1b2ba066243701548fb44332a87ecb0f.ppt

- Количество слайдов: 19

Monitoring and Manipulations: Asset Prices When Agents are Marked-to-Market Gary Gorton Yale University and NBER Ping He Tsinghua University Lixin Huang Georgia State University

Monitoring and Manipulations: Asset Prices When Agents are Marked-to-Market Gary Gorton Yale University and NBER Ping He Tsinghua University Lixin Huang Georgia State University

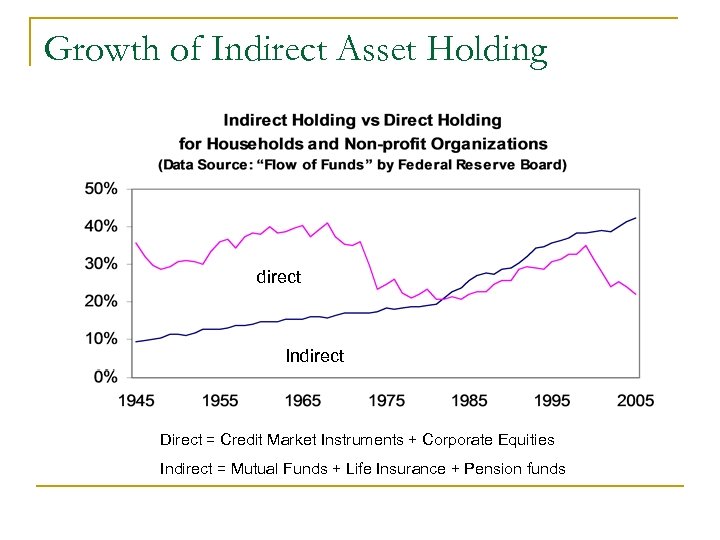

Growth of Indirect Asset Holding direct Indirect Direct = Credit Market Instruments + Corporate Equities Indirect = Mutual Funds + Life Insurance + Pension funds

Growth of Indirect Asset Holding direct Indirect Direct = Credit Market Instruments + Corporate Equities Indirect = Mutual Funds + Life Insurance + Pension funds

Delegated Trading n Trading in security markets is conducted by professional portfolio managers and traders q q n Derivative markets (June 2007): interest rate derivatives, $346. 9 trillion; credit default swaps, $42. 6 trillion (Bank for International Settlements (2007)) Public equity market: In 2004, U. S. households directly held less than 40% of corporate equities, while they held about 90% in 1950 and 70% in 1970 ("Flow of Funds" issued by the Federal Reserve Board) The asset pricing models with only direct investors could be potentially invalid

Delegated Trading n Trading in security markets is conducted by professional portfolio managers and traders q q n Derivative markets (June 2007): interest rate derivatives, $346. 9 trillion; credit default swaps, $42. 6 trillion (Bank for International Settlements (2007)) Public equity market: In 2004, U. S. households directly held less than 40% of corporate equities, while they held about 90% in 1950 and 70% in 1970 ("Flow of Funds" issued by the Federal Reserve Board) The asset pricing models with only direct investors could be potentially invalid

Related Literature n Exogenous benchmark-adjusted compensation q n Asset pricing with optimal contracts q n Allen & Gorton (93, RES), Dow & Gorton (97, JPE) Moral hazard problem due to different horizons q n Ou-Yang (03, RFS), Stoughton (93, JF), Starks (87, JFQA) Interaction of adverse selection and moral hazard q n Admati & Pfleiderer (97, JB), Brennan (93, WP) Dow & Gorton (94, JF), Goldman & Slezak (03, JF), Plantin, Sapra & Shin (05, WP), Allen & Carletti(06, WP) Monitoring manager with market price q Holmstrom and Tirole (1993, JPE)

