fbb3207854a22bc47f82b41e9b2b3735.ppt

- Количество слайдов: 42

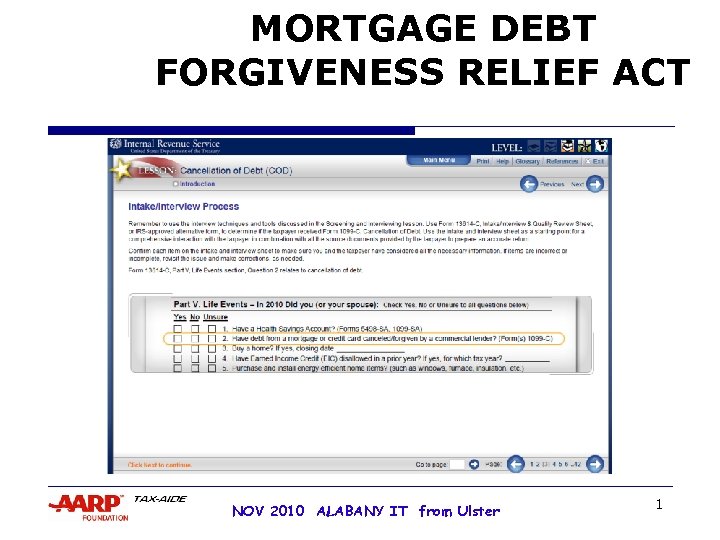

MORTGAGE DEBT FORGIVENESS RELIEF ACT NOV 2010 ALABANY IT from Ulster 1

MORTGAGE DEBT FORGIVENESS RELIEF ACT o Enacted in 2007 and expires end of 2012. o Allows taxpayers to exclude from income certain cancelled debt on their principal residence o May be eligible for exclusion of gain upon sale NOV 2010 ALABANY IT from Ulster 2

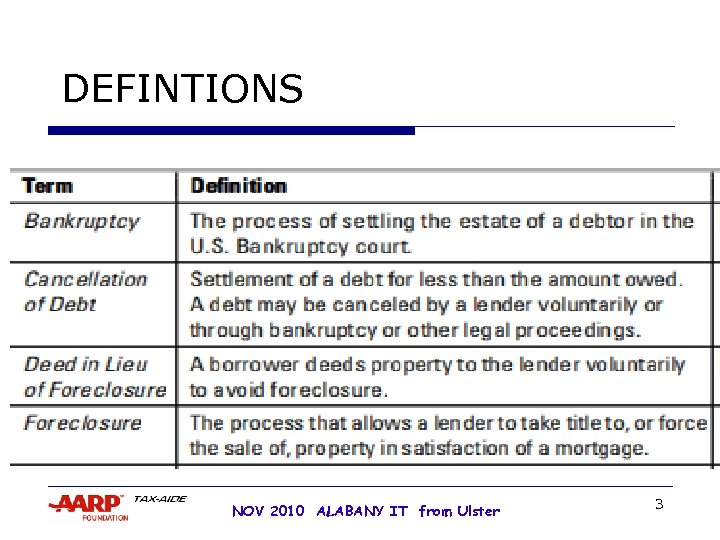

DEFINTIONS NOV 2010 ALABANY IT from Ulster 3

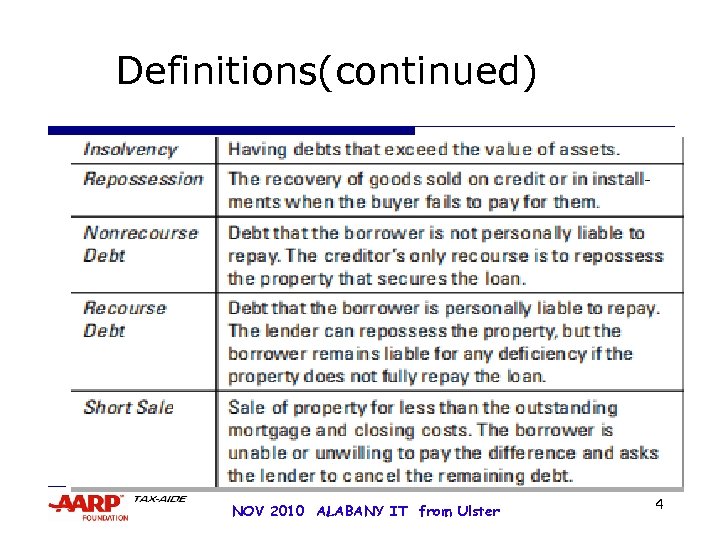

Definitions(continued) NOV 2010 ALABANY IT from Ulster 4

Mortgage Actions o Mortgage modification(workout): refinancing to change principal, interest rate, or term for use in main home or other areas o Debt Reduction: Reduction in mortgage indebtedness from renegotiation – Homeowner keeps possession NOV 2010 ALABANY IT from Ulster 5

Possible Lender Transactions ¨ Lender issues: ¨ Form 1099 -A upon either Foreclosure(lender) or Abandonment(Borrower) and/or ¨ Form 1099 -C Upon Debt Cancellation ¨ Same calendar year: Debt canceled in conjunction with Foreclosure or Abandonment Lender has option to issue only Form 1099 -C ¨ Short Sale and Deed in Lieu of Foreclosure equivalent to Foreclosure ¨ Lender not required to accept and/or cancel debt ¨ Typically may occur prior to formal FORECLOSURE NOV 2010 ALABANY IT from Ulster 6

Possible Lender Transactions(continued) ¨ Most mortgages are recourse debt ¨ BOX 5 , Form 1099 -A indicates recourse or nonrecourse ¨ If lender issues Form 1099 -C instead: implies a recourse loan NOV 2010 ALABANY IT from Ulster 7

