MULTINATIONALS and RFP.ppt

- Количество слайдов: 21

Multinationals and Russian Foreign Policy February 15, 2009 Philipp G. Khanin Ph. D in p. s. , Associate professor School of International relations, SPSU

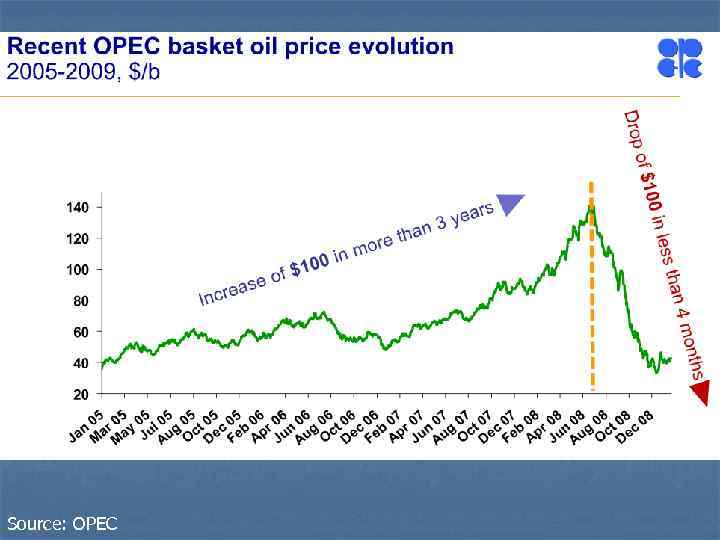

Source: OPEC

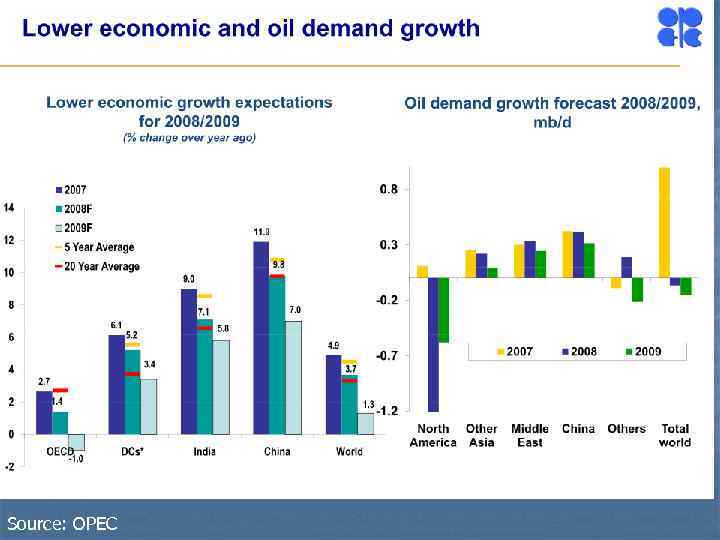

Source: OPEC

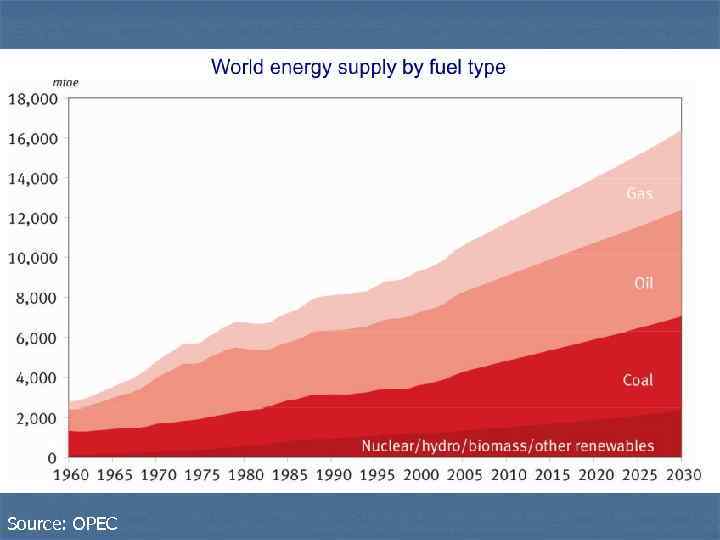

Source: OPEC

5 Biggest Russian companies Gazprom Oil and gas Rosneft Oil and gas LUKoil Oil and gas Sberbank Banking Nor. Nikel Non-ferrous metallurgy Source: Expert rating agency

Is a multinational?

