879f0c2ffea8a3db7a2a06c6e24a9f10.ppt

- Количество слайдов: 40

NASFAA Graduate & Professional Issues Caucus (GPIC) Task Force and Federal Update Bob Coughlin MASFAA GPCC Symposium February 6, 2015

NASFAA Graduate & Professional Issues Caucus (GPIC) Task Force and Federal Update Bob Coughlin MASFAA GPCC Symposium February 6, 2015

NASFAA Task Force/Caucus o Project-focused n o o o More flexible Shorter time periods More inclusive for members to participate n o Specific topics Allows more members to be involved More responsive to acute needs

NASFAA Task Force/Caucus o Project-focused n o o o More flexible Shorter time periods More inclusive for members to participate n o Specific topics Allows more members to be involved More responsive to acute needs

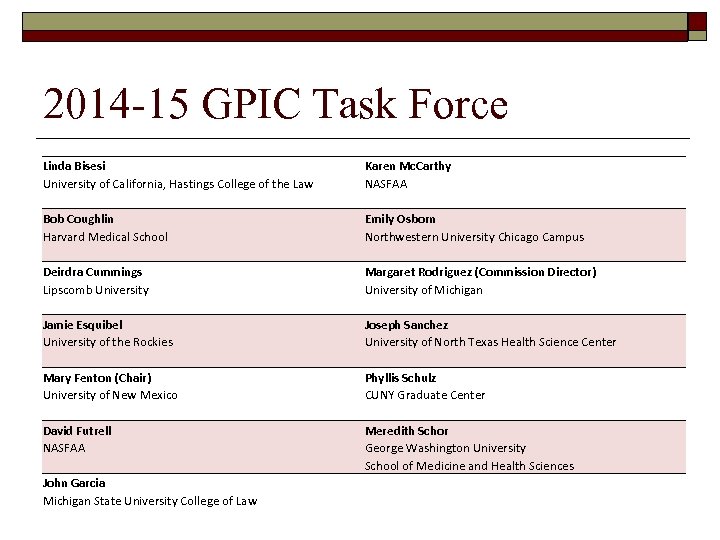

2014 -15 GPIC Task Force Linda Bisesi University of California, Hastings College of the Law Karen Mc. Carthy NASFAA Bob Coughlin Harvard Medical School Deirdra Cummings Lipscomb University Emily Osborn Northwestern University Chicago Campus Margaret Rodriguez (Commission Director) University of Michigan Jamie Esquibel University of the Rockies Mary Fenton (Chair) University of New Mexico Joseph Sanchez University of North Texas Health Science Center Phyllis Schulz CUNY Graduate Center David Futrell NASFAA John Garcia Michigan State University College of Law Meredith Schor George Washington University School of Medicine and Health Sciences

2014 -15 GPIC Task Force Linda Bisesi University of California, Hastings College of the Law Karen Mc. Carthy NASFAA Bob Coughlin Harvard Medical School Deirdra Cummings Lipscomb University Emily Osborn Northwestern University Chicago Campus Margaret Rodriguez (Commission Director) University of Michigan Jamie Esquibel University of the Rockies Mary Fenton (Chair) University of New Mexico Joseph Sanchez University of North Texas Health Science Center Phyllis Schulz CUNY Graduate Center David Futrell NASFAA John Garcia Michigan State University College of Law Meredith Schor George Washington University School of Medicine and Health Sciences

GPIC Priorities o Address specific needs or objectives of G/P community n o Discuss federal policy issues – effect on G/P sector Represent a voice for the G/P community n n Communicate through GPIC listserv Confer with ED officials as issues arise o n Provide awareness and policy impact on G/P sector Collaborate with outside organizations supporting G/P community o Ex: Access Group Financial Education Survey

GPIC Priorities o Address specific needs or objectives of G/P community n o Discuss federal policy issues – effect on G/P sector Represent a voice for the G/P community n n Communicate through GPIC listserv Confer with ED officials as issues arise o n Provide awareness and policy impact on G/P sector Collaborate with outside organizations supporting G/P community o Ex: Access Group Financial Education Survey

GPIC Activities (June 2014 – January 2015) o Policy Discussion Topics n n n n Perkins loan program SAP (repeat coursework) Citizenship documentation requirements Preparatory coursework and gainful employment Truth in lending requirements PPY tax data PSLF ED resources for G/P students

GPIC Activities (June 2014 – January 2015) o Policy Discussion Topics n n n n Perkins loan program SAP (repeat coursework) Citizenship documentation requirements Preparatory coursework and gainful employment Truth in lending requirements PPY tax data PSLF ED resources for G/P students

GPIC Activities (June 2014 – January 2015) o Hold monthly conference calls with FSA/ED n Loan/technical issues o o o o Grad vs undergrad entrance/exit counseling Servicer inconsistencies, customer service NSLDS, Clearinghouse PSLF – loan forgiveness application Interest capitalization Perkins benefits Consolidation Loans: 30+ loans, save button, grace period SAP

GPIC Activities (June 2014 – January 2015) o Hold monthly conference calls with FSA/ED n Loan/technical issues o o o o Grad vs undergrad entrance/exit counseling Servicer inconsistencies, customer service NSLDS, Clearinghouse PSLF – loan forgiveness application Interest capitalization Perkins benefits Consolidation Loans: 30+ loans, save button, grace period SAP

GPIC Activities o Conduct a visit to Capitol Hill (October 2014) n Talking points: o o n End origination fees Maintain PSLF program Maintain campus-based programs (Perkins, FWS) Maintain Grad PLUS program House Committee on Education and the Workforce congressional staff visited: o o o Rep. Mike Kelly (R-PA) Rep. Dave Loebsack (D-IA) Rep. Caroline Mc. Carthy (D-NY) Rep. Matt Salmon (R-AZ) Rep. Tim Walberg (R-MI)

