571dca39966ba9a0a5bc13600dc2b25c.ppt

- Количество слайдов: 83

National Income Accounts • National saving-the total income in the economy that remains after paying for the consumption and government purchases.

National Income Accounts • National saving-the total income in the economy that remains after paying for the consumption and government purchases.

• Remember that GDP can be divided up into four components: consumption, investment, government purchases, and net exports.

• Remember that GDP can be divided up into four components: consumption, investment, government purchases, and net exports.

National Savings • To make the concept easy pretend we have a closed economy where no trade occurs. • So for our GDP equation it would be • Y=C+I+G

National Savings • To make the concept easy pretend we have a closed economy where no trade occurs. • So for our GDP equation it would be • Y=C+I+G

National Savings • So Y=C+G+I • To isolate investment, we can subtract C and G from both sides: • Y-C-G=I • Or GDP-Consumption-Government Purchases =Investment • What is left is called national savings. • Savings=Y-C-G=I • Savings =Investing

National Savings • So Y=C+G+I • To isolate investment, we can subtract C and G from both sides: • Y-C-G=I • Or GDP-Consumption-Government Purchases =Investment • What is left is called national savings. • Savings=Y-C-G=I • Savings =Investing

• You will have to keep reminding students what the term “investment” means to macroeconomists. Outside of the economics profession, most people use the terms “saving” and “investing” interchangeably. • In macroeconomics, investment refers to the purchase of new capital, such as equipment or buildings. (factories) • If an individual spends less than he earns and uses the rest to buy stocks or mutual funds, economists call this saving.

• You will have to keep reminding students what the term “investment” means to macroeconomists. Outside of the economics profession, most people use the terms “saving” and “investing” interchangeably. • In macroeconomics, investment refers to the purchase of new capital, such as equipment or buildings. (factories) • If an individual spends less than he earns and uses the rest to buy stocks or mutual funds, economists call this saving.

• Definition of National Saving (Saving): the total income in the economy that remains after paying for consumption and government purchases

• Definition of National Saving (Saving): the total income in the economy that remains after paying for consumption and government purchases

Saving Continued • Savings=GDP-Consumption-Govt Spending • If T= Taxes and Transfer payments back to SS and Welfare It can be broken down also like this S=(Y-T-C) + (T-G) This breaks down into private savings and public savings

Saving Continued • Savings=GDP-Consumption-Govt Spending • If T= Taxes and Transfer payments back to SS and Welfare It can be broken down also like this S=(Y-T-C) + (T-G) This breaks down into private savings and public savings

• Private Saving: the income that households have left after paying for taxes and consumption. • Public Saving: the tax revenue that the government has left after paying for its spending. • Budget Surplus: an excess of tax revenue over government spending. • Budget Deficit: a shortfall of tax revenue from government spending.

• Private Saving: the income that households have left after paying for taxes and consumption. • Public Saving: the tax revenue that the government has left after paying for its spending. • Budget Surplus: an excess of tax revenue over government spending. • Budget Deficit: a shortfall of tax revenue from government spending.

Breaking down National Savings S=(Y-T-C) + (T-G) Private Savings • Private Savings-is the amount of income that households have left after paying their taxes and paying for their consumption Public Savings-is the amount of tax revenue that the government has left after paying for it spending

Breaking down National Savings S=(Y-T-C) + (T-G) Private Savings • Private Savings-is the amount of income that households have left after paying their taxes and paying for their consumption Public Savings-is the amount of tax revenue that the government has left after paying for it spending

Types of Savings • Budget surplus-If govt receives more then they pay out. T-G is positive

Types of Savings • Budget surplus-If govt receives more then they pay out. T-G is positive

Types of Savings • Budget Deficit T-G is negative

Types of Savings • Budget Deficit T-G is negative

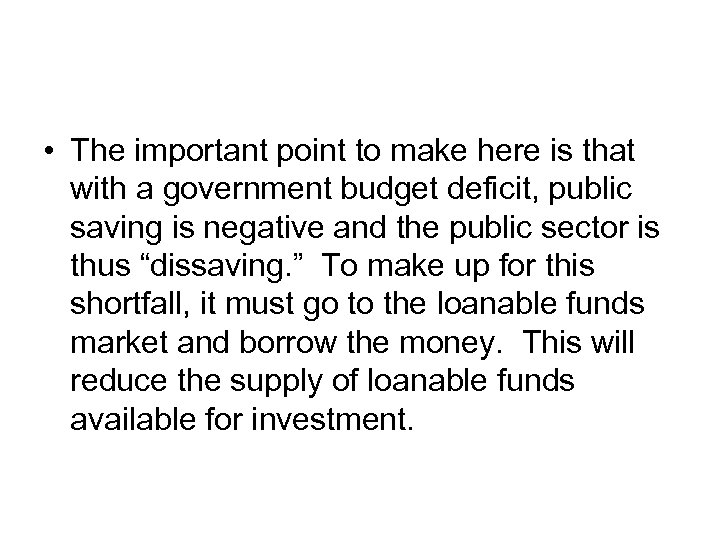

• The important point to make here is that with a government budget deficit, public saving is negative and the public sector is thus “dissaving. ” To make up for this shortfall, it must go to the loanable funds market and borrow the money. This will reduce the supply of loanable funds available for investment.

• The important point to make here is that with a government budget deficit, public saving is negative and the public sector is thus “dissaving. ” To make up for this shortfall, it must go to the loanable funds market and borrow the money. This will reduce the supply of loanable funds available for investment.

THE MARKET FOR LOANABLE FUNDS • Financial markets coordinate the economy’s saving and investment in the market for loanable funds. • The market for loanable funds is the market in which those who want to save supply funds and those who want to borrow to invest demand funds.

THE MARKET FOR LOANABLE FUNDS • Financial markets coordinate the economy’s saving and investment in the market for loanable funds. • The market for loanable funds is the market in which those who want to save supply funds and those who want to borrow to invest demand funds.

Market for Loanable Funds • To analyze how Government policies influence savings and investing we assume the economy has only one financial market and it is called the Market for Loanable funds.

Market for Loanable Funds • To analyze how Government policies influence savings and investing we assume the economy has only one financial market and it is called the Market for Loanable funds.

Supply and Demand for Loanable Funds • Loanable funds refers to all income that people have chosen to save and lend out, rather than use for their own consumption. • The supply of loanable funds comes from people who have extra income they want to save and lend out. • The demand for loanable funds comes from households and firms that wish to borrow to make investments.

Supply and Demand for Loanable Funds • Loanable funds refers to all income that people have chosen to save and lend out, rather than use for their own consumption. • The supply of loanable funds comes from people who have extra income they want to save and lend out. • The demand for loanable funds comes from households and firms that wish to borrow to make investments.

Supply and Demand for Loanable Funds • Interest rate – the price of the loan – the amount that borrowers pay for loans and the amount that lenders receive on their saving – in the market for loanable funds, the real interest rate.

Supply and Demand for Loanable Funds • Interest rate – the price of the loan – the amount that borrowers pay for loans and the amount that lenders receive on their saving – in the market for loanable funds, the real interest rate.

Supply and Demand for Loanable Funds • Financial markets work much like other markets in the economy. • The equilibrium of the supply and demand for loanable funds determines the real interest rate.

Supply and Demand for Loanable Funds • Financial markets work much like other markets in the economy. • The equilibrium of the supply and demand for loanable funds determines the real interest rate.

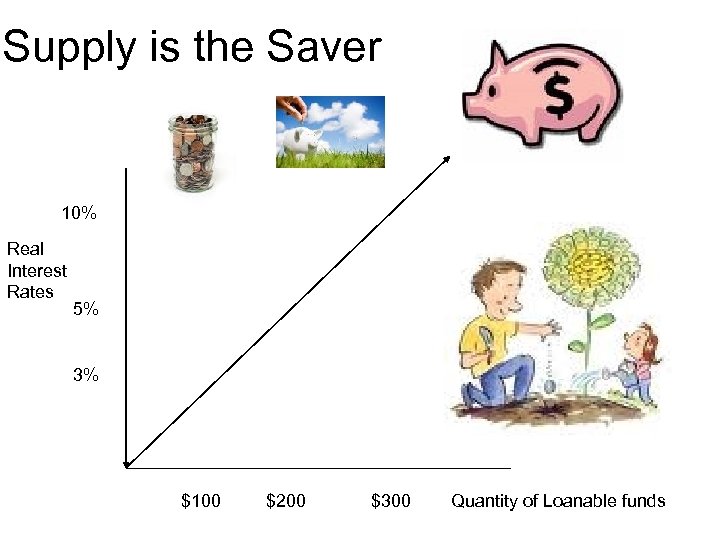

Supply is the Saver 10% Real Interest Rates 5% 3% $100 $200 $300 Quantity of Loanable funds

Supply is the Saver 10% Real Interest Rates 5% 3% $100 $200 $300 Quantity of Loanable funds

Lets look at it! 10% Real Interest Rates 5% 3% Supply of loan able funds of people who have extra income they want to SAVE or Financial Investment!!!!! $100 $200 $300 Quantity of Loanable funds

Lets look at it! 10% Real Interest Rates 5% 3% Supply of loan able funds of people who have extra income they want to SAVE or Financial Investment!!!!! $100 $200 $300 Quantity of Loanable funds

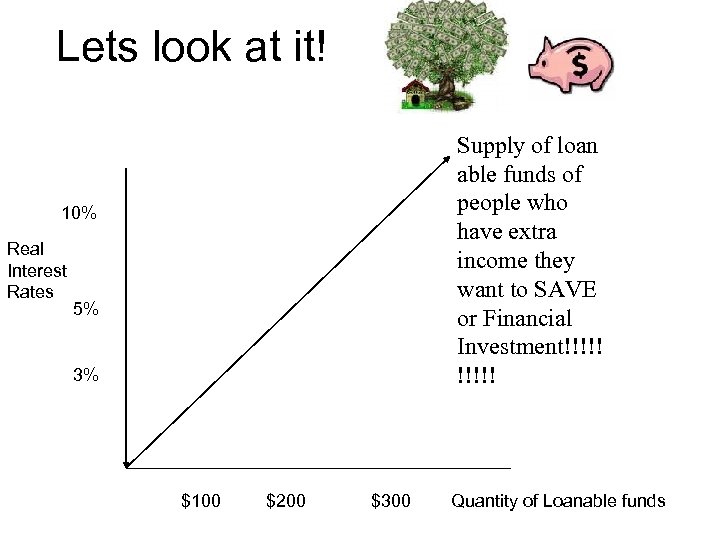

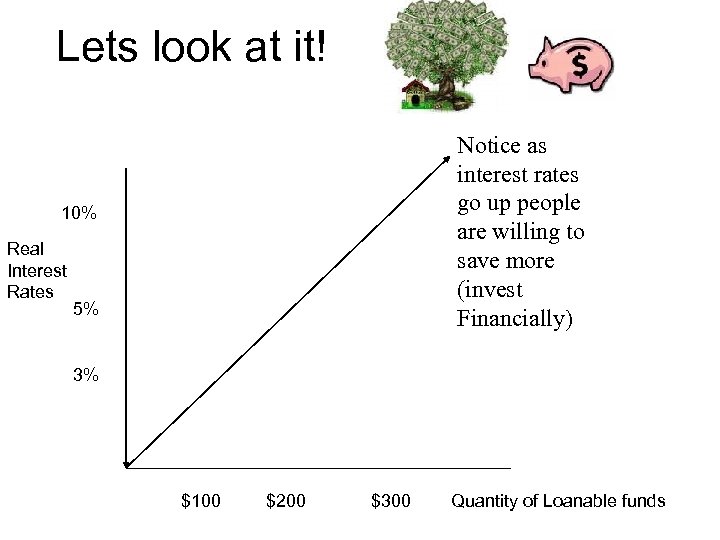

Lets look at it! 10% Real Interest Rates 5% Notice as interest rates go up people are willing to save more (invest Financially) 3% $100 $200 $300 Quantity of Loanable funds

