9345b0f5d04e2eb8478c5bdc84ad8e66.ppt

- Количество слайдов: 54

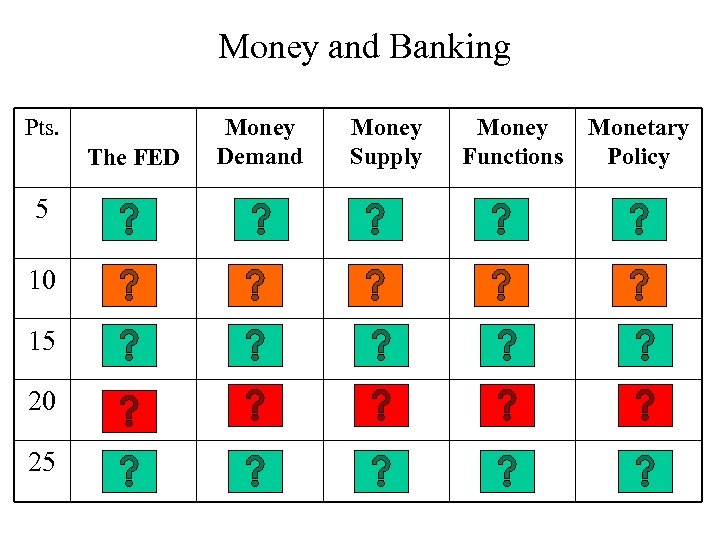

Money and Banking Pts. The FED 5 10 15 20 25 Money Demand Money Supply Money Functions Monetary Policy

5 Points • Authority to appoint the Federal reserve Chair?

That’s right! • Who is the President?

5 Points • The type of demand needed to purchase goods and services in the economy.

That’s right! • What is transactional demand?

5 Points • Currency is a part of M 1, M 2 and/or M 3. Which one or combination?

That’s right! • All three?

5 Points • The three primary tools the FED has to increase or decrease the money supply. .

That’s right! • Open market operations • Discount rate • Required reserve ratio

5 Points • The type of function money serves when you purchase a new car.

That’s right! • Medium of Exchange

10 Points • Current FED Chair

That’s right! • Who is Ben Bernanke ?

10 Points • This type of demand for money varies inversely with interest rates.

That’s right! • What is asset demand?

10 Points • The position of the money supply curve.

That’s right! • What is Vertical?

10 Points • When you put money into a savings account you are using money as this.

That’s right! • What is a store of value?

10 Points • The FED should do this in its open market operations if it wants to get us out of a recession.

That’s right! • What is buy bonds?

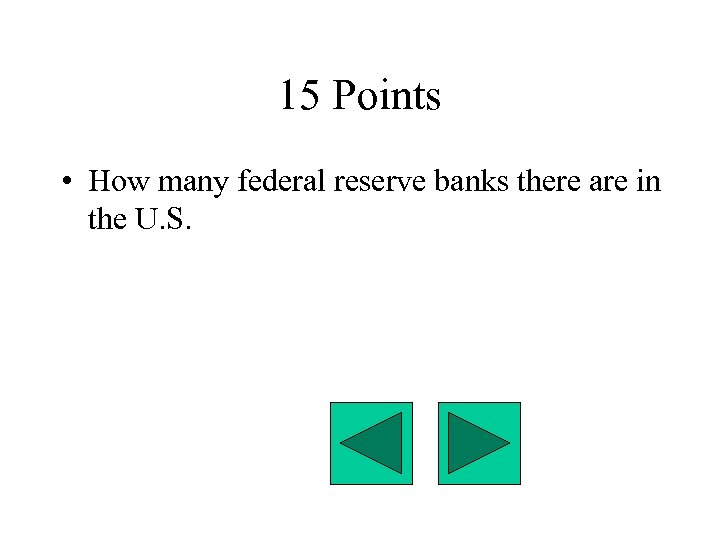

15 Points • How many federal reserve banks there are in the U. S.

That’s right! • What is 12?

15 Points • If NGDP increased we would expect this to happen to the money demand curve.

That’s right! • What is shift right?

15 Points • The more common name for demand deposits.

That’s right! • What are checking accounts?

15 Points • When you are a contestant on the price is right and you are guessing the value of a can of peas you are using money as this.

That’s right! • What is a unit of account?

15 Points • The impact an easy monetary policy has on Investment spending.

That’s right! • What is increases it?

20 Points • The primary committee responsible for buying and selling government securities.

That’s right! • What is the federal open market committee?

20 Points • If the government decrease spending on public works projects we would expect this to happen to the money demand curve.

That’s right! • What is shift left?

20 Points • The type of money that is easily convertible into M 1.

That’s right! • What is near monies?

20 Points • The term that describes money that is not backed by gold or silver but backed by the faith of the U. S. government and its citizens.

That’s right! • What is Fiat Money?

20 Points • The impact of a tight monetary policy on Aggregate Demand.

That’s right! • What is shift it to the left?

25 Points • The committee that is in charge of setting the Discount rate and the Required Reserve Ratio.

That’s right! • What is the Board of Governors?

25 Points • The type of relationship fiscal policy and money demand have.

That’s right! • What is direct?

25 Points • Which of the following are NOT a part of M 2: Cash, Currency, savings accounts, stocks, credit cards. HINT there is more than one answer.

That’s right! • What are stocks and credit cards?

25 Points • The official name of paper currency as it is printed.

That’s right! • What are Federal Reserve Notes?

25 Points • The appropriate monetary policy response to fiscal crowding out.

That’s right! • What is increase the money supply? Click here for final Jeopardy

Final Jeopardy The final Jeopardy Question is :

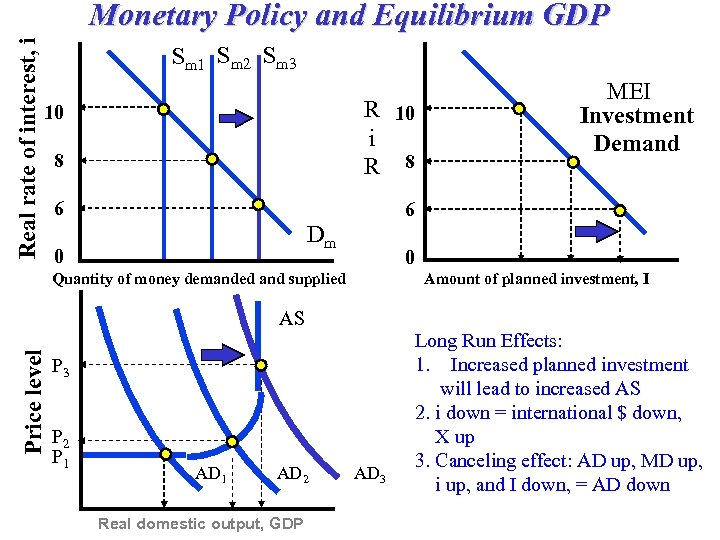

1. Describe the sequence of an easy monetary policy. What are its effects on i-rates, Investment, AD, and RGDP. Additionally, what is the canceling potential and the effect on net exports?

Real rate of interest, i Monetary Policy and Equilibrium GDP Sm 1 Sm 2 Sm 3 8 R 10 i R 8 6 MEI Investment Demand 6 10 Dm 0 0 Quantity of money demanded and supplied Amount of planned investment, I Price level AS P 3 P 2 P 1 AD 2 Real domestic output, GDP AD 3 Long Run Effects: 1. Increased planned investment will lead to increased AS 2. i down = international $ down, X up 3. Canceling effect: AD up, MD up, i up, and I down, = AD down

9345b0f5d04e2eb8478c5bdc84ad8e66.ppt