f27e9eaff8b8712c2b8b90fcb71ecdba.ppt

- Количество слайдов: 33

NATIONAL CREDIT REGULATOR A BRIEFING TO THE PORTFOLIO COMMITTEE ON TRADE AND INDUSTRY: NCR STRATEGIC PLAN 2015/16 – 2019/20 & 3 YEAR ANNUAL PERFOMANCE PLAN 2015/16 – 2017/18 PRESENTED BY MS NOMSA MOTSHEGARE (NCR CEO) 14 April 2015 1

MANDATE OF THE NCR q It is established in terms of the section 12 of the National Credit Act (NCA). q Its main purpose is to regulate consumer credit, monitor compliance and enforce the NCA. q The National Credit Amendment Act (NCAA): assented to and signed by the President on 19 May 2014; proclamation signed and regulation published on 13 March 2015 2

OVERVIEW OF THE PRESENTAION v Vision and Mission v NCR Programmes: Snapshot v Government Priorities v Dti Priorities: outcome 4 v Programmes 1 -5 v 3 Year annual performance plan 2015 -2018 v Budget: 2015/16 – 2019/20 v Possible challenges for programmes 1 -5 v Remedies for challenges to programmes 1 -5 3

VISION & MISSION VISION v To promote a South African consumer credit market that is fair, transparent, accessible and dynamic. MISSION To support the social and economic advancement of South Africa, by: v regulating for a fair and non-discriminatory market for access to consumer credit; and v promoting responsible credit granting, use and effective redress. 4

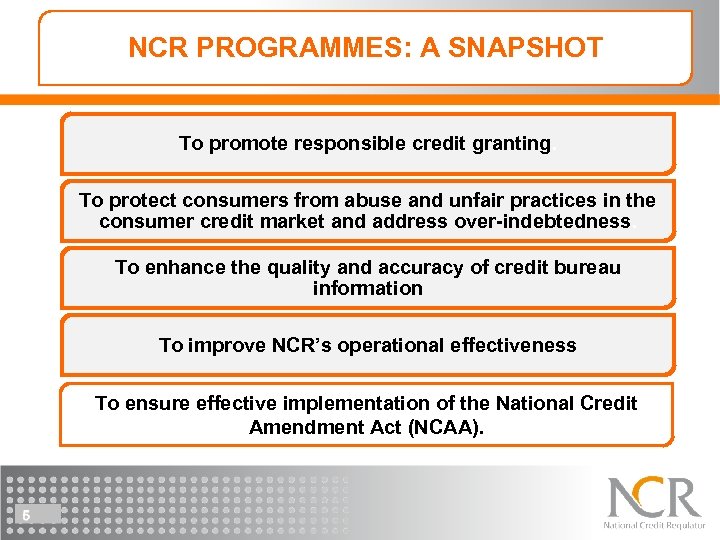

NCR PROGRAMMES: A SNAPSHOT To promote responsible credit granting. To protect consumers from abuse and unfair practices in the consumer credit market and address over-indebtedness. To enhance the quality and accuracy of credit bureau information To improve NCR’s operational effectiveness To ensure effective implementation of the National Credit Amendment Act (NCAA).

GOVERNMENT PRIORITIES MTSF 2014 -2019 Targets: Increasing employment & reducing unemployment Increase share in h/hold income of the poorest of h/holds MTSF = Medium Term Strategic Framework h/holds = households NDP aim: Eliminate poverty, reduce inequalities & unemployment

THE dti PRIORITY: OUTCOME 4 To achieve this national goal, the dti, plays a pivotal role in ensuring the achievement of Outcome 4. OUTCOME 4 Decent Employment through Inclusive Economic Growth.

PROGRAMME (1) dti Strategic Outcome – oriented goals Facilitate broad-based economic participation through targeted interventions to achieve more inclusive economic growth. 8 NCR To promote responsible credit granting

PROGRAMME (2) dti Strategic Outcome – oriented goals Create a fair regulatory environment that enables investment, trade and enterprise development in an equitable and socially responsible manner 9 NCR To protect consumers from abuse and unfair practices in the consumer credit market and address over-indebtedness. To ensure effective implementation of the NCAA.