Lets look at it! 10% Real Interest Rates 5% Notice as interest rates go up people are willing to save more (invest Financially) 3% $100 $200 $300 Quantity of Loanable funds

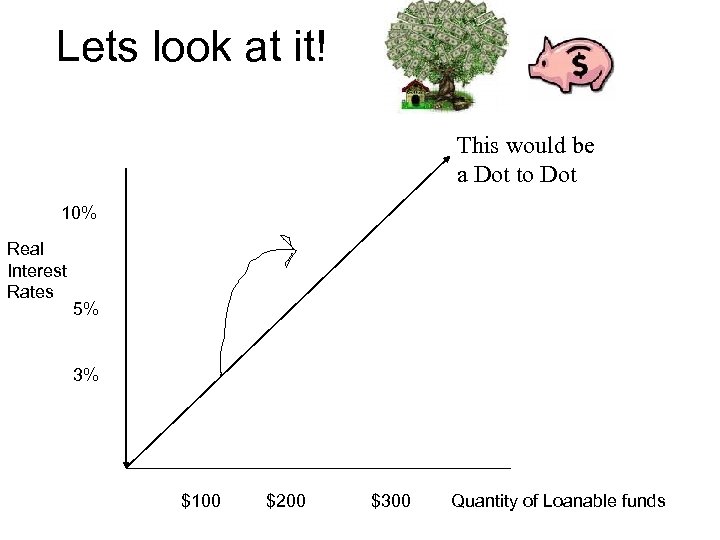

Lets look at it! This would be a Dot to Dot 10% Real Interest Rates 5% 3% $100 $200 $300 Quantity of Loanable funds

Lets look at it! This would be a Dot to Dot 10% Real Interest Rates 5% 3% $100 $200 $300 Quantity of Loanable funds

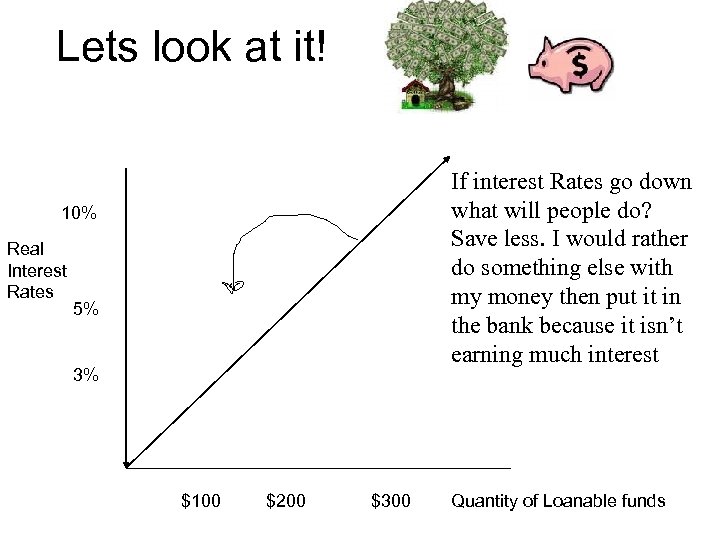

Lets look at it! 10% Real Interest Rates 5% 3% If interest Rates go down what will people do? Save less. I would rather do something else with my money then put it in the bank because it isn’t earning much interest $100 $200 $300 Quantity of Loanable funds

Lets look at it! 10% Real Interest Rates 5% 3% If interest Rates go down what will people do? Save less. I would rather do something else with my money then put it in the bank because it isn’t earning much interest $100 $200 $300 Quantity of Loanable funds

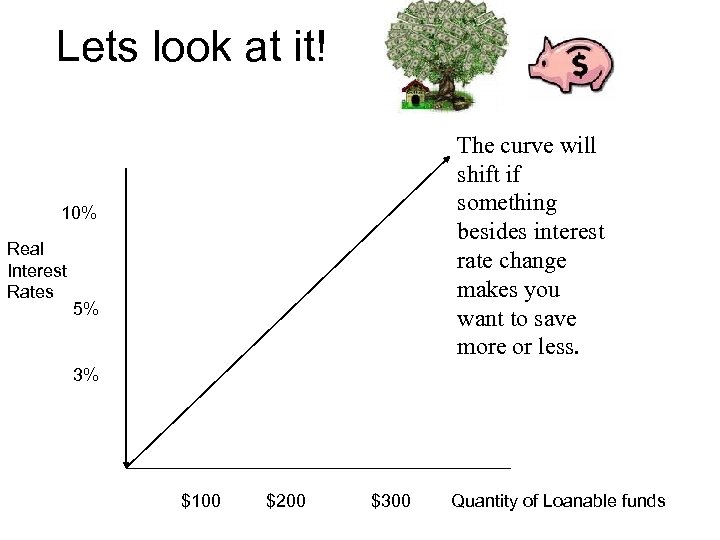

Lets look at it! 10% Real Interest Rates 5% The curve will shift if something besides interest rate change makes you want to save more or less. 3% $100 $200 $300 Quantity of Loanable funds

Lets look at it! 10% Real Interest Rates 5% The curve will shift if something besides interest rate change makes you want to save more or less. 3% $100 $200 $300 Quantity of Loanable funds

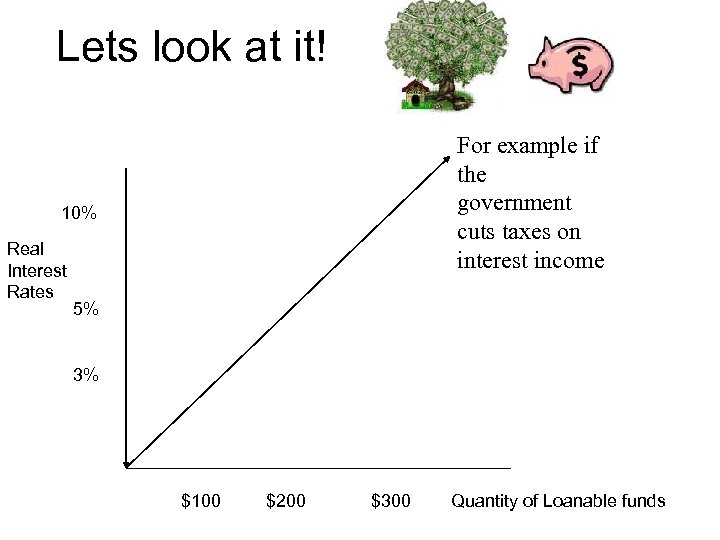

Lets look at it! 10% Real Interest Rates For example if the government cuts taxes on interest income 5% 3% $100 $200 $300 Quantity of Loanable funds

Lets look at it! 10% Real Interest Rates For example if the government cuts taxes on interest income 5% 3% $100 $200 $300 Quantity of Loanable funds

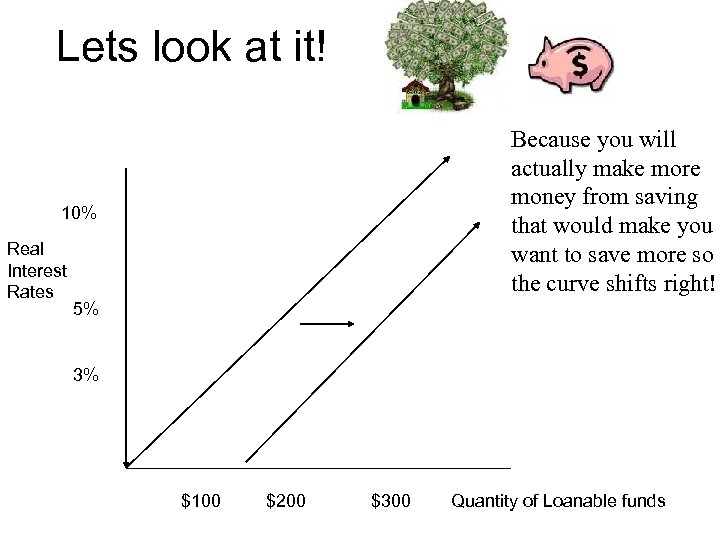

Lets look at it! 10% Real Interest Rates Because you will actually make more money from saving that would make you want to save more so the curve shifts right! 5% 3% $100 $200 $300 Quantity of Loanable funds

Lets look at it! 10% Real Interest Rates Because you will actually make more money from saving that would make you want to save more so the curve shifts right! 5% 3% $100 $200 $300 Quantity of Loanable funds

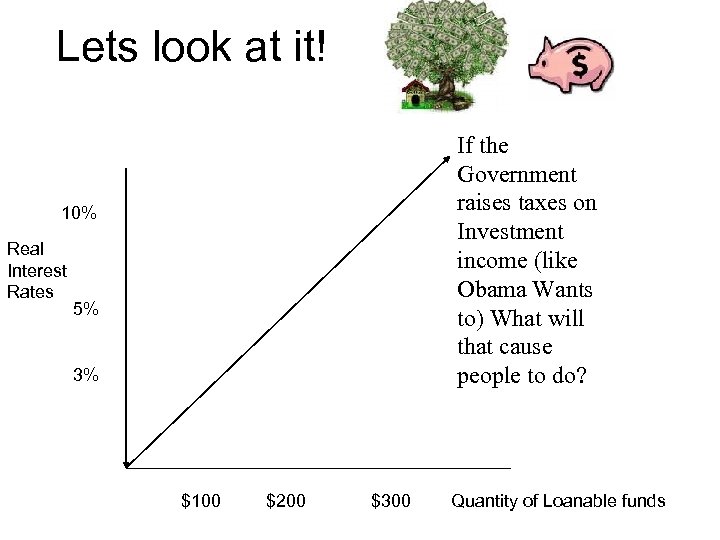

Lets look at it! 10% Real Interest Rates 5% 3% If the Government raises taxes on Investment income (like Obama Wants to) What will that cause people to do? $100 $200 $300 Quantity of Loanable funds

Lets look at it! 10% Real Interest Rates 5% 3% If the Government raises taxes on Investment income (like Obama Wants to) What will that cause people to do? $100 $200 $300 Quantity of Loanable funds

