27e74ac41ef13c6ea86702cca03f693a.ppt

- Количество слайдов: 18

MTAC Association Presentation: The U. S. Catalog Mailing Industry – Today and Tomorrow Hamilton Davison Executive Director January 31, 2008 USPS Headquarters Washington, DC 1

MTAC Association Presentation: The U. S. Catalog Mailing Industry – Today and Tomorrow Hamilton Davison Executive Director January 31, 2008 USPS Headquarters Washington, DC 1

Current Members • • • • Ambrose American Girl Arandell Corporation Barco Products Company Baudville, Inc. Belardi. Ostroy/ALC, LLC Blue Sky Brands Carrot-Top Industries Crate and Barrel Crestline Co. Cuddledown Day-Timers, Inc. DMin. Site Farm. Tek Gardener’s Supply Company • • • • • GAIAM Hello Direct, Inc. Info. USA J. Schmid Associates Johnson Smith Co. Jos. A Banks K-Log Lillian Vernon Magnetic Concepts MARCO Market Force Corp. Miles Kimball Company Merit. Direct MOKRYNSKIdirect New Page Corporation Northern Safety Company Oriental Trading Company Paradysz Matera • • • • • Paul Fredrick Menstyle PC/Nametag Peruvian Connection Pet. Edge Positive Promotions Potpourri Group Professional Cutlery Direct, LLC Quebecor World Rivertown Greetings See’s Candies, Inc. Seton Specialty Store Services Taylor Corporation The Occasions Group Transcontinental Printing Vermont Country Store Ulla Popken, Ltd. Ultimate Office Upbeat, Inc. Last updated: December 2, 2007 2

Current Members • • • • Ambrose American Girl Arandell Corporation Barco Products Company Baudville, Inc. Belardi. Ostroy/ALC, LLC Blue Sky Brands Carrot-Top Industries Crate and Barrel Crestline Co. Cuddledown Day-Timers, Inc. DMin. Site Farm. Tek Gardener’s Supply Company • • • • • GAIAM Hello Direct, Inc. Info. USA J. Schmid Associates Johnson Smith Co. Jos. A Banks K-Log Lillian Vernon Magnetic Concepts MARCO Market Force Corp. Miles Kimball Company Merit. Direct MOKRYNSKIdirect New Page Corporation Northern Safety Company Oriental Trading Company Paradysz Matera • • • • • Paul Fredrick Menstyle PC/Nametag Peruvian Connection Pet. Edge Positive Promotions Potpourri Group Professional Cutlery Direct, LLC Quebecor World Rivertown Greetings See’s Candies, Inc. Seton Specialty Store Services Taylor Corporation The Occasions Group Transcontinental Printing Vermont Country Store Ulla Popken, Ltd. Ultimate Office Upbeat, Inc. Last updated: December 2, 2007 2

