a4be3c3a0578e47d8e2d1e6392712576.ppt

- Количество слайдов: 28

Money Management: Part 1

Money Management: Part 1

Homework (Passport page 18)

Homework (Passport page 18)

How’s It Going?

How’s It Going?

Money Management • Tracking our Spending • Setting Goals • Creating a Budget

Money Management • Tracking our Spending • Setting Goals • Creating a Budget

What Do You Know? (Pre-Test page 4)

What Do You Know? (Pre-Test page 4)

Let’s Talk About You

Let’s Talk About You

Did You Know? • 61% of U. S. households don't have a budget. • More than 11 million Americans have no idea how much they spend on food, housing and entertainment and don’t keep track of overall spending. • 24% of U. S. households report not paying all their bills on time. • 1 in 3 adults (34%) carry credit card debt from month-to-month. 15% or 35 million people carry $2, 500 or more of credit card debt monthly. • 32% of U. S. adults do not save any portion of their income for retirement, and 34% have no emergency savings. Source: April 2014 Consumer Financial Literacy Survey by Harris Interactive, Inc

Did You Know? • 61% of U. S. households don't have a budget. • More than 11 million Americans have no idea how much they spend on food, housing and entertainment and don’t keep track of overall spending. • 24% of U. S. households report not paying all their bills on time. • 1 in 3 adults (34%) carry credit card debt from month-to-month. 15% or 35 million people carry $2, 500 or more of credit card debt monthly. • 32% of U. S. adults do not save any portion of their income for retirement, and 34% have no emergency savings. Source: April 2014 Consumer Financial Literacy Survey by Harris Interactive, Inc

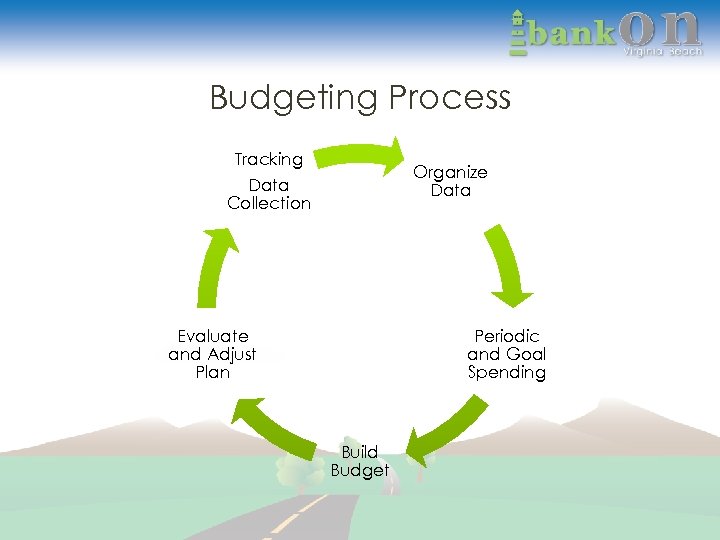

Budgeting Process Tracking Data Collection Organize Data Evaluate and Adjust Plan Periodic and Goal Spending Build Budget

Budgeting Process Tracking Data Collection Organize Data Evaluate and Adjust Plan Periodic and Goal Spending Build Budget

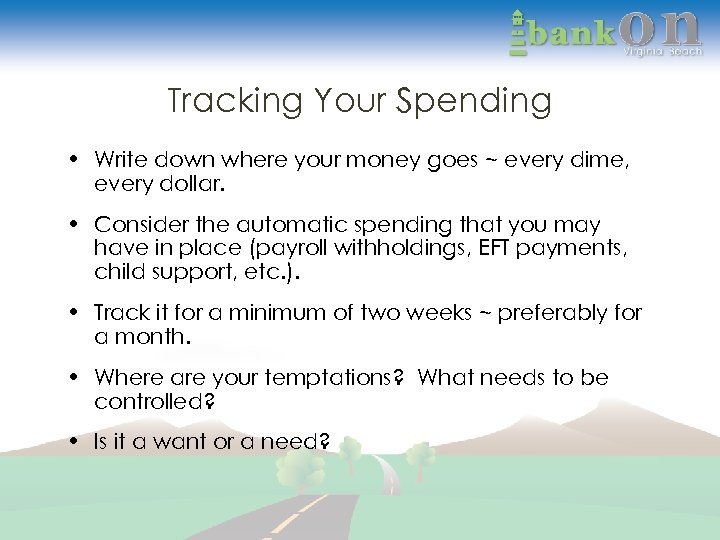

Tracking Your Spending • Write down where your money goes ~ every dime, every dollar. • Consider the automatic spending that you may have in place (payroll withholdings, EFT payments, child support, etc. ). • Track it for a minimum of two weeks ~ preferably for a month. • Where are your temptations? What needs to be controlled? • Is it a want or a need?