GPIC Activities o Conduct a visit to Capitol Hill (October 2014) n Talking points: o o n End origination fees Maintain PSLF program Maintain campus-based programs (Perkins, FWS) Maintain Grad PLUS program House Committee on Education and the Workforce congressional staff visited: o o o Rep. Mike Kelly (R-PA) Rep. Dave Loebsack (D-IA) Rep. Caroline Mc. Carthy (D-NY) Rep. Matt Salmon (R-AZ) Rep. Tim Walberg (R-MI)

GPIC Activities o Propose G/P Discussion Topics for FSA Conference (December 2014) n Birds of a Feather o o o Origination fees – status Perkins program Grad PLUS counseling tool Title IV changes – effect on G/P schools Entrance/exit counseling specific to G/P students 150% rule

GPIC Activities o Propose G/P Discussion Topics for FSA Conference (December 2014) n Birds of a Feather o o o Origination fees – status Perkins program Grad PLUS counseling tool Title IV changes – effect on G/P schools Entrance/exit counseling specific to G/P students 150% rule

GPIC Activities o Propose G/P sessions for NASFAA Conference (July 2015) n n n n Educating ED and Congress about Graduate Education Financial Literacy for G/P Students Future of PSLF G/P Legislative Update G/P Orientation – Changing Practices G/P Town Hall Grad Schools: Your Map to IFAP (alternate session) HRSA Federal Update

GPIC Activities o Propose G/P sessions for NASFAA Conference (July 2015) n n n n Educating ED and Congress about Graduate Education Financial Literacy for G/P Students Future of PSLF G/P Legislative Update G/P Orientation – Changing Practices G/P Town Hall Grad Schools: Your Map to IFAP (alternate session) HRSA Federal Update

GPIC Activities o Prepare Final Report for NASFAA Board of Directors n n n Address Issues Provide Recommendations Describe Rationale

GPIC Activities o Prepare Final Report for NASFAA Board of Directors n n n Address Issues Provide Recommendations Describe Rationale

NASFAA Policy Task Forces Impacting Grad/Prof Schools Talking Points from Megan Mc. Clean NASFAA

NASFAA Policy Task Forces Impacting Grad/Prof Schools Talking Points from Megan Mc. Clean NASFAA

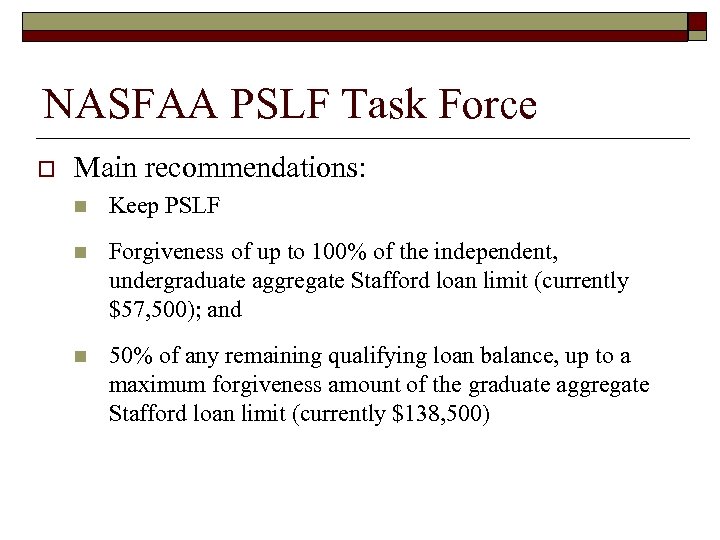

NASFAA PSLF Task Force o Main recommendations: n Keep PSLF n Forgiveness of up to 100% of the independent, undergraduate aggregate Stafford loan limit (currently $57, 500); and n 50% of any remaining qualifying loan balance, up to a maximum forgiveness amount of the graduate aggregate Stafford loan limit (currently $138, 500)

NASFAA PSLF Task Force o Main recommendations: n Keep PSLF n Forgiveness of up to 100% of the independent, undergraduate aggregate Stafford loan limit (currently $57, 500); and n 50% of any remaining qualifying loan balance, up to a maximum forgiveness amount of the graduate aggregate Stafford loan limit (currently $138, 500)

Consumer Information Task Force • Study the usefulness of consumer disclosures not related to Title IV aid and determine the most effective, and least burdensome, method of disclosure. • Eliminate the vague disclosure requirement to report the placement of, and types of employment obtained by, graduates of an institution's degree or certificate programs. • Establish that the online entrance counseling provided by ED constitutes a compliance “safe harbor. ” • Use consistent metrics when presenting borrowing levels (ie. “median” vs. “average”).

Consumer Information Task Force • Study the usefulness of consumer disclosures not related to Title IV aid and determine the most effective, and least burdensome, method of disclosure. • Eliminate the vague disclosure requirement to report the placement of, and types of employment obtained by, graduates of an institution's degree or certificate programs. • Establish that the online entrance counseling provided by ED constitutes a compliance “safe harbor. ” • Use consistent metrics when presenting borrowing levels (ie. “median” vs. “average”).

