a42cc95c8a6d836310f5031dbe2d63b8.ppt

- Количество слайдов: 34

Monetary policy with an inflation target

Monetary policy with an inflation target

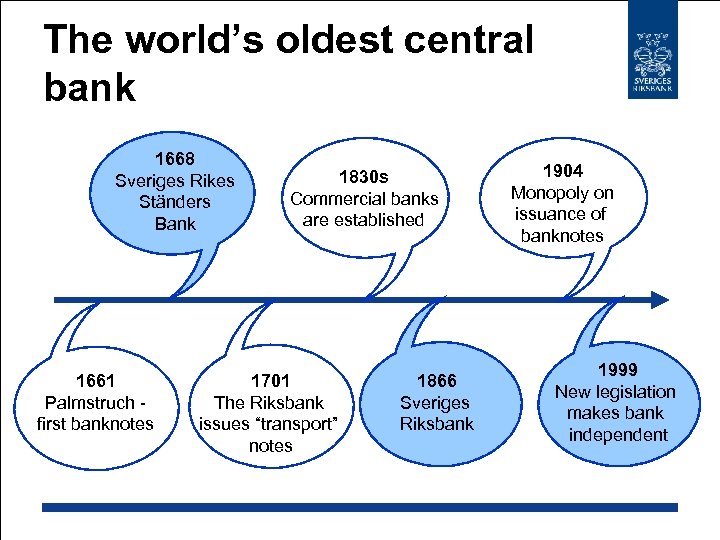

The world’s oldest central bank 1668 Sveriges Rikes Ständers Bank 1661 Palmstruch first banknotes 1830 s Commercial banks are established 1701 The Riksbank issues “transport” notes 1866 Sveriges Riksbank 1904 Monopoly on issuance of banknotes 1999 New legislation makes bank independent

The world’s oldest central bank 1668 Sveriges Rikes Ständers Bank 1661 Palmstruch first banknotes 1830 s Commercial banks are established 1701 The Riksbank issues “transport” notes 1866 Sveriges Riksbank 1904 Monopoly on issuance of banknotes 1999 New legislation makes bank independent

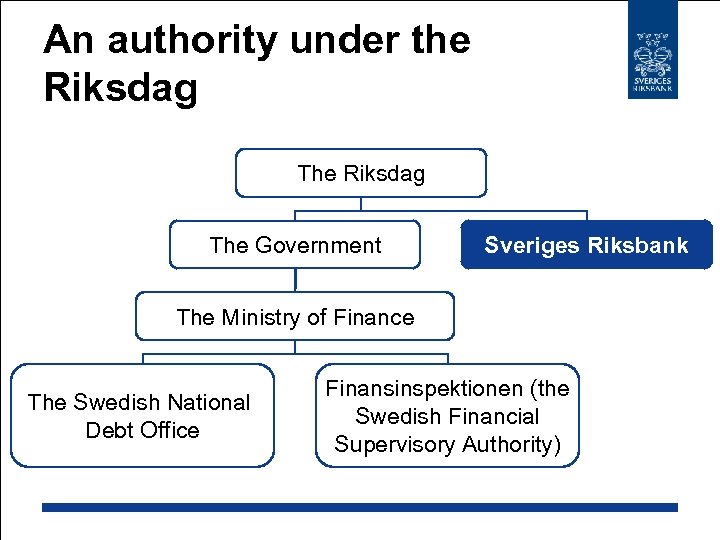

An authority under the Riksdag The Government Sveriges Riksbank The Ministry of Finance The Swedish National Debt Office Finansinspektionen (the Swedish Financial Supervisory Authority)

An authority under the Riksdag The Government Sveriges Riksbank The Ministry of Finance The Swedish National Debt Office Finansinspektionen (the Swedish Financial Supervisory Authority)

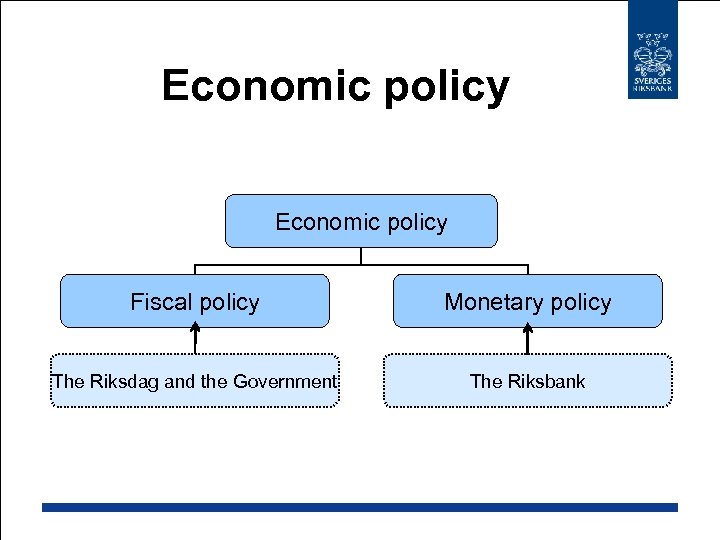

Economic policy Fiscal policy Monetary policy The Riksdag and the Government The Riksbank

Economic policy Fiscal policy Monetary policy The Riksdag and the Government The Riksbank