PROGRAMME (3) dti Strategic Outcome – oriented goals Facilitate broad-based economic participation through targeted interventions to achieve more inclusive economic growth 10 NCR To enhance the quality & accuracy of credit bureau information

PROGRAMMES (4&5) dti Strategic Outcome – oriented goals Promote a professional, ethical, dynamic, competitive and customer-focused work environment that ensures effective and efficient service delivery 11 NCR To promote NCR’s operational effectiveness To ensure effective implementation of the NCAA

3 YEAR ANNUAL PERFOMANCE PLAN Programme 1: To promote responsible credit granting. Goal/ Outcome Output Reduced levels of Improve over-indebtedness. compliance with affordability assessment regulations. Performance Indicator/ measure Estimate Performance 2014/15 1 workshop • Number of workshops conducted on affordability assessment regulations and appropriate enforcement action taken where necessary. Medium Term Targets 2015/16 • 9 workshops conducted on affordability assessment regulations. 2016/17 2017/18 9 provinces visited to monitor credit provider compliance and appropriate enforcement action taken on non-compliant credit providers where necessary 12 enforcement where necessary.

3 YEAR ANNUAL PERFOMANCE PLAN Programme 1: To promote responsible credit granting Goal/ Outcome Output Reduced levels of Improve over-indebtedness. compliance with affordability assessment regulations. 13 Performance Indicator/ measure Estimate Performance 2014/15 R 6. 6 m • Number of provinces visited to monitor compliance and appropriate enforcement action takenwhere necessary. Medium Term Targets 2015/16 2016/17 R 7. 6 m • 9 provinces visited to monitor credit provider compliance and appropriate enforcement action taken on noncompliant credit providers where necessary 2017/18 R 8. 4 m

3 YEAR ANNUAL PERFOMANCE PLAN Programme 1: To promote responsible credit granting Goal/ Outcome Output Performance Indicator/ measure Affordable levels of Increase • Number of credit promoted. compliance investigations with regulations conducted to pertaining to the total cost of credit enforce Estimate Performance 2014/15 Conduct a study to review the current levels of the total cost of credit. regulations and appropriate Medium Term Targets 2015/16 Conduct 10 investigations and appropriate enforcement action taken where necessary. 2016/17 Conduct 15 investigations and appropriate enforcement action taken where necessary. 2017/18 Conduct 18 investigations and appropriate enforcement action taken where necessary. 14 R 10. 4 m R 11. 1 m R 12. 8 m

