N O TO TI UC TE OD RA TR PO E IN R NC CO NA R E FI C T U LE 1

N O TO TI UC TE OD RA TR PO E IN R NC CO NA R E FI C T U LE 1

QUESTIONS 1. Financial management and the goal of the firm 2. The decision functions of financial management 3. Organization of the financial management function 4. The business environment 5. The financial environment 6. The tax environment 7. Agency relationship

QUESTIONS 1. Financial management and the goal of the firm 2. The decision functions of financial management 3. Organization of the financial management function 4. The business environment 5. The financial environment 6. The tax environment 7. Agency relationship

Financial management and the goal of the firm

Financial management and the goal of the firm

BASIC AREAS OF FINANCE (VIDEO) • Corporate finance • Investments • Financial institutions • International finance 4 1.

BASIC AREAS OF FINANCE (VIDEO) • Corporate finance • Investments • Financial institutions • International finance 4 1.

INVESTMENTS • Work with financial assets such as stocks and bonds • Value of financial assets, risk versus return and asset allocation • Job opportunities • Stockbroker or financial advisor • Portfolio manager • Security analyst 5 1.

INVESTMENTS • Work with financial assets such as stocks and bonds • Value of financial assets, risk versus return and asset allocation • Job opportunities • Stockbroker or financial advisor • Portfolio manager • Security analyst 5 1.

FINANCIAL INSTITUTIONS Companies that specialize in financial matters § Banks – commercial and investment, credit unions, savings and loans § Insurance companies § Brokerage firms Job opportunities 6 1.

FINANCIAL INSTITUTIONS Companies that specialize in financial matters § Banks – commercial and investment, credit unions, savings and loans § Insurance companies § Brokerage firms Job opportunities 6 1.

INTERNATIONAL FINANCE This is an area of specialization among all of the areas discussed so far It may allow you to work in other countries or at least travel on a regular basis Need to be familiar with exchange rates and political risk Need to understand the customs of other countries and speaking a foreign language fluently is also helpful 7 1.

INTERNATIONAL FINANCE This is an area of specialization among all of the areas discussed so far It may allow you to work in other countries or at least travel on a regular basis Need to be familiar with exchange rates and political risk Need to understand the customs of other countries and speaking a foreign language fluently is also helpful 7 1.

WHY STUDY FINANCE? Marketing § Budgets, marketing research, marketing financial products Accounting § Dual accounting and finance function, preparation of financial statements Management § Strategic thinking, job performance and profitability Personal finance § Budgeting, retirement planning, college planning, day-to-day cash flow issues 8 1.

WHY STUDY FINANCE? Marketing § Budgets, marketing research, marketing financial products Accounting § Dual accounting and finance function, preparation of financial statements Management § Strategic thinking, job performance and profitability Personal finance § Budgeting, retirement planning, college planning, day-to-day cash flow issues 8 1.

BUSINESS FINANCE Some important questions that are answered using finance § What long-term investments should the firm take on? § Where will we get the long-term financing to pay for the investment? § How will we manage the everyday financial activities of the firm? 9 1.

BUSINESS FINANCE Some important questions that are answered using finance § What long-term investments should the firm take on? § Where will we get the long-term financing to pay for the investment? § How will we manage the everyday financial activities of the firm? 9 1.

GOAL OF FINANCIAL MANAGEMENT What should be the goal of a corporation? § Maximize profit? § Minimize costs? § Maximize market share? § Maximize the current value of the company’s stock? Does this mean we should do anything and everything to maximize owner wealth? 10 1.

GOAL OF FINANCIAL MANAGEMENT What should be the goal of a corporation? § Maximize profit? § Minimize costs? § Maximize market share? § Maximize the current value of the company’s stock? Does this mean we should do anything and everything to maximize owner wealth? 10 1.

POSSIBLE GOALS OF FINANCIAL MANAGEMENT Survival Avoid financial distress and bankruptcy Beat the competition Maximise sales or market share Minimise costs Maximise profits Maintain steady earnings growth

POSSIBLE GOALS OF FINANCIAL MANAGEMENT Survival Avoid financial distress and bankruptcy Beat the competition Maximise sales or market share Minimise costs Maximise profits Maintain steady earnings growth

PROBLEMS WITH THESE GOALS Each of these goals presents problems. These goals are either associated with increasing profitability or reducing risk. They are not consistent with the long-term interests of shareholders. It is necessary to find a goal that can encompass both profitability and risk. 1 -

PROBLEMS WITH THESE GOALS Each of these goals presents problems. These goals are either associated with increasing profitability or reducing risk. They are not consistent with the long-term interests of shareholders. It is necessary to find a goal that can encompass both profitability and risk. 1 -

THE FIRM’S OBJECTIVE The goal of financial management is to maximise shareholders’ wealth. Shareholders’ wealth can be measured as the current value per share of existing shares. This goal overcomes the problems encountered with the goals outlined above.

THE FIRM’S OBJECTIVE The goal of financial management is to maximise shareholders’ wealth. Shareholders’ wealth can be measured as the current value per share of existing shares. This goal overcomes the problems encountered with the goals outlined above.

EFFICIENT FINANCIAL MANAGEMENT The most important objectives (goals) are: profit maximization; value creation; the management's and the shareholders' goals; the social responsibility of the firm.

EFFICIENT FINANCIAL MANAGEMENT The most important objectives (goals) are: profit maximization; value creation; the management's and the shareholders' goals; the social responsibility of the firm.

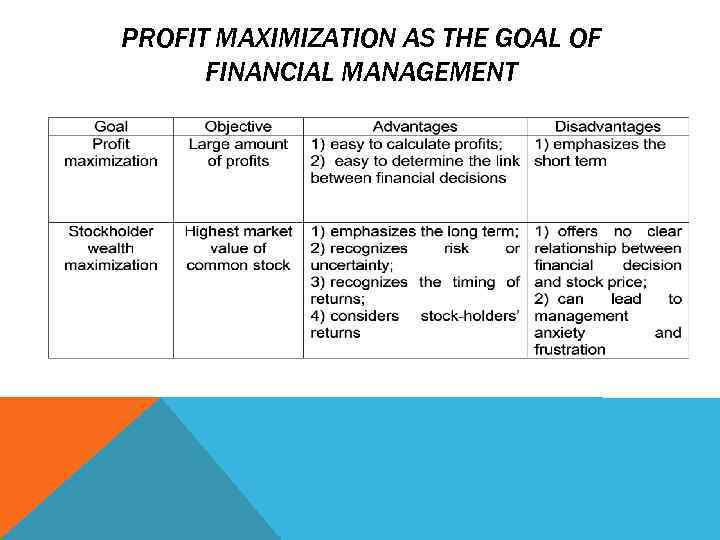

PROFIT MAXIMIZATION AS THE GOAL OF FINANCIAL MANAGEMENT 1) Maximizing profits (earnings after taxes, EAT) is often offered as the proper objective of the firm. 2) Maximizing earnings per share (EPS) is advocated as an improved version of profit maximization. 15

PROFIT MAXIMIZATION AS THE GOAL OF FINANCIAL MANAGEMENT 1) Maximizing profits (earnings after taxes, EAT) is often offered as the proper objective of the firm. 2) Maximizing earnings per share (EPS) is advocated as an improved version of profit maximization. 15

PROFIT MAXIMIZATION AS THE GOAL OF FINANCIAL MANAGEMENT

PROFIT MAXIMIZATION AS THE GOAL OF FINANCIAL MANAGEMENT

THE SOCIAL RESPONSIBILITY OF THE FIRM

THE SOCIAL RESPONSIBILITY OF THE FIRM

The decision functions of financial management

The decision functions of financial management

WHAT IS CORPORATE FINANCE? Corporate finance attempts to find the answers to the following questions: § What investments should the business take on? THE INVESTMENT DECISION § How can finance be obtained to pay for the required investments? THE FINANCE DECISION § Should dividends be paid? If so, how much? THE DIVIDEND DECISION

WHAT IS CORPORATE FINANCE? Corporate finance attempts to find the answers to the following questions: § What investments should the business take on? THE INVESTMENT DECISION § How can finance be obtained to pay for the required investments? THE FINANCE DECISION § Should dividends be paid? If so, how much? THE DIVIDEND DECISION

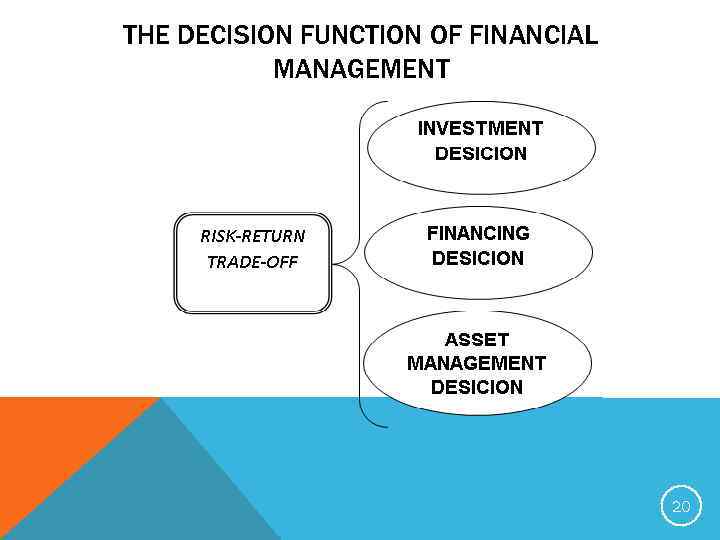

THE DECISION FUNCTION OF FINANCIAL MANAGEMENT 20

THE DECISION FUNCTION OF FINANCIAL MANAGEMENT 20

Profit has been defined as the reward resulting from the decision of bearing a risk. The greater the risk associated with any financial decision, the greater the return expected from it. The other side of the coin is that risk is associated with the possibility of incurring losses.