Tracking Your Spending • Write down where your money goes ~ every dime, every dollar. • Consider the automatic spending that you may have in place (payroll withholdings, EFT payments, child support, etc. ). • Track it for a minimum of two weeks ~ preferably for a month. • Where are your temptations? What needs to be controlled? • Is it a want or a need?

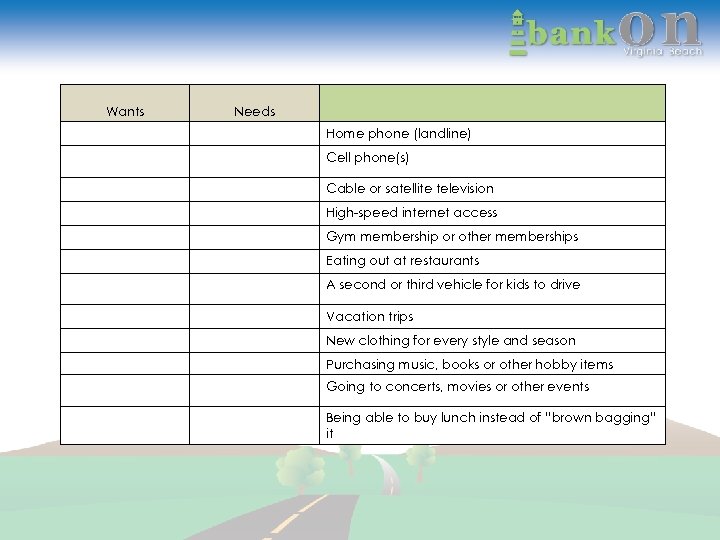

Wants Separating Wants and Needs Home phone (landline) Cell phone(s) Cable or satellite television High-speed internet access Gym membership or other memberships Eating out at restaurants A second or third vehicle for kids to drive Vacation trips New clothing for every style and season Purchasing music, books or other hobby items Going to concerts, movies or other events Being able to buy lunch instead of “brown bagging” it

Wants Separating Wants and Needs Home phone (landline) Cell phone(s) Cable or satellite television High-speed internet access Gym membership or other memberships Eating out at restaurants A second or third vehicle for kids to drive Vacation trips New clothing for every style and season Purchasing music, books or other hobby items Going to concerts, movies or other events Being able to buy lunch instead of “brown bagging” it

Types of Expenses • Fixed • Variable • Periodic • Discretionary • Non-discretionary

Types of Expenses • Fixed • Variable • Periodic • Discretionary • Non-discretionary

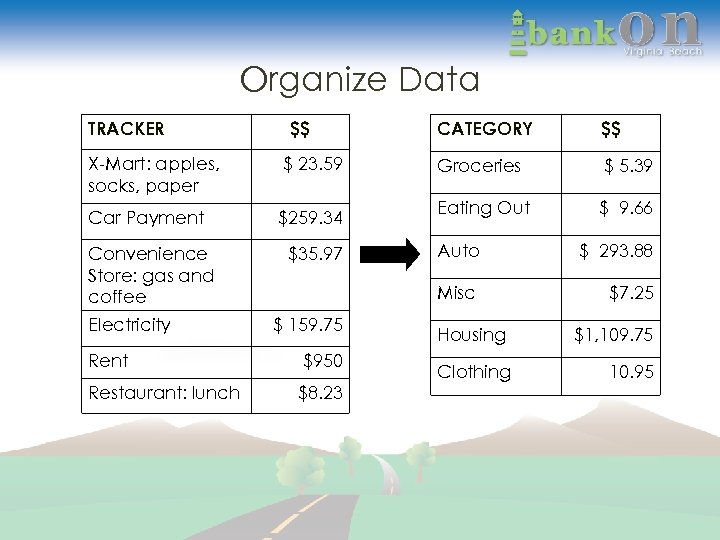

Organize Data TRACKER $$ X-Mart: apples, socks, paper $ 23. 59 Car Payment $259. 34 Convenience Store: gas and coffee $35. 97 Electricity CATEGORY $$ Groceries $ 5. 39 Eating Out $ 9. 66 Rent $950 Restaurant: lunch $8. 23 $ 293. 88 Misc $ 159. 75 Auto $7. 25 Housing $1, 109. 75 Clothing 10. 95

