23dc423344ee99784325f17f5c115111.ppt

- Количество слайдов: 69

MTN Group Limited Final audited results for the year ended 31 December 2006

MTN Group Limited Final audited results for the year ended 31 December 2006

Agenda Strategic & operational overview Phuthuma Nhleko Group President and CEO Financial overview Rob Nisbet Group Finance Director Looking ahead… Phuthuma Nhleko 2

Agenda Strategic & operational overview Phuthuma Nhleko Group President and CEO Financial overview Rob Nisbet Group Finance Director Looking ahead… Phuthuma Nhleko 2

Strategic and operational overview Phuthuma Nhleko Group President and CEO

Strategic and operational overview Phuthuma Nhleko Group President and CEO

MTN Vision To be the leader in telecommunications in

MTN Vision To be the leader in telecommunications in

Key considerations for the period… • Investcom acquisition – Integration almost complete – Synergy benefits included in 2007 budgets, including rebranding – Asset base increased • Significant interest in emerging markets, operations more competitive • Increased regulatory intervention • Margin management key • Changes in ownership levels – Increased shareholding in Côte d’Ivoire, Uganda, Botswana and Nigeria Significantly different Group going forward 5

Key considerations for the period… • Investcom acquisition – Integration almost complete – Synergy benefits included in 2007 budgets, including rebranding – Asset base increased • Significant interest in emerging markets, operations more competitive • Increased regulatory intervention • Margin management key • Changes in ownership levels – Increased shareholding in Côte d’Ivoire, Uganda, Botswana and Nigeria Significantly different Group going forward 5

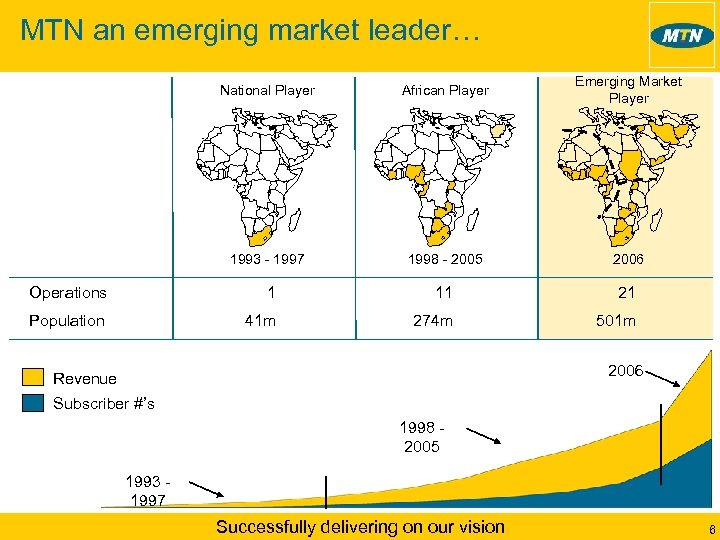

MTN an emerging market leader… National Player African Player Emerging Market Player 1993 - 1997 1998 - 2005 2006 Operations 1 11 21 Population 41 m 274 m 501 m 2006 Revenue Subscriber #’s 1998 2005 1993 1997 Successfully delivering on our vision 6

MTN an emerging market leader… National Player African Player Emerging Market Player 1993 - 1997 1998 - 2005 2006 Operations 1 11 21 Population 41 m 274 m 501 m 2006 Revenue Subscriber #’s 1998 2005 1993 1997 Successfully delivering on our vision 6

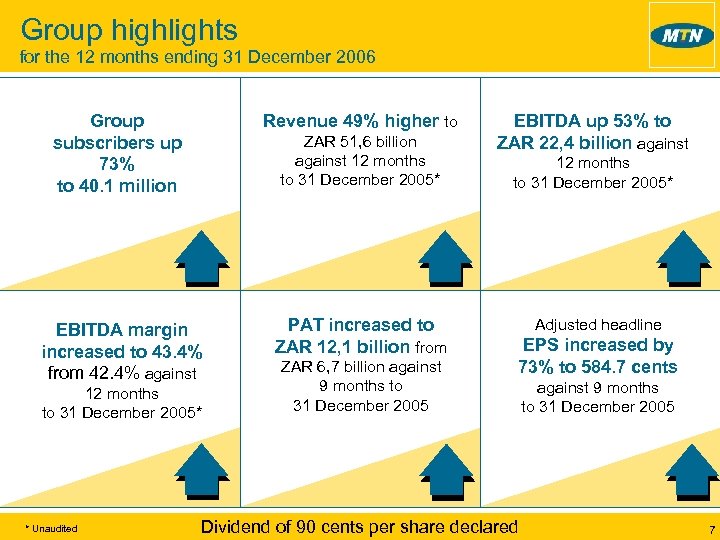

Group highlights for the 12 months ending 31 December 2006 Group subscribers up 73% to 40. 1 million Revenue 49% higher to EBITDA margin increased to 43. 4% from 42. 4% against PAT increased to ZAR 12, 1 billion from ZAR 51, 6 billion against 12 months to 31 December 2005* * Unaudited ZAR 6, 7 billion against 9 months to 31 December 2005 EBITDA up 53% to ZAR 22, 4 billion against 12 months to 31 December 2005* Adjusted headline EPS increased by 73% to 584. 7 cents Dividend of 90 cents per share declared against 9 months to 31 December 2005 7

Group highlights for the 12 months ending 31 December 2006 Group subscribers up 73% to 40. 1 million Revenue 49% higher to EBITDA margin increased to 43. 4% from 42. 4% against PAT increased to ZAR 12, 1 billion from ZAR 51, 6 billion against 12 months to 31 December 2005* * Unaudited ZAR 6, 7 billion against 9 months to 31 December 2005 EBITDA up 53% to ZAR 22, 4 billion against 12 months to 31 December 2005* Adjusted headline EPS increased by 73% to 584. 7 cents Dividend of 90 cents per share declared against 9 months to 31 December 2005 7

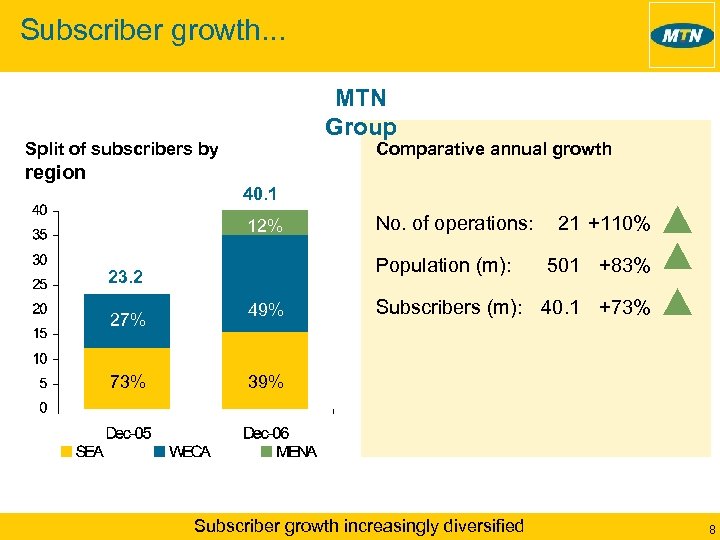

Subscriber growth. . . MTN Group Split of subscribers by Comparative annual growth region 40. 1 12% Population (m): 23. 2 27% 73% No. of operations: 49% 21 +110% 501 +83% Subscribers (m): 40. 1 +73% 39% Subscriber growth increasingly diversified 8

Subscriber growth. . . MTN Group Split of subscribers by Comparative annual growth region 40. 1 12% Population (m): 23. 2 27% 73% No. of operations: 49% 21 +110% 501 +83% Subscribers (m): 40. 1 +73% 39% Subscriber growth increasingly diversified 8

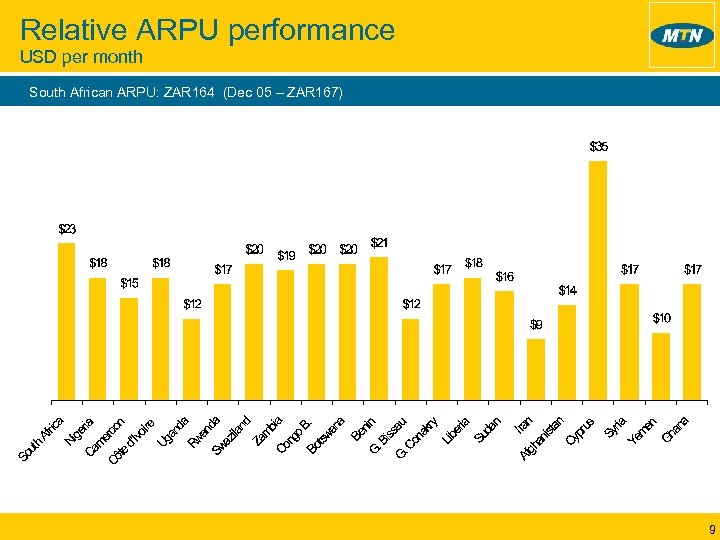

Relative ARPU performance USD per month South African ARPU: ZAR 164 (Dec 05 – ZAR 167) 9

Relative ARPU performance USD per month South African ARPU: ZAR 164 (Dec 05 – ZAR 167) 9

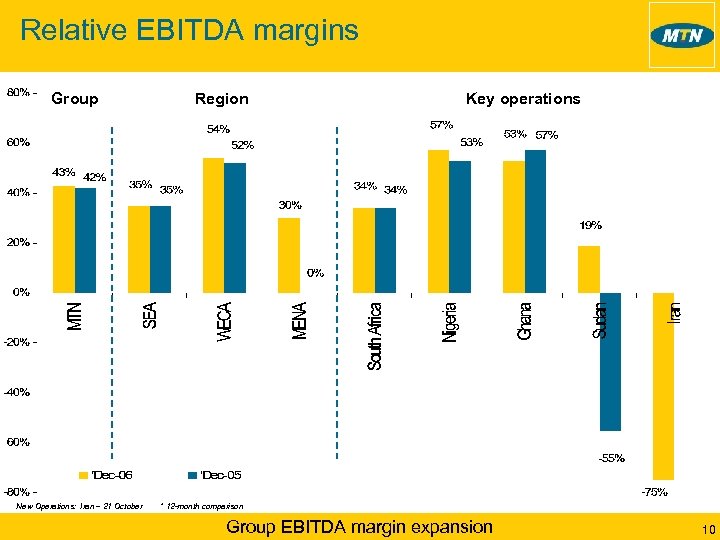

Relative EBITDA margins Group New Operations: Iran – 21 October Region Key operations * 12 -month comparison Group EBITDA margin expansion 10

Relative EBITDA margins Group New Operations: Iran – 21 October Region Key operations * 12 -month comparison Group EBITDA margin expansion 10

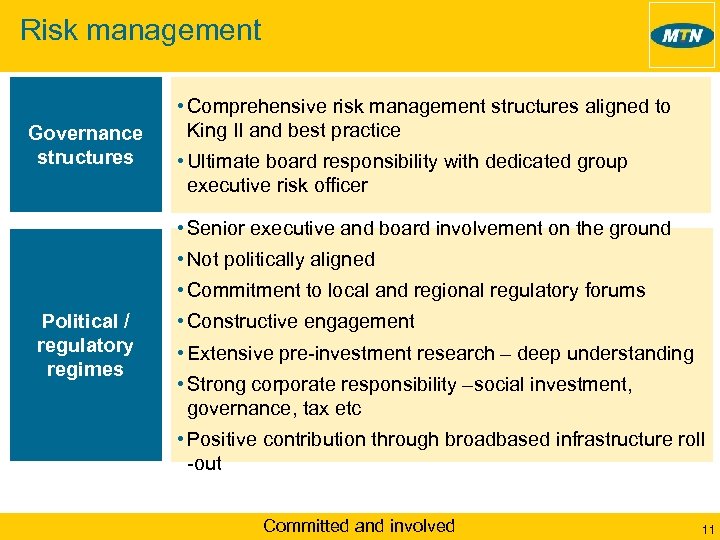

Risk management Governance structures • Comprehensive risk management structures aligned to King II and best practice • Ultimate board responsibility with dedicated group executive risk officer • Senior executive and board involvement on the ground • Not politically aligned • Commitment to local and regional regulatory forums Political / regulatory regimes • Constructive engagement • Extensive pre-investment research – deep understanding • Strong corporate responsibility –social investment, governance, tax etc • Positive contribution through broadbased infrastructure roll -out Committed and involved 11

Risk management Governance structures • Comprehensive risk management structures aligned to King II and best practice • Ultimate board responsibility with dedicated group executive risk officer • Senior executive and board involvement on the ground • Not politically aligned • Commitment to local and regional regulatory forums Political / regulatory regimes • Constructive engagement • Extensive pre-investment research – deep understanding • Strong corporate responsibility –social investment, governance, tax etc • Positive contribution through broadbased infrastructure roll -out Committed and involved 11

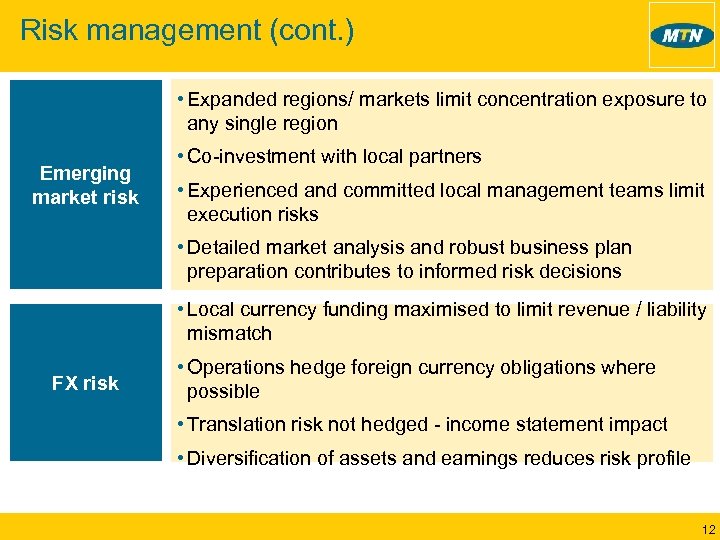

Risk management (cont. ) • Expanded regions/ markets limit concentration exposure to any single region Emerging market risk • Co-investment with local partners • Experienced and committed local management teams limit execution risks • Detailed market analysis and robust business plan preparation contributes to informed risk decisions • Local currency funding maximised to limit revenue / liability mismatch FX risk • Operations hedge foreign currency obligations where possible • Translation risk not hedged - income statement impact • Diversification of assets and earnings reduces risk profile 12

Risk management (cont. ) • Expanded regions/ markets limit concentration exposure to any single region Emerging market risk • Co-investment with local partners • Experienced and committed local management teams limit execution risks • Detailed market analysis and robust business plan preparation contributes to informed risk decisions • Local currency funding maximised to limit revenue / liability mismatch FX risk • Operations hedge foreign currency obligations where possible • Translation risk not hedged - income statement impact • Diversification of assets and earnings reduces risk profile 12

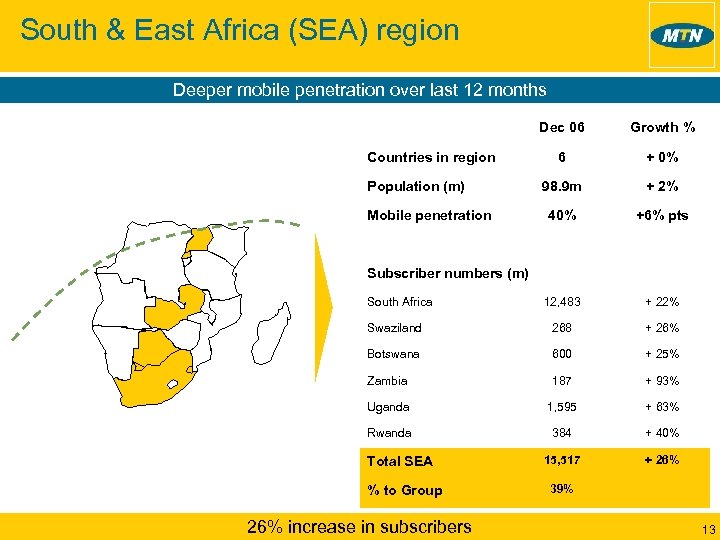

South & East Africa (SEA) region Deeper mobile penetration over last 12 months Dec 06 Growth % 6 + 0% 98. 9 m + 2% 40% +6% pts 12, 483 + 22% Swaziland 268 + 26% Botswana 600 + 25% Zambia 187 + 93% Uganda 1, 595 + 63% Rwanda 384 + 40% 15, 517 + 26% Countries in region Population (m) Mobile penetration Subscriber numbers (m) South Africa Total SEA % to Group 26% increase in subscribers 39% 13

South & East Africa (SEA) region Deeper mobile penetration over last 12 months Dec 06 Growth % 6 + 0% 98. 9 m + 2% 40% +6% pts 12, 483 + 22% Swaziland 268 + 26% Botswana 600 + 25% Zambia 187 + 93% Uganda 1, 595 + 63% Rwanda 384 + 40% 15, 517 + 26% Countries in region Population (m) Mobile penetration Subscriber numbers (m) South Africa Total SEA % to Group 26% increase in subscribers 39% 13

