1fe06a47afd153b3e1e065315c5e3bfe.ppt

- Количество слайдов: 35

“Money Services Businesses. Access to the Banking System” Presented to The FDIC Committee on Economic Inclusion Tom Haider Money. Gram International Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved. October 24, 2007

Money. Gram International Our Purpose: “To help people and businesses by providing affordable, reliable and convenient payment services. ” 2 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

Money. Gram International Table of Contents Ø Company Overview Ø Security vs. Economic Inclusion – Are they Mutually Exclusive? Ø Bank Discontinuance Ø Next Steps 3 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

Money. Gram International Ø Payment services company conducting business in 170 countries through more than 138, 000 locations Ø Core products § Money transfers § Money orders § Official checks Ø Publicly traded on NYSE § $2 billon market cap Ø Founded in 1940 as Travelers Express – a money order company § Merged with Money. Gram in 1998 § Money. Gram started by American Express in 1989 § Headquartered in Minneapolis 4 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

Money. Gram International Money Transfers Ø Consumers § § Recent immigrants who want to send money home to their families Debtors who need to pay overdue loan to avoid collection action People who need funds in an emergency Average industry transaction is $300 Ø Sellers § Money. Gram’s services are sold through a network of “agent” locations § Agents include banks, supermarkets, convenience stores, post offices, and “mom and pop” retailers ü 138, 000+ agent locations in 170 countries Ø Fees § Consumers can send up to $1, 000 to many countries for a flat fee of about $10 § A foreign exchange between 1 to 2% is applied to most currency conversions 5 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

Global Agent Partners 6 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

Money. Gram International Money Orders Ø Definition § Payment instrument used in lieu of a personal check to pay regular bills, like rent and utilities § Average face amount is $150 Ø Consumers § § Ø Low and fixed income Individuals who cannot maintain a bank account Renters whose landlords require payment by money order Small merchants who convert cash to money orders to reduce crime Sellers § Many of the same entities that sell money transfers § 55, 000 retail locations in all 50 states Ø Fees § Fee is determined by the seller § Retail average is less than $1 7 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

Security / Anti - Money Laundering vs. Economic Inclusion Security / Anti-Money Laundering How can the two interests be brought into balance to better achieve everyone’s goals? 8 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

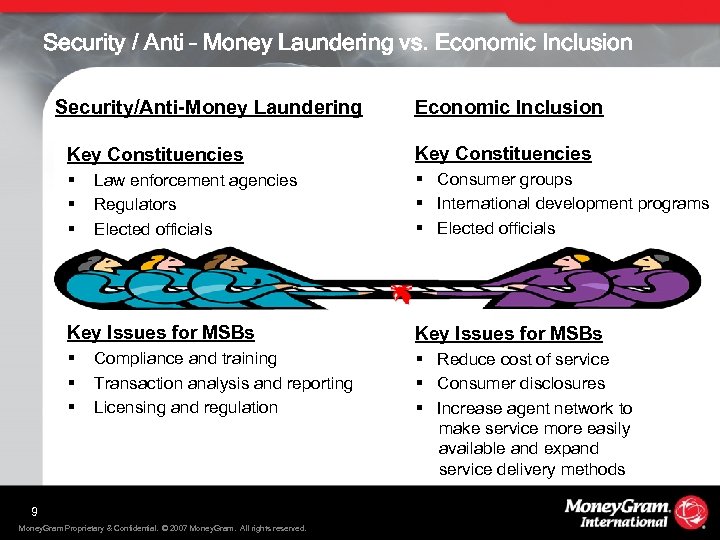

Security / Anti – Money Laundering vs. Economic Inclusion Security/Anti-Money Laundering Economic Inclusion Key Constituencies § § Consumer groups § International development programs § Elected officials Law enforcement agencies Regulators Elected officials Key Issues for MSBs § § Reduce cost of service § Consumer disclosures § Increase agent network to make service more easily available and expand service delivery methods Compliance and training Transaction analysis and reporting Licensing and regulation 9 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

