c50fdb427db8db266373f5183fa34de4.ppt

- Количество слайдов: 32

Money Management Dividing up income to meet expenses ©PDST Home Economics

Money Management Dividing up income to meet expenses ©PDST Home Economics

n n A budget is a plan for spending and saving money Dividing up income and allowing a certain amount towards each expense and saving

n n A budget is a plan for spending and saving money Dividing up income and allowing a certain amount towards each expense and saving

Income n n Income can be in the form of Wages (weekly), Salary (monthly), Pension, Social welfare payment, Interest on savings, Dividends or Shares Gross income – Deductions = Net income

Income n n Income can be in the form of Wages (weekly), Salary (monthly), Pension, Social welfare payment, Interest on savings, Dividends or Shares Gross income – Deductions = Net income

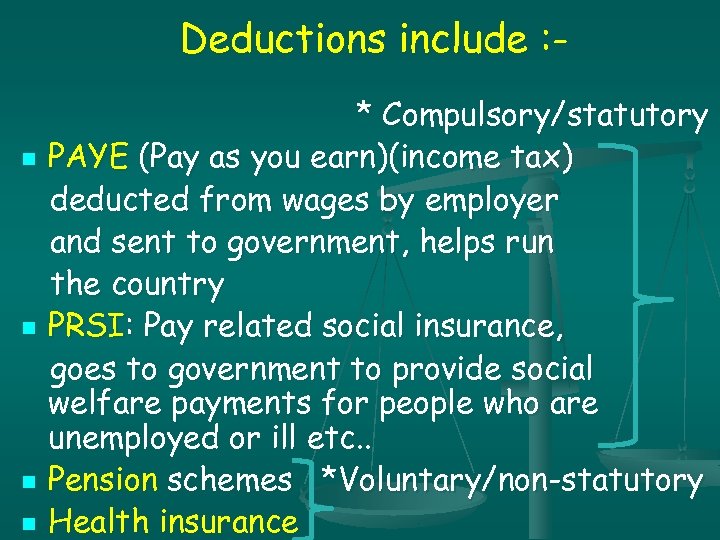

Deductions include : n n * Compulsory/statutory PAYE (Pay as you earn)(income tax) deducted from wages by employer and sent to government, helps run the country PRSI: Pay related social insurance, goes to government to provide social welfare payments for people who are unemployed or ill etc. . Pension schemes *Voluntary/non-statutory Health insurance

Deductions include : n n * Compulsory/statutory PAYE (Pay as you earn)(income tax) deducted from wages by employer and sent to government, helps run the country PRSI: Pay related social insurance, goes to government to provide social welfare payments for people who are unemployed or ill etc. . Pension schemes *Voluntary/non-statutory Health insurance

Tax Liability n 1. 2. Two rates of tax in Ireland A low/standard rate of 20% A high rate of 42% People on very low incomes do not pay any tax.

Tax Liability n 1. 2. Two rates of tax in Ireland A low/standard rate of 20% A high rate of 42% People on very low incomes do not pay any tax.

Tax Credits n Part of income that is not taxed

Tax Credits n Part of income that is not taxed

Expenses n n n n n Expenses within households vary Family expenses: Rent / Mortgage Food Household Expenses (electricity, oil, cleaning agents) Education/ Childcare Travel (car repayments, tax, insurance, NCT, petrol, servicing, bus fares) Clothing Medical expenses (dentist, dr. , health insurance, medicines) Savings Entertainment ( TV licence, newspapers, magazines, books, DVD’s, CD’s, going out, cinema, holidays)

Expenses n n n n n Expenses within households vary Family expenses: Rent / Mortgage Food Household Expenses (electricity, oil, cleaning agents) Education/ Childcare Travel (car repayments, tax, insurance, NCT, petrol, servicing, bus fares) Clothing Medical expenses (dentist, dr. , health insurance, medicines) Savings Entertainment ( TV licence, newspapers, magazines, books, DVD’s, CD’s, going out, cinema, holidays)

Budget Planning n n n n n List all expected net income List planned expenditure (mortgage, phone, E. S. B. ) Overestimate rather than underestimate. Add up totals and ÷ by 52 Set aside money to cover planned spending Allow for discretionary spending – Christmas, birthdays Allow for personal spending – cinema, clothing Allow for saving – future education, pension Avoid impulse buying Fill in cheque stubs

