1a6b09b425d2f89d31e9a6e00a834199.ppt

- Количество слайдов: 49

MSME Finance Converting challenges into opportunities

MSME Finance Converting challenges into opportunities

MSME Finance

MSME Finance

MSME Finance

MSME Finance

MSME Finance

MSME Finance

MSME Finance

MSME Finance

MSME Finance

MSME Finance

MSME Finance l More than 50% of the labour force l Large proportion of total output l Employment to semi skilled labour l Seedbed of entrepreneurship l Made to order/small batches/sub contract l Complementary to large scale industries

MSME Finance l More than 50% of the labour force l Large proportion of total output l Employment to semi skilled labour l Seedbed of entrepreneurship l Made to order/small batches/sub contract l Complementary to large scale industries

MSME Finance l 26 Million SMEs in India l 45% of the manufactured output l Employing 60 million people l 40% of total exports from the country

MSME Finance l 26 Million SMEs in India l 45% of the manufactured output l Employing 60 million people l 40% of total exports from the country

MSME Finance l Earlier definitions: l Small Scale Industries l Small Enterprises (traders, services) l Professionals l Small Road Transport organizations Now renamed as MSME Sector

MSME Finance l Earlier definitions: l Small Scale Industries l Small Enterprises (traders, services) l Professionals l Small Road Transport organizations Now renamed as MSME Sector

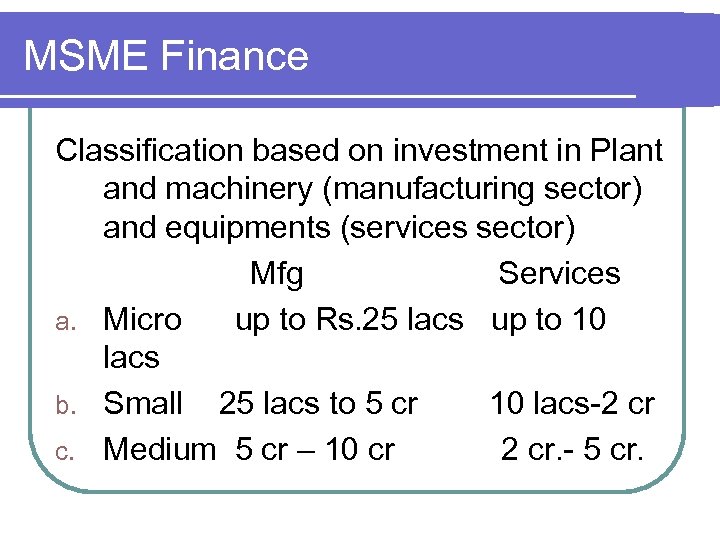

MSME Finance Classification based on investment in Plant and machinery (manufacturing sector) and equipments (services sector) Mfg Services a. Micro up to Rs. 25 lacs up to 10 lacs b. Small 25 lacs to 5 cr 10 lacs-2 cr c. Medium 5 cr – 10 cr 2 cr. - 5 cr.

MSME Finance Classification based on investment in Plant and machinery (manufacturing sector) and equipments (services sector) Mfg Services a. Micro up to Rs. 25 lacs up to 10 lacs b. Small 25 lacs to 5 cr 10 lacs-2 cr c. Medium 5 cr – 10 cr 2 cr. - 5 cr.

MSME Finance l MSMED Act 2006 l MSME Ministry at Central Government l Scheduled Commercial Banks to achieve 20% Y-o-Y growth in credit to Micro and Small enterprises l 60% of the above to go to Micro sector

MSME Finance l MSMED Act 2006 l MSME Ministry at Central Government l Scheduled Commercial Banks to achieve 20% Y-o-Y growth in credit to Micro and Small enterprises l 60% of the above to go to Micro sector

MSME Finance l Present scenario: l Only 10% growth in bank credit to SMEs l MSMEs suffer from lack of technology l Lack of research and technology l Lack of adequate, timely credit l Lack of financial literacy

MSME Finance l Present scenario: l Only 10% growth in bank credit to SMEs l MSMEs suffer from lack of technology l Lack of research and technology l Lack of adequate, timely credit l Lack of financial literacy

