f65aa3ddf1b95de64a775396e547ba47.ppt

- Количество слайдов: 26

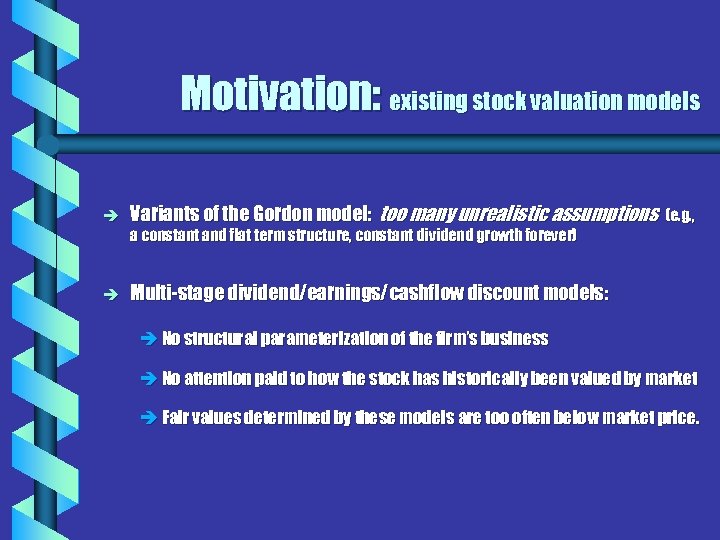

Motivation: existing stock valuation models è Variants of the Gordon model: too many unrealistic assumptions a constant and flat term structure, constant dividend growth forever) è (e. g. , Multi-stage dividend/earnings/cashflow discount models: è No structural parameterization of the firm’s business è No attention paid to how the stock has historically been valued by market è Fair values determined by these models are too often below market price.

Motivation: existing stock valuation models è Variants of the Gordon model: too many unrealistic assumptions a constant and flat term structure, constant dividend growth forever) è (e. g. , Multi-stage dividend/earnings/cashflow discount models: è No structural parameterization of the firm’s business è No attention paid to how the stock has historically been valued by market è Fair values determined by these models are too often below market price.

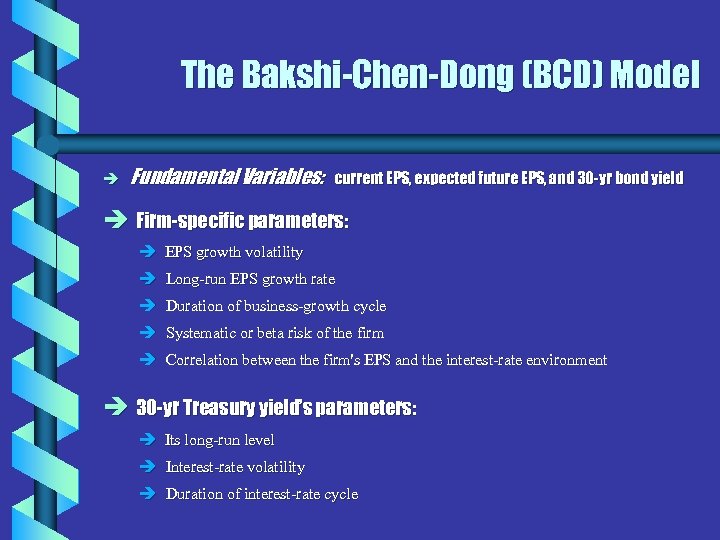

The Bakshi-Chen-Dong (BCD) Model è Fundamental Variables: current EPS, expected future EPS, and 30 -yr bond yield è Firm-specific parameters: è EPS growth volatility è Long-run EPS growth rate è Duration of business-growth cycle è Systematic or beta risk of the firm è Correlation between the firm's EPS and the interest-rate environment è 30 -yr Treasury yield’s parameters: è Its long-run level è Interest-rate volatility è Duration of interest-rate cycle

The Bakshi-Chen-Dong (BCD) Model è Fundamental Variables: current EPS, expected future EPS, and 30 -yr bond yield è Firm-specific parameters: è EPS growth volatility è Long-run EPS growth rate è Duration of business-growth cycle è Systematic or beta risk of the firm è Correlation between the firm's EPS and the interest-rate environment è 30 -yr Treasury yield’s parameters: è Its long-run level è Interest-rate volatility è Duration of interest-rate cycle

