0c22d8f0177ac94c31accefed10a80aa.ppt

- Количество слайдов: 33

MULTIPLE-EFIN SETUP Tax. Wise Setup for Computers Used At More Than One Site Revised November 9, 2009 NTC/TCS Training Dallas 2009 1

MULTIPLE-EFIN SETUP Tax. Wise Setup for Computers Used At More Than One Site Revised November 9, 2009 NTC/TCS Training Dallas 2009 1

Computers at Multiple Sites o With or without networks, some things are the same o Different sites have unique SIDNs and most sites use different EFINs NTC/TCS Training Dallas 2009 2

Computers at Multiple Sites o With or without networks, some things are the same o Different sites have unique SIDNs and most sites use different EFINs NTC/TCS Training Dallas 2009 2

SIDNs and EFINs. . . o Every site where returns are prepared has a unique Site IDentification Number – a SIDN o Every site where e-files are prepared also uses an Electronic Filing Identification Number – an EFIN NTC/TCS Training Dallas 2009 3

SIDNs and EFINs. . . o Every site where returns are prepared has a unique Site IDentification Number – a SIDN o Every site where e-files are prepared also uses an Electronic Filing Identification Number – an EFIN NTC/TCS Training Dallas 2009 3

Why Multiple-EFIN Setup? o May be discretionary for interoperability q All computers in a district can be set up to work at any site in the district o May be mandatory for computers used at multiple sites, each with its own EFIN. q Tax. Wise site-license rule q Exceptions for “one-day” and “ad hoc” sites q See TMG and Pub 3189 for details This presentation covers the mandatory case. NTC/TCS Training Dallas 2009 4

Why Multiple-EFIN Setup? o May be discretionary for interoperability q All computers in a district can be set up to work at any site in the district o May be mandatory for computers used at multiple sites, each with its own EFIN. q Tax. Wise site-license rule q Exceptions for “one-day” and “ad hoc” sites q See TMG and Pub 3189 for details This presentation covers the mandatory case. NTC/TCS Training Dallas 2009 4

If possible, Use TWO Using Tax. Wise Online avoids the multiple. EFIN setup challenges of Tax. Wise Desktop. Just log-in to the EFIN where you are working today! NTC/TCS Training Dallas 2009 5

If possible, Use TWO Using Tax. Wise Online avoids the multiple. EFIN setup challenges of Tax. Wise Desktop. Just log-in to the EFIN where you are working today! NTC/TCS Training Dallas 2009 5

If possible, Use Networks Using Private Networks (LANs) can solve many configuration issues: o Allows computers to be used as workstations at different sites without actually installing Tax. Wise on them o Server computer can also be used as a workstation at other sites o Avoids complex multiple-EFIN setups o Simplifies Printer Sharing NTC/TCS Training Dallas 2009 6

If possible, Use Networks Using Private Networks (LANs) can solve many configuration issues: o Allows computers to be used as workstations at different sites without actually installing Tax. Wise on them o Server computer can also be used as a workstation at other sites o Avoids complex multiple-EFIN setups o Simplifies Printer Sharing NTC/TCS Training Dallas 2009 6

If possible, Use Networks Using Private Networks (LANs) can also solve many operational issues: o Eliminates backup from Preparing and restore to Transmitting computer o Fewer Tax. Wise installations to keep Up-To-Date o More secure because only server computers contain Taxpayer data Networking Tax. Wise Procedures available on AARP Extra. Net NTC/TCS Training Dallas 2009 7

If possible, Use Networks Using Private Networks (LANs) can also solve many operational issues: o Eliminates backup from Preparing and restore to Transmitting computer o Fewer Tax. Wise installations to keep Up-To-Date o More secure because only server computers contain Taxpayer data Networking Tax. Wise Procedures available on AARP Extra. Net NTC/TCS Training Dallas 2009 7

