32574213b6619aeabe554c5c84526615.ppt

- Количество слайдов: 24

Multi Life Update February 24, 2009 © 2009 Genworth Financial, Inc. All rights reserved. Company Confidential

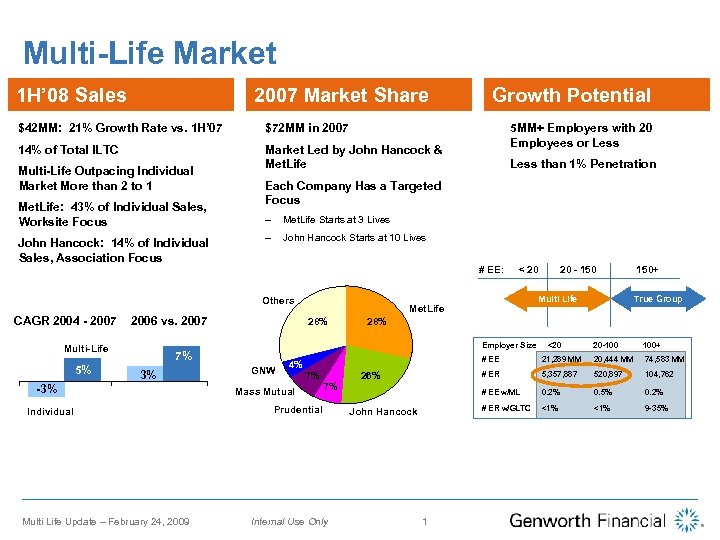

Multi-Life Market 1 H’ 08 Sales 2007 Market Share $42 MM: 21% Growth Rate vs. 1 H’ 07 • 14% of Total ILTC • Multi-Life Outpacing Individual Market More than 2 to 1 Met. Life: 43% of Individual Sales, Worksite Focus John Hancock: 14% of Individual Sales, Association Focus • $72 MM in 2007 • Market Led by John Hancock & Met. Life – 5% – John Hancock Starts at 10 Lives # EE: -3% Individual Multi Life Update – February 24, 2009 < 20 4% 150+ True Group 28% Employer Size GNW 20 - 150 Multi Life Met. Life 28% 7% 3% Less than 1% Penetration Met. Life Starts at 3 Lives 2006 vs. 2007 Multi-Life • 5 MM+ Employers with 20 Employees or Less Each Company Has a Targeted Focus Others CAGR 2004 - 2007 Growth Potential <20 20 -100 100+ # EE 7% Mass Mutual 7% Prudential Internal Use Only 5, 357, 887 520, 897 104, 762 0. 2% 0. 5% 0. 2% # ER w/GLTC 1 74, 583 MM # EE w/ML John Hancock 20, 444 MM # ER 26% 21, 289 MM <1% 9 -35%

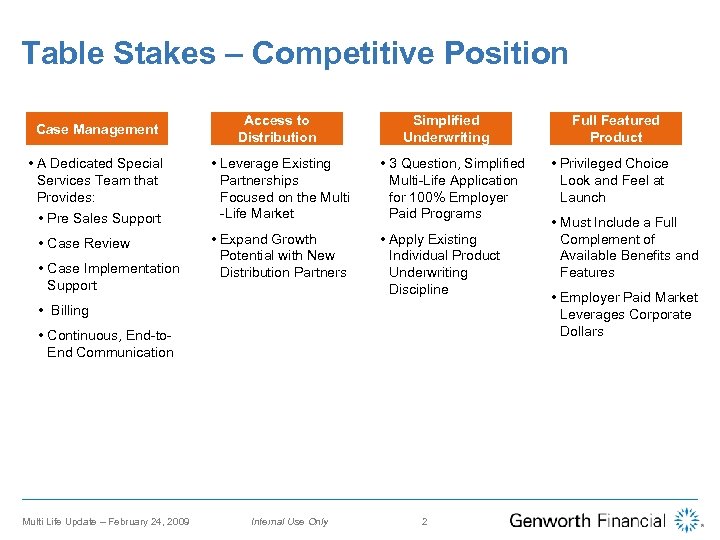

Table Stakes – Competitive Position Case Management Access to Distribution • A Dedicated Special Services Team that Provides: • Pre Sales Support • Leverage Existing Partnerships Focused on the Multi -Life Market • 3 Question, Simplified Multi-Life Application for 100% Employer Paid Programs • Expand Growth Potential with New Distribution Partners • Apply Existing Individual Product Underwriting Discipline • Case Review • Case Implementation Support Simplified Underwriting • Billing • Continuous, End-to. End Communication Multi Life Update – February 24, 2009 Internal Use Only 2 Full Featured Product • Privileged Choice Look and Feel at Launch • Must Include a Full Complement of Available Benefits and Features • Employer Paid Market Leverages Corporate Dollars

