d8ea7b483917ef091cb26e756fd7fcee.ppt

- Количество слайдов: 78

Money $ Money • What is money? • Anything that performs these functions: – A medium of exchange – A unit of account – A store of value

Money $ Money • What is money? • Anything that performs these functions: – A medium of exchange – A unit of account – A store of value

Medium of Exchange • Anything used to determine value during the exchange of goods and services • Money makes these transactions easier • The alternative is barter

Medium of Exchange • Anything used to determine value during the exchange of goods and services • Money makes these transactions easier • The alternative is barter

Unit of Account • Allows us to compare the values of goods and services

Unit of Account • Allows us to compare the values of goods and services

Store of Value • Keeps its value over a period of time • What threatens this? –Inflation

Store of Value • Keeps its value over a period of time • What threatens this? –Inflation

Types of Money • Commodity Money – Something that is used as a medium of exchange that has value in its own right (gold, silver, cigarettes) • Representative Money – Commodity backed money – A bank note redeemable for a commodity (gold or silver) • Fiat Money – Something that has value because government says that it has value

Types of Money • Commodity Money – Something that is used as a medium of exchange that has value in its own right (gold, silver, cigarettes) • Representative Money – Commodity backed money – A bank note redeemable for a commodity (gold or silver) • Fiat Money – Something that has value because government says that it has value

Types of Money • What type of money is today’s U. S. dollar? • Fiat Money

Types of Money • What type of money is today’s U. S. dollar? • Fiat Money

Measuring the Money Supply M 1 Money Supply (most liquid) • Includes currency in circulation, coins, travelers checks, and checkable/demand deposits (checking accts) **About 50/50 Currency and coins to Deposits

Measuring the Money Supply M 1 Money Supply (most liquid) • Includes currency in circulation, coins, travelers checks, and checkable/demand deposits (checking accts) **About 50/50 Currency and coins to Deposits

Measuring the Money Supply M 2 Money Supply • Includes M 1 and “near moneys” -savings deposits (savings accounts) and other interest bearing accounts like CD’s • M 1 is about 20% of M 2

Measuring the Money Supply M 2 Money Supply • Includes M 1 and “near moneys” -savings deposits (savings accounts) and other interest bearing accounts like CD’s • M 1 is about 20% of M 2

The Goldsmiths and the Origins of Paper Money • Goldsmiths provided a place of storage for an individual’s gold and silver • They would charge a fee for this service • They would issue a receipt to the owner of the specie (gold and silver)

The Goldsmiths and the Origins of Paper Money • Goldsmiths provided a place of storage for an individual’s gold and silver • They would charge a fee for this service • They would issue a receipt to the owner of the specie (gold and silver)

The Goldsmiths and the Origins of Paper Money • Receipts then began to be exchanged for goods and services • Why? The receipts were accepted as a medium of exchange • Voila! The first paper money!

The Goldsmiths and the Origins of Paper Money • Receipts then began to be exchanged for goods and services • Why? The receipts were accepted as a medium of exchange • Voila! The first paper money!

The Goldsmiths and the Origins of Paper Money • Then some shrewd Goldsmith realized he could issue receipts in excess of the amount of gold he had. Why? • They rarely had to exchange receipts for gold! • Voila! The first bank loan!

The Goldsmiths and the Origins of Paper Money • Then some shrewd Goldsmith realized he could issue receipts in excess of the amount of gold he had. Why? • They rarely had to exchange receipts for gold! • Voila! The first bank loan!

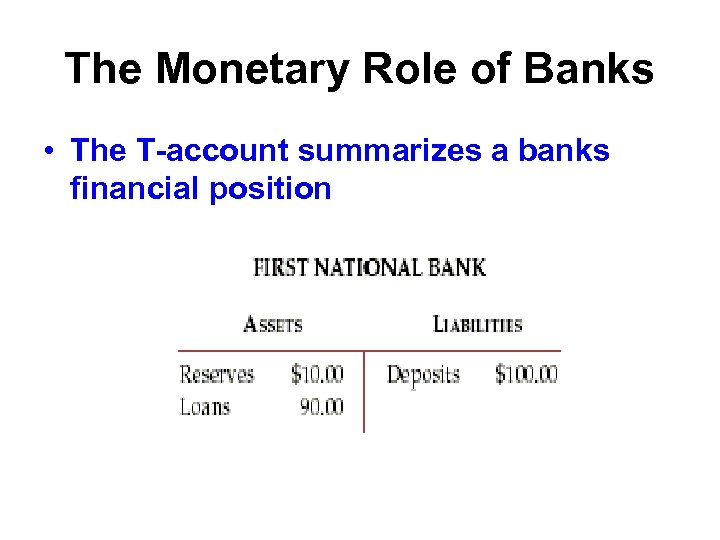

The Monetary Role of Banks • About half of M 1 money supply is bank deposits • What Banks Do – Uses its assets to finance the investments of borrowers – Not all assets are lent out – Some assets must be kept on hand to satisfy the demands of depositors that want to withdraw their funds (Reserves)

The Monetary Role of Banks • About half of M 1 money supply is bank deposits • What Banks Do – Uses its assets to finance the investments of borrowers – Not all assets are lent out – Some assets must be kept on hand to satisfy the demands of depositors that want to withdraw their funds (Reserves)

Fractional Reserve Banking System • The assets that a bank must keep in reserve is established by the Fed • This is known as the RESERVE RATIO or the RESERVE REQUIREMENT

Fractional Reserve Banking System • The assets that a bank must keep in reserve is established by the Fed • This is known as the RESERVE RATIO or the RESERVE REQUIREMENT

It’s a Wonderful Banking System! • What would happen, if for some reason, all a bank’s depositors wanted their deposits at the same time?

It’s a Wonderful Banking System! • What would happen, if for some reason, all a bank’s depositors wanted their deposits at the same time?

It’s a Wonderful Banking System! • Is this a problem today? • Not likely. Why not? • The Federal Deposit Insurance Corporation (FDIC) • Insures bank deposits (of member banks) up to $250, 000 (result of a new law President Obama signed in 2010)

It’s a Wonderful Banking System! • Is this a problem today? • Not likely. Why not? • The Federal Deposit Insurance Corporation (FDIC) • Insures bank deposits (of member banks) up to $250, 000 (result of a new law President Obama signed in 2010)

It’s a Wonderful Banking System! • The insurance also eliminates the cause of bank runs

It’s a Wonderful Banking System! • The insurance also eliminates the cause of bank runs

How Banks Create New Money • Let’s look at an initial $1000 cash deposit into a checking acct. (demand deposit) • First key point – This does NOT add anything NEW to the money supply – There is $1000 less currency and $1000 more in demand deposits – No net increase

How Banks Create New Money • Let’s look at an initial $1000 cash deposit into a checking acct. (demand deposit) • First key point – This does NOT add anything NEW to the money supply – There is $1000 less currency and $1000 more in demand deposits – No net increase

