6aa1919b8392d75416f8e6ff59977f18.ppt

- Количество слайдов: 33

Moneytalks “How to Trade” Workshops www. Moneytalks. net Kamloops / Kelowna / Surrey May 18, 19, 20 Victor Adair www. Victor. Adair. com

Moneytalks “How to Trade” Workshops www. Moneytalks. net Kamloops / Kelowna / Surrey May 18, 19, 20 Victor Adair www. Victor. Adair. com

Outline • Part One • Definition of trading • Motives, objectives, opinions, consequences • Learning how to trade • Part Two • Charts I watch

Outline • Part One • Definition of trading • Motives, objectives, opinions, consequences • Learning how to trade • Part Two • Charts I watch

This is not a school • This is just me talking about my ideas, my way of looking at things • Perhaps you will get an idea that will help you

This is not a school • This is just me talking about my ideas, my way of looking at things • Perhaps you will get an idea that will help you

Definition of trading • To be in the right thing at the right time • Not (necessarily) day trading • To move from one asset to another or to cash • To be short in a down market • Everything is a spread • Learn, think, see, assign probabilities, manage risk, act, sit.

Definition of trading • To be in the right thing at the right time • Not (necessarily) day trading • To move from one asset to another or to cash • To be short in a down market • Everything is a spread • Learn, think, see, assign probabilities, manage risk, act, sit.

Motives for learning to trade • It’s necessary to learn how to look after yourself • Zero returns on cash • You can trade from anywhere • The world is changing very fast - get free from your old opinions • It’s better than working!

Motives for learning to trade • It’s necessary to learn how to look after yourself • Zero returns on cash • You can trade from anywhere • The world is changing very fast - get free from your old opinions • It’s better than working!

Learn to think like a trader • What’s done is done – what can you learn from it – what are you going to do now? • Opinions are necessary – and dangerous – why do you believe what you believe? • Why Buy often means Sell • Psychology is more important than math • Look for the relationships between markets • Anticipate – then wait for confirmation!

Learn to think like a trader • What’s done is done – what can you learn from it – what are you going to do now? • Opinions are necessary – and dangerous – why do you believe what you believe? • Why Buy often means Sell • Psychology is more important than math • Look for the relationships between markets • Anticipate – then wait for confirmation!

Opinions • Credit Boom = Asset Boom + Risk • Not an ordinary recession – a post bubble credit contraction • More money borrowed than will ever be repaid – lenders and borrowers less willing • Authorities launched massive stimulus to reflate economies • Inflation or Deflation? • Something big breaks – the Euro?

Opinions • Credit Boom = Asset Boom + Risk • Not an ordinary recession – a post bubble credit contraction • More money borrowed than will ever be repaid – lenders and borrowers less willing • Authorities launched massive stimulus to reflate economies • Inflation or Deflation? • Something big breaks – the Euro?

Opinions • Market psychology swings between willingness to embrace risk (whistling past the graveyard) and trying to escape from risk • Musical Chairs: everyone (? ) knows there’s danger, but they think they can avoid it • Capital moves back and forth between the center (safe) and the periphery (risky)

Opinions • Market psychology swings between willingness to embrace risk (whistling past the graveyard) and trying to escape from risk • Musical Chairs: everyone (? ) knows there’s danger, but they think they can avoid it • Capital moves back and forth between the center (safe) and the periphery (risky)

Consequences • Massive and growing Gov’t debts and deficits – who pays? How to they pay? • Raise taxes? • Cut services / break promises? • Default? • Inflate away? • Rising interest rates as investors shun debt? • More gov’t in your future? Welcomed by who?

Consequences • Massive and growing Gov’t debts and deficits – who pays? How to they pay? • Raise taxes? • Cut services / break promises? • Default? • Inflate away? • Rising interest rates as investors shun debt? • More gov’t in your future? Welcomed by who?

What am I doing? • • • Semi-retired, managing my own money Savings: very conservative, liquid Trading accounts: very little leverage No debts, no assets 40 years of trading experience and trying to learn more • Re-examine everything, protect myself from the government • Objective: maintain and grow my purchasing power while managing risk of loss; maintain independence, mobility

What am I doing? • • • Semi-retired, managing my own money Savings: very conservative, liquid Trading accounts: very little leverage No debts, no assets 40 years of trading experience and trying to learn more • Re-examine everything, protect myself from the government • Objective: maintain and grow my purchasing power while managing risk of loss; maintain independence, mobility

