d4d92e1ad6a3914a855e6b2dd3047014.ppt

- Количество слайдов: 127

Mortgages & Mortgage-Backed Securities Part-1

Definition of a Mortgage n What is a mortgage? n n It is a loan that is secured by the pledge of a specific piece of real estate property. The borrower called the `mortgager’ pledges the property on account of the loan taken from the lender, who is known as the `mortgagee’.

Title vs Lien n When the property is pledged is the title to the property transferred to the lender. n It depends. n n In some states in the U. S. , this is actually the case. In other states, the lender merely has lien on the property that is pledged.

Mortgage Markets n These are markets where funds are borrowed to finance the acquisition of houses. n n A mortgage is a pledge of property to secure payment of a debt. Such loans are made by banks and financial institutions, and are collateralized by the property so acquired.

Mortgages n In 1990 the mortgage finance market in the U. S. was larger than the markets for U. S government securities and U. S. corporate bonds combined.

Importance n n n Why is the market for home loans important? One of the most important goals for many families is the acquisition of a home. Typically, such real estate purchases are financed by partly borrowing the funds required.

Importance (Cont…) n n Why do people aspire to own homes? An investment in a home serves as a long-term hedge against inflation. n n It has been observed that the market value of homes has risen substantially faster than the rate of inflation in the long run. Besides the interest paid on home loans is tax deductible. n This reduces the after-tax interest cost.

Disadvantages? n Owning a home is not without its negatives however. n n Homes are difficult to sell, that is the market is relatively illiquid compared to security markets. A home typically constitutes a family’s largest investment. n n This makes diversification of wealth difficult. Home values tend to fluctuate with the economy and with changes in their age and condition.

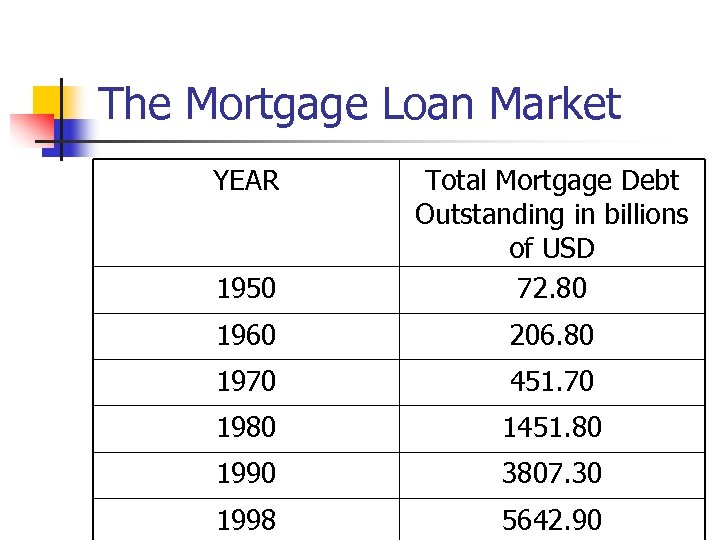

The Mortgage Loan Market YEAR 1950 Total Mortgage Debt Outstanding in billions of USD 72. 80 1960 206. 80 1970 451. 70 1980 1451. 80 1990 3807. 30 1998 5642. 90

Market (Cont…) n n In 1982 residential mortgages accounted for 82. 1% of the loans that were outstanding. The balance 17. 9% was on account of loans secured by business and farm properties.

A Standard Mortgage n The traditional mortgage loan is characterized by: n n n A 30 year period (in the U. S. ) A constant or level monthly payment (EMI) Such mortgages are called: n Level payment, fixed rate mortgages (FRM)

A Standard Mortgage (Cont…) n n n A standard mortgage is repaid by a series of constant monthly payments during its life. Each payment consists partly of principal and partly of interest repayment. The process of repayment in this fashion is called `Amortization’.

A Standard Mortgage (Cont…) n n n For a given loan amount, the higher the mortgage rate the greater will be the monthly payment. In the initial years most of the EMI consists of interest payment. As the mortgage progresses however, the EMIs will consist mainly of principal repayments.

Features of Amortized Loans n Mortgages are usually for 30 years (360 months). n n The interest component is equal to one twelfth the annual rate of interest multiplied by the amount outstanding at the beginning of the previous month. With the payment of each installment, the interest component will keep declining and the principal component will keep increasing.

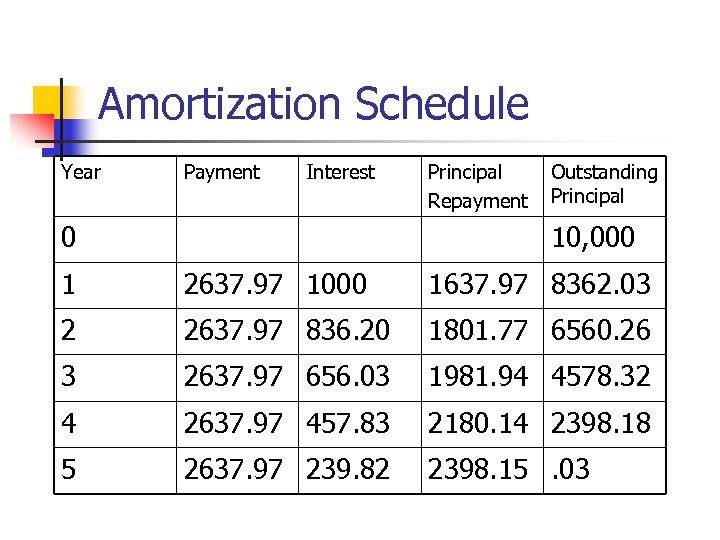

Features…(Cont…) n n The installment payments form an annuity whose present value is equal to the original loan amount. A Amortization Schedule is a table that shows the division of each payment into principal and interest, and the outstanding loan balance after each payment.