How Banks Create New Money • Now let’s assume the bank has a 10% reserve requirement (rr) • The bank must keep $100 in reserve in its vaults (required reserves) • It can then lend out the $900 in excess reserves • This begins the process of money creation

How Banks Create New Money • Now let’s assume the bank has a 10% reserve requirement (rr) • The bank must keep $100 in reserve in its vaults (required reserves) • It can then lend out the $900 in excess reserves • This begins the process of money creation

How Banks Create New Money • How much NEW money will be created initially? • How much NEW money will be created in the end (total)? • The first step is to determine the money multiplier • ***1/rr OR 1/reserve requirement*** • Multiplier of 10

How Banks Create New Money • How much NEW money will be created initially? • How much NEW money will be created in the end (total)? • The first step is to determine the money multiplier • ***1/rr OR 1/reserve requirement*** • Multiplier of 10

How Banks Create New Money • How much new money will be created initially? • $900 • How much total new money will be created? • The initial new money times the multiplier • $900 X 10 • In this instance, the $900 excess reserves is multiplied 10 times throughout the economy - $9000 in total NEW money

How Banks Create New Money • How much new money will be created initially? • $900 • How much total new money will be created? • The initial new money times the multiplier • $900 X 10 • In this instance, the $900 excess reserves is multiplied 10 times throughout the economy - $9000 in total NEW money

How Banks Create New Money • If a bank initially lent out $1000 in excess reserves, $10, 000 in NEW money would be created • What if you were asked the change in demand deposits as a result of this? • The initial $1000 demand deposit would result in how much of a total change in demand deposits? • $10000

How Banks Create New Money • If a bank initially lent out $1000 in excess reserves, $10, 000 in NEW money would be created • What if you were asked the change in demand deposits as a result of this? • The initial $1000 demand deposit would result in how much of a total change in demand deposits? • $10000

From the 2009 AP Test • 3. Assume that the reserve requirement is 20 percent and banks hold no excess reserves. – (a) Assume that Kim deposits $100 of cash from her pocket into her checking account. Calculate each of the following. • (i) The maximum dollar amount the commercial bank can initially lend • (ii) The maximum total change in demand deposits in the banking system • (iii) The maximum change in the money supply

From the 2009 AP Test • 3. Assume that the reserve requirement is 20 percent and banks hold no excess reserves. – (a) Assume that Kim deposits $100 of cash from her pocket into her checking account. Calculate each of the following. • (i) The maximum dollar amount the commercial bank can initially lend • (ii) The maximum total change in demand deposits in the banking system • (iii) The maximum change in the money supply

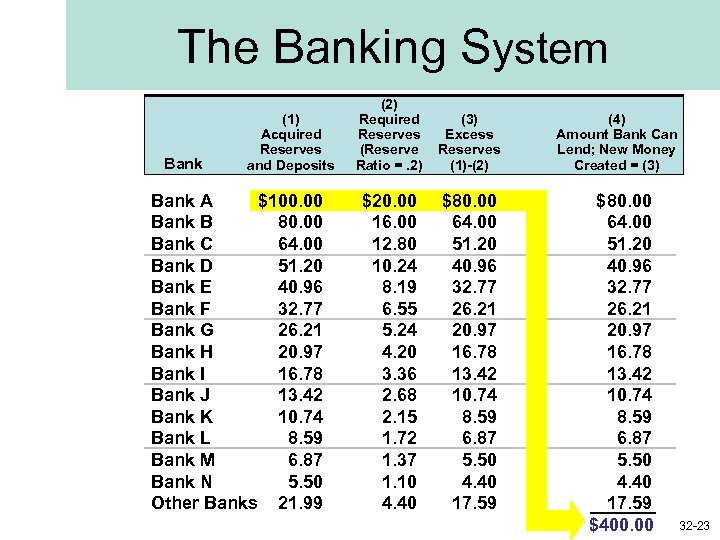

The Banking System Bank (1) Acquired Reserves and Deposits Bank A $100. 00 Bank B 80. 00 Bank C 64. 00 Bank D 51. 20 Bank E 40. 96 Bank F 32. 77 Bank G 26. 21 Bank H 20. 97 Bank I 16. 78 Bank J 13. 42 Bank K 10. 74 Bank L 8. 59 Bank M 6. 87 Bank N 5. 50 Other Banks 21. 99 (2) Required Reserves (Reserve Ratio =. 2) (3) Excess Reserves (1)-(2) $20. 00 16. 00 12. 80 10. 24 8. 19 6. 55 5. 24 4. 20 3. 36 2. 68 2. 15 1. 72 1. 37 1. 10 4. 40 $80. 00 64. 00 51. 20 40. 96 32. 77 26. 21 20. 97 16. 78 13. 42 10. 74 8. 59 6. 87 5. 50 4. 40 17. 59 (4) Amount Bank Can Lend; New Money Created = (3) $80. 00 64. 00 51. 20 40. 96 32. 77 26. 21 20. 97 16. 78 13. 42 10. 74 8. 59 6. 87 5. 50 4. 40 17. 59 $400. 00 32 -23

The Banking System Bank (1) Acquired Reserves and Deposits Bank A $100. 00 Bank B 80. 00 Bank C 64. 00 Bank D 51. 20 Bank E 40. 96 Bank F 32. 77 Bank G 26. 21 Bank H 20. 97 Bank I 16. 78 Bank J 13. 42 Bank K 10. 74 Bank L 8. 59 Bank M 6. 87 Bank N 5. 50 Other Banks 21. 99 (2) Required Reserves (Reserve Ratio =. 2) (3) Excess Reserves (1)-(2) $20. 00 16. 00 12. 80 10. 24 8. 19 6. 55 5. 24 4. 20 3. 36 2. 68 2. 15 1. 72 1. 37 1. 10 4. 40 $80. 00 64. 00 51. 20 40. 96 32. 77 26. 21 20. 97 16. 78 13. 42 10. 74 8. 59 6. 87 5. 50 4. 40 17. 59 (4) Amount Bank Can Lend; New Money Created = (3) $80. 00 64. 00 51. 20 40. 96 32. 77 26. 21 20. 97 16. 78 13. 42 10. 74 8. 59 6. 87 5. 50 4. 40 17. 59 $400. 00 32 -23

