5041087fdd48b4759fa5f8343d366815.ppt

- Количество слайдов: 24

Monetary Valuations in Repeated Markets: Do Prices Matter? Andrea Isoni CREED-CEDEX-UEA Meeting on Experimental Economics Amsterdam, 5 th and 6 th June 2008 Joint with: P. Brooks, G. Loomes and R. Sugden

Monetary Valuations in Repeated Markets: Do Prices Matter? Andrea Isoni CREED-CEDEX-UEA Meeting on Experimental Economics Amsterdam, 5 th and 6 th June 2008 Joint with: P. Brooks, G. Loomes and R. Sugden

Outline 1. 2. 3. 4. 5. The issues Research questions The Experiment Results Conclusion

Outline 1. 2. 3. 4. 5. The issues Research questions The Experiment Results Conclusion

The issues Anomalies reduced in markets WTA/WTP disparity (e. g. Coursey et al. , 1987; Shogren et al. , 1994, 2001; Loomes et al. , 2003, 2007) Preference reversal (Cox and Grether, 1996; Braga et al. , 2006) Shaping effects Decay compatible with ‘price following’ (e. g. Shogren et al. , 2001; Cox and Grether, 1996; Knetsch 2001, Loomes et al. , 2003, ) Anchoring manipulations persist after market repetition (Ariely et al. , 2003) Price sensitivity and ‘bad-deal’ aversion A model with in-built shaping effects (Isoni, 2008) 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

The issues Anomalies reduced in markets WTA/WTP disparity (e. g. Coursey et al. , 1987; Shogren et al. , 1994, 2001; Loomes et al. , 2003, 2007) Preference reversal (Cox and Grether, 1996; Braga et al. , 2006) Shaping effects Decay compatible with ‘price following’ (e. g. Shogren et al. , 2001; Cox and Grether, 1996; Knetsch 2001, Loomes et al. , 2003, ) Anchoring manipulations persist after market repetition (Ariely et al. , 2003) Price sensitivity and ‘bad-deal’ aversion A model with in-built shaping effects (Isoni, 2008) 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Research questions Do market prices shape valuations? Does market interaction eliminate the effect of external manipulations? Shaping effects Anchoring 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion General ability of repeated markets to reveal consistent preferences

Research questions Do market prices shape valuations? Does market interaction eliminate the effect of external manipulations? Shaping effects Anchoring 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion General ability of repeated markets to reveal consistent preferences

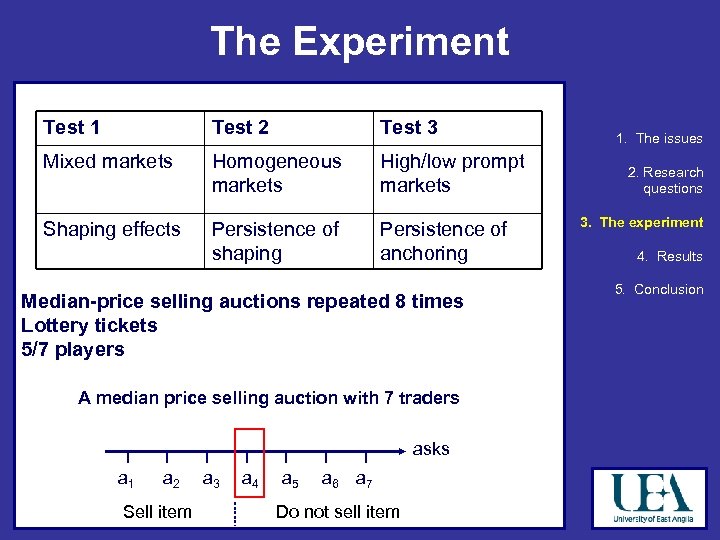

The Experiment Test 1 Test 2 Test 3 Mixed markets Homogeneous markets High/low prompt markets Shaping effects Persistence of shaping Persistence of anchoring Median-price selling auctions repeated 8 times Lottery tickets 5/7 players A median price selling auction with 7 traders asks a 1 a 2 Sell item a 3 a 4 a 5 a 6 a 7 Do not sell item 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