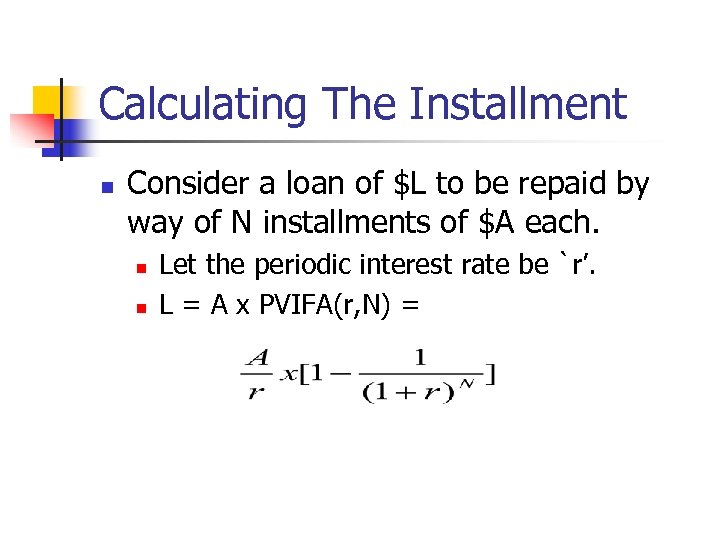

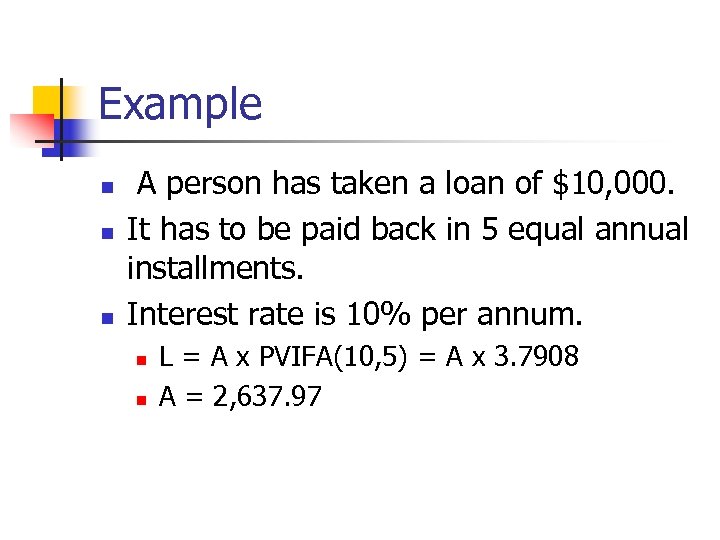

Calculating The Installment n Consider a loan of $L to be repaid by way of N installments of $A each. n n Let the periodic interest rate be `r’. L = A x PVIFA(r, N) =

Example n n n A person has taken a loan of $10, 000. It has to be paid back in 5 equal annual installments. Interest rate is 10% per annum. n n L = A x PVIFA(10, 5) = A x 3. 7908 A = 2, 637. 97

Amortization Schedule Year Payment Interest 0 Principal Repayment Outstanding Principal 10, 000 1 2637. 97 1000 1637. 97 8362. 03 2 2637. 97 836. 20 1801. 77 6560. 26 3 2637. 97 656. 03 1981. 94 4578. 32 4 2637. 97 457. 83 2180. 14 2398. 18 5 2637. 97 239. 82 2398. 15. 03

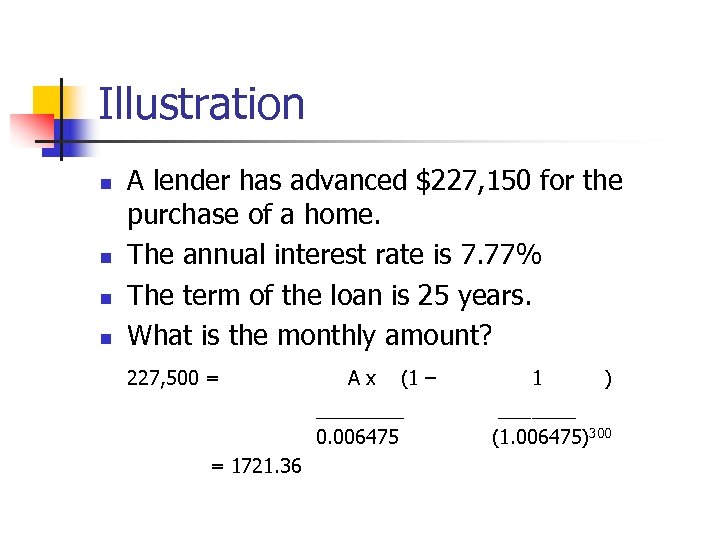

Illustration n n A lender has advanced $227, 150 for the purchase of a home. The annual interest rate is 7. 77% The term of the loan is 25 years. What is the monthly amount? 227, 500 = Ax (1 – ____ 0. 006475 = 1721. 36 1 ) _______ (1. 006475)300

