cf58810698f8df3115d2750db3576bb4.ppt

- Количество слайдов: 30

Mortgage Fraud Tool?

Mortgage Fraud Tool?

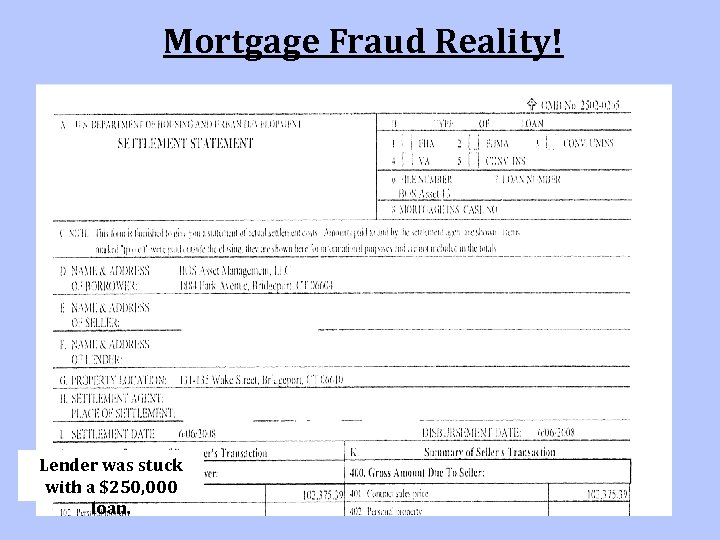

Mortgage Fraud Reality! Lender was stuck with a $250, 000 loan.

Mortgage Fraud Reality! Lender was stuck with a $250, 000 loan.

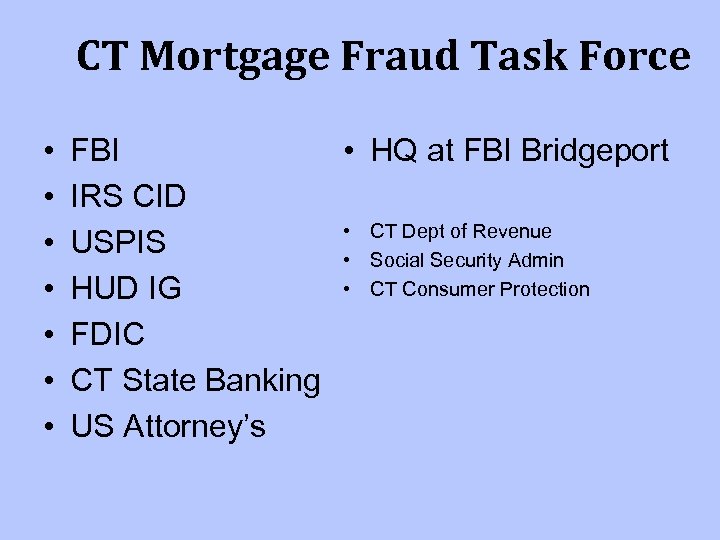

CT Mortgage Fraud Task Force • • FBI • HQ at FBI Bridgeport IRS CID • CT Dept of Revenue USPIS • Social Security Admin • CT Consumer Protection HUD IG FDIC CT State Banking US Attorney’s

CT Mortgage Fraud Task Force • • FBI • HQ at FBI Bridgeport IRS CID • CT Dept of Revenue USPIS • Social Security Admin • CT Consumer Protection HUD IG FDIC CT State Banking US Attorney’s

Mortgage Fraud Defined Mortgage Fraud is a material misstatement, misrepresentation, or omission relied upon by an underwriter or lender to fund, purchase, or insure a loan.

Mortgage Fraud Defined Mortgage Fraud is a material misstatement, misrepresentation, or omission relied upon by an underwriter or lender to fund, purchase, or insure a loan.