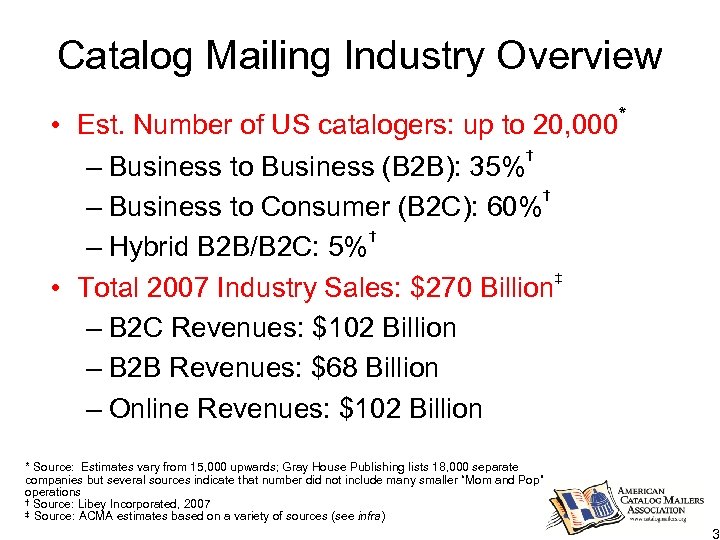

Catalog Mailing Industry Overview • Est. Number of US catalogers: up to 20, 000* † – Business to Business (B 2 B): 35% † – Business to Consumer (B 2 C): 60% † – Hybrid B 2 B/B 2 C: 5% ‡ • Total 2007 Industry Sales: $270 Billion – B 2 C Revenues: $102 Billion – B 2 B Revenues: $68 Billion – Online Revenues: $102 Billion * Source: Estimates vary from 15, 000 upwards; Gray House Publishing lists 18, 000 separate companies but several sources indicate that number did not include many smaller “Mom and Pop” operations † Source: Libey Incorporated, 2007 ‡ Source: ACMA estimates based on a variety of sources (see infra) 3

Catalog Mailing Industry Overview • Est. Number of US catalogers: up to 20, 000* † – Business to Business (B 2 B): 35% † – Business to Consumer (B 2 C): 60% † – Hybrid B 2 B/B 2 C: 5% ‡ • Total 2007 Industry Sales: $270 Billion – B 2 C Revenues: $102 Billion – B 2 B Revenues: $68 Billion – Online Revenues: $102 Billion * Source: Estimates vary from 15, 000 upwards; Gray House Publishing lists 18, 000 separate companies but several sources indicate that number did not include many smaller “Mom and Pop” operations † Source: Libey Incorporated, 2007 ‡ Source: ACMA estimates based on a variety of sources (see infra) 3

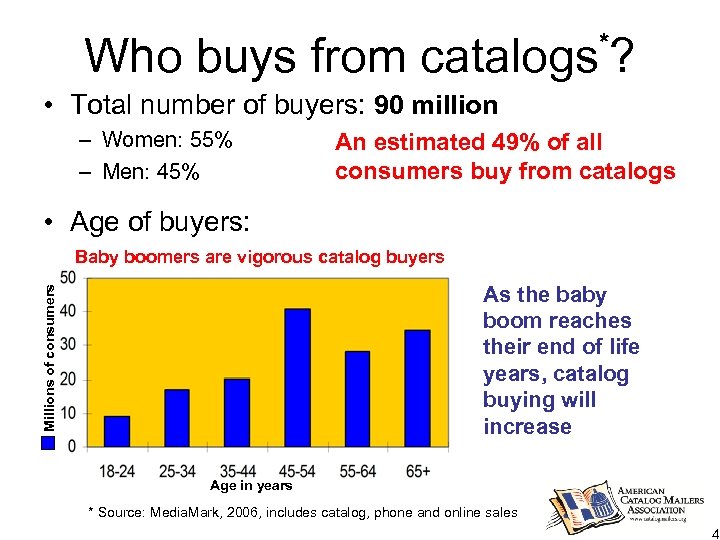

* Who buys from catalogs ? • Total number of buyers: 90 million – Women: 55% – Men: 45% An estimated 49% of all consumers buy from catalogs • Age of buyers: Baby boomers are vigorous catalog buyers Millions of consumers As the baby boom reaches their end of life years, catalog buying will increase Age in years * Source: Media. Mark, 2006, includes catalog, phone and online sales 4

* Who buys from catalogs ? • Total number of buyers: 90 million – Women: 55% – Men: 45% An estimated 49% of all consumers buy from catalogs • Age of buyers: Baby boomers are vigorous catalog buyers Millions of consumers As the baby boom reaches their end of life years, catalog buying will increase Age in years * Source: Media. Mark, 2006, includes catalog, phone and online sales 4