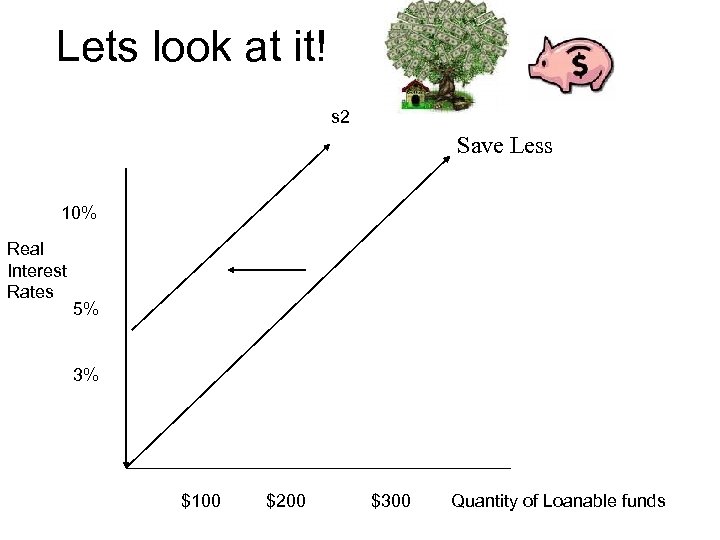

Lets look at it! s 2 Save Less 10% Real Interest Rates 5% 3% $100 $200 $300 Quantity of Loanable funds

Lets look at it! s 2 Save Less 10% Real Interest Rates 5% 3% $100 $200 $300 Quantity of Loanable funds

• The supply of loanable funds comes from those who spend less than they earn. The supply can occur directly through the purchase of some stock or bonds or indirectly through a financial intermediary.

• The supply of loanable funds comes from those who spend less than they earn. The supply can occur directly through the purchase of some stock or bonds or indirectly through a financial intermediary.

• This Is Very Important • You will have to keep reminding students what the term “investment” means to macroeconomists. Outside of the economics profession, most people use the terms “saving” and “investing” interchangeably. • In macroeconomics, investment refers to the purchase of new capital, such as equipment or buildings. (factories) • If an individual spends less than he earns and uses the rest to buy stocks or mutual funds, economists call this saving.

• This Is Very Important • You will have to keep reminding students what the term “investment” means to macroeconomists. Outside of the economics profession, most people use the terms “saving” and “investing” interchangeably. • In macroeconomics, investment refers to the purchase of new capital, such as equipment or buildings. (factories) • If an individual spends less than he earns and uses the rest to buy stocks or mutual funds, economists call this saving.

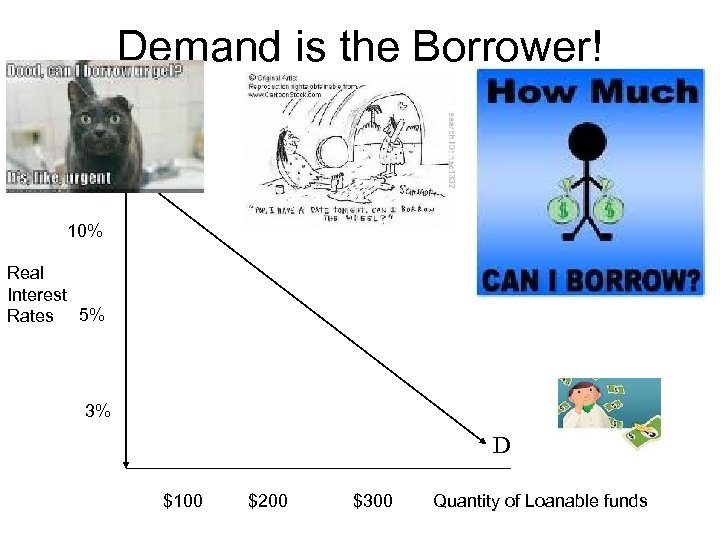

Demand is the Borrower! 10% Real Interest Rates 5% 3% D $100 $200 $300 Quantity of Loanable funds

Demand is the Borrower! 10% Real Interest Rates 5% 3% D $100 $200 $300 Quantity of Loanable funds

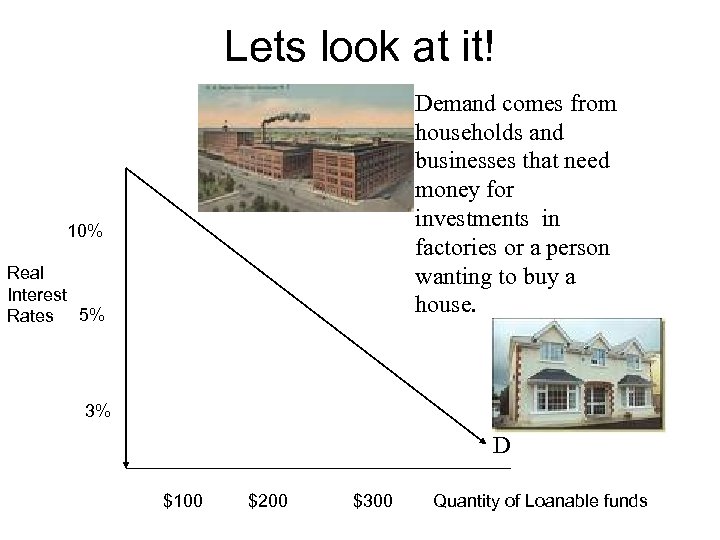

Lets look at it! 10% Real Interest Rates 5% Demand comes from households and businesses that need money for investments in factories or a person wanting to buy a house. 3% D $100 $200 $300 Quantity of Loanable funds

Lets look at it! 10% Real Interest Rates 5% Demand comes from households and businesses that need money for investments in factories or a person wanting to buy a house. 3% D $100 $200 $300 Quantity of Loanable funds

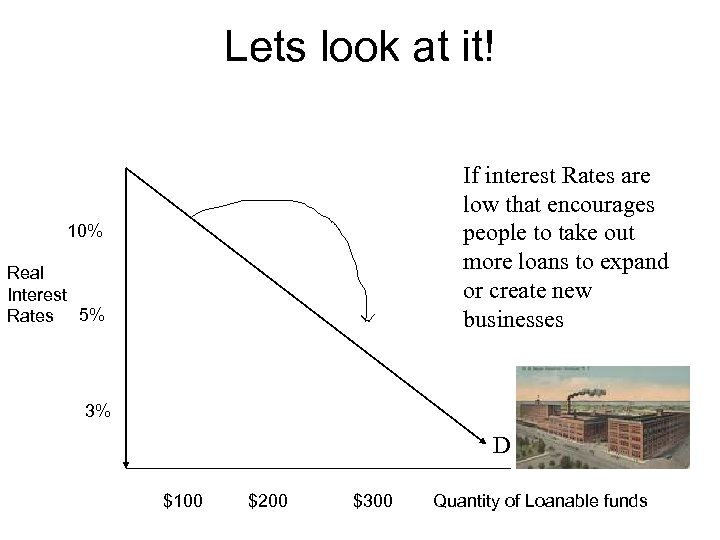

Lets look at it! 10% Real Interest Rates 5% If interest Rates are low that encourages people to take out more loans to expand or create new businesses 3% D $100 $200 $300 Quantity of Loanable funds

Lets look at it! 10% Real Interest Rates 5% If interest Rates are low that encourages people to take out more loans to expand or create new businesses 3% D $100 $200 $300 Quantity of Loanable funds

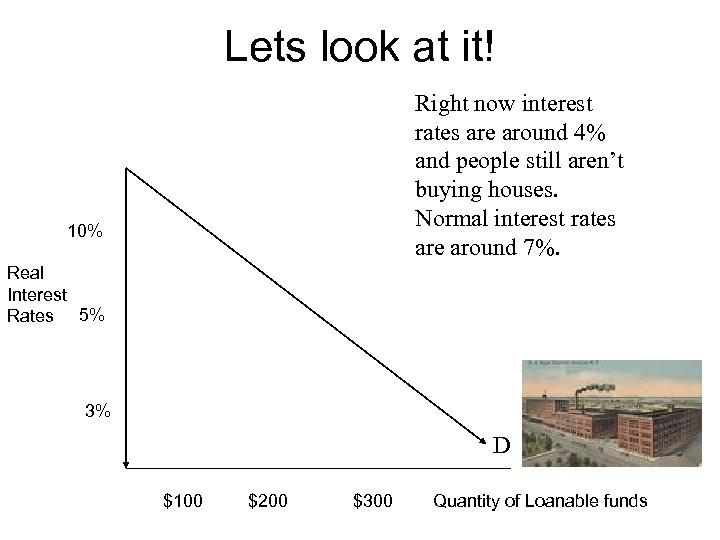

Lets look at it! 10% Right now interest rates are around 4% and people still aren’t buying houses. Normal interest rates are around 7%. Real Interest Rates 5% 3% D $100 $200 $300 Quantity of Loanable funds

Lets look at it! 10% Right now interest rates are around 4% and people still aren’t buying houses. Normal interest rates are around 7%. Real Interest Rates 5% 3% D $100 $200 $300 Quantity of Loanable funds

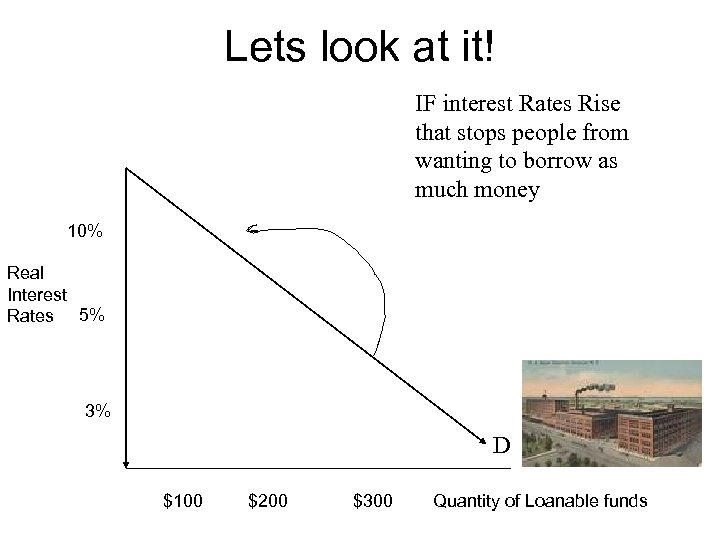

Lets look at it! IF interest Rates Rise that stops people from wanting to borrow as much money 10% Real Interest Rates 5% 3% D $100 $200 $300 Quantity of Loanable funds

Lets look at it! IF interest Rates Rise that stops people from wanting to borrow as much money 10% Real Interest Rates 5% 3% D $100 $200 $300 Quantity of Loanable funds