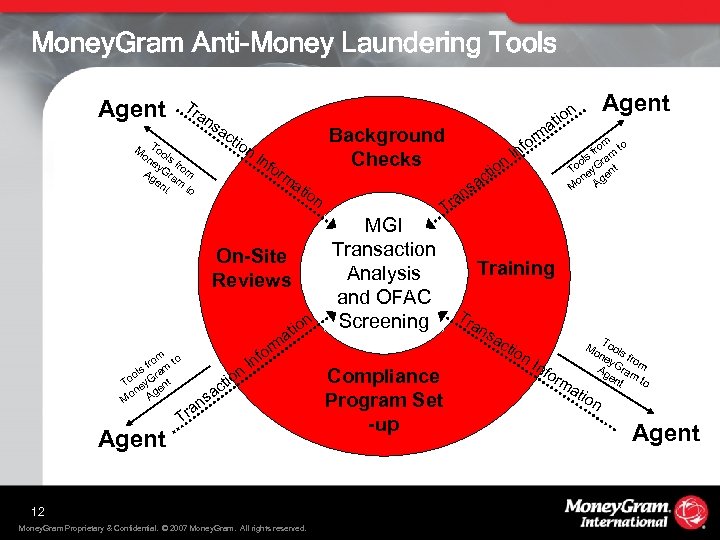

Security / Anti – Money Laundering Money. Gram Action Ø Know Your Agent § Background screening of all agent applicants Ø Ongoing training and testing of all agents § In-person reviews of select agents § On-line, computer based refresher training § Compliance Program set-up Ø Continuous investment in technology and staffing § Multi-million $ transaction analysis and OFAC screening systems § 5% of global workforce dedicated to compliance/regulatory issues 10 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

Security / Anti – Money Laundering Money. Gram Action Ø Licensed and regulated by 48 State Banking Departments Ø IRS is primary regulator for Bank Secrecy Act compliance § Money. Gram and agents examined by States and IRS Ø Close cooperation with law enforcement § § 38, 000+ SARs/year 4, 000+ CTRs/year 4, 500+ information requests/year Regular joint-training programs 11 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

Money. Gram Anti-Money Laundering Tools Agent Tr an sa cti M Too on ls ey fro Ag Gra m en m to t nfo rm ati on a ns n tio or f In c T ra 12 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved. n In o cti sa m or f m o fro m t ols ra To ey. G ent on Ag M n MGI Transaction On-Site Analysis Reviews and OFAC n Screening tio a m m fro to ls ram o To ey. G nt on Age M Agent on I a Background Checks Compliance Program Set -up a Tr Agent n tio Training Tr an sa cti on Inf orm ati T Mo ool ne s fr om y Ag Gram en to t on Agent

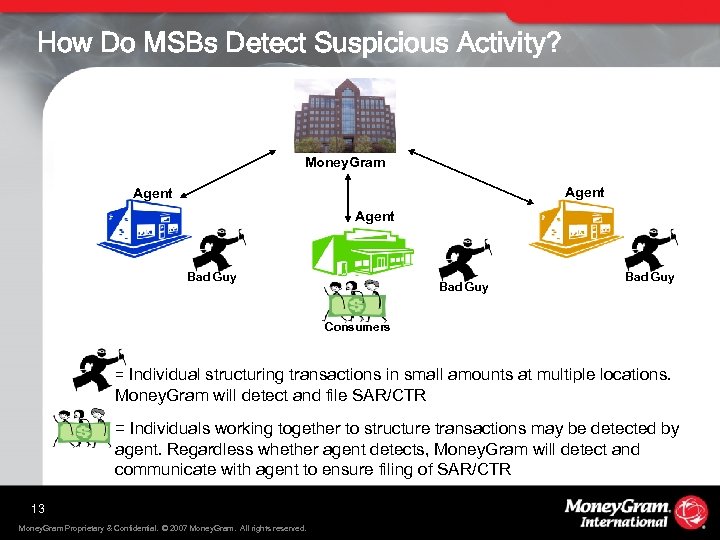

How Do MSBs Detect Suspicious Activity? Money. Gram Agent Bad Guy Consumers = Individual structuring transactions in small amounts at multiple locations. Money. Gram will detect and file SAR/CTR = Individuals working together to structure transactions may be detected by agent. Regardless whether agent detects, Money. Gram will detect and communicate with agent to ensure filing of SAR/CTR 13 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