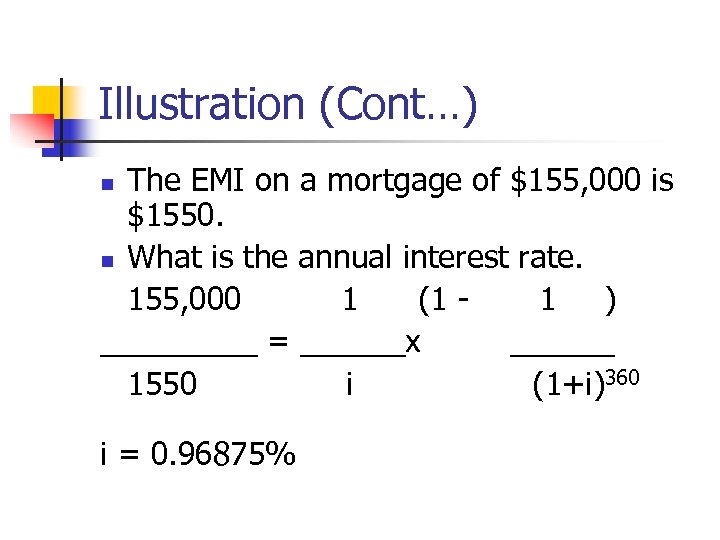

Illustration (Cont…) The EMI on a mortgage of $155, 000 is $1550. n What is the annual interest rate. 155, 000 1 (1 1 ) _____ = ______x ______ 1550 i (1+i)360 n i = 0. 96875%

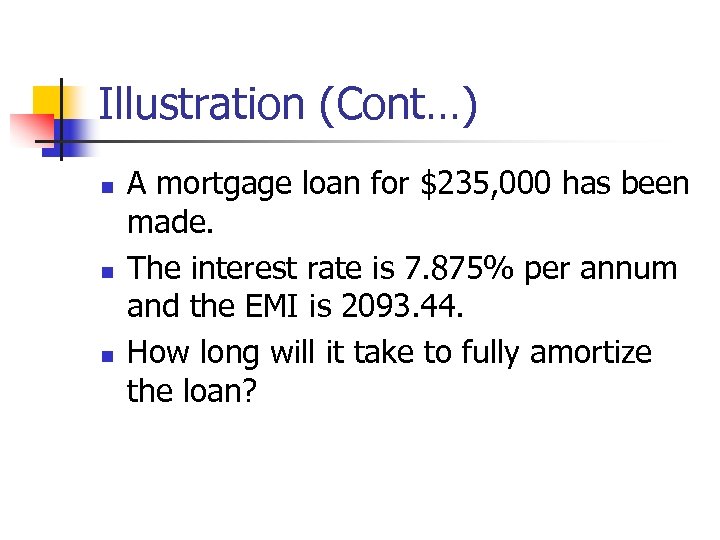

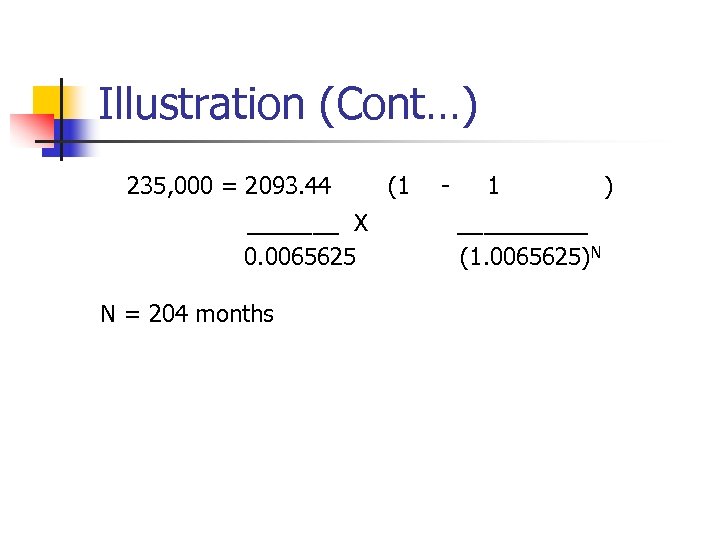

Illustration (Cont…) n n n A mortgage loan for $235, 000 has been made. The interest rate is 7. 875% per annum and the EMI is 2093. 44. How long will it take to fully amortize the loan?

Illustration (Cont…) 235, 000 = 2093. 44 _______ X 0. 0065625 N = 204 months (1 - 1 _____ (1. 0065625)N )

