8aa12379256090247995df81d4089380.ppt

- Количество слайдов: 15

Multinational Corporations in a Local Perspective – the Case of Varkaus in Finland Prof Raimo Lovio Helsinki School of Economics

Multinational Corporations in a Local Perspective – the Case of Varkaus in Finland Prof Raimo Lovio Helsinki School of Economics

The message of the paper • In favorable circumstances local business units may have surprising power vis-à-vis multinational companies • Multinational companies lose a significant amount of knowledge base and innovation potential if they fail to use knowledge available in their local units = think locally, act globally

The message of the paper • In favorable circumstances local business units may have surprising power vis-à-vis multinational companies • Multinational companies lose a significant amount of knowledge base and innovation potential if they fail to use knowledge available in their local units = think locally, act globally

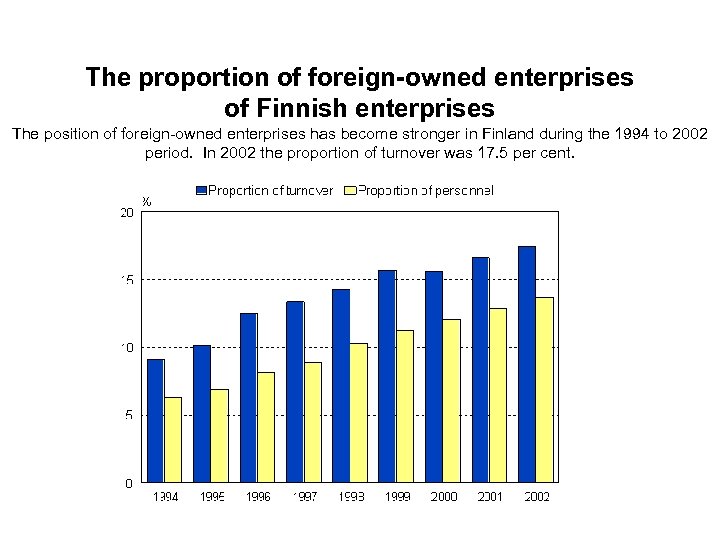

The proportion of foreign-owned enterprises of Finnish enterprises The position of foreign-owned enterprises has become stronger in Finland during the 1994 to 2002 period. In 2002 the proportion of turnover was 17. 5 per cent.

The proportion of foreign-owned enterprises of Finnish enterprises The position of foreign-owned enterprises has become stronger in Finland during the 1994 to 2002 period. In 2002 the proportion of turnover was 17. 5 per cent.

The effects of foreign acquisitions in Finland? • Foreign ownership has primarily had a positive influence on the profitability and productivity of the acquired enterprises • It has changed the management style of the acquired companies • Some concern is related to the R&D investments and growth perspectives of the acquired enterprises • The effects of foreign acquisitions have been mainly studied on the corporate level, therefore focus in the paper is on the level of local business units

The effects of foreign acquisitions in Finland? • Foreign ownership has primarily had a positive influence on the profitability and productivity of the acquired enterprises • It has changed the management style of the acquired companies • Some concern is related to the R&D investments and growth perspectives of the acquired enterprises • The effects of foreign acquisitions have been mainly studied on the corporate level, therefore focus in the paper is on the level of local business units

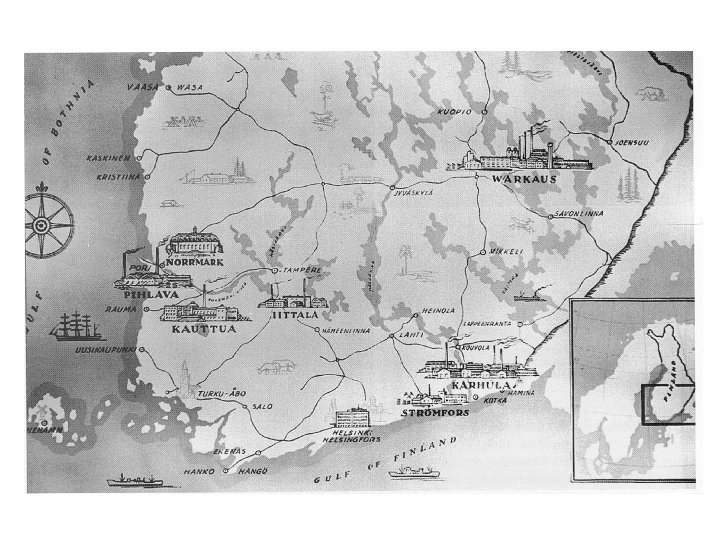

Varkaus case in a nutshell • Small industrial company-town with 23 000 inhabitants in eastern Finland, first industrial units established in the 1850 s • Ahlström Ltd continued invest in its factories in Varkaus up until the 1980 s: a sawmill, pulp mill, four paper machines, three engineering units (steam boilers, pulping equipment, screen plates), process automation unit, etc. employees over 3 000 • Between 1985 – 2002 all units were sold to international companies