The Experiment Test 1 Test 2 Test 3 Mixed markets Homogeneous markets High/low prompt markets Shaping effects Persistence of shaping Persistence of anchoring Median-price selling auctions repeated 8 times Lottery tickets 5/7 players A median price selling auction with 7 traders asks a 1 a 2 Sell item a 3 a 4 a 5 a 6 a 7 Do not sell item 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

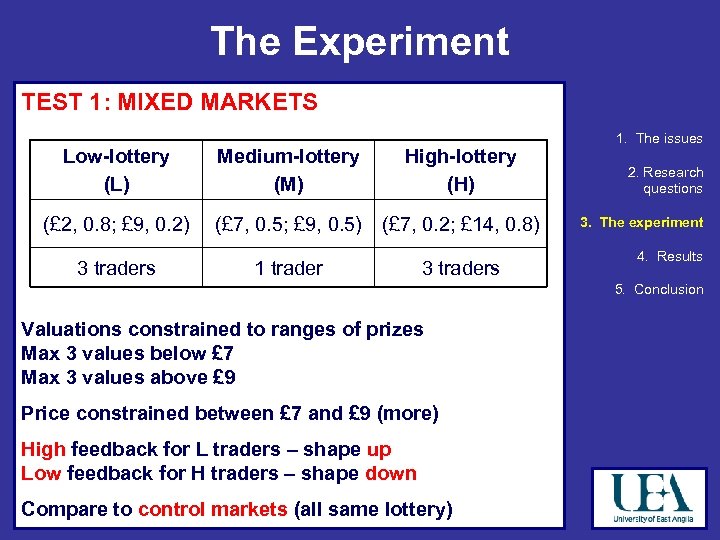

The Experiment TEST 1: MIXED MARKETS Low-lottery (L) Medium-lottery (M) High-lottery (H) (£ 2, 0. 8; £ 9, 0. 2) (£ 7, 0. 5; £ 9, 0. 5) (£ 7, 0. 2; £ 14, 0. 8) 3 traders 1 trader 3 traders 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion Valuations constrained to ranges of prizes Max 3 values below £ 7 Max 3 values above £ 9 Price constrained between £ 7 and £ 9 (more) High feedback for L traders – shape up Low feedback for H traders – shape down Compare to control markets (all same lottery)

The Experiment TEST 1: MIXED MARKETS Low-lottery (L) Medium-lottery (M) High-lottery (H) (£ 2, 0. 8; £ 9, 0. 2) (£ 7, 0. 5; £ 9, 0. 5) (£ 7, 0. 2; £ 14, 0. 8) 3 traders 1 trader 3 traders 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion Valuations constrained to ranges of prizes Max 3 values below £ 7 Max 3 values above £ 9 Price constrained between £ 7 and £ 9 (more) High feedback for L traders – shape up Low feedback for H traders – shape down Compare to control markets (all same lottery)

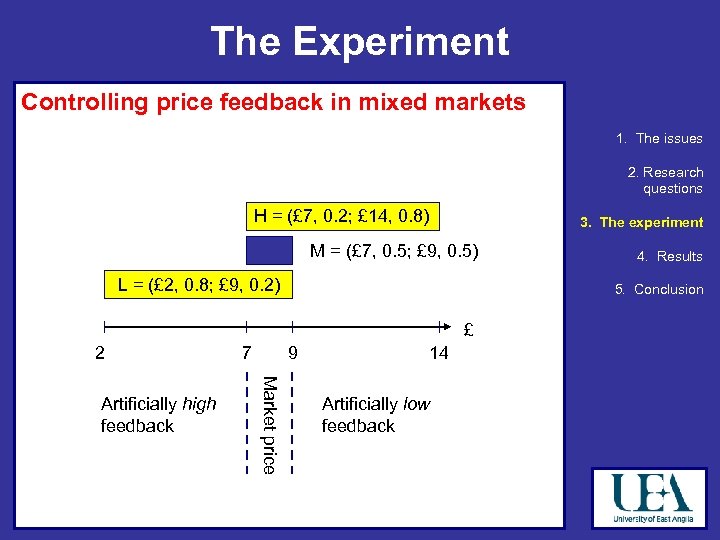

The Experiment Controlling price feedback in mixed markets 1. The issues 2. Research questions H = (£ 7, 0. 2; £ 14, 0. 8) 3. The experiment M = (£ 7, 0. 5; £ 9, 0. 5) L = (£ 2, 0. 8; £ 9, 0. 2) 5. Conclusion £ 2 9 Market price Artificially high feedback 7 4. Results 14 Artificially low feedback