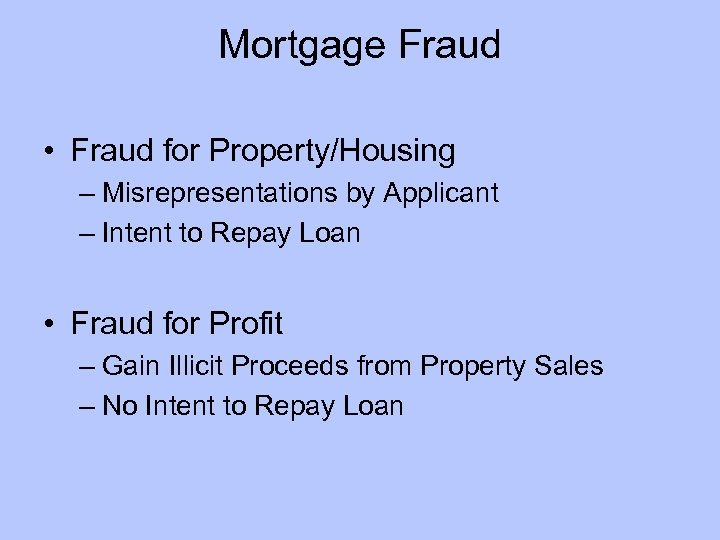

Mortgage Fraud • Fraud for Property/Housing – Misrepresentations by Applicant – Intent to Repay Loan • Fraud for Profit – Gain Illicit Proceeds from Property Sales – No Intent to Repay Loan

Mortgage Fraud • Fraud for Property/Housing – Misrepresentations by Applicant – Intent to Repay Loan • Fraud for Profit – Gain Illicit Proceeds from Property Sales – No Intent to Repay Loan

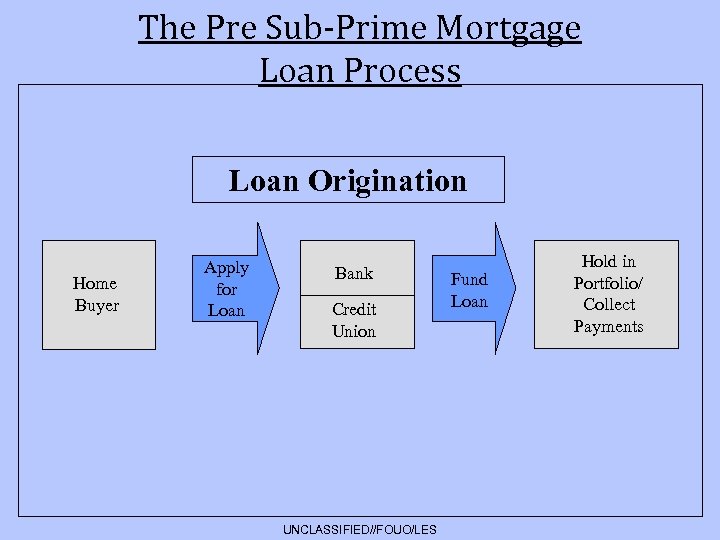

The Pre Sub-Prime Mortgage Loan Process Loan Origination Home Buyer Apply for Loan Bank Credit Union UNCLASSIFIED//FOUO/LES Fund Loan Hold in Portfolio/ Collect Payments

The Pre Sub-Prime Mortgage Loan Process Loan Origination Home Buyer Apply for Loan Bank Credit Union UNCLASSIFIED//FOUO/LES Fund Loan Hold in Portfolio/ Collect Payments

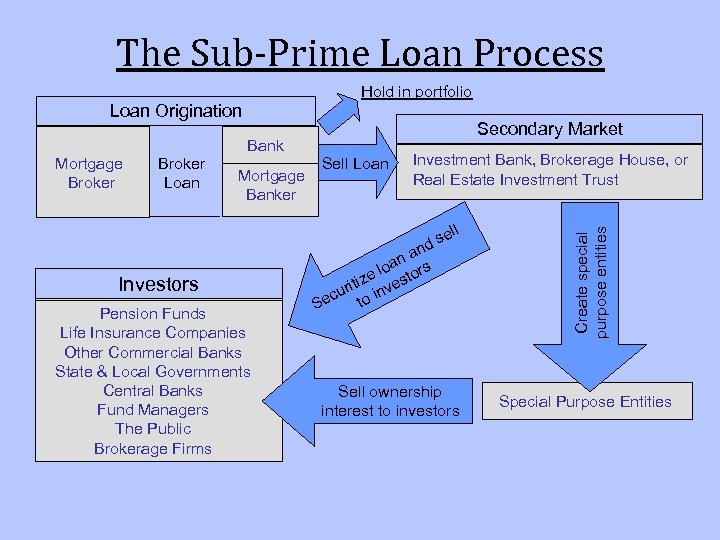

The Sub-Prime Loan Process Hold in portfolio Loan Origination Secondary Market Mortgage Broker Loan Mortgage Banker Sell Loan Investment Bank, Brokerage House, or Real Estate Investment Trust l sel d Investors Pension Funds Life Insurance Companies Other Commercial Banks State & Local Governments Central Banks Fund Managers The Public Brokerage Firms n na s a e lo stor tiz uri inve c to Se Sell ownership interest to investors Create special purpose entities Bank Special Purpose Entities