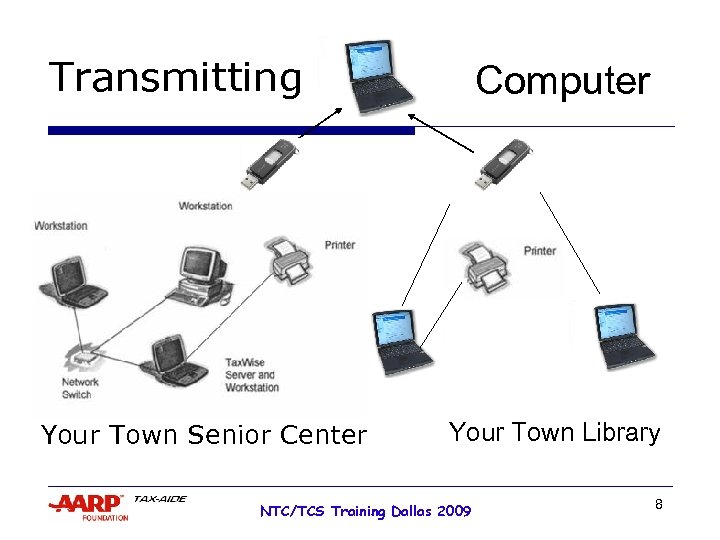

Transmitting Your Town Senior Center Computer Your Town Library NTC/TCS Training Dallas 2009 8

Transmitting Your Town Senior Center Computer Your Town Library NTC/TCS Training Dallas 2009 8

SPECIAL SITUATIONS. . . o Sometimes a computer is used at more than one site with a different EFIN for each site o And sometimes a computer actually transmits e-files for more than one site with different EFINs q A special kind of registration code makes this possible NTC/TCS Training Dallas 2009 9

SPECIAL SITUATIONS. . . o Sometimes a computer is used at more than one site with a different EFIN for each site o And sometimes a computer actually transmits e-files for more than one site with different EFINs q A special kind of registration code makes this possible NTC/TCS Training Dallas 2009 9

THE 20 -DIGIT ALPHA-NUMERIC TRANSMIT CODE. . . o This code – also called an XMIT code – is not the same as the standard 20 digit alpha-numeric REG code for an EFIN o XMIT codes allow returns to be created on and/or transmitted from a single computer for more than one EFIN without changing Tax. Wise Setup Options o XMIT codes must be requested through your SPEC Office or directly from CCH NTC/TCS Training Dallas 2009 10

THE 20 -DIGIT ALPHA-NUMERIC TRANSMIT CODE. . . o This code – also called an XMIT code – is not the same as the standard 20 digit alpha-numeric REG code for an EFIN o XMIT codes allow returns to be created on and/or transmitted from a single computer for more than one EFIN without changing Tax. Wise Setup Options o XMIT codes must be requested through your SPEC Office or directly from CCH NTC/TCS Training Dallas 2009 10

Ordering an XMIT code o When an XMIT code is ordered, the order must specify the two EFINs involved and the relationship between them. o The order should be worded, "a Transmit Code that allows EFIN-A to transmit for EFIN-B“ and should specify the EFINs by number. NTC/TCS Training Dallas 2009 11

Ordering an XMIT code o When an XMIT code is ordered, the order must specify the two EFINs involved and the relationship between them. o The order should be worded, "a Transmit Code that allows EFIN-A to transmit for EFIN-B“ and should specify the EFINs by number. NTC/TCS Training Dallas 2009 11

INITIAL SETUP. . . o Complete the setup screens as usual q Company – your Primary EFIN q General – set DCN suffix (just a counter) q Must be UNIQUE within an EFIN q Do not change during season q Printer q Color – must click FINISH to save settings NTC/TCS Training Dallas 2009 12

INITIAL SETUP. . . o Complete the setup screens as usual q Company – your Primary EFIN q General – set DCN suffix (just a counter) q Must be UNIQUE within an EFIN q Do not change during season q Printer q Color – must click FINISH to save settings NTC/TCS Training Dallas 2009 12