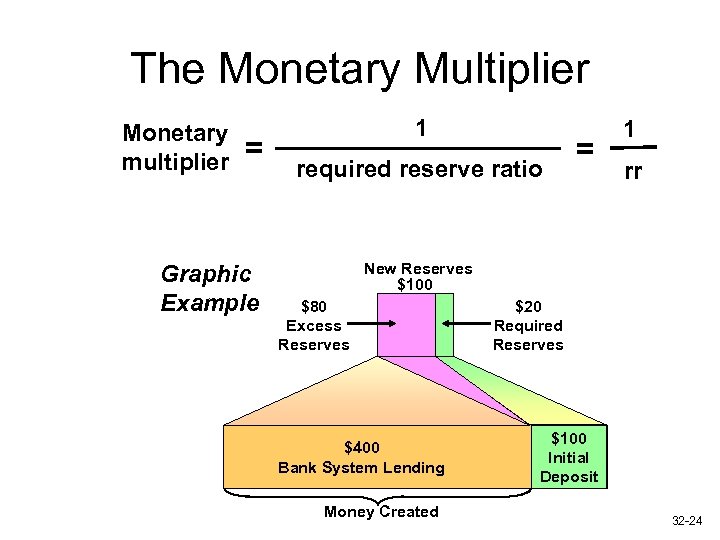

The Monetary Multiplier Monetary multiplier = Graphic Example 1 required reserve ratio = 1 rr New Reserves $100 $80 Excess Reserves $400 Bank System Lending Money Created $20 Required Reserves $100 Initial Deposit 32 -24

The Monetary Multiplier Monetary multiplier = Graphic Example 1 required reserve ratio = 1 rr New Reserves $100 $80 Excess Reserves $400 Bank System Lending Money Created $20 Required Reserves $100 Initial Deposit 32 -24

The Federal Reserve System • Historical Background • Prior to 1913, the U. S. had a decentralized and unregulated banking system • This led to much economic instability, (fraud, different currencies, bank failures)

The Federal Reserve System • Historical Background • Prior to 1913, the U. S. had a decentralized and unregulated banking system • This led to much economic instability, (fraud, different currencies, bank failures)

The Federal Reserve System • A financial crisis in 1907 led to the desire to create a centralized banking system with control over the money supply • In 1913 Congress passed and President Wilson signed, The Federal Reserve Act

The Federal Reserve System • A financial crisis in 1907 led to the desire to create a centralized banking system with control over the money supply • In 1913 Congress passed and President Wilson signed, The Federal Reserve Act

The Federal Reserve System • The Federal Reserve Act (1913) • The Board of Governors – 7 members – Appointed by the President, Confirmed by the Senate – 14 year terms; staggered so one member is replaced every two years (above political pressure)

The Federal Reserve System • The Federal Reserve Act (1913) • The Board of Governors – 7 members – Appointed by the President, Confirmed by the Senate – 14 year terms; staggered so one member is replaced every two years (above political pressure)

The Federal Reserve System • President chooses a board member to be the Chairman of the Fed (4 year term) • Janet Yellen

The Federal Reserve System • President chooses a board member to be the Chairman of the Fed (4 year term) • Janet Yellen

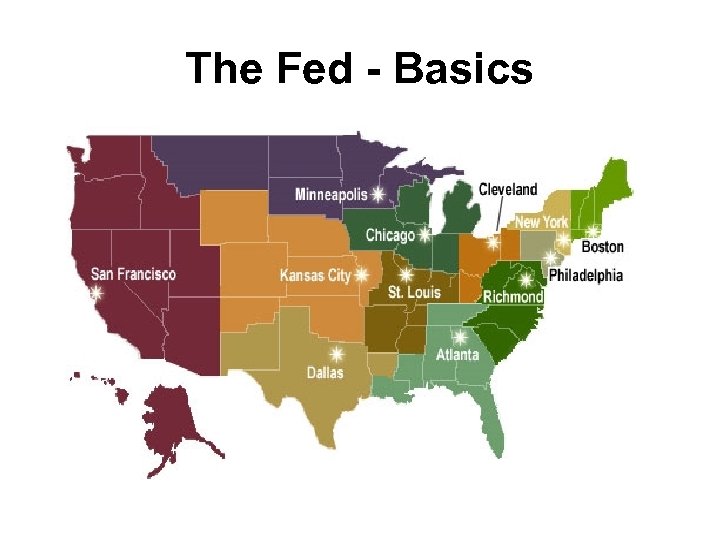

The Fed - Basics

The Fed - Basics

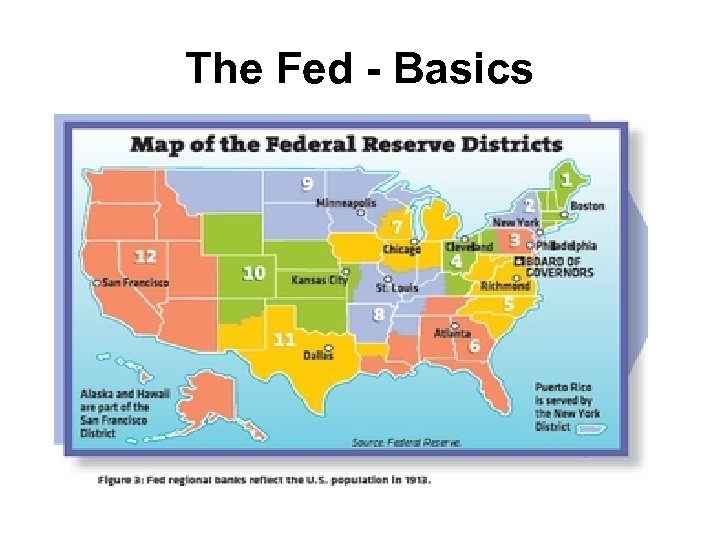

The Fed - Basics

The Fed - Basics

The Fed - Basics • Main Functions of The Fed – A bank to banks and to the Federal government – Regulate the banks in their district – Provide a safe and stable financial system – ****Monetary Policy

The Fed - Basics • Main Functions of The Fed – A bank to banks and to the Federal government – Regulate the banks in their district – Provide a safe and stable financial system – ****Monetary Policy

The Fed - Basics • Monetary Policy – Manipulation of the money supply in order to bring about the desired macroeconomic goals (expanding Real GDP, low inflation, low unemployment)

The Fed - Basics • Monetary Policy – Manipulation of the money supply in order to bring about the desired macroeconomic goals (expanding Real GDP, low inflation, low unemployment)

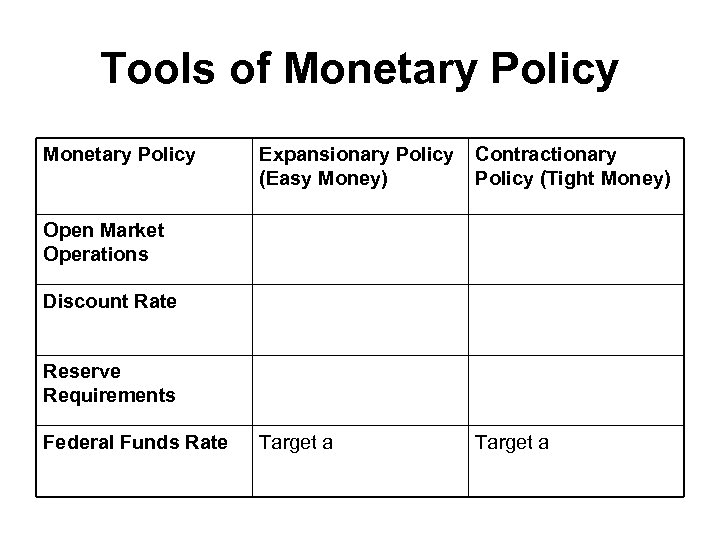

The Tools of the Fed • Manipulate the Discount Rate – The interest rate the Fed charges to banks that want to borrow money • Manipulate the Reserve Ratio • The percentage of reserves a bank is required to keep on hand as cash • Target a higher or lower FEDERAL FUNDS RATE --> by selling or buying government bonds (Open Market Operations)