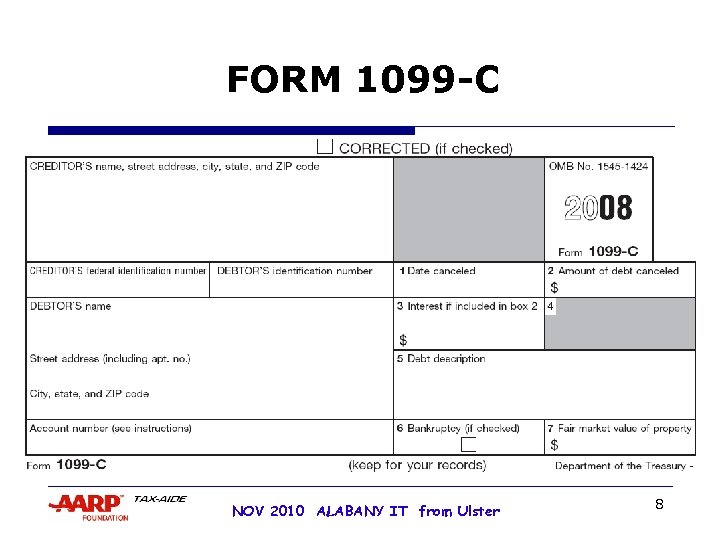

FORM 1099 -C NOV 2010 ALABANY IT from Ulster 8

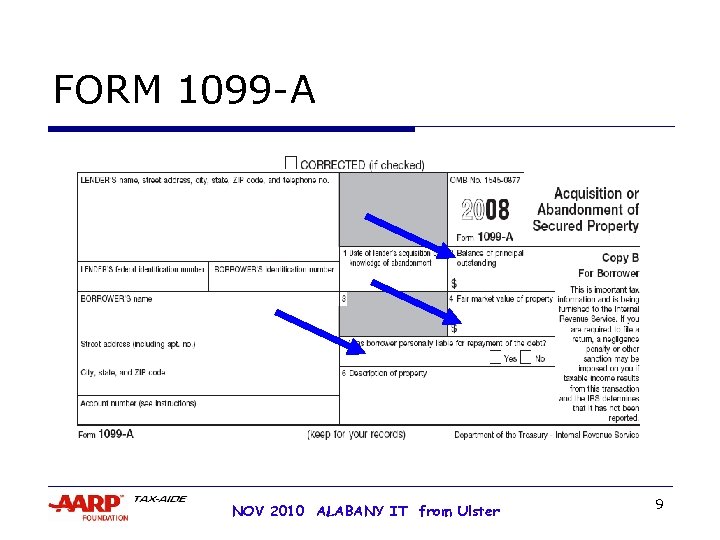

FORM 1099 -A NOV 2010 ALABANY IT from Ulster 9

CAUTION ¨ Most mortgages are recourse debt ¨ Some states have anti-deficiency laws ¨ Prevent lenders from pursuing the borrower for deficiency after foreclosure ¨ Mortgages may be classified as nonrecourse debt subject even if loan contains a promise by borrower to repay the loan NOV 2010 ALABANY IT from Ulster 10

NY STATE ¨ One action state; Lender must choose: ¨ (1) Foreclosing on property ¨ (2) Sue to collect debt NOV 2010 ALABANY IT from Ulster 11

Possible Taxpayer Transactions ¨ Debt canceled, abandonment, foreclosure ¨ Form 982 Reduction of Tax Attributes Due to Discharge Indebtedness…. . ¨ Gain or loss on sale ¨ Schedule D: Worksheet 2 ¨ SALE of (MAIN)Home and/or ¨ Section 125 EXCLUSION may apply for Gain ¨ Schedule D ¨ Loss on principal residence is always ZERO(0) NOV 2010 ALABANY IT from Ulster 12

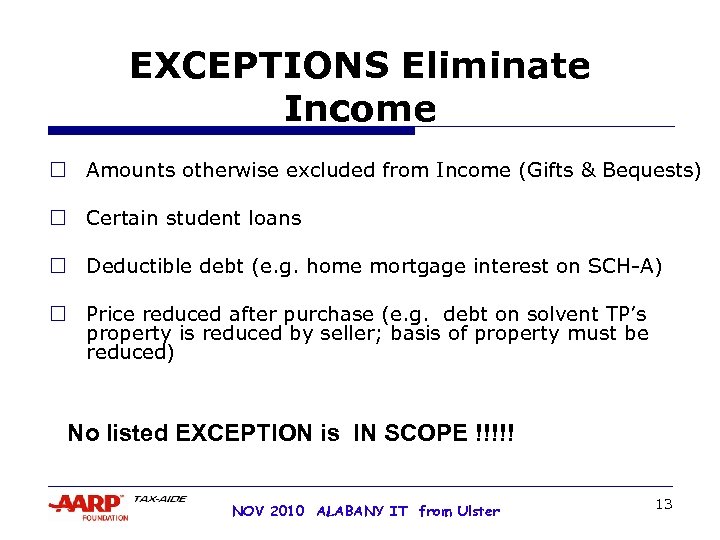

EXCEPTIONS Eliminate Income ¨ Amounts otherwise excluded from Income (Gifts & Bequests) ¨ Certain student loans ¨ Deductible debt (e. g. home mortgage interest on SCH-A) ¨ Price reduced after purchase (e. g. debt on solvent TP’s property is reduced by seller; basis of property must be reduced) No listed EXCEPTION is IN SCOPE !!!!! NOV 2010 ALABANY IT from Ulster 13

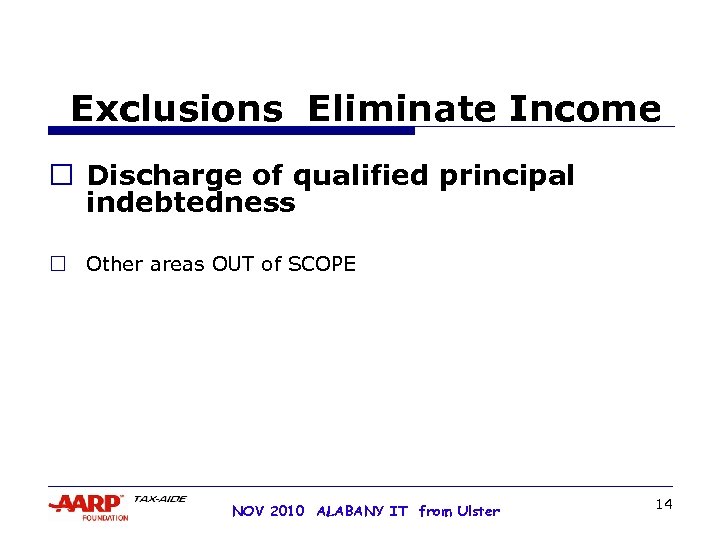

Exclusions Eliminate Income ¨ Discharge of qualified principal indebtedness ¨ Other areas OUT of SCOPE NOV 2010 ALABANY IT from Ulster 14

