f1012cd0f9e8319ffaa527c5a044ad1b.ppt

- Количество слайдов: 70

National Income Powerpoint produced by Rachel Farrell Sources of information: SEC Marking Schemes & newspaper articles

Syllabus • Determination of National Income and its Fluctuations • Concept of national income; its measurement and statistical sources. Factors influencing the size and composition of national income. Its limitations as a measure of economic performance.

Studyclix Click here to access on-line 3

COLLATED EXAM QUESTIONS ORDINARY LEVEL HIGHER LEVEL

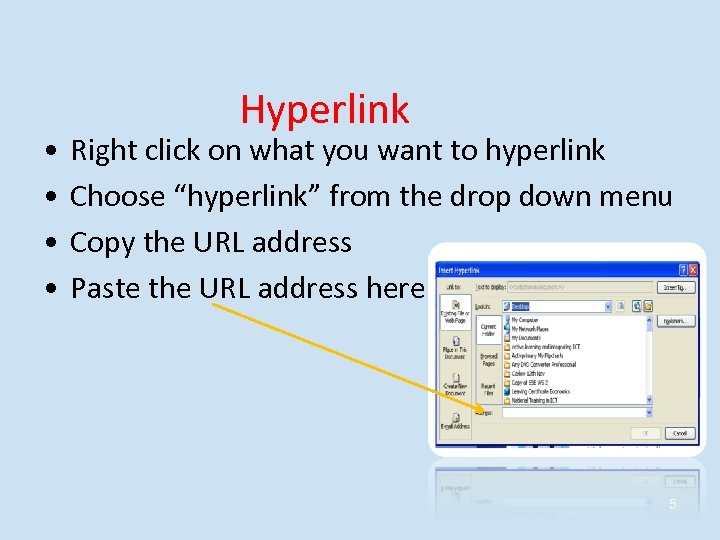

• • Hyperlink Right click on what you want to hyperlink Choose “hyperlink” from the drop down menu Copy the URL address Paste the URL address here 5

Click here for thousands of ideas for teaching accounting, business, economics 6

SEE SCANNING EXERCISE

CSO • The Central Statistics Office calculates the National Income for Ireland.

National Income • Is the income earned by the permanent residents of a country from current economic activity during a specified period, usually one year.

3 Methods of Measuring National Income 1. Production/output method 2. Income method 3. Expenditure method

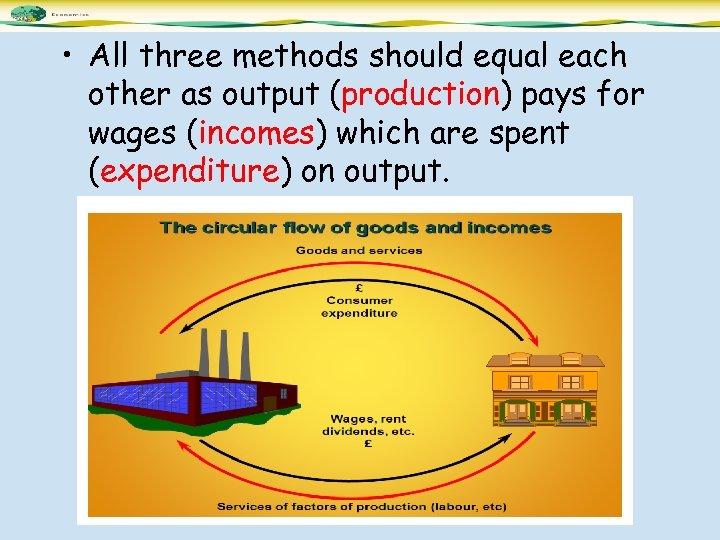

• All three methods should equal each other as output (production) pays for wages (incomes) which are spent (expenditure) on output.

• However there can by stastistical discrepancies (small differences) due to the different methods used.