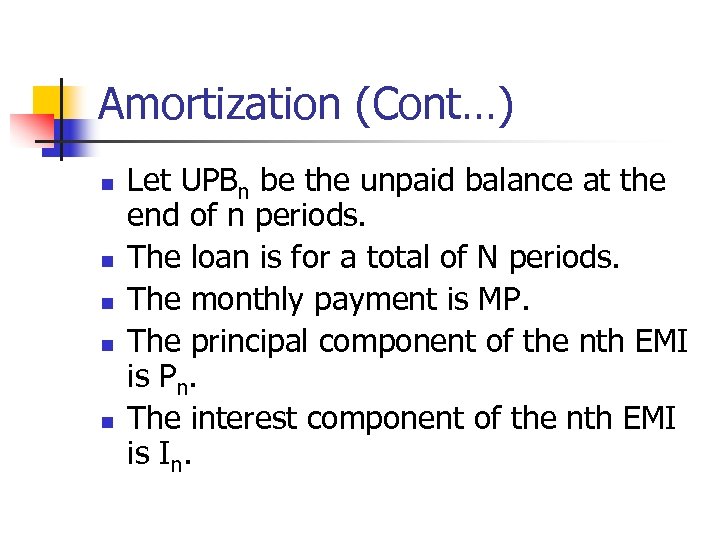

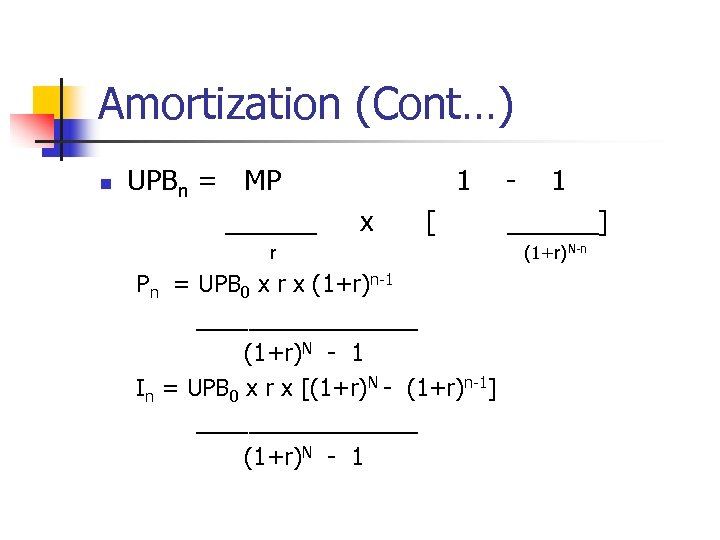

Amortization (Cont…) n n n Let UPBn be the unpaid balance at the end of n periods. The loan is for a total of N periods. The monthly payment is MP. The principal component of the nth EMI is Pn. The interest component of the nth EMI is In.

Amortization (Cont…) n UPBn = MP ______ 1 x [ r Pn = UPB 0 x r x (1+r)n-1 _________ (1+r)N - 1 In = UPB 0 x r x [(1+r)N - (1+r)n-1] _________ (1+r)N - 1 ______] (1+r)N-n

Illustration n n Consider a 30 year 8. 88% loan for $225, 000. Calculate the principal and interest components of the 180 th payment. P 180 = 471. 57 I 180 = 1319. 44

Bi-weekly Payment Mortgages n n Americans get paid on a bi-weekly basis, that is, once a fortnight. In a bi-weekly mortgage the EMI is calculated assuming that payments are made monthly. Half of the calculated EMI is the bi-weekly payment. Since there are 26 fortnights in a year the biweekly interest rate is 6/13 of the monthly rate.

The life of the mortgage is then calculated as follow. MP x PVIFA(r, M) = MP ___ x PVIFA(rα, N) 2 N = 545 fortnights Ξ 21 years n

Alternative Mortgage Structures n One alternative to a standard 30 year mortgage is a 15 year fixed rate mortgage. n n In this case the interest rate continues to be fixed. But the amortization period is 50% of that of a 30 year mortgage.

Alternative…(Cont…) n n Due to the shorter amortization period, the EMIs of the 15 year mortgage contain a larger percentage by way of principal repayments as compared to a 30 year mortgage. The faster repayment and the shorter maturity makes such 15 year loans attractive for lenders.

Alternative (Cont…) n n Hence 15 year mortgages tend to be offered at a lower rate as compared to a 30 year mortgage. Tax reforms in the U. S. also had an impact. n n When the marginal tax rate is lowered the deductibility of mortgage interest payments for tax purposes becomes less attractive. Thus the advantage of 30 year loans over 15 year loans was reduced.

Alternative…(Cont…) n n n The 1980 s in the U. S. were characterized by high inflation. Consequently, mortgage lending rates were also high. Due to high and uncertain inflation, lenders could not offer 30 year fixed rate loans.

Alternative…(Cont…) n It must be remembered that most lenders like banks were financing longterm mortgage loans with short-term deposits. n n Thus there was a asset-liability mismatch. Lenders therefore wanted to offer loans with shorter maturities.

Alternative…(Cont…) n n n From the borrowers’ perspective, due to higher interest rates, the EMIs were becoming large and unaffordable. This lead to the creation of ARMs or adjustable rate mortgages. In general an ARM has a 30 year amortization period n But interest rates are adjustable – usually on an annual basis.

Alternative…(Cont…) n n The interest rate adjustment is based on an index rate plus a spread called `margin’. The index may be a: n n T-bill rate Or a cost of fund index

Alternative…(Cont…) n n Although rates can be adjusted, usually there is a band within which changes can be made. A majority of ARMs have a cap

Alternative…(Cont…) n A Graduated Payment Mortgage (GPM) is also an alternative to an FRM. n n n A GPM has a 30 year maturity. But a lower EMI in the initial years as compared to an FRM. The interest rate on the loan will steadily rise for a specified period (so will the EMI) and will then level off.

Alternative…(Cont…) n n Because of lower payments in the earlier years, GPMs exhibit negative amortization. That is, in the earlier years, the EMIs are inadequate to cover even the interest that is due. n Consequently, instead of declining, the principal amount actually increases.

ARMs (Cont…) n n To induce borrowers to accept an ARM and to compensate them partially for future payment uncertainty, lenders offer them at a lower interest rate as compared to fixed rate mortgages. The initial rate is known as a Teaser Rate. n It is typically 50 -100 b. p below the rate for a fixed rate mortgage.

ARMs (Cont…) n n n Periodic interest rate caps and floors limit the amount by which the rate on the ARM may change. A cap fixes the upper limit while a floor fixes the lower limit. There are two types of Caps n n Periodic caps Lifetime caps

ARMs (Cont…) n There are two types of periodic caps n n n Rate caps and payment caps Rate caps limit the amount that the contract rate may increase or decrease at the reset date. The most common rate cap on an annual reset loan is 2%

ARMs (Cont…) n n n Payment caps are less common These limit the change in the monthly mortgage payment rather than in the interest rate on the reset date. Payment caps may lead to negative amortization.

ARMs (Cont…) n n n Lifetime caps and floors. These impose upper and lower limits on the contract rate that could be charged over the life of the loan. The lifetime cap is expressed in terms of the interest rate n n The cap is typically 5 -6%. Thus if the initial rate is 7% and the cap is 5% the maximum rate chargeable is 12%.

Mortgage Originators n n The entity that initiates the mortgage loan is called the Originators include: n n Commercial Banks Life Insurance Companies Pension Funds Savings & Loan Institutions or Thrifts

Origination (Cont…) n What does an originator look for? n He considers the following n Debt-to-Income Ratio n n The current income of the borrower is compared with the monthly expense incurred in connection with owning the house. These expenses are referred to as PITI. That is: n Monthly payment of principal plus interest n Property taxes n Insurance premia As a rule of thumb, the debt to income ratio should not exceed 25%.