Budget Planning n n n n n List all expected net income List planned expenditure (mortgage, phone, E. S. B. ) Overestimate rather than underestimate. Add up totals and ÷ by 52 Set aside money to cover planned spending Allow for discretionary spending – Christmas, birthdays Allow for personal spending – cinema, clothing Allow for saving – future education, pension Avoid impulse buying Fill in cheque stubs

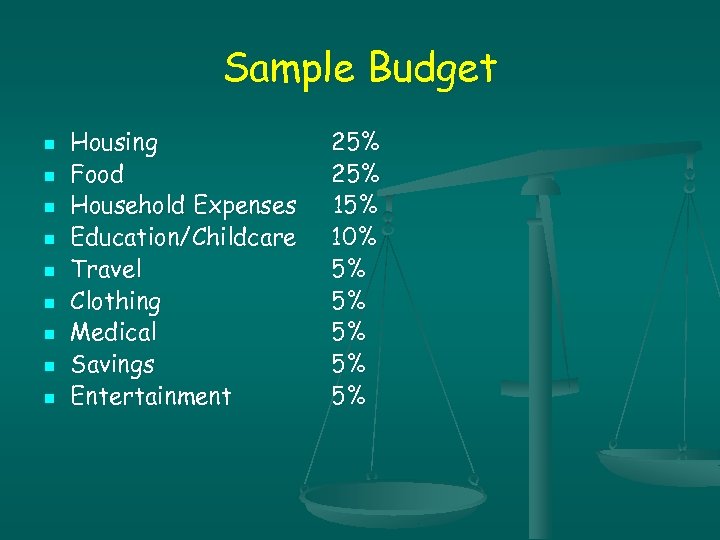

Sample Budget n n n n n Housing Food Household Expenses Education/Childcare Travel Clothing Medical Savings Entertainment 25% 15% 10% 5% 5% 5%

Sample Budget n n n n n Housing Food Household Expenses Education/Childcare Travel Clothing Medical Savings Entertainment 25% 15% 10% 5% 5% 5%

Sample budget € 400 per week n n n n n Housing € 100 Food € 100 Household expenses € 60 Education/childcare € 40 Travel € 10 Clothing € 10 Medical € 10 Savings € 10 Entertainment € 10

Sample budget € 400 per week n n n n n Housing € 100 Food € 100 Household expenses € 60 Education/childcare € 40 Travel € 10 Clothing € 10 Medical € 10 Savings € 10 Entertainment € 10

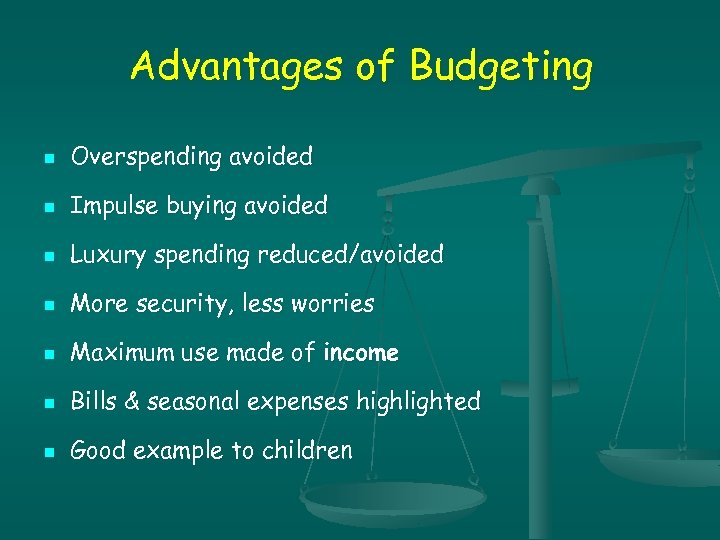

Advantages of Budgeting n Overspending avoided n Impulse buying avoided n Luxury spending reduced/avoided n More security, less worries n Maximum use made of income n Bills & seasonal expenses highlighted n Good example to children

Advantages of Budgeting n Overspending avoided n Impulse buying avoided n Luxury spending reduced/avoided n More security, less worries n Maximum use made of income n Bills & seasonal expenses highlighted n Good example to children