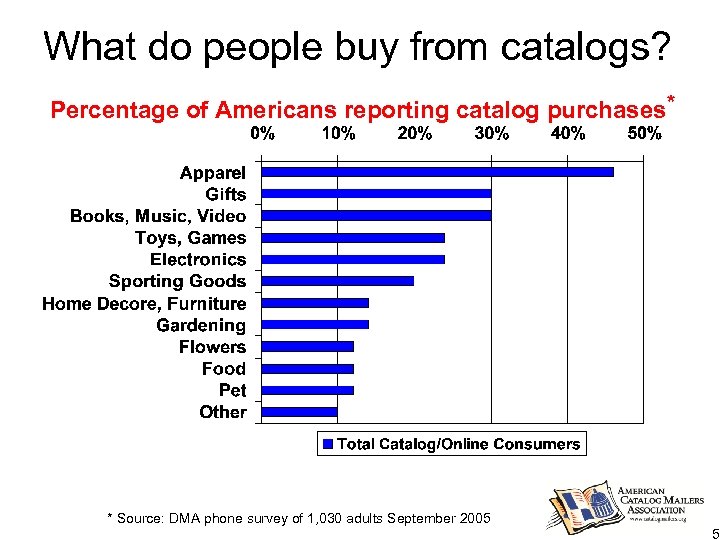

What do people buy from catalogs? Percentage of Americans reporting catalog purchases* * Source: DMA phone survey of 1, 030 adults September 2005 5

What do people buy from catalogs? Percentage of Americans reporting catalog purchases* * Source: DMA phone survey of 1, 030 adults September 2005 5

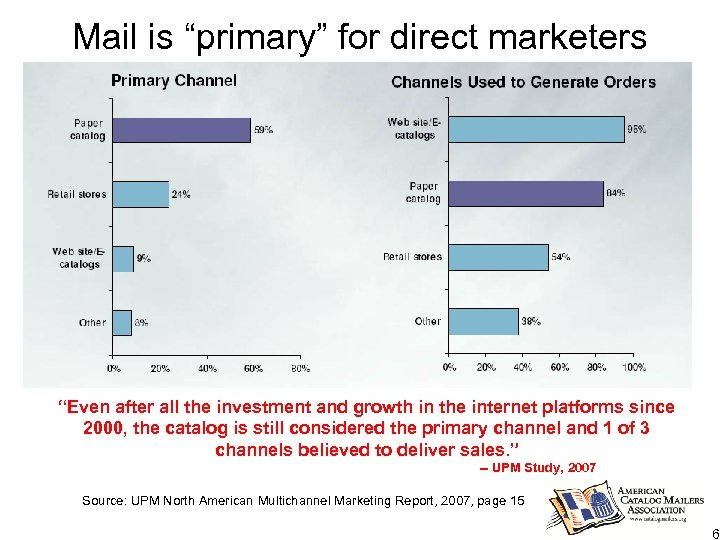

Mail is “primary” for direct marketers “Even after all the investment and growth in the internet platforms since 2000, the catalog is still considered the primary channel and 1 of 3 channels believed to deliver sales. ” -- UPM Study, 2007 Source: UPM North American Multichannel Marketing Report, 2007, page 15 6

Mail is “primary” for direct marketers “Even after all the investment and growth in the internet platforms since 2000, the catalog is still considered the primary channel and 1 of 3 channels believed to deliver sales. ” -- UPM Study, 2007 Source: UPM North American Multichannel Marketing Report, 2007, page 15 6

