4ade0d7a2a491f92f6507a8543aab8ef.ppt

- Количество слайдов: 42

More on health regulation © Allen C. Goodman, 2013

More on health regulation © Allen C. Goodman, 2013

General goals More generally the goal is to promote minimal quality levels while eliminating the inefficient components of spending. Inefficiency includes: - Technical inefficiency - Allocative inefficiency - Inefficiencies associated with economies of scale and scope.

General goals More generally the goal is to promote minimal quality levels while eliminating the inefficient components of spending. Inefficiency includes: - Technical inefficiency - Allocative inefficiency - Inefficiencies associated with economies of scale and scope.

Brief overview of controls Fee Controls and Rate Regulation Sloan: Originally, it involved establishing the terms under which public and/or private insurers pay hospitals. Generally done at the state levels. Generally done retrospectively. Prospective Reimbursement: Says, “here is what we will pay you. ” We'll see that this can lead to an efficient form of regulation, if done properly.

Brief overview of controls Fee Controls and Rate Regulation Sloan: Originally, it involved establishing the terms under which public and/or private insurers pay hospitals. Generally done at the state levels. Generally done retrospectively. Prospective Reimbursement: Says, “here is what we will pay you. ” We'll see that this can lead to an efficient form of regulation, if done properly.

Quantity and Capacity Controls Certificate-of-need (CON) laws. Generally tend to limit large -scale capital expenditures. Utilization Review. Related to quality, and quantity of care. Three general forms of UR: - Preadmission review examines the necesssity of hospital admission, before admission occurs, to determine if inpatient care is necessary. - Concurrent review ascertains whether patient needs continuing care, by means of record review. - Retrospective review attempts to identify questionable patterns of care.

Quantity and Capacity Controls Certificate-of-need (CON) laws. Generally tend to limit large -scale capital expenditures. Utilization Review. Related to quality, and quantity of care. Three general forms of UR: - Preadmission review examines the necesssity of hospital admission, before admission occurs, to determine if inpatient care is necessary. - Concurrent review ascertains whether patient needs continuing care, by means of record review. - Retrospective review attempts to identify questionable patterns of care.

Effect of Regulation A lot of the material has come from the literature on bundled goods. In this literature we see a good with more than 1 attribute; the attributes are bundled together and sold with one price. The resulting price with, e. g. two attributes is: P = P (X, Z). There is some literature on what the actual implicit valuations in the market of X and Z are, or P/ Z, P/ X. These implicit valuations are used in housing literature, and are referred to as hedonic prices. It's worth spending some time on this. We want to look at the consumer's optimization, then at how the prices are developed. Standard article is Rosen (JPE, 1974).

Effect of Regulation A lot of the material has come from the literature on bundled goods. In this literature we see a good with more than 1 attribute; the attributes are bundled together and sold with one price. The resulting price with, e. g. two attributes is: P = P (X, Z). There is some literature on what the actual implicit valuations in the market of X and Z are, or P/ Z, P/ X. These implicit valuations are used in housing literature, and are referred to as hedonic prices. It's worth spending some time on this. We want to look at the consumer's optimization, then at how the prices are developed. Standard article is Rosen (JPE, 1974).

Bundled Goods Start first from a utility maximization. Assume that the good has two attributes, X and Z, which yield P (X, Z). You may want to think of X as quantity and Z as quality. L = U (X, Z, a) + (P (X, Z) + a - y) Maximize with respect to X, Z, a. L/ X = UX + PX = 0 L/ Z = UZ + PZ = 0 L/ a = Ua + = 0. This gives us UX/UZ = PX/PZ, and so on.

Bundled Goods Start first from a utility maximization. Assume that the good has two attributes, X and Z, which yield P (X, Z). You may want to think of X as quantity and Z as quality. L = U (X, Z, a) + (P (X, Z) + a - y) Maximize with respect to X, Z, a. L/ X = UX + PX = 0 L/ Z = UZ + PZ = 0 L/ a = Ua + = 0. This gives us UX/UZ = PX/PZ, and so on.

Bundled Goods Question here is how this is derived. You want to consider it as the joint envelope of “bid” functions and “offer” functions. The “bid” functions hold utility constant. The “offer” functions hold profit constant. A lot of people think that you have to make fancy assumptions about long or short run eq'a. Not so. All that has to be happening is that there is some competition (including monopolistic competition) that would lead to constant profits among competitors. For the constant utility bid function.

Bundled Goods Question here is how this is derived. You want to consider it as the joint envelope of “bid” functions and “offer” functions. The “bid” functions hold utility constant. The “offer” functions hold profit constant. A lot of people think that you have to make fancy assumptions about long or short run eq'a. Not so. All that has to be happening is that there is some competition (including monopolistic competition) that would lead to constant profits among competitors. For the constant utility bid function.

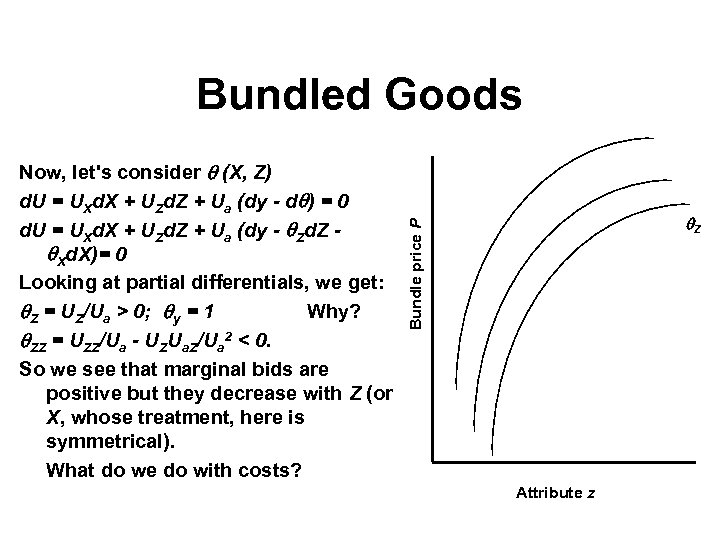

Bundled Goods Z Bundle price P Now, let's consider (X, Z) d. U = UXd. X + UZd. Z + Ua (dy - d ) = 0 d. U = UXd. X + UZd. Z + Ua (dy - Zd. Z Xd. X)= 0 Looking at partial differentials, we get: Z = UZ/Ua > 0; y = 1 Why? ZZ = UZZ/Ua - UZUa. Z/Ua 2 < 0. So we see that marginal bids are positive but they decrease with Z (or X, whose treatment, here is symmetrical). What do we do with costs? Attribute z

Bundled Goods Z Bundle price P Now, let's consider (X, Z) d. U = UXd. X + UZd. Z + Ua (dy - d ) = 0 d. U = UXd. X + UZd. Z + Ua (dy - Zd. Z Xd. X)= 0 Looking at partial differentials, we get: Z = UZ/Ua > 0; y = 1 Why? ZZ = UZZ/Ua - UZUa. Z/Ua 2 < 0. So we see that marginal bids are positive but they decrease with Z (or X, whose treatment, here is symmetrical). What do we do with costs? Attribute z