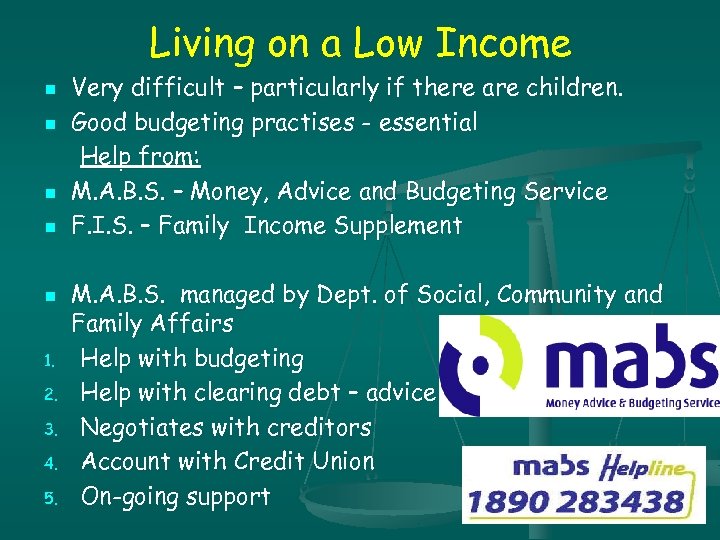

Living on a Low Income n n n 1. 2. 3. 4. 5. Very difficult – particularly if there are children. Good budgeting practises - essential Help from: M. A. B. S. – Money, Advice and Budgeting Service F. I. S. – Family Income Supplement M. A. B. S. managed by Dept. of Social, Community and Family Affairs Help with budgeting Help with clearing debt – advice Negotiates with creditors Account with Credit Union On-going support

Living on a Low Income n n n 1. 2. 3. 4. 5. Very difficult – particularly if there are children. Good budgeting practises - essential Help from: M. A. B. S. – Money, Advice and Budgeting Service F. I. S. – Family Income Supplement M. A. B. S. managed by Dept. of Social, Community and Family Affairs Help with budgeting Help with clearing debt – advice Negotiates with creditors Account with Credit Union On-going support

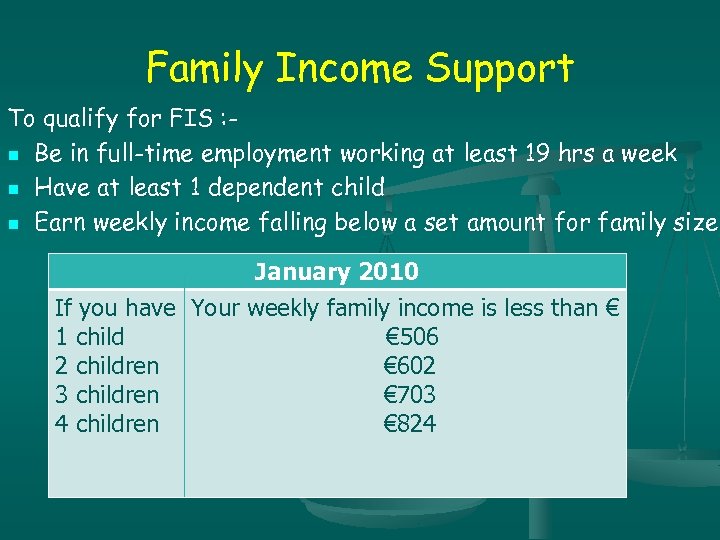

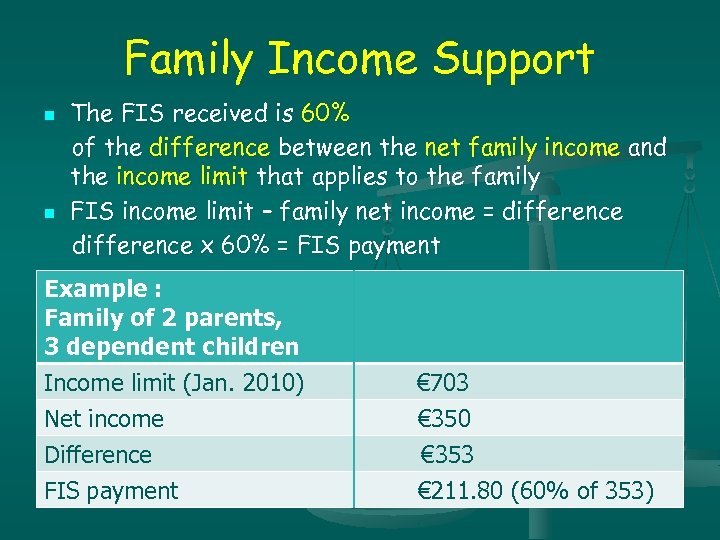

Family Income Support To qualify for FIS : n Be in full-time employment working at least 19 hrs a week n Have at least 1 dependent child n Earn weekly income falling below a set amount for family size January 2010 If you have Your weekly family income is less than € 1 child € 506 2 children € 602 3 children € 703 4 children € 824