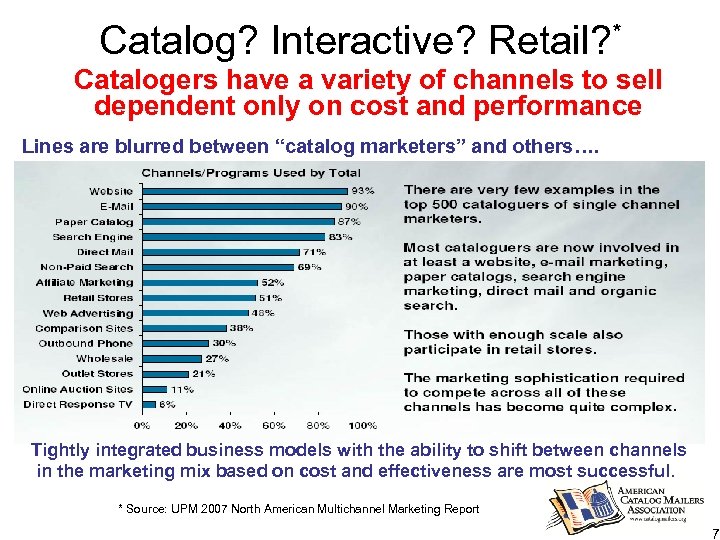

Catalog? Interactive? Retail? * Catalogers have a variety of channels to sell dependent only on cost and performance Lines are blurred between “catalog marketers” and others…. Tightly integrated business models with the ability to shift between channels in the marketing mix based on cost and effectiveness are most successful. * Source: UPM 2007 North American Multichannel Marketing Report 7

Catalog? Interactive? Retail? * Catalogers have a variety of channels to sell dependent only on cost and performance Lines are blurred between “catalog marketers” and others…. Tightly integrated business models with the ability to shift between channels in the marketing mix based on cost and effectiveness are most successful. * Source: UPM 2007 North American Multichannel Marketing Report 7

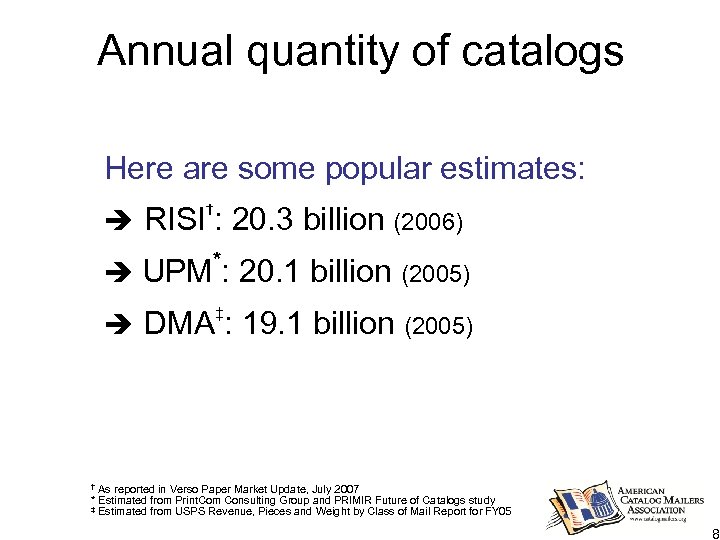

Annual quantity of catalogs Here are some popular estimates: RISI : 20. 3 billion (2006) † * UPM : 20. 1 billion (2005) ‡ DMA : 19. 1 billion (2005) As reported in Verso Paper Market Update, July 2007 * Estimated from Print. Com Consulting Group and PRIMIR Future of Catalogs study ‡ Estimated from USPS Revenue, Pieces and Weight by Class of Mail Report for FY 05 † 8

Annual quantity of catalogs Here are some popular estimates: RISI : 20. 3 billion (2006) † * UPM : 20. 1 billion (2005) ‡ DMA : 19. 1 billion (2005) As reported in Verso Paper Market Update, July 2007 * Estimated from Print. Com Consulting Group and PRIMIR Future of Catalogs study ‡ Estimated from USPS Revenue, Pieces and Weight by Class of Mail Report for FY 05 † 8

