MSU (IB Club) M&A Case Polyus Gold & Kazakh Gold

Table of Contents Section Page Polyus Gold at a Glance 3 Strategic Introduction 4 Potential Targets Overview 5 Kazakh Gold Overview 6 Outputs of the M&A Model 7 Risks and their Solutions 8 Investment Highlights 9 2

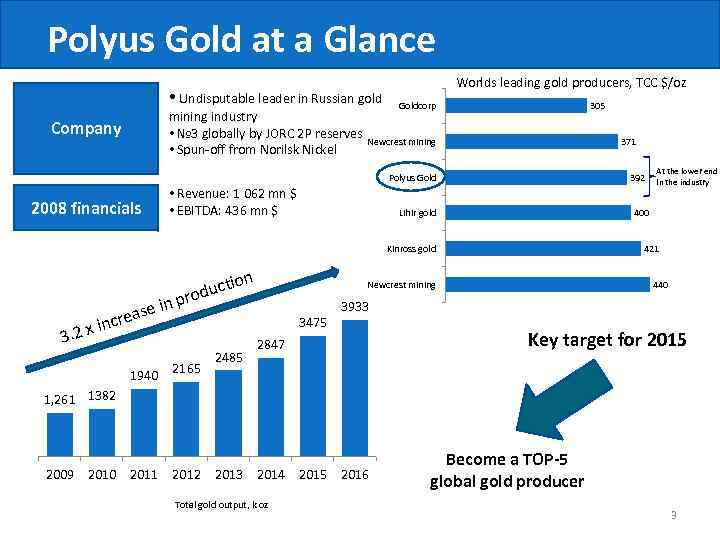

Polyus Gold at a Glance • Undisputable leader in Russian gold mining industry • № 3 globally by JORC 2 P reserves • Spun-off from Norilsk Nickel Company Worlds leading gold producers, TCC $/oz Goldcorp 305 Newcrest mining 371 Polyus Gold 2008 financials • Revenue: 1 062 mn $ • EBITDA: 436 mn $ 392 Lihir gold 400 Kinross gold n io duct ro n p i ease cr 2 x in 3. 1940 2165 2485 421 Newcrest mining 3475 At the lower end In the industry 440 3933 2847 Key target for 2015 1, 261 1382 2009 2010 2011 2012 2013 2014 2015 2016 Total gold output, k oz Become a TOP-5 global gold producer 3

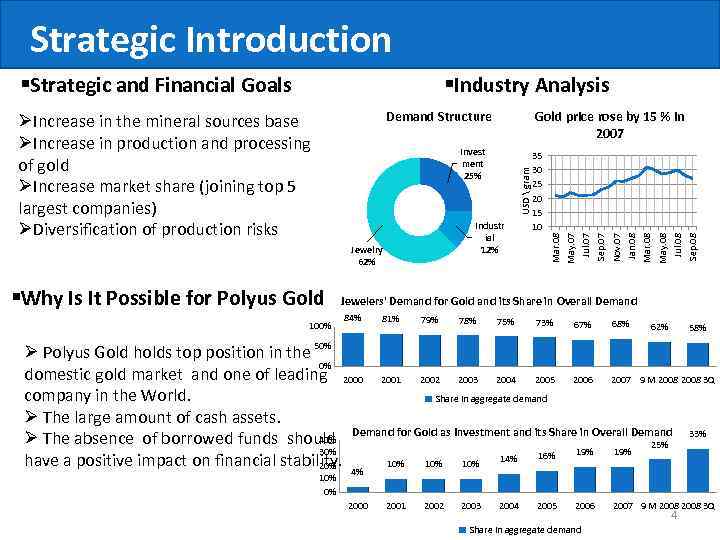

Strategic Introduction §Industry Analysis Demand Structure Gold price rose by 15 % in 2007 100% Sep. 08 Jul. 08 May. 08 Mar. 08 Jan. 08 Sep. 07 Nov. 07 35 30 25 20 15 10 Jul. 07 Industr ial 12% Jewelry 62% §Why Is It Possible for Polyus Gold USD gram Invest ment 25% May. 07 ØIncrease in the mineral sources base ØIncrease in production and processing of gold ØIncrease market share (joining top 5 largest companies) ØDiversification of production risks Mar. 08 §Strategic and Financial Goals Jewelers' Demand for Gold and its Share in Overall Demand 84% 81% 79% 78% 75% 73% 67% 68% 62% 58% Ø Polyus Gold holds top position in the 50% 0% domestic gold market and one of leading 2000 2001 2002 2003 2004 2005 2006 2007 9 M 2008 3 Q company in the World. Share in aggregate demand Ø The large amount of cash assets. 40% Ø The absence of borrowed funds should Demand for Gold as Investment and its Share in Overall Demand 33% 25% 30% 19% 16% 14% have a positive impact on financial stability. 10% 10% 20% 10% 0% 4% 2000 2001 2002 2003 2004 2005 2006 Share in aggregate demand 2007 9 M 2008 3 Q 4

