7156750d5d1e67bfd79d2cf43dbcb517.ppt

- Количество слайдов: 20

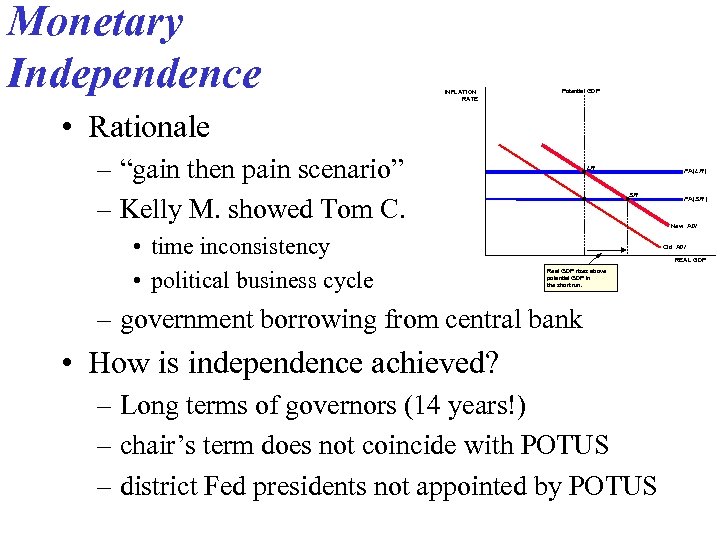

Monetary Independence 30_01 INFLATION RATE Potential GDP • Rationale – “gain then pain scenario” – Kelly M. showed Tom C. • time inconsistency • political business cycle LR PA (LR ) SR PA (SR ) New ADI Old ADI REAL GDP Real GDP rises above potential GDP in the short run. – government borrowing from central bank • How is independence achieved? – Long terms of governors (14 years!) – chair’s term does not coincide with POTUS – district Fed presidents not appointed by POTUS

Monetary Independence 30_01 INFLATION RATE Potential GDP • Rationale – “gain then pain scenario” – Kelly M. showed Tom C. • time inconsistency • political business cycle LR PA (LR ) SR PA (SR ) New ADI Old ADI REAL GDP Real GDP rises above potential GDP in the short run. – government borrowing from central bank • How is independence achieved? – Long terms of governors (14 years!) – chair’s term does not coincide with POTUS – district Fed presidents not appointed by POTUS

Arthur Burns, Fed chair under Richard Nixon, was criticized for letting money grow too quickly, raising inflation, despite what he said here in congressional testimony

Arthur Burns, Fed chair under Richard Nixon, was criticized for letting money grow too quickly, raising inflation, despite what he said here in congressional testimony

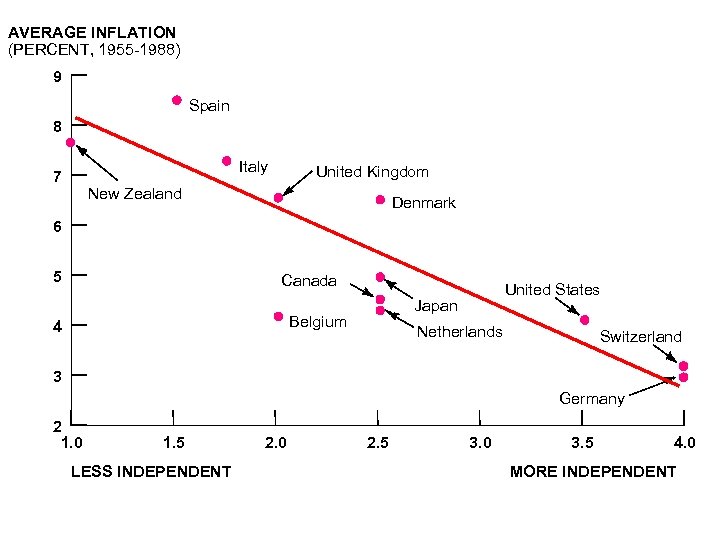

30_02 AVERAGE INFLATION (PERCENT, 1955 -1988) 9 Spain 8 Italy 7 United Kingdom New Zealand Denmark 6 5 Canada Japan Belgium 4 United States Netherlands Switzerland 3 Germany 2 1. 0 1. 5 LESS INDEPENDENT 2. 0 2. 5 3. 0 3. 5 4. 0 MORE INDEPENDENT