Special Operations Pre-Sales • • • Case Set-Up Apply & Submit U/W App & Issue Cert Customer Service Dedicated Multi-Life Operations Team Directly Accessible by Producers, Intermediaries, & Wholesalers One Stop Shopping / First Call Resolution Responsible for Case Ownership Through the Entire Lifecycle Consistent, Repeatable Service Offering & Experience Expertise in Case Management, Billing, Resolution, and Customer Service Multi Life Update – February 24, 2009 Internal Use Only 3

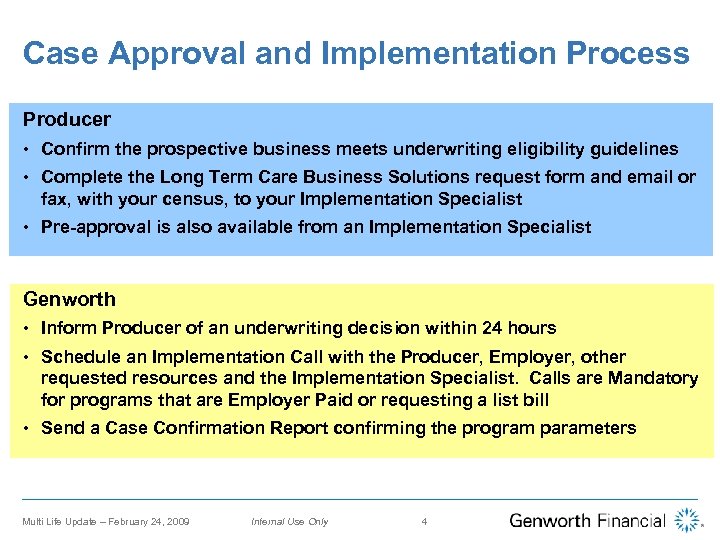

Case Approval and Implementation Process Producer • Confirm the prospective business meets underwriting eligibility guidelines • Complete the Long Term Care Business Solutions request form and email or fax, with your census, to your Implementation Specialist • Pre-approval is also available from an Implementation Specialist Genworth • Inform Producer of an underwriting decision within 24 hours • Schedule an Implementation Call with the Producer, Employer, other requested resources and the Implementation Specialist. Calls are Mandatory for programs that are Employer Paid or requesting a list bill • Send a Case Confirmation Report confirming the program parameters Multi Life Update – February 24, 2009 Internal Use Only 4

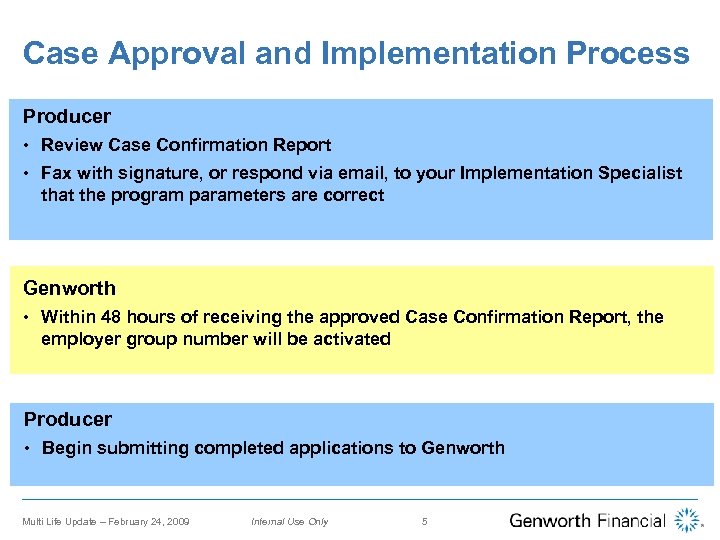

Case Approval and Implementation Process Producer • Review Case Confirmation Report • Fax with signature, or respond via email, to your Implementation Specialist that the program parameters are correct Genworth • Within 48 hours of receiving the approved Case Confirmation Report, the employer group number will be activated Producer • Begin submitting completed applications to Genworth Multi Life Update – February 24, 2009 Internal Use Only 5