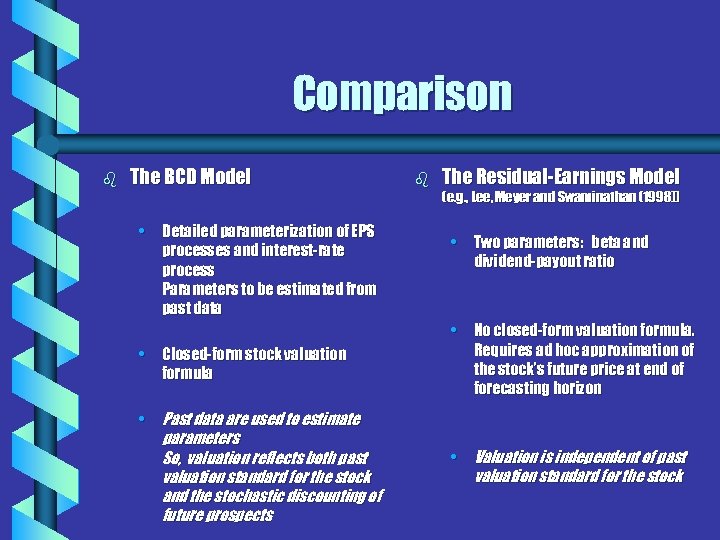

Comparison b The BCD Model • Detailed parameterization of EPS processes and interest-rate process Parameters to be estimated from past data b The Residual-Earnings Model (e. g. , Lee, Meyer and Swaminathan (1998)) • Two parameters: beta and dividend-payout ratio • Closed-form stock valuation formula • No closed-form valuation formula. Requires ad hoc approximation of the stock’s future price at end of forecasting horizon • Past data are used to estimate parameters So, valuation reflects both past valuation standard for the stock and the stochastic discounting of future prospects • Valuation is independent of past valuation standard for the stock

Comparison b The BCD Model • Detailed parameterization of EPS processes and interest-rate process Parameters to be estimated from past data b The Residual-Earnings Model (e. g. , Lee, Meyer and Swaminathan (1998)) • Two parameters: beta and dividend-payout ratio • Closed-form stock valuation formula • No closed-form valuation formula. Requires ad hoc approximation of the stock’s future price at end of forecasting horizon • Past data are used to estimate parameters So, valuation reflects both past valuation standard for the stock and the stochastic discounting of future prospects • Valuation is independent of past valuation standard for the stock

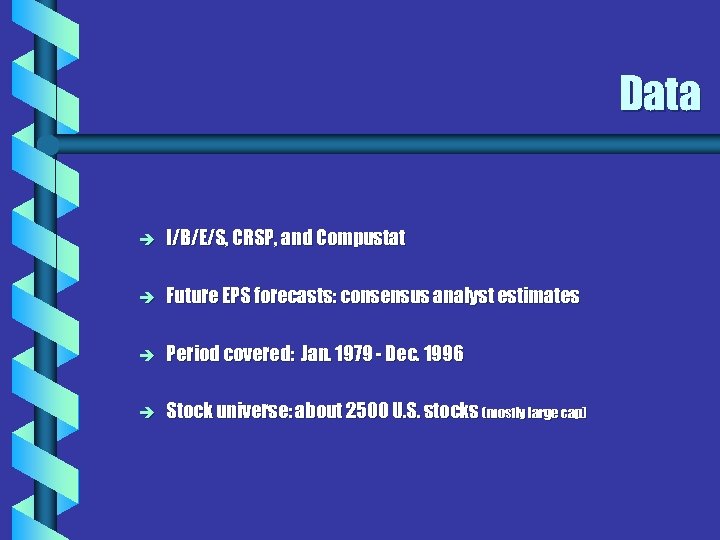

Data è I/B/E/S, CRSP, and Compustat è Future EPS forecasts: consensus analyst estimates è Period covered: Jan. 1979 - Dec. 1996 è Stock universe: about 2500 U. S. stocks (mostly large cap)

Data è I/B/E/S, CRSP, and Compustat è Future EPS forecasts: consensus analyst estimates è Period covered: Jan. 1979 - Dec. 1996 è Stock universe: about 2500 U. S. stocks (mostly large cap)

What Constitutes a Good Stock-Selection Measure? è Mean-reverting, è Not too persistent, è High predictive power of future stock performance so that if too low, you can buy the stock, counting on the measure to go back to its norm. e. g. , if book/market ratio is too persistent, you will not want to buy a stock just because it has a high B/M ratio. You would like fast mean-reversion

What Constitutes a Good Stock-Selection Measure? è Mean-reverting, è Not too persistent, è High predictive power of future stock performance so that if too low, you can buy the stock, counting on the measure to go back to its norm. e. g. , if book/market ratio is too persistent, you will not want to buy a stock just because it has a high B/M ratio. You would like fast mean-reversion

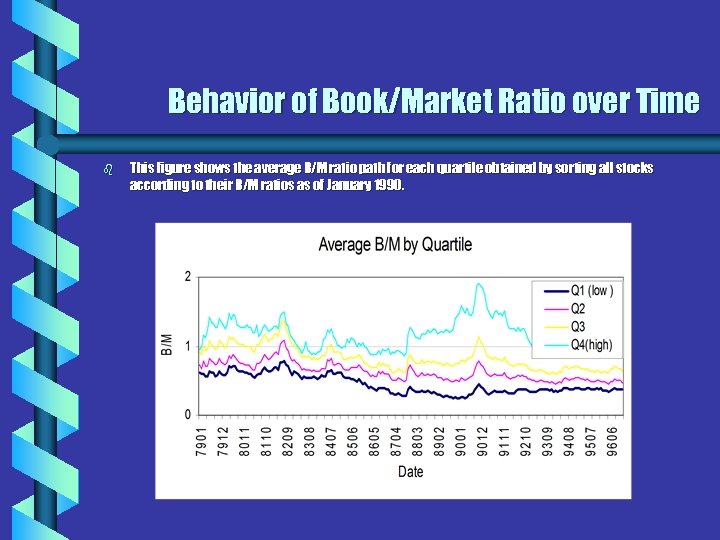

Behavior of Book/Market Ratio over Time b This figure shows the average B/M ratio path for each quartile obtained by sorting all stocks according to their B/M ratios as of January 1990.