Profit has been defined as the reward resulting from the decision of bearing a risk. The greater the risk associated with any financial decision, the greater the return expected from it. The other side of the coin is that risk is associated with the possibility of incurring losses.

THE INVESTMENT DECISION is the most important of the firm's three major decisions. It begins with the determination of the total amount of assets needed to be held by the firm. Even when this number is known, the composition of the assets must still be decided: how much of the firm's total assets should be devoted to cash, to inventory or to fixed assets. 22

THE INVESTMENT DECISION is the most important of the firm's three major decisions. It begins with the determination of the total amount of assets needed to be held by the firm. Even when this number is known, the composition of the assets must still be decided: how much of the firm's total assets should be devoted to cash, to inventory or to fixed assets. 22

CAPITAL INVESTMENT DECISIONS are long-term corporate finance decisions relating to fixed assets and capital structure. Decisions are based on several inter-related criteria: (1) Corporate management seeks to maximize the value of the firm by investing in projects which yield a positive net present value when valued using an appropriate discount rate. (2) These projects must also be financed appropriately. (3) If no such opportunities exist, maximizing shareholder value dictates that management must return excess cash to shareholders (i. e. , distribution via dividends). 23

CAPITAL INVESTMENT DECISIONS are long-term corporate finance decisions relating to fixed assets and capital structure. Decisions are based on several inter-related criteria: (1) Corporate management seeks to maximize the value of the firm by investing in projects which yield a positive net present value when valued using an appropriate discount rate. (2) These projects must also be financed appropriately. (3) If no such opportunities exist, maximizing shareholder value dictates that management must return excess cash to shareholders (i. e. , distribution via dividends). 23

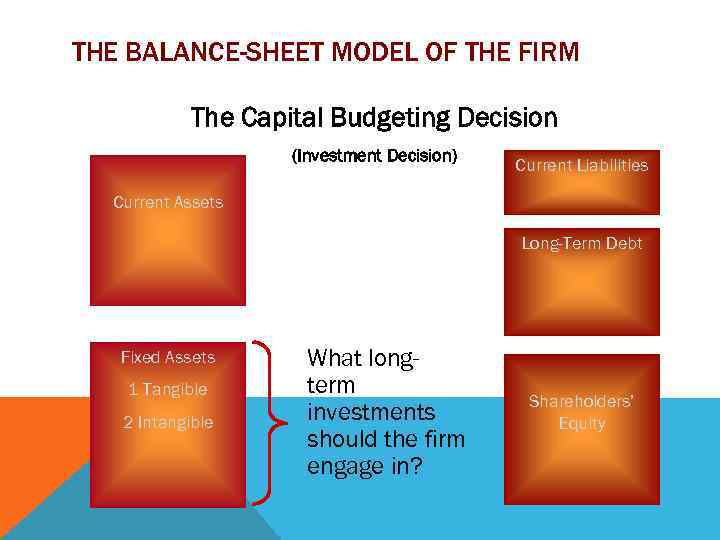

THE INVESTMENT DECISION Capital budgeting is the planning and control of cash outflows in the expectation of deriving future cash inflows from investments in non-current assets. Involves evaluating the: § size of future cash flows § timing of future cash flows § risk of future cash flows.

THE INVESTMENT DECISION Capital budgeting is the planning and control of cash outflows in the expectation of deriving future cash inflows from investments in non-current assets. Involves evaluating the: § size of future cash flows § timing of future cash flows § risk of future cash flows.

THE BALANCE-SHEET MODEL OF THE FIRM The Capital Budgeting Decision (Investment Decision) Current Liabilities Current Assets Long-Term Debt Fixed Assets 1 Tangible 2 Intangible What longterm investments should the firm engage in? Shareholders’ Equity

THE BALANCE-SHEET MODEL OF THE FIRM The Capital Budgeting Decision (Investment Decision) Current Liabilities Current Assets Long-Term Debt Fixed Assets 1 Tangible 2 Intangible What longterm investments should the firm engage in? Shareholders’ Equity

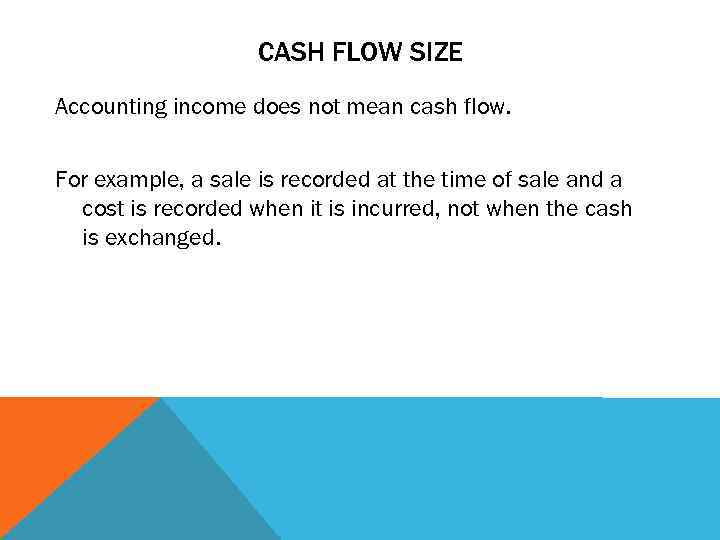

CASH FLOW SIZE Accounting income does not mean cash flow. For example, a sale is recorded at the time of sale and a cost is recorded when it is incurred, not when the cash is exchanged.

CASH FLOW SIZE Accounting income does not mean cash flow. For example, a sale is recorded at the time of sale and a cost is recorded when it is incurred, not when the cash is exchanged.

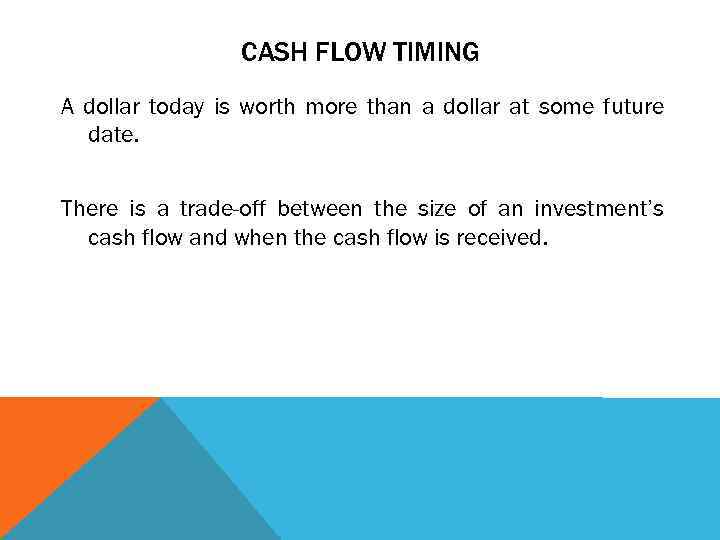

CASH FLOW TIMING A dollar today is worth more than a dollar at some future date. There is a trade-off between the size of an investment’s cash flow and when the cash flow is received.

CASH FLOW TIMING A dollar today is worth more than a dollar at some future date. There is a trade-off between the size of an investment’s cash flow and when the cash flow is received.

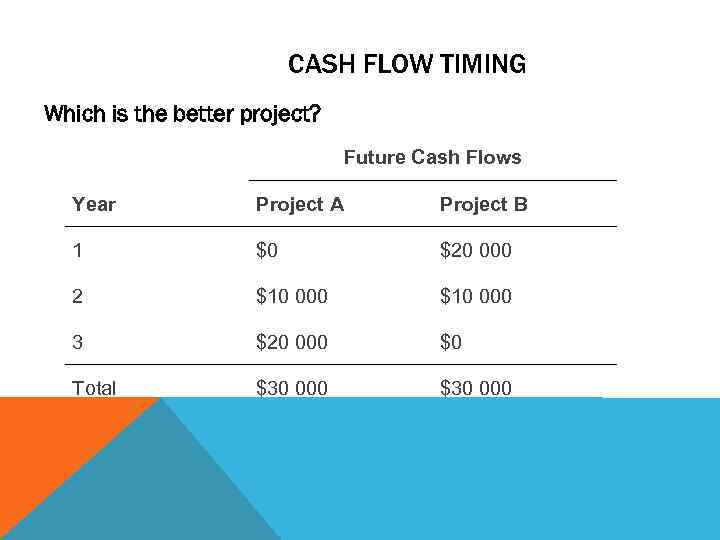

CASH FLOW TIMING Which is the better project? Future Cash Flows Year Project A Project B 1 $0 $20 000 2 $10 000 3 $20 000 $0 Total $30 000

CASH FLOW TIMING Which is the better project? Future Cash Flows Year Project A Project B 1 $0 $20 000 2 $10 000 3 $20 000 $0 Total $30 000

CASH FLOW RISK The role of the financial manager is to deal with the uncertainty associated with investment decisions. Assessing the risk associated with the size and timing of expected future cash flows is critical to investment decisions.

CASH FLOW RISK The role of the financial manager is to deal with the uncertainty associated with investment decisions. Assessing the risk associated with the size and timing of expected future cash flows is critical to investment decisions.