Organize Data TRACKER $$ X-Mart: apples, socks, paper $ 23. 59 Car Payment $259. 34 Convenience Store: gas and coffee $35. 97 Electricity CATEGORY $$ Groceries $ 5. 39 Eating Out $ 9. 66 Rent $950 Restaurant: lunch $8. 23 $ 293. 88 Misc $ 159. 75 Auto $7. 25 Housing $1, 109. 75 Clothing 10. 95

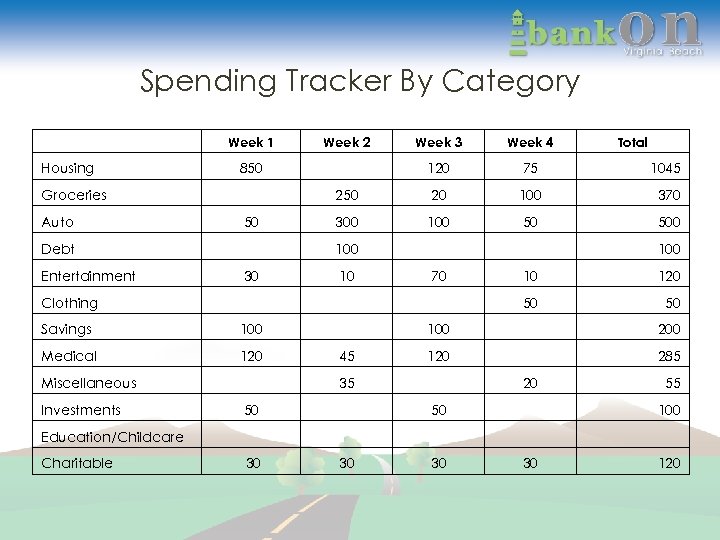

Spending Tracker By Category Housing Week 1 Week 4 120 75 1045 250 50 Debt Entertainment Week 3 20 100 370 300 100 50 500 850 Groceries Auto Week 2 100 30 10 100 70 Savings 100 Medical 120 Miscellaneous 10 120 50 Clothing Investments Total 50 100 45 200 120 285 35 50 20 50 55 100 Education/Childcare Charitable 30 30 120

Spending Tracker By Category Housing Week 1 Week 4 120 75 1045 250 50 Debt Entertainment Week 3 20 100 370 300 100 50 500 850 Groceries Auto Week 2 100 30 10 100 70 Savings 100 Medical 120 Miscellaneous 10 120 50 Clothing Investments Total 50 100 45 200 120 285 35 50 20 50 55 100 Education/Childcare Charitable 30 30 120

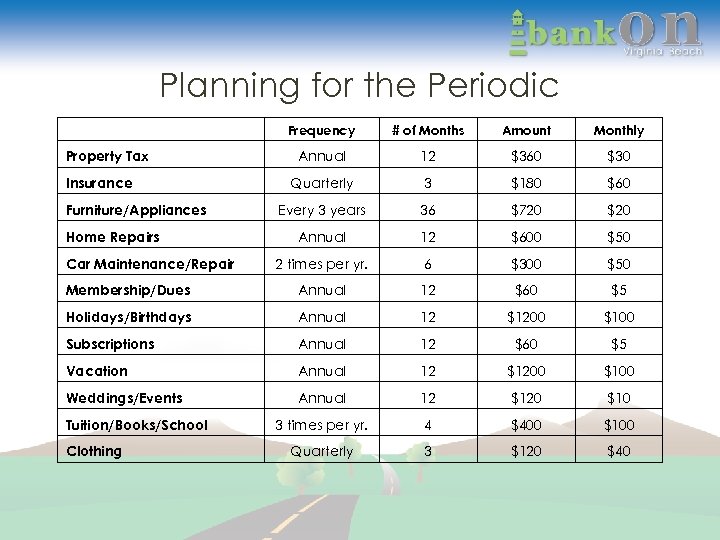

Budgeting for Periodic • Identify the cost and the timeframe for the expense: – Example: Each June, I pay $360 in personal property taxes. – Quarterly, I pay $180 for car insurance. • Break the cost into monthly costs: Personal Property $360 for 12 months = $30 per month Insurance $180 for 3 months = $60 per month