Servicing Issues Task Force o Joint task force with the Direct Loan Coalition o Focus on understanding current servicing practices and making recommendations to FSA and loan contractors on how to improve the process for borrowers o Charged with specific outcomes: n A report to be delivered to ED and other relevant agencies containing recommendations for improving federal student loan servicing, clearing indicating (1) areas of deficiency in loan servicing, (2) the extent (how widespread) of those deficiencies, and (2) proposed solutions

Servicing Issues Task Force o Joint task force with the Direct Loan Coalition o Focus on understanding current servicing practices and making recommendations to FSA and loan contractors on how to improve the process for borrowers o Charged with specific outcomes: n A report to be delivered to ED and other relevant agencies containing recommendations for improving federal student loan servicing, clearing indicating (1) areas of deficiency in loan servicing, (2) the extent (how widespread) of those deficiencies, and (2) proposed solutions

Servicing Issues Task Force o o Report released February 4, 2015 Six Recommendations: Information/Communication/Standardization n n n Develop a central loan portal where students can manage all of their loans Remove servicer branding from communication with borrowers ED should provide standard consumer protections that are in line with other consumer products ED should permit the use of innovative technologies in order to allow servicers to more efficiently and effectively communicate with students Regulatory requirements of entrance/exit counseling should be incorporated into ED’s Final Awareness Counseling Tool (FACT) ED should develop a policies and procedures manual for servicing

Servicing Issues Task Force o o Report released February 4, 2015 Six Recommendations: Information/Communication/Standardization n n n Develop a central loan portal where students can manage all of their loans Remove servicer branding from communication with borrowers ED should provide standard consumer protections that are in line with other consumer products ED should permit the use of innovative technologies in order to allow servicers to more efficiently and effectively communicate with students Regulatory requirements of entrance/exit counseling should be incorporated into ED’s Final Awareness Counseling Tool (FACT) ED should develop a policies and procedures manual for servicing

Other Task Force Items of Note • Campus-based Allocation Formula Task Force • Benchmarking Task Force • Return of Title IV Funds Task Force

Other Task Force Items of Note • Campus-based Allocation Formula Task Force • Benchmarking Task Force • Return of Title IV Funds Task Force

Federal Update Talking Points from Megan Mc. Clean NASFAA

Federal Update Talking Points from Megan Mc. Clean NASFAA

Washington Political Climate

Washington Political Climate

Washington Political Climate o Partisanship, Brinkmanship and “Blame Game” o Deficit Reduction o Budget Politics Dictating Policy n n o Continuing Resolution (CR) Omnibus Spending bill 2016 Election!

Washington Political Climate o Partisanship, Brinkmanship and “Blame Game” o Deficit Reduction o Budget Politics Dictating Policy n n o Continuing Resolution (CR) Omnibus Spending bill 2016 Election!

Student Aid & the Budget • Funding for student aid falls into the Labor, Health, Human Services, and Education Appropriations Subcommittee (Labor-H) • This is always a very complex bill because so many important programs share the same pot of funds • Most student aid funds are“forward funded” meaning they fund the following award year • Ex: FY 2014 funds the 2014 -15 award year

Student Aid & the Budget • Funding for student aid falls into the Labor, Health, Human Services, and Education Appropriations Subcommittee (Labor-H) • This is always a very complex bill because so many important programs share the same pot of funds • Most student aid funds are“forward funded” meaning they fund the following award year • Ex: FY 2014 funds the 2014 -15 award year

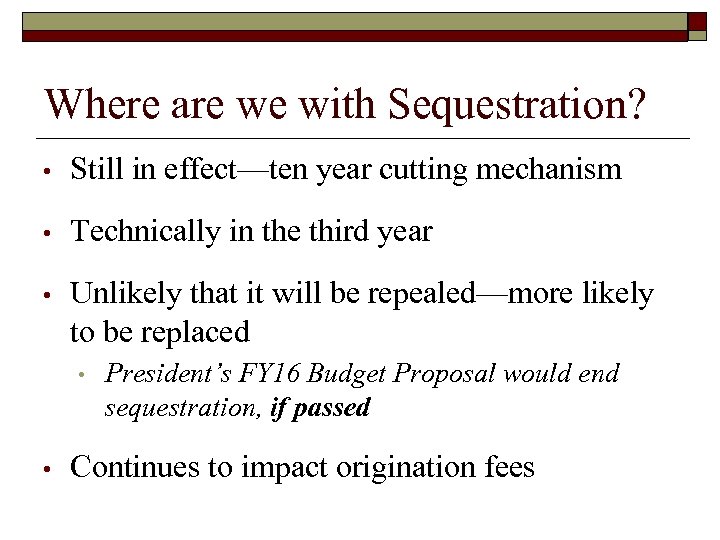

Where are we with Sequestration? • Still in effect—ten year cutting mechanism • Technically in the third year • Unlikely that it will be repealed—more likely to be replaced • • President’s FY 16 Budget Proposal would end sequestration, if passed Continues to impact origination fees

Where are we with Sequestration? • Still in effect—ten year cutting mechanism • Technically in the third year • Unlikely that it will be repealed—more likely to be replaced • • President’s FY 16 Budget Proposal would end sequestration, if passed Continues to impact origination fees

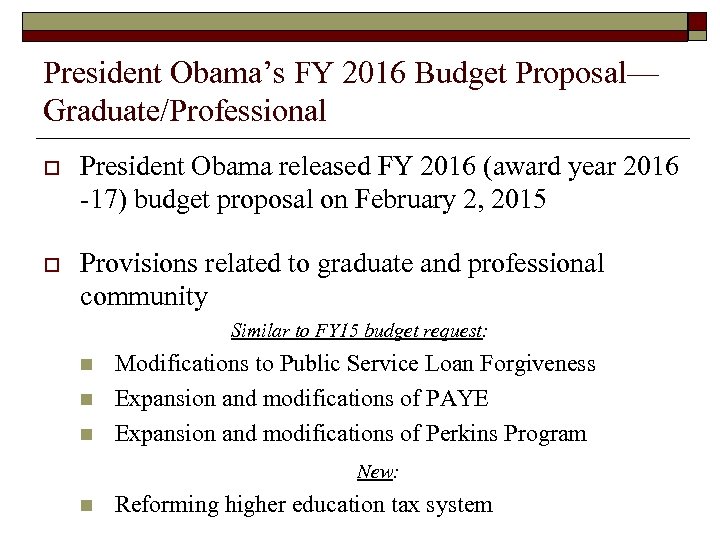

President Obama’s FY 2016 Budget Proposal— Graduate/Professional o President Obama released FY 2016 (award year 2016 -17) budget proposal on February 2, 2015 o Provisions related to graduate and professional community Similar to FY 15 budget request: n n n Modifications to Public Service Loan Forgiveness Expansion and modifications of PAYE Expansion and modifications of Perkins Program New: n Reforming higher education tax system