MSME Finance l What banks can do: l Soft interventions and hard interventions l Soft intervention: l SME Literacy l Meetings l Industry interface l Formation of clusters, teaching simple accounting practices

MSME Finance l What banks can do: l Soft interventions and hard interventions l Soft intervention: l SME Literacy l Meetings l Industry interface l Formation of clusters, teaching simple accounting practices

MSME Finance l Hard interventions: l Separate MSME branches l Relationship officers/Managers l Quick decisions l Schematic lending, wherever possible l Cluster financing to be encouraged l Financing for warehouse l Financing for exhibition-halls

MSME Finance l Hard interventions: l Separate MSME branches l Relationship officers/Managers l Quick decisions l Schematic lending, wherever possible l Cluster financing to be encouraged l Financing for warehouse l Financing for exhibition-halls

MSME Finance IOB MSE Plus – a new credit scheme for Micro and small Enterprises Adv/521/2010 -11 dt. 11 -02 -2011 A novel scheme Both working capital and term loan, as a single loan Repayment in monthly instalments

MSME Finance IOB MSE Plus – a new credit scheme for Micro and small Enterprises Adv/521/2010 -11 dt. 11 -02 -2011 A novel scheme Both working capital and term loan, as a single loan Repayment in monthly instalments

MSME Finance l Both manufacturing and service sectors l Maximum Rs. 100 lakhs l Construction/purchase of workshed/factory premises l Acquisition of plant/machinery/equipments l Working capital needs l Margin 30% and 15% respectively l Medium enterprises NOT eligible

MSME Finance l Both manufacturing and service sectors l Maximum Rs. 100 lakhs l Construction/purchase of workshed/factory premises l Acquisition of plant/machinery/equipments l Working capital needs l Margin 30% and 15% respectively l Medium enterprises NOT eligible

MSME Finance Important circulars/instructions/tie ups of our Bank, with regard to SME financing: a) Adv/417/20 10 -11 dated 17 -052010(Mou with Ashok Leyland Ltd for financing of commercial vehicles b) Earlier agreements with Tata Motors and Asia Motor Works Ltd

MSME Finance Important circulars/instructions/tie ups of our Bank, with regard to SME financing: a) Adv/417/20 10 -11 dated 17 -052010(Mou with Ashok Leyland Ltd for financing of commercial vehicles b) Earlier agreements with Tata Motors and Asia Motor Works Ltd

MSME Finance l SME/459/2010 -2011 dated 28 -08 -2010 All MSE advances up to a limit of Rs. 10 lakhs must be granted without collateral security All MSE advances should also be granted without collateral security, up to Rs. 100 lakhs, if CGTMSE guarantee is available

MSME Finance l SME/459/2010 -2011 dated 28 -08 -2010 All MSE advances up to a limit of Rs. 10 lakhs must be granted without collateral security All MSE advances should also be granted without collateral security, up to Rs. 100 lakhs, if CGTMSE guarantee is available

MSME Finance l Adv/414/2010 -11 dated 14 -05 -2010: l No collateral should be obtained upto a limit of Rs. 10 lakhs for finance to Micro and Small enterprises (both mfg and service sector). Such loans are to be covered under CGTMSE, wherever applicable

MSME Finance l Adv/414/2010 -11 dated 14 -05 -2010: l No collateral should be obtained upto a limit of Rs. 10 lakhs for finance to Micro and Small enterprises (both mfg and service sector). Such loans are to be covered under CGTMSE, wherever applicable

MSME Finance l Adv/405/2010 -2011 dated 22 -04 -2010: on MSME Finance, giving comprehensive guidelines l Cash credit l Term Loans l Export credit l Non fund based limits l Purchase of cheques and bills for SMEs

MSME Finance l Adv/405/2010 -2011 dated 22 -04 -2010: on MSME Finance, giving comprehensive guidelines l Cash credit l Term Loans l Export credit l Non fund based limits l Purchase of cheques and bills for SMEs

MSME Finance l Loans under DRI l Loans under government sponsored schemes- TUFs/PMEGP/REMOT

MSME Finance l Loans under DRI l Loans under government sponsored schemes- TUFs/PMEGP/REMOT

