4e6a8f21063c3da2f651e36247b2669f.ppt

- Количество слайдов: 37

Monetary Policy the “Fed” Alan Greenspan

Monetary Policy the “Fed” Alan Greenspan

How Banks Create Money

How Banks Create Money

The Monetary Multiplier :

The Monetary Multiplier :

MPS Multiplier

MPS Multiplier

RR Multiplier

RR Multiplier

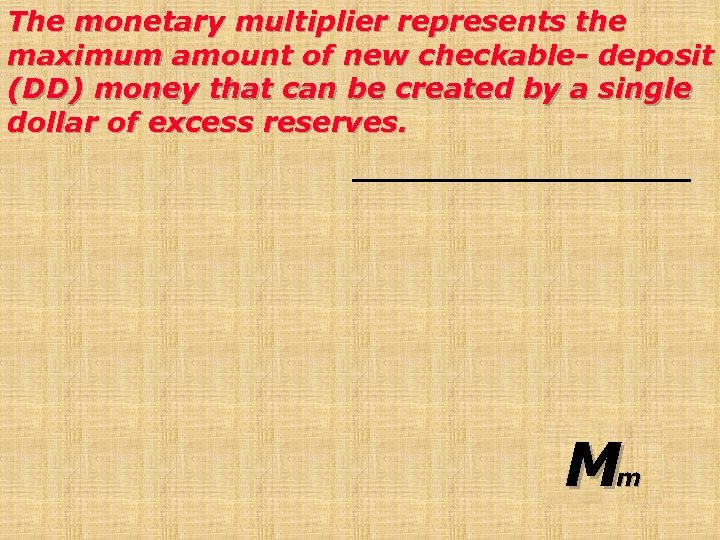

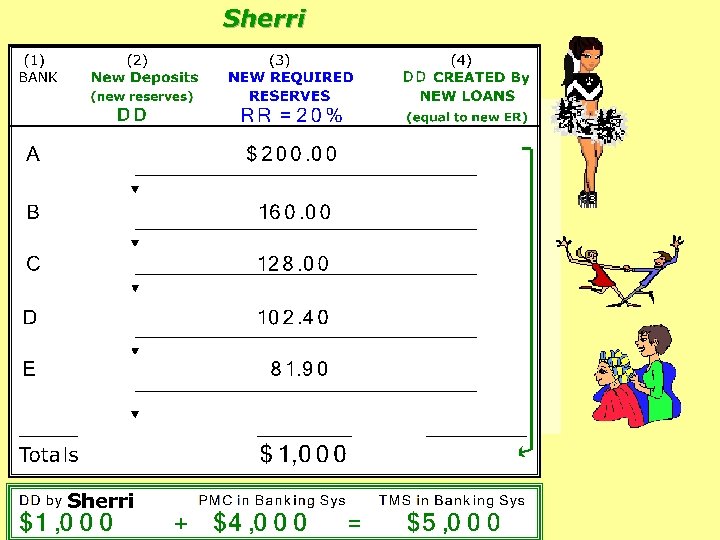

The monetary multiplier represents the maximum amount of new checkable- deposit (DD) money that can be created by a single dollar of excess reserves. M m

The monetary multiplier represents the maximum amount of new checkable- deposit (DD) money that can be created by a single dollar of excess reserves. M m

Sherri Dell Sam’s Canon Target Sherri

Sherri Dell Sam’s Canon Target Sherri

TMS = $500. 00

TMS = $500. 00

Monetary policy; the deliberate changes in the money supply to influence interest rates and thus the total level of spending in the econom Only “fiscal or monetary policy can get me back on my feet and allow “Sam” to get back up u

Monetary policy; the deliberate changes in the money supply to influence interest rates and thus the total level of spending in the econom Only “fiscal or monetary policy can get me back on my feet and allow “Sam” to get back up u

When the economy is not partying at all (recession), the Fed job is to “spike the punch. ”

When the economy is not partying at all (recession), the Fed job is to “spike the punch. ”

ASSETS of the Fed; • Securities government bonds that are ; part of the public debt (money borrowe borrow by the government). Securities accoun for 90% of the Fed’s assets • Loans to Commercial Banks; IOUs of commercial banks that are claims against the assets of commercial bank

ASSETS of the Fed; • Securities government bonds that are ; part of the public debt (money borrowe borrow by the government). Securities accoun for 90% of the Fed’s assets • Loans to Commercial Banks; IOUs of commercial banks that are claims against the assets of commercial bank

LIABILITIES of the Fed; • Reserves of Commercial Banks ; the Fed requires banks to hold reserves against thei checkable deposits. These reserves are stor in Federal Reserve Banks. • Treasury Depositsthe U. S. Treasury keeps ; deposits in the Fed and draws checks on the to pay its obligations. • Federal Reserve Notes ; money in circulation is a claim against the assets of Federal Reserv Banks. 90% of the Fed’s liabilities are reser notes.