30_02 AVERAGE INFLATION (PERCENT, 1955 -1988) 9 Spain 8 Italy 7 United Kingdom New Zealand Denmark 6 5 Canada Japan Belgium 4 United States Netherlands Switzerland 3 Germany 2 1. 0 1. 5 LESS INDEPENDENT 2. 0 2. 5 3. 0 3. 5 4. 0 MORE INDEPENDENT

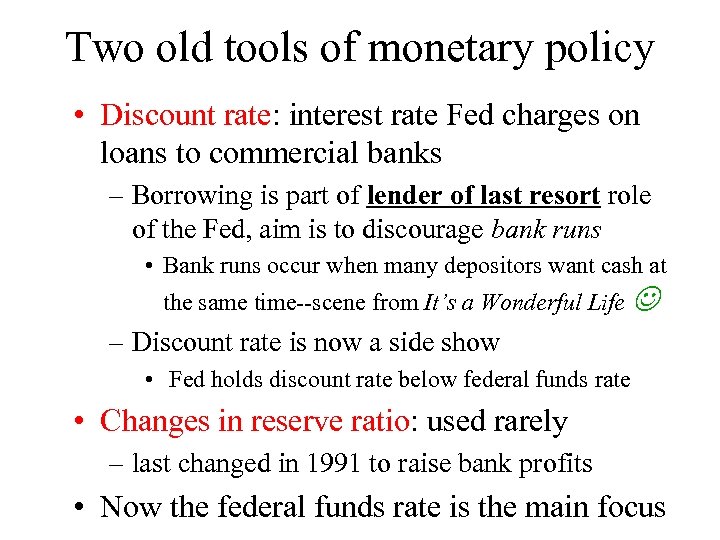

Two old tools of monetary policy • Discount rate: interest rate Fed charges on loans to commercial banks – Borrowing is part of lender of last resort role of the Fed, aim is to discourage bank runs • Bank runs occur when many depositors want cash at the same time--scene from It’s a Wonderful Life – Discount rate is now a side show • Fed holds discount rate below federal funds rate • Changes in reserve ratio: used rarely – last changed in 1991 to raise bank profits • Now the federal funds rate is the main focus

Two old tools of monetary policy • Discount rate: interest rate Fed charges on loans to commercial banks – Borrowing is part of lender of last resort role of the Fed, aim is to discourage bank runs • Bank runs occur when many depositors want cash at the same time--scene from It’s a Wonderful Life – Discount rate is now a side show • Fed holds discount rate below federal funds rate • Changes in reserve ratio: used rarely – last changed in 1991 to raise bank profits • Now the federal funds rate is the main focus

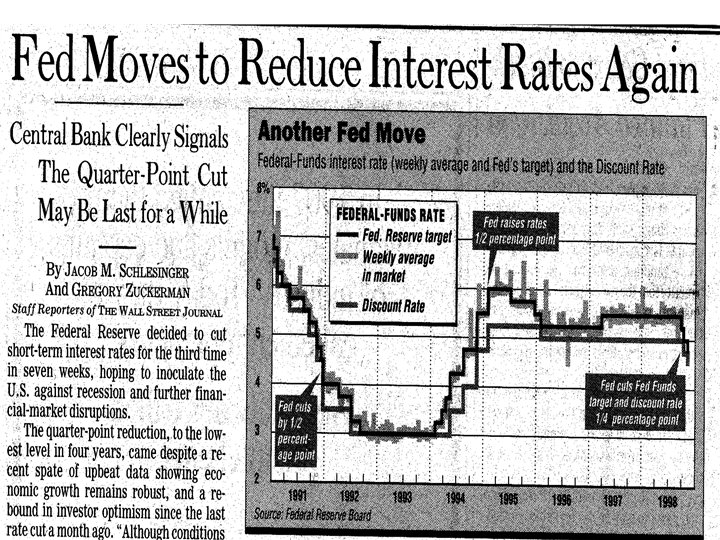

How the Fed changes the federal funds rate • Example, what does it do to cut the rate from 5. 0 % to 4. 75 % as it did last week? • A “short-cut” explanation is that it buys bonds which raises bond prices and lowers the interest rate • For a fuller explanation we look at money demand, money supply and the interest rate that gives equilibrium between them

How the Fed changes the federal funds rate • Example, what does it do to cut the rate from 5. 0 % to 4. 75 % as it did last week? • A “short-cut” explanation is that it buys bonds which raises bond prices and lowers the interest rate • For a fuller explanation we look at money demand, money supply and the interest rate that gives equilibrium between them