Three methods are used to ensure that there is; 1. Accuracy Using three methods gives a more accurate result. 2. A cross-check Estimates under one method can be crosschecked under the other two methods. 3. Each method brings valuable information lacking in the other two.

• The output method is a supply-side analysis which focuses on the payments received from the supply of goods and services. • Understanding the outputs of different sectors is vital for infrastructural advancement, research and development (R&D) clusters, export competitiveness etc.

Output method • Add the total value of output producded by; 1. Agriculture, forestry, fishing 2. Industry 3. Building & construction 4. Distribution, transport & communication 5. Public administration & defense 6. Other services (including rent)

Double counting • When using the output method, care must be taken to avoid “double counting”. • If a dressmaker buys material for 100 and makes a dress worth 300, their output is only 200. • This is known as the value added of the business.

The income method is a supplyside analysis which focuses on all factor payments made to households. This allows planners to know the levels of taxes and transfers that are appropriate for given families.

Income method Add the annual returns for income tax purposes of; 1. Income from agriculture, forestry & fishing 2. Non-agricultural income: a) Company & trading profits & professional earnings b) Wages & salaries (including BIK) c) Rent (actual & imputed)

Incomes-in-kind Benefit-in-kind • Incomes received in non money form. • Payment made in the form of good or service. • Eg. Company car. • Included in National Income.

Imputed Rent • Employer may allow employee to live in house rent free. • No money changes hands. • Will be lost from NI statistics unless reported to the revenue commissioners.

Transfer Payment • Is payment received for which no FOP/good or service has been supplied. • It occurs when tax on income earned by one person is given as income to another eg. social welfare, student grants • It is this not included in National Income as it would lead to double counting.

• The expenditure method (often associated with the writings of Keynes). • Unlike the other two, the expenditure method focuses on the levels of demand in the economy and it allows planners to assess the balance between investment and consumption, public and private activity, imports and exports (the balance of trade) etc.

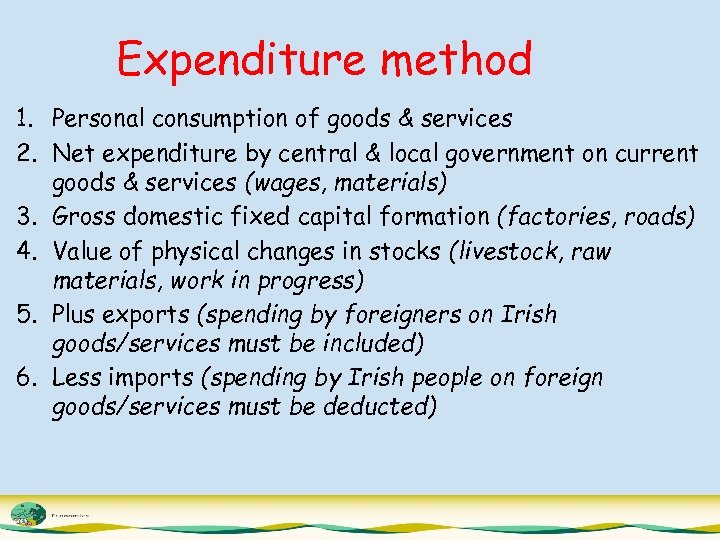

Expenditure method 1. Personal consumption of goods & services 2. Net expenditure by central & local government on current goods & services (wages, materials) 3. Gross domestic fixed capital formation (factories, roads) 4. Value of physical changes in stocks (livestock, raw materials, work in progress) 5. Plus exports (spending by foreigners on Irish goods/services must be included) 6. Less imports (spending by Irish people on foreign goods/services must be deducted)

Relationship between GDP @ CMP and NNP @ FC Gross Domestic Product @ current market prices ± Net Factor Income from abroad (ROW) = Gross National Product @ current market prices Less indirect taxes Plus subsidies = Gross National Product @ factor cost Less Depreciation = Net National Product at factor cost (National Income)