The Sub-Prime Loan Process Hold in portfolio Loan Origination Secondary Market Mortgage Broker Loan Mortgage Banker Sell Loan Investment Bank, Brokerage House, or Real Estate Investment Trust l sel d Investors Pension Funds Life Insurance Companies Other Commercial Banks State & Local Governments Central Banks Fund Managers The Public Brokerage Firms n na s a e lo stor tiz uri inve c to Se Sell ownership interest to investors Create special purpose entities Bank Special Purpose Entities

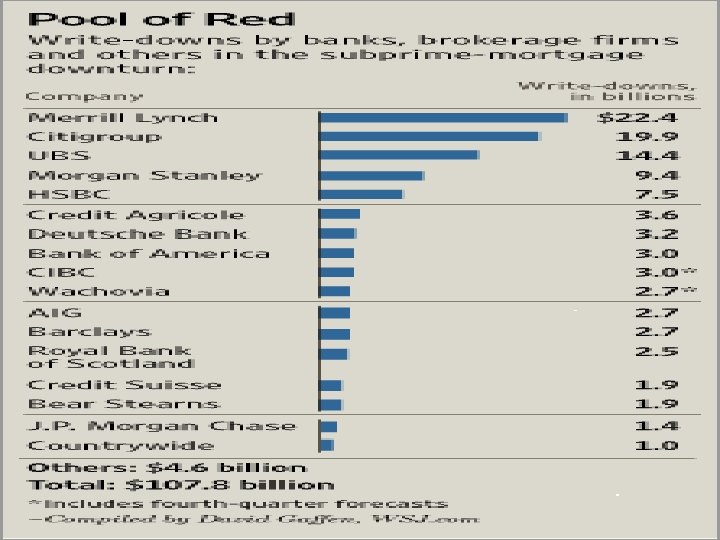

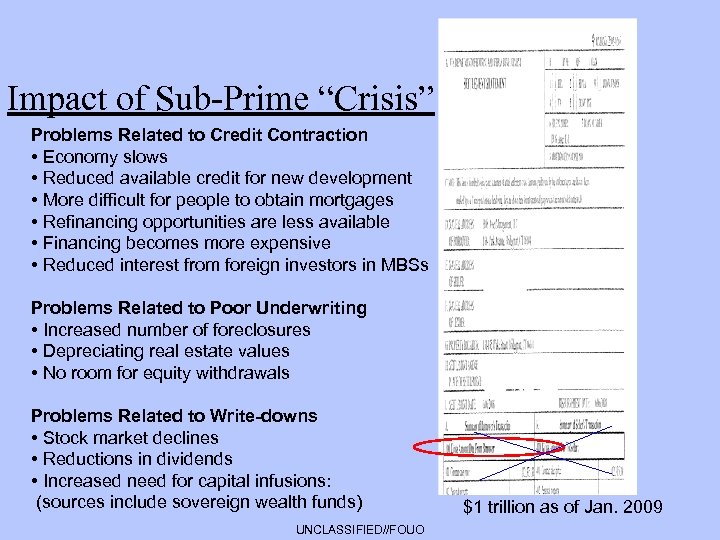

Impact of Sub-Prime “Crisis” Problems Related to Credit Contraction • Economy slows • Reduced available credit for new development • More difficult for people to obtain mortgages • Refinancing opportunities are less available • Financing becomes more expensive • Reduced interest from foreign investors in MBSs Problems Related to Poor Underwriting • Increased number of foreclosures • Depreciating real estate values • No room for equity withdrawals Problems Related to Write-downs • Stock market declines • Reductions in dividends • Increased need for capital infusions: (sources include sovereign wealth funds) UNCLASSIFIED//FOUO $1 trillion as of Jan. 2009