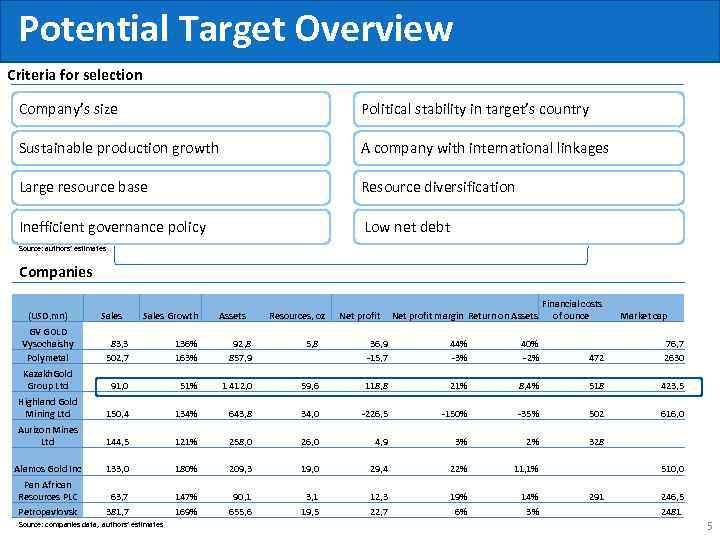

Potential Target Overview Potential Targets Overview Criteria for selection Company’s size Political stability in target’s country Sustainable production growth A company with international linkages Large resource base Resource diversification Inefficient governance policy Low net debt Source: authors’ estimates Companies Sales Growth Sales GV GOLD Vysochaishy Polymetal 83, 3 502, 7 136% 92, 8 5, 8 163% 857, 9 36, 9 -15, 7 44% -3% 40% -2% 472 76, 7 2630 Kazakh. Gold 91, 0 Group Ltd 51% 1 412, 0 59, 6 118, 8 21% 8, 4% 518 423, 5 Highland Gold Mining Ltd 150, 4 134% 643, 8 34, 0 -226, 5 -150% -35% 502 616, 0 Aurizon Mines 144, 5 Ltd 121% 258, 0 26, 0 4, 9 3% 2% 328 Alamos Gold Inc 133, 0 180% 209, 3 19, 0 29, 4 22% 11, 1% 510, 0 Pan African Resources PLC 63, 7 Petropavlovsk 381, 7 147% 90, 1 3, 1 169% 655, 6 19, 5 12, 3 22, 7 19% 6% 14% 3% 291 246, 5 2481 Source: companies data, authors’ estimates Assets Resources, oz Net profit margin Return on Assets Financial costs of ounce (USD, mn) Market cap 5

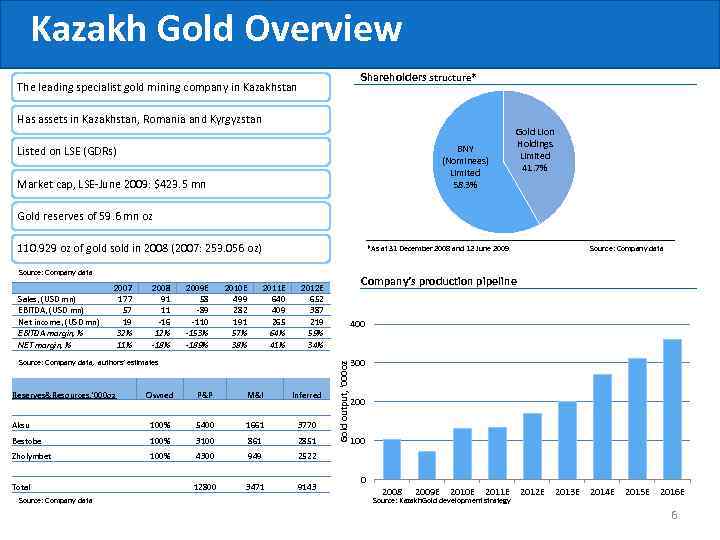

Kazakh Gold Overview Shareholders structure* The leading specialist gold mining company in Kazakhstan Has assets in Kazakhstan, Romania and Kyrgyzstan BNY (Nominees) Limited 58. 3% Listed on LSE (GDRs) Market cap, LSE-June 2009: $423. 5 mn Gold Lion Holdings Limited 41. 7% Gold reserves of 59. 6 mn oz 110. 929 oz of gold sold in 2008 (2007: 253. 056 oz) *As at 31 December 2008 and 12 June 2009 Source: Company data Sales, (USD mn) EBITDA, (USD mn) Net income, (USD mn) EBITDA margin, % NET margin, % 2007 177 57 19 32% 11% 2008 91 11 -16 12% -18% 2009 E 58 -89 -110 -153% -189% 2010 E 499 282 191 57% 38% 2011 E 640 409 265 64% 41% Source: Company data, authors’ estimates Reserves&Resources, '000 oz Owned P&P M&I Company’s production pipeline 2012 E 652 387 219 59% 34% Inferred Aksu 100% 5400 1661 3770 Bestobe 100% 3100 861 2851 Zholymbet 100% 4300 949 Total 12800 3471 9143 300 2522 400 Gold output, '000 oz Source: Company data 100 0 2008 2009 E 2010 E 2011 E 2012 E 2013 E 2014 E 2015 E 2016 E Source: Kazakh. Gold development strategy 6