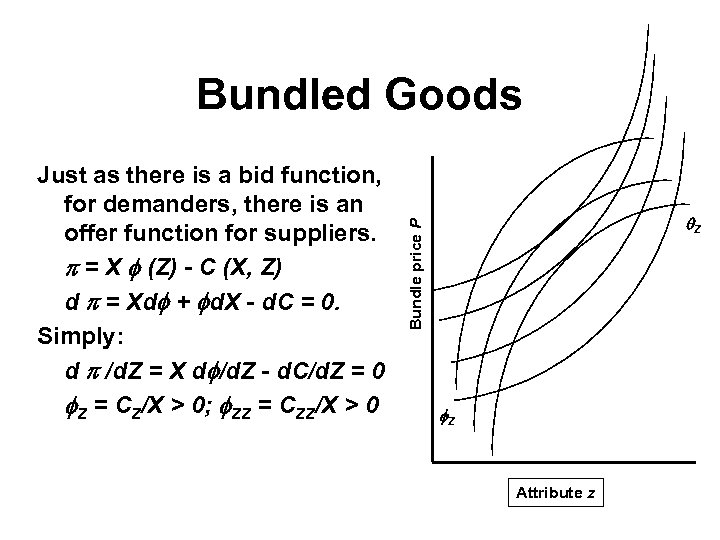

Bundled Goods Z Bundle price P Just as there is a bid function, for demanders, there is an offer function for suppliers. = X (Z) - C (X, Z) d = Xd + d. X - d. C = 0. Simply: d /d. Z = X d /d. Z - d. C/d. Z = 0 Z = CZ/X > 0; ZZ = CZZ/X > 0 Z Attribute z

Bundled Goods Z Bundle price P Just as there is a bid function, for demanders, there is an offer function for suppliers. = X (Z) - C (X, Z) d = Xd + d. X - d. C = 0. Simply: d /d. Z = X d /d. Z - d. C/d. Z = 0 Z = CZ/X > 0; ZZ = CZZ/X > 0 Z Attribute z

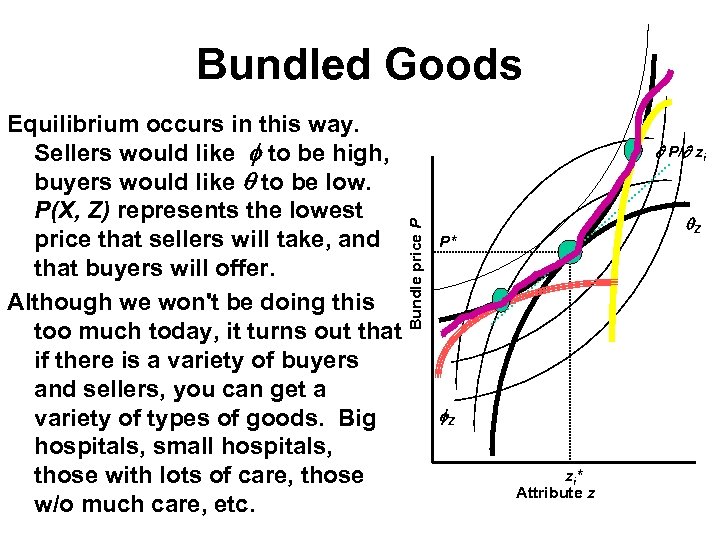

Bundled Goods P/ zi Bundle price P Equilibrium occurs in this way. Sellers would like to be high, buyers would like to be low. P(X, Z) represents the lowest price that sellers will take, and that buyers will offer. Although we won't be doing this too much today, it turns out that if there is a variety of buyers and sellers, you can get a variety of types of goods. Big hospitals, small hospitals, those with lots of care, those w/o much care, etc. Z P* Z zi* Attribute z

Bundled Goods P/ zi Bundle price P Equilibrium occurs in this way. Sellers would like to be high, buyers would like to be low. P(X, Z) represents the lowest price that sellers will take, and that buyers will offer. Although we won't be doing this too much today, it turns out that if there is a variety of buyers and sellers, you can get a variety of types of goods. Big hospitals, small hospitals, those with lots of care, those w/o much care, etc. Z P* Z zi* Attribute z

Regulation • These types of models have been used to demonstrate tax incidence. They show that the form of the tax is not unimportant because of the incentives that the various taxes provide. • An ad valorem tax on the value of the attributes bundle gives the incentive to remove the attributes and sell them tax free. In a hospital sense, if you control the prices of radiologists who work for the hospital, but not those that are contracted out (bill separately) you could avoid some of the tax.

Regulation • These types of models have been used to demonstrate tax incidence. They show that the form of the tax is not unimportant because of the incentives that the various taxes provide. • An ad valorem tax on the value of the attributes bundle gives the incentive to remove the attributes and sell them tax free. In a hospital sense, if you control the prices of radiologists who work for the hospital, but not those that are contracted out (bill separately) you could avoid some of the tax.

Regulation • A per unit tax literally applies only to those attributes specified by the tax. It would lead to a reconfiguration to reduce the contribution of the taxed attribute. • In particular they look at rate review as a ceiling on the value of the hospital care bundle, and in, the absence of other constraints, it provides incentives to remove services from the hospital care bundle. • In this formulation, the physician combines hospital services with his own time to produce medical care. The consumers are indifferent to the prices of the individual components, but do care about the price of the bundle.

Regulation • A per unit tax literally applies only to those attributes specified by the tax. It would lead to a reconfiguration to reduce the contribution of the taxed attribute. • In particular they look at rate review as a ceiling on the value of the hospital care bundle, and in, the absence of other constraints, it provides incentives to remove services from the hospital care bundle. • In this formulation, the physician combines hospital services with his own time to produce medical care. The consumers are indifferent to the prices of the individual components, but do care about the price of the bundle.

Prospective Payment • The enactment of Medicare and Medicaid got the Federal government into the reimbursement of services in a big way. As we have seen, there have been substantial increases in the costs of these programs through the years. As costs have grown, so has interest in cost containment policies. • A wide variety of cost containment efforts have been initiated by government in the past two decades, aimed both at Medicare and Medicaid costs, and health care costs in general. CON, UR and RR were discussed above; the incentives to adopt managed care systems in the previous chapter.

Prospective Payment • The enactment of Medicare and Medicaid got the Federal government into the reimbursement of services in a big way. As we have seen, there have been substantial increases in the costs of these programs through the years. As costs have grown, so has interest in cost containment policies. • A wide variety of cost containment efforts have been initiated by government in the past two decades, aimed both at Medicare and Medicaid costs, and health care costs in general. CON, UR and RR were discussed above; the incentives to adopt managed care systems in the previous chapter.

Prospective Payment • Here, we focus on the Medicare program which converted the financing of Medicare hospital care to a prospective payment system based on diagnosis related groups (DRGs). • To understand PPS under DRGs requires what prospective payment means, and what DRGs are. Prospective payment is best seen in contrast to the former retrospective reimbursement system under Medicare. • Under retrospective payment, a hospital submits bill to Medicare after the care has been given and the costs to the hospital are known. Retrospective payment allowed the hospitals to recover their expenses, whether expenses were high or low, excessive or efficient. Under retrospective reimbursement, questionable incentives for cost efficiency.

Prospective Payment • Here, we focus on the Medicare program which converted the financing of Medicare hospital care to a prospective payment system based on diagnosis related groups (DRGs). • To understand PPS under DRGs requires what prospective payment means, and what DRGs are. Prospective payment is best seen in contrast to the former retrospective reimbursement system under Medicare. • Under retrospective payment, a hospital submits bill to Medicare after the care has been given and the costs to the hospital are known. Retrospective payment allowed the hospitals to recover their expenses, whether expenses were high or low, excessive or efficient. Under retrospective reimbursement, questionable incentives for cost efficiency.

DRGs Prospective payment sets payment rates prior to the period for which care is given. By setting a fixed reimbursement level per admission, prospective payment provides economic incentives to conserve on the use of input resources. Hospitals who use more resources than covered by the flat rate lose the difference. Those with costs below that rate retain the difference. The rates themselves are determined by DRGs. Under PPS, patients are admitted according to their condition. Each DRG attempts to represent a case type identifying patients with similar conditions and processes of care.