Impact of Sub-Prime “Crisis” Problems Related to Credit Contraction • Economy slows • Reduced available credit for new development • More difficult for people to obtain mortgages • Refinancing opportunities are less available • Financing becomes more expensive • Reduced interest from foreign investors in MBSs Problems Related to Poor Underwriting • Increased number of foreclosures • Depreciating real estate values • No room for equity withdrawals Problems Related to Write-downs • Stock market declines • Reductions in dividends • Increased need for capital infusions: (sources include sovereign wealth funds) UNCLASSIFIED//FOUO $1 trillion as of Jan. 2009

Incentives for Mortgage Fraud • Low Risk High Yield Returns • Shift Risk to Others – Sub-Standard Loans for Unqualified Buyers – Knew Based on Fraudulent information – Pool Loans and Sale to Secondary markets – Knew Markets would React – Would React and Purchase

Incentives for Mortgage Fraud • Low Risk High Yield Returns • Shift Risk to Others – Sub-Standard Loans for Unqualified Buyers – Knew Based on Fraudulent information – Pool Loans and Sale to Secondary markets – Knew Markets would React – Would React and Purchase

Escalation of Mortgages • Less Quality Control • Take Advantage of No Industry Oversight of Scrutiny • Due Diligence Completely Lacking

Escalation of Mortgages • Less Quality Control • Take Advantage of No Industry Oversight of Scrutiny • Due Diligence Completely Lacking

Fraud for Property Schemes • Occupancy Fraud • – borrower states on the loan application that they will occupy the property as a primary residence. • Income Fraud • – borrower overstates their income to qualify for a mortgage.

Fraud for Property Schemes • Occupancy Fraud • – borrower states on the loan application that they will occupy the property as a primary residence. • Income Fraud • – borrower overstates their income to qualify for a mortgage.

Fraud for Property Schemes • Employment Fraud • – borrower claims self-employment in nonexistent company or claims a higher position in a real company to justify fraudulent income. • Failure to disclose liabilities • – borrower conceals liabilities such as mortgages on other properties or newly acquired debt. This artificially lowers debtto-income ratio.

Fraud for Property Schemes • Employment Fraud • – borrower claims self-employment in nonexistent company or claims a higher position in a real company to justify fraudulent income. • Failure to disclose liabilities • – borrower conceals liabilities such as mortgages on other properties or newly acquired debt. This artificially lowers debtto-income ratio.

Backwards Application Scheme • • Incomes Inflated Assets created Credit Reports Altered Previous Residences Altered

Backwards Application Scheme • • Incomes Inflated Assets created Credit Reports Altered Previous Residences Altered

Fraud for Profit Schemes • • Appraisal Fraud Property Flipping Foreclosure Rescue Short Sale Fraud Loan Modification Builder Bailout Reverse Mortgage

Fraud for Profit Schemes • • Appraisal Fraud Property Flipping Foreclosure Rescue Short Sale Fraud Loan Modification Builder Bailout Reverse Mortgage

Asset Rental Scheme • Temporarily Transfer Funds into account under borrower’s name • Account used as Asset on Loan Application • Can be verified by Lender for 30 days

Asset Rental Scheme • Temporarily Transfer Funds into account under borrower’s name • Account used as Asset on Loan Application • Can be verified by Lender for 30 days

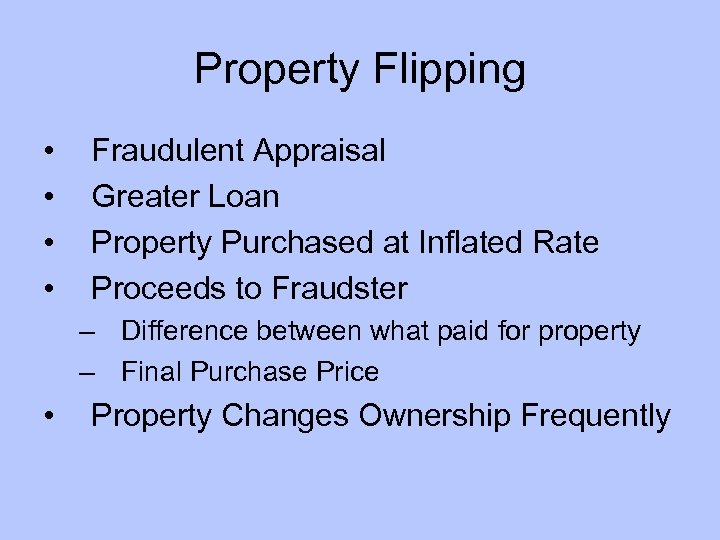

Property Flipping • • Fraudulent Appraisal Greater Loan Property Purchased at Inflated Rate Proceeds to Fraudster – Difference between what paid for property – Final Purchase Price • Property Changes Ownership Frequently

