38440172fcdfe4def2a18737520d94a8.ppt

- Количество слайдов: 39

Money Never Sleeps Presentation to the Government Investment Officers Association David Hendler Head of U. S. Financial Services dhendler@creditsights. com

Money Never Sleeps Presentation to the Government Investment Officers Association David Hendler Head of U. S. Financial Services dhendler@creditsights. com

Credit. Sights - Fundamental Research Topical, Strategic, Sector and Company credit research on unsecured bonds, CDS, loans, hybrid securities, and select equities of the major companies in the U. S. and Europe. A newly established research team in Asia is expanding our research coverage in the Asia. Pacific region. Benefits · Independence/Investor pays model · Timely · Quality of research · Unique insight · Focus/Time · Third party verification · Cost 2

Credit. Sights - Fundamental Research Topical, Strategic, Sector and Company credit research on unsecured bonds, CDS, loans, hybrid securities, and select equities of the major companies in the U. S. and Europe. A newly established research team in Asia is expanding our research coverage in the Asia. Pacific region. Benefits · Independence/Investor pays model · Timely · Quality of research · Unique insight · Focus/Time · Third party verification · Cost 2

Credit. Sights - Coverage · 75 analysts covering 40 industries across 7 broadly defined sectors, plus U. S. , European & Asian Credit Strategy · 700 companies in core coverage, 1, 400 companies with written research · US 495 Companies · European/Asian 205 Companies · High Grade 459 Companies · High Yield 241 Companies · 55 Industry Outlooks to be published in early 2011 3

Credit. Sights - Coverage · 75 analysts covering 40 industries across 7 broadly defined sectors, plus U. S. , European & Asian Credit Strategy · 700 companies in core coverage, 1, 400 companies with written research · US 495 Companies · European/Asian 205 Companies · High Grade 459 Companies · High Yield 241 Companies · 55 Industry Outlooks to be published in early 2011 3

Credit. Sights - Customers · 950 Institutions and 6, 000 people · Mutual Funds · Insurance Companies · Investment Advisors · Hedge Funds · Dealers/Banks · Pension Funds · Government Sponsored Entities · Government Regulators · Corporations 4

Credit. Sights - Customers · 950 Institutions and 6, 000 people · Mutual Funds · Insurance Companies · Investment Advisors · Hedge Funds · Dealers/Banks · Pension Funds · Government Sponsored Entities · Government Regulators · Corporations 4

Policy Time Table Update: 2011 • Financial Stability and Bank Capital Regime > Dodd-Frank Wall Street Reform/Consumer Protection Act (July ’ 10) Ø Regulatory interpretations and studies Ø Phase-ins and follow-up regs Ø Fed’s SCAP-2 for dividends & buybacks > BIS III and IMF Global Financial Stability Study (August ’ 10) Ø New/higher capital standards/global coordination Ø Loss absorbency regime – write-downs/conversions/bail-ins Ø Huge global infrastructure overlay on top of market mechanisms • U. S. Mortgage Market Dynamics > Reforming America’s Housing Finance Market (February ‘ 11) Ø GSEs est. losses from $200 B to $400 B Ø Enhanced HAMP released by Obama Administration (March ‘ 10) Ø Proposed Global Servicing Settlement (Fed and State AGs) Ø Questions on legality/fairness/loss distribution between 1 st and 2 nd liens ($20 B? ) Ø Republican pushback in favor of banks 5

Policy Time Table Update: 2011 • Financial Stability and Bank Capital Regime > Dodd-Frank Wall Street Reform/Consumer Protection Act (July ’ 10) Ø Regulatory interpretations and studies Ø Phase-ins and follow-up regs Ø Fed’s SCAP-2 for dividends & buybacks > BIS III and IMF Global Financial Stability Study (August ’ 10) Ø New/higher capital standards/global coordination Ø Loss absorbency regime – write-downs/conversions/bail-ins Ø Huge global infrastructure overlay on top of market mechanisms • U. S. Mortgage Market Dynamics > Reforming America’s Housing Finance Market (February ‘ 11) Ø GSEs est. losses from $200 B to $400 B Ø Enhanced HAMP released by Obama Administration (March ‘ 10) Ø Proposed Global Servicing Settlement (Fed and State AGs) Ø Questions on legality/fairness/loss distribution between 1 st and 2 nd liens ($20 B? ) Ø Republican pushback in favor of banks 5

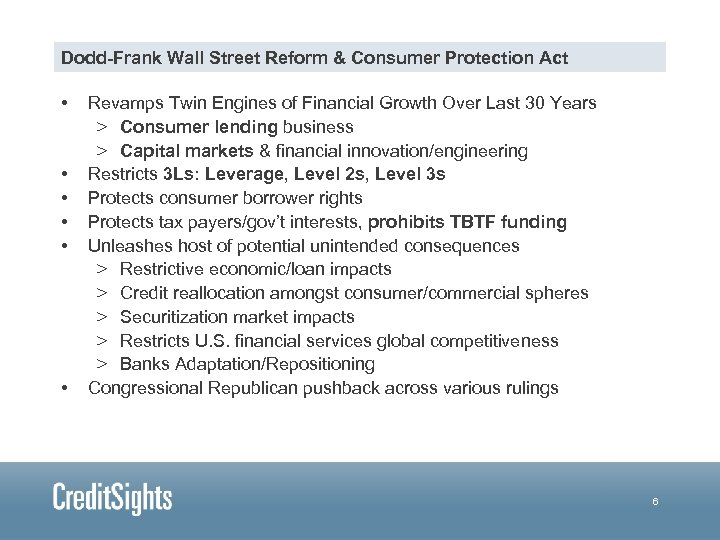

Dodd-Frank Wall Street Reform & Consumer Protection Act • • • Revamps Twin Engines of Financial Growth Over Last 30 Years > Consumer lending business > Capital markets & financial innovation/engineering Restricts 3 Ls: Leverage, Level 2 s, Level 3 s Protects consumer borrower rights Protects tax payers/gov’t interests, prohibits TBTF funding Unleashes host of potential unintended consequences > Restrictive economic/loan impacts > Credit reallocation amongst consumer/commercial spheres > Securitization market impacts > Restricts U. S. financial services global competitiveness > Banks Adaptation/Repositioning Congressional Republican pushback across various rulings 6

Dodd-Frank Wall Street Reform & Consumer Protection Act • • • Revamps Twin Engines of Financial Growth Over Last 30 Years > Consumer lending business > Capital markets & financial innovation/engineering Restricts 3 Ls: Leverage, Level 2 s, Level 3 s Protects consumer borrower rights Protects tax payers/gov’t interests, prohibits TBTF funding Unleashes host of potential unintended consequences > Restrictive economic/loan impacts > Credit reallocation amongst consumer/commercial spheres > Securitization market impacts > Restricts U. S. financial services global competitiveness > Banks Adaptation/Repositioning Congressional Republican pushback across various rulings 6