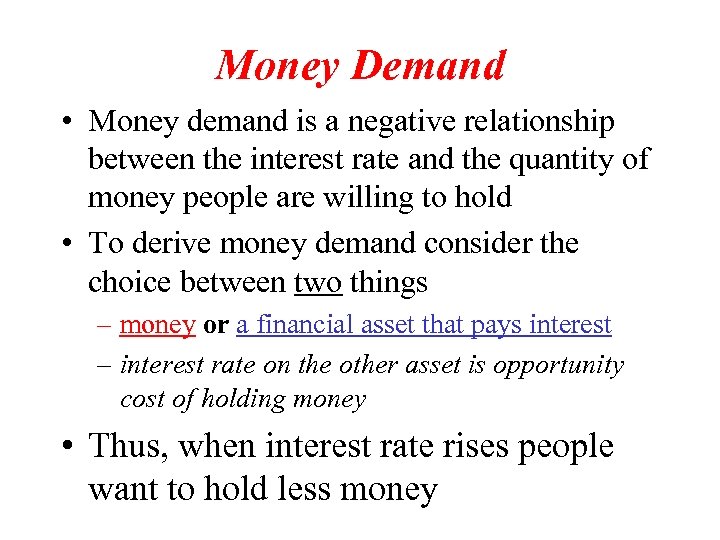

Money Demand • Money demand is a negative relationship between the interest rate and the quantity of money people are willing to hold • To derive money demand consider the choice between two things – money or a financial asset that pays interest – interest rate on the other asset is opportunity cost of holding money • Thus, when interest rate rises people want to hold less money

Money Demand • Money demand is a negative relationship between the interest rate and the quantity of money people are willing to hold • To derive money demand consider the choice between two things – money or a financial asset that pays interest – interest rate on the other asset is opportunity cost of holding money • Thus, when interest rate rises people want to hold less money