The Tools of the Fed • Manipulate the Discount Rate – The interest rate the Fed charges to banks that want to borrow money • Manipulate the Reserve Ratio • The percentage of reserves a bank is required to keep on hand as cash • Target a higher or lower FEDERAL FUNDS RATE --> by selling or buying government bonds (Open Market Operations)

The Federal Funds Rate • Banks keep some of their reserves in accounts at a Federal Reserve bank • Sometimes bank required reserves go lower than a bank wants or needs • Banks with excess reserves willingly lend deficient banks funds from their Federal Reserve accounts ($1 Million minimum)

The Federal Funds Rate • Banks keep some of their reserves in accounts at a Federal Reserve bank • Sometimes bank required reserves go lower than a bank wants or needs • Banks with excess reserves willingly lend deficient banks funds from their Federal Reserve accounts ($1 Million minimum)

The Federal Funds Rate • The interest rate that banks charge each other for these short-term, often overnight loans, is known as the FEDERAL FUNDS RATE • The Federal Reserve does NOT set the Fed Funds Rate but it does target a rate that they would like (0 to 0. 25) (0. 09) • They influence the rate through their Open Market Operations

The Federal Funds Rate • The interest rate that banks charge each other for these short-term, often overnight loans, is known as the FEDERAL FUNDS RATE • The Federal Reserve does NOT set the Fed Funds Rate but it does target a rate that they would like (0 to 0. 25) (0. 09) • They influence the rate through their Open Market Operations

The Federal Funds Rate • The lower the Federal Funds Rate, the more it encourages banks to borrow from each other • The higher the Federal Funds Rate, the more it discourages banks to borrow from each other • The current Fed Funds target rate is really a range, from 0 to 0. 25%

The Federal Funds Rate • The lower the Federal Funds Rate, the more it encourages banks to borrow from each other • The higher the Federal Funds Rate, the more it discourages banks to borrow from each other • The current Fed Funds target rate is really a range, from 0 to 0. 25%

The Tools of the Fed • Carry out Open Market Operations (OMO) – Buying and selling of government securities (bonds) – Executed by the Federal Open Market Committee (FOMC) – 7 member Board of Governors, President of the New York Fed, 4 other bank presidents on a rotating basis

The Tools of the Fed • Carry out Open Market Operations (OMO) – Buying and selling of government securities (bonds) – Executed by the Federal Open Market Committee (FOMC) – 7 member Board of Governors, President of the New York Fed, 4 other bank presidents on a rotating basis

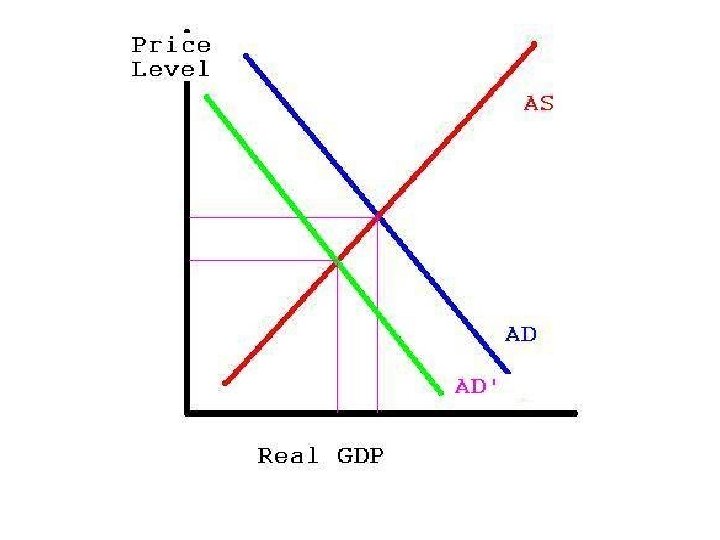

The Tools of the Fed • Expansionary Monetary Policy – Aka – Easy Money Policy –Increasing the money supply (increasing excess reserves) –Lowers interest rates –To fight against recession –Stimulate AD (through Ig)

The Tools of the Fed • Expansionary Monetary Policy – Aka – Easy Money Policy –Increasing the money supply (increasing excess reserves) –Lowers interest rates –To fight against recession –Stimulate AD (through Ig)

The Tools of the Fed • Contractionary Monetary Policy – Aka – Tight Money Policy or Restrictive Policy – Decreasing the money supply (decreasing excess reserves) – Increases interest rates – To fight against inflation – To reduce AD (through Ig)

The Tools of the Fed • Contractionary Monetary Policy – Aka – Tight Money Policy or Restrictive Policy – Decreasing the money supply (decreasing excess reserves) – Increases interest rates – To fight against inflation – To reduce AD (through Ig)

Tools of Monetary Policy Expansionary Policy (Easy Money) Contractionary Policy (Tight Money) Target a Open Market Operations Discount Rate Reserve Requirements Federal Funds Rate

Tools of Monetary Policy Expansionary Policy (Easy Money) Contractionary Policy (Tight Money) Target a Open Market Operations Discount Rate Reserve Requirements Federal Funds Rate