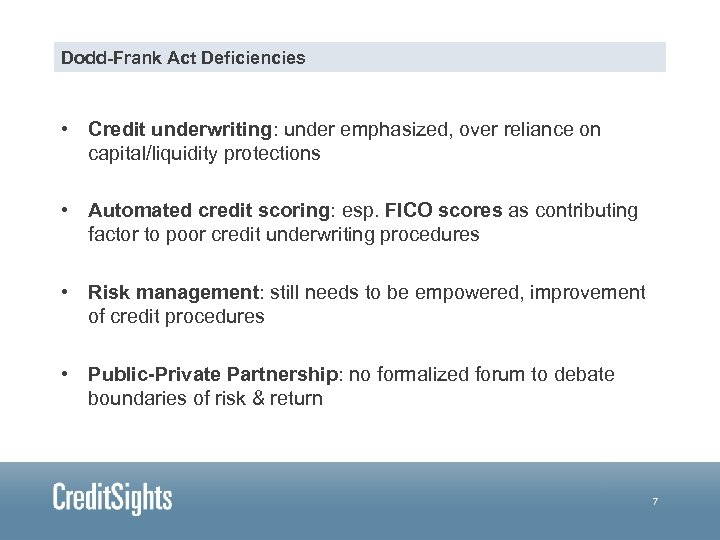

Dodd-Frank Act Deficiencies • Credit underwriting: under emphasized, over reliance on capital/liquidity protections • Automated credit scoring: esp. FICO scores as contributing factor to poor credit underwriting procedures • Risk management: still needs to be empowered, improvement of credit procedures • Public-Private Partnership: no formalized forum to debate boundaries of risk & return 7

Dodd-Frank Act Deficiencies • Credit underwriting: under emphasized, over reliance on capital/liquidity protections • Automated credit scoring: esp. FICO scores as contributing factor to poor credit underwriting procedures • Risk management: still needs to be empowered, improvement of credit procedures • Public-Private Partnership: no formalized forum to debate boundaries of risk & return 7

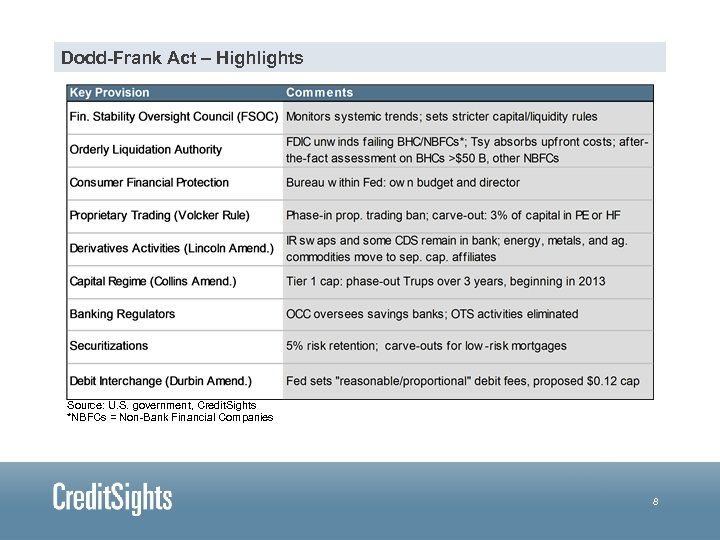

Dodd-Frank Act – Highlights Source: U. S. government, Credit. Sights *NBFCs = Non-Bank Financial Companies 8

Dodd-Frank Act – Highlights Source: U. S. government, Credit. Sights *NBFCs = Non-Bank Financial Companies 8

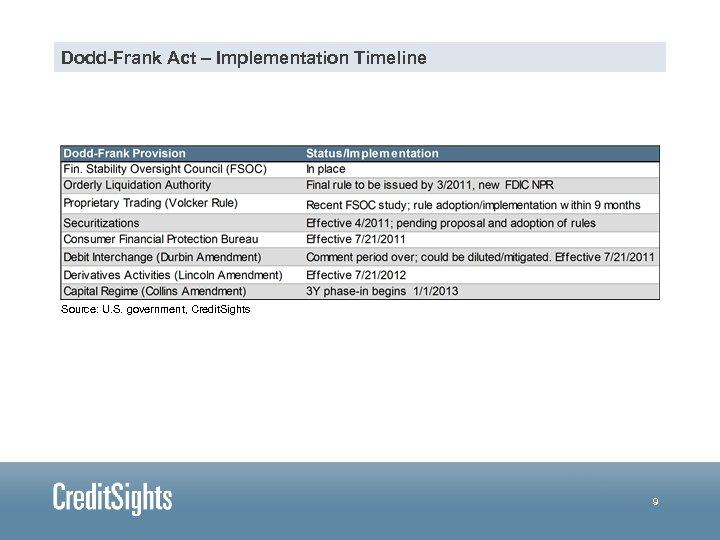

Dodd-Frank Act – Implementation Timeline Source: U. S. government, Credit. Sights 9

Dodd-Frank Act – Implementation Timeline Source: U. S. government, Credit. Sights 9

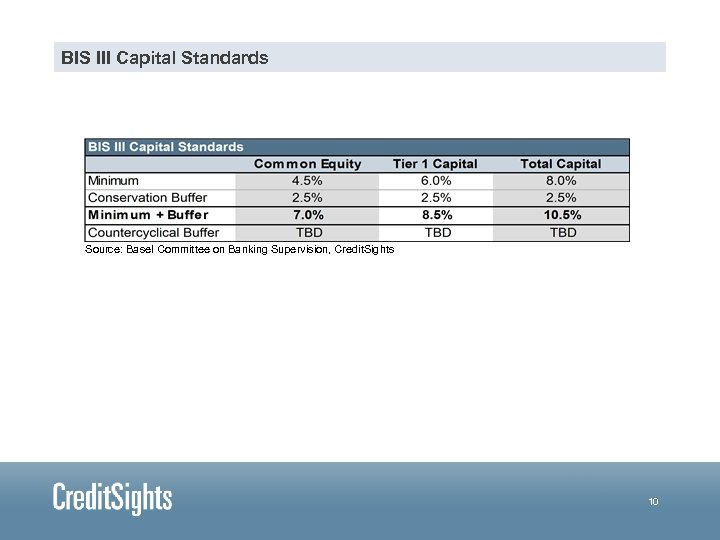

BIS III Capital Standards Source: Basel Committee on Banking Supervision, Credit. Sights 10

BIS III Capital Standards Source: Basel Committee on Banking Supervision, Credit. Sights 10

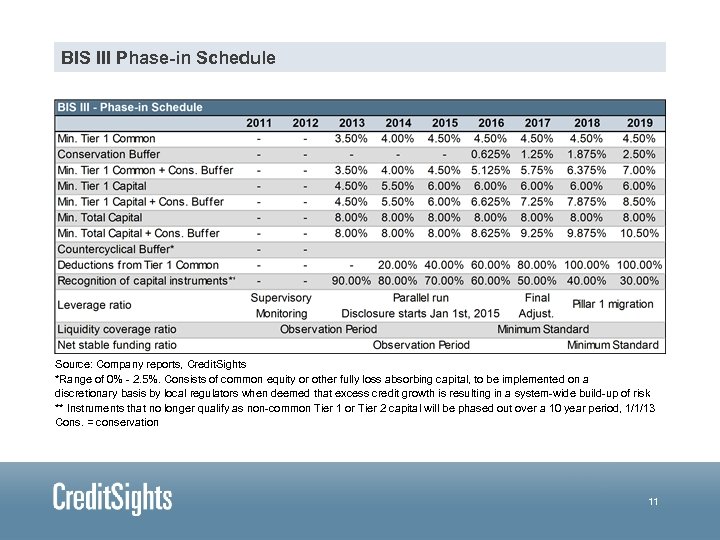

BIS III Phase-in Schedule Source: Company reports, Credit. Sights *Range of 0% - 2. 5%. Consists of common equity or other fully loss absorbing capital, to be implemented on a discretionary basis by local regulators when deemed that excess credit growth is resulting in a system-wide build-up of risk ** Instruments that no longer qualify as non-common Tier 1 or Tier 2 capital will be phased out over a 10 year period, 1/1/13 Cons. = conservation 11