LIABILITIES of the Fed; • Reserves of Commercial Banks ; the Fed requires banks to hold reserves against thei checkable deposits. These reserves are stor in Federal Reserve Banks. • Treasury Depositsthe U. S. Treasury keeps ; deposits in the Fed and draws checks on the to pay its obligations. • Federal Reserve Notes ; money in circulation is a claim against the assets of Federal Reserv Banks. 90% of the Fed’s liabilities are reser notes.

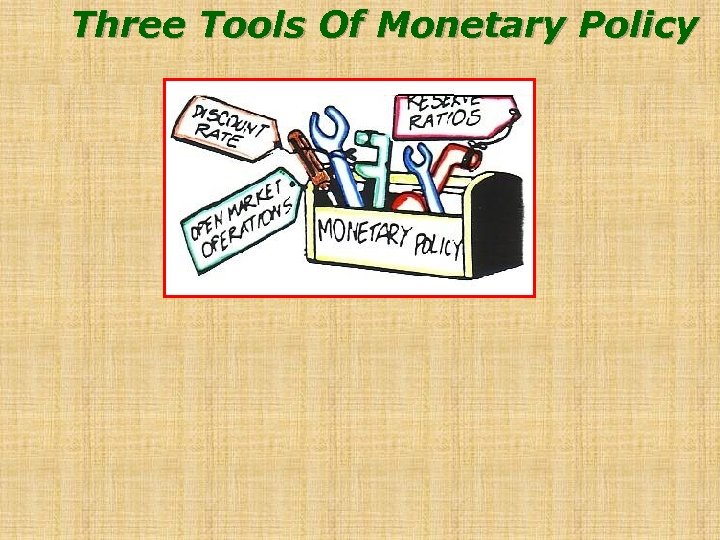

Three Tools Of Monetary Policy

Three Tools Of Monetary Policy

2. The Reserve Ratio - The most powerful & seldom used - It affects money creation by changing ER and the multiplier RR - Atomic Bomb of Monetary Policy

2. The Reserve Ratio - The most powerful & seldom used - It affects money creation by changing ER and the multiplier RR - Atomic Bomb of Monetary Policy

The Reserve Ratio: RR - Atomic Bomb of Monetary Policy

The Reserve Ratio: RR - Atomic Bomb of Monetary Policy

Atomic Bomb of Monetary Policy Suppose the banking system has $500 billion in DD. The RR is 12% & TR is $60 billion There areno ER. in this system, thus no new loans can be made (500 x. 12 = 60). Now, what if the Fed lowers the RR to 10%, hat w would be the affect on the banking system?

Atomic Bomb of Monetary Policy Suppose the banking system has $500 billion in DD. The RR is 12% & TR is $60 billion There areno ER. in this system, thus no new loans can be made (500 x. 12 = 60). Now, what if the Fed lowers the RR to 10%, hat w would be the affect on the banking system?