Behavior of Book/Market Ratio over Time b This figure shows the average B/M ratio path for each quartile obtained by sorting all stocks according to their B/M ratios as of January 1990.

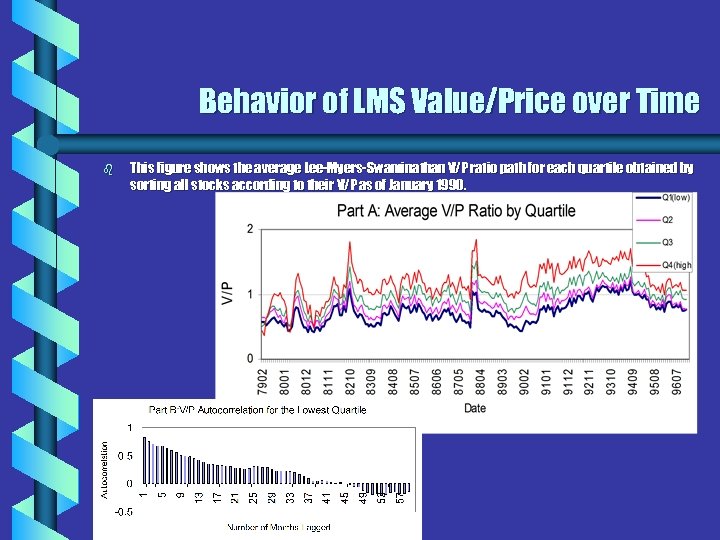

Behavior of LMS Value/Price over Time b This figure shows the average Lee-Myers-Swaminathan V/P ratio path for each quartile obtained by sorting all stocks according to their V/P as of January 1990.

Behavior of LMS Value/Price over Time b This figure shows the average Lee-Myers-Swaminathan V/P ratio path for each quartile obtained by sorting all stocks according to their V/P as of January 1990.

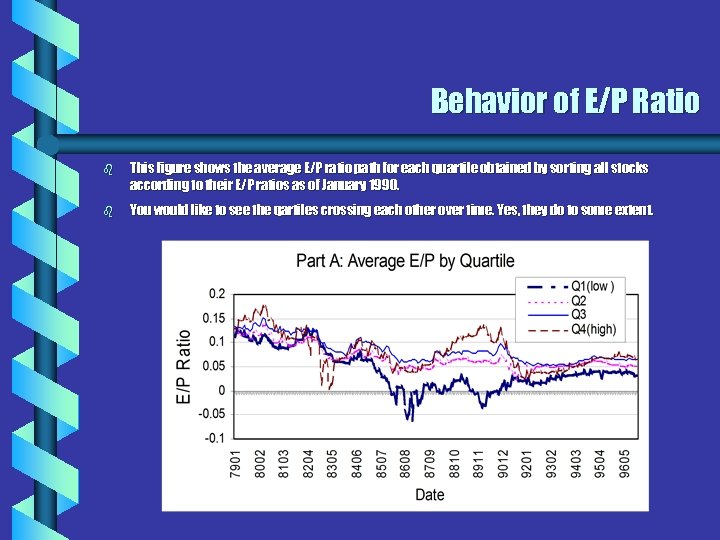

Behavior of E/P Ratio b This figure shows the average E/P ratio path for each quartile obtained by sorting all stocks according to their E/P ratios as of January 1990. b You would like to see the qartiles crossing each other over time. Yes, they do to some extent.

Behavior of E/P Ratio b This figure shows the average E/P ratio path for each quartile obtained by sorting all stocks according to their E/P ratios as of January 1990. b You would like to see the qartiles crossing each other over time. Yes, they do to some extent.

BCD Model Mispricing è Step 1: use past 2 -yr data to estimate model parameters for è Step 2: use current EPS, 1 -yr-forward EPS forecast and 30 -yr è Mispricing = [market price - model price] / model price è Thus, a negative mispricing means an undervalued stock, and so on. the stock yield, plus the estimated parameters, to compute the stock’s current model price (out of sample)

BCD Model Mispricing è Step 1: use past 2 -yr data to estimate model parameters for è Step 2: use current EPS, 1 -yr-forward EPS forecast and 30 -yr è Mispricing = [market price - model price] / model price è Thus, a negative mispricing means an undervalued stock, and so on. the stock yield, plus the estimated parameters, to compute the stock’s current model price (out of sample)

