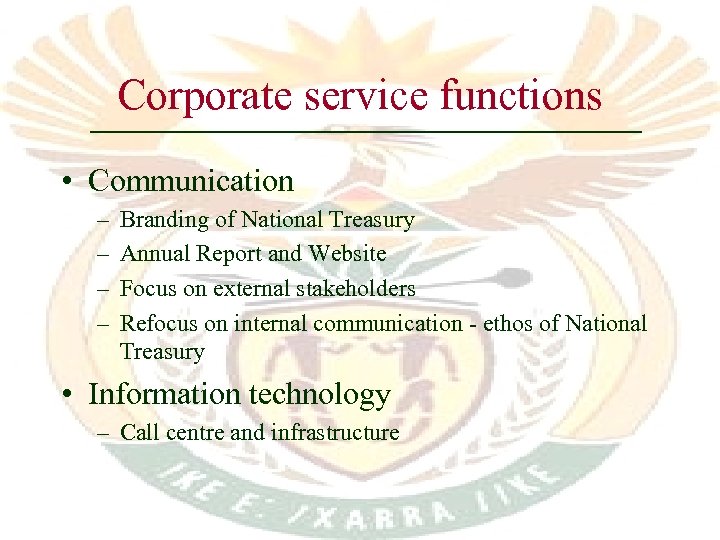

Corporate service functions • Communication – – Branding of National Treasury Annual Report and Website Focus on external stakeholders Refocus on internal communication - ethos of National Treasury • Information technology – Call centre and infrastructure

Corporate service functions • Communication – – Branding of National Treasury Annual Report and Website Focus on external stakeholders Refocus on internal communication - ethos of National Treasury • Information technology – Call centre and infrastructure

Corporate services (cont. ) • Financial management – – Implementation of PFMA Procurement reform Audit Committee appointed Internal Audit unit outsourced • Legal services – Legal advice & drafting; management of litigation

Corporate services (cont. ) • Financial management – – Implementation of PFMA Procurement reform Audit Committee appointed Internal Audit unit outsourced • Legal services – Legal advice & drafting; management of litigation

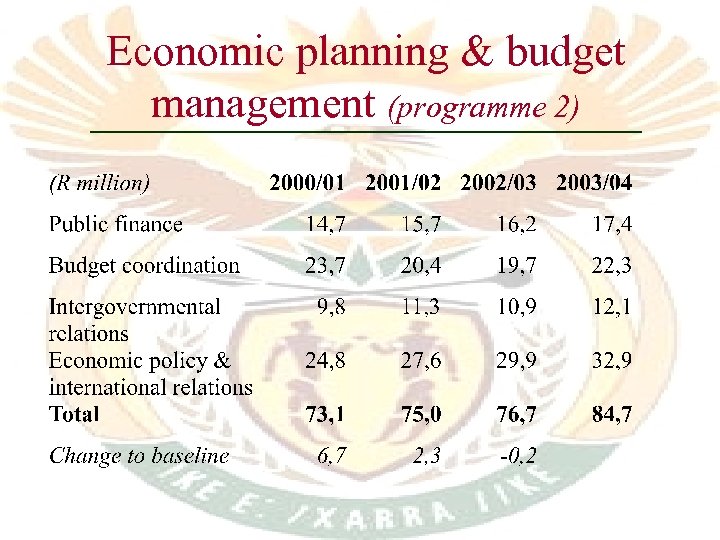

Economic planning & budget management (programme 2)

Economic planning & budget management (programme 2)

Economic planning & budget management - policy priorities • Budget reform: service delivery information • Promotion of growth, employment & redistribution through sound public policies • Financial regulatory reforms: stability, efficient markets, consumer protection • Strengthening infrastructure investment • Promotion of sound public-private partnerships

Economic planning & budget management - policy priorities • Budget reform: service delivery information • Promotion of growth, employment & redistribution through sound public policies • Financial regulatory reforms: stability, efficient markets, consumer protection • Strengthening infrastructure investment • Promotion of sound public-private partnerships