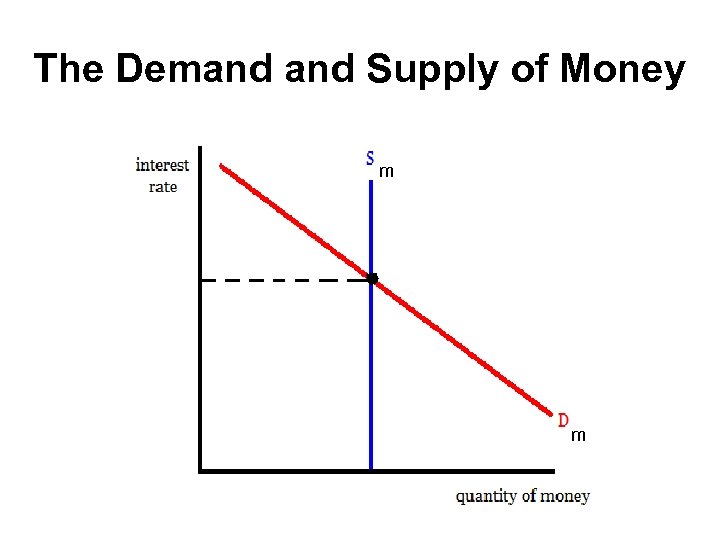

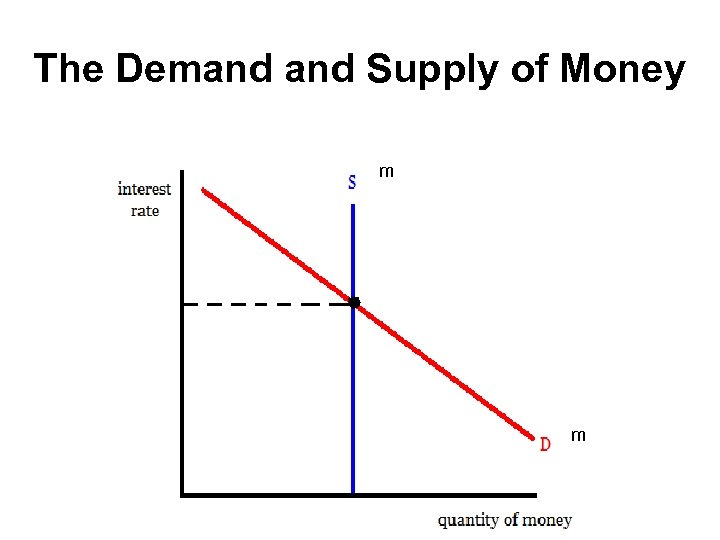

The Demand Supply of Money m m

The Demand Supply of Money m m

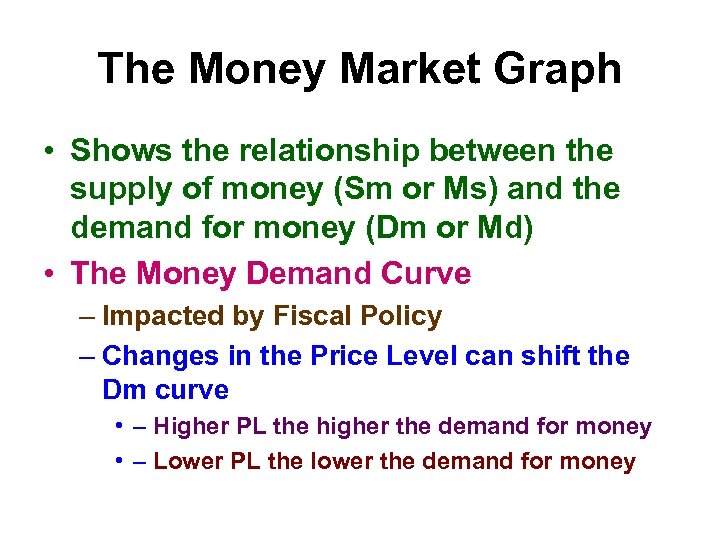

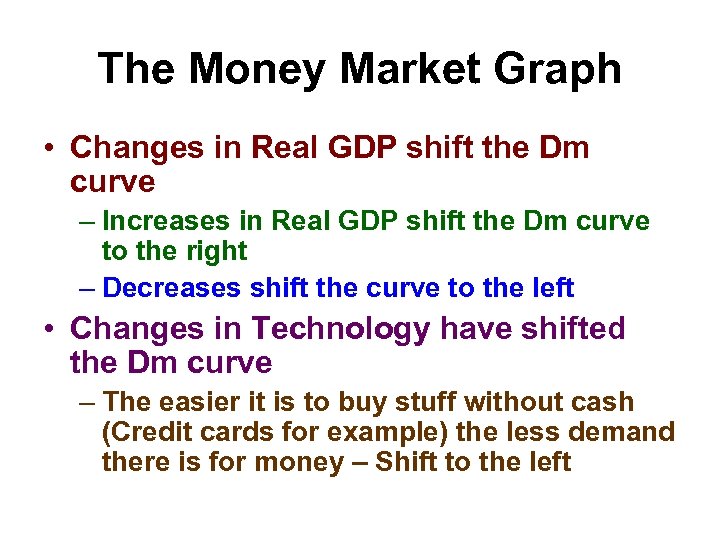

The Money Market Graph • Shows the relationship between the supply of money (Sm or Ms) and the demand for money (Dm or Md) • The Money Demand Curve – Impacted by Fiscal Policy – Changes in the Price Level can shift the Dm curve • – Higher PL the higher the demand for money • – Lower PL the lower the demand for money

The Money Market Graph • Shows the relationship between the supply of money (Sm or Ms) and the demand for money (Dm or Md) • The Money Demand Curve – Impacted by Fiscal Policy – Changes in the Price Level can shift the Dm curve • – Higher PL the higher the demand for money • – Lower PL the lower the demand for money

The Money Market Graph • Changes in Real GDP shift the Dm curve – Increases in Real GDP shift the Dm curve to the right – Decreases shift the curve to the left • Changes in Technology have shifted the Dm curve – The easier it is to buy stuff without cash (Credit cards for example) the less demand there is for money – Shift to the left

The Money Market Graph • Changes in Real GDP shift the Dm curve – Increases in Real GDP shift the Dm curve to the right – Decreases shift the curve to the left • Changes in Technology have shifted the Dm curve – The easier it is to buy stuff without cash (Credit cards for example) the less demand there is for money – Shift to the left

The Money Market Graph • The Money Supply curve – Impacted by Monetary Policy – Fed actions shift the curve depending on whether the money supply has been increased or decreased

The Money Market Graph • The Money Supply curve – Impacted by Monetary Policy – Fed actions shift the curve depending on whether the money supply has been increased or decreased

The Demand Supply of Money m m

The Demand Supply of Money m m

What would happen to the money supply AND interest rates if the Fed • Targeted a reduction of the Federal Funds Rate • Raised the Discount Rate • Lowered the Reserve Requirement • Bought government securities on the open market • Targeted an increase the Federal Funds Rate • Sold government securities on the open market

What would happen to the money supply AND interest rates if the Fed • Targeted a reduction of the Federal Funds Rate • Raised the Discount Rate • Lowered the Reserve Requirement • Bought government securities on the open market • Targeted an increase the Federal Funds Rate • Sold government securities on the open market

Money Supply or Money Demand? • The rate of inflation declines (disinflation) • The Fed buys bonds • The reserve requirement is raised • There is economic growth (a rise in Real GDP) • The Fed targets an increase in the federal funds rate

Money Supply or Money Demand? • The rate of inflation declines (disinflation) • The Fed buys bonds • The reserve requirement is raised • There is economic growth (a rise in Real GDP) • The Fed targets an increase in the federal funds rate

Interest Rates and Bond Prices • Bonds are bought and sold in the open market based on supply and demand • They sell for a certain price and pay fixed interest rates • Suppose a $1000 bond pays an annual $50 in interest • That’s a 5% yield annually (5% interest rate)

Interest Rates and Bond Prices • Bonds are bought and sold in the open market based on supply and demand • They sell for a certain price and pay fixed interest rates • Suppose a $1000 bond pays an annual $50 in interest • That’s a 5% yield annually (5% interest rate)