Origination (Cont…) n In addition, the originator will consider the other long-term as well as short-term liabilities of the borrower. n A party who is substantially in debt would be offered a loan only if he were to have a lower debt to income ratio.

Origination (Cont…) n The credit history of the borrower is also a factor. n n This usually includes the payment history of the credit cards owned by the borrower, and other short-term loans taken by him. Property Appraisal is yet another factor. n n n The appraised market value of the house is also a key decision variable. As part of the loan application the value of the house as appraised by a professional property appraiser should be supplied. This value should be significantly higher than the amount that is sought to be borrowed.

Origination (Cont…) n The down payment is a key factor as well. n n Typically the lender will finance only 80 -90% of the cost of acquisition. The ratio of the loan amount to the purchase price is called the LTV – Loan to Value ratio.

Major Mortgage Lenders n Originators can be divided into three categories: n n n Commercial Banks Savings & Loans or Thrifts Mortgage Bankers

Lenders…(Cont…) n Commercial banks and thrifts are known as depository lenders n n That is they accept deposits from the public and make loans to homeowners Mortgage bankers are non-depository lenders n n They fund originations from short-term lines of credit obtained from commercial banks These loans are repaid by selling the newly originated mortgages.

Primary vs. Secondary Markets n n The market where the lenders or the originators deal with borrowers is called the Primary Mortgage market. The market where newly originated loans are sold to investors is called the Secondary Mortgage market.

Lenders…(Cont…) n n The three categories of lenders account for virtually all of the loans that are originated. Mortgage banks have become increasingly important. n They account for more than 50% of the loans that are originated in the U. S.

Mortgage Bankers n n n They act as a channel through which builders or contractors in need of long-term funds can find mortgage financing. The funds required for this purpose are obtained from commercial banks. But within a short period after extending these loans, the mortgages are sold to longterm institutional investors.

Sources of Income For The Originator n n They charge an origination fee. This is expressed in terms of points. n n A point is 1% of the borrowed funds. For instance a fee of 2 points on a loan of $100, 000 is $2, 000. The originators can subsequently sell the loans in the secondary market. If interest rates have declined they will make a capital gain.

Income For The Originator n If the originator chooses to hold the loan asset, he will earn interest income.

Mortgage Servicing n n Once a loan is made, it has to be serviced. Servicing can be done by the lender himself, or can be contracted out to an external agency.

Servicing n Servicing involves the following activities. n n n Collection of monthly payments. Sending payment notices to the mortgagors. Sending reminders for overdue payments. Maintaining records of outstanding principal. Initiating foreclosure proceedings if required.

Sources of Income For The Servicer n He gets a servicing fee. n n n The fee is a fixed percentage of the outstanding mortgage balance. As each installment is made, the outstanding balance will decline. Hence so will the servicing fee.

Servicing Income n Servicers also earn a float on the monthly mortgage payment. n n This is because there is a delay between the time they receive the payment and the time they pass it on to the lender. They also earn a late fee if payments are overdue.

Mortgage Insurance n Lenders require mortgage insurance as a safeguard against default. n n The cost is borne by the borrowers in the form of a higher rate of interest. Why is insurance required? n n n A mortgage is a debt instrument. And like any other private debt is subject to credit risk. A mortgage is generally considered to be in default if the borrower fails to pay the EMI in three consecutive months.

Insurance (Cont…) n The incidence of default is positively related to the LTV ratio. n n The risk tends to be particularly high if the LYV exceeds 80%. Thus to originate mortgages with LTVs exceeding 80%, originators normally insist that the mortgage be insured.

Insurance…(Cont…) n In the case of default the insurer has two options: n n Pay the lender the insured amount and let him take the title to the house Or else reimburse the lender for the entire loan amount and take over the title by itself

Insurance…(Cont…) n In the U. S insurance is provided by: n Federal Housing Administration n n It provides insurance mainly to promote home ownership for low and moderate-income families. The FHA charges a premium which is borne by the borrower.

Insurance…(Cont…) n Veterans Administration n It guarantees mortgage loans made to eligible veterans There is no premium charged Private Mortgage Insurance n n Mortgages that are not insured by government agencies are called `conventional’ mortgages. Depending on the LTV they may be insured by a private company or else may remain uninsured.