Property Flipping • • Fraudulent Appraisal Greater Loan Property Purchased at Inflated Rate Proceeds to Fraudster – Difference between what paid for property – Final Purchase Price • Property Changes Ownership Frequently

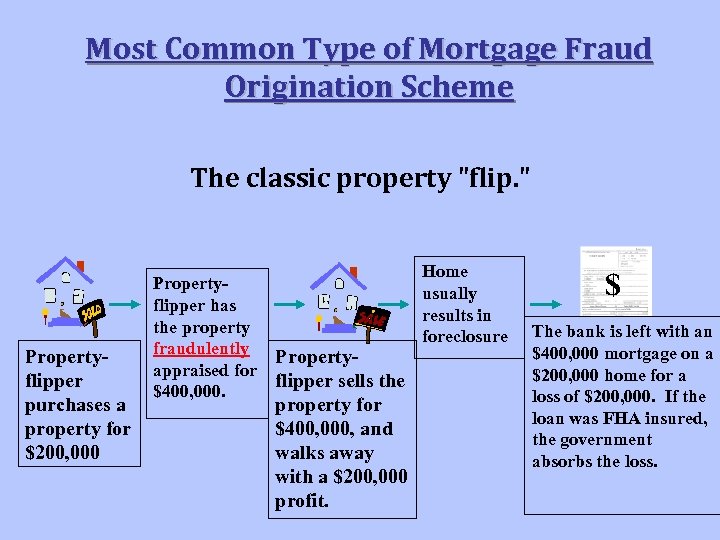

Most Common Type of Mortgage Fraud Origination Scheme The classic property "flip. " Propertyflipper purchases a property for $200, 000 Propertyflipper has the property fraudulently appraised for $400, 000. Propertyflipper sells the property for $400, 000, and walks away with a $200, 000 profit. Home usually results in foreclosure $ The bank is left with an $400, 000 mortgage on a $200, 000 home for a loss of $200, 000. If the loan was FHA insured, the government absorbs the loss.

Most Common Type of Mortgage Fraud Origination Scheme The classic property "flip. " Propertyflipper purchases a property for $200, 000 Propertyflipper has the property fraudulently appraised for $400, 000. Propertyflipper sells the property for $400, 000, and walks away with a $200, 000 profit. Home usually results in foreclosure $ The bank is left with an $400, 000 mortgage on a $200, 000 home for a loss of $200, 000. If the loan was FHA insured, the government absorbs the loss.

Foreclosure Rescue • Stop Foreclosure Now! • We guarantee to stop your foreclosure. • We have special relationships with banks that can speed up case approvals. • We can save your home. Guaranteed. Free Consultation. • We stop foreclosures everyday. Our team of professionals can stop your this week!

Foreclosure Rescue • Stop Foreclosure Now! • We guarantee to stop your foreclosure. • We have special relationships with banks that can speed up case approvals. • We can save your home. Guaranteed. Free Consultation. • We stop foreclosures everyday. Our team of professionals can stop your this week!

