2bf5fe1808dabefba768b0662188eff5.ppt

- Количество слайдов: 29

Multnomah County Deferred Compensation Plan Louisville Skyline October 26, 2011 – Lincoln Building 12: 00 PM

Melinda Lewis Investment Advisor Representative 200 SW Market St. , Suite 1700 Portland, OR 97201 503 -937 -0378 Securities and investment advisory services offered through ING Financial Partners, members SIPC

Important Information You should consider the investment objectives, risks, and charges and expenses of the investment options carefully before investing. Fund prospectuses and an information booklet can be obtained by contacting your local representative. Please read carefully before investing. (bold and same size as majority of text in presentation) Group annuity contracts offered through a retirement program are long-term investments designed for retirement purposes. Money distributed will be taxed as ordinary income in the year the money is received. Account values fluctuate with market conditions and, when surrendered, the principal may be worth more or less than the original amount invested. An annuity does not provide any additional tax deferral benefit, tax deferral is provided by the plan. Annuities may be subject to additional fees and expenses to which other tax-qualified plan funding vehicles may not be subject. However, annuities provide features and benefits such as lifetime income payments and death benefits that may be valuable to you. The Participant Information Booklet and fund prospectuses contain additional information about the expenses associated with the investment options. Insurance products issued by ING Life Insurance and Annuity Company. Securities distributed by ING Financial Advisers, LLC (member SIPC), One Orange Way, Windsor, CT 060954774 or other broker/dealers with which ING has selling agreements.

Deferred Compensation 102 Topics • Effective 1/1/12 Multnomah County will be adding Alternative investment options* for you to consider within the Multnomah County 457 Plan – Roth 457 option – Self Directed Brokerage Account option * Both the Roth 457 and the Self Directed Brokerage Account options become available to Multnomah County employees on January 1, 2012. 4

The Roth 457 option A Roth 457(b) offers you the potential for tax-free* income when you retire. *Certain qualifying conditions apply.

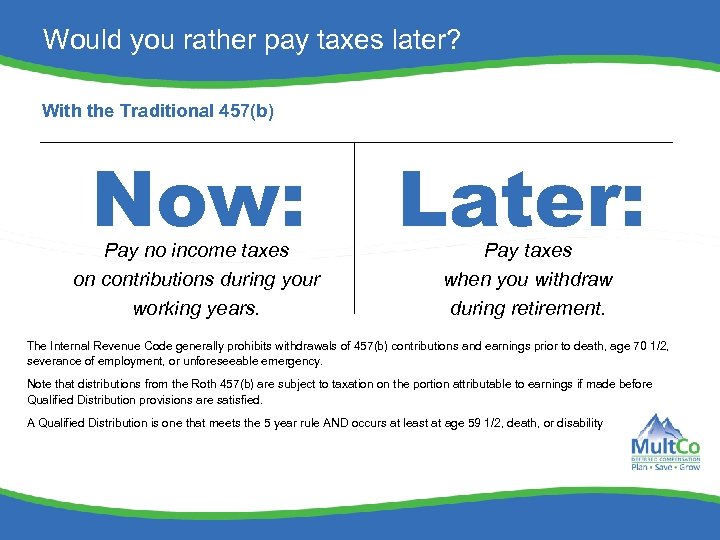

Would you rather pay taxes later? With the Traditional 457(b) Now: Pay no income taxes on contributions during your working years. Later: Pay taxes when you withdraw during retirement. The Internal Revenue Code generally prohibits withdrawals of 457(b) contributions and earnings prior to death, age 70 1/2, severance of employment, or unforeseeable emergency. Note that distributions from the Roth 457(b) are subject to taxation on the portion attributable to earnings if made before Qualified Distribution provisions are satisfied. A Qualified Distribution is one that meets the 5 year rule AND occurs at least at age 59 1/2, death, or disability