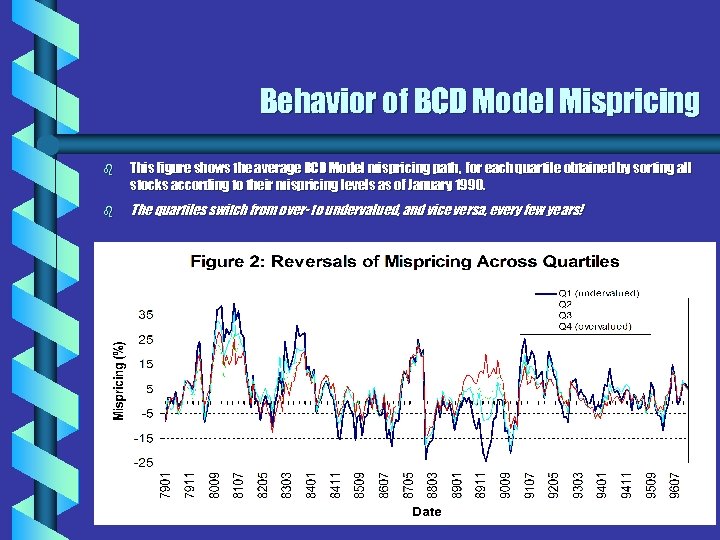

Behavior of BCD Model Mispricing b This figure shows the average BCD Model mispricing path, for each quartile obtained by sorting all stocks according to their mispricing levels as of January 1990. b The quartiles switch from over- to undervalued, and vice versa, every few years!

Behavior of BCD Model Mispricing b This figure shows the average BCD Model mispricing path, for each quartile obtained by sorting all stocks according to their mispricing levels as of January 1990. b The quartiles switch from over- to undervalued, and vice versa, every few years!

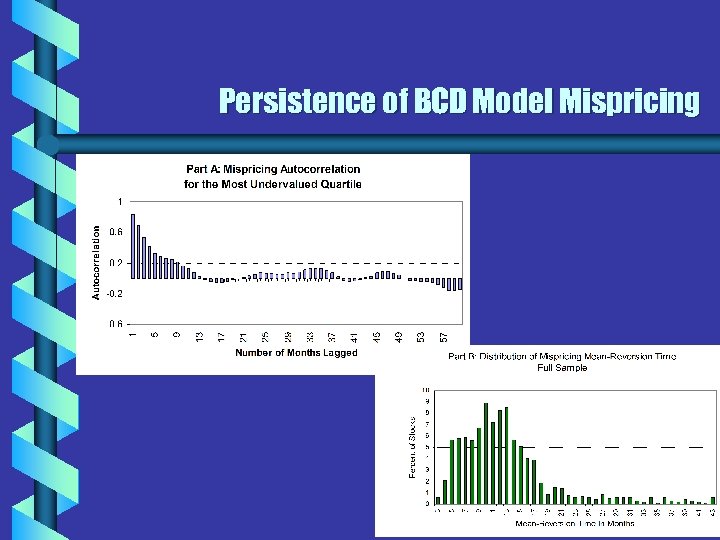

Persistence of BCD Model Mispricing

Persistence of BCD Model Mispricing

A Small Summary è BCD Model mispricing is the least persistent over time and mean-reverting the fastest è It takes about 1. 5 years for a group of stocks to go from most over - to most underpriced, or the reverse è P/E ratio is the second least persistent. è High P/E stocks do not always have the highest P/E. è B/M and V/P are the most persistent. è Stocks with the highest B/M seem to be always so. Low B/M stocks seem to always have low B/M.

A Small Summary è BCD Model mispricing is the least persistent over time and mean-reverting the fastest è It takes about 1. 5 years for a group of stocks to go from most over - to most underpriced, or the reverse è P/E ratio is the second least persistent. è High P/E stocks do not always have the highest P/E. è B/M and V/P are the most persistent. è Stocks with the highest B/M seem to be always so. Low B/M stocks seem to always have low B/M.