Case Approval and Implementation Process Genworth • Implementation Specialist will review the applications and verify they have been completed properly • The applications will then go to underwriting for review and decision • A weekly email report will outline the status of the case • The Master Application, Master Policy, and Individual Certificates will be issued as requested by the Producer (all at once or individually) Producer • Have the Master Application signed and returned to Genworth • After 2 weeks, the Implementation Specialist will call to see if there any questions • Will conduct a second follow-up call at the next modal billing period Multi Life Update – February 24, 2009 Internal Use Only 6

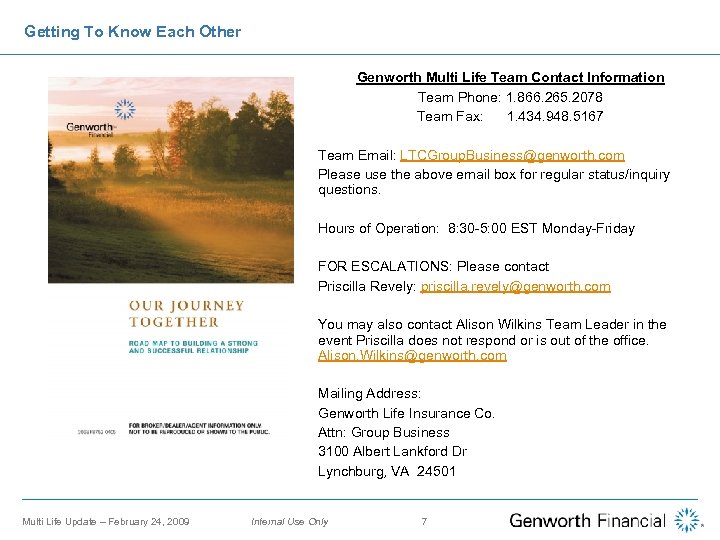

Getting To Know Each Other Genworth Multi Life Team Contact Information Team Phone: 1. 866. 265. 2078 Team Fax: 1. 434. 948. 5167 Team Email: LTCGroup. Business@genworth. com Please use the above email box for regular status/inquiry questions. Hours of Operation: 8: 30 -5: 00 EST Monday-Friday FOR ESCALATIONS: Please contact Priscilla Revely: priscilla. revely@genworth. com You may also contact Alison Wilkins Team Leader in the event Priscilla does not respond or is out of the office. Alison. Wilkins@genworth. com Mailing Address: Genworth Life Insurance Co. Attn: Group Business 3100 Albert Lankford Dr Lynchburg, VA 24501 Multi Life Update – February 24, 2009 Internal Use Only 7

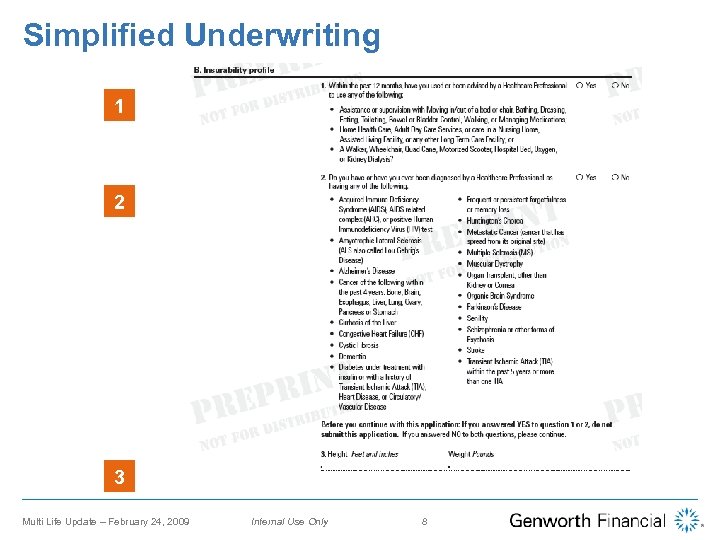

Simplified Underwriting 1 2 3 Multi Life Update – February 24, 2009 Internal Use Only 8

