78eaf1ec77785deff22210b992170876.ppt

- Количество слайдов: 48

MONETARY POLICY

MONETARY POLICY

MONETARY POLICY It is a policy statement, traditionally bi-annual, through which RBI targets a key set of indicators to ensure price stability in the economy. Besides, the policy also provides a platform for the Apex Bank to announce norms for financial bodies governed by it like banks, financial institutions, nonbanking finance companies, primary dealers, etc.

MONETARY POLICY It is a policy statement, traditionally bi-annual, through which RBI targets a key set of indicators to ensure price stability in the economy. Besides, the policy also provides a platform for the Apex Bank to announce norms for financial bodies governed by it like banks, financial institutions, nonbanking finance companies, primary dealers, etc.

IMPORTANT OBJECTIVES v To ensure the economic stability at full employment or potential level of output. v To achieve price stability by controlling inflation and deflation. v To promote and encourage economic growth in the economy. v Exchange Rate Stability

IMPORTANT OBJECTIVES v To ensure the economic stability at full employment or potential level of output. v To achieve price stability by controlling inflation and deflation. v To promote and encourage economic growth in the economy. v Exchange Rate Stability

MONETARY POLICY • It is concerned with changing the supply of money stock and rate of interest for the purpose of stabilizing the economy at full employment or potential output level by influencing the level of aggregate demand. • At times of recession monetary policy involves the adoption of some monetary tools which tend to increase the money supply and lower interest rate so as to stimulate aggregate demand in the economy. • At the time of inflation monetary policy seeks to contract aggregate spending by tightening the money supply or raising the rate of return.

MONETARY POLICY • It is concerned with changing the supply of money stock and rate of interest for the purpose of stabilizing the economy at full employment or potential output level by influencing the level of aggregate demand. • At times of recession monetary policy involves the adoption of some monetary tools which tend to increase the money supply and lower interest rate so as to stimulate aggregate demand in the economy. • At the time of inflation monetary policy seeks to contract aggregate spending by tightening the money supply or raising the rate of return.

Money Supply the total stock of money which is in circulation in an economy at any given point of time. It implies the total stock of money held by the public

Money Supply the total stock of money which is in circulation in an economy at any given point of time. It implies the total stock of money held by the public

Money Supply • Money is a stock as well as a flow concept • When money supply is viewed at a given point of time, it is a stock. • It consists of total currency notes, coins demand deposits (deposits in saving account and current accounts) with the bank held by the public. • Thus, stock of money held by the public is called money supply.

Money Supply • Money is a stock as well as a flow concept • When money supply is viewed at a given point of time, it is a stock. • It consists of total currency notes, coins demand deposits (deposits in saving account and current accounts) with the bank held by the public. • Thus, stock of money held by the public is called money supply.

• When money supply is viewed over a period of time, money supply becomes a flow concept. • Here money may be spent several times during a given time period, passing from one hand to another.

• When money supply is viewed over a period of time, money supply becomes a flow concept. • Here money may be spent several times during a given time period, passing from one hand to another.

• The average number of times a unit of money circulating from one hand to another in the process of spending during a given year is called as the ‘velocity of circulation of money • The flow of money supply over the period of time can be calculated by multiplying stock of money held by the public (M) by the velocity of circulation of money (V) • The flow of money supply as given by Fisher is : MV

• The average number of times a unit of money circulating from one hand to another in the process of spending during a given year is called as the ‘velocity of circulation of money • The flow of money supply over the period of time can be calculated by multiplying stock of money held by the public (M) by the velocity of circulation of money (V) • The flow of money supply as given by Fisher is : MV

Definition of Money Supply in India • Based on two fundamental functions of money viz. medium of exchange and store of value, the reserve bank of India has adopted four measures of money supply expressed as M 1, M 2, M 3 and M 4

Definition of Money Supply in India • Based on two fundamental functions of money viz. medium of exchange and store of value, the reserve bank of India has adopted four measures of money supply expressed as M 1, M 2, M 3 and M 4

Concept of M 1 Money Aggregates Old Series

Concept of M 1 Money Aggregates Old Series

Concept of M 2 • M 2 is a broader concept of money supply in India than M 1. In addition to the above mentioned three items of M 1, this concept of M 2 includes saving deposits with post office saving banks. Thus, M 2 = M 1 + saving deposits with post office • Post office saving banks is not as liquid as demand deposits with banks (commercial or cooperative) as they are not chequeable account. However, saving deposits with post office are more liquid than time deposits with the bank. Money Aggregates Old Series

Concept of M 2 • M 2 is a broader concept of money supply in India than M 1. In addition to the above mentioned three items of M 1, this concept of M 2 includes saving deposits with post office saving banks. Thus, M 2 = M 1 + saving deposits with post office • Post office saving banks is not as liquid as demand deposits with banks (commercial or cooperative) as they are not chequeable account. However, saving deposits with post office are more liquid than time deposits with the bank. Money Aggregates Old Series