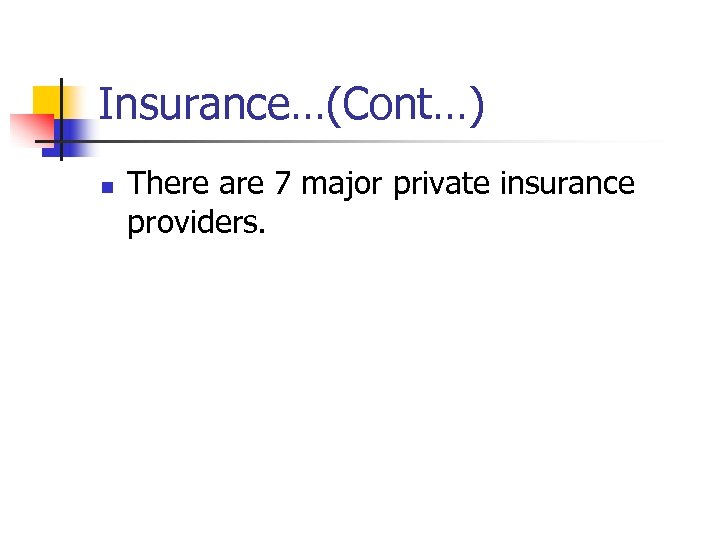

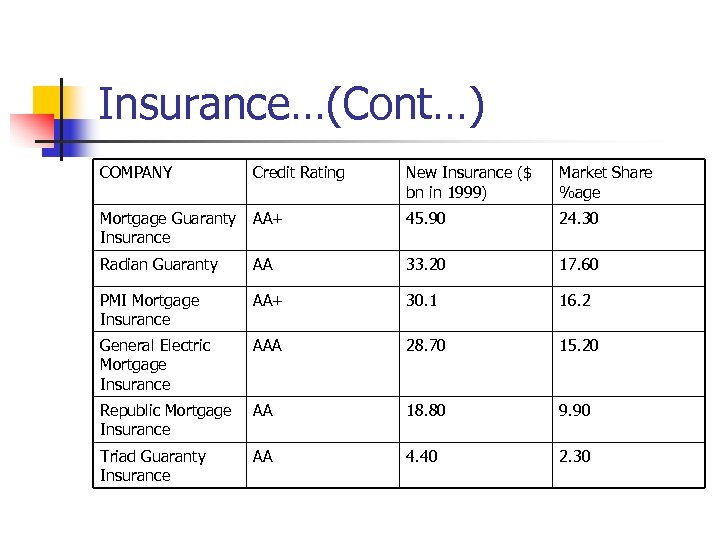

Insurance…(Cont…) n There are 7 major private insurance providers.

Insurance…(Cont…) COMPANY Credit Rating New Insurance ($ bn in 1999) Market Share %age Mortgage Guaranty Insurance AA+ 45. 90 24. 30 Radian Guaranty AA 33. 20 17. 60 PMI Mortgage Insurance AA+ 30. 1 16. 2 General Electric Mortgage Insurance AAA 28. 70 15. 20 Republic Mortgage Insurance AA 18. 80 9. 90 Triad Guaranty Insurance AA 4. 40 2. 30

Insurance…(Cont…) n n n Most privately insured mortgages have LTVs of 90 to 95%. But companies only insure about 25 -30% of the face amount of the loans. In the case of default the insurer can: n n Pay the insurance coverage to the lender and let him retain the property for liquidation Reimburse him for the entire loan amount and take the title for liquidation

Insurance (Cont…) n Many mortgagors acquire Credit Life Insurance from life insurance companies. n n Such insurance provides for a continuation of monthly payments even if the mortgagor were to die. Thus dependents will not lose possession of the property.

Prepayment n n What is prepayment? While a mortgage is intended to be a long-term loan, the mortgager has the right to retire the debt before maturity. n n Such premature retirement is called `prepayment’. In The U. S, mortgages are almost always pre-payable at par without penalties

Prepayment (Cont…) n Since most mortgagors prepay, the outstanding principal balance of a mortgage diminishes much more rapidly than its scheduled amortization. n The term `pre-payment’ refers to only the paydown of the outstanding balance of a mortgage that is in excess of its scheduled amortization.

Prepayment (Cont…) n n n The speed of the excess paydown is referred to as the prepayment rate. Why do homeowners prepay? There are two main reasons: n n Refinancing Housing Turnover

Refinancing n n When interest rates are declining, borrowers have a tendency to borrow at the prevailing rate of interest and prepay the high cost loan taken earlier. Refinancing will obviously lead to a lower EMI.

Housing Turnover n n n However, even in a stable interest rate regime, homeowners tend to prepay. This occurs due to a change in the ownership of the collateral, which is of course the house that was mortgaged. Ownership changes could occur on account of one of the following reasons.

Housing Turnover (Cont…) n Home sale n A homeowner may sell his home for reasons like: n n Upgrading to a better property Changing his job Divorce Conventional mortgages have a due-on-sale clause n That is, the mortgagor has to prepay when the house is sold.

Housing Turnover (Cont…) n Default n n n The financial condition of the borrower may deteriorate to an extent that he is unable to make the monthly payment. If the condition is temporary, the mortgage is said to be in `delinquency’. However if EMIs are not paid for more than 3 months the mortgage is said to be in `default’.

Housing Turnover (Cont…) n In the case of default, the lender can enforce foreclosure proceedings n n This will cause the house to be liquidated But the actual incidence of default in the U. S. is fairly low n It is currently less than 0. 5%

Housing Turnover (Cont…) n Disaster n A mortgage may be prepaid because of severe damage to the property due to: n n Fire Flood Earthquake Now we should add Tsunami

Housing Turnover (Cont…) n n Since the house is the collateral, severe damage eliminates the collateral. If the house has casualty insurance the mortgage will be prepaid. Else it will end up in default. Death n n In the case of death the executor of the will usually sell the property and prepay Else if the mortgage becomes defaulted the lender will launch foreclosure proceedings which also tantamounts to prepayment.

Prepayments n The mortgagor has a right to payoff the mortgage prematurely either in part or in full without significant penalties. n n Thus the borrower has a Call Option. For the lender it introduces cash flow uncertainty. The uncertainty about when and how a borrower will prepay is called Prepayment Risk. Because of this risk the valuation of mortgages and mortgages related securities is more complex.

The Role of the Government n There are three key parties in the housing market n n n Those who demand funds for buying homes – borrowers Those who supply funds by investing in mortgage loans or mortgage related products – investors Those who supply housing - builders

Role…(Cont…) n n The amount of housing construction and the funds demanded for purchasing housing are determined by the combined actions of these three groups. The government has influenced the behaviour of all three groups by creating government agencies or government sponsored entities.