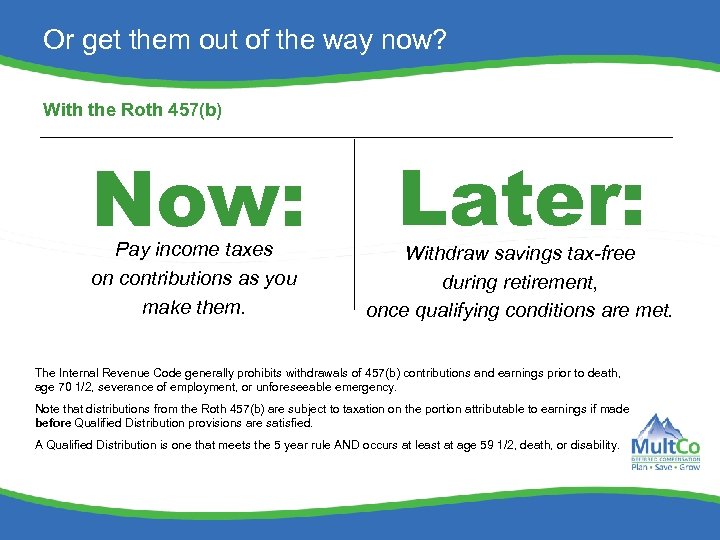

Or get them out of the way now? With the Roth 457(b) Now: Pay income taxes on contributions as you make them. Later: Withdraw savings tax-free during retirement, once qualifying conditions are met. The Internal Revenue Code generally prohibits withdrawals of 457(b) contributions and earnings prior to death, age 70 1/2, severance of employment, or unforeseeable emergency. Note that distributions from the Roth 457(b) are subject to taxation on the portion attributable to earnings if made before Qualified Distribution provisions are satisfied. A Qualified Distribution is one that meets the 5 year rule AND occurs at least at age 59 1/2, death, or disability.

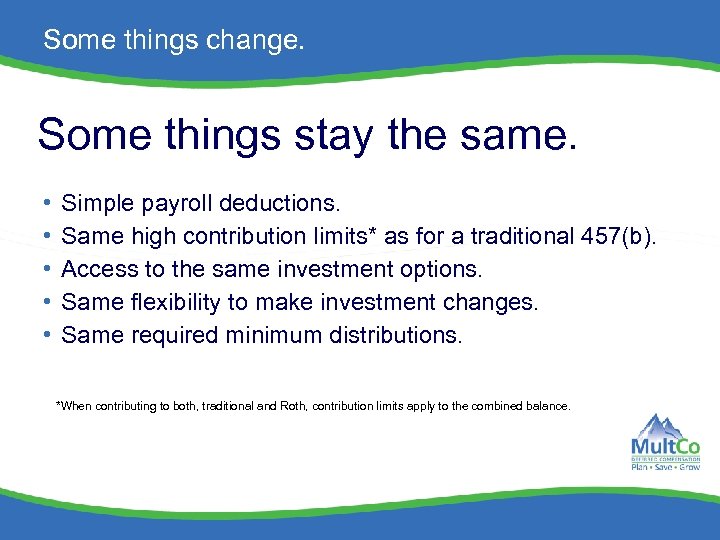

Some things change. Some things stay the same. • • • Simple payroll deductions. Same high contribution limits* as for a traditional 457(b). Access to the same investment options. Same flexibility to make investment changes. Same required minimum distributions. *When contributing to both, traditional and Roth, contribution limits apply to the combined balance.