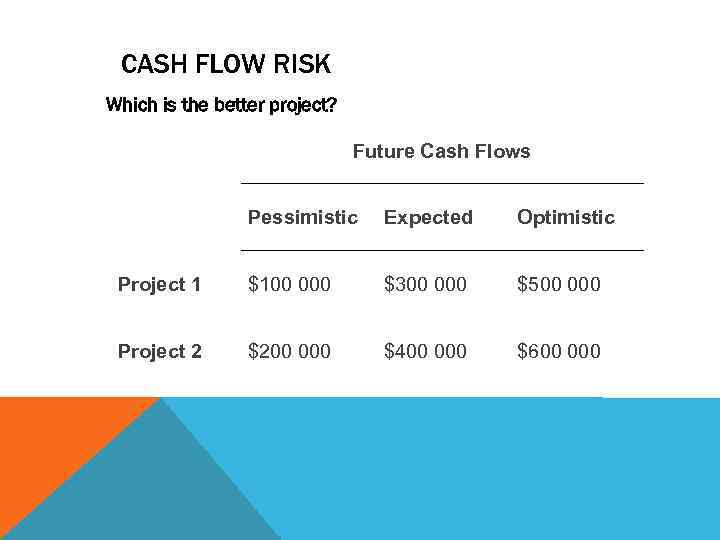

CASH FLOW RISK Which is the better project? Future Cash Flows Pessimistic Expected Optimistic Project 1 $100 000 $300 000 $500 000 Project 2 $200 000 $400 000 $600 000

CASH FLOW RISK Which is the better project? Future Cash Flows Pessimistic Expected Optimistic Project 1 $100 000 $300 000 $500 000 Project 2 $200 000 $400 000 $600 000

THE FINANCING DECISION (VIDEO) is the second major decision of the firm. If one looks at the mix of financing for firms across industries, he will see marked differences. Some firms have high relative amounts of debt, while others are almost debt-free. Does the type of financing employed make a difference? Is it possible to define the optimal financial structure of the firm? 31

THE FINANCING DECISION (VIDEO) is the second major decision of the firm. If one looks at the mix of financing for firms across industries, he will see marked differences. Some firms have high relative amounts of debt, while others are almost debt-free. Does the type of financing employed make a difference? Is it possible to define the optimal financial structure of the firm? 31

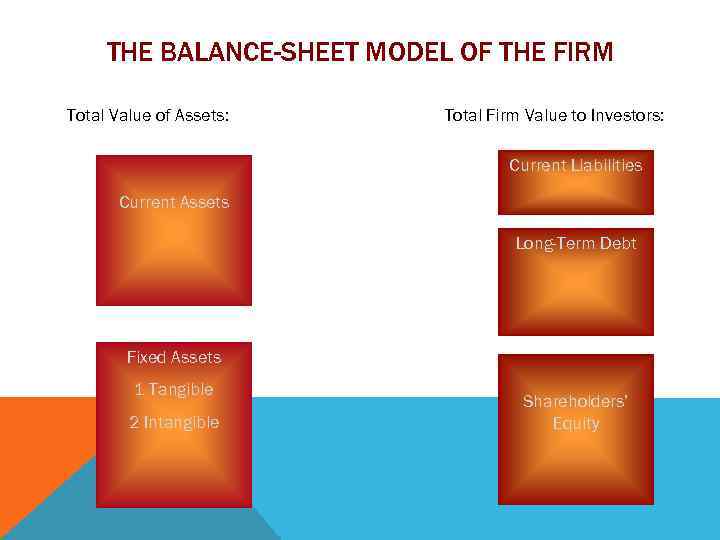

THE BALANCE-SHEET MODEL OF THE FIRM Total Value of Assets: Total Firm Value to Investors: Current Liabilities Current Assets Long-Term Debt Fixed Assets 1 Tangible 2 Intangible Shareholders’ Equity

THE BALANCE-SHEET MODEL OF THE FIRM Total Value of Assets: Total Firm Value to Investors: Current Liabilities Current Assets Long-Term Debt Fixed Assets 1 Tangible 2 Intangible Shareholders’ Equity

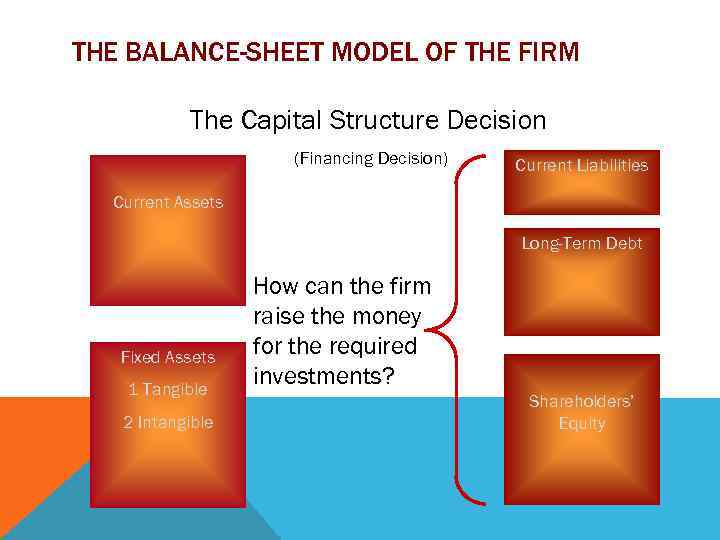

THE BALANCE-SHEET MODEL OF THE FIRM The Capital Structure Decision (Financing Decision) Current Liabilities Current Assets Long-Term Debt Fixed Assets 1 Tangible 2 Intangible How can the firm raise the money for the required investments? Shareholders’ Equity

THE BALANCE-SHEET MODEL OF THE FIRM The Capital Structure Decision (Financing Decision) Current Liabilities Current Assets Long-Term Debt Fixed Assets 1 Tangible 2 Intangible How can the firm raise the money for the required investments? Shareholders’ Equity

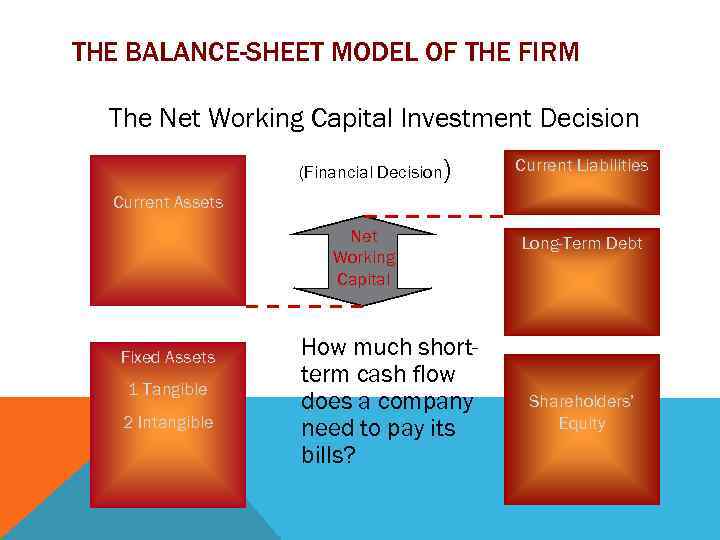

THE BALANCE-SHEET MODEL OF THE FIRM The Net Working Capital Investment Decision (Financial Decision) Current Liabilities Current Assets Net Working Capital Fixed Assets 1 Tangible 2 Intangible How much shortterm cash flow does a company need to pay its bills? Long-Term Debt Shareholders’ Equity

THE BALANCE-SHEET MODEL OF THE FIRM The Net Working Capital Investment Decision (Financial Decision) Current Liabilities Current Assets Net Working Capital Fixed Assets 1 Tangible 2 Intangible How much shortterm cash flow does a company need to pay its bills? Long-Term Debt Shareholders’ Equity

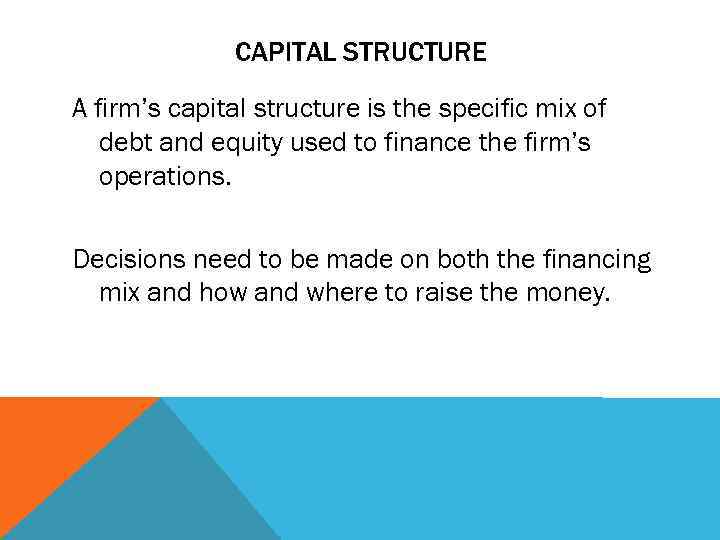

CAPITAL STRUCTURE A firm’s capital structure is the specific mix of debt and equity used to finance the firm’s operations. Decisions need to be made on both the financing mix and how and where to raise the money.

CAPITAL STRUCTURE A firm’s capital structure is the specific mix of debt and equity used to finance the firm’s operations. Decisions need to be made on both the financing mix and how and where to raise the money.

