7d6bae2e98f742dd50cb5939ef68f301.ppt

- Количество слайдов: 29

NAFTA 101: Understanding the Basics Jo. Ann Queen Trade Promotion Programs Trade Information Center June, 2009

FREE TRADE AGREEMENTS Objectives Promote trade • Greater market access • Promote fair competition • Establish framework for further cooperation •

BENEFIT FOR U. S. PRODUCTS Immediate Benefit: No Duties • Elimination is not automatic • Certain steps must be followed • Products must contain sufficient North American content to meet the requirements of the NAFTA Rules of Origin

FREE TRADE AGREEMENTS Taking Advantage of Free Trade Agreements • Understand the specific free trade agreement • Ensure products meet the FTA requirements • Complete the documentation

Free Trade Agreements A Few Common Misconceptions: w w w U. S. , Canadian & Mexican Tariffs are the same Originating means purchased in a NAFTA Country NAFTA Certification is Mandatory NAFTA Certificates are required to clear Canada customs A producer is required to supply a buyer with a NAFTA Certificate of Origin

Free Trade Agreements in Force • • • Israel NAFTA Jordan Chile Singapore Australia Morocco CAFTA-DR Bahrain Costa Rica Oman Peru January 1, 1985 January 1, 1994 December 17, 2001 January 1, 2004 January 1, 2005 January 1, 2006 March/April 1, 2006 August 1, 2006 January 1, 2009

Free Trade Agreements w Qualify Your Products

HOW TO DETERMINE POTENTIAL BENEFITS Benefits for U. S. Products Require Certain Steps: w w w Find the appropriate HS number Determine the duty rates in your export market Determine if your product meets the requirements of its specific NAFTA Rule of Origin

HOW TO DETERMINE POTENTIAL BENEFITS Classification Systems: w Harmonized System Numbers (HS) w Schedule B w Harmonized Tariff Schedule of the United States (HTS)

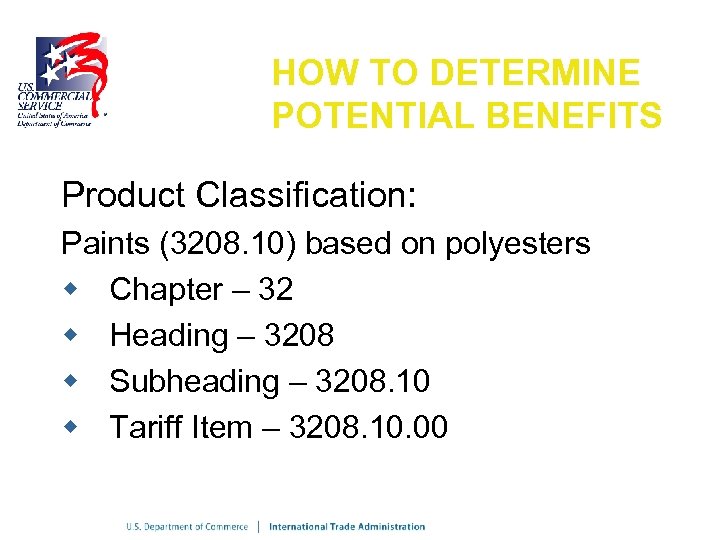

HOW TO DETERMINE POTENTIAL BENEFITS Product Classification: Paints (3208. 10) based on polyesters w Chapter – 32 w Heading – 3208 w Subheading – 3208. 10 w Tariff Item – 3208. 10. 00

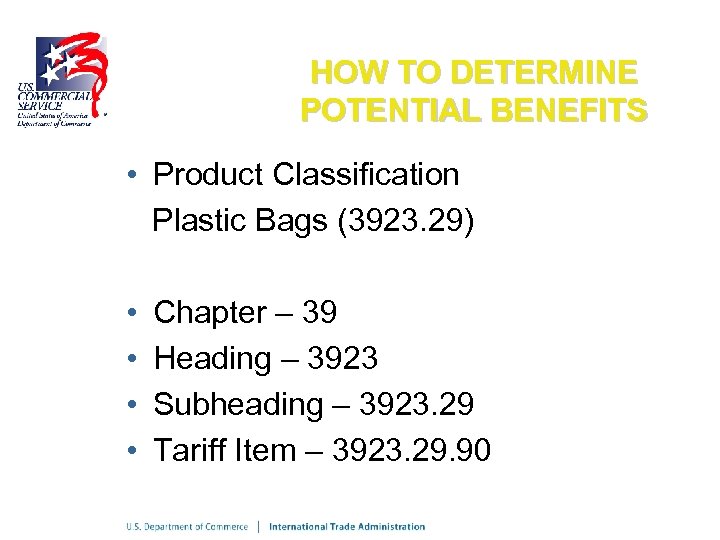

HOW TO DETERMINE POTENTIAL BENEFITS • Product Classification Plastic Bags (3923. 29) • • Chapter – 39 Heading – 3923 Subheading – 3923. 29 Tariff Item – 3923. 29. 90