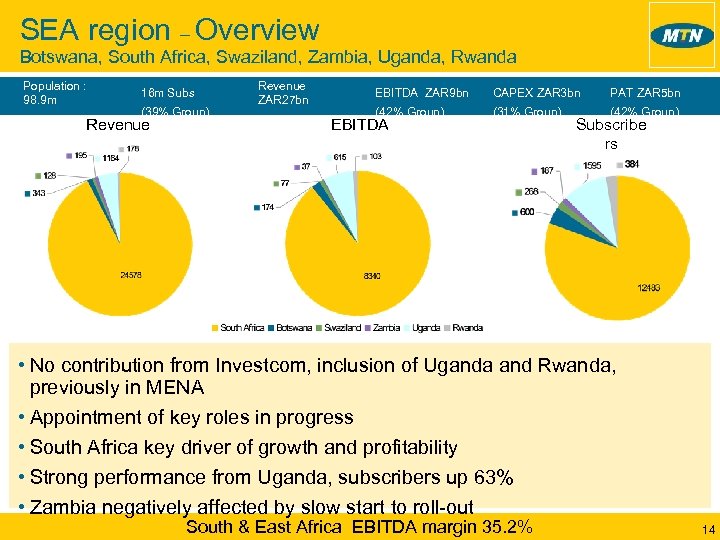

SEA region – Overview Botswana, South Africa, Swaziland, Zambia, Uganda, Rwanda Population : 98. 9 m (20%Group) 16 m Subs (39% Group) Revenue ZAR 27 bn (52% Group) EBITDA ZAR 9 bn CAPEX ZAR 3 bn PAT ZAR 5 bn (42% Group) (31% Group) (42% Group) EBITDA Subscribe rs • No contribution from Investcom, inclusion of Uganda and Rwanda, previously in MENA • Appointment of key roles in progress • South Africa key driver of growth and profitability • Strong performance from Uganda, subscribers up 63% • Zambia negatively affected by slow start to roll-out South & East Africa EBITDA margin 35. 2% 14

SEA region – Overview Botswana, South Africa, Swaziland, Zambia, Uganda, Rwanda Population : 98. 9 m (20%Group) 16 m Subs (39% Group) Revenue ZAR 27 bn (52% Group) EBITDA ZAR 9 bn CAPEX ZAR 3 bn PAT ZAR 5 bn (42% Group) (31% Group) (42% Group) EBITDA Subscribe rs • No contribution from Investcom, inclusion of Uganda and Rwanda, previously in MENA • Appointment of key roles in progress • South Africa key driver of growth and profitability • Strong performance from Uganda, subscribers up 63% • Zambia negatively affected by slow start to roll-out South & East Africa EBITDA margin 35. 2% 14

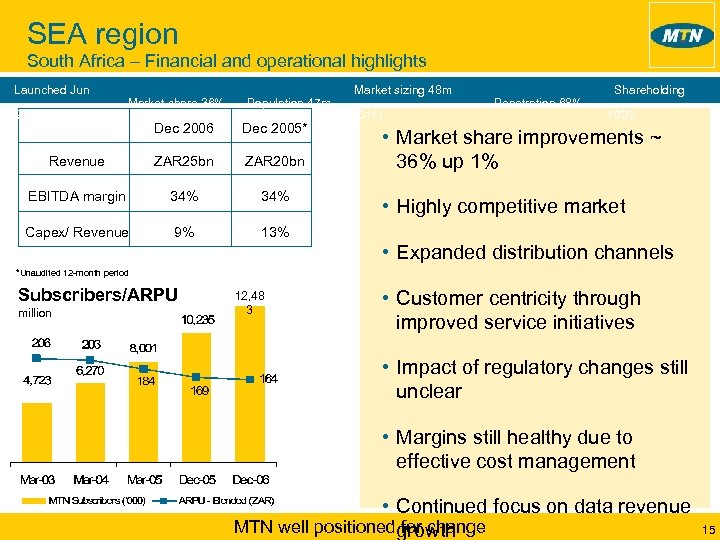

SEA region South Africa – Financial and operational highlights Launched Jun 1994 Market share 36% Population 47 m Dec 2006 Dec 2005* Revenue ZAR 25 bn ZAR 20 bn EBITDA margin 34% Capex/ Revenue 9% Market sizing 48 m (2011) Penetration 68% Shareholding 100% 13% • Market share improvements ~ 36% up 1% • Highly competitive market • Expanded distribution channels *Unaudited 12 -month period Subscribers/ARPU million 12, 48 3 • Customer centricity through improved service initiatives • Impact of regulatory changes still unclear • Margins still healthy due to effective cost management • Continued focus on data revenue MTN well positionedgrowth for change 15

SEA region South Africa – Financial and operational highlights Launched Jun 1994 Market share 36% Population 47 m Dec 2006 Dec 2005* Revenue ZAR 25 bn ZAR 20 bn EBITDA margin 34% Capex/ Revenue 9% Market sizing 48 m (2011) Penetration 68% Shareholding 100% 13% • Market share improvements ~ 36% up 1% • Highly competitive market • Expanded distribution channels *Unaudited 12 -month period Subscribers/ARPU million 12, 48 3 • Customer centricity through improved service initiatives • Impact of regulatory changes still unclear • Margins still healthy due to effective cost management • Continued focus on data revenue MTN well positionedgrowth for change 15

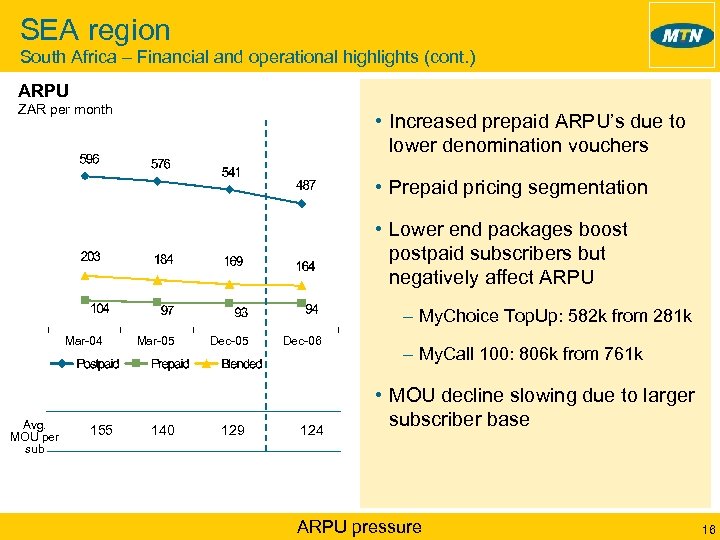

SEA region South Africa – Financial and operational highlights (cont. ) ARPU ZAR per month • Increased prepaid ARPU’s due to lower denomination vouchers • Prepaid pricing segmentation • Lower end packages boost postpaid subscribers but negatively affect ARPU – My. Choice Top. Up: 582 k from 281 k Mar-04 Avg. MOU per sub 155 Mar-05 140 Dec-05 129 Dec-06 124 – My. Call 100: 806 k from 761 k • MOU decline slowing due to larger subscriber base ARPU pressure 16

SEA region South Africa – Financial and operational highlights (cont. ) ARPU ZAR per month • Increased prepaid ARPU’s due to lower denomination vouchers • Prepaid pricing segmentation • Lower end packages boost postpaid subscribers but negatively affect ARPU – My. Choice Top. Up: 582 k from 281 k Mar-04 Avg. MOU per sub 155 Mar-05 140 Dec-05 129 Dec-06 124 – My. Call 100: 806 k from 761 k • MOU decline slowing due to larger subscriber base ARPU pressure 16

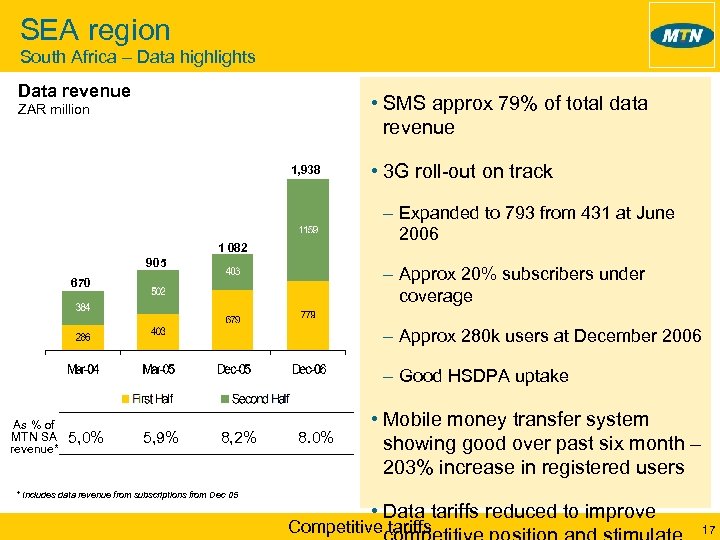

SEA region South Africa – Data highlights Data revenue • SMS approx 79% of total data revenue ZAR million 1, 938 • 3 G roll-out on track – Expanded to 793 from 431 at June 2006 1 082 905 – Approx 20% subscribers under coverage 670 – Approx 280 k users at December 2006 – Good HSDPA uptake As % of MTN SA revenue* 5, 0% 5, 9% 8, 2% * Includes data revenue from subscriptions from Dec 05 8. 0% • Mobile money transfer system showing good over past six month – 203% increase in registered users • Data tariffs reduced to improve Competitive tariffs 17

SEA region South Africa – Data highlights Data revenue • SMS approx 79% of total data revenue ZAR million 1, 938 • 3 G roll-out on track – Expanded to 793 from 431 at June 2006 1 082 905 – Approx 20% subscribers under coverage 670 – Approx 280 k users at December 2006 – Good HSDPA uptake As % of MTN SA revenue* 5, 0% 5, 9% 8, 2% * Includes data revenue from subscriptions from Dec 05 8. 0% • Mobile money transfer system showing good over past six month – 203% increase in registered users • Data tariffs reduced to improve Competitive tariffs 17

SEA region South Africa – Regulatory changes • Electronic Communications Act (ECA) Promulgated on 19 July 2006 – Licence conversion process still pending – Existing rights and obligations “protected” - new terms still unclear • Interconnect Ongoing dialogue – COA/CAM submitted to ICASA in March 2007, awaiting approval – Market definitions as prescribed in ECA now proposed • Re alignment of ICT BEE charter in process New DTI codes announced in December 2006 • Other – Court rules Cell C CST roll-out irregular – interconnect settlement pending – MNP operational from 10 Nov 2006 – limited impact, 40 k subscribers to end Feb 2007 Constructive engagement 18

SEA region South Africa – Regulatory changes • Electronic Communications Act (ECA) Promulgated on 19 July 2006 – Licence conversion process still pending – Existing rights and obligations “protected” - new terms still unclear • Interconnect Ongoing dialogue – COA/CAM submitted to ICASA in March 2007, awaiting approval – Market definitions as prescribed in ECA now proposed • Re alignment of ICT BEE charter in process New DTI codes announced in December 2006 • Other – Court rules Cell C CST roll-out irregular – interconnect settlement pending – MNP operational from 10 Nov 2006 – limited impact, 40 k subscribers to end Feb 2007 Constructive engagement 18

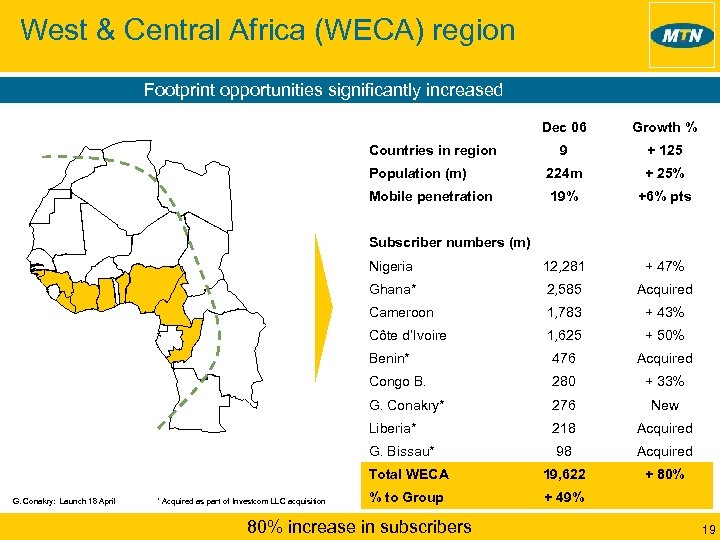

West & Central Africa (WECA) region Footprint opportunities significantly increased Dec 06 Growth % 9 + 125 Population (m) 224 m + 25% Mobile penetration 19% +6% pts Nigeria 12, 281 + 47% Ghana* 2, 585 Acquired Cameroon 1, 783 + 43% Côte d’Ivoire 1, 625 + 50% Benin* 476 Acquired Congo B. 280 + 33% G. Conakry* 276 New Liberia* 218 Acquired G. Bissau* 98 Acquired Total WECA 19, 622 + 80% % to Group + 49% Countries in region Subscriber numbers (m) G. Conakry: Launch 18 April * Acquired as part of Investcom LLC acquisition 80% increase in subscribers 19

West & Central Africa (WECA) region Footprint opportunities significantly increased Dec 06 Growth % 9 + 125 Population (m) 224 m + 25% Mobile penetration 19% +6% pts Nigeria 12, 281 + 47% Ghana* 2, 585 Acquired Cameroon 1, 783 + 43% Côte d’Ivoire 1, 625 + 50% Benin* 476 Acquired Congo B. 280 + 33% G. Conakry* 276 New Liberia* 218 Acquired G. Bissau* 98 Acquired Total WECA 19, 622 + 80% % to Group + 49% Countries in region Subscriber numbers (m) G. Conakry: Launch 18 April * Acquired as part of Investcom LLC acquisition 80% increase in subscribers 19

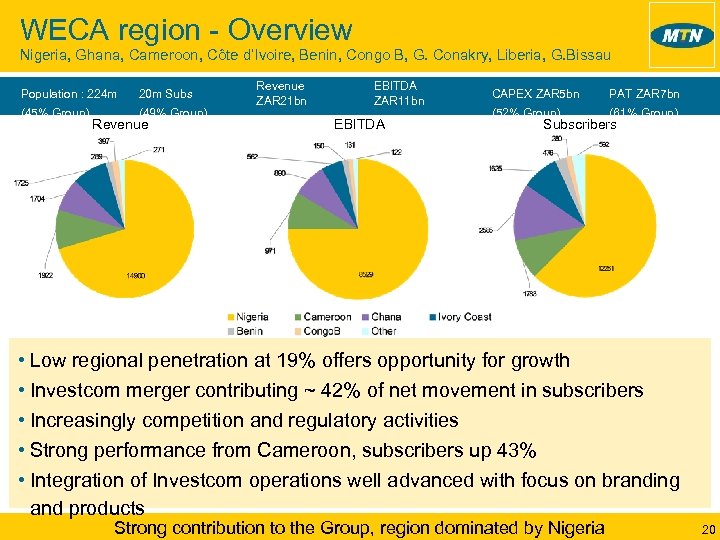

WECA region - Overview Nigeria, Ghana, Cameroon, Côte d’Ivoire, Benin, Congo B, G. Conakry, Liberia, G. Bissau Population : 224 m 20 m Subs (45% Group) (49% Group) Revenue ZAR 21 bn EBITDA ZAR 11 bn (41% Group) EBITDA (50% Group) CAPEX ZAR 5 bn PAT ZAR 7 bn (52% Group) (61% Group) Subscribers • Low regional penetration at 19% offers opportunity for growth • Investcom merger contributing ~ 42% of net movement in subscribers • Increasingly competition and regulatory activities • Strong performance from Cameroon, subscribers up 43% • Integration of Investcom operations well advanced with focus on branding and products Strong contribution to the Group, region dominated by Nigeria 20

WECA region - Overview Nigeria, Ghana, Cameroon, Côte d’Ivoire, Benin, Congo B, G. Conakry, Liberia, G. Bissau Population : 224 m 20 m Subs (45% Group) (49% Group) Revenue ZAR 21 bn EBITDA ZAR 11 bn (41% Group) EBITDA (50% Group) CAPEX ZAR 5 bn PAT ZAR 7 bn (52% Group) (61% Group) Subscribers • Low regional penetration at 19% offers opportunity for growth • Investcom merger contributing ~ 42% of net movement in subscribers • Increasingly competition and regulatory activities • Strong performance from Cameroon, subscribers up 43% • Integration of Investcom operations well advanced with focus on branding and products Strong contribution to the Group, region dominated by Nigeria 20