Economic policy & budget management (cont. ) • Equitable allocations to provinces & local government • Improved intergovernmental financial arrangements • Sound management of international development cooperation • Promotion of international & regional financial cooperation

Economic policy & budget management (cont. ) • Equitable allocations to provinces & local government • Improved intergovernmental financial arrangements • Sound management of international development cooperation • Promotion of international & regional financial cooperation

Economic policy & budget management - outputs • • • Macroeconomic & international financial policy advice Financial policy & regulatory advice Tax policy Sectoral & departmental policy advice Budget framework & division of revenue Budget documentation PPP agreements International cooperation agreements Framework for provincial & local grants

Economic policy & budget management - outputs • • • Macroeconomic & international financial policy advice Financial policy & regulatory advice Tax policy Sectoral & departmental policy advice Budget framework & division of revenue Budget documentation PPP agreements International cooperation agreements Framework for provincial & local grants

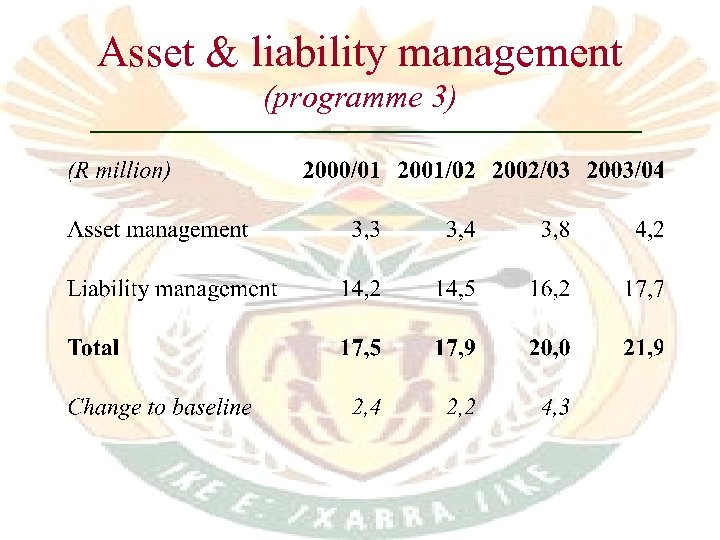

Asset & liability management (programme 3)

Asset & liability management (programme 3)

Asset & liability management priorities • Meet annual borrowing requirement • Manage foreign and domestic debt portfolios • Restructuring and financial management of state assets • Sound cash management

Asset & liability management priorities • Meet annual borrowing requirement • Manage foreign and domestic debt portfolios • Restructuring and financial management of state assets • Sound cash management

Asset & liability management objectives & outputs • Liability management – financing at favourable terms – contribute to development of the bond market – broaden and improve the international investor base – minimise long-term debt cost, subject to acceptable risk – efficient operational support

Asset & liability management objectives & outputs • Liability management – financing at favourable terms – contribute to development of the bond market – broaden and improve the international investor base – minimise long-term debt cost, subject to acceptable risk – efficient operational support

Asset & liability management objectives & outputs • Asset management – advise on restructuring of state assets – promote principles of sound corporate governance – manage risk exposure of Government arising from public enterprise borrowing & activities – resolve financial problems in SOEs – improve government cash management

Asset & liability management objectives & outputs • Asset management – advise on restructuring of state assets – promote principles of sound corporate governance – manage risk exposure of Government arising from public enterprise borrowing & activities – resolve financial problems in SOEs – improve government cash management