Interest Rates and Bond Prices • Now, what happens interest rates rise to 7. 5% • Would you want to purchase the old bond at 5% when you could get a new one at 7. 5%? • What would make you be willing to purchase the $1000 old bond? • If it was sold for less than $1000

Interest Rates and Bond Prices • Now, what happens interest rates rise to 7. 5% • Would you want to purchase the old bond at 5% when you could get a new one at 7. 5%? • What would make you be willing to purchase the $1000 old bond? • If it was sold for less than $1000

Interest Rates and Bond Prices • In fact, if you could buy the old bond for $667 and receive the fixed $50 interest you would be receiving 7. 5% annually on your investment • THUS, WHEN INTEREST RATES RISE BOND PRICES DECLINE • WHEN INTEREST RATES DECLINE, BOND PRICES RISE

Interest Rates and Bond Prices • In fact, if you could buy the old bond for $667 and receive the fixed $50 interest you would be receiving 7. 5% annually on your investment • THUS, WHEN INTEREST RATES RISE BOND PRICES DECLINE • WHEN INTEREST RATES DECLINE, BOND PRICES RISE

One Final Point • If the Fed buys $10, 000 in government bonds, does the money supply initially increase by $10, 000? • Yes it does!!! • Why? • Because the money in the vaults of Fed banks is not considered to be a demand deposit and is therefore not part of M 1

One Final Point • If the Fed buys $10, 000 in government bonds, does the money supply initially increase by $10, 000? • Yes it does!!! • Why? • Because the money in the vaults of Fed banks is not considered to be a demand deposit and is therefore not part of M 1

One Final Point • So, there is a difference between you taking $1, 000 cash and putting it into your checking account and the Fed making a $1, 000 purchase of government bonds. • What is that difference? • The Fed purchase initially increases the M 1 money supply by $1, 000, the cash deposit does not

One Final Point • So, there is a difference between you taking $1, 000 cash and putting it into your checking account and the Fed making a $1, 000 purchase of government bonds. • What is that difference? • The Fed purchase initially increases the M 1 money supply by $1, 000, the cash deposit does not

– Practice Monetary Policy problems • 2014 #2 • 2012 #1

– Practice Monetary Policy problems • 2014 #2 • 2012 #1

Limitations of Monetary Policy • Hard to determine how much money growth is optimal • Can’t always predict the exact results of a monetary action • Lag time before the actions of the Fed kick in • World events make things more complex • Congress may do things (Fiscal Policy) that conflict with the Fed

Limitations of Monetary Policy • Hard to determine how much money growth is optimal • Can’t always predict the exact results of a monetary action • Lag time before the actions of the Fed kick in • World events make things more complex • Congress may do things (Fiscal Policy) that conflict with the Fed

Practice • Complete • Connections: Countercyclical Monetary Policies (On the back of Countercyclical Fiscal Policies) • Examine the 2012 exam question on TAccounts

Practice • Complete • Connections: Countercyclical Monetary Policies (On the back of Countercyclical Fiscal Policies) • Examine the 2012 exam question on TAccounts

The Monetarists • When Keynesian fiscal policy failed to deal with the stagflation of the 1970’s, some economists put forth the concept of MONETARISM • They believed that a steady growth of the money supply would assure economic growth and macroeconomic stability

The Monetarists • When Keynesian fiscal policy failed to deal with the stagflation of the 1970’s, some economists put forth the concept of MONETARISM • They believed that a steady growth of the money supply would assure economic growth and macroeconomic stability

The Monetarists • Monetarists call for a steady increase of the money supply (say at 3% a year) regardless of the status of the economy • They rejected an active monetary policy (an important distinction). • In other words, they didn’t feel that the supply of money should be expanded and contracted (Monetary Policy) to meet certain conditions because of its limitations • They are basically conservative, laissez-faire economists

The Monetarists • Monetarists call for a steady increase of the money supply (say at 3% a year) regardless of the status of the economy • They rejected an active monetary policy (an important distinction). • In other words, they didn’t feel that the supply of money should be expanded and contracted (Monetary Policy) to meet certain conditions because of its limitations • They are basically conservative, laissez-faire economists

The Monetarists • Milton Friedman was its leading advocate and he has become a conservative icon over the last 30+ years

The Monetarists • Milton Friedman was its leading advocate and he has become a conservative icon over the last 30+ years

The Equation of Exchange • The fundamental equation for monetarists is MV=PQ • M is the supply of money • V is the velocity of money (the average number of times a dollar is spent during a year – this is relatively stable they believe) • P is the price level • Q is the quantity of all goods and services produced

The Equation of Exchange • The fundamental equation for monetarists is MV=PQ • M is the supply of money • V is the velocity of money (the average number of times a dollar is spent during a year – this is relatively stable they believe) • P is the price level • Q is the quantity of all goods and services produced

The Equation of Exchange • MV is the money supply multiplied by the number of times the money is spent throughout the year • PQ is basically nominal GDP • MV (Spending) equals the value of PQ (Output)

The Equation of Exchange • MV is the money supply multiplied by the number of times the money is spent throughout the year • PQ is basically nominal GDP • MV (Spending) equals the value of PQ (Output)

The Equation of Exchange • If V is relatively stable and predictable, INCREASING THE MONEY SUPPLY WILL INCREASE NOMINAL GDP

The Equation of Exchange • If V is relatively stable and predictable, INCREASING THE MONEY SUPPLY WILL INCREASE NOMINAL GDP