Relationship between NNP @ FC and GDP @ CMP Net National Product @ factor cost (National Income) Plus Depreciation =Gross Domestic Prices @ factor cost +/- Net Factor Income from abroad (ROW) = Gross National Product @ factor cost Plus indirect taxes Less subsidies = Gross National Product @ market prices

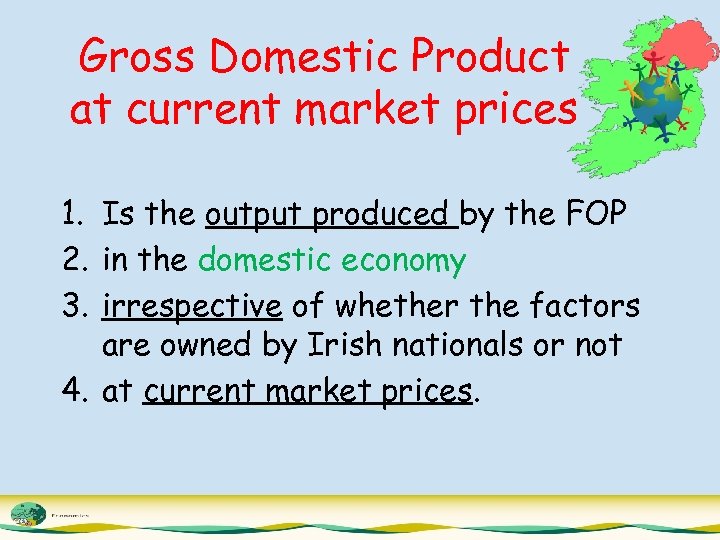

Gross Domestic Product at current market prices 1. Is the output produced by the FOP 2. in the domestic economy 3. irrespective of whether the factors are owned by Irish nationals or not 4. at current market prices.

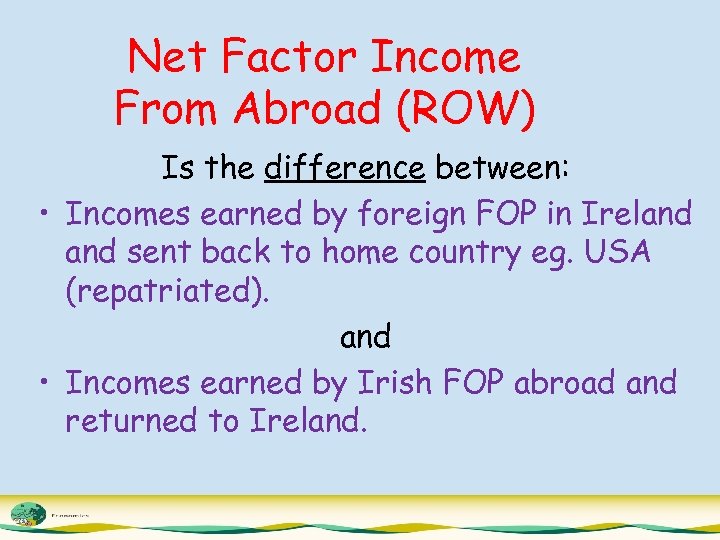

Net Factor Income From Abroad (ROW) Is the difference between: • Incomes earned by foreign FOP in Ireland sent back to home country eg. USA (repatriated). and • Incomes earned by Irish FOP abroad and returned to Ireland.

Is this + or - for Ireland Minus in 2011 because: 1. Large no. of foreign owned co. ’s in Ireland repatriating profits. 2. Immigrants sending wages back home. 3. Repayments of National Debt to foreign institutions. Therefore GNP < GDP or GDP > GNP

Note • Gross Domestic Product is a better guide to the level of economic activity. • Gross National Product is a better guide to the Standard of Living.

Gross National Product @ Current Market Prices 1. 2. 3. 4. Is the output produced by Irish owned FOP in Ireland elsewhere at current market prices.