Concept of M 3: M 3 is again a broad concept of money supply. It is based on Milton Freidman’s approach to the definition of money supply which include time deposits besides demand deposits and currency money as the components of money supply thus, M 3 = M 1 + Time Deposits with Banks This is the broadest measure of money; it is used by economists to estimate the entire supply of money within an economy. M 3 is also called as Aggregate Monetary Resources ( AMR ) Money Aggregates Old Series

Concept of M 3: M 3 is again a broad concept of money supply. It is based on Milton Freidman’s approach to the definition of money supply which include time deposits besides demand deposits and currency money as the components of money supply thus, M 3 = M 1 + Time Deposits with Banks This is the broadest measure of money; it is used by economists to estimate the entire supply of money within an economy. M 3 is also called as Aggregate Monetary Resources ( AMR ) Money Aggregates Old Series

Concept of M 4 • M 4 is an expanded measure of M 3. • M 4 =M 3 + Total Deposits with the Post Office Saving Organization(excluding NSC) • The Reserve Bank of India regards these four measures of money supply i. e. M 1, M 2, M 3 and M 4 in the descending order of liquidity. It supplies data on them in its annual Report on Currency and Finance. Money Aggregates Old Series

Concept of M 4 • M 4 is an expanded measure of M 3. • M 4 =M 3 + Total Deposits with the Post Office Saving Organization(excluding NSC) • The Reserve Bank of India regards these four measures of money supply i. e. M 1, M 2, M 3 and M 4 in the descending order of liquidity. It supplies data on them in its annual Report on Currency and Finance. Money Aggregates Old Series

Monetary Aggregates: New Series • RBI has revised monetary data since April 1992, and since 1999, has started publishing the new monetary aggregates, namely M 0 ( monetary base), NM 1(Narrow money), NM 2 ( Intermediate monetary aggregate) and NM 3 ( Broad money) based on the residency concept. • The new series clearly distinguishes between monetary aggregates and liquidity aggregates.

Monetary Aggregates: New Series • RBI has revised monetary data since April 1992, and since 1999, has started publishing the new monetary aggregates, namely M 0 ( monetary base), NM 1(Narrow money), NM 2 ( Intermediate monetary aggregate) and NM 3 ( Broad money) based on the residency concept. • The new series clearly distinguishes between monetary aggregates and liquidity aggregates.

NM 1= Currency with public + Demand deposits with the banking system + other deposits with RBI + Demand liabilities portion of savings deposits with the banking system NM 2= NM 1 + time liabilities portion of savings deposits with the banking system + certificates of deposits issued by banks + term deposits of residents with a contractual maturity upto and including one year with the banking system Monetary Aggregates: New Series

NM 1= Currency with public + Demand deposits with the banking system + other deposits with RBI + Demand liabilities portion of savings deposits with the banking system NM 2= NM 1 + time liabilities portion of savings deposits with the banking system + certificates of deposits issued by banks + term deposits of residents with a contractual maturity upto and including one year with the banking system Monetary Aggregates: New Series

NM 3= NM 2+ Long-term deposits of residents + Call/Term funding from financial institutions NM 1 includes only non-interest bearing assets, monetary liabilities of the banking sector. NM 3, on the other hand, is an all encompassing measure that includes long-term deposits. NM 2 is an intermediate monetary aggregate that stands in between narrow money NM 1 and Broad money NM 3. Monetary Aggregates: New Series

NM 3= NM 2+ Long-term deposits of residents + Call/Term funding from financial institutions NM 1 includes only non-interest bearing assets, monetary liabilities of the banking sector. NM 3, on the other hand, is an all encompassing measure that includes long-term deposits. NM 2 is an intermediate monetary aggregate that stands in between narrow money NM 1 and Broad money NM 3. Monetary Aggregates: New Series

Liquidity Indicators Along with the above monetary aggregates for the proper assessment of the liquidity the RBI also compiles and evaluates three different liquidity indicators L 1, L 2 and L 3. L 1 = NM 3 + All deposits with the post office savings banks ( excluding National Savings Certificate)

Liquidity Indicators Along with the above monetary aggregates for the proper assessment of the liquidity the RBI also compiles and evaluates three different liquidity indicators L 1, L 2 and L 3. L 1 = NM 3 + All deposits with the post office savings banks ( excluding National Savings Certificate)

Liquidity Indicators L 2 = L 1+ Term deposits with term lending institutions and refinancing institutions (FIs) + Term borrowing by FIs + Certificate of deposits issued by FIs L 3 = L 2 + Public deposits of non- banking financial companies.

Liquidity Indicators L 2 = L 1+ Term deposits with term lending institutions and refinancing institutions (FIs) + Term borrowing by FIs + Certificate of deposits issued by FIs L 3 = L 2 + Public deposits of non- banking financial companies.

TOOLS OF MONETARY POLICY • • Bank rate Open market operations Changing reserve ratio (CRR/SLR) Undertaking selective credit controls

TOOLS OF MONETARY POLICY • • Bank rate Open market operations Changing reserve ratio (CRR/SLR) Undertaking selective credit controls

BANK RATE • Bank rate is the minimum rate at which the central bank of a country provides loan to the commercial bank of the country. • Bank rate is also called discount rate because bank provide finance to the commercial bank by rediscounting the bills of exchange. • When central bank raises the bank rate, the commercial bank raises their lending rates, it results in less borrowings and reduces money supply in the economy.