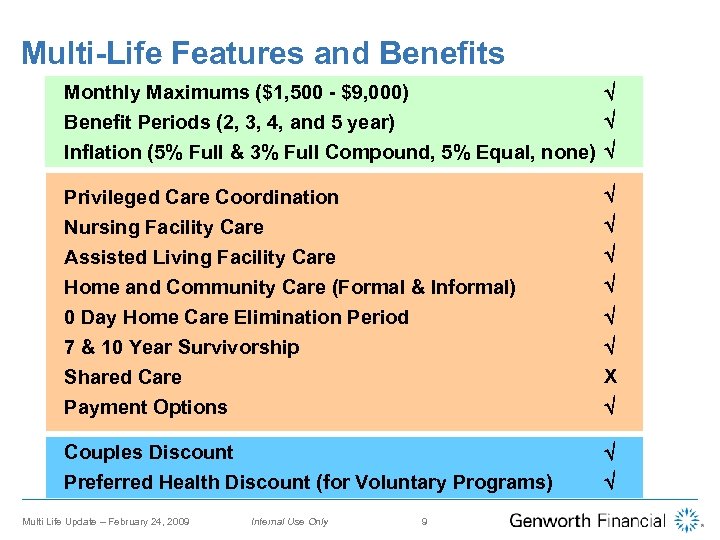

Multi-Life Features and Benefits Monthly Maximums ($1, 500 - $9, 000) Benefit Periods (2, 3, 4, and 5 year) Inflation (5% Full & 3% Full Compound, 5% Equal, none) Privileged Care Coordination Nursing Facility Care Assisted Living Facility Care Home and Community Care (Formal & Informal) 0 Day Home Care Elimination Period 7 & 10 Year Survivorship Shared Care Payment Options Couples Discount Preferred Health Discount (for Voluntary Programs) Multi Life Update – February 24, 2009 Internal Use Only 9 X

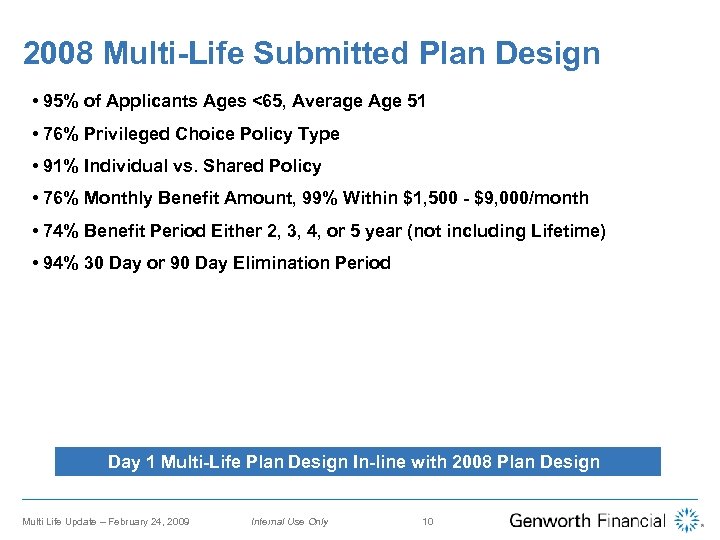

2008 Multi-Life Submitted Plan Design • 95% of Applicants Ages <65, Average Age 51 • 76% Privileged Choice Policy Type • 91% Individual vs. Shared Policy • 76% Monthly Benefit Amount, 99% Within $1, 500 - $9, 000/month • 74% Benefit Period Either 2, 3, 4, or 5 year (not including Lifetime) • 94% 30 Day or 90 Day Elimination Period Day 1 Multi-Life Plan Design In-line with 2008 Plan Design Multi Life Update – February 24, 2009 Internal Use Only 10

Why a Group Chassis • “Your” Policy – Specifically Designed for Your Business • Full Featured Product with Certificates Issued to Insureds • Certificates are Fully Portable: Same Coverage, Premium, and Discounts • Extreme Product Flexibility • Billing Flexibility • Case Tracking • Multiple Fulfillment Tools for the Producer Including the Web • Producer Licensing Advantages • No Broker of Record Letter Multi Life Update – February 24, 2009 Internal Use Only 11