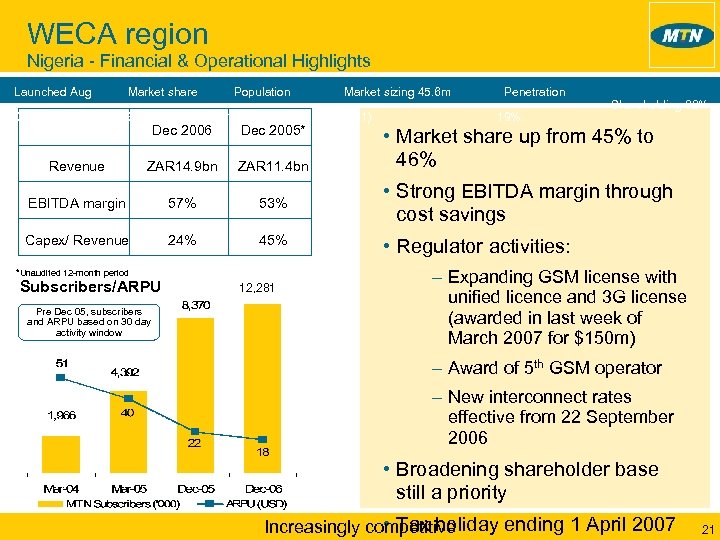

WECA region Nigeria - Financial & Operational Highlights Launched Aug 2001 Market share 46% Dec 2006 Population 138. 9 m Dec 2005* Market sizing 45. 6 m (2011) Penetration 19% Shareholding 82% • Market share up from 45% to 46% Revenue ZAR 14. 9 bn ZAR 11. 4 bn EBITDA margin 57% 53% • Strong EBITDA margin through cost savings Capex/ Revenue 24% 45% • Regulator activities: *Unaudited 12 -month period Subscribers/ARPU Pre Dec 05, subscribers and ARPU based on 30 day activity window 12, 281 – Expanding GSM license with unified licence and 3 G license (awarded in last week of March 2007 for $150 m) – Award of 5 th GSM operator – New interconnect rates effective from 22 September 2006 • Broadening shareholder base still a priority • Tax holiday ending 1 April 2007 Increasingly competitive 21

WECA region Nigeria - Financial & Operational Highlights Launched Aug 2001 Market share 46% Dec 2006 Population 138. 9 m Dec 2005* Market sizing 45. 6 m (2011) Penetration 19% Shareholding 82% • Market share up from 45% to 46% Revenue ZAR 14. 9 bn ZAR 11. 4 bn EBITDA margin 57% 53% • Strong EBITDA margin through cost savings Capex/ Revenue 24% 45% • Regulator activities: *Unaudited 12 -month period Subscribers/ARPU Pre Dec 05, subscribers and ARPU based on 30 day activity window 12, 281 – Expanding GSM license with unified licence and 3 G license (awarded in last week of March 2007 for $150 m) – Award of 5 th GSM operator – New interconnect rates effective from 22 September 2006 • Broadening shareholder base still a priority • Tax holiday ending 1 April 2007 Increasingly competitive 21

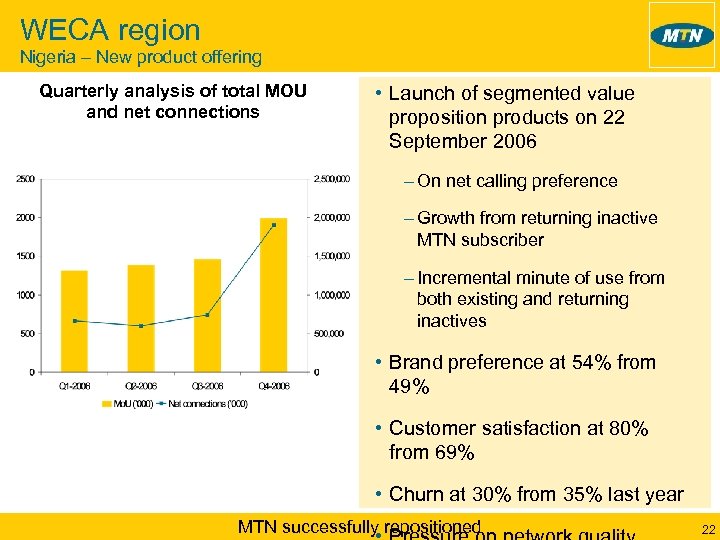

WECA region Nigeria – New product offering Quarterly analysis of total MOU and net connections • Launch of segmented value proposition products on 22 September 2006 – On net calling preference – Growth from returning inactive MTN subscriber – Incremental minute of use from both existing and returning inactives • Brand preference at 54% from 49% • Customer satisfaction at 80% from 69% • Churn at 30% from 35% last year MTN successfully repositioned 22

WECA region Nigeria – New product offering Quarterly analysis of total MOU and net connections • Launch of segmented value proposition products on 22 September 2006 – On net calling preference – Growth from returning inactive MTN subscriber – Incremental minute of use from both existing and returning inactives • Brand preference at 54% from 49% • Customer satisfaction at 80% from 69% • Churn at 30% from 35% last year MTN successfully repositioned 22

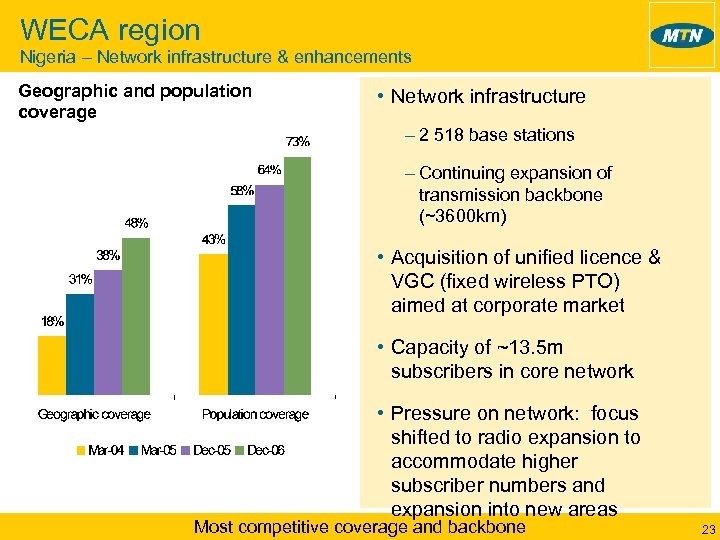

WECA region Nigeria – Network infrastructure & enhancements Geographic and population coverage • Network infrastructure – 2 518 base stations – Continuing expansion of transmission backbone (~3600 km) • Acquisition of unified licence & VGC (fixed wireless PTO) aimed at corporate market • Capacity of ~13. 5 m subscribers in core network • Pressure on network: focus shifted to radio expansion to accommodate higher subscriber numbers and expansion into new areas Most competitive coverage and backbone 23

WECA region Nigeria – Network infrastructure & enhancements Geographic and population coverage • Network infrastructure – 2 518 base stations – Continuing expansion of transmission backbone (~3600 km) • Acquisition of unified licence & VGC (fixed wireless PTO) aimed at corporate market • Capacity of ~13. 5 m subscribers in core network • Pressure on network: focus shifted to radio expansion to accommodate higher subscriber numbers and expansion into new areas Most competitive coverage and backbone 23

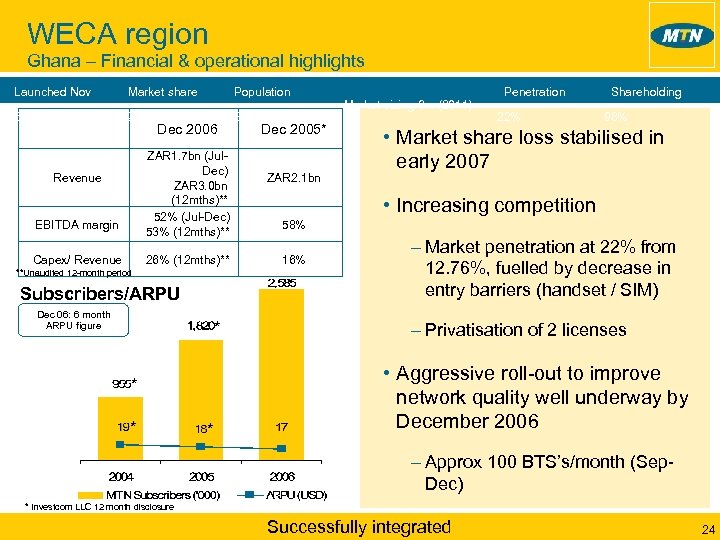

WECA region Ghana – Financial & operational highlights Launched Nov 96 Market share 52% Population Dec 2006 22. 4 m ZAR 1. 7 bn (Jul. Dec) ZAR 3. 0 bn (12 mths)** 52% (Jul-Dec) 53% (12 mths)** Revenue EBITDA margin Capex/ Revenue 26% (12 mths)** **Unaudited 12 -month period Subscribers/ARPU Dec 06: 6 month ARPU figure * * Dec 2005* ZAR 2. 1 bn Market sizing 9 m (2011) Penetration 22% Shareholding 98% • Market share loss stabilised in early 2007 • Increasing competition 58% 16% – Market penetration at 22% from 12. 76%, fuelled by decrease in entry barriers (handset / SIM) – Privatisation of 2 licenses • Aggressive roll-out to improve network quality well underway by December 2006 – Approx 100 BTS’s/month (Sep. Dec) * Investcom LLC 12 month disclosure Successfully integrated 24

WECA region Ghana – Financial & operational highlights Launched Nov 96 Market share 52% Population Dec 2006 22. 4 m ZAR 1. 7 bn (Jul. Dec) ZAR 3. 0 bn (12 mths)** 52% (Jul-Dec) 53% (12 mths)** Revenue EBITDA margin Capex/ Revenue 26% (12 mths)** **Unaudited 12 -month period Subscribers/ARPU Dec 06: 6 month ARPU figure * * Dec 2005* ZAR 2. 1 bn Market sizing 9 m (2011) Penetration 22% Shareholding 98% • Market share loss stabilised in early 2007 • Increasing competition 58% 16% – Market penetration at 22% from 12. 76%, fuelled by decrease in entry barriers (handset / SIM) – Privatisation of 2 licenses • Aggressive roll-out to improve network quality well underway by December 2006 – Approx 100 BTS’s/month (Sep. Dec) * Investcom LLC 12 month disclosure Successfully integrated 24

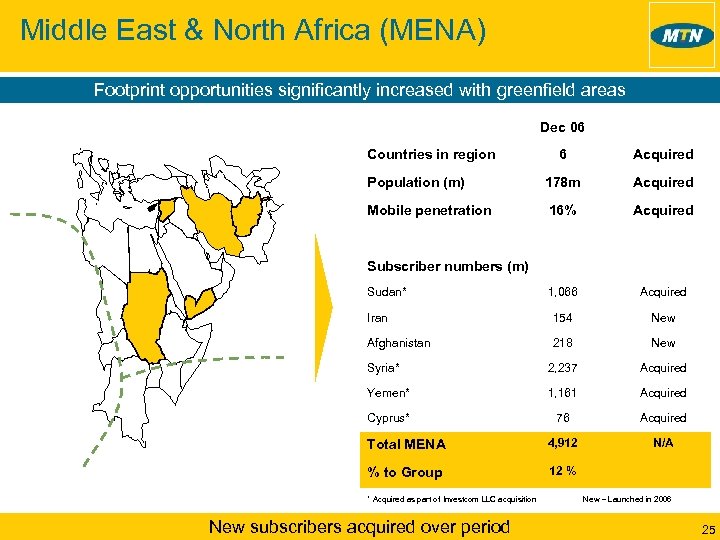

Middle East & North Africa (MENA) Footprint opportunities significantly increased with greenfield areas Dec 06 Countries in region 6 Acquired Population (m) 178 m Acquired Mobile penetration 16% Acquired 1, 066 Acquired Iran 154 New Afghanistan 218 New Syria* 2, 237 Acquired Yemen* 1, 161 Acquired Cyprus* 76 Acquired Total MENA 4, 912 N/A % to Group 12 % Subscriber numbers (m) Sudan* * Acquired as part of Investcom LLC acquisition New subscribers acquired over period New – Launched in 2006 25

Middle East & North Africa (MENA) Footprint opportunities significantly increased with greenfield areas Dec 06 Countries in region 6 Acquired Population (m) 178 m Acquired Mobile penetration 16% Acquired 1, 066 Acquired Iran 154 New Afghanistan 218 New Syria* 2, 237 Acquired Yemen* 1, 161 Acquired Cyprus* 76 Acquired Total MENA 4, 912 N/A % to Group 12 % Subscriber numbers (m) Sudan* * Acquired as part of Investcom LLC acquisition New subscribers acquired over period New – Launched in 2006 25

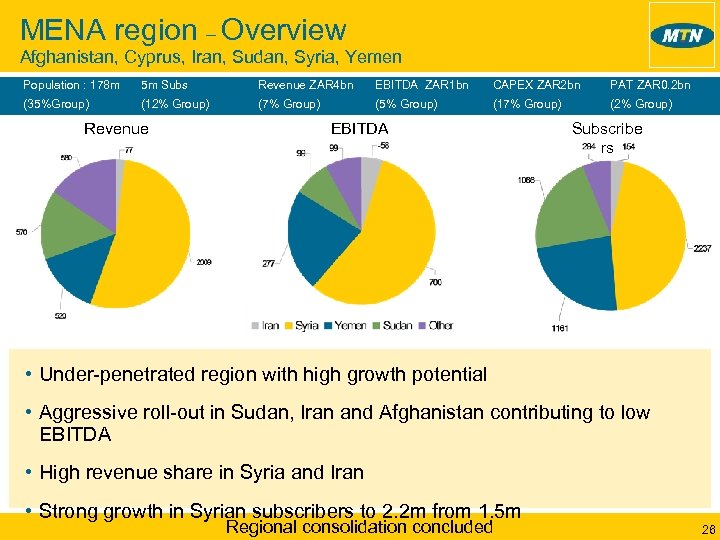

MENA region – Overview Afghanistan, Cyprus, Iran, Sudan, Syria, Yemen Population : 178 m 5 m Subs Revenue ZAR 4 bn EBITDA ZAR 1 bn CAPEX ZAR 2 bn PAT ZAR 0. 2 bn (35%Group) (12% Group) (7% Group) (5% Group) (17% Group) (2% Group) Revenue EBITDA Subscribe rs • Under-penetrated region with high growth potential • Aggressive roll-out in Sudan, Iran and Afghanistan contributing to low EBITDA • High revenue share in Syria and Iran • Strong growth in Syrian subscribers to 2. 2 m from 1. 5 m Regional consolidation concluded 26

MENA region – Overview Afghanistan, Cyprus, Iran, Sudan, Syria, Yemen Population : 178 m 5 m Subs Revenue ZAR 4 bn EBITDA ZAR 1 bn CAPEX ZAR 2 bn PAT ZAR 0. 2 bn (35%Group) (12% Group) (7% Group) (5% Group) (17% Group) (2% Group) Revenue EBITDA Subscribe rs • Under-penetrated region with high growth potential • Aggressive roll-out in Sudan, Iran and Afghanistan contributing to low EBITDA • High revenue share in Syria and Iran • Strong growth in Syrian subscribers to 2. 2 m from 1. 5 m Regional consolidation concluded 26

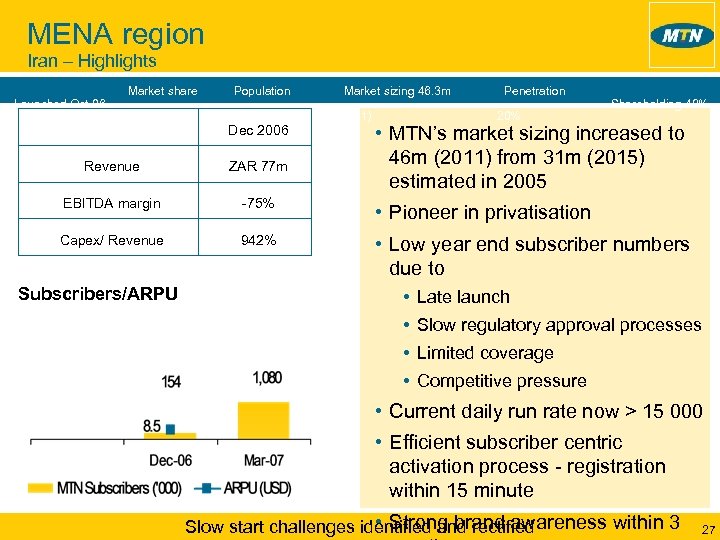

MENA region Iran – Highlights Launched Oct 06 Market share 1% Population 69. 5 m Dec 2006 Market sizing 46. 3 m (2011) Penetration 20% Shareholding 49% • MTN’s market sizing increased to 46 m (2011) from 31 m (2015) estimated in 2005 Revenue ZAR 77 m EBITDA margin -75% • Pioneer in privatisation Capex/ Revenue 942% • Low year end subscriber numbers due to Subscribers/ARPU • Late launch • Slow regulatory approval processes • Limited coverage • Competitive pressure • Current daily run rate now > 15 000 • Efficient subscriber centric activation process - registration within 15 minute • Strong brand awareness within 3 Slow start challenges identified and rectified 27

MENA region Iran – Highlights Launched Oct 06 Market share 1% Population 69. 5 m Dec 2006 Market sizing 46. 3 m (2011) Penetration 20% Shareholding 49% • MTN’s market sizing increased to 46 m (2011) from 31 m (2015) estimated in 2005 Revenue ZAR 77 m EBITDA margin -75% • Pioneer in privatisation Capex/ Revenue 942% • Low year end subscriber numbers due to Subscribers/ARPU • Late launch • Slow regulatory approval processes • Limited coverage • Competitive pressure • Current daily run rate now > 15 000 • Efficient subscriber centric activation process - registration within 15 minute • Strong brand awareness within 3 Slow start challenges identified and rectified 27