REGISTER SOFTWARE. . . o The Register Software dialog box will appear, showing your Primary EFIN o Put in your standard 20 -digit alphanumeric REG code for that EFIN q Note that you’ll be back at the Tax. Wise main page. q Click Tools, Utilities/Setup Options to return to the Utilities screen NTC/TCS Training Dallas 2009 13

REGISTER SOFTWARE. . . o The Register Software dialog box will appear, showing your Primary EFIN o Put in your standard 20 -digit alphanumeric REG code for that EFIN q Note that you’ll be back at the Tax. Wise main page. q Click Tools, Utilities/Setup Options to return to the Utilities screen NTC/TCS Training Dallas 2009 13

REGISTER Tax. Wise FOR MULTIPLE LOCATIONS. . . o Click Setup, Register Software o Put in the secondary EFIN for which you will transmit or prepare returns o Press TAB, and put in the special XMIT code for that EFIN as the Registration Code o Repeat as needed for additional secondary EFINs NTC/TCS Training Dallas 2009 14

REGISTER Tax. Wise FOR MULTIPLE LOCATIONS. . . o Click Setup, Register Software o Put in the secondary EFIN for which you will transmit or prepare returns o Press TAB, and put in the special XMIT code for that EFIN as the Registration Code o Repeat as needed for additional secondary EFINs NTC/TCS Training Dallas 2009 14

Create the Tax. Wise Users o There must be a separate User created for each EFIN o There may be multiple Users for an EFIN if it is used at multiple sites o Set defaults for these Users q Form 8879 – EFIN, SIDN, Site Address information q Main Info – SIDN q Sales Tax Deduction Worksheet defaults NTC/TCS Training Dallas 2009 15

Create the Tax. Wise Users o There must be a separate User created for each EFIN o There may be multiple Users for an EFIN if it is used at multiple sites o Set defaults for these Users q Form 8879 – EFIN, SIDN, Site Address information q Main Info – SIDN q Sales Tax Deduction Worksheet defaults NTC/TCS Training Dallas 2009 15

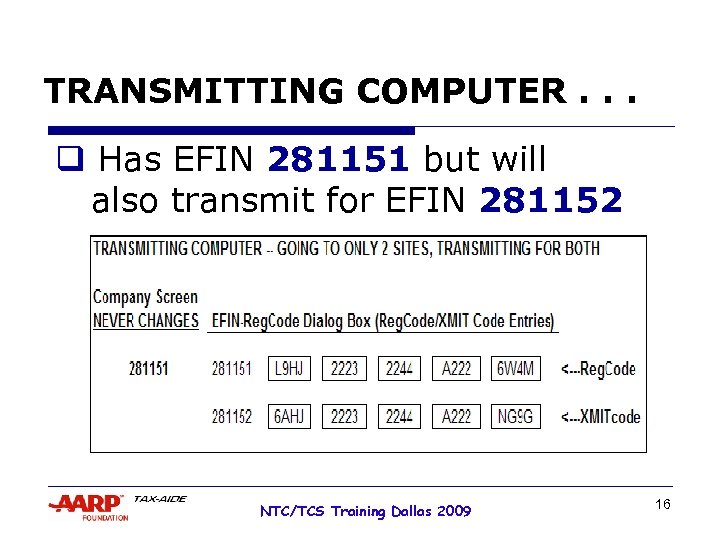

TRANSMITTING COMPUTER. . . q Has EFIN 281151 but will also transmit for EFIN 281152 NTC/TCS Training Dallas 2009 16

TRANSMITTING COMPUTER. . . q Has EFIN 281151 but will also transmit for EFIN 281152 NTC/TCS Training Dallas 2009 16

NON-TRANSMITTING COMPUTERS. . . o Transmit Codes can also be used by computers going to multiple sites with different EFINs if the computer will NOT transmit any returns. o Just back-up prepared returns for each EFIN and restore them to the Transmitting Computer for that EFIN. NTC/TCS Training Dallas 2009 17