DRGs Prospective payment sets payment rates prior to the period for which care is given. By setting a fixed reimbursement level per admission, prospective payment provides economic incentives to conserve on the use of input resources. Hospitals who use more resources than covered by the flat rate lose the difference. Those with costs below that rate retain the difference. The rates themselves are determined by DRGs. Under PPS, patients are admitted according to their condition. Each DRG attempts to represent a case type identifying patients with similar conditions and processes of care.

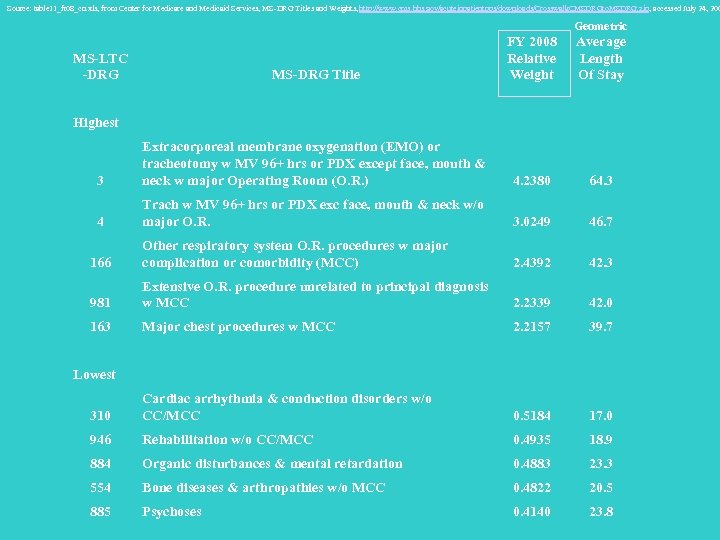

DRGs • There used to be about 500 DRGs. • In 2007 -2008, CMS adopted a new set of 745 Medicare Severity Long-Term Care Diagnostic Related Groups (MS-DRGs) that replace the existing 538 DRGs with ones that better recognize severity of illness. • CMS does not expect the new DRGs to result in any savings to Medicare but will increase payments to hospitals treating more severely ill and costlier patients. Payments to hospitals for treating less severely ill patients will decline.

DRGs • There used to be about 500 DRGs. • In 2007 -2008, CMS adopted a new set of 745 Medicare Severity Long-Term Care Diagnostic Related Groups (MS-DRGs) that replace the existing 538 DRGs with ones that better recognize severity of illness. • CMS does not expect the new DRGs to result in any savings to Medicare but will increase payments to hospitals treating more severely ill and costlier patients. Payments to hospitals for treating less severely ill patients will decline.

Weights • Since a disease is an insurable event, each DRG represents the average resources needed to treat patients grouped to that DRG relative to a national average. • To accomplish this, relative weights (RWs) are assigned to each DRG, an insurance factor that reflects the cost of caring for that particular disease, including any procedures. • The DRG system then uses these relative weights to determine case rate mix, and ultimately hospital reimbursement

Weights • Since a disease is an insurable event, each DRG represents the average resources needed to treat patients grouped to that DRG relative to a national average. • To accomplish this, relative weights (RWs) are assigned to each DRG, an insurance factor that reflects the cost of caring for that particular disease, including any procedures. • The DRG system then uses these relative weights to determine case rate mix, and ultimately hospital reimbursement

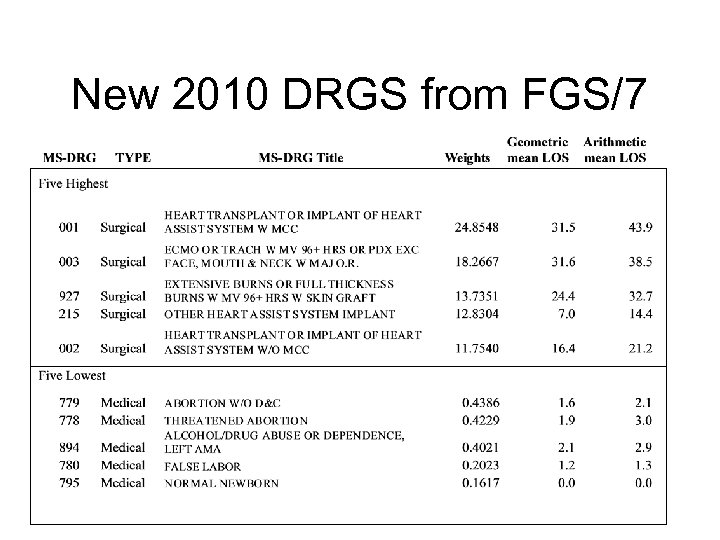

New 2010 DRGS from FGS/7

New 2010 DRGS from FGS/7

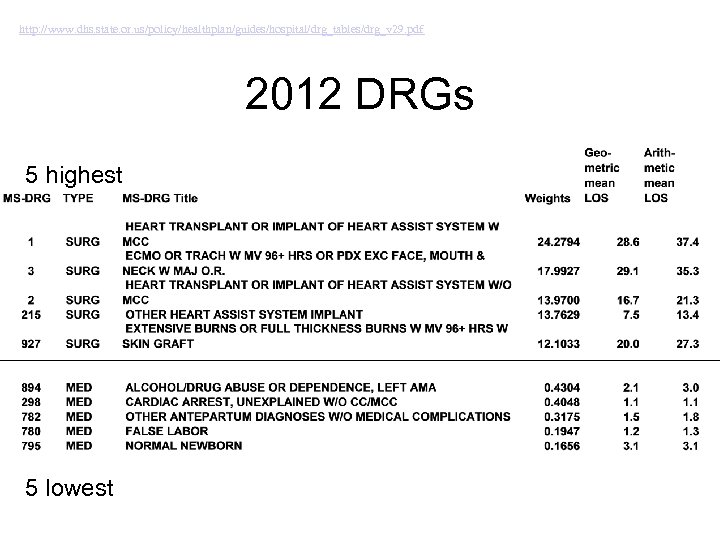

http: //www. dhs. state. or. us/policy/healthplan/guides/hospital/drg_tables/drg_v 29. pdf 2012 DRGs 5 highest 5 lowest

http: //www. dhs. state. or. us/policy/healthplan/guides/hospital/drg_tables/drg_v 29. pdf 2012 DRGs 5 highest 5 lowest

DRGs • Each DRG is given a flat payment rate calculated in part on the basis of costs incurred for that DRG nationally. • These rates are modified somewhat in practice to account for differences in local wages, urban versus rural location, and other factors such as whether the hospital is a teaching hospital. • The rates are flat in the important sense that they are not varied or softened for hospitals who spend more than the rate, or for that matter less.

DRGs • Each DRG is given a flat payment rate calculated in part on the basis of costs incurred for that DRG nationally. • These rates are modified somewhat in practice to account for differences in local wages, urban versus rural location, and other factors such as whether the hospital is a teaching hospital. • The rates are flat in the important sense that they are not varied or softened for hospitals who spend more than the rate, or for that matter less.

Yardstick Competition • Shleifer (1985) has described theory of a payment system he calls yardstick competition, which is a close approximation of the prospective payment system under DRGs. • We can think of yardstick competition as the ideal form of such a system, while the actual Medicare payment system is a real life approximation. As such it is helpful to consider the economics behind it. • Shleifer describes yardstick competition in the context of markets where firms are monopolists or at least have some monopoly power. • Since most medical providers face downward sloping demand curves, they possess some degree of monopoly power. This characterizes the hospital care market reasonably well.