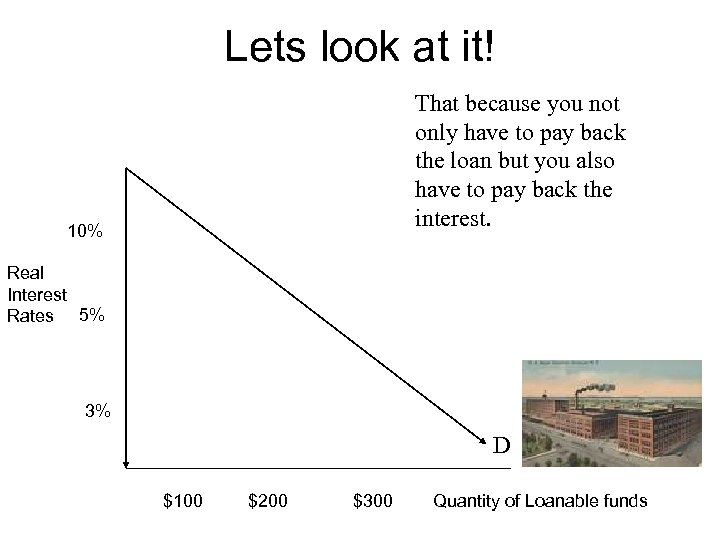

Lets look at it! 10% That because you not only have to pay back the loan but you also have to pay back the interest. Real Interest Rates 5% 3% D $100 $200 $300 Quantity of Loanable funds

Lets look at it! 10% That because you not only have to pay back the loan but you also have to pay back the interest. Real Interest Rates 5% 3% D $100 $200 $300 Quantity of Loanable funds

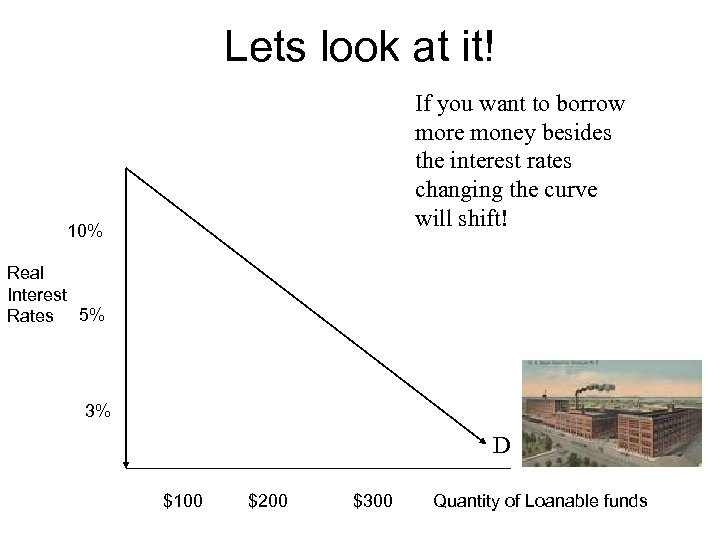

Lets look at it! 10% If you want to borrow more money besides the interest rates changing the curve will shift! Real Interest Rates 5% 3% D $100 $200 $300 Quantity of Loanable funds

Lets look at it! 10% If you want to borrow more money besides the interest rates changing the curve will shift! Real Interest Rates 5% 3% D $100 $200 $300 Quantity of Loanable funds

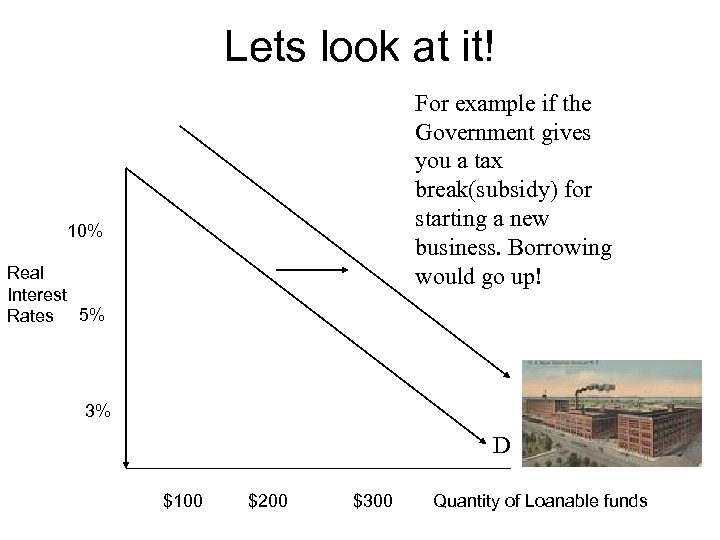

Lets look at it! 10% Real Interest Rates 5% For example if the Government gives you a tax break(subsidy) for starting a new business. Borrowing would go up! 3% D $100 $200 $300 Quantity of Loanable funds

Lets look at it! 10% Real Interest Rates 5% For example if the Government gives you a tax break(subsidy) for starting a new business. Borrowing would go up! 3% D $100 $200 $300 Quantity of Loanable funds

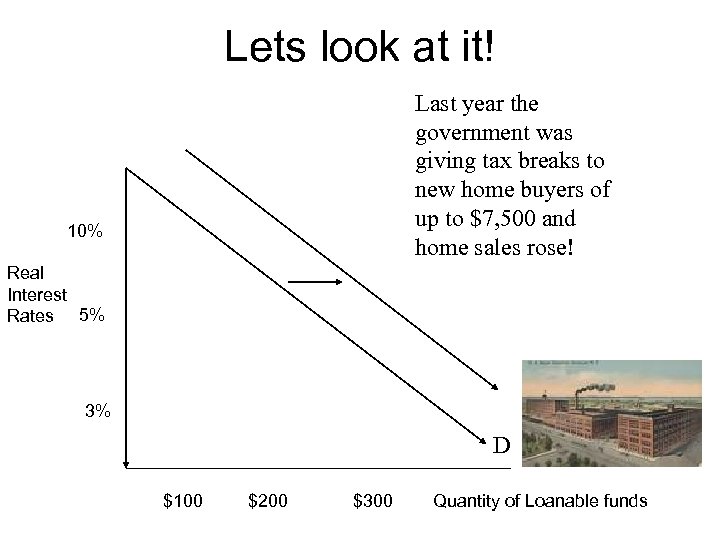

Lets look at it! 10% Last year the government was giving tax breaks to new home buyers of up to $7, 500 and home sales rose! Real Interest Rates 5% 3% D $100 $200 $300 Quantity of Loanable funds

Lets look at it! 10% Last year the government was giving tax breaks to new home buyers of up to $7, 500 and home sales rose! Real Interest Rates 5% 3% D $100 $200 $300 Quantity of Loanable funds

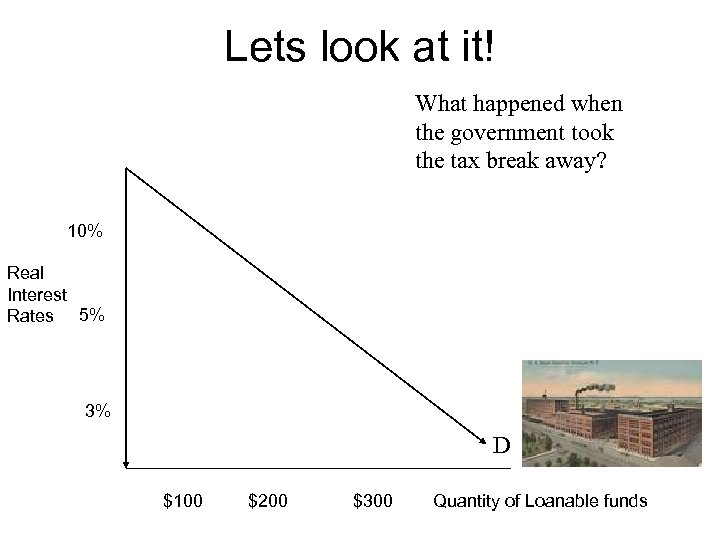

Lets look at it! What happened when the government took the tax break away? 10% Real Interest Rates 5% 3% D $100 $200 $300 Quantity of Loanable funds

Lets look at it! What happened when the government took the tax break away? 10% Real Interest Rates 5% 3% D $100 $200 $300 Quantity of Loanable funds

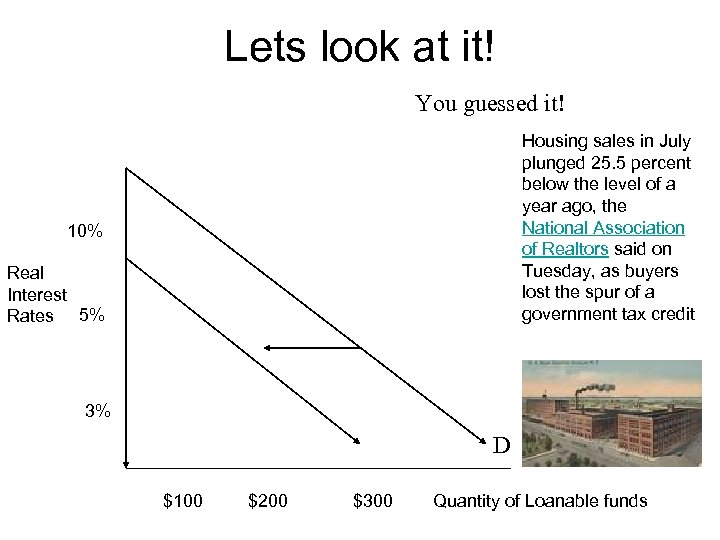

Lets look at it! You guessed it! Housing sales in July plunged 25. 5 percent below the level of a year ago, the National Association of Realtors said on Tuesday, as buyers lost the spur of a government tax credit 10% Real Interest Rates 5% 3% D $100 $200 $300 Quantity of Loanable funds

Lets look at it! You guessed it! Housing sales in July plunged 25. 5 percent below the level of a year ago, the National Association of Realtors said on Tuesday, as buyers lost the spur of a government tax credit 10% Real Interest Rates 5% 3% D $100 $200 $300 Quantity of Loanable funds

• The demand for loans comes from households and firms who wish to borrow funds to make investments. Families generally invest in new homes while firms may borrow to purchase new equipment or to build factories.

• The demand for loans comes from households and firms who wish to borrow funds to make investments. Families generally invest in new homes while firms may borrow to purchase new equipment or to build factories.