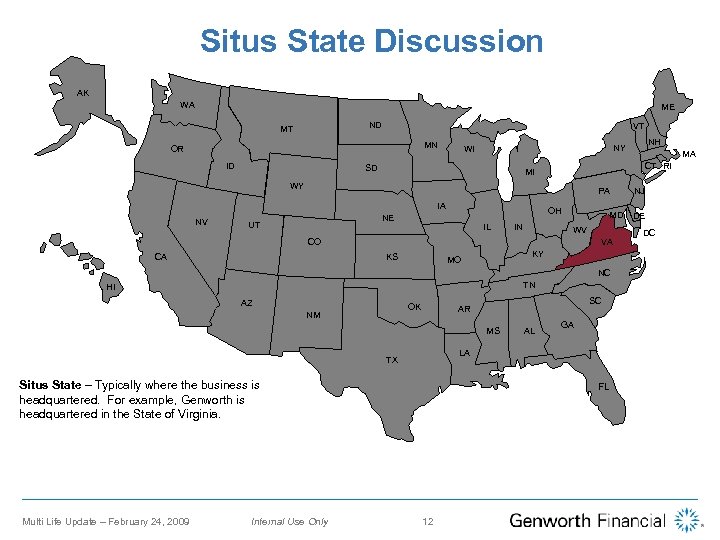

Situs State Discussion AK WA ME ND MT VT MN OR ID SD WY PA IA NV UT OH IL IN MD WV VA CO KS CA KY MO NC TN HI AZ OK NM SC AR MS Situs State – Typically where the business is headquartered. For example, Genworth is headquartered in the State of Virginia. Internal Use Only GA LA TX Multi Life Update – February 24, 2009 AL FL 12 MA CT RI MI NE NH NY WI NJ DE DC

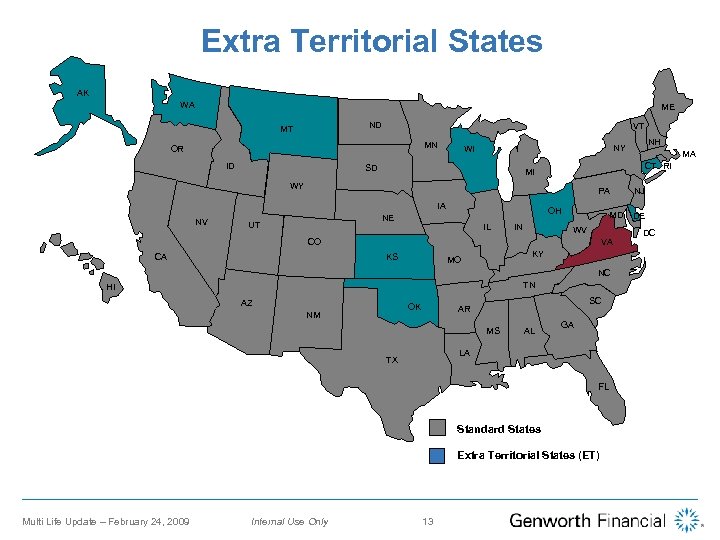

Extra Territorial States AK WA ME ND MT VT MN OR ID SD WY PA IA NV UT OH IL IN MD WV VA CO KS CA KY MO NC TN HI AZ OK NM SC AR MS AL GA LA TX FL Standard States Extra Territorial States (ET) Multi Life Update – February 24, 2009 Internal Use Only 13 MA CT RI MI NE NH NY WI NJ DE DC

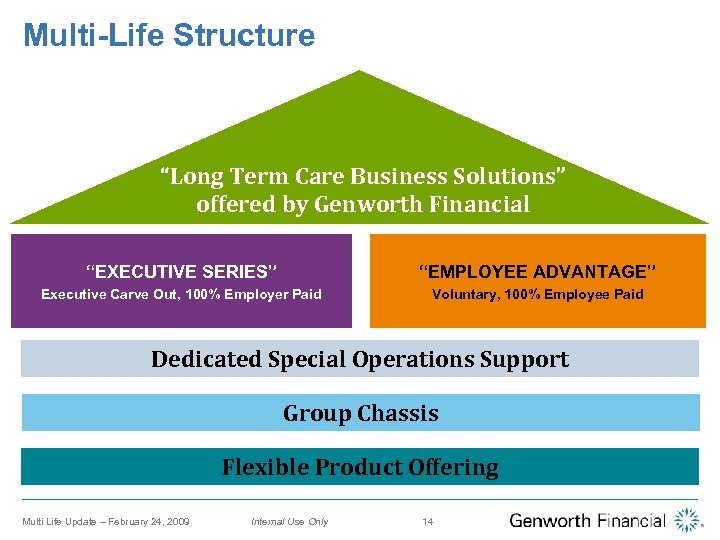

Multi-Life Structure “Long Term Care Business Solutions” offered by Genworth Financial “EXECUTIVE SERIES” “EMPLOYEE ADVANTAGE” Executive Carve Out, 100% Employer Paid Voluntary, 100% Employee Paid Dedicated Special Operations Support Group Chassis Flexible Product Offering Multi Life Update – February 24, 2009 Internal Use Only 14