BIS III Phase-in Schedule Source: Company reports, Credit. Sights *Range of 0% - 2. 5%. Consists of common equity or other fully loss absorbing capital, to be implemented on a discretionary basis by local regulators when deemed that excess credit growth is resulting in a system-wide build-up of risk ** Instruments that no longer qualify as non-common Tier 1 or Tier 2 capital will be phased out over a 10 year period, 1/1/13 Cons. = conservation 11

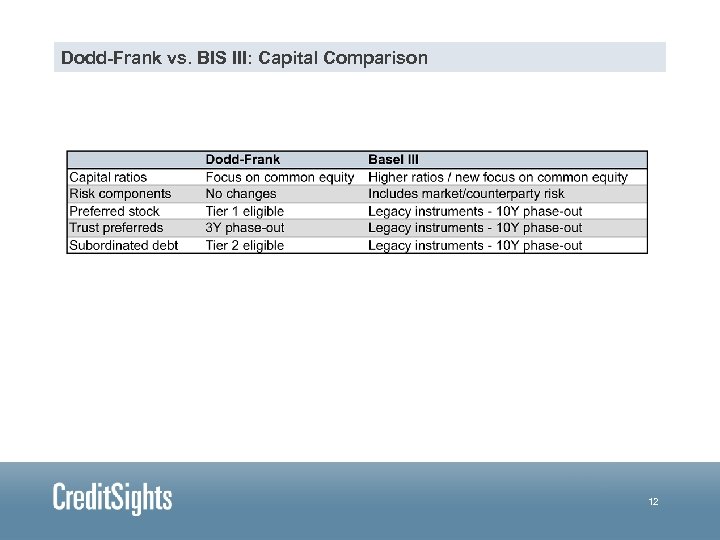

Dodd-Frank vs. BIS III: Capital Comparison 12

Dodd-Frank vs. BIS III: Capital Comparison 12

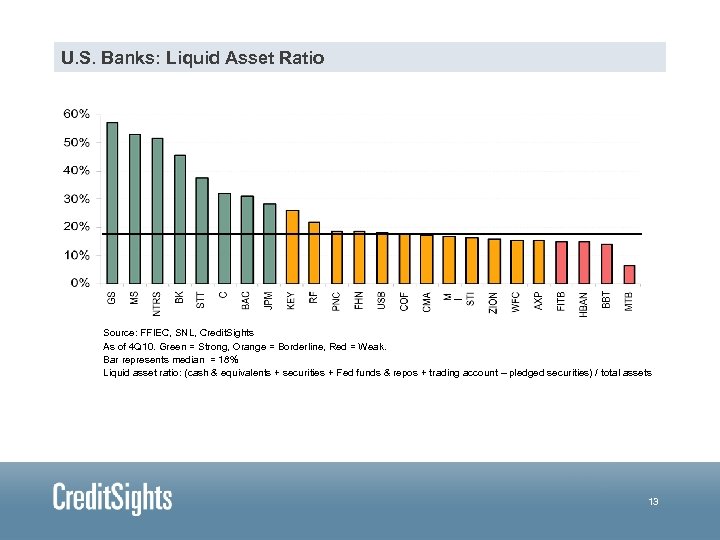

U. S. Banks: Liquid Asset Ratio Source: FFIEC, SNL, Credit. Sights As of 4 Q 10. Green = Strong, Orange = Borderline, Red = Weak. Bar represents median = 18% Liquid asset ratio: (cash & equivalents + securities + Fed funds & repos + trading account – pledged securities) / total assets 13

U. S. Banks: Liquid Asset Ratio Source: FFIEC, SNL, Credit. Sights As of 4 Q 10. Green = Strong, Orange = Borderline, Red = Weak. Bar represents median = 18% Liquid asset ratio: (cash & equivalents + securities + Fed funds & repos + trading account – pledged securities) / total assets 13

Orderly Liquidation Authority: Hope or Hostage? • Key Takeaway: taxpayer bailout prohibited; capital structure vulnerable • BIS proposals differ as public monies still available, broader loss sharing to subordinated debt, possibly to senior debt • Harmonizing global regulation – BIS 3 gravitating to Dodd-Frank • Investment bank "bail-in" plans now part of BIS proposals • Market Discipline: priority of claims, bridge banks, loss assessments 14

Orderly Liquidation Authority: Hope or Hostage? • Key Takeaway: taxpayer bailout prohibited; capital structure vulnerable • BIS proposals differ as public monies still available, broader loss sharing to subordinated debt, possibly to senior debt • Harmonizing global regulation – BIS 3 gravitating to Dodd-Frank • Investment bank "bail-in" plans now part of BIS proposals • Market Discipline: priority of claims, bridge banks, loss assessments 14

Bail-Ins Brouhaha – System Stabilizer? • Bail-in part of BIS 3 discussion; could recapitalize “nonviable” SIFIs • “Pre-packaged bankruptcy-type" mechanism for allocating losses across unsecured capital structure, but within a regulatory framework • Triggers “automatic” recapitalization plan designed to be activated in a crisis, before public sector capital support • Could preserve franchise value as "going concern", reducing writedown potential of senior unsecured debt • Maintains protections for depositors/swaps, through key risk enablers; repo at FMV according to FDIC Interim Final Rule (1/18/2011) • Could work as an alternative, instead of wind-down, bankruptcy 15

Bail-Ins Brouhaha – System Stabilizer? • Bail-in part of BIS 3 discussion; could recapitalize “nonviable” SIFIs • “Pre-packaged bankruptcy-type" mechanism for allocating losses across unsecured capital structure, but within a regulatory framework • Triggers “automatic” recapitalization plan designed to be activated in a crisis, before public sector capital support • Could preserve franchise value as "going concern", reducing writedown potential of senior unsecured debt • Maintains protections for depositors/swaps, through key risk enablers; repo at FMV according to FDIC Interim Final Rule (1/18/2011) • Could work as an alternative, instead of wind-down, bankruptcy 15

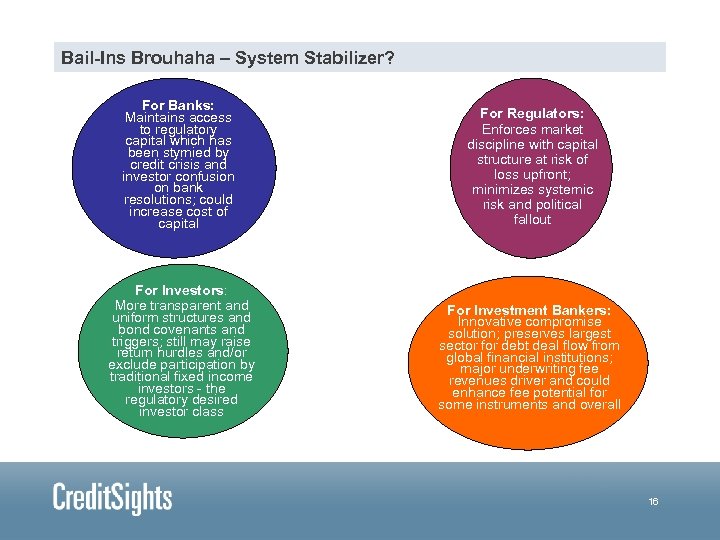

Bail-Ins Brouhaha – System Stabilizer? For Banks: Maintains access to regulatory capital which has been stymied by credit crisis and investor confusion on bank resolutions; could increase cost of capital For Regulators: Enforces market discipline with capital structure at risk of loss upfront; minimizes systemic risk and political fallout For Investors: More transparent and uniform structures and bond covenants and triggers; still may raise return hurdles and/or exclude participation by traditional fixed income investors - the regulatory desired investor class For Investment Bankers: Innovative compromise solution; preserves largest sector for debt deal flow from global financial institutions; major underwriting fee revenues driver and could enhance fee potential for some instruments and overall 16