HOW TO DETERMINE POTENTIAL BENEFITS • Product Classification Get started by visiting the Census website at www. census. gov/scheduleb to use the Schedule B Search Engine to obtain classification numbers for both the end product and its foreign components

HOW TO DETERMINE POTENTIAL BENEFITS NAFTA Rules of Origin Define how much foreign input is allowed Specific by product and are based on the harmonized system (HS) May require a Tariff Shift, Regional Value Content, or Both

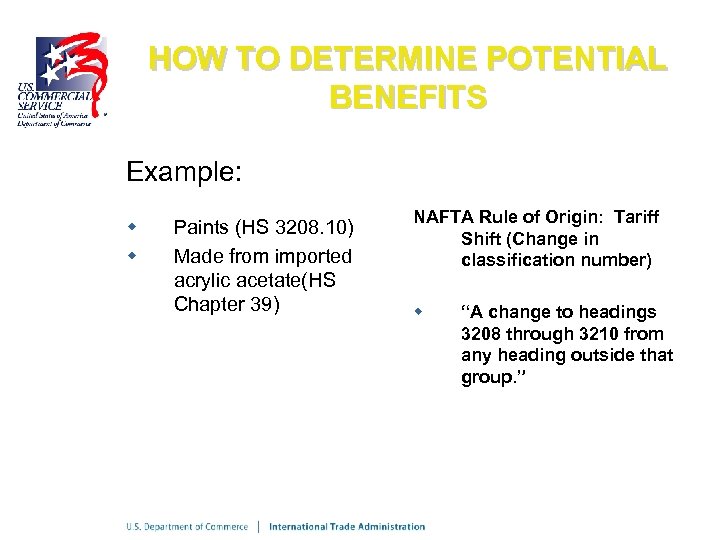

HOW TO DETERMINE POTENTIAL BENEFITS Example: w w Paints (HS 3208. 10) Made from imported acrylic acetate(HS Chapter 39) NAFTA Rule of Origin: Tariff Shift (Change in classification number) w “A change to headings 3208 through 3210 from any heading outside that group. ”

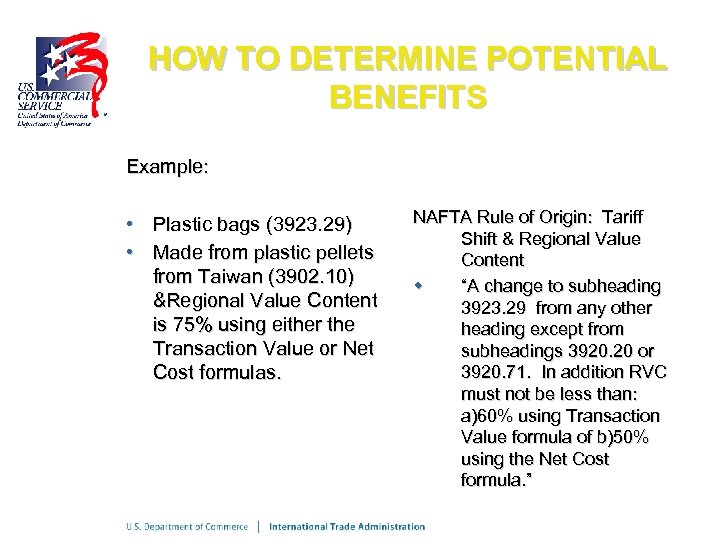

HOW TO DETERMINE POTENTIAL BENEFITS Example: • Plastic bags (3923. 29) • Made from plastic pellets from Taiwan (3902. 10) &Regional Value Content is 75% using either the Transaction Value or Net Cost formulas. NAFTA Rule of Origin: Tariff Shift & Regional Value Content w “A change to subheading 3923. 29 from any other heading except from subheadings 3920. 20 or 3920. 71. In addition RVC must not be less than: a)60% using Transaction Value formula of b)50% using the Net Cost formula. ”