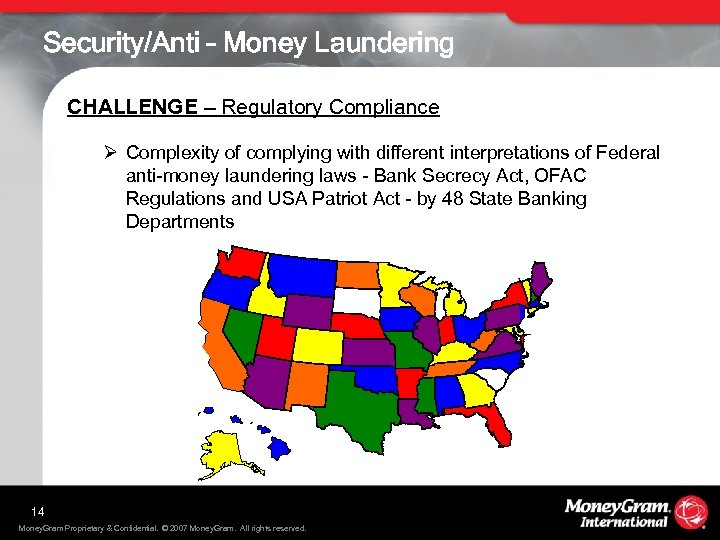

Security/Anti – Money Laundering CHALLENGE – Regulatory Compliance Ø Complexity of complying with different interpretations of Federal anti-money laundering laws - Bank Secrecy Act, OFAC Regulations and USA Patriot Act - by 48 State Banking Departments 14 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

Security/Anti – Money Laundering SOLUTION – Federal Licensing Ø Establish an optional Federal regulator for MSBs that can provide uniformity and efficiencies in compliance 15 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

Security/Anti – Money Laundering CHALLENGE - MSB Definitions Ø Anti-money laundering laws treat all MSBs the same § Who’s the MSB? ü Money. Gram ü American Express ü Hilton Hotels ü Carlson Wagonlit Travel ü Albertsons ü Jackson Hewitt Tax Service ü Bob’s Deli § Objective standards are now overshadowed by complex and often confusing risk-based, subjective requirements 16 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

Security/Anti – Money Laundering SOLUTION - Re-define MSB Ø Re-define MSBs to facilitate compliance by agents § Treasury Secretary Paulson and Fin. CEN Director Fries have stated their intent to re-examine the MSB definition § Treasury should adopt a “rules based” approach – not “principles based” – for smaller agents ü Rules will improve compliance if MSB service is only an ancillary part of agents’ business ü Policies and procedures should not be the priority 17 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

Security / Anti – Money Laundering vs. Economic Inclusion Security/Anti-Money Laundering Economic Inclusion Key Constituencies § § Consumer groups § International development programs § Elected officials Law enforcement agencies Regulators Elected officials Key Issues for MSBs § § Reduce cost of service § Consumer disclosures § Increase agent network to make service more easily available and expand service delivery methods Compliance and training Transaction analysis and reporting Licensing and regulation 18 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