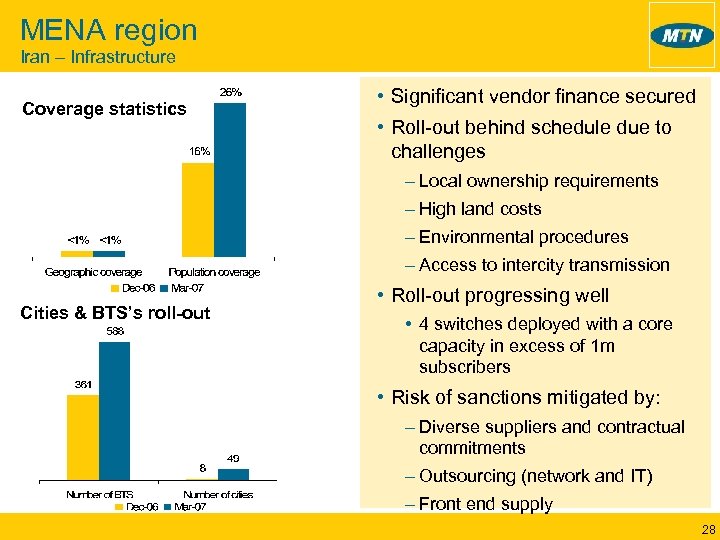

MENA region Iran – Infrastructure Coverage statistics • Significant vendor finance secured • Roll-out behind schedule due to challenges – Local ownership requirements – High land costs – Environmental procedures – Access to intercity transmission Cities & BTS’s roll-out • Roll-out progressing well • 4 switches deployed with a core capacity in excess of 1 m subscribers • Risk of sanctions mitigated by: – Diverse suppliers and contractual commitments – Outsourcing (network and IT) – Front end supply 28

MENA region Iran – Infrastructure Coverage statistics • Significant vendor finance secured • Roll-out behind schedule due to challenges – Local ownership requirements – High land costs – Environmental procedures – Access to intercity transmission Cities & BTS’s roll-out • Roll-out progressing well • 4 switches deployed with a core capacity in excess of 1 m subscribers • Risk of sanctions mitigated by: – Diverse suppliers and contractual commitments – Outsourcing (network and IT) – Front end supply 28

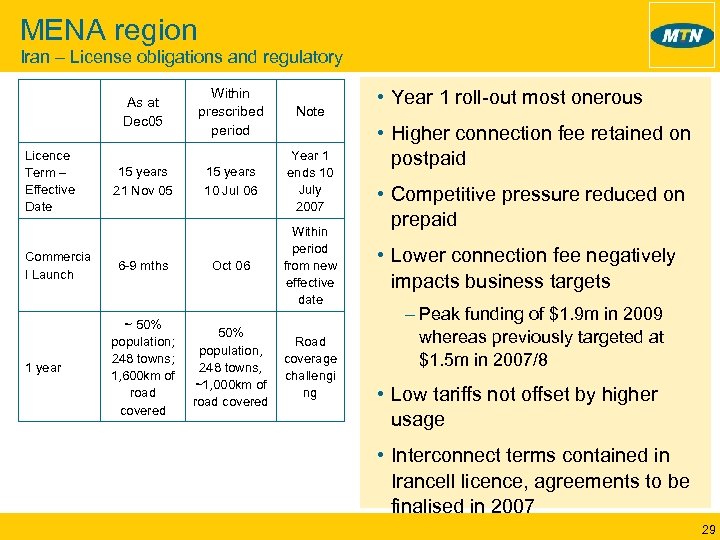

MENA region Iran – License obligations and regulatory As at Dec 05 Licence Term – Effective Date Commercia l Launch 1 year 15 years 21 Nov 05 6 -9 mths ~ 50% population; 248 towns; 1, 600 km of road covered Within prescribed period Note 15 years 10 Jul 06 Year 1 ends 10 July 2007 Oct 06 Within period from new effective date 50% population, 248 towns, ~1, 000 km of road covered Road coverage challengi ng • Year 1 roll-out most onerous • Higher connection fee retained on postpaid • Competitive pressure reduced on prepaid • Lower connection fee negatively impacts business targets – Peak funding of $1. 9 m in 2009 whereas previously targeted at $1. 5 m in 2007/8 • Low tariffs not offset by higher usage • Interconnect terms contained in Irancell licence, agreements to be finalised in 2007 29

MENA region Iran – License obligations and regulatory As at Dec 05 Licence Term – Effective Date Commercia l Launch 1 year 15 years 21 Nov 05 6 -9 mths ~ 50% population; 248 towns; 1, 600 km of road covered Within prescribed period Note 15 years 10 Jul 06 Year 1 ends 10 July 2007 Oct 06 Within period from new effective date 50% population, 248 towns, ~1, 000 km of road covered Road coverage challengi ng • Year 1 roll-out most onerous • Higher connection fee retained on postpaid • Competitive pressure reduced on prepaid • Lower connection fee negatively impacts business targets – Peak funding of $1. 9 m in 2009 whereas previously targeted at $1. 5 m in 2007/8 • Low tariffs not offset by higher usage • Interconnect terms contained in Irancell licence, agreements to be finalised in 2007 29

![MENA region Sudan Launched Market share [Sep 05] Population 36 m 25% Dec 2006 MENA region Sudan Launched Market share [Sep 05] Population 36 m 25% Dec 2006](https://present5.com/presentation/23dc423344ee99784325f17f5c115111/image-30.jpg) MENA region Sudan Launched Market share [Sep 05] Population 36 m 25% Dec 2006 Dec 2005* Revenue ZAR 570 m (Jul-Dec) ZAR 887 m (12 mths)** ZAR 130 m(12 mths) EBITDA margin 17% (Jul-Dec) 19% (12 mths)** Capex/ Revenue **Unaudited 12 -month period 70% Penetration 12% Shareholding 85% • First full year of operation • Market share growth to 25% • Regulatory & logistical challenges -55% (12 mths)** 256% (12 mths) • Despite roll-out challenges – 36% of population covered – 3 G and GPRS launched Subscribers/ARPU – 662 BTS’s and 3 MSC’s Dec 06: 6 month ARPU figure 19* Market sizing 22 m (2011) 16* • Introduction of aggressive CDMA competitor • ARPU dilution limited, low tariffs * * Investcom LLC 12 month disclosure • Dinar appreciation of 15% vs USD in 2006, positive contribution to margin High growth market, 800 k net adds for the year 30

MENA region Sudan Launched Market share [Sep 05] Population 36 m 25% Dec 2006 Dec 2005* Revenue ZAR 570 m (Jul-Dec) ZAR 887 m (12 mths)** ZAR 130 m(12 mths) EBITDA margin 17% (Jul-Dec) 19% (12 mths)** Capex/ Revenue **Unaudited 12 -month period 70% Penetration 12% Shareholding 85% • First full year of operation • Market share growth to 25% • Regulatory & logistical challenges -55% (12 mths)** 256% (12 mths) • Despite roll-out challenges – 36% of population covered – 3 G and GPRS launched Subscribers/ARPU – 662 BTS’s and 3 MSC’s Dec 06: 6 month ARPU figure 19* Market sizing 22 m (2011) 16* • Introduction of aggressive CDMA competitor • ARPU dilution limited, low tariffs * * Investcom LLC 12 month disclosure • Dinar appreciation of 15% vs USD in 2006, positive contribution to margin High growth market, 800 k net adds for the year 30

Financial overview Rob Nisbet Group Finance Director

Financial overview Rob Nisbet Group Finance Director

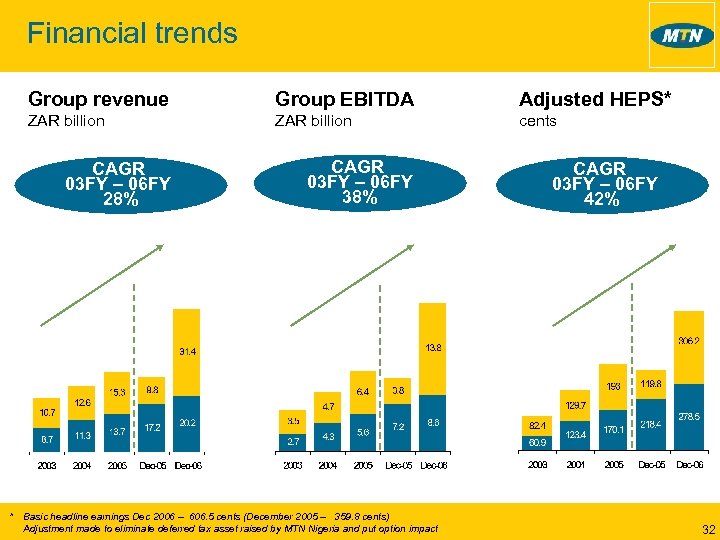

Financial trends Group revenue Group EBITDA Adjusted HEPS* ZAR billion cents CAGR 03 FY – 06 FY 28% * CAGR 03 FY – 06 FY 38% Basic headline earnings Dec 2006 – 606. 5 cents (December 2005 – 359. 8 cents) Adjustment made to eliminate deferred tax asset raised by MTN Nigeria and put option impact CAGR 03 FY – 06 FY 42% 32

Financial trends Group revenue Group EBITDA Adjusted HEPS* ZAR billion cents CAGR 03 FY – 06 FY 28% * CAGR 03 FY – 06 FY 38% Basic headline earnings Dec 2006 – 606. 5 cents (December 2005 – 359. 8 cents) Adjustment made to eliminate deferred tax asset raised by MTN Nigeria and put option impact CAGR 03 FY – 06 FY 42% 32

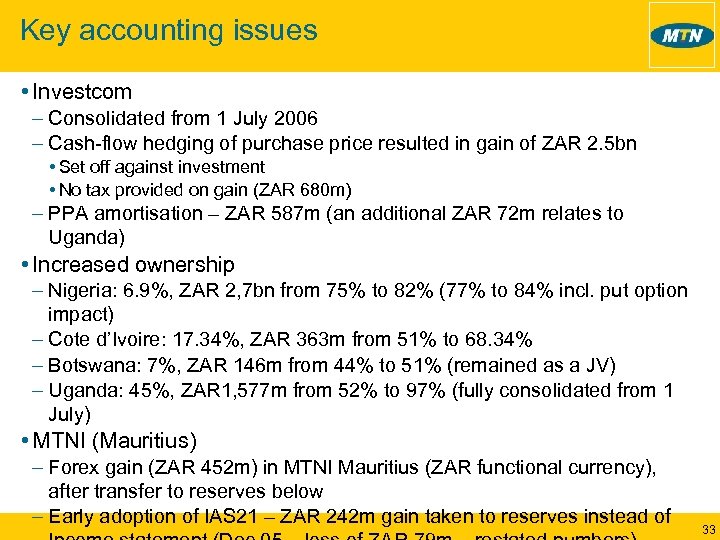

Key accounting issues • Investcom – Consolidated from 1 July 2006 – Cash-flow hedging of purchase price resulted in gain of ZAR 2. 5 bn • Set off against investment • No tax provided on gain (ZAR 680 m) – PPA amortisation – ZAR 587 m (an additional ZAR 72 m relates to Uganda) • Increased ownership – Nigeria: 6. 9%, ZAR 2, 7 bn from 75% to 82% (77% to 84% incl. put option impact) – Cote d’Ivoire: 17. 34%, ZAR 363 m from 51% to 68. 34% – Botswana: 7%, ZAR 146 m from 44% to 51% (remained as a JV) – Uganda: 45%, ZAR 1, 577 m from 52% to 97% (fully consolidated from 1 July) • MTNI (Mauritius) – Forex gain (ZAR 452 m) in MTNI Mauritius (ZAR functional currency), after transfer to reserves below – Early adoption of IAS 21 – ZAR 242 m gain taken to reserves instead of 33

Key accounting issues • Investcom – Consolidated from 1 July 2006 – Cash-flow hedging of purchase price resulted in gain of ZAR 2. 5 bn • Set off against investment • No tax provided on gain (ZAR 680 m) – PPA amortisation – ZAR 587 m (an additional ZAR 72 m relates to Uganda) • Increased ownership – Nigeria: 6. 9%, ZAR 2, 7 bn from 75% to 82% (77% to 84% incl. put option impact) – Cote d’Ivoire: 17. 34%, ZAR 363 m from 51% to 68. 34% – Botswana: 7%, ZAR 146 m from 44% to 51% (remained as a JV) – Uganda: 45%, ZAR 1, 577 m from 52% to 97% (fully consolidated from 1 July) • MTNI (Mauritius) – Forex gain (ZAR 452 m) in MTNI Mauritius (ZAR functional currency), after transfer to reserves below – Early adoption of IAS 21 – ZAR 242 m gain taken to reserves instead of 33

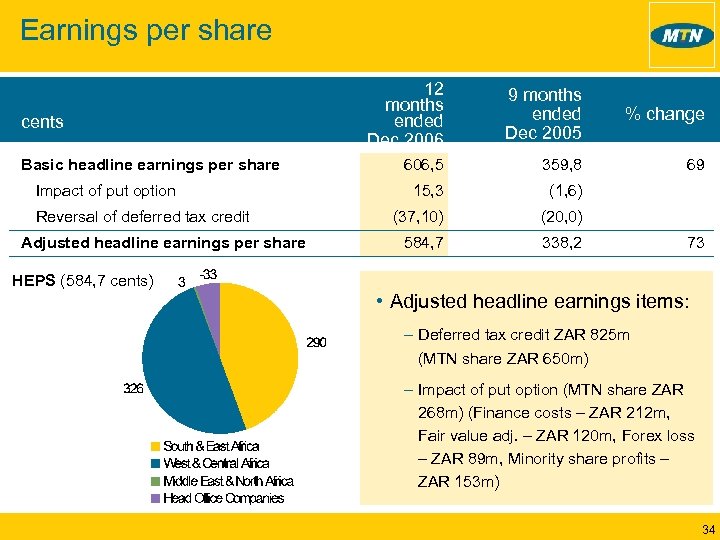

Earnings per share cents Basic headline earnings per share Impact of put option Reversal of deferred tax credit Adjusted headline earnings per share HEPS (584, 7 cents) 12 months ended Dec 2006 9 months ended Dec 2005 % change 606, 5 359, 8 69 15, 3 (1, 6) (37, 10) (20, 0) 584, 7 338, 2 73 • Adjusted headline earnings items: – Deferred tax credit ZAR 825 m (MTN share ZAR 650 m) – Impact of put option (MTN share ZAR 268 m) (Finance costs – ZAR 212 m, Fair value adj. – ZAR 120 m, Forex loss – ZAR 89 m, Minority share profits – ZAR 153 m) 34

Earnings per share cents Basic headline earnings per share Impact of put option Reversal of deferred tax credit Adjusted headline earnings per share HEPS (584, 7 cents) 12 months ended Dec 2006 9 months ended Dec 2005 % change 606, 5 359, 8 69 15, 3 (1, 6) (37, 10) (20, 0) 584, 7 338, 2 73 • Adjusted headline earnings items: – Deferred tax credit ZAR 825 m (MTN share ZAR 650 m) – Impact of put option (MTN share ZAR 268 m) (Finance costs – ZAR 212 m, Fair value adj. – ZAR 120 m, Forex loss – ZAR 89 m, Minority share profits – ZAR 153 m) 34

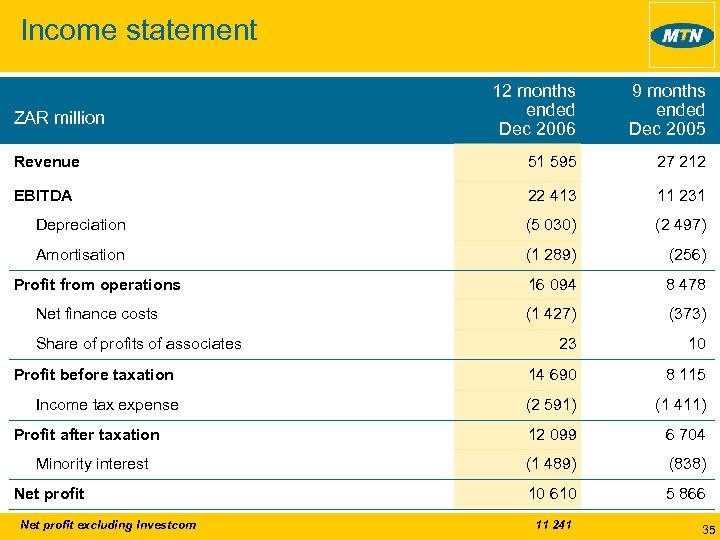

Income statement 12 months ended Dec 2006 9 months ended Dec 2005 Revenue 51 595 27 212 EBITDA 22 413 11 231 Depreciation (5 030) (2 497) Amortisation (1 289) (256) Profit from operations 16 094 8 478 Net finance costs (1 427) (373) 23 10 Profit before taxation 14 690 8 115 Income tax expense (2 591) (1 411) 12 099 6 704 (1 489) (838) 10 610 5 866 ZAR million Share of profits of associates Profit after taxation Minority interest Net profit excluding Investcom 11 241 35

Income statement 12 months ended Dec 2006 9 months ended Dec 2005 Revenue 51 595 27 212 EBITDA 22 413 11 231 Depreciation (5 030) (2 497) Amortisation (1 289) (256) Profit from operations 16 094 8 478 Net finance costs (1 427) (373) 23 10 Profit before taxation 14 690 8 115 Income tax expense (2 591) (1 411) 12 099 6 704 (1 489) (838) 10 610 5 866 ZAR million Share of profits of associates Profit after taxation Minority interest Net profit excluding Investcom 11 241 35