Varkaus case in a nutshell • Small industrial company-town with 23 000 inhabitants in eastern Finland, first industrial units established in the 1850 s • Ahlström Ltd continued invest in its factories in Varkaus up until the 1980 s: a sawmill, pulp mill, four paper machines, three engineering units (steam boilers, pulping equipment, screen plates), process automation unit, etc. employees over 3 000 • Between 1985 – 2002 all units were sold to international companies

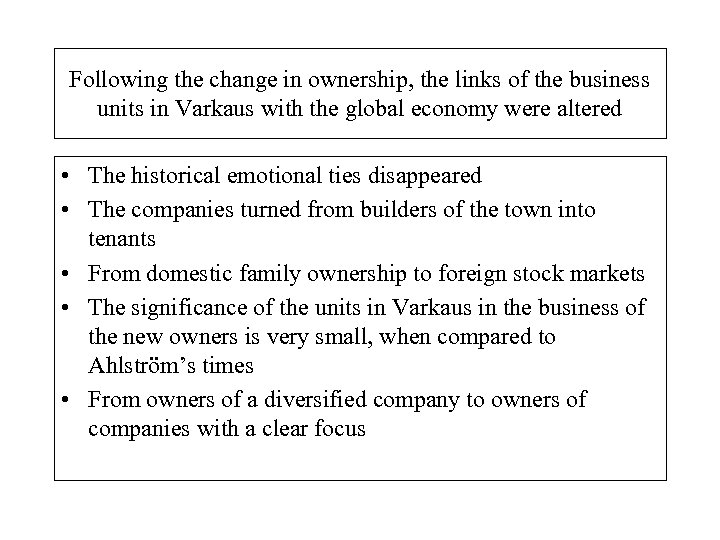

Following the change in ownership, the links of the business units in Varkaus with the global economy were altered • The historical emotional ties disappeared • The companies turned from builders of the town into tenants • From domestic family ownership to foreign stock markets • The significance of the units in Varkaus in the business of the new owners is very small, when compared to Ahlström’s times • From owners of a diversified company to owners of companies with a clear focus

Following the change in ownership, the links of the business units in Varkaus with the global economy were altered • The historical emotional ties disappeared • The companies turned from builders of the town into tenants • From domestic family ownership to foreign stock markets • The significance of the units in Varkaus in the business of the new owners is very small, when compared to Ahlström’s times • From owners of a diversified company to owners of companies with a clear focus

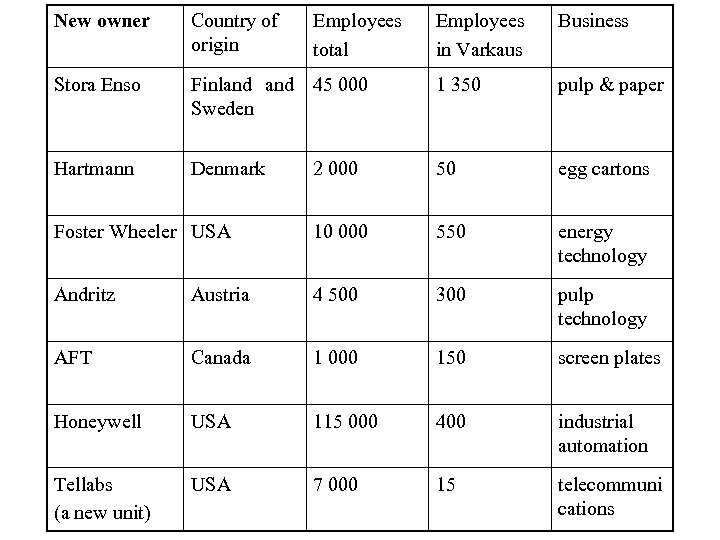

New owner Country of origin Stora Enso Hartmann Employees total Employees in Varkaus Business Finland 45 000 Sweden 1 350 pulp & paper Denmark 2 000 50 egg cartons Foster Wheeler USA 10 000 550 energy technology Andritz Austria 4 500 300 pulp technology AFT Canada 1 000 150 screen plates Honeywell USA 115 000 400 industrial automation Tellabs (a new unit) USA 7 000 15 telecommuni cations