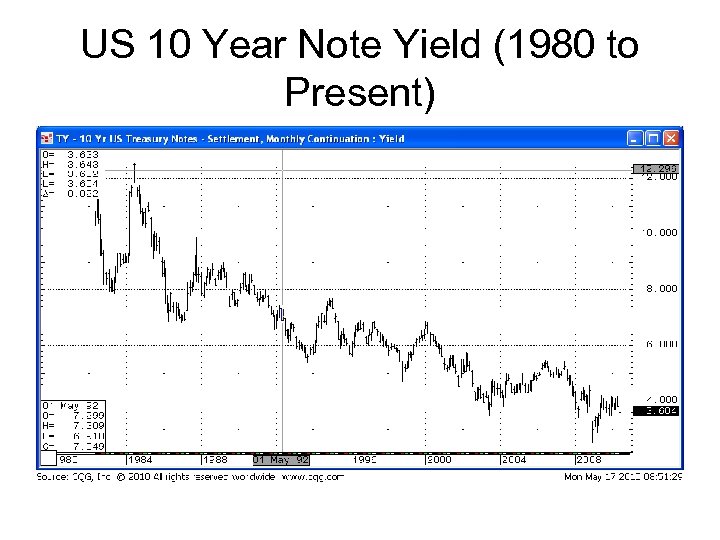

US 10 Year Note Yield (1980 to Present)

US 10 Year Note Yield (1980 to Present)