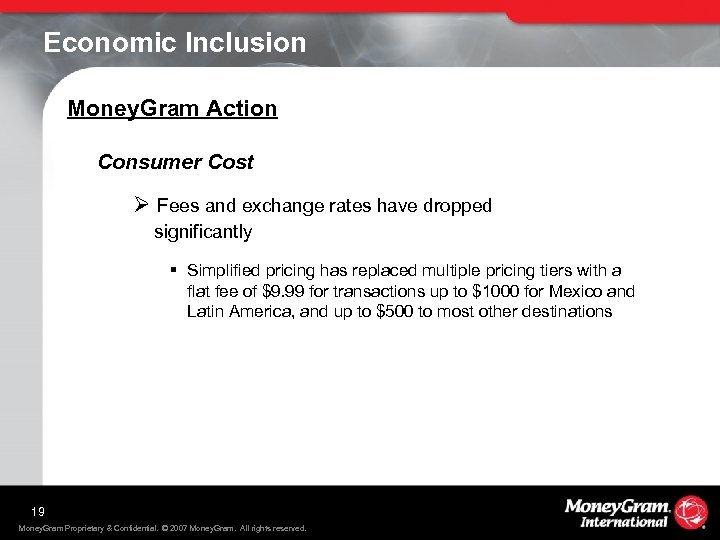

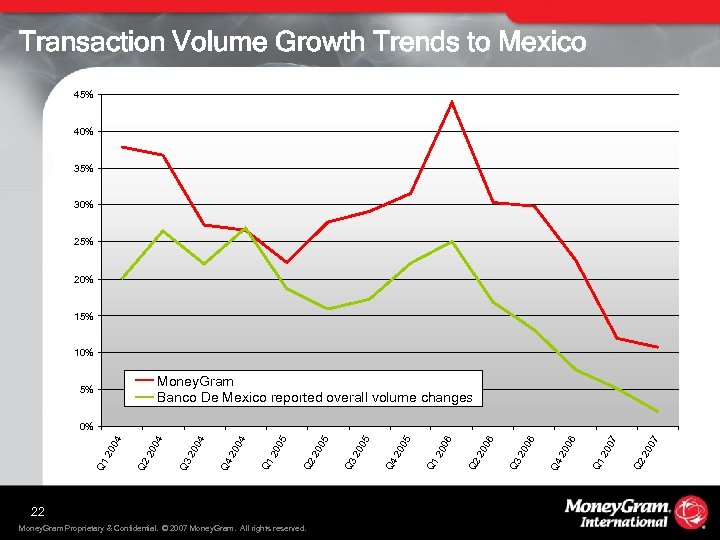

Economic Inclusion Money. Gram Action Consumer Cost Ø Fees and exchange rates have dropped significantly § Simplified pricing has replaced multiple pricing tiers with a flat fee of $9. 99 for transactions up to $1000 for Mexico and Latin America, and up to $500 to most other destinations 19 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

Money. Gram’s Average Fee Per Transaction 20 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

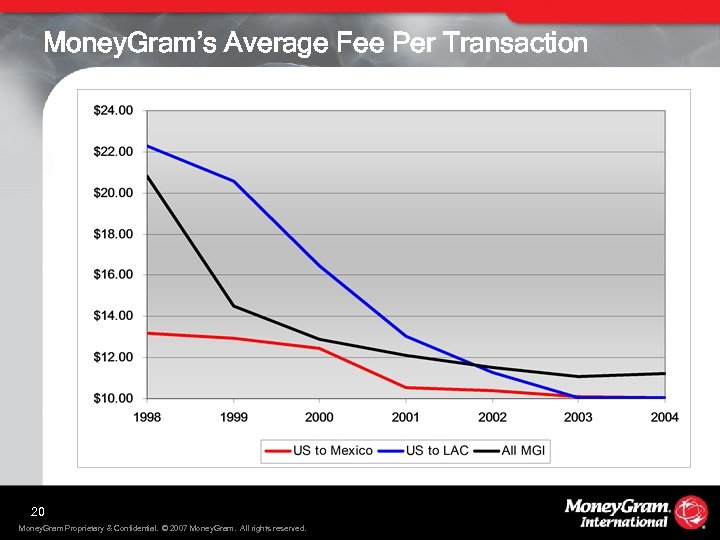

Money. Gram’s Average Foreign Exchange Rate to Mexico 21 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

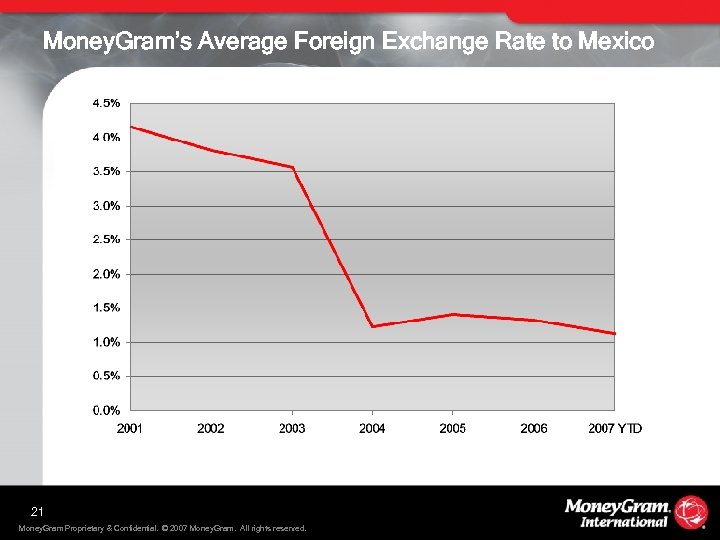

Transaction Volume Growth Trends to Mexico 45% 40% 35% 30% 25% 20% 15% 10% Money. Gram Banco De Mexico reported overall volume changes 5% 22 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved. 07 20 Q 2 07 20 Q 1 06 20 Q 4 06 20 Q 3 06 20 Q 2 06 20 Q 1 05 20 Q 4 05 20 Q 3 05 Q 2 20 05 20 Q 1 04 20 Q 4 04 20 Q 3 04 20 Q 2 Q 1 20 04 0%

Economic Inclusion Consumer Cost Ø Fees are about as low as they can go without regulatory streamlining rs’ tte mi ns Tra Tag e ey on Pric t en 23 _ $_ _ __ on ssi mi m Co _ __ M ion iss mm _ $_ _ __ g o d. A t. C en en S g _ e. A __ eiv e c __ r $ nc Re itte plia sm __ n om __ Tra $_ LC for AM es e _ t k. F __ an Agen B n __ $ d atio an _ nic __ mu __ ing $ in com Tra ele d. T pts an nt C ge cei e P A , R for ms or s, F n Sig Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