Budgeting for Periodic • Identify the cost and the timeframe for the expense: – Example: Each June, I pay $360 in personal property taxes. – Quarterly, I pay $180 for car insurance. • Break the cost into monthly costs: Personal Property $360 for 12 months = $30 per month Insurance $180 for 3 months = $60 per month

Planning for the Periodic Frequency # of Months Amount Monthly Annual 12 $360 $30 Quarterly 3 $180 $60 Every 3 years 36 $720 $20 Annual 12 $600 $50 2 times per yr. 6 $300 $50 Membership/Dues Annual 12 $60 $5 Holidays/Birthdays Annual 12 $1200 $100 Subscriptions Annual 12 $60 $5 Vacation Annual 12 $1200 $100 Weddings/Events Annual 12 $120 $10 3 times per yr. 4 $400 $100 Quarterly 3 $120 $40 Property Tax Insurance Furniture/Appliances Home Repairs Car Maintenance/Repair Tuition/Books/School Clothing

Planning for the Periodic Frequency # of Months Amount Monthly Annual 12 $360 $30 Quarterly 3 $180 $60 Every 3 years 36 $720 $20 Annual 12 $600 $50 2 times per yr. 6 $300 $50 Membership/Dues Annual 12 $60 $5 Holidays/Birthdays Annual 12 $1200 $100 Subscriptions Annual 12 $60 $5 Vacation Annual 12 $1200 $100 Weddings/Events Annual 12 $120 $10 3 times per yr. 4 $400 $100 Quarterly 3 $120 $40 Property Tax Insurance Furniture/Appliances Home Repairs Car Maintenance/Repair Tuition/Books/School Clothing

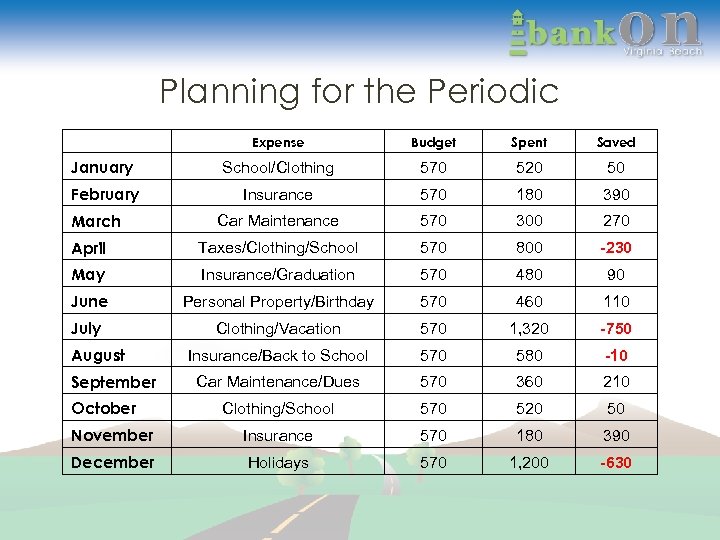

Planning for the Periodic Expense Budget Spent Saved January School/Clothing 570 520 50 February Insurance 570 180 390 Car Maintenance 570 300 270 April Taxes/Clothing/School 570 800 -230 May Insurance/Graduation 570 480 90 June Personal Property/Birthday 570 460 110 July Clothing/Vacation 570 1, 320 -750 Insurance/Back to School 570 580 -10 Car Maintenance/Dues 570 360 210 Clothing/School 570 520 50 November Insurance 570 180 390 December Holidays 570 1, 200 -630 March August September October

Planning for the Periodic Expense Budget Spent Saved January School/Clothing 570 520 50 February Insurance 570 180 390 Car Maintenance 570 300 270 April Taxes/Clothing/School 570 800 -230 May Insurance/Graduation 570 480 90 June Personal Property/Birthday 570 460 110 July Clothing/Vacation 570 1, 320 -750 Insurance/Back to School 570 580 -10 Car Maintenance/Dues 570 360 210 Clothing/School 570 520 50 November Insurance 570 180 390 December Holidays 570 1, 200 -630 March August September October