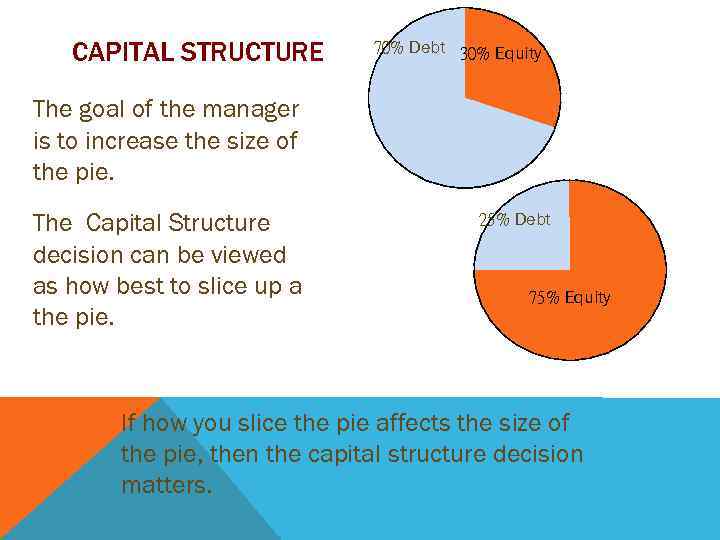

CAPITAL STRUCTURE 70% Debt 30% Equity The goal of the manager is to increase the size of the pie. The Capital Structure decision can be viewed as how best to slice up a the pie. 25% Debt 50% Equity 75% If how you slice the pie affects the size of the pie, then the capital structure decision matters.

CAPITAL STRUCTURE 70% Debt 30% Equity The goal of the manager is to increase the size of the pie. The Capital Structure decision can be viewed as how best to slice up a the pie. 25% Debt 50% Equity 75% If how you slice the pie affects the size of the pie, then the capital structure decision matters.

WORKING CAPITAL MANAGEMENT How much cash and inventory should be kept on hand? Should credit terms be extended? If so, what are the conditions? How is short-term financing acquired?

WORKING CAPITAL MANAGEMENT How much cash and inventory should be kept on hand? Should credit terms be extended? If so, what are the conditions? How is short-term financing acquired?

THE ASSET MANAGEMENT DECISION is the third important decision of the firm. The financial manager is charged with varying degrees of operating responsibility over existing assets. 38

THE ASSET MANAGEMENT DECISION is the third important decision of the firm. The financial manager is charged with varying degrees of operating responsibility over existing assets. 38

DIVIDEND DECISION is a decision made by the directors of a company. It relatives to the amount and timing of any cash payments made to the company's stockholders. The decision is an important one for the firm as it may influence its capital structure and stock price. In addition, the decision may determine the amount of taxation that stockholders pay. There are three main factors that may influence a firm's dividend decision: Free-cash flow Dividend clienteles Information signalling 39

DIVIDEND DECISION is a decision made by the directors of a company. It relatives to the amount and timing of any cash payments made to the company's stockholders. The decision is an important one for the firm as it may influence its capital structure and stock price. In addition, the decision may determine the amount of taxation that stockholders pay. There are three main factors that may influence a firm's dividend decision: Free-cash flow Dividend clienteles Information signalling 39

Organization of the financial management function

Organization of the financial management function

FINANCIAL MANAGER Financial managers try to answer some or all of these questions The top financial manager within a firm is usually the Chief Financial Officer (CFO) § Treasurer – oversees cash management, credit management, capital expenditures and financial planning § Controller – oversees taxes, cost accounting, financial accounting and data processing 41 1.

FINANCIAL MANAGER Financial managers try to answer some or all of these questions The top financial manager within a firm is usually the Chief Financial Officer (CFO) § Treasurer – oversees cash management, credit management, capital expenditures and financial planning § Controller – oversees taxes, cost accounting, financial accounting and data processing 41 1.

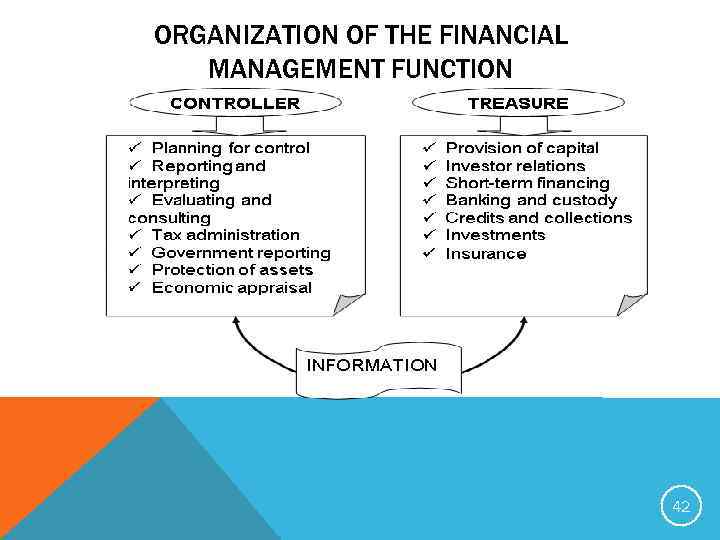

ORGANIZATION OF THE FINANCIAL MANAGEMENT FUNCTION 42

ORGANIZATION OF THE FINANCIAL MANAGEMENT FUNCTION 42

The controller is basically concerned with internal matters, such as financial and cost accounting, taxes, budgeting and control functions. The treasurer responsibilities fall into decision areas usually associated with financial management such as investment (pension management), financing (commercial banking and investment banking relationships, investors relations, dividend disbursement) and asset management (cash management, credit management). The financial vice president supervises all phases of financial activity, and serves as the financial adviser to the Board of Directors. 43

The controller is basically concerned with internal matters, such as financial and cost accounting, taxes, budgeting and control functions. The treasurer responsibilities fall into decision areas usually associated with financial management such as investment (pension management), financing (commercial banking and investment banking relationships, investors relations, dividend disbursement) and asset management (cash management, credit management). The financial vice president supervises all phases of financial activity, and serves as the financial adviser to the Board of Directors. 43

The business environment

The business environment

BASIC FORMS OF BUSINESS ORGANIZATION 1)sole proprietorship; 2)partnership; 3)corporation.

BASIC FORMS OF BUSINESS ORGANIZATION 1)sole proprietorship; 2)partnership; 3)corporation.

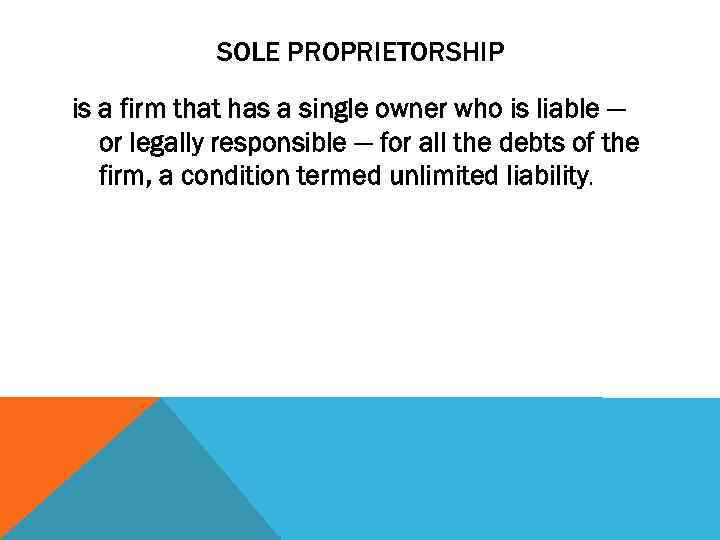

SOLE PROPRIETORSHIP is a firm that has a single owner who is liable — or legally responsible — for all the debts of the firm, a condition termed unlimited liability.

SOLE PROPRIETORSHIP is a firm that has a single owner who is liable — or legally responsible — for all the debts of the firm, a condition termed unlimited liability.

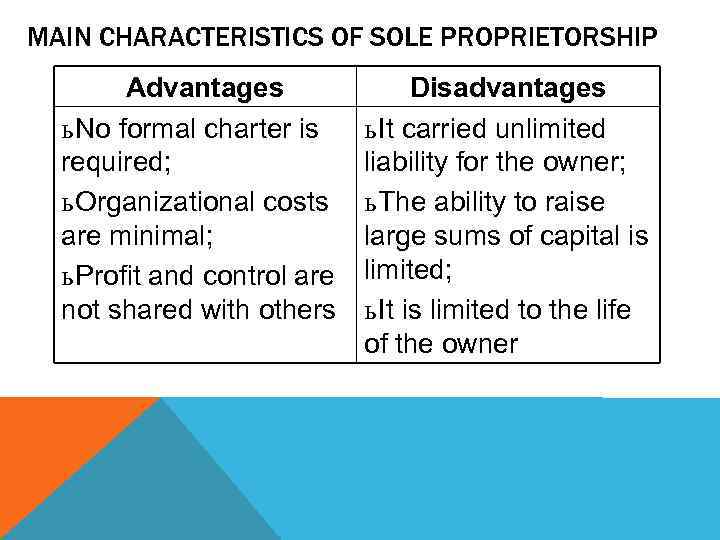

MAIN CHARACTERISTICS OF SOLE PROPRIETORSHIP Advantages ь No formal charter is required; ь Organizational costs are minimal; ь Profit and control are not shared with others Disadvantages ь It carried unlimited liability for the owner; ь The ability to raise large sums of capital is limited; ь It is limited to the life of the owner