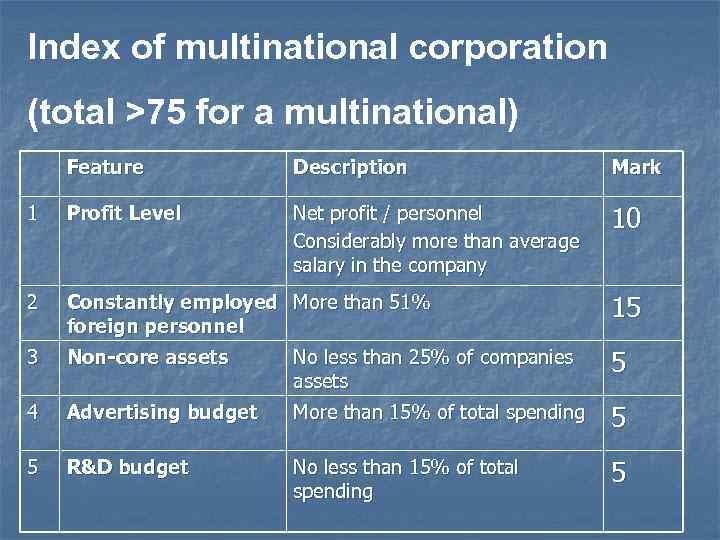

Index of multinational corporation (total >75 for a multinational) Feature Description Mark 1 Profit Level Net profit / personnel Considerably more than average salary in the company 10 2 Constantly employed More than 51% foreign personnel 15 3 Non-core assets No less than 25% of companies assets 5 4 Advertising budget More than 15% of total spending 5 5 R&D budget No less than 15% of total spending 5

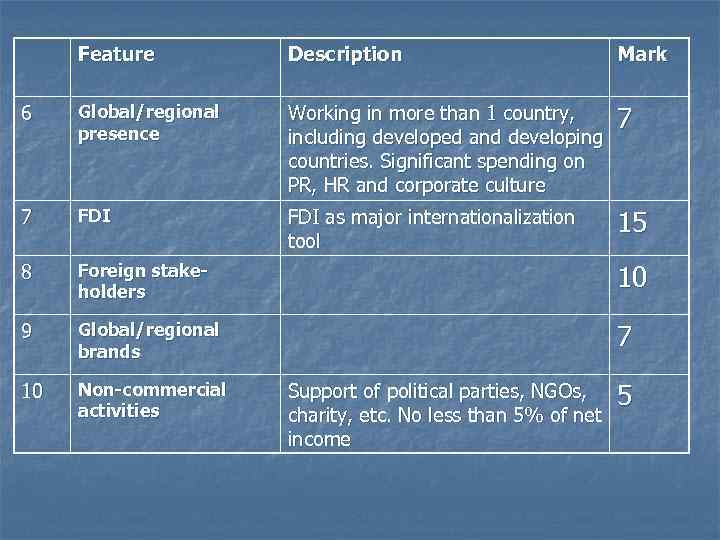

Feature Description Mark 6 Global/regional presence Working in more than 1 country, including developed and developing countries. Significant spending on PR, HR and corporate culture 7 7 FDI as major internationalization tool 15 8 Foreign stakeholders 10 9 Global/regional brands 7 10 Non-commercial activities Support of political parties, NGOs, charity, etc. No less than 5% of net income 5

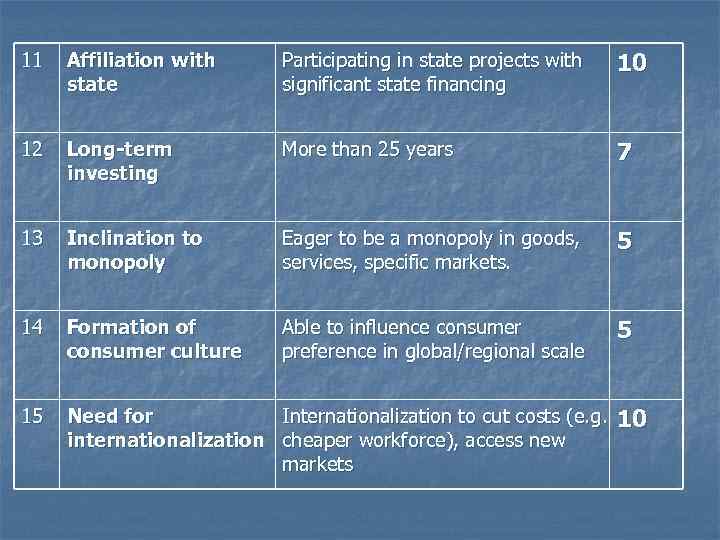

11 Affiliation with state Participating in state projects with significant state financing 10 12 Long-term investing More than 25 years 7 13 Inclination to monopoly Eager to be a monopoly in goods, services, specific markets. 5 14 Formation of consumer culture Able to influence consumer preference in global/regional scale 5 15 Need for Internationalization to cut costs (e. g. internationalization cheaper workforce), access new markets 10