Yardstick Competition • Shleifer (1985) has described theory of a payment system he calls yardstick competition, which is a close approximation of the prospective payment system under DRGs. • We can think of yardstick competition as the ideal form of such a system, while the actual Medicare payment system is a real life approximation. As such it is helpful to consider the economics behind it. • Shleifer describes yardstick competition in the context of markets where firms are monopolists or at least have some monopoly power. • Since most medical providers face downward sloping demand curves, they possess some degree of monopoly power. This characterizes the hospital care market reasonably well.

Yardstick Competition • Here is the context in which yardstick competition is effective. It requires a situation, which seems quite realistic, where existing firms are at present not as cost efficient as they could be. • Shleifer assumes that firms could reduce costs with suitable investments. To get a feel for what this means, consider an example where a hospital knows it could be more cost efficient if it would hire a team of efficiency experts (which are costly) and carry out their advice (which also is costly). • An optimal scheme would lead the firm to invest so as to reduce costs. The problem for yardstick competition is to set up a payment scheme so that these firms have the incentives to expend just the right amount of money and effort on reducing production costs.

Yardstick Competition • Here is the context in which yardstick competition is effective. It requires a situation, which seems quite realistic, where existing firms are at present not as cost efficient as they could be. • Shleifer assumes that firms could reduce costs with suitable investments. To get a feel for what this means, consider an example where a hospital knows it could be more cost efficient if it would hire a team of efficiency experts (which are costly) and carry out their advice (which also is costly). • An optimal scheme would lead the firm to invest so as to reduce costs. The problem for yardstick competition is to set up a payment scheme so that these firms have the incentives to expend just the right amount of money and effort on reducing production costs.

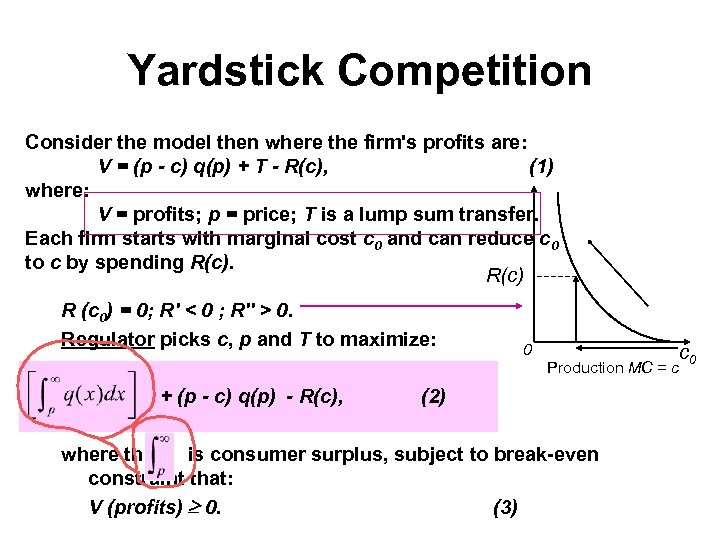

Yardstick Competition Consider the model then where the firm's profits are: V = (p - c) q(p) + T - R(c), (1) where: V = profits; p = price; T is a lump sum transfer. Each firm starts with marginal cost c 0 and can reduce c 0 to c by spending R(c) R (c 0) = 0; R' < 0 ; R'' > 0. Regulator picks c, p and T to maximize: 0 Production MC = c + (p - c) q(p) - R(c), (2) where the is consumer surplus, subject to break-even constraint that: V (profits) 0. (3) c 0

Yardstick Competition Consider the model then where the firm's profits are: V = (p - c) q(p) + T - R(c), (1) where: V = profits; p = price; T is a lump sum transfer. Each firm starts with marginal cost c 0 and can reduce c 0 to c by spending R(c) R (c 0) = 0; R' < 0 ; R'' > 0. Regulator picks c, p and T to maximize: 0 Production MC = c + (p - c) q(p) - R(c), (2) where the is consumer surplus, subject to break-even constraint that: V (profits) 0. (3) c 0

Yardstick Competition This can be solved for a social optimum as: R (c*) = T* (4) p* = c * (5) - R' = q (p*) (6) (4) says that transfers just cover costs of cost reduction. (5) says that MC = price (6) says that lowering unit costs by c requires R' c investment in cost reduction, but reduces production costs by q(p) c. At the optimum the two must be equal.

Yardstick Competition This can be solved for a social optimum as: R (c*) = T* (4) p* = c * (5) - R' = q (p*) (6) (4) says that transfers just cover costs of cost reduction. (5) says that MC = price (6) says that lowering unit costs by c requires R' c investment in cost reduction, but reduces production costs by q(p) c. At the optimum the two must be equal.

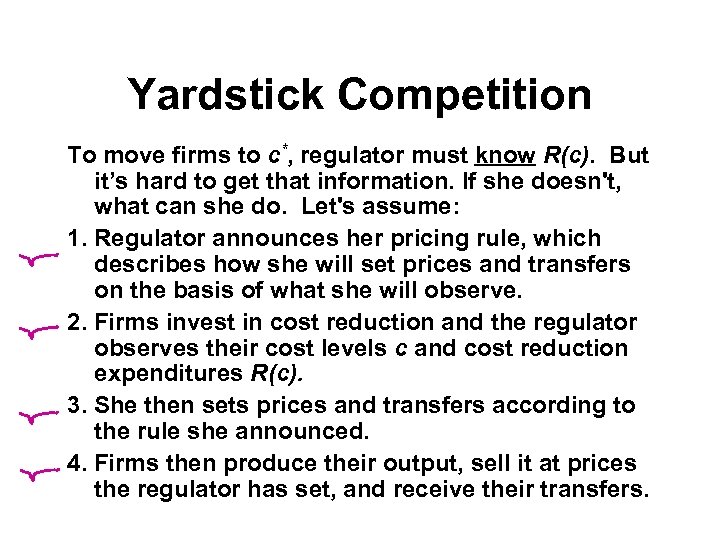

Yardstick Competition To move firms to c*, regulator must know R(c). But it’s hard to get that information. If she doesn't, what can she do. Let's assume: 1. Regulator announces her pricing rule, which describes how she will set prices and transfers on the basis of what she will observe. 2. Firms invest in cost reduction and the regulator observes their cost levels c and cost reduction expenditures R(c). 3. She then sets prices and transfers according to the rule she announced. 4. Firms then produce their output, sell it at prices the regulator has set, and receive their transfers.

Yardstick Competition To move firms to c*, regulator must know R(c). But it’s hard to get that information. If she doesn't, what can she do. Let's assume: 1. Regulator announces her pricing rule, which describes how she will set prices and transfers on the basis of what she will observe. 2. Firms invest in cost reduction and the regulator observes their cost levels c and cost reduction expenditures R(c). 3. She then sets prices and transfers according to the rule she announced. 4. Firms then produce their output, sell it at prices the regulator has set, and receive their transfers.