Related Literature n Exogenous benchmark-adjusted compensation q n Asset pricing with optimal contracts q n Allen & Gorton (93, RES), Dow & Gorton (97, JPE) Moral hazard problem due to different horizons q n Ou-Yang (03, RFS), Stoughton (93, JF), Starks (87, JFQA) Interaction of adverse selection and moral hazard q n Admati & Pfleiderer (97, JB), Brennan (93, WP) Dow & Gorton (94, JF), Goldman & Slezak (03, JF), Plantin, Sapra & Shin (05, WP), Allen & Carletti(06, WP) Monitoring manager with market price q Holmstrom and Tirole (1993, JPE)

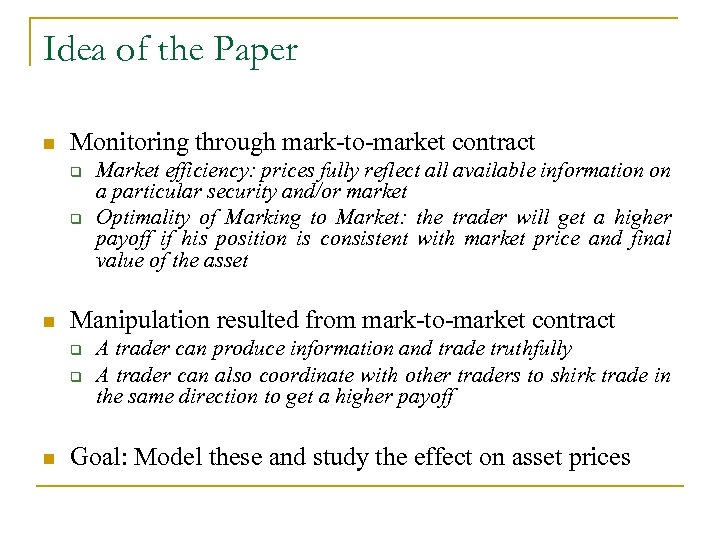

Idea of the Paper n Monitoring through mark-to-market contract q q n Manipulation resulted from mark-to-market contract q q n Market efficiency: prices fully reflect all available information on a particular security and/or market Optimality of Marking to Market: the trader will get a higher payoff if his position is consistent with market price and final value of the asset A trader can produce information and trade truthfully A trader can also coordinate with other traders to shirk trade in the same direction to get a higher payoff Goal: Model these and study the effect on asset prices

Idea of the Paper n Monitoring through mark-to-market contract q q n Manipulation resulted from mark-to-market contract q q n Market efficiency: prices fully reflect all available information on a particular security and/or market Optimality of Marking to Market: the trader will get a higher payoff if his position is consistent with market price and final value of the asset A trader can produce information and trade truthfully A trader can also coordinate with other traders to shirk trade in the same direction to get a higher payoff Goal: Model these and study the effect on asset prices

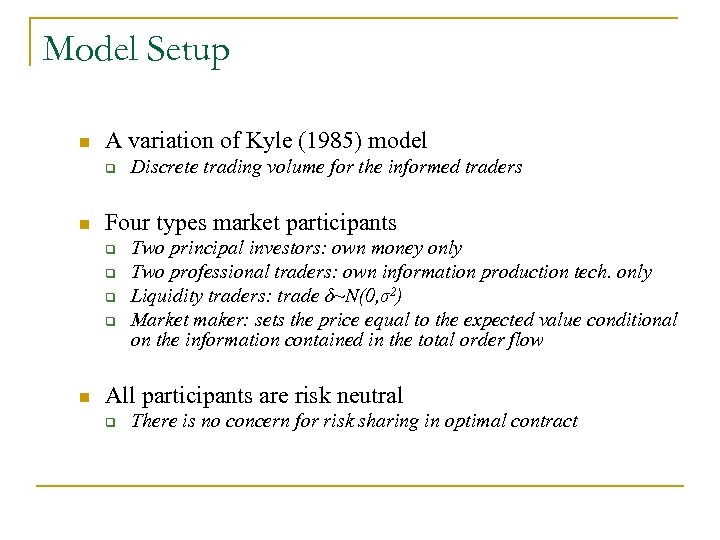

Model Setup n A variation of Kyle (1985) model q n Four types market participants q q n Discrete trading volume for the informed traders Two principal investors: own money only Two professional traders: own information production tech. only Liquidity traders: trade δ~N(0, σ2) Market maker: sets the price equal to the expected value conditional on the information contained in the total order flow All participants are risk neutral q There is no concern for risk sharing in optimal contract