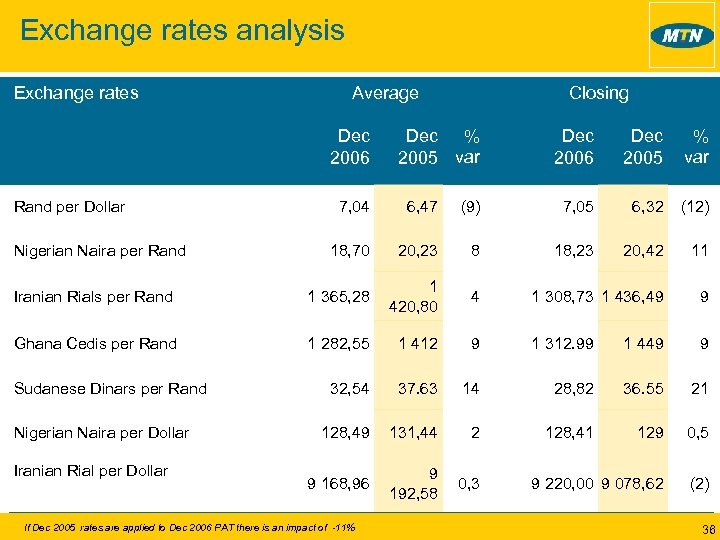

Exchange rates analysis Exchange rates Average Dec 2006 Rand per Dollar Closing Dec % 2005 var Dec 2006 Dec 2005 % var 7, 04 6, 47 (9) 7, 05 6, 32 (12) 18, 70 20, 23 8 18, 23 20, 42 11 Iranian Rials per Rand 1 365, 28 1 420, 80 4 1 308, 73 1 436, 49 9 Ghana Cedis per Rand 1 282, 55 1 412 9 1 312. 99 1 449 9 32, 54 37. 63 14 28, 82 36. 55 21 128, 49 131, 44 2 128, 41 129 0, 5 9 168, 96 9 192, 58 0, 3 9 220, 00 9 078, 62 (2) Nigerian Naira per Rand Sudanese Dinars per Rand Nigerian Naira per Dollar Iranian Rial per Dollar If Dec 2005 rates are applied to Dec 2006 PAT there is an impact of -11% 36

Exchange rates analysis Exchange rates Average Dec 2006 Rand per Dollar Closing Dec % 2005 var Dec 2006 Dec 2005 % var 7, 04 6, 47 (9) 7, 05 6, 32 (12) 18, 70 20, 23 8 18, 23 20, 42 11 Iranian Rials per Rand 1 365, 28 1 420, 80 4 1 308, 73 1 436, 49 9 Ghana Cedis per Rand 1 282, 55 1 412 9 1 312. 99 1 449 9 32, 54 37. 63 14 28, 82 36. 55 21 128, 49 131, 44 2 128, 41 129 0, 5 9 168, 96 9 192, 58 0, 3 9 220, 00 9 078, 62 (2) Nigerian Naira per Rand Sudanese Dinars per Rand Nigerian Naira per Dollar Iranian Rial per Dollar If Dec 2005 rates are applied to Dec 2006 PAT there is an impact of -11% 36

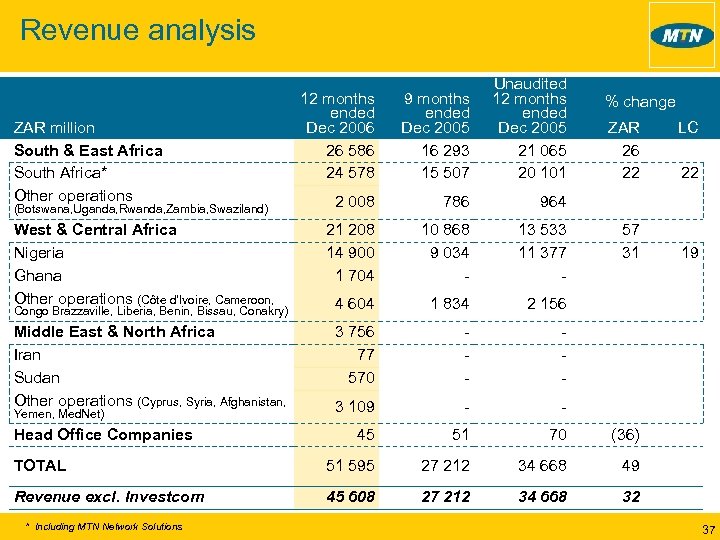

Revenue analysis 12 months ended Dec 2006 26 586 24 578 9 months ended Dec 2005 16 293 15 507 Unaudited 12 months ended Dec 2005 21 065 20 101 2 008 786 964 21 208 14 900 1 704 10 868 9 034 - 13 533 11 377 - 4 604 1 834 2 156 3 756 77 570 - - 3 109 - - 45 51 70 (36) TOTAL 51 595 27 212 34 668 49 Revenue excl. Investcom 45 608 27 212 34 668 32 ZAR million South & East Africa South Africa* Other operations (Botswana, Uganda, Rwanda, Zambia, Swaziland) West & Central Africa Nigeria Ghana Other operations (Côte d’Ivoire, Cameroon, Congo Brazzaville, Liberia, Benin, Bissau, Conakry) Middle East & North Africa Iran Sudan Other operations (Cyprus, Syria, Afghanistan, Yemen, Med. Net) Head Office Companies * Including MTN Network Solutions % change ZAR 26 22 57 31 LC 22 19 37

Revenue analysis 12 months ended Dec 2006 26 586 24 578 9 months ended Dec 2005 16 293 15 507 Unaudited 12 months ended Dec 2005 21 065 20 101 2 008 786 964 21 208 14 900 1 704 10 868 9 034 - 13 533 11 377 - 4 604 1 834 2 156 3 756 77 570 - - 3 109 - - 45 51 70 (36) TOTAL 51 595 27 212 34 668 49 Revenue excl. Investcom 45 608 27 212 34 668 32 ZAR million South & East Africa South Africa* Other operations (Botswana, Uganda, Rwanda, Zambia, Swaziland) West & Central Africa Nigeria Ghana Other operations (Côte d’Ivoire, Cameroon, Congo Brazzaville, Liberia, Benin, Bissau, Conakry) Middle East & North Africa Iran Sudan Other operations (Cyprus, Syria, Afghanistan, Yemen, Med. Net) Head Office Companies * Including MTN Network Solutions % change ZAR 26 22 57 31 LC 22 19 37

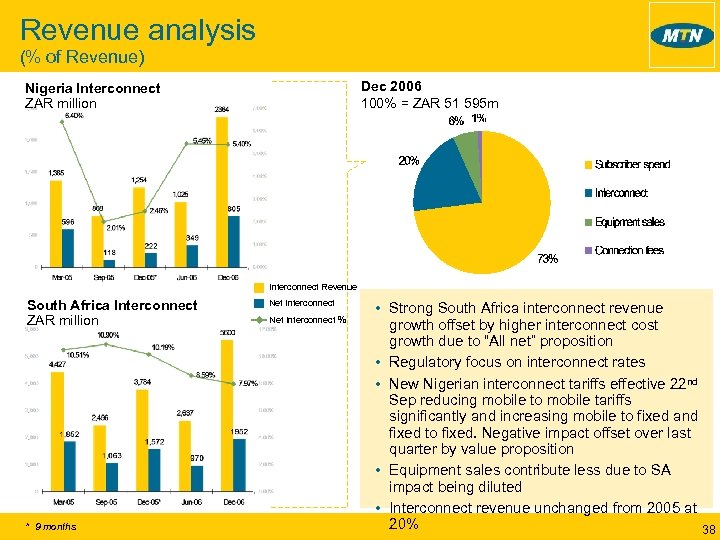

Revenue analysis (% of Revenue) Dec 2006 100% = ZAR 51 595 m Nigeria Interconnect ZAR million Interconnect Revenue South Africa Interconnect ZAR million * 9 months Net Interconnect % • Strong South Africa interconnect revenue growth offset by higher interconnect cost growth due to “All net” proposition • Regulatory focus on interconnect rates • New Nigerian interconnect tariffs effective 22 nd Sep reducing mobile to mobile tariffs significantly and increasing mobile to fixed and fixed to fixed. Negative impact offset over last quarter by value proposition • Equipment sales contribute less due to SA impact being diluted • Interconnect revenue unchanged from 2005 at 20% 38

Revenue analysis (% of Revenue) Dec 2006 100% = ZAR 51 595 m Nigeria Interconnect ZAR million Interconnect Revenue South Africa Interconnect ZAR million * 9 months Net Interconnect % • Strong South Africa interconnect revenue growth offset by higher interconnect cost growth due to “All net” proposition • Regulatory focus on interconnect rates • New Nigerian interconnect tariffs effective 22 nd Sep reducing mobile to mobile tariffs significantly and increasing mobile to fixed and fixed to fixed. Negative impact offset over last quarter by value proposition • Equipment sales contribute less due to SA impact being diluted • Interconnect revenue unchanged from 2005 at 20% 38

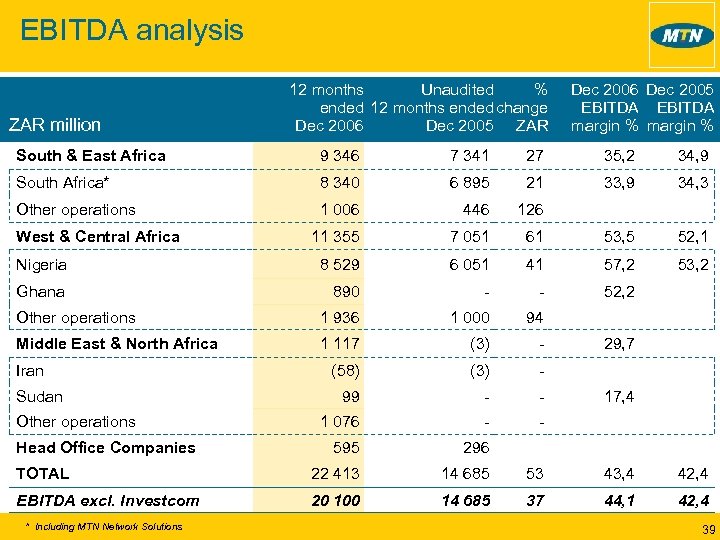

EBITDA analysis ZAR million 12 months Unaudited % ended 12 months ended change Dec 2006 Dec 2005 ZAR Dec 2006 Dec 2005 EBITDA margin % South & East Africa 9 346 7 341 27 35, 2 34, 9 South Africa* 8 340 6 895 21 33, 9 34, 3 Other operations 1 006 446 126 11 355 7 051 61 53, 5 52, 1 Nigeria 8 529 6 051 41 57, 2 53, 2 Ghana 890 - - 52, 2 Other operations 1 936 1 000 94 Middle East & North Africa 1 117 (3) - (58) (3) - 99 - - 1 076 - - 595 296 TOTAL 22 413 14 685 53 43, 4 42, 4 EBITDA excl. Investcom 20 100 14 685 37 44, 1 42, 4 West & Central Africa Iran Sudan Other operations Head Office Companies * Including MTN Network Solutions 29, 7 17, 4 39

EBITDA analysis ZAR million 12 months Unaudited % ended 12 months ended change Dec 2006 Dec 2005 ZAR Dec 2006 Dec 2005 EBITDA margin % South & East Africa 9 346 7 341 27 35, 2 34, 9 South Africa* 8 340 6 895 21 33, 9 34, 3 Other operations 1 006 446 126 11 355 7 051 61 53, 5 52, 1 Nigeria 8 529 6 051 41 57, 2 53, 2 Ghana 890 - - 52, 2 Other operations 1 936 1 000 94 Middle East & North Africa 1 117 (3) - (58) (3) - 99 - - 1 076 - - 595 296 TOTAL 22 413 14 685 53 43, 4 42, 4 EBITDA excl. Investcom 20 100 14 685 37 44, 1 42, 4 West & Central Africa Iran Sudan Other operations Head Office Companies * Including MTN Network Solutions 29, 7 17, 4 39

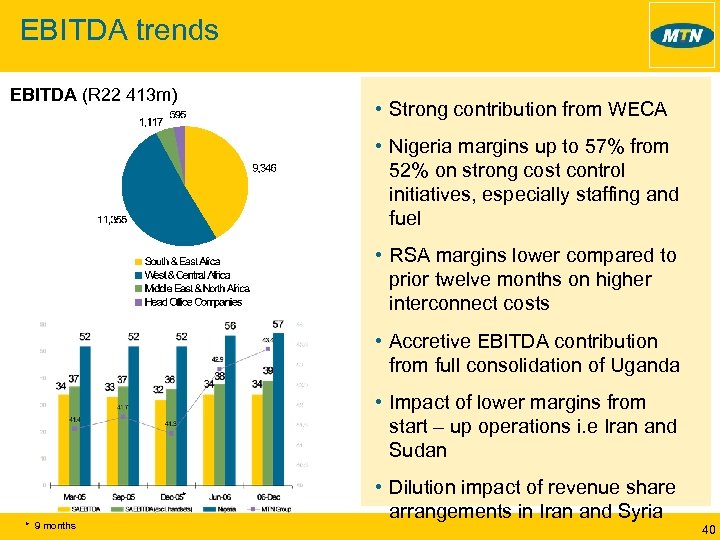

EBITDA trends EBITDA (R 22 413 m) • Strong contribution from WECA • Nigeria margins up to 57% from 52% on strong cost control initiatives, especially staffing and fuel • RSA margins lower compared to prior twelve months on higher interconnect costs • Accretive EBITDA contribution from full consolidation of Uganda • Impact of lower margins from start – up operations i. e Iran and Sudan * * 9 months • Dilution impact of revenue share arrangements in Iran and Syria 40

EBITDA trends EBITDA (R 22 413 m) • Strong contribution from WECA • Nigeria margins up to 57% from 52% on strong cost control initiatives, especially staffing and fuel • RSA margins lower compared to prior twelve months on higher interconnect costs • Accretive EBITDA contribution from full consolidation of Uganda • Impact of lower margins from start – up operations i. e Iran and Sudan * * 9 months • Dilution impact of revenue share arrangements in Iran and Syria 40

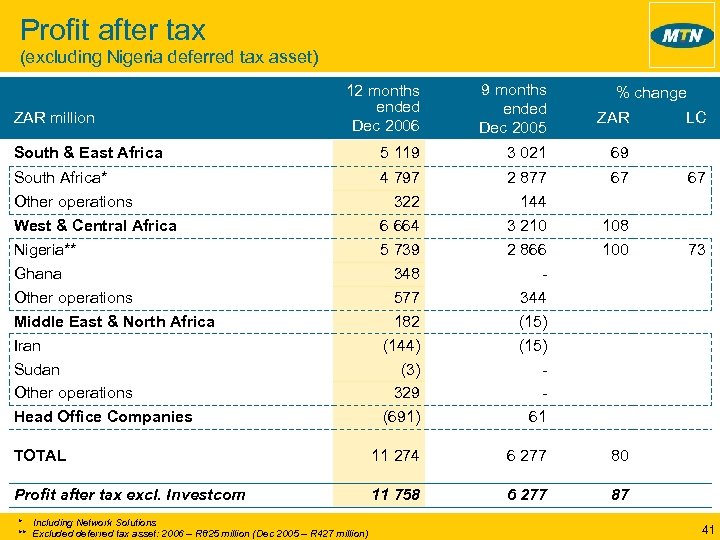

Profit after tax (excluding Nigeria deferred tax asset) 12 months ended Dec 2006 9 months ended Dec 2005 South & East Africa 5 119 3 021 69 South Africa* Other operations West & Central Africa 4 797 322 6 664 2 877 144 3 210 67 108 Nigeria** 5 739 2 866 100 Ghana Other operations Middle East & North Africa Iran Sudan Other operations Head Office Companies 348 577 182 (144) (3) 329 (691) 344 (15) 61 TOTAL 11 274 6 277 80 Profit after tax excl. Investcom 11 758 6 277 87 ZAR million * Including Network Solutions ** Excluded deferred tax asset: 2006 – R 825 million (Dec 2005 – R 427 million) % change ZAR LC 67 73 41

Profit after tax (excluding Nigeria deferred tax asset) 12 months ended Dec 2006 9 months ended Dec 2005 South & East Africa 5 119 3 021 69 South Africa* Other operations West & Central Africa 4 797 322 6 664 2 877 144 3 210 67 108 Nigeria** 5 739 2 866 100 Ghana Other operations Middle East & North Africa Iran Sudan Other operations Head Office Companies 348 577 182 (144) (3) 329 (691) 344 (15) 61 TOTAL 11 274 6 277 80 Profit after tax excl. Investcom 11 758 6 277 87 ZAR million * Including Network Solutions ** Excluded deferred tax asset: 2006 – R 825 million (Dec 2005 – R 427 million) % change ZAR LC 67 73 41