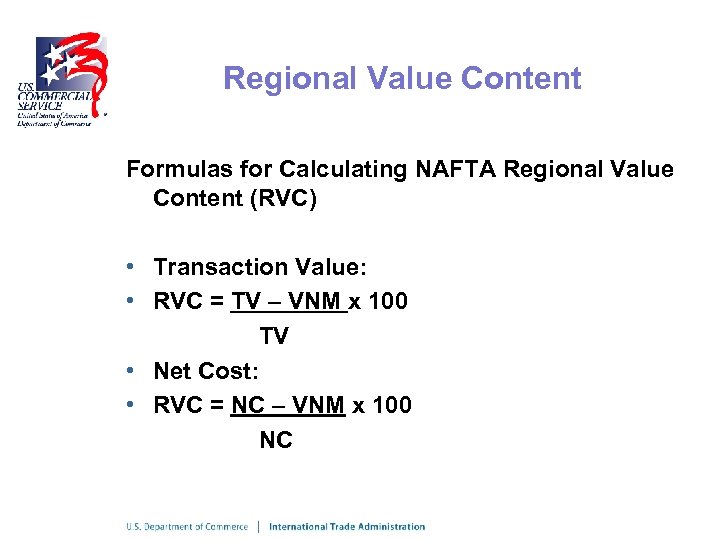

Regional Value Content Formulas for Calculating NAFTA Regional Value Content (RVC) • Transaction Value: • RVC = TV – VNM x 100 TV • Net Cost: • RVC = NC – VNM x 100 NC

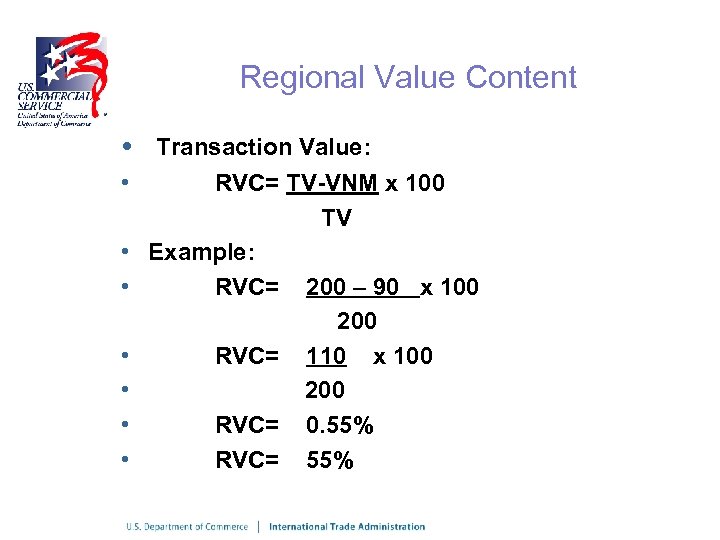

Regional Value Content • • Transaction Value: RVC= TV-VNM x 100 TV Example: RVC= 200 – 90 x 100 200 RVC= 110 x 100 200 RVC= 0. 55% RVC= 55%

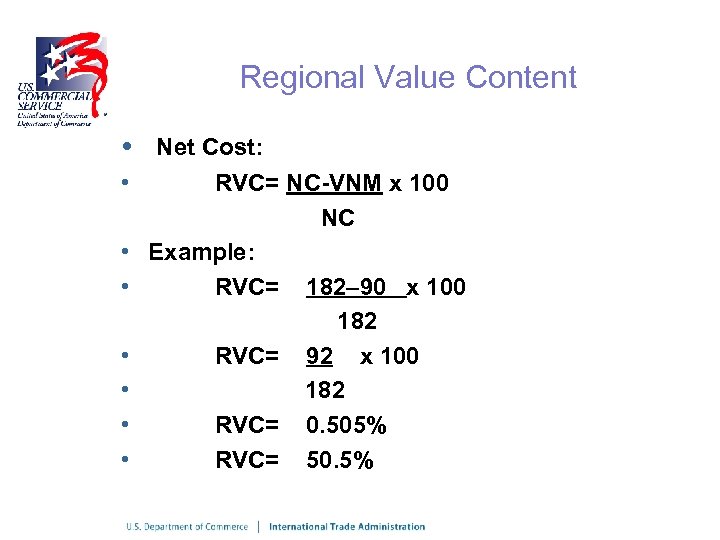

Regional Value Content • • Net Cost: RVC= NC-VNM x 100 NC Example: RVC= 182– 90 x 100 182 RVC= 92 x 100 182 RVC= 0. 505% RVC= 50. 5%

• NAFTA Preference Criteria The NAFTA Preference Criteria are grouped into categories identified on the Certificate by letters A through F.