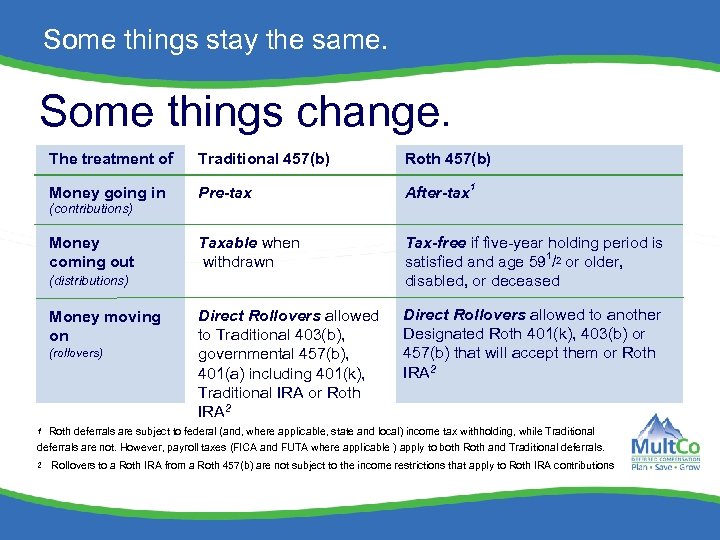

Some things stay the same. Some things change. The treatment of Traditional 457(b) Roth 457(b) Money going in Pre-tax After-tax 1 Taxable when withdrawn Tax-free if five-year holding period is satisfied and age 591/2 or older, disabled, or deceased Direct Rollovers allowed to Traditional 403(b), governmental 457(b), 401(a) including 401(k), Traditional IRA or Roth IRA 2 Direct Rollovers allowed to another Designated Roth 401(k), 403(b) or 457(b) that will accept them or Roth IRA 2 (contributions) Money coming out (distributions) Money moving on (rollovers) Roth deferrals are subject to federal (and, where applicable, state and local) income tax withholding, while Traditional deferrals are not. However, payroll taxes (FICA and FUTA where applicable ) apply to both Roth and Traditional deferrals. 1 2 Rollovers to a Roth IRA from a Roth 457(b) are not subject to the income restrictions that apply to Roth IRA contributions

The Roth 457(b) might be right for you if. . . Just starting career Relatively lower income tax bracket Believes income (and taxes) will increase in the future Isn’t worried about current tax deduction

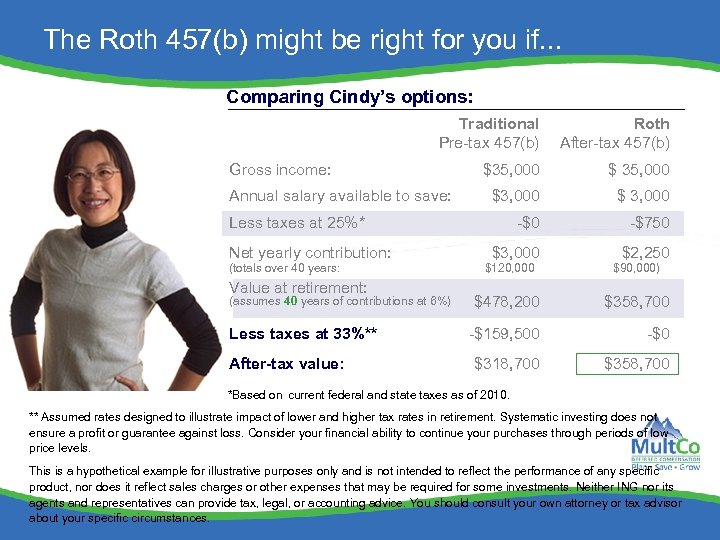

The Roth 457(b) might be right for you if. . . Comparing Cindy’s options: Traditional Pre-tax 457(b) Roth After-tax 457(b) $35, 000 $3, 000 $ 3, 000 -$750 Gross income: Annual salary available to save: Less taxes at 25%* Net yearly contribution: (totals over 40 years: Value at retirement: (assumes 40 years of contributions at 6%) Less taxes at 33%** After-tax value: $3, 000 $2, 250 $120, 000 $90, 000) $478, 200 $358, 700 -$159, 500 -$0 $318, 700 $358, 700 *Based on current federal and state taxes as of 2010. ** Assumed rates designed to illustrate impact of lower and higher tax rates in retirement. Systematic investing does not ensure a profit or guarantee against loss. Consider your financial ability to continue your purchases through periods of low price levels. This is a hypothetical example for illustrative purposes only and is not intended to reflect the performance of any specific product, nor does it reflect sales charges or other expenses that may be required for some investments. Neither ING nor its agents and representatives can provide tax, legal, or accounting advice. You should consult your own attorney or tax advisor about your specific circumstances.

“I’m more the traditional type. ” Can’t really afford more taxes now Needs more tax deductions Doesn’t expect to be in a higher tax bracket when he retires

