OW_BestRegards Final.pptx

- Количество слайдов: 21

Moscow 2014

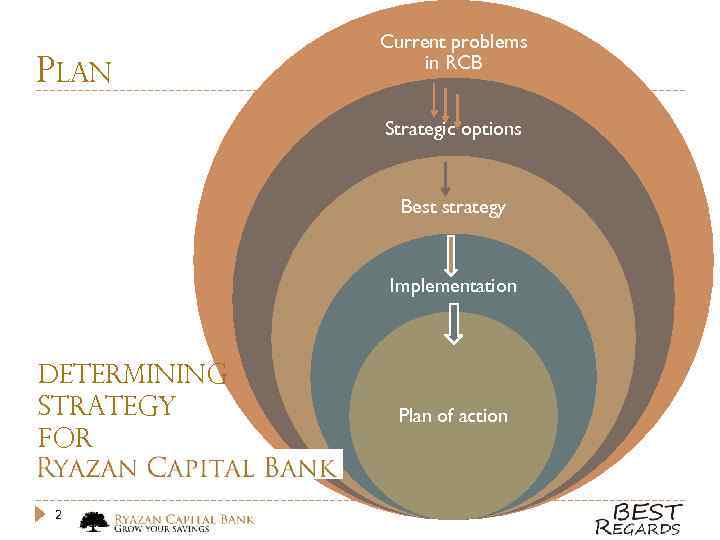

PLAN Current problems in RCB Strategic options Best strategy Implementation Determining strategy for 2 Plan of action

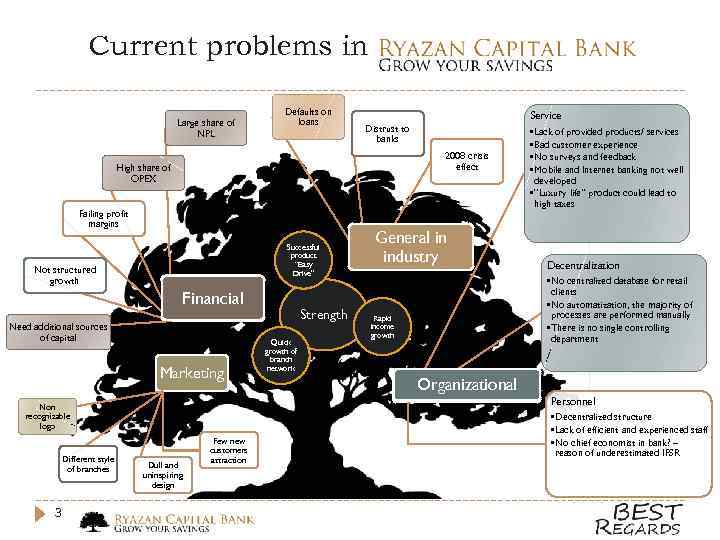

Current problems in Large share of NPL Defaults on loans Distrust to banks 2008 crisis effect High share of OPEX developed • “Luxury life” product could lead to high taxes Failing profit margins Successful product “Easy Drive” Not structured growth Financial Need additional sources of capital Marketing Non recognizable logo Different style of branches 3 Service • Lack of provided products/ services • Bad customer experience • No surveys and feedback • Mobile and Internet banking not well Dull and uninspiring design Few new customers attraction Strength Quick growth of branch network General in industry Decentralization • No centralized database for retail clients • No automatization, the majority of processes are performed manually • There is no single controlling department Rapid income growth Organizational Personnel • Decentralized structure • Lack of efficient and experienced staff • No chief economist in bank? – reason of underestimated IFSR

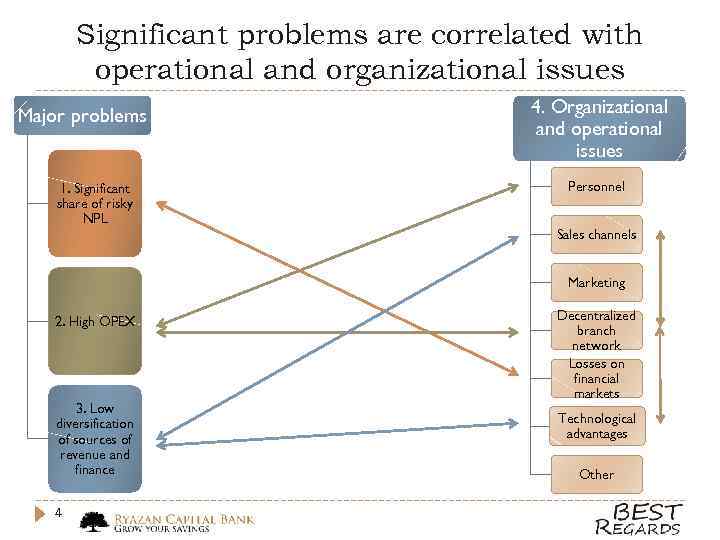

Significant problems are correlated with operational and organizational issues Major problems 1. Significant share of risky NPL 4. Organizational and operational issues Personnel Sales channels Marketing 2. High OPEX 3. Low diversification of sources of revenue and finance 4 Decentralized branch network Losses on financial markets Technological advantages Other