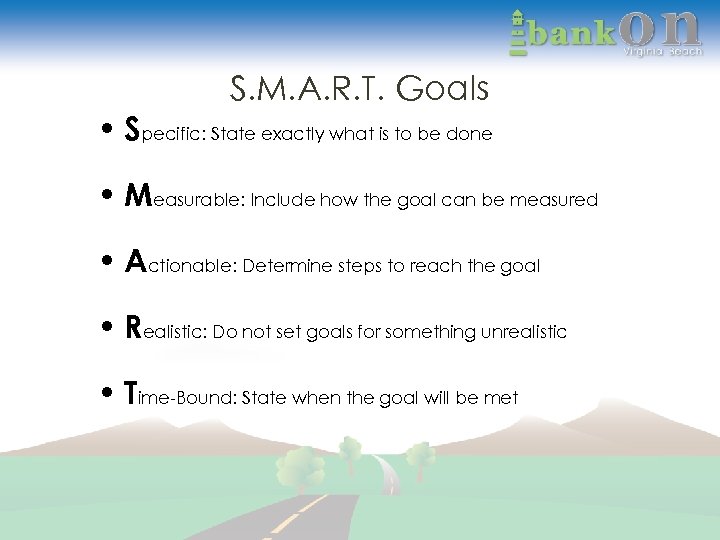

Setting Goals • Short-Term Goals: less than one year • Long-Term Goals: more than one year • S. M. A. R. T. Goals

Setting Goals • Short-Term Goals: less than one year • Long-Term Goals: more than one year • S. M. A. R. T. Goals

S. M. A. R. T. Goals • Specific: State exactly what is to be done • Measurable: Include how the goal can be measured • Actionable: Determine steps to reach the goal • Realistic: Do not set goals for something unrealistic • Time-Bound: State when the goal will be met

S. M. A. R. T. Goals • Specific: State exactly what is to be done • Measurable: Include how the goal can be measured • Actionable: Determine steps to reach the goal • Realistic: Do not set goals for something unrealistic • Time-Bound: State when the goal will be met

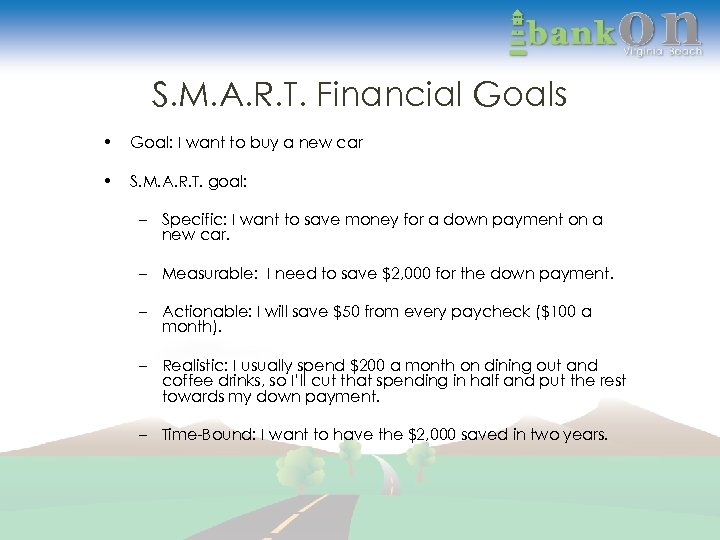

S. M. A. R. T. Financial Goals • Goal: I want to buy a new car • S. M. A. R. T. goal: – Specific: I want to save money for a down payment on a new car. – Measurable: I need to save $2, 000 for the down payment. – Actionable: I will save $50 from every paycheck ($100 a month). – Realistic: I usually spend $200 a month on dining out and coffee drinks, so I’ll cut that spending in half and put the rest towards my down payment. – Time-Bound: I want to have the $2, 000 saved in two years.

S. M. A. R. T. Financial Goals • Goal: I want to buy a new car • S. M. A. R. T. goal: – Specific: I want to save money for a down payment on a new car. – Measurable: I need to save $2, 000 for the down payment. – Actionable: I will save $50 from every paycheck ($100 a month). – Realistic: I usually spend $200 a month on dining out and coffee drinks, so I’ll cut that spending in half and put the rest towards my down payment. – Time-Bound: I want to have the $2, 000 saved in two years.