Model Setup n A variation of Kyle (1985) model q n Four types market participants q q n Discrete trading volume for the informed traders Two principal investors: own money only Two professional traders: own information production tech. only Liquidity traders: trade δ~N(0, σ2) Market maker: sets the price equal to the expected value conditional on the information contained in the total order flow All participants are risk neutral q There is no concern for risk sharing in optimal contract

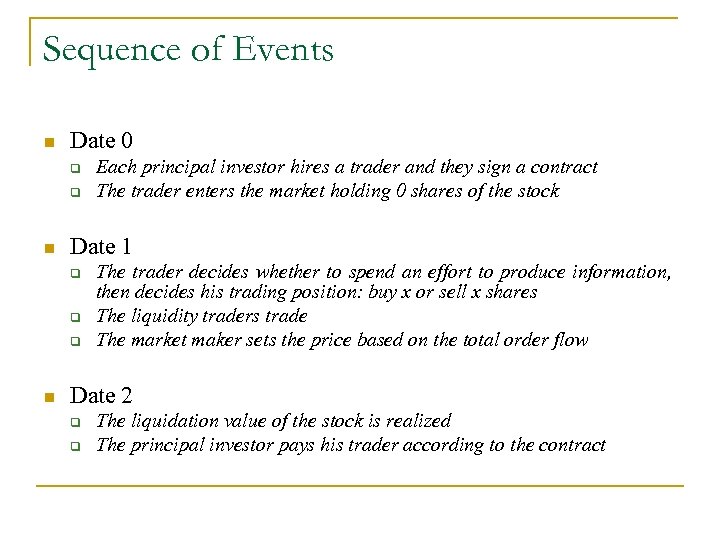

Sequence of Events n Date 0 q q n Date 1 q q q n Each principal investor hires a trader and they sign a contract The trader enters the market holding 0 shares of the stock The trader decides whether to spend an effort to produce information, then decides his trading position: buy x or sell x shares The liquidity traders trade The market maker sets the price based on the total order flow Date 2 q q The liquidation value of the stock is realized The principal investor pays his trader according to the contract

Sequence of Events n Date 0 q q n Date 1 q q q n Each principal investor hires a trader and they sign a contract The trader enters the market holding 0 shares of the stock The trader decides whether to spend an effort to produce information, then decides his trading position: buy x or sell x shares The liquidity traders trade The market maker sets the price based on the total order flow Date 2 q q The liquidation value of the stock is realized The principal investor pays his trader according to the contract

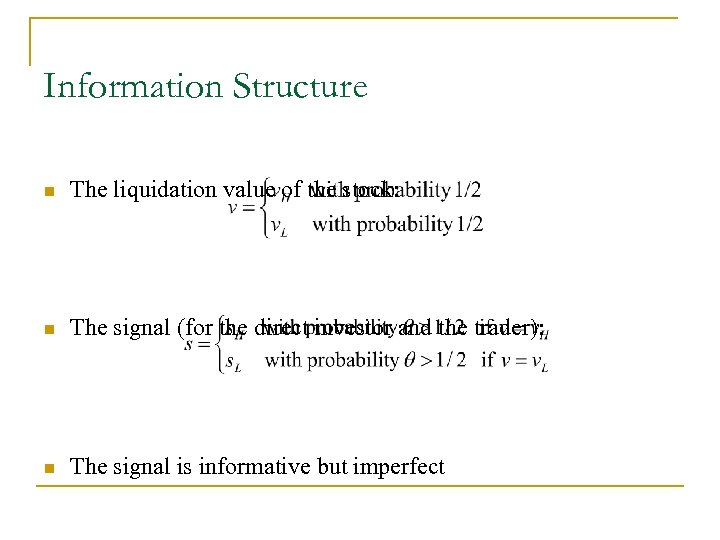

Information Structure n The liquidation value of the stock: n The signal (for the direct investor and the trader): n The signal is informative but imperfect