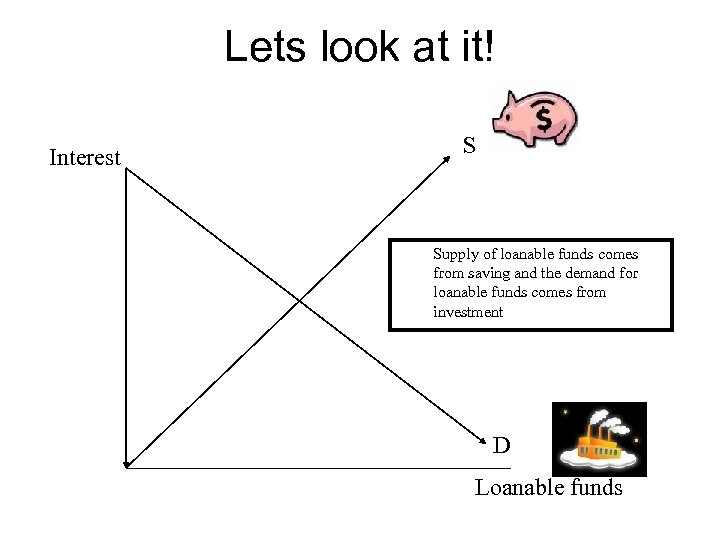

Lets look at it! Interest S Supply of loanable funds comes from saving and the demand for loanable funds comes from investment D Loanable funds

Lets look at it! Interest S Supply of loanable funds comes from saving and the demand for loanable funds comes from investment D Loanable funds

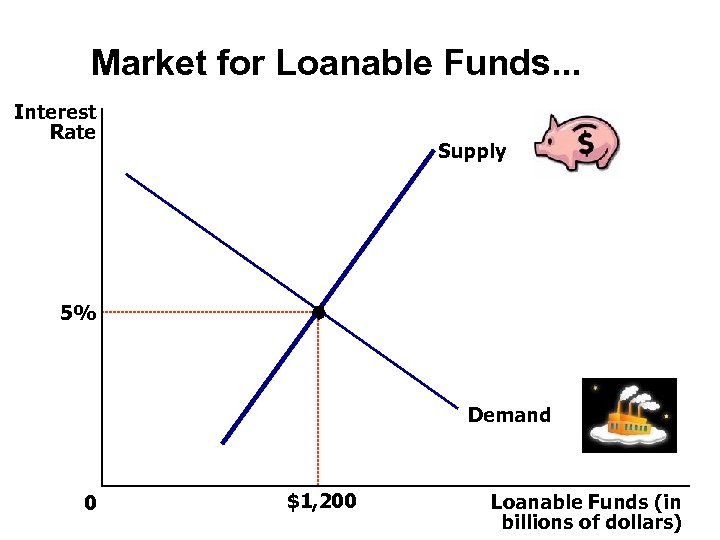

Market for Loanable Funds. . . Interest Rate Supply 5% Demand 0 $1, 200 Loanable Funds (in billions of dollars)

Market for Loanable Funds. . . Interest Rate Supply 5% Demand 0 $1, 200 Loanable Funds (in billions of dollars)

Supply and Demand for Loanable Funds • Government Policies That Affect Saving and Investment – Taxes and saving – Taxes and investment – Government budget deficits and surpluses

Supply and Demand for Loanable Funds • Government Policies That Affect Saving and Investment – Taxes and saving – Taxes and investment – Government budget deficits and surpluses

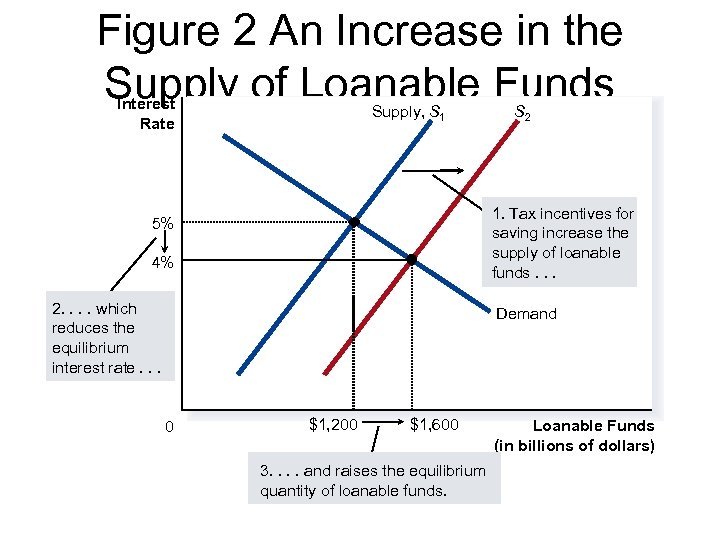

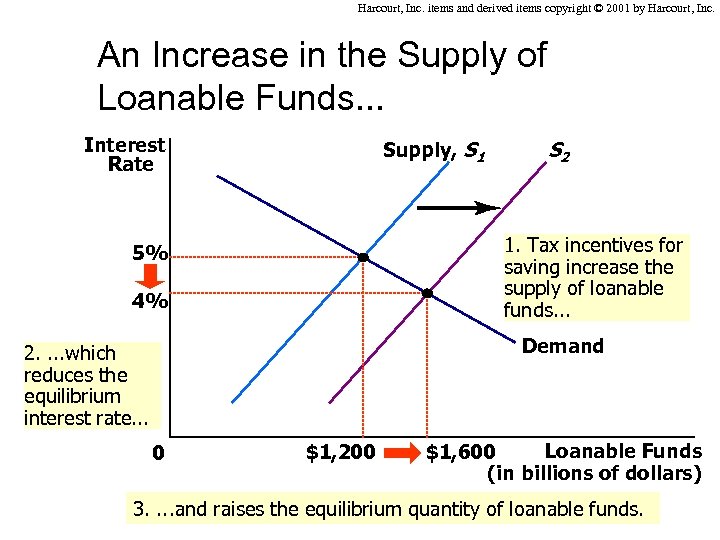

Policy 1: Saving Incentives • Taxes on interest income substantially reduce the future payoff from current saving and, as a result, reduce the incentive to save. • A tax decrease increases the incentive for households to save at any given interest rate. – The supply of loanable funds curve shifts right. – The equilibrium interest rate decreases. – The quantity demanded for loanable funds increases.

Policy 1: Saving Incentives • Taxes on interest income substantially reduce the future payoff from current saving and, as a result, reduce the incentive to save. • A tax decrease increases the incentive for households to save at any given interest rate. – The supply of loanable funds curve shifts right. – The equilibrium interest rate decreases. – The quantity demanded for loanable funds increases.

Figure 2 An Increase in the Supply of Loanable Funds Interest Rate Supply, S 1 S 2 1. Tax incentives for saving increase the supply of loanable funds. . . 5% 4% 2. . which reduces the equilibrium interest rate. . . Demand 0 $1, 200 $1, 600 3. . and raises the equilibrium quantity of loanable funds. Loanable Funds (in billions of dollars)

Figure 2 An Increase in the Supply of Loanable Funds Interest Rate Supply, S 1 S 2 1. Tax incentives for saving increase the supply of loanable funds. . . 5% 4% 2. . which reduces the equilibrium interest rate. . . Demand 0 $1, 200 $1, 600 3. . and raises the equilibrium quantity of loanable funds. Loanable Funds (in billions of dollars)

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc. An Increase in the Supply of Loanable Funds. . . Interest Rate Supply, S 1 S 2 1. Tax incentives for saving increase the supply of loanable funds. . . 5% 4% Demand 2. . which reduces the equilibrium interest rate. . . 0 $1, 200 Loanable Funds $1, 600 (in billions of dollars) 3. . and raises the equilibrium quantity of loanable funds.

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc. An Increase in the Supply of Loanable Funds. . . Interest Rate Supply, S 1 S 2 1. Tax incentives for saving increase the supply of loanable funds. . . 5% 4% Demand 2. . which reduces the equilibrium interest rate. . . 0 $1, 200 Loanable Funds $1, 600 (in billions of dollars) 3. . and raises the equilibrium quantity of loanable funds.

Policy 1: Saving Incentives • If a change in tax law encourages greater saving, the result will be lower interest rates and greater investment.

Policy 1: Saving Incentives • If a change in tax law encourages greater saving, the result will be lower interest rates and greater investment.

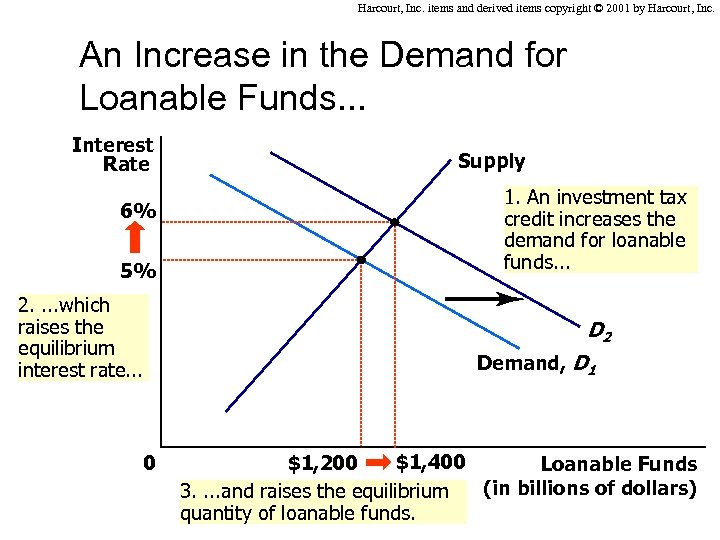

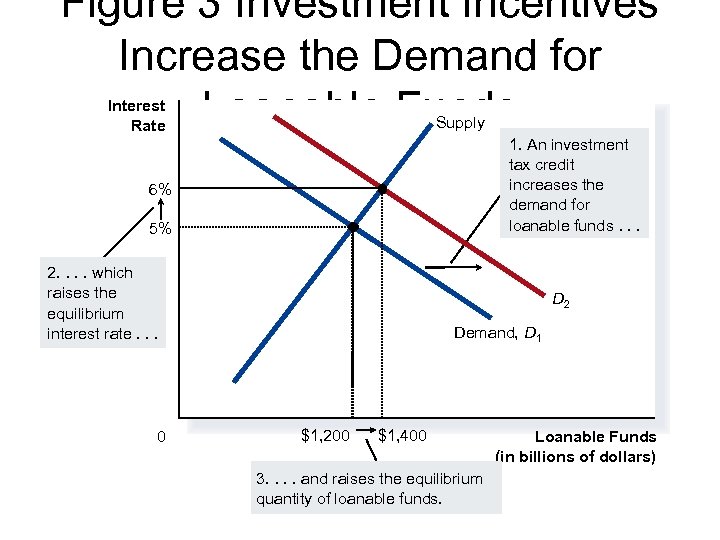

Policy 2: Investment Incentives • An investment tax credit increases the incentive to borrow. • Increases the demand for loanable funds. • Shifts the demand curve to the right. • Results in a higher interest rate and a greater quantity saved.

Policy 2: Investment Incentives • An investment tax credit increases the incentive to borrow. • Increases the demand for loanable funds. • Shifts the demand curve to the right. • Results in a higher interest rate and a greater quantity saved.

Policy 2: Investment Incentives • If a change in tax laws encourages greater investment, the result will be higher interest rates and greater saving.

Policy 2: Investment Incentives • If a change in tax laws encourages greater investment, the result will be higher interest rates and greater saving.

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc. An Increase in the Demand for Loanable Funds. . . Interest Rate 6% 5% 2. . which raises the equilibrium interest rate. . . 0 Supply 1. An investment tax credit increases the demand for loanable funds. . . D 2 Demand, D 1 $1, 400 $1, 200 Loanable Funds (in billions of dollars) 3. . and raises the equilibrium quantity of loanable funds.