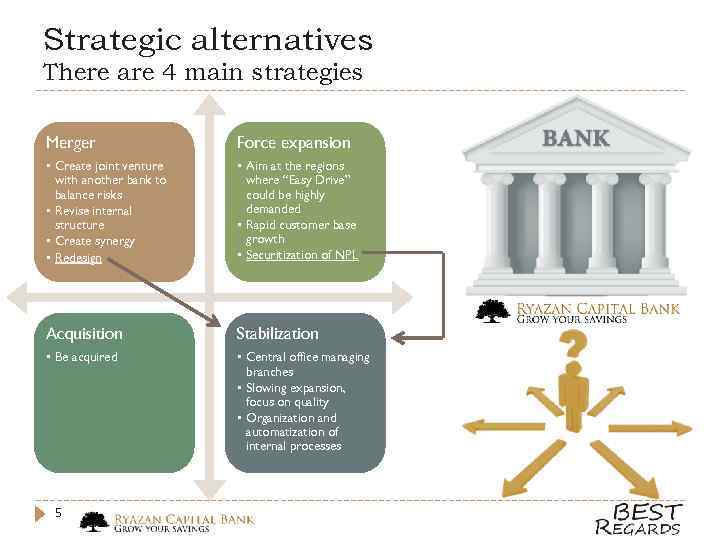

Strategic alternatives There are 4 main strategies Merger Force expansion • Create joint venture with another bank to balance risks • Revise internal structure • Create synergy • Redesign • Aim at the regions where “Easy Drive” could be highly demanded • Rapid customer base growth • Securitization of NPL Acquisition Stabilization • Be acquired • Central office managing branches • Slowing expansion, focus on quality • Organization and automatization of internal processes 5

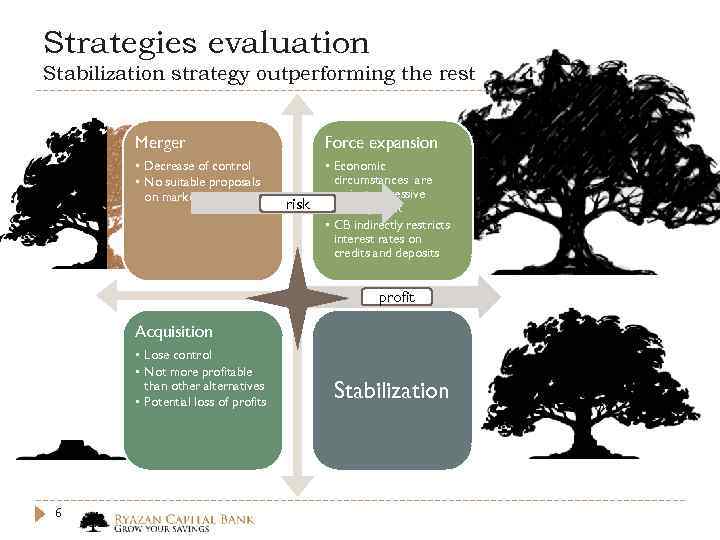

Strategies evaluation Stabilization strategy outperforming the rest Merger Force expansion • Decrease of control • No suitable proposals on market • Economic circumstances are against aggressive development • CB indirectly restricts interest rates on credits and deposits risk profit Acquisition • Lose control • Not more profitable than other alternatives • Potential loss of profits 6 Stabilization