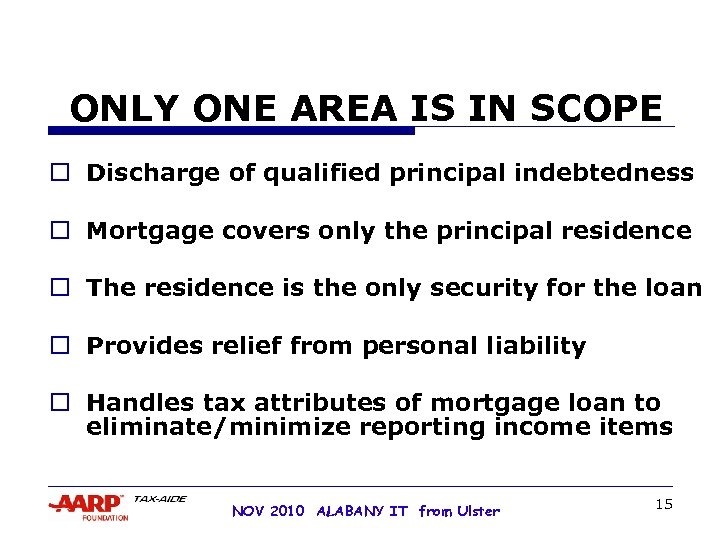

ONLY ONE AREA IS IN SCOPE ¨ Discharge of qualified principal indebtedness ¨ Mortgage covers only the principal residence ¨ The residence is the only security for the loan ¨ Provides relief from personal liability ¨ Handles tax attributes of mortgage loan to eliminate/minimize reporting income items NOV 2010 ALABANY IT from Ulster 15

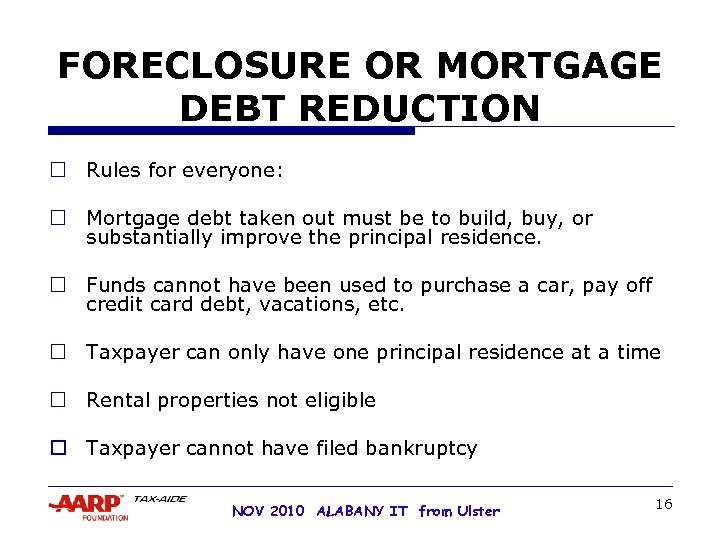

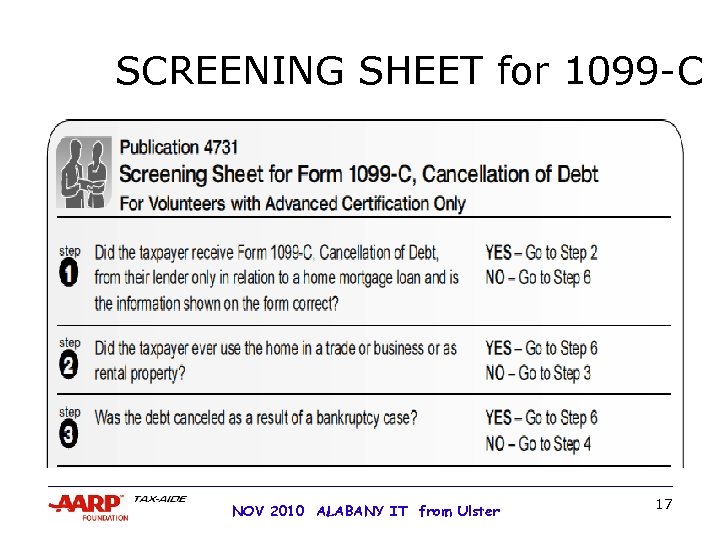

FORECLOSURE OR MORTGAGE DEBT REDUCTION ¨ Rules for everyone: ¨ Mortgage debt taken out must be to build, buy, or substantially improve the principal residence. ¨ Funds cannot have been used to purchase a car, pay off credit card debt, vacations, etc. ¨ Taxpayer can only have one principal residence at a time ¨ Rental properties not eligible o Taxpayer cannot have filed bankruptcy NOV 2010 ALABANY IT from Ulster 16