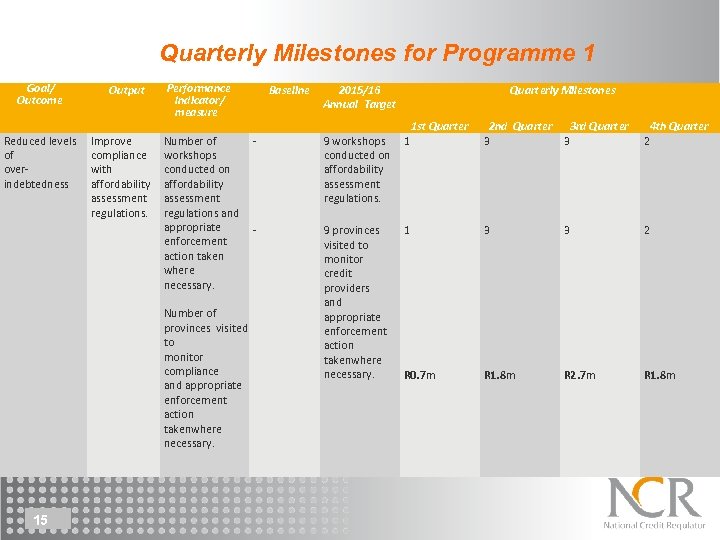

Quarterly Milestones for Programme 1 Goal/ Outcome Reduced levels of overindebtedness Output Improve compliance with affordability assessment regulations. Performance Indicator/ measure Number of workshops conducted on affordability assessment regulations and appropriate enforcement action taken where necessary. Number of provinces visited to monitor compliance and appropriate enforcement action takenwhere necessary. 15 Baseline 2015/16 Annual Target Quarterly Milestones 1 st Quarter 2 nd Quarter 3 rd Quarter 3 3 2 4 th Quarter - 9 workshops conducted on affordability assessment regulations. 1 - 9 provinces visited to monitor credit providers and appropriate enforcement action takenwhere necessary. 1 3 3 2 R 0. 7 m R 1. 8 m R 2. 7 m R 1. 8 m

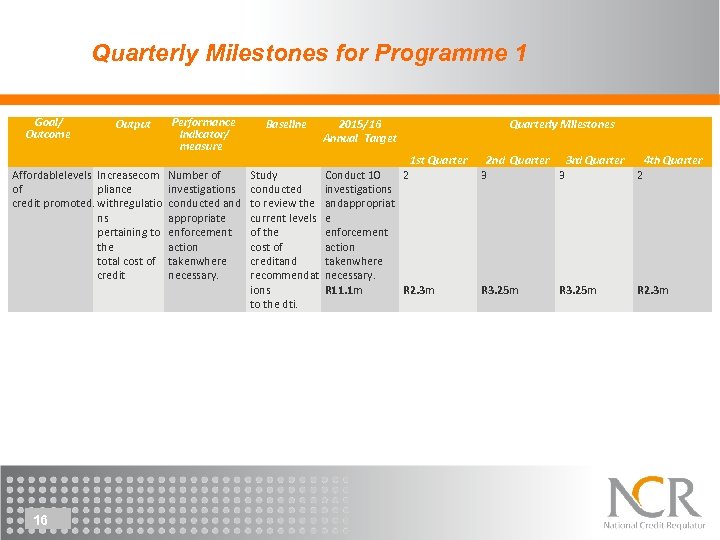

Quarterly Milestones for Programme 1 Goal/ Outcome Output Affordablelevels Increasecom of pliance credit promoted. withregulatio ns pertaining to the total cost of credit 16 Performance Indicator/ measure Baseline Number of investigations conducted and appropriate enforcement action takenwhere necessary. Study conducted to review the current levels of the cost of creditand recommendat ions to the dti. 2015/16 Annual Target 1 st Quarter Conduct 10 2 investigations andappropriat e enforcement action takenwhere necessary. R 11. 1 m R 2. 3 m Quarterly Milestones 2 nd Quarter 3 rd Quarter 3 3 2 R 3. 25 m R 2. 3 m R 3. 25 m 4 th Quarter

3 YEAR ANNUAL PERFOMANCE PLAN Programme 2: To protect consumers from abuse and unfair practices in the consumer credit market and address over-indebtedness. Goal/ Outcome Decreased levels of reckless lending practices. Output Number of credit providers investigated and appropriate enforcement action taken where necessary. Medium Term Targets 2015/16 2016/17 2017/18 15 Compliance notices/ compliance certificates where necessary. 20 credit providers investigated and appropriate enforcement action taken where necessary. 25 30 R 29 m 17 Conduct reckless lending investigations and appropriate enforcement action where necessary. Performance Estimate Indicator/ measure Performance 2014/15 R 30. 4 m R 32. 9 m R 35. 6 m

Quarterly Milestones for Programme 2 Goal/ Outcome Decreased levels of reckless lending practices. Output Conduct reckless lending investigations and appropriate enforcement action where necessary. Performance Indicator/ measure Number of credit providers investigated and appropriate enforcement action taken where necessary. Baseline 15 Compliance notices issued and compliance certificate where necessary. 2015/16 Annual Target Quarter 20 credit 4 providers investigated and appropriate enforcement action taken where necessary. R 30. 4 m 18 Quarterly Milestones 1 st 2 nd Quarter 6 R 5. 9 m R 9. 7 m 3 rd Quarter 4 th Quarter 5 5 R 7. 4 m