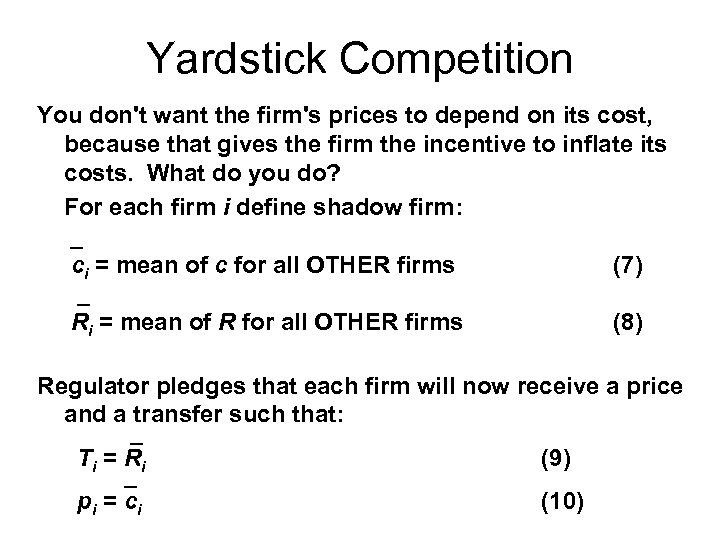

Yardstick Competition You don't want the firm's prices to depend on its cost, because that gives the firm the incentive to inflate its costs. What do you do? For each firm i define shadow firm: _ ci = mean of c for all OTHER firms (7) _ Ri = mean of R for all OTHER firms (8) Regulator pledges that each firm will now receive a price and a transfer such that: _ T i = Ri (9) _ p i = ci (10)

Yardstick Competition You don't want the firm's prices to depend on its cost, because that gives the firm the incentive to inflate its costs. What do you do? For each firm i define shadow firm: _ ci = mean of c for all OTHER firms (7) _ Ri = mean of R for all OTHER firms (8) Regulator pledges that each firm will now receive a price and a transfer such that: _ T i = Ri (9) _ p i = ci (10)

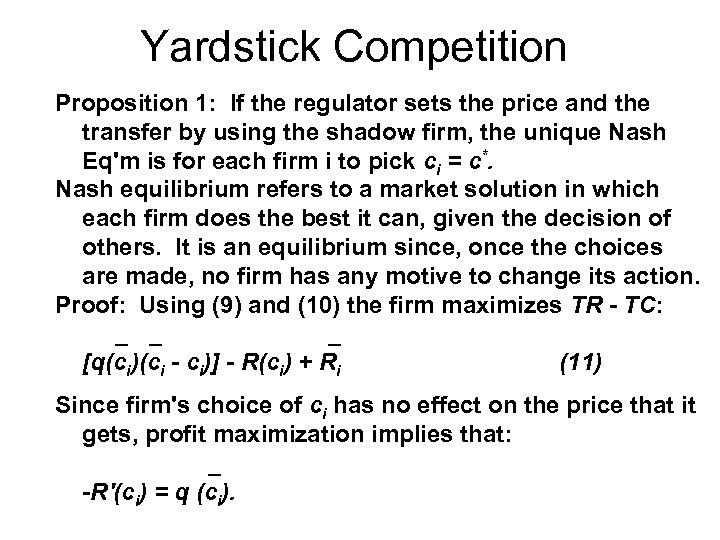

Yardstick Competition Proposition 1: If the regulator sets the price and the transfer by using the shadow firm, the unique Nash Eq'm is for each firm i to pick ci = c*. Nash equilibrium refers to a market solution in which each firm does the best it can, given the decision of others. It is an equilibrium since, once the choices are made, no firm has any motive to change its action. Proof: Using (9) and (10) the firm maximizes TR - TC: _ _ _ [q(ci)(ci - ci)] - R(ci) + Ri (11) Since firm's choice of ci has no effect on the price that it gets, profit maximization implies that: _ -R'(ci) = q (ci).

Yardstick Competition Proposition 1: If the regulator sets the price and the transfer by using the shadow firm, the unique Nash Eq'm is for each firm i to pick ci = c*. Nash equilibrium refers to a market solution in which each firm does the best it can, given the decision of others. It is an equilibrium since, once the choices are made, no firm has any motive to change its action. Proof: Using (9) and (10) the firm maximizes TR - TC: _ _ _ [q(ci)(ci - ci)] - R(ci) + Ri (11) Since firm's choice of ci has no effect on the price that it gets, profit maximization implies that: _ -R'(ci) = q (ci).

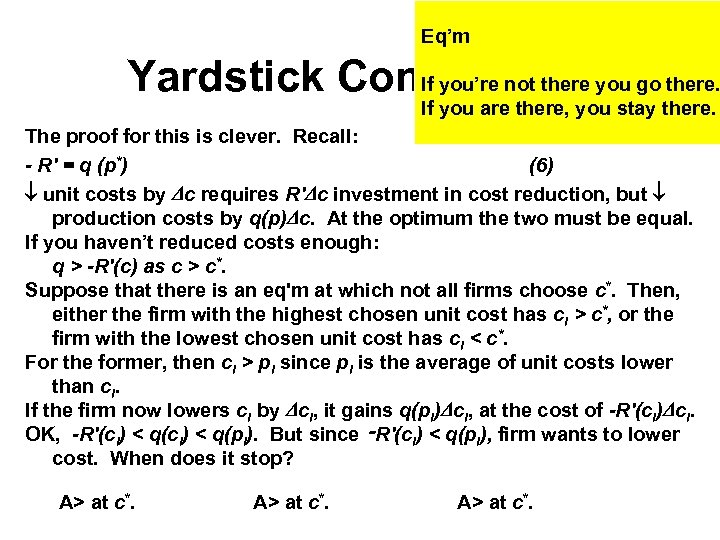

Eq’m Yardstick Competition you go there. If you’re not there If you are there, you stay there. The proof for this is clever. Recall: - R' = q (p*) (6) unit costs by c requires R' c investment in cost reduction, but production costs by q(p) c. At the optimum the two must be equal. If you haven’t reduced costs enough: q > -R'(c) as c > c*. Suppose that there is an eq'm at which not all firms choose c*. Then, either the firm with the highest chosen unit cost has ci > c*, or the firm with the lowest chosen unit cost has ci < c*. For the former, then ci > pi since pi is the average of unit costs lower than ci. If the firm now lowers ci by ci, it gains q(pi) ci, at the cost of -R'(ci) ci. OK, -R'(ci) < q(pi). But since ‑R'(ci) < q(pi), firm wants to lower cost. When does it stop? A> at c*.

Eq’m Yardstick Competition you go there. If you’re not there If you are there, you stay there. The proof for this is clever. Recall: - R' = q (p*) (6) unit costs by c requires R' c investment in cost reduction, but production costs by q(p) c. At the optimum the two must be equal. If you haven’t reduced costs enough: q > -R'(c) as c > c*. Suppose that there is an eq'm at which not all firms choose c*. Then, either the firm with the highest chosen unit cost has ci > c*, or the firm with the lowest chosen unit cost has ci < c*. For the former, then ci > pi since pi is the average of unit costs lower than ci. If the firm now lowers ci by ci, it gains q(pi) ci, at the cost of -R'(ci) ci. OK, -R'(ci) < q(pi). But since ‑R'(ci) < q(pi), firm wants to lower cost. When does it stop? A> at c*.