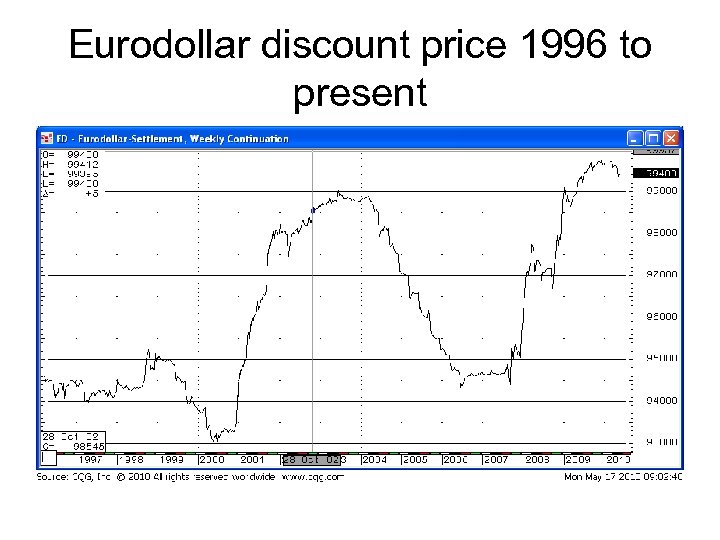

Eurodollar discount price 1996 to present

Eurodollar discount price 1996 to present

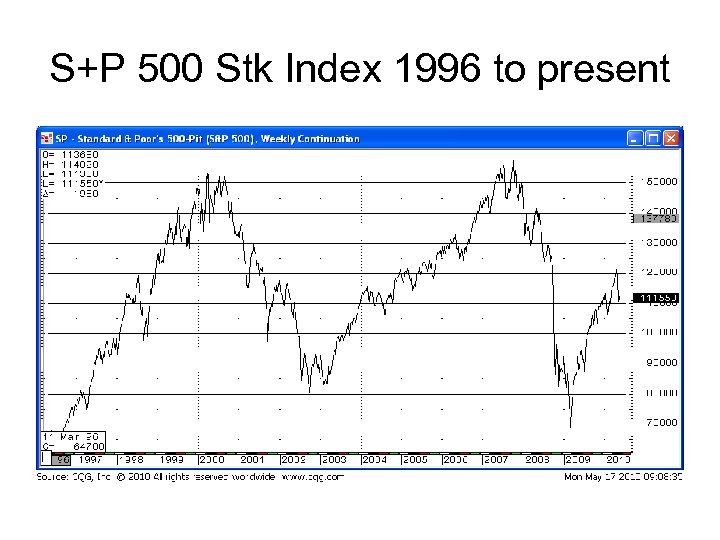

S+P 500 Stk Index 1996 to present

S+P 500 Stk Index 1996 to present

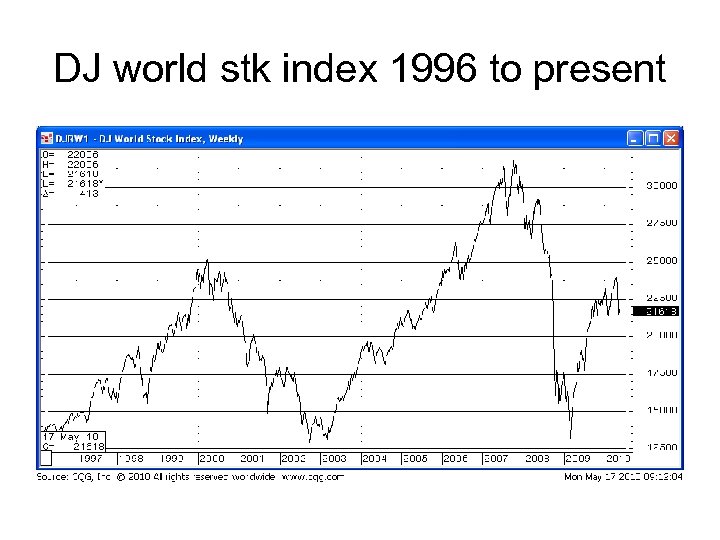

DJ world stk index 1996 to present

DJ world stk index 1996 to present

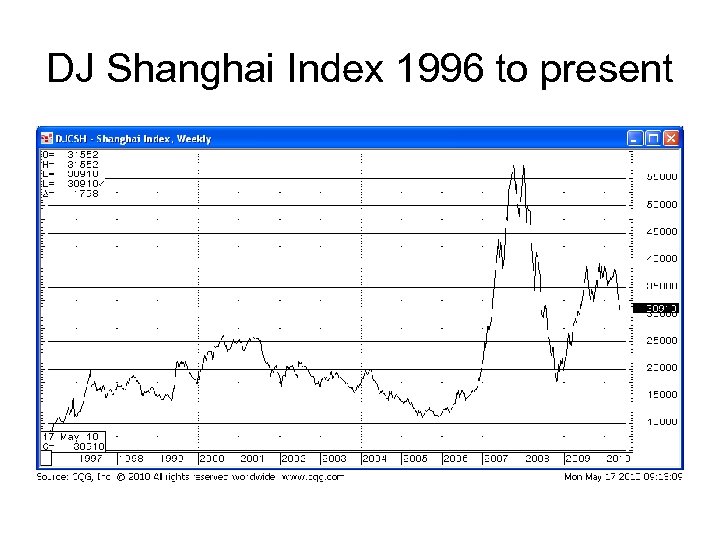