BANK RATE • Bank rate is the minimum rate at which the central bank of a country provides loan to the commercial bank of the country. • Bank rate is also called discount rate because bank provide finance to the commercial bank by rediscounting the bills of exchange. • When central bank raises the bank rate, the commercial bank raises their lending rates, it results in less borrowings and reduces money supply in the economy.

LIMITATIONS • Well organized money market should exist in the economy. • It is useful during the times of inflation but it does not fullfill its purpose during the time of recession or depression.

LIMITATIONS • Well organized money market should exist in the economy. • It is useful during the times of inflation but it does not fullfill its purpose during the time of recession or depression.

OPEN MARKET OPERATIONS • It means the purchase and sale of securities by central bank of the country. • The sale of security by the central bank leads to contraction of credit and purchase there of to credit expansion.

OPEN MARKET OPERATIONS • It means the purchase and sale of securities by central bank of the country. • The sale of security by the central bank leads to contraction of credit and purchase there of to credit expansion.

LIMITATIONS The bank will expand contract credit according to prevailing economic and political circumstances and not merely with reference to their cash reserves. When the commercial bank cash balance increases, the demand for loan and advance should increase. This may not happen due to economic and political uncertainty. The circulation of bank credit should have a constant velocity.

LIMITATIONS The bank will expand contract credit according to prevailing economic and political circumstances and not merely with reference to their cash reserves. When the commercial bank cash balance increases, the demand for loan and advance should increase. This may not happen due to economic and political uncertainty. The circulation of bank credit should have a constant velocity.

CHANGING THE CRR/SLR • CRR - Scheduled banks are required to maintain with the RBI an average cash balance, the amount of which shall not be less than certain % of the total of the Net Demand Time Liabilities (NDTL), on a fortnightly basis • Increase in the CRR leads to the contraction of credit • Decrease in the CRR leads to the expansion of credit and banks tends to make more money available to borrowers.

CHANGING THE CRR/SLR • CRR - Scheduled banks are required to maintain with the RBI an average cash balance, the amount of which shall not be less than certain % of the total of the Net Demand Time Liabilities (NDTL), on a fortnightly basis • Increase in the CRR leads to the contraction of credit • Decrease in the CRR leads to the expansion of credit and banks tends to make more money available to borrowers.

CHANGING THE CRR/SLR • Statutory liquidity ratio (SLR) that the commercial banks in India require to maintain in the form of gold, government approved securities before providing credit to the customers. • Increase in the SLR leads to the contraction of credit • Decrease in the SLR leads to the expansion of credit and banks tends to make more money available to borrowers.

CHANGING THE CRR/SLR • Statutory liquidity ratio (SLR) that the commercial banks in India require to maintain in the form of gold, government approved securities before providing credit to the customers. • Increase in the SLR leads to the contraction of credit • Decrease in the SLR leads to the expansion of credit and banks tends to make more money available to borrowers.

CHANGING THE REPO/REVERSE • REPO • REVERSE REPO

CHANGING THE REPO/REVERSE • REPO • REVERSE REPO

Selective Credit Control • • • Rationing of credit Margin Requirement Variable interest rates Regulation of consumer credit Moral Suasion

Selective Credit Control • • • Rationing of credit Margin Requirement Variable interest rates Regulation of consumer credit Moral Suasion

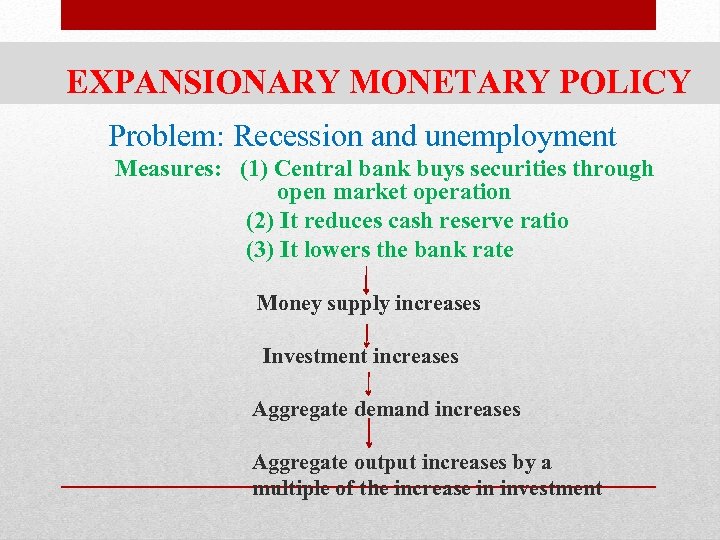

EXPANSIONARY MONETARY POLICY Problem: Recession and unemployment Measures: (1) Central bank buys securities through open market operation (2) It reduces cash reserve ratio (3) It lowers the bank rate Money supply increases Investment increases Aggregate demand increases Aggregate output increases by a multiple of the increase in investment