NON-TRANSMITTING COMPUTERS. . . o Transmit Codes can also be used by computers going to multiple sites with different EFINs if the computer will NOT transmit any returns. o Just back-up prepared returns for each EFIN and restore them to the Transmitting Computer for that EFIN. NTC/TCS Training Dallas 2009 17

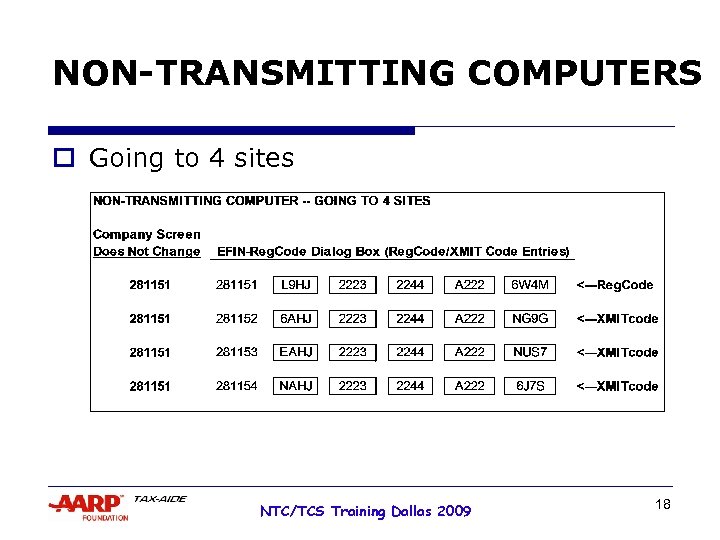

NON-TRANSMITTING COMPUTERS o Going to 4 sites NTC/TCS Training Dallas 2009 18

NON-TRANSMITTING COMPUTERS o Going to 4 sites NTC/TCS Training Dallas 2009 18

TRANSMITTING COMPUTERS o Only install an XMIT code on the Transmitting Computer that will transmit ALL returns for the EFIN using that XMIT code. o Must always have the Primary EFIN on the Company Setup screen when q sending returns q getting acknowledgements q using Tax. Wise e-mail NTC/TCS Training Dallas 2009 19

TRANSMITTING COMPUTERS o Only install an XMIT code on the Transmitting Computer that will transmit ALL returns for the EFIN using that XMIT code. o Must always have the Primary EFIN on the Company Setup screen when q sending returns q getting acknowledgements q using Tax. Wise e-mail NTC/TCS Training Dallas 2009 19

TRANSMITTING COMPUTERS q When there are separate Transmitting Computers for the EFINs whose Preparing Computers use XMIT codes… q. Each Transmitting Computer registers only its REG code and not its XMIT code. NTC/TCS Training Dallas 2009 20

TRANSMITTING COMPUTERS q When there are separate Transmitting Computers for the EFINs whose Preparing Computers use XMIT codes… q. Each Transmitting Computer registers only its REG code and not its XMIT code. NTC/TCS Training Dallas 2009 20

TRANSMITTING COMPUTERS o Separate Transmitting Computers cannot prepare returns for the sites they don’t transmit for by using a single set of Setup Options. o If they need to prepare returns for another Transmitting Computer, they will have to use a different setup method using multiple separate EFINs… NTC/TCS Training Dallas 2009 21

TRANSMITTING COMPUTERS o Separate Transmitting Computers cannot prepare returns for the sites they don’t transmit for by using a single set of Setup Options. o If they need to prepare returns for another Transmitting Computer, they will have to use a different setup method using multiple separate EFINs… NTC/TCS Training Dallas 2009 21

MULTIPLE SEPARATE EFINS o Multiple EFINs can also be registered separately to Tax. Wise one at a time using their REG codes without using XMIT codes o This is a less preferable option because the Setup Options in Tax. Wise have to be reset when starting a session at a site with a different EFIN NTC/TCS Training Dallas 2009 22