President Obama’s FY 2016 Budget Proposal— Graduate/Professional o President Obama released FY 2016 (award year 2016 -17) budget proposal on February 2, 2015 o Provisions related to graduate and professional community Similar to FY 15 budget request: n n n Modifications to Public Service Loan Forgiveness Expansion and modifications of PAYE Expansion and modifications of Perkins Program New: n Reforming higher education tax system

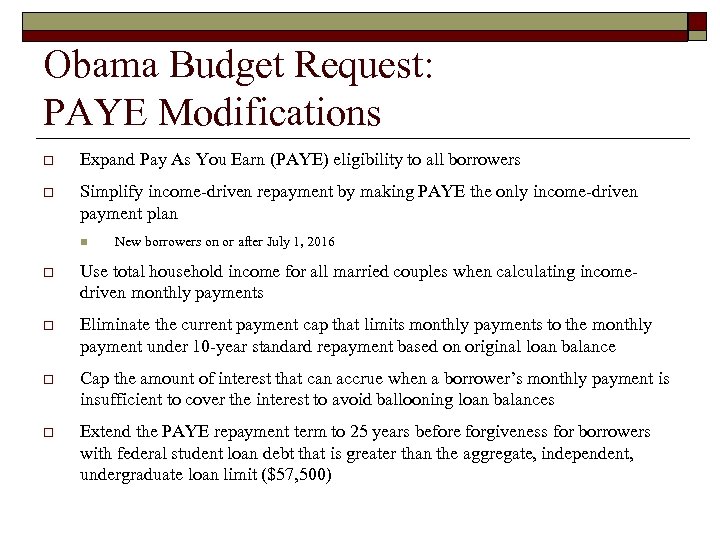

Obama Budget Request: PAYE Modifications o Expand Pay As You Earn (PAYE) eligibility to all borrowers o Simplify income-driven repayment by making PAYE the only income-driven payment plan n New borrowers on or after July 1, 2016 o Use total household income for all married couples when calculating incomedriven monthly payments o Eliminate the current payment cap that limits monthly payments to the monthly payment under 10 -year standard repayment based on original loan balance o Cap the amount of interest that can accrue when a borrower’s monthly payment is insufficient to cover the interest to avoid ballooning loan balances o Extend the PAYE repayment term to 25 years before forgiveness for borrowers with federal student loan debt that is greater than the aggregate, independent, undergraduate loan limit ($57, 500)

Obama Budget Request: PAYE Modifications o Expand Pay As You Earn (PAYE) eligibility to all borrowers o Simplify income-driven repayment by making PAYE the only income-driven payment plan n New borrowers on or after July 1, 2016 o Use total household income for all married couples when calculating incomedriven monthly payments o Eliminate the current payment cap that limits monthly payments to the monthly payment under 10 -year standard repayment based on original loan balance o Cap the amount of interest that can accrue when a borrower’s monthly payment is insufficient to cover the interest to avoid ballooning loan balances o Extend the PAYE repayment term to 25 years before forgiveness for borrowers with federal student loan debt that is greater than the aggregate, independent, undergraduate loan limit ($57, 500)

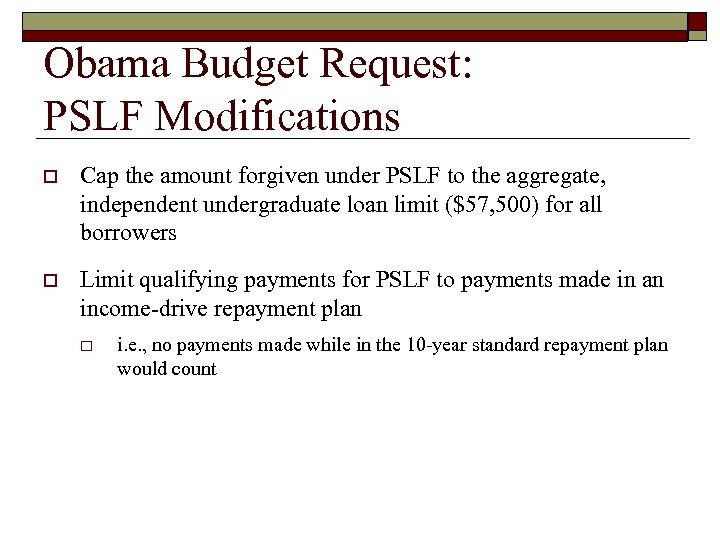

Obama Budget Request: PSLF Modifications o Cap the amount forgiven under PSLF to the aggregate, independent undergraduate loan limit ($57, 500) for all borrowers o Limit qualifying payments for PSLF to payments made in an income-drive repayment plan o i. e. , no payments made while in the 10 -year standard repayment plan would count

Obama Budget Request: PSLF Modifications o Cap the amount forgiven under PSLF to the aggregate, independent undergraduate loan limit ($57, 500) for all borrowers o Limit qualifying payments for PSLF to payments made in an income-drive repayment plan o i. e. , no payments made while in the 10 -year standard repayment plan would count