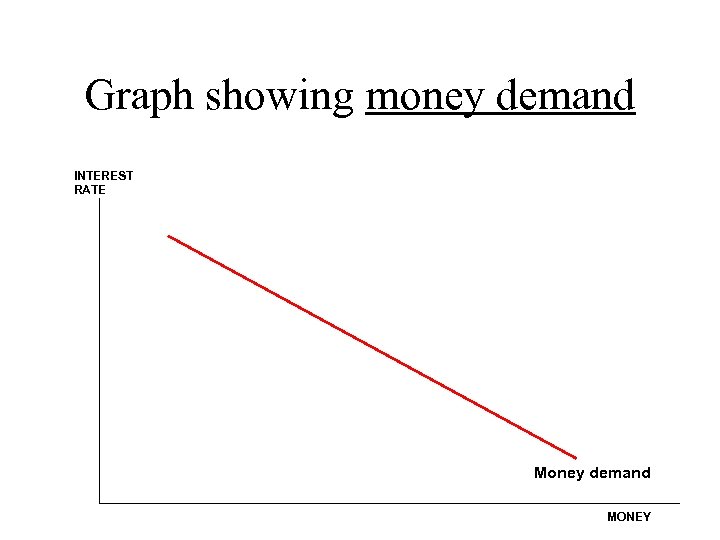

Graph showing money demand 30_0 3 INTEREST RATE Money demand MONEY

Graph showing money demand 30_0 3 INTEREST RATE Money demand MONEY

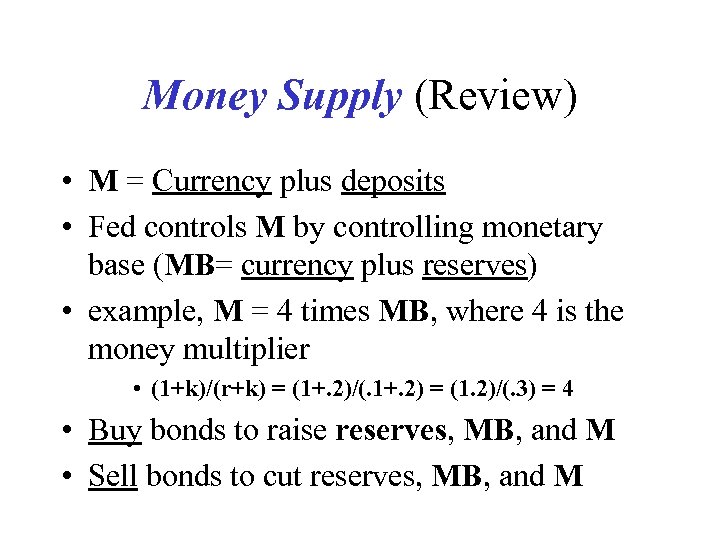

Money Supply (Review) • M = Currency plus deposits • Fed controls M by controlling monetary base (MB= currency plus reserves) • example, M = 4 times MB, where 4 is the money multiplier • (1+k)/(r+k) = (1+. 2)/(. 1+. 2) = (1. 2)/(. 3) = 4 • Buy bonds to raise reserves, MB, and M • Sell bonds to cut reserves, MB, and M

Money Supply (Review) • M = Currency plus deposits • Fed controls M by controlling monetary base (MB= currency plus reserves) • example, M = 4 times MB, where 4 is the money multiplier • (1+k)/(r+k) = (1+. 2)/(. 1+. 2) = (1. 2)/(. 3) = 4 • Buy bonds to raise reserves, MB, and M • Sell bonds to cut reserves, MB, and M

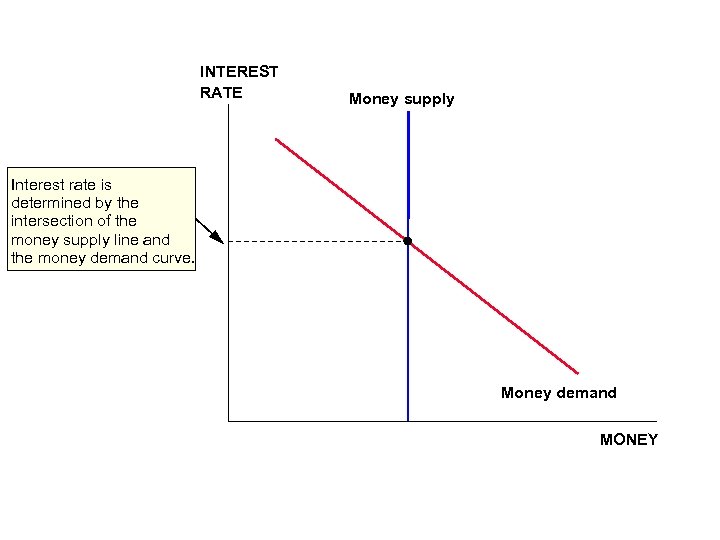

30_04 INTEREST RATE Money supply Interest rate is determined by the intersection of the money supply line and the money demand curve. Money demand MONEY

30_04 INTEREST RATE Money supply Interest rate is determined by the intersection of the money supply line and the money demand curve. Money demand MONEY

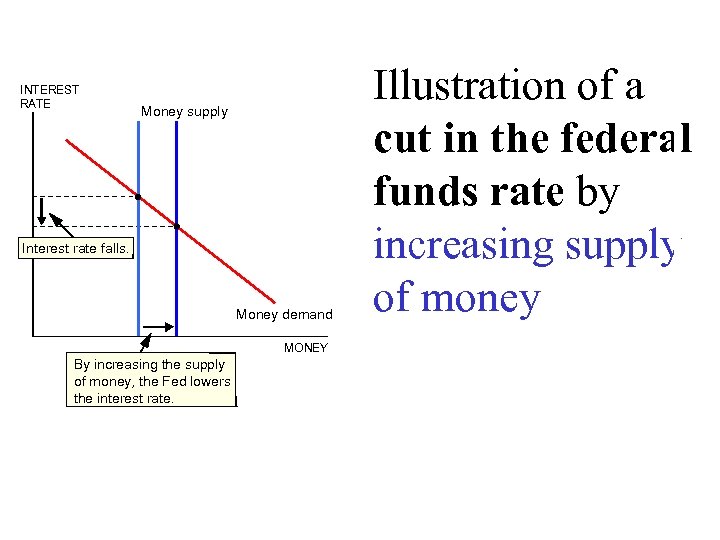

30_05 INTEREST RATE Money supply Interest rate falls. Money demand MONEY By increasing the supply of money, the Fed lowers the interest rate. Illustration of a cut in the federal funds rate by increasing supply of money

30_05 INTEREST RATE Money supply Interest rate falls. Money demand MONEY By increasing the supply of money, the Fed lowers the interest rate. Illustration of a cut in the federal funds rate by increasing supply of money