Family Income Support To qualify for FIS : n Be in full-time employment working at least 19 hrs a week n Have at least 1 dependent child n Earn weekly income falling below a set amount for family size January 2010 If you have Your weekly family income is less than € 1 child € 506 2 children € 602 3 children € 703 4 children € 824

Family Income Support n n The FIS received is 60% of the difference between the net family income and the income limit that applies to the family FIS income limit – family net income = difference x 60% = FIS payment Example : Family of 2 parents, 3 dependent children Income limit (Jan. 2010) € 703 Net income € 350 Difference € 353 FIS payment € 211. 80 (60% of 353)

Family Income Support n n The FIS received is 60% of the difference between the net family income and the income limit that applies to the family FIS income limit – family net income = difference x 60% = FIS payment Example : Family of 2 parents, 3 dependent children Income limit (Jan. 2010) € 703 Net income € 350 Difference € 353 FIS payment € 211. 80 (60% of 353)

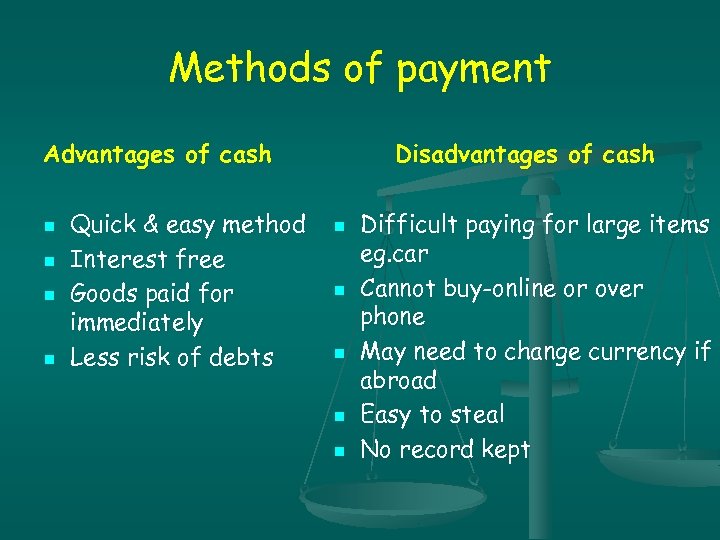

Methods of payment Advantages of cash n n Quick & easy method Interest free Goods paid for immediately Less risk of debts Disadvantages of cash n n n Difficult paying for large items eg. car Cannot buy-online or over phone May need to change currency if abroad Easy to steal No record kept

Methods of payment Advantages of cash n n Quick & easy method Interest free Goods paid for immediately Less risk of debts Disadvantages of cash n n n Difficult paying for large items eg. car Cannot buy-online or over phone May need to change currency if abroad Easy to steal No record kept

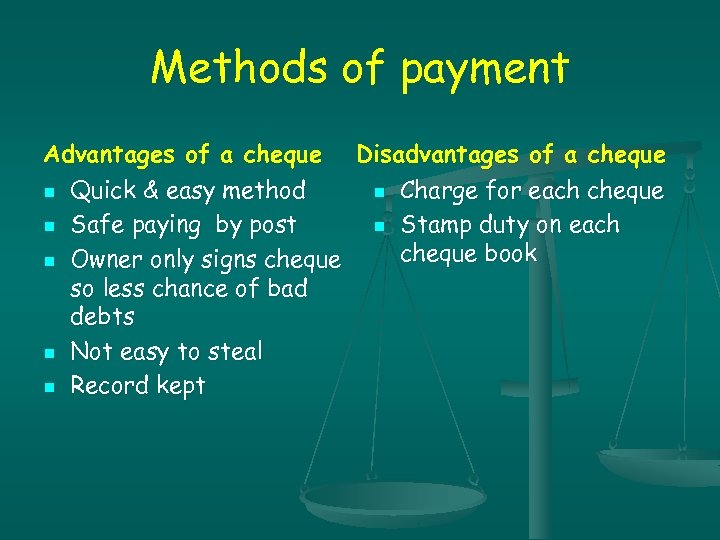

Methods of payment Advantages of a cheque Disadvantages of a cheque n Quick & easy method n Charge for each cheque n Safe paying by post n Stamp duty on each cheque book n Owner only signs cheque so less chance of bad debts n Not easy to steal n Record kept

Methods of payment Advantages of a cheque Disadvantages of a cheque n Quick & easy method n Charge for each cheque n Safe paying by post n Stamp duty on each cheque book n Owner only signs cheque so less chance of bad debts n Not easy to steal n Record kept