Atomic Bomb of Monetary Policy

Atomic Bomb of Monetary Policy

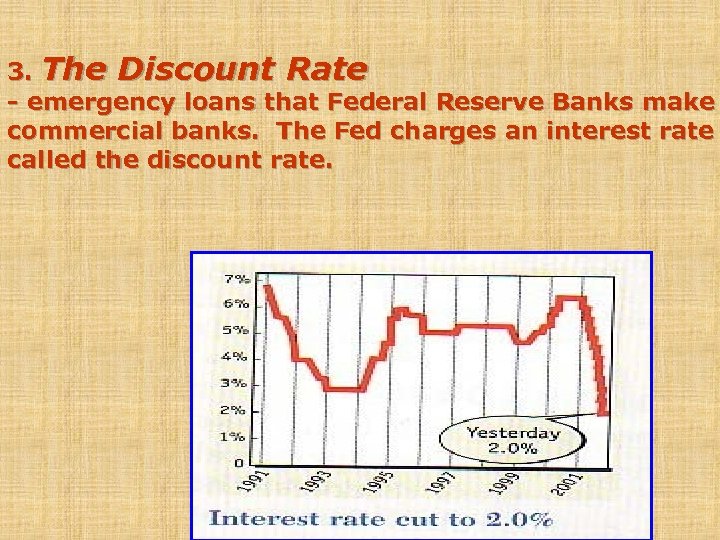

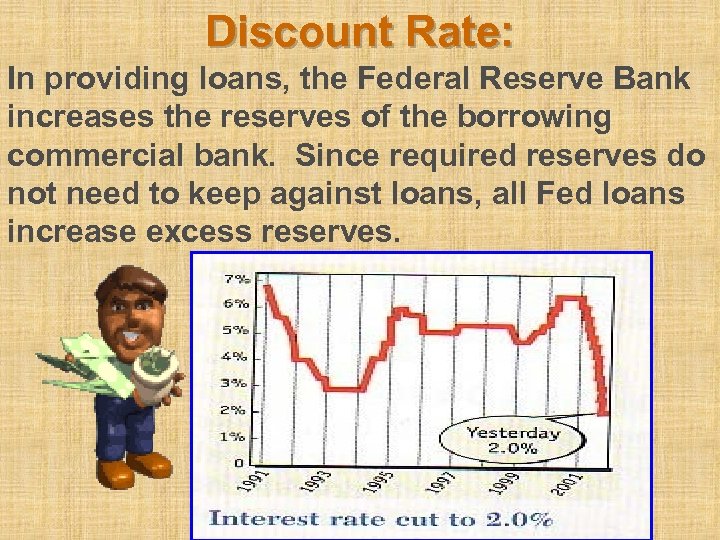

3. The Discount Rate - emergency loans that Federal Reserve Banks make commercial banks. The Fed charges an interest rate called the discount rate.

3. The Discount Rate - emergency loans that Federal Reserve Banks make commercial banks. The Fed charges an interest rate called the discount rate.

Discount Rate: In providing loans, the Federal Reserve Bank increases the reserves of the borrowing commercial bank. Since required reserves do not need to keep against loans, all Fed loans increase excess reserves.

Discount Rate: In providing loans, the Federal Reserve Bank increases the reserves of the borrowing commercial bank. Since required reserves do not need to keep against loans, all Fed loans increase excess reserves.

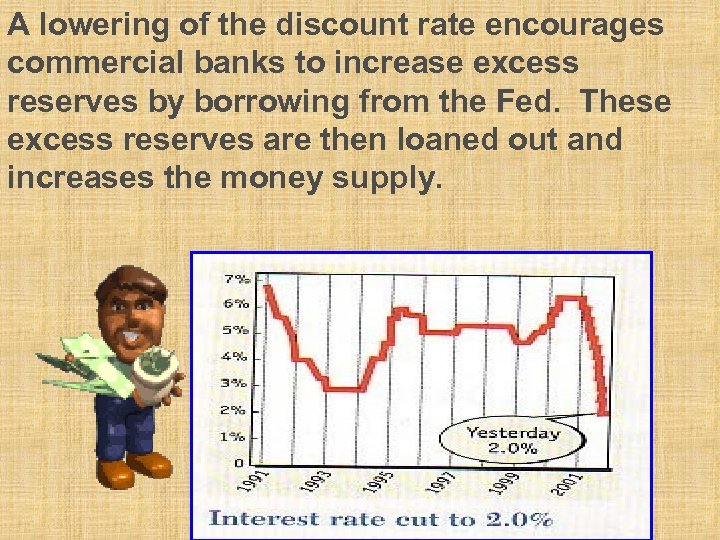

A lowering of the discount rate encourages commercial banks to increase excess reserves by borrowing from the Fed. These excess reserves are then loaned out and increases the money supply.

A lowering of the discount rate encourages commercial banks to increase excess reserves by borrowing from the Fed. These excess reserves are then loaned out and increases the money supply.