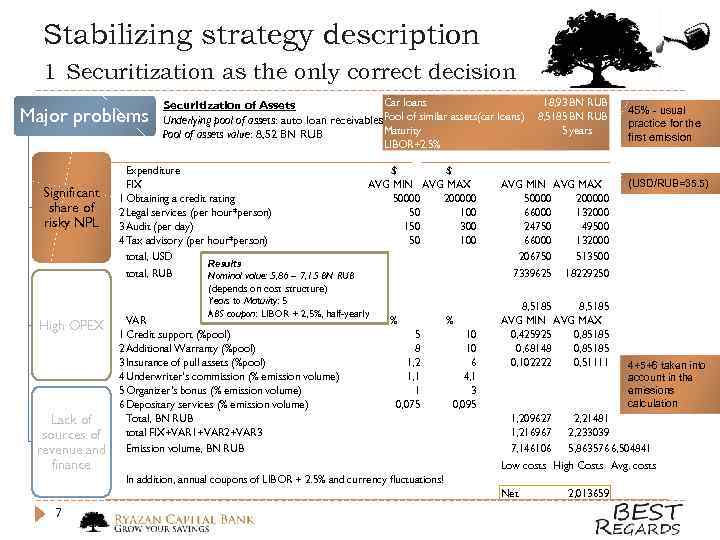

Stabilizing strategy description 1 Securitization as the only correct decision Major problems Car loans Securitization of Assets Underlying pool of assets: auto loan receivables. Pool of similar assets(car loans) Maturity Pool of assets value: 8, 52 BN RUB 18, 93 BN RUB 8, 5185 BN RUB 5 years LIBOR+2. 5% Significant share of risky NPL High OPEX Lack of sources of revenue and finance Expenditure $ $ FIX AVG MIN AVG MAX 1 Obtaining a credit rating 50000 200000 2 Legal services (per hour*person) 50 100 3 Audit (per day) 150 300 4 Tax advisory (per hour*person) 50 100 total, USD Results total, RUB Nominal value: 5, 86 – 7, 15 BN RUB (depends on cost structure) Years to Maturity: 5 ABS coupon: LIBOR + 2, 5%, half-yearly VAR % % 1 Credit support (%pool) 5 10 2 Additional Warranty (%pool) 8 10 3 Insurance of pull assets (%pool) 1, 2 6 4 Underwriter’s commission (% emission volume) 1, 1 4, 1 5 Organizer's bonus (% emission volume) 1 3 6 Depositary services (% emission volume) 0, 075 0, 095 Total, BN RUB total FIX+VAR 1+VAR 2+VAR 3 Emission volume, BN RUB AVG MIN AVG MAX 50000 200000 66000 132000 24750 49500 66000 132000 206750 513500 7339625 18229250 8, 5185 AVG MIN AVG MAX 0, 425925 0, 85185 0, 68148 0, 85185 0, 102222 0, 51111 (USD/RUB=35. 5) 4+5+6 taken into account in the emissions calculation 1, 209627 2, 21481 1, 216967 2, 233039 7, 146106 5, 863576 6, 504841 Low costs High Costs Avg. costs In addition, annual coupons of LIBOR + 2. 5% and currency fluctuations! Net 7 45% - usual practice for the first emission 2, 013659

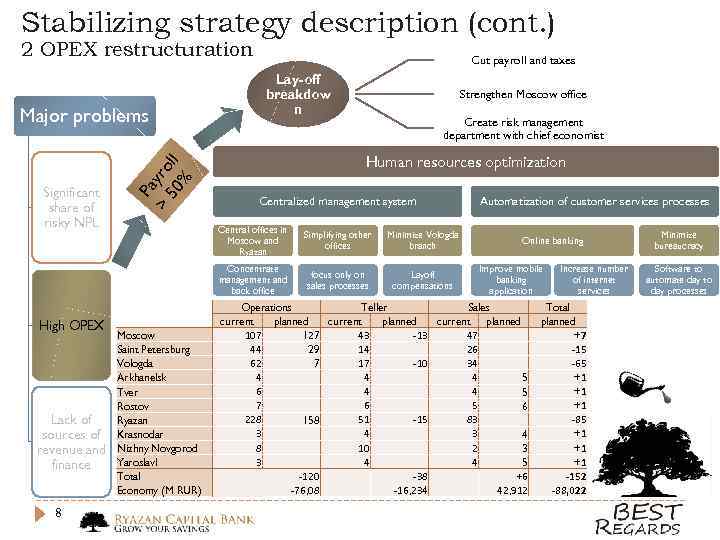

Stabilizing strategy description (cont. ) 2 OPEX restructuration Significant share of risky NPL Pa > yro 50 ll % Major problems Cut payroll and taxes Lay-off breakdow n Strengthen Moscow office Create risk management department with chief economist Human resources optimization Centralized management system Lack of sources of revenue and finance 8 Moscow Saint Petersburg Vologda Arkhanelsk Tver Rostov Ryazan Krasnodar Nizhny Novgorod Yaroslavl Total Economy (M RUR) Simplifying other offices Minimize Vologda branch Concentrate management and back office High OPEX Central offices in Moscow and Ryazan focus only on sales processes Layoff compensations Automatization of customer services processes Online banking Improve mobile banking application Operations Teller Sales current planned 107 127 43 -13 47 44 14 26 29 62 17 -10 34 7 4 4 4 5 6 4 4 5 7 6 5 6 228 51 -15 83 158 3 4 8 10 2 3 3 4 4 5 -120 -38 +6 -76, 08 -16, 234 42, 912 Increase number of internet services Total planned +7 -15 -65 +1 +1 +1 -85 +1 +1 +1 -152 -88, 022 Minimize bureaucracy Software to automate day to day processes