Bail-Ins Brouhaha – System Stabilizer? For Banks: Maintains access to regulatory capital which has been stymied by credit crisis and investor confusion on bank resolutions; could increase cost of capital For Regulators: Enforces market discipline with capital structure at risk of loss upfront; minimizes systemic risk and political fallout For Investors: More transparent and uniform structures and bond covenants and triggers; still may raise return hurdles and/or exclude participation by traditional fixed income investors - the regulatory desired investor class For Investment Bankers: Innovative compromise solution; preserves largest sector for debt deal flow from global financial institutions; major underwriting fee revenues driver and could enhance fee potential for some instruments and overall 16

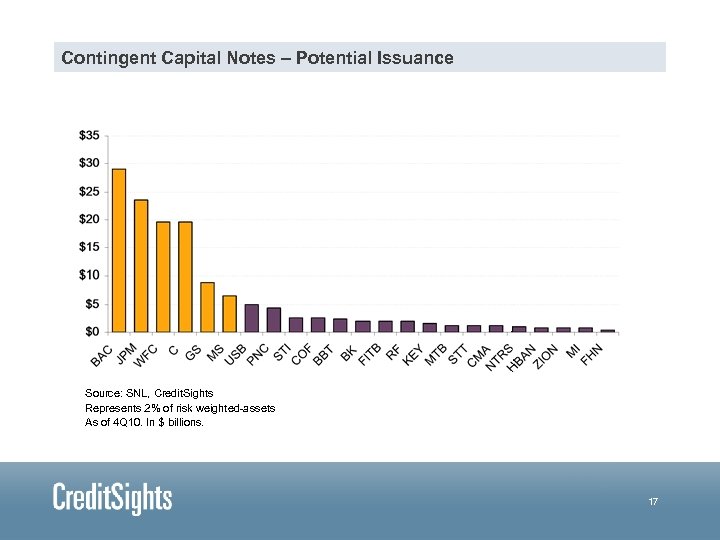

Contingent Capital Notes – Potential Issuance Source: SNL, Credit. Sights Represents 2% of risk weighted-assets As of 4 Q 10. In $ billions. 17

Contingent Capital Notes – Potential Issuance Source: SNL, Credit. Sights Represents 2% of risk weighted-assets As of 4 Q 10. In $ billions. 17

Ratings Agencies: Proposed Changes • S&P Ø Places greater emphasis on country, economics, and industry risk Ø Individual company analysis increases importance of capital/funding Ø Earnings de-emphasized Ø Short-term debt: brokers more vulnerable to downgrade to A 2 • Moody’s Ø Reassesses government willingness and capacity for support Ø Higher likelihood of govt. sharing bailout cost with debt holders Ø Focused mainly on the ratings impact to bank subordinated debt Ø Possible negative impact to acquirers of distressed banks Source: S&P, Moody’s, Credit. Sights 18

Ratings Agencies: Proposed Changes • S&P Ø Places greater emphasis on country, economics, and industry risk Ø Individual company analysis increases importance of capital/funding Ø Earnings de-emphasized Ø Short-term debt: brokers more vulnerable to downgrade to A 2 • Moody’s Ø Reassesses government willingness and capacity for support Ø Higher likelihood of govt. sharing bailout cost with debt holders Ø Focused mainly on the ratings impact to bank subordinated debt Ø Possible negative impact to acquirers of distressed banks Source: S&P, Moody’s, Credit. Sights 18

Mega-Trends: Banks High margin products - C&I Lending (small/middle/large) - CRE Lending - Affluent Customers - Pre-paid cards for non-prime - Overseas Ops. Higher operating leverage - Cards: Convenience vs. Credit - Basic Capital Markets/Transactions Services - “Nuts & Bolts Banking” vs. “Casino Royale” 19

Mega-Trends: Banks High margin products - C&I Lending (small/middle/large) - CRE Lending - Affluent Customers - Pre-paid cards for non-prime - Overseas Ops. Higher operating leverage - Cards: Convenience vs. Credit - Basic Capital Markets/Transactions Services - “Nuts & Bolts Banking” vs. “Casino Royale” 19

Mega-Trends: Possible Winners & Divestors FAVORS Wells Fargo ADAPTORS Bigger Regional Banks Bank of America Citigroup Processor Banks JPMorgan Asset Managers Goldman Sachs Morgan Stanley DIVESTORS Bank of America Citigroup 20

Mega-Trends: Possible Winners & Divestors FAVORS Wells Fargo ADAPTORS Bigger Regional Banks Bank of America Citigroup Processor Banks JPMorgan Asset Managers Goldman Sachs Morgan Stanley DIVESTORS Bank of America Citigroup 20

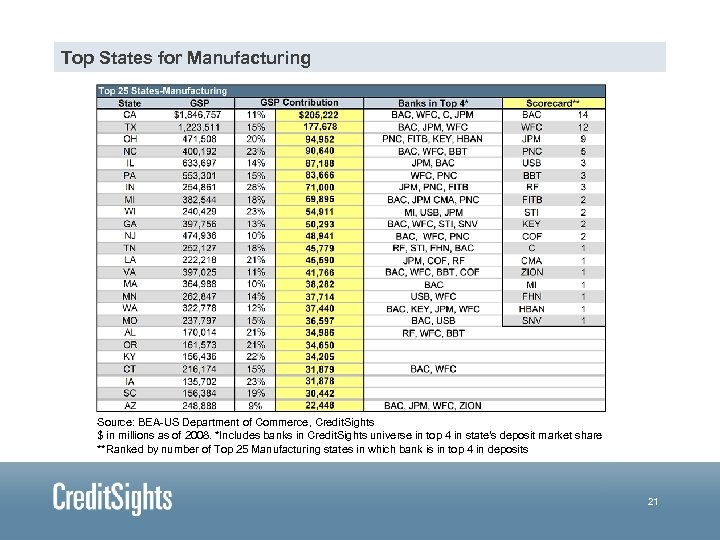

Top States for Manufacturing Source: BEA-US Department of Commerce, Credit. Sights $ in millions as of 2008. *Includes banks in Credit. Sights universe in top 4 in state's deposit market share **Ranked by number of Top 25 Manufacturing states in which bank is in top 4 in deposits 21

Top States for Manufacturing Source: BEA-US Department of Commerce, Credit. Sights $ in millions as of 2008. *Includes banks in Credit. Sights universe in top 4 in state's deposit market share **Ranked by number of Top 25 Manufacturing states in which bank is in top 4 in deposits 21

GSE Reform: U. S. Treasury Proposals • Government and GSE role in housing finance likely to lessen, more private sector involvement • Three Proposals: > Option 1: Limited govt role, privatized system of housing finance > Option 2: Govt backstop, privatized system of housing finance > Option 3: Govt reinsurance for MBS, privatized housing finance • More discussion in 2011, probably punted to next Administration 22