3 YEAR ANNUAL PERFOMANCE PLAN Programme 3: To enhance the quality and accuracy of credit bureau information Goal/ Outcome Output Performance Indicator/ measure Estimate Performance 2014/15 Improved Increase consumer credit compliance by information. credit bureaus in respect of consumer credit information. 2015/16 2016/17 2017/18 2 credit bureau investigated and appropriate enforcement action taken where necessary. R 14 m 19 Number of credit bureau investigated and appropriate enforcement action taken where necessary. Medium Term Targets R 16 m R 17 m R 18. 5 m

3 YEAR ANNUL PERFOMANCE PLAN Programme 3: To enhance the quality and accuracy of credit bureau information. Goal/ Outcome Output Performance Indicator/ measure Estimate Performance 2014/15 Number of credit 14 credit bureau audited reports Reports reviewed. and appropriate enforcement action taken where necessary. R 9. 6 m 20 Medium Term Targets 2015/16 2016/17 2017/18 14 credit bureau audited reports reviewed and appropriate enforcement action taken where necessary. R 10. 3 m R 11. 5 m R 12. 3 m

3 YEAR ANNUAL PERFOMANCE PLAN Goal/ Outcome Output Performance Indicator/ measure Estimate Medium Term Targets Performance 2014/15 2015/16 2016/17 Number of credit 14 credit bureau audited reports Reports reviewed and reviewed appropriate and appropriate enforcement action taken where necessary. R 9. 6 m 21 R 10. 3 m R 11. 5 m 2017/18 14 credit bureau audited reports reviewed and appropriate enforcement action taken where necessary. R 12. 3 m

Quarterly Milestones for Programme 3 Goal/ Outcome Output Performance Indicator / measure Baseline Quarterly Milestones 2015/16 Annual Target 1 st Quarter 22 Increase compliance by credit bureaus in respect of consumer credit information. Number of credit bureaus investigated and appropriate enforcement action taken where necessary. Number of credit bureau audited reports reviewed and appropriate enforcement action taken where necessary. 2 credit bureaus investigated and appropriate enforcement action taken where necessary. 14 credit bureau audited reports reviewed. 3 rd Quarter 4 th Quarter 2 credit Draft Terms bureaus of investigated Reference. and appropriate enforcement action taken where necessary. Appoint Service provider and commence investigation. Continue with investigation and finalise. Take appropriate enforcement action where necessary. R 16 m Improved consumer credit information. 2 nd Quarter R 0. 500 m R 2 m R 9 m R 4. 5 m 14 credit bureau audited reports reviewed and appropriate enforcement action taken where necessary Review auditors reports from credit bureaus. Take appropriate enforcement action where necessary in terms of the audit reports. Continue to take appropriate enforcement action where necessary. R 10. 3 m R 1. 5 m R 3. 15 m R 2. 5 m

3 YEAR ANNUAL PERFOMANCE PLAN Programme 4: To improve NCR’s operational effectiveness Goal/ Outcome Output Efficient service Improve delivery. operational efficiency through automated processes. Performance Indicator/ measure Estimate Performance 2014/15 2015/16 2016/17 % of uptime Implementation 95% uptime of 96% uptime of availability of the IT system. recommendations of the ICT assessment. R 44. 1 m 23 Medium Term Targets R 42. 8 m R 46. 3 m 2017/18 97% uptime of the IT system. R 50. 1 m

Quarterly Milestones for Programme 4 Goal/ Outcome Efficient service delivery. Output Performanc e Indicator / measure Improve % of uptime operational availability of efficiency the IT system through automated systems Baseline 2015/16 Annual Target 1 st Quarter 2 nd Quarter 3 rd Quarter 4 th Quarter Implementat 95% uptime 95% uptime ion of of the IT of the IT recommend system. ations of the ICT assessment R 42. 8 m 24 Quarterly Milestones R 9. 8 m R 10. 9 m R 12. 1 m