EXPANSIONARY MONETARY POLICY Problem: Recession and unemployment Measures: (1) Central bank buys securities through open market operation (2) It reduces cash reserve ratio (3) It lowers the bank rate Money supply increases Investment increases Aggregate demand increases Aggregate output increases by a multiple of the increase in investment

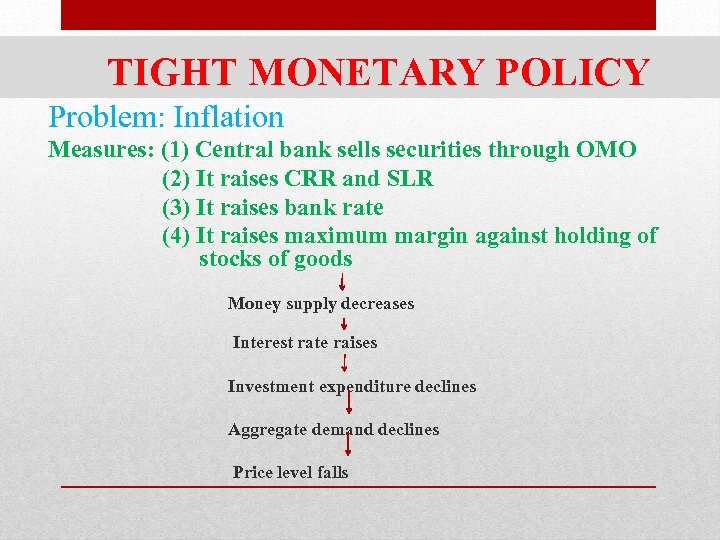

TIGHT MONETARY POLICY Problem: Inflation Measures: (1) Central bank sells securities through OMO (2) It raises CRR and SLR (3) It raises bank rate (4) It raises maximum margin against holding of stocks of goods Money supply decreases Interest rate raises Investment expenditure declines Aggregate demand declines Price level falls

TIGHT MONETARY POLICY Problem: Inflation Measures: (1) Central bank sells securities through OMO (2) It raises CRR and SLR (3) It raises bank rate (4) It raises maximum margin against holding of stocks of goods Money supply decreases Interest rate raises Investment expenditure declines Aggregate demand declines Price level falls

ROLE OF MONETARY POLICY IN ECONOMIC GROWTH • Monetary policy and savings. • Monetary policy and investment. • Cost of credit. . • Monetary policy and public investment. • Monetary policy and private investment. • Allocation of investment funds.

ROLE OF MONETARY POLICY IN ECONOMIC GROWTH • Monetary policy and savings. • Monetary policy and investment. • Cost of credit. . • Monetary policy and public investment. • Monetary policy and private investment. • Allocation of investment funds.

RBI’S ANNUAL POLICY STATEMENT 2015 -16 The macroeconomic environment is expected to improve in 2015 -16, with fiscal policy gearing to an investment-led growth strategy The Reserve Bank’s consumer confidence survey (CCS) points to growing consumer optimism since June 2014, reflecting purchasing power gains arising from lower inflation as well as improved perception of income, spending and employment growth

RBI’S ANNUAL POLICY STATEMENT 2015 -16 The macroeconomic environment is expected to improve in 2015 -16, with fiscal policy gearing to an investment-led growth strategy The Reserve Bank’s consumer confidence survey (CCS) points to growing consumer optimism since June 2014, reflecting purchasing power gains arising from lower inflation as well as improved perception of income, spending and employment growth

RBI’S ANNUAL POLICY STATEMENT 2015 -16 CPI inflation will remain below the target of 6 per cent set for January 2016, hovering around 5 per cent in the first half of 2015 -16, and a little above 5. 5 per cent in the second half. Uncertainties surrounding commodity prices, monsoon and weather-related disturbances, volatility in prices of seasonal items and spillovers from external developments through exchange rate, inflation is projected to be 3. 7 per cent to 7. 9 per cent around the baseline inflation projection of 5. 8 per cent for Q 4 of 2015 -16.

RBI’S ANNUAL POLICY STATEMENT 2015 -16 CPI inflation will remain below the target of 6 per cent set for January 2016, hovering around 5 per cent in the first half of 2015 -16, and a little above 5. 5 per cent in the second half. Uncertainties surrounding commodity prices, monsoon and weather-related disturbances, volatility in prices of seasonal items and spillovers from external developments through exchange rate, inflation is projected to be 3. 7 per cent to 7. 9 per cent around the baseline inflation projection of 5. 8 per cent for Q 4 of 2015 -16.

RBI’S ANNUAL POLICY STATEMENT 2015 -16 Monetary Policy Stance • Faced by the combination of deflationary/ disinflationary pressures and weak growth, central banks in both AEs and EMEs have pursued accommodative monetary policies. In the US, monetary policy remains highly accommodative with interest rates close to zero. • Facing persistent deflation, the Bank of Japan has continued with its target of monetary base expansion of 80 trillion yen per year.