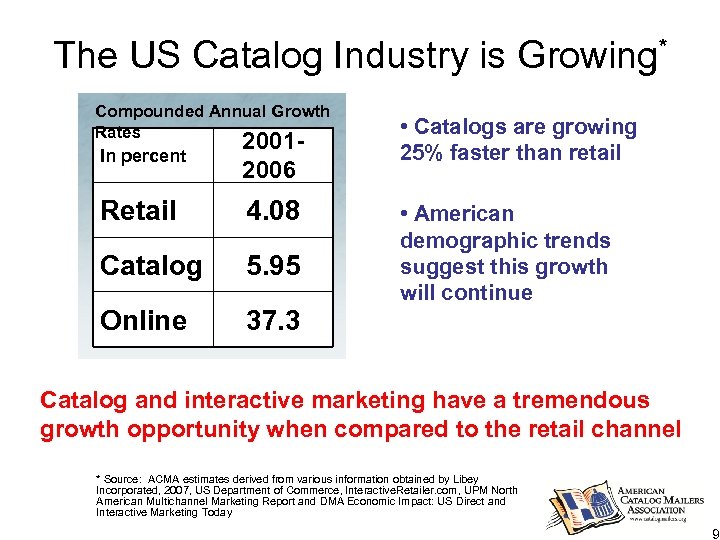

The US Catalog Industry is Growing Compounded Annual Growth Rates In percent 20012006 Retail 4. 08 Catalog 5. 95 Online 37. 3 * • Catalogs are growing 25% faster than retail • American demographic trends suggest this growth will continue Catalog and interactive marketing have a tremendous growth opportunity when compared to the retail channel * Source: ACMA estimates derived from various information obtained by Libey Incorporated, 2007, US Department of Commerce, Interactive. Retailer. com, UPM North American Multichannel Marketing Report and DMA Economic Impact: US Direct and Interactive Marketing Today 9

The US Catalog Industry is Growing Compounded Annual Growth Rates In percent 20012006 Retail 4. 08 Catalog 5. 95 Online 37. 3 * • Catalogs are growing 25% faster than retail • American demographic trends suggest this growth will continue Catalog and interactive marketing have a tremendous growth opportunity when compared to the retail channel * Source: ACMA estimates derived from various information obtained by Libey Incorporated, 2007, US Department of Commerce, Interactive. Retailer. com, UPM North American Multichannel Marketing Report and DMA Economic Impact: US Direct and Interactive Marketing Today 9

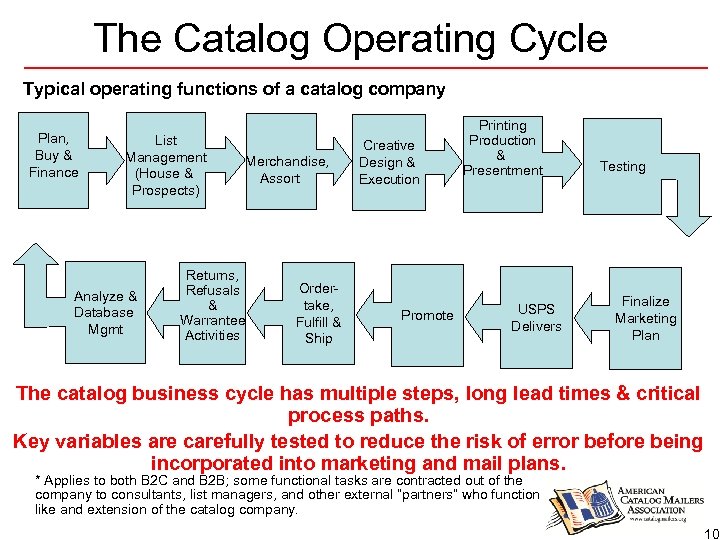

The Catalog Operating Cycle Typical operating functions of a catalog company Plan, Buy & Finance List Management (House & Prospects) Analyze & Database Mgmt Merchandise, Assort Returns, Refusals & Warrantee Activities Ordertake, Fulfill & Ship Creative Design & Execution Promote Printing Production & Presentment USPS Delivers Testing Finalize Marketing Plan The catalog business cycle has multiple steps, long lead times & critical process paths. Key variables are carefully tested to reduce the risk of error before being incorporated into marketing and mail plans. * Applies to both B 2 C and B 2 B; some functional tasks are contracted out of the company to consultants, list managers, and other external “partners” who function like and extension of the catalog company. 10