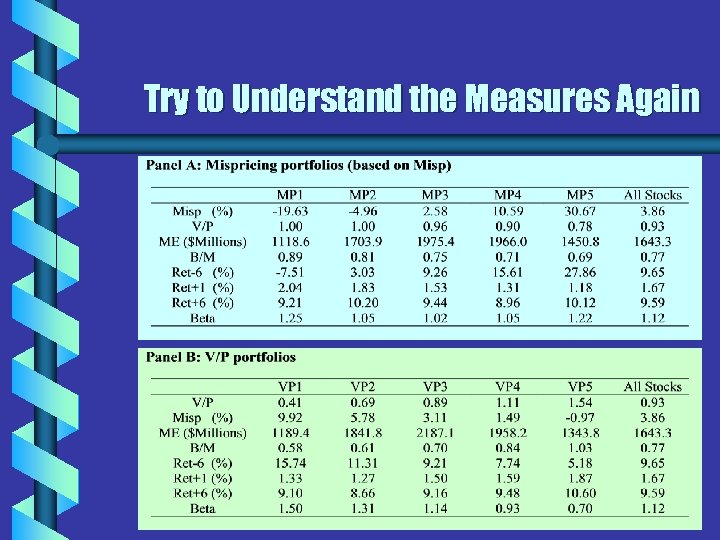

Try to Understand the Measures Again

Try to Understand the Measures Again

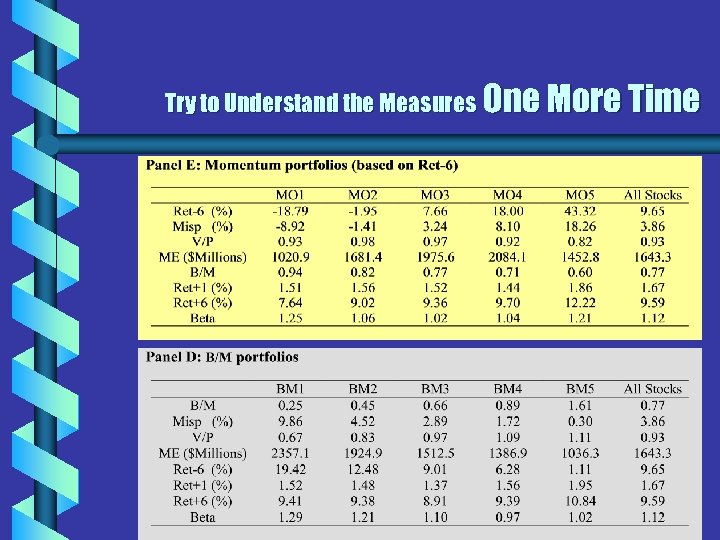

Try to Understand the Measures One More Time

Try to Understand the Measures One More Time

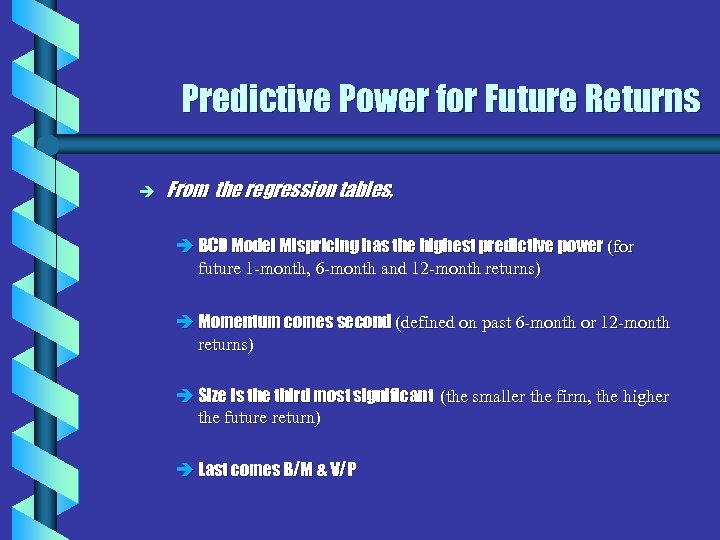

Predictive Power for Future Returns è From the regression tables, è BCD Model Mispricing has the highest predictive power (for future 1 -month, 6 -month and 12 -month returns) è Momentum comes second (defined on past 6 -month or 12 -month returns) è Size is the third most significant (the smaller the firm, the higher the future return) è Last comes B/M & V/P

Predictive Power for Future Returns è From the regression tables, è BCD Model Mispricing has the highest predictive power (for future 1 -month, 6 -month and 12 -month returns) è Momentum comes second (defined on past 6 -month or 12 -month returns) è Size is the third most significant (the smaller the firm, the higher the future return) è Last comes B/M & V/P