DJ Shanghai Index 1996 to present

DJ Shanghai Index 1996 to present

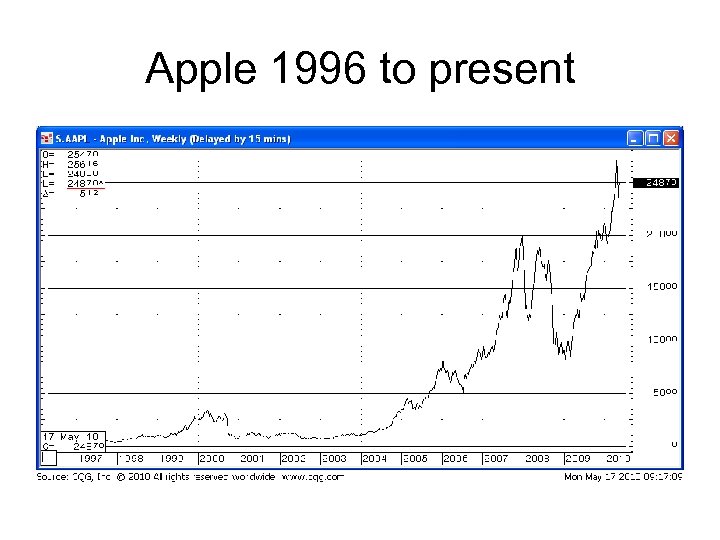

Apple 1996 to present

Apple 1996 to present

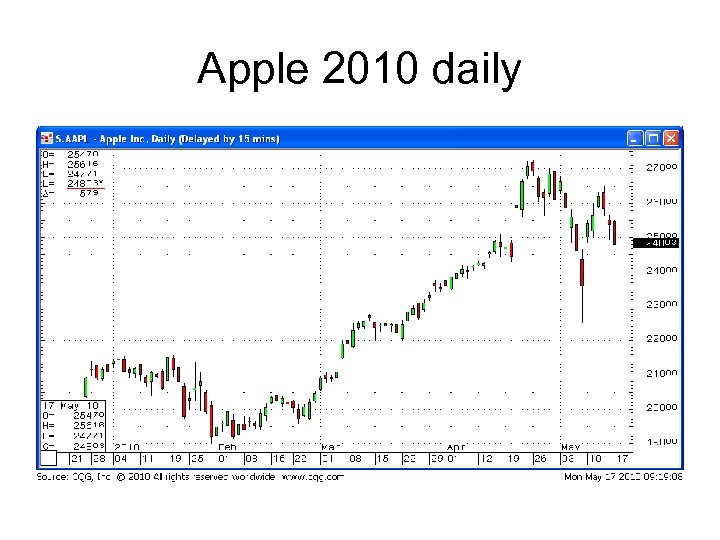

Apple 2010 daily

Apple 2010 daily

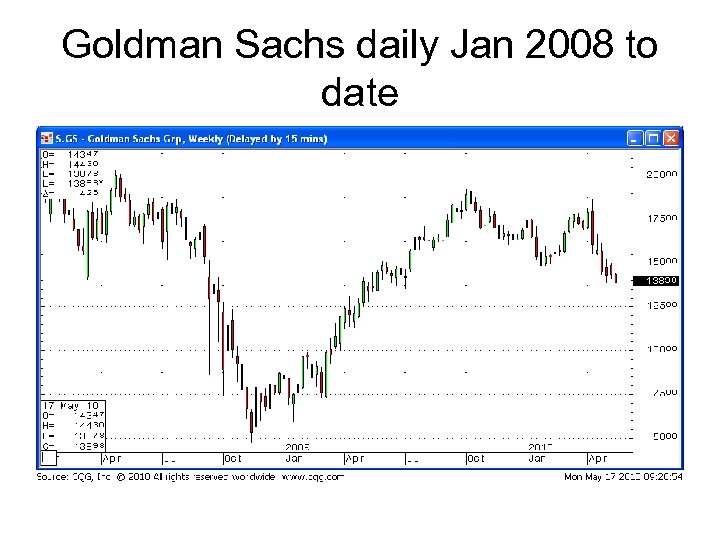

Goldman Sachs daily Jan 2008 to date

Goldman Sachs daily Jan 2008 to date

