4091e2bf02a44300b60c596ce536c097.ppt

- Количество слайдов: 21

Monetary policy in the recovery process Prof. Zvi Eckstein Deputy Governor, Bank of Israel YPO 2010 06. 2010 1

Monetary policy in the recovery process Prof. Zvi Eckstein Deputy Governor, Bank of Israel YPO 2010 06. 2010 1

Outline • The Israeli Macro Economic • Monetary Policy • Israel Industry • Challenges 2

Outline • The Israeli Macro Economic • Monetary Policy • Israel Industry • Challenges 2

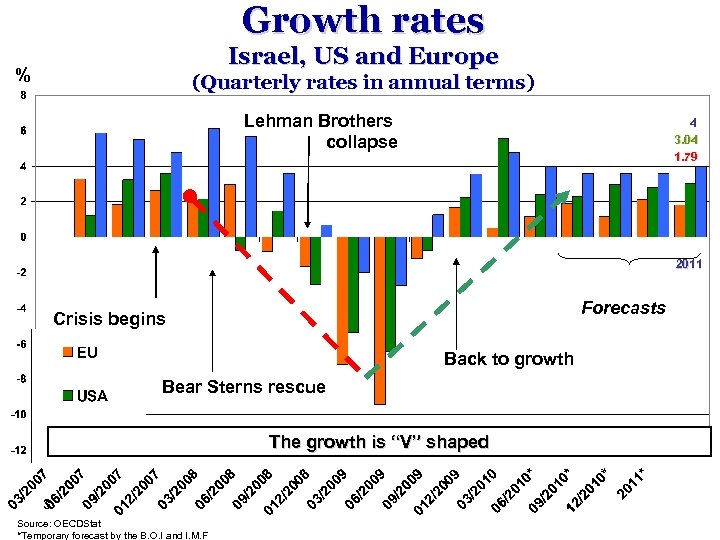

Growth rates Israel, US and Europe % (Quarterly rates in annual terms) Lehman Brothers collapse 4 3. 04 1. 79 2011 Forecasts Crisis begins Back to growth Bear Sterns rescue The growth is “V” shaped 3 Source: OECDStat *Temporary forecast by the B. O. I and I. M. F

Growth rates Israel, US and Europe % (Quarterly rates in annual terms) Lehman Brothers collapse 4 3. 04 1. 79 2011 Forecasts Crisis begins Back to growth Bear Sterns rescue The growth is “V” shaped 3 Source: OECDStat *Temporary forecast by the B. O. I and I. M. F

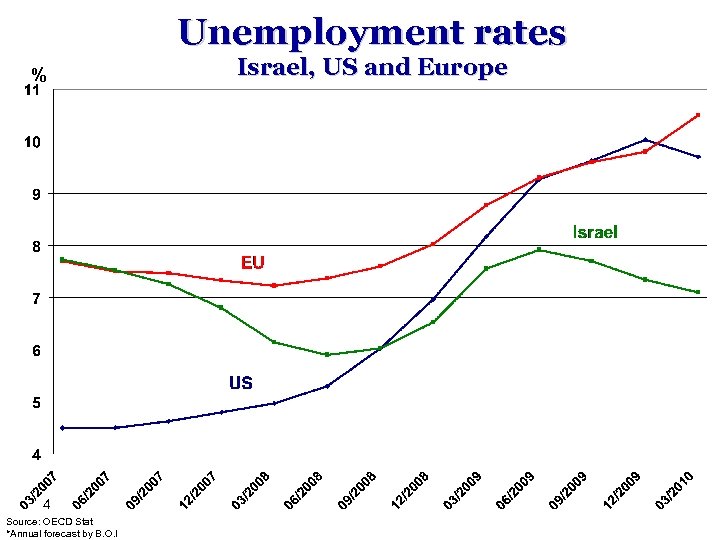

Unemployment rates % 4 Source: OECD Stat *Annual forecast by B. O. I Israel, US and Europe