Easy money Policy: When the economy faces a recession and unemployment, the Fed will decide to increase the money supply in order to increase aggregate demand. To do this the Fed will either;

Easy money Policy: When the economy faces a recession and unemployment, the Fed will decide to increase the money supply in order to increase aggregate demand. To do this the Fed will either;

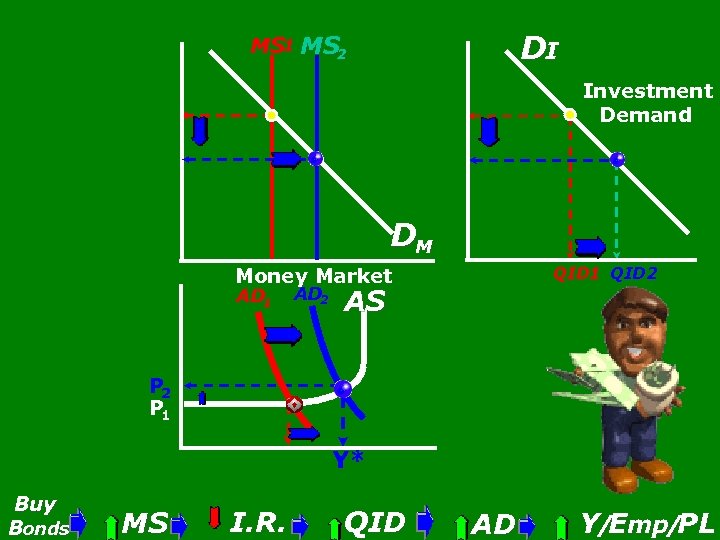

DI MS 1 MS 2 Investment Demand DM Money Market AD 1 AD 2 QID 1 QID 2 AS P 2 P 1 Y* Buy Bonds MS I. R. QID AD Y/Emp/PL

DI MS 1 MS 2 Investment Demand DM Money Market AD 1 AD 2 QID 1 QID 2 AS P 2 P 1 Y* Buy Bonds MS I. R. QID AD Y/Emp/PL

Tight money Policy: When the economy is in an inflationary spiral, the Fed will decide to decrease the money supply in order to decrease aggregate demand, which will decrease demand-pull inflation. They will do this by;

Tight money Policy: When the economy is in an inflationary spiral, the Fed will decide to decrease the money supply in order to decrease aggregate demand, which will decrease demand-pull inflation. They will do this by;

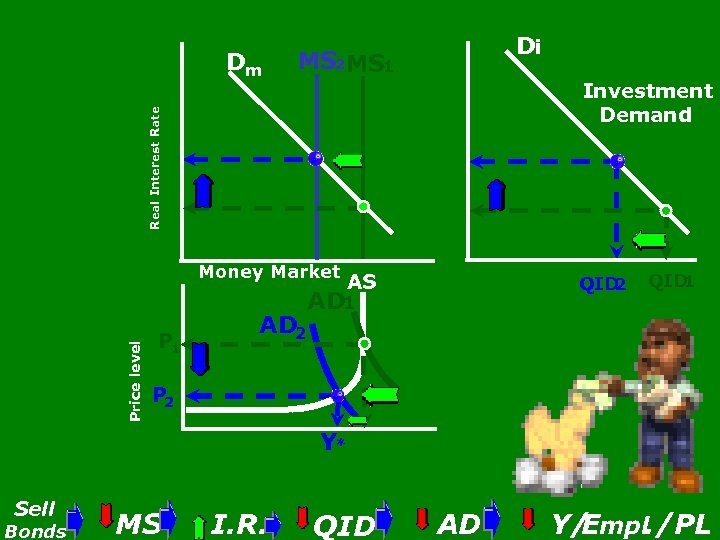

MS 2 MS 1 Investment Demand Real Interest Rate Dm Di Price level Money Market P 1 AD 2 AS QID 2 AD 1 QID 1 P 2 Y* Sell Bonds MS I. R. QID AD Y/ mpl. /PL E

MS 2 MS 1 Investment Demand Real Interest Rate Dm Di Price level Money Market P 1 AD 2 AS QID 2 AD 1 QID 1 P 2 Y* Sell Bonds MS I. R. QID AD Y/ mpl. /PL E