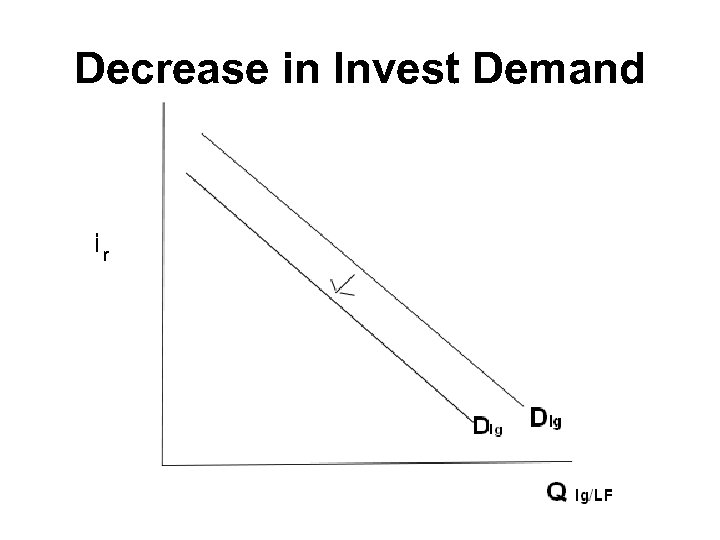

Decrease in Invest Demand r

Decrease in Invest Demand r

The Monetary Role of Banks • The T-account summarizes a banks financial position

The Monetary Role of Banks • The T-account summarizes a banks financial position

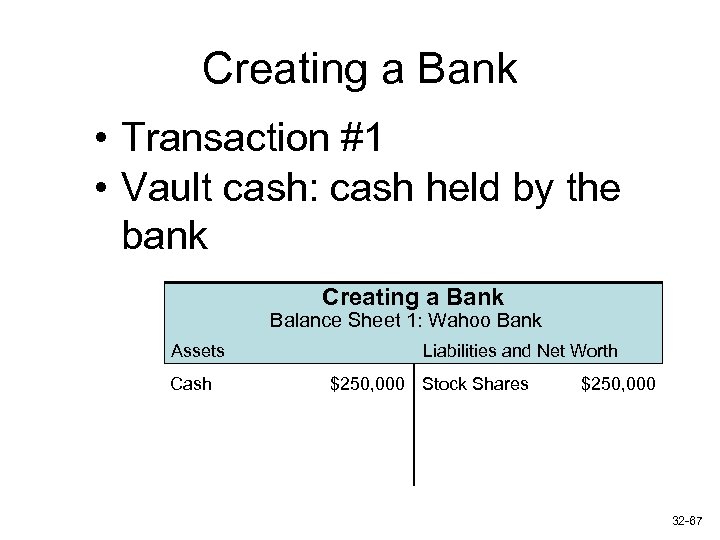

Creating a Bank • Transaction #1 • Vault cash: cash held by the bank Creating a Bank Balance Sheet 1: Wahoo Bank Assets Cash Liabilities and Net Worth $250, 000 Stock Shares $250, 000 32 -67

Creating a Bank • Transaction #1 • Vault cash: cash held by the bank Creating a Bank Balance Sheet 1: Wahoo Bank Assets Cash Liabilities and Net Worth $250, 000 Stock Shares $250, 000 32 -67

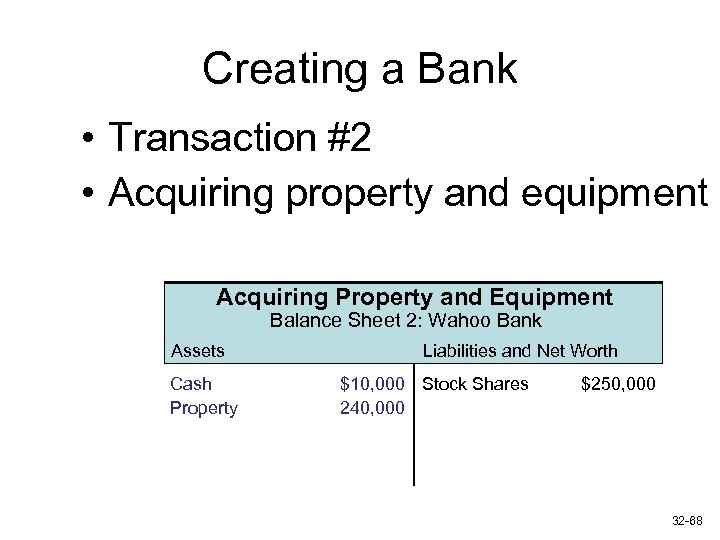

Creating a Bank • Transaction #2 • Acquiring property and equipment Acquiring Property and Equipment Balance Sheet 2: Wahoo Bank Assets Cash Property Liabilities and Net Worth $10, 000 Stock Shares 240, 000 $250, 000 32 -68

Creating a Bank • Transaction #2 • Acquiring property and equipment Acquiring Property and Equipment Balance Sheet 2: Wahoo Bank Assets Cash Property Liabilities and Net Worth $10, 000 Stock Shares 240, 000 $250, 000 32 -68

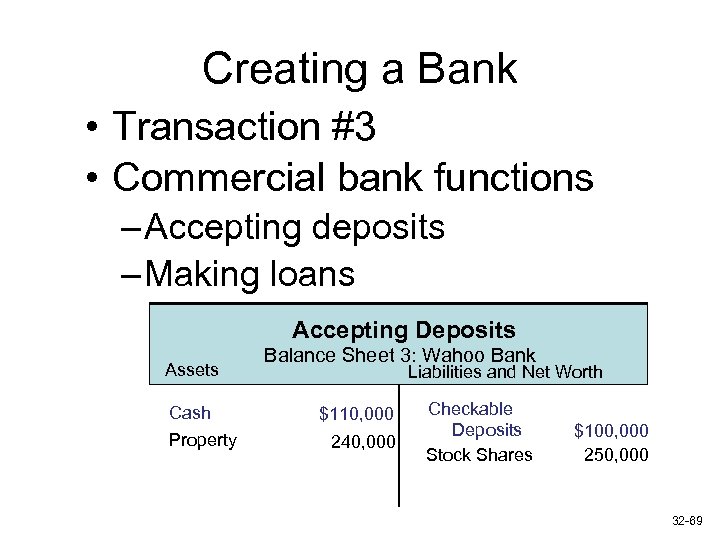

Creating a Bank • Transaction #3 • Commercial bank functions – Accepting deposits – Making loans Accepting Deposits Assets Cash Property Balance Sheet 3: Wahoo Bank Liabilities and Net Worth $110, 000 240, 000 Checkable Deposits Stock Shares $100, 000 250, 000 32 -69

Creating a Bank • Transaction #3 • Commercial bank functions – Accepting deposits – Making loans Accepting Deposits Assets Cash Property Balance Sheet 3: Wahoo Bank Liabilities and Net Worth $110, 000 240, 000 Checkable Deposits Stock Shares $100, 000 250, 000 32 -69

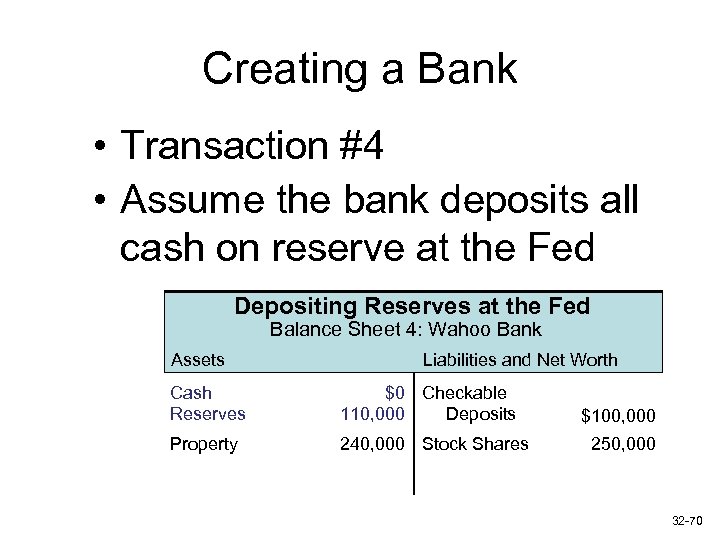

Creating a Bank • Transaction #4 • Assume the bank deposits all cash on reserve at the Fed Depositing Reserves at the Fed Balance Sheet 4: Wahoo Bank Assets Liabilities and Net Worth Cash Reserves $0 Checkable 110, 000 Deposits Property 240, 000 Stock Shares $100, 000 250, 000 32 -70