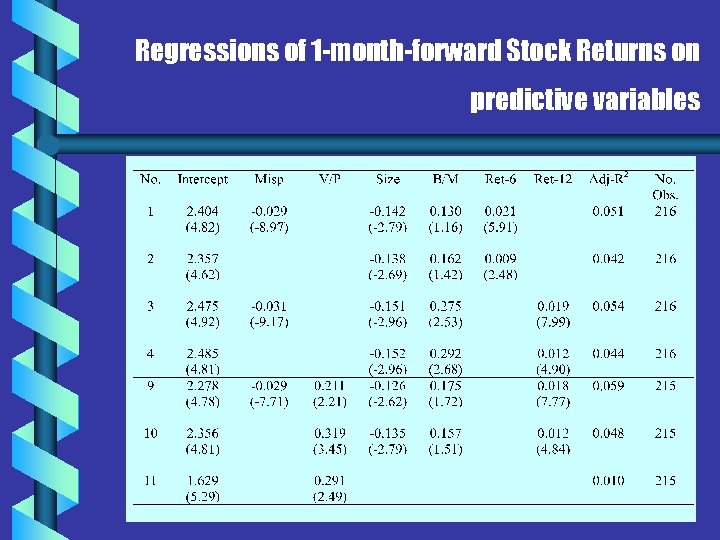

Regressions of 1 -month-forward Stock Returns on predictive variables

Regressions of 1 -month-forward Stock Returns on predictive variables

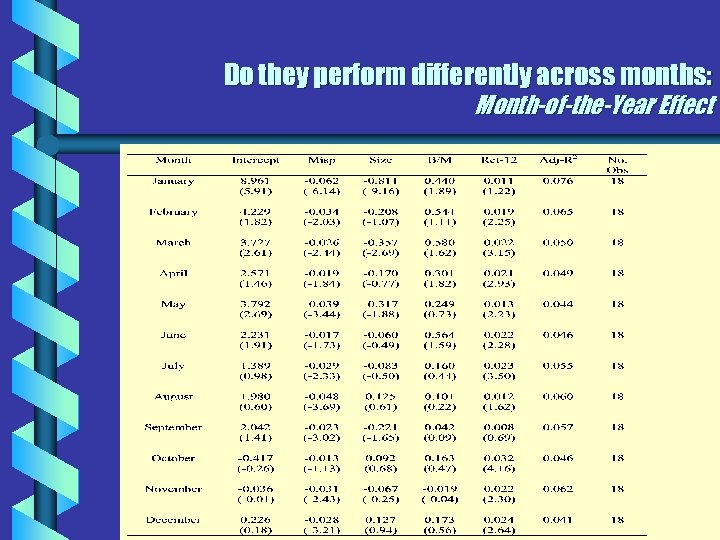

Do they perform differently across months: Month-of-the-Year Effect

Do they perform differently across months: Month-of-the-Year Effect

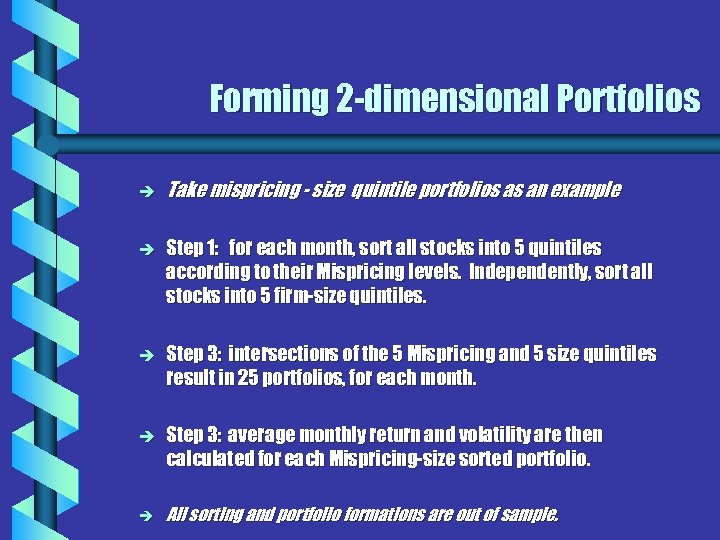

Forming 2 -dimensional Portfolios è Take mispricing - size quintile portfolios as an example è Step 1: for each month, sort all stocks into 5 quintiles according to their Mispricing levels. Independently, sort all stocks into 5 firm-size quintiles. è Step 3: intersections of the 5 Mispricing and 5 size quintiles result in 25 portfolios, for each month. è Step 3: average monthly return and volatility are then calculated for each Mispricing-size sorted portfolio. è All sorting and portfolio formations are out of sample.

Forming 2 -dimensional Portfolios è Take mispricing - size quintile portfolios as an example è Step 1: for each month, sort all stocks into 5 quintiles according to their Mispricing levels. Independently, sort all stocks into 5 firm-size quintiles. è Step 3: intersections of the 5 Mispricing and 5 size quintiles result in 25 portfolios, for each month. è Step 3: average monthly return and volatility are then calculated for each Mispricing-size sorted portfolio. è All sorting and portfolio formations are out of sample.