The Experiment Controlling price feedback in mixed markets 1. The issues 2. Research questions H = (£ 7, 0. 2; £ 14, 0. 8) 3. The experiment M = (£ 7, 0. 5; £ 9, 0. 5) L = (£ 2, 0. 8; £ 9, 0. 2) 5. Conclusion £ 2 9 Market price Artificially high feedback 7 4. Results 14 Artificially low feedback

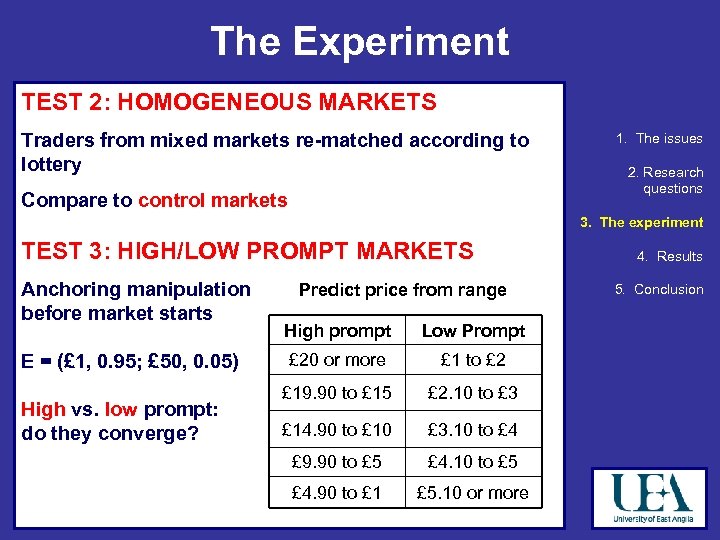

The Experiment TEST 2: HOMOGENEOUS MARKETS Traders from mixed markets re-matched according to lottery Compare to control markets 1. The issues 2. Research questions 3. The experiment TEST 3: HIGH/LOW PROMPT MARKETS Anchoring manipulation before market starts E = (£ 1, 0. 95; £ 50, 0. 05) High vs. low prompt: do they converge? Predict price from range High prompt Low Prompt £ 20 or more £ 1 to £ 2 £ 19. 90 to £ 15 £ 2. 10 to £ 3 £ 14. 90 to £ 10 £ 3. 10 to £ 4 £ 9. 90 to £ 5 £ 4. 10 to £ 5 £ 4. 90 to £ 1 £ 5. 10 or more 4. Results 5. Conclusion

The Experiment TEST 2: HOMOGENEOUS MARKETS Traders from mixed markets re-matched according to lottery Compare to control markets 1. The issues 2. Research questions 3. The experiment TEST 3: HIGH/LOW PROMPT MARKETS Anchoring manipulation before market starts E = (£ 1, 0. 95; £ 50, 0. 05) High vs. low prompt: do they converge? Predict price from range High prompt Low Prompt £ 20 or more £ 1 to £ 2 £ 19. 90 to £ 15 £ 2. 10 to £ 3 £ 14. 90 to £ 10 £ 3. 10 to £ 4 £ 9. 90 to £ 5 £ 4. 10 to £ 5 £ 4. 90 to £ 1 £ 5. 10 or more 4. Results 5. Conclusion

Results Lab: Social Science for the Environment Virtual Reality and Experimental Laboratories (SSEVREL) of the University of East Anglia Sessions: 18 overall 1. The issues 2. Research questions 3. The experiment Participants: 204 subjects from general student population 4. Results 5. Conclusion Duration: about 1 hour 20 minutes per session Earnings: £ 7. 50 on average Software: z-Tree (Fischbacher, 2007)

Results Lab: Social Science for the Environment Virtual Reality and Experimental Laboratories (SSEVREL) of the University of East Anglia Sessions: 18 overall 1. The issues 2. Research questions 3. The experiment Participants: 204 subjects from general student population 4. Results 5. Conclusion Duration: about 1 hour 20 minutes per session Earnings: £ 7. 50 on average Software: z-Tree (Fischbacher, 2007)