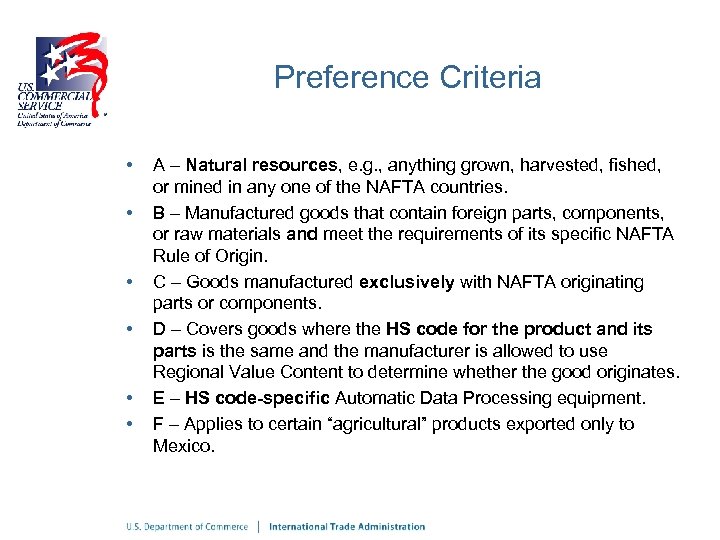

Preference Criteria • • • A – Natural resources, e. g. , anything grown, harvested, fished, or mined in any one of the NAFTA countries. B – Manufactured goods that contain foreign parts, components, or raw materials and meet the requirements of its specific NAFTA Rule of Origin. C – Goods manufactured exclusively with NAFTA originating parts or components. D – Covers goods where the HS code for the product and its parts is the same and the manufacturer is allowed to use Regional Value Content to determine whether the good originates. E – HS code-specific Automatic Data Processing equipment. F – Applies to certain “agricultural” products exported only to Mexico.

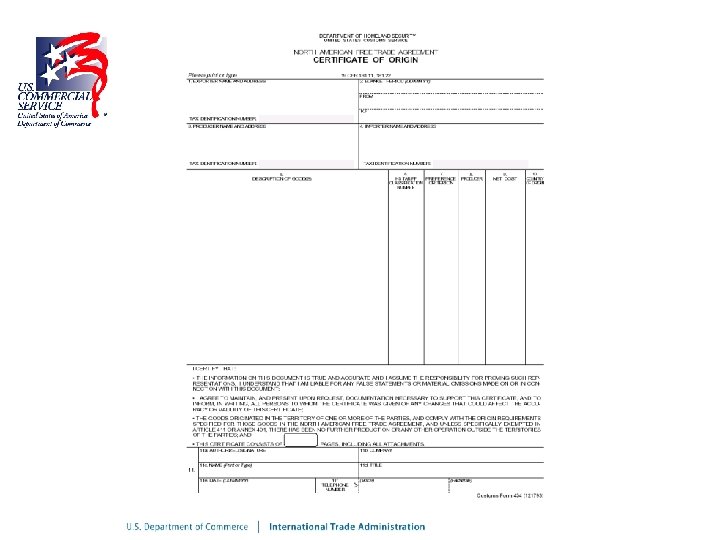

Complete the NAFTA Certificate of Origin

NAFTA Certificate of Origin • Completed by the exporting (or selling) company • Original is forwarded to customer

Recordkeeping • Importers and exporters should maintain documents to support a NAFTA claim for up to seven years after importation • Documents relate to the purchase, cost, value, and payment for all materials, direct or indirect, used in production • Customs officials can seek information from either party

Free Trade Agreements • Bill of Materials (BOM) chart is a widely employed and accepted method of documenting origin determinations • BOM chart lists all inputs by product description, supply source, origin, HS classification, and value

NAFTA Successes • Turner Marine in Neoga, IL - Exporting for the first time, contacted the Commercial Service and received necessary international trade information and NAFTA assistance allowing them to successfully export to Canada. • Roe Sales in Peoria, IL - Called the Commercial Service and received NAFTA information and assistance with qualifying their product. It was later learned that they had successfully completed a NAFTA Certificate of Origin and exported their product the same day to Canada.

Rep. CAN 2009 Business Matchmaking Toronto, Ontario - September 28 - 29, 2009 Montreal, Quebec - September 30 - October 1, 2009 Vancouver, British Columbia - October 5 -6, 2009 Rep. CAN 2009 offers: • • One-on-one business meetings with potential business partners in each city Opportunities to display and distribute your promotional materials Networking events with Canadian business, industry and government contacts National market exposure for your product and services in Canada Visibility on Commercial Service Canada's Featured U. S. Exporters (FUSE) webpage Assistance with logistics and customs Expert business counseling before, during and after your participation

Rep. CAN 2009 Business Matchmaking Register Today for Rep. CAN - Space is Limited! http: //www. buyusa. gov/canada/en/repcan 2009. html • Small Company Cost: US $1, 500 per city location • Large Company Cost: US $3, 000 per city location For Additional Information Contact: Madellon Lopes, Project Manager (416) 595 -5412, Ext. 227 madellon. lopes@mail. doc. gov

For further information or assistance contact: Jo. Ann Queen Phone: 800 -8723 ext. 35226 or 202 -482 -5226 Fax: Email: 202 -482 -4473 joann. queen@mail. doc. gov

7d6bae2e98f742dd50cb5939ef68f301.ppt