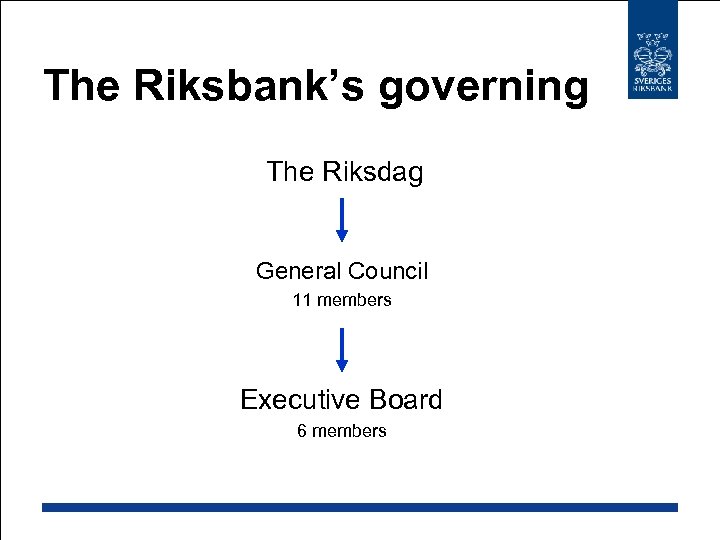

The Riksbank’s governing The Riksdag General Council 11 members Executive Board 6 members

The Riksbank’s governing The Riksdag General Council 11 members Executive Board 6 members

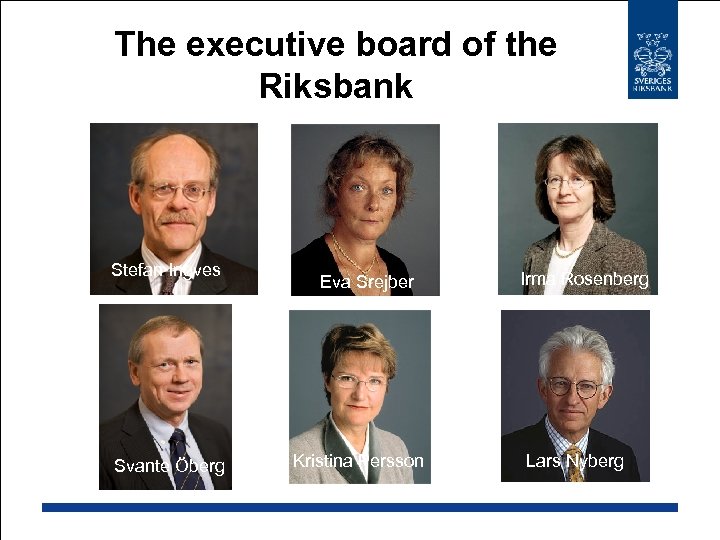

The executive board of the Riksbank Stefan Ingves Lars Heikensten Svante Öberg Eva Srejber Kristina Persson Irma Rosenberg Lars Nyberg

The executive board of the Riksbank Stefan Ingves Lars Heikensten Svante Öberg Eva Srejber Kristina Persson Irma Rosenberg Lars Nyberg

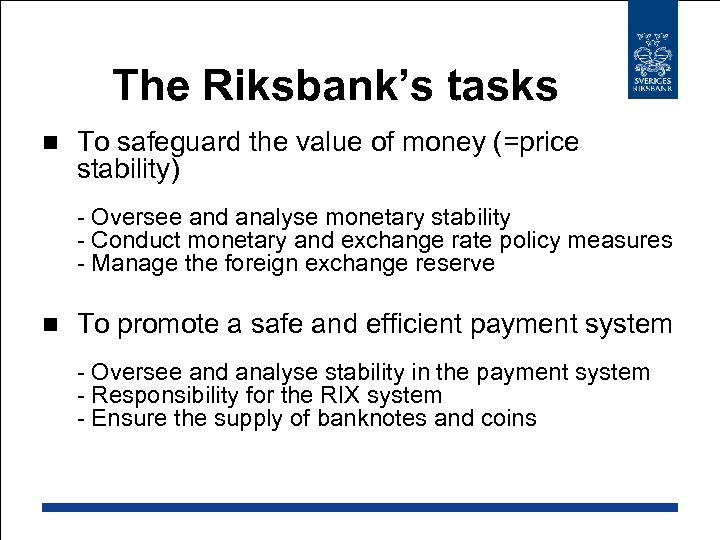

The Riksbank’s tasks n To safeguard the value of money (=price stability) - Oversee and analyse monetary stability - Conduct monetary and exchange rate policy measures - Manage the foreign exchange reserve n To promote a safe and efficient payment system - Oversee and analyse stability in the payment system - Responsibility for the RIX system - Ensure the supply of banknotes and coins

The Riksbank’s tasks n To safeguard the value of money (=price stability) - Oversee and analyse monetary stability - Conduct monetary and exchange rate policy measures - Manage the foreign exchange reserve n To promote a safe and efficient payment system - Oversee and analyse stability in the payment system - Responsibility for the RIX system - Ensure the supply of banknotes and coins

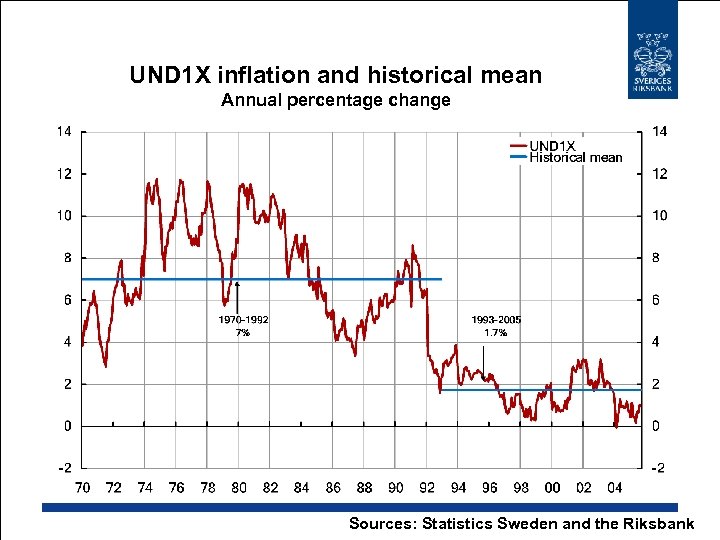

UND 1 X inflation and historical mean Annual percentage change Sources: Statistics Sweden and the Riksbank