3 YEAR ANNUAL PERFOMANCE PLAN Programme 5: To ensure effective implementation of the National Credit Amendment Act (NCAA) Goal/ Outcome Improved compliance with regulations and consumer protection Output Improve awareness and compliance Performance Indicator/ measure Number of workshops conducted with relevant stakeholders. Number of multimedia awareness campaigns (radio/ TV/interviews/ news print) conducted. 25 Estimate Performance Medium Term Targets 2014/15 2015/16 30 workshops 40 workshops with relevant stakeholders and monitor compliance with the NCAA. R 10 m R 9. 3 m 18 of any of the following: -Radio -TV -Interviews -News print and monitor compliance with the NCAA. R 2. 3 m 2016/17 45 workshops with relevant stakeholders 2017/18 50 workshops with relevant stakeholders. R 10. 8 m R 11. 2 m 30 of any of the following: - Radio - TV - Interviews - News print R 2 m R 2. 1 m R 2. 5 m

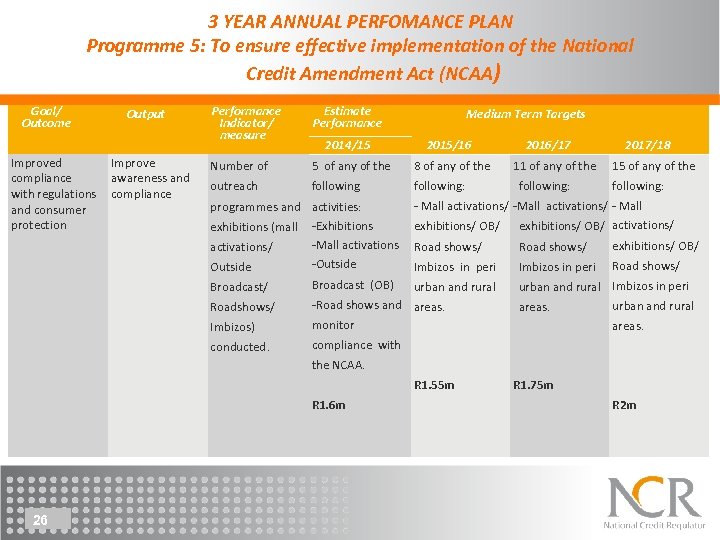

3 YEAR ANNUAL PERFOMANCE PLAN Programme 5: To ensure effective implementation of the National Credit Amendment Act (NCAA) Goal/ Outcome Improved compliance with regulations and consumer protection Output Improve awareness and compliance Performance Indicator/ measure Estimate Performance 2014/15 2015/16 Number of 5 of any of the 8 of any of the outreach following: programmes and activities: exhibitions (mall activations/ Outside Broadcast/ Roadshows/ Imbizos) conducted. -Exhibitions -Mall activations -Outside Broadcast (OB) -Road shows and monitor compliance with the NCAA. Medium Term Targets 26 11 of any of the following: 2017/18 15 of any of the following: - Mall activations/ - Mall exhibitions/ OB/ activations/ Road shows/ exhibitions/ OB/ Imbizos in peri Road shows/ urban and rural Imbizos in peri urban and rural areas. R 1. 55 m R 1. 6 m 2016/17 R 1. 75 m R 2 m