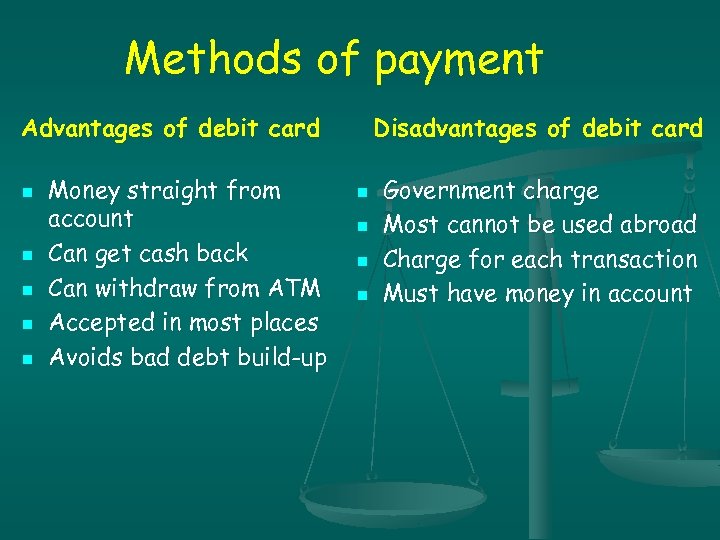

Methods of payment Disadvantages of debit card Advantages of debit card n n n Money straight from account Can get cash back Can withdraw from ATM Accepted in most places Avoids bad debt build-up n n Government charge Most cannot be used abroad Charge for each transaction Must have money in account

Methods of payment Disadvantages of debit card Advantages of debit card n n n Money straight from account Can get cash back Can withdraw from ATM Accepted in most places Avoids bad debt build-up n n Government charge Most cannot be used abroad Charge for each transaction Must have money in account

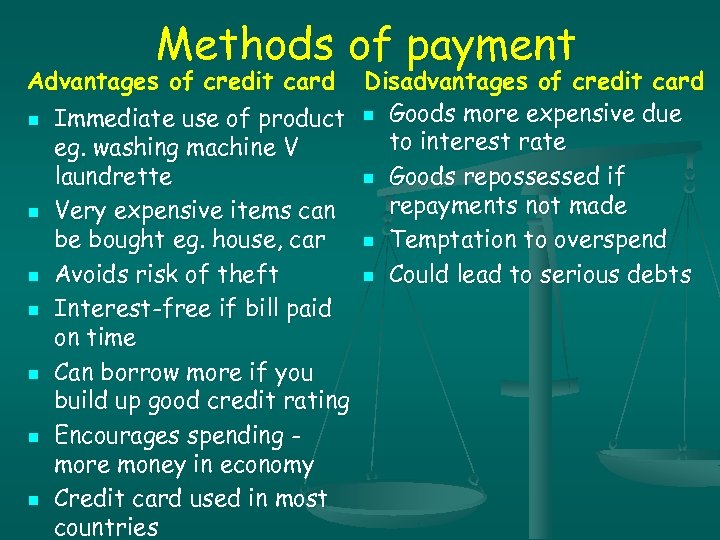

Methods of payment Advantages of credit card n n n n Disadvantages of credit card Immediate use of product n Goods more expensive due to interest rate eg. washing machine V laundrette n Goods repossessed if repayments not made Very expensive items can be bought eg. house, car n Temptation to overspend Avoids risk of theft n Could lead to serious debts Interest-free if bill paid on time Can borrow more if you build up good credit rating Encourages spending more money in economy Credit card used in most countries

Methods of payment Advantages of credit card n n n n Disadvantages of credit card Immediate use of product n Goods more expensive due to interest rate eg. washing machine V laundrette n Goods repossessed if repayments not made Very expensive items can be bought eg. house, car n Temptation to overspend Avoids risk of theft n Could lead to serious debts Interest-free if bill paid on time Can borrow more if you build up good credit rating Encourages spending more money in economy Credit card used in most countries