New owner Country of origin Stora Enso Hartmann Employees total Employees in Varkaus Business Finland 45 000 Sweden 1 350 pulp & paper Denmark 2 000 50 egg cartons Foster Wheeler USA 10 000 550 energy technology Andritz Austria 4 500 300 pulp technology AFT Canada 1 000 150 screen plates Honeywell USA 115 000 400 industrial automation Tellabs (a new unit) USA 7 000 15 telecommuni cations

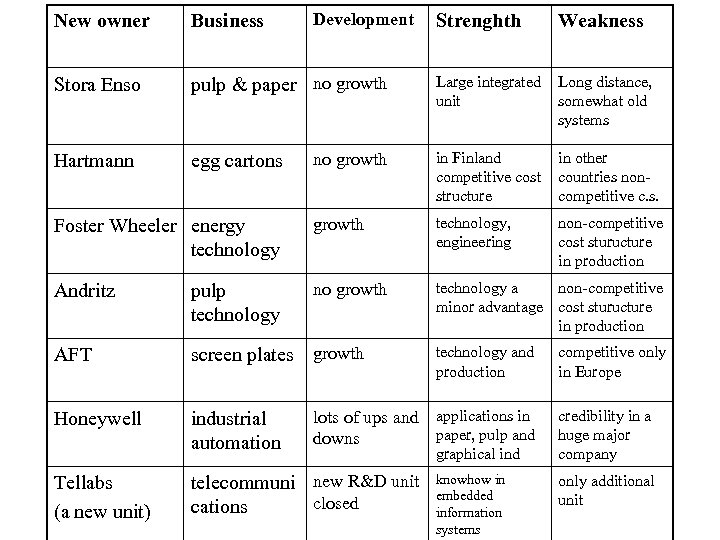

New owner Business Stora Enso Hartmann egg cartons Development Strenghth Weakness pulp & paper no growth Large integrated unit Long distance, somewhat old systems no growth in Finland competitive cost structure in other countries noncompetitive c. s. Foster Wheeler energy technology growth technology, engineering non-competitive cost sturucture in production Andritz pulp technology no growth technology a non-competitive minor advantage cost sturucture in production AFT screen plates growth Honeywell industrial automation Tellabs (a new unit) technology and production lots of ups and applications in paper, pulp and downs telecommuni new R&D unit closed cations graphical ind knowhow in embedded information systems competitive only in Europe credibility in a huge major company only additional unit

New owner Business Stora Enso Hartmann egg cartons Development Strenghth Weakness pulp & paper no growth Large integrated unit Long distance, somewhat old systems no growth in Finland competitive cost structure in other countries noncompetitive c. s. Foster Wheeler energy technology growth technology, engineering non-competitive cost sturucture in production Andritz pulp technology no growth technology a non-competitive minor advantage cost sturucture in production AFT screen plates growth Honeywell industrial automation Tellabs (a new unit) technology and production lots of ups and applications in paper, pulp and downs telecommuni new R&D unit closed cations graphical ind knowhow in embedded information systems competitive only in Europe credibility in a huge major company only additional unit