Unemployment rates % 4 Source: OECD Stat *Annual forecast by B. O. I Israel, US and Europe

World Financial Conditions: Libor and banks’ CDS spread Lehman Brothers collapse Bear-Sterns rescue Back to growth PIIGS Crisis begins CDS (right) 3 M Libor-OIS (left) 5 Source: BOI. CDS spread: average of world’s 9 largest banks

World Financial Conditions: Libor and banks’ CDS spread Lehman Brothers collapse Bear-Sterns rescue Back to growth PIIGS Crisis begins CDS (right) 3 M Libor-OIS (left) 5 Source: BOI. CDS spread: average of world’s 9 largest banks

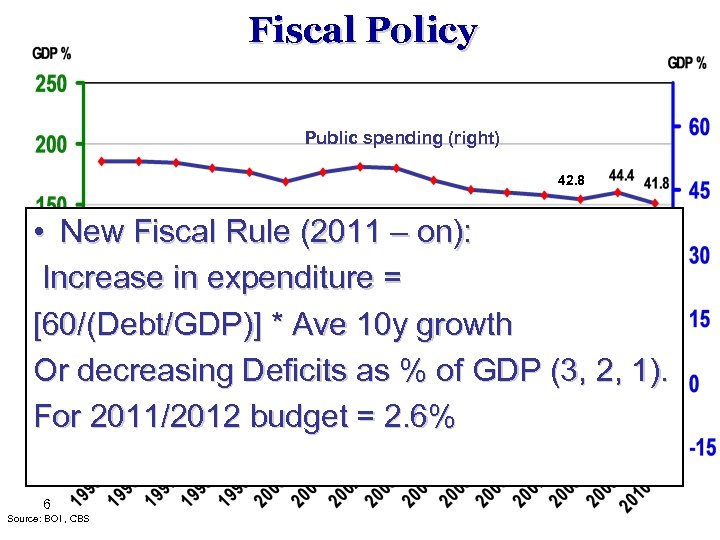

Fiscal Policy Public spending (right) 42. 8 • New Fiscal Rule (2011 (left) – on): Debt 76. 8 Increase in expenditure = [60/(Debt/GDP)] * Ave 10 y growth Deficit (right) 6. 5 3. 8 2. 6 Or decreasing Deficits as % of GDP (3, 2, 1). For 2011/2012 budget = 2. 6% 6 Source: BOI , CBS

Fiscal Policy Public spending (right) 42. 8 • New Fiscal Rule (2011 (left) – on): Debt 76. 8 Increase in expenditure = [60/(Debt/GDP)] * Ave 10 y growth Deficit (right) 6. 5 3. 8 2. 6 Or decreasing Deficits as % of GDP (3, 2, 1). For 2011/2012 budget = 2. 6% 6 Source: BOI , CBS

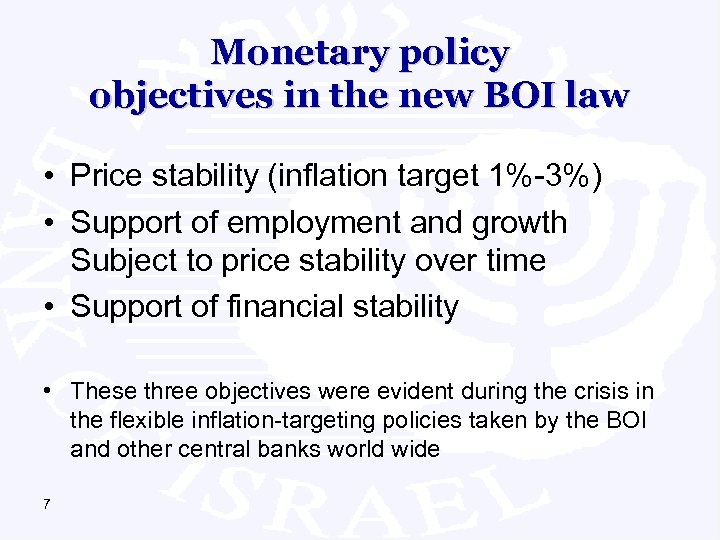

Monetary policy objectives in the new BOI law • Price stability (inflation target 1%-3%) • Support of employment and growth Subject to price stability over time • Support of financial stability • These three objectives were evident during the crisis in the flexible inflation-targeting policies taken by the BOI and other central banks world wide 7