Gross Domestic Product Gross National Product

Indirect tax • Is tax on spending. • Eg. VAT

Subsidy 2002 Q 8 OL • Is a direct payment by the government to a producer/exporter. • In order to decrease the cost of production and/or the price per unit.

Gross National Product @ Factor Cost 1. 2. 3. 4. Is the output produced by Irish owned FOP in Ireland & elsewhere valued at payments to the factors of production.

Factor Cost • It is the payment to the factors of production for producing goods & services. • It includes subsidies and excludes taxes. • Note: to get Market Prices – sub + tax

Depreciation • Is the reduction in the value of capital goods/fixed assets in the production of goods & services in the economy.

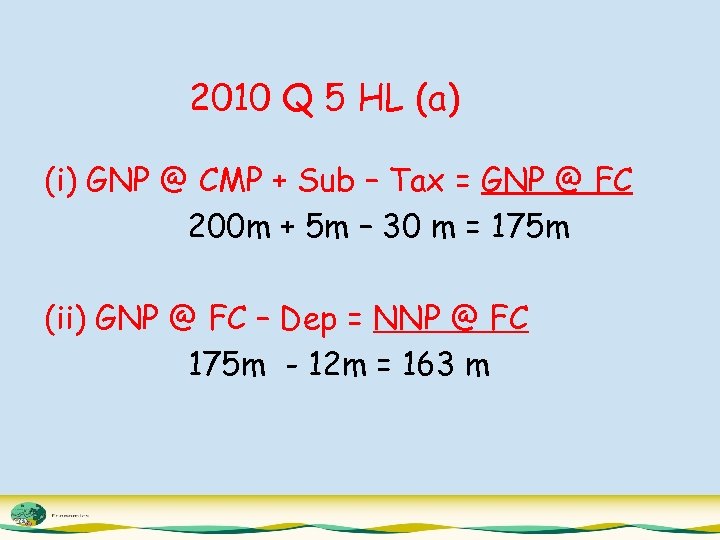

2010 Q 5 HL (a) (i) GNP @ CMP + Sub – Tax = GNP @ FC 200 m + 5 m – 30 m = 175 m (ii) GNP @ FC – Dep = NNP @ FC 175 m - 12 m = 163 m

2005 HL SQ 9 (i) GNP @ CMP + Sub – Tax = GNP @ FC 180 m + 4 m – 25 m = 159 m (ii) GNP @ FC – Dep = NNP @ FC 159 m - 15 m = 144 m

2010 Q 5 (b) HL • Explain the economic effect which each of the following could have on the level of GNP at Market Prices. (i) A reduction in the general level of VAT (ii) A reduction in the subsidies paid to farmers.

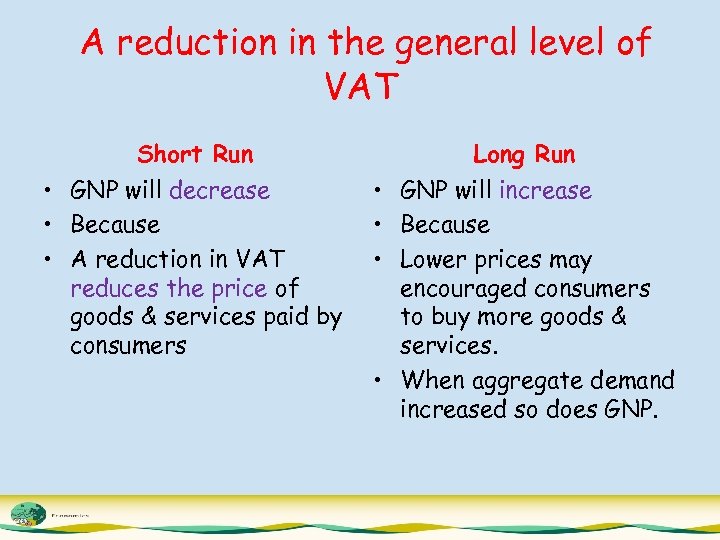

A reduction in the general level of VAT Short Run Long Run • GNP will decrease • Because • A reduction in VAT reduces the price of goods & services paid by consumers • GNP will increase • Because • Lower prices may encouraged consumers to buy more goods & services. • When aggregate demand increased so does GNP.