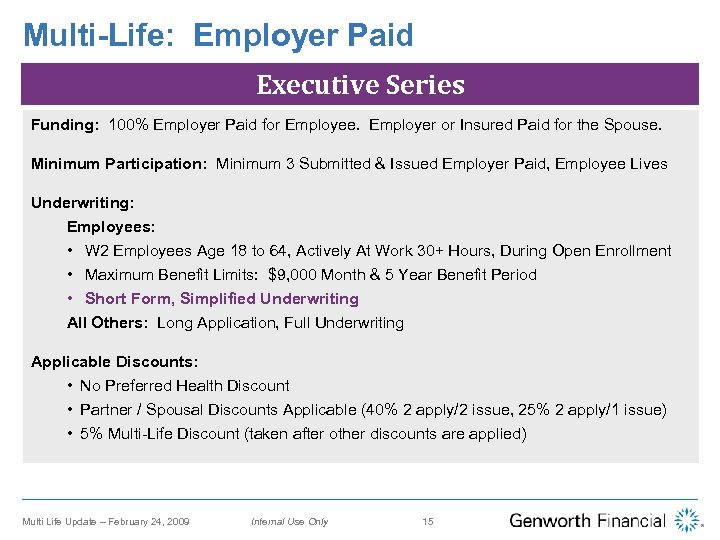

Multi-Life: Employer Paid Executive Series Funding: 100% Employer Paid for Employee. Employer or Insured Paid for the Spouse. Minimum Participation: Minimum 3 Submitted & Issued Employer Paid, Employee Lives Underwriting: Employees: • W 2 Employees Age 18 to 64, Actively At Work 30+ Hours, During Open Enrollment • Maximum Benefit Limits: $9, 000 Month & 5 Year Benefit Period • Short Form, Simplified Underwriting All Others: Long Application, Full Underwriting Applicable Discounts: • No Preferred Health Discount • Partner / Spousal Discounts Applicable (40% 2 apply/2 issue, 25% 2 apply/1 issue) • 5% Multi-Life Discount (taken after other discounts are applied) Multi Life Update – February 24, 2009 Internal Use Only 15

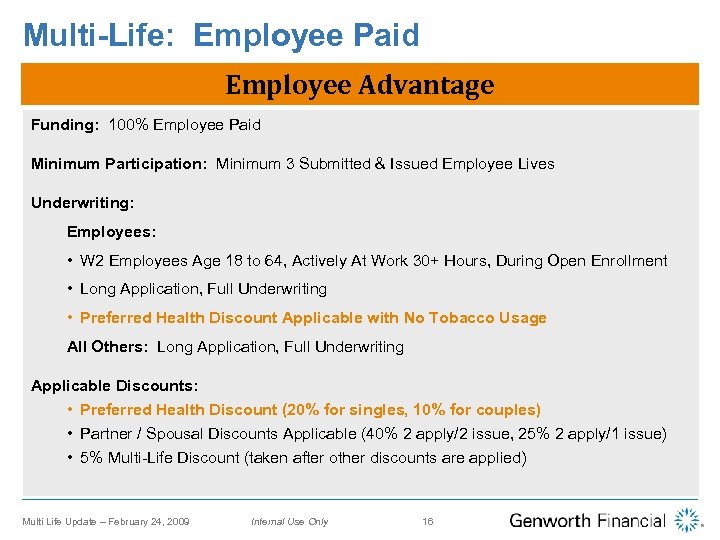

Multi-Life: Employee Paid Employee Advantage Funding: 100% Employee Paid Minimum Participation: Minimum 3 Submitted & Issued Employee Lives Underwriting: Employees: • W 2 Employees Age 18 to 64, Actively At Work 30+ Hours, During Open Enrollment • Long Application, Full Underwriting • Preferred Health Discount Applicable with No Tobacco Usage All Others: Long Application, Full Underwriting Applicable Discounts: • Preferred Health Discount (20% for singles, 10% for couples) • Partner / Spousal Discounts Applicable (40% 2 apply/2 issue, 25% 2 apply/1 issue) • 5% Multi-Life Discount (taken after other discounts are applied) Multi Life Update – February 24, 2009 Internal Use Only 16