Economic Inclusion Money. Gram Action Consumer Disclosures and Services Ø Senders receive a receipt showing § § Amount paid Transaction fee Exchange rate Amount of local currency their recipient will be paid Ø Senders receive free calling card to notify recipient Ø Receivers can pick up transaction within minutes after sent Ø Free, multi-lingual customer service available 24 x 7 24 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

Economic Inclusion Money. Gram Action Service Availability Ø Money. Gram’s agent network rapidly expanding globally to provide greater consumer convenience § Network is the key to providing consumers with service when and where they want it § Network provides consistency in pricing – Money. Gram receivers are never charged a fee § Network provides consumers certainty that funds will be available ü Amount is guaranteed ü Funds can be picked up within minutes of being sent 25 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

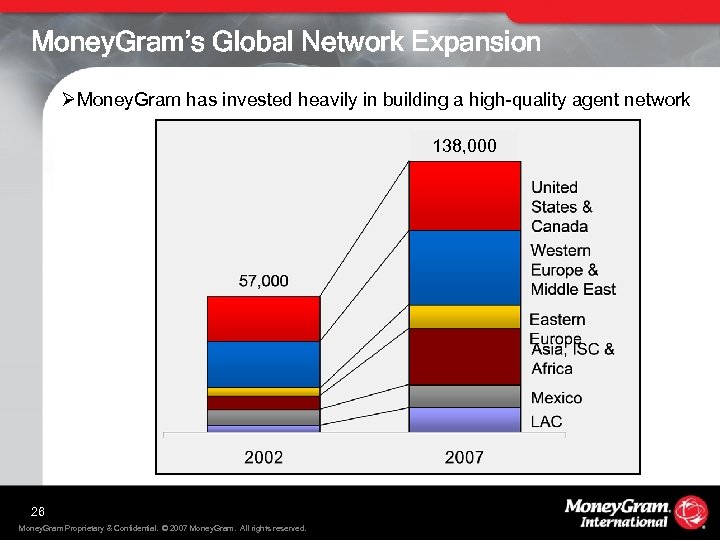

Money. Gram’s Global Network Expansion ØMoney. Gram has invested heavily in building a high-quality agent network 138, 000 26 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

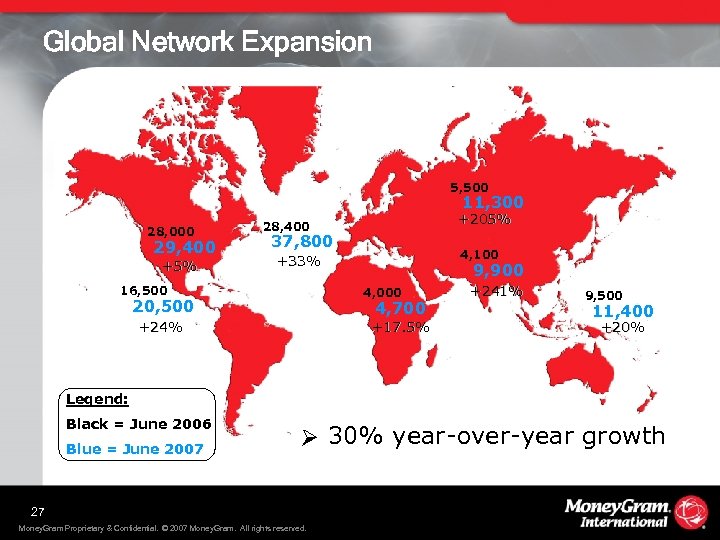

Global Network Expansion 5, 500 11, 300 28, 000 29, 400 +5% +205% 28, 400 37, 800 4, 100 +33% 16, 500 9, 900 4, 000 20, 500 4, 700 +24% +17. 5% +241% 9, 500 11, 400 +20% Legend: Black = June 2006 Blue = June 2007 Ø 30% year-over-year growth 27 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

Economic Inclusion Money. Gram Action Service Availability Ø Partnering with banks around the world § U. S. ü 2, 500+ US Bancorp locations § International ü Standard Bank in Africa; ICBC in China; Bank Pekao in Poland; Bank of Ireland; Privat Bank in Romania; Rosbank in Russia; etc. 28 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