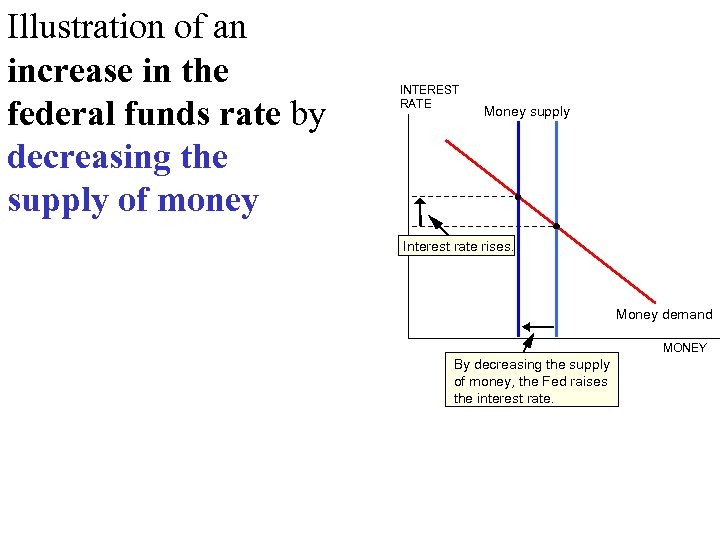

30_05 Illustration of an increase in the federal funds rate by decreasing the supply of money INTEREST RATE Money supply Interest rate rises. Money demand MONEY By decreasing the supply of money, the Fed raises the interest rate. t h r a t e d s

30_05 Illustration of an increase in the federal funds rate by decreasing the supply of money INTEREST RATE Money supply Interest rate rises. Money demand MONEY By decreasing the supply of money, the Fed raises the interest rate. t h r a t e d s

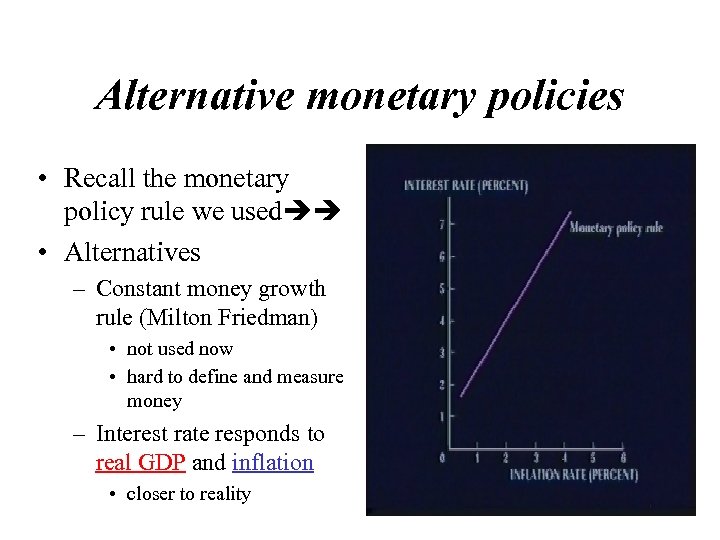

Alternative monetary policies • Recall the monetary policy rule we used • Alternatives – Constant money growth rule (Milton Friedman) • not used now • hard to define and measure money – Interest rate responds to real GDP and inflation • closer to reality

Alternative monetary policies • Recall the monetary policy rule we used • Alternatives – Constant money growth rule (Milton Friedman) • not used now • hard to define and measure money – Interest rate responds to real GDP and inflation • closer to reality

Questions for Alan Greenspan • Dr. Greenspan, we’ve heard a lot about the Fed • How does the Fed conduct monetary policy? • Does it set interest rates? • What about the money supply? • Is there any systematic framework?

Questions for Alan Greenspan • Dr. Greenspan, we’ve heard a lot about the Fed • How does the Fed conduct monetary policy? • Does it set interest rates? • What about the money supply? • Is there any systematic framework?

Key buzz words in Greenspan’s statement • we have been setting the funds rate directly • money demand has become too difficult to predict • inflation is fundamentally a monetary phenomenon --determined by the growth rate of money • there are lags in the effect of money • we have a firm commitment to control inflation

Key buzz words in Greenspan’s statement • we have been setting the funds rate directly • money demand has become too difficult to predict • inflation is fundamentally a monetary phenomenon --determined by the growth rate of money • there are lags in the effect of money • we have a firm commitment to control inflation

END OF LECTURE

END OF LECTURE