d8ebd67e948265deed6061583067b6a8.ppt

- Количество слайдов: 44

Monopoly Chapter 7 Mc. Graw-Hill/Irwin Copyright © 2011 by The Mc. Graw-Hill Companies, Inc. All Rights Reserved.

Monopoly Chapter 7 Mc. Graw-Hill/Irwin Copyright © 2011 by The Mc. Graw-Hill Companies, Inc. All Rights Reserved.

Monopoly Structure: Monopoly • Market power is the ability to alter the price of a good or service. • A monopoly is one firm that produces the entire market supply of a particular good or service. • Since there is only one firm in a monopoly industry, the firm is the industry. LO-1 7 -2

Monopoly Structure: Monopoly • Market power is the ability to alter the price of a good or service. • A monopoly is one firm that produces the entire market supply of a particular good or service. • Since there is only one firm in a monopoly industry, the firm is the industry. LO-1 7 -2

Monopoly = Industry • The firm’s demand curve is identical to the market demand curve for the product. – Market demand is the total quantity of a good or service people are willing and able to buy at alternative prices in a given time period. LO-1 7 -3

Monopoly = Industry • The firm’s demand curve is identical to the market demand curve for the product. – Market demand is the total quantity of a good or service people are willing and able to buy at alternative prices in a given time period. LO-1 7 -3

Price versus Marginal Revenue • Marginal revenue (MR) is the change in total revenue that results from a oneunit increase in quantity sold. • Price equals marginal revenue only for perfectly competitive firms. • Marginal revenue is always less than price for a monopolist. LO-1 7 -4

Price versus Marginal Revenue • Marginal revenue (MR) is the change in total revenue that results from a oneunit increase in quantity sold. • Price equals marginal revenue only for perfectly competitive firms. • Marginal revenue is always less than price for a monopolist. LO-1 7 -4

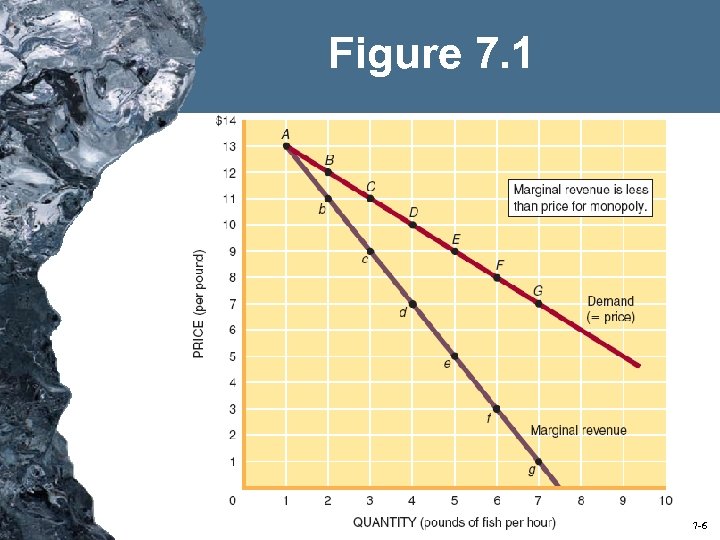

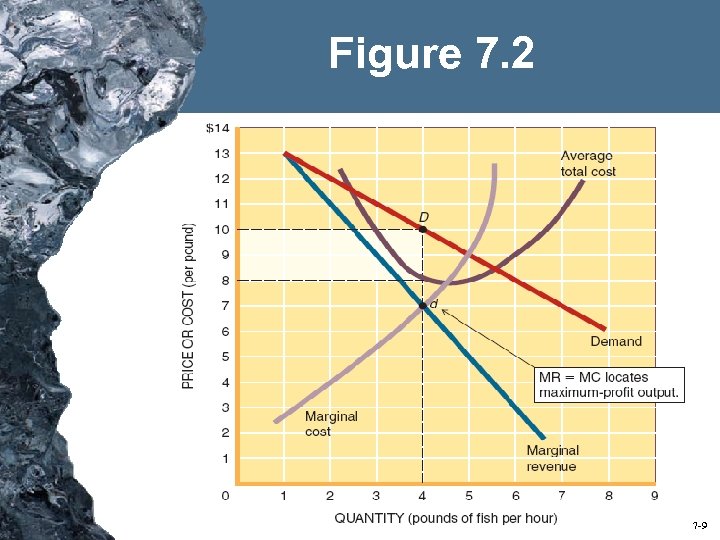

Price versus Marginal Revenue • A monopolist can sell additional output only if it reduces prices. • The MR curve lies below the demand curve at every point but the first. LO-2 7 -5