Information Structure n The liquidation value of the stock: n The signal (for the direct investor and the trader): n The signal is informative but imperfect

Discussion of the Model n Kyle Model q Non-competitive market with downward sloping demand curve n Discrete stock holding q For tractability q Without loss of much generality (for the trader) n Gaussian liquidity trading noise q Monotone likelihood ratio property n We also impose a limit on the maximum wage q Bounded optimal contract

Discussion of the Model n Kyle Model q Non-competitive market with downward sloping demand curve n Discrete stock holding q For tractability q Without loss of much generality (for the trader) n Gaussian liquidity trading noise q Monotone likelihood ratio property n We also impose a limit on the maximum wage q Bounded optimal contract

Regular Equilibrium n Definition q q n Both traders produce information Both traders trade truthfully based on the information they acquire, i. e. , they buy x shares when a good signal is received and sell x shares when a bad signal is received Incentive Constraints q q The trader has incentive to trade at the best interest of the indirect investor given the signal The trader has incentive to produce information

Regular Equilibrium n Definition q q n Both traders produce information Both traders trade truthfully based on the information they acquire, i. e. , they buy x shares when a good signal is received and sell x shares when a bad signal is received Incentive Constraints q q The trader has incentive to trade at the best interest of the indirect investor given the signal The trader has incentive to produce information

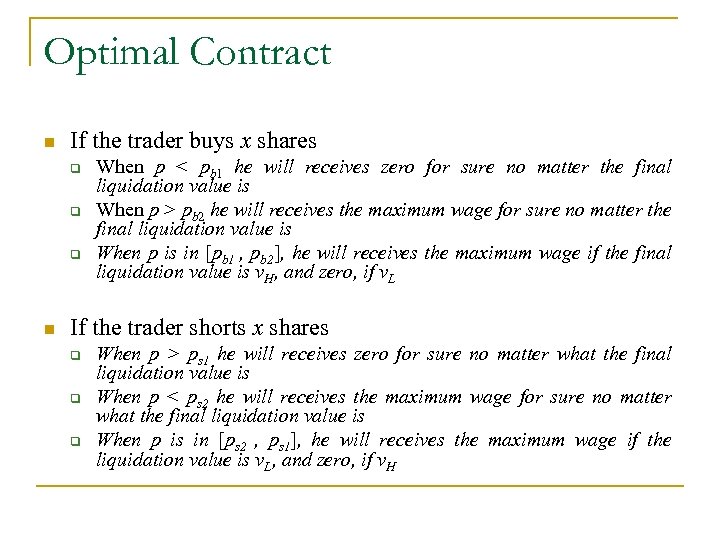

Optimal Contract n If the trader buys x shares q q q n When p < pb 1 he will receives zero for sure no matter the final liquidation value is When p > pb 2 he will receives the maximum wage for sure no matter the final liquidation value is When p is in [pb 1 , pb 2], he will receives the maximum wage if the final liquidation value is v. H, and zero, if v. L If the trader shorts x shares q q q When p > ps 1 he will receives zero for sure no matter what the final liquidation value is When p < ps 2 he will receives the maximum wage for sure no matter what the final liquidation value is When p is in [ps 2 , ps 1], he will receives the maximum wage if the liquidation value is v. L, and zero, if v. H

Optimal Contract n If the trader buys x shares q q q n When p < pb 1 he will receives zero for sure no matter the final liquidation value is When p > pb 2 he will receives the maximum wage for sure no matter the final liquidation value is When p is in [pb 1 , pb 2], he will receives the maximum wage if the final liquidation value is v. H, and zero, if v. L If the trader shorts x shares q q q When p > ps 1 he will receives zero for sure no matter what the final liquidation value is When p < ps 2 he will receives the maximum wage for sure no matter what the final liquidation value is When p is in [ps 2 , ps 1], he will receives the maximum wage if the liquidation value is v. L, and zero, if v. H