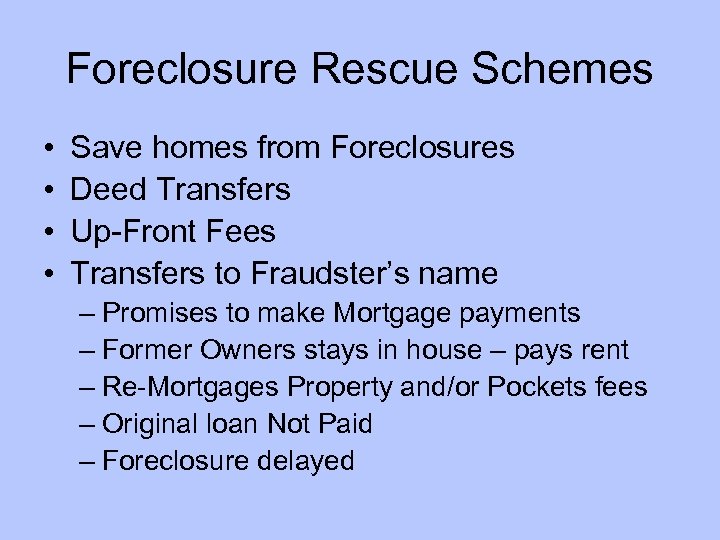

Foreclosure Rescue Schemes • • Save homes from Foreclosures Deed Transfers Up-Front Fees Transfers to Fraudster’s name – Promises to make Mortgage payments – Former Owners stays in house – pays rent – Re-Mortgages Property and/or Pockets fees – Original loan Not Paid – Foreclosure delayed

Foreclosure Rescue Schemes • • Save homes from Foreclosures Deed Transfers Up-Front Fees Transfers to Fraudster’s name – Promises to make Mortgage payments – Former Owners stays in house – pays rent – Re-Mortgages Property and/or Pockets fees – Original loan Not Paid – Foreclosure delayed

Types of Foreclosure Rescue Scams • Phantom help – The rescuer charges exorbitant fees for telephone calls and paperwork the homeowner could have handled and promises services that never materialize. • Bailout – The rescuer bails out the homeowner by helping “dispose” of the house. The homeowner surrenders the title and believes they can stay on as a renter and repurchase later. The terms are so onerous that repurchase is impossible and they permanently lose possession. The rescuer ends up with the home’s equity.

Types of Foreclosure Rescue Scams • Phantom help – The rescuer charges exorbitant fees for telephone calls and paperwork the homeowner could have handled and promises services that never materialize. • Bailout – The rescuer bails out the homeowner by helping “dispose” of the house. The homeowner surrenders the title and believes they can stay on as a renter and repurchase later. The terms are so onerous that repurchase is impossible and they permanently lose possession. The rescuer ends up with the home’s equity.

Types of Foreclosure Rescue Scams • Bait and switch – Rescuers tell victims they will obtain a new loan but in reality they sign documents that give the scammers ownership of the home while the victims remain responsible for the mortgage. Many victims believed they were signing documents for a new loan and had no intention of giving up their homes.

Types of Foreclosure Rescue Scams • Bait and switch – Rescuers tell victims they will obtain a new loan but in reality they sign documents that give the scammers ownership of the home while the victims remain responsible for the mortgage. Many victims believed they were signing documents for a new loan and had no intention of giving up their homes.

Re-emerging Scheme: Foreclosure Rescue Scams

Re-emerging Scheme: Foreclosure Rescue Scams

Short Sale Fraud • Short Sale • a pre-foreclosure sale in which the lender agrees to sell a property for less than the mortgage owed.

Short Sale Fraud • Short Sale • a pre-foreclosure sale in which the lender agrees to sell a property for less than the mortgage owed.

Types of Short Sale Fraud • Homeowner involved – perpetrator uses a straw buyer to purchase a home with the intention of defaulting. • Often uses an inflated appraisal or fictitious improvements. • Prior to foreclosure the perpetrator offers to purchase in a short sale. • The lender agrees not knowing that the short sale was premeditated.

Types of Short Sale Fraud • Homeowner involved – perpetrator uses a straw buyer to purchase a home with the intention of defaulting. • Often uses an inflated appraisal or fictitious improvements. • Prior to foreclosure the perpetrator offers to purchase in a short sale. • The lender agrees not knowing that the short sale was premeditated.

Short Sale Fraud

Short Sale Fraud

Types of Short Sale Fraud • Homeowner not involved – recruit or are real estate agents who solicit homeowners in foreclosure. • They have a true offer for the property but negotiate with the bank for a lesser offer from a co-conspirator. • The co-conspirator purchases the property and then flips to the ultimate buyer for a profit unbeknownst to the lender and homeowner.

Types of Short Sale Fraud • Homeowner not involved – recruit or are real estate agents who solicit homeowners in foreclosure. • They have a true offer for the property but negotiate with the bank for a lesser offer from a co-conspirator. • The co-conspirator purchases the property and then flips to the ultimate buyer for a profit unbeknownst to the lender and homeowner.