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc. An Increase in the Demand for Loanable Funds. . . Interest Rate 6% 5% 2. . which raises the equilibrium interest rate. . . 0 Supply 1. An investment tax credit increases the demand for loanable funds. . . D 2 Demand, D 1 $1, 400 $1, 200 Loanable Funds (in billions of dollars) 3. . and raises the equilibrium quantity of loanable funds.

Figure 3 Investment Incentives Increase the Demand for Loanable Funds Interest Rate Supply 1. An investment tax credit increases the demand for loanable funds. . . 6% 5% 2. . which raises the equilibrium interest rate. . . 0 D 2 Demand, D 1 $1, 200 $1, 400 3. . and raises the equilibrium quantity of loanable funds. Loanable Funds (in billions of dollars)

Figure 3 Investment Incentives Increase the Demand for Loanable Funds Interest Rate Supply 1. An investment tax credit increases the demand for loanable funds. . . 6% 5% 2. . which raises the equilibrium interest rate. . . 0 D 2 Demand, D 1 $1, 200 $1, 400 3. . and raises the equilibrium quantity of loanable funds. Loanable Funds (in billions of dollars)

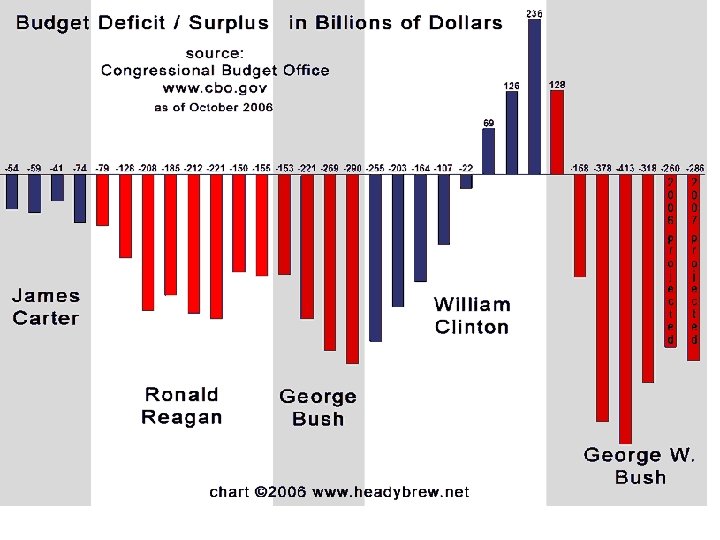

Policy 3: Government Budget Deficits and Surpluses • When the government spends more than it receives in tax revenues, the short fall is called the budget deficit. • The accumulation of past budget deficits is called the government debt.

Policy 3: Government Budget Deficits and Surpluses • When the government spends more than it receives in tax revenues, the short fall is called the budget deficit. • The accumulation of past budget deficits is called the government debt.

• Budget Deficit • Budget Surplus-

• Budget Deficit • Budget Surplus-

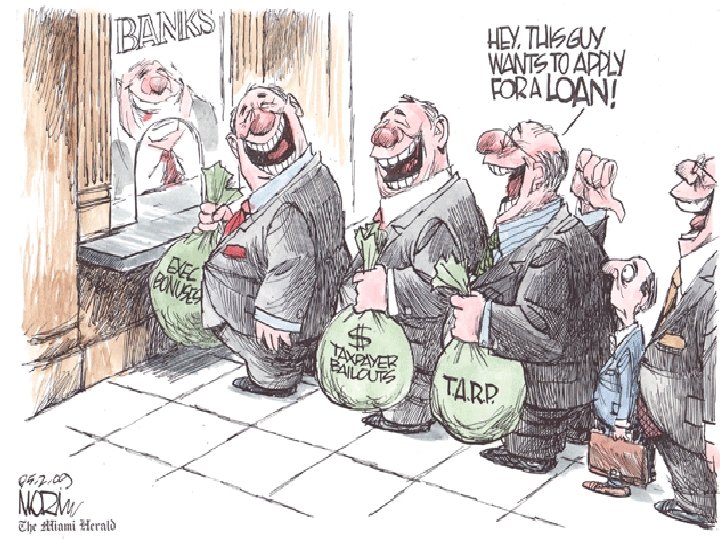

Policy 3: Government Budget Deficits and Surpluses • Government borrowing to finance its budget deficit reduces the supply of loanable funds available to finance investment by households and firms. • This fall in investment is referred to as Crowding Out EFFECT – The deficit borrowing crowds out private borrowers who are trying to finance investments.

Policy 3: Government Budget Deficits and Surpluses • Government borrowing to finance its budget deficit reduces the supply of loanable funds available to finance investment by households and firms. • This fall in investment is referred to as Crowding Out EFFECT – The deficit borrowing crowds out private borrowers who are trying to finance investments.

• Crowding out effect-govt taking all the money so cost families more to borrow because there is less money available.

• Crowding out effect-govt taking all the money so cost families more to borrow because there is less money available.

Policy 3: Government Budget Deficits and Surpluses • A budget deficit decreases the supply of loanable funds. • Shifts the supply curve to the left. • Increases the equilibrium interest rate. • Reduces the equilibrium quantity of loanable funds.

Policy 3: Government Budget Deficits and Surpluses • A budget deficit decreases the supply of loanable funds. • Shifts the supply curve to the left. • Increases the equilibrium interest rate. • Reduces the equilibrium quantity of loanable funds.

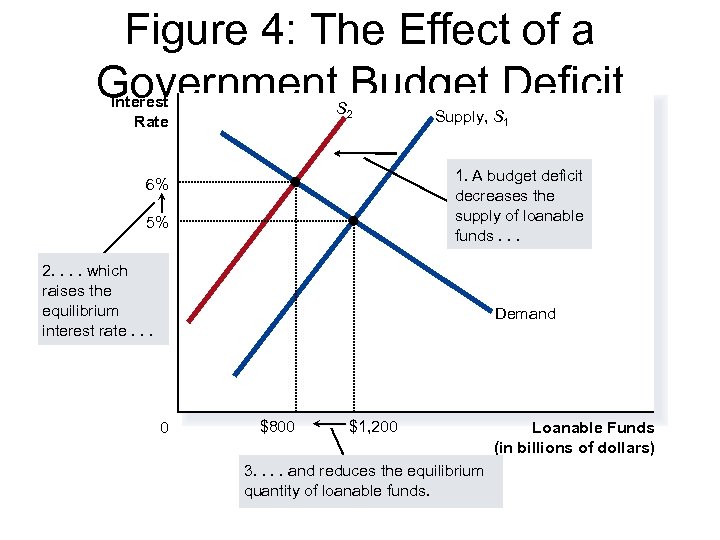

Figure 4: The Effect of a Government Budget Deficit Interest Rate S 2 Supply, S 1 1. A budget deficit decreases the supply of loanable funds. . . 6% 5% 2. . which raises the equilibrium interest rate. . . Demand 0 $800 $1, 200 3. . and reduces the equilibrium quantity of loanable funds. Loanable Funds (in billions of dollars)

Figure 4: The Effect of a Government Budget Deficit Interest Rate S 2 Supply, S 1 1. A budget deficit decreases the supply of loanable funds. . . 6% 5% 2. . which raises the equilibrium interest rate. . . Demand 0 $800 $1, 200 3. . and reduces the equilibrium quantity of loanable funds. Loanable Funds (in billions of dollars)

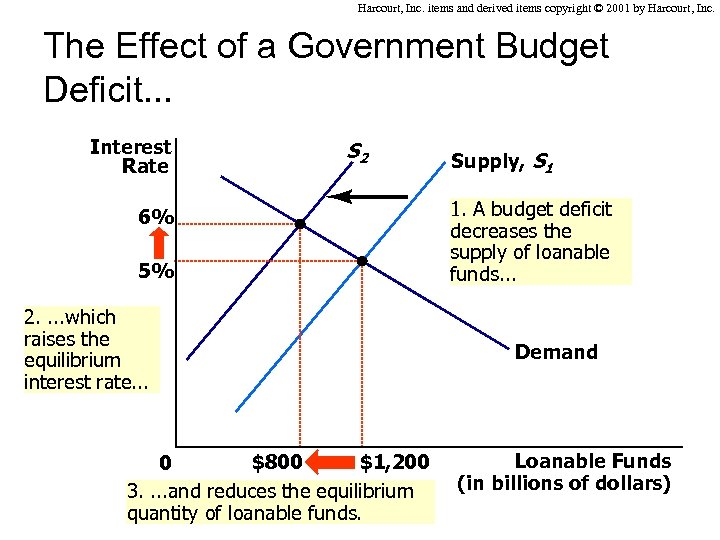

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc. The Effect of a Government Budget Deficit. . . Interest Rate S 2 6% 5% 2. . which raises the equilibrium interest rate. . . $1, 200 $800 0 3. . and reduces the equilibrium quantity of loanable funds. Supply, S 1 1. A budget deficit decreases the supply of loanable funds. . . Demand Loanable Funds (in billions of dollars)

Harcourt, Inc. items and derived items copyright © 2001 by Harcourt, Inc. The Effect of a Government Budget Deficit. . . Interest Rate S 2 6% 5% 2. . which raises the equilibrium interest rate. . . $1, 200 $800 0 3. . and reduces the equilibrium quantity of loanable funds. Supply, S 1 1. A budget deficit decreases the supply of loanable funds. . . Demand Loanable Funds (in billions of dollars)

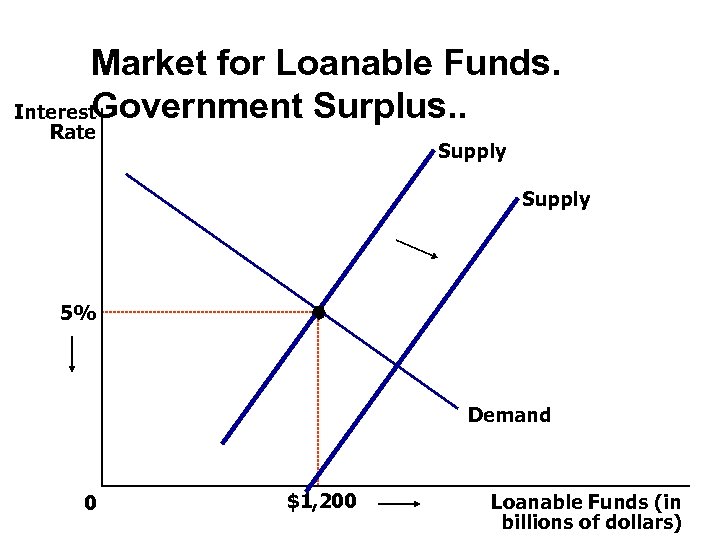

Policy 3: Government Budget Deficits and Surpluses • When government reduces national saving by running a deficit, the interest rate rises and investment falls. • A budget surplus increases the supply of loanable funds, reduces the interest rate, and stimulates investment.