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

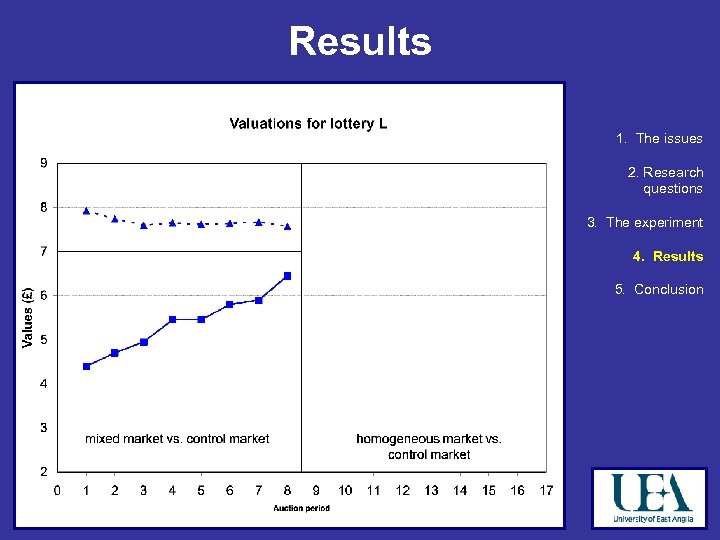

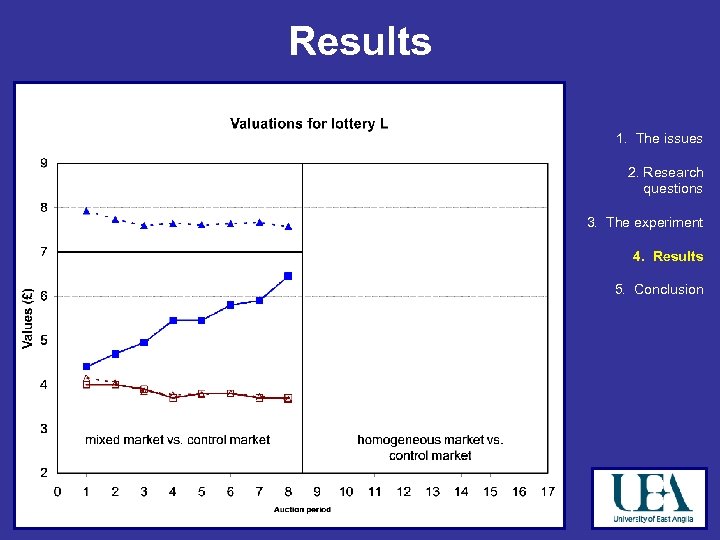

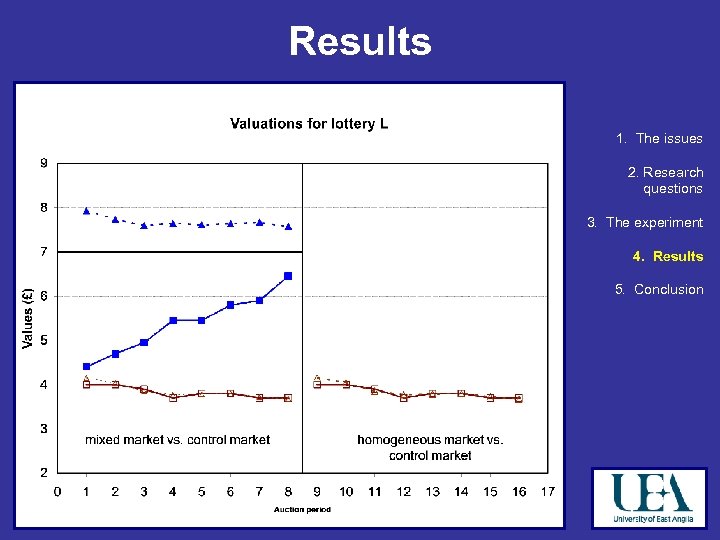

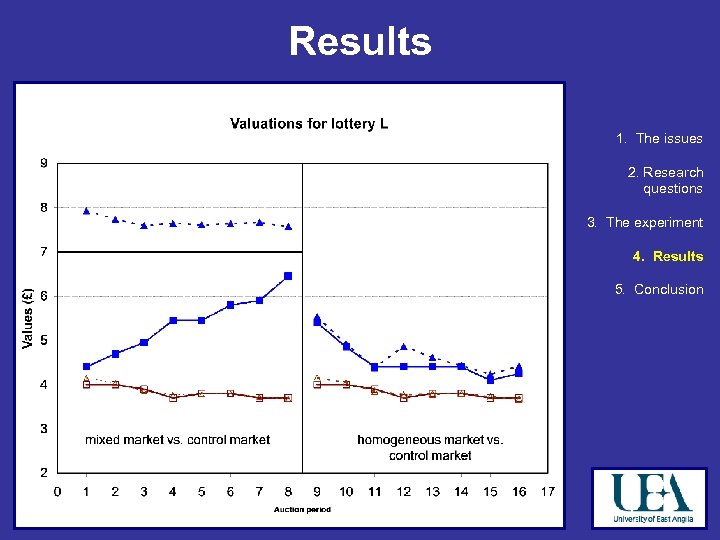

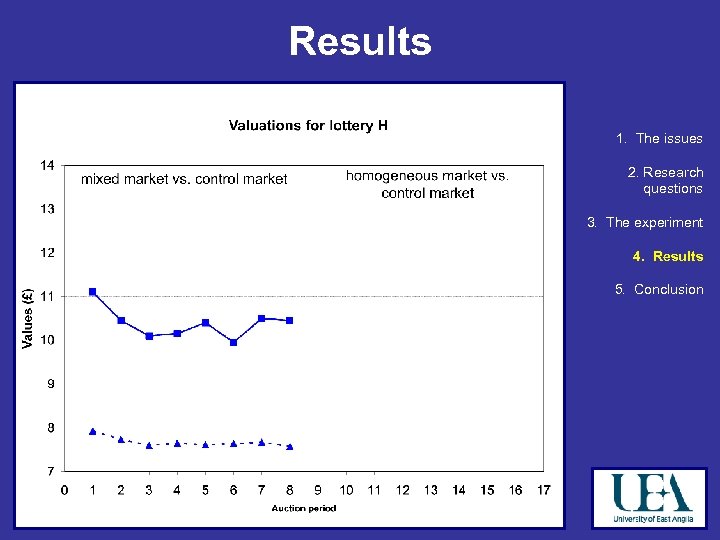

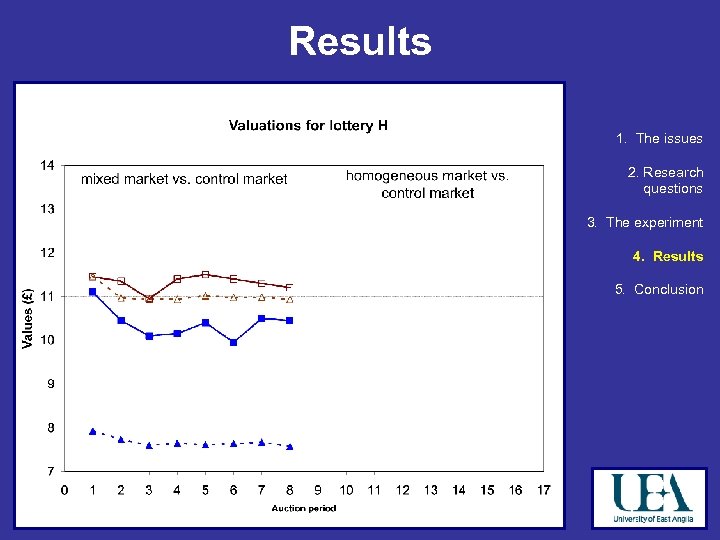

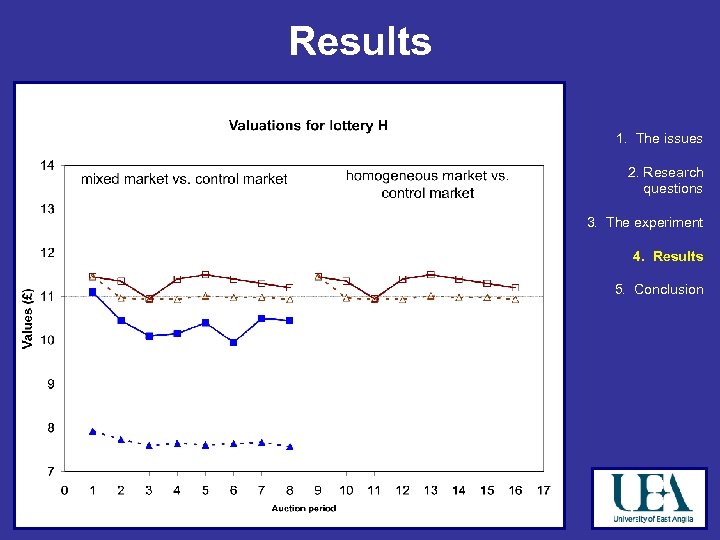

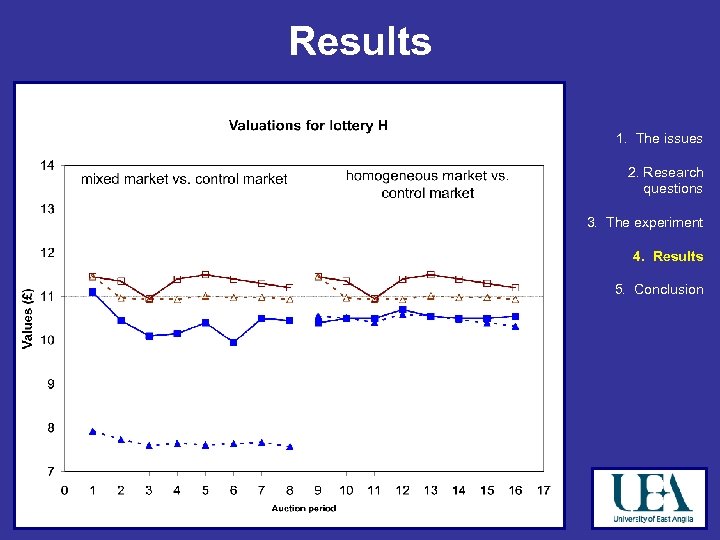

Results To recap TEST 1 Large shaping effects, stronger when feedback is artificially high (L) than when it is low (H) Asymmetry compatible with ‘bad-deal’ aversion - when price is high, valuations pulled up to avoid bad deals (L) - when price is low, valuations pulled downwards to make good deals (H) TEST 2 Strong de-shaping for high feedback (L), but still significant difference after 8 rounds General persistence for low feedback (H) Some tendency to underlying values/market discipline? 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results To recap TEST 1 Large shaping effects, stronger when feedback is artificially high (L) than when it is low (H) Asymmetry compatible with ‘bad-deal’ aversion - when price is high, valuations pulled up to avoid bad deals (L) - when price is low, valuations pulled downwards to make good deals (H) TEST 2 Strong de-shaping for high feedback (L), but still significant difference after 8 rounds General persistence for low feedback (H) Some tendency to underlying values/market discipline? 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Results 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