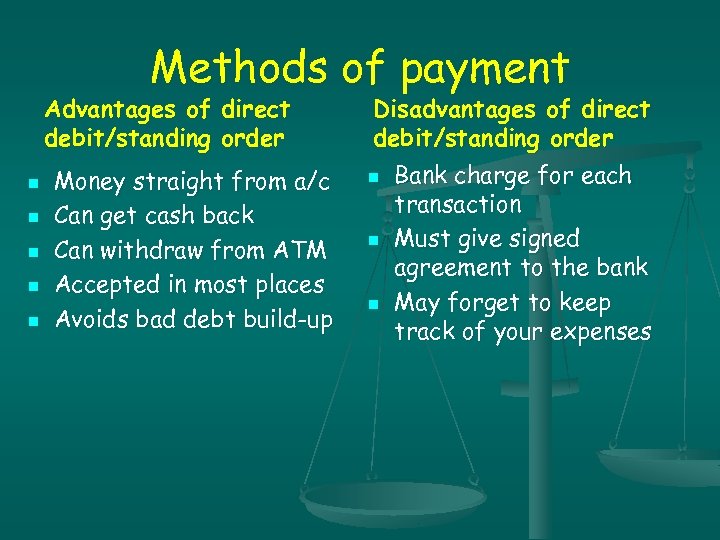

Methods of payment Advantages of direct debit/standing order n n n Money straight from a/c Can get cash back Can withdraw from ATM Accepted in most places Avoids bad debt build-up Disadvantages of direct debit/standing order n n n Bank charge for each transaction Must give signed agreement to the bank May forget to keep track of your expenses

Methods of payment Advantages of direct debit/standing order n n n Money straight from a/c Can get cash back Can withdraw from ATM Accepted in most places Avoids bad debt build-up Disadvantages of direct debit/standing order n n n Bank charge for each transaction Must give signed agreement to the bank May forget to keep track of your expenses

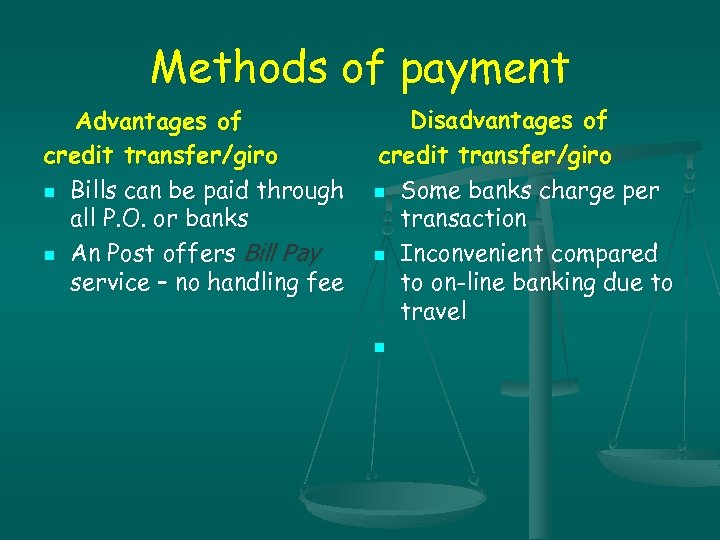

Methods of payment Advantages of credit transfer/giro n Bills can be paid through all P. O. or banks n An Post offers Bill Pay service – no handling fee Disadvantages of credit transfer/giro n Some banks charge per transaction n Inconvenient compared to on-line banking due to travel n

Methods of payment Advantages of credit transfer/giro n Bills can be paid through all P. O. or banks n An Post offers Bill Pay service – no handling fee Disadvantages of credit transfer/giro n Some banks charge per transaction n Inconvenient compared to on-line banking due to travel n

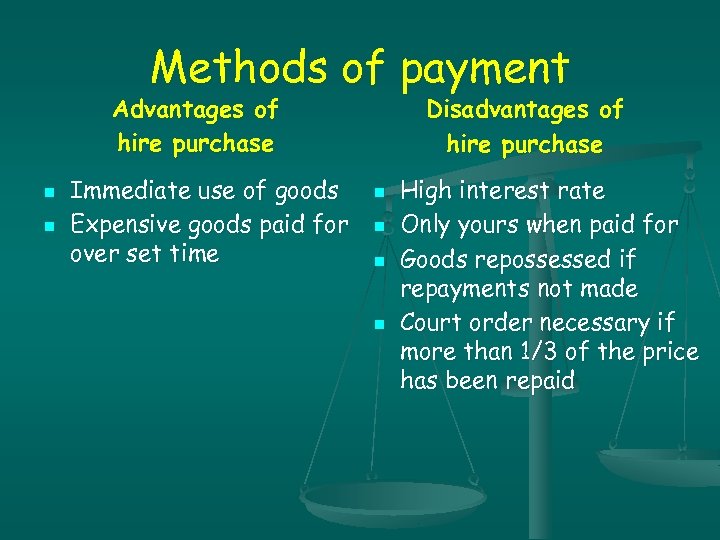

Methods of payment Advantages of hire purchase n n Immediate use of goods Expensive goods paid for over set time Disadvantages of hire purchase n n High interest rate Only yours when paid for Goods repossessed if repayments not made Court order necessary if more than 1/3 of the price has been repaid