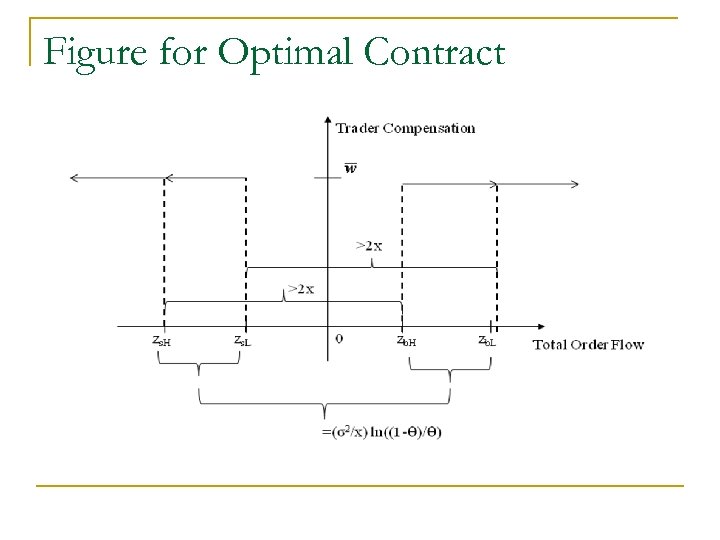

Figure for Optimal Contract

Figure for Optimal Contract

Externality of Marking-to-Market n Given the optimal Mark-to-Market contract, if one trader shirks and buys (sells) x shares, it is the other trader’s best response to follow. Joint shirking would give traders higher payoffs than what they receive in a Regular Equilibrium n However, if a trader always shirk, then he will not be hired at the first place. Therefore, traders can jointly shirk and coordinate to trade in the same direction with some probability q < 1

Externality of Marking-to-Market n Given the optimal Mark-to-Market contract, if one trader shirks and buys (sells) x shares, it is the other trader’s best response to follow. Joint shirking would give traders higher payoffs than what they receive in a Regular Equilibrium n However, if a trader always shirk, then he will not be hired at the first place. Therefore, traders can jointly shirk and coordinate to trade in the same direction with some probability q < 1

Coordination Device and Manipulation Eq. n We introduce an irrelevant noise signal, r, which is, with probability q, observed by the traders before they make their effort to acquire information. The noise signal is independent of the fundamentals n A Pure Strategy Manipulation Equilibrium is a Nash equilibrium in which a trader produces information and trades truthfully only when he does not observe the irrelevant signal. Upon observing the irrelevant signal, the traders both shirk and buy x shares if the signal is 1, and they both sell x shares if the signal is 0

Coordination Device and Manipulation Eq. n We introduce an irrelevant noise signal, r, which is, with probability q, observed by the traders before they make their effort to acquire information. The noise signal is independent of the fundamentals n A Pure Strategy Manipulation Equilibrium is a Nash equilibrium in which a trader produces information and trades truthfully only when he does not observe the irrelevant signal. Upon observing the irrelevant signal, the traders both shirk and buy x shares if the signal is 1, and they both sell x shares if the signal is 0

Properties of A Manipulation Equilibrium n In a Pure Strategy Manipulation Equilibrium q q q The trader’s payoff net of the information production cost is increasing with the propensity of shirking, q The expected payoff to the principal is decreasing with q The exogenous liquidity traders benefit from a higher q When z

Properties of A Manipulation Equilibrium n In a Pure Strategy Manipulation Equilibrium q q q The trader’s payoff net of the information production cost is increasing with the propensity of shirking, q The expected payoff to the principal is decreasing with q The exogenous liquidity traders benefit from a higher q When z