GSE Reform: U. S. Treasury Proposals • Government and GSE role in housing finance likely to lessen, more private sector involvement • Three Proposals: > Option 1: Limited govt role, privatized system of housing finance > Option 2: Govt backstop, privatized system of housing finance > Option 3: Govt reinsurance for MBS, privatized housing finance • More discussion in 2011, probably punted to next Administration 22

Mortgage Mods: Response vs. Reality • e. HAMP > Obama program provides relief to indebted homeowners > Target of 7 -8 million modifications > To date, 1. 4 million trial modifications, 500 K permanent modifications • Potential Federal Regulators and State AGs Settlement > Force servicers to offer principal reductions if LTV>100%, subject to NPV test > May levy fines against infractions, fund programs to avoid foreclosures, etc. > Settlement costs could add up to $20 B > GOP pushback against government strong arm tactics > Possible proportionate write-downs of 2 nd liens • Bank Initiated > More inclined to extend terms rather than principal reductions > Driven mostly by NPV tests 23

Mortgage Mods: Response vs. Reality • e. HAMP > Obama program provides relief to indebted homeowners > Target of 7 -8 million modifications > To date, 1. 4 million trial modifications, 500 K permanent modifications • Potential Federal Regulators and State AGs Settlement > Force servicers to offer principal reductions if LTV>100%, subject to NPV test > May levy fines against infractions, fund programs to avoid foreclosures, etc. > Settlement costs could add up to $20 B > GOP pushback against government strong arm tactics > Possible proportionate write-downs of 2 nd liens • Bank Initiated > More inclined to extend terms rather than principal reductions > Driven mostly by NPV tests 23

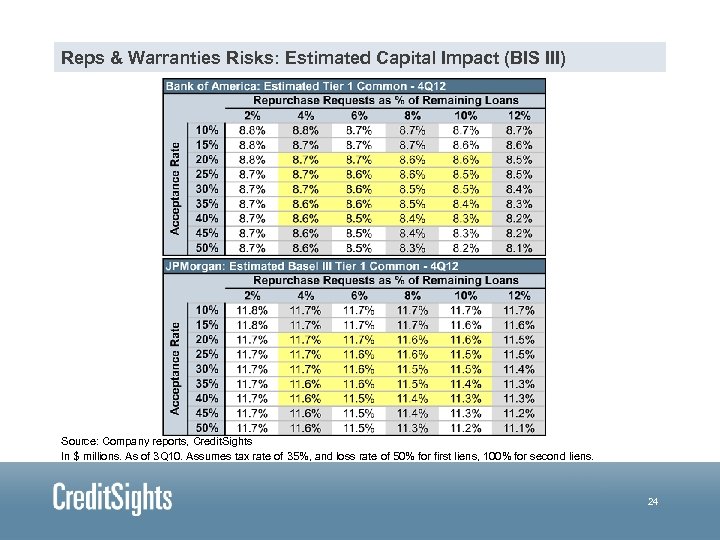

Reps & Warranties Risks: Estimated Capital Impact (BIS III) Source: Company reports, Credit. Sights In $ millions. As of 3 Q 10. Assumes tax rate of 35%, and loss rate of 50% for first liens, 100% for second liens. 24

Reps & Warranties Risks: Estimated Capital Impact (BIS III) Source: Company reports, Credit. Sights In $ millions. As of 3 Q 10. Assumes tax rate of 35%, and loss rate of 50% for first liens, 100% for second liens. 24

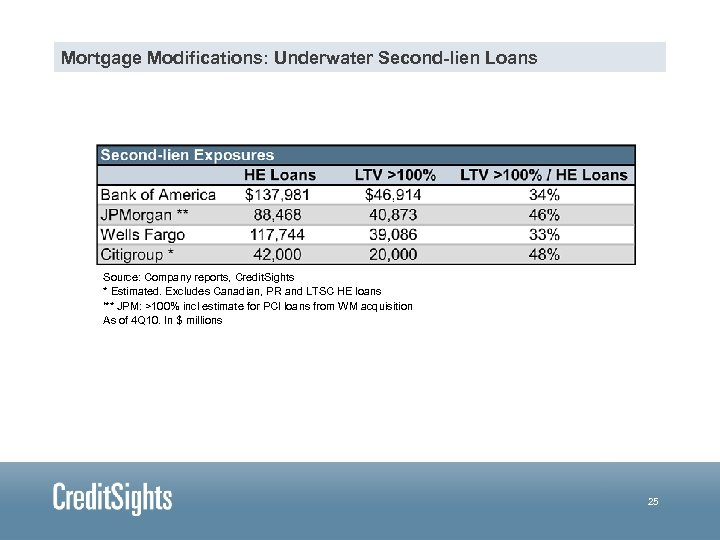

Mortgage Modifications: Underwater Second-lien Loans Source: Company reports, Credit. Sights * Estimated. Excludes Canadian, PR and LTSC HE loans '** JPM: >100% incl estimate for PCI loans from WM acquisition As of 4 Q 10. In $ millions 25

Mortgage Modifications: Underwater Second-lien Loans Source: Company reports, Credit. Sights * Estimated. Excludes Canadian, PR and LTSC HE loans '** JPM: >100% incl estimate for PCI loans from WM acquisition As of 4 Q 10. In $ millions 25

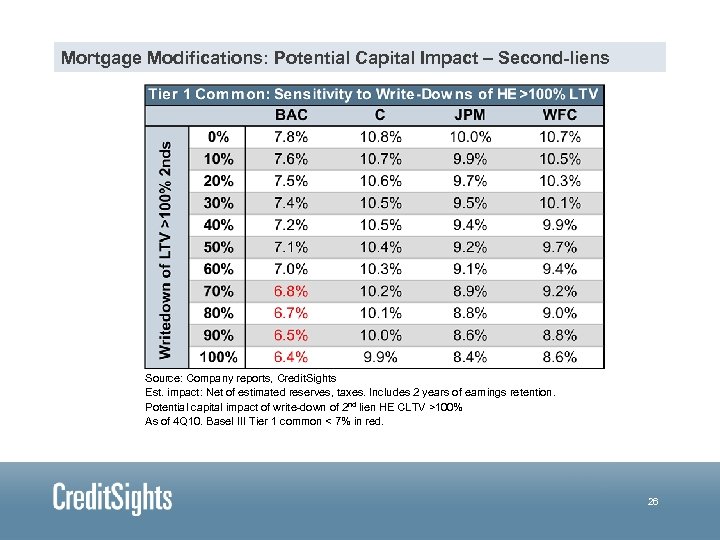

Mortgage Modifications: Potential Capital Impact – Second-liens Source: Company reports, Credit. Sights Est. impact: Net of estimated reserves, taxes. Includes 2 years of earnings retention. Potential capital impact of write-down of 2 nd lien HE CLTV >100% As of 4 Q 10. Basel III Tier 1 common < 7% in red. 26

Mortgage Modifications: Potential Capital Impact – Second-liens Source: Company reports, Credit. Sights Est. impact: Net of estimated reserves, taxes. Includes 2 years of earnings retention. Potential capital impact of write-down of 2 nd lien HE CLTV >100% As of 4 Q 10. Basel III Tier 1 common < 7% in red. 26