MULTIPLE SEPARATE EFINS o Multiple EFINs can also be registered separately to Tax. Wise one at a time using their REG codes without using XMIT codes o This is a less preferable option because the Setup Options in Tax. Wise have to be reset when starting a session at a site with a different EFIN NTC/TCS Training Dallas 2009 22

MULTIPLE SEPARATE EFINS o Multiple-EFIN setups without XMIT codes require that the EFIN being used be listed on the Company page of Setup Options. o This can be done manually – OR o TW Make Icons, part of the FL 1 Clone Tools, can be used to automate this task by building a unique desktop shortcut (icon) for launching Tax. Wise set up for each site. A description of this tool is posted on the Technology page of the AARP Tax-Aide Extra. Net. NTC/TCS Training Dallas 2009 23

MULTIPLE SEPARATE EFINS o Multiple-EFIN setups without XMIT codes require that the EFIN being used be listed on the Company page of Setup Options. o This can be done manually – OR o TW Make Icons, part of the FL 1 Clone Tools, can be used to automate this task by building a unique desktop shortcut (icon) for launching Tax. Wise set up for each site. A description of this tool is posted on the Technology page of the AARP Tax-Aide Extra. Net. NTC/TCS Training Dallas 2009 23

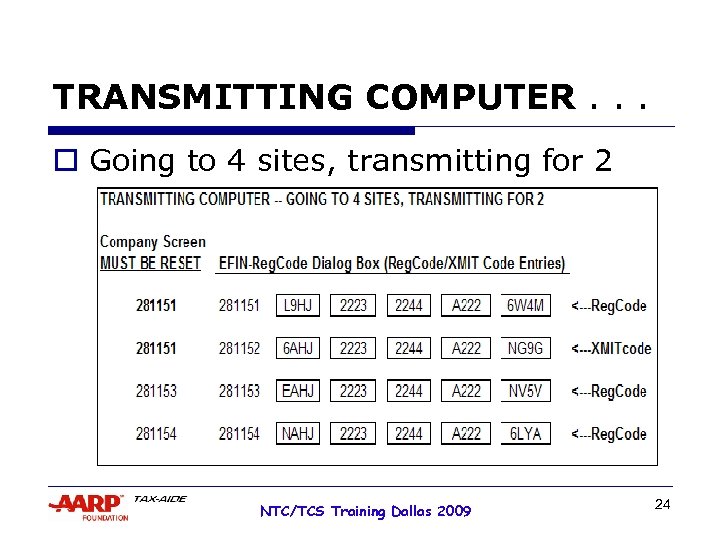

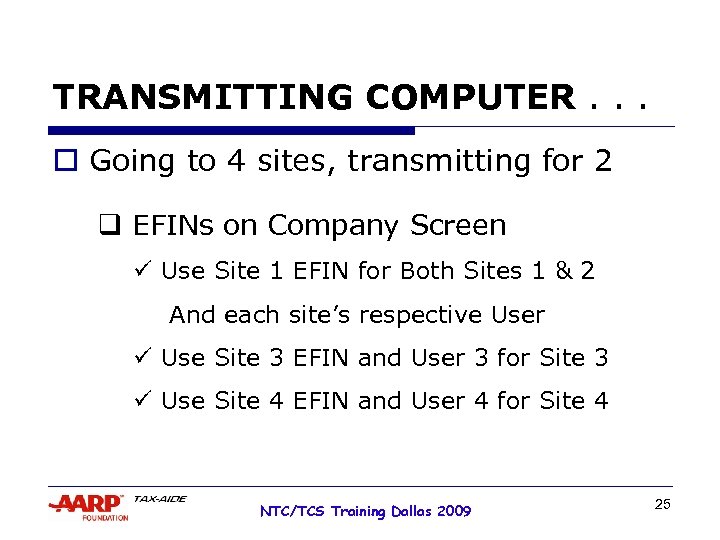

TRANSMITTING COMPUTER. . . o Going to 4 sites, transmitting for 2 NTC/TCS Training Dallas 2009 24

