8fae62e23ac4d66477e7b00dfa3a2b1f.ppt

- Количество слайдов: 17

Mortgage Financing Risks & Mitigates Presented by: Mirza Adeel Baig Branch Manager Meezan Bank Limited

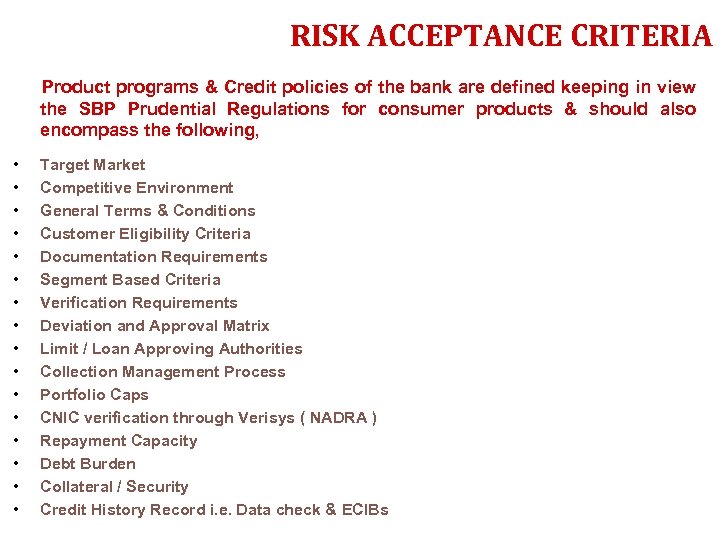

RISK ACCEPTANCE CRITERIA Product programs & Credit policies of the bank are defined keeping in view the SBP Prudential Regulations for consumer products & should also encompass the following, • • • • Target Market Competitive Environment General Terms & Conditions Customer Eligibility Criteria Documentation Requirements Segment Based Criteria Verification Requirements Deviation and Approval Matrix Limit / Loan Approving Authorities Collection Management Process Portfolio Caps CNIC verification through Verisys ( NADRA ) Repayment Capacity Debt Burden Collateral / Security Credit History Record i. e. Data check & ECIBs

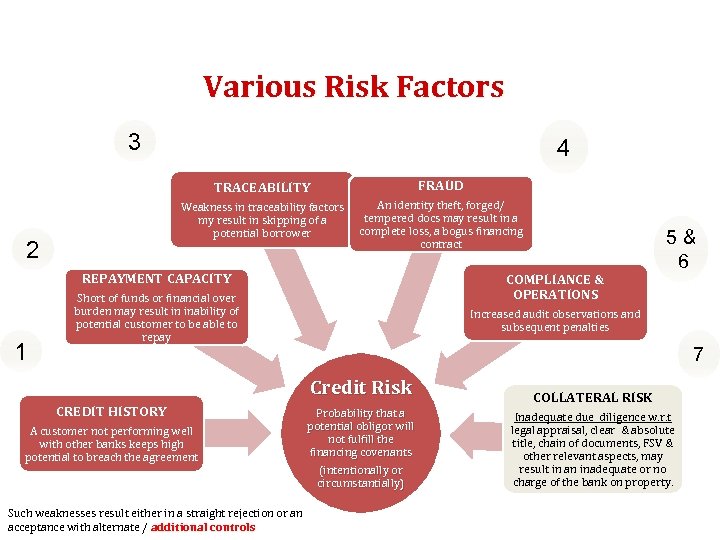

Various Risk Factors 3 4 TRACEABILITY Weakness in traceability factors my result in skipping of a potential borrower 2 FRAUD An identity theft, forged/ tempered docs may result in a complete loss, a bogus financing contract REPAYMENT CAPACITY 1 COMPLIANCE & OPERATIONS Short of funds or financial over burden may result in inability of potential customer to be able to repay 5 & 6 Increased audit observations and subsequent penalties 7 Credit Risk CREDIT HISTORY A customer not performing well with other banks keeps high potential to breach the agreement Such weaknesses result either in a straight rejection or an acceptance with alternate / additional controls COLLATERAL RISK Probability that a potential obligor will not fulfill the financing covenants (intentionally or circumstantially) Inadequate due diligence w. r. t legal appraisal, clear & absolute title, chain of documents, FSV & other relevant aspects, may result in an inadequate or no charge of the bank on property.