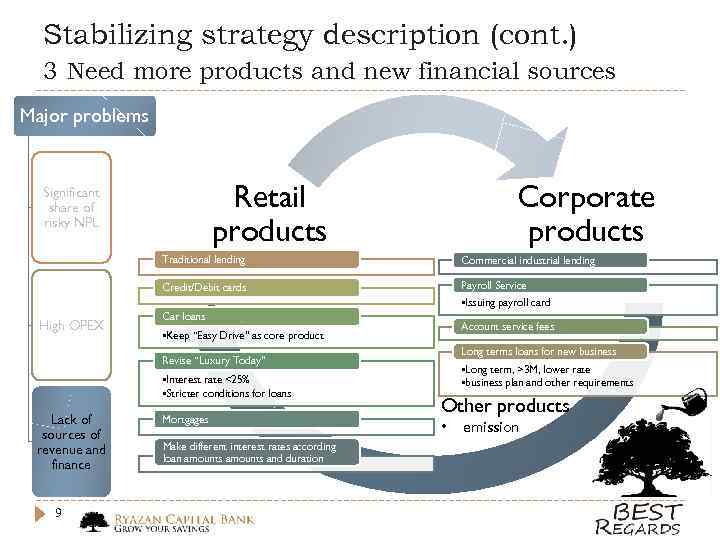

Stabilizing strategy description (cont. ) 3 Need more products and new financial sources Major problems Corporate products Retail products Significant share of risky NPL Traditional lending Commercial industrial lending Credit/Debit cards Payroll Service • Issuing payroll card High OPEX Car loans Account service fees • Keep “Easy Drive” as core product Long terms loans for new business Revise “Luxury Today” • Interest rate <25% • Stricter conditions for loans Lack of sources of revenue and finance 9 Mortgages Make different interest rates according loan amounts and duration • Long term, >3 M, lower rate • business plan and other requirements Other products • emission

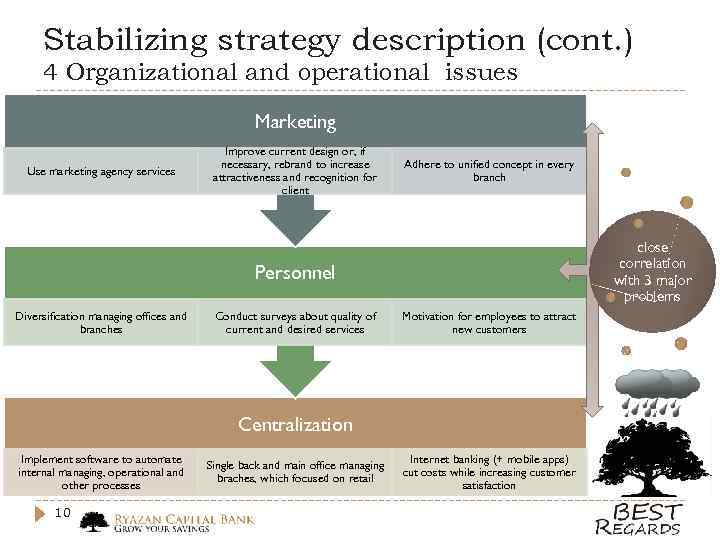

Stabilizing strategy description (cont. ) 4 Organizational and operational issues Marketing Use marketing agency services Improve current design or, if necessary, rebrand to increase attractiveness and recognition for client Adhere to unified concept in every branch close correlation with 3 major problems Personnel Diversification managing offices and branches Conduct surveys about quality of current and desired services Motivation for employees to attract new customers Centralization Implement software to automate internal managing, operational and other processes 10 Single back and main office managing braches, which focused on retail Internet banking (+ mobile apps) cut costs while increasing customer satisfaction