Monetary policy objectives in the new BOI law • Price stability (inflation target 1%-3%) • Support of employment and growth Subject to price stability over time • Support of financial stability • These three objectives were evident during the crisis in the flexible inflation-targeting policies taken by the BOI and other central banks world wide 7

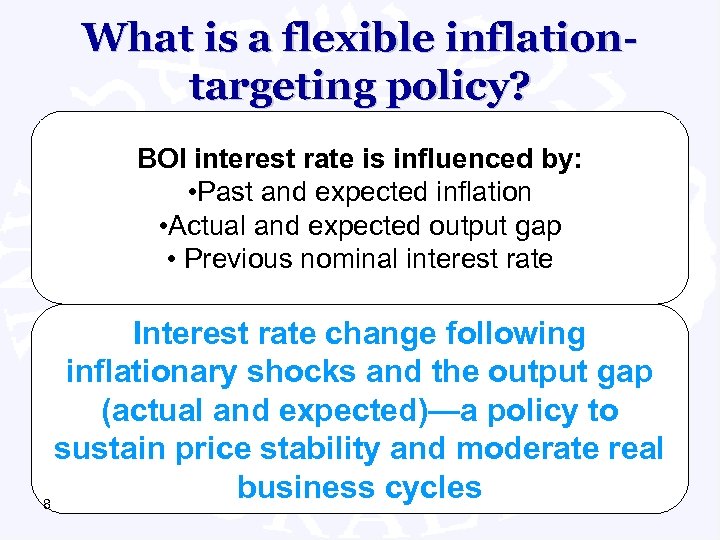

What is a flexible inflationtargeting policy? BOI interest rate is influenced by: • Past and expected inflation • Actual and expected output gap • Previous nominal interest rate Interest rate change following inflationary shocks and the output gap (actual and expected)—a policy to sustain price stability and moderate real business cycles 8

What is a flexible inflationtargeting policy? BOI interest rate is influenced by: • Past and expected inflation • Actual and expected output gap • Previous nominal interest rate Interest rate change following inflationary shocks and the output gap (actual and expected)—a policy to sustain price stability and moderate real business cycles 8

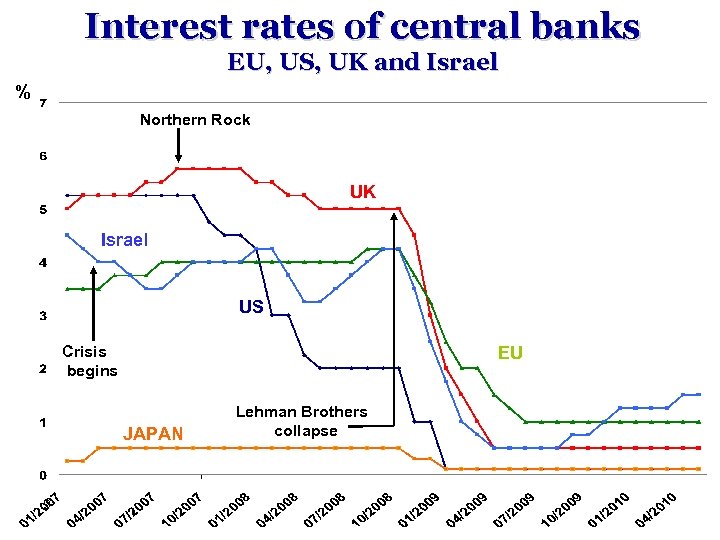

Interest rates of central banks EU, US, UK and Israel % Northern Rock UK Israel US Crisis begins EU JAPAN 9 Lehman Brothers collapse