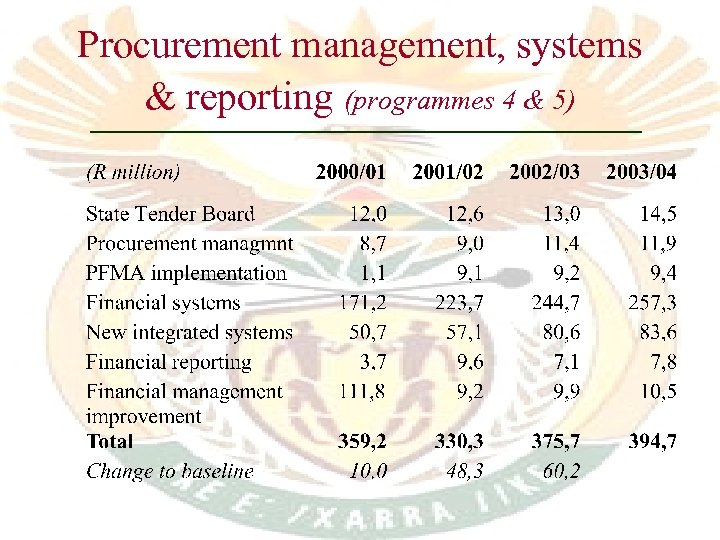

Procurement management, systems & reporting (programmes 4 & 5)

Procurement management, systems & reporting (programmes 4 & 5)

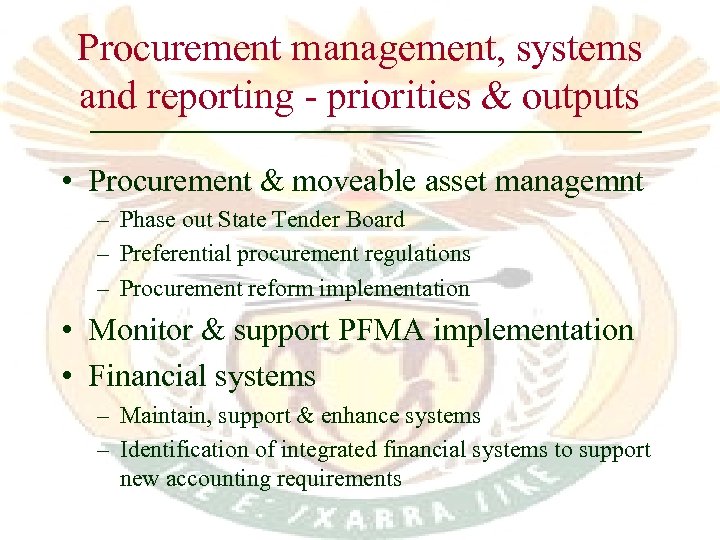

Procurement management, systems and reporting - priorities & outputs • Procurement & moveable asset managemnt – Phase out State Tender Board – Preferential procurement regulations – Procurement reform implementation • Monitor & support PFMA implementation • Financial systems – Maintain, support & enhance systems – Identification of integrated financial systems to support new accounting requirements

Procurement management, systems and reporting - priorities & outputs • Procurement & moveable asset managemnt – Phase out State Tender Board – Preferential procurement regulations – Procurement reform implementation • Monitor & support PFMA implementation • Financial systems – Maintain, support & enhance systems – Identification of integrated financial systems to support new accounting requirements

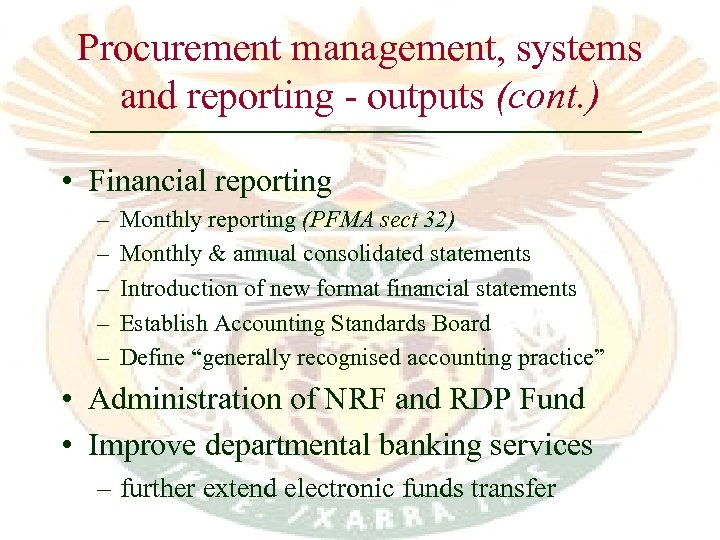

Procurement management, systems and reporting - outputs (cont. ) • Financial reporting – – – Monthly reporting (PFMA sect 32) Monthly & annual consolidated statements Introduction of new format financial statements Establish Accounting Standards Board Define “generally recognised accounting practice” • Administration of NRF and RDP Fund • Improve departmental banking services – further extend electronic funds transfer