Price versus Marginal Revenue • A monopolist can sell additional output only if it reduces prices. • The MR curve lies below the demand curve at every point but the first. LO-2 7 -5

Figure 7. 1 7 -6

Figure 7. 1 7 -6

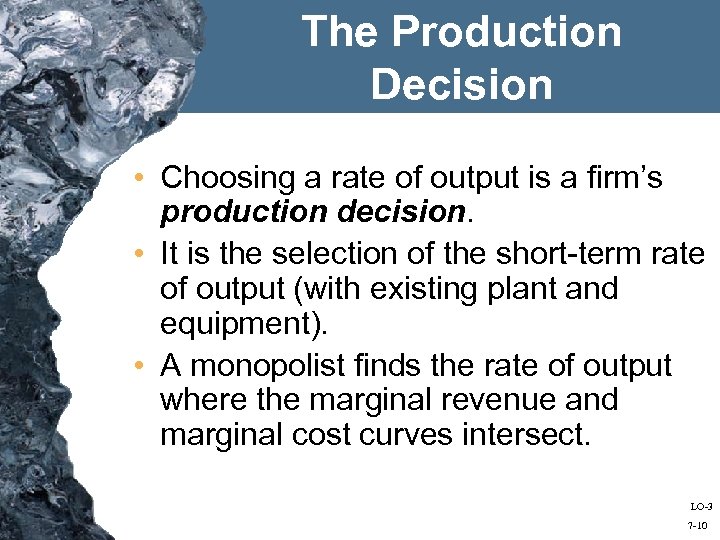

Profit Maximization • The monopolist uses the profitmaximization rule to determine its rate of output. • According to the rule, a monopolist maximizes profit at the rate of output where MR = MC. LO-3 7 -7

Profit Maximization • The monopolist uses the profitmaximization rule to determine its rate of output. • According to the rule, a monopolist maximizes profit at the rate of output where MR = MC. LO-3 7 -7

Profit Maximization • The profit maximization rule applies to all firms: – A perfectly competitive firm produces the quantity where MC = MR (= p) – A monopolist produces the quantity where MC = MR (< p) LO-3 7 -8

Profit Maximization • The profit maximization rule applies to all firms: – A perfectly competitive firm produces the quantity where MC = MR (= p) – A monopolist produces the quantity where MC = MR (< p) LO-3 7 -8

Figure 7. 2 7 -9

Figure 7. 2 7 -9

The Production Decision • Choosing a rate of output is a firm’s production decision. • It is the selection of the short-term rate of output (with existing plant and equipment). • A monopolist finds the rate of output where the marginal revenue and marginal cost curves intersect. LO-3 7 -10

The Production Decision • Choosing a rate of output is a firm’s production decision. • It is the selection of the short-term rate of output (with existing plant and equipment). • A monopolist finds the rate of output where the marginal revenue and marginal cost curves intersect. LO-3 7 -10

The Monopoly Price • The intersection of the marginal revenue and marginal cost curves establishes the profit-maximizing rate of output. • The demand curve tells us the highest price consumers are willing to pay for that specific quantity of output. • Only one price is compatible with the profit-maximizing rate of output. LO-3 7 -11

The Monopoly Price • The intersection of the marginal revenue and marginal cost curves establishes the profit-maximizing rate of output. • The demand curve tells us the highest price consumers are willing to pay for that specific quantity of output. • Only one price is compatible with the profit-maximizing rate of output. LO-3 7 -11

Monopoly Profits • Total profit equals profit per unit times the number of units produced. • Profit per unit = price minus average total cost Profit per unit = p – ATC • Total profit = profit per unit times quantity Total profit = (p – ATC) x q LO-3 7 -12

Monopoly Profits • Total profit equals profit per unit times the number of units produced. • Profit per unit = price minus average total cost Profit per unit = p – ATC • Total profit = profit per unit times quantity Total profit = (p – ATC) x q LO-3 7 -12

Monopoly Profits • Profit can also be calculated by subtracting total cost from total revenue: Total profit = TR – TC LO-3 7 -13

Monopoly Profits • Profit can also be calculated by subtracting total cost from total revenue: Total profit = TR – TC LO-3 7 -13