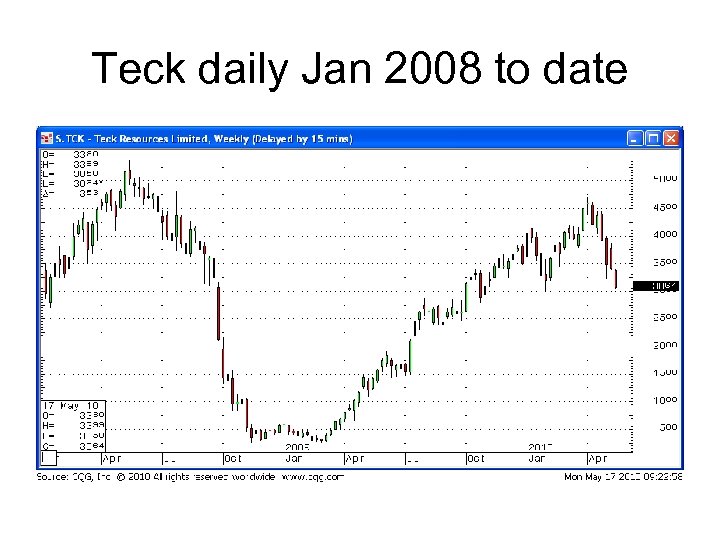

Teck daily Jan 2008 to date

Teck daily Jan 2008 to date

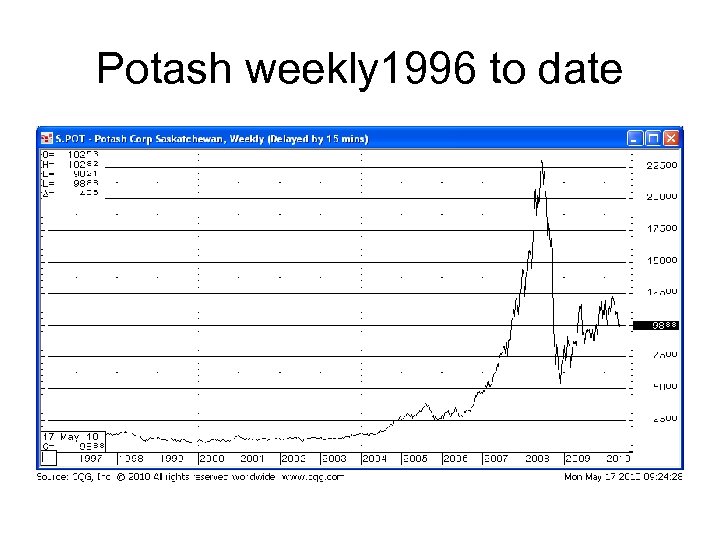

Potash weekly 1996 to date

Potash weekly 1996 to date

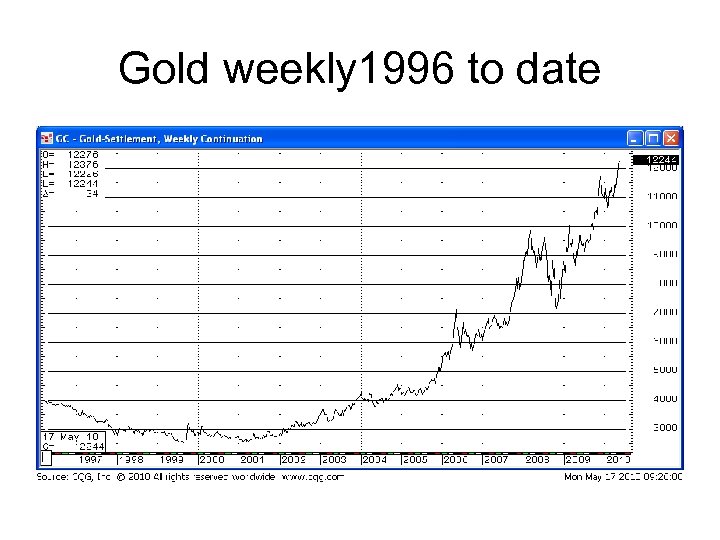

Gold weekly 1996 to date

Gold weekly 1996 to date

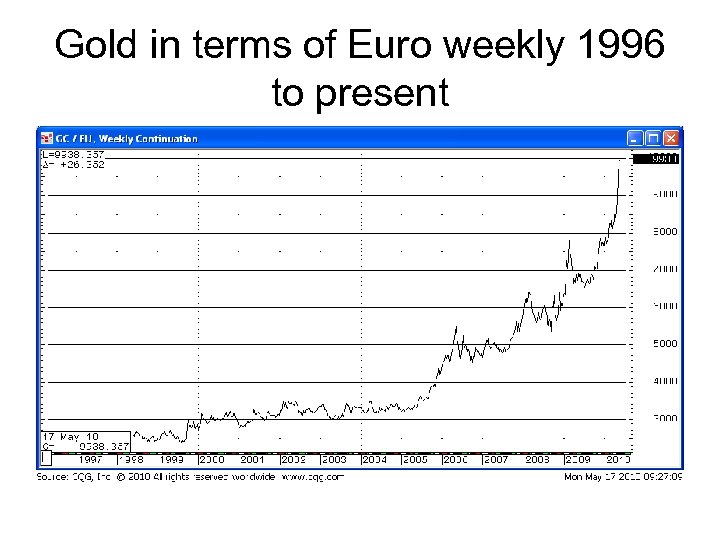

Gold in terms of Euro weekly 1996 to present