MAIN CHARACTERISTICS OF SOLE PROPRIETORSHIP Advantages ь No formal charter is required; ь Organizational costs are minimal; ь Profit and control are not shared with others Disadvantages ь It carried unlimited liability for the owner; ь The ability to raise large sums of capital is limited; ь It is limited to the life of the owner

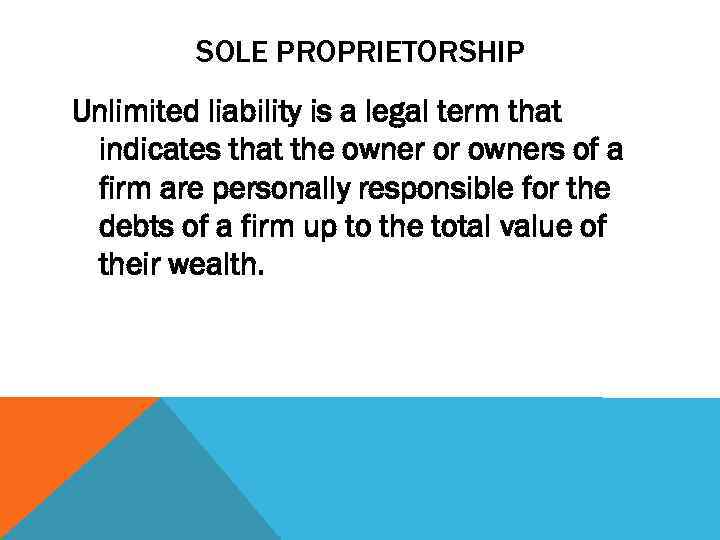

SOLE PROPRIETORSHIP Unlimited liability is a legal term that indicates that the owner or owners of a firm are personally responsible for the debts of a firm up to the total value of their wealth.

SOLE PROPRIETORSHIP Unlimited liability is a legal term that indicates that the owner or owners of a firm are personally responsible for the debts of a firm up to the total value of their wealth.

PARTNERSHIP is an extended form of the proprietorship. Rather than one owner, a partnership has two or more co-owners. These partners — who are team members — share financing of capital investments and, in return, the firm's residual claims to profits.

PARTNERSHIP is an extended form of the proprietorship. Rather than one owner, a partnership has two or more co-owners. These partners — who are team members — share financing of capital investments and, in return, the firm's residual claims to profits.

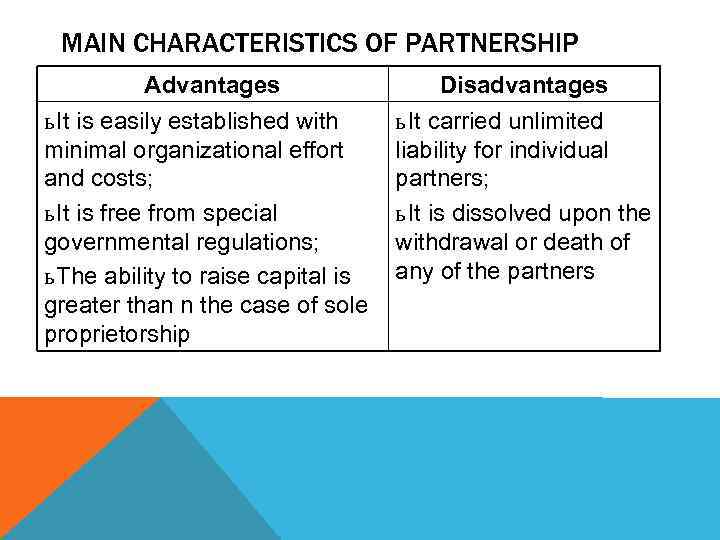

MAIN CHARACTERISTICS OF PARTNERSHIP Advantages ь It is easily established with minimal organizational effort and costs; ь It is free from special governmental regulations; ь The ability to raise capital is greater than n the case of sole proprietorship Disadvantages ь It carried unlimited liability for individual partners; ь It is dissolved upon the withdrawal or death of any of the partners

MAIN CHARACTERISTICS OF PARTNERSHIP Advantages ь It is easily established with minimal organizational effort and costs; ь It is free from special governmental regulations; ь The ability to raise capital is greater than n the case of sole proprietorship Disadvantages ь It carried unlimited liability for individual partners; ь It is dissolved upon the withdrawal or death of any of the partners

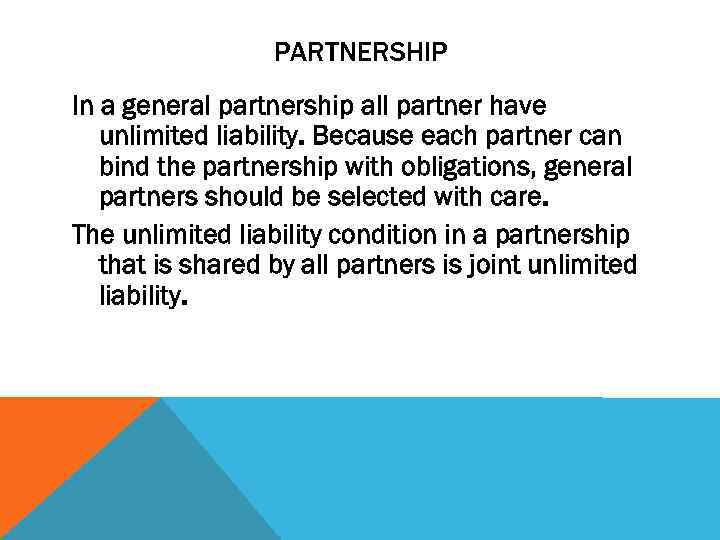

PARTNERSHIP In a general partnership all partner have unlimited liability. Because each partner can bind the partnership with obligations, general partners should be selected with care. The unlimited liability condition in a partnership that is shared by all partners is joint unlimited liability.

PARTNERSHIP In a general partnership all partner have unlimited liability. Because each partner can bind the partnership with obligations, general partners should be selected with care. The unlimited liability condition in a partnership that is shared by all partners is joint unlimited liability.

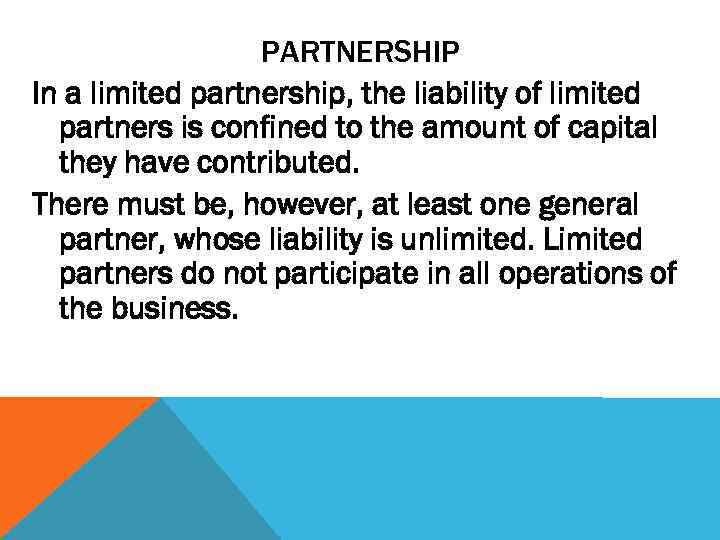

PARTNERSHIP In a limited partnership, the liability of limited partners is confined to the amount of capital they have contributed. There must be, however, at least one general partner, whose liability is unlimited. Limited partners do not participate in all operations of the business.

PARTNERSHIP In a limited partnership, the liability of limited partners is confined to the amount of capital they have contributed. There must be, however, at least one general partner, whose liability is unlimited. Limited partners do not participate in all operations of the business.

CORPORATION is a business form separate from its owners. The principal feature of this form of business is that the corporation exists legally separate and apart from its owners.

CORPORATION is a business form separate from its owners. The principal feature of this form of business is that the corporation exists legally separate and apart from its owners.

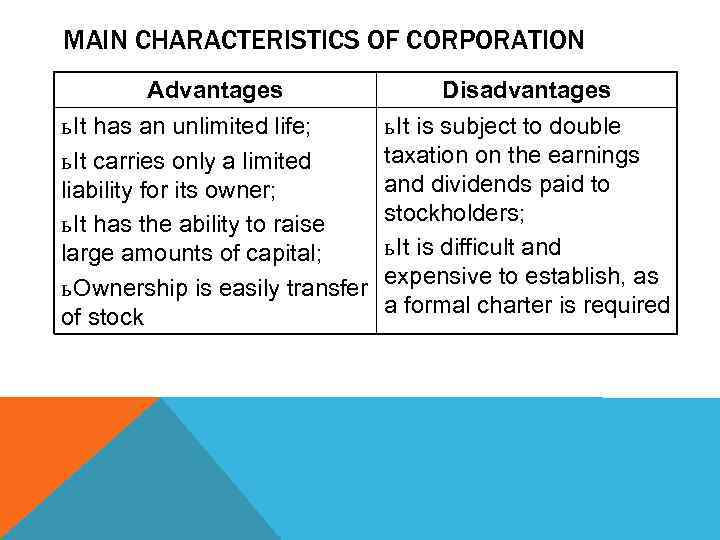

MAIN CHARACTERISTICS OF CORPORATION Advantages ь It has an unlimited life; ь It carries only a limited liability for its owner; ь It has the ability to raise large amounts of capital; ь Ownership is easily transfer of stock Disadvantages ь It is subject to double taxation on the earnings and dividends paid to stockholders; ь It is difficult and expensive to establish, as a formal charter is required