Procurement management, systems and reporting - outputs (cont. ) • Financial reporting – – – Monthly reporting (PFMA sect 32) Monthly & annual consolidated statements Introduction of new format financial statements Establish Accounting Standards Board Define “generally recognised accounting practice” • Administration of NRF and RDP Fund • Improve departmental banking services – further extend electronic funds transfer

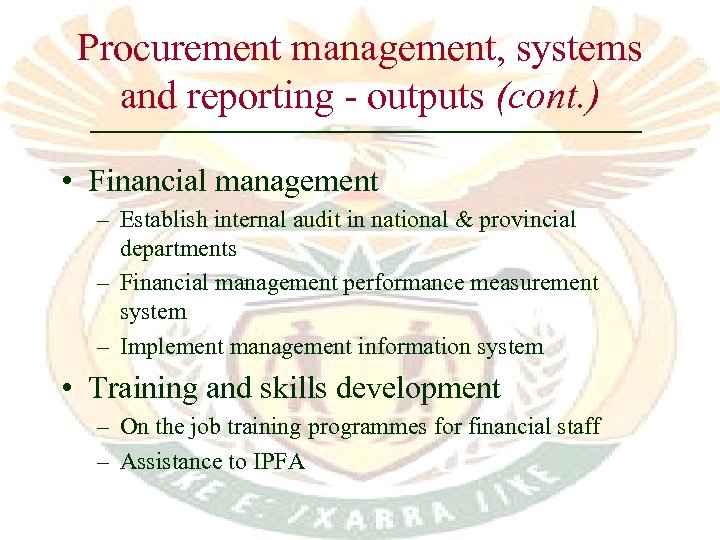

Procurement management, systems and reporting - outputs (cont. ) • Financial management – Establish internal audit in national & provincial departments – Financial management performance measurement system – Implement management information system • Training and skills development – On the job training programmes for financial staff – Assistance to IPFA

Procurement management, systems and reporting - outputs (cont. ) • Financial management – Establish internal audit in national & provincial departments – Financial management performance measurement system – Implement management information system • Training and skills development – On the job training programmes for financial staff – Assistance to IPFA

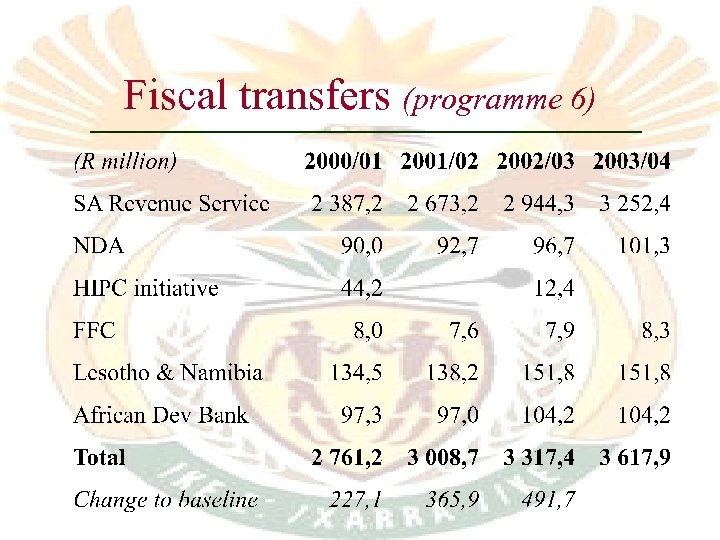

Fiscal transfers (programme 6)

Fiscal transfers (programme 6)