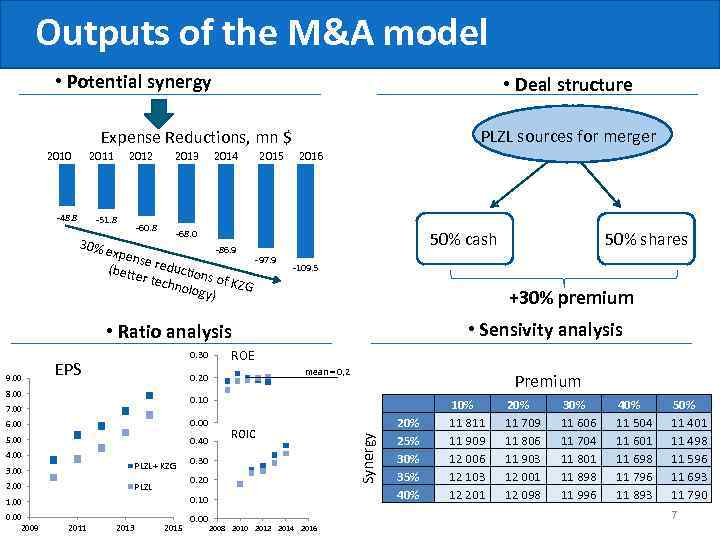

Outputs of the M&A model • Potential synergy • Deal structure PLZL sources for merger Expense Reductions, mn $ 2010 2011 -48. 8 2012 -51. 8 -60. 8 30% e 2013 2014 2015 2016 -68. 0 -86. 9 xpens -97. 9 e red uctio (bette ns r tech nolog of KZG y) 50% cash -109. 5 +30% premium • Sensivity analysis • Ratio analysis EPS mean = 0, 2 0. 20 8. 00 Premium 0. 10 7. 00 6. 00 0. 00 5. 00 0. 40 4. 00 3. 00 PLZL+ KZG 2. 00 PLZL ROIC 0. 30 0. 20 0. 10 1. 00 0. 00 2009 ROE 2011 2013 2015 0. 00 Synergy 9. 00 0. 30 50% shares 20% 25% 30% 35% 40% 10% 20% 30% 40% 50% 11 811 11 709 11 606 11 504 11 401 11 909 11 806 11 704 11 601 11 498 12 006 11 903 11 801 11 698 11 596 12 103 12 001 11 898 11 796 11 693 12 201 12 098 11 996 11 893 11 790 7 2008 2010 2012 2014 2016

Risks and their Solutions Country Risks – Kazakhstan’s policy, Government, tax and economic risks Solution (partially) – financing M&A as 50% shares and 50% cash Risk of negative changes in gold prices and demand for gold Solution – diversification of number of products, that possible owing to Kazakh Gold’s reserves Risk of reduction flow of funds to shareholders, at least in the next few years Solution - financing M&A as 50% shares and 50% cash, not to sharply reduce the cash 8

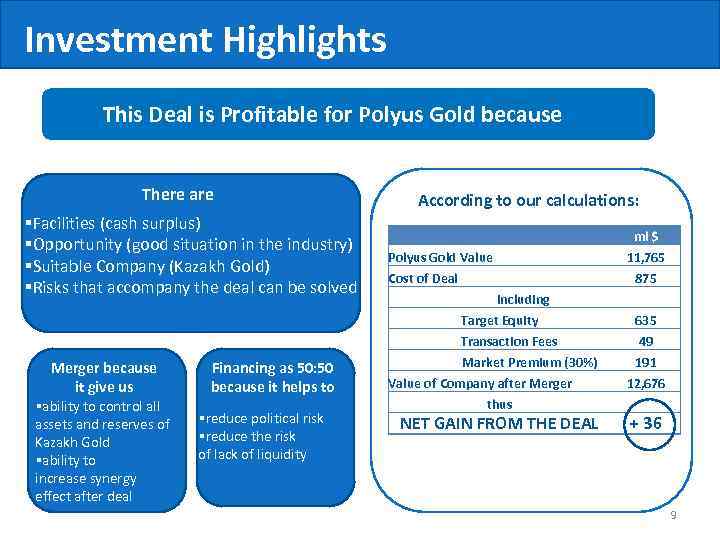

Investment Highlights This Deal is Profitable for Polyus Gold because There are §Facilities (cash surplus) §Opportunity (good situation in the industry) §Suitable Company (Kazakh Gold) §Risks that accompany the deal can be solved Merger because it give us §ability to control all assets and reserves of Kazakh Gold §ability to increase synergy effect after deal Financing as 50: 50 because it helps to §reduce political risk §reduce the risk of lack of liquidity According to our calculations: Polyus Gold Value Cost of Deal including Target Equity Transaction Fees Market Premium (30%) Value of Company after Merger thus NET GAIN FROM THE DEAL ml $ 11, 765 875 635 49 191 12, 676 + 36 9