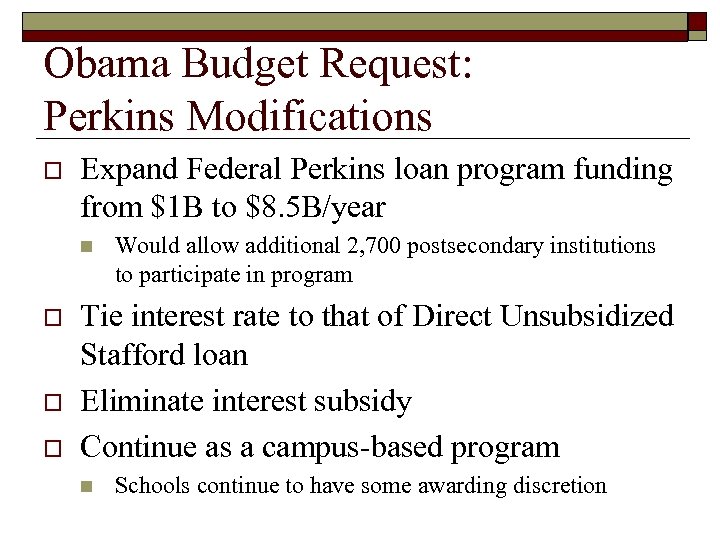

Obama Budget Request: Perkins Modifications o Expand Federal Perkins loan program funding from $1 B to $8. 5 B/year n o o o Would allow additional 2, 700 postsecondary institutions to participate in program Tie interest rate to that of Direct Unsubsidized Stafford loan Eliminate interest subsidy Continue as a campus-based program n Schools continue to have some awarding discretion

Obama Budget Request: Perkins Modifications o Expand Federal Perkins loan program funding from $1 B to $8. 5 B/year n o o o Would allow additional 2, 700 postsecondary institutions to participate in program Tie interest rate to that of Direct Unsubsidized Stafford loan Eliminate interest subsidy Continue as a campus-based program n Schools continue to have some awarding discretion

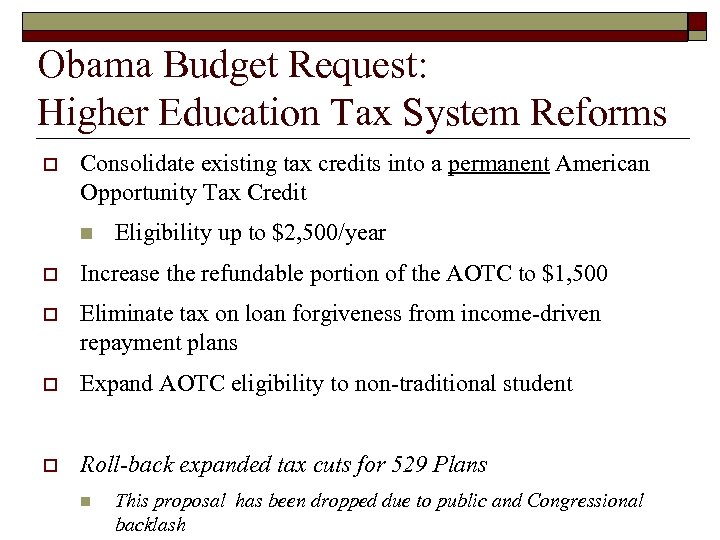

Obama Budget Request: Higher Education Tax System Reforms o Consolidate existing tax credits into a permanent American Opportunity Tax Credit n Eligibility up to $2, 500/year o Increase the refundable portion of the AOTC to $1, 500 o Eliminate tax on loan forgiveness from income-driven repayment plans o Expand AOTC eligibility to non-traditional student o Roll-back expanded tax cuts for 529 Plans n This proposal has been dropped due to public and Congressional backlash

Obama Budget Request: Higher Education Tax System Reforms o Consolidate existing tax credits into a permanent American Opportunity Tax Credit n Eligibility up to $2, 500/year o Increase the refundable portion of the AOTC to $1, 500 o Eliminate tax on loan forgiveness from income-driven repayment plans o Expand AOTC eligibility to non-traditional student o Roll-back expanded tax cuts for 529 Plans n This proposal has been dropped due to public and Congressional backlash

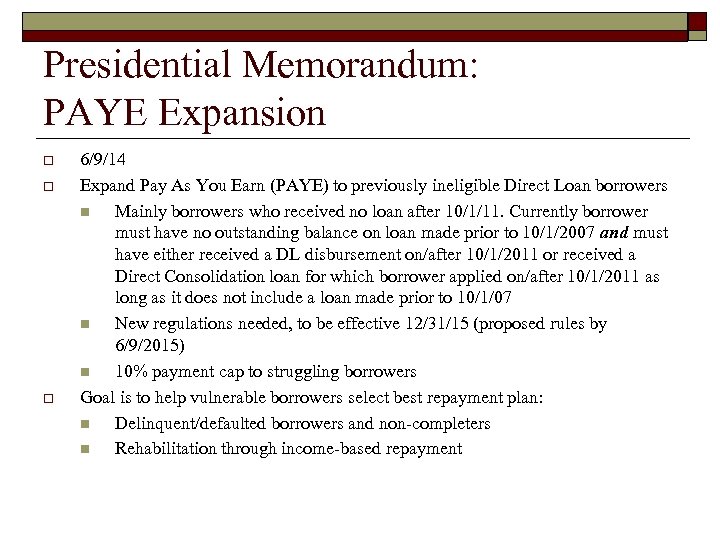

Presidential Memorandum: PAYE Expansion o o o 6/9/14 Expand Pay As You Earn (PAYE) to previously ineligible Direct Loan borrowers n Mainly borrowers who received no loan after 10/1/11. Currently borrower must have no outstanding balance on loan made prior to 10/1/2007 and must have either received a DL disbursement on/after 10/1/2011 or received a Direct Consolidation loan for which borrower applied on/after 10/1/2011 as long as it does not include a loan made prior to 10/1/07 n New regulations needed, to be effective 12/31/15 (proposed rules by 6/9/2015) n 10% payment cap to struggling borrowers Goal is to help vulnerable borrowers select best repayment plan: n Delinquent/defaulted borrowers and non-completers n Rehabilitation through income-based repayment