UND 1 X inflation and historical mean Annual percentage change Sources: Statistics Sweden and the Riksbank

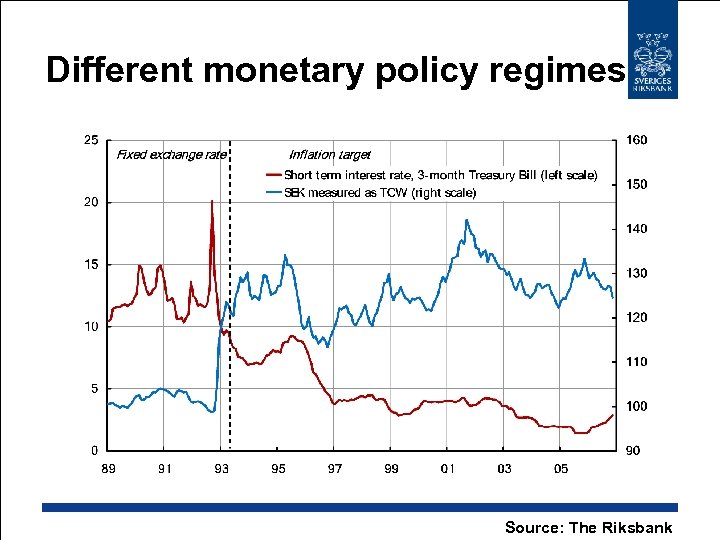

Different monetary policy regimes Source: The Riksbank

Different monetary policy regimes Source: The Riksbank

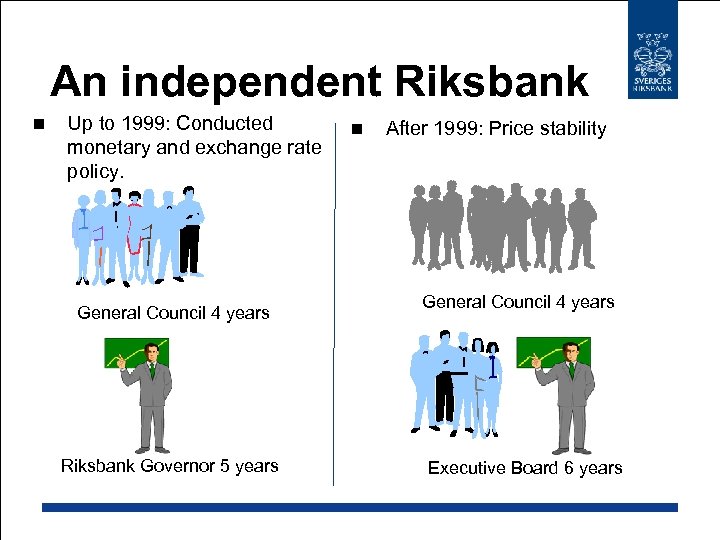

An independent Riksbank n Up to 1999: Conducted monetary and exchange rate policy. General Council 4 years Riksbank Governor 5 years n After 1999: Price stability General Council 4 years Executive Board 6 years

An independent Riksbank n Up to 1999: Conducted monetary and exchange rate policy. General Council 4 years Riksbank Governor 5 years n After 1999: Price stability General Council 4 years Executive Board 6 years

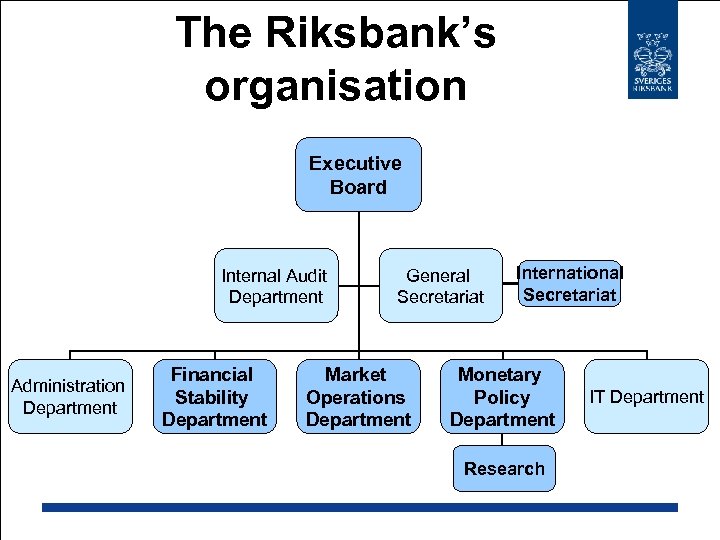

The Riksbank’s organisation Executive Board Internal Audit Department Administration Department Financial Stability Department General Secretariat Market Operations Department International Secretariat Monetary Policy Department Research IT Department

The Riksbank’s organisation Executive Board Internal Audit Department Administration Department Financial Stability Department General Secretariat Market Operations Department International Secretariat Monetary Policy Department Research IT Department