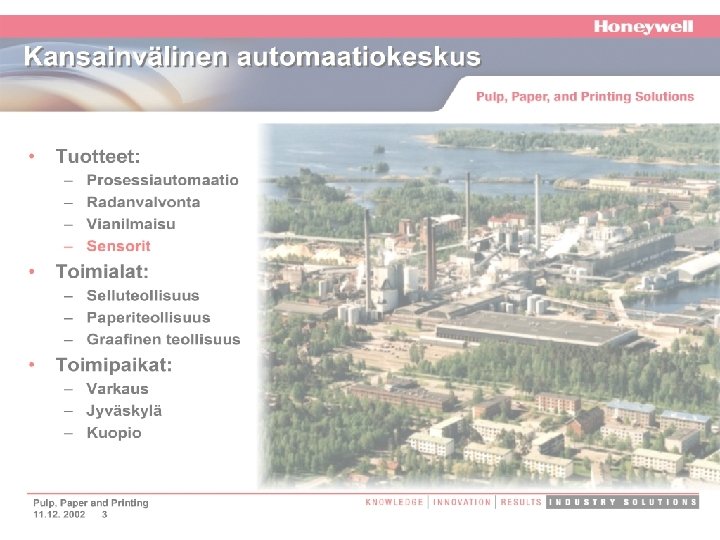

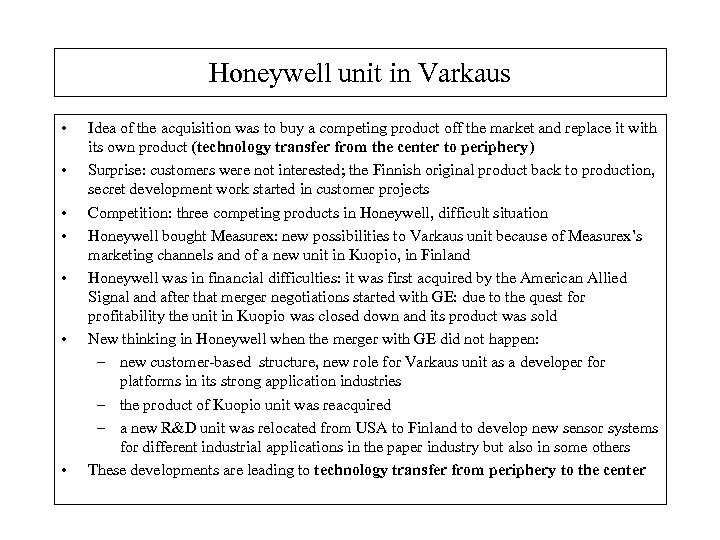

Honeywell unit in Varkaus • • Idea of the acquisition was to buy a competing product off the market and replace it with its own product (technology transfer from the center to periphery) Surprise: customers were not interested; the Finnish original product back to production, secret development work started in customer projects Competition: three competing products in Honeywell, difficult situation Honeywell bought Measurex: new possibilities to Varkaus unit because of Measurex’s marketing channels and of a new unit in Kuopio, in Finland Honeywell was in financial difficulties: it was first acquired by the American Allied Signal and after that merger negotiations started with GE: due to the quest for profitability the unit in Kuopio was closed down and its product was sold New thinking in Honeywell when the merger with GE did not happen: – new customer-based structure, new role for Varkaus unit as a developer for platforms in its strong application industries – the product of Kuopio unit was reacquired – a new R&D unit was relocated from USA to Finland to develop new sensor systems for different industrial applications in the paper industry but also in some others These developments are leading to technology transfer from periphery to the center

Honeywell unit in Varkaus • • Idea of the acquisition was to buy a competing product off the market and replace it with its own product (technology transfer from the center to periphery) Surprise: customers were not interested; the Finnish original product back to production, secret development work started in customer projects Competition: three competing products in Honeywell, difficult situation Honeywell bought Measurex: new possibilities to Varkaus unit because of Measurex’s marketing channels and of a new unit in Kuopio, in Finland Honeywell was in financial difficulties: it was first acquired by the American Allied Signal and after that merger negotiations started with GE: due to the quest for profitability the unit in Kuopio was closed down and its product was sold New thinking in Honeywell when the merger with GE did not happen: – new customer-based structure, new role for Varkaus unit as a developer for platforms in its strong application industries – the product of Kuopio unit was reacquired – a new R&D unit was relocated from USA to Finland to develop new sensor systems for different industrial applications in the paper industry but also in some others These developments are leading to technology transfer from periphery to the center

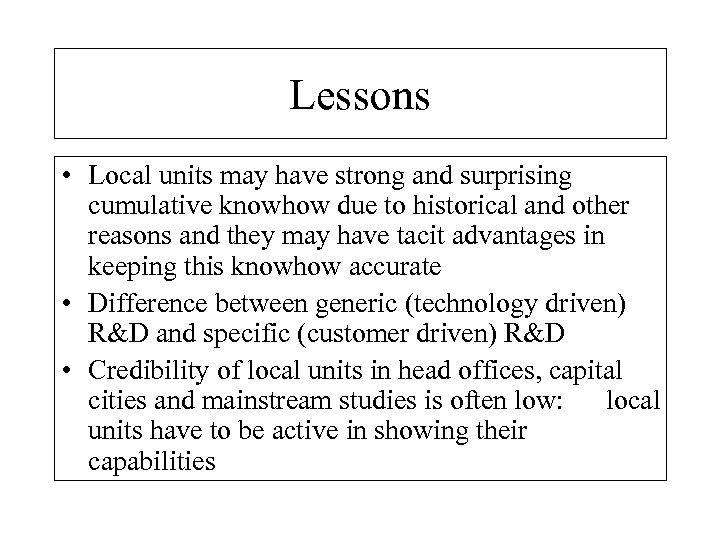

Lessons • Local units may have strong and surprising cumulative knowhow due to historical and other reasons and they may have tacit advantages in keeping this knowhow accurate • Difference between generic (technology driven) R&D and specific (customer driven) R&D • Credibility of local units in head offices, capital cities and mainstream studies is often low: local units have to be active in showing their capabilities

Lessons • Local units may have strong and surprising cumulative knowhow due to historical and other reasons and they may have tacit advantages in keeping this knowhow accurate • Difference between generic (technology driven) R&D and specific (customer driven) R&D • Credibility of local units in head offices, capital cities and mainstream studies is often low: local units have to be active in showing their capabilities