SCREENING SHEET for 1099 -C NOV 2010 ALABANY IT from Ulster 17

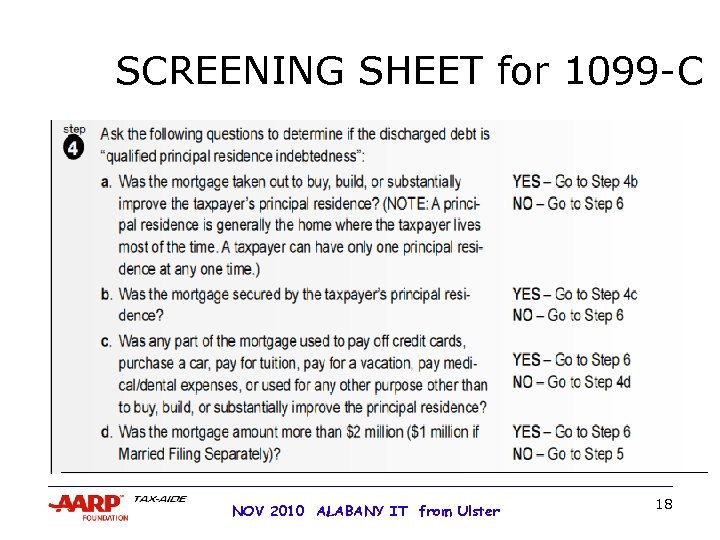

SCREENING SHEET for 1099 -C NOV 2010 ALABANY IT from Ulster 18

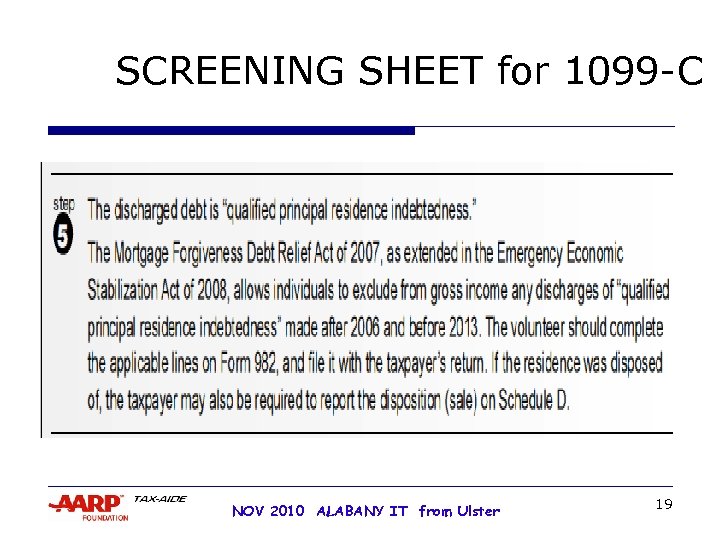

SCREENING SHEET for 1099 -C NOV 2010 ALABANY IT from Ulster 19

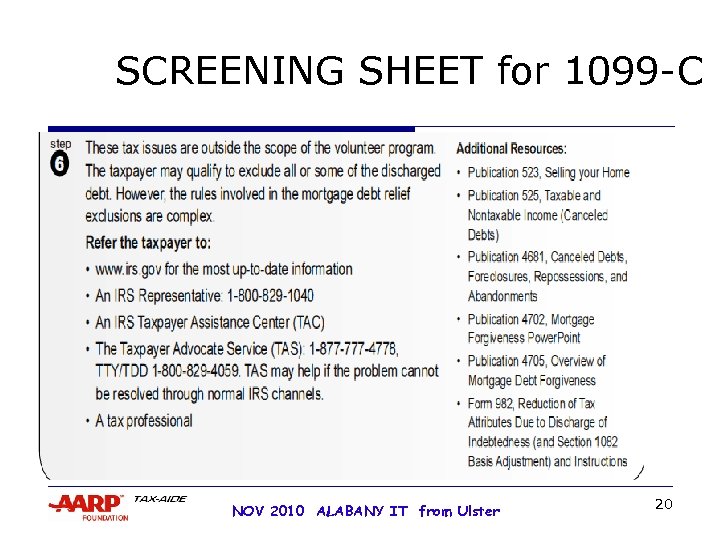

SCREENING SHEET for 1099 -C NOV 2010 ALABANY IT from Ulster 20

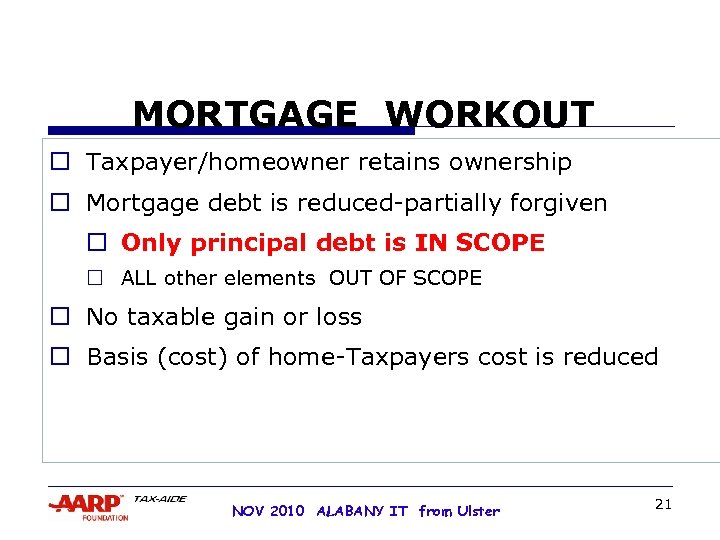

MORTGAGE WORKOUT ¨ Taxpayer/homeowner retains ownership ¨ Mortgage debt is reduced-partially forgiven ¨ Only principal debt is IN SCOPE ¨ ALL other elements OUT OF SCOPE o No taxable gain or loss o Basis (cost) of home-Taxpayers cost is reduced NOV 2010 ALABANY IT from Ulster 21

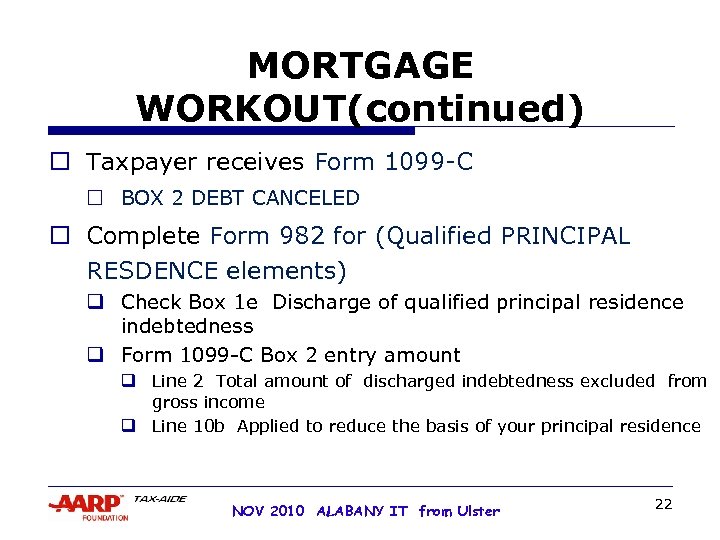

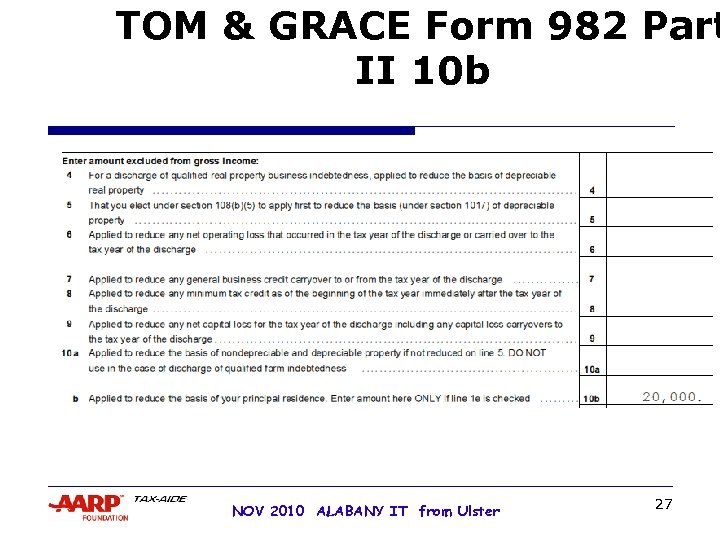

MORTGAGE WORKOUT(continued) ¨ Taxpayer receives Form 1099 -C ¨ BOX 2 DEBT CANCELED o Complete Form 982 for (Qualified PRINCIPAL RESDENCE elements) q Check Box 1 e Discharge of qualified principal residence indebtedness q Form 1099 -C Box 2 entry amount q Line 2 Total amount of discharged indebtedness excluded from gross income q Line 10 b Applied to reduce the basis of your principal residence NOV 2010 ALABANY IT from Ulster 22