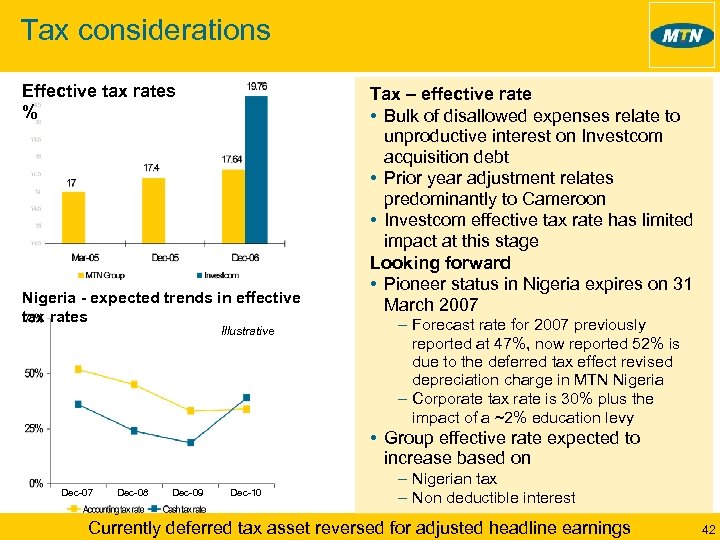

Tax considerations Effective tax rates % Nigeria - expected trends in effective tax rates Illustrative Tax – effective rate • Bulk of disallowed expenses relate to unproductive interest on Investcom acquisition debt • Prior year adjustment relates predominantly to Cameroon • Investcom effective tax rate has limited impact at this stage Looking forward • Pioneer status in Nigeria expires on 31 March 2007 – Forecast rate for 2007 previously reported at 47%, now reported 52% is due to the deferred tax effect revised depreciation charge in MTN Nigeria – Corporate tax rate is 30% plus the impact of a ~2% education levy • Group effective rate expected to increase based on Dec-07 Dec-08 Dec-09 Dec-10 – Nigerian tax – Non deductible interest Currently deferred tax asset reversed for adjusted headline earnings 42

Tax considerations Effective tax rates % Nigeria - expected trends in effective tax rates Illustrative Tax – effective rate • Bulk of disallowed expenses relate to unproductive interest on Investcom acquisition debt • Prior year adjustment relates predominantly to Cameroon • Investcom effective tax rate has limited impact at this stage Looking forward • Pioneer status in Nigeria expires on 31 March 2007 – Forecast rate for 2007 previously reported at 47%, now reported 52% is due to the deferred tax effect revised depreciation charge in MTN Nigeria – Corporate tax rate is 30% plus the impact of a ~2% education levy • Group effective rate expected to increase based on Dec-07 Dec-08 Dec-09 Dec-10 – Nigerian tax – Non deductible interest Currently deferred tax asset reversed for adjusted headline earnings 42

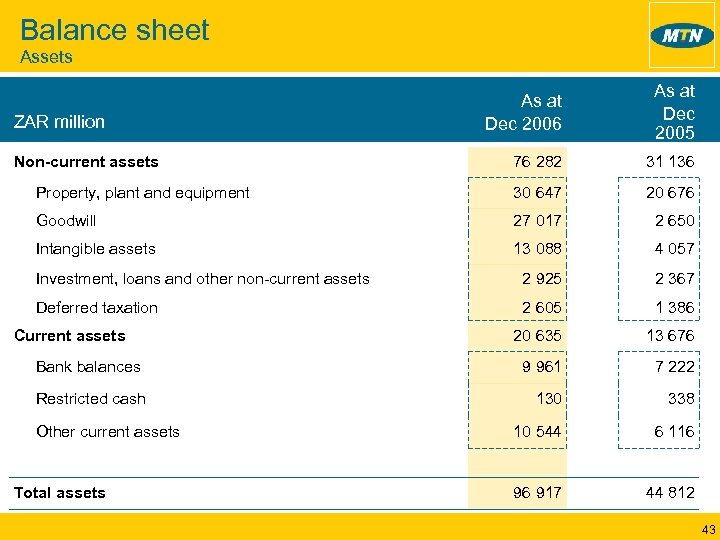

Balance sheet Assets As at Dec 2006 As at Dec 2005 76 282 31 136 Property, plant and equipment 30 647 20 676 Goodwill 27 017 2 650 Intangible assets 13 088 4 057 Investment, loans and other non-current assets 2 925 2 367 Deferred taxation 2 605 1 386 20 635 13 676 9 961 7 222 130 338 10 544 6 116 96 917 44 812 ZAR million Non-current assets Current assets Bank balances Restricted cash Other current assets Total assets 43

Balance sheet Assets As at Dec 2006 As at Dec 2005 76 282 31 136 Property, plant and equipment 30 647 20 676 Goodwill 27 017 2 650 Intangible assets 13 088 4 057 Investment, loans and other non-current assets 2 925 2 367 Deferred taxation 2 605 1 386 20 635 13 676 9 961 7 222 130 338 10 544 6 116 96 917 44 812 ZAR million Non-current assets Current assets Bank balances Restricted cash Other current assets Total assets 43

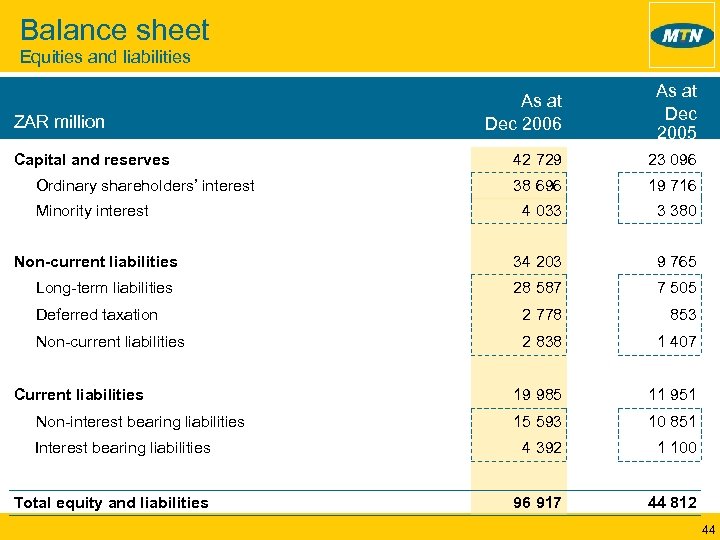

Balance sheet Equities and liabilities As at Dec 2006 As at Dec 2005 42 729 23 096 38 696 19 716 Minority interest 4 033 3 380 Non-current liabilities 34 203 9 765 Long-term liabilities 28 587 7 505 Deferred taxation 2 778 853 Non-current liabilities 2 838 1 407 19 985 11 951 15 593 10 851 Interest bearing liabilities 4 392 1 100 Total equity and liabilities 96 917 44 812 ZAR million Capital and reserves Ordinary shareholders’ interest Current liabilities Non-interest bearing liabilities 44

Balance sheet Equities and liabilities As at Dec 2006 As at Dec 2005 42 729 23 096 38 696 19 716 Minority interest 4 033 3 380 Non-current liabilities 34 203 9 765 Long-term liabilities 28 587 7 505 Deferred taxation 2 778 853 Non-current liabilities 2 838 1 407 19 985 11 951 15 593 10 851 Interest bearing liabilities 4 392 1 100 Total equity and liabilities 96 917 44 812 ZAR million Capital and reserves Ordinary shareholders’ interest Current liabilities Non-interest bearing liabilities 44

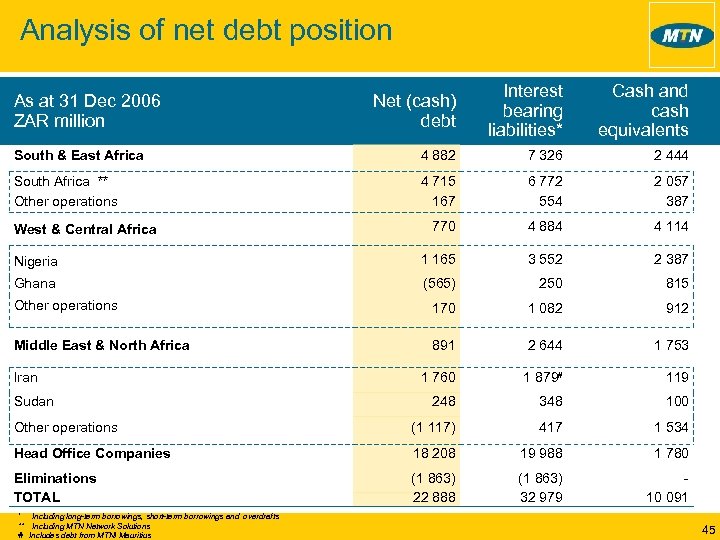

Analysis of net debt position Net (cash) debt Interest bearing liabilities* Cash and cash equivalents South & East Africa 4 882 7 326 2 444 South Africa ** Other operations 4 715 167 6 772 554 2 057 387 770 4 884 4 114 Nigeria 1 165 3 552 2 387 Ghana (565) 250 815 Other operations 170 1 082 912 Middle East & North Africa 891 2 644 1 753 1 760 1 879# 119 248 348 100 Other operations (1 117) 417 1 534 Head Office Companies 18 208 19 988 1 780 Eliminations TOTAL (1 863) 22 888 (1 863) 32 979 10 091 As at 31 Dec 2006 ZAR million West & Central Africa Iran Sudan * Including long-term borrowings, short-term borrowings and overdrafts ** Including MTN Network Solutions # Includes debt from MTNI Mauritius 45

Analysis of net debt position Net (cash) debt Interest bearing liabilities* Cash and cash equivalents South & East Africa 4 882 7 326 2 444 South Africa ** Other operations 4 715 167 6 772 554 2 057 387 770 4 884 4 114 Nigeria 1 165 3 552 2 387 Ghana (565) 250 815 Other operations 170 1 082 912 Middle East & North Africa 891 2 644 1 753 1 760 1 879# 119 248 348 100 Other operations (1 117) 417 1 534 Head Office Companies 18 208 19 988 1 780 Eliminations TOTAL (1 863) 22 888 (1 863) 32 979 10 091 As at 31 Dec 2006 ZAR million West & Central Africa Iran Sudan * Including long-term borrowings, short-term borrowings and overdrafts ** Including MTN Network Solutions # Includes debt from MTNI Mauritius 45

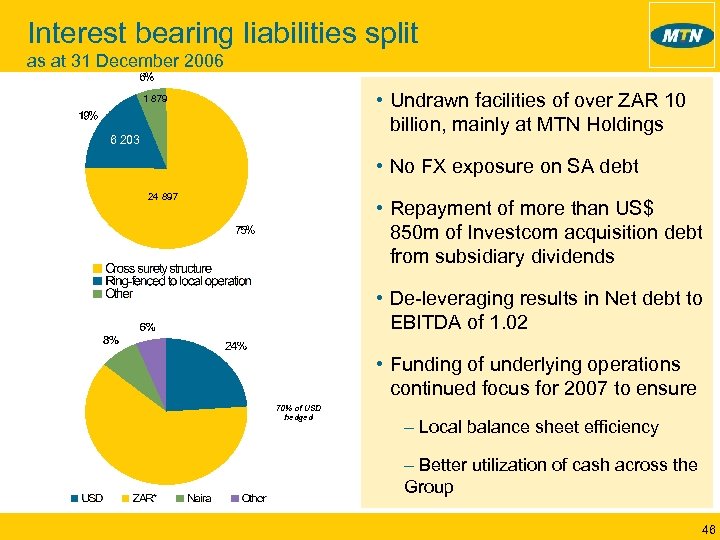

Interest bearing liabilities split as at 31 December 2006 • Undrawn facilities of over ZAR 10 billion, mainly at MTN Holdings 1 879 6 203 • No FX exposure on SA debt 24 897 • Repayment of more than US$ 850 m of Investcom acquisition debt from subsidiary dividends • De-leveraging results in Net debt to EBITDA of 1. 02 • Funding of underlying operations continued focus for 2007 to ensure 70% of USD hedged – Local balance sheet efficiency – Better utilization of cash across the Group 46

Interest bearing liabilities split as at 31 December 2006 • Undrawn facilities of over ZAR 10 billion, mainly at MTN Holdings 1 879 6 203 • No FX exposure on SA debt 24 897 • Repayment of more than US$ 850 m of Investcom acquisition debt from subsidiary dividends • De-leveraging results in Net debt to EBITDA of 1. 02 • Funding of underlying operations continued focus for 2007 to ensure 70% of USD hedged – Local balance sheet efficiency – Better utilization of cash across the Group 46

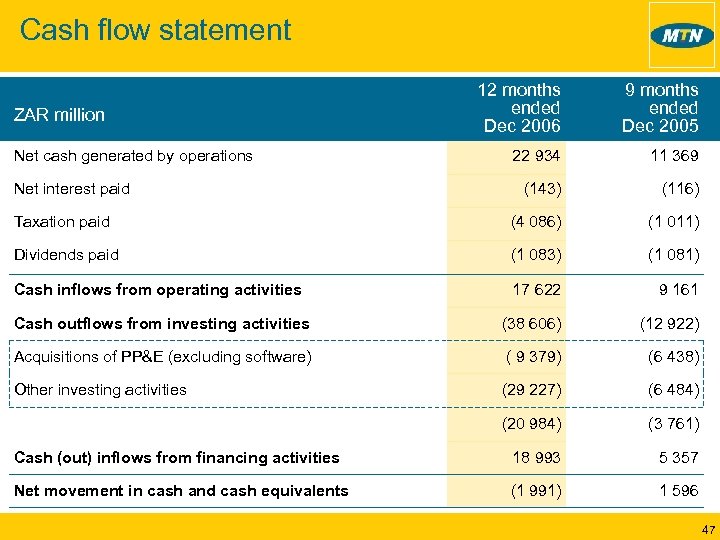

Cash flow statement 12 months ended Dec 2006 9 months ended Dec 2005 22 934 11 369 (143) (116) Taxation paid (4 086) (1 011) Dividends paid (1 083) (1 081) Cash inflows from operating activities 17 622 9 161 Cash outflows from investing activities (38 606) (12 922) Acquisitions of PP&E (excluding software) ( 9 379) (6 438) Other investing activities (29 227) (6 484) (20 984) (3 761) Cash (out) inflows from financing activities 18 993 5 357 Net movement in cash and cash equivalents (1 991) 1 596 ZAR million Net cash generated by operations Net interest paid 47

Cash flow statement 12 months ended Dec 2006 9 months ended Dec 2005 22 934 11 369 (143) (116) Taxation paid (4 086) (1 011) Dividends paid (1 083) (1 081) Cash inflows from operating activities 17 622 9 161 Cash outflows from investing activities (38 606) (12 922) Acquisitions of PP&E (excluding software) ( 9 379) (6 438) Other investing activities (29 227) (6 484) (20 984) (3 761) Cash (out) inflows from financing activities 18 993 5 357 Net movement in cash and cash equivalents (1 991) 1 596 ZAR million Net cash generated by operations Net interest paid 47

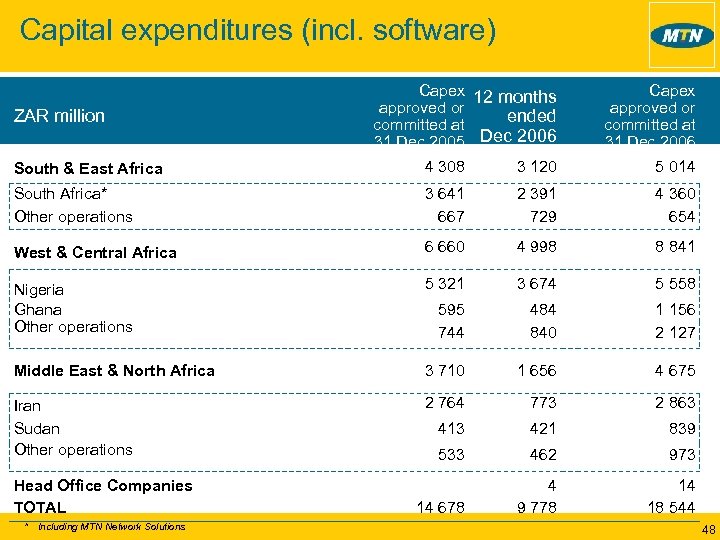

Capital expenditures (incl. software) ZAR million Capex 12 months approved or ended committed at 31 Dec 2005 Dec 2006 Capex approved or committed at 31 Dec 2006 South & East Africa 4 308 3 120 5 014 South Africa* Other operations 3 641 667 2 391 729 4 360 654 West & Central Africa 6 660 4 998 8 841 Nigeria Ghana Other operations 5 321 3 674 5 558 595 744 484 840 1 156 2 127 Middle East & North Africa 3 710 1 656 4 675 Iran Sudan Other operations 2 764 773 2 863 413 421 839 533 462 973 14 678 4 9 778 14 18 544 Head Office Companies TOTAL * Including MTN Network Solutions 48

Capital expenditures (incl. software) ZAR million Capex 12 months approved or ended committed at 31 Dec 2005 Dec 2006 Capex approved or committed at 31 Dec 2006 South & East Africa 4 308 3 120 5 014 South Africa* Other operations 3 641 667 2 391 729 4 360 654 West & Central Africa 6 660 4 998 8 841 Nigeria Ghana Other operations 5 321 3 674 5 558 595 744 484 840 1 156 2 127 Middle East & North Africa 3 710 1 656 4 675 Iran Sudan Other operations 2 764 773 2 863 413 421 839 533 462 973 14 678 4 9 778 14 18 544 Head Office Companies TOTAL * Including MTN Network Solutions 48