Gold in terms of Euro weekly 1996 to present

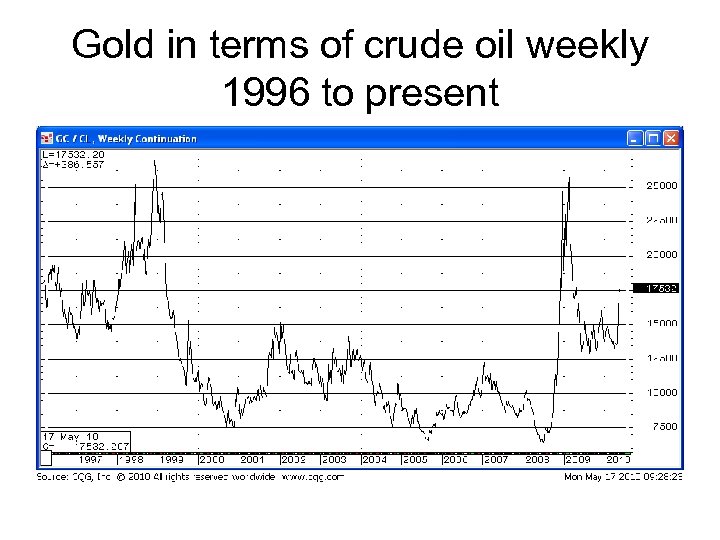

Gold in terms of crude oil weekly 1996 to present

Gold in terms of crude oil weekly 1996 to present

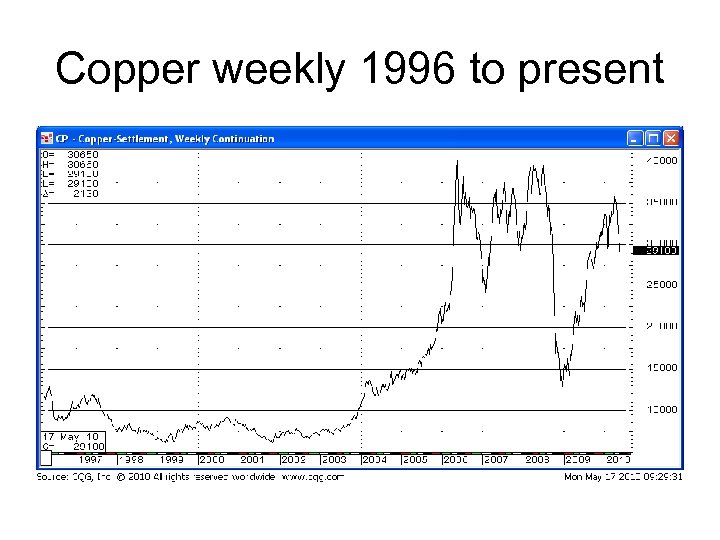

Copper weekly 1996 to present

Copper weekly 1996 to present

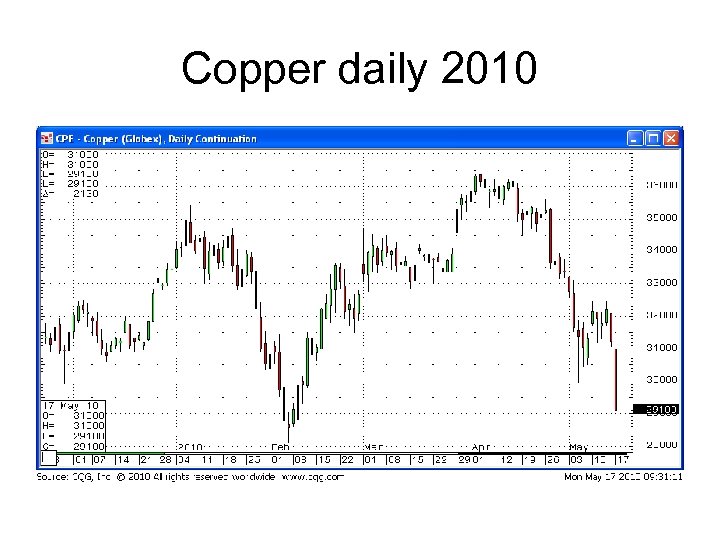

Copper daily 2010

Copper daily 2010