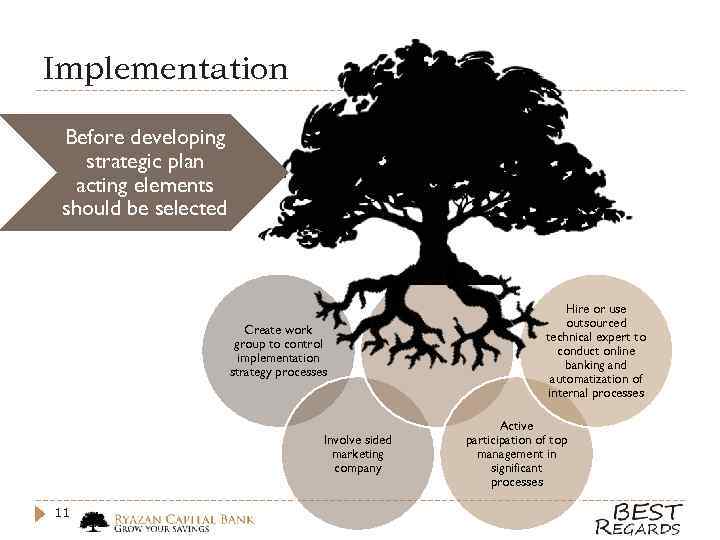

Implementation Before developing strategic plan acting elements should be selected Create work group to control implementation strategy processes Involve sided marketing company 11 Hire or use outsourced technical expert to conduct online banking and automatization of internal processes Active participation of top management in significant processes

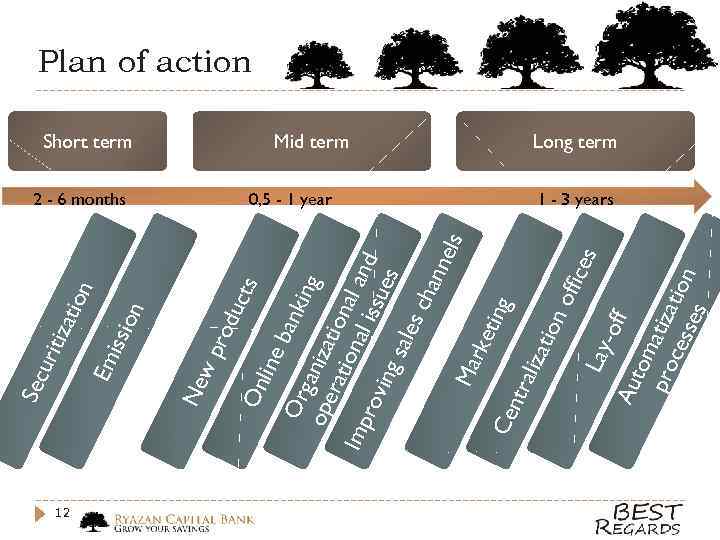

12 Short term 2 - 6 months Ne wp rod uct s On line ban Or kin gan g ope iza rat tion al a Imp al i rov ssu nd ing es sale s ch ann els Ma rke ting Ce ntr aliz atio no ffic es Lay -off Au tom pro atiza ces tion ses n issi o Em ion izat urit Sec Plan of action Mid term 0, 5 - 1 year Long term 1 - 3 years

Attention to details Make business successful 13

Appendix 14

Balance sheet, BN RUB Assets Cash and cash equivalents Placement with banks Loans to customers Loans to legal entities Large corporate clients SME Loans to individuals Car loans Corporate individuals Other Impairment allowance P&L Securities AFS securities Property, equipment and intangible assets Other assets Deferred tax assets Total assets Liabilities Money from CB Deposits and balances from banks Accounts and deposits from customers Dept securities issued Subordinated loans Other liabilities Capital 15 2012 38, 07 6, 49 0 29, 12 8, 7 6, 43 2, 27 20, 42 18, 93 0, 4 1, 09 (1, 88) 3, 07 0 0, 67 0, 6 0 38, 07 35, 39 2, 3 0, 33 24, 72 6, 4 1, 55 0, 09 2, 68 2011 30, 09 5, 11 0, 46 22, 07 8, 64 7, 03 1, 61 13, 43 12, 13 0, 34 0, 96 (0, 98) 2, 42 0 0, 55 0, 46 0 30, 09 27, 38 0 0, 05 23, 94 2, 9 0, 39 0, 1 2, 71 Diff. 7, 98 1, 38 -0, 46 7, 05 0, 06 -0, 66 6, 99 6, 8 0, 06 0, 13 -0, 9 0, 65 0 0, 12 0, 14 0 7, 98 8, 01 2, 3 0, 28 0, 78 3, 5 1, 16 -0, 01 -0, 03 Diff. % 27% -100% 32% 1% -9% 41% 52% 56% 18% 14% 92% 27% 0% 22% 30% 0% 27% 29% 100% 560% 3% 121% 297% -10% -1% Signif. sign sign imm sign imm sign sign imm Ref. in EXH 21 EXH 24 EXH 23 calc EXH 5 calc EXH 6 EXH 1 EXH 23 N/A EXH 24 calc N/A calc EXH 21 EXH 22 calc EXH 22 calc