MAIN CHARACTERISTICS OF CORPORATION Advantages ь It has an unlimited life; ь It carries only a limited liability for its owner; ь It has the ability to raise large amounts of capital; ь Ownership is easily transfer of stock Disadvantages ь It is subject to double taxation on the earnings and dividends paid to stockholders; ь It is difficult and expensive to establish, as a formal charter is required

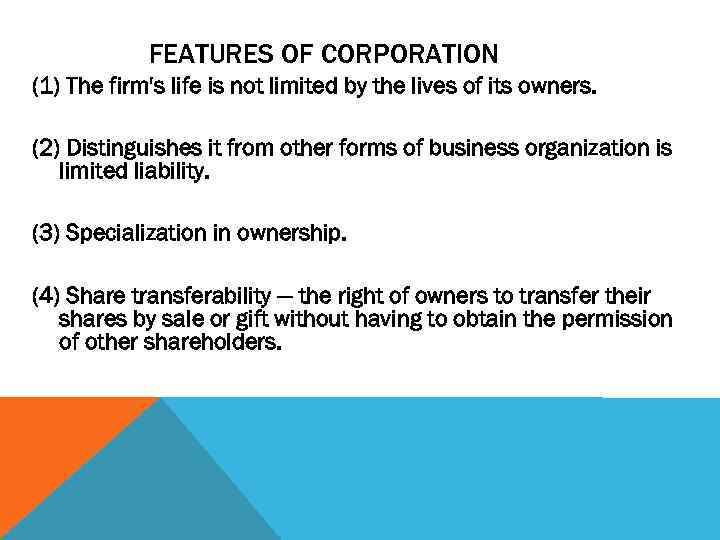

FEATURES OF CORPORATION (1) The firm's life is not limited by the lives of its owners. (2) Distinguishes it from other forms of business organization is limited liability. (3) Specialization in ownership. (4) Share transferability — the right of owners to transfer their shares by sale or gift without having to obtain the permission of other shareholders.

FEATURES OF CORPORATION (1) The firm's life is not limited by the lives of its owners. (2) Distinguishes it from other forms of business organization is limited liability. (3) Specialization in ownership. (4) Share transferability — the right of owners to transfer their shares by sale or gift without having to obtain the permission of other shareholders.

CORPORATION Limited liability is the legal term indicating that owners of corporations are not responsible for the debts of the firm except for the amount they have invested in shares of ownership.

CORPORATION Limited liability is the legal term indicating that owners of corporations are not responsible for the debts of the firm except for the amount they have invested in shares of ownership.

Main types of business organization (VIDEO) 57

Main types of business organization (VIDEO) 57

The financial environment

The financial environment

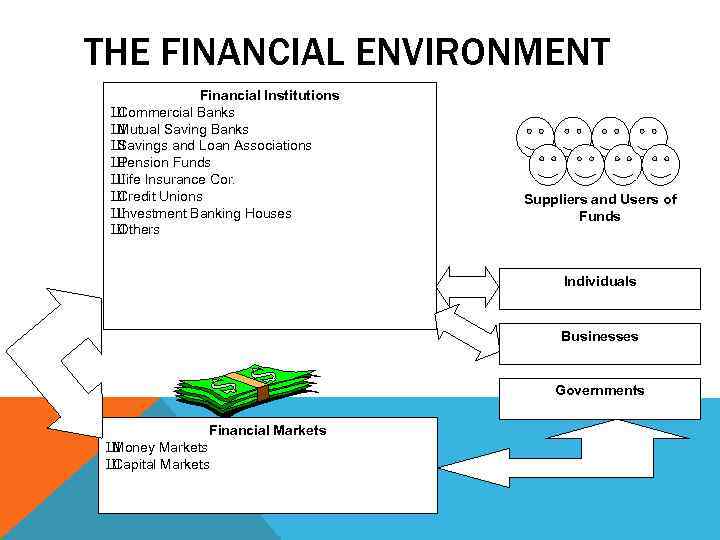

THE FINANCIAL ENVIRONMENT Financial Institutions Ш Commercial Banks Ш Mutual Saving Banks Ш Savings and Loan Associations Ш Pension Funds Ш Insurance Cor. Life Ш Credit Unions Ш Investment Banking Houses Ш Others Suppliers and Users of Funds Individuals Businesses Governments Financial Markets Ш Money Markets Ш Capital Markets

THE FINANCIAL ENVIRONMENT Financial Institutions Ш Commercial Banks Ш Mutual Saving Banks Ш Savings and Loan Associations Ш Pension Funds Ш Insurance Cor. Life Ш Credit Unions Ш Investment Banking Houses Ш Others Suppliers and Users of Funds Individuals Businesses Governments Financial Markets Ш Money Markets Ш Capital Markets

A financial institution is a business whose primary activity is buying, selling, or holding financial assets.

A financial institution is a business whose primary activity is buying, selling, or holding financial assets.

TYPES OF FINANCIAL INSTITUTIONS 1. Depository Institutions are financial institutions whose primary financial liability is deposits in checking accounts. It includes commercial banks, savings and loan associations (S&Ls), and credit unions.

TYPES OF FINANCIAL INSTITUTIONS 1. Depository Institutions are financial institutions whose primary financial liability is deposits in checking accounts. It includes commercial banks, savings and loan associations (S&Ls), and credit unions.

TYPES OF FINANCIAL INSTITUTIONS Commercial banks make money by lending your deposits (primarily in the form of business and commercial loans), charging the borrower a higher interest rate than they pay the depositor.

TYPES OF FINANCIAL INSTITUTIONS Commercial banks make money by lending your deposits (primarily in the form of business and commercial loans), charging the borrower a higher interest rate than they pay the depositor.

TYPES OF FINANCIAL INSTITUTIONS Savings banks and S&Ls handled savings accounts and mortgages; they were not allowed to issue checking accounts.

TYPES OF FINANCIAL INSTITUTIONS Savings banks and S&Ls handled savings accounts and mortgages; they were not allowed to issue checking accounts.

TYPES OF FINANCIAL INSTITUTIONS 2. Contractual Intermediaries The most important contractual intermediaries are insurance companies and pension funds. These institutions promise, for a fee, to pay an individual a certain amount of money in the future, either when some event happens (a fire or death) or, in the case of pension funds and some kinds of life insurance, when the individual reaches a certain age or dies.

TYPES OF FINANCIAL INSTITUTIONS 2. Contractual Intermediaries The most important contractual intermediaries are insurance companies and pension funds. These institutions promise, for a fee, to pay an individual a certain amount of money in the future, either when some event happens (a fire or death) or, in the case of pension funds and some kinds of life insurance, when the individual reaches a certain age or dies.

TYPES OF FINANCIAL INSTITUTIONS 3. Investment Intermediaries Investment intermediaries provide a mechanism through which small savers pool funds to purchase a variety of financial assets rather than just one or two.

TYPES OF FINANCIAL INSTITUTIONS 3. Investment Intermediaries Investment intermediaries provide a mechanism through which small savers pool funds to purchase a variety of financial assets rather than just one or two.

TYPES OF FINANCIAL INSTITUTIONS A mutual fund enables a small saver to diversify (spread out) his or her savings (for a fee, of course).

TYPES OF FINANCIAL INSTITUTIONS A mutual fund enables a small saver to diversify (spread out) his or her savings (for a fee, of course).

TYPES OF FINANCIAL INSTITUTIONS Finance companies make loans to individuals and businesses, as do banks, but instead of holding deposits, as banks do, finance companies borrow the money they lend. They borrow from individuals by selling them bonds and commercial paper.

TYPES OF FINANCIAL INSTITUTIONS Finance companies make loans to individuals and businesses, as do banks, but instead of holding deposits, as banks do, finance companies borrow the money they lend. They borrow from individuals by selling them bonds and commercial paper.

TYPES OF FINANCIAL INSTITUTIONS 4. Financial Brokers Financial brokers are of two main types: investment banks brokerage houses.

TYPES OF FINANCIAL INSTITUTIONS 4. Financial Brokers Financial brokers are of two main types: investment banks brokerage houses.

TYPES OF FINANCIAL INSTITUTIONS Investment banks assist companies in selling financial assets such as stocks and bonds. They provide advice, expertise, and the sales force to sell the stocks or bonds. They handle such things as mergers and takeovers of companies.

TYPES OF FINANCIAL INSTITUTIONS Investment banks assist companies in selling financial assets such as stocks and bonds. They provide advice, expertise, and the sales force to sell the stocks or bonds. They handle such things as mergers and takeovers of companies.

TYPES OF FINANCIAL INSTITUTIONS A merger occurs when two or more companies join to form one new company. A takeover occurs when one company buys out another company.

TYPES OF FINANCIAL INSTITUTIONS A merger occurs when two or more companies join to form one new company. A takeover occurs when one company buys out another company.

TYPES OF FINANCIAL INSTITUTIONS Brokerage houses assist individuals in selling previously issued financial assets. Brokerage houses create a secondary market in financial assets, as we'll see shortly.

TYPES OF FINANCIAL INSTITUTIONS Brokerage houses assist individuals in selling previously issued financial assets. Brokerage houses create a secondary market in financial assets, as we'll see shortly.

A FINANCIAL MARKET is a market where financial assets and financial liabilities are bought and sold. The stock market, the bond market, and bank activities are all examples of financial markets.