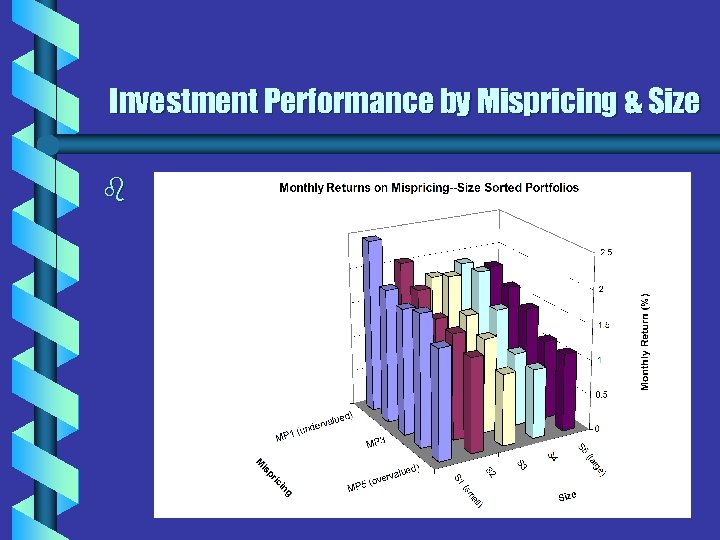

Investment Performance by Mispricing & Size b

Investment Performance by Mispricing & Size b

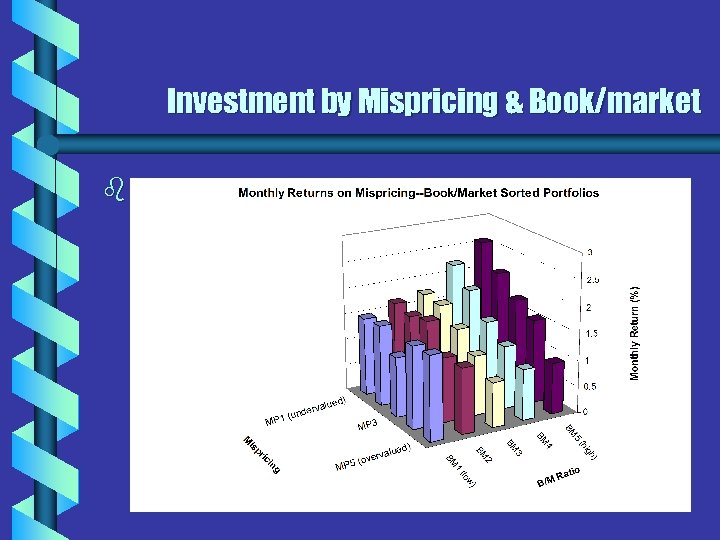

Investment by Mispricing & Book/market b

Investment by Mispricing & Book/market b

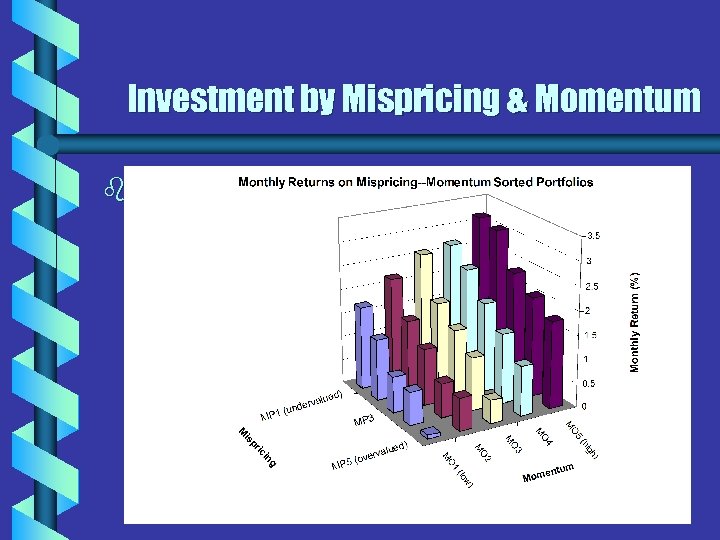

Investment by Mispricing & Momentum b

Investment by Mispricing & Momentum b

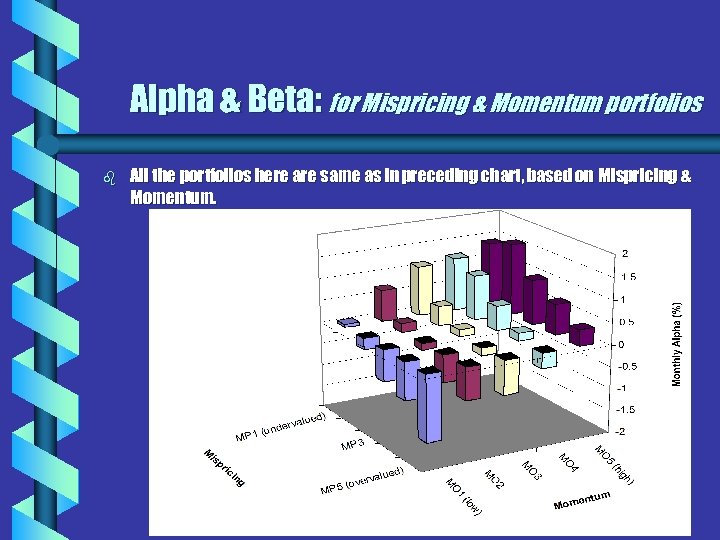

Alpha & Beta: for Mispricing & Momentum portfolios b All the portfolios here are same as in preceding chart, based on Mispricing & Momentum.

Alpha & Beta: for Mispricing & Momentum portfolios b All the portfolios here are same as in preceding chart, based on Mispricing & Momentum.

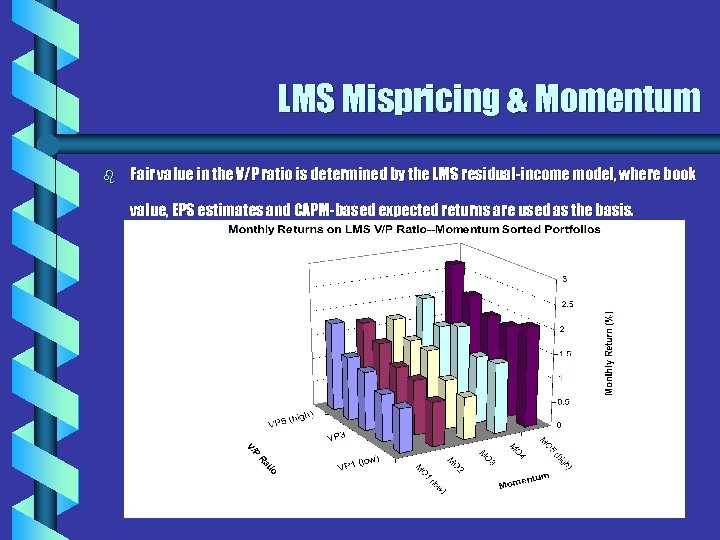

LMS Mispricing & Momentum b Fair value in the V/P ratio is determined by the LMS residual-income model, where book value, EPS estimates and CAPM-based expected returns are used as the basis.