Interest rates of central banks EU, US, UK and Israel % Northern Rock UK Israel US Crisis begins EU JAPAN 9 Lehman Brothers collapse

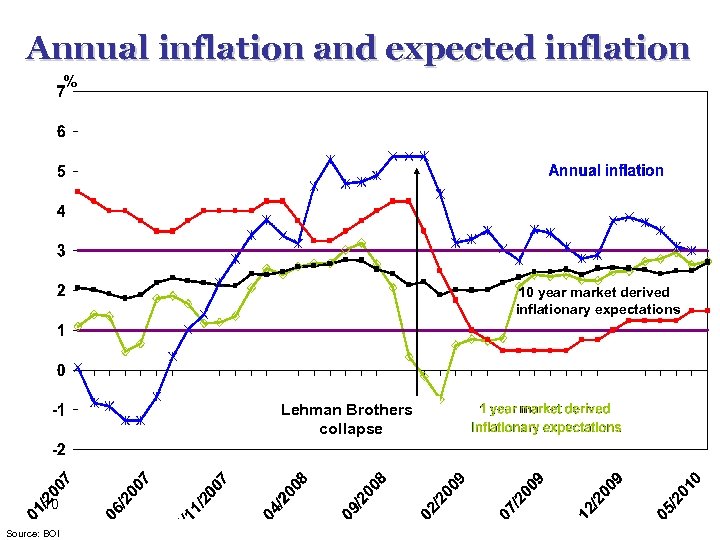

Annual inflation and expected inflation % 10 year market derived inflationary expectations Lehman Brothers collapse 10 Source: BOI

Annual inflation and expected inflation % 10 year market derived inflationary expectations Lehman Brothers collapse 10 Source: BOI

Interest rate and year-on-year inflation fan charts Inflation 11 BOI interest rate

Interest rate and year-on-year inflation fan charts Inflation 11 BOI interest rate

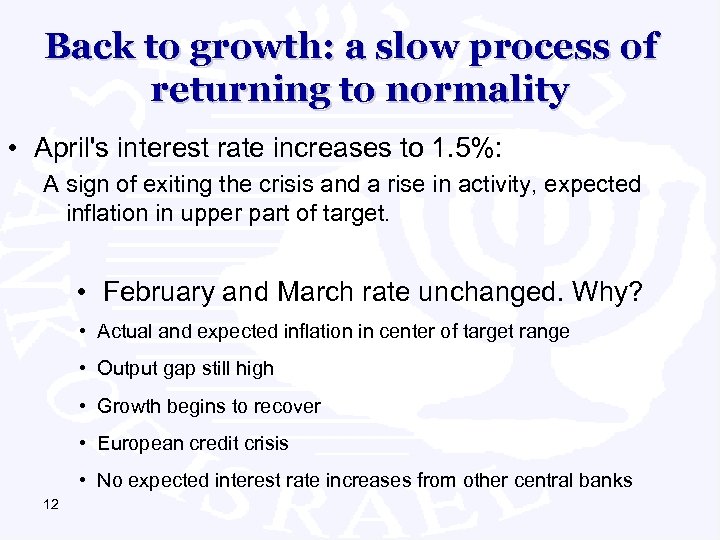

Back to growth: a slow process of returning to normality • April's interest rate increases to 1. 5%: A sign of exiting the crisis and a rise in activity, expected inflation in upper part of target. • February and March rate unchanged. Why? • Actual and expected inflation in center of target range • Output gap still high • Growth begins to recover • European credit crisis • No expected interest rate increases from other central banks 12

Back to growth: a slow process of returning to normality • April's interest rate increases to 1. 5%: A sign of exiting the crisis and a rise in activity, expected inflation in upper part of target. • February and March rate unchanged. Why? • Actual and expected inflation in center of target range • Output gap still high • Growth begins to recover • European credit crisis • No expected interest rate increases from other central banks 12