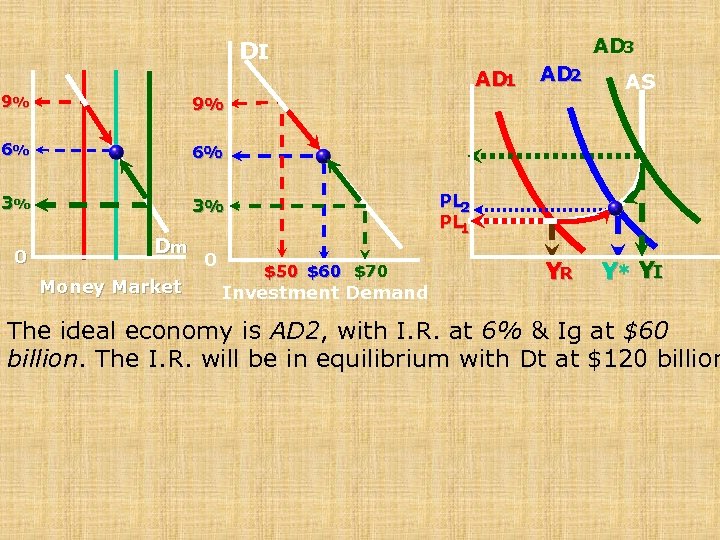

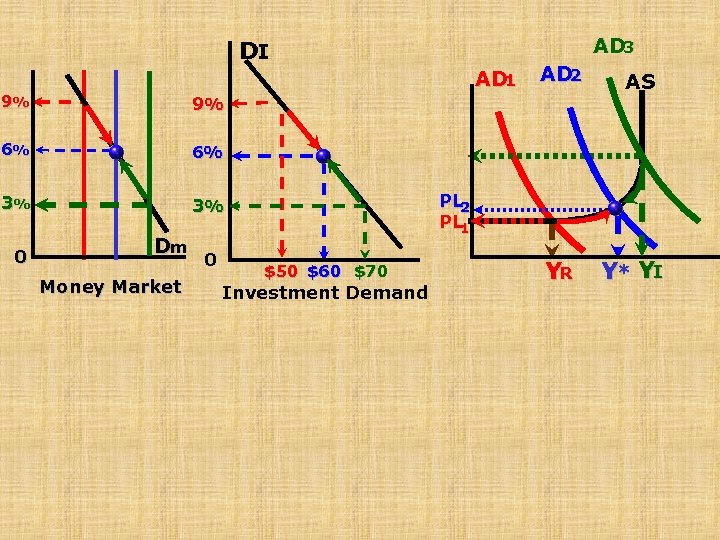

AD 3 DI AD 1 9% 9% 6% 3% AS 6% 3% AD 2 0 Dm Money Market 0 PL 2 PL 1 $50 $60 $70 Investment Demand YR Y* YI The ideal economy is AD 2, with I. R. at 6% & Ig at $60 billion. The I. R. will be in equilibrium with Dt at $120 billion

AD 3 DI AD 1 9% 9% 6% 3% AS 6% 3% AD 2 0 Dm Money Market 0 PL 2 PL 1 $50 $60 $70 Investment Demand YR Y* YI The ideal economy is AD 2, with I. R. at 6% & Ig at $60 billion. The I. R. will be in equilibrium with Dt at $120 billion

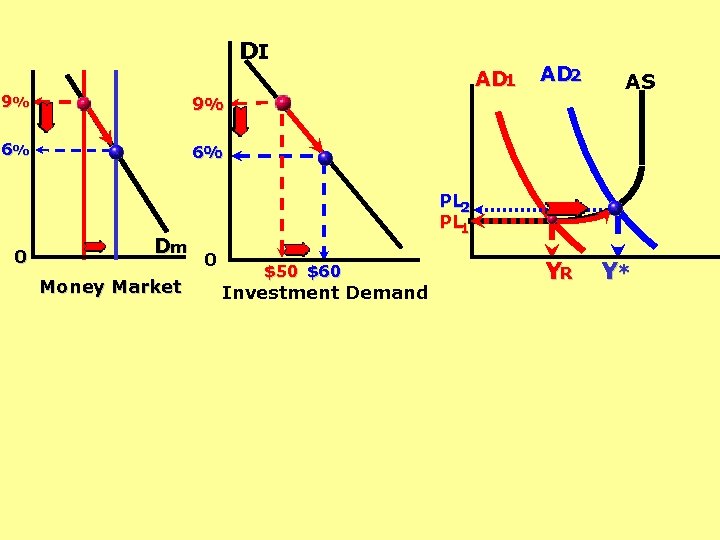

DI AD 1 9% 9% 6% AD 2 AS 6% 0 Dm Money Market PL 2 PL 1 0 $50 $60 Investment Demand YR Y*

DI AD 1 9% 9% 6% AD 2 AS 6% 0 Dm Money Market PL 2 PL 1 0 $50 $60 Investment Demand YR Y*