A FINANCIAL MARKET is a market where financial assets and financial liabilities are bought and sold. The stock market, the bond market, and bank activities are all examples of financial markets.

FINANCIAL MARKET is an institution that brings buyers and sellers of financial assets together.

FINANCIAL MARKET is an institution that brings buyers and sellers of financial assets together.

THERE ARE VARIOUS TYPES OF FINANCIAL MARKETS: 1. Primary financial market 2. Secondary financial market

THERE ARE VARIOUS TYPES OF FINANCIAL MARKETS: 1. Primary financial market 2. Secondary financial market

PRIMARY FINANCIAL MARKET is a market in which newly issued financial assets are sold. These markets transfer savings to borrowers who want to invest (buy real assets). Sellers in this market include venture capital firms (which sell part ownerships in new companies) investment banks (which sell new stock and new bonds for existing companies).

PRIMARY FINANCIAL MARKET is a market in which newly issued financial assets are sold. These markets transfer savings to borrowers who want to invest (buy real assets). Sellers in this market include venture capital firms (which sell part ownerships in new companies) investment banks (which sell new stock and new bonds for existing companies).

SECONDARY FINANCIAL MARKET is a market in which previously issued financial assets can he bought and sold. Financial markets provide a mechanism through which the financial manager may obtain funds from a wide range of sources, including financial institutions.

SECONDARY FINANCIAL MARKET is a market in which previously issued financial assets can he bought and sold. Financial markets provide a mechanism through which the financial manager may obtain funds from a wide range of sources, including financial institutions.

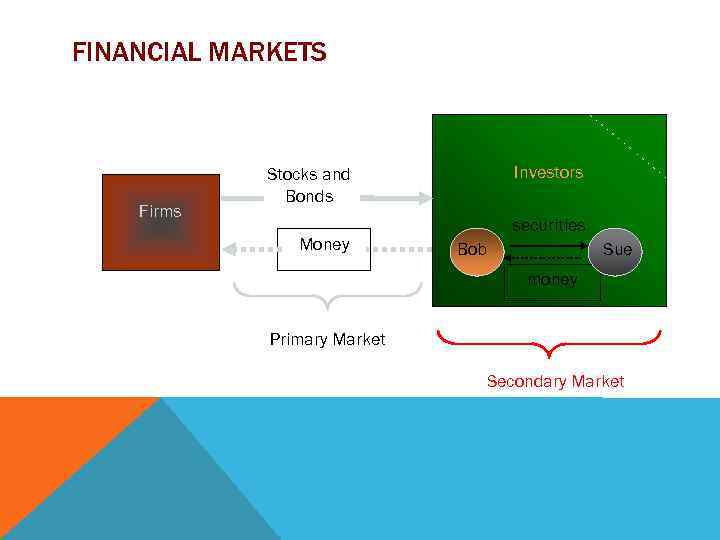

FINANCIAL MARKETS Primary Market § When a corporation issues securities, cash flows from investors to the firm. § Usually an underwriter is involved Secondary Markets § Involve the sale of “used” securities from one investor to another. § Securities may be exchange traded or trade over-the-counter in a dealer market.

FINANCIAL MARKETS Primary Market § When a corporation issues securities, cash flows from investors to the firm. § Usually an underwriter is involved Secondary Markets § Involve the sale of “used” securities from one investor to another. § Securities may be exchange traded or trade over-the-counter in a dealer market.

FINANCIAL MARKETS Firms Investors Stocks and Bonds Money securities Bob Sue money Primary Market Secondary Market

FINANCIAL MARKETS Firms Investors Stocks and Bonds Money securities Bob Sue money Primary Market Secondary Market

THE FINANCIAL MARKETS ARE COMPOSED OF money markets capital markets.

THE FINANCIAL MARKETS ARE COMPOSED OF money markets capital markets.

MONEY MARKETS are the markets for short-term (less than one year) debt securities.

MONEY MARKETS are the markets for short-term (less than one year) debt securities.

CAPITAL MARKETS are the markets for long-term debt and corporate stock.

CAPITAL MARKETS are the markets for long-term debt and corporate stock.

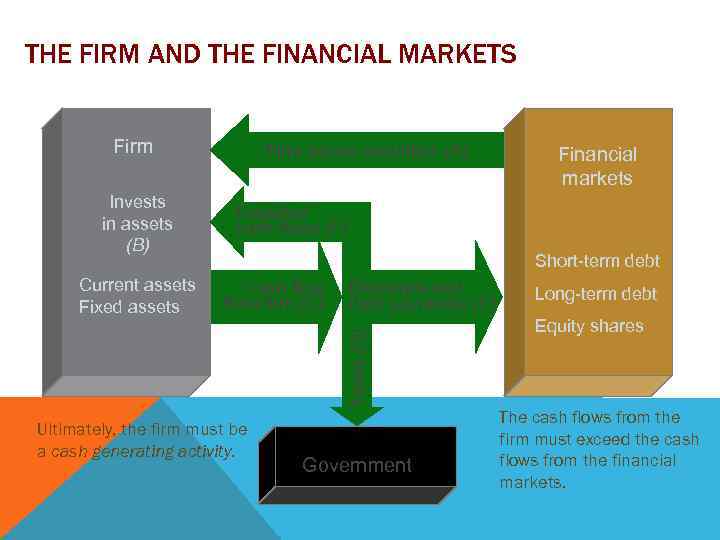

THE FIRM AND THE FINANCIAL MARKETS Firm Invests in assets (B) Financial markets Retained cash flows (F) Short-term debt Cash flow from firm (C) Dividends and debt payments (E) Taxes (D) Current assets Fixed assets Firm issues securities (A) Ultimately, the firm must be a cash generating activity. Government Long-term debt Equity shares The cash flows from the firm must exceed the cash flows from the financial markets.

THE FIRM AND THE FINANCIAL MARKETS Firm Invests in assets (B) Financial markets Retained cash flows (F) Short-term debt Cash flow from firm (C) Dividends and debt payments (E) Taxes (D) Current assets Fixed assets Firm issues securities (A) Ultimately, the firm must be a cash generating activity. Government Long-term debt Equity shares The cash flows from the firm must exceed the cash flows from the financial markets.

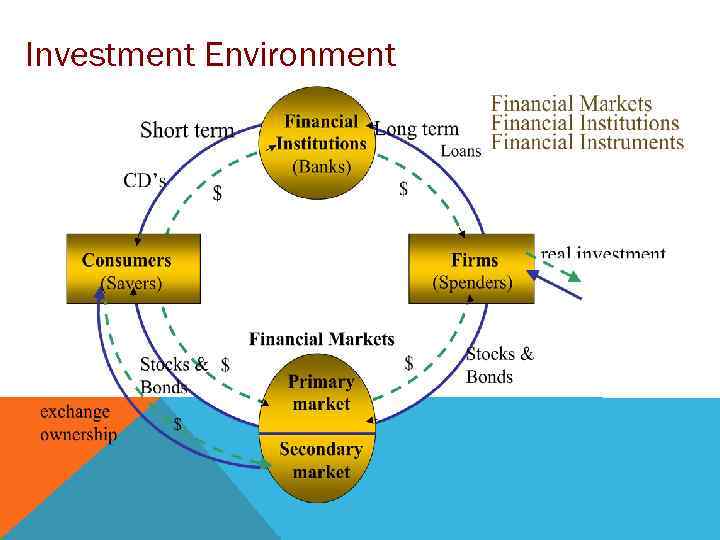

Investment Environment

Investment Environment

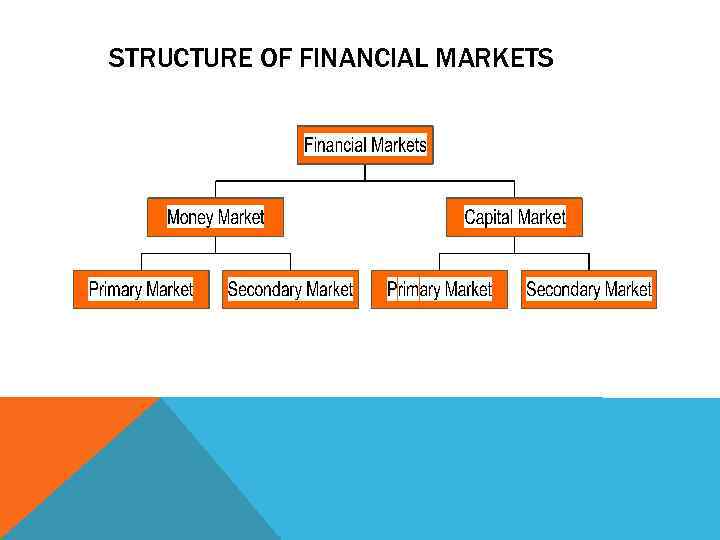

FINANCIAL MARKETS Financial markets bring together the buyers and sellers of debt and equity securities. Money markets involve the trading of short-term debt securities. Capital markets involve the trading of long-term debt securities. Primary markets involve the original sale of securities. Secondary markets involve the continual buying and selling of issued securities.

FINANCIAL MARKETS Financial markets bring together the buyers and sellers of debt and equity securities. Money markets involve the trading of short-term debt securities. Capital markets involve the trading of long-term debt securities. Primary markets involve the original sale of securities. Secondary markets involve the continual buying and selling of issued securities.