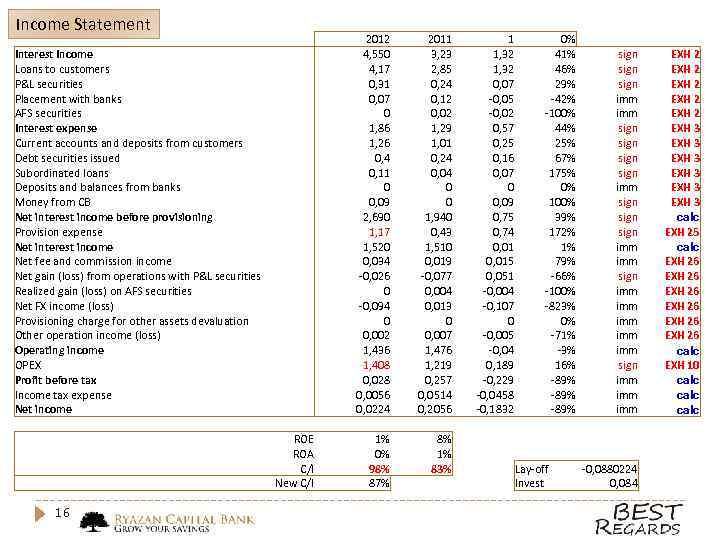

Income Statement 2012 4, 550 4, 17 0, 31 0, 07 0 1, 86 1, 26 0, 4 0, 11 0 0, 09 2, 690 1, 17 1, 520 0, 034 -0, 026 0 -0, 094 0 0, 002 1, 436 1, 408 0, 028 0, 0056 0, 0224 Interest Income Loans to customers P&L securities Placement with banks AFS securities Interest expense Current accounts and deposits from customers Debt securities issued Subordinated loans Deposits and balances from banks Money from CB Net interest income before provisioning Provision expense Net interest income Net fee and commission income Net gain (loss) from operations with P&L securities Realized gain (loss) on AFS securities Net FX income (loss) Provisioning charge for other assets devaluation Other operation income (loss) Operating income OPEX Profit before tax Income tax expense Net income ROE ROA C/I New C/I 16 2011 3, 23 2, 85 0, 24 0, 12 0, 02 1, 29 1, 01 0, 24 0, 04 0 0 1, 940 0, 43 1, 510 0, 019 -0, 077 0, 004 0, 013 0 0, 007 1, 476 1, 219 0, 257 0, 0514 0, 2056 1% 0% 98% 87% 8% 1% 83% 1 1, 32 0, 07 -0, 05 -0, 02 0, 57 0, 25 0, 16 0, 07 0 0, 09 0, 75 0, 74 0, 015 0, 051 -0, 004 -0, 107 0 -0, 005 -0, 04 0, 189 -0, 229 -0, 0458 -0, 1832 0% 41% 46% 29% -42% -100% 44% 25% 67% 175% 0% 100% 39% 172% 1% 79% -66% -100% -823% 0% -71% -3% 16% -89% Lay-off Invest sign sign imm sign imm imm sign imm imm -0, 0880224 0, 084 EXH 2 EXH 2 EXH 3 EXH 3 calc EXH 25 calc EXH 26 EXH 26 calc EXH 10 calc