LMS Mispricing & Momentum b Fair value in the V/P ratio is determined by the LMS residual-income model, where book value, EPS estimates and CAPM-based expected returns are used as the basis.

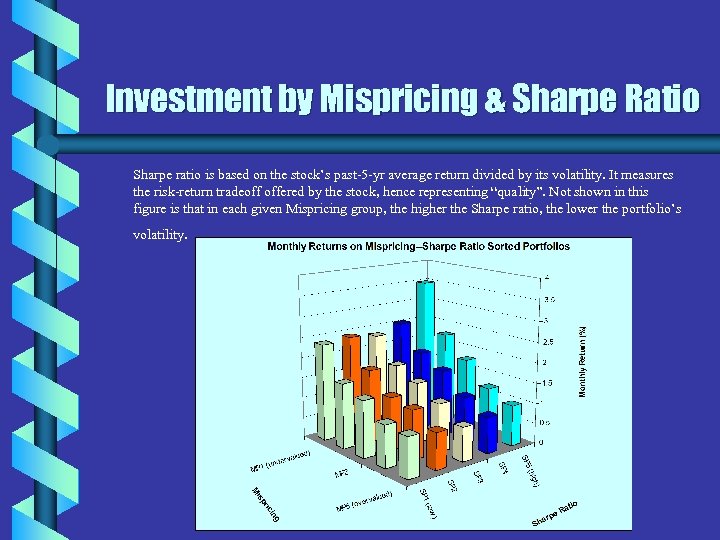

Investment by Mispricing & Sharpe Ratio Sharpe ratio is based on the stock’s past-5 -yr average return divided by its volatility. It measures the risk-return tradeoff offered by the stock, hence representing “quality”. Not shown in this figure is that in each given Mispricing group, the higher the Sharpe ratio, the lower the portfolio’s volatility.

Investment by Mispricing & Sharpe Ratio Sharpe ratio is based on the stock’s past-5 -yr average return divided by its volatility. It measures the risk-return tradeoff offered by the stock, hence representing “quality”. Not shown in this figure is that in each given Mispricing group, the higher the Sharpe ratio, the lower the portfolio’s volatility.

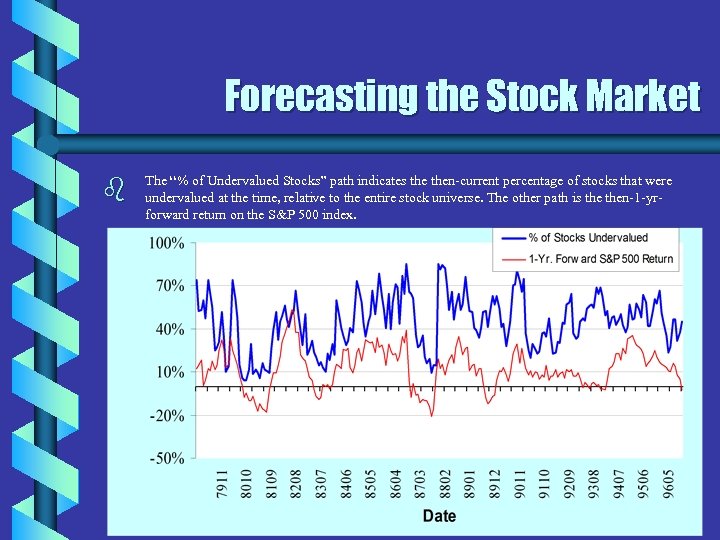

Forecasting the Stock Market b The “% of Undervalued Stocks” path indicates then-current percentage of stocks that were undervalued at the time, relative to the entire stock universe. The other path is then-1 -yrforward return on the S&P 500 index.

Forecasting the Stock Market b The “% of Undervalued Stocks” path indicates then-current percentage of stocks that were undervalued at the time, relative to the entire stock universe. The other path is then-1 -yrforward return on the S&P 500 index.

Concluding Remarks è BCD Mispricing is strongly mean-reverting è overvalued => undervalued => overvalued => undervalued …. . è BCD Mispricing shows persistent winner-loser reversals (once every 1. 5 years or so) è The winning strategy: è “ BCD Valuation + Momentum + Size ”

Concluding Remarks è BCD Mispricing is strongly mean-reverting è overvalued => undervalued => overvalued => undervalued …. . è BCD Mispricing shows persistent winner-loser reversals (once every 1. 5 years or so) è The winning strategy: è “ BCD Valuation + Momentum + Size ”