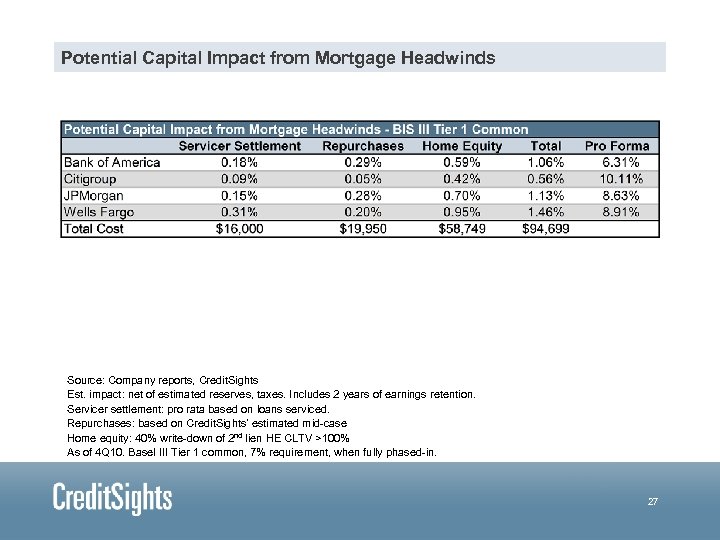

Potential Capital Impact from Mortgage Headwinds Source: Company reports, Credit. Sights Est. impact: net of estimated reserves, taxes. Includes 2 years of earnings retention. Servicer settlement: pro rata based on loans serviced. Repurchases: based on Credit. Sights’ estimated mid-case Home equity: 40% write-down of 2 nd lien HE CLTV >100% As of 4 Q 10. Basel III Tier 1 common, 7% requirement, when fully phased-in. 27

Potential Capital Impact from Mortgage Headwinds Source: Company reports, Credit. Sights Est. impact: net of estimated reserves, taxes. Includes 2 years of earnings retention. Servicer settlement: pro rata based on loans serviced. Repurchases: based on Credit. Sights’ estimated mid-case Home equity: 40% write-down of 2 nd lien HE CLTV >100% As of 4 Q 10. Basel III Tier 1 common, 7% requirement, when fully phased-in. 27

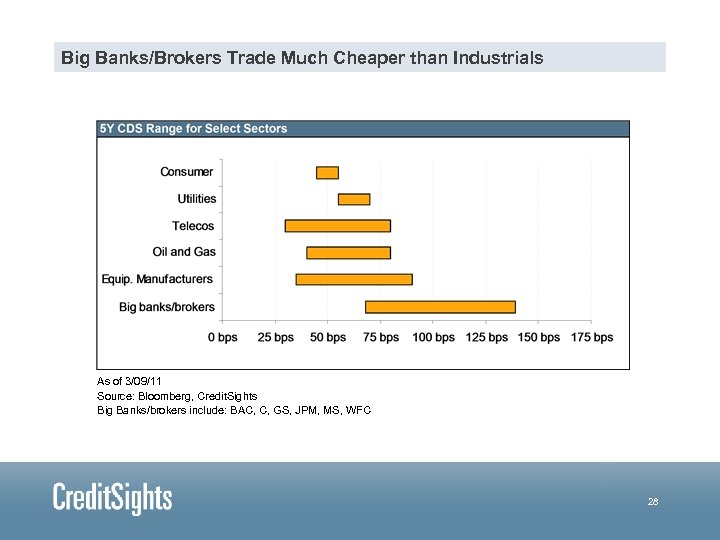

Big Banks/Brokers Trade Much Cheaper than Industrials As of 3/09/11 Source: Bloomberg, Credit. Sights Big Banks/brokers include: BAC, C, GS, JPM, MS, WFC 28

Big Banks/Brokers Trade Much Cheaper than Industrials As of 3/09/11 Source: Bloomberg, Credit. Sights Big Banks/brokers include: BAC, C, GS, JPM, MS, WFC 28

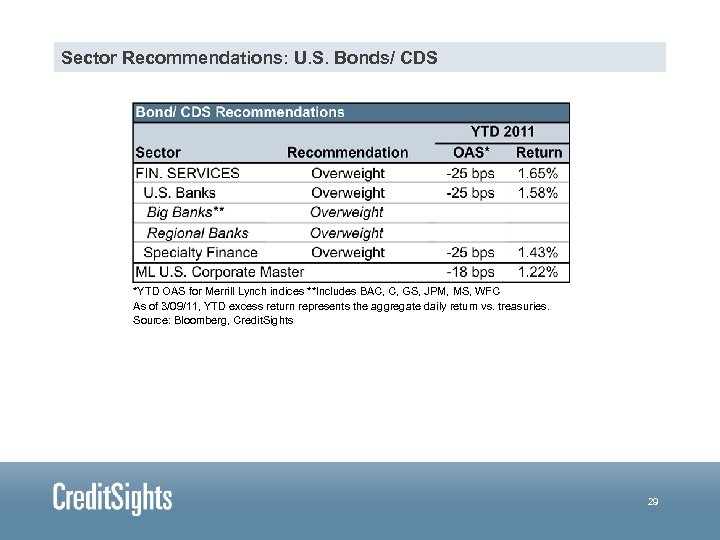

Sector Recommendations: U. S. Bonds/ CDS *YTD OAS for Merrill Lynch indices **Includes BAC, C, GS, JPM, MS, WFC As of 3/09/11, YTD excess return represents the aggregate daily return vs. treasuries. Source: Bloomberg, Credit. Sights 29

Sector Recommendations: U. S. Bonds/ CDS *YTD OAS for Merrill Lynch indices **Includes BAC, C, GS, JPM, MS, WFC As of 3/09/11, YTD excess return represents the aggregate daily return vs. treasuries. Source: Bloomberg, Credit. Sights 29

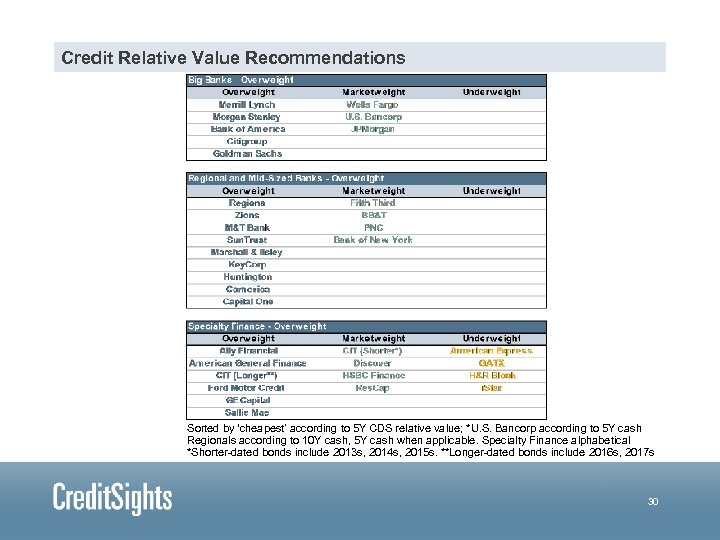

Credit Relative Value Recommendations Sorted by ‘cheapest’ according to 5 Y CDS relative value; *U. S. Bancorp according to 5 Y cash Regionals according to 10 Y cash, 5 Y cash when applicable. Specialty Finance alphabetical *Shorter-dated bonds include 2013 s, 2014 s, 2015 s. **Longer-dated bonds include 2016 s, 2017 s 30

Credit Relative Value Recommendations Sorted by ‘cheapest’ according to 5 Y CDS relative value; *U. S. Bancorp according to 5 Y cash Regionals according to 10 Y cash, 5 Y cash when applicable. Specialty Finance alphabetical *Shorter-dated bonds include 2013 s, 2014 s, 2015 s. **Longer-dated bonds include 2016 s, 2017 s 30