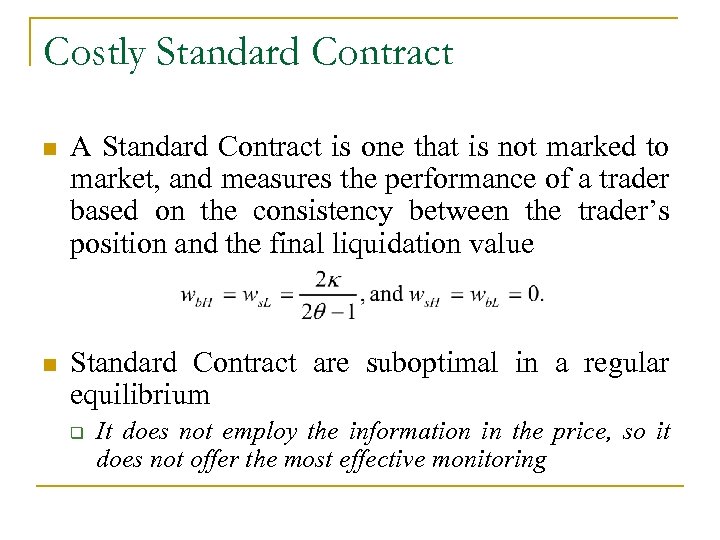

Costly Standard Contract n A Standard Contract is one that is not marked to market, and measures the performance of a trader based on the consistency between the trader’s position and the final liquidation value n Standard Contract are suboptimal in a regular equilibrium q It does not employ the information in the price, so it does not offer the most effective monitoring

Costly Standard Contract n A Standard Contract is one that is not marked to market, and measures the performance of a trader based on the consistency between the trader’s position and the final liquidation value n Standard Contract are suboptimal in a regular equilibrium q It does not employ the information in the price, so it does not offer the most effective monitoring

Benefit of A Standard Contract n Benefit: A standard contract precludes the possibility of market manipulation and provides the agent-trader incentive to acquire information, and this benefit is increasing with the propensity of shirking, q n Cost: A standard contract results in more costly monitoring due to its failure to fully utilize the market information to monitor the agent-trader n As q increases, the benefit of a Standard Contract will exceeds its cost, a pure strategy Manipulation Equilibrium with Mark-to-Market Contract cannot exist

Benefit of A Standard Contract n Benefit: A standard contract precludes the possibility of market manipulation and provides the agent-trader incentive to acquire information, and this benefit is increasing with the propensity of shirking, q n Cost: A standard contract results in more costly monitoring due to its failure to fully utilize the market information to monitor the agent-trader n As q increases, the benefit of a Standard Contract will exceeds its cost, a pure strategy Manipulation Equilibrium with Mark-to-Market Contract cannot exist

A Mixed Strategy Manipulation Eq. n A Mixed Strategy Manipulation Equilibrium is a Nash equilibrium in which principals and traders adopt the following strategies q Both principals independently offer a mark-to-market contract with probability m and a standard contract with probability 1 -m q If both traders receive a mark-to-market contract, then they shirk upon observing, with probability q, an irrelevant noise signal r; otherwise they collect information and trade truthfully n In reality, traders’ compensation is discretionary in this way, and principals do not make such stark choices. Principals recognize that compensation should be based on performance, without explicitly committing to one contract form or the other

A Mixed Strategy Manipulation Eq. n A Mixed Strategy Manipulation Equilibrium is a Nash equilibrium in which principals and traders adopt the following strategies q Both principals independently offer a mark-to-market contract with probability m and a standard contract with probability 1 -m q If both traders receive a mark-to-market contract, then they shirk upon observing, with probability q, an irrelevant noise signal r; otherwise they collect information and trade truthfully n In reality, traders’ compensation is discretionary in this way, and principals do not make such stark choices. Principals recognize that compensation should be based on performance, without explicitly committing to one contract form or the other

Concluding Remarks n News could move the market for many reasons q q q n We provide an example that a non-fundamental information is traded as a coordination device The market efficiency is weakened because of the agency problem Asset pricing neglecting issues in the industrial organization of the financial could be invalid to explain some stylized facts Future works q q Capture delegated trading in a more general asset pricing model Empirical studies

Concluding Remarks n News could move the market for many reasons q q q n We provide an example that a non-fundamental information is traded as a coordination device The market efficiency is weakened because of the agency problem Asset pricing neglecting issues in the industrial organization of the financial could be invalid to explain some stylized facts Future works q q Capture delegated trading in a more general asset pricing model Empirical studies