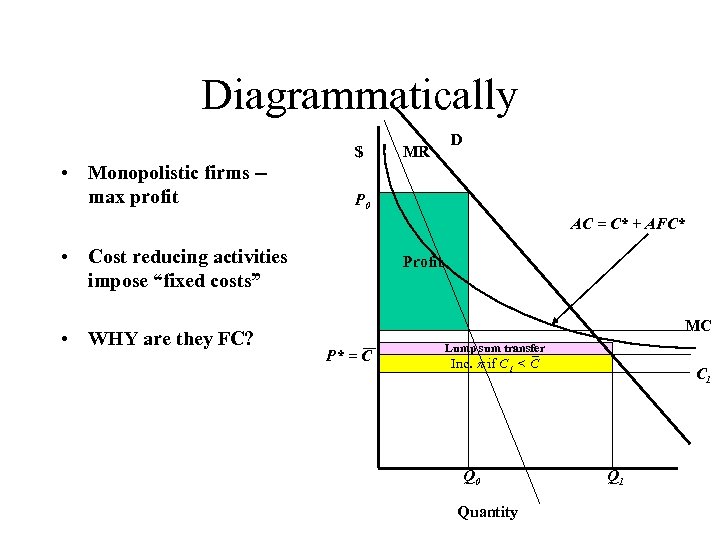

Diagrammatically $ • Monopolistic firms -max profit MR D P 0 AC = C* + AFC* • Cost reducing activities impose “fixed costs” • WHY are they FC? Profit MC P* = C Lump sum transfer Inc. if C 1 < C Q 0 Quantity C 1 Q 1

Diagrammatically $ • Monopolistic firms -max profit MR D P 0 AC = C* + AFC* • Cost reducing activities impose “fixed costs” • WHY are they FC? Profit MC P* = C Lump sum transfer Inc. if C 1 < C Q 0 Quantity C 1 Q 1

Yardstick Competition Yardstick competition works because it doesn't allow an inefficient cost choice by a firm to influence the price and transfer payments that it receives. By using the prices of other hospitals, the regulator is assuring that sector-specific cost conditions are addressed. By omitting the hospital's own costs in setting the rate, the regulator keeps the hospital from influencing the price by inflating its own costs. The model presented implicitly assumes that all firms, in this case hospitals, are the same. Shleifer, however, shows how one could construct a multiple regression model that would control for cost differences among firms (let's say due to factor costs or case-mix) that would help to generate a similar solution in the more realistic case where firm's are different from each other. Clearly the question here involves how good the multiple regression results are.

Yardstick Competition Yardstick competition works because it doesn't allow an inefficient cost choice by a firm to influence the price and transfer payments that it receives. By using the prices of other hospitals, the regulator is assuring that sector-specific cost conditions are addressed. By omitting the hospital's own costs in setting the rate, the regulator keeps the hospital from influencing the price by inflating its own costs. The model presented implicitly assumes that all firms, in this case hospitals, are the same. Shleifer, however, shows how one could construct a multiple regression model that would control for cost differences among firms (let's say due to factor costs or case-mix) that would help to generate a similar solution in the more realistic case where firm's are different from each other. Clearly the question here involves how good the multiple regression results are.

DRGs as practiced • Return now to DRGs as practiced. It is important to note that, consistent with Shleifer's formulation, a hospital's actual costs do not enter the formula for its payment rate. • As a result, the hospital must become a pricetaker in the strictest sense. • If it costs the hospital more to provide the service than the DRGs allow, the hospital either loses money on the service and is forced to stop offering it, or is forced to cross-subsidize the service from other services that may be produced at costs lower than their DRGs. • Thus the cost-cutting incentives are strong.

DRGs as practiced • Return now to DRGs as practiced. It is important to note that, consistent with Shleifer's formulation, a hospital's actual costs do not enter the formula for its payment rate. • As a result, the hospital must become a pricetaker in the strictest sense. • If it costs the hospital more to provide the service than the DRGs allow, the hospital either loses money on the service and is forced to stop offering it, or is forced to cross-subsidize the service from other services that may be produced at costs lower than their DRGs. • Thus the cost-cutting incentives are strong.

Supplemental

Supplemental

Regulating Quantity The easiest way to discuss this is to consider the total valuation and the total cost functions for hospital services. Think of the two dimensions as X of quantity and Z or quality, and their ratio Z/X. The higher Z/X the more consumers are willing to pay for unit of X. Let's write TV, and TC, as: TV = t (X, Z); TC = c (X, Z). TV/ X = t. X > 0; TV/ Z = t. Z > 0; t. XX < 0; t. XZ > 0. TC/ X = c. X > 0; TV/ Z = c. Z > 0; c. XX > 0; c. XZ > 0.

Regulating Quantity The easiest way to discuss this is to consider the total valuation and the total cost functions for hospital services. Think of the two dimensions as X of quantity and Z or quality, and their ratio Z/X. The higher Z/X the more consumers are willing to pay for unit of X. Let's write TV, and TC, as: TV = t (X, Z); TC = c (X, Z). TV/ X = t. X > 0; TV/ Z = t. Z > 0; t. XX < 0; t. XZ > 0. TC/ X = c. X > 0; TV/ Z = c. Z > 0; c. XX > 0; c. XZ > 0.

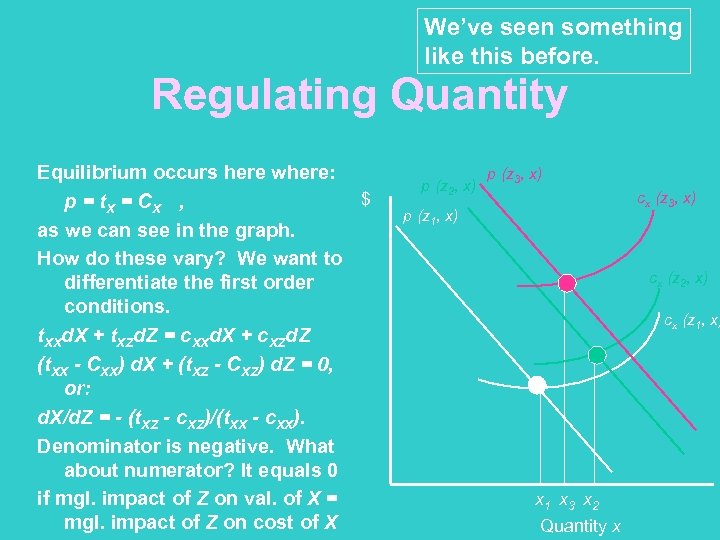

We’ve seen something like this before. Regulating Quantity Equilibrium occurs here where: $ p = t. X = C X , as we can see in the graph. How do these vary? We want to differentiate the first order conditions. t. XXd. X + t. XZd. Z = c. XXd. X + c. XZd. Z (t. XX - CXX) d. X + (t. XZ - CXZ) d. Z = 0, or: d. X/d. Z = - (t. XZ - c. XZ)/(t. XX - c. XX). Denominator is negative. What about numerator? It equals 0 if mgl. impact of Z on val. of X = mgl. impact of Z on cost of X p (z 2, x) p (z 3, x) cx (z 3, x) p (z 1, x) cx (z 2, x) cx (z 1, x) x 1 x 3 x 2 Quantity x

We’ve seen something like this before. Regulating Quantity Equilibrium occurs here where: $ p = t. X = C X , as we can see in the graph. How do these vary? We want to differentiate the first order conditions. t. XXd. X + t. XZd. Z = c. XXd. X + c. XZd. Z (t. XX - CXX) d. X + (t. XZ - CXZ) d. Z = 0, or: d. X/d. Z = - (t. XZ - c. XZ)/(t. XX - c. XX). Denominator is negative. What about numerator? It equals 0 if mgl. impact of Z on val. of X = mgl. impact of Z on cost of X p (z 2, x) p (z 3, x) cx (z 3, x) p (z 1, x) cx (z 2, x) cx (z 1, x) x 1 x 3 x 2 Quantity x