RBI’S ANNUAL POLICY STATEMENT 2015 -16 Monetary Policy Stance • Faced by the combination of deflationary/ disinflationary pressures and weak growth, central banks in both AEs and EMEs have pursued accommodative monetary policies. In the US, monetary policy remains highly accommodative with interest rates close to zero. • Facing persistent deflation, the Bank of Japan has continued with its target of monetary base expansion of 80 trillion yen per year.

RBI’S ANNUAL POLICY STATEMENT 2015 -16 Monetary and Liquidity Measures • On the basis of an assessment of the current and evolving macroeconomic situation, it has been decided to: • keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 7. 5 per cent; • keep the cash reserve ratio (CRR) of scheduled banks unchanged at 4. 0 per cent of net demand time liability (NDTL); and

RBI’S ANNUAL POLICY STATEMENT 2015 -16 Monetary and Liquidity Measures • On the basis of an assessment of the current and evolving macroeconomic situation, it has been decided to: • keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 7. 5 per cent; • keep the cash reserve ratio (CRR) of scheduled banks unchanged at 4. 0 per cent of net demand time liability (NDTL); and

RBI’S ANNUAL POLICY STATEMENT 2015 -16 • continue to provide liquidity under overnight repos at 0. 25 per cent of bank-wise NDTL at the LAF repo rate and liquidity under 7 -day and 14 -day term repos of up to 0. 75 per cent of NDTL of the banking system through auctions; and • The reverse repo rate under the LAF will remain unchanged at 6. 5 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 8. 5 per cent. • SLR is 21. 5 %

RBI’S ANNUAL POLICY STATEMENT 2015 -16 • continue to provide liquidity under overnight repos at 0. 25 per cent of bank-wise NDTL at the LAF repo rate and liquidity under 7 -day and 14 -day term repos of up to 0. 75 per cent of NDTL of the banking system through auctions; and • The reverse repo rate under the LAF will remain unchanged at 6. 5 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 8. 5 per cent. • SLR is 21. 5 %

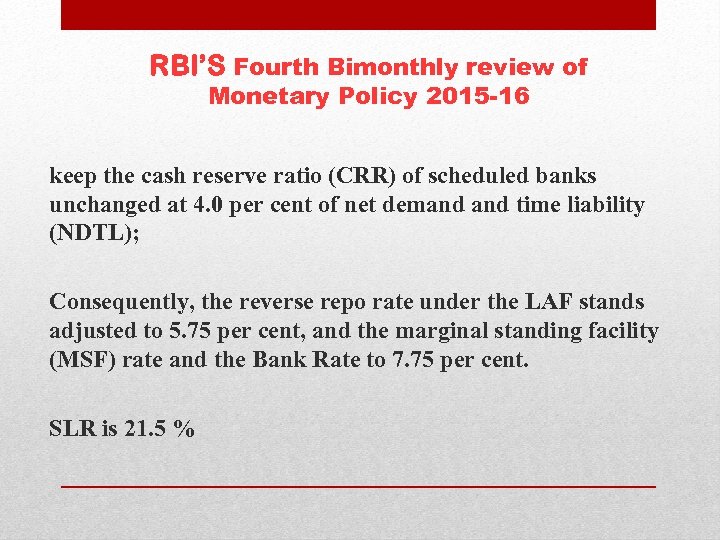

RBI’S Fourth Bimonthly review of Monetary Policy 2015 -16 30 th September 2015 Monetary and Liquidity Measures • On the basis of an assessment of the current and evolving macroeconomic situation, it has been decided to: • reduce the policy repo rate under the liquidity adjustment facility (LAF) by 50 basis points from 7. 25 per cent to 6. 75 per cent with immediate effect;

RBI’S Fourth Bimonthly review of Monetary Policy 2015 -16 30 th September 2015 Monetary and Liquidity Measures • On the basis of an assessment of the current and evolving macroeconomic situation, it has been decided to: • reduce the policy repo rate under the liquidity adjustment facility (LAF) by 50 basis points from 7. 25 per cent to 6. 75 per cent with immediate effect;

RBI’S Fourth Bimonthly review of Monetary Policy 2015 -16 keep the cash reserve ratio (CRR) of scheduled banks unchanged at 4. 0 per cent of net demand time liability (NDTL); Consequently, the reverse repo rate under the LAF stands adjusted to 5. 75 per cent, and the marginal standing facility (MSF) rate and the Bank Rate to 7. 75 per cent. SLR is 21. 5 %

RBI’S Fourth Bimonthly review of Monetary Policy 2015 -16 keep the cash reserve ratio (CRR) of scheduled banks unchanged at 4. 0 per cent of net demand time liability (NDTL); Consequently, the reverse repo rate under the LAF stands adjusted to 5. 75 per cent, and the marginal standing facility (MSF) rate and the Bank Rate to 7. 75 per cent. SLR is 21. 5 %

Finance Commission of India v The Finance Commission of India came into existence in 1951. v It was established under Article 280 of the Indian Constitution by the President of India. v It was formed to define the financial relations between the centre and the state. v The Finance Commission Act of 1951 states the terms of qualification, appointment and disqualification, the term, eligibility and powers of the Finance Commission.