Monetary policy theory Why a price stability target? n Monetary policy can not affect employment in the long run n Establishing inflation expectations n High and fluctuating inflation increases uncertainty and affects investment n Costly to hold back inflation n High inflation leads to redistribution of income and wealth n One instrument – one target

Monetary policy theory Why a price stability target? n Monetary policy can not affect employment in the long run n Establishing inflation expectations n High and fluctuating inflation increases uncertainty and affects investment n Costly to hold back inflation n High inflation leads to redistribution of income and wealth n One instrument – one target

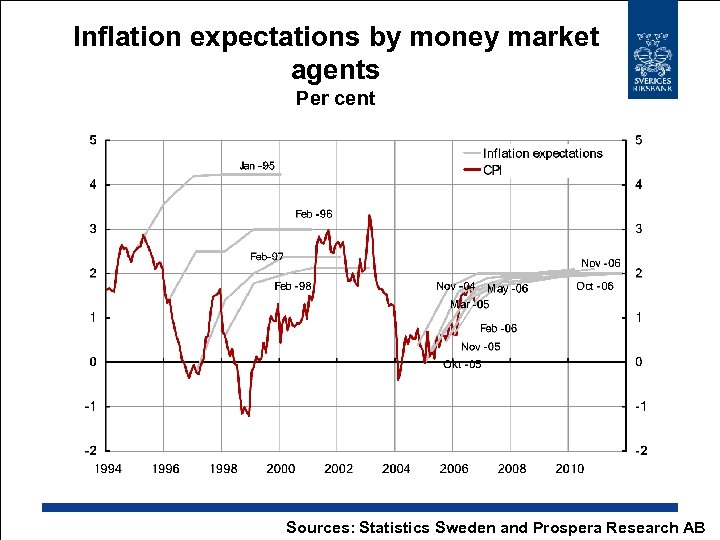

Inflation expectations by money market agents Per cent Sources: Statistics Sweden and Prospera Research AB

Inflation expectations by money market agents Per cent Sources: Statistics Sweden and Prospera Research AB

Why one to two years ahead? n Uncertainty over the transmisson mechanism n Reduce fluctuations in the real economy

Why one to two years ahead? n Uncertainty over the transmisson mechanism n Reduce fluctuations in the real economy

CPI or UND 1 X? …. . the change in the consumer price index as from 1995 shall be limited to 2 per cent, with a tolerance for deviations of 1 percentage point. General Council of the Riksbank 15 -011993 however excl. transitory effects (interest expenditure and indirect taxes) supply shocks – longer time horizon Executive Board of the Riksbank 04 -02 -1999

CPI or UND 1 X? …. . the change in the consumer price index as from 1995 shall be limited to 2 per cent, with a tolerance for deviations of 1 percentage point. General Council of the Riksbank 15 -011993 however excl. transitory effects (interest expenditure and indirect taxes) supply shocks – longer time horizon Executive Board of the Riksbank 04 -02 -1999

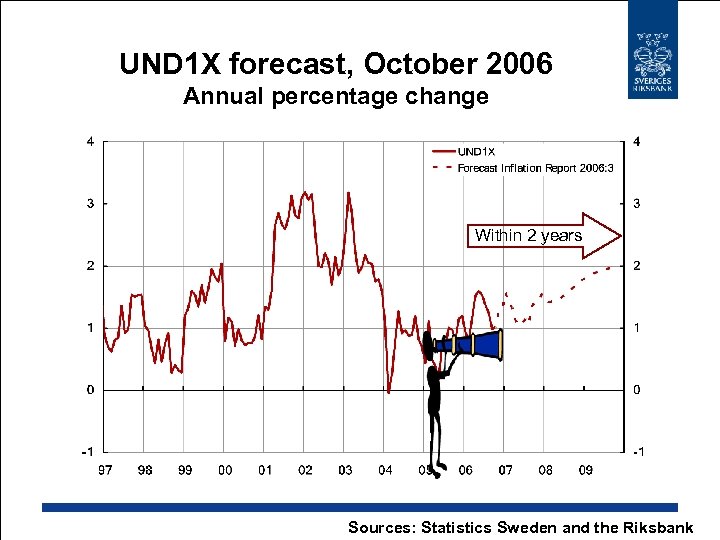

UND 1 X forecast, October 2006 Annual percentage change Within 2 years Sources: Statistics Sweden and the Riksbank

UND 1 X forecast, October 2006 Annual percentage change Within 2 years Sources: Statistics Sweden and the Riksbank

Inflation forecasts 8 monetary policy meetings per year - 4 (3) Inflation Reports - 4 updated assessments - 2 public hearings before the Riksdag Committee on Finance n

Inflation forecasts 8 monetary policy meetings per year - 4 (3) Inflation Reports - 4 updated assessments - 2 public hearings before the Riksdag Committee on Finance n