MSME Finance l Technology Up -gradation Fund (TUF) l Administered by Ministry of Textiles, Government of India l For technology up gradation, by inducting state-of-the-art machinery l 15% Credit Linked Capital Subsidy scheme l 5% interest subsidy scheme

MSME Finance l Technology Up -gradation Fund (TUF) l Administered by Ministry of Textiles, Government of India l For technology up gradation, by inducting state-of-the-art machinery l 15% Credit Linked Capital Subsidy scheme l 5% interest subsidy scheme

MSME Finance l The relevant circulars are: l Adv/298/2003 -2004 dated 26 -02 -2004 l Adv/400/2005 -2006 dated 30 -06 -2006 l Adv/18/2011 -2012 dated 04 -06 -2011 (restructured TUF scheme)

MSME Finance l The relevant circulars are: l Adv/298/2003 -2004 dated 26 -02 -2004 l Adv/400/2005 -2006 dated 30 -06 -2006 l Adv/18/2011 -2012 dated 04 -06 -2011 (restructured TUF scheme)

MSME Finance l Indirect finance to SMEs: l To NBFCs for on lending to MSMEs l To cooperatives of producersartisans/village and cottage industries l Suppliers of inputs and those marketing outputs

MSME Finance l Indirect finance to SMEs: l To NBFCs for on lending to MSMEs l To cooperatives of producersartisans/village and cottage industries l Suppliers of inputs and those marketing outputs

MSME Finance l Credit Guarantee Fund Trust for Micro and Small Enterprises: l Guarantee cover up to Rs. 100 lakhs l Advantages of CGTMSE cover l No hassles such as mortgage and documentation issues l Sovereign guarantee

MSME Finance l Credit Guarantee Fund Trust for Micro and Small Enterprises: l Guarantee cover up to Rs. 100 lakhs l Advantages of CGTMSE cover l No hassles such as mortgage and documentation issues l Sovereign guarantee

MSME Finance l No Provision requirements for guaranteed portion l Entrepreneurs with viable projects, but with no collateral to offer will benefit l Recovery through sale of collateral l Retail trade finance and finance to educational institutions not covered

MSME Finance l No Provision requirements for guaranteed portion l Entrepreneurs with viable projects, but with no collateral to offer will benefit l Recovery through sale of collateral l Retail trade finance and finance to educational institutions not covered

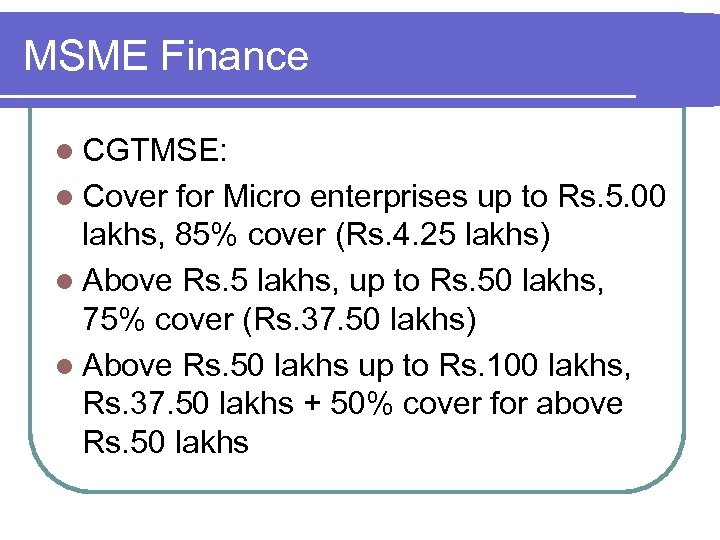

MSME Finance l CGTMSE: l Cover for Micro enterprises up to Rs. 5. 00 lakhs, 85% cover (Rs. 4. 25 lakhs) l Above Rs. 5 lakhs, up to Rs. 50 lakhs, 75% cover (Rs. 37. 50 lakhs) l Above Rs. 50 lakhs up to Rs. 100 lakhs, Rs. 37. 50 lakhs + 50% cover for above Rs. 50 lakhs

MSME Finance l CGTMSE: l Cover for Micro enterprises up to Rs. 5. 00 lakhs, 85% cover (Rs. 4. 25 lakhs) l Above Rs. 5 lakhs, up to Rs. 50 lakhs, 75% cover (Rs. 37. 50 lakhs) l Above Rs. 50 lakhs up to Rs. 100 lakhs, Rs. 37. 50 lakhs + 50% cover for above Rs. 50 lakhs