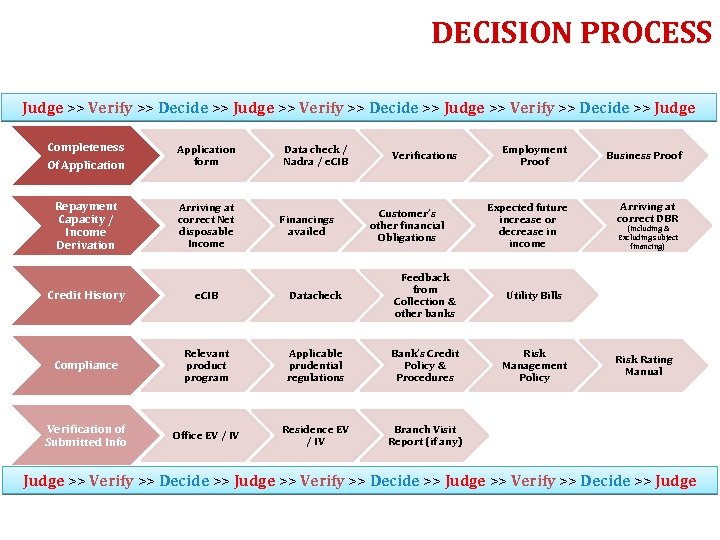

DECISION PROCESS Judge >> Verify >> Decide >> Judge Completeness Of Application form Repayment Capacity / Income Derivation Arriving at correct Net disposable Income Data check / Nadra / e. CIB Financings availed Verifications Customer’s other financial Obligations Credit History e. CIB Datacheck Feedback from Collection & other banks Compliance Relevant product program Applicable prudential regulations Bank’s Credit Policy & Procedures Verification of Submitted Info Office EV / IV Residence EV / IV Employment Proof Expected future increase or decrease in income Business Proof Arriving at correct DBR (Including & Excluding subject financing) Branch Visit Report (if any) Utility Bills Risk Management Policy Risk Rating Manual Judge >> Verify >> Decide >> Judge

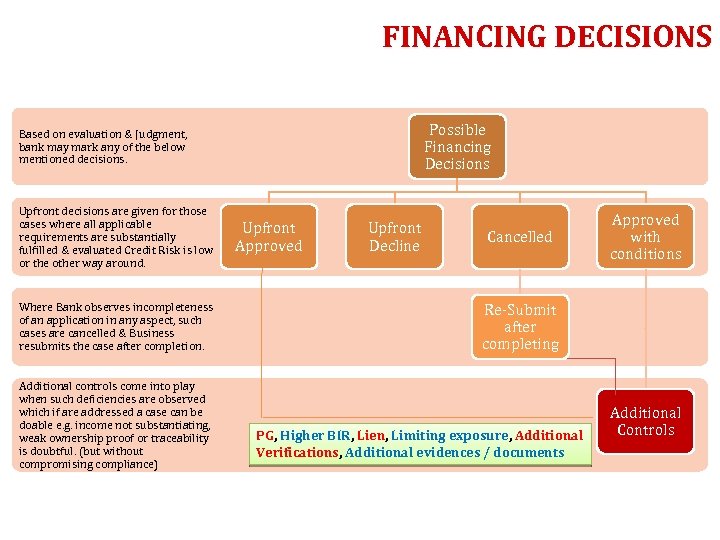

FINANCING DECISIONS Possible Financing Decisions Based on evaluation & Judgment, bank may mark any of the below mentioned decisions. Upfront decisions are given for those cases where all applicable requirements are substantially fulfilled & evaluated Credit Risk is low or the other way around. Where Bank observes incompleteness of an application in any aspect, such cases are cancelled & Business resubmits the case after completion. Additional controls come into play when such deficiencies are observed which if are addressed a case can be doable e. g. income not substantiating, weak ownership proof or traceability is doubtful. (but without compromising compliance) Upfront Approved Upfront Decline Cancelled Approved with conditions Re-Submit after completing PG, Higher BIR, Lien, Limiting exposure, Additional Verifications, Additional evidences / documents Additional Controls