Role…(Cont…) n The actions take by these agencies include: n Insuring or guaranteeing mortgage loans against default n n Thereby enabling weaker sections of society to acquire homes These guarantees also made such loans attractive for investors to invest in

Role…(Cont…) n n Introduced various types of mortgage designs that are more attractive to borrowers and investors Developed mortgage backed securities such as pass-throughs and CMOs and guaranteed them against default risk to enable institutional investors to supply funds to the mortgage market

Role…(Cont…) n n Standardized mortgage loan terms and documentation Provided liquidity to the mortgage market by buying mortgage loans Provided credit facilities to certain lenders in the housing market Granted loans at below market rates to encourage the construction of low income housing

The Early Mortgage Market n In the first few decades of the post World War-II period n n n The bulk of mortgage loans were originated by depository institutions And were held by them as assets Thus the supply of funds to the mortgage market was dependent on the ability of depository institutions to raise funds.

Early…(Cont…) n n However most institutions were constrained by law to confine their deposit seeking and lending activities to their local markets. Thus the allocation mechanism was poor n n Some regions had excess supply and low rates Others had excess demand high rates

Early…(Cont…) n n n This situation lead to the emergence of the mortgage banker and the mortgage broker Mortgage bankers do not provide funds from deposit taking They originate mortgages and sell them n n To life insurance companies And to depository institutions in cash rich regions

Early…(Cont…) n n n The 1960 s were characterized by high inflation and interest rates. Government ceilings on interest rates lead to reduced deposits with banks and S&Ls. Even when funds were available n n FRMs were not preferred Because of an asset-liability mismatch

Early…(Cont…) n n To mitigate the problem, a mortgage market that was not dependent on depository institutions had to be developed. This required a strong secondary market where n Non-depository financial institutions and life insurance companies would find it attractive to make investments.

Building a Secondary Market n n The Federal Housing Administration (FHA) was set up in 1934. It did two things following the war: n n It reduced credit risk for investors by offering insurance against mortgage default Not all mortgages could be insured To get insurance the applicant had to satisfy the underwriting standards of the FHA. Thus the FHA standardized mortgage design

Building…(Cont…) n n Prior to the formation of the FHA, only balloon mortgages were available. Borrowers in these cases paid only interest over the term of the mortgage At the maturity date, after 5 -10 years, the entire principal was repaid as a bullet. To repay the original mortgage, typically a fresh loan was taken.

Building…(Cont…) n This structure encouraged default n n If the borrower could not take a fresh loan at the time of maturity, he would obviously default The FHA developed the self-amortizing long -term loans that we have today

Building…(Cont…) n n n The question arose who would invest in these mortgages? To encourage investment there was a need to develop a liquid market where loans could be traded. The government created the Federal National Mortgage Association (FNMA) to provide liquidity.

Fannie Mae n n n Fannie Mae was mandated to create a liquid secondary market for mortgages by buying FHA insured mortgages. But the secondary market did not take off. Origination was still dependent on depository institutions.

Fannie Mae (Cont…) n In response, the government divided Fannie Mae into two organizations n n n The Fannie Mae that we know today And the Government National Mortgage Association – Ginnie Mae’s function was to use the full faith and credit of the government to: n n Support FHA insured loans And loans insured by VA and the Farmers Home Administration

Fannie Mae (Cont…) n n In 1970 Fannie Mae was authorized to buy conventional mortgage loans And the Federal Home Loan Mortgage Corporation (Freddie Mac) was created to support conventional as well as FHA/VA loans.

Agencies n n n Fannie Mae and Freddie Mac are referred to as agencies of the U. S. government. They are both listed on the NYSE Thus they are quasi-private They do not receive any subsidies from the government They are taxed like any other corporation

Agencies (Cont…) n n n They are most appropriately referred to as: Government Sponsored Entities Their guarantees are not backed by the full faith or credit of the U. S government In contrast Ginnie Mae is a government related agency Its guarantees have federal backing

Securitization n n Ginnie Mae guarantees securities issued by private entities that pool FHA, VA mortgages together using the mortgages as collateral for the security. Freddie Mac and Fannie Mae purchase and pool conventional mortgages and then issue securities using the pool as collateral.

Securitization (Cont…) n These mortgage backed securities are then bought by investors who were typically unprepared to buy individual mortgage loans.

Pooling of Mortgages n n Mortgage originators do not usually hold on to the loans made by them, but rather sell them. In order to sell these loans, many small loans are put together as a collection, called a Mortgage Pool.

Rationale for Pooling n n Consider ten separate loans of $100, 000 each. Assume that each loan has been made by a separate lender. n n n Every lender therefore faces prepayment risk. It is not easy for a lender to forecast prepayments, since each is dealing with an individual borrower. Prepayment behaviour will obviously differ from borrower to borrower.

Rationale for Pooling n n n If these ten loans were to be pooled, then the average prepayment is likely to be more predictable and statistical tools of analyses can be used. However it is expensive for one party to own the pool since it would entail an investment of 10 MM. However the pooled loans can be used as collateral to issue securities in large numbers to enable individual investors to invest.

Securitization n Securitization is a process of converting a pool of illiquid assets into liquid financial instruments. n n In the case of mortgages, the pool serves as the source for the payments which have to be made on the assets which are issued with the pool as collateral. Because of the ability to securitize, lenders can repeatedly rollover their investments in mortgages and the country as a whole gets greater access to housing finance.

Standardization n n Before pooling mortgage loans care is taken to standardize the loans. This means that all the pooled loans will have: n n n The same rate of interest. The same period to maturity. The same kind of insurance. The same kind of property. And will come from the same geographical location.

Standardization n The advantage of standardization is that the cash flows from the pool are easier to predict. Although each mortgage loan is insured individually, some times the pool as a whole is additionally insured. A mortgage pool is therefore like a large loan with a coupon rate and term to maturity.

Special Purpose Vehicles (SPVs) n Before securitization, the pool of mortgages is transferred to an SPV. n n n An SPV is a separate legal entity that is set up for the purpose of issuing mortgage backed securities. The objective is to ensure that there is a distance between the originators and the pool. Thus even if the originators were to go bankrupt, it would not affect the pool held by the SPV.