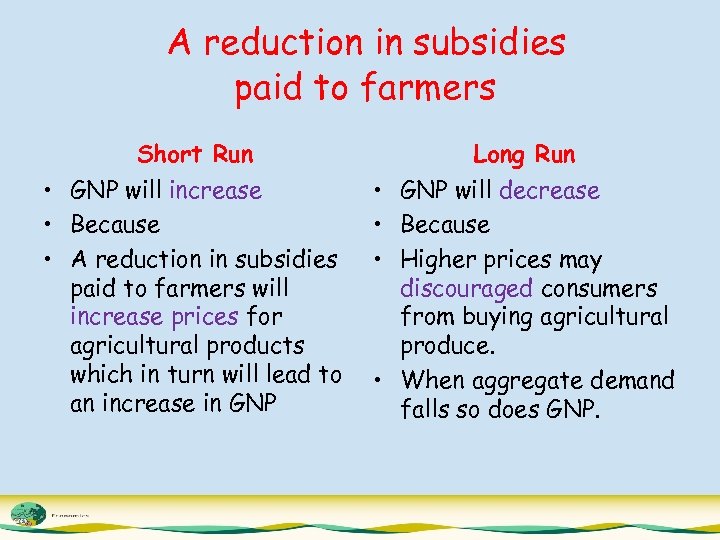

A reduction in subsidies paid to farmers Short Run Long Run • GNP will increase • Because • A reduction in subsidies paid to farmers will increase prices for agricultural products which in turn will lead to an increase in GNP • GNP will decrease • Because • Higher prices may discouraged consumers from buying agricultural produce. • When aggregate demand falls so does GNP.

Current Market Prices V Constant Prices • When measuring national income statistics it is important to distinguish between nominal(monetary) and real (physical) changes

• When comparing the national income statistics from year to year at current market prices no allowance is made for inflation. • So an increase in national income could be due to price increases and not due to the volume of activity increasing.

• To overcome the problem of inflation each year’s figures can be measured at a constant price. • Therefore a more realistic comparison can be made between years.