The Catalog Operating Cycle Typical operating functions of a catalog company Plan, Buy & Finance List Management (House & Prospects) Analyze & Database Mgmt Merchandise, Assort Returns, Refusals & Warrantee Activities Ordertake, Fulfill & Ship Creative Design & Execution Promote Printing Production & Presentment USPS Delivers Testing Finalize Marketing Plan The catalog business cycle has multiple steps, long lead times & critical process paths. Key variables are carefully tested to reduce the risk of error before being incorporated into marketing and mail plans. * Applies to both B 2 C and B 2 B; some functional tasks are contracted out of the company to consultants, list managers, and other external “partners” who function like and extension of the catalog company. 10

The Catalog Business Model • RFM: Recency, Frequency and Monetary Value The catalog mantra: How recently did they buy? How frequently? How much do they spend? • Low profit (~5%), high volume business • Sophisticated marketing based on systematic, quantitative assessments of customer segments • House list (existing customers) • Prospect lists (new customers) • Product, Marketing, Fulfillment Costs (including “Shipping & Handling”) “This complex business has little margin for error” -- President $250 million hard goods cataloger 11

The Catalog Business Model • RFM: Recency, Frequency and Monetary Value The catalog mantra: How recently did they buy? How frequently? How much do they spend? • Low profit (~5%), high volume business • Sophisticated marketing based on systematic, quantitative assessments of customer segments • House list (existing customers) • Prospect lists (new customers) • Product, Marketing, Fulfillment Costs (including “Shipping & Handling”) “This complex business has little margin for error” -- President $250 million hard goods cataloger 11

Catalogs Are Uniquely Valuable • To the U. S. Economy – Drives an industry worth over $300 billion a year – Employs three million Americans • To Consumers – – Valued over other kinds of mail (consumers welcome it) Like a magazine (purchase = subscription) People with disabilities, limited access to internet or retail stores Enhances “mail moment” • To the Postal Service – Growing & recurrent volume – Not likely to saturate consumers – Extremely high “multiplier” effect (1 purchase = 20 -40 pieces of mail) Keeps other mail—and mail in general—relevant as a means of communication. * Source: Libey Incorporated estimate, 2007 12

Catalogs Are Uniquely Valuable • To the U. S. Economy – Drives an industry worth over $300 billion a year – Employs three million Americans • To Consumers – – Valued over other kinds of mail (consumers welcome it) Like a magazine (purchase = subscription) People with disabilities, limited access to internet or retail stores Enhances “mail moment” • To the Postal Service – Growing & recurrent volume – Not likely to saturate consumers – Extremely high “multiplier” effect (1 purchase = 20 -40 pieces of mail) Keeps other mail—and mail in general—relevant as a means of communication. * Source: Libey Incorporated estimate, 2007 12