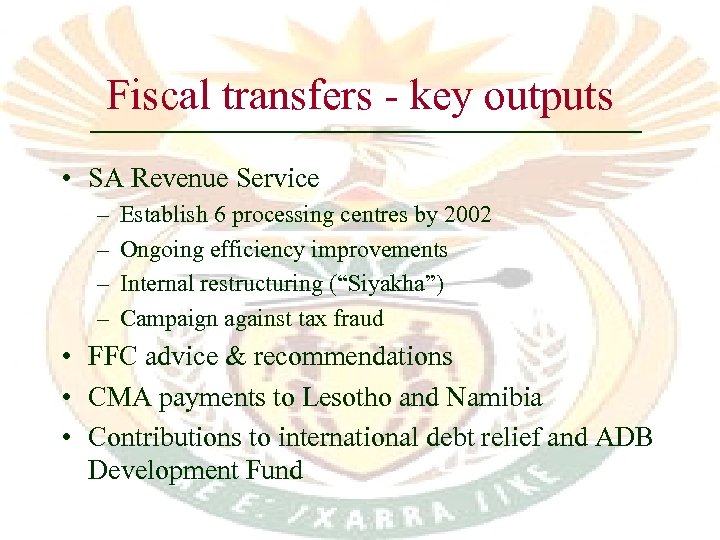

Fiscal transfers - key outputs • SA Revenue Service – – Establish 6 processing centres by 2002 Ongoing efficiency improvements Internal restructuring (“Siyakha”) Campaign against tax fraud • FFC advice & recommendations • CMA payments to Lesotho and Namibia • Contributions to international debt relief and ADB Development Fund

Fiscal transfers - key outputs • SA Revenue Service – – Establish 6 processing centres by 2002 Ongoing efficiency improvements Internal restructuring (“Siyakha”) Campaign against tax fraud • FFC advice & recommendations • CMA payments to Lesotho and Namibia • Contributions to international debt relief and ADB Development Fund

International strategic themes • Regional integration – monetary & fiscal coordination in SADC and SACU • Understanding & promotion of capital flows • Securing finance for development projects in Africa • Supporting HIPC debt relief • Promoting interests of developing countries in international trade

International strategic themes • Regional integration – monetary & fiscal coordination in SADC and SACU • Understanding & promotion of capital flows • Securing finance for development projects in Africa • Supporting HIPC debt relief • Promoting interests of developing countries in international trade

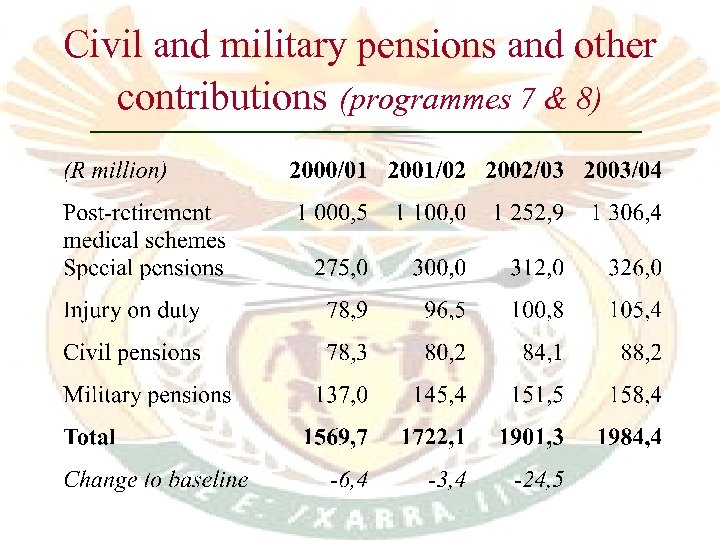

Civil and military pensions and other contributions (programmes 7 & 8)

Civil and military pensions and other contributions (programmes 7 & 8)