MSME Finance l One time guarantee fee: 1. 50% l Annual Service Fee: 0. 75%

MSME Finance l One time guarantee fee: 1. 50% l Annual Service Fee: 0. 75%

MSME Finance l Adv/308/2009 -2010 dated 25 -07 -2009 l Policy on nursing and rehabilitation of sick MSME units

MSME Finance l Adv/308/2009 -2010 dated 25 -07 -2009 l Policy on nursing and rehabilitation of sick MSME units

MSME Finance l Adv/342/2009 -2010 dated 26 -10 -2009 of SME department l Comprehensive Loan policy of our Bank for SME financing

MSME Finance l Adv/342/2009 -2010 dated 26 -10 -2009 of SME department l Comprehensive Loan policy of our Bank for SME financing

MSME Finance l Our Bank’s Mo. U with SME Rating Agency of India (SMERA) l Concessional charges for rating l Enhances the reputation of the SMEs with their buyers-domestic and foreign l SMERA- Independent third party organisation

MSME Finance l Our Bank’s Mo. U with SME Rating Agency of India (SMERA) l Concessional charges for rating l Enhances the reputation of the SMEs with their buyers-domestic and foreign l SMERA- Independent third party organisation

IOB Advance Term Loan Scheme l IOB SME Advance Term Loan Scheme l Adv/445/2010 -11 dated 05 -08 -2010 l One year validity l Only for existing MSME customers l Maximum limit Rs. 25 lakhs l CGTMSE cover is available l Cash generation/repayment capacity

IOB Advance Term Loan Scheme l IOB SME Advance Term Loan Scheme l Adv/445/2010 -11 dated 05 -08 -2010 l One year validity l Only for existing MSME customers l Maximum limit Rs. 25 lakhs l CGTMSE cover is available l Cash generation/repayment capacity

PMEGP l Prime Minister’s Employment Generation Scheme (PMEGP) l Merger of PMRY and REGP l Ministry of Micro, Small and Medium Enterprises l KVIC implementing agency l KVIC directorates, KVIBs and DICs

PMEGP l Prime Minister’s Employment Generation Scheme (PMEGP) l Merger of PMRY and REGP l Ministry of Micro, Small and Medium Enterprises l KVIC implementing agency l KVIC directorates, KVIBs and DICs

MSME Finance l Objectives: l To generate employment in rural and urban areas, through Self Employment ventures l Give opportunities to artisans l Prevent migration of artisans/rural youth to urban areas

MSME Finance l Objectives: l To generate employment in rural and urban areas, through Self Employment ventures l Give opportunities to artisans l Prevent migration of artisans/rural youth to urban areas

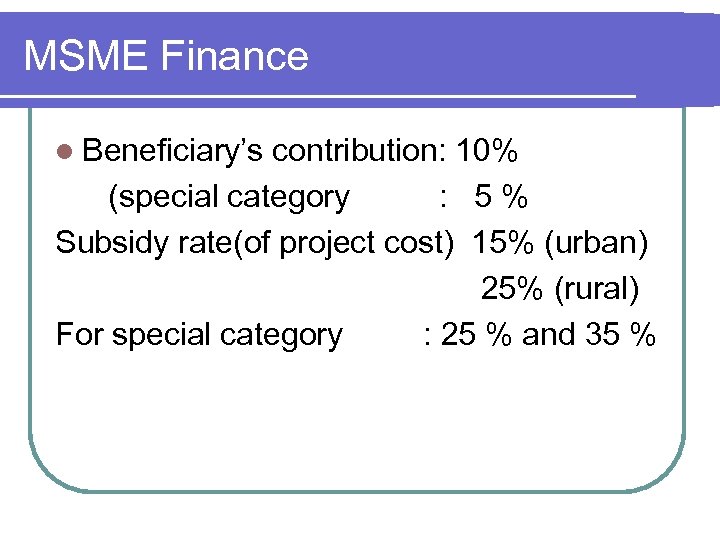

MSME Finance l Beneficiary’s contribution: 10% (special category : 5% Subsidy rate(of project cost) 15% (urban) 25% (rural) For special category : 25 % and 35 %