TRANSMITTING COMPUTER. . . o Going to 4 sites, transmitting for 2 NTC/TCS Training Dallas 2009 24

TRANSMITTING COMPUTER. . . o Going to 4 sites, transmitting for 2 q EFINs on Company Screen ü Use Site 1 EFIN for Both Sites 1 & 2 And each site’s respective User ü Use Site 3 EFIN and User 3 for Site 3 ü Use Site 4 EFIN and User 4 for Site 4 NTC/TCS Training Dallas 2009 25

TRANSMITTING COMPUTER. . . o Going to 4 sites, transmitting for 2 q EFINs on Company Screen ü Use Site 1 EFIN for Both Sites 1 & 2 And each site’s respective User ü Use Site 3 EFIN and User 3 for Site 3 ü Use Site 4 EFIN and User 4 for Site 4 NTC/TCS Training Dallas 2009 25

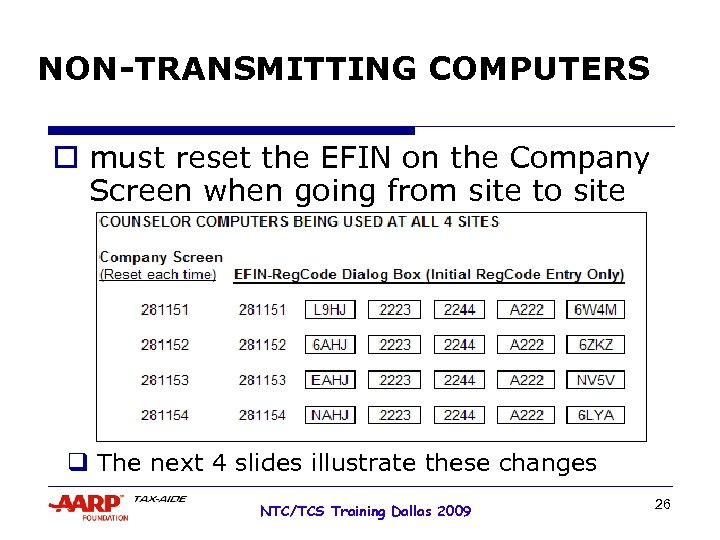

NON-TRANSMITTING COMPUTERS o must reset the EFIN on the Company Screen when going from site to site q The next 4 slides illustrate these changes NTC/TCS Training Dallas 2009 26

NON-TRANSMITTING COMPUTERS o must reset the EFIN on the Company Screen when going from site to site q The next 4 slides illustrate these changes NTC/TCS Training Dallas 2009 26