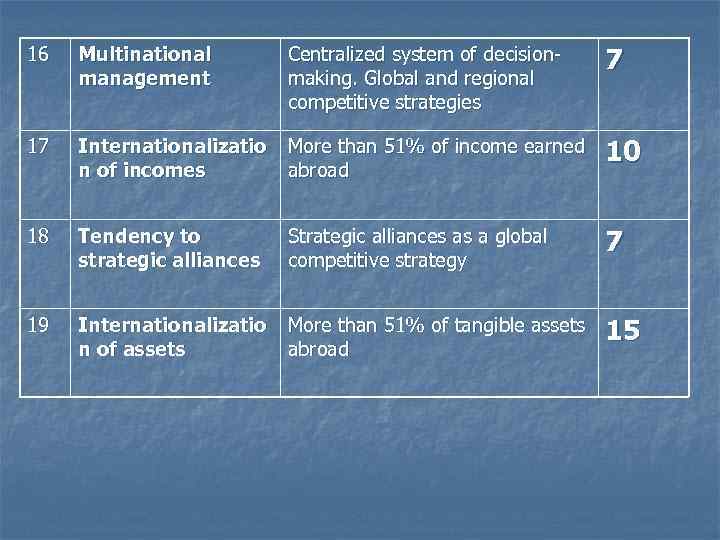

16 Multinational management Centralized system of decisionmaking. Global and regional competitive strategies 7 17 Internationalizatio n of incomes More than 51% of income earned abroad 10 18 Tendency to strategic alliances Strategic alliances as a global competitive strategy 7 19 Internationalizatio n of assets More than 51% of tangible assets abroad 15