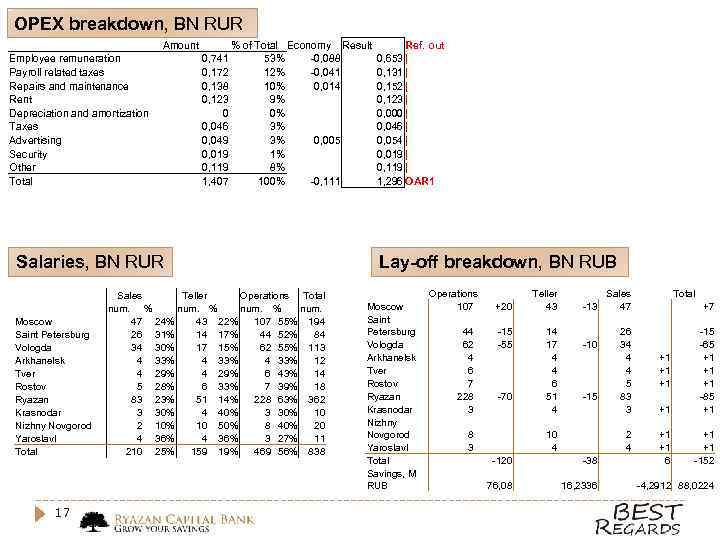

OPEX breakdown, BN RUR Employee remuneration Payroll related taxes Repairs and maintenance Rent Depreciation and amortization Taxes Advertising Security Other Total Amount 0, 741 0, 172 0, 138 0, 123 0 0, 046 0, 049 0, 019 0, 119 1, 407 % of Total Economy Result 53% -0, 088 12% -0, 041 10% 0, 014 9% 0% 3% 3% 0, 005 1% 8% 100% -0, 111 Salaries, BN RUR Moscow Saint Petersburg Vologda Arkhanelsk Tver Rostov Ryazan Krasnodar Nizhny Novgorod Yaroslavl Total 17 Sales Teller Operations Total num. % num. 47 24% 43 22% 107 55% 194 26 31% 14 17% 44 52% 84 34 30% 17 15% 62 55% 113 4 33% 12 4 29% 6 43% 14 5 28% 6 33% 7 39% 18 83 23% 51 14% 228 63% 362 3 30% 4 40% 3 30% 10 2 10% 10 50% 8 40% 20 4 36% 3 27% 11 210 25% 159 19% 469 56% 838 Ref. out 0, 653 | 0, 131 | 0, 152 | 0, 123 | 0, 000 | 0, 046 | 0, 054 | 0, 019 | 0, 119 | 1, 296 OAR 1 Lay-off breakdown, BN RUB Moscow Saint Petersburg Vologda Arkhanelsk Tver Rostov Ryazan Krasnodar Nizhny Novgorod Yaroslavl Total Savings, M RUB Operations 107 44 62 4 6 7 228 3 +20 -15 -55 -70 8 3 Teller 43 -13 14 17 4 4 6 51 4 -10 -15 10 4 Sales 47 26 34 4 4 5 83 3 2 4 -120 -38 76, 08 16, 2336 Total +7 +1 -15 -65 +1 +1 +1 -85 +1 +1 +1 6 +1 +1 -152 +1 +1 +1 -4, 2912 88, 0224

Employee remuneration in commercial banks industry, RUR Position Low level to 35600 59600 68000 38000 53200 46600 61000 70000 42600 53300 43000 40000 63300 55000 from 35600 59600 68000 38000 53200 46600 61000 70000 42600 53300 43000 40000 63300 55000 Avr. Oper. Teller Sales manager Customer manager Operationist Back office staff Treasury staff Loan manager Risk analyst Currency operationist Collector Mortgage staff Cards products manager Financial analyst Financial controller from 28000 34500 30000 25000 32000 30000 55000 330000 35000 32500 Medium level to 43200 84700 120000 51600 75000 63200 94000 85000 52200 76600 51300 50000 91600 77500 High level from 43200 84700 120000 51600 75000 63200 94000 85000 52200 76600 51300 50000 91600 77500 52833 http: //www. kausgroup. ru/knowledge/salaries/salary-finance/ Ref-in 18 Ref. out to 51000 OAR 2 110000 OAR 2 170000 65000 90000 80000 130000 100000 62000 100000 60000 1100000 OAR 2