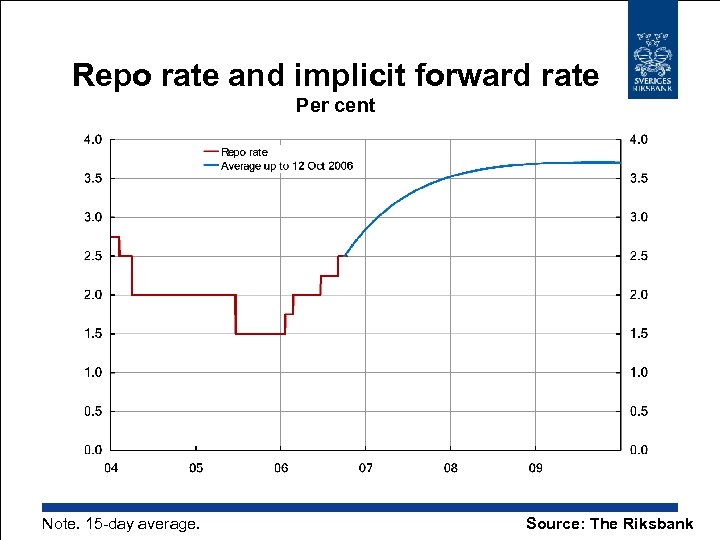

Repo rate and implicit forward rate Per cent Note. 15 -day average. Source: The Riksbank

Repo rate and implicit forward rate Per cent Note. 15 -day average. Source: The Riksbank

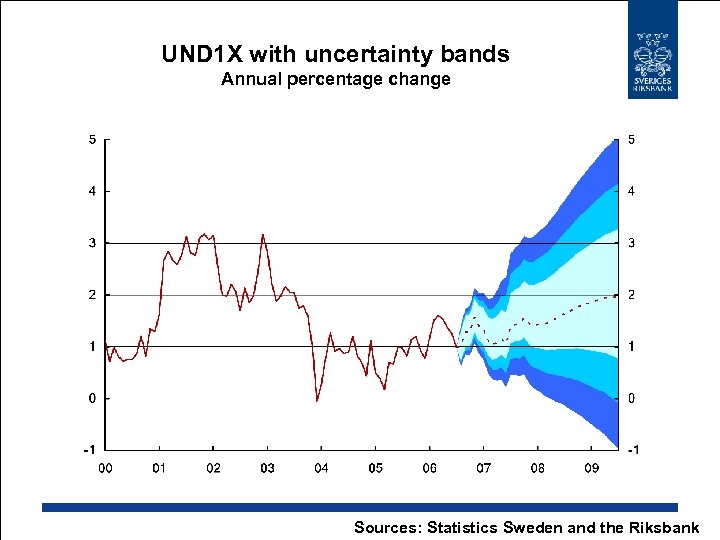

UND 1 X with uncertainty bands Annual percentage change Sources: Statistics Sweden and the Riksbank

UND 1 X with uncertainty bands Annual percentage change Sources: Statistics Sweden and the Riksbank

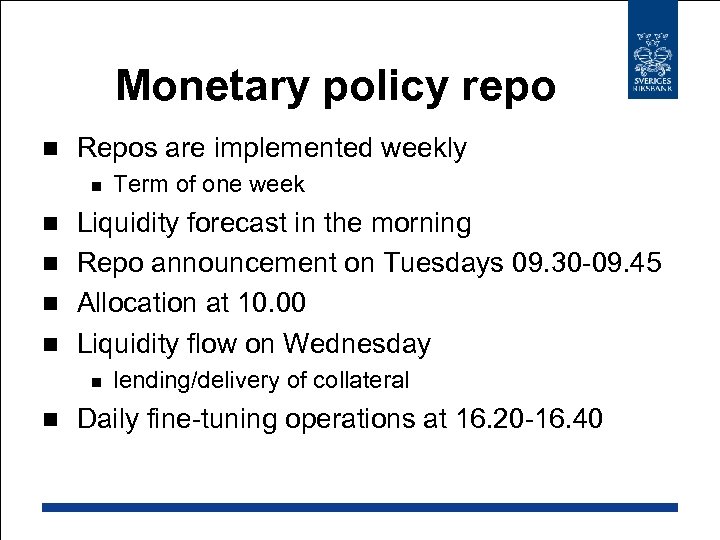

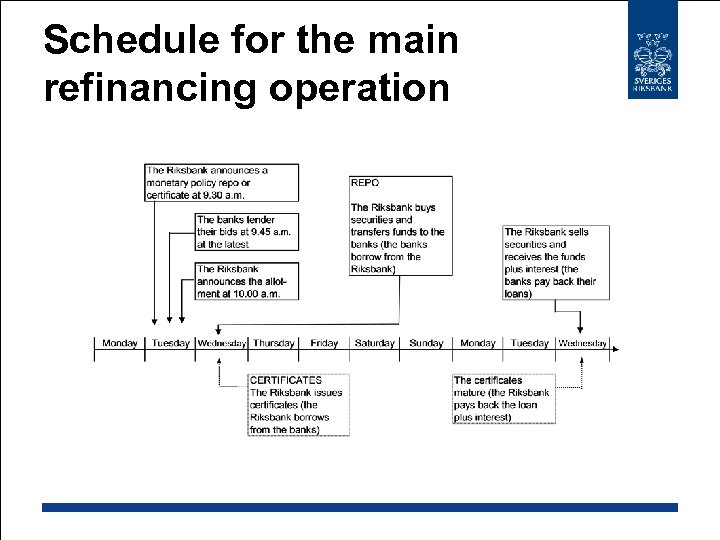

Monetary policy repo n Repos are implemented weekly n Term of one week Liquidity forecast in the morning n Repo announcement on Tuesdays 09. 30 -09. 45 n Allocation at 10. 00 n Liquidity flow on Wednesday n n n lending/delivery of collateral Daily fine-tuning operations at 16. 20 -16. 40

Monetary policy repo n Repos are implemented weekly n Term of one week Liquidity forecast in the morning n Repo announcement on Tuesdays 09. 30 -09. 45 n Allocation at 10. 00 n Liquidity flow on Wednesday n n n lending/delivery of collateral Daily fine-tuning operations at 16. 20 -16. 40