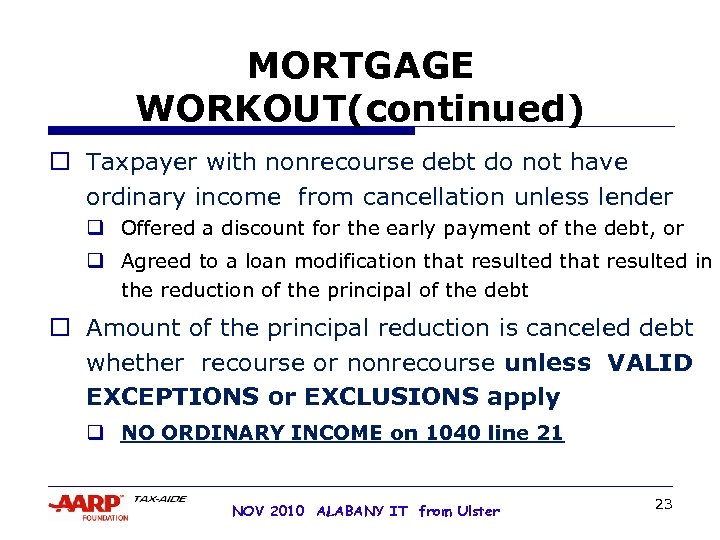

MORTGAGE WORKOUT(continued) o Taxpayer with nonrecourse debt do not have ordinary income from cancellation unless lender q Offered a discount for the early payment of the debt, or q Agreed to a loan modification that resulted in the reduction of the principal of the debt o Amount of the principal reduction is canceled debt whether recourse or nonrecourse unless VALID EXCEPTIONS or EXCLUSIONS apply q NO ORDINARY INCOME on 1040 line 21 NOV 2010 ALABANY IT from Ulster 23

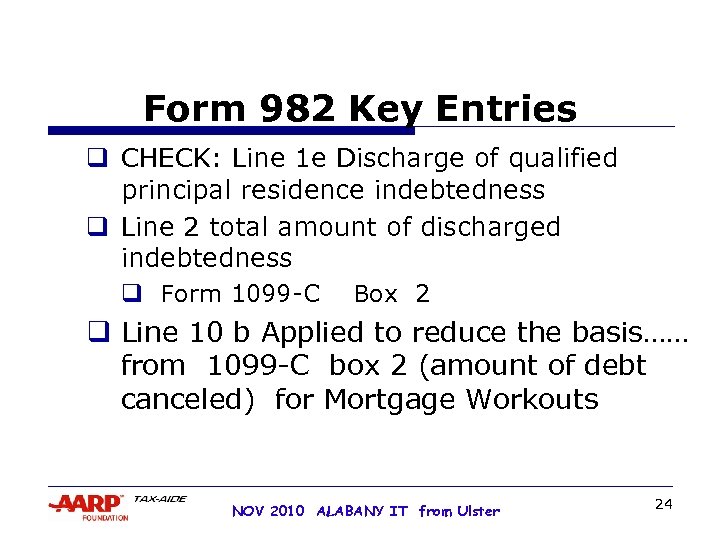

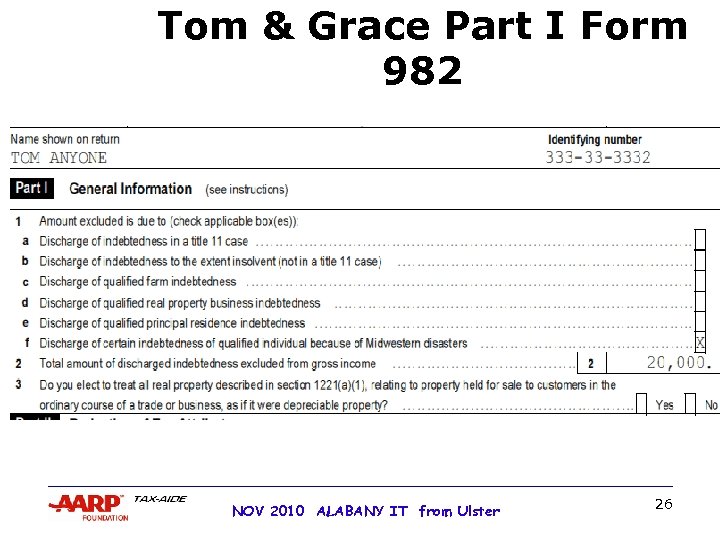

Form 982 Key Entries q CHECK: Line 1 e Discharge of qualified principal residence indebtedness q Line 2 total amount of discharged indebtedness q Form 1099 -C Box 2 q Line 10 b Applied to reduce the basis…… from 1099 -C box 2 (amount of debt canceled) for Mortgage Workouts NOV 2010 ALABANY IT from Ulster 24

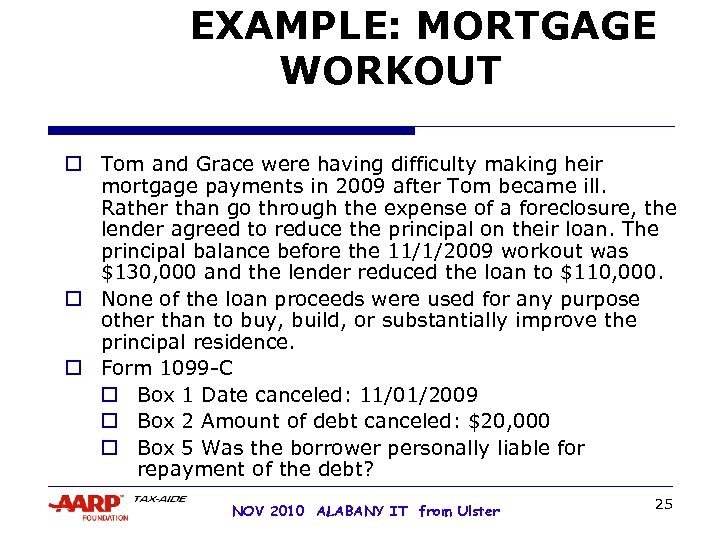

EXAMPLE: MORTGAGE WORKOUT o Tom and Grace were having difficulty making heir mortgage payments in 2009 after Tom became ill. Rather than go through the expense of a foreclosure, the lender agreed to reduce the principal on their loan. The principal balance before the 11/1/2009 workout was $130, 000 and the lender reduced the loan to $110, 000. o None of the loan proceeds were used for any purpose other than to buy, build, or substantially improve the principal residence. o Form 1099 -C o Box 1 Date canceled: 11/01/2009 o Box 2 Amount of debt canceled: $20, 000 o Box 5 Was the borrower personally liable for repayment of the debt? NOV 2010 ALABANY IT from Ulster 25