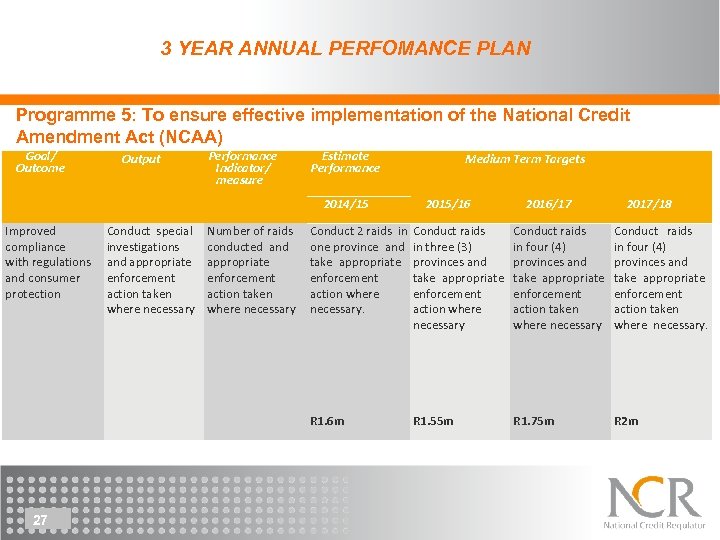

3 YEAR ANNUAL PERFOMANCE PLAN Programme 5: To ensure effective implementation of the National Credit Amendment Act (NCAA) Goal/ Outcome Output Performance Indicator/ measure Estimate Performance 2014/15 Improved compliance with regulations and consumer protection Number of raids conducted and appropriate enforcement action taken where necessary 2015/16 2016/17 2017/18 Conduct 2 raids in one province and take appropriate enforcement action where necessary. Conduct raids in three (3) provinces and take appropriate enforcement action where necessary Conduct raids in four (4) provinces and take appropriate enforcement action taken where necessary. R 1. 6 m 27 Conduct special investigations and appropriate enforcement action taken where necessary Medium Term Targets R 1. 55 m R 1. 75 m R 2 m

Quarterly Milestones for Programme 5 Goal/ Outcome Output Performance Indicator / measure Baseline 2015/16 Annual Target Quarterly Milestones 1 st Quarter 2 nd 3 rd Quarter 4 th Quarter 28 Improve awareness and compliance Number of 5 of any of the 8 of any of outreach following 2 2 R 0. 225 m Improved compliance with regulations and consumer protection R 0. 550 m R 0. 225 m R 0. 550 m the following: -Mall and special focus on activations exhibitions peri urban and -Exhibitions/ -OB/ Road (mall rural areas: shows/ Imbizos in activations/ -Exhibitions peri -Mall activations urban and Outside -Outside rural areas. Broadcast/ Road shows/ Broadcast (OB) -Road shows Imbizos) Imbizos and conducted. monitor compliance with R 1. 55 m the NCAA. programmes activities with

Quarterly Milestones for Programme 5 Goal/ Outcome Improved compliance with regulations and consumer protection Output Number of raids conducted and appropriate enforcement actions taken where necessary. Baseline Conduct 2 raids in one province and take appropriate enforcement action where necessary. 2015/16 Annual Target Quarterly Milestones 1 st Quarter 2 nd Quarter 3 rd Quarter 4 th Quarter Conduct Planning and Conduct 1 raids information raid in three (3) gathering. in one provinces province and take appropriate enforcement enforcemen action taken t action where necessary Conduct 1 raid in one province and appropriate enforcement action taken where necessary 1. 55 m 29 Conduct special investigation s and take appropriate enforcement action where necessary. Performance Indicator / measure R 0. 550 m R 0. 225 m

BUDGET FOR THE 2015/16 - 2019/20 30

POSSIBLE CHALLENGES FOR PROGRAMMES 1 -5 Possible reckless lending leading to over-indebtedness Low of non-response from registrants Inadequate reporting on the level of compliance from data sources i. e. accuracy, validity, meeting submission deadlines NCR presence in the rural & underserved communities Lack of understanding of the NCAA Inefficient service delivery Funding

REMEDIES FOR CHALLENGES TO PROGRAMMES 1 -5 q q Compliance monitoring: Affordability assessment Targeted consumer awareness & education initiatives Coordination with other regulators Regular compliance monitoring of registrants and enforcement of the Act q Funding Challenge: to find creative ways to perform some functions: Consumer education & research; continue to engage dti; fees for new registrants q Engagement with registrants & key stakeholders q Improve operational efficiency through improved automated processes 32

Thank You! www. ncr. org. za 33

f27e9eaff8b8712c2b8b90fcb71ecdba.ppt