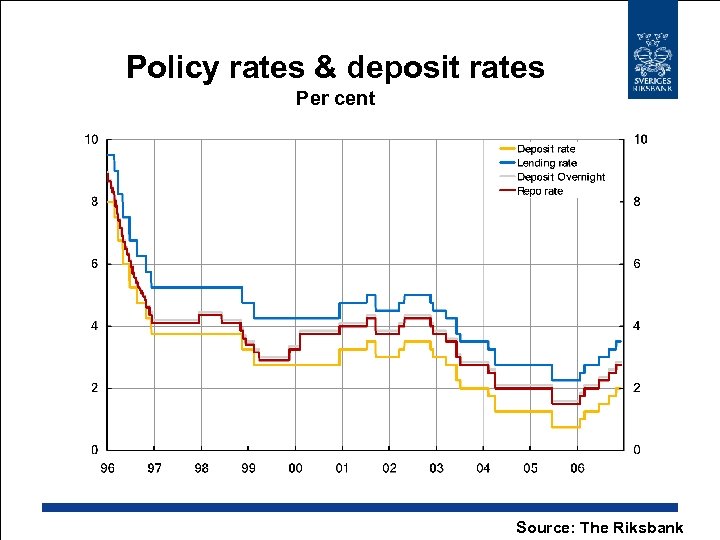

Policy rates & deposit rates Per cent Source: The Riksbank

Policy rates & deposit rates Per cent Source: The Riksbank

Signalling – influencing expectations n Inflation reports n Speeches n Minutes of monetary policy meetings n Policy rates

Signalling – influencing expectations n Inflation reports n Speeches n Minutes of monetary policy meetings n Policy rates

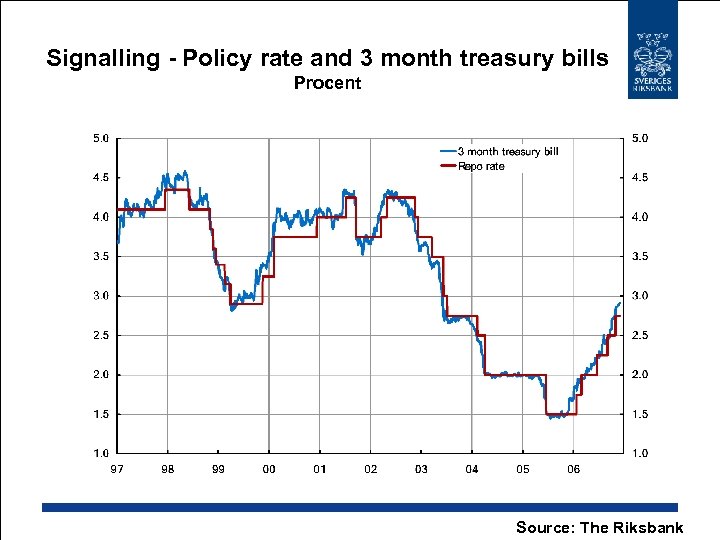

Signalling - Policy rate and 3 month treasury bills Procent Source: The Riksbank

Signalling - Policy rate and 3 month treasury bills Procent Source: The Riksbank

Summary n n n The Riksbank is an authority under the Riksdag Reasonably low inflation is beneficial (target of 2% +-1%) Repo rate change achieves full impact after 1 -2 years Independent from 1999 Openness => a tool that creates legitimacy

Summary n n n The Riksbank is an authority under the Riksdag Reasonably low inflation is beneficial (target of 2% +-1%) Repo rate change achieves full impact after 1 -2 years Independent from 1999 Openness => a tool that creates legitimacy

Monetary policy implementation

Monetary policy implementation

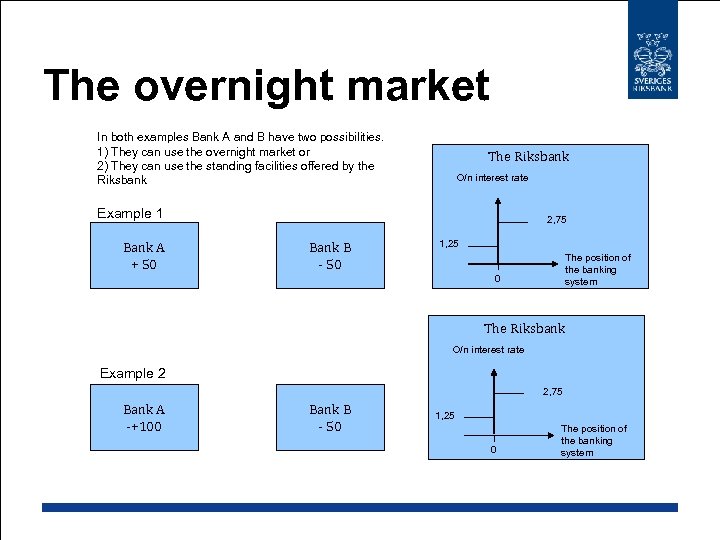

The overnight market In both examples Bank A and B have two possibilities. 1) They can use the overnight market or 2) They can use the standing facilities offered by the Riksbank The Riksbank O/n interest rate Example 1 Bank A + 50 2, 75 Bank B - 50 1, 25 The position of the banking system 0 The Riksbank O/n interest rate Example 2 2, 75 Bank A -+100 Bank B - 50 1, 25 0 The position of the banking system