Presidential Memorandum: PAYE Expansion o o o 6/9/14 Expand Pay As You Earn (PAYE) to previously ineligible Direct Loan borrowers n Mainly borrowers who received no loan after 10/1/11. Currently borrower must have no outstanding balance on loan made prior to 10/1/2007 and must have either received a DL disbursement on/after 10/1/2011 or received a Direct Consolidation loan for which borrower applied on/after 10/1/2011 as long as it does not include a loan made prior to 10/1/07 n New regulations needed, to be effective 12/31/15 (proposed rules by 6/9/2015) n 10% payment cap to struggling borrowers Goal is to help vulnerable borrowers select best repayment plan: n Delinquent/defaulted borrowers and non-completers n Rehabilitation through income-based repayment

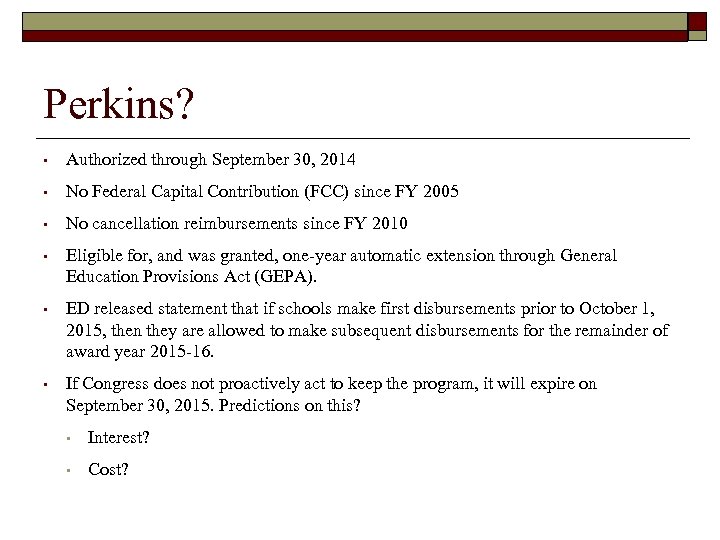

Perkins? • Authorized through September 30, 2014 • No Federal Capital Contribution (FCC) since FY 2005 • No cancellation reimbursements since FY 2010 • Eligible for, and was granted, one-year automatic extension through General Education Provisions Act (GEPA). • ED released statement that if schools make first disbursements prior to October 1, 2015, then they are allowed to make subsequent disbursements for the remainder of award year 2015 -16. • If Congress does not proactively act to keep the program, it will expire on September 30, 2015. Predictions on this? • Interest? • Cost?

Perkins? • Authorized through September 30, 2014 • No Federal Capital Contribution (FCC) since FY 2005 • No cancellation reimbursements since FY 2010 • Eligible for, and was granted, one-year automatic extension through General Education Provisions Act (GEPA). • ED released statement that if schools make first disbursements prior to October 1, 2015, then they are allowed to make subsequent disbursements for the remainder of award year 2015 -16. • If Congress does not proactively act to keep the program, it will expire on September 30, 2015. Predictions on this? • Interest? • Cost?

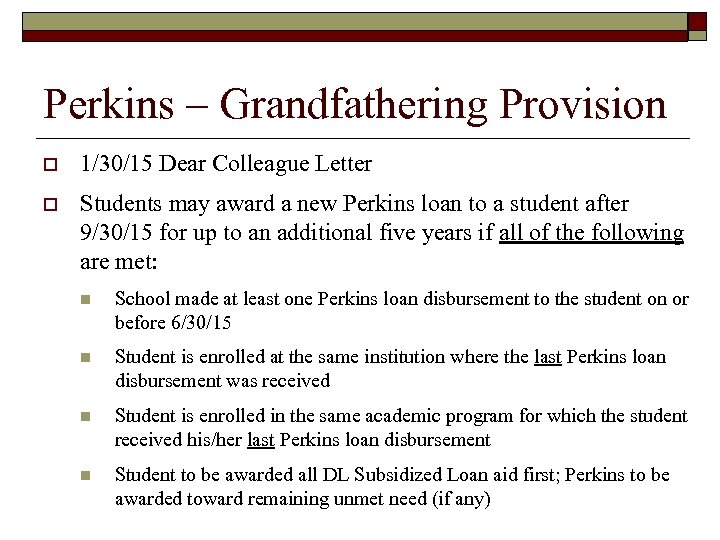

Perkins – Grandfathering Provision o 1/30/15 Dear Colleague Letter o Students may award a new Perkins loan to a student after 9/30/15 for up to an additional five years if all of the following are met: n School made at least one Perkins loan disbursement to the student on or before 6/30/15 n Student is enrolled at the same institution where the last Perkins loan disbursement was received n Student is enrolled in the same academic program for which the student received his/her last Perkins loan disbursement n Student to be awarded all DL Subsidized Loan aid first; Perkins to be awarded toward remaining unmet need (if any)