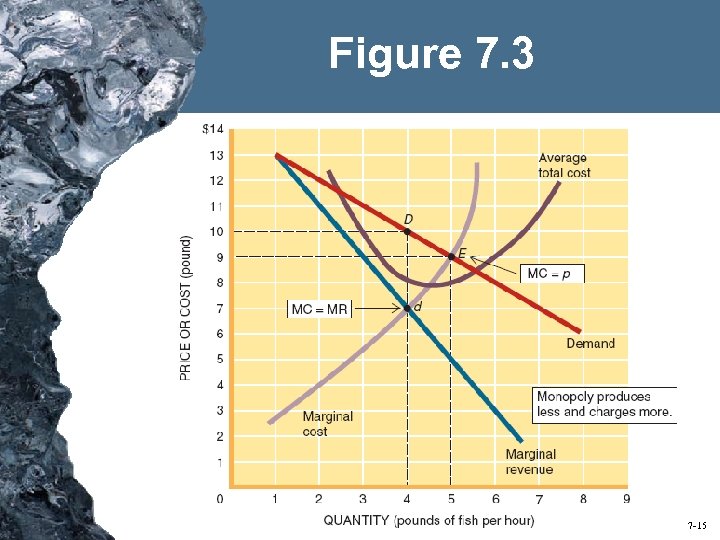

Monopoly versus Competitive Outcomes • A monopolist produces less and charges a higher price than would a competitive industry. LO-4 7 -14

Monopoly versus Competitive Outcomes • A monopolist produces less and charges a higher price than would a competitive industry. LO-4 7 -14

Figure 7. 3 7 -15

Figure 7. 3 7 -15

Barriers to Entry • Obstacles that make it difficult or impossible for would-be producers to enter a particular market. • Examples include patents, legal harassment, exclusive licensing, bundled products, and government franchises. LO-4 7 -16

Barriers to Entry • Obstacles that make it difficult or impossible for would-be producers to enter a particular market. • Examples include patents, legal harassment, exclusive licensing, bundled products, and government franchises. LO-4 7 -16

Patent Protection • A patent is a government grant of exclusive ownership of an innovation. • A patent is a source of monopoly power. – Polaroid’s patents forced Kodak out of the instant-photography business. LO-4 7 -17

Patent Protection • A patent is a government grant of exclusive ownership of an innovation. • A patent is a source of monopoly power. – Polaroid’s patents forced Kodak out of the instant-photography business. LO-4 7 -17

Legal Harassment • Suing potential new entrants can deter entry into an industry. • Lengthy legal battles are so expensive that the threat of legal action may deter entry into a monopolized market. LO-4 7 -18

Legal Harassment • Suing potential new entrants can deter entry into an industry. • Lengthy legal battles are so expensive that the threat of legal action may deter entry into a monopolized market. LO-4 7 -18

Exclusive Licensing • Lack of a license makes it difficult for potential competitors to acquire the factors of production they need. LO-4 7 -19

Exclusive Licensing • Lack of a license makes it difficult for potential competitors to acquire the factors of production they need. LO-4 7 -19

Bundled Products • Forcing consumers to purchase complementary products thwarts competition. • Bundling products makes it difficult for competitors to sell their products profitably. – Microsoft bundles software applications with its Windows operating systems (although the European Union required Microsoft to offer alternatives to consumers). LO-4 7 -20

Bundled Products • Forcing consumers to purchase complementary products thwarts competition. • Bundling products makes it difficult for competitors to sell their products profitably. – Microsoft bundles software applications with its Windows operating systems (although the European Union required Microsoft to offer alternatives to consumers). LO-4 7 -20

Government Franchises • A monopoly granted by a government license. – These include local power, telephone, and cable TV companies. – Another example is the U. S. Postal Service, which has a monopoly in providing first-class mail. LO-4 7 -21

Government Franchises • A monopoly granted by a government license. – These include local power, telephone, and cable TV companies. – Another example is the U. S. Postal Service, which has a monopoly in providing first-class mail. LO-4 7 -21

Comparative Outcomes • A monopoly’s market power allows it to change the way the market responds to consumer demands. LO-4 7 -22

Comparative Outcomes • A monopoly’s market power allows it to change the way the market responds to consumer demands. LO-4 7 -22