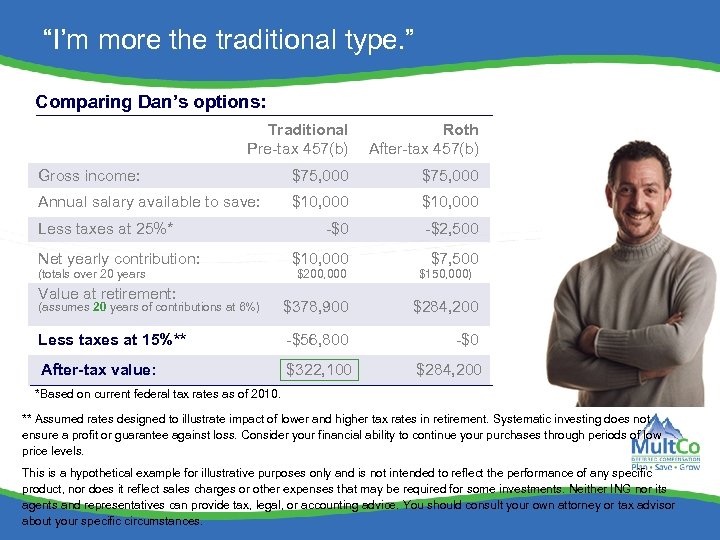

“I’m more the traditional type. ” Comparing Dan’s options: Traditional Pre-tax 457(b) Roth After-tax 457(b) Gross income: $75, 000 Annual salary available to save: $10, 000 -$0 -$2, 500 Less taxes at 25%* Net yearly contribution: (totals over 20 years Value at retirement: $10, 000 $200, 000 $7, 500 $150, 000) (assumes 20 years of contributions at 6%) $378, 900 $284, 200 Less taxes at 15%** -$56, 800 -$0 After-tax value: $322, 100 $284, 200 *Based on current federal tax rates as of 2010. ** Assumed rates designed to illustrate impact of lower and higher tax rates in retirement. Systematic investing does not ensure a profit or guarantee against loss. Consider your financial ability to continue your purchases through periods of low price levels. This is a hypothetical example for illustrative purposes only and is not intended to reflect the performance of any specific product, nor does it reflect sales charges or other expenses that may be required for some investments. Neither ING nor its agents and representatives can provide tax, legal, or accounting advice. You should consult your own attorney or tax advisor about your specific circumstances.

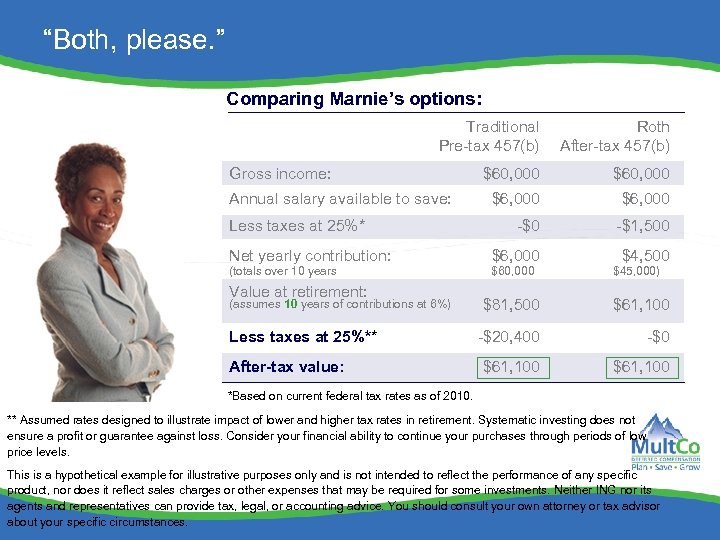

“Both, please. ” Isn’t sure whether taxes will be higher or lower in retirement Wants to diversify tax strategy Still wants a current income tax deduction

“Both, please. ” Comparing Marnie’s options: Traditional Pre-tax 457(b) Roth After-tax 457(b) $60, 000 $6, 000 -$0 -$1, 500 Gross income: Annual salary available to save: Less taxes at 25%* Net yearly contribution: (totals over 10 years Value at retirement: (assumes 10 years of contributions at 6%) Less taxes at 25%** After-tax value: $6, 000 $60, 000 $4, 500 $45, 000) $81, 500 $61, 100 -$20, 400 -$0 $61, 100 *Based on current federal tax rates as of 2010. ** Assumed rates designed to illustrate impact of lower and higher tax rates in retirement. Systematic investing does not ensure a profit or guarantee against loss. Consider your financial ability to continue your purchases through periods of low price levels. This is a hypothetical example for illustrative purposes only and is not intended to reflect the performance of any specific product, nor does it reflect sales charges or other expenses that may be required for some investments. Neither ING nor its agents and representatives can provide tax, legal, or accounting advice. You should consult your own attorney or tax advisor about your specific circumstances.