Finance Commission of India v The Finance Commission of India came into existence in 1951. v It was established under Article 280 of the Indian Constitution by the President of India. v It was formed to define the financial relations between the centre and the state. v The Finance Commission Act of 1951 states the terms of qualification, appointment and disqualification, the term, eligibility and powers of the Finance Commission.

Finance Commission of India v As per the Constitution, the commission is appointed every five years and consists of a chairman and four other members. v Parliament may by law determine the requisite qualifications for appointment as members of the Commission and the procedure of selection.

Finance Commission of India v As per the Constitution, the commission is appointed every five years and consists of a chairman and four other members. v Parliament may by law determine the requisite qualifications for appointment as members of the Commission and the procedure of selection.

Finance Commission of India Functions v. Distribution of net proceeds of taxes between Centre and the States, to be divided as per their respective contributions to the taxes. v. Determine factors governing Grants-in Aid to the states and the magnitude of the same. vto make recommendations to President as to the measures needed to augment the Consolidated Fund of a State to supplement the resources of the panchayats and municipalities in the state on the basis of the recommendations made by the Finance Commission of the state.

Finance Commission of India Functions v. Distribution of net proceeds of taxes between Centre and the States, to be divided as per their respective contributions to the taxes. v. Determine factors governing Grants-in Aid to the states and the magnitude of the same. vto make recommendations to President as to the measures needed to augment the Consolidated Fund of a State to supplement the resources of the panchayats and municipalities in the state on the basis of the recommendations made by the Finance Commission of the state.

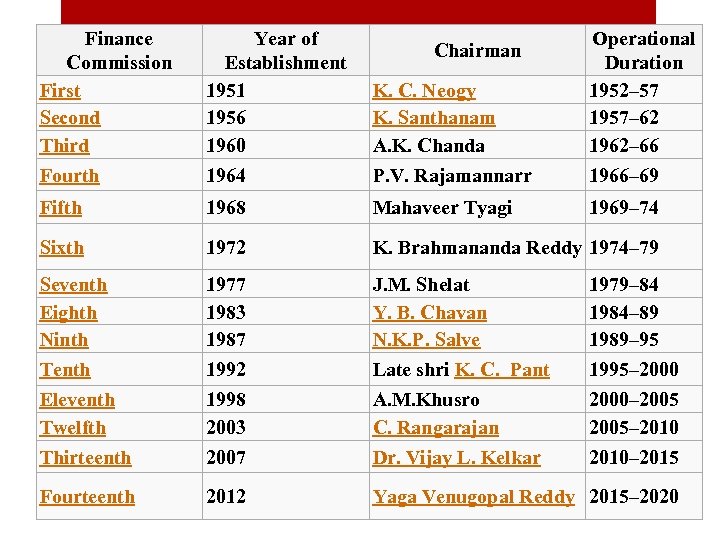

Finance Commission First Second Third Year of Establishment 1951 1956 1960 K. C. Neogy K. Santhanam A. K. Chanda Operational Duration 1952– 57 1957– 62 1962– 66 Fourth 1964 P. V. Rajamannarr 1966– 69 Fifth 1968 Mahaveer Tyagi 1969– 74 Sixth 1972 K. Brahmananda Reddy 1974– 79 Seventh Eighth Ninth 1977 1983 1987 J. M. Shelat Y. B. Chavan N. K. P. Salve 1979– 84 1984– 89 1989– 95 Tenth 1992 Late shri K. C. Pant 1995– 2000 Eleventh Twelfth 1998 2003 A. M. Khusro C. Rangarajan 2000– 2005– 2010 Thirteenth 2007 Dr. Vijay L. Kelkar 2010– 2015 Fourteenth 2012 Yaga Venugopal Reddy 2015– 2020 Chairman

Finance Commission First Second Third Year of Establishment 1951 1956 1960 K. C. Neogy K. Santhanam A. K. Chanda Operational Duration 1952– 57 1957– 62 1962– 66 Fourth 1964 P. V. Rajamannarr 1966– 69 Fifth 1968 Mahaveer Tyagi 1969– 74 Sixth 1972 K. Brahmananda Reddy 1974– 79 Seventh Eighth Ninth 1977 1983 1987 J. M. Shelat Y. B. Chavan N. K. P. Salve 1979– 84 1984– 89 1989– 95 Tenth 1992 Late shri K. C. Pant 1995– 2000 Eleventh Twelfth 1998 2003 A. M. Khusro C. Rangarajan 2000– 2005– 2010 Thirteenth 2007 Dr. Vijay L. Kelkar 2010– 2015 Fourteenth 2012 Yaga Venugopal Reddy 2015– 2020 Chairman