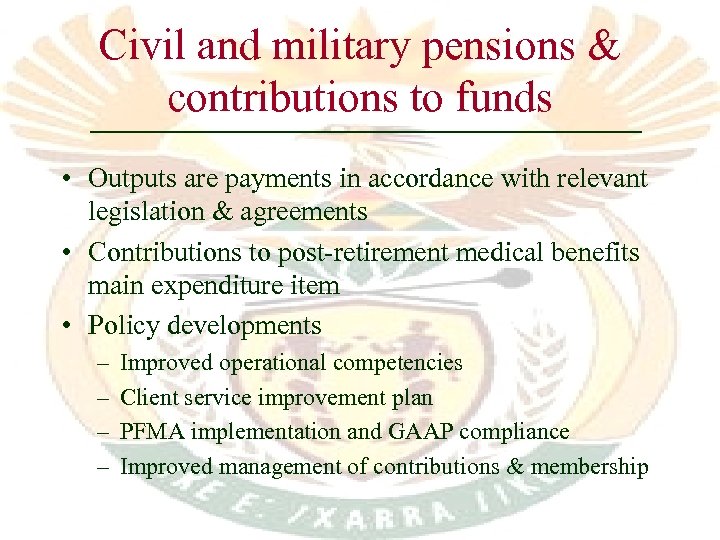

Civil and military pensions & contributions to funds • Outputs are payments in accordance with relevant legislation & agreements • Contributions to post-retirement medical benefits main expenditure item • Policy developments – – Improved operational competencies Client service improvement plan PFMA implementation and GAAP compliance Improved management of contributions & membership

Civil and military pensions & contributions to funds • Outputs are payments in accordance with relevant legislation & agreements • Contributions to post-retirement medical benefits main expenditure item • Policy developments – – Improved operational competencies Client service improvement plan PFMA implementation and GAAP compliance Improved management of contributions & membership

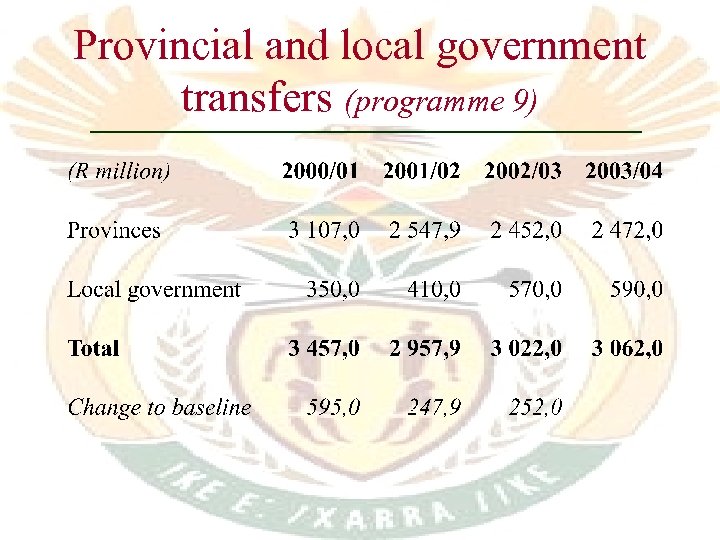

Provincial and local government transfers (programme 9)

Provincial and local government transfers (programme 9)

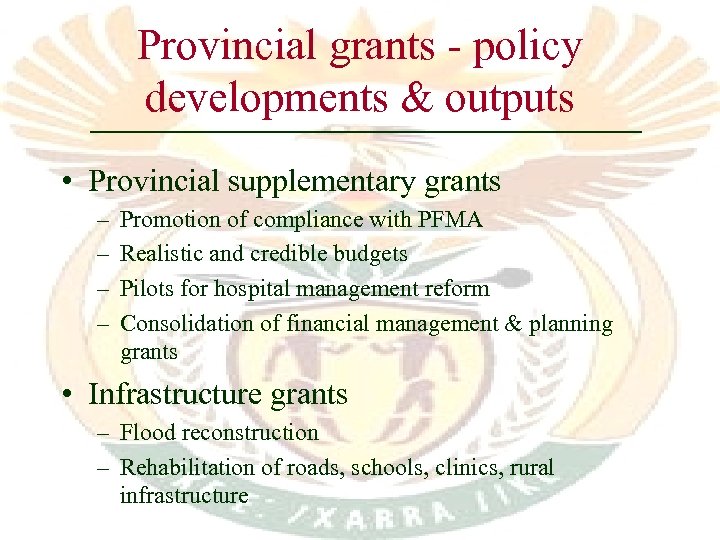

Provincial grants - policy developments & outputs • Provincial supplementary grants – – Promotion of compliance with PFMA Realistic and credible budgets Pilots for hospital management reform Consolidation of financial management & planning grants • Infrastructure grants – Flood reconstruction – Rehabilitation of roads, schools, clinics, rural infrastructure