Tom & Grace Part I Form 982 NOV 2010 ALABANY IT from Ulster 26

TOM & GRACE Form 982 Part II 10 b NOV 2010 ALABANY IT from Ulster 27

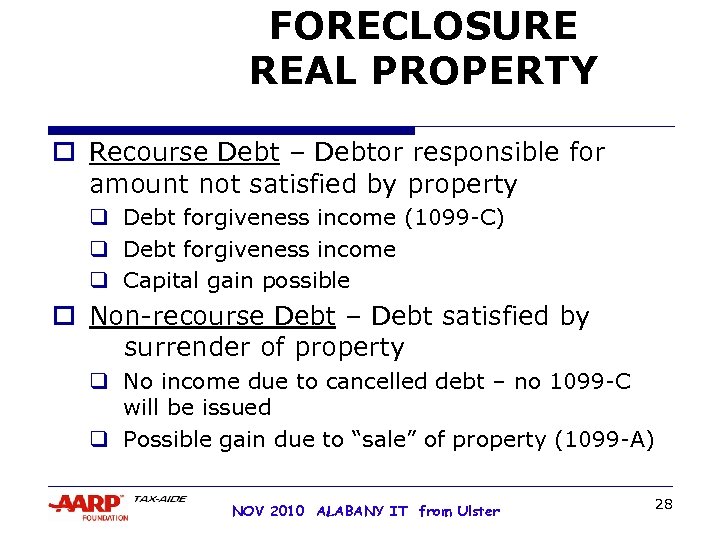

FORECLOSURE REAL PROPERTY o Recourse Debt – Debtor responsible for amount not satisfied by property q Debt forgiveness income (1099 -C) q Debt forgiveness income q Capital gain possible o Non-recourse Debt – Debt satisfied by surrender of property q No income due to cancelled debt – no 1099 -C will be issued q Possible gain due to “sale” of property (1099 -A) NOV 2010 ALABANY IT from Ulster 28

FORECLOSUREHOMEOWNER LOSES POSSESSION ¨ Results in sale of property to lender-Taxpayer receives Form 1099 -A: maybe 1099 -C o Loss is not deductible o Gain may be taxable-gains highly unlikely q If taxable, gain must be entered on Schedule D manually- does not transfer NOV 2010 ALABANY IT from Ulster 29

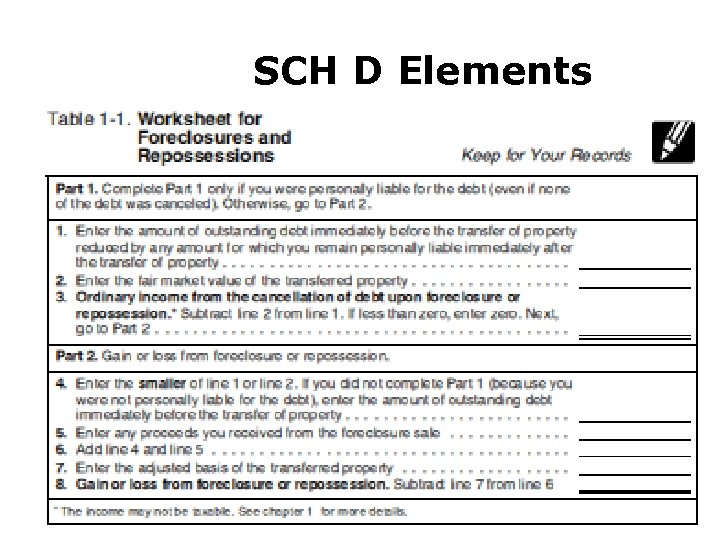

SCH D Elements NOV 2010 ALABANY IT from Ulster 30

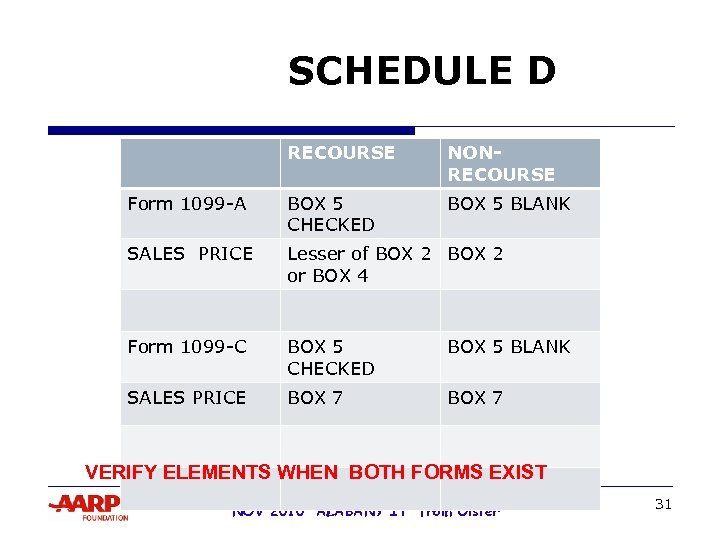

SCHEDULE D RECOURSE NONRECOURSE Form 1099 -A BOX 5 CHECKED BOX 5 BLANK SALES PRICE Lesser of BOX 2 or BOX 4 Form 1099 -C BOX 5 CHECKED BOX 5 BLANK SALES PRICE BOX 7 VERIFY ELEMENTS WHEN BOTH FORMS EXIST NOV 2010 ALABANY IT from Ulster 31

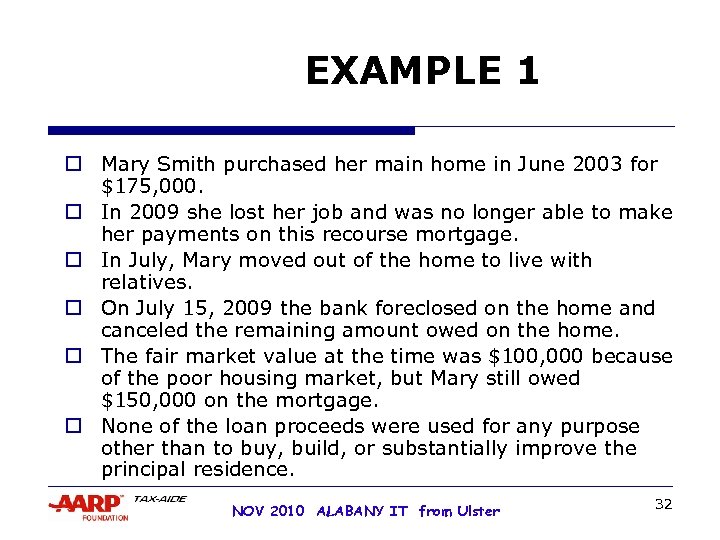

EXAMPLE 1 o Mary Smith purchased her main home in June 2003 for $175, 000. o In 2009 she lost her job and was no longer able to make her payments on this recourse mortgage. o In July, Mary moved out of the home to live with relatives. o On July 15, 2009 the bank foreclosed on the home and canceled the remaining amount owed on the home. o The fair market value at the time was $100, 000 because of the poor housing market, but Mary still owed $150, 000 on the mortgage. o None of the loan proceeds were used for any purpose other than to buy, build, or substantially improve the principal residence. NOV 2010 ALABANY IT from Ulster 32