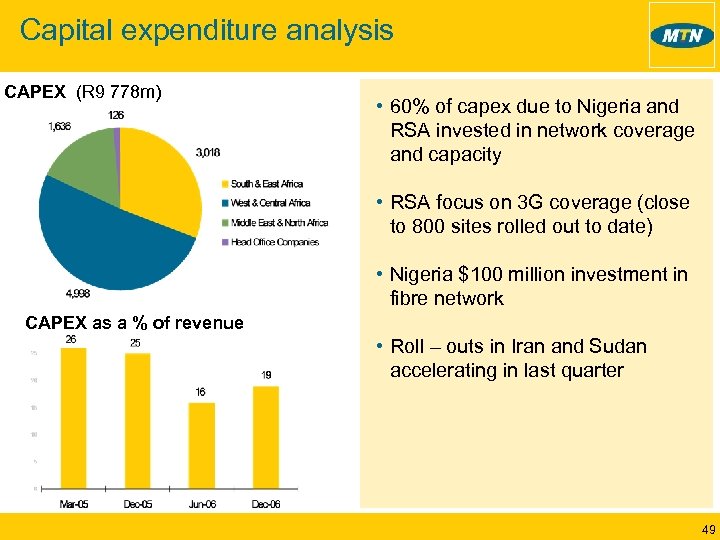

Capital expenditure analysis CAPEX (R 9 778 m) • 60% of capex due to Nigeria and RSA invested in network coverage and capacity • RSA focus on 3 G coverage (close to 800 sites rolled out to date) • Nigeria $100 million investment in fibre network CAPEX as a % of revenue • Roll – outs in Iran and Sudan accelerating in last quarter 49

Capital expenditure analysis CAPEX (R 9 778 m) • 60% of capex due to Nigeria and RSA invested in network coverage and capacity • RSA focus on 3 G coverage (close to 800 sites rolled out to date) • Nigeria $100 million investment in fibre network CAPEX as a % of revenue • Roll – outs in Iran and Sudan accelerating in last quarter 49

Looking forward. . Phuthuma Nhleko

Looking forward. . Phuthuma Nhleko

Looking forward… • Drive regional synergies • Take advantage of opportunities within the value chain – Payment solutions to enable transfer of funds in under-serviced markets; – Data opportunities • Improve operational efficiency through our least-cost operator strategy • Aggressive roll-out and subscriber acquisition strategy for Iran • Pursue appropriate expansion opportunities to diversify earnings and consolidate position in emerging markets; 51

Looking forward… • Drive regional synergies • Take advantage of opportunities within the value chain – Payment solutions to enable transfer of funds in under-serviced markets; – Data opportunities • Improve operational efficiency through our least-cost operator strategy • Aggressive roll-out and subscriber acquisition strategy for Iran • Pursue appropriate expansion opportunities to diversify earnings and consolidate position in emerging markets; 51

Thank you Questions? 52

Thank you Questions? 52

Notice The information contained in this document has not been verified independently. No representation or warranty express or implied is made as to and no reliance should be placed on the fairness, accuracy, completeness or correctness of the information or opinions contained herein. Opinions and forward looking statements expressed represent those of the Company at the time. Undue reliance should not be placed on such statements and opinions because by nature, they are subjective to known and unknown risk and uncertainties and can be affected by other factors that could cause actual results and Company plans and objectives to differ materially from those expressed or implied in the forward looking statements. Neither the Company nor any of its respective affiliates, advisors or representatives shall have any liability whatsoever (based on negligence or otherwise) for any loss howsoever arising from any use of this presentation or its contents or otherwise arising in connection with this presentation and do not undertake to publicly update or revise any of its opinions or forward looking statements whether to reflect new information or future events or circumstances otherwise. This presentation does not constitute an offer or invitation to purchase or subscribe for any securities and no part of it shall form the basis of or be relied upon in connection with any contract or commitment whatsoever. 53

Notice The information contained in this document has not been verified independently. No representation or warranty express or implied is made as to and no reliance should be placed on the fairness, accuracy, completeness or correctness of the information or opinions contained herein. Opinions and forward looking statements expressed represent those of the Company at the time. Undue reliance should not be placed on such statements and opinions because by nature, they are subjective to known and unknown risk and uncertainties and can be affected by other factors that could cause actual results and Company plans and objectives to differ materially from those expressed or implied in the forward looking statements. Neither the Company nor any of its respective affiliates, advisors or representatives shall have any liability whatsoever (based on negligence or otherwise) for any loss howsoever arising from any use of this presentation or its contents or otherwise arising in connection with this presentation and do not undertake to publicly update or revise any of its opinions or forward looking statements whether to reflect new information or future events or circumstances otherwise. This presentation does not constitute an offer or invitation to purchase or subscribe for any securities and no part of it shall form the basis of or be relied upon in connection with any contract or commitment whatsoever. 53

Annexure I

Annexure I

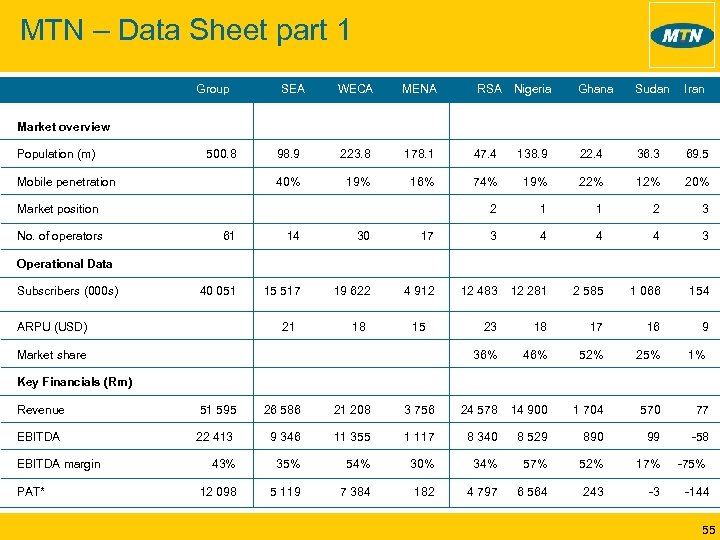

MTN – Data Sheet part 1 Group SEA WECA MENA RSA Nigeria Ghana Sudan Iran 98. 9 223. 8 178. 1 47. 4 138. 9 22. 4 36. 3 69. 5 40% 19% 16% 74% 19% 22% 12% 20% 2 1 1 2 3 Market overview Population (m) 500. 8 Mobile penetration Market position No. of operators 61 14 30 17 3 4 4 4 3 40 051 15 517 19 622 4 912 12 483 12 281 2 585 1 066 154 23 18 17 16 9 36% 46% 52% 25% 1% Operational Data Subscribers (000 s) ARPU (USD) 21 18 15 Market share Key Financials (Rm) Revenue 51 595 26 586 21 208 3 756 24 578 14 900 1 704 570 77 EBITDA 22 413 9 346 11 355 1 117 8 340 8 529 890 99 -58 43% 35% 54% 30% 34% 57% 52% 17% -75% 12 098 5 119 7 384 182 4 797 6 564 243 -3 -144 EBITDA margin PAT* 55

MTN – Data Sheet part 1 Group SEA WECA MENA RSA Nigeria Ghana Sudan Iran 98. 9 223. 8 178. 1 47. 4 138. 9 22. 4 36. 3 69. 5 40% 19% 16% 74% 19% 22% 12% 20% 2 1 1 2 3 Market overview Population (m) 500. 8 Mobile penetration Market position No. of operators 61 14 30 17 3 4 4 4 3 40 051 15 517 19 622 4 912 12 483 12 281 2 585 1 066 154 23 18 17 16 9 36% 46% 52% 25% 1% Operational Data Subscribers (000 s) ARPU (USD) 21 18 15 Market share Key Financials (Rm) Revenue 51 595 26 586 21 208 3 756 24 578 14 900 1 704 570 77 EBITDA 22 413 9 346 11 355 1 117 8 340 8 529 890 99 -58 43% 35% 54% 30% 34% 57% 52% 17% -75% 12 098 5 119 7 384 182 4 797 6 564 243 -3 -144 EBITDA margin PAT* 55

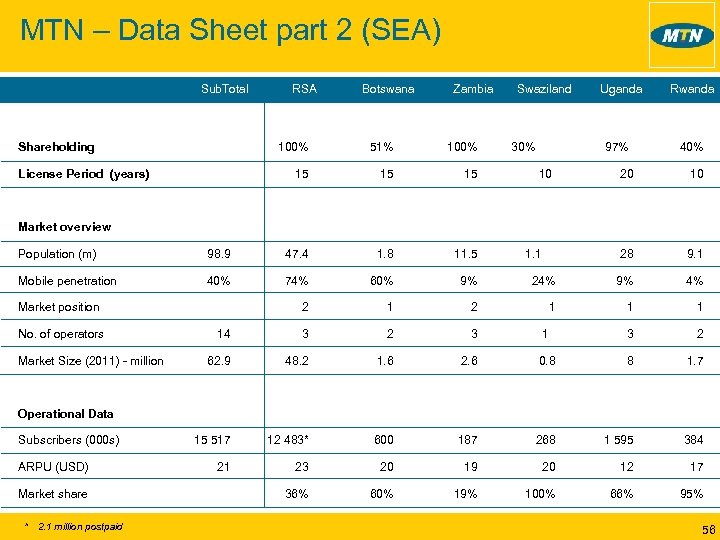

MTN – Data Sheet part 2 (SEA) Sub. Total Shareholding RSA Botswana Zambia 100% 15 License Period (years) 51% 15 15 Swaziland 30% Uganda 97% 10 Rwanda 40% 20 10 28 9. 1 Market overview Population (m) 98. 9 47. 4 1. 8 11. 5 Mobile penetration 40% 74% 60% 9% 24% 9% 4% 2 1 1 1 14 3 2 3 1 3 2 62. 9 48. 2 1. 6 2. 6 0. 8 8 1. 7 15 517 12 483* 600 187 268 1 595 384 21 23 20 19 20 12 17 36% 60% 19% 100% 66% 95% Market position No. of operators Market Size (2011) - million 1. 1 Operational Data Subscribers (000 s) ARPU (USD) Market share * 2. 1 million postpaid 56

MTN – Data Sheet part 2 (SEA) Sub. Total Shareholding RSA Botswana Zambia 100% 15 License Period (years) 51% 15 15 Swaziland 30% Uganda 97% 10 Rwanda 40% 20 10 28 9. 1 Market overview Population (m) 98. 9 47. 4 1. 8 11. 5 Mobile penetration 40% 74% 60% 9% 24% 9% 4% 2 1 1 1 14 3 2 3 1 3 2 62. 9 48. 2 1. 6 2. 6 0. 8 8 1. 7 15 517 12 483* 600 187 268 1 595 384 21 23 20 19 20 12 17 36% 60% 19% 100% 66% 95% Market position No. of operators Market Size (2011) - million 1. 1 Operational Data Subscribers (000 s) ARPU (USD) Market share * 2. 1 million postpaid 56

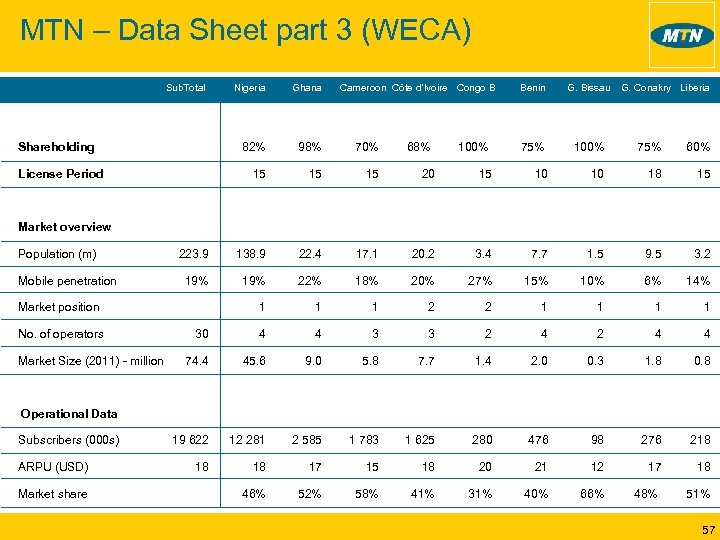

MTN – Data Sheet part 3 (WECA) Sub. Total Nigeria Ghana Benin G. Bissau 82% 98% 70% 100% 75% 60% 15 15 15 20 15 10 10 18 15 223. 9 138. 9 22. 4 17. 1 20. 2 3. 4 7. 7 1. 5 9. 5 3. 2 19% 22% 18% 20% 27% 15% 10% 6% 14% 1 1 1 2 2 1 1 30 4 4 3 3 2 4 4 74. 4 45. 6 9. 0 5. 8 7. 7 1. 4 2. 0 0. 3 1. 8 0. 8 19 622 12 281 2 585 1 783 1 625 280 476 98 276 218 18 18 17 15 18 20 21 12 17 18 46% 52% 58% 41% 31% 40% 66% 48% 51% Shareholding License Period Cameroon Côte d’Ivoire Congo B 68% G. Conakry Liberia Market overview Population (m) Mobile penetration Market position No. of operators Market Size (2011) - million Operational Data Subscribers (000 s) ARPU (USD) Market share 57

MTN – Data Sheet part 3 (WECA) Sub. Total Nigeria Ghana Benin G. Bissau 82% 98% 70% 100% 75% 60% 15 15 15 20 15 10 10 18 15 223. 9 138. 9 22. 4 17. 1 20. 2 3. 4 7. 7 1. 5 9. 5 3. 2 19% 22% 18% 20% 27% 15% 10% 6% 14% 1 1 1 2 2 1 1 30 4 4 3 3 2 4 4 74. 4 45. 6 9. 0 5. 8 7. 7 1. 4 2. 0 0. 3 1. 8 0. 8 19 622 12 281 2 585 1 783 1 625 280 476 98 276 218 18 18 17 15 18 20 21 12 17 18 46% 52% 58% 41% 31% 40% 66% 48% 51% Shareholding License Period Cameroon Côte d’Ivoire Congo B 68% G. Conakry Liberia Market overview Population (m) Mobile penetration Market position No. of operators Market Size (2011) - million Operational Data Subscribers (000 s) ARPU (USD) Market share 57

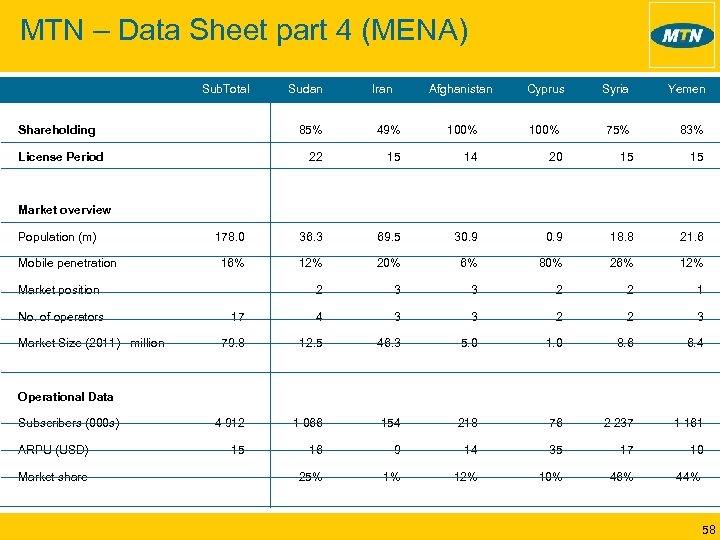

MTN – Data Sheet part 4 (MENA) Sub. Total Shareholding Sudan Iran Afghanistan Cyprus Syria Yemen 85% 49% 100% 75% 83% 22 15 14 20 15 15 178. 0 36. 3 69. 5 30. 9 18. 8 21. 6 16% 12% 20% 6% 80% 26% 12% 2 3 3 2 2 1 17 4 3 3 2 2 3 79. 8 12. 5 46. 3 5. 0 1. 0 8. 6 6. 4 4 912 1 066 154 218 76 2 237 1 161 15 16 9 14 35 17 10 25% 1% 12% 10% 46% 44% License Period Market overview Population (m) Mobile penetration Market position No. of operators Market Size (2011) - million Operational Data Subscribers (000 s) ARPU (USD) Market share 58

MTN – Data Sheet part 4 (MENA) Sub. Total Shareholding Sudan Iran Afghanistan Cyprus Syria Yemen 85% 49% 100% 75% 83% 22 15 14 20 15 15 178. 0 36. 3 69. 5 30. 9 18. 8 21. 6 16% 12% 20% 6% 80% 26% 12% 2 3 3 2 2 1 17 4 3 3 2 2 3 79. 8 12. 5 46. 3 5. 0 1. 0 8. 6 6. 4 4 912 1 066 154 218 76 2 237 1 161 15 16 9 14 35 17 10 25% 1% 12% 10% 46% 44% License Period Market overview Population (m) Mobile penetration Market position No. of operators Market Size (2011) - million Operational Data Subscribers (000 s) ARPU (USD) Market share 58