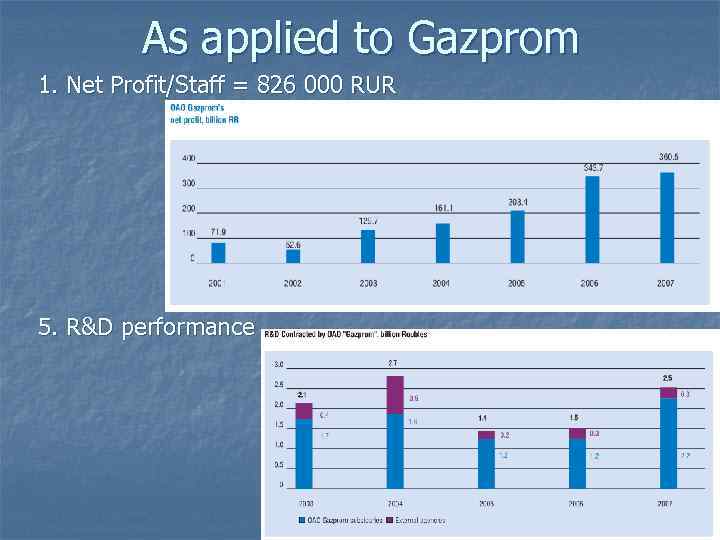

As applied to Gazprom 1. Net Profit/Staff = 826 000 RUR 5. R&D performance

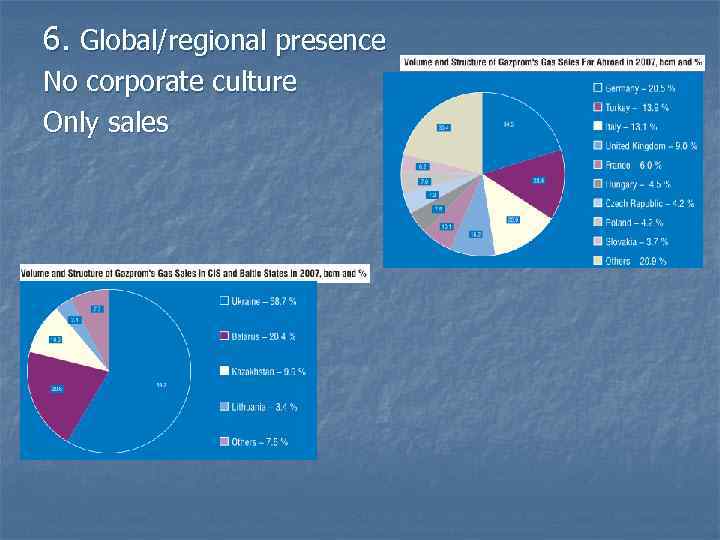

6. Global/regional presence No corporate culture Only sales

9. Global/regional brands

10. Non-commercial activities 6, 6 bln RUR in 2007 (excluding sponsorship of FC Zenit) 0, 6% of profit

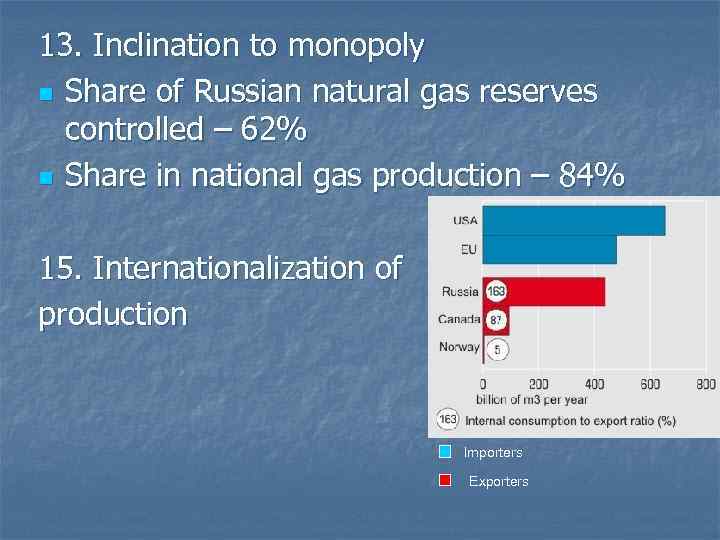

13. Inclination to monopoly n Share of Russian natural gas reserves controlled – 62% n Share in national gas production – 84% 15. Internationalization of production Importers Exporters

TOTAL: 1. Profits +10 5. R&D +5 6. Global/regional presence +7 9. Brands +7 11. Affiliation with the state + 10 12. Monopolism +5 ____________ 44

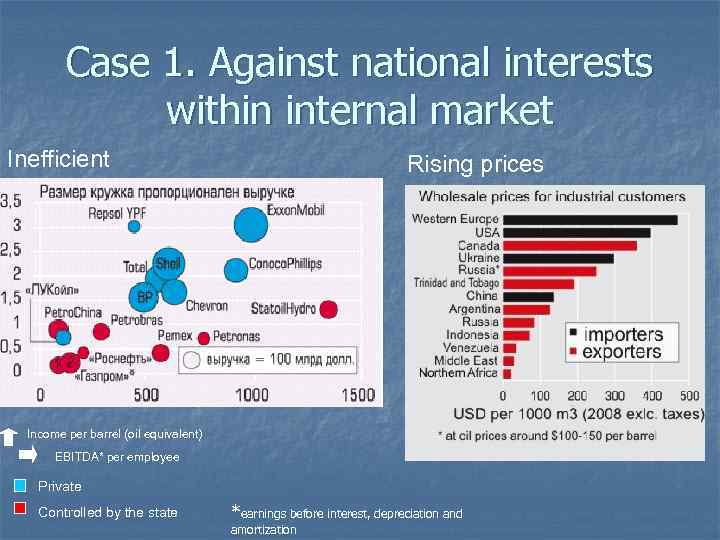

Case 1. Against national interests within internal market Inefficient Rising prices Income per barrel (oil equivalent) EBITDA* per employee Private Controlled by the state *earnings before interest, depreciation and amortization

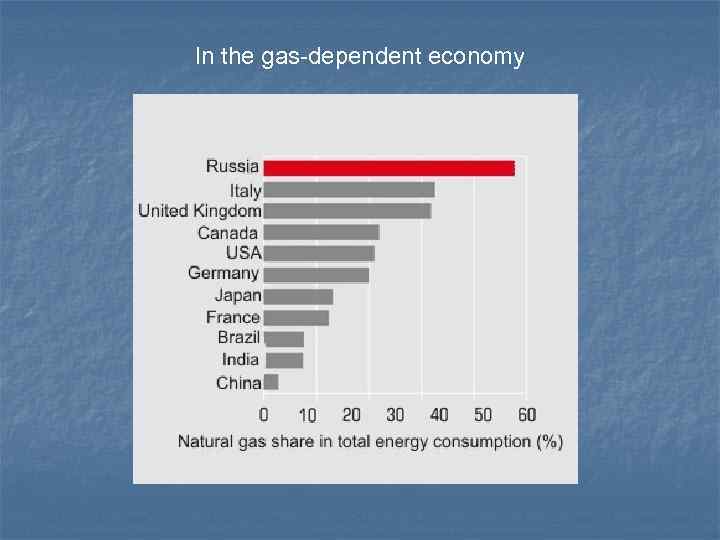

In the gas-dependent economy

Case 2. Hand-in-Hand with the state in foreign policy

Thank you!

MULTINATIONALS and RFP.ppt