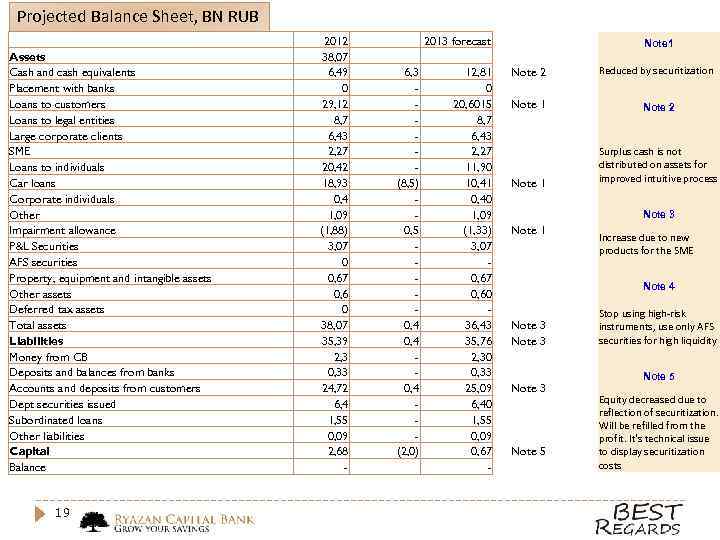

Projected Balance Sheet, BN RUB Assets Cash and cash equivalents Placement with banks Loans to customers Loans to legal entities Large corporate clients SME Loans to individuals Car loans Corporate individuals Other Impairment allowance P&L Securities AFS securities Property, equipment and intangible assets Other assets Deferred tax assets Total assets Liabilities Money from CB Deposits and balances from banks Accounts and deposits from customers Dept securities issued Subordinated loans Other liabilities Capital Balance 19 2012 38, 07 6, 49 0 29, 12 8, 7 6, 43 2, 27 20, 42 18, 93 0, 4 1, 09 (1, 88) 3, 07 0 0, 67 0, 6 0 38, 07 35, 39 2, 3 0, 33 24, 72 6, 4 1, 55 0, 09 2, 68 - 2013 forecast 6, 3 (8, 5) 0, 5 0, 4 (2, 0) 12, 81 0 20, 6015 8, 7 6, 43 2, 27 11, 90 10, 41 0, 40 1, 09 (1, 33) 3, 07 0, 60 36, 43 35, 76 2, 30 0, 33 25, 09 6, 40 1, 55 0, 09 0, 67 - Note 1 Note 2 Reduced by securitization Note 1 Note 2 Note 1 Surplus cash is not distributed on assets for improved intuitive process Note 3 Note 1 Increase due to new products for the SME Note 4 Note 3 Note 5 Stop using high-risk instruments, use only AFS securities for high liquidity Note 5 Equity decreased due to reflection of securitization. Will be refilled from the profit. It's technical issue to display securitization costs

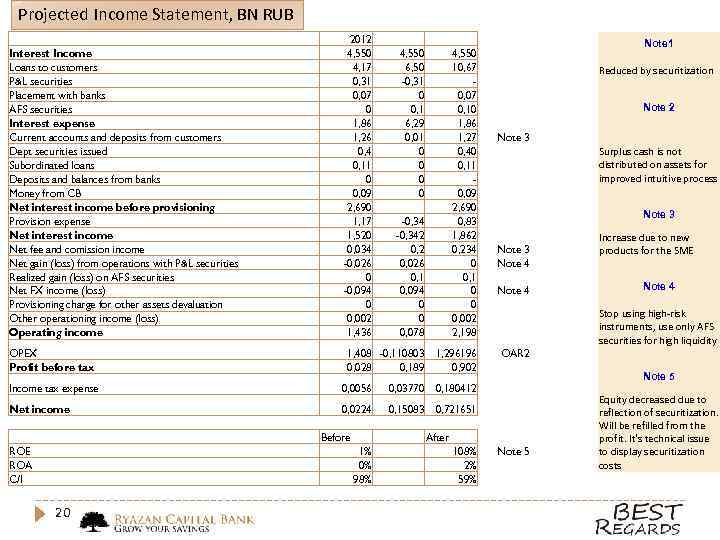

Projected Income Statement, BN RUB Interest Income Loans to customers P&L securities Placement with banks AFS securities Interest expense Current accounts and deposits from customers Dept securities issued Subordinated loans Deposits and balances from banks Money from CB Net interest income before provisioning Provision expense Net interest income Net fee and comission income Net gain (loss) from operations with P&L securities Realized gain (loss) on AFS securities Net FX income (loss) Provisioning charge for other assets devaluation Other operationing income (loss) Operating income OPEX Profit before tax 2012 4, 550 4, 17 0, 31 0, 07 0 1, 86 1, 26 0, 4 0, 11 0 0, 09 2, 690 1, 17 1, 520 0, 034 -0, 026 0 -0, 094 0 0, 002 1, 436 4, 550 6, 50 -0, 31 0 0, 1 6, 29 0, 01 0 0 -0, 342 0, 026 0, 1 0, 094 0 0 0, 078 4, 550 10, 67 0, 07 0, 10 1, 86 1, 27 0, 40 0, 11 0, 09 2, 690 0, 83 1, 862 0, 234 0 0, 1 0 0 0, 002 2, 198 1, 408 -0, 110803 0, 028 0, 189 1, 296196 0, 902 Income tax expense 0, 0056 0, 03770 0, 0224 0, 15083 Reduced by securitization Note 2 Note 3 Surplus cash is not distributed on assets for improved intuitive process Note 3 Note 4 Before Note 5 After 1% 0% 98% 20 108% 2% 59% Note 4 OAR 2 0, 721651 ROE ROA C/I Increase due to new products for the SME Stop using high-risk instruments, use only AFS securities for high liquidity 0, 180412 Net income Note 1 Note 5 Equity decreased due to reflection of securitization. Will be refilled from the profit. It's technical issue to display securitization costs

REFERENCE OLIVER WYMAN IMPACT. MAKE A BREAKTHROUGH. MAKE AN IMPACT. , 2014, Oliver Wyman Recruitment agency of unique specialists, 2014, 21 www. kaus-group. ru/knowledge/salaries/salary-finance/

OW_BestRegards Final.pptx