Perkins – Grandfathering Provision o 1/30/15 Dear Colleague Letter o Students may award a new Perkins loan to a student after 9/30/15 for up to an additional five years if all of the following are met: n School made at least one Perkins loan disbursement to the student on or before 6/30/15 n Student is enrolled at the same institution where the last Perkins loan disbursement was received n Student is enrolled in the same academic program for which the student received his/her last Perkins loan disbursement n Student to be awarded all DL Subsidized Loan aid first; Perkins to be awarded toward remaining unmet need (if any)

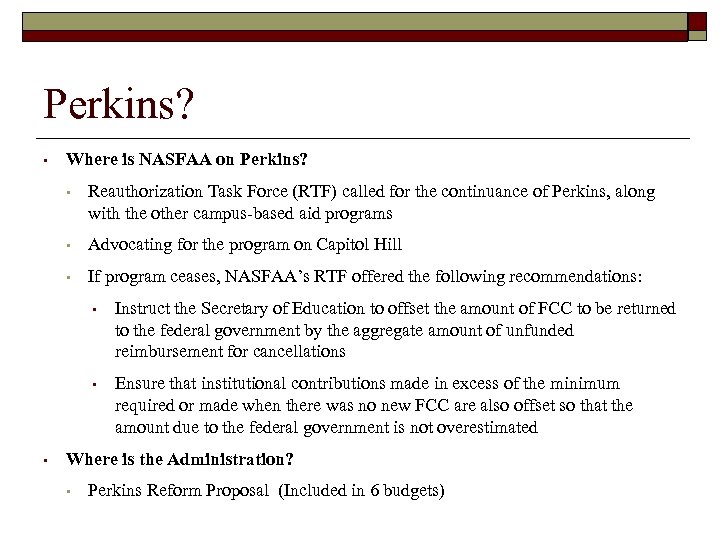

Perkins? • Where is NASFAA on Perkins? • Reauthorization Task Force (RTF) called for the continuance of Perkins, along with the other campus-based aid programs • Advocating for the program on Capitol Hill • If program ceases, NASFAA’s RTF offered the following recommendations: • • • Instruct the Secretary of Education to offset the amount of FCC to be returned to the federal government by the aggregate amount of unfunded reimbursement for cancellations Ensure that institutional contributions made in excess of the minimum required or made when there was no new FCC are also offset so that the amount due to the federal government is not overestimated Where is the Administration? • Perkins Reform Proposal (Included in 6 budgets)

Perkins? • Where is NASFAA on Perkins? • Reauthorization Task Force (RTF) called for the continuance of Perkins, along with the other campus-based aid programs • Advocating for the program on Capitol Hill • If program ceases, NASFAA’s RTF offered the following recommendations: • • • Instruct the Secretary of Education to offset the amount of FCC to be returned to the federal government by the aggregate amount of unfunded reimbursement for cancellations Ensure that institutional contributions made in excess of the minimum required or made when there was no new FCC are also offset so that the amount due to the federal government is not overestimated Where is the Administration? • Perkins Reform Proposal (Included in 6 budgets)

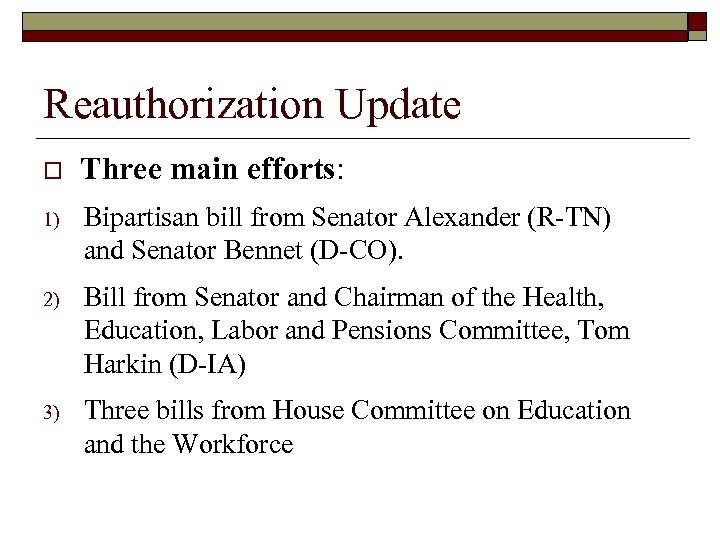

Reauthorization Update o Three main efforts: 1) Bipartisan bill from Senator Alexander (R-TN) and Senator Bennet (D-CO). 2) Bill from Senator and Chairman of the Health, Education, Labor and Pensions Committee, Tom Harkin (D-IA) 3) Three bills from House Committee on Education and the Workforce

Reauthorization Update o Three main efforts: 1) Bipartisan bill from Senator Alexander (R-TN) and Senator Bennet (D-CO). 2) Bill from Senator and Chairman of the Health, Education, Labor and Pensions Committee, Tom Harkin (D-IA) 3) Three bills from House Committee on Education and the Workforce

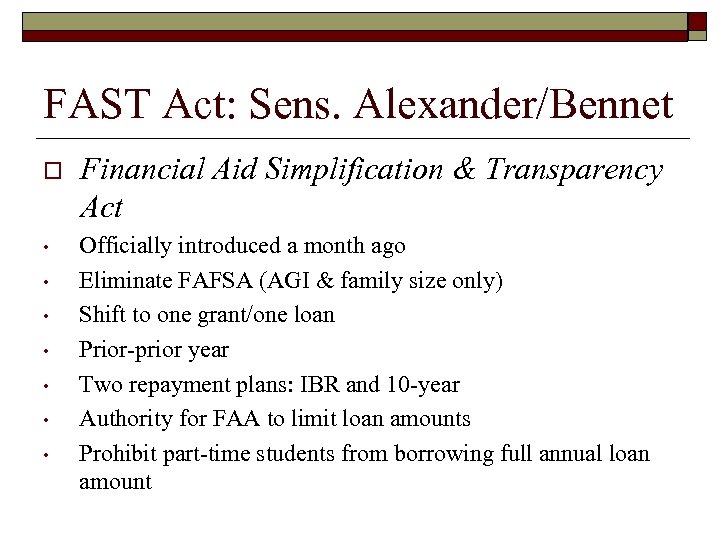

FAST Act: Sens. Alexander/Bennet o Financial Aid Simplification & Transparency Act • Officially introduced a month ago Eliminate FAFSA (AGI & family size only) Shift to one grant/one loan Prior-prior year Two repayment plans: IBR and 10 -year Authority for FAA to limit loan amounts Prohibit part-time students from borrowing full annual loan amount • • •