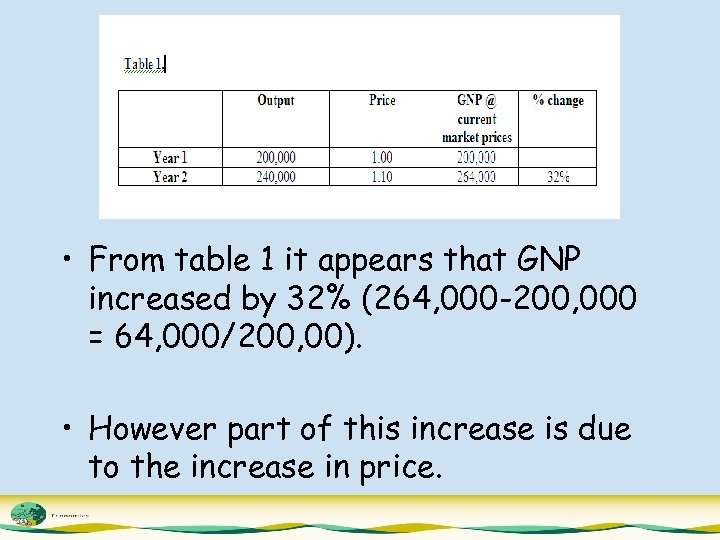

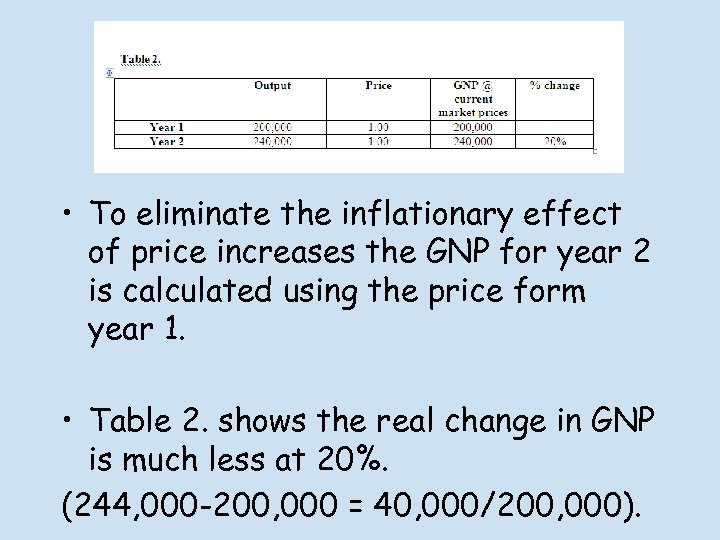

• From table 1 it appears that GNP increased by 32% (264, 000 -200, 000 = 64, 000/200, 00). • However part of this increase is due to the increase in price.

• To eliminate the inflationary effect of price increases the GNP for year 2 is calculated using the price form year 1. • Table 2. shows the real change in GNP is much less at 20%. (244, 000 -200, 000 = 40, 000/200, 000).

Uses of NI statistics 1. Measures changes in the level of economic growth. 2. Indicates changes in standard of living. 3. Distribution of income. 4. Negotiation of Partnership agreements. 5. International comparisons. Students: write a brief explanation of each of thee headings.

Limits of NI statistics • Care should be taken when using National Income Statistics as a measure of economic performance of a country for the following reasons;

Limits of NI statistics 1. Inflation/deflation 2. Population changes 3. Employment / Unemployment 4. Levels of taxation 5. Measures flow of wealth not welfare 6. Distribution of national income 7. Nature of the goods produced Students: write a brief explanation of each of thee headings.

Limits of international comparisons of NI stats 1. 2. 3. 4. Rates of exchange Nature of expenditure Distribution of national income Size of population Students: write a brief explanation of each of thee headings.

Human Development Index • Is a comparative measure of life expectancy, literacy, education and standard of living for countries worldwide. • It is a standard measure of human wellbeing, especially child welfare. • The HDI is used by the United Nations Development Programme.

GNP HDI V

Factors that affect the size of National Income 2001 Q 4 OL

Effects of inflation & population on SOL 2001 Q 4 OL

Black Economy • Is any economic activity which takes place which is not recorded and therefore not included in national income accounts.

Examples of work in the black economy • A teacher giving grinds, without declaring the income for tax purposes. • A plumber fixing a washing machine for cash payment and not declaring the income for tax purposes

Reasons for the growth of the Black Economy • Unemployment: those who have lost their jobs cannot afford VAT inclusive prices and/or are prepared to take a job for cash only to avoid paying income tax. • Disillusionment with government policies: some think that the tax system is unfair.

Reasons for the growth of the Black Economy • Reduced disposable incomes: people can’t afford to pay the legitimate prices for goods / services. • Increased VAT rates: causing prices to increase and consumers want to avoid the higher taxes.

Economic effects of the black economy in Ireland 1. Loss of tax revenue to the government. 2. Decline in legitimate business activity 3. Increased government expenditure on enforcement. 4. Pressure on government services / finances. 5. Increase crime levels. 6. Standards of products/services. Students: write a brief explanation of each of thee headings.

Economic measures the Irish Government could take to discourage the black economy 1. Reduce direct taxation rates. 2. Reduce indirect taxation. 3. Better enforcement by revenue commissioners. 4. Educate the public about the importance of tax revenue to the state. 5. Simplification of the tax system / close all tax loopholes. Students: write a brief explanation of each of thee headings.

f1012cd0f9e8319ffaa527c5a044ad1b.ppt