Is Roth right for you? Consider this … q Are you looking for tax-free (subject to qualifying conditions) retirement income? q Do you expect your taxes to be higher when you retire? q Are you currently in a lower income tax bracket? q Do you like the idea of diversifying your tax strategy by contributing to both the 457(b) and the Roth 457(b) options? These materials are not intended to be used to avoid tax penalties, and were prepared to support the promotion or marketing of the matter addressed in this document. The taxpayer should seek advice from an independent tax advisor. There’s more …

Is Roth right for you? Consider this. q Are you already maxing out your Traditional 457(b) contributions? q Can you afford a reduction in take-home pay to contribute the same amount to your Roth 457(b)? F For those already contributing to a Traditional 457(b) and wishing to switch to a Roth 457(b) q Are you looking to leave tax-free assets to your heirs? F A Roth 457(b) may be rolled over to Roth IRA: age 70 ½ required distributions do not apply to a Roth IRA F A traditional 457(b) may be rolled over to a Roth IRA which may be advantageous as set forth above. In order to complete the rollover to the Roth IRA, taxes will need to be paid on the traditional 457(b) If you answered “yes” to any of these, a Roth may make sense for you.

Self Directed Brokerage Account option… The TD AMERITRADE SDBA is an additional investment option available through Multnomah County’s 457 Plan Provides the freedom to invest in a wider array of investment choices including: – – open-end mutual funds fixed income securities Exchange Traded Funds (ETFs); and publicly traded stocks

How is an SDBA different? The same rules and restrictions that govern the core account apply to the dollars transferred to an TD AMERITRADE SDBA. The TD AMERITRADE SDBA can only be funded through transfers from the Plan’s core investment options. Some securities and transactions are not available through the TD AMERITRADE SDBA: short sales, margin trading, options trading, foreign securities, currencies, limited partnerships, pink sheet securities, bulletin board securities, futures/commodities, promissory notes, real estate/property, collectibles, municipal bonds and unit investment trusts.

Are the investment options different? Yes, there is a significant difference… • Plan investment options are selected by a thorough due-diligence process to ensure a diverse and balanced array investment options. • The investment choices available through TD AMERITRADE are not approved, selected, monitored or reviewed by ING or your employersponsored Plan. • When you elect to open a TD AMERITRADE SDBA, you assume the sole responsibility for researching, selecting, monitoring and managing the investments in your TD AMERITRADE SDBA.

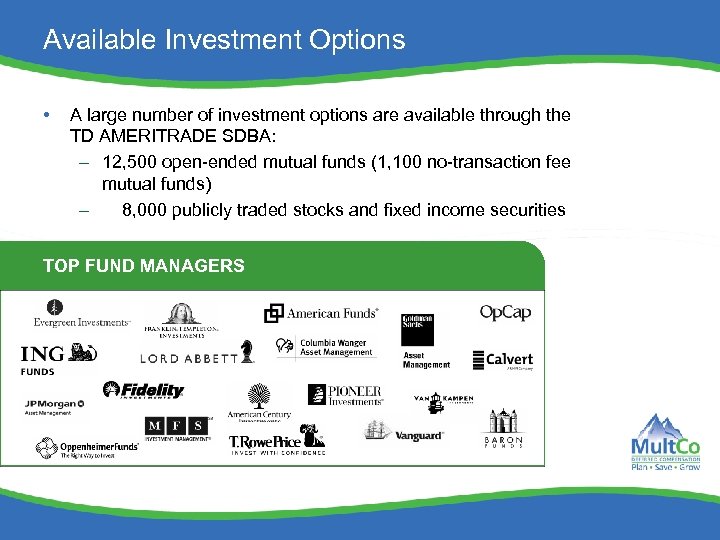

Available Investment Options • A large number of investment options are available through the TD AMERITRADE SDBA: – 12, 500 open-ended mutual funds (1, 100 no-transaction fee mutual funds) – 8, 000 publicly traded stocks and fixed income securities TOP FUND MANAGERS