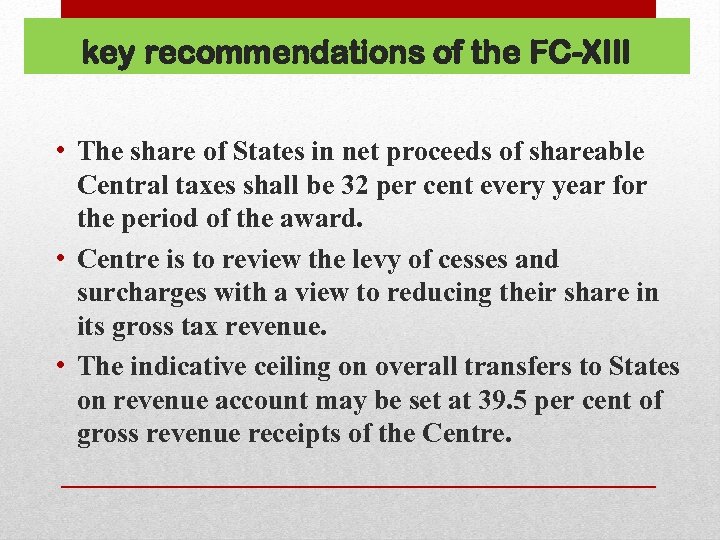

key recommendations of the FC-XIII • The share of States in net proceeds of shareable Central taxes shall be 32 per cent every year for the period of the award. • Centre is to review the levy of cesses and surcharges with a view to reducing their share in its gross tax revenue. • The indicative ceiling on overall transfers to States on revenue account may be set at 39. 5 per cent of gross revenue receipts of the Centre.

key recommendations of the FC-XIII • The share of States in net proceeds of shareable Central taxes shall be 32 per cent every year for the period of the award. • Centre is to review the levy of cesses and surcharges with a view to reducing their share in its gross tax revenue. • The indicative ceiling on overall transfers to States on revenue account may be set at 39. 5 per cent of gross revenue receipts of the Centre.

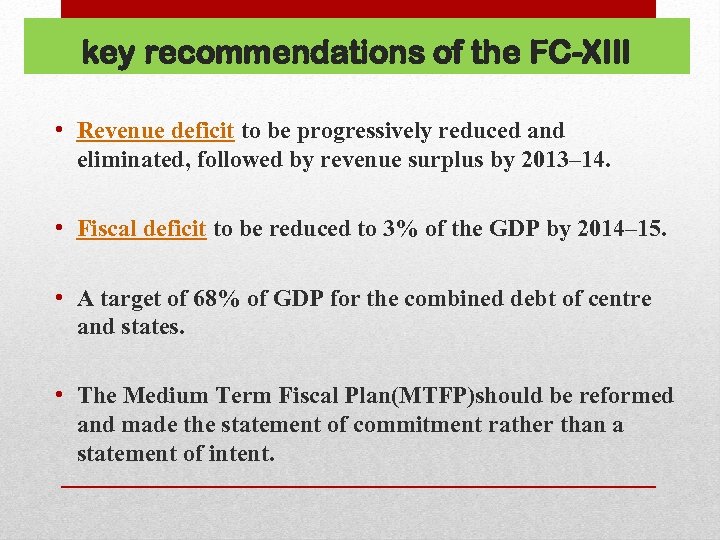

key recommendations of the FC-XIII • Revenue deficit to be progressively reduced and eliminated, followed by revenue surplus by 2013– 14. • Fiscal deficit to be reduced to 3% of the GDP by 2014– 15. • A target of 68% of GDP for the combined debt of centre and states. • The Medium Term Fiscal Plan(MTFP)should be reformed and made the statement of commitment rather than a statement of intent.

key recommendations of the FC-XIII • Revenue deficit to be progressively reduced and eliminated, followed by revenue surplus by 2013– 14. • Fiscal deficit to be reduced to 3% of the GDP by 2014– 15. • A target of 68% of GDP for the combined debt of centre and states. • The Medium Term Fiscal Plan(MTFP)should be reformed and made the statement of commitment rather than a statement of intent.

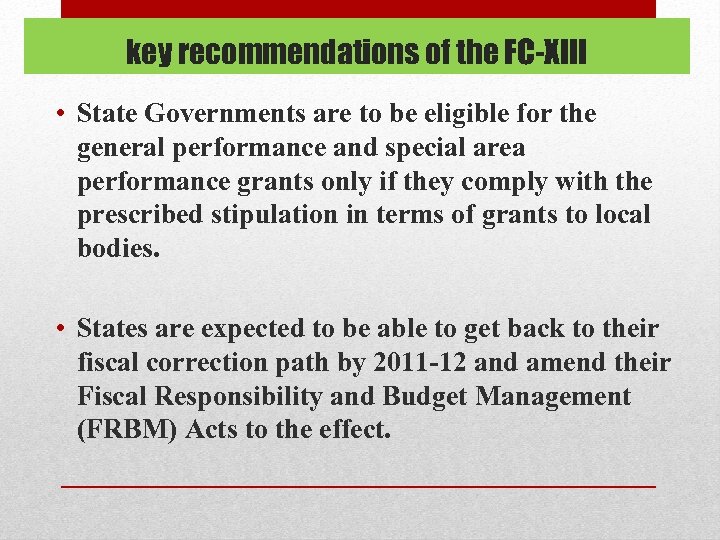

key recommendations of the FC-XIII • State Governments are to be eligible for the general performance and special area performance grants only if they comply with the prescribed stipulation in terms of grants to local bodies. • States are expected to be able to get back to their fiscal correction path by 2011 -12 and amend their Fiscal Responsibility and Budget Management (FRBM) Acts to the effect.