Budgeting for Goals • Identify the cost and the timeframe for the goal: – Example: I want to save $3, 000 over the next two years for a down payment on a new car. • Break the cost into annual costs – $3, 000 for 2 years = $1, 500 per year • Divide annual cost by 12 to get monthly amount needed: – $1, 500/12 = $125 monthly

Budgeting for Goals • Identify the cost and the timeframe for the goal: – Example: I want to save $3, 000 over the next two years for a down payment on a new car. • Break the cost into annual costs – $3, 000 for 2 years = $1, 500 per year • Divide annual cost by 12 to get monthly amount needed: – $1, 500/12 = $125 monthly

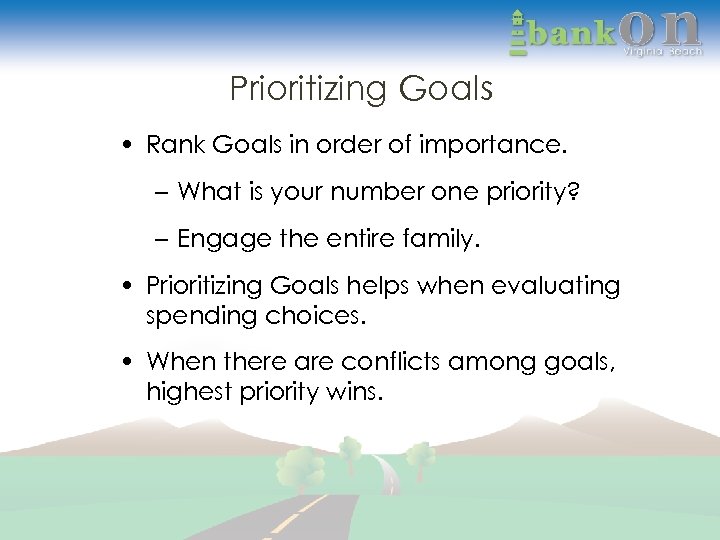

Prioritizing Goals • Rank Goals in order of importance. – What is your number one priority? – Engage the entire family. • Prioritizing Goals helps when evaluating spending choices. • When there are conflicts among goals, highest priority wins.

Prioritizing Goals • Rank Goals in order of importance. – What is your number one priority? – Engage the entire family. • Prioritizing Goals helps when evaluating spending choices. • When there are conflicts among goals, highest priority wins.

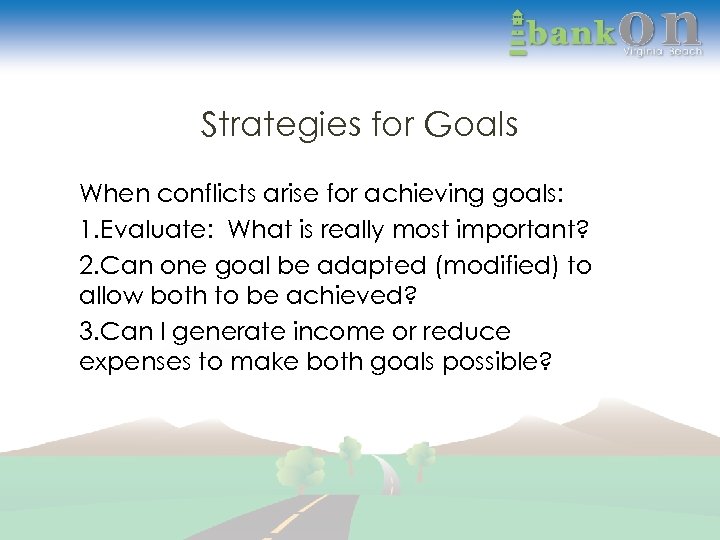

Strategies for Goals When conflicts arise for achieving goals: 1. Evaluate: What is really most important? 2. Can one goal be adapted (modified) to allow both to be achieved? 3. Can I generate income or reduce expenses to make both goals possible?

Strategies for Goals When conflicts arise for achieving goals: 1. Evaluate: What is really most important? 2. Can one goal be adapted (modified) to allow both to be achieved? 3. Can I generate income or reduce expenses to make both goals possible?