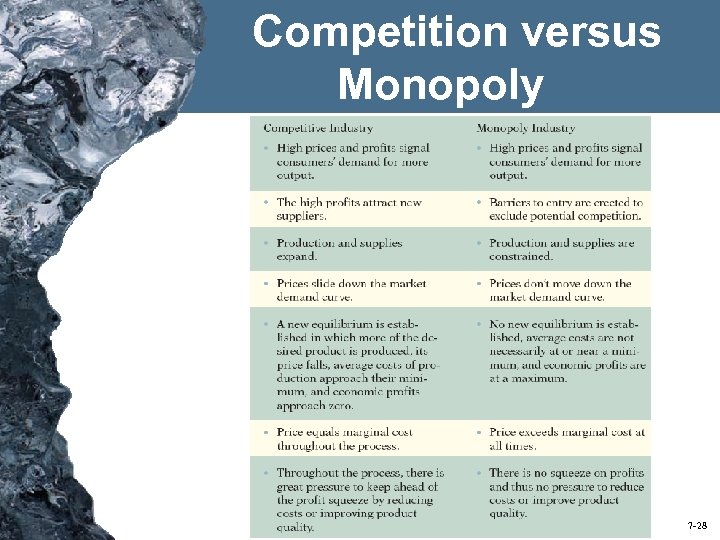

Competition versus Monopoly • In competition, as well as in monopoly, high prices and profits signal consumers’ demand for more output. • In competition, the high profits attract new suppliers. • In monopoly, barriers to entry are erected to exclude potential competition. LO-4 7 -23

Competition versus Monopoly • In competition, as well as in monopoly, high prices and profits signal consumers’ demand for more output. • In competition, the high profits attract new suppliers. • In monopoly, barriers to entry are erected to exclude potential competition. LO-4 7 -23

Competition versus Monopoly • In competition, production and supplies expand, and prices slide down the market demand curve. • In monopoly, production and supplies are constrained, and prices don’t move down the market demand curve. LO-4 7 -24

Competition versus Monopoly • In competition, production and supplies expand, and prices slide down the market demand curve. • In monopoly, production and supplies are constrained, and prices don’t move down the market demand curve. LO-4 7 -24

Competition versus Monopoly • In competition, a new equilibrium is established, and average costs of production approach their minimum. • In monopoly, no new equilibrium is established, and average costs are not necessarily at or near a minimum. LO-4 7 -25

Competition versus Monopoly • In competition, a new equilibrium is established, and average costs of production approach their minimum. • In monopoly, no new equilibrium is established, and average costs are not necessarily at or near a minimum. LO-4 7 -25

Competition versus Monopoly • In competition, economic profits approach zero, and price equals marginal cost throughout the process. • In monopoly, economic profits are at a maximum, and price exceeds marginal cost at all times. LO-4 7 -26

Competition versus Monopoly • In competition, economic profits approach zero, and price equals marginal cost throughout the process. • In monopoly, economic profits are at a maximum, and price exceeds marginal cost at all times. LO-4 7 -26

Competition versus Monopoly • In competition, the profit squeeze pressures firms to reduce costs or improve product quality. • In monopoly, there is no profit squeeze to pressure the firm to reduce costs or improve product quality. LO-4 7 -27

Competition versus Monopoly • In competition, the profit squeeze pressures firms to reduce costs or improve product quality. • In monopoly, there is no profit squeeze to pressure the firm to reduce costs or improve product quality. LO-4 7 -27

Competition versus Monopoly 7 -28

Competition versus Monopoly 7 -28

Near Monopolies • Two or more firms may rig the market to replicate monopoly outcomes and profits. LO-4 7 -29

Near Monopolies • Two or more firms may rig the market to replicate monopoly outcomes and profits. LO-4 7 -29

Near Monopolies • In duopoly two firms together produce the industry output. • In oligopoly several firms dominate the market. • In monopolistic competition many firms each have a monopoly on their own brand image but must still contend with competing brands. LO-4 7 -30

Near Monopolies • In duopoly two firms together produce the industry output. • In oligopoly several firms dominate the market. • In monopolistic competition many firms each have a monopoly on their own brand image but must still contend with competing brands. LO-4 7 -30

Redeeming Qualities of Monopolies? Monopolies could also benefit society. We must consider: • Research and Development • Entrepreneurial Incentives • Economies of Scale • Natural Monopolies • Contestable Markets • Structure versus behavior LO-5 7 -31

Redeeming Qualities of Monopolies? Monopolies could also benefit society. We must consider: • Research and Development • Entrepreneurial Incentives • Economies of Scale • Natural Monopolies • Contestable Markets • Structure versus behavior LO-5 7 -31

Research and Development • In principle, monopolies have a greater ability to pursue research and development. – They have the resources available to invest in expensive R&D functions. • However, they have no clear incentive for invention and innovation, and can continue to make profits by maintaining market power. LO-5 7 -32

Research and Development • In principle, monopolies have a greater ability to pursue research and development. – They have the resources available to invest in expensive R&D functions. • However, they have no clear incentive for invention and innovation, and can continue to make profits by maintaining market power. LO-5 7 -32