The overnight market In both examples Bank A and B have two possibilities. 1) They can use the overnight market or 2) They can use the standing facilities offered by the Riksbank The Riksbank O/n interest rate Example 1 Bank A + 50 2, 75 Bank B - 50 1, 25 The position of the banking system 0 The Riksbank O/n interest rate Example 2 2, 75 Bank A -+100 Bank B - 50 1, 25 0 The position of the banking system

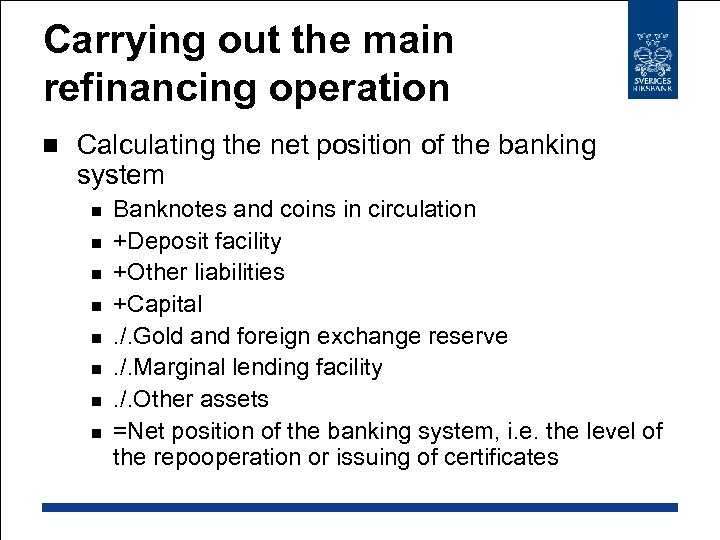

Carrying out the main refinancing operation n Calculating the net position of the banking system n n n n Banknotes and coins in circulation +Deposit facility +Other liabilities +Capital. /. Gold and foreign exchange reserve. /. Marginal lending facility. /. Other assets =Net position of the banking system, i. e. the level of the repooperation or issuing of certificates

Carrying out the main refinancing operation n Calculating the net position of the banking system n n n n Banknotes and coins in circulation +Deposit facility +Other liabilities +Capital. /. Gold and foreign exchange reserve. /. Marginal lending facility. /. Other assets =Net position of the banking system, i. e. the level of the repooperation or issuing of certificates

Schedule for the main refinancing operation

Schedule for the main refinancing operation

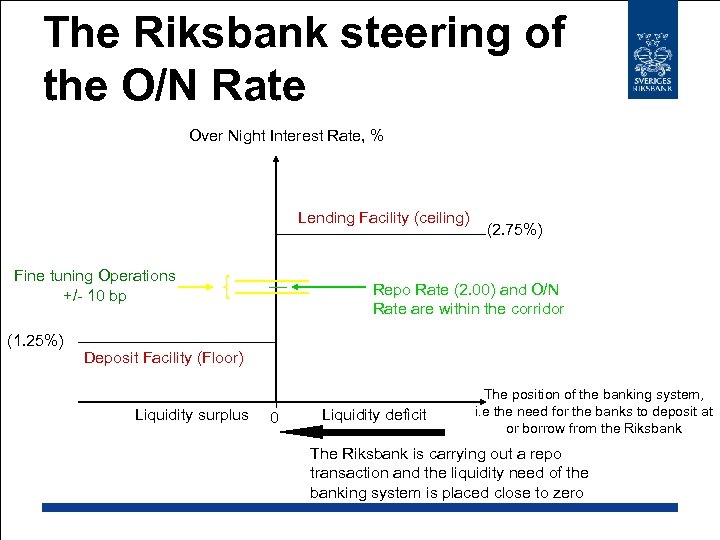

The Riksbank steering of the O/N Rate Over Night Interest Rate, % Lending Facility (ceiling) Fine tuning Operations +/- 10 bp (1. 25%) (2. 75%) Repo Rate (2. 00) and O/N Rate are within the corridor Deposit Facility (Floor) Liquidity surplus 0 Liquidity deficit The position of the banking system, i. e the need for the banks to deposit at or borrow from the Riksbank The Riksbank is carrying out a repo transaction and the liquidity need of the banking system is placed close to zero

The Riksbank steering of the O/N Rate Over Night Interest Rate, % Lending Facility (ceiling) Fine tuning Operations +/- 10 bp (1. 25%) (2. 75%) Repo Rate (2. 00) and O/N Rate are within the corridor Deposit Facility (Floor) Liquidity surplus 0 Liquidity deficit The position of the banking system, i. e the need for the banks to deposit at or borrow from the Riksbank The Riksbank is carrying out a repo transaction and the liquidity need of the banking system is placed close to zero

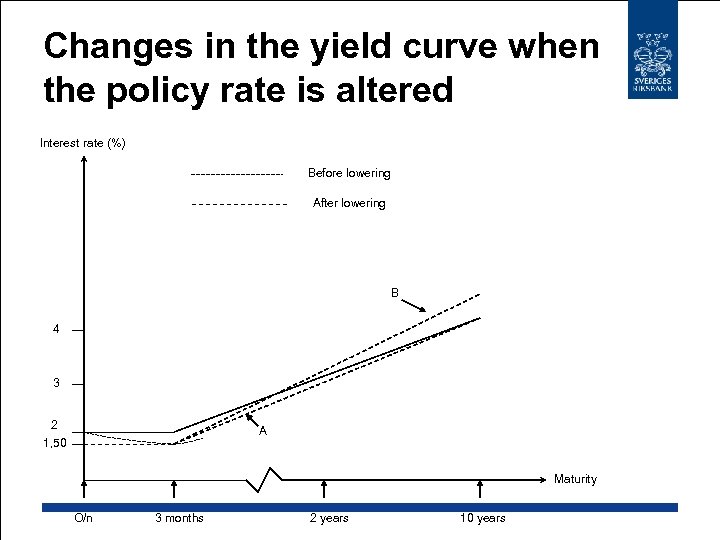

Changes in the yield curve when the policy rate is altered Interest rate (%) Before lowering After lowering B 4 3 2 1, 50 A Maturity O/n 3 months 2 years 10 years