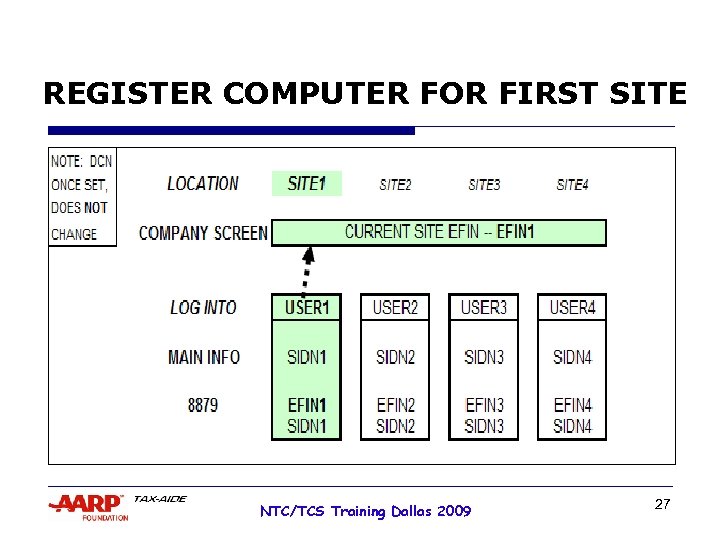

REGISTER COMPUTER FOR FIRST SITE NTC/TCS Training Dallas 2009 27

REGISTER COMPUTER FOR FIRST SITE NTC/TCS Training Dallas 2009 27

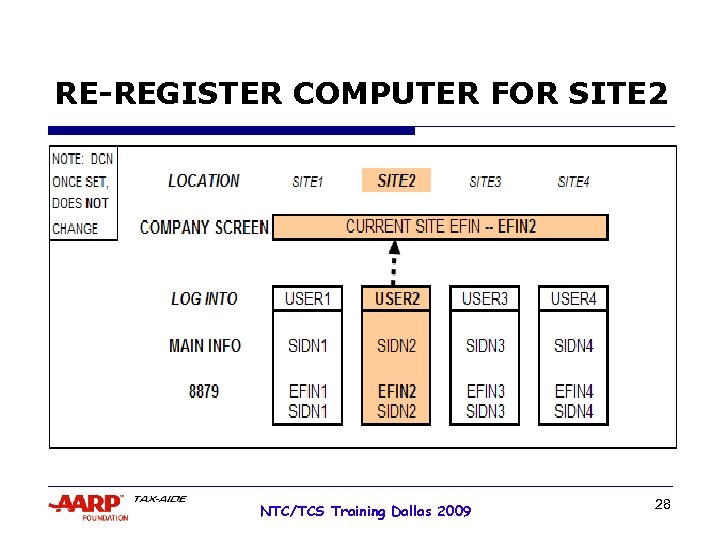

RE-REGISTER COMPUTER FOR SITE 2 NTC/TCS Training Dallas 2009 28

RE-REGISTER COMPUTER FOR SITE 2 NTC/TCS Training Dallas 2009 28

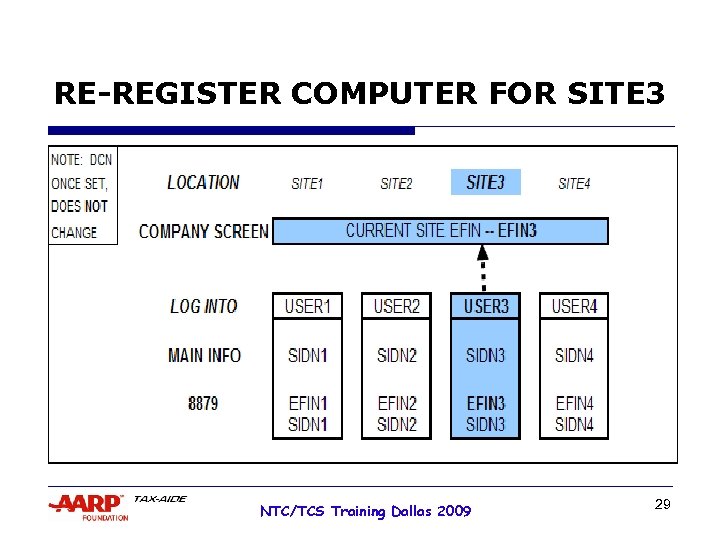

RE-REGISTER COMPUTER FOR SITE 3 NTC/TCS Training Dallas 2009 29

RE-REGISTER COMPUTER FOR SITE 3 NTC/TCS Training Dallas 2009 29

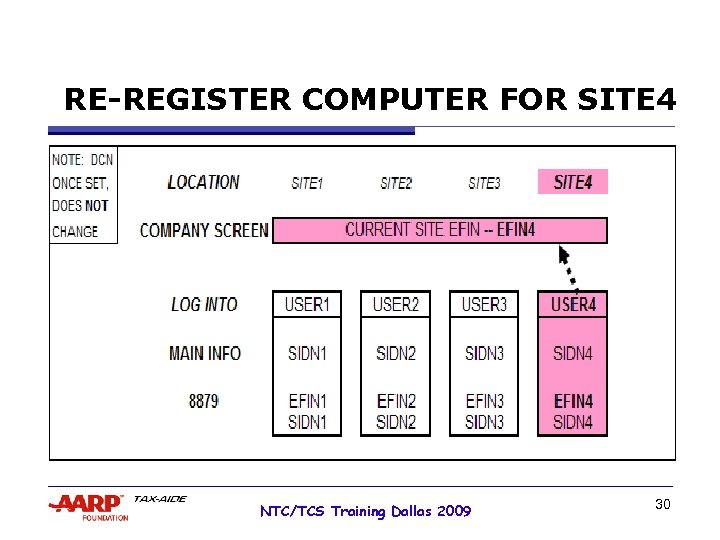

RE-REGISTER COMPUTER FOR SITE 4 NTC/TCS Training Dallas 2009 30

RE-REGISTER COMPUTER FOR SITE 4 NTC/TCS Training Dallas 2009 30

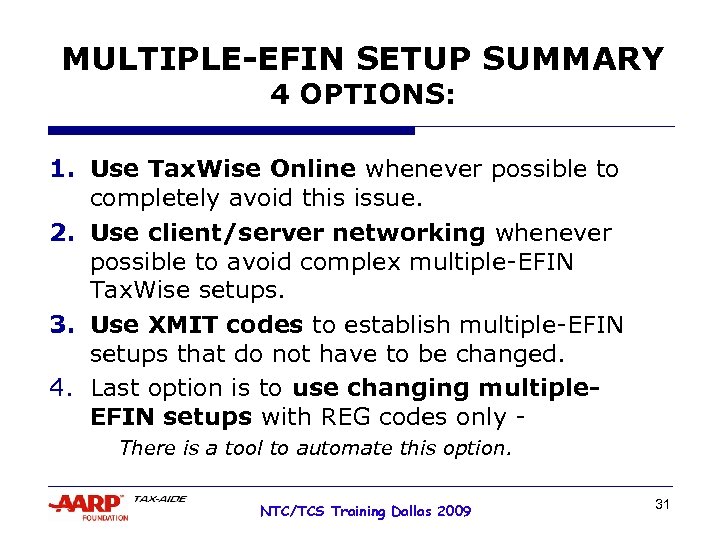

MULTIPLE-EFIN SETUP SUMMARY 4 OPTIONS: 1. Use Tax. Wise Online whenever possible to completely avoid this issue. 2. Use client/server networking whenever possible to avoid complex multiple-EFIN Tax. Wise setups. 3. Use XMIT codes to establish multiple-EFIN setups that do not have to be changed. 4. Last option is to use changing multiple. EFIN setups with REG codes only There is a tool to automate this option. NTC/TCS Training Dallas 2009 31

MULTIPLE-EFIN SETUP SUMMARY 4 OPTIONS: 1. Use Tax. Wise Online whenever possible to completely avoid this issue. 2. Use client/server networking whenever possible to avoid complex multiple-EFIN Tax. Wise setups. 3. Use XMIT codes to establish multiple-EFIN setups that do not have to be changed. 4. Last option is to use changing multiple. EFIN setups with REG codes only There is a tool to automate this option. NTC/TCS Training Dallas 2009 31

MULTIPLE-EFIN SETUP THE LAST WORD o There have been proposals for and experiments with installing multiple copies of the same year of Tax. Wise on a single computer. o This approach is NOT recommended or supported! NTC/TCS Training Dallas 2009 32

MULTIPLE-EFIN SETUP THE LAST WORD o There have been proposals for and experiments with installing multiple copies of the same year of Tax. Wise on a single computer. o This approach is NOT recommended or supported! NTC/TCS Training Dallas 2009 32

Multiple-EFIN Setup Questions ? ? ? NTC/TCS Training Dallas 2009 33

Multiple-EFIN Setup Questions ? ? ? NTC/TCS Training Dallas 2009 33