Policy 3: Government Budget Deficits and Surpluses • When government reduces national saving by running a deficit, the interest rate rises and investment falls. • A budget surplus increases the supply of loanable funds, reduces the interest rate, and stimulates investment.

Market for Loanable Funds. Government Surplus. . Interest Rate Supply 5% Demand 0 $1, 200 Loanable Funds (in billions of dollars)

Market for Loanable Funds. Government Surplus. . Interest Rate Supply 5% Demand 0 $1, 200 Loanable Funds (in billions of dollars)

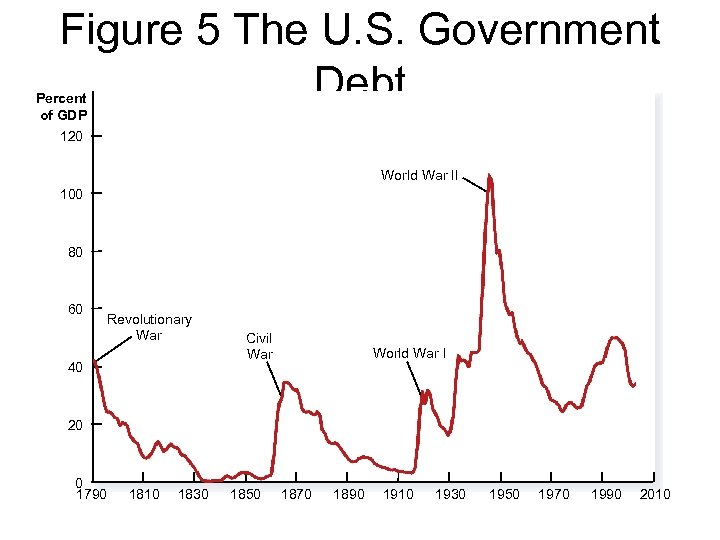

Figure 5 The U. S. Government Debt Percent of GDP 120 World War II 100 80 60 Revolutionary War 40 Civil War World War I 20 0 1790 1810 1830 1850 1870 1890 1910 1930 1950 1970 1990 2010

Figure 5 The U. S. Government Debt Percent of GDP 120 World War II 100 80 60 Revolutionary War 40 Civil War World War I 20 0 1790 1810 1830 1850 1870 1890 1910 1930 1950 1970 1990 2010

• The U. S. financial system is made up of financial institutions such as the bond market, the stock market, banks, and mutual funds. • All these institutions act to direct the resources of households who want to save some of their income into the hands of households and firms who want to borrow.

• The U. S. financial system is made up of financial institutions such as the bond market, the stock market, banks, and mutual funds. • All these institutions act to direct the resources of households who want to save some of their income into the hands of households and firms who want to borrow.

• National income accounting identities reveal some important relationships among macroeconomic variables. • In particular, in a closed economy, national saving must equal investment. • Financial institutions attempt to match one person’s saving with another person’s investment.

• National income accounting identities reveal some important relationships among macroeconomic variables. • In particular, in a closed economy, national saving must equal investment. • Financial institutions attempt to match one person’s saving with another person’s investment.

• The interest rate is determined by the supply and demand for loanable funds. • The supply of loanable funds comes from households who want to save some of their income. • The demand for loanable funds comes from households and firms who want to borrow for investment.

• The interest rate is determined by the supply and demand for loanable funds. • The supply of loanable funds comes from households who want to save some of their income. • The demand for loanable funds comes from households and firms who want to borrow for investment.

• National saving equals private saving plus public saving. • A government budget deficit represents negative public saving and, therefore, reduces national saving and the supply of loanable funds. • When a government budget deficit crowds out investment, it reduces the growth of productivity and GDP.

• National saving equals private saving plus public saving. • A government budget deficit represents negative public saving and, therefore, reduces national saving and the supply of loanable funds. • When a government budget deficit crowds out investment, it reduces the growth of productivity and GDP.

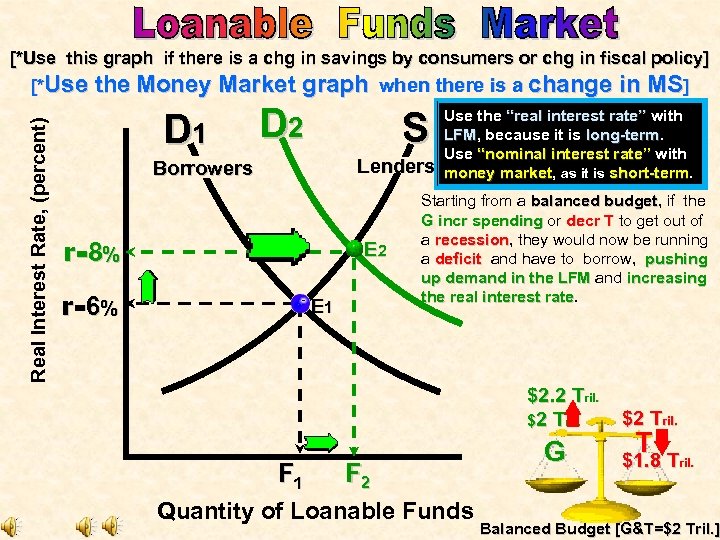

Real Interest Rate, (percent) [*Use this graph if there is a chg in savings by consumers or chg in fiscal policy] [*Use the Money Market graph when there is a change in MS] D 1 D 2 S Lenders Borrowers r= 8 % E 2 r= 6 % E 1 Use the “real interest rate” with LFM, because it is long-term. LFM long-term Use “nominal interest rate” with money market, as it is short-term. market short-term Starting from a balanced budget, if the budget G incr spending or decr T to get out of spending T a recession, they would now be running recession a deficit and have to borrow, pushing deficit up demand in the LFM and increasing LFM the real interest rate $2. 2 Tril. . ril $2 Tril. F 1 F 2 Quantity of Loanable Funds G $2 Tril. . ril T $1. 8 Tril. . $1. 8 Tril Balanced Budget [G&T=$2 Tril. ]

Real Interest Rate, (percent) [*Use this graph if there is a chg in savings by consumers or chg in fiscal policy] [*Use the Money Market graph when there is a change in MS] D 1 D 2 S Lenders Borrowers r= 8 % E 2 r= 6 % E 1 Use the “real interest rate” with LFM, because it is long-term. LFM long-term Use “nominal interest rate” with money market, as it is short-term. market short-term Starting from a balanced budget, if the budget G incr spending or decr T to get out of spending T a recession, they would now be running recession a deficit and have to borrow, pushing deficit up demand in the LFM and increasing LFM the real interest rate $2. 2 Tril. . ril $2 Tril. F 1 F 2 Quantity of Loanable Funds G $2 Tril. . ril T $1. 8 Tril. . $1. 8 Tril Balanced Budget [G&T=$2 Tril. ]

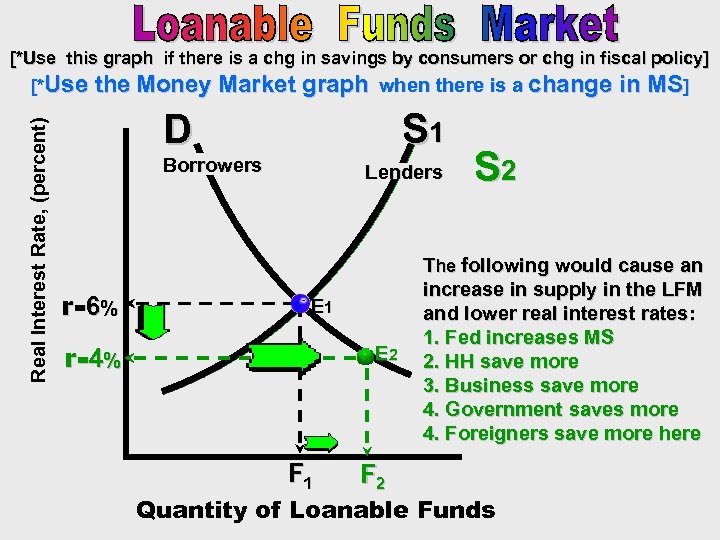

Real Interest Rate, (percent) [*Use this graph if there is a chg in savings by consumers or chg in fiscal policy] [*Use the Money Market graph when there is a change in MS] S 1 D Borrowers r= 6 % Lenders E 1 r= 4 % E 2 F 1 F 2 S 2 The following would cause an increase in supply in the LFM and lower real interest rates: 1. Fed increases MS 2. HH save more 3. Business save more 4. Government saves more 4. Foreigners save more here Quantity of Loanable Funds

Real Interest Rate, (percent) [*Use this graph if there is a chg in savings by consumers or chg in fiscal policy] [*Use the Money Market graph when there is a change in MS] S 1 D Borrowers r= 6 % Lenders E 1 r= 4 % E 2 F 1 F 2 S 2 The following would cause an increase in supply in the LFM and lower real interest rates: 1. Fed increases MS 2. HH save more 3. Business save more 4. Government saves more 4. Foreigners save more here Quantity of Loanable Funds

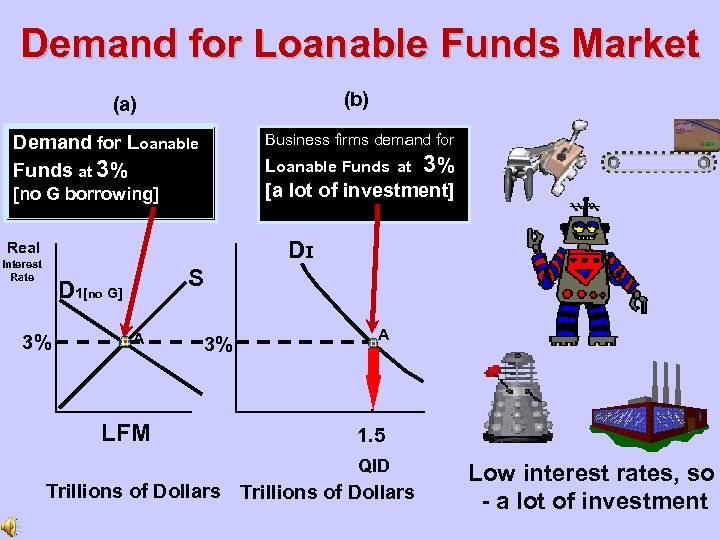

Demand for Loanable Funds Market (b) (a) Business firms demand for Demand for Loanable Funds at 3% [a lot of investment] [no G borrowing] DI Real Interest Rate S D 1[no G] 3% A LFM 3% A 1. 5 QID Trillions of Dollars Low interest rates, so - a lot of investment

Demand for Loanable Funds Market (b) (a) Business firms demand for Demand for Loanable Funds at 3% [a lot of investment] [no G borrowing] DI Real Interest Rate S D 1[no G] 3% A LFM 3% A 1. 5 QID Trillions of Dollars Low interest rates, so - a lot of investment