MSME Finance l Beneficiary’s contribution: 10% (special category : 5% Subsidy rate(of project cost) 15% (urban) 25% (rural) For special category : 25 % and 35 %

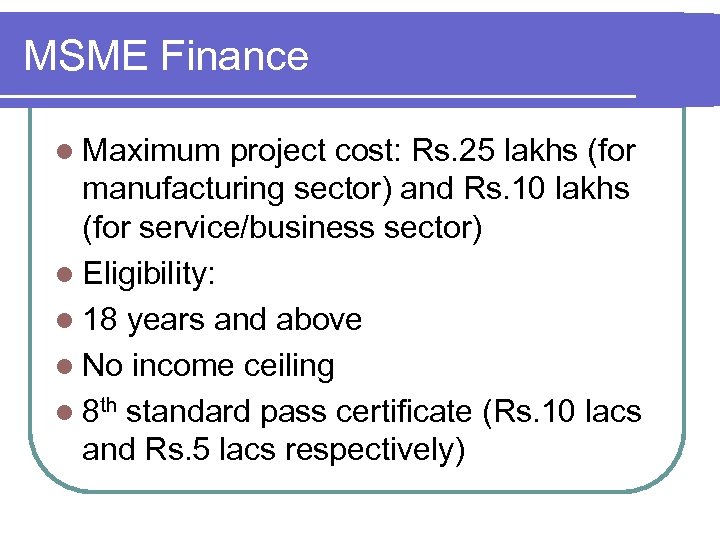

MSME Finance l Maximum project cost: Rs. 25 lakhs (for manufacturing sector) and Rs. 10 lakhs (for service/business sector) l Eligibility: l 18 years and above l No income ceiling l 8 th standard pass certificate (Rs. 10 lacs and Rs. 5 lacs respectively)

MSME Finance l Maximum project cost: Rs. 25 lakhs (for manufacturing sector) and Rs. 10 lakhs (for service/business sector) l Eligibility: l 18 years and above l No income ceiling l 8 th standard pass certificate (Rs. 10 lacs and Rs. 5 lacs respectively)

MSME Finance l SHGs are also eligible l Capital expenditure is a must l Project cost to include capital cost plus one cycle of working capital l All viable micro enterprises l KVIC Mumbai is the implementing agency l Identification by a Task Force

MSME Finance l SHGs are also eligible l Capital expenditure is a must l Project cost to include capital cost plus one cycle of working capital l All viable micro enterprises l KVIC Mumbai is the implementing agency l Identification by a Task Force

MSME Finance l District Collector/Deputy Commissioner l Banks’ active involvement l EDP training l Score card to be the basis l Bank finance to the extent of 90% (95%) of the project cost l Normal rate of interest l Repayment 3 years to 7 years

MSME Finance l District Collector/Deputy Commissioner l Banks’ active involvement l EDP training l Score card to be the basis l Bank finance to the extent of 90% (95%) of the project cost l Normal rate of interest l Repayment 3 years to 7 years

MSME Finance l Up to Rs. 10 lakhs no collateral security l EDP training (at least 2 weeks) l After training, beneficiary should deposit own contribution l After release of bank finance, margin money claim will be submitted l 3 years FD/no int. One time assistance

MSME Finance l Up to Rs. 10 lakhs no collateral security l EDP training (at least 2 weeks) l After training, beneficiary should deposit own contribution l After release of bank finance, margin money claim will be submitted l 3 years FD/no int. One time assistance

MSME Finance l Rs. 2500/- to Rs. 4000/- training cost reimbursible by KVIC l A shelf of projects

MSME Finance l Rs. 2500/- to Rs. 4000/- training cost reimbursible by KVIC l A shelf of projects

IOB Artisan Credit card l IOB Artisan Credit Card scheme (ACC) l Adv/317/2009 -2010 dated 29 -08 -2009 l For working capital needs or investment needs to artisans l Preference to artisans registered with Development Commissioner (Handicrafts) l Cash credit, with a passbook l Maximum limit Rs. 2. 00 lakhs