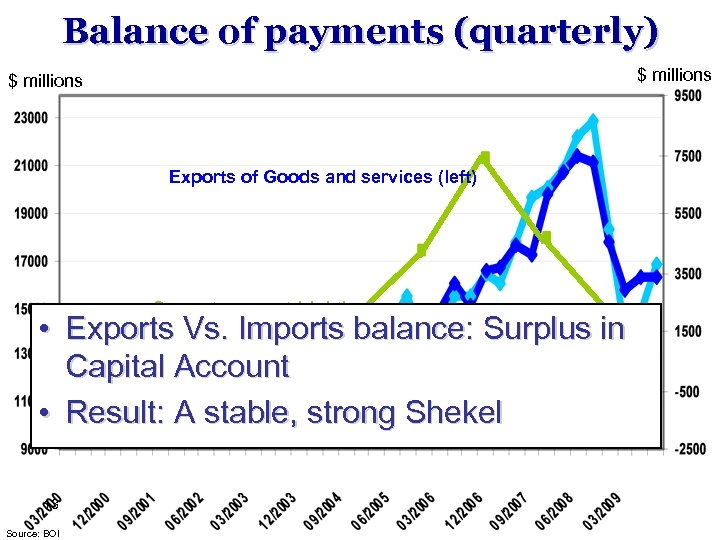

Balance of payments (quarterly) $ millions Exports of Goods and services (left) Current account (right) • Exports Vs. Imports balance: Surplus in Capital Account Imports of Goods • Result: A stable, strongservices (left) and Shekel 13 Source: BOI

Balance of payments (quarterly) $ millions Exports of Goods and services (left) Current account (right) • Exports Vs. Imports balance: Surplus in Capital Account Imports of Goods • Result: A stable, strongservices (left) and Shekel 13 Source: BOI

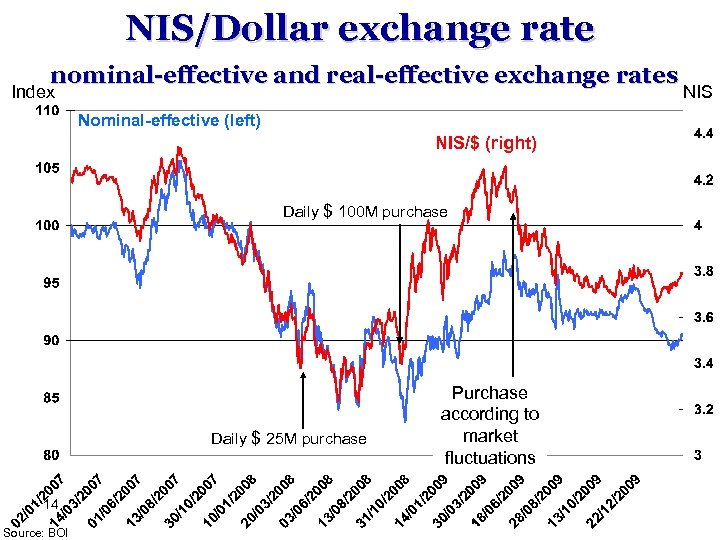

NIS/Dollar exchange rate nominal-effective and real-effective exchange rates Index Nominal-effective (left) NIS/$ (right) Daily $ 100 M purchase Daily $ 25 M purchase 14 Source: BOI Purchase according to market fluctuations NIS

NIS/Dollar exchange rate nominal-effective and real-effective exchange rates Index Nominal-effective (left) NIS/$ (right) Daily $ 100 M purchase Daily $ 25 M purchase 14 Source: BOI Purchase according to market fluctuations NIS

BOI’s foreign exchange market policy: Long Run – FX market free of intervention excepting anomalous events Short run – Slow process of returning to normality 15

BOI’s foreign exchange market policy: Long Run – FX market free of intervention excepting anomalous events Short run – Slow process of returning to normality 15