Mortgage Backed Securities n n The net result of securitization is the creation of assets which are backed by the underlying pool of mortgages. These assets are claims on the cash flows that are generated by the underlying pool.

Pass-throughs n A pass-through is a type of mortgage backed security. n n It is formed by pooling mortgages and creating undivided interests. Undivided, means that each holder of a pass-through has a proportionate interest in each cash flow that is generated from the underlying pool.

Illustration n n Consider 10 loans of $100, 000 each that are pooled together. Assume that an agency purchases these loans and issues fresh securities using these loans as collateral. n n This is the function of Ginnie Mae, Fannie Mae, Freddie Mac etc. Assume that 40 units of such securities are sold.

Illustration n n Thus each security will be worth $25, 000. Each security will be entitled to 1/40 th or 2. 5% of each cash flow emanating from the underlying pool. The net result is that by investing $25, 000 an investor gains exposure to the total pre-payment risk of all ten loans rather than to the risk of a single loan. This is appealing from the point of risk reduction.

Collateralized Mortgage Obligations (CMOs) n Now consider the case where the ten loans are pooled to issue three categories of securities. n n Class A Bonds: Par Value of $400, 000 Class B Bonds: Par Value of $350, 000 Class C Bonds: Par Value of $250, 000 For each class, multiple units of a security that represents that particular class are issued.

CMOs n For instance if 50 units of class A bonds are issued, then each will have a face value of $8000. n n Each will be entitled to 2% of the cash flows receivable by the class as a whole. Assume that the cash flows are distributed according to certain predecided rules.

Example Of Distribution Rules n n n Class A securities will receive all principal payments – both scheduled and unscheduled until the entire par value is paid off. Once class A securities have been fully retired, class B bondholders will start receiving principal payments – scheduled and unscheduled, until the entire par value is paid off. After class B securities are retired, class C security holders will start receiving principal payments.

CMOs n n All security holders will receive interest every period, based on the amount of the par value that is outstanding for that particular class. This is an example of a CMO. In this case certain categories of securities will receive payments before others. Unlike a pass-through, all securities are not equally exposed to pre-payment risk.

CMOs n Class A bonds will absorb prepayments first, followed by class B, and then by class C. n n Class A bonds will have a shorter term to maturity than the other two categories. Class C securities will have the longest maturity.

A Pass-Through A Detailed Illustration n A person has borrowed $4800 to buy a house. n n n He agrees to pay $100 every month as principal repayment, and to pay interest every month on the outstanding principal at the rate of 6% per annum. A total of 48 payments are due. The first payment will be $124 which consists of $100 by way of principal repayment and $24 by way of interest.

Illustration Cont… n n n The last payment due will be $100. 50 which will consist of $100 by way of principal repayment and $0. 50 by way of interest. We will assume that there are 4 owners who agree to share each payment equally. If payments are made as per schedule, each party will receive $31 after the first month, and $25. 125 in the last month.

Illustration Cont… n n Assume that at the end of three months the mortgagor pays an extra $40 by way of principal. So each of the four owners will get an extra payment of $10. Since $10 is prepaid the monthly interest in subsequent months will go down by 20 cents. In the last month (48 th) the mortgagor will pay $60 by way of principal and 30 cents by way of interest.

Illustration of CMO n Assume that instead of agreeing to share the payments equally, the four owners want the following system. n n Party A wants his principal back by the end of the first year. Party B wants his principal by the end of the second year. Party C wants his principal by the end of the third year. Party D wants his principal during the last year.

CMO Illustration Cont… n So every month all the investors will get interest on the amount outstanding to them. n n But all principal payments will go first to A. Once A is fully paid, B will start receiving principal payments. After B is fully paid, C will start receiving principal payments. Finally D will start getting principal payments.

CMO Illustration Cont… n In the first year A will get $100 every month plus interest on the outstanding balance. n n The other three will get interest of $6 per month. From the 13 th month B will start receiving $100 per month plus interest on the outstanding balance. From the 25 th month C will start receiving $100 per month. From the 37 th month D will start receiving $100 per month.

CMO Illustration Cont… n n n Each class of ownership is called a tranche. A CMO must obviously have a minimum of 2 tranches. Now assume that in the third month the mortgagor makes an extra payment of $40. n n This will entirely go to party A. In subsequent months he will continue to get $100 by way of principal repayments, but will receive 20 cents less by way of interest.

CMO Illustration Cont… n n n In the 12 th month he will get only $60. The remaining $40 will go to B. In the 24 th month, B will get $60 and C will get $40. In the 36 th month, C will get $60 and D will get $40. Such a distribution principle is called Sequential Pay Prepayment.

Differences Between Conventional Bonds and Mortgage Backed Securities n n n In a conventional bond the principal is returned in one lump sum at maturity. Holders of mortgage backed securities receive their principal back in installments, as the underlying loans are paid off. Since the speed and timing of principal repayments can vary, the cash flows on mortgage backed securities can be very irregular.

Mortgage Backed Securities n n When a homeowner prepays, the remaining stake of the holders of the mortgage backed securities will be reduced by the same amount. Since the principal outstanding will reduce, the interest income will also decrease. The monthly cash flow for a mortgage backed security will be less than the monthly amount paid by the mortgagors. The difference is equal to the servicing and guaranteeing fees.

Categories of Pass-throughs n n Ginnie Maes Fannie Maes Freddie Macs Private Label

Asset Backed Securities n n n These are similar to mortgage backed securities. But the assets which are pooled are not home loans. Examples of such assets include credit card receivables, automobile loan receivables etc.

d4d92e1ad6a3914a855e6b2dd3047014.ppt