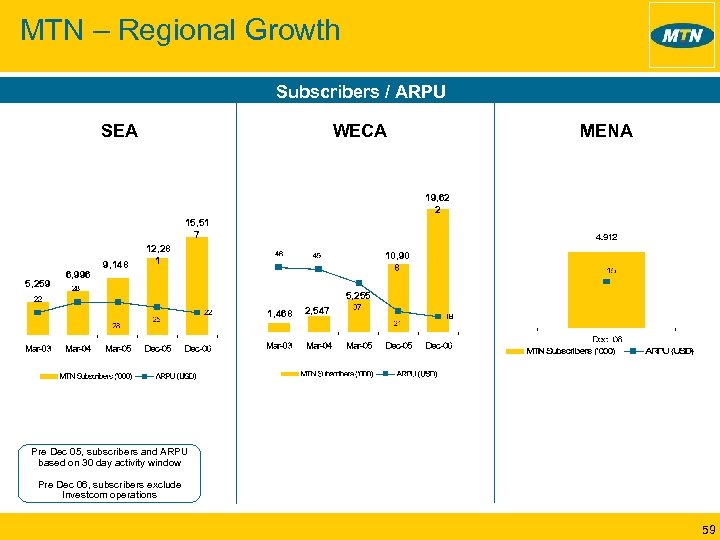

MTN – Regional Growth Subscribers / ARPU SEA WECA MENA 19, 62 2 15, 51 7 5, 259 6, 996 9, 148 12, 28 1 10, 90 8 5, 255 1, 468 2, 547 Pre Dec 05, subscribers and ARPU based on 30 day activity window Pre Dec 06, subscribers exclude Investcom operations 59

MTN – Regional Growth Subscribers / ARPU SEA WECA MENA 19, 62 2 15, 51 7 5, 259 6, 996 9, 148 12, 28 1 10, 90 8 5, 255 1, 468 2, 547 Pre Dec 05, subscribers and ARPU based on 30 day activity window Pre Dec 06, subscribers exclude Investcom operations 59

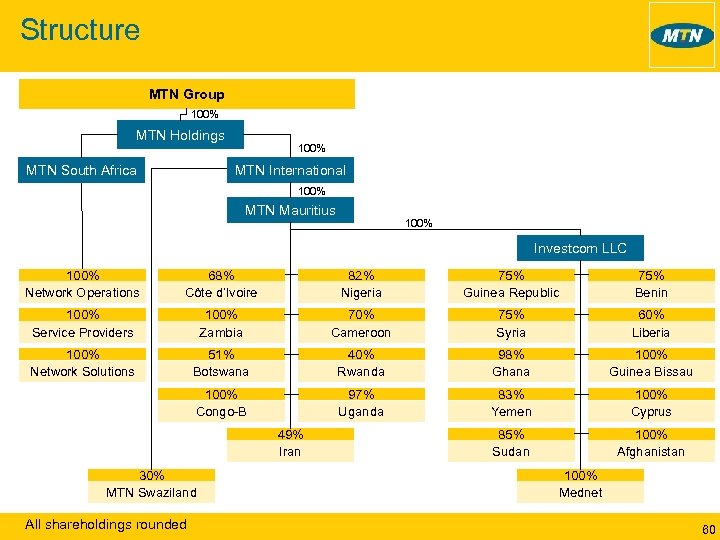

Structure MTN Group 100% MTN Holdings MTN South Africa 100% MTN International 100% MTN Mauritius 100% Investcom LLC 100% Network Operations 68% Côte d’Ivoire 82% Nigeria 75% Guinea Republic 75% Benin 100% Service Providers 100% Zambia 70% Cameroon 75% Syria 60% Liberia 100% Network Solutions 51% Botswana 40% Rwanda 98% Ghana 100% Guinea Bissau 100% Congo-B 97% Uganda 83% Yemen 100% Cyprus 85% Sudan 100% Afghanistan 49% Iran 30% MTN Swaziland All shareholdings rounded 100% Mednet 60

Structure MTN Group 100% MTN Holdings MTN South Africa 100% MTN International 100% MTN Mauritius 100% Investcom LLC 100% Network Operations 68% Côte d’Ivoire 82% Nigeria 75% Guinea Republic 75% Benin 100% Service Providers 100% Zambia 70% Cameroon 75% Syria 60% Liberia 100% Network Solutions 51% Botswana 40% Rwanda 98% Ghana 100% Guinea Bissau 100% Congo-B 97% Uganda 83% Yemen 100% Cyprus 85% Sudan 100% Afghanistan 49% Iran 30% MTN Swaziland All shareholdings rounded 100% Mednet 60

Annexure II

Annexure II

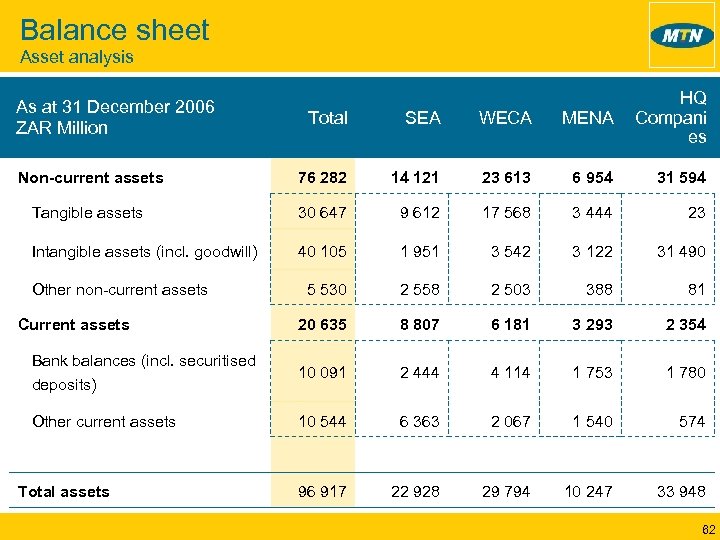

Balance sheet Asset analysis Total SEA WECA MENA HQ Compani es Non-current assets 76 282 14 121 23 613 6 954 31 594 Tangible assets 30 647 9 612 17 568 3 444 23 Intangible assets (incl. goodwill) 40 105 1 951 3 542 3 122 31 490 5 530 2 558 2 503 388 81 20 635 8 807 6 181 3 293 2 354 Bank balances (incl. securitised deposits) 10 091 2 444 4 114 1 753 1 780 Other current assets 10 544 6 363 2 067 1 540 574 96 917 22 928 29 794 10 247 33 948 As at 31 December 2006 ZAR Million Other non-current assets Current assets Total assets 62

Balance sheet Asset analysis Total SEA WECA MENA HQ Compani es Non-current assets 76 282 14 121 23 613 6 954 31 594 Tangible assets 30 647 9 612 17 568 3 444 23 Intangible assets (incl. goodwill) 40 105 1 951 3 542 3 122 31 490 5 530 2 558 2 503 388 81 20 635 8 807 6 181 3 293 2 354 Bank balances (incl. securitised deposits) 10 091 2 444 4 114 1 753 1 780 Other current assets 10 544 6 363 2 067 1 540 574 96 917 22 928 29 794 10 247 33 948 As at 31 December 2006 ZAR Million Other non-current assets Current assets Total assets 62

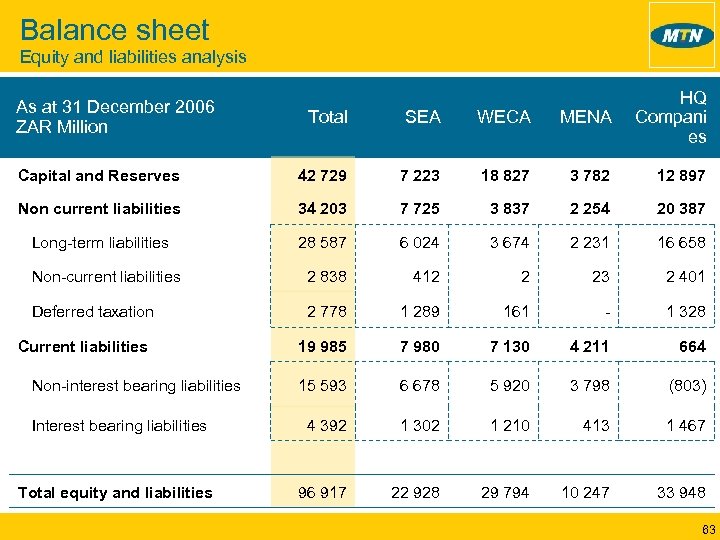

Balance sheet Equity and liabilities analysis Total SEA WECA MENA HQ Compani es Capital and Reserves 42 729 7 223 18 827 3 782 12 897 Non current liabilities 34 203 7 725 3 837 2 254 20 387 Long-term liabilities 28 587 6 024 3 674 2 231 16 658 Non-current liabilities 2 838 412 2 23 2 401 Deferred taxation 2 778 1 289 161 - 1 328 19 985 7 980 7 130 4 211 664 15 593 6 678 5 920 3 798 (803) Interest bearing liabilities 4 392 1 302 1 210 413 1 467 Total equity and liabilities 96 917 22 928 29 794 10 247 33 948 As at 31 December 2006 ZAR Million Current liabilities Non-interest bearing liabilities 63

Balance sheet Equity and liabilities analysis Total SEA WECA MENA HQ Compani es Capital and Reserves 42 729 7 223 18 827 3 782 12 897 Non current liabilities 34 203 7 725 3 837 2 254 20 387 Long-term liabilities 28 587 6 024 3 674 2 231 16 658 Non-current liabilities 2 838 412 2 23 2 401 Deferred taxation 2 778 1 289 161 - 1 328 19 985 7 980 7 130 4 211 664 15 593 6 678 5 920 3 798 (803) Interest bearing liabilities 4 392 1 302 1 210 413 1 467 Total equity and liabilities 96 917 22 928 29 794 10 247 33 948 As at 31 December 2006 ZAR Million Current liabilities Non-interest bearing liabilities 63

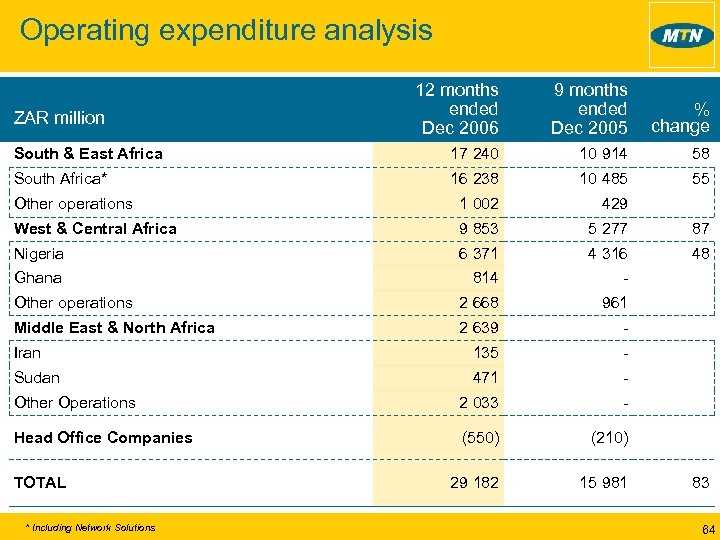

Operating expenditure analysis 12 months ended Dec 2006 9 months ended Dec 2005 % change South & East Africa 17 240 10 914 58 South Africa* 16 238 10 485 55 Other operations 1 002 429 West & Central Africa 9 853 5 277 87 Nigeria 6 371 4 316 48 Ghana 814 - Other operations 2 668 961 Middle East & North Africa 2 639 - Iran 135 - Sudan 471 - Other Operations 2 033 - Head Office Companies (550) (210) 29 182 15 981 ZAR million TOTAL * Including Network Solutions 83 64

Operating expenditure analysis 12 months ended Dec 2006 9 months ended Dec 2005 % change South & East Africa 17 240 10 914 58 South Africa* 16 238 10 485 55 Other operations 1 002 429 West & Central Africa 9 853 5 277 87 Nigeria 6 371 4 316 48 Ghana 814 - Other operations 2 668 961 Middle East & North Africa 2 639 - Iran 135 - Sudan 471 - Other Operations 2 033 - Head Office Companies (550) (210) 29 182 15 981 ZAR million TOTAL * Including Network Solutions 83 64

EBITDA analysis 9 months ended Dec 2005 RAZ ZAR million 12 months ended Dec 2006 % 5 367 change 74 5 009 67 South & East Africa 9 346 South Africa* 8 340 Other operations 1 006 358 181 11 355 5 599 Nigeria Ghana Other operations 8 529 890 1 936 Middle East & North Africa Dec 2006 Dec 2005 EBITDA margin % 35, 2 32, 9 33, 9 32, 3 103 53, 5 51, 5 4 727 872 80 122 57, 2 52, 3 1 117 (6) - 29, 7 (58) 99 (6) - (867) - 17, 4 1 076 - - 595 271 120 TOTAL 22 413 11 231 100 43, 4 41, 3 EBITDA excl. Investcom 20 100 11 231 79 44, 1 41, 3 West & Central Africa Iran Sudan Other operations Head Office Companies * Including MTN Network Solutions 65

EBITDA analysis 9 months ended Dec 2005 RAZ ZAR million 12 months ended Dec 2006 % 5 367 change 74 5 009 67 South & East Africa 9 346 South Africa* 8 340 Other operations 1 006 358 181 11 355 5 599 Nigeria Ghana Other operations 8 529 890 1 936 Middle East & North Africa Dec 2006 Dec 2005 EBITDA margin % 35, 2 32, 9 33, 9 32, 3 103 53, 5 51, 5 4 727 872 80 122 57, 2 52, 3 1 117 (6) - 29, 7 (58) 99 (6) - (867) - 17, 4 1 076 - - 595 271 120 TOTAL 22 413 11 231 100 43, 4 41, 3 EBITDA excl. Investcom 20 100 11 231 79 44, 1 41, 3 West & Central Africa Iran Sudan Other operations Head Office Companies * Including MTN Network Solutions 65

Depreciation analysis 12 months ended Dec 2006 9 months ended Dec 2005 % change South & East Africa 1 334 842 58 South Africa* 1 065 744 43 269 98 West & Central Africa 3 282 1 652 99 Nigeria 2 699 1 455 85 Ghana 124 - Other operations 459 197 Middle East & North Africa 414 - Iran 15 - Sudan 52 - 347 - - 3 5 030 2 497 ZAR million Other operations Other Operations Head Office Companies TOTAL * Including MTN Network Solutions 101 66

Depreciation analysis 12 months ended Dec 2006 9 months ended Dec 2005 % change South & East Africa 1 334 842 58 South Africa* 1 065 744 43 269 98 West & Central Africa 3 282 1 652 99 Nigeria 2 699 1 455 85 Ghana 124 - Other operations 459 197 Middle East & North Africa 414 - Iran 15 - Sudan 52 - 347 - - 3 5 030 2 497 ZAR million Other operations Other Operations Head Office Companies TOTAL * Including MTN Network Solutions 101 66

Amortisation analysis 12 months ended Dec 2006 9 months ended Dec 2005 % change 203 50 306 86 39 121 Other operations 117 11 West & Central Africa 801 206 289 Nigeria 191 116 65 Ghana 317 - Other operations 293 90 Middle East & North Africa 284 - Iran 19 - Sudan 65 - 200 - 1 289 256 ZAR million South & East Africa South Africa* Other Operations Head Office Companies TOTAL * Including MTN Network Solutions 404 67

Amortisation analysis 12 months ended Dec 2006 9 months ended Dec 2005 % change 203 50 306 86 39 121 Other operations 117 11 West & Central Africa 801 206 289 Nigeria 191 116 65 Ghana 317 - Other operations 293 90 Middle East & North Africa 284 - Iran 19 - Sudan 65 - 200 - 1 289 256 ZAR million South & East Africa South Africa* Other Operations Head Office Companies TOTAL * Including MTN Network Solutions 404 67

Finance cost analysis Net Finance Cost Finance Income South & East Africa 571 (238) 640 173 (4) South Africa* 494 (223) 598 122 (3) Other operations 77 (15) 42 51 (1) West & Central Africa 49 (591) 557 115 (32) Nigeria (92) (558) 472 11 (17) Ghana (15) (27) 10 9 (7) Other operations 156 (6) 75 95 (8) Middle East & North Africa (90) (74) 31 42 (89) Iran (43) (44) 1 - - Sudan (33) - 4 26 (63) Other Operations (14) (30) 26 16 (26) Head Office Companies 897 (295) 1 379 370 (557) 1 427 (1 198) 2 607 700 (682) ZAR million TOTAL * Including Network Solutions Finance Forex Costs Losses Forex Gains 68

Finance cost analysis Net Finance Cost Finance Income South & East Africa 571 (238) 640 173 (4) South Africa* 494 (223) 598 122 (3) Other operations 77 (15) 42 51 (1) West & Central Africa 49 (591) 557 115 (32) Nigeria (92) (558) 472 11 (17) Ghana (15) (27) 10 9 (7) Other operations 156 (6) 75 95 (8) Middle East & North Africa (90) (74) 31 42 (89) Iran (43) (44) 1 - - Sudan (33) - 4 26 (63) Other Operations (14) (30) 26 16 (26) Head Office Companies 897 (295) 1 379 370 (557) 1 427 (1 198) 2 607 700 (682) ZAR million TOTAL * Including Network Solutions Finance Forex Costs Losses Forex Gains 68

Thank You www. mtn. com investor_relations@mtn. co. za

Thank You www. mtn. com investor_relations@mtn. co. za