AD 3 DI AD 1 9% 9% 6% 3% AS 6% 3% AD 2 0 Dm Money Market 0 PL 2 PL 1 $50 $60 $70 Investment Demand YR Y* YI

AD 3 DI AD 1 9% 9% 6% 3% AS 6% 3% AD 2 0 Dm Money Market 0 PL 2 PL 1 $50 $60 $70 Investment Demand YR Y* YI

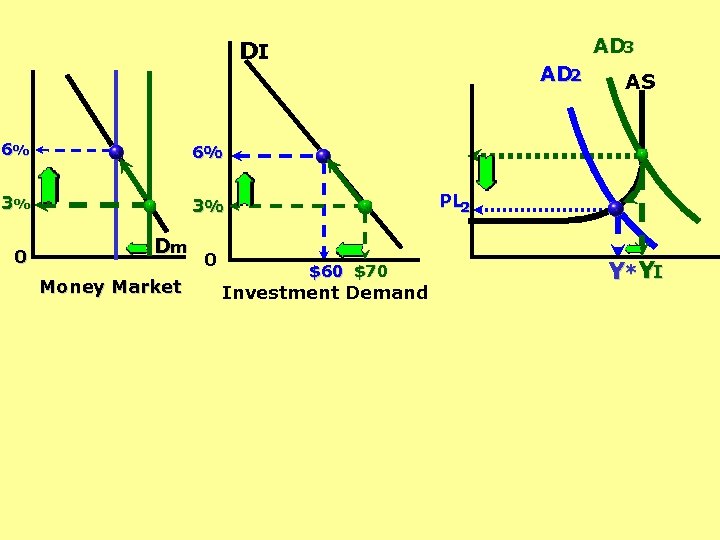

AD 3 DI 6% 3% AS 6% 3% AD 2 0 Dm Money Market 0 PL 2 $60 $70 Investment Demand Y*YI

AD 3 DI 6% 3% AS 6% 3% AD 2 0 Dm Money Market 0 PL 2 $60 $70 Investment Demand Y*YI

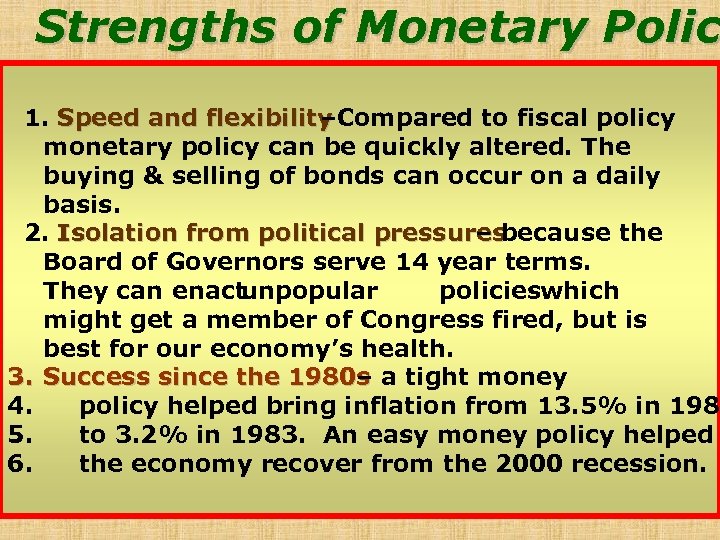

Strengths of Monetary Polic 1. Speed and flexibility –Compared to fiscal policy monetary policy can be quickly altered. The buying & selling of bonds can occur on a daily basis. 2. Isolation from political pressures – because the Board of Governors serve 14 year terms. They can enact unpopular policieswhich might get a member of Congress fired, but is best for our economy’s health. 3. Success since the 1980 s a tight money – 4. policy helped bring inflation from 13. 5% in 198 5. to 3. 2% in 1983. An easy money policy helped 6. the economy recover from the 2000 recession.

Strengths of Monetary Polic 1. Speed and flexibility –Compared to fiscal policy monetary policy can be quickly altered. The buying & selling of bonds can occur on a daily basis. 2. Isolation from political pressures – because the Board of Governors serve 14 year terms. They can enact unpopular policieswhich might get a member of Congress fired, but is best for our economy’s health. 3. Success since the 1980 s a tight money – 4. policy helped bring inflation from 13. 5% in 198 5. to 3. 2% in 1983. An easy money policy helped 6. the economy recover from the 2000 recession.

The End

The End