Provincial grants - policy developments & outputs • Provincial supplementary grants – – Promotion of compliance with PFMA Realistic and credible budgets Pilots for hospital management reform Consolidation of financial management & planning grants • Infrastructure grants – Flood reconstruction – Rehabilitation of roads, schools, clinics, rural infrastructure

Local government grants - policy and outputs • Restructuring grant – Modernisation and restructuring of large municipalities – Credible and sustainable budgets • Financial management grant – – Three-year budgeting in local sphere GAMAP: new accounting standards Financial management reforms Division to approved pilots & roll-out plan

Local government grants - policy and outputs • Restructuring grant – Modernisation and restructuring of large municipalities – Credible and sustainable budgets • Financial management grant – – Three-year budgeting in local sphere GAMAP: new accounting standards Financial management reforms Division to approved pilots & roll-out plan

Auxiliary and associated services (programme 10)

Auxiliary and associated services (programme 10)

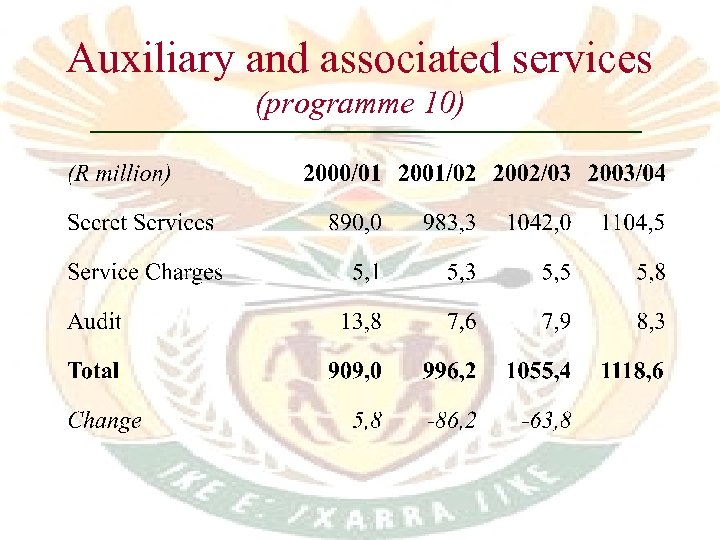

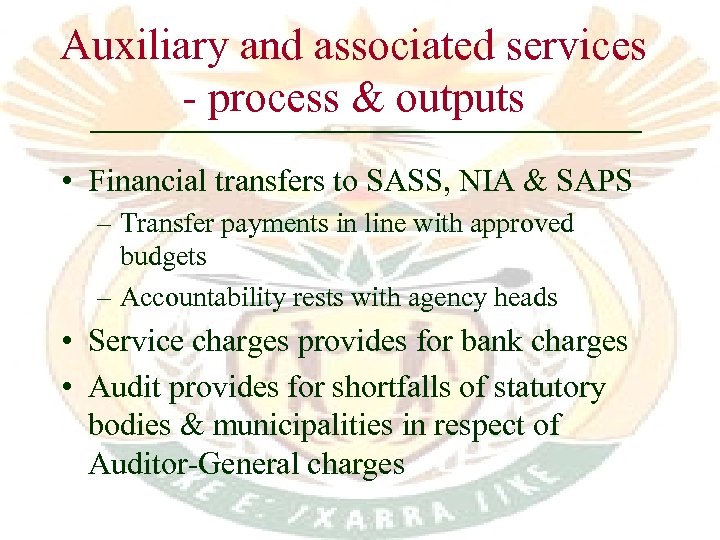

Auxiliary and associated services - process & outputs • Financial transfers to SASS, NIA & SAPS – Transfer payments in line with approved budgets – Accountability rests with agency heads • Service charges provides for bank charges • Audit provides for shortfalls of statutory bodies & municipalities in respect of Auditor-General charges