key recommendations of the FC-XIII • State Governments are to be eligible for the general performance and special area performance grants only if they comply with the prescribed stipulation in terms of grants to local bodies. • States are expected to be able to get back to their fiscal correction path by 2011 -12 and amend their Fiscal Responsibility and Budget Management (FRBM) Acts to the effect.

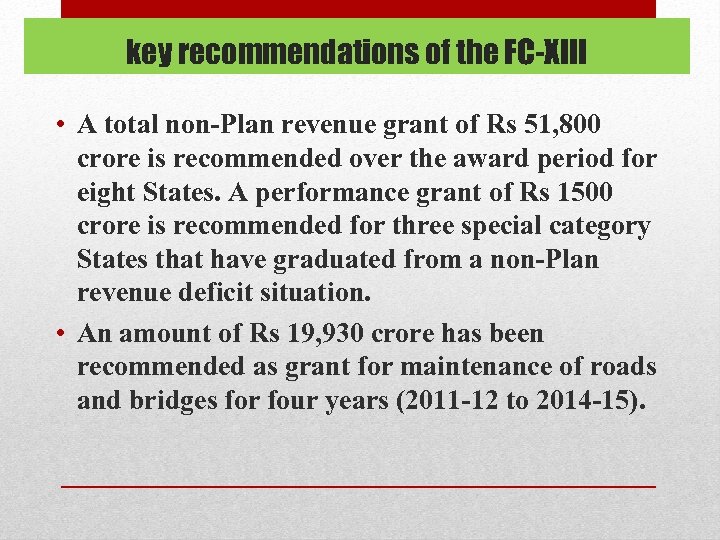

key recommendations of the FC-XIII • A total non-Plan revenue grant of Rs 51, 800 crore is recommended over the award period for eight States. A performance grant of Rs 1500 crore is recommended for three special category States that have graduated from a non-Plan revenue deficit situation. • An amount of Rs 19, 930 crore has been recommended as grant for maintenance of roads and bridges for four years (2011 -12 to 2014 -15).

key recommendations of the FC-XIII • A total non-Plan revenue grant of Rs 51, 800 crore is recommended over the award period for eight States. A performance grant of Rs 1500 crore is recommended for three special category States that have graduated from a non-Plan revenue deficit situation. • An amount of Rs 19, 930 crore has been recommended as grant for maintenance of roads and bridges for four years (2011 -12 to 2014 -15).

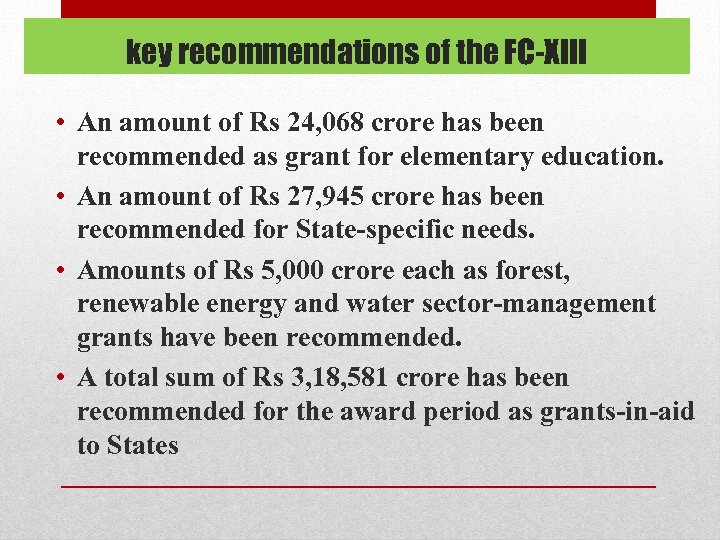

key recommendations of the FC-XIII • An amount of Rs 24, 068 crore has been recommended as grant for elementary education. • An amount of Rs 27, 945 crore has been recommended for State-specific needs. • Amounts of Rs 5, 000 crore each as forest, renewable energy and water sector-management grants have been recommended. • A total sum of Rs 3, 18, 581 crore has been recommended for the award period as grants-in-aid to States

key recommendations of the FC-XIII • An amount of Rs 24, 068 crore has been recommended as grant for elementary education. • An amount of Rs 27, 945 crore has been recommended for State-specific needs. • Amounts of Rs 5, 000 crore each as forest, renewable energy and water sector-management grants have been recommended. • A total sum of Rs 3, 18, 581 crore has been recommended for the award period as grants-in-aid to States

THANK U

THANK U