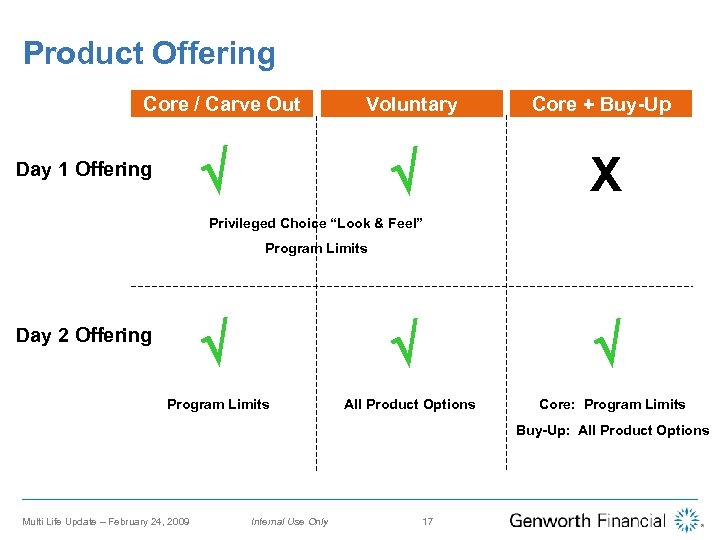

Product Offering Core / Carve Out Voluntary Day 1 Offering Core + Buy-Up X Privileged Choice “Look & Feel” Program Limits Day 2 Offering Program Limits All Product Options Core: Program Limits Buy-Up: All Product Options Multi Life Update – February 24, 2009 Internal Use Only 17

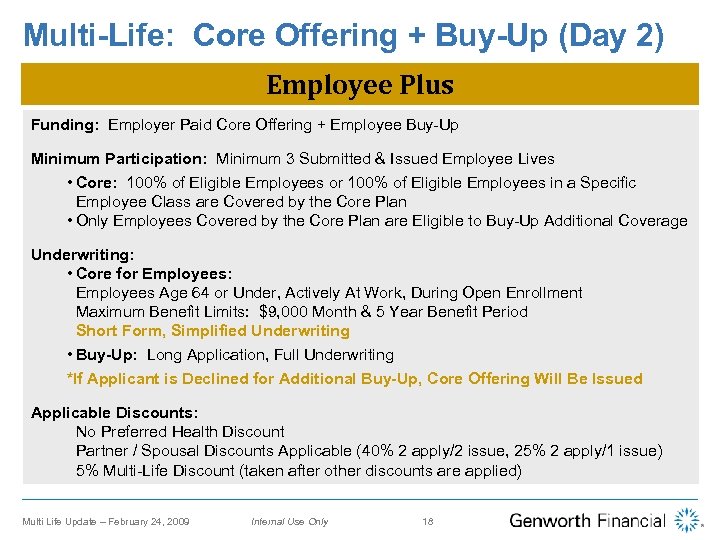

Multi-Life: Core Offering + Buy-Up (Day 2) Employee Plus Funding: Employer Paid Core Offering + Employee Buy-Up Minimum Participation: Minimum 3 Submitted & Issued Employee Lives • Core: 100% of Eligible Employees or 100% of Eligible Employees in a Specific Employee Class are Covered by the Core Plan • Only Employees Covered by the Core Plan are Eligible to Buy-Up Additional Coverage Underwriting: • Core for Employees: Employees Age 64 or Under, Actively At Work, During Open Enrollment Maximum Benefit Limits: $9, 000 Month & 5 Year Benefit Period Short Form, Simplified Underwriting • Buy-Up: Long Application, Full Underwriting *If Applicant is Declined for Additional Buy-Up, Core Offering Will Be Issued Applicable Discounts: No Preferred Health Discount Partner / Spousal Discounts Applicable (40% 2 apply/2 issue, 25% 2 apply/1 issue) 5% Multi-Life Discount (taken after other discounts are applied) Multi Life Update – February 24, 2009 Internal Use Only 18