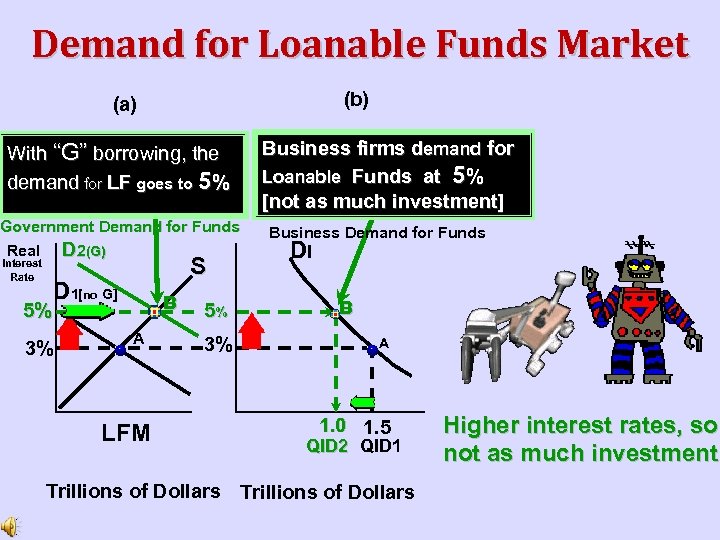

Demand for Loanable Funds Market (b) (a) With “G” borrowing, the demand for LF goes to 5% Government Demand for Funds Real D 2(G) Interest Rate 5% S D 1[no G] 3% B A LFM 5% 3% Business firms demand for Loanable Funds at 5% [not as much investment] Business Demand for Funds DI B A 1. 0 1. 5 QID 2 QID 1 Trillions of Dollars Higher interest rates, so not as much investment

Demand for Loanable Funds Market (b) (a) With “G” borrowing, the demand for LF goes to 5% Government Demand for Funds Real D 2(G) Interest Rate 5% S D 1[no G] 3% B A LFM 5% 3% Business firms demand for Loanable Funds at 5% [not as much investment] Business Demand for Funds DI B A 1. 0 1. 5 QID 2 QID 1 Trillions of Dollars Higher interest rates, so not as much investment

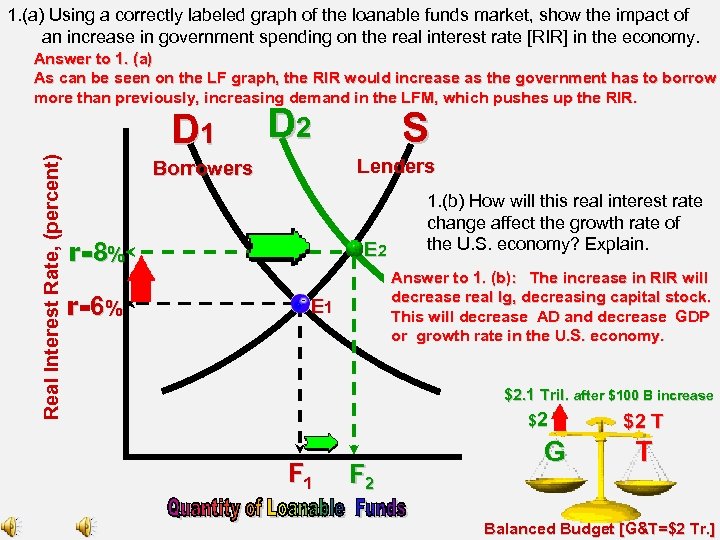

1. (a) Using a correctly labeled graph of the loanable funds market, show the impact of an increase in government spending on the real interest rate [RIR] in the economy. Answer to 1. (a) As can be seen on the LF graph, the RIR would increase as the government has to borrow more than previously, increasing demand in the LFM, which pushes up the RIR. Real Interest Rate, (percent) D 1 D 2 Lenders Borrowers r= 8 % r= 6 % S E 2 1. (b) How will this real interest rate change affect the growth rate of the U. S. economy? Explain. Answer to 1. (b): The increase in RIR will decrease real Ig, decreasing capital stock. This will decrease AD and decrease GDP or growth rate in the U. S. economy. E 1 $2. 1 Tril. after $100 B increase $2 T F 1 F 2 G $2 T T Balanced Budget [G&T=$2 Tr. ]

1. (a) Using a correctly labeled graph of the loanable funds market, show the impact of an increase in government spending on the real interest rate [RIR] in the economy. Answer to 1. (a) As can be seen on the LF graph, the RIR would increase as the government has to borrow more than previously, increasing demand in the LFM, which pushes up the RIR. Real Interest Rate, (percent) D 1 D 2 Lenders Borrowers r= 8 % r= 6 % S E 2 1. (b) How will this real interest rate change affect the growth rate of the U. S. economy? Explain. Answer to 1. (b): The increase in RIR will decrease real Ig, decreasing capital stock. This will decrease AD and decrease GDP or growth rate in the U. S. economy. E 1 $2. 1 Tril. after $100 B increase $2 T F 1 F 2 G $2 T T Balanced Budget [G&T=$2 Tr. ]

![Real Interest Rate, (percent) [3 pts] Using a correctly labeled graph of the loanable Real Interest Rate, (percent) [3 pts] Using a correctly labeled graph of the loanable](https://present5.com/presentation/571dca39966ba9a0a5bc13600dc2b25c/image-79.jpg) Real Interest Rate, (percent) [3 pts] Using a correctly labeled graph of the loanable funds market, market show a decision by households to increase saving for retirement will affect the real interest rate in the short run. retirement rate D r 1 S 1 [3 points showing correctly labeled graph, showing increase in supply & real I. R. dropping. ] E 1 r 2 S 2 E 2 F 1 F 2 Quantity of Loanable Funds Answer: If householders save more the banks have more money to loan out [S 2] which would decrease the real interest rate [to r 2].

Real Interest Rate, (percent) [3 pts] Using a correctly labeled graph of the loanable funds market, market show a decision by households to increase saving for retirement will affect the real interest rate in the short run. retirement rate D r 1 S 1 [3 points showing correctly labeled graph, showing increase in supply & real I. R. dropping. ] E 1 r 2 S 2 E 2 F 1 F 2 Quantity of Loanable Funds Answer: If householders save more the banks have more money to loan out [S 2] which would decrease the real interest rate [to r 2].

![2. [6 pts] Assume that as a result of increased political instability, investors move 2. [6 pts] Assume that as a result of increased political instability, investors move](https://present5.com/presentation/571dca39966ba9a0a5bc13600dc2b25c/image-81.jpg) 2. [6 pts] Assume that as a result of increased political instability, investors move pts Real Interest Rate, (%) their funds out of the country of Tara. (a) [2 pts] How will this decision by investors affect the international value of Tara’s pts currency on the foreign exchange market? Explain. Answer to 2. (a) As foreign investors pull their money out of Tara, there would be a decrease in demand for their currency, which would depreciate their currency. [ 2 pts for saying their currency depreciates because demand for it decreases. ] (b) [2 pts] Using a graph of the loanable funds market in Tara, show the impact pts Tara of foreign investors pulling money out on Tara on their real interest rates. S 2 D LFM r 2 r 1 E 2 E 1 S 1 Answer to 2. (b) As can be seen on the graph, as foreign investors pull their money out of Tara, there is a decrease in their supply of loanable funds [1 pt], increasing the RIR [1 pt]. F 2 F 1 Quantity of Loanable Funds (c) [2 pts] Given your answer in part b, what will happen to Tara’s rate of economic pts growth? Explain. Answer to 2. (c) As the RIR increases, it becomes less profitable for firms to invest in capital equipment, which decreases economic growth. [1 point for decrease in growth rate and 1 point for decrease in capital formation {can’t just say “investment”}, but capital formation or equipment. ]

2. [6 pts] Assume that as a result of increased political instability, investors move pts Real Interest Rate, (%) their funds out of the country of Tara. (a) [2 pts] How will this decision by investors affect the international value of Tara’s pts currency on the foreign exchange market? Explain. Answer to 2. (a) As foreign investors pull their money out of Tara, there would be a decrease in demand for their currency, which would depreciate their currency. [ 2 pts for saying their currency depreciates because demand for it decreases. ] (b) [2 pts] Using a graph of the loanable funds market in Tara, show the impact pts Tara of foreign investors pulling money out on Tara on their real interest rates. S 2 D LFM r 2 r 1 E 2 E 1 S 1 Answer to 2. (b) As can be seen on the graph, as foreign investors pull their money out of Tara, there is a decrease in their supply of loanable funds [1 pt], increasing the RIR [1 pt]. F 2 F 1 Quantity of Loanable Funds (c) [2 pts] Given your answer in part b, what will happen to Tara’s rate of economic pts growth? Explain. Answer to 2. (c) As the RIR increases, it becomes less profitable for firms to invest in capital equipment, which decreases economic growth. [1 point for decrease in growth rate and 1 point for decrease in capital formation {can’t just say “investment”}, but capital formation or equipment. ]

![Real Interest Rate, (%) 1. A. [2 pts] In order to finance an increase Real Interest Rate, (%) 1. A. [2 pts] In order to finance an increase](https://present5.com/presentation/571dca39966ba9a0a5bc13600dc2b25c/image-83.jpg) Real Interest Rate, (%) 1. A. [2 pts] In order to finance an increase in government spending on national defense, the government borrows funds from the public. Using a correctly labeled graph of the loanable funds market, show the effect of the government’s borrowing on the real interest rate. B. [2 pts] Given the change in the real interest rate in part (d), what is the impact on each of the following? (i) Investment (ii) Economic growth rate. Explain. D 2 LFM D 1 r 2 r 1 E 2 E 1 S Answer to 1. A. 1 pt for correctly labeled graph of the LFM. 1 pt for showing a rightward shift of the demand OR curve resulting in a higher interest rate a leftward shift of the supply curve resulting in a higher RIR. F 1 F 2 Quantity of Loanable Funds Answer to 1. B. (i) [1 pt] The higher RIR will result in less investment in tools and machinery. 1. B. (ii) [1 pt] The decrease in tools and machinery will decrease overall productivity and economic growth [capital stock].

Real Interest Rate, (%) 1. A. [2 pts] In order to finance an increase in government spending on national defense, the government borrows funds from the public. Using a correctly labeled graph of the loanable funds market, show the effect of the government’s borrowing on the real interest rate. B. [2 pts] Given the change in the real interest rate in part (d), what is the impact on each of the following? (i) Investment (ii) Economic growth rate. Explain. D 2 LFM D 1 r 2 r 1 E 2 E 1 S Answer to 1. A. 1 pt for correctly labeled graph of the LFM. 1 pt for showing a rightward shift of the demand OR curve resulting in a higher interest rate a leftward shift of the supply curve resulting in a higher RIR. F 1 F 2 Quantity of Loanable Funds Answer to 1. B. (i) [1 pt] The higher RIR will result in less investment in tools and machinery. 1. B. (ii) [1 pt] The decrease in tools and machinery will decrease overall productivity and economic growth [capital stock].