Investment options disclosure information You should consider the investment objectives, risks, and charges and expenses of the investment company carefully before investing. To obtain a prospectus containing this and other important information, please call a TD AMERITRADE representative at 866766 -4015. Please read the prospectus carefully before investing. 1 Participants need to read and accept the Terms of Use at www. tdameritraderetirement. com prior to enrolling in the program. Once enrolled, participants can buy and sell shares of the eligible ETFs, commission-free. Should a customer sell shares of an ETF purchased under the program held for less than 30 days, a short-term trading fee of $19. 99 will be assessed. 2 You should consider the investment objectives, risks, and charges and expenses of the investment company carefully before investing. Prospectuses for the investment company containing this and other information can be ordered online at www. tdameritraderetirement. com. Please read the prospectus carefully before investing. 3 No Transaction Fee (NTF) mutual funds are no-load mutual funds for which TD AMERITRADE does not charge a transaction fee. NTF funds have other fees and expenses that apply to a continued investment in the fund are described in the prospectus. Funds held 90 days or less may be subject to a Short-Term Redemption Fee. This fee is in addition to any applicable transaction fees or fees addressed in the fund's prospectus. Brokerage services provided by TD Ameritrade, Division of TD Ameritrade, Inc. , member FINRA/SIPC/NFA. TD Ameritrade is a trademark jointly owned by TD Ameritrade IP Company, Inc. and The Toronto-Dominion Bank. © 2011 TD Ameritrade IP Company, Inc. All rights reserved. Used with permission. TD Ameritrade is an independent entity and not a corporate affiliate of ING Financial Advisers, LLC (Member SIPC).

Is the SDBA option right for me? Consider this … q Do you consider yourself an experienced investor who wants to independently and actively manage an even greater choice of investments? q Are you willing to pay additional fees and accept full responsibility for researching, selecting, monitoring and managing investments? q Are you confident with an independent approach to actively managing the retirement assets you’ve invested in the Plan?

Are there fees associated with the SDBA option? Yes, if you choose an SDBA option… You will be charged a $50 fee, annually on November 1 st or the next business day the New York Stock Exchange (NYSE) is open, irrespective of when the account was opened. This fee will be deducted from the core investment options in your account under the Plan with ING. Additionally, participants will also pay the brokerage account commission and fees as described in the Commission Schedule. 1 1 Please refer to the TD AMERITRADE Commission Schedule located on http: //www. tdameritraderetirement. com/forms/ACS 1009. pdf or www. ingretirementplans. com for a copy of the commission schedule. Please refer to the mutual fund prospectus for additional fees and charges that may apply to mutual fund trades.

How do I open a TD Ameritrade SDBA? You must follow these steps… Complete a TD Ameritrade account applications which is available through the Multnomah County custom website. Complete Multnomah County’s SDBA authorization form. Return the application and authorization form to TD AMERITRADE. – TD AMERITRADE will open your Account within two business days. – Once the account is opened, TD AMERITRADE will send a Welcome Kit that includes your brokerage account number and explains their brokerage account services, procedures, commissions and fees. – Additionally, you will receive a Personal Identification Number (PIN) under separate cover. This will arrive separately for security purposes.

Are there any restrictions upon the SDBA option? Yes, there are… The minimum transfer amount is $2, 500. You must also maintain a minimum core account balance of $5, 000. A confirmation of the transfer from your core account will be mailed immediately following the transfer. No contributions may be directed to the SDBA. No withdrawals may be made directly from SDBA. No transfers in kind from SDBA – must transfer money to core product account and then process withdrawal.

Can I transfer assets back to the core account? Yes, to transfer assets to your core account… • You may first need to redeem/sell the securities held in your TD AMERITRADE SDBA. • Once the trades have settled (generally one to three business days, depending upon the type of security), you can request a transfer to your core account at www. ingretirementplans. com/custom/multnomah by selecting Manage Investments/Fund Transfer.

What account information will you receive? You will continue to receive your regular quarterly statement showing the total account value of your core investment options in addition to the aggregate value of your TD AMERITRADE account. You will also receive a separate statement from TD AMERITRADE for your SDBA account. – Statements will be received monthly when there is trade activity in your TD AMERITRADE account, and quarterly when there is no activity. You will also receive fund prospectuses, semi-annual and annual reports for the investments in your TD AMERITRADE SDBA.

Questions 29 29

2bf5fe1808dabefba768b0662188eff5.ppt