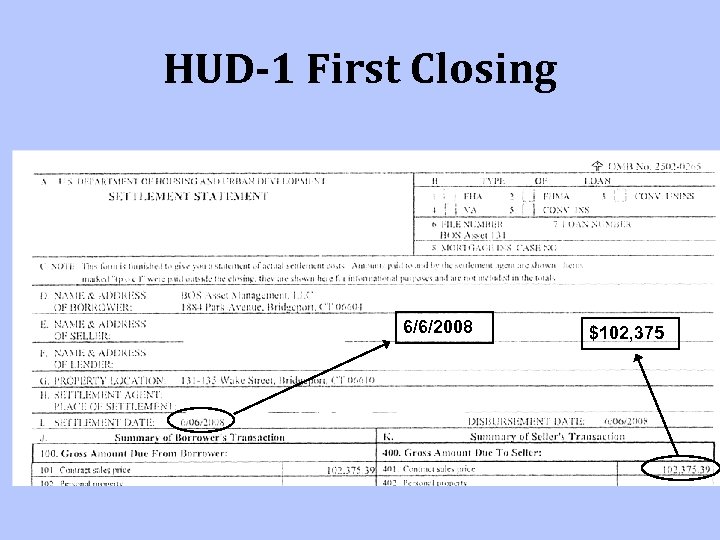

HUD-1 First Closing 6/6/2008 $102, 375

HUD-1 First Closing 6/6/2008 $102, 375

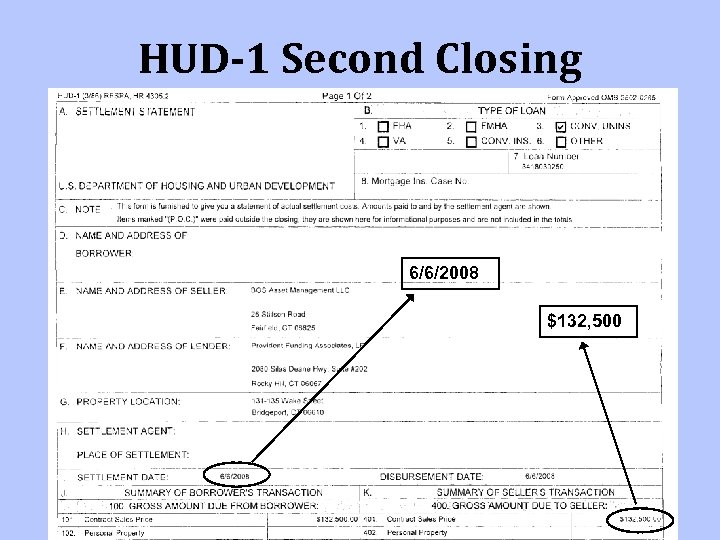

HUD-1 Second Closing 6/6/2008 $132, 500

HUD-1 Second Closing 6/6/2008 $132, 500

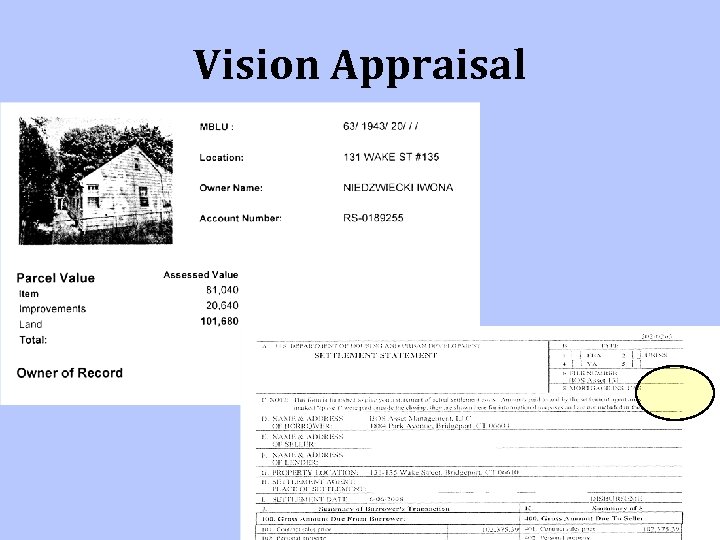

Vision Appraisal

Vision Appraisal