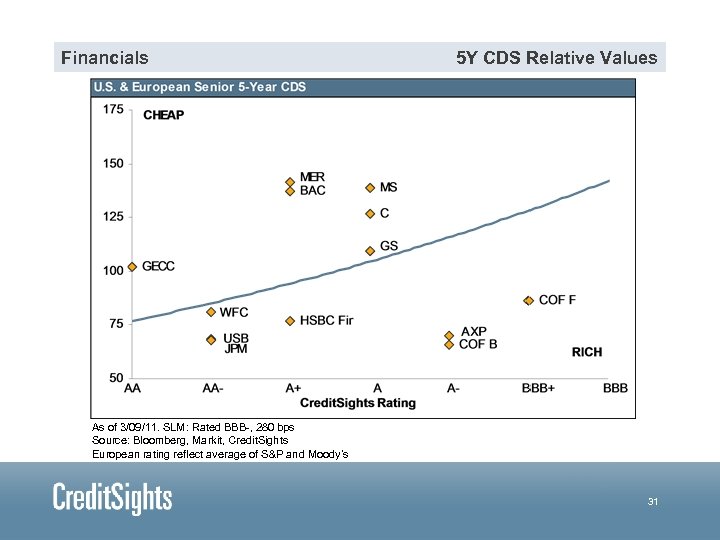

Financials 5 Y CDS Relative Values As of 3/09/11. SLM: Rated BBB-, 280 bps Source: Bloomberg, Markit, Credit. Sights European rating reflect average of S&P and Moody’s 31

Financials 5 Y CDS Relative Values As of 3/09/11. SLM: Rated BBB-, 280 bps Source: Bloomberg, Markit, Credit. Sights European rating reflect average of S&P and Moody’s 31

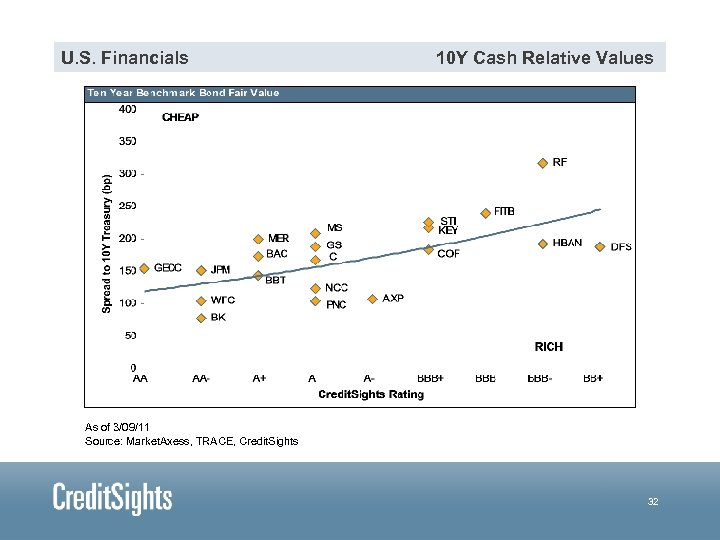

U. S. Financials 10 Y Cash Relative Values As of 3/09/11 Source: Market. Axess, TRACE, Credit. Sights 32

U. S. Financials 10 Y Cash Relative Values As of 3/09/11 Source: Market. Axess, TRACE, Credit. Sights 32

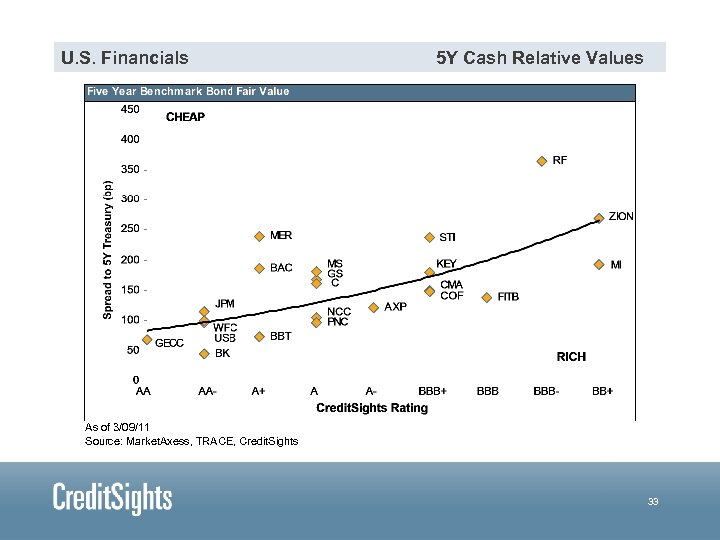

U. S. Financials 5 Y Cash Relative Values As of 3/09/11 Source: Market. Axess, TRACE, Credit. Sights 33

U. S. Financials 5 Y Cash Relative Values As of 3/09/11 Source: Market. Axess, TRACE, Credit. Sights 33

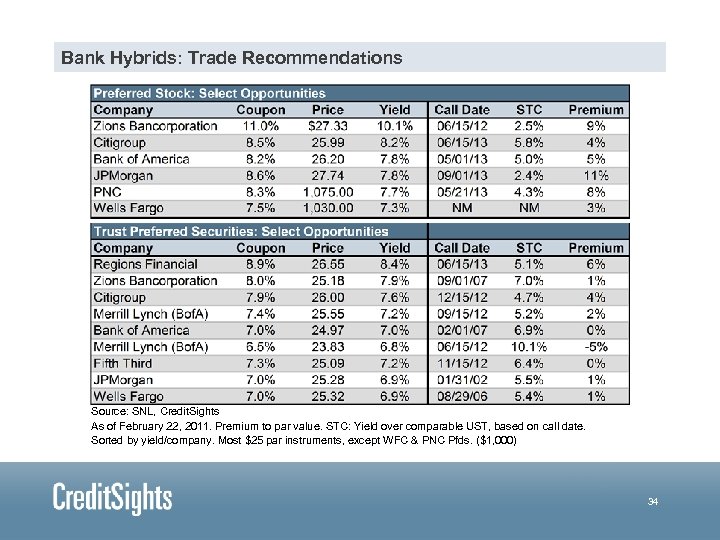

Bank Hybrids: Trade Recommendations Source: SNL, Credit. Sights As of February 22, 2011. Premium to par value. STC: Yield over comparable UST, based on call date. Sorted by yield/company. Most $25 par instruments, except WFC & PNC Pfds. ($1, 000) 34

Bank Hybrids: Trade Recommendations Source: SNL, Credit. Sights As of February 22, 2011. Premium to par value. STC: Yield over comparable UST, based on call date. Sorted by yield/company. Most $25 par instruments, except WFC & PNC Pfds. ($1, 000) 34