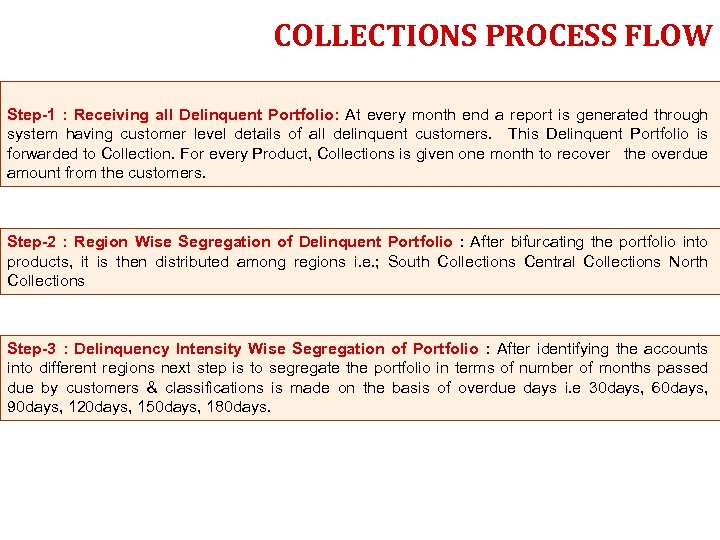

COLLECTIONS PROCESS FLOW Step-1 : Receiving all Delinquent Portfolio: At every month end a report is generated through system having customer level details of all delinquent customers. This Delinquent Portfolio is forwarded to Collection. For every Product, Collections is given one month to recover the overdue amount from the customers. Step-2 : Region Wise Segregation of Delinquent Portfolio : After bifurcating the portfolio into products, it is then distributed among regions i. e. ; South Collections Central Collections North Collections Step-3 : Delinquency Intensity Wise Segregation of Portfolio : After identifying the accounts into different regions next step is to segregate the portfolio in terms of number of months passed due by customers & classifications is made on the basis of overdue days i. e 30 days, 60 days, 90 days, 120 days, 150 days, 180 days.

COLLECTIONS PROCESS FLOW Step- 4 : Distribution of already segregated / classified customers among Tele-Callers, Collection Officers & Supervisors: After identifying the accounts into different Products, regions, DPDs, Size of loan the a/c’s are distributed among Tele-Callers and Collections Officers. Distribution is being done as Product---Region---City---DPD. Following elements are significant & considered: • Who can do what? • Probable Seniority impact on resolution of a certain class of customers. • Officers residential address for assigning him to the accounts of his own area so that he could do rigorous follow-up. • Officers specific experience to resolve certain class of customers, e. g. skip cases, legal cases; etc. Step-5 : Continuous Performance Monitoring After effectively distributing the portfolio among collectors next step is to have a close eye on their day to day performance, to ensure that they achieve pre-defined benchmarks / standards / goals. Following steps are taken: • Preparation of Product and DPD wise daily resolution report • Individual Collector wise resolution report • Randomly review of accounts to help officers resolve problematic accounts. • Giving time to time performance incentives to good performers so that they could be further motivated.

RISK MANAGEMENT Early identification of borrowers at risk has become a best practice to manage the higher default levels driven by various reasons. Building on early identification of borrowers at risk, includes portfolio segmentation by delinquency status, credit score, and loan product type. Portfolio segmentation identifies which borrowers are most at risk and which are not.

RISK MANAGEMENT Bank can then form segmentation strategies for borrower contact and collections that optimize operational cost expenditures and minimize losses. For example, the borrowers most at risk need earlier and/or more intervention than borrowers less at risk, who can be managed less expensively through automated or less frequent contacts. Adoption of collections management systems and processes including operational systems to process individual delinquent mortgages and make decisions on forbearance and loss mitigation alternatives, behavioral scoring and portfolio analysis and reporting.