STRUCTURE OF FINANCIAL MARKETS

STRUCTURE OF FINANCIAL MARKETS

The tax environment

The tax environment

THE CORPORATE TAX STRUCTURE IN WESTERN COUNTRIES INCLUDES 1. Corporate income taxes 2. Interest and dividend income 3. Interest and dividends paid by a corporation 4. Capital gain 5. Operating loss carryback and carryforward 6. Depreciation

THE CORPORATE TAX STRUCTURE IN WESTERN COUNTRIES INCLUDES 1. Corporate income taxes 2. Interest and dividend income 3. Interest and dividends paid by a corporation 4. Capital gain 5. Operating loss carryback and carryforward 6. Depreciation

1. CORPORATE INCOME TAXES is found by deducting all expenses, including depreciation and interest, from revenues. is then subject to a graduated tax structure, called the marginal tax rate. The average tax rate is measured by dividing taxes actually paid by taxable income.

1. CORPORATE INCOME TAXES is found by deducting all expenses, including depreciation and interest, from revenues. is then subject to a graduated tax structure, called the marginal tax rate. The average tax rate is measured by dividing taxes actually paid by taxable income.

2. INTEREST AND DIVIDEND INCOME Interest income is taxed as ordinary income at the regular corporate tax rate. Dividends income represents the distribution of earnings by a company whose stock is owned by a corporation. In order to reduce the effects of double taxation, a certain percentage of such dividends is tax exempt. The remainder is taxed at the corporate tax rate.

2. INTEREST AND DIVIDEND INCOME Interest income is taxed as ordinary income at the regular corporate tax rate. Dividends income represents the distribution of earnings by a company whose stock is owned by a corporation. In order to reduce the effects of double taxation, a certain percentage of such dividends is tax exempt. The remainder is taxed at the corporate tax rate.

3. INTEREST AND DIVIDENDS PAID BY A CORPORATION Interest paid is a tax deductible expense. Thus, interest is paid with before-tax money. Dividends on stock paid by a firm are not deductible, and are therefore paid with after-tax money.

3. INTEREST AND DIVIDENDS PAID BY A CORPORATION Interest paid is a tax deductible expense. Thus, interest is paid with before-tax money. Dividends on stock paid by a firm are not deductible, and are therefore paid with after-tax money.

4. CAPITAL GAIN Capital gains are one major form of corporate income. They result when old assets are sold at prices above the original purchase prices. Capital losses are deductible only against capital gains.

4. CAPITAL GAIN Capital gains are one major form of corporate income. They result when old assets are sold at prices above the original purchase prices. Capital losses are deductible only against capital gains.

5. OPERATING LOSS CARRYBACK AND CARRYFORWARD If a company has an operating loss, such loss may be applied against income in other years. The loss can be carried back 3 years and then forward for 15 years. This means that the firm must first apply the loss against the taxable income in the 3 prior years. If the loss is not completely absorbed by the profits in these 3 years, it may be carried forward to each of the 15 following years.

5. OPERATING LOSS CARRYBACK AND CARRYFORWARD If a company has an operating loss, such loss may be applied against income in other years. The loss can be carried back 3 years and then forward for 15 years. This means that the firm must first apply the loss against the taxable income in the 3 prior years. If the loss is not completely absorbed by the profits in these 3 years, it may be carried forward to each of the 15 following years.

6. DEPRECIATION Depreciation is the systematic allocation of the cost of a capital asset over a period of time for reporting and tax purposes. Depreciation deductions taken on a firm's tax returns are treated as expense items. Thus they lower taxable income.

6. DEPRECIATION Depreciation is the systematic allocation of the cost of a capital asset over a period of time for reporting and tax purposes. Depreciation deductions taken on a firm's tax returns are treated as expense items. Thus they lower taxable income.

Agency relationship

Agency relationship

THE MODERN CORPORATION Modern Corporation Shareholders Management There exists a SEPARATION between owners and managers.

THE MODERN CORPORATION Modern Corporation Shareholders Management There exists a SEPARATION between owners and managers.

ROLE OF MANAGEMENT Management acts as an agent for the owners (shareholders) of the firm. An agent is an individual authorized by another person, called the principal, to act in the latter’s behalf.

ROLE OF MANAGEMENT Management acts as an agent for the owners (shareholders) of the firm. An agent is an individual authorized by another person, called the principal, to act in the latter’s behalf.

AGENCY THEORY u. Jensen and Meckling developed a theory of the firm based on agency theory Agency Theory is a branch of economics relating to the behavior of principals and their agents.

AGENCY THEORY u. Jensen and Meckling developed a theory of the firm based on agency theory Agency Theory is a branch of economics relating to the behavior of principals and their agents.

AGENCY THEORY u Principals must provide incentives so that management acts in the principals’ best interests and then monitor results. Incentives include stock options, perquisites, and bonuses

AGENCY THEORY u Principals must provide incentives so that management acts in the principals’ best interests and then monitor results. Incentives include stock options, perquisites, and bonuses

AGENCY RELATIONSHIPS The agency relationship is the relationship between the shareholders (owners) and the management of a firm. The agency problem is the possibility of conflict of interests between these two parties. Agency costs refer to the direct and indirect costs arising from this conflict of interest. ht

AGENCY RELATIONSHIPS The agency relationship is the relationship between the shareholders (owners) and the management of a firm. The agency problem is the possibility of conflict of interests between these two parties. Agency costs refer to the direct and indirect costs arising from this conflict of interest. ht

DO MANAGERS ACT IN SHAREHOLDERS’ INTERESTS? The answer to this will depend on two factors: how closely management goals are aligned with shareholder goals the ease with which management can be replaced if it does not act in shareholders’ best interests.

DO MANAGERS ACT IN SHAREHOLDERS’ INTERESTS? The answer to this will depend on two factors: how closely management goals are aligned with shareholder goals the ease with which management can be replaced if it does not act in shareholders’ best interests.

ALIGNMENT OF GOALS The conflict of interests is limited due to: management compensation schemes monitoring of management the threat of takeover other stakeholders.

ALIGNMENT OF GOALS The conflict of interests is limited due to: management compensation schemes monitoring of management the threat of takeover other stakeholders.

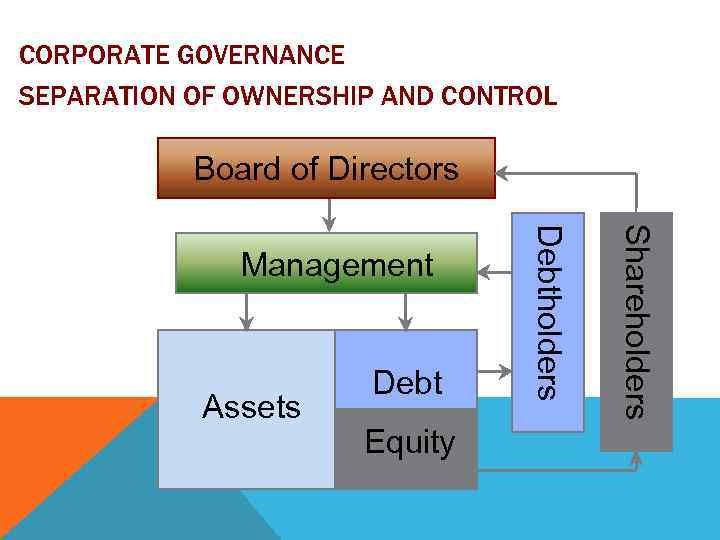

CORPORATE GOVERNANCE SEPARATION OF OWNERSHIP AND CONTROL Board of Directors Equity Shareholders Assets Debtholders Management

CORPORATE GOVERNANCE SEPARATION OF OWNERSHIP AND CONTROL Board of Directors Equity Shareholders Assets Debtholders Management

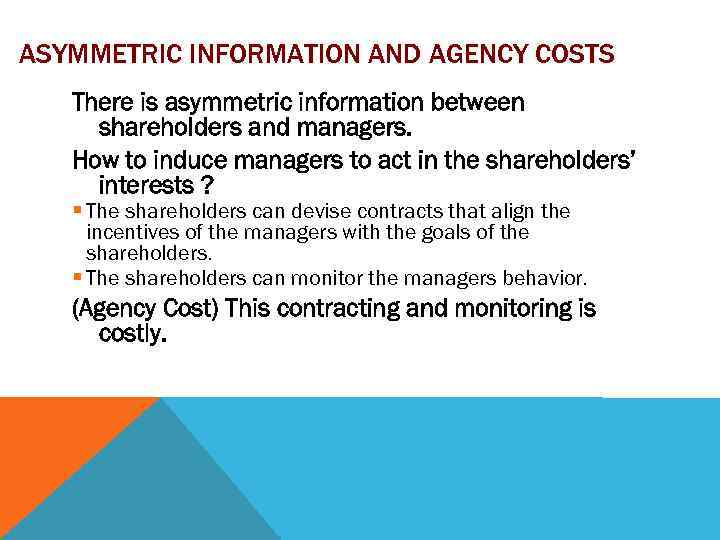

ASYMMETRIC INFORMATION AND AGENCY COSTS There is asymmetric information between shareholders and managers. How to induce managers to act in the shareholders’ interests ? § The shareholders can devise contracts that align the incentives of the managers with the goals of the shareholders. § The shareholders can monitor the managers behavior. (Agency Cost) This contracting and monitoring is costly.

ASYMMETRIC INFORMATION AND AGENCY COSTS There is asymmetric information between shareholders and managers. How to induce managers to act in the shareholders’ interests ? § The shareholders can devise contracts that align the incentives of the managers with the goals of the shareholders. § The shareholders can monitor the managers behavior. (Agency Cost) This contracting and monitoring is costly.