FAST Act: Sens. Alexander/Bennet o Financial Aid Simplification & Transparency Act • Officially introduced a month ago Eliminate FAFSA (AGI & family size only) Shift to one grant/one loan Prior-prior year Two repayment plans: IBR and 10 -year Authority for FAA to limit loan amounts Prohibit part-time students from borrowing full annual loan amount • • •

Reauthorization: Sen. Harkin o Higher Education Affordability Act • Prior-prior year Eliminate origination fees One IBR plan (auto enrollment if 150 days or more delinquent) Private loans dischargeable in bankruptcy Full school certification of private loans Exclude HHS loans from definition of private loan (thanks GPIC!) Include private loans and HHS loans in NSLDS Strengthen entrance and exit counseling • •

Reauthorization: Sen. Harkin o Higher Education Affordability Act • Prior-prior year Eliminate origination fees One IBR plan (auto enrollment if 150 days or more delinquent) Private loans dischargeable in bankruptcy Full school certification of private loans Exclude HHS loans from definition of private loan (thanks GPIC!) Include private loans and HHS loans in NSLDS Strengthen entrance and exit counseling • •

Reauthorization: House Ed and Workforce o Simplifying the Application for Student Aid Act n o Prior-prior year Strengthening Transparency in Higher Education Act n Replace College Navigator with College Dashboard n Institutional-level information (e. g. , enrollment, completion rates, costs, financial aid, CDR)

Reauthorization: House Ed and Workforce o Simplifying the Application for Student Aid Act n o Prior-prior year Strengthening Transparency in Higher Education Act n Replace College Navigator with College Dashboard n Institutional-level information (e. g. , enrollment, completion rates, costs, financial aid, CDR)

Reauthorization: House Ed and Workforce o Empowering Students Through Enhanced Financial Counseling Act • Exit counseling: more borrower-specific information • Entrance counseling would change to annual counseling • • Must be completed before acceptance of loan Borrowers must actively accept every loan (i. e. , no passive confirmation)

Reauthorization: House Ed and Workforce o Empowering Students Through Enhanced Financial Counseling Act • Exit counseling: more borrower-specific information • Entrance counseling would change to annual counseling • • Must be completed before acceptance of loan Borrowers must actively accept every loan (i. e. , no passive confirmation)

Reauthorization: Other “Markers” • Fee Free Student Loan Act, Rep. Susan Davis (D-CA) • • End origination fees Repay Act, Senators King (I-ME) and Burr (R-NC) • Streamline repayment plans into two plans: one ten year and one simplified income-driven repayment plan

Reauthorization: Other “Markers” • Fee Free Student Loan Act, Rep. Susan Davis (D-CA) • • End origination fees Repay Act, Senators King (I-ME) and Burr (R-NC) • Streamline repayment plans into two plans: one ten year and one simplified income-driven repayment plan

Negotiated Rulemaking. Program Integrity and Improvement • • • No consensus State authorization and Cash Management delayed Gainful Employment final rule released November 1 • Similar to 2011 regs that were vacated by court • Big difference: elimination of program level CDR • New disclosures effective Jan. 1, 2017, current requirements apply through Dec. 2016 • All other GE rules are effective 7/1/15. Most pressing issue is reporting. First batch due in July and goes back several years. ED just did a 2 hr webinar on just reporting, the archive should be up for viewing soon.

Negotiated Rulemaking. Program Integrity and Improvement • • • No consensus State authorization and Cash Management delayed Gainful Employment final rule released November 1 • Similar to 2011 regs that were vacated by court • Big difference: elimination of program level CDR • New disclosures effective Jan. 1, 2017, current requirements apply through Dec. 2016 • All other GE rules are effective 7/1/15. Most pressing issue is reporting. First batch due in July and goes back several years. ED just did a 2 hr webinar on just reporting, the archive should be up for viewing soon.

Negotiated Rulemaking. PLUS, Adverse Credit • • • Final rule published in October ED just announced early implementation date of March 29 Main provisions: • Loosened criteria (debts over $2, 085) • If a borrower has an endorser due to adverse credit history, they will need to complete credit counseling

Negotiated Rulemaking. PLUS, Adverse Credit • • • Final rule published in October ED just announced early implementation date of March 29 Main provisions: • Loosened criteria (debts over $2, 085) • If a borrower has an endorser due to adverse credit history, they will need to complete credit counseling

Neg Reg PAYE ED held public hearings to set the agenda this fall: Washington, DC and Anaheim, CA ED announced it will hold PAYE Neg Reg this spring • • • Feb. 24 -26 Mar 31 -Apr. 3 Apr. 28 -30

Neg Reg PAYE ED held public hearings to set the agenda this fall: Washington, DC and Anaheim, CA ED announced it will hold PAYE Neg Reg this spring • • • Feb. 24 -26 Mar 31 -Apr. 3 Apr. 28 -30

Questions?

Questions?