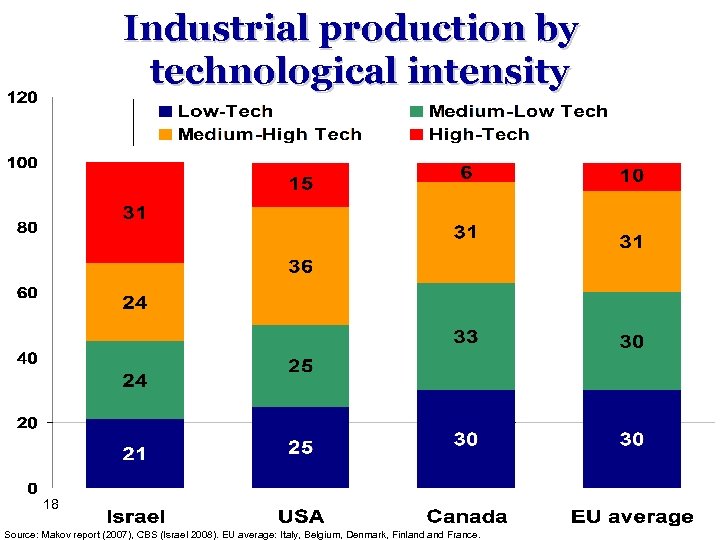

Israel Industry • High Share of High Tech • High correlation with International Trade • Low innovation in traditional industry • Problem: Strong Shekel 16

Israel Industry • High Share of High Tech • High correlation with International Trade • Low innovation in traditional industry • Problem: Strong Shekel 16

Exports by technology intensity $ millions 17 Source: BOI

Exports by technology intensity $ millions 17 Source: BOI

Industrial production by technological intensity 18 Source: Makov report (2007), CBS (Israel 2008). EU average: Italy, Belgium, Denmark, Finland France.

Industrial production by technological intensity 18 Source: Makov report (2007), CBS (Israel 2008). EU average: Italy, Belgium, Denmark, Finland France.

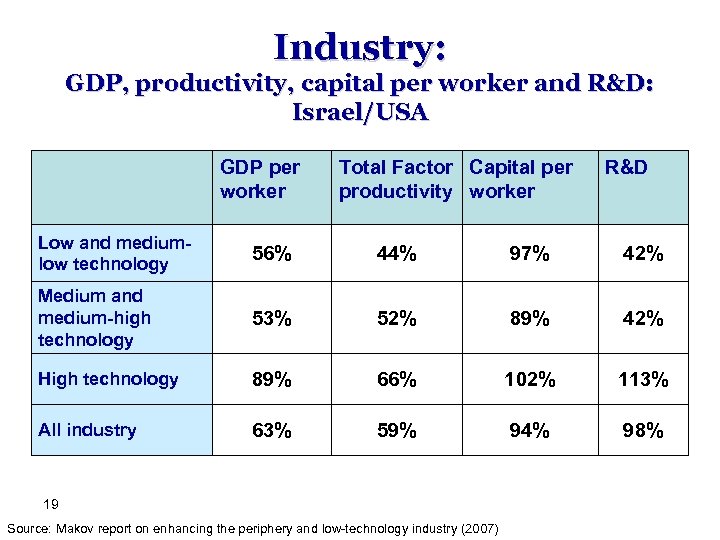

Industry: GDP, productivity, capital per worker and R&D: Israel/USA GDP per worker Total Factor Capital per productivity worker R&D Low and mediumlow technology 56% 44% 97% 42% Medium and medium-high technology 53% 52% 89% 42% High technology 89% 66% 102% 113% All industry 63% 59% 94% 98% 19 Source: Makov report on enhancing the periphery and low-technology industry (2007)

Industry: GDP, productivity, capital per worker and R&D: Israel/USA GDP per worker Total Factor Capital per productivity worker R&D Low and mediumlow technology 56% 44% 97% 42% Medium and medium-high technology 53% 52% 89% 42% High technology 89% 66% 102% 113% All industry 63% 59% 94% 98% 19 Source: Makov report on enhancing the periphery and low-technology industry (2007)

Challenges • Low participation and poverty • Education • Peace and economy 20

Challenges • Low participation and poverty • Education • Peace and economy 20

Thank you! 21

Thank you! 21