IOB Artisan Credit card l IOB Artisan Credit Card scheme (ACC) l Adv/317/2009 -2010 dated 29 -08 -2009 l For working capital needs or investment needs to artisans l Preference to artisans registered with Development Commissioner (Handicrafts) l Cash credit, with a passbook l Maximum limit Rs. 2. 00 lakhs

TREAD l Trade Related Entrepreneurship Assistance and Development (TREAD) l Adv/237/2008 -2009 dated 12 -01 -2009 l Economic empowerment of Women l Scheme sponsored by MSME ministry l Implemented through NGOs and training institutions

TREAD l Trade Related Entrepreneurship Assistance and Development (TREAD) l Adv/237/2008 -2009 dated 12 -01 -2009 l Economic empowerment of Women l Scheme sponsored by MSME ministry l Implemented through NGOs and training institutions

MSME Finance l Women SHGs or women entrepreneurs l Government subsidy- 30% of project cost l Applications to be forwarded by applicaants to Development Commissioner, Ministry of MSME l RK Puram branch (New Delhi) is the nodal branch

MSME Finance l Women SHGs or women entrepreneurs l Government subsidy- 30% of project cost l Applications to be forwarded by applicaants to Development Commissioner, Ministry of MSME l RK Puram branch (New Delhi) is the nodal branch

IOB Tools Scheme IOB Tools scheme: Carpenters/plumbers/el ectricians/ auto mechanics/packagin g technicians/fabricator s/water service providers etc. ,

IOB Tools Scheme IOB Tools scheme: Carpenters/plumbers/el ectricians/ auto mechanics/packagin g technicians/fabricator s/water service providers etc. ,

MSME Finance l Our Bank’s tie up with MICO Bosch l Rs. 50000/- (maximum) l Hypothecation of assets l Maximum repayment: 36 months l Priority sector classification

MSME Finance l Our Bank’s tie up with MICO Bosch l Rs. 50000/- (maximum) l Hypothecation of assets l Maximum repayment: 36 months l Priority sector classification

IOB SME Insta fund l Adv/64/2011 -12 dt. 12 -09 -2011 l To meet bulk orders-exceptional cases l For existing SME units enjoying regular limits (over & above limits) l In the form of CC/non l Valid till next renewalfund-based limits l Valid till renewal of limits

IOB SME Insta fund l Adv/64/2011 -12 dt. 12 -09 -2011 l To meet bulk orders-exceptional cases l For existing SME units enjoying regular limits (over & above limits) l In the form of CC/non l Valid till next renewalfund-based limits l Valid till renewal of limits

Laghu Udayami Credit card scheme l Laghu Udhyami Credit Card Scheme: l Small Business, Retail Traders, Professionals, Self-employed etc. , l Maximum Rs. 2 lakhs/Hyp of stocks l No collateral security l Separate ledger / cheque leaves l LUCC (Adv/76/02 -02 -2002)

Laghu Udayami Credit card scheme l Laghu Udhyami Credit Card Scheme: l Small Business, Retail Traders, Professionals, Self-employed etc. , l Maximum Rs. 2 lakhs/Hyp of stocks l No collateral security l Separate ledger / cheque leaves l LUCC (Adv/76/02 -02 -2002)

CLCSS l Credit Linked Capital Subsidy Scheme (CLCSS) for Technology up-gradation for Small and Medium Enterprises l (Adv/424/2005 -2006) l Validity up to year 2012 l Maximum limit Rs. 100 lakhs l Subsidy : 15%

CLCSS l Credit Linked Capital Subsidy Scheme (CLCSS) for Technology up-gradation for Small and Medium Enterprises l (Adv/424/2005 -2006) l Validity up to year 2012 l Maximum limit Rs. 100 lakhs l Subsidy : 15%

MSME Finance l SIDBI and NABARD – implementing agencies l Adv/424/2005 -2006 dated 13 -10 -2005 l Adv/298/2003 -2004 dated 26 -02 -2004 l Adv/285/2003 -2004 dated 14 -01 -2004

MSME Finance l SIDBI and NABARD – implementing agencies l Adv/424/2005 -2006 dated 13 -10 -2005 l Adv/298/2003 -2004 dated 26 -02 -2004 l Adv/285/2003 -2004 dated 14 -01 -2004