Methods of payment Advantages of hire purchase n n Immediate use of goods Expensive goods paid for over set time Disadvantages of hire purchase n n High interest rate Only yours when paid for Goods repossessed if repayments not made Court order necessary if more than 1/3 of the price has been repaid

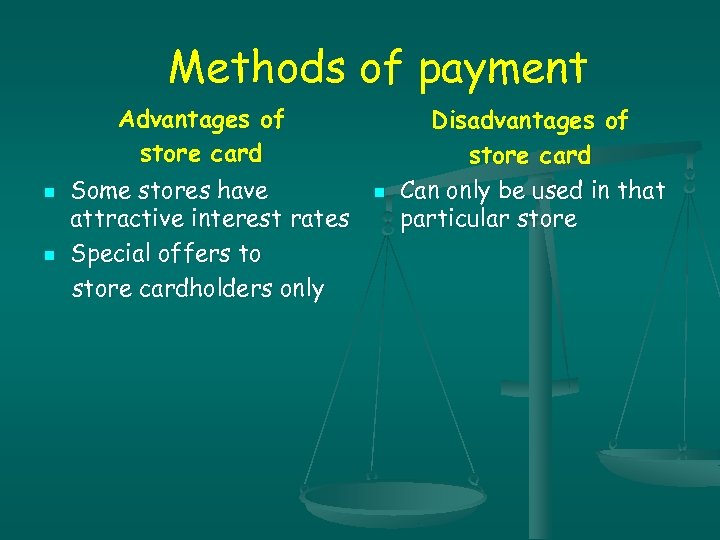

Methods of payment n n Advantages of Disadvantages of store card Some stores have n Can only be used in that attractive interest rates particular store Special offers to store cardholders only

Methods of payment n n Advantages of Disadvantages of store card Some stores have n Can only be used in that attractive interest rates particular store Special offers to store cardholders only

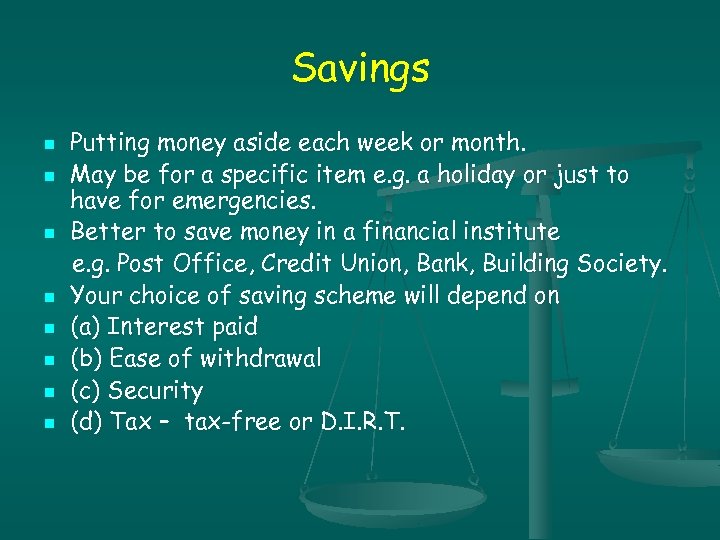

Savings n n n n Putting money aside each week or month. May be for a specific item e. g. a holiday or just to have for emergencies. Better to save money in a financial institute e. g. Post Office, Credit Union, Bank, Building Society. Your choice of saving scheme will depend on (a) Interest paid (b) Ease of withdrawal (c) Security (d) Tax – tax-free or D. I. R. T.

Savings n n n n Putting money aside each week or month. May be for a specific item e. g. a holiday or just to have for emergencies. Better to save money in a financial institute e. g. Post Office, Credit Union, Bank, Building Society. Your choice of saving scheme will depend on (a) Interest paid (b) Ease of withdrawal (c) Security (d) Tax – tax-free or D. I. R. T.