Entrepreneurial Incentives • The promise of even greater profits is a strong incentive for monopolies to innovate. • Innovators in perfect competition also have the ability to earn large profits. LO-5 7 -33

Entrepreneurial Incentives • The promise of even greater profits is a strong incentive for monopolies to innovate. • Innovators in perfect competition also have the ability to earn large profits. LO-5 7 -33

Economies of Scale • Economies of scale are present if average costs fall as the size (scale) of plant and equipment increases. • A large firm can produce goods at a lower unit cost than can a small firm because of economies of scale. • Consumers may not benefit from the lower costs if the monopolist doesn’t lower its prices. LO-5 7 -34

Economies of Scale • Economies of scale are present if average costs fall as the size (scale) of plant and equipment increases. • A large firm can produce goods at a lower unit cost than can a small firm because of economies of scale. • Consumers may not benefit from the lower costs if the monopolist doesn’t lower its prices. LO-5 7 -34

Natural Monopoly • A natural monopoly is an industry in which one firm can achieve economies of scale over the entire range of market supply. – Examples include local telephone, cable, and utility services. LO-1 7 -35

Natural Monopoly • A natural monopoly is an industry in which one firm can achieve economies of scale over the entire range of market supply. – Examples include local telephone, cable, and utility services. LO-1 7 -35

Contestable Markets • A contestable market is an imperfectly competitive industry subject to potential entry if prices or profits increase. • How contestable a market is depends not so much on its structure as it does on its barriers to entry. LO-5 7 -36

Contestable Markets • A contestable market is an imperfectly competitive industry subject to potential entry if prices or profits increase. • How contestable a market is depends not so much on its structure as it does on its barriers to entry. LO-5 7 -36

Structure versus Behavior • If potential rivals force a monopolist to behave like a competitive firm, then monopoly imposes no cost on consumers or on society at large. • The experience with the Model T suggests that potential competition can force a monopoly to change its ways. LO-5 7 -37

Structure versus Behavior • If potential rivals force a monopolist to behave like a competitive firm, then monopoly imposes no cost on consumers or on society at large. • The experience with the Model T suggests that potential competition can force a monopoly to change its ways. LO-5 7 -37

Flying Monopoly Air • Market structure explains why it can be cheap to fly to one place and expensive to fly somewhere else of equal distance. • From a national perspective, the airline industry looks pretty competitive. • However, all of these companies do not fly to the same places. LO-5 7 -38

Flying Monopoly Air • Market structure explains why it can be cheap to fly to one place and expensive to fly somewhere else of equal distance. • From a national perspective, the airline industry looks pretty competitive. • However, all of these companies do not fly to the same places. LO-5 7 -38

Industry Behavior • Air fares from airports dominated by one or two carriers are 45 – 85% higher than at more competitive airports. LO-5 7 -39

Industry Behavior • Air fares from airports dominated by one or two carriers are 45 – 85% higher than at more competitive airports. LO-5 7 -39

Entry Effects • How fares change when airlines enter or exit a specific market can be used to assess the impact of market structure on prices. • American Airlines cut its fares when low-cost carriers entered a market it dominated—then raised them when the low-cost carriers left. LO-5 7 -40

Entry Effects • How fares change when airlines enter or exit a specific market can be used to assess the impact of market structure on prices. • American Airlines cut its fares when low-cost carriers entered a market it dominated—then raised them when the low-cost carriers left. LO-5 7 -40

Entry Effects • Predatory pricing – temporary price reductions designed to drive out competition. LO-5 7 -41

Entry Effects • Predatory pricing – temporary price reductions designed to drive out competition. LO-5 7 -41

Barriers to Entry • One of the most formidable entry barriers to the airline industry is the ownership of landing rights and gates. • At Washington, D. C. ’s National Airport, the six largest carriers owned 97 percent of available takeoff/landing slots in 2000. LO-5 7 -42

Barriers to Entry • One of the most formidable entry barriers to the airline industry is the ownership of landing rights and gates. • At Washington, D. C. ’s National Airport, the six largest carriers owned 97 percent of available takeoff/landing slots in 2000. LO-5 7 -42

Barriers to Entry • To offer service from that airport, a new entrant would have to buy or lease a slot from one of these firms. • If existing firms are unwilling to sell or lease their slots, then competition is thwarted. LO-5 7 -43

Barriers to Entry • To offer service from that airport, a new entrant would have to buy or lease a slot from one of these firms. • If existing firms are unwilling to sell or lease their slots, then competition is thwarted. LO-5 7 -43

End of Chapter 7

End of Chapter 7