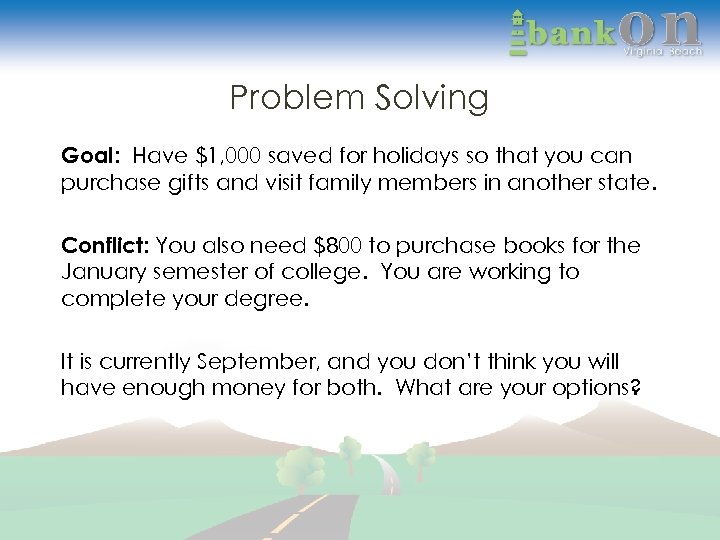

Problem Solving Goal: Have $1, 000 saved for holidays so that you can purchase gifts and visit family members in another state. Conflict: You also need $800 to purchase books for the January semester of college. You are working to complete your degree. It is currently September, and you don’t think you will have enough money for both. What are your options?

Problem Solving Goal: Have $1, 000 saved for holidays so that you can purchase gifts and visit family members in another state. Conflict: You also need $800 to purchase books for the January semester of college. You are working to complete your degree. It is currently September, and you don’t think you will have enough money for both. What are your options?

Creating YOUR Budget • Your spending trackers. – Remember, you’ll need at least two weeks worth of data, but more is even better. • Historical data from paystubs, bank and credit card statements. • Your S. M. A. R. T. goals and other priorities (paying off debt, vacation, etc. ). – Be sure to record how much money you’ll need for these. • Your income and expenses ~ fixed, variable and periodic.

Creating YOUR Budget • Your spending trackers. – Remember, you’ll need at least two weeks worth of data, but more is even better. • Historical data from paystubs, bank and credit card statements. • Your S. M. A. R. T. goals and other priorities (paying off debt, vacation, etc. ). – Be sure to record how much money you’ll need for these. • Your income and expenses ~ fixed, variable and periodic.

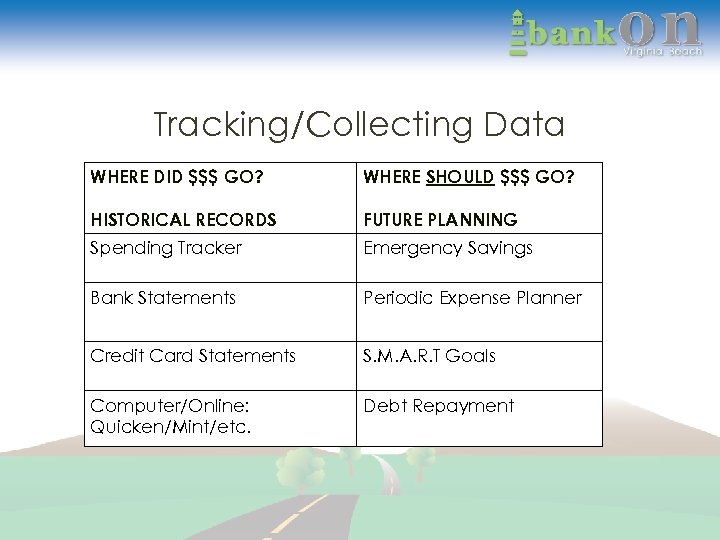

Tracking/Collecting Data WHERE DID $$$ GO? WHERE SHOULD $$$ GO? HISTORICAL RECORDS FUTURE PLANNING Spending Tracker Emergency Savings Bank Statements Periodic Expense Planner Credit Card Statements S. M. A. R. T Goals Computer/Online: Quicken/Mint/etc. Debt Repayment

Tracking/Collecting Data WHERE DID $$$ GO? WHERE SHOULD $$$ GO? HISTORICAL RECORDS FUTURE PLANNING Spending Tracker Emergency Savings Bank Statements Periodic Expense Planner Credit Card Statements S. M. A. R. T Goals Computer/Online: Quicken/Mint/etc. Debt Repayment

What Have You Learned? (Post-Test page 18)

What Have You Learned? (Post-Test page 18)

Homework (Passport page 22)

Homework (Passport page 22)

Questions?

Questions?