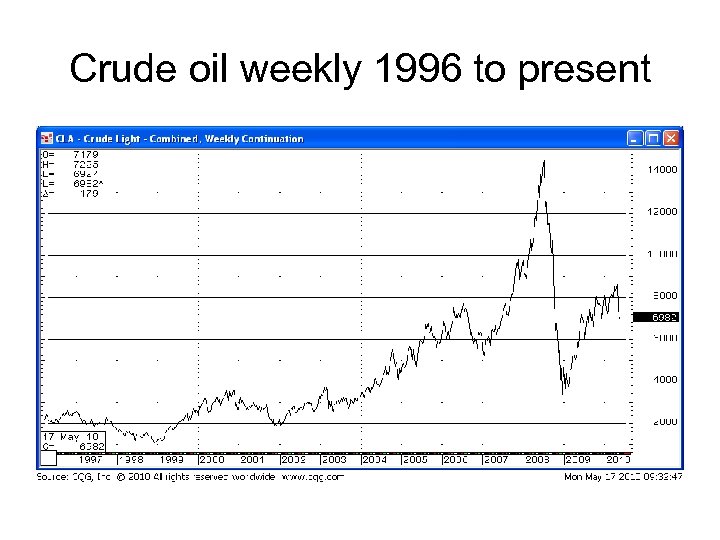

Crude oil weekly 1996 to present

Crude oil weekly 1996 to present

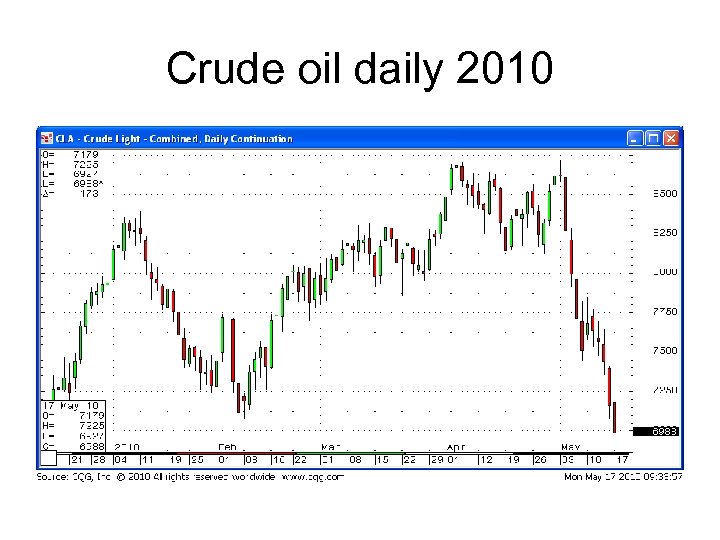

Crude oil daily 2010

Crude oil daily 2010

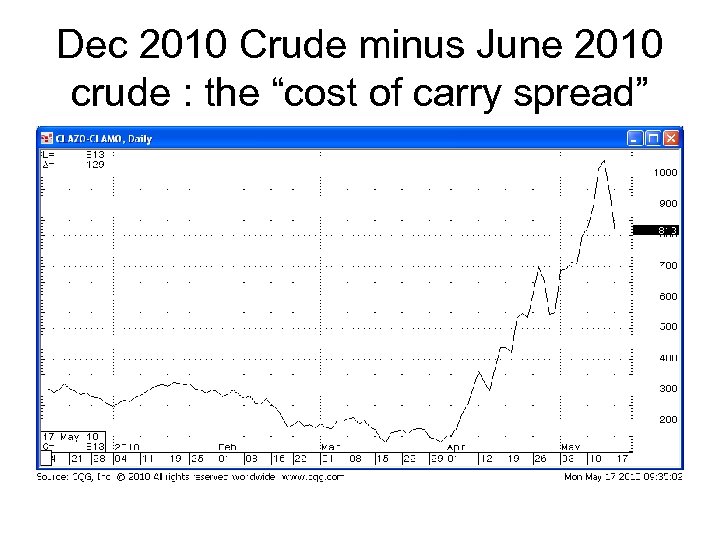

Dec 2010 Crude minus June 2010 crude : the “cost of carry spread”

Dec 2010 Crude minus June 2010 crude : the “cost of carry spread”