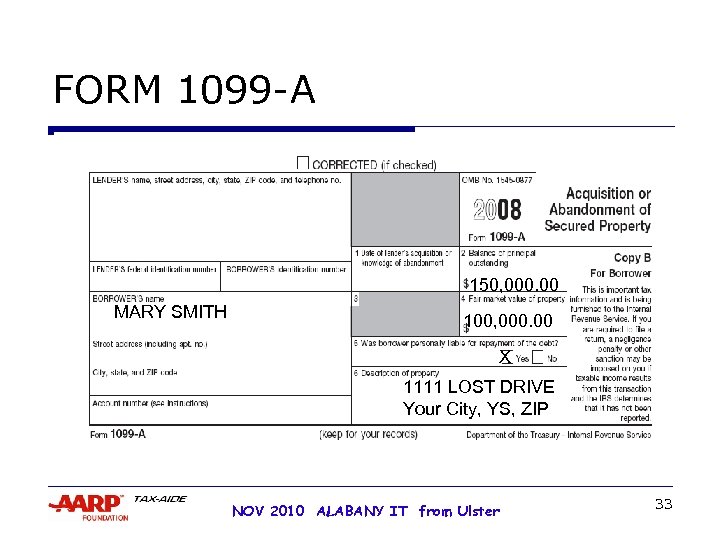

FORM 1099 -A 150, 000. 00 MARY SMITH 100, 000. 00 X 1111 LOST DRIVE Your City, YS, ZIP NOV 2010 ALABANY IT from Ulster 33

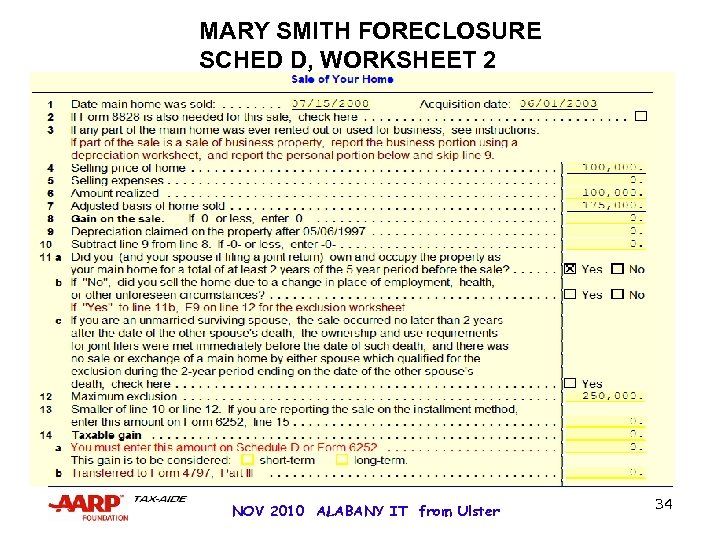

MARY SMITH FORECLOSURE SCHED D, WORKSHEET 2 NOV 2010 ALABANY IT from Ulster 34

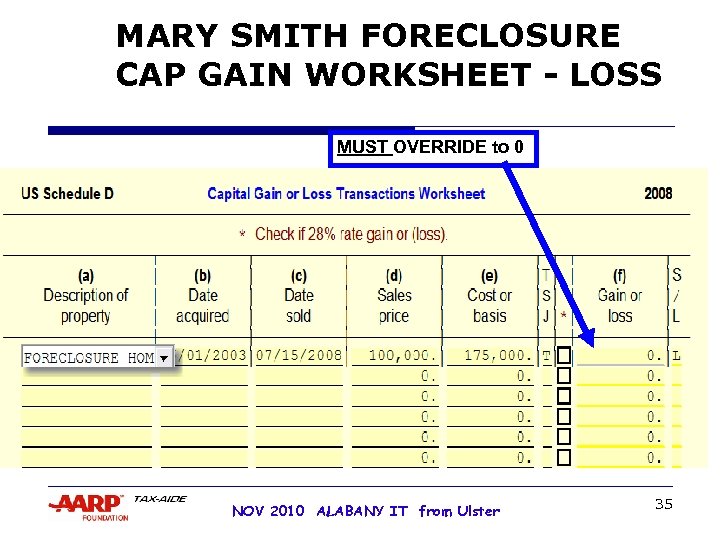

MARY SMITH FORECLOSURE CAP GAIN WORKSHEET - LOSS MUST OVERRIDE to 0 NOV 2010 ALABANY IT from Ulster 35

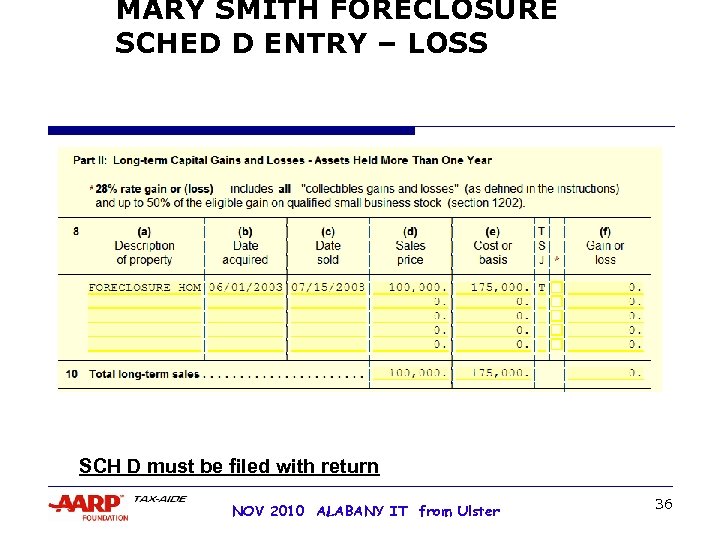

MARY SMITH FORECLOSURE SCHED D ENTRY – LOSS SCH D must be filed with return NOV 2010 ALABANY IT from Ulster 36