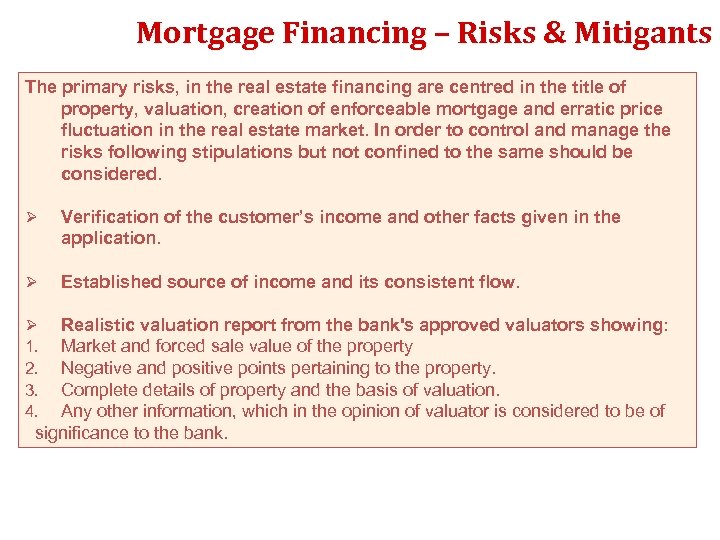

Mortgage Financing – Risks & Mitigants The primary risks, in the real estate financing are centred in the title of property, valuation, creation of enforceable mortgage and erratic price fluctuation in the real estate market. In order to control and manage the risks following stipulations but not confined to the same should be considered. Ø Verification of the customer’s income and other facts given in the application. Ø Established source of income and its consistent flow. Realistic valuation report from the bank's approved valuators showing: Market and forced sale value of the property Negative and positive points pertaining to the property. Complete details of property and the basis of valuation. Any other information, which in the opinion of valuator is considered to be of significance to the bank. Ø 1. 2. 3. 4.

Mortgage Financing – Risks & Mitigants Ø Surveyor’s/architect's report on estimated cost of completion of house in case of house is to be constructed Ø Genuineness of the title documents should be vetted by the approved legal counsel. Ø Property is not in the name of minor. In case of joint owners, none of them are minor(s) or any other person with no legal recourse. Ø There should not be any restriction on transfer of title in the property Ø Any other significant factors.

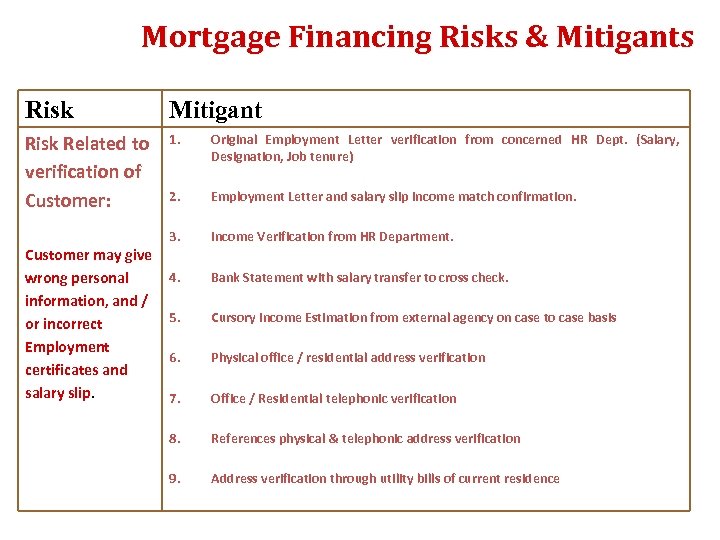

Mortgage Financing Risks & Mitigants Risk Mitigant Risk Related to verification of Customer: 1. Original Employment Letter verification from concerned HR Dept. (Salary, Designation, Job tenure) 2. Employment Letter and salary slip income match confirmation. 3. Income Verification from HR Department. 4. Bank Statement with salary transfer to cross check. 5. Cursory Income Estimation from external agency on case to case basis 6. Physical office / residential address verification 7. Office / Residential telephonic verification 8. References physical & telephonic address verification 9. Address verification through utility bills of current residence Customer may give wrong personal information, and / or incorrect Employment certificates and salary slip.