An Post Saving Schemes n n n See page 237 ‘Lifelines’ , Enright and Flynn See page 267 ‘Studies in Home Economics’, Mc. Loughlin & Mc. Garvey See page 209 - 210 ‘Home Matters’, Ryan, Frawley, Henderson, Keane and Mooney

An Post Saving Schemes n n n See page 237 ‘Lifelines’ , Enright and Flynn See page 267 ‘Studies in Home Economics’, Mc. Loughlin & Mc. Garvey See page 209 - 210 ‘Home Matters’, Ryan, Frawley, Henderson, Keane and Mooney

Banks & Building Societies Saving Schemes n n n See page 238 ‘Lifelines’ , Enright and Flynn See page 268 ‘Studies in Home Economics’, Mc. Loughlin & Mc. Garvey See page 209 ‘Home Matters’, Ryan, Frawley, Henderson, Keane and Mooney

Banks & Building Societies Saving Schemes n n n See page 238 ‘Lifelines’ , Enright and Flynn See page 268 ‘Studies in Home Economics’, Mc. Loughlin & Mc. Garvey See page 209 ‘Home Matters’, Ryan, Frawley, Henderson, Keane and Mooney

Advantages and Disadvantages of Saving n n n Advantages More security, less worries Cope better with unexpected payments Less risk of bad debts Good example to children Avoids paying on credit Safer than money kept at home n n Disadvantages Interest can be really low Money may not be easily avai

Advantages and Disadvantages of Saving n n n Advantages More security, less worries Cope better with unexpected payments Less risk of bad debts Good example to children Avoids paying on credit Safer than money kept at home n n Disadvantages Interest can be really low Money may not be easily avai

Credit Buying n n n Credit means that you buy now and pay later Buyers borrow money to buy goods and pay it back later usually with interest. Often used to buy large items like houses and cars but can be used for small things too like furniture or electrical goods.

Credit Buying n n n Credit means that you buy now and pay later Buyers borrow money to buy goods and pay it back later usually with interest. Often used to buy large items like houses and cars but can be used for small things too like furniture or electrical goods.

Forms of Credit n Bank Overdraft n Loan from bank, building society, credit union n Mortgage (for land or buildings only) n Hire Purchase n Credit cards n In-store card n Interest -free credit

Forms of Credit n Bank Overdraft n Loan from bank, building society, credit union n Mortgage (for land or buildings only) n Hire Purchase n Credit cards n In-store card n Interest -free credit

Advantages and disadvantages of credit n n n n Advantages Immediate use of goods Necessary for large items e. g. houses Good for economy Avoid s carrying large sums of money Avoids risk of theft Interest-free if credit bill paid on time Can borrow more over time if you build up good credit rating n n Disadvantages Interest charged – goods more expensive Temptation to overspend Goods repossessed if repayments not made Could lead to serious debts

Advantages and disadvantages of credit n n n n Advantages Immediate use of goods Necessary for large items e. g. houses Good for economy Avoid s carrying large sums of money Avoids risk of theft Interest-free if credit bill paid on time Can borrow more over time if you build up good credit rating n n Disadvantages Interest charged – goods more expensive Temptation to overspend Goods repossessed if repayments not made Could lead to serious debts

Consumer Credit Act 1995 Ø Ø Ø n n n Implemented by the Director of Consumer Affairs. Consolidates all consumer credit legislation into one act Deals with : Credit advertising Credit agreements Hire purchase agreements Home loans Bank charges Control and licensing of money lenders

Consumer Credit Act 1995 Ø Ø Ø n n n Implemented by the Director of Consumer Affairs. Consolidates all consumer credit legislation into one act Deals with : Credit advertising Credit agreements Hire purchase agreements Home loans Bank charges Control and licensing of money lenders

Hire Purchase Act 1946, 1960 States that H. P. agreements must include: n cash price of goods n amount of initial deposit n instalment arrangements and due date n a description of the goods n total H. P. price including interest n information on termination of agreement, recovery of goods (repossession) n APR – rate of interest being charged n details of penalty clauses n details of 10 day 'cooling off period’ n give names and addresses of the parties

Hire Purchase Act 1946, 1960 States that H. P. agreements must include: n cash price of goods n amount of initial deposit n instalment arrangements and due date n a description of the goods n total H. P. price including interest n information on termination of agreement, recovery of goods (repossession) n APR – rate of interest being charged n details of penalty clauses n details of 10 day 'cooling off period’ n give names and addresses of the parties

Household Filing System n Place for bills, receipts, guarantees, school report, bank statements, etc n Compare past and present bills n Monitor use of fuel & energy n Use past bills to create next budget n Check bank statements & saving accounts

Household Filing System n Place for bills, receipts, guarantees, school report, bank statements, etc n Compare past and present bills n Monitor use of fuel & energy n Use past bills to create next budget n Check bank statements & saving accounts