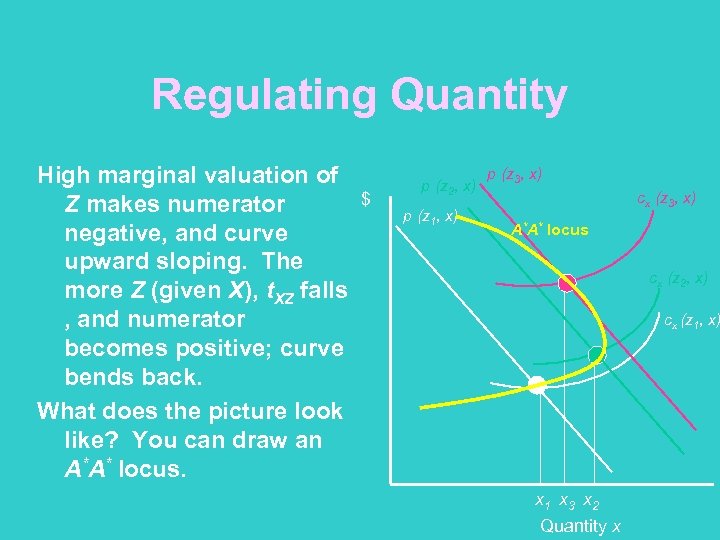

Regulating Quantity High marginal valuation of Z makes numerator negative, and curve upward sloping. The more Z (given X), t. XZ falls , and numerator becomes positive; curve bends back. What does the picture look like? You can draw an A*A* locus. $ p (z 2, x) p (z 1, x) p (z 3, x) cx (z 3, x) A*A* locus cx (z 2, x) cx (z 1, x) x 1 x 3 x 2 Quantity x

Regulating Quantity High marginal valuation of Z makes numerator negative, and curve upward sloping. The more Z (given X), t. XZ falls , and numerator becomes positive; curve bends back. What does the picture look like? You can draw an A*A* locus. $ p (z 2, x) p (z 1, x) p (z 3, x) cx (z 3, x) A*A* locus cx (z 2, x) cx (z 1, x) x 1 x 3 x 2 Quantity x

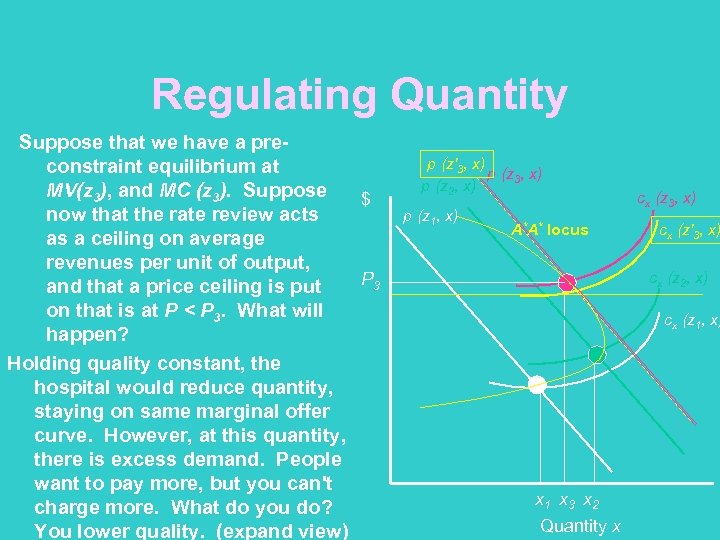

Regulating Quantity Suppose that we have a preconstraint equilibrium at MV(z 3), and MC (z 3). Suppose $ now that the rate review acts as a ceiling on average revenues per unit of output, P 3 and that a price ceiling is put on that is at P < P 3. What will happen? Holding quality constant, the hospital would reduce quantity, staying on same marginal offer curve. However, at this quantity, there is excess demand. People want to pay more, but you can't charge more. What do you do? You lower quality. (expand view) p (z'3, x) p (z 2, x) p (z 1, x) A*A* locus cx (z 3, x) cx (z'3, x) cx (z 2, x) cx (z 1, x) x 1 x 3 x 2 Quantity x

Regulating Quantity Suppose that we have a preconstraint equilibrium at MV(z 3), and MC (z 3). Suppose $ now that the rate review acts as a ceiling on average revenues per unit of output, P 3 and that a price ceiling is put on that is at P < P 3. What will happen? Holding quality constant, the hospital would reduce quantity, staying on same marginal offer curve. However, at this quantity, there is excess demand. People want to pay more, but you can't charge more. What do you do? You lower quality. (expand view) p (z'3, x) p (z 2, x) p (z 1, x) A*A* locus cx (z 3, x) cx (z'3, x) cx (z 2, x) cx (z 1, x) x 1 x 3 x 2 Quantity x

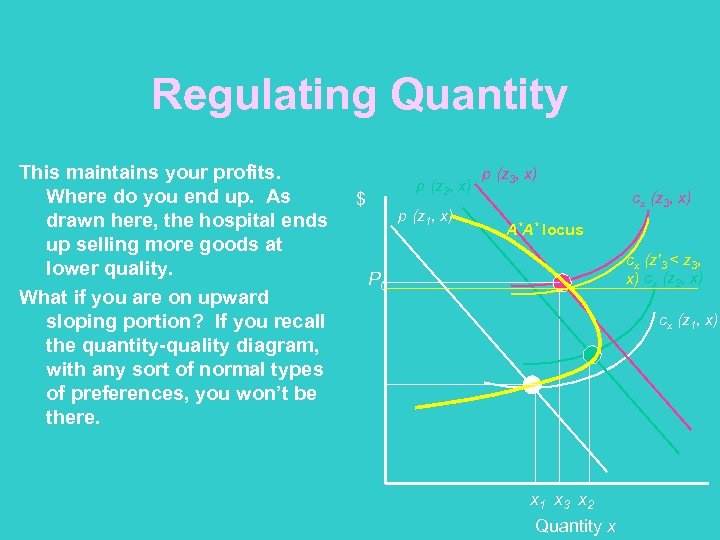

Regulating Quantity This maintains your profits. Where do you end up. As drawn here, the hospital ends up selling more goods at lower quality. What if you are on upward sloping portion? If you recall the quantity-quality diagram, with any sort of normal types of preferences, you won’t be there. p (z 2, x) $ p (z 1, x) p (z 3, x) cx (z 3, x) A*A* locus cx (z'3 < z 3, x) cx (z 2, x) P 0 cx (z 1, x) x 1 x 3 x 2 Quantity x

Regulating Quantity This maintains your profits. Where do you end up. As drawn here, the hospital ends up selling more goods at lower quality. What if you are on upward sloping portion? If you recall the quantity-quality diagram, with any sort of normal types of preferences, you won’t be there. p (z 2, x) $ p (z 1, x) p (z 3, x) cx (z 3, x) A*A* locus cx (z'3 < z 3, x) cx (z 2, x) P 0 cx (z 1, x) x 1 x 3 x 2 Quantity x

Source: table 11_fr 08_cn. xls, from Center for Medicare and Medicaid Services, MS-DRG Titles and Weights, http: //www. cms. hhs. gov/acuteinpatientpps/downloads/Crosswalk. CMSDRGto. MSDRG. zip, accessed July 24, 200 Geometric MS-DRG Title FY 2008 Relative Weight Average Length Of Stay 3 Extracorporeal membrane oxygenation (EMO) or tracheotomy w MV 96+ hrs or PDX except face, mouth & neck w major Operating Room (O. R. ) 4. 2380 64. 3 4 Trach w MV 96+ hrs or PDX exc face, mouth & neck w/o major O. R. 3. 0249 46. 7 166 Other respiratory system O. R. procedures w major complication or comorbidity (MCC) 2. 4392 42. 3 981 Extensive O. R. procedure unrelated to principal diagnosis w MCC 2. 2339 42. 0 163 Major chest procedures w MCC 2. 2157 39. 7 310 Cardiac arrhythmia & conduction disorders w/o CC/MCC 0. 5184 17. 0 946 Rehabilitation w/o CC/MCC 0. 4935 18. 9 884 Organic disturbances & mental retardation 0. 4883 23. 3 554 Bone diseases & arthropathies w/o MCC 0. 4822 20. 5 885 Psychoses 0. 4140 23. 8 MS-LTC -DRG Highest Lowest