Auxiliary and associated services - process & outputs • Financial transfers to SASS, NIA & SAPS – Transfer payments in line with approved budgets – Accountability rests with agency heads • Service charges provides for bank charges • Audit provides for shortfalls of statutory bodies & municipalities in respect of Auditor-General charges

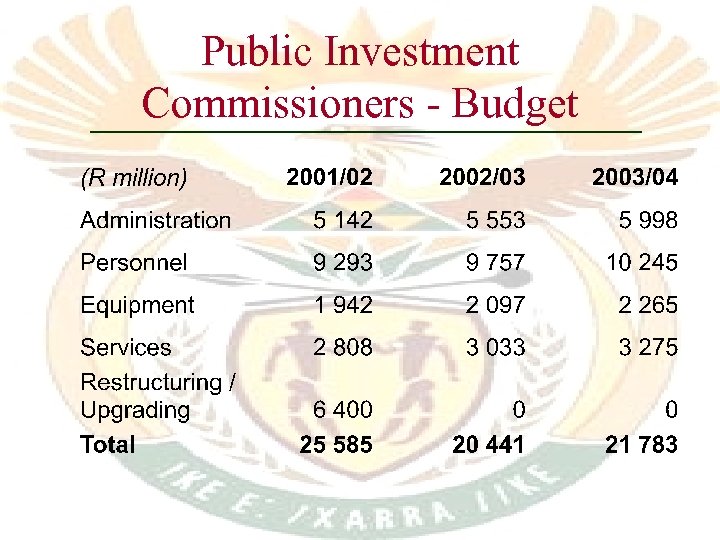

Public Investment Commissioners - Budget

Public Investment Commissioners - Budget

Key objectives of the PIC • Upgrading professional asset management capacity • Integration of national economic priorities more fully into investment profile • Review of restructuring / integration with GEPF • Compliance with Employment Equity Bill

Key objectives of the PIC • Upgrading professional asset management capacity • Integration of national economic priorities more fully into investment profile • Review of restructuring / integration with GEPF • Compliance with Employment Equity Bill

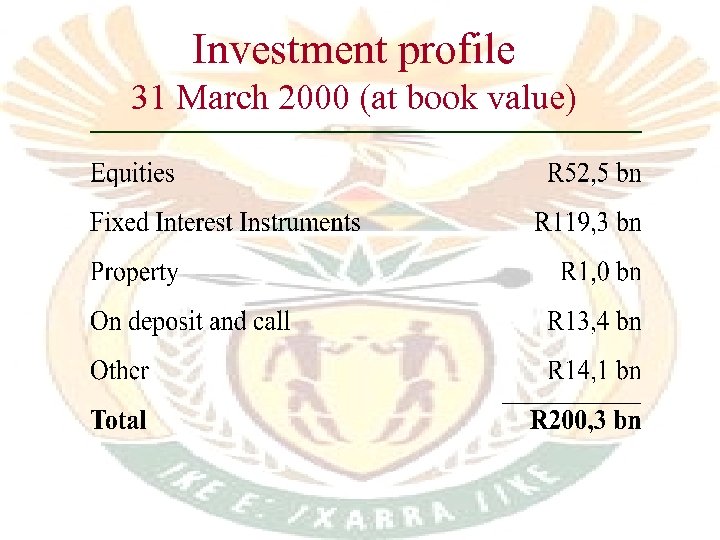

Investment profile 31 March 2000 (at book value)

Investment profile 31 March 2000 (at book value)

Conclusion: Main changes to baseline • • Increase in SARS allocations Provision for Financial Intelligence Centre Increases in local government grants Merging of smaller provincial capacitybuilding grants into supplementary grants • Adjustment to Secret Service allocations • Termination of allocation for computer service (SITA)

Conclusion: Main changes to baseline • • Increase in SARS allocations Provision for Financial Intelligence Centre Increases in local government grants Merging of smaller provincial capacitybuilding grants into supplementary grants • Adjustment to Secret Service allocations • Termination of allocation for computer service (SITA)