South American Banking Relationships Colombia • Banco Davivienda Ecuador • Banco del Pichincha • Banco del Austro • Banco del Pacifico • Cooperativa de Ahorro Peru • Banco Financiero del Peru • FENACREP Bolivia Banco Nacional de Bolivia 29 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved. Brazil • Banco Itau • Banco Bankpar Paraguay • Banco Integracion Uruguay • Exprinter Argentina Banco Itau Buen Ayre • Banco Piano

Central American Banking Relationships Honduras Belize • Banco Atlantida • BGA • Banco Mercantil • Federacion de Cooperativas de Ahorro y Credito • Banco Fichosa • Belize Bank Guatemala • Banco de Desarrollo Rural • Banco Industrial • FENACOAC Nicaragua El Salvador • Banco Agricola Comercial • Banco Cuscatlan • FEDECACES • Scotia. Bank El Salvador • FEDECREDITO • Banco Pro. America 30 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved. Costa Rica • Banco de San Jose • Banco De Costa Rica • Banco BANEX • Banco de la Producci ón • Central Cooperativa de Ahorro y Credito • Banco Uno Nicaragua

Economic Inclusion Bank Discontinuance Ø Solving the Bank Discontinuance problem will improve the availability of MSB services § MSB industry - working with bank trade groups - has drafted legislation to address the problem § Regulatory support of legislation will increase the chance of success § Why is legislation needed? ü Guidance issued in April 2005 by Fin. CEN and Federal Banking Agencies did not solve the problem ü FFIEC’s BSA/AML Examination Manual does not provide clear examples of when banks do not need to review an MSB’s BSA/AML program 31 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

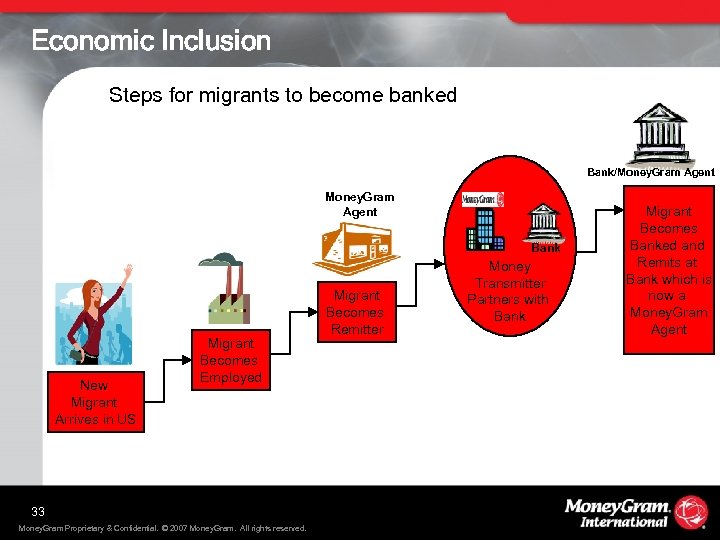

Economic Inclusion Banks and MSBs Working Together Ø Money. Gram seeking opportunities to partner with more banks § Money Orders § Money Transfers Ø Regulators can help by reducing banks’ concerns with MSB accounts Ø Money transfers can help migrants become banked consumers 32 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

Economic Inclusion Steps for migrants to become banked Bank/Money. Gram Agent Bank New Migrant Arrives in US Migrant Becomes Employed 33 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved. Migrant Becomes Remitter Money Transmitter Partners with Bank Migrant Becomes Banked and Remits at Bank which is now a Money. Gram Agent

Security/Anti – Money Laundering vs. Economic Inclusion MGI recommends the Committee on Economic Inclusion Ø Seek greater uniformity, consistency, and clarity in the regulation of MSBs by allowing MSBs to opt for a federal license Ø Encourage Treasury to revise the definition of MSBs to facilitate compliance by agents, focusing on a rules-based approach for smaller agents Ø Encourage greater partnerships and linkages between MSBs and banks Ø Address the critical issue of MSB banking relationships through further regulatory guidance or Congressional action 34 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

Security/Anti – Money Laundering vs. Economic Inclusion Conclusion Ø MSBs provide vital services to consumers Ø MSBs work with banks around the world Ø Money transfer fees have dropped significantly Ø The regulatory environment influences the ability of MSBs to serve consumers Ø A balance is needed between ensuring that our nation’s interests are protected through strong AML regulation, while at the same time making sure MSBs are able to serve their consumers 35 Money. Gram Proprietary & Confidential. © 2007 Money. Gram. All rights reserved.

1fe06a47afd153b3e1e065315c5e3bfe.ppt