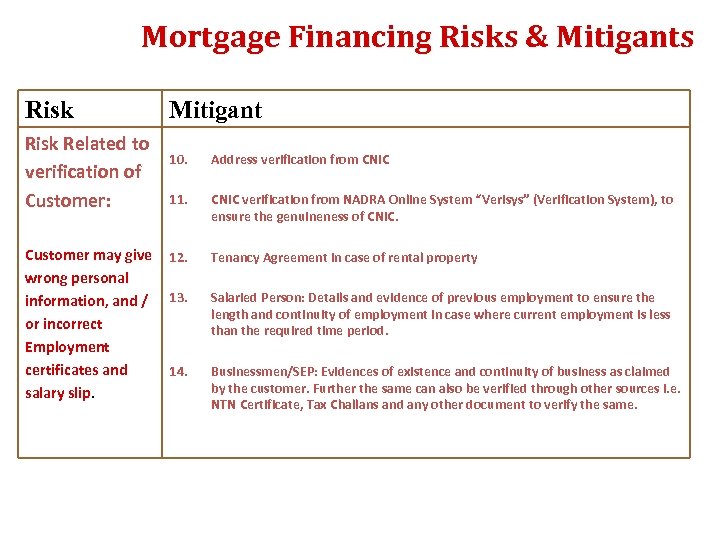

Mortgage Financing Risks & Mitigants Risk Related to verification of Customer: Customer may give wrong personal information, and / or incorrect Employment certificates and salary slip. Mitigant 10. Address verification from CNIC 11. CNIC verification from NADRA Online System “Verisys” (Verification System), to ensure the genuineness of CNIC. 12. Tenancy Agreement in case of rental property 13. Salaried Person: Details and evidence of previous employment to ensure the length and continuity of employment in case where current employment is less than the required time period. 14. Businessmen/SEP: Evidences of existence and continuity of business as claimed by the customer. Further the same can also be verified through other sources i. e. NTN Certificate, Tax Challans and any other document to verify the same.

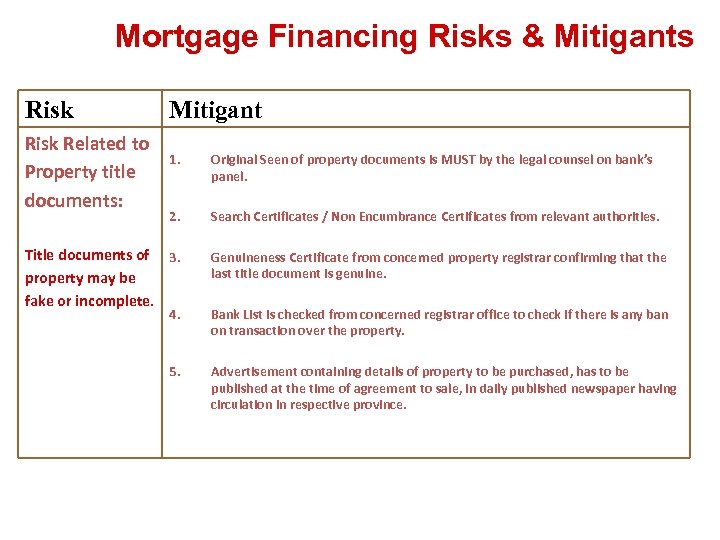

Mortgage Financing Risks & Mitigants Risk Related to Property title documents: Mitigant 1. Original Seen of property documents is MUST by the legal counsel on bank’s panel. 2. Search Certificates / Non Encumbrance Certificates from relevant authorities. Title documents of 3. property may be fake or incomplete. Genuineness Certificate from concerned property registrar confirming that the last title document is genuine. 4. Bank List is checked from concerned registrar office to check if there is any ban on transaction over the property. 5. Advertisement containing details of property to be purchased, has to be published at the time of agreement to sale, in daily published newspaper having circulation in respective province.