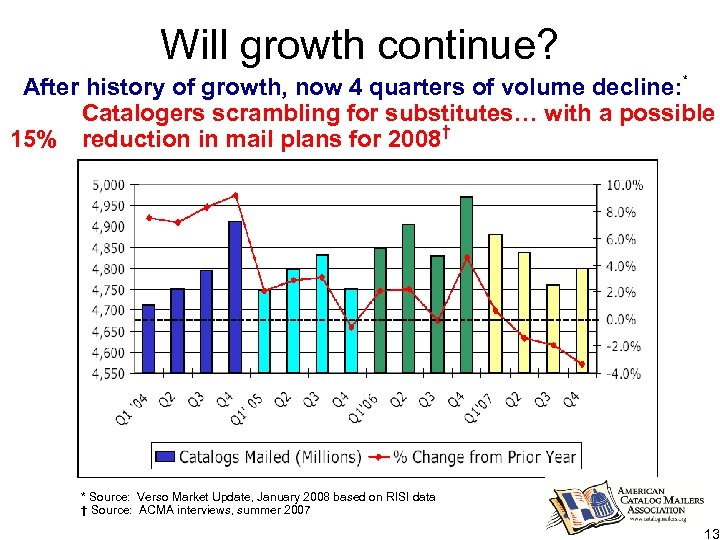

Will growth continue? After history of growth, now 4 quarters of volume decline: * Catalogers scrambling for substitutes… with a possible 15% reduction in mail plans for 2008† * Source: Verso Market Update, January 2008 based on RISI data † Source: ACMA interviews, summer 2007 13

Will growth continue? After history of growth, now 4 quarters of volume decline: * Catalogers scrambling for substitutes… with a possible 15% reduction in mail plans for 2008† * Source: Verso Market Update, January 2008 based on RISI data † Source: ACMA interviews, summer 2007 13

Illustration of Multichannel Marketing Source: UPM North American Multichannel Marketing Report, 2007, page 16 14

Illustration of Multichannel Marketing Source: UPM North American Multichannel Marketing Report, 2007, page 16 14

Impact of the R 2006 -1 Rate Increase • Industry is particularly vulnerable – High volume low profit, – Competing with retail stores (so it’s hard to pass on costs to consumers) – Postage makes up a large percentage of overall costs • Can’t turn on a dime – Easy fixes don’t work (e. g. “slim jims”) – Long planning cycles • Disrupts planning cycle – Resource shift from “growth” to “treading water” • Forced to cut circulation – Provides immediate cost savings – Some existing customers become unprofitable • Forced to cut prospect mailings – Eliminates multiplier effect – Limits potential for new growth It may take years to fully evaluate the impact of R 2006 -1. 15

Impact of the R 2006 -1 Rate Increase • Industry is particularly vulnerable – High volume low profit, – Competing with retail stores (so it’s hard to pass on costs to consumers) – Postage makes up a large percentage of overall costs • Can’t turn on a dime – Easy fixes don’t work (e. g. “slim jims”) – Long planning cycles • Disrupts planning cycle – Resource shift from “growth” to “treading water” • Forced to cut circulation – Provides immediate cost savings – Some existing customers become unprofitable • Forced to cut prospect mailings – Eliminates multiplier effect – Limits potential for new growth It may take years to fully evaluate the impact of R 2006 -1. 15

Reacting to R 2006 -1 Catalogers are considering all alternatives and rethinking their business plans. Catalogers are trying to minimize the impact of: • 20% - 40% increase to postage cost • Increased cost of compliance • $3 - $4/hundred weight in paper cost • 6% - 8% increase to ink cost • Increased freight • Weak dollar 16

Reacting to R 2006 -1 Catalogers are considering all alternatives and rethinking their business plans. Catalogers are trying to minimize the impact of: • 20% - 40% increase to postage cost • Increased cost of compliance • $3 - $4/hundred weight in paper cost • 6% - 8% increase to ink cost • Increased freight • Weak dollar 16

Mailers Technical Advisory Committee • Partner to keep catalogs in the mail – Contribution to USPS operational costs – Content value that helps keep mail relevant – Postage makes up a large percentage of overall costs • New to postal affairs • Generally do not understand technical details – Large and dispersed group of companies – Importance of partners • Enormous change – To cataloging economics – To environmental influencers – To how flats mail is processed In the enlightened self interest of every mailer to have a vibrant catalog channel 17

Mailers Technical Advisory Committee • Partner to keep catalogs in the mail – Contribution to USPS operational costs – Content value that helps keep mail relevant – Postage makes up a large percentage of overall costs • New to postal affairs • Generally do not understand technical details – Large and dispersed group of companies – Importance of partners • Enormous change – To cataloging economics – To environmental influencers – To how flats mail is processed In the enlightened self interest of every mailer to have a vibrant catalog channel 17

Questions & Answers 18

Questions & Answers 18