Source: table 11_fr 08_cn. xls, from Center for Medicare and Medicaid Services, MS-DRG Titles and Weights, http: //www. cms. hhs. gov/acuteinpatientpps/downloads/Crosswalk. CMSDRGto. MSDRG. zip, accessed July 24, 200 Geometric MS-DRG Title FY 2008 Relative Weight Average Length Of Stay 3 Extracorporeal membrane oxygenation (EMO) or tracheotomy w MV 96+ hrs or PDX except face, mouth & neck w major Operating Room (O. R. ) 4. 2380 64. 3 4 Trach w MV 96+ hrs or PDX exc face, mouth & neck w/o major O. R. 3. 0249 46. 7 166 Other respiratory system O. R. procedures w major complication or comorbidity (MCC) 2. 4392 42. 3 981 Extensive O. R. procedure unrelated to principal diagnosis w MCC 2. 2339 42. 0 163 Major chest procedures w MCC 2. 2157 39. 7 310 Cardiac arrhythmia & conduction disorders w/o CC/MCC 0. 5184 17. 0 946 Rehabilitation w/o CC/MCC 0. 4935 18. 9 884 Organic disturbances & mental retardation 0. 4883 23. 3 554 Bone diseases & arthropathies w/o MCC 0. 4822 20. 5 885 Psychoses 0. 4140 23. 8 MS-LTC -DRG Highest Lowest

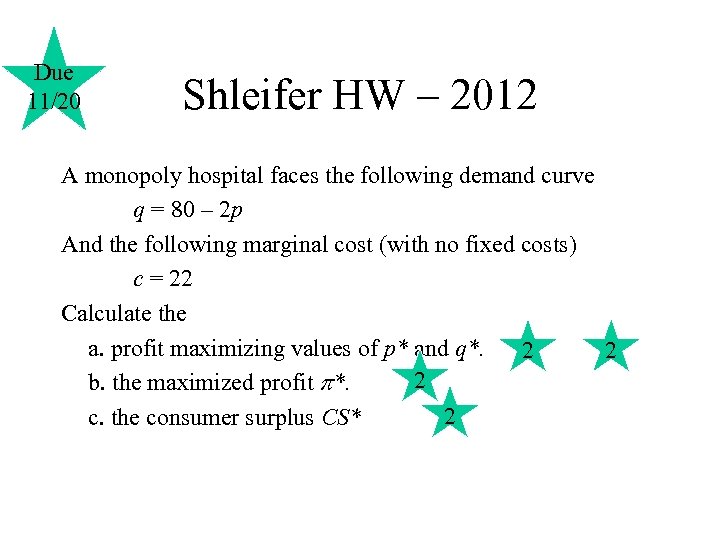

Due 11/20 Shleifer HW – 2012 A monopoly hospital faces the following demand curve q = 80 – 2 p And the following marginal cost (with no fixed costs) c = 22 Calculate the a. profit maximizing values of p* and q*. 2 2 2 b. the maximized profit *. 2 c. the consumer surplus CS*

Due 11/20 Shleifer HW – 2012 A monopoly hospital faces the following demand curve q = 80 – 2 p And the following marginal cost (with no fixed costs) c = 22 Calculate the a. profit maximizing values of p* and q*. 2 2 2 b. the maximized profit *. 2 c. the consumer surplus CS*

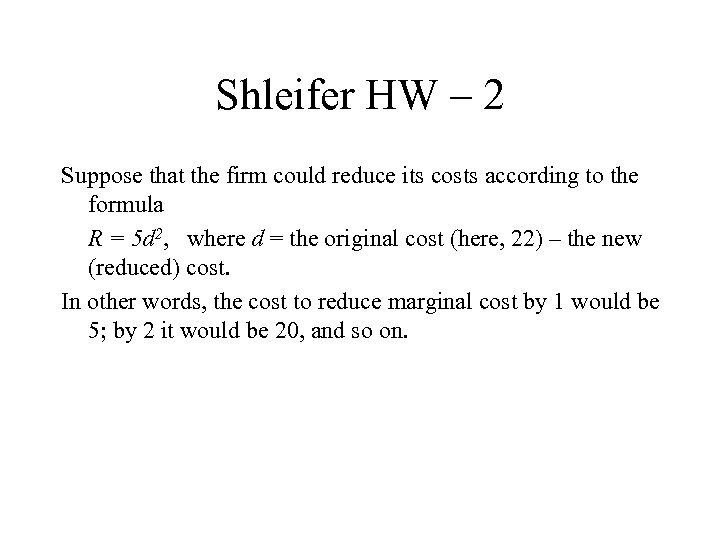

Shleifer HW – 2 Suppose that the firm could reduce its costs according to the formula R = 5 d 2, where d = the original cost (here, 22) – the new (reduced) cost. In other words, the cost to reduce marginal cost by 1 would be 5; by 2 it would be 20, and so on.

Shleifer HW – 2 Suppose that the firm could reduce its costs according to the formula R = 5 d 2, where d = the original cost (here, 22) – the new (reduced) cost. In other words, the cost to reduce marginal cost by 1 would be 5; by 2 it would be 20, and so on.

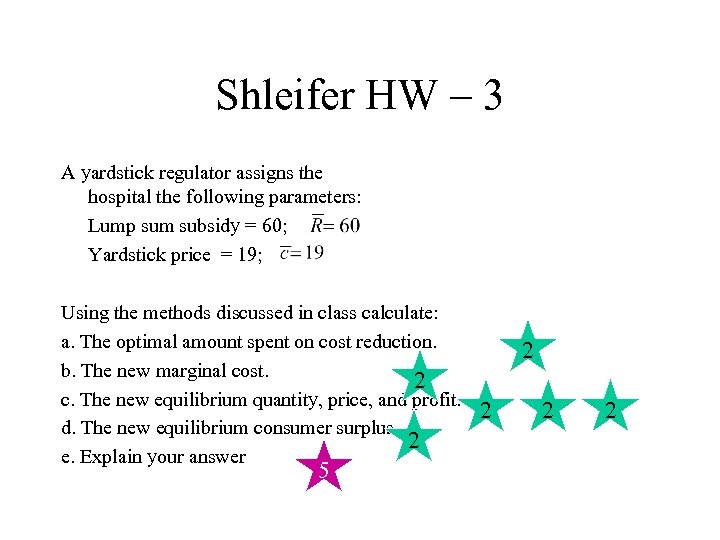

Shleifer HW – 3 A yardstick regulator assigns the hospital the following parameters: Lump sum subsidy = 60; Yardstick price = 19; Using the methods discussed in class calculate: a. The optimal amount spent on cost reduction. b. The new marginal cost. 2 c. The new equilibrium quantity, price, and profit. d. The new equilibrium consumer surplus 2 e. Explain your answer 5 2 2

Shleifer HW – 3 A yardstick regulator assigns the hospital the following parameters: Lump sum subsidy = 60; Yardstick price = 19; Using the methods discussed in class calculate: a. The optimal amount spent on cost reduction. b. The new marginal cost. 2 c. The new equilibrium quantity, price, and profit. d. The new equilibrium consumer surplus 2 e. Explain your answer 5 2 2