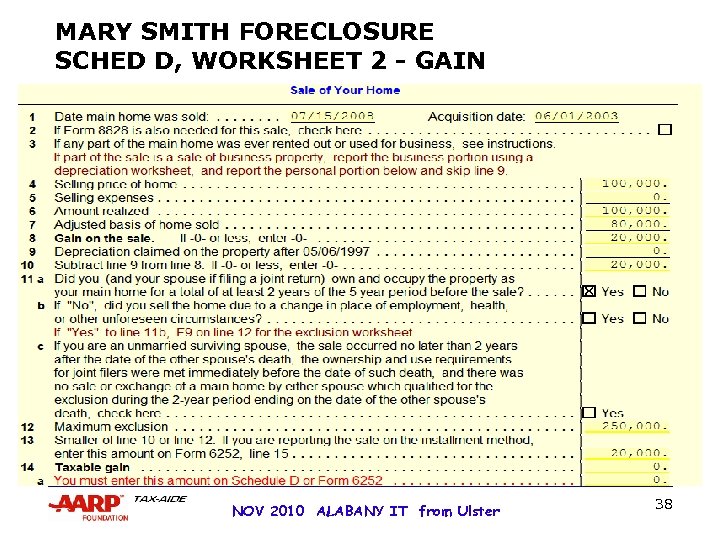

EXAMPLE 2: FORECLOSURE GAIN WITHIN EXCLUSION o Mary Smith purchased her main home in June 2003 for $175, 000. (From 1 st Example) o Change purchase price to $80, 000 NOV 2010 ALABANY IT from Ulster 37

MARY SMITH FORECLOSURE SCHED D, WORKSHEET 2 - GAIN NOV 2010 ALABANY IT from Ulster 38

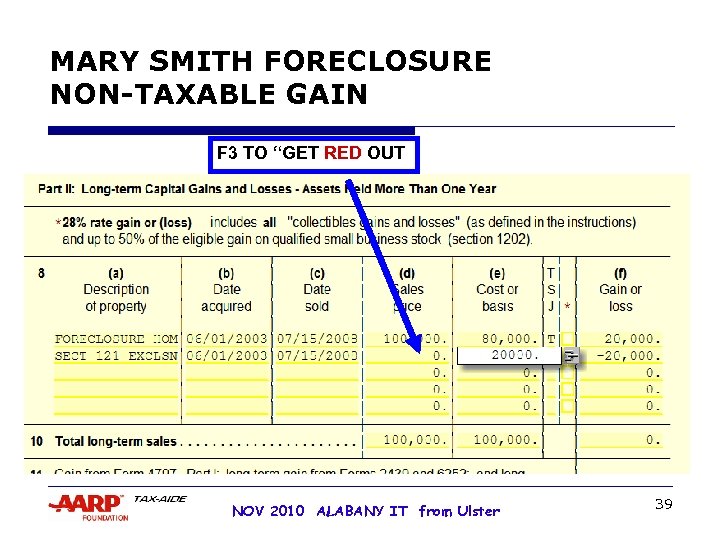

MARY SMITH FORECLOSURE NON-TAXABLE GAIN F 3 TO “GET RED OUT NOV 2010 ALABANY IT from Ulster 39

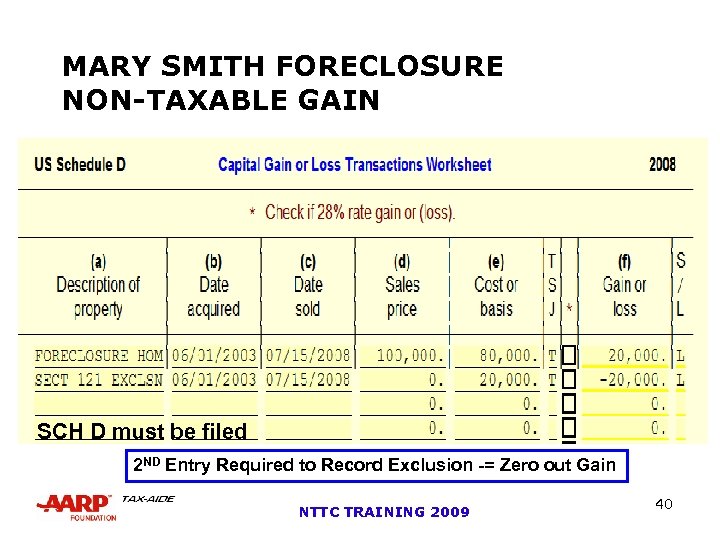

MARY SMITH FORECLOSURE NON-TAXABLE GAIN SCH D must be filed 2 ND Entry Required to Record Exclusion -= Zero out Gain NTTC TRAINING 2009 40

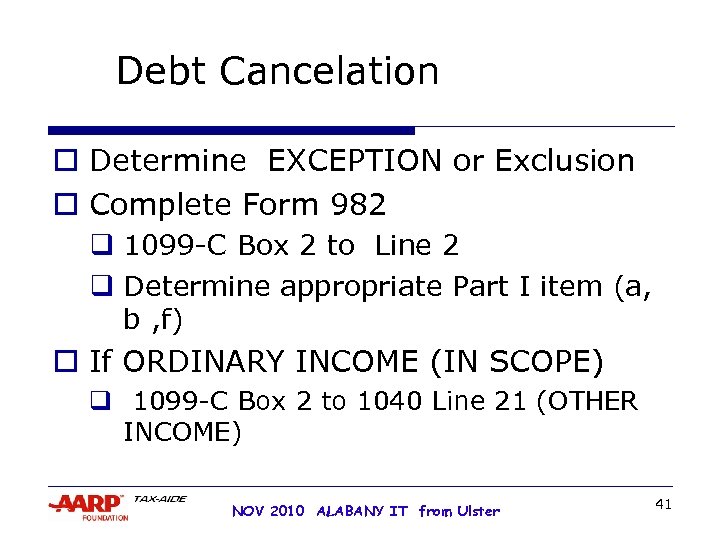

Debt Cancelation o Determine EXCEPTION or Exclusion o Complete Form 982 q 1099 -C Box 2 to Line 2 q Determine appropriate Part I item (a, b , f) o If ORDINARY INCOME (IN SCOPE) q 1099 -C Box 2 to 1040 Line 21 (OTHER INCOME) NOV 2010 ALABANY IT from Ulster 41

MORTGAGE DEBT FORGIVENESS RELIEF ACT QUESTIONS? COMMENTS? Like a duck upon the sea serenely paddling unaware of the fathomless depths below NOV 2010 ALABANY IT from Ulster 42

fbb3207854a22bc47f82b41e9b2b3735.ppt