Changes in the yield curve when the policy rate is altered Interest rate (%) Before lowering After lowering B 4 3 2 1, 50 A Maturity O/n 3 months 2 years 10 years

To sum up The banking system has always the possibility to deposit or borrow over night at predefined interest rates, thus the overnight interest rate will be between these two interest rates. n In order to stabilise the short term interest rate we carry out different monetary policy operations, above all a weekly repo operation and daily fine tuning. n

To sum up The banking system has always the possibility to deposit or borrow over night at predefined interest rates, thus the overnight interest rate will be between these two interest rates. n In order to stabilise the short term interest rate we carry out different monetary policy operations, above all a weekly repo operation and daily fine tuning. n

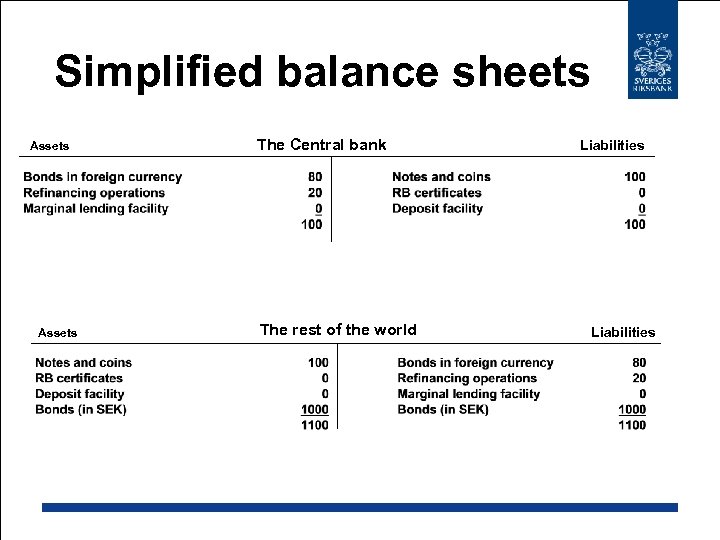

Simplified balance sheets Assets The Central bank The rest of the world Liabilities

Simplified balance sheets Assets The Central bank The rest of the world Liabilities

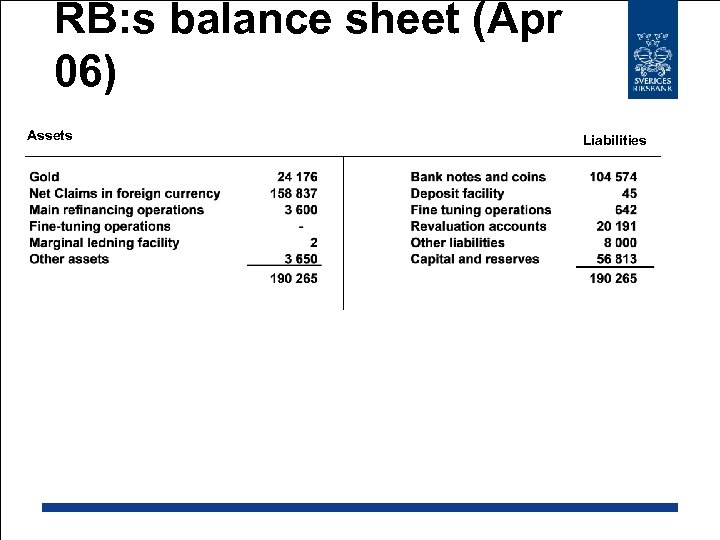

RB: s balance sheet (Apr 06) Assets Liabilities

RB: s balance sheet (Apr 06) Assets Liabilities

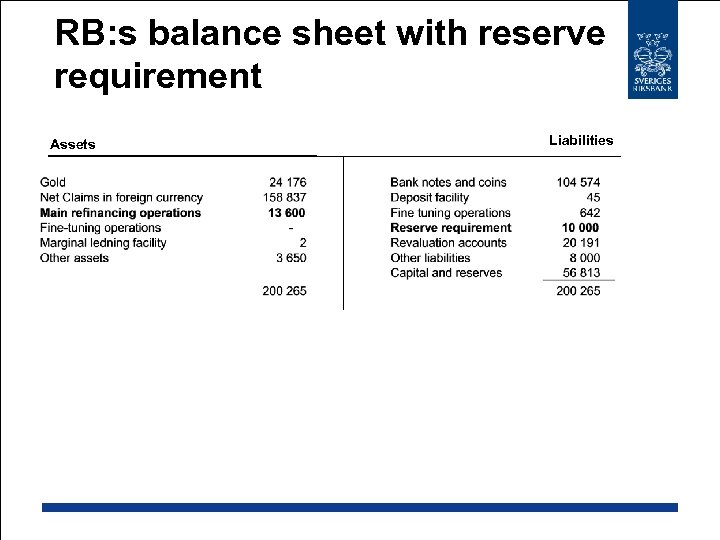

RB: s balance sheet with reserve requirement Assets Liabilities

RB: s balance sheet with reserve requirement Assets Liabilities