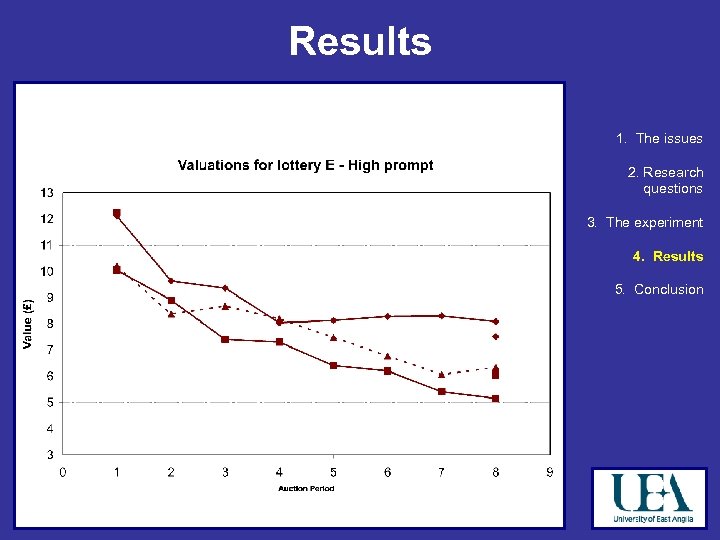

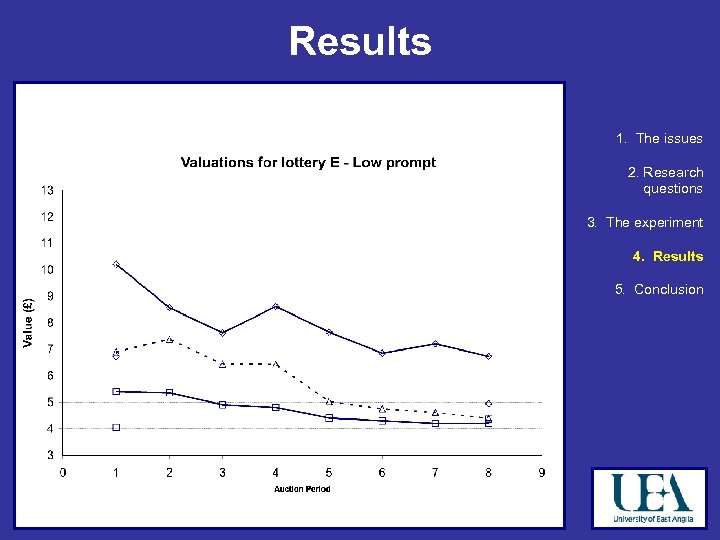

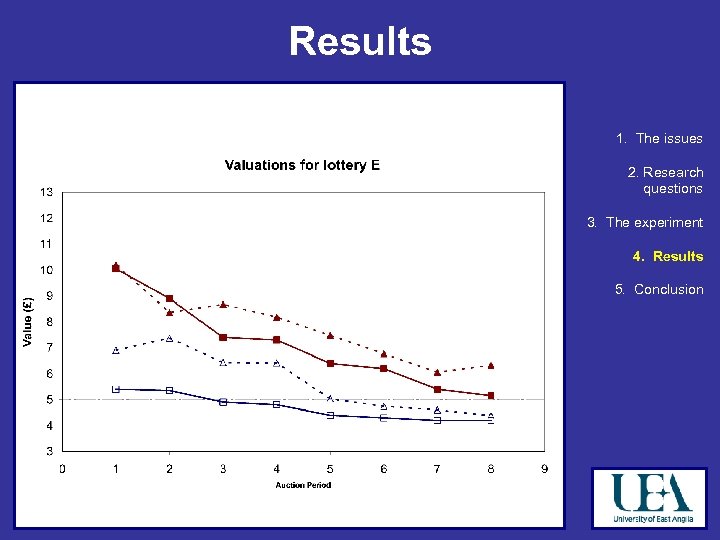

Results To recap TEST 3 Strong and persistent effect of prompt on valuations 1. The issues 2. Research questions 3. The experiment Effect possibly reinforced by group-specific feedback (a form of shaping? ) - valuations not significantly different across trading groups in period 1 - significant differences arise in last period 4. Results 5. Conclusion

Results To recap TEST 3 Strong and persistent effect of prompt on valuations 1. The issues 2. Research questions 3. The experiment Effect possibly reinforced by group-specific feedback (a form of shaping? ) - valuations not significantly different across trading groups in period 1 - significant differences arise in last period 4. Results 5. Conclusion

Conclusion Monetary valuations are malleable - Via price feedback (especially if high) - Via anchoring manipulations Market forces do not eliminate these effects - Shaping effects mostly persist when feedback is artificially low, and are somewhat eroded when it is artificially high - Anchoring effects persist and are possibly reinforced through group-specific feedback Prices DO matter in markets Markets do not necessarily reveal consistent preferences (provided such preferences exist) 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Conclusion Monetary valuations are malleable - Via price feedback (especially if high) - Via anchoring manipulations Market forces do not eliminate these effects - Shaping effects mostly persist when feedback is artificially low, and are somewhat eroded when it is artificially high - Anchoring effects persist and are possibly reinforced through group-specific feedback Prices DO matter in markets Markets do not necessarily reveal consistent preferences (provided such preferences exist) 1. The issues 2. Research questions 3. The experiment 4. Results 5. Conclusion

Thank you!

Thank you!