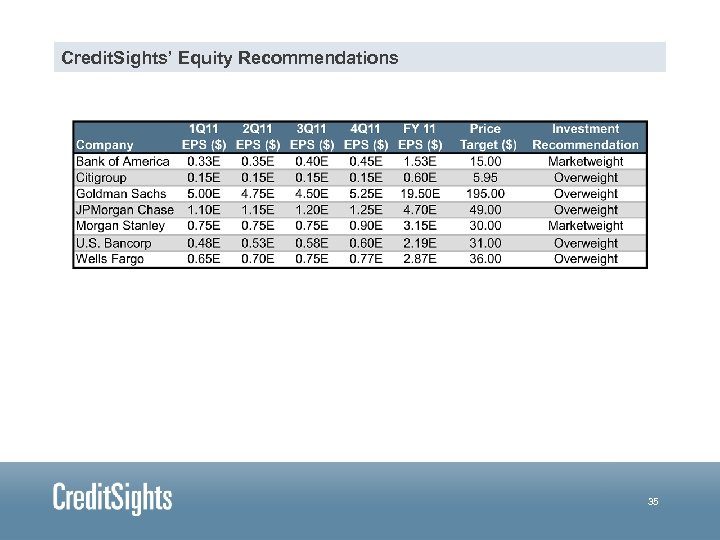

Credit. Sights’ Equity Recommendations 35

Credit. Sights’ Equity Recommendations 35

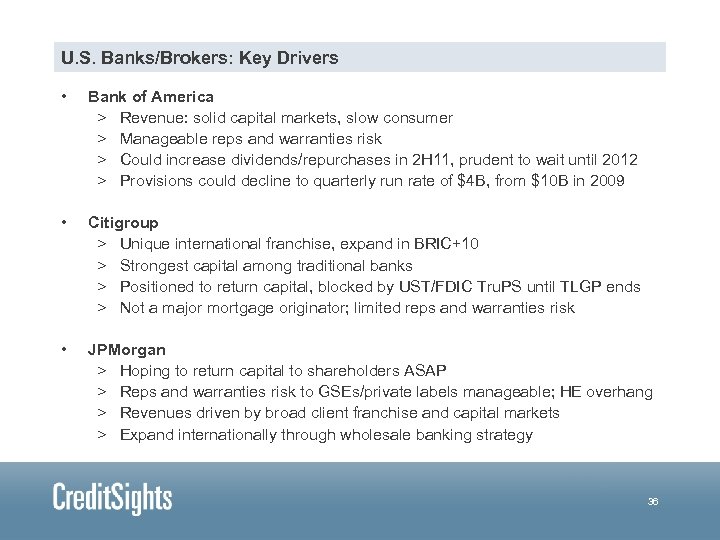

U. S. Banks/Brokers: Key Drivers • Bank of America > Revenue: solid capital markets, slow consumer > Manageable reps and warranties risk > Could increase dividends/repurchases in 2 H 11, prudent to wait until 2012 > Provisions could decline to quarterly run rate of $4 B, from $10 B in 2009 • Citigroup > Unique international franchise, expand in BRIC+10 > Strongest capital among traditional banks > Positioned to return capital, blocked by UST/FDIC Tru. PS until TLGP ends > Not a major mortgage originator; limited reps and warranties risk • JPMorgan > Hoping to return capital to shareholders ASAP > Reps and warranties risk to GSEs/private labels manageable; HE overhang > Revenues driven by broad client franchise and capital markets > Expand internationally through wholesale banking strategy 36

U. S. Banks/Brokers: Key Drivers • Bank of America > Revenue: solid capital markets, slow consumer > Manageable reps and warranties risk > Could increase dividends/repurchases in 2 H 11, prudent to wait until 2012 > Provisions could decline to quarterly run rate of $4 B, from $10 B in 2009 • Citigroup > Unique international franchise, expand in BRIC+10 > Strongest capital among traditional banks > Positioned to return capital, blocked by UST/FDIC Tru. PS until TLGP ends > Not a major mortgage originator; limited reps and warranties risk • JPMorgan > Hoping to return capital to shareholders ASAP > Reps and warranties risk to GSEs/private labels manageable; HE overhang > Revenues driven by broad client franchise and capital markets > Expand internationally through wholesale banking strategy 36

U. S. Banks/Brokers: Key Drivers • Wells Fargo > Reps and warranties manageable: mostly GSE; large HE run-off > Focus on cross-selling; impacted the most by debit interchange > Could look to return capital; capital somewhat lower on BIS III • Goldman Sachs > More focused on share repurchases than dividends > Revenue helped by broad client franchise in FI, equities, and commodities > Growth strategy focused on BRIC+10 • Morgan Stanley > More work to be done to reach BIS III capital levels > Revenues hampered by underperformance in sales and trading > Asset/Wealth Management stabilizing; growth scarce • U. S. Bancorp > Hoping to return capital to shareholders ASAP > Focus on growth of fee-generating businesses (processing, wealth mgmt) > Commercial loan growth could become key balance sheet driver 37

U. S. Banks/Brokers: Key Drivers • Wells Fargo > Reps and warranties manageable: mostly GSE; large HE run-off > Focus on cross-selling; impacted the most by debit interchange > Could look to return capital; capital somewhat lower on BIS III • Goldman Sachs > More focused on share repurchases than dividends > Revenue helped by broad client franchise in FI, equities, and commodities > Growth strategy focused on BRIC+10 • Morgan Stanley > More work to be done to reach BIS III capital levels > Revenues hampered by underperformance in sales and trading > Asset/Wealth Management stabilizing; growth scarce • U. S. Bancorp > Hoping to return capital to shareholders ASAP > Focus on growth of fee-generating businesses (processing, wealth mgmt) > Commercial loan growth could become key balance sheet driver 37

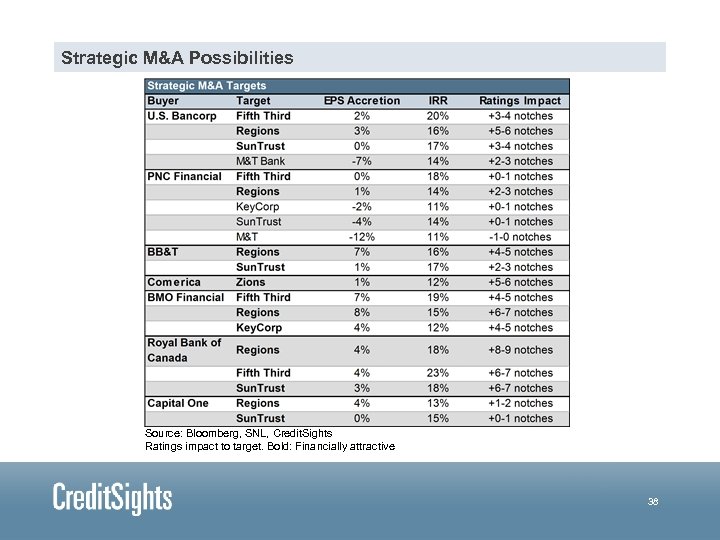

Strategic M&A Possibilities Source: Bloomberg, SNL, Credit. Sights Ratings impact to target. Bold: Financially attractive 38

Strategic M&A Possibilities Source: Bloomberg, SNL, Credit. Sights Ratings impact to target. Bold: Financially attractive 38

Copyright © 2011 Credit. Sights, Inc. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The information in this report has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. If you have any questions regarding the contents of this report, contact Credit. Sights, Inc. at (1) 212 3403840 in the United States or (44) 20 7429 2080 in Europe. Credit. Sights Limited is authorised and regulated by The Financial Services Authority. This product is not intended for use in the UK by Private Customers, as defined by the Financial Services Authority. 39

Copyright © 2011 Credit. Sights, Inc. All rights reserved. Reproduction of this report, even for internal distribution, is strictly prohibited. The information in this report has been obtained from sources believed to be reliable. However, neither its accuracy and completeness, nor the opinions based thereon are guaranteed. If you have any questions regarding the contents of this report, contact Credit. Sights, Inc. at (1) 212 3403840 in the United States or (44) 20 7429 2080 in Europe. Credit. Sights Limited is authorised and regulated by The Financial Services Authority. This product is not intended for use in the UK by Private Customers, as defined by the Financial Services Authority. 39