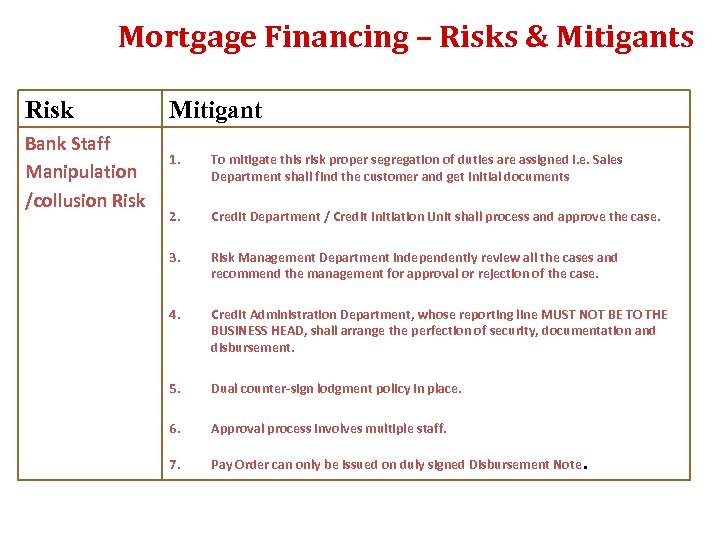

Mortgage Financing – Risks & Mitigants Risk Bank Staff Manipulation /collusion Risk Mitigant 1. To mitigate this risk proper segregation of duties are assigned i. e. Sales Department shall find the customer and get initial documents 2. Credit Department / Credit Initiation Unit shall process and approve the case. 3. Risk Management Department independently review all the cases and recommend the management for approval or rejection of the case. 4. Credit Administration Department, whose reporting line MUST NOT BE TO THE BUSINESS HEAD, shall arrange the perfection of security, documentation and disbursement. 5. Dual counter-sign lodgment policy in place. 6. Approval process involves multiple staff. 7. Pay Order can only be issued on duly signed Disbursement Note .

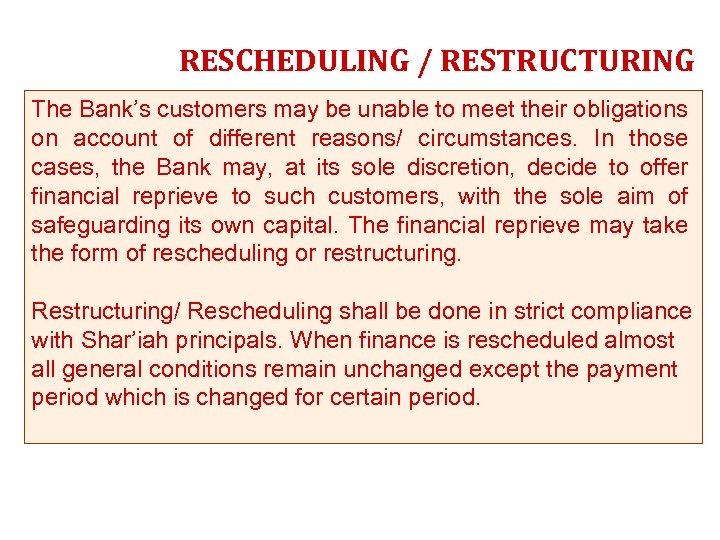

RESCHEDULING / RESTRUCTURING The Bank’s customers may be unable to meet their obligations on account of different reasons/ circumstances. In those cases, the Bank may, at its sole discretion, decide to offer financial reprieve to such customers, with the sole aim of safeguarding its own capital. The financial reprieve may take the form of rescheduling or restructuring. Restructuring/ Rescheduling shall be done in strict compliance with Shar’iah principals. When finance is rescheduled almost all general conditions remain unchanged except the payment period which is changed for certain period.

RESCHEDULING / RESTRUCTURING When a financing is restructured following concessions / remissions can be considered: 1. Reduction in rate of profit/rent 2. Change in financial covenants. 3. Increase in grace period. 4. Extension in maturity. 5. Any other change on case to case basis In deciding on any restructuring / rescheduling due weightage should be given to the present value of the restructured financing/investment amount versus an estimate of the present value of a potential scenario involving realization of security.

8fae62e23ac4d66477e7b00dfa3a2b1f.ppt