Creating a Bank • Transaction #4 • Assume the bank deposits all cash on reserve at the Fed Depositing Reserves at the Fed Balance Sheet 4: Wahoo Bank Assets Liabilities and Net Worth Cash Reserves $0 Checkable 110, 000 Deposits Property 240, 000 Stock Shares $100, 000 250, 000 32 -70

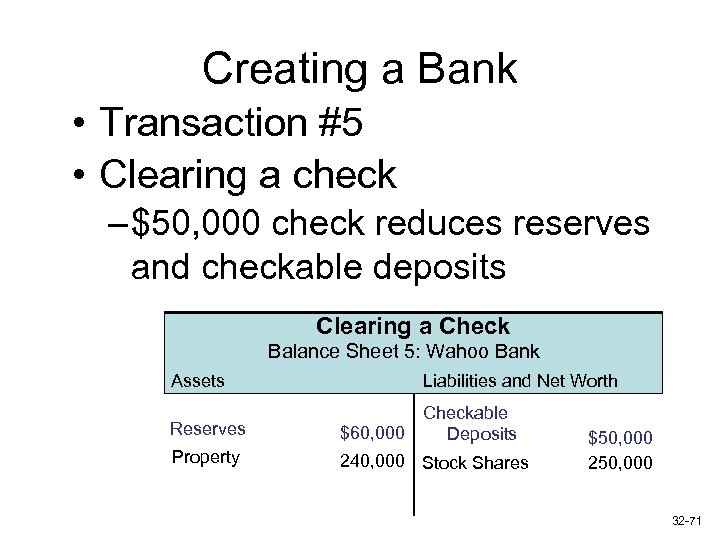

Creating a Bank • Transaction #5 • Clearing a check – $50, 000 check reduces reserves and checkable deposits Clearing a Check Balance Sheet 5: Wahoo Bank Assets Reserves Property Liabilities and Net Worth Checkable $60, 000 Deposits 240, 000 Stock Shares $50, 000 250, 000 32 -71

Creating a Bank • Transaction #5 • Clearing a check – $50, 000 check reduces reserves and checkable deposits Clearing a Check Balance Sheet 5: Wahoo Bank Assets Reserves Property Liabilities and Net Worth Checkable $60, 000 Deposits 240, 000 Stock Shares $50, 000 250, 000 32 -71

Financial Institutions • Institutions offering checkable deposits – Commercial banks • JP Morgan Chase • Bank of America • Wells Fargo – Credit unions 31 -72

Financial Institutions • Institutions offering checkable deposits – Commercial banks • JP Morgan Chase • Bank of America • Wells Fargo – Credit unions 31 -72

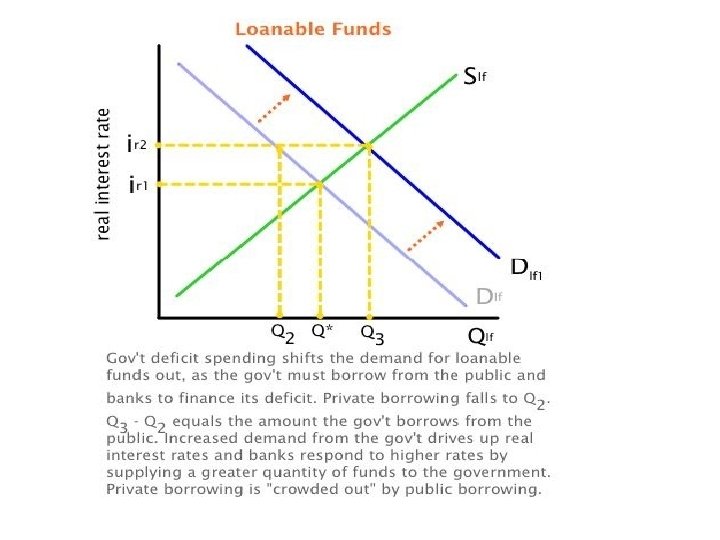

Crowding Out - Revisited • Initiated by Government deficit spending to pay for an ________ fiscal policy.

Crowding Out - Revisited • Initiated by Government deficit spending to pay for an ________ fiscal policy.

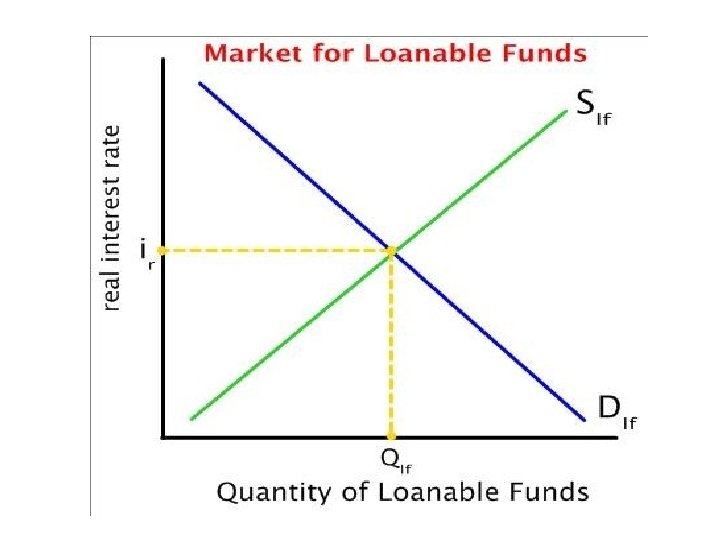

The Loanable Funds Market • A market that brings together borrowers and lenders • There is a supply of loanable funds and a demand for those loanable funds

The Loanable Funds Market • A market that brings together borrowers and lenders • There is a supply of loanable funds and a demand for those loanable funds

Shifts in the Demand for LF • Business and Consumer expectations – Optimistism leads to increased demand of LF – Pessimism leads to declining demand of LF • Government borrowing to finance an expansionary fiscal policy increases the demand for LF (Which leads to crowding out)

Shifts in the Demand for LF • Business and Consumer expectations – Optimistism leads to increased demand of LF – Pessimism leads to declining demand of LF • Government borrowing to finance an expansionary fiscal policy increases the demand for LF (Which leads to crowding out)

Shifts in the Supply of LF • Changes in private savings behavior – More savings increases the supply of LF – Less savings decrease the supply of LF • Changes in the flow of foreign investment in the U. S. (We will understand this when we study the international economy)

Shifts in the Supply of LF • Changes in private savings behavior – More savings increases the supply of LF – Less savings decrease the supply of LF • Changes in the flow of foreign investment in the U. S. (We will understand this when we study the international economy)