Multi Life Update – February 24, 2009 Internal Use Only 19

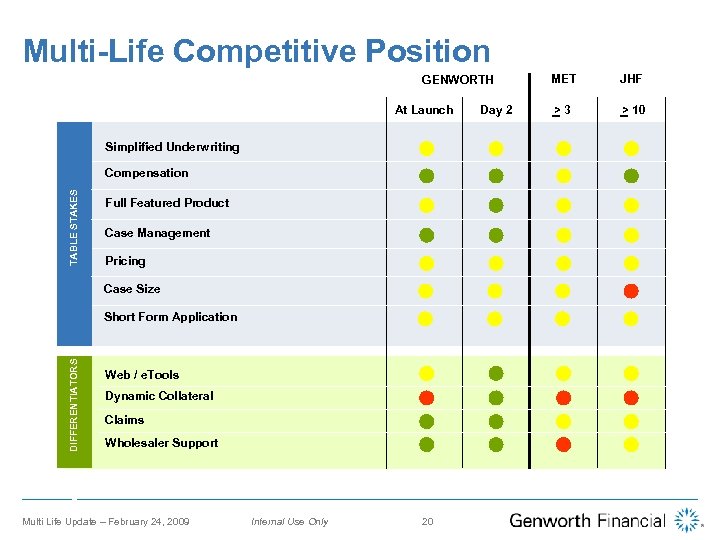

Multi-Life Competitive Position GENWORTH At Launch Simplified Underwriting TABLE STAKES Compensation Full Featured Product Case Management Pricing Case Size U/W DIFFERENTIATORS Short Form Application Web / e. Tools Dynamic Collateral Claims Wholesaler Support Multi Life Update – February 24, 2009 Internal Use Only 20 4 Day 2 MET JHF >3 > 10

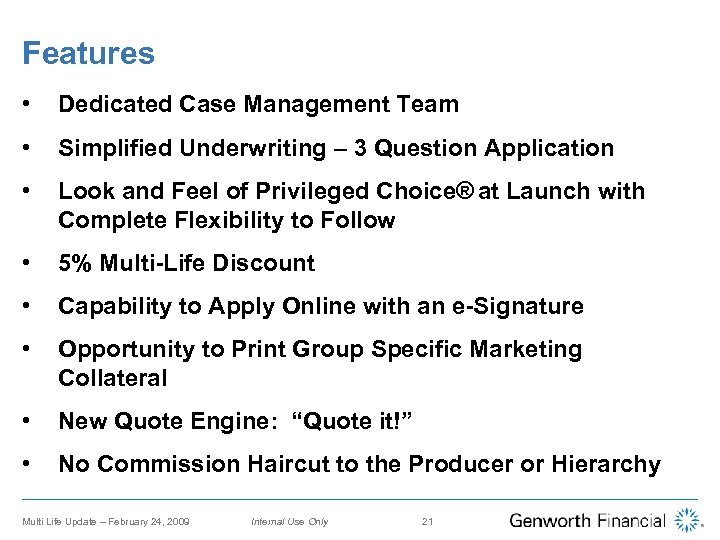

Features • Dedicated Case Management Team • Simplified Underwriting – 3 Question Application • Look and Feel of Privileged Choice® at Launch with Complete Flexibility to Follow • 5% Multi-Life Discount • Capability to Apply Online with an e-Signature • Opportunity to Print Group Specific Marketing Collateral • New Quote Engine: “Quote it!” • No Commission Haircut to the Producer or Hierarchy Multi Life Update – February 24, 2009 Internal Use Only 21

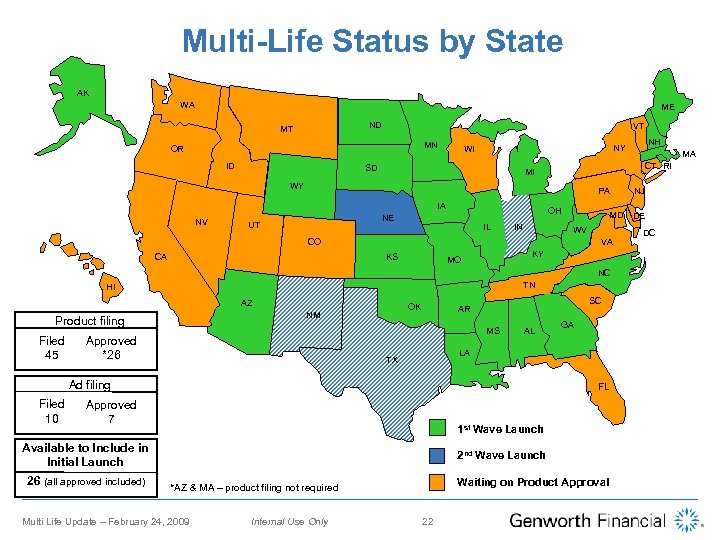

Multi-Life Status by State AK WA ME ND MT VT MN OR ID SD WY PA IA NV UT OH IL IN MD WV VA CO KS CA KY MO NC TN HI AZ Product filing Filed 45 OK NM SC AR MS Approved *26 AL Ad filing Filed 10 FL Approved 7 1 st Wave Launch Available to Include in Initial Launch 26 (all approved included) GA LA TX 2 nd Wave Launch Waiting on Product Approval *AZ & MA – product filing not required Multi Life Update – February 24, 2009 Internal Use Only 22 MA CT RI MI NE NH NY WI NJ DE DC

Multi Life Update – February 24, 2009 Internal Use Only 23

32574213b6619aeabe554c5c84526615.ppt