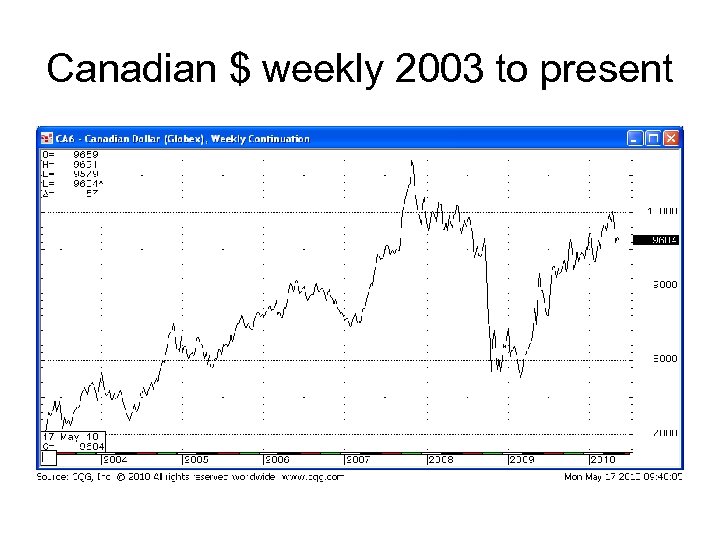

Canadian $ weekly 2003 to present

Canadian $ weekly 2003 to present

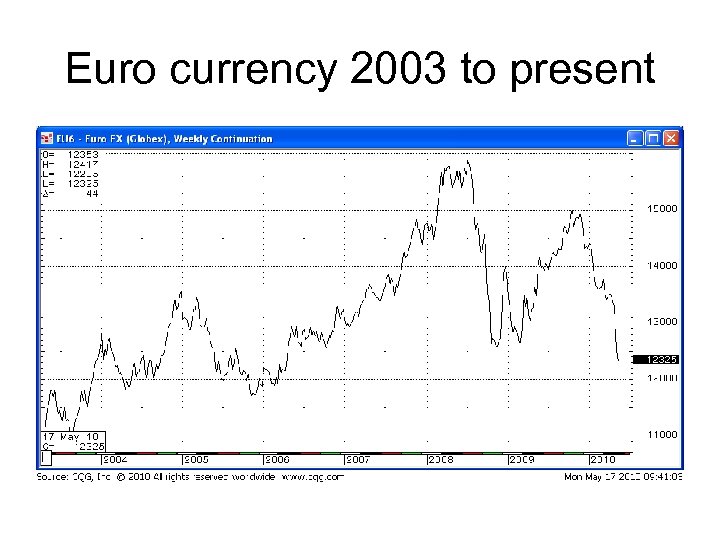

Euro currency 2003 to present

Euro currency 2003 to present

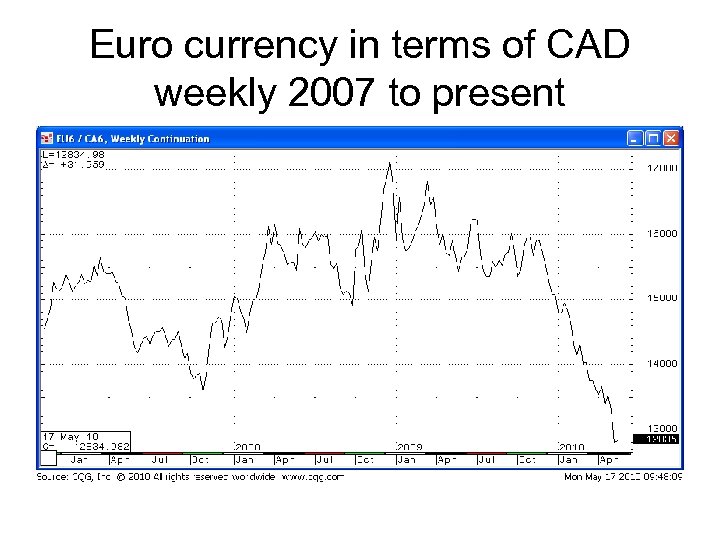

Euro currency in terms of CAD weekly 2007 to present

Euro currency in terms of CAD weekly 2007 to present

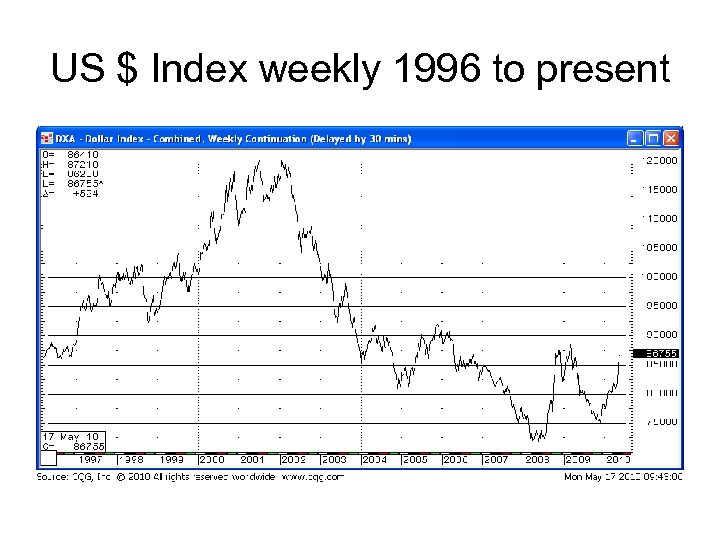

US $ Index weekly 1996 to present

US $ Index weekly 1996 to present

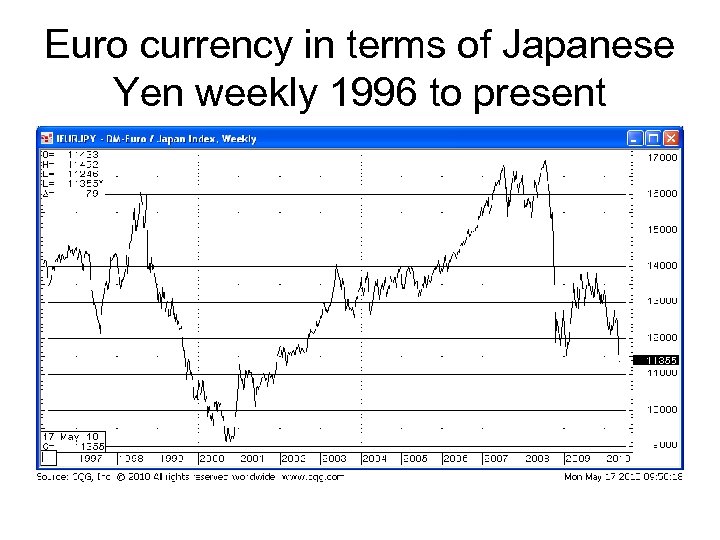

Euro currency in terms of Japanese Yen